Supply Chain Risk Management: Literature Review

Abstract

1. Introduction

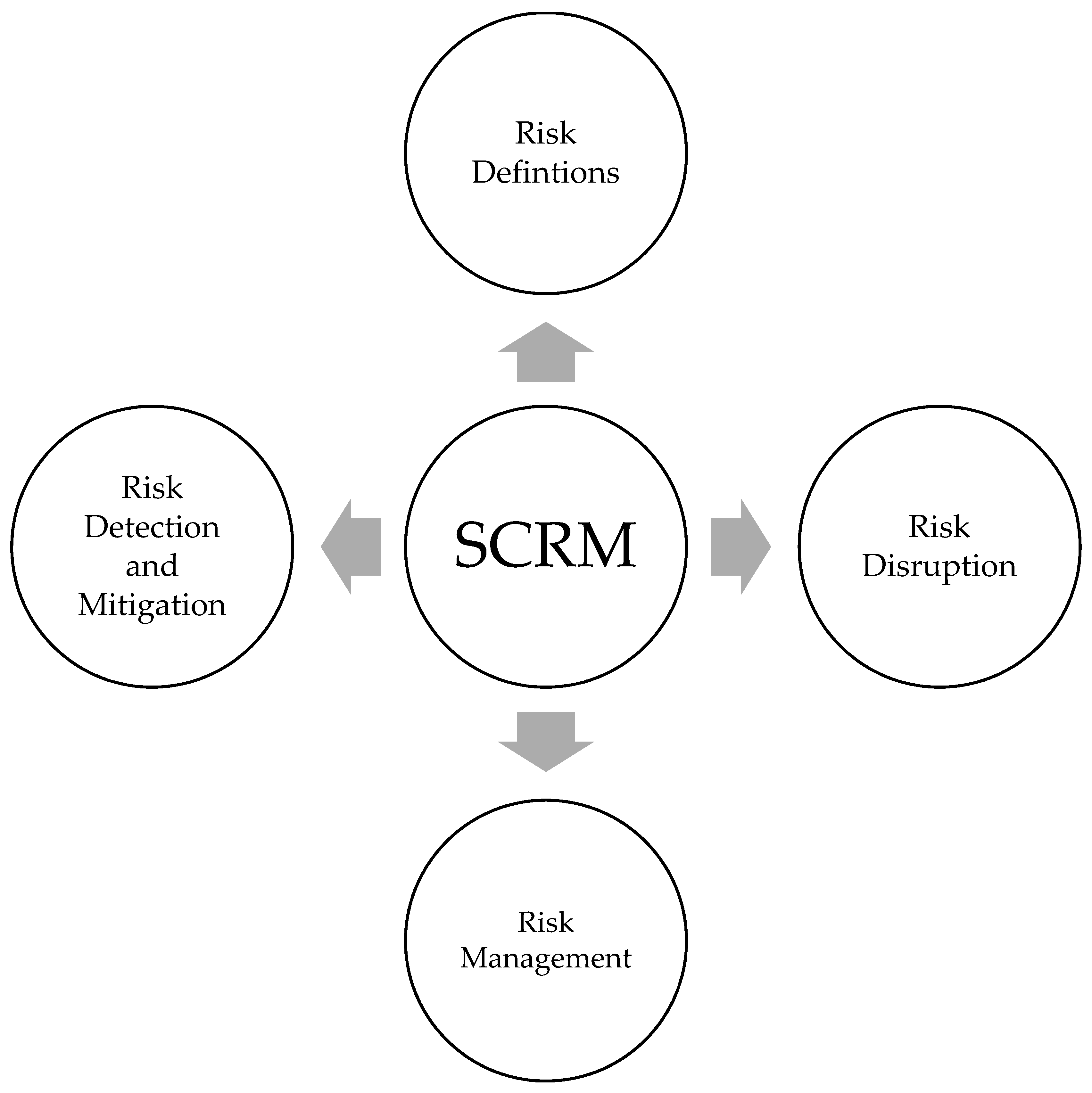

2. Literature Review and Research Design

2.1. SCRM Definitions

2.2. Risk Disruption

2.3. Risk Management

2.4. Risk Detection and Mitigation Strategies

- Material collection;

- Descriptive analysis;

- Category selection;

- Material evaluation.

3. Analysis and Discussions

4. Research Implications in SCRM

5. Conclusions

Author Contributions

Funding

Conflicts of Interest

Appendix A

| Journal Title | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | Total |

|---|---|---|---|---|---|---|---|---|---|---|---|

| A* | |||||||||||

| European Journal of Operational Research | 2 | 2 | 3 | 3 | 1 | 1 | 1 | 13 | |||

| Production & Operations Management | 2 | 3 | 1 | 2 | 8 | ||||||

| Decision Sciences | 1 | 1 | 2 | 1 | 5 | ||||||

| Journal of Operations Management | 1 | 1 | 1 | 2 | 5 | ||||||

| Transportation Research: Part E | 1 | 1 | 1 | 1 | 4 | ||||||

| Decision Support Systems | 2 | 1 | 3 | ||||||||

| Management Science | 1 | 1 | 1 | 3 | |||||||

| Human Resource Management | 1 | 1 | |||||||||

| International Journal of Information Management | 1 | 1 | |||||||||

| Journal of Construction Engineering & Management | 1 | 1 | |||||||||

| Journal of Management Information Systems | 1 | 1 | |||||||||

| Management Accounting Research | 1 | 1 | |||||||||

| Manufacturing & Service Operations Management | 1 | 1 | |||||||||

| Transportation Research Part A: Policy & Practice | 1 | 1 | |||||||||

| A | |||||||||||

| International Journal of Production Economics | 1 | 2 | 8 | 2 | 5 | 5 | 9 | 6 | 3 | 41 | |

| International Journal of Production Research | 1 | 3 | 2 | 2 | 2 | 6 | 5 | 2 | 3 | 5 | 31 |

| Computers & Industrial Engineering | 1 | 1 | 1 | 1 | 1 | 6 | 2 | 6 | 19 | ||

| Journal of Cleaner Production | 1 | 1 | 2 | 3 | 5 | 7 | 19 | ||||

| Industrial Management & Data Systems | 2 | 1 | 1 | 6 | 10 | ||||||

| Omega | 1 | 3 | 1 | 1 | 3 | 9 | |||||

| International Journal of Operations & Production Management | 1 | 1 | 1 | 4 | 1 | 8 | |||||

| Production Planning & Control | 2 | 2 | 1 | 2 | 7 | ||||||

| Annals of Operations Research | 1 | 1 | 3 | 1 | 6 | ||||||

| International Journal of Logistics Management | 1 | 1 | 1 | 2 | 1 | 6 | |||||

| International Journal of Physical Distribution & Logistics Management | 1 | 1 | 1 | 2 | 1 | 6 | |||||

| Computers & Operations Research | 1 | 2 | 1 | 4 | |||||||

| Journal of Business Logistics | 1 | 1 | 1 | 1 | 4 | ||||||

| Journal of Purchasing & Supply Management | 2 | 1 | 3 | ||||||||

| Journal of Retailing & Consumer Services | 1 | 2 | 3 | ||||||||

| Journal of Supply Chain Management | 1 | 1 | 1 | 3 | |||||||

| Computers & Security | 1 | 1 | 2 | ||||||||

| Systems Research & Behavioral Science | 2 | 2 | |||||||||

| Applied Economics | 1 | 1 | |||||||||

| Construction Management & Economics | 1 | 1 | |||||||||

| Energy Policy | 1 | 1 | |||||||||

| Harvard International Law Journal | 1 | 1 | |||||||||

| IEEE Transactions on Engineering Management | 1 | 1 | |||||||||

| IIE Transactions | 1 | 1 | |||||||||

| International Journal of Project Management | 1 | 1 | |||||||||

| International Journal of Retail & Distribution Management | 1 | 1 | |||||||||

| Journal of Business & Industrial Marketing | 1 | 1 | |||||||||

| Journal of Business Research | 1 | 1 | |||||||||

| Journal of Enterprise Information Management | 1 | 1 | |||||||||

| Journal of Global Information Management | 1 | 1 | |||||||||

| Journal of Information Systems | 1 | 1 | |||||||||

| Journal of Management in Engineering | 1 | 1 | |||||||||

| MIT Sloan Management Review | 1 | 1 | |||||||||

| Technovation | 1 | 1 | |||||||||

| Transportation Science | 1 | 1 | |||||||||

| B | |||||||||||

| Benchmarking: An International Journal | 1 | 1 | 2 | 1 | 2 | 2 | 2 | 11 | |||

| Journal of Manufacturing Technology Management | 1 | 1 | 1 | 1 | 1 | 5 | |||||

| International Journal of Logistics: Research & Applications | 1 | 1 | 1 | 3 | |||||||

| Management Decision | 1 | 1 | 1 | 3 | |||||||

| Thunderbird International Business Review | 1 | 2 | 3 | ||||||||

| Transportation Journal (Pennsylvania State University Press) | 2 | 1 | 3 | ||||||||

| Business Horizons | 2 | 2 | |||||||||

| Business Process Management Journal | 1 | 1 | 2 | ||||||||

| International Food & Agribusiness Management Review | 1 | 1 | 2 | ||||||||

| Journal of Marketing Channels | 1 | 1 | 2 | ||||||||

| Review of Quantitative Finance & Accounting | 1 | 1 | 2 | ||||||||

| Cogent Economics & Finance | 1 | 1 | |||||||||

| International Journal of Computer Integrated Manufacturing | 1 | 1 | |||||||||

| International Journal of Productivity & Performance Management | 1 | 1 | |||||||||

| International Journal of Quality & Reliability Management | 1 | 1 | |||||||||

| Journal of Environmental Planning & Management | 1 | 1 | |||||||||

| Journal of Intelligent Manufacturing | 1 | 1 | |||||||||

| Journal of Manufacturing Systems | 1 | 1 | |||||||||

| Journal of Revenue & Pricing Management | 1 | 1 | |||||||||

| Multinational Finance Journal | 1 | 1 | |||||||||

| Resources Policy | 1 | 1 | |||||||||

| C | |||||||||||

| Intellectual Property & Technology Law Journal | 1 | 2 | 3 | ||||||||

| Journal of Risk Research | 1 | 1 | 1 | 3 | |||||||

| African Journal of Business & Economic Research | 1 | 1 | |||||||||

| Business Law Review | 1 | 1 | |||||||||

| China Agricultural Economic Review | 1 | 1 | |||||||||

| Competitiveness Review | 1 | 1 | |||||||||

| Information Resources Management Journal | 1 | 1 | |||||||||

| International Journal of Managing Projects in Business | 1 | 1 | |||||||||

| Journal of Business & Economics Review (JBER) | 1 | 1 | |||||||||

| Journal of Food Distribution Research | 1 | 1 | |||||||||

| Journal of Management Development | 1 | 1 | |||||||||

| Strategy & Leadership | 1 | 1 | |||||||||

| Total | 14 | 16 | 27 | 22 | 37 | 27 | 35 | 37 | 45 | 52 | 312 |

References

- Achrol, Ravi Singh, Torger Reve, and Louis W. Stern. 1983. The Environment of Marketing Channel Dyads: A Framework for Comparative Analysis. Journal of Marketing 47: 55–67. [Google Scholar] [CrossRef]

- Alhawari, Samer, Louay Karadsheh, Amine Nehari Talet, and Ebrahim Mansour. 2012. Knowledge-Based Risk Management framework for Information Technology project. International Journal of Information Management 32: 50–65. [Google Scholar] [CrossRef]

- Altay, Nezih, and Andres Ramirez. 2010. Impact of Disasters on Firms in Different Sectors: Implications for Supply Chains. Journal of Supply Chain Management 46: 59–80. [Google Scholar] [CrossRef]

- Aqlan, Faisal, and Sarah S. Lam. 2016. Supply chain optimization under risk and uncertainty: A case study for high-end server manufacturing. Computers & Industrial Engineering 93: 78–87. [Google Scholar] [CrossRef]

- Azad, Nader, Georgios K. D. Saharidis, Hamid Davoudpour, Hooman Malekly, and Seyed Alireza Yektamaram. 2012. Strategies for protecting supply chain networks against facility and transportation disruptions: An improved Benders decomposition approach. Annals of Operations Research 210: 125–63. [Google Scholar] [CrossRef]

- Bates, Hilary, Matthias Holweg, Michael Lewis, and Nick Oliver. 2007. Motor vehicle recalls: Trends, patterns and emerging issues. Omega 35: 202–10. [Google Scholar] [CrossRef]

- Blackhurst, Jennifer, Christopher W. Craighead, Debra Elkins, and Robert Beaudion Handfield. 2005. An empirically derived agenda of critical research issues for managing supply-chain disruptions. International Journal of Production Research 43: 4067–81. [Google Scholar] [CrossRef]

- Bogataj, David, and Marija Bogataj. 2007. Measuring the supply chain risk and vulnerability in frequency space. International Journal of Production Economics 108: 291–301. [Google Scholar] [CrossRef]

- Braithwaite, Alan, and Darren Hall. 1999. Risky business? Critical decisions in supply chain management. Supply Chain Practice 1: 40–55. [Google Scholar]

- Brewerton, Paul, and Lynne Millward. 2001. Organizational Research Methods. Thousand Oaks: SAGE. [Google Scholar]

- Bryson, Kweku-Muata, Harvey Millar, Anito Joseph, and Ayodele Mobolurin. 2002. Using formal MS/OR modeling to support disaster recovery planning. European Journal of Operational Research 141: 679–88. [Google Scholar] [CrossRef]

- Bucklin, Louis P. 1965. Postponement, Speculation and the Structure of Distribution Channels. Journal of Marketing Research 2: 26–31. [Google Scholar] [CrossRef]

- Cagliano, Anna Corinna, Alberto De Marco, Sabrina Grimaldi, and Carlo Rafele. 2012. An integrated approach to supply chain risk analysis. Journal of Risk Research 15: 817–40. [Google Scholar] [CrossRef]

- Caniato, Federico, and James B. Rice, Jr. 2003. Building a secure and resilient supply network. Supply Chain Management Review 7: 22–30. [Google Scholar]

- Chandra, Charu, and Janis Grabis. 2007. Supply Chain Configuration-Concepts, Solutions, and Applications, 1st ed. New York: Springer. [Google Scholar]

- Chapman, Paul, Martin Christopher, Uta Jüttner, Helen Peck, and Richard Wilding. 2002. Identifying and Managing Supply Chain Vulnerability. Logistics & Transport Focus 4: 59–64. [Google Scholar]

- Chichilnisky, Graciela, and Geoffrey Heal. 1998. Managing Unknown Risks. The Journal of Portfolio Management 24: 85–91. [Google Scholar] [CrossRef]

- Chiou, Jyh-Shen, Lei-Yu Wu, and Jason C. Hsu. 2002. The Adoption of Form Postponement Strategy in a Global Logistics System: The Case of Taiwanese Information Technology Industry. Journal of Business Logistics 23: 107–24. [Google Scholar] [CrossRef]

- Choi, Kanghwa, Ram Narasimhan, and Soo Wook Kim. 2012. Postponement strategy for international transfer of products in a global supply chain: A system dynamics examination. Journal of Operations Management 30: 167–79. [Google Scholar] [CrossRef]

- Chopra, Sunil, and ManMohan S. Sodhi. 2004. Managing risk to avoid supply-chain breakdown: By understanding the variety and interconnectedness of supply-chain risks, managers can tailor balanced, effective risk-reduction strategies for their companies. MIT Sloan Management Review 46: 53. [Google Scholar]

- Chopra, Sunil, and ManMohan S. Sodhi. 2014. Reducing the Risk of Supply Chain Disruptions. MIT Sloan Management Review 55: 73–80. [Google Scholar]

- Christopher, Martin. 1992. Logistics: The Strategic Issues, 1st ed. New York: Chapman & Hall. [Google Scholar]

- Christopher, Martin, and Hau Lee. 2004. Mitigating supply chain risk through improved confidence. International Journal of Physical Distribution & Logistics Management 34: 388–96. [Google Scholar] [CrossRef]

- Christopher, Martin, and Helen Peck. 2004. Building the Resilient Supply Chain. The International Journal of Logistics Management 15: 1–14. [Google Scholar] [CrossRef]

- Cigolini, Roberto, and Tommaso Rossi. 2010. Managing operational risks along the oil supply chain. Production Planning & Control 21: 452–67. [Google Scholar] [CrossRef]

- Colicchia, Claudia, Richard Wilding, and Fernanda Strozzi. 2012. Supply chain risk management: A new methodology for a systematic literature review. Supply Chain Management: An International Journal 17: 403–18. [Google Scholar] [CrossRef]

- Craighead, Christopher W., Jennifer Blackhurst, M. Johnny Rungtusanatham, and Robert B. Handfield. 2007. The Severity of Supply Chain Disruptions: Design Characteristics and Mitigation Capabilities. Decision Sciences 38: 131–56. [Google Scholar] [CrossRef]

- de Matta, Renato. 2016. Contingency planning during the formation of a supply chain. Annals of Operations Research 257: 45–75. [Google Scholar] [CrossRef]

- Dey, Asoke, Paul LaGuardia, and Mahesh Srinivasan. 2011. Building sustainability in logistics operations: A research agenda. Management Research Review 34: 1237–59. [Google Scholar] [CrossRef]

- Diehl, Doreen, and Stefan Spinler. 2013. Defining a common ground for supply chain risk management—A case study in the fast-moving consumer goods industry. International Journal of Logistics Research and Applications 16: 311–27. [Google Scholar] [CrossRef]

- Dyer, Jeffrey H., and Kentaro Nobeoka. 2000. Creating and managing a high-performance knowledge-sharing network: The Toyota case. Strategic Management Journal 21: 345–67. [Google Scholar] [CrossRef]

- Ellis, Scott C., Raymond M. Henry, and Jeff Shockley. 2010. Buyer perceptions of supply disruption risk: A behavioral view and empirical assessment. Journal of Operations Management 28: 34–46. [Google Scholar] [CrossRef]

- Ellram, Lisa M., and P. Sue Siferd. 1998. Total cost of ownership: A key concept in strategic cost management decisions. Journal of Business Logistics 19: 55. [Google Scholar]

- Fernandes, Leão José, Ana Paula Barbosa-Póvoa, and Susana Relvas. 2011. Supply Chain Risk Management Review and a New Framework for Petroleum Supply Chains. In Quantitative Financial Risk Management. Edited by Dash Wu. Heidelberg: Springer, pp. 227–64. [Google Scholar]

- Fink, Arlene. 1998. Conducting Research Literature Reviews: From Paper to the Internet. Thousand Oaks: Sage Publications. [Google Scholar]

- Fugate, Brian, Funda Sahin, and John T. Mentzer. 2006. Supply Chain Management Coordination Mechanisms. Journal of Business Logistics 27: 129–61. [Google Scholar] [CrossRef]

- Garvey, Myles D., Steven Carnovale, and Sengun Yeniyurt. 2015. An analytical framework for supply network risk propagation: A Bayesian network approach. European Journal of Operational Research 243: 618–27. [Google Scholar] [CrossRef]

- Giunipero, Larry C., and Reham Aly Eltantawy. 2004. Securing the upstream supply chain: A risk management approach. International Journal of Physical Distribution & Logistics Management 34: 698–713. [Google Scholar] [CrossRef]

- Goh, Mark, Joseph Y. S. Lim, and Fanwen Meng. 2007. A stochastic model for risk management in global supply chain networks. European Journal of Operational Research 182: 164–73. [Google Scholar] [CrossRef]

- Gurtu, Amulya, and Jestin Johny. 2019. Potential of blockchain technology in supply chain management: A literature review. International Journal of Physical Distribution & Logistics Management 49: 881–900. [Google Scholar] [CrossRef]

- Gurtu, Amulya, Mohamad Y. Jaber, and Cory Searcy. 2015. Impact of fuel price and emissions on inventory policies. Applied Mathematical Modelling 39: 1202–16. [Google Scholar] [CrossRef]

- Gurtu, Amulya, Cory Searcy, and M. Y. Jaber. 2016. Effects of offshore outsourcing on a nation. Sustainable Production and Consumption 7: 94–105. [Google Scholar] [CrossRef]

- Hachicha, Wafik, and Manel Elmsalmi. 2014. An integrated approach based-structural modeling for risk prioritization in supply network management. Journal of Risk Research 17: 1301–24. [Google Scholar] [CrossRef]

- Handfield, Robert B., and Kevin McCormack. 2008. Supply Chain Risk Management: Minimizing Disruptions in Global Sourcing. New York: Auerbach Publications. [Google Scholar]

- Harland, C. M., R. C. Lamming, H. Walker, W. E. Phillips, N. D. Caldwell, T. E. Johnsen, L. A. Knight, and J. Zheng. 2006. Supply management: Is it a discipline? International Journal of Operations & Production Management 26: 730–53. [Google Scholar] [CrossRef]

- Hayes, Robert H., and Steven C. Wheelwright. 1979. Link manufacturing process and product life cycles. Harvard Business Review 57: 133. [Google Scholar]

- Hendricks, Kevin B., and Vinod R. Singhal. 2003. The effect of supply chain glitches on shareholder wealth. Journal of Operations Management 21: 501–22. [Google Scholar] [CrossRef]

- Hendricks, Kevin B., and Vinod R. Singhal. 2009. An Empirical Analysis of the Effect of Supply Chain Disruptions on Long-Run Stock Price Performance and Equity Risk of the Firm. Production and Operations Management 14: 35–52. [Google Scholar] [CrossRef]

- Huang, H. Y., Y. C. Chou, and S. Chang. 2009. A dynamic system model for proactive control of dynamic events in full-load states of manufacturing chains. International Journal of Production Research 47: 2485–506. [Google Scholar] [CrossRef]

- Hubbard, Douglas W. 2007. How to Measure Anything: Finding the Value of "Intangibles" in Business. Hoboken: John Wiley & Sons. [Google Scholar]

- Hubbard, Douglas W. 2020. The Failure of Risk Management. Hoboken: Wiley. [Google Scholar]

- Jemison, David B. 1987. Risk and the Relationship Among Strategy, Organizational Processes, and Performance. Management Science 33: 1087–101. [Google Scholar] [CrossRef]

- Jüttner, Uta. 2005. Supply chain risk management. The International Journal of Logistics Management 16: 120–41. [Google Scholar] [CrossRef]

- Jüttner, Uta, Helen Peck, and Martin Christopher. 2010. Supply chain risk management: Outlining an agenda for future research. International Journal of Logistics Research and Applications 6: 197–210. [Google Scholar] [CrossRef]

- Khan, Omera, and Bernard Burnes. 2007. Risk and supply chain management: Creating a research agenda. The International Journal of Logistics Management 18: 197–216. [Google Scholar] [CrossRef]

- Kleindorfer, Paul R., and Germaine H. Saad. 2009. Managing Disruption Risks in Supply Chains. Production and Operations Management 14: 53–68. [Google Scholar] [CrossRef]

- Knight, Frank H. 1921. Risk, Uncertainty and Profit. Boston and New York: Houghton Mifflin. [Google Scholar]

- Kouvelis, Panos, and Jian Li. 2008. Flexible Backup Supply and the Management of Lead-Time Uncertainty. Production and Operations Management 17: 184–99. [Google Scholar] [CrossRef]

- Lavastre, Olivier, Angappa Gunasekaran, and Alain Spalanzani. 2012. Supply chain risk management in French companies. Decision Support Systems 52: 828–38. [Google Scholar] [CrossRef]

- Lee, Hau L., and Seungjin Whang. 2005. Higher supply chain security with lower cost: Lessons from total quality management. International Journal of Production Economics 96: 289–300. [Google Scholar] [CrossRef]

- Lucas, Louise. 2013. Diageo overhauls its supply chain. Financial Times, March 11. [Google Scholar]

- Macneil, Ian R. 1978. Contracts: Adjustment of Long-Term Economic Relations under Classical and Neoclassical, and Relational Contract Law. Northwestern University Law Review 72: 854–905. [Google Scholar]

- Manuj, Ila, and John T. Mentzer. 2008. Global supply chain risk management strategies. International Journal of Physical Distribution & Logistics Management 38: 192–223. [Google Scholar] [CrossRef]

- MeInyk, Steven A., Gary L. Ragatz, and George A. Zsidisin. 2005. The dark side of supply chain management. Supply Chain Management Review 9: 46–52. [Google Scholar]

- Mentzer, John T., James S. Keebler, Nancy W. Nix, Carlo D. Smith, and Zach G. Zacharia. 2001. Defining Supply Chain Management. Journal of Business Logistics 22: 1–25. [Google Scholar] [CrossRef]

- Meredith, Jack. 1993. Theory Building through Conceptual Methods. International Journal of Operations & Production Management 13: 3–11. [Google Scholar] [CrossRef]

- Miller, Kent D. 1992. A Framework for Integrated Risk Management in International Business. Journal of International Business Studies 23: 311–31. [Google Scholar] [CrossRef]

- Mingers, John, and Leroy White. 2010. A review of the recent contribution of systems thinking to operational research and management science. European Journal of Operational Research 207: 1147–61. [Google Scholar] [CrossRef]

- Mortimer, L. Downey. 2004. The Challenge of Transportation Security. Supply Chain Management Review 8: 9. [Google Scholar]

- Narasimhan, Ram, and Srinivas Talluri. 2009. Perspectives on risk management in supply chains. Journal of Operations Management 27: 114–18. [Google Scholar] [CrossRef]

- Natarajarathinam, Malini, R. Glenn Richey, Ismail Capar, and Arunachalam Narayanan. 2009. Managing supply chains in times of crisis: A review of literature and insights. International Journal of Physical Distribution & Logistics Management 39: 535–73. [Google Scholar] [CrossRef]

- Norrman, Andreas, and Ulf Jansson. 2004. Ericsson’s proactive supply chain risk management approach after a serious sub-supplier accident. International Journal of Physical Distribution & Logistics Management 34: 434–56. [Google Scholar] [CrossRef]

- Perry, James H. 1991. Emerging Economic and Technological Futures: Implications for Design and Management of Logistics Systems in the 1990s. Journal of Business Logistics 12: 1. [Google Scholar]

- Prasad, Sameer, Rimi Zakaria, and Nezih Altay. 2016. Big data in humanitarian supply chain networks: A resource dependence perspective. Annals of Operations Research 270: 383–413. [Google Scholar] [CrossRef]

- Rao, Shashank, and Thomas J. Goldsby. 2009. Supply chain risks: A review and typology. The International Journal of Logistics Management 20: 97–123. [Google Scholar] [CrossRef]

- Ritchie, Bob, and Clare Brindley. 2007. Supply chain risk management and performance. International Journal of Operations & Production Management 27: 303–22. [Google Scholar] [CrossRef]

- Rodd, Zolkos. 2003. Many companies still ignoring supply-chain risks. Business Insurance 37: 21. [Google Scholar]

- Roloff, Julia, and Michael S. Aßländer. 2010. Corporate Autonomy and Buyer–Supplier Relationships: The Case of Unsafe Mattel Toys. Journal of Business Ethics 97: 517–34. [Google Scholar] [CrossRef]

- Seuring, Stefan, and Martin Müller. 2008. From a literature review to a conceptual framework for sustainable supply chain management. Journal of Cleaner Production 16: 1699–710. [Google Scholar] [CrossRef]

- Sheffi, Yossi. 2001. Supply Chain Management under the Threat of International Terrorism. The International Journal of Logistics Management 12: 1–11. [Google Scholar] [CrossRef]

- Sheffi, Yossi. 2005. Resilient Enterprise Overcoming Vulnerability for Competitive Advantage. Cambridge: The MIT Press. [Google Scholar]

- Sheffi, Yossi, and James B. Rice, Jr. 2005. A Supply Chain View of the Resilient Enterprise. MIT Sloan Management Review 47: 41. [Google Scholar]

- Silva, Juliano, and Surender Reddy. 2011. A framework for reducing disaster risks in supply chains. International Journal of Business Research 11: 112–17. [Google Scholar]

- Slack, Nigel, and Michael Lewis. 2002. Operations Strategy, 3rd ed. Harlow: Prentice-Hall. [Google Scholar]

- Sodhi, ManMohan S., and S. Lee. 2007. An analysis of sources of risk in the consumer electronics industry. J Oper Res Soc 58: 1430–39. [Google Scholar] [CrossRef] [PubMed]

- Sodhi, ManMohan S., Byung-Gak Son, and Christopher S. Tang. 2012. Researchers’ Perspectives on Supply Chain Risk Management. Production and Operations Management 21: 1–13. [Google Scholar] [CrossRef]

- Sofyalıoğlu, Çiğdem, and Burak Kartal. 2012. The Selection of Global Supply Chain Risk Management Strategies by Using Fuzzy Analytical Hierarchy Process—A Case from Turkey. Procedia—Social and Behavioral Sciences 58: 1448–57. [Google Scholar] [CrossRef]

- Spekman, Robert E., and Edward W. Davis. 2004. Risky business: Expanding the discussion on risk and the extended enterprise. International Journal of Physical Distribution & Logistics Management 34: 414–33. [Google Scholar] [CrossRef]

- Tang, Christopher S. 2007. Robust strategies for mitigating supply chain disruptions. International Journal of Logistics Research and Applications 9: 33–45. [Google Scholar] [CrossRef]

- Tang, Ou, and S. Nurmaya Musa. 2011. Identifying risk issues and research advancements in supply chain risk management. International Journal of Production Economics 133: 25–34. [Google Scholar] [CrossRef]

- Teigen, Karl Halvor. 1996. Risk-taking behavior, J. Frank Yates (ed.), Chichester: John Wiley, 1992, 345 pp., ISBN 0-471-92250-1, (hc), ISBN 0-471-95140-4 (pb). Journal of Behavioral Decision Making 9: 73–74. [Google Scholar] [CrossRef]

- Thun, Jörn-Henrik, Martin Drüke, and Daniel Hoenig. 2011. Managing uncertainty—An empirical analysis of supply chain risk management in small and medium-sized enterprises. International Journal of Production Research 49: 5511–25. [Google Scholar] [CrossRef]

- Vahid Nooraie, S., and Mahour Mellat Parast. 2016. Mitigating supply chain disruptions through the assessment of trade-offs among risks, costs and investments in capabilities. International Journal of Production Economics 171: 8–21. [Google Scholar] [CrossRef]

- Vanany, Iwan, Suhaiza Zailani, and Nyoman Pujawan. 2009. Supply Chain Risk Management: Literature Review and Future Research. International Journal of Information Systems and Supply Chain Management 2: 16–33. [Google Scholar] [CrossRef]

- Verbano, Chiara, and Karen Venturini. 2011. Development paths of risk management: Approaches, methods and fields of application. Journal of Risk Research 14: 519–50. [Google Scholar] [CrossRef]

- Véronneau, Simon, and Jacques Roy. 2014. Security at the source: Securing today’s critical supply chain networks. Journal of Transportation Security 7: 359–71. [Google Scholar] [CrossRef]

- Vorst, Jack G. A. J., Andrie J. M. Beulens, W. Wit, and Paul Beek. 1998. Supply Chain Management in Food Chains: Improving Performance by Reducing Uncertainty. International Transactions in Operational Research 5: 487–99. [Google Scholar] [CrossRef]

- Wagner, Stephan M., and Christoph Bode. 2006. An empirical investigation into supply chain vulnerability. Journal of Purchasing and Supply Management 12: 301–12. [Google Scholar] [CrossRef]

- Wang, Xihui, Yunfei Wu, Liang Liang, and Zhimin Huang. 2014. Service outsourcing and disaster response methods in a relief supply chain. Annals of Operations Research 240: 471–87. [Google Scholar] [CrossRef]

- Williams, Zachary, Matthew Waller, Jason E. Lueg, and Stephen A. LeMay. 2008. Supply chain security: An overview and research agenda. The International Journal of Logistics Management 19: 254–81. [Google Scholar] [CrossRef]

- Williamson, Oliver E. 1979. Transaction-Cost Economics: The Governance of Contractual Relations. The Journal of Law and Economics 22: 233–61. [Google Scholar] [CrossRef]

- Wilson, Martha C. 2007. The impact of transportation disruptions on supply chain performance. Transportation Research Part E: Logistics and Transportation Review 43: 295–320. [Google Scholar] [CrossRef]

- Wu, Ing-Long, Cheng-Hung Chuang, and Chien-Hua Hsu. 2014. Information sharing and collaborative behaviors in enabling supply chain performance: A social exchange perspective. International Journal of Production Economics 148: 122–32. [Google Scholar] [CrossRef]

- Xanthopoulos, Anastasios, Dimitrios Vlachos, and Eleftherios Iakovou. 2012. Optimal newsvendor policies for dual-sourcing supply chains: A disruption risk management framework. Computers & Operations Research 39: 350–57. [Google Scholar] [CrossRef]

- Xu, Jie, Jun Zhuang, and Zigeng Liu. 2015. Modeling and mitigating the effects of supply chain disruption in a defender–attacker game. Annals of Operations Research 236: 255–70. [Google Scholar] [CrossRef]

- Zsidisin, George A. 2003. A grounded definition of supply risk. Journal of Purchasing and Supply Management 9: 217–24. [Google Scholar] [CrossRef]

| Authors | Definitions |

|---|---|

| Bogataj and Bogataj (2007) | “The potential variation of outcomes that influence the decrease [in] value added at any activity cell in a chain.” |

| Wagner and Bode (2006) | “The negative deviation from the expected value of a certain performance measure, resulting in negative consequences for the focal firm.” |

| Norrman and Jansson (2004) | “To collaborate with partners in a supply chain apply risk management process tools to deal with risks and uncertainties caused by, or impacting on, logistics related activities or resources.” |

| Tang (2007) | “The management of supply chain risks through coordination or collaboration among the supply chain partners so as to ensure profitability and continuity.” |

| Jüttner (2005), Jüttner et al. (2010) | “The identification and management of risks for the supply chain, through a coordinated approach amongst supply chain members, to reduce supply chain vulnerability as a whole.” |

| Goh et al. (2007) | “The identification and management of risks within the supply network and externally through a coordinated approach amongst supply chain members to reduce supply chain vulnerability as a whole.” |

| Thun et al. (2011) | “Characterized by a cross-company orientation aiming at the identification and reduction [in] risks not only at the company level, but rather focusing on the entire supply chain.” |

| Jüttner et al. (2010) | “Any risks for the information, material and product flows from original suppliers to the delivery of the final product for the end user.” |

| Ellis et al. (2010) | “An individual’s perception of that total potential loss associated with the disruption of supply chain of a particular item from a particular supplier.” |

| Zsidisin (2003) | “The probability of an incident associated with inbound supply from individual supplier failures or the supply market, occurring, in which its outcomes result in the inability of the purchasing firm to meet customer demand or cause threats to customer life and safety.” |

| Authors | Research Methodology | Key Findings/Contributions |

|---|---|---|

| Jüttner et al. (2010) | Focus group discussions, interviews, and statistical analyses. | Developed four basic conceptual constructs around risks |

| Khan and Burnes (2007) | Literature review | There is a need for analytical models |

| Natarajarathinam et al. (2009) | Literature review | Management of disruptions for rapid recovery needs improvements. |

| Rao and Goldsby (2009) | Literature review | Classification of risks into environmental, industry, and organizational risks |

| Tang and Nurmaya Musa (2011) | Literature survey and bibliographic analysis | There is a need for quantitative modeling in SCRM |

| Vanany et al. (2009) | Literature review from 2000 to 2007 | Entreprise Resource Planning (ERP) will become a vital tool in SCRM. There is a need for collaborative strategies in SCM. |

| Williams et al. (2008) | Literature review | The authors built theories by working on the different categories of literature in SCM. However, they also stressed quantitative assessments for a better understanding of SCRM. |

| Document Type | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | 2018 | 2019 | Total |

|---|---|---|---|---|---|---|---|---|---|---|---|

| Non-ABDC Journals | |||||||||||

| Article | 6 | 11 | 12 | 8 | 17 | 15 | 15 | 11 | 22 | 22 | 139 |

| Case Study | 1 | 1 | 2 | ||||||||

| Opinion | 1 | 1 | |||||||||

| Interview | 1 | 1 | |||||||||

| Non-ABDC Total | 6 | 11 | 12 | 9 | 17 | 16 | 16 | 11 | 23 | 22 | 143 |

| ABDC Journals | |||||||||||

| Article | 14 | 14 | 26 | 21 | 36 | 26 | 32 | 35 | 45 | 52 | 303 |

| Case Study | 1 | 1 | 1 | 1 | 1 | 2 | 2 | 9 | |||

| ABDC Total | 14 | 15 | 27 | 22 | 37 | 27 | 34 | 37 | 45 | 52 | 312 |

| Overall Total | 20 | 26 | 39 | 31 | 54 | 43 | 50 | 48 | 68 | 74 | 455 |

| Journal Name | No. of Publications |

|---|---|

| International Journal of Production Economics | 41 |

| International Journal of Production Research | 31 |

| Journal of Cleaner Production | 19 |

| Computers and Industrial Engineering | 19 |

| European Journal of Operational Research | 13 |

| Benchmarking: An International Journal | 11 |

| Industrial Management and Data Systems | 10 |

| Number of Papers Published | Number of Journals | Number of Papers in These Journals |

|---|---|---|

| More than 10 | 6 | 134 |

| 10 | 1 | 10 |

| 9 | 1 | 9 |

| 8 | 2 | 16 |

| 7 | 1 | 7 |

| 6 | 3 | 18 |

| 5 | 3 | 15 |

| 4 | 3 | 12 |

| 3 | 11 | 33 |

| 2 | 7 | 14 |

| 1 | 44 | 44 |

| Total | 82 | 312 |

| Publisher | No. of Articles | % |

|---|---|---|

| Elsevier B.V. | 130 | 41.67 |

| Emerald Publishing | 61 | 19.55 |

| Taylor & Francis Ltd. | 53 | 16.99 |

| Wiley-Blackwell | 31 | 9.94 |

| Springer Nature | 9 | 2.88 |

| INFORMS: Institute for Operations Research | 5 | 1.60 |

| Aspen Publishers Inc. | 3 | 0.96 |

| Pennsylvania State University Press | 3 | 0.96 |

| IGI Global | 2 | 0.64 |

| American Society of Civil Engineers | 2 | 0.64 |

| Wageningen Academic Publishers | 2 | 0.64 |

| American Accounting Association | 1 | 0.32 |

| Adonis & Abbey Publishers Ltd. | 1 | 0.32 |

| Palgrave Macmillan Ltd. | 1 | 0.32 |

| Food Distribution Research Society | 1 | 0.32 |

| Sloan Management Review | 1 | 0.32 |

| Global Academy of Training & Research (GATR) Enterprise | 1 | 0.32 |

| IEEE | 1 | 0.32 |

| Kluwer Law International | 1 | 0.32 |

| Global Business Publications | 1 | 0.32 |

| Academic Press Inc. | 1 | 0.32 |

| Harvard University | 1 | 0.32 |

| Total | 312 | 100 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Gurtu, A.; Johny, J. Supply Chain Risk Management: Literature Review. Risks 2021, 9, 16. https://doi.org/10.3390/risks9010016

Gurtu A, Johny J. Supply Chain Risk Management: Literature Review. Risks. 2021; 9(1):16. https://doi.org/10.3390/risks9010016

Chicago/Turabian StyleGurtu, Amulya, and Jestin Johny. 2021. "Supply Chain Risk Management: Literature Review" Risks 9, no. 1: 16. https://doi.org/10.3390/risks9010016

APA StyleGurtu, A., & Johny, J. (2021). Supply Chain Risk Management: Literature Review. Risks, 9(1), 16. https://doi.org/10.3390/risks9010016