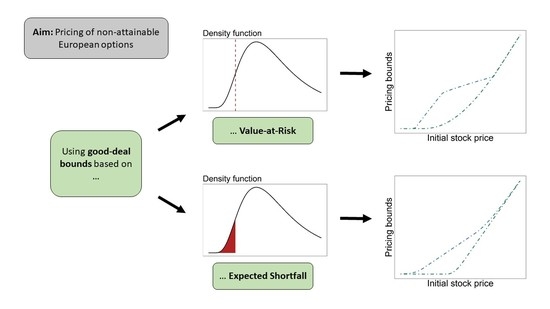

Good-Deal Bounds for Option Prices under Value-at-Risk and Expected Shortfall Constraints

Abstract

1. Introduction

2. Multi-Asset Risk Measures

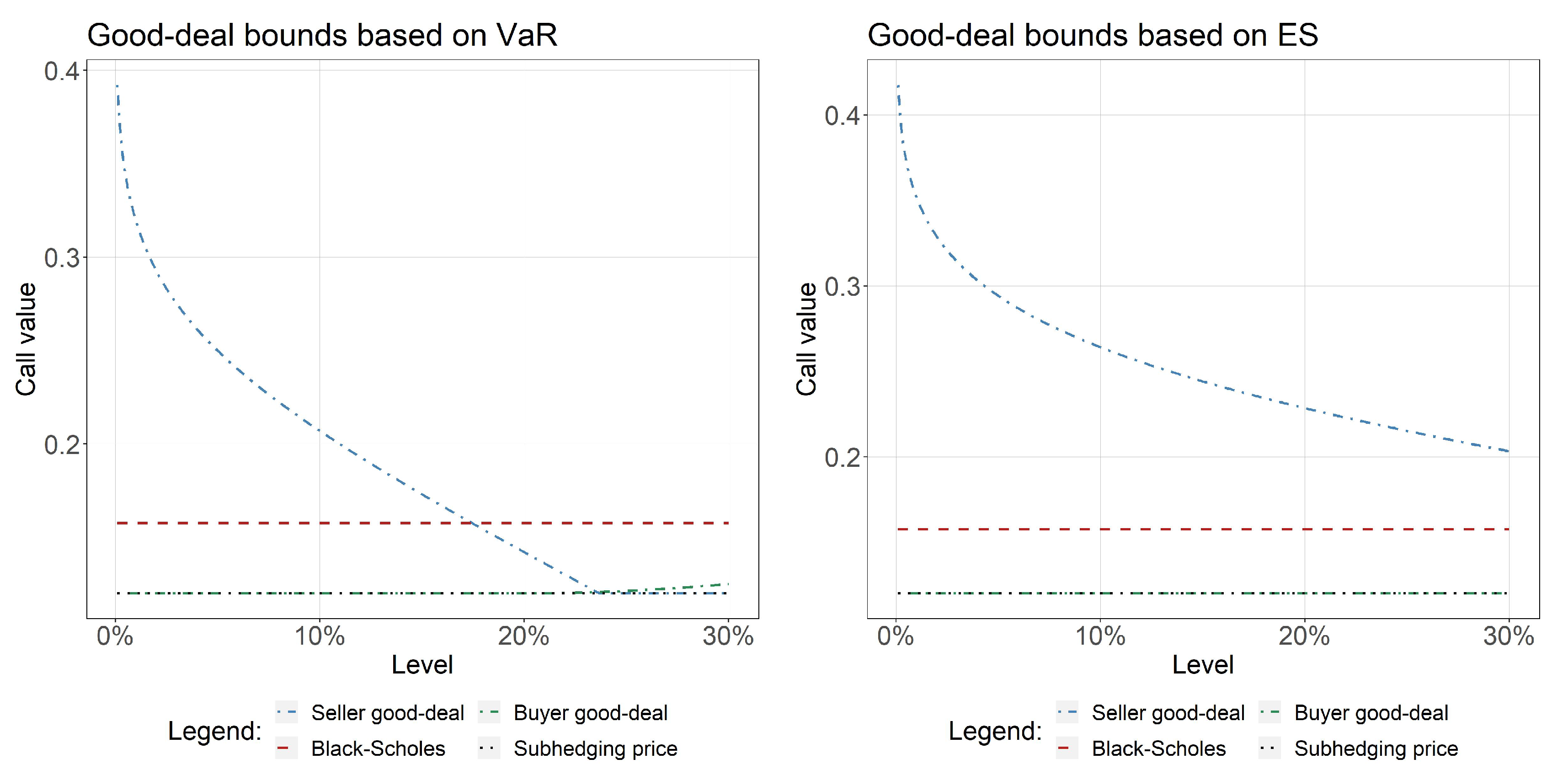

2.1. Financial Market

- (i)

- The market is incomplete.

- (ii)

- A European call option with strike is not attainable.

2.2. Acceptance Sets

- (i)

- Finiteness at 0:.

- (ii)

- Monotonicity:For all s.t. -a.s. it holds .

- (iii)

- Cash invariance:For all and it holds .

- (iv)

- Convexity:For all and it holds .

- (v)

- Positive homogeneity:For all and it holds .

- (i)

- The Value-at-Risk (VaR) for a random variable at level is defined by . We obtain the following expression for it:The VaR acceptance setis a cone, but not a convex set in general.

- (ii)

- The Expected Shortfall (ES) with level is defined for a random variable by . The corresponding acceptance setis a convex cone.

2.3. Multi-Asset Risk Measures

- (i)

- is decreasing.

- (ii)

- is -additive, that is, for all and all the translation property holds.

- (iii)

- If is convex, then is convex, that is, the epigraph is convex.

- (iv)

- If is a cone, then is positively homogeneous, that is, the epigraph is a cone.

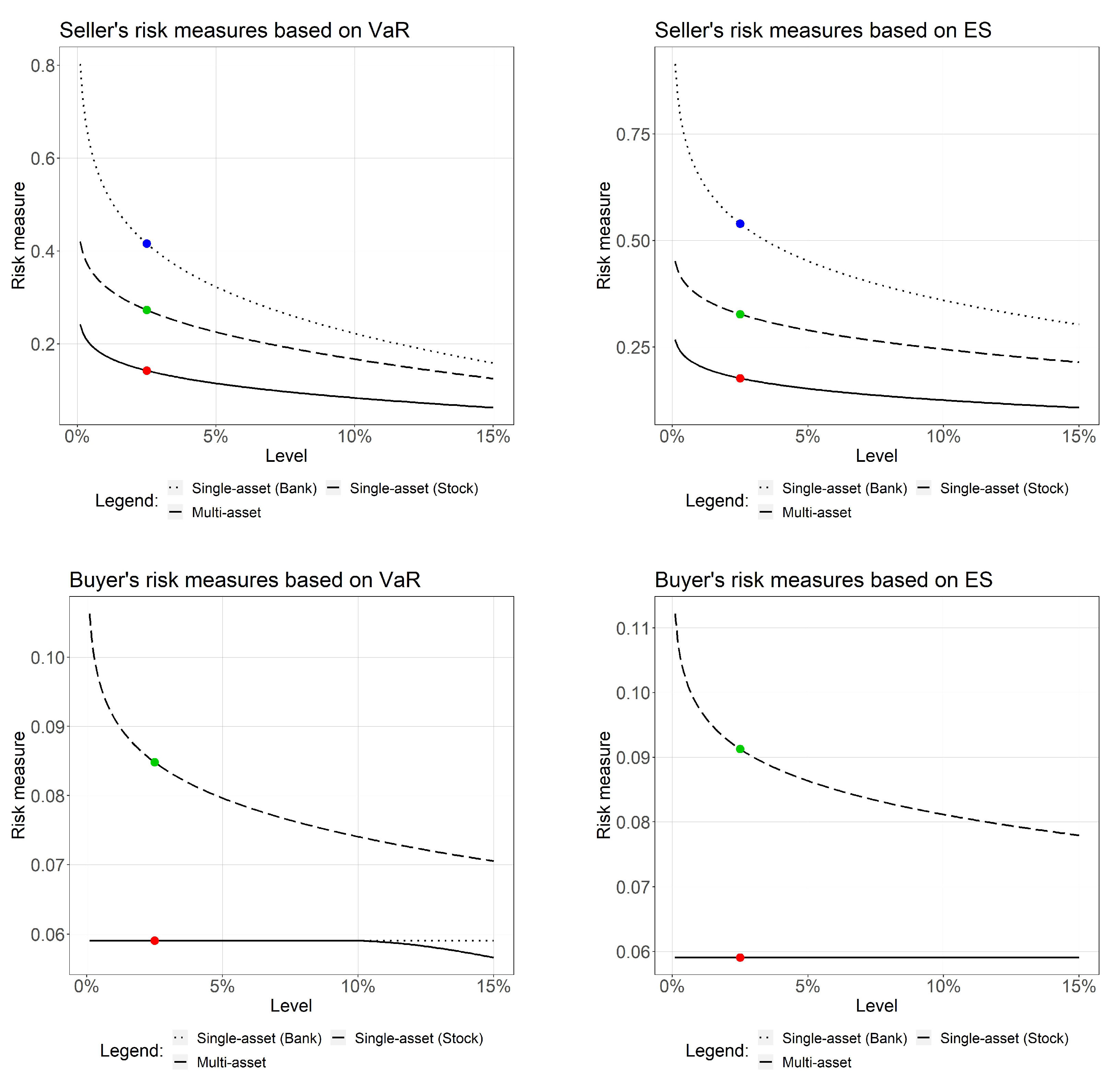

3. Hedging with Multi-Asset Risk Measures

3.1. Representation and Absence of Acceptability Arbitrage

- (i)

- Consider a level , initial prices , zero interest rate and . In such a model, VaR leads to acceptability arbitrage opportunities, while ES does not.

- (ii)

- Assume that there are more risky assets in the market. In an analog manner to the proof of Theorem 1 we could show that the multi-asset risk measure of the zero payoff is zero iff for every point in the unit sphere it holds that . Furthermore, we obtain a representation result by taking the infimum over all elements in and replacing products with the scalar product in (9) if necessary.

3.2. Value-at-Risk and Expected Shortfall

- (i)

- is finite.

- (ii)

- is lower semicontinuous.

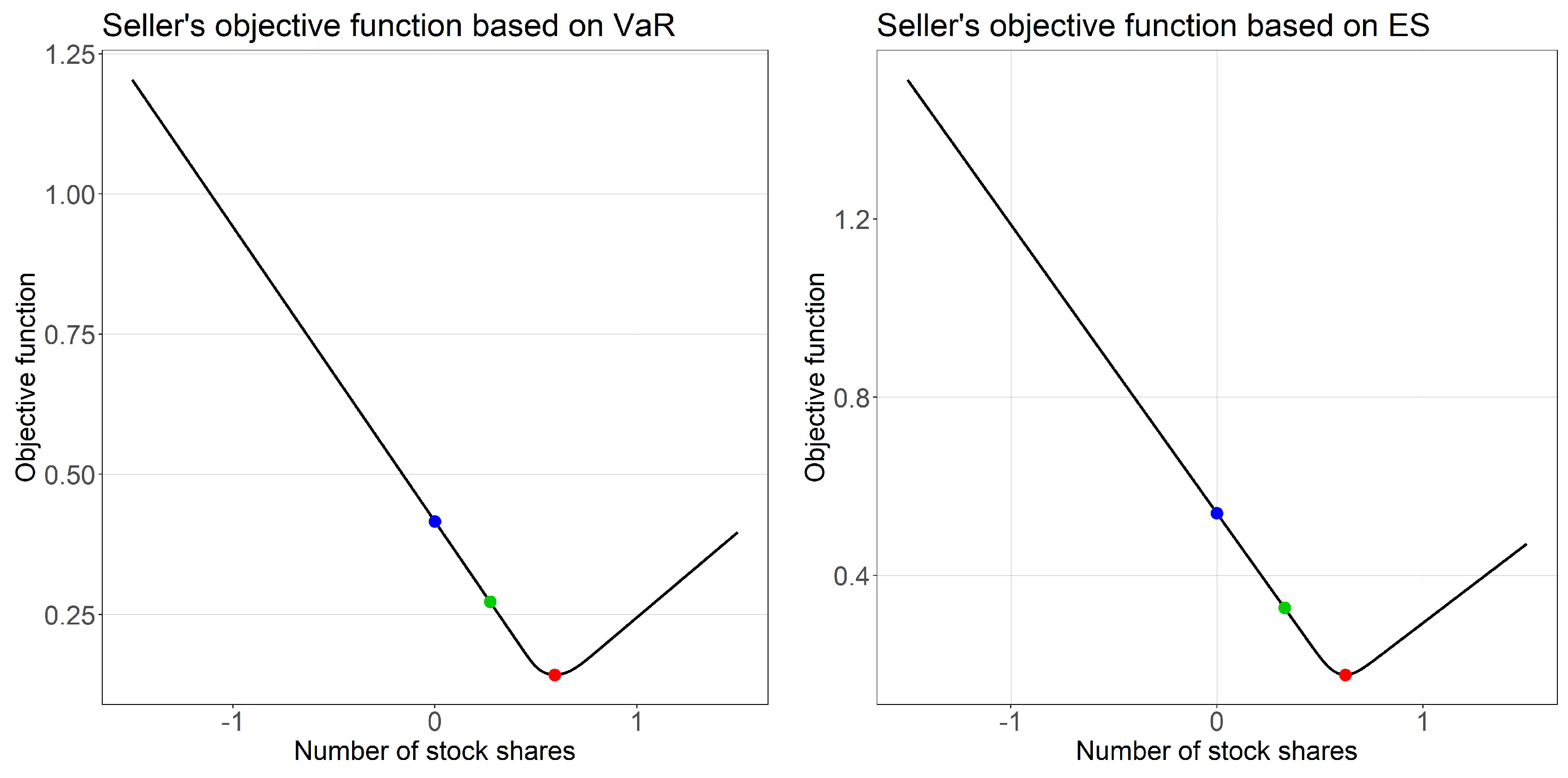

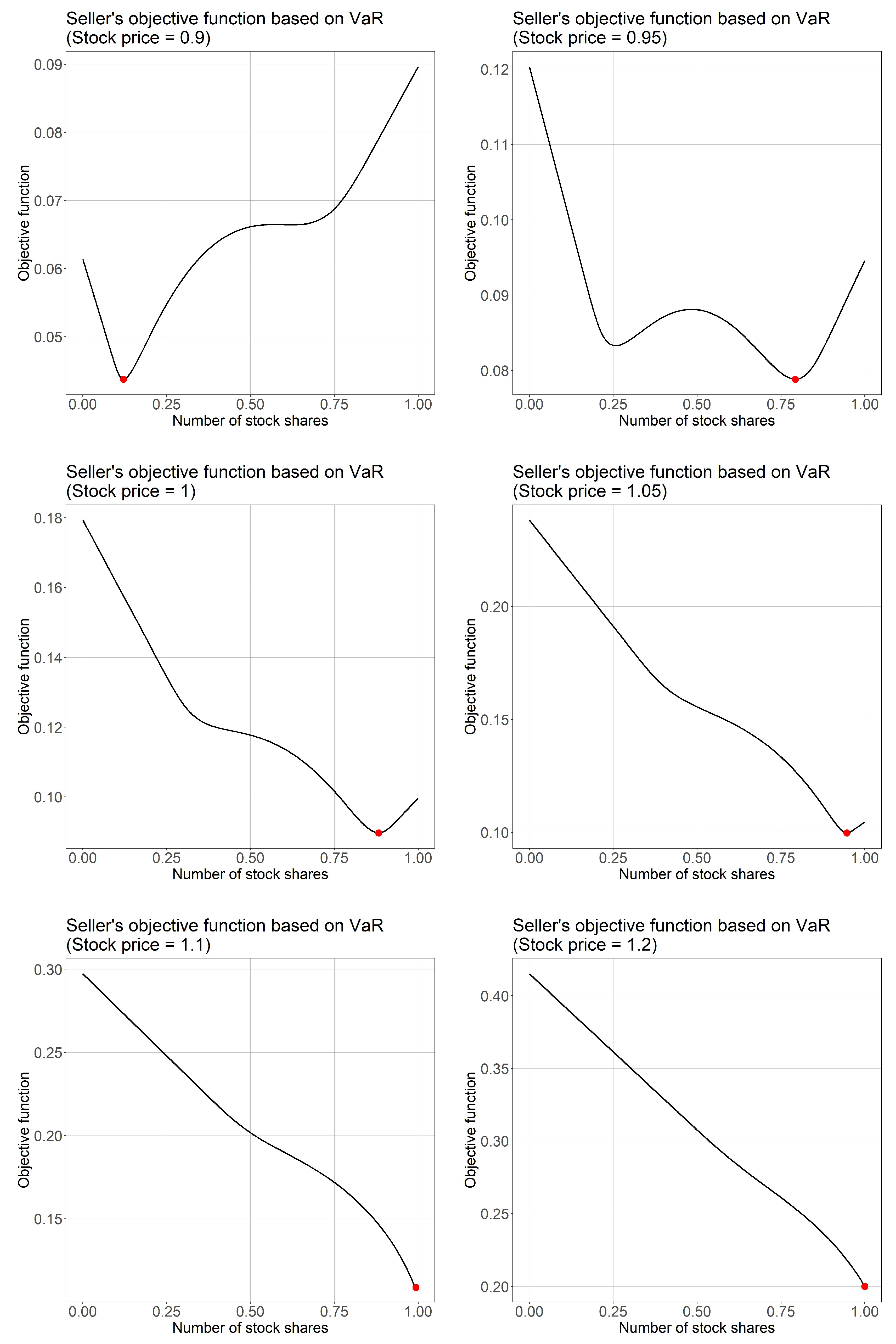

3.3. European Options

- (i)

- The expression in the infimum in (13) admits a clear interpretation. For a number φ of stocks, we end up with a new position which is influenced by stochastic risk in , more precisely this position is . The discounted risk of this position is the investment into the bank account.

- (ii)

- The condition of comonotonicity is among others fulfilled for VaR and ES risk measures.

- (iii)

- The risk measures for a European put option could be easily determined by using the put-call parity and Theorem 3.

4. Pricing with Multi-Asset Risk Measures

4.1. Good-Deals of the First Kind

- (i)

- In a financial market model with multiple stocks the absence of good-deals of the first kind is equivalent to the condition that for each it holds that .

- (ii)

- Lemma 4 shows that in our model the absence of good-deals of the first kind implies the absence of acceptability arbitrage, since (16) implies (10) which by Theorem 1 is equivalent to the absence of acceptability arbitrage opportunities. But this is not true in general, as the subsequent counterexample shows.

4.2. Good-Deal Bounds for Option Prices

4.3. Limiting Behavior

- It becomes more likely that the option is exercised, resulting in a loss for the seller.

- Higher losses for the seller become more probable.

5. Extension of the Basis Market

5.1. Duality Relations

5.2. Failure of the Extension Theorem

6. Conclusions and Outlook

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

References

- Aliprantis, Charalambos D., and Kim C. Border. 2006. Infinite Dimensional Analysis: A Hitchhiker’s Guide, 3rd ed. Berlin and Heidelberg: Springer. [Google Scholar] [CrossRef]

- Arai, Takuji. 2011. Good Deal Bounds Induced by Shortfall Risk. SIAM Journal on Financial Mathematics 2: 1–21. [Google Scholar] [CrossRef]

- Arai, Takuji, and Masaaki Fukasawa. 2014. Convex Risk Measures for Good Deal Bounds. Mathematical Finance 24: 464–84. [Google Scholar] [CrossRef][Green Version]

- Artzner, Philippe, Freddy Delbaen, Jean-Marc Eber, and David Heath. 1999. Coherent Measures of Risk. Mathematical Finance 9: 203–28. [Google Scholar] [CrossRef]

- Artzner, Philippe, Freddy Delbaen, and Pablo Koch-Medina. 2009. Risk Measures and Efficient use of Capital 1. ASTIN Bulletin: The Journal of the IAA 39: 101–16. [Google Scholar] [CrossRef]

- Baes, Michel, Pablo Koch-Medina, and Cosimo Munari. 2020. Existence, uniqueness, and stability of optimal payoffs of eligible assets. Mathematical Finance 30: 128–66. [Google Scholar] [CrossRef]

- Bernardo, Antonio E., and Olivier Ledoit. 2000. Gain, Loss, and Asset Pricing. Journal of Political Economy 108: 144–72. [Google Scholar] [CrossRef]

- Björk, Tomas, and Irina Slinko. 2006. Towards a General Theory of Good-Deal Bounds. Review of Finance 10: 221–60. [Google Scholar] [CrossRef]

- Carr, Peter, Helyette Geman, and Dilip B. Madan. 2001. Pricing and hedging in incomplete markets. Journal of Financial Economics 62: 131–67. [Google Scholar] [CrossRef]

- Cheridito, Patrick, and Tianhui Li. 2009. Risk Measures on Orlicz Hearts. Mathematical Finance 19: 189–214. [Google Scholar] [CrossRef]

- Cochrane, John H., and Jesus Saa-Requejo. 2000. Beyond Arbitrage: Good-Deal Asset Price Bounds in Incomplete Markets. Journal of Political Economy 108: 79–19. [Google Scholar] [CrossRef]

- Cox, John C., Stephen A. Ross, and Mark Rubinstein. 1979. Option pricing: A simplified approach. Journal of Financial Economics 7: 229–63. [Google Scholar] [CrossRef]

- Farkas, Walter, Pablo Koch-Medina, and Cosimo Munari. 2014. Beyond cash-additive risk measures: When changing the numéraire fails. Finance and Stochastics 18: 145–73. [Google Scholar] [CrossRef]

- Farkas, Walter, Pablo Koch-Medina, and Cosimo Munari. 2015. Measuring risk with multiple eligible assets. Mathematics and Financial Economics 9: 3–27. [Google Scholar] [CrossRef]

- Föllmer, Hans, and Alexander Schied. 2016. Stochastic Finance: An Introduction in Discrete Time. Berlin and Boston: Walter de Gruyter. [Google Scholar]

- Geissel, Sebastian, Jörn Sass, and Frank Thomas Seifried. 2018. Optimal expected utility risk measures. Statistics & Risk Modeling 35: 73–87. [Google Scholar] [CrossRef]

- Jaschke, Stefan, and Uwe Küchler. 2001. Coherent risk measures and good-deal bounds. Finance and Stochastics 5: 181–200. [Google Scholar] [CrossRef]

- Larsen, Kasper, Traian A. Pirvu, Steven E. Shreve, and Reha Tütüncü. 2005. Satisfying convex risk limits by trading. Finance and Stochastics 9: 177–95. [Google Scholar] [CrossRef]

- Liebrich, Felix-Benedikt, and Gregor Svindland. 2017. Model spaces for risk measures. Insurance: Mathematics and Economics 77: 150–65. [Google Scholar] [CrossRef]

- Liebrich, Felix-Benedikt, and Gregor Svindland. 2019. Risk sharing for capital requirements with multidimensional security markets. Finance and Stochastics 23: 925–73. [Google Scholar] [CrossRef]

- Munari, Cosimo-Andrea. 2015. Measuring Risk Beyond the Cash-Additive Paradigm. Ph.D. Thesis, ETH Zurich, Zurich, Switzerland. [Google Scholar]

- R Core Team. 2020. R: A Language and Environment for Statistical Computing. Vienna: R Foundation for Statistical Computing. [Google Scholar]

- Scandolo, Giacomo. 2004. Models of Capital Requirements in Static and Dynamic Settings. Economic Notes 33: 415–35. [Google Scholar] [CrossRef]

- Staum, Jeremy. 2004. Fundamental Theorems of Asset Pricing for Good Deal Bounds. Mathematical Finance 14: 141–61. [Google Scholar] [CrossRef]

- Wang, Ruodu, and Ričardas Zitikis. 2020. An Axiomatic Foundation for the Expected Shortfall. Management Science. Published online in Articles in Advance 14 Sepertember 2020. [Google Scholar] [CrossRef]

- Černý, Aleš. 2003. Generalised Sharpe Ratios and Asset Pricing in Incomplete Markets. Review of Finance 7: 191–233. [Google Scholar] [CrossRef]

- Černý, Aleš, and Stewart Hodges. 2002. The Theory of Good-Deal Pricing in Financial Markets. In Mathematical Finance—Bachelier Congress 2000: Selected Papers from the First World Congress of the Bachelier Finance Society, Paris, June 29–July 1, 2000. Edited by Hélyette Geman, Dilip Madan, Stanley R. Pliska and Ton Vorst. Finance, Berlin and Heidelberg: Springer, pp. 175–202. [Google Scholar] [CrossRef]

| 1. | For comonotonic risk measures we refer to (Föllmer and Schied 2016, Section 4.7). |

| 2. | Let K be a convex set of claims disjoint from the origin. It is called boundedly generated if there exists a closed bounded subset s.t. any point in K can be regarded as a scalar multiple of a point in B, see (Černý and Hodges 2002, Definition 2.2). |

| 3. | Nevertheless, the VaR acceptance set is closed in , see (Munari 2015, Proposition 2.4.5). |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Desmettre, S.; Laudagé, C.; Sass, J. Good-Deal Bounds for Option Prices under Value-at-Risk and Expected Shortfall Constraints. Risks 2020, 8, 114. https://doi.org/10.3390/risks8040114

Desmettre S, Laudagé C, Sass J. Good-Deal Bounds for Option Prices under Value-at-Risk and Expected Shortfall Constraints. Risks. 2020; 8(4):114. https://doi.org/10.3390/risks8040114

Chicago/Turabian StyleDesmettre, Sascha, Christian Laudagé, and Jörn Sass. 2020. "Good-Deal Bounds for Option Prices under Value-at-Risk and Expected Shortfall Constraints" Risks 8, no. 4: 114. https://doi.org/10.3390/risks8040114

APA StyleDesmettre, S., Laudagé, C., & Sass, J. (2020). Good-Deal Bounds for Option Prices under Value-at-Risk and Expected Shortfall Constraints. Risks, 8(4), 114. https://doi.org/10.3390/risks8040114