Abstract

This paper aims to identify the determinants and predictors of Small and Medium-sized Enterprises (SMEs)’ financial failure. Within this framework, we have opted for a quantitative method based on a sample of healthy and failing SMEs of a Moroccan bank. The main results of the different optimal models are obtained by the stepwise method of estimating logistic regression. These results show, in a normal economic context, that the variables that discriminate between healthy and failing SMEs are the main predictors of financial failure. Autonomy ratio, interest to sales, asset turnover, days in accounts receivable, and duration of trade payables are the variables that increase the probability of financial failure, while repayment capacity and return on assets reduce the probability of failure. These variables present an overall classification rate of healthy and failing SMEs of 91.11% three years before failure and of 84.44% two years and one year before failure.

1. Introduction

Business failure is a complex phenomenon. It has attracted the attention of researchers since the beginning of the 20th century with the first studies held by (Fitzpatrick 1932). Globally, the works on business failure can be economic, financial, strategic, organizational and managerial. Casta and Zerbib (1979) gave three definitions of business failure. In the legal sense, failure concerns the action of filing for bankruptcy due to an insolvency situation. In the economic sense, it is characterized by deterioration in the profitability and assets of the firm. In the financial sense, the failure relates to cash flow problems (the available assets of the company cannot meet its liabilities).

Failure does not occur suddenly; it is a process that extends over several stages, and the origin of which varies from one company to another. Signs of failure that the company gives to its stakeholders can first be through financial data. Second, lack of concern can be a factor that may lead the company at any time to the spiral of failure that follows the following chain of events: an unbalanced financial structure, deterioration in liquidity and solvency. Such a situation can only lead lenders to limit their support and to be more distrustful (Crutzen and Van Caillie 2007). In this study, we will define and analyze the situation of Moroccan Small and Medium-sized Enterprises (SMEs)1 in relation to failure from a financial point of view.

SMEs form the basis of the Moroccan economy. According to the latest survey conducted by the Haut-Commissariat au Plan (HCP)2, whose results are published in 2019, the share of Very Small and Medium-sized Business (VSMB) accounts for 93% of all companies in Morocco. A total of 7% is Large Business (LB), 29% is represented by SMEs, and 64% is accounted for by Very Small Business (VSB). However, the participation of SMEs in Gross Domestic Product (GDP) remains very limited (20%), which reflects the number of challenges faced by this category of companies, the ones that can have a negative impact on their potential for development and innovation.

Against this backdrop, business failure in Morocco increased by 5.1% in 2019. Indeed, the year 2019 ended with the bankruptcy of 8439 companies (Euler Hermes 2019). According to Inforisk (2020), there is a correlation between longer payment terms and business failures. As a result, it is the leading cause of business mortality in 40% of cases. VSBs accounted for 98.7% of businesses failing in 2019 and are, therefore, the first victims of payment delays with an average delay of 7 months. More specifically, business failure is concentrated in Morocco’s major cities: Casablanca (30%), Rabat-Salé-Kenitra (14%), Tangier-Assilah (8%) and Fez (5%). In regard to sectors of activity, the failure record is dominated by three sectors: trade (35%), real estate (21%) and construction (15%).

In the face of this alarming situation, it is necessary to determine which variables can explain the failure of Moroccan SMEs. However, there is a major lack of agreement among researchers on the variables that determine and predict SME failure. In recent years, financial and legal approaches have attracted considerable interest. However, there is a need to clarify which variables play the most influential role in predicting and determining the failure of Moroccan SMEs. In this sense, the present article attempts to contribute to filling this gap by providing empirical answers to this problem while focusing on the financial approach. Thus, the empirical analysis is based on two basic elements.

- First, we adopted a financial approach to define business failure. In the Moroccan context, we have retained the official definition of Bank Al-Maghrib that enabled us to build a sample of 90 SMEs located in the Fez-Meknes region, 45 of which are considered to be failing in 2019 and 45 of which are considered healthy, with a Moroccan bank. The data are thus collected in such a way that accounting data are available for three successive years, 2016, 2017, and 2018.

- Second, on these collected data, we used an econometric model of logistic regression that is applied to determine, on the one hand, the determinants of business failure and, on the other hand, the predictors of business failure. The empirical study used has the advantage of incorporating certain variables related to the context of the study. These variables are selected solely on their capacity to explain and predict the financial failure of Moroccan SMEs without depending on a theoretical approach.

This study contributes to the literature in three ways. First, and in the context of advanced regionalization in Morocco, this study is part of the exploration of the economic model of the Fez-Meknes region, and to the best of our knowledge, there is no published work on corporate failure in this region (a central region in Morocco known for its economic specificities). Second, our study proposes to integrate specific variables related to the context of the study. Third, unlike most research in the field, our study shows that the best horizon for predicting financial distress is three years before failure.

The remaining of the paper is organized as follows: Section 2 presents the relevant literature review on corporate financial failure. In Section 3, the article describes the data and methodology of the empirical study. Section 4 is dedicated to presenting the empirical results. Finally, Section 5 and Section 6 present discussion and conclusions.

2. Literature Review

The determinants and predictors of SMEs’ business failure can be classified into two broad categories: those that are related to the firm’s ability to meet its short- or long-term debts (liquidity and solvency ratios), and those that are related to the firm’s ability to generate profit (profitability ratios).

For liquidity ratios, they assess the company’s ability to repay its short-term debts when they become due (Pompe and Bilderbeek 2005; Refait-Alexandre 2004). The absence of liquidity over time generates a default situation since the firm is unable to pay its creditors (Charalambous et al. 2000). On a sample of 74 Finnish companies, Back et al. (1996) find that liquidity is the most important factor in prediction of business failure, and that the introduction of liquidity variables reduced the misclassification rate over three years prior to business failure. Bunn and Redwood (2003) add that current ratio reduces the probability of business failure and is one of the key variables for measuring liquidity. In a systematic review of 103 bankruptcy prediction models developed in the Visegrad group countries between 1993 and 2018, Kovacova et al. (2019) confirm that current ratio, a liquidity variable, is the most used in these countries.

As for solvency ratios, they make it possible to assess a firm’s ability to cover all its debts (Cayssials et al. 2007). According to Pindado and Rodrigues (2004), banks are increasingly interested in firms’ solvency and, more specifically, their equity. According to the same authors, a preventive diagnosis of companies’ financial failure can be made with a small set of solvency variables. Using the multiple regression analysis, Valaskova et al. (2018) identify working capital and the ratio of working capital to total assets as one of the best predictors of the financial health of Slovak companies over the period 2015–2016. On two panels of healthy and failing firms between 1986 and 1990, Blazy et al. (1993) show that the financial difficulties of French firms appear several years in advance and that it is preferable for a firm to have positive working capital to avoid insolvency situation. If a firm’s financial equilibrium is not maintained, its survival may be jeopardized (Altman 1984; Gilbert et al. 1990).

With respect to activity and profitability ratios, several studies have shown that declining activity and profitability ratios are one of the main factors leading to firm failure. As a follow-up to Argenti’s studies (Argenti 1976) on the failure paths, Crutzen and Van Caillie (2007) have tried to propose a unifying model of the chain of failure factors for the company and show that a negative growth in the firm’s turnover is considered to be the first warning sign that the firm is bankrupt and may subsequently become insolvent owing to a lack of liquidity. In terms of profitability, Altman (1968) retained five ratios in the final discriminant function (Z-score) with a large contribution from the profitability ratios, which are retained earnings to total assets, earnings before interest, and taxes to total assets. Geng et al. (2015) suggest that profitability indicators such as return on assets and net profit margin of total assets play an important role in the early prediction of Chinese corporate failures. On a sample of 104 Iranian companies listed on the stock exchange, Ramezani Sharifabadi et al. (2017) propose that profitability ratios, namely operating profit to total assets and current assets to total assets, reduce the probability of SMEs’ corporate failure. Kamaluddin et al. (2019) show that profitability ratios have a negative impact on the financial distress of Malaysian companies. In the same vein, declining profitability increases the likelihood of corporate financial failure and leads banks becoming more reluctant to make lending decisions (Sung et al. 1999).

In light of this literature review, it appears that there is no consensus on the financial ratios that determine business failure. Indeed, the determinants of bankruptcy are not exhaustive, and they differ according to the specificities of each context.

The prediction of financial failure is a topical issue that has been studied by several authors in different counties, and that has made significant progress over the last few decades (Kristóf and Virág 2020). The majority of business failure prediction models are based on financial data (Waqas and Md-Rus 2018). These models have a common purpose, which is to classify firms into one of two categories: failing firms and non-failing firms. Early work on bankruptcy prediction dates back to the 1930s with the work of Fitzpatrick (1932) and Merwin (1942). However, the first application of statistical tools to predict business failure began with the univariate analysis of Beaver (1966). On a sample of 79 firms that went bankrupt between 1954 and 1964, Beaver developed a unidimensional dichotomous classification based on a single discriminating ratio, namely cash flow to total debt. This ratio resulted in an overall classification rate of 77%. Despite the fact that Beaver’s method is simple and effective, it has rarely been used in subsequent studies (Deakin (1972) and Gebhardt (1980)) because of the lack of robustness associated with the uniqueness of the ratio used.

Given the complexity of the failure process, Altman (1968) is the first to use several ratios simultaneously, through Multiple Discriminant Analysis (MDA). MDA is a statistical technique that allowed the author to develop the Z-score model, a linear combination of the selected coefficients and the independents variables, which makes it possible to best discriminate between failing and non-failing groups. On a sample of 66 firms, Altman selected 5 ratios on the basis of a battery of 22 potentially significant ratios. These ratios resulted in a critical Z value of 2.675, which allowed 95% of the companies to be correctly classified. However, MDA requires several strict statistical conditions. The technique imposes that the predictors must be normally distributed, and their variance–covariance matrices must be identical for both groups (failing and non-failing firms).

Given the limitations of the Z-score model, several techniques have been developed in recent decades to help companies predict their financial stability in the coming years, improve the accuracy of the models and allow a better understanding of business failure (Stefko et al. 2019). Alaka et al. (2018) have classified models for predicting firm failure into two groups: statistical models such as logistic regression and multiple discriminant analysis, and artificial intelligence models such as neural networks and decision trees. In addition to discriminant analysis, Du Jardin (2009) identifies more than 50 models used to predict business failure, mainly logistic regression, probit regression, spline regression, rule induction, neural networks, etc.

In a systematic review of the literature on models for predicting business failure used between 1968 and 2017, Shi and Li (2019) find that one of the models most frequently studied and used by the authors is logistic regression. Affes and Hentati-Kaffel (2019) show that the logit model performs better than discriminant analysis in terms of good classification rate. In a comparative study of the different models used to assess the financial health of European SMEs, Altman et al. (2020) confirm the superiority of logistic regression and neural networks over other tools in terms of predictive accuracy. The logistic regression model was first used by Ohlson (1980) on a sample of 105 U.S. publicly traded firms that filed for bankruptcy between 1970 and 1976. Unlike discriminant analysis, this model does not require that the study’s predictors be normally distributed. Moreover, the model allows several indicators of bankruptcy to be combined into a probability score that indicates the likelihood of business failure (Karlson 2015). Given the reliability and the predictive accuracy of logit models (Ben Jabeur 2017; Charalambakis and Garrett 2018; Gupta et al. 2015), we will use this technique in our empirical study.

3. Data and Methodology of the Empirical Study

3.1. Constitution of the Sample

In order to constitute the sample, we have retained the definition of (Bank Al-Maghrib 2002), which stipulates in article 4: Outstanding debts are those that present a risk of total or partial non-recovery, in view of the deterioration of the counterparty’s immediate and/or future repayment capacity. Outstanding debts are therefore classified into three categories according to the degree of risk of loss:

- Pre-doubtful debts: outstanding loans of which maturity is not settled 90 days after its due date;

- Doubtful debts: outstanding loans of which maturity is not settled 180 days after its due date;

- Receivables were: outstanding loans of which maturity is not settled 360 days after its due date.

Following the definition adopted, we contacted the major banks listed on the stock exchange and located in the Fez-Meknes region. After several attempts, we were given access to financial data from a single bank, which allowed us to build a final sample of 90 SMEs in the Fez-Meknes region with 45 firms in each of the two groups, namely, the healthy firms and the failing firms in 2019. The data were collected in such a way that accounting data are available for the three years prior to the failure. Indeed, the initial sample was composed of 126 SMEs, and 36 SMEs were excluded for the following reasons: lack of continuity of accounts, lack of information for at least three consecutive years, and the specific nature of the activities that have an impact on the establishment of statements (agricultural companies, start-ups, financials companies, insurance companies …).

The Fez-Meknes region is one of the twelve regions in Morocco. According to the Haut-Commissariat au Plan (2018), the region contributes 8.4% to the national GDP, and it occupies the second place in terms of contribution in the primary sector with 14.5%. A total of 9% of Moroccan companies are located in this region, and 11.2% of companies in the construction sector are concentrated there (Haut-Commissariat au Plan 2019). The choice of the Fez-Meknes region is justified by the following reasons: Firstly, there is no study on business failure in this region. Second, the limited studies on business failure of Moroccan firms have been conducted on the Casablanca–Kenitra axis, while the other regions of Morocco remain under-studied.

The study sample covers three sectors of activity, namely, trade (45.6%), construction (37.8%) and industry (16.7%).

3.2. Variable Analysis

The variable of interest in this empirical study is the failure of an SME as defined by the circular of Bank Al-Maghrib in the previous paragraph. Therefore, this variable takes the value of 1 if an SME is at least 90 days in arrears with its payments and is therefore considered to be in a financial failure situation vis-à-vis its bank. Otherwise, the company is considered healthy and will take the value of 0.

The choice of variables remains a problem in the development of models of the determinants and prediction of business failure. Indeed, there is no consensus on techniques for choosing and constructing consistent accounting and financial ratios. Overall, the selection of indicators is somewhat subjective, given the lack of justification in several empirical studies. Some authors suggest an empirical and/or selective choice of indicators. In this context, we have selected the accounting and financial indicators that have been the most tested in previous empirical studies (Ben Jabeur 2017; Crutzen and Van Caillie 2010; Kherrazi and Ahsina 2016; Kliestik et al. 2018; Matoussi et al. 1999; Mselmi et al. 2017) and that have shown high predictive power and a strong capacity to discriminate between healthy and failing firms. However, our results will be influenced by the Moroccan context, which has its own economic, financial and managerial characteristics.

Table 1 brings together 34 ratios reflecting the most important aspects of SME activity and the different financial dimensions that can predict failure and discriminate between failing and healthy firms.

Table 1.

Ratios used in the empirical study.

Although these ratios present reassuring levels of significance with respect to failure in the literature consulted, they are not all homogeneous in terms of the unit of measurement. Payment term ratios are measured in days, while the others are in monetary units. Moreover, even if one approach to defining business failure is specified in the scientific works, indicators can be linked to several approaches (economic, financial, etc.). In this study, the financial approach is the most dominant.

3.3. Process for Selecting Analysis Variables

The empirical studies of business failure initiated by Altman (1968) are based on several statistical techniques and econometric models. Discriminant analysis is found to be the most prominent in previous contributions. Studies using this tool suffer from the problem of the normal distribution of variables and the impossibility of introducing qualitative factors. This may call into question the quality of the model, and, in particular, its predictive capacity (Eisenbeis 1977). In sharp contrast, the great interest of logistic regression is justified by its non-parametric nature, which does not impose the condition of normality, and its capacity to introduce both metric and non-metric factors3. Despite some reservations, logistic regression is adopted as an alternative in several works (Bae 2012; Ben Jabeur 2017; Charalambakis and Garrett 2018; Lin et al. 2012) and the arguments for choosing between several techniques remain debatable.

In this study, the construction of the model should make it possible to predict business failure in three, two and one years before failure and to highlight the most discriminating ratios. In this context, the implementation of the logistic regression model aims to determine the main predictors of failure, which will enable us to correctly classify SMEs as either failing or healthy companies. The signs of the coefficients and the marginal effect of the explanatory variables will allow us to determine the nature of the effect of these variables on the occurrence of business failure.

3.4. Logit Model

The subject variable of the study is the financial failure of an SME; it takes the value of 1 in the case of failure, and 0 if applicable. Given this particularity, we choose the logistic regression model to predict the probability of the failure event occurring. In this binary choice model, we seek to estimate the probability of the occurrence of the event of the SME as a function of a vector of variables . To do so, we introduce the underlying model expressed by the latent variable . The latter is a linear function of the vector . In order to make it take only 0 or 1, we introduce the logistic transformation:

This equation can be written as a function of P as follows:

The probability of failure is the decision-support rule for the construction of the assignment classes for failing or healthy SMEs. The decision threshold (probability of P) most adopted by previous research and by the software is 50%. Therefore, the decision rule can be written as follows:

Furthermore, the decision rule consists in comparing the calculated probability of failure with the critical threshold . Therefore:

4. Results

4.1. Exploratory Descriptive Analysis

The number of ratios found in the literature and the context of the study is high. Our choice will focus on those that contribute to discrimination between SMEs that are healthy and those that are failing with respect to the definition we have adopted. One of the most widely used methods in this framework is a non-parametric Wilcoxon–Mann–Whitney test, as shown in Table 2. This becomes essential when the samples are independent, unmatched, and do not assume data normality. The test consists of comparing the medians of the variables used between healthy and failing SMEs. The null hypothesis of the test assumes that the medians of healthy and failing firms are equal on one variable. The alternative hypothesis postulates the existence of a difference (>, <) between healthy and failing SMEs. In the latter case, a positive “ω” indicates a higher median for healthy SMEs, and vice versa at the significance level of the |z| statistic: *** 1%, ** 5% and * 10%. If the difference is significant, we reject the null hypothesis (RH0) of equality of the medians and accept the alternative hypothesis of the ability of a variable to discriminate healthy firms from those that are failing.

: median for healthy SMEs, and : median for failing SMEs.

Table 2.

Wilcoxon–Mann–Whitney test.

The results of the Wilcoxon–Mann–Whitney test indicate that in 2016 (three years before failure), seven ratios are significant and have a discriminating power between failing and healthy SMEs: autonomy ratio (R8), repayment capacity (R9), bank loans (R12), external consumption to sales (R13), interest to sales (R17), days in accounts receivable (R27), and duration of trade payables (R28). Two years before failure (2017), we find that 12/34 ratios are significant, including 9 at the 1% threshold: interest to sales (R17), return on assets 1 (R20), return on assets 2 (R21), asset turnover (R22), return on equity (R24), profit margin (R25), days in accounts receivable (R27), duration of trade payables (R28), and share of financial expenses (R32) and 3 at the 5%: autonomy ratio (R8), and external consumption to sales (R13), and 10%: gross operating profit to sales (R14) thresholds. One year before default, we have an increase in the number of ratios that discriminate between healthy and failing SMEs. The significance level of the majority of ratios (10 ratios) is 1%: autonomy ratio (R8), personnel expenses to sales (R15), interest to sales (R17), current income to sales (R18), return on assets 1 (R20), return on assets 2 (R21), asset turnover (R22), return on equity (R24), days in accounts receivable (R27), and duration of trade payables (R28); two ratios are significant at the 5% threshold: external consumption to sales (R13), and profit margin (R25), and only share of financial expenses (R32) at the 10% threshold.

For the solvency and financial structure ratios, healthy SMEs have an autonomy ratio (R8) that is probably lower than that of failing SMEs. This ratio indicates that the total share of financial debts in the average total liabilities is high for failing SMEs (21.85%) compared to healthy SMEs (10.89%). The repayment capacity (R9) of the failing SMEs is probably high, mainly due to their over-indebtedness. However, this ratio loses its significance in 2017 and 2018. Healthy SMEs are more indebted in terms of bank loans (R12) in 2016.

An analysis of profitability ratios makes it possible to assess in relative terms the weighting of essential expenses and certain intermediate balance. For healthy SMEs, the weight of expenses (R13, R15 and R17) is significantly lower than for failing SMEs. The overall average also shows that the weight of expenses is high among failing SMEs. On the contrary, the ratios intermediate balances are positive, indicating that the weight of gross operating profit (R14), earnings before interest and taxes (R16), and current income (R18) is greater in healthy firms. These businesses maintain value creation and improve the profitability of the operations. Moreover, the difference between the medians is positive, implying a high economic and financial profitability of healthy SMEs compared to their failing counterparts. Table 3 indicates that the average of return on assets 1 (R20), return on equity (R24), and profit margin (R25) for failing firms is negative, while the average of return on assets 2 (R21) and asset turnover (R22) is positive but remains lower than that of healthy firms.

Table 3.

Descriptive statistics.

In terms of management ratios, days in accounts receivable and trade payables are probably low among healthy SMEs compared to those failing at the 1% threshold. For example, descriptive statistics indicate that the average days in accounts receivable is 137 days for healthy SMEs compared with 342 days for failures. We also find that the average duration of trade payables is high for defaulted SMEs (146 days) compared to healthy SMEs (91 days). The standard deviation also shows a wide dispersion of durations among failing SMEs.

The ω statistic shows that the ratios of value added are not significant, except for the ratio of the share of financial expenses (R32) in two years and one year before failure. The statistics show that financial expenses weigh heavily on the added value of failing SMEs.

Finally, after this exploratory analysis, the variables selected for the regression model are: Autonomy ratio (R8), repayment capacity (R9), banks loans (R12), external consumption to sales (R13), gross operating profit to sales (R14), personnel expenses to sales (R15), interest to sales (R17), current income to sales (R18), return on assets 1 (R20), return on assets 2 (R21), asset turnover (R22), return on equity (R24), profit margin (R25), days in accounts receivable (R27), duration of trade payables (R28), and share of financial expenses (R32).

4.2. Econometric Results

4.2.1. Examination of the Correlation Matrix

Table 4 shows the existence of a high correlation between certain variables. This is particularly the case for variable R13, which is highly correlated with other variables (R14, R15, R17, R18, R21, R22, R25, and R27). We also find that the variables R14, R15, R18, and R25 are highly correlated with each other and with other variables, generally at the 1% threshold. These variables may negatively affect the predictive quality of logistic regression models, which is why we decided to exclude them from the analysis.

Table 4.

Pearson correlation matrix.

4.2.2. Logistic Regression Results

Before starting to interpret the results of econometric models for predicting SME financial failure, we will perform the main tests of estimation quality for each of them. First, the logit model was estimated using the maximum likelihood (LR) function. We regressed all the variables for each year on the explanatory variable of the failure by selecting the most significant ones using the stepwise method on STATA 15 software (StataCorp LLC, Texas 77845, USA). The stepwise method allowed us to remove from an estimated model, stepwise, the non-significant variables and those that reduce the good classification rate.

- Results of estimation three years before failure (Logit-1)

The LR statistic of the maximum likelihood ratio is 71.04 (chi-square model: (8)) significant at the 1% threshold (p >: ). From this result, we reject the null hypothesis () of nullity of the coefficients, and we accept (the alternative hypothesis) the fact that there is at least one variable in the equation that better predicts the probability of the presence of the failure. This indicates that the model has good fit quality. The value of Mc-Fadden’s pseudo-R² tells us that the final model predicts 56.94% of the probability of the occurrence of the event . The Hosmer et al. (1989) test shows a value of (8) = 0.1198 not significant at the 1% threshold 1% (p >: ). This indicates that the predicted and observed values are consistent, and the difference between them is not significant.

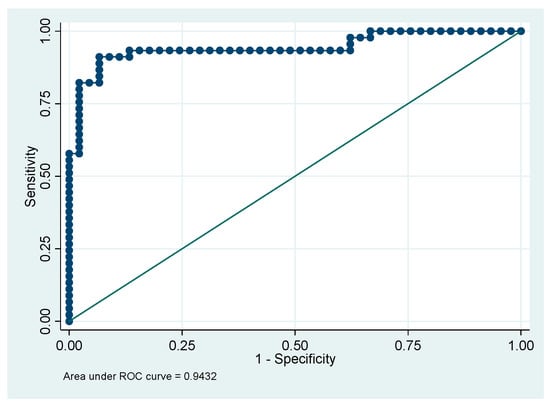

The Area Under the Curve (AUC) or area under the Receiver Operating Characteristic (ROC) curve measures the overall predictive power of exogenous variables. This test shows in Figure 1 a perfect discrimination capacity (AUC-ROC = 0.9432) according to the thresholds set by (Long and Freese 2006).

Figure 1.

The ROC curve of the model three years before failure.

Sensitivity represents the ability of the model to correctly predict that the event (failure) is 88.89% (40/45), and specificity represents the ability of the model to predict that the null (healthy) event is 93.33% (42/45). The risk of diagnosing a failing firm among healthy firms is 1-specificity. The latter called the error rate for classifying failing firms as healthy is 11.11% (5/45) (type I error α), and the error rate for classifying healthy firms as failing is 6.67% (3/45) (type II error β). The overall rate of classification of healthy and failing companies is 91.11% (42 + 40)/90, as shown in Table 5.

Table 5.

Classification of failing firms (FF) and healthy firms (HF) three years earlier.

Based on the results of the regression Table 6, eight variables were selected by the final logit regression model. All variables are significant at the 5% threshold and therefore predict the occurrence of the failure event within three years, except variable 24 is insignificant. Consequently, the selected variables make it possible to classify the SMEs in their membership groups as either healthy or failing. These variables are as follows: autonomy ratio (R8) is more important for healthy firms; repayment capacity (R9) may reduce SME failure and interest to sales (R17) increase the probability of failure; return on assets 2 (R21) has a negative impact on the probability of default; and asset turnover (R22) has an amplifying effect on the risk of bankruptcy, days in accounts receivable (R27) and duration of trade payables (R28), whose increase significantly raises the risk of failure and is greater for failing SMEs compared to healthy SMEs. The marginal effect shows that the increase in R28 (respectively R27) raises the risk of bankruptcy by 0.5% and by 0.098%.

Table 6.

Regression results three years before failure.

- Results of estimation two years before failure (Logit-2)

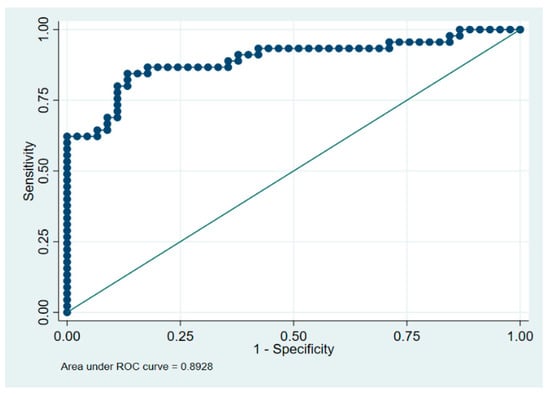

The logistic regression model of two years before default allowed us to retain five significant variables at the 5% threshold. The table below summarizes the indicators of the quality of the model for predicting SME failure. The value of LR (54.79; p >: ) indicates the existence of at least one predictor of SME failure in the estimated model, and according to the pseudo-R², the model predicts 43.91% of the probability of SME failure occurrence. Finally the Hosmer–Lemeshow test (76.84; p = 0.808 > 5%) is insignificant, which indicates consistency between the predicted and observed values. The overall predictive power of the exogenous variables measured by the area under the ROC curve shows an excellent rate of about 90, as shown in Figure 2.

Figure 2.

The ROC curve of the model two years before failure.

The true positive rate (sensitivity) is 80% (36/45), and the specificity is 88.89%. The false positive (1-specificity) or the type I error (α) is 20% (9/45), while the type II error (β) is 11.11% (5/45). The overall classification rate of SMEs as healthy and failing by the exogenous factors selected is 84.44% in two years before the failure, as shown in Table 7.

Table 7.

Classification of failing firms (FF) and healthy firms (HF) two years earlier.

Table 8 shows the results of the logistic regression two years before SME failure. The variables that allow us to discriminate between failing and healthy SMEs are as follows: Interest to sales (R17) tells us that the increase in the share of interests in turnover raises the probability of SME failure. According to the Wilcoxon–Mann–Whitney test, R17 is higher among failing SMEs; the return on assets ratio (R21) indicates that its increase reduces the probability of failure by 145% and is higher among healthy SMEs; the asset turnover ratio (R22) significantly increases the probability of bankruptcy. Days in accounts receivable (R27) and duration of trade payables (R28) show a positive sign, indicating that they have a positive effect on the probability of default of SMEs. The marginal effect shows that increasing R27 (respectively R28) increases the risk of bankruptcy by 0.09% (respectively 0.33%).

Table 8.

Regression results two years before failure.

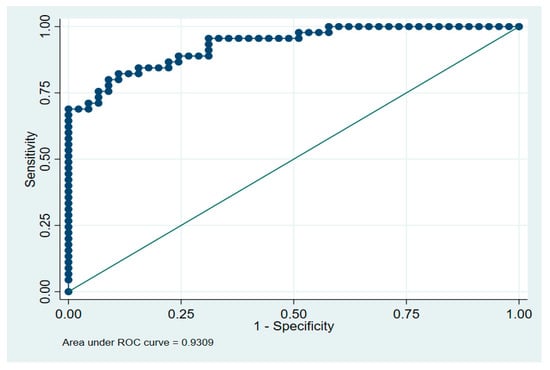

- Results of estimation one year before failure (Logit-3)

Estimation of the logistic regression model in one year before failure allowed us to retain five variables, four of which were retained in two years before failure. Indeed, the latter model removed return on assets 2 (R21) in favor of return on assets 1 (R20). This did not lead to any change in the overall ranking rate (84.44%) and false prediction, as shown in Table 9. However, we did notice a clear improvement in the model’s quality indicators. The pseudo-R² indicates that the model predicts a 52.07% probability of SME failure, and the LR statistic (64.97; p = 0.000) is significant, which rejects the hypothesis of nullity of the coefficients. On the other hand, the Hosmer–Lemeshow test (4.88; p = 0.7704 > 5%) indicates that there is no significant difference between the predicted and observed values. The overall predictive power of the exogenous variables measured by the area under the ROC curve shows a perfect rate equal to 0.9309, as presented in Figure 3.

Table 9.

Classification of failing firms (FF) and healthy firms (HF) one year earlier.

Figure 3.

The ROC curve of the model one year before failure.

Table 10 shows that the variables interest to sales (R17), return on assets 1 (R20), asset turnover (R22), days in accounts receivable (R27), and duration of trade payables (R28) are the best predictors of SME failure and make it possible to discriminate clearly between healthy firms and failing firms. All variables kept the same sign from three years before failure until one year before failure. However, the return on assets 1 (R20) became more discriminating than return on assets 2 (R21) and may lead to a reduction in the probability of bankruptcy of 278% (the marginal effect).

Table 10.

Regression results one year before failure.

5. Discussion

Our results show in three years before financial distress that seven variables manage to discriminate between sound SMEs and failing SMEs: two solvency ratios (autonomy ratio and repayment capacity), three profitability ratios (interest to sales, return on assets, and asset turnover), and two management ratios (days in accounts receivable and duration of trade payables). In two years, and one year before financial distress, five of the seven variables selected in 2016 remain discriminating: interest to sales, return on assets, asset turnover, days in accounts receivable, and duration of trade payables. In general, failing SMEs are more indebted and have low profitability and solvency. They are also characterized by long customer and supplier payment delays.

Indeed, the variables belonging to the profitability and solvency categories have already shown their ability to discriminate between sound and failing firms in several previous studies (Altman 1968; Amor et al. 2009; Charalambakis and Garrett 2018; Gregova et al. 2020; Jamel and Derbali 2019; Matoussi et al. 1999; Mselmi et al. 2017; Ohlson 1980). The same observation was made for the Moroccan context using the logistic regression—Kherrazi and Ahsina (2016) and Jamel and Derbali (2019) found on a sample of SMEs in the Gharb-Chrarda-Beni Hssen region that insufficient permanent funds and lack of commercial profitability help to explain the failure of SMEs in the region. Moreover, Nokairi (2018) confirms that negative profitability and lack of solvency are among the main characteristics of failing Moroccan companies.

However, our results show the importance of considering specific variables related to the context of the study as management ratios (Tian et al. 2015). In Morocco, our finding are in line with those of Azayite and Achchab (2017), who by using neural network models and variable selection techniques, found that the payment delays of customers and suppliers are alarming signals for creditors and investors. Our results confirm the findings of the study conducted by Inforisk (2020) that indicates that longer payment terms are one of the main reasons for corporate failure.

The variables selected by stepwise logistic regression give an overall classification rate of 84.44% two years and one year prior to failure. These performances are inferior to those obtained by Matoussi et al. (1999), Selma (2017), and Charalambakis and Garrett (2018). In Morocco, for example, Selma (2017) obtains by logistic regression an overall classification rate of 88.2% over two years. However, our performances are higher than the accuracies of Amor et al. (2009), and Bae (2012). For instance, Amor et al. (2009) obtain through logistic regression a good classification rate of 72.84% one year before default, and 63.63% two years before failure. Unlike most works, the overall classification rate improves three years before failure at 91.11%. This can be explained by the willingness of company managers to conceal the fragile financial situation of their companies. Indeed, managers are led to manipulate financial and accounting data when financial distress becomes imminent in order to gain the confidence of creditors and obtain new credits (Bisogno and De Luca 2015; Hsiao et al. 2010).

6. Conclusions

The paper aimed to identify the determinants and predictors of Moroccan SMEs’ financial failure. Although several studies have been conducted to determine and predict financial failure, none of them has succeeded in finding an optimal set of financial ratios. In addition to this, the prediction accuracy depends on the specific ratios used as well as the context of the study. The limited research on financial failure in Morocco and the absence of work in the Fez-Meknes region led us to conduct our investigation.

To reach our objective, we constituted a sample of 90 SMEs in the Fez-Meknes region divided into two groups of 45 healthy and 45 failing firms in 2019 according to article 4 of the circular n° 19/G/2002 of Bank Al-Maghrib. The data were collected from a major bank of the area over three consecutive years, 2016, 2017, and 2018.

The results obtained according to the logistic regression show that financial failure can be determined by seven variables: five variables that increase the probability of financial failure: autonomy ratio (solvency ratio), interest to sales (profitability category), asset turnover (profitability category), days in accounts receivable (management category), and duration of trade payables (management category), and two variables decreasing the probability of failure: return on assets (profitability category) and repayment capacity (solvency category).

These same variables give us an overall classification rate of 84.44% two years and one year prior to failure. Unlike most works, the overall classification rate improves three years before failure at 91.11%.

The results of our study have practical implications for creditors, investors, and managers. In order to avoid the costs associated with counterparty risk, creditors need to properly assess the financial health of borrowing firms by taking into account specific variables such as those presented by this article. As far as investors are concerned, the determinants and predictors we have identified will enable them to avoid investing in companies with a high risk of default. Finally, for company managers, our findings will help them to act upstream and take corrective measures to avoid the occurrence of financial failure.

However, this study suffers from certain limitations that must be cited. Firstly, the limited sample size, given the difficulties of access to financial information for SMEs in the Fez-Meknes region (absence of open access databases and the confidential nature of the financial statements of non-listed companies), must be noted. In addition, the results of the paper can be improved by the introduction of qualitative and macroeconomic variables. For purposes of improvement, it would be interesting to integrate macroeconomic variables into a larger sample that includes all regions of Morocco.

Author Contributions

Y.Z., M.O. and A.E.M. contributed equally to this work. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Affes, Zeineb, and Rania Hentati-Kaffel. 2019. Predicting US banks bankruptcy: Logit versus Canonical Discriminant analysis. Computational Economics 54: 199–244. [Google Scholar] [CrossRef]

- Alaka, Hafiz A., Lukumon O. Oyedele, Hakeem A. Owolabi, Vikas Kumar, Saheed O. Ajayi, Olugbenga O. Akinade, and Muhammad Bilal. 2018. Systematic review of bankruptcy prediction models: Towards a framework for tool selection. Expert Systems with Applications 94: 164–84. [Google Scholar] [CrossRef]

- Altman, Edward I. 1968. Financial ratios, discriminant analysis and the prediction of corporate bankruptcy. The Journal of Finance 23: 589–609. [Google Scholar] [CrossRef]

- Altman, Edward I. 1984. A Further Empirical Investigation of the Bankruptcy Cost Question. The Journal of Finance 39: 1067–89. [Google Scholar] [CrossRef]

- Altman, Edward I., Małgorzata Iwanicz-Drozdowska, Erkki K. Laitinen, and Arto Suvas. 2020. A race for long horizon bankruptcy prediction. Applied Economics 52: 1–20. [Google Scholar] [CrossRef]

- Amor, S. Ben, Nabil Khoury, and Marko Savor. 2009. Modèle prévisionnel de la défaillance financière des PME québécoises emprunteuses. Journal of Small Business and Entrepreneurship 22: 517–34. [Google Scholar] [CrossRef]

- Argenti, John. 1976. Corporate planning and Corporate Collapse. Long Range Planning 9: 12–17. [Google Scholar] [CrossRef]

- Azayite, Fatima Zahra, and Said Achchab. 2017. The impact of payment delays on bankruptcy prediction: A comparative analysis of variables selection models and neural networks. Paper presented at 2017 3rd International Conference of Cloud Computing Technologies and Applications (CloudTech), Rabat, Morocco, October 24–26; pp. 1–7. [Google Scholar]

- Back, Barbro, Teija Laitinen, Kaisa Sere, and Michiel van Wezel. 1996. Choosing bankruptcy predictors using discriminant analysis, logit analysis, and genetic algorithms. Turku Centre for Computer Science Technical Report 40: 1–18. [Google Scholar]

- Bae, Jae Kwon. 2012. Predicting financial distress of the South Korean manufacturing industries. Expert Systems with Applications 39: 9159–65. [Google Scholar] [CrossRef]

- Bank Al-Maghrib. 2002. Circulaire du Gouverneur de Bank Al-Maghrib n°19/G/2002 du 23 décembre 2002 (18 chaoual 1423) Relative à la Classification des Créances et à leur Couverture par les Provisions. Rabat: Bank Al-Maghrib. [Google Scholar]

- Beaver, William H. 1966. Financial ratios as predictors of failure. Journal of Accounting Research, 71–111. [Google Scholar] [CrossRef]

- Ben Jabeur, Sami. 2017. Bankruptcy prediction using Partial Least Squares Logistic Regression. Journal of Retailing and Consumer Services 36: 197–202. [Google Scholar] [CrossRef]

- Bisogno, Marco, and Roberto De Luca. 2015. Financial distress and earnings manipulation: Evidence from Italian SMEs. Journal of Accounting and Finance 4: 42–51. [Google Scholar]

- Blazy, Régis, Patricia Charlety, and Jérôme Combier. 1993. Les défaillances d’entreprises: Des difficultés visibles plusieurs années à l’avance. Economie et Statistique 268: 101–11. [Google Scholar] [CrossRef]

- Bunn, Philip, and Victoria Redwood. 2003. Company Accounts-Based Modelling of Business Failures and the Implications for Financial Stability. Bank of England Working Paper No. 210. London: Bank of England. [Google Scholar] [CrossRef]

- Casta, Jean-François, and J. P. Zerbib. 1979. Prévoir la défaillance des entreprises? Revue Française de Comptabilité 97: 506–26. [Google Scholar]

- Cayssials, Jean-Luc, Elisabeth Kremp, and Christophe Peter. 2007. Dix années de dynamique financière des PME en France. Bulletin de La Banque de France 165: 31–48. [Google Scholar]

- Charalambakis, Evangelos C., and Ian Garrett. 2018. On corporate financial distress prediction: What can we learn from private firms in a developing economy? Evidence from Greece. Review of Quantitative Finance and Accounting. [Google Scholar] [CrossRef]

- Charalambous, Chris, Andreas Charitou, and Froso Kaourou. 2000. Comparative analysis of artificial neural network models: Application in bankruptcy prediction. Annals of Operations Research 99: 403–25. [Google Scholar] [CrossRef]

- Crutzen, Nathalie, and Didier Van Caillie. 2007. The Business Failure Process: Towards an Integrative Model of the Literature. Paper presented at International Workshop on Default Risk and Financial Distress, Rennes, France, September; Available online: https://orbi.uliege.be/handle/2268/31504 (accessed on 10 October 2020).

- Crutzen, Nathalie, and Didier Van Caillie. 2010. Towards a taxonomy of explanatory failure patterns for small firms: A quantitative research analysis. Review of Business and Economic Literature 55: 438–63. [Google Scholar]

- Deakin, Edward B. 1972. A discriminant analysis of predictors of business failure. Journal of Accounting Research, 167–79. [Google Scholar] [CrossRef]

- Du Jardin, Philippe. 2009. Bankruptcy prediction models: How to choose the most relevant variables? Bankers, Markets & Investors 98: 39–46. [Google Scholar]

- Eisenbeis, Robert A. 1977. Pitfalls in the application of discriminant analysis in business, finance, and economics. The Journal of Finance 32: 875–900. [Google Scholar] [CrossRef]

- Euler Hermes. 2019. L’Indice Globale des Défaillances 2019. Paris: Euler Hermes. [Google Scholar]

- Fitzpatrick, Paul Joseph. 1932. A Comparison of the Ratios of Successful Industrial Enterprises with Those of Failed Companies. Lanzhou: The Certified Public Account. [Google Scholar]

- Gebhardt, G. 1980. Insolvency prediction based on annual financial statements according to the company law. An assessment of the reform of annual statements by the law of 1965 from the view of external addresses. Bochumer Beitrage Zur Untennehmungs Und Unternehmens-Forschung 22. [Google Scholar]

- Geng, Ruibin, Indranil Bose, and Xi Chen. 2015. Prediction of financial distress: An empirical study of listed chinese companies using data mining. In European Journal of Operational Research 241: 236–47. [Google Scholar] [CrossRef]

- Gilbert, Lisa R., Krishnagopal Menon, and Kenneth B. Schwartz. 1990. Predicting bankruptcy for firms in financial distress. Journal of Business Finance & Accounting 17: 161–71. [Google Scholar]

- Gregova, Elena, Katarina Valaskova, Peter Adamko, Milos Tumpach, and Jaroslav Jaros. 2020. Predicting financial distress of slovak enterprises: Comparison of selected traditional and learning algorithms methods. Sustainability 12: 3954. [Google Scholar] [CrossRef]

- Gupta, Jairaj, Andros Gregoriou, and Jerome Healy. 2015. Forecasting bankruptcy for SMEs using hazard function: To what extent does size matter? Review of Quantitative Finance and Accounting 45: 845–69. [Google Scholar] [CrossRef]

- Haut-Commissariat au Plan. 2018. Note D’information Relative aux Comptes Régionaux de L’année 2018. Casablanca: Haut-Commissariat au Plan. [Google Scholar]

- Haut-Commissariat au Plan. 2019. Enquête Nationale Auprès des Entreprises, Premiers Résultats 2019. Casablanca: Haut-Commissariat au Plan. [Google Scholar]

- Hosmer, David W., Stanley Lemeshow, and Rod X. Sturdivant. 1989. The multiple logistic regression model. Applied Logistic Regression 1: 25–37. [Google Scholar]

- Hsiao-Fen Hsiao, Szu-Hsien Lin, and Ai-Chi Hsu. 2010. Earnings management, corporate governance, and auditor’s opinions: A financial distress prediction model. Investment Management and Financial Innovations 7: 29–40. [Google Scholar]

- Inforisk. 2020. Étude Inforisk, Défaillances Maroc 2019. Casablanca: Inforisk. [Google Scholar]

- Jamel, Lamia, and Abdelkader Derbali. 2019. Modeling and Analysis of Business Failures: Application to Moroccan SMEs. Journal of Economic and Business Studies 2: 131. [Google Scholar]

- Kamaluddin, Amrizah, Norhafizah Ishak, and Nor Farizal Mohammed. 2019. Financial distress prediction through cash flow ratios analysis. International Journal of Financial Research 10: 63–76. [Google Scholar] [CrossRef]

- Karlson, Kristian Bernt. 2015. Another look at the method of y-standardization in logit and probit models. The Journal of Mathematical Sociology 39: 29–38. [Google Scholar] [CrossRef]

- Kherrazi, Soufiane, and Khalifa Ahsina. 2016. Défaillance et politique d’entreprises: Modélisation financière déployée sous un modèle logistique appliqué aux PME marocaines. La Revue Gestion et Organisation 8: 53–64. [Google Scholar] [CrossRef]

- Kliestik, Tomas, Maria Misankova, Katarina Valaskova, and Lucia Svabova. 2018. Bankruptcy Prevention: New Effort to Reflect on Legal and Social Changes. Science and Engineering Ethics 24: 791–803. [Google Scholar] [CrossRef]

- Kovacova, Maria, Tomas Kliestik, Katarina Valaskova, Pavol Durana, and Zuzana Juhaszova. 2019. Systematic review of variables applied in bankruptcy prediction models of Visegrad group countries. Oeconomia Copernicana 10: 743–72. [Google Scholar] [CrossRef]

- Kristóf, Tamás, and Miklós Virág. 2020. A Comprehensive Review of Corporate Bankruptcy Prediction in Hungary. Journal of Risk and Financial Management 13: 35. [Google Scholar] [CrossRef]

- Lin, Simon M., Jake Ansell, and Galina Andreeva. 2012. Predicting default of a small business using different definitions of financial distress. Journal of the Operational Research Society 63: 539–48. [Google Scholar] [CrossRef]

- Long, J. Scott, and Jeremy Freese. 2006. Regression Models for Categorical Dependent Variables Using Stata. College Station: Stata Press. [Google Scholar]

- Matoussi, Hamadi, Rim Mouelhi, and Sayah Salah. 1999. La Prédiction de Faillite des Entreprises Tunisiennes par la Régression Logistique. Paper presented at 20ÈME CONGRES DE L’AFC, Paris, France, May 21–22; pp. 1–23. [Google Scholar]

- Merwin, Charles L. 1942. Financing Small Corporations in Five Manufacturing Industries 1926–1936. New York: National Bureau of Economic Research. [Google Scholar]

- Mselmi, Nada, Amine Lahiani, and Taher Hamza. 2017. Financial distress prediction: The case of French small and medium-sized firms. International Review of Financial Analysis 50: 67–80. [Google Scholar] [CrossRef]

- Nokairi, Wafia. 2018. Financial characteristics of companies in failure situation in Morocco Les déterminants financiers des entreprises en situation de défaut de paiement au Maroc. Revue du Contrôle de la Comptabilité et de l’Audit 2: 564–91. [Google Scholar]

- Ohlson, James A. 1980. Financial ratios and the probabilistic prediction of bankruptcy. Journal of Accounting Research, 109–31. [Google Scholar] [CrossRef]

- Pindado, Julio, and Luis F. Rodrigues. 2004. Parsimonious models of financial insolvency in small companies. Small Business Economics 22: 51–66. [Google Scholar] [CrossRef]

- Pompe, Paul PM, and Jan Bilderbeek. 2005. The prediction of bankruptcy of small-and medium-sized industrial firms. Journal of Business Venturing 20: 847–68. [Google Scholar] [CrossRef]

- Ramezani Sharifabadi, M., M. Mirhaj, and Naser Izadinia. 2017. The impact of financial ratios on the prediction of bankruptcy of small and medium companies. QUID: Investigación, Ciencia y Tecnología 1: 164–73. [Google Scholar]

- Refait-Alexandre, Catherine. 2004. La prévision de la faillite fondée sur l’analyse financière de l’entreprise: Un état des lieux. Economie Prevision 1: 129–47. [Google Scholar] [CrossRef]

- Selma, Haj Khlifa. 2017. Predicting default risk of SMEs in developing economies: Evidence from Morocco. Journal of WEI Business and Economics-December 6: 3. [Google Scholar]

- Shi, Yin, and Xiaoni Li. 2019. An overview of bankruptcy prediction models for corporate firms: A systematic literature review. Intangible Capital 15: 114–27. [Google Scholar] [CrossRef]

- Stefko, Robert, Beata Gavurova, Martin Rigelsky, and Viera Ivankova. 2019. Evaluation of selected indicators of patient satisfaction and economic indices in OECD country. Economics & Sociology 12: 149–332. [Google Scholar]

- Sung, Tae Kyung, Namsik Chang, and Gunhee Lee. 1999. Dynamics of modeling in data mining: Interpretive approach to bankruptcy prediction. Journal of Management Information Systems 16: 63–85. [Google Scholar] [CrossRef]

- Tian, Shaonan, Yan Yu, and Hui Guo. 2015. Variable selection and corporate bankruptcy forecasts. Journal of Banking & Finance 52: 89–100. [Google Scholar]

- Valaskova, Katarina, Tomas Kliestik, Lucia Svabova, and Peter Adamko. 2018. Financial risk measurement and prediction modelling for sustainable development of business entities using regression analysis. Sustainability 10: 2144. [Google Scholar] [CrossRef]

- Waqas, Hamid, and Rohani Md-Rus. 2018. Predicting financial distress: Applicability of O-score and logit model for Pakistani firms. Business and Economic Horizons (BEH) 14: 389–401. [Google Scholar] [CrossRef]

| 1 | According to Moroccan-SME agency (2018), SMEs are companies with a turnover of less than or equal to 200 million dirhams. |

| 2 | An independent governmental statistical institution established in 2003. It represents the main source of economic, demographic and social statistical data in Morocco. |

| 3 | Normality tests on the study variables showed negative results at the 5% significance level. |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).