1. Introduction

Numerous data sets in the field of actuarial science, finance, and medicine contain random variables, such as stock indexes and returns, that cannot be treated under the assumption of independence. A copula is one of the tools that can be used to extract the dependence behaviors among variables, regardless of the individualistic behavior of each variable.

A copula is a multivariate distribution function whose margins are the uniform distribution on the unit interval. Sklar’s theorem (see

Sklar (

1959)) proves the existence of a unique copula that captures the dependence structures among continuous random variables. This allows researchers to expand venues for modeling multivariate data in the real world; not only by using existing copulas, but also by establishing new copulas (

Nelsen (

2006);

Joe (

2015)). Such real-world data include stock returns and heavy-tailed finance data; see, e.g.,

Nguyen et al. (

2020) and references therein.

In the bivariate case, if two continuous random variables, X and Y, with margins F and G have a joint distribution function (cdf) , there exists a unique copula C such that Let and . The copula function C is a cdf given by , where and are the respective quantile functions of X and The joint probability density function (pdf), denoted by is therefore where f and g are the respective pdf’s of X and Y and c is the copula pdf such that A copula C is called Archimedean if it can be expressed as where the generator is a continuous, strictly decreasing, and convex function with The pseudo inverse is if and 0 if The generator is called strict if and .

One purpose of this paper is to construct new bivariate copulas. Sklar’s theorem gives rise to the inversion method that derives copula representations from multivariate joint distributions. Another method studied by

Joe and Hu (

1996) is known as the mixture of max-infinity divisible (max-id) method and is given by

where

K is a bivariate max-id copula and

is a Laplace transform function. This method is used to build the bivariate families of copulas BB1-BB7; see

Joe (

2015). Another approach is to develop new Archimedean generators using various rules explained by

Genest et al. (

1995) in

Frees and Valdez (

1998).

Here, we are interested in employing the distortion method. A function

T is called a distortion function if it is continuous and increasing on [0,1] with

and

The following framework is then used to construct a new family of copulas:

which is the distortion of the third kind in

Valdez and Xiao (

2011). If

C is Archimedean, then

where

is the generator of

That is, in this case,

is Archimedean with generator

which is the right composition of the generator

and the inverse distortion

Di Bernardino and Rulliere (

2013) obtained admissible conditions such that

in (1) is a copula function. For example,

T could take the form of

, where

is a survival distribution satisfying certain admissible requirements; see

Durante et al. (

2010).

Samanthi and Sepanski (

2019) investigated beta-distorted copulas where the beta distribution serves as the distortion function. Recent literature focusing on how the tail dependence properties are modified under various distortions include

Sepanski (

2020);

Lin et al. (

2018); and

Durante et al. (

2010).

For example,

T could take the form of

, where

is a survival distribution satisfying certain admissible requirements; see

Durante et al. (

2010).

Samanthi and Sepanski (

2019) investigated beta-distorted copulas where the beta distribution serves as the distortion function.

Di Bernardino and Rulliere (

2013) obtained admissible conditions, such that

in (1) is a copula function.

In this paper, we propose a distortion function, named unit-Lomax distortion. It is derived from a transformation of the non-negative two-parameter Lomax random variable into a variable whose support is the unit interval. This paper is organized as follows.

Section 2 contains the proposed unit-Lomax distortion, admissibility specification of the parameter space, general forms of the cdf, pdf, and conditional distribution of the induced copula, and some examples. Limiting cases and tail behaviors are featured in

Section 3 and

Section 4, respectively.

Section 5 and

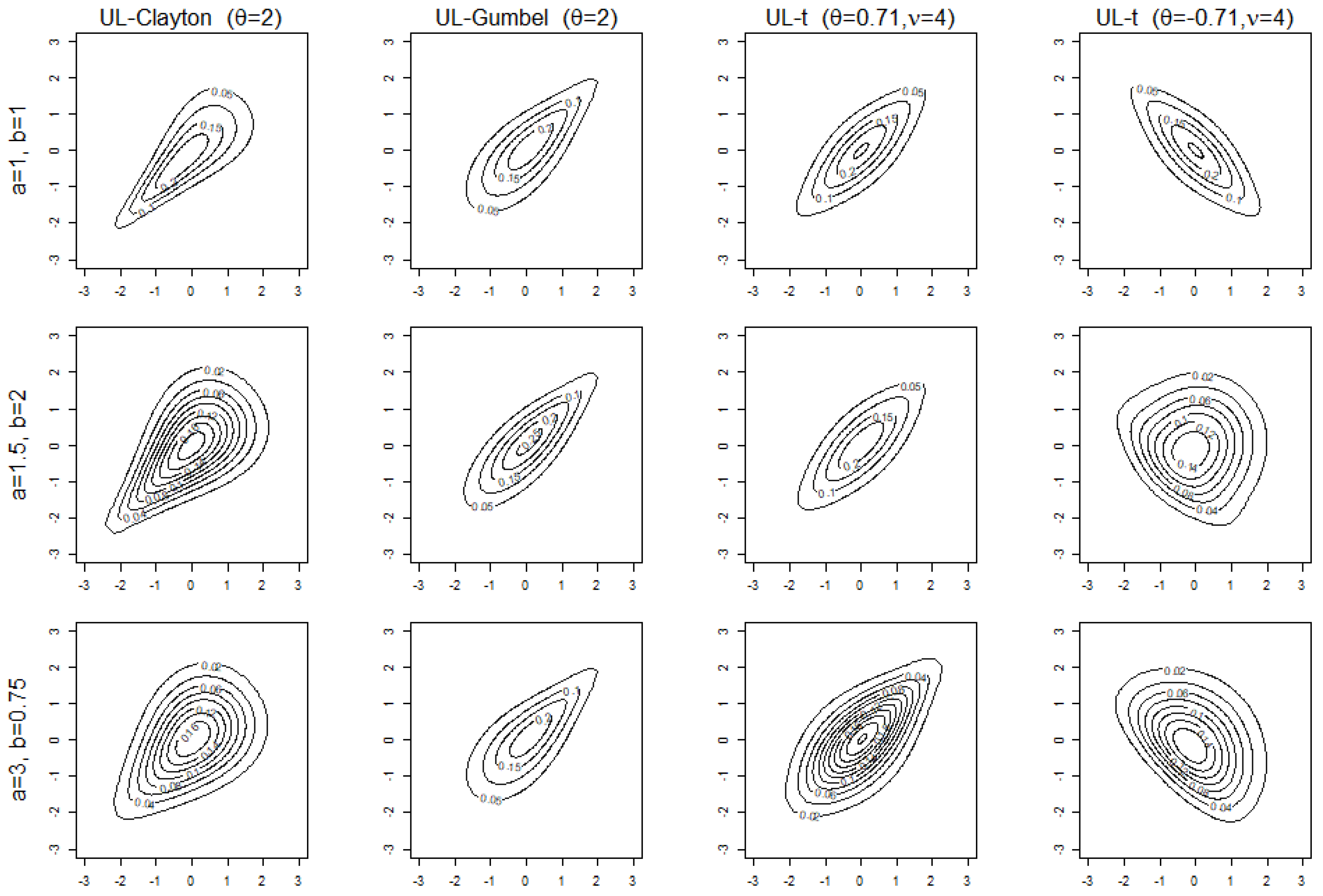

Section 6 present formulas for Kendall’s tau and Spearman’s rho and concordance ordering of the induced copula Density contour plots and simulation studies are illustrated in

Section 7.

Section 8 presents an application with performance results, followed by concluding remarks in

Section 9.

3. Limiting Cases

This section deals with the limiting behavior as one or more parameters go to a boundary for the UL-distorted copulas. If

or

,

T approaches the power distortion and the UL-distorted copula in (

8) is of the following expression

The following proposition studies the limit of the UL-distorted copulas as without specifying the base copula.

Proposition 1. Let C be any base copula. Consider the UL-distorted copula defined in (8) with . The UL-distorted copula approaches the Clayton copula as Proof. Set

As

or

x and

y go to 1. Define

From (

8) and by L’Hopital’s Rule, we have

since

goes to 1, the conditional copula cdf’s

and the copula

go to 1 as

Therefore,

which is the Clayton copula with parameter

Note that the generator of the Clayton copula is . By L’Hopital’s Rule, it goes to as Therefore, the Clayton copula approaches the independence copula as a goes to ∞. □

Example 9. Consider the UL-independence copula in Example 3. Note that, with a fixed, That is, as the UL-independence copula approaches the Clayton copula, which further confirms the results in Proposition 1. As The resulting Clayton copula in (10) goes to where for The independence copula of total lack of concordance has been transformed into a family of UL-independence copulas with a concordance measure ranging from 0 to 1. The limit of

in the parameter

or

inherited from the base copula can be evaluated through the limit of the base copula in the parameter. The limits of some existing copulas can be found in

Joe (

2015). If the base copula

C converges to

where

, then,

since

T is increasing. Copulas that approach

as their parameter go to

∞ include the Clayton, Frank, and Gumbel, BB1 copulas. If a base copula converges in its parameter to the independence copula, the corresponding UL distorted copula converges to the UL-independence copula in the parameter. The Clayton copula approaches the independence copula as

goes to 0; so do the Frank and Galambos copulas.

4. Tail Dependence Coefficients and Tail Orders

Tail dependence properties can be useful in determining an appropriate copula model for data fitting. In this section, we first expound briefly preliminaries and then establish the relationships in tail dependence coefficients and tail orders between the base copula and the affiliated UL-distorted copula.

A function

f is regularly varying at

with index

if

for each

, and is slowly varying at

if

Let

and

be two functions. If

we denote it by

as

Define

and the survival copula

. If

as

for some slowly varying function

is called the lower tail order of

C. If

for some slowly varying function

then

is the upper tail order of

C. The lower tail dependence coefficient is defined as

; and the upper tail dependence is defined as

If

(or

then

(or

For more details, see

Joe (

2015).

The lower tail dependence coefficient for the UL-distorted copula on the grounds of the form indicated in (

1) is denoted and given by, with

The upper tail dependence coefficient is denoted and given by

The following Theorems 1 and 2 respectively present the relationships in the lower and upper tail behaviors between the initial copula and the induced copula.

Theorem 1. Let T be the admissible UL distortion. Assume that as , where is slowly varying. Let be the lower tail order of in (1). Then - (i)

the lower tail order of is

- (ii)

the lower tail dependence coefficient of is

Proof. Note that, for

Therefore,

and

as

. Since

as

, we obtain

Note that, for any

, we have

Since ℓ is slowly varying, it follows that and is slowly varying. Therefore, by definition, the lower tail order of is

The lower tail dependence coefficient of

is, if exists,

When the parameters , the upper tail order and dependence coefficient of the induced copula are indeed same as those of the base copula. □

Theorem 2. Let T be the admissible UL distortion. Assume that as , where is slowly varying. Let be the upper tail order of in (1). Then - (i)

the upper tail order of is

- (ii)

the upper tail dependence coefficient of is

Proof. Applying Taylor series, we have

as

and

Since

and by (

11), it follows that

That is, the induced copula has an upper tail order

The upper tail dependence coefficient is given by

by L’Hopital’s rule and

If

, the UL distortion is the power distortion. The results for the tail dependence coefficients are the same as those shown in

Durante et al. (

2010). □

Adopting Table 4.1 in

Joe (

2015), we next display the tail orders or tail dependence coefficients for some commonly used based copulas and the UL distorted copulas.

In

Table 1,

where

is the univariate Student t cdf with

degrees of freedom. Since

, the UL distortion leads to a copula model with weaker lower tail dependence and identical upper tail dependence as the base copula model.

5. Measures of Concordance

In this section, we derive formulas of two widely used nonparametric concordance measures known as Kendall’s tau and Spearman’s rho for the UL-distorted copulas.

For a base copula

Kendall’s tau and Spearman’s rho are, respectively, given by

where

Applying (7) and (

1), Kendall’s tau, denoted by

and Spearman’s rho, denoted by

of the UL-distorted copulas can be, respectively, derived as follows

where

and

If

C is Archimedean with generator

Kendall’s tau coefficient can be calculated by

where

In this case, the induced copula

is Archimedean with generator

Kendall’s tau of the induced copula is given by, with a substitution of

which may need to be computed numerically.

Example 10. Kendall’s tau of the UL-Clayton copula. Since the Clayton copula is Archimedean with generator and By (12), we have Example 11. Kendall’s tau of the UL-Gumbel copulas. The Gumbel copula is Archimedean with generator and By (12), Kendall’s tau is given by Example 12. Kendall’s tau of the UL-Frank copula. The Frank copula is Archimedean with generator and By (12), Kendall’s tau is derived as If

Kendall’s tau is equal to

where the Debye function is defined as

see (

Nelsen (

2006),

p. 171).

8. Application

Here, we analyze CRSPday data to see the performance of the UL-distorted copulas. The data are readily available in “Ecdat” R package. It contains daily returns collected between 1989 and 1998 in the United States. We consider daily returns for IBM stock (IBM) and the historical value-weighted indexes (CRSP) by the Center for Research in Security Price. Based on the definition and research by the National Bureau of Economic Research (NBER) and

Walsh (

1993), the eight-month period between July 1990 and March 1991 is a recession in the NBER’s chronology. After the recession, the 1990s was a period of economic growth. We thus split the sample period into two sub-periods: the crisis period (July 1990 to March 1991) and the post-crisis period (April 1991 to December 1998). Splitting the sample allows us to explore the impact of a financial crisis and differences in the relations between the two variables, by using copula models.

Table 2 presents summary statistics in percentage of the two variables, including the standard deviation (SD), first quartile (Q1), and third quartile (Q3) for the crisis and post-crisis periods separately. Other than the maximum values for IBM, there are few differences between the crisis and post-crisis periods in summary statistics for the two variables.

Scatter plots are displayed in

Figure 6 to visualize possible data features, such as the joint behavior of extreme values between IBM and CRSP or between pseudo-IBM (

) and pseudo-CRSP (

), i.e, the empirical distributions of IBM and CRSP. The scatter plots indicate that there is a stronger agreement in IBM and CRSP for the crisis-period data than for the post-crisis data. Note that 0the sample Kendall’s taus for crisis and post-crisis periods are 0.55 and 0.30, respectively. From

Figure 6a, there seems to be upper tail dependence and weak lower tail dependence in the crisis-period data. One might therefore choose copula models with upper tail dependence such as Galambos and Gumbel copulas in

Table 3. For the post-crisis data,

Figure 6b appears to have lower and upper tail dependence, in which case, t-copula and BB1 copulas might be appropriate.

The maximum pseudo-likelihood estimation (MPLE) introduced by

Genest et al. (

1995) is used to fit parameters of a copula model. Let

be the set of observations. Define

and

where

is the indicator function. The MPLE method first estimates the marginal distributions

F and

G using the empirical distributions

and

and then maximizes the pseudo-log-likelihood function given by

where

is the copula pdf and the pseudo-observations

and

In addition to the parameter estimates with their standard error in the parentheses,

Table 3 containing results for the crisis-period data and

Table 4 for the post-crisis data report the maximum pesudo-log-likelihood value (MPLL) in (

13), AIC,

and

The asterisk notation (*) indicates that either the lower or the upper tail dependence coefficient has a value of 0. The parameter estimate computed for the base copula is used as the initial value when maximizing the UL-distorted copula models. The built-in R function optim() is employed to solve for the MPLE estimates.

Since the sample size for the crisis-period data is smaller, one would expect that the standard errors of parameter estimates for each model in

Table 3 are larger than those in

Table 4. Furthermore, the UL-distorted copula model is expected to perform better than its base copula model in terms of MPLL, due to the extra parameters.

In

Table 3, not surprisingly, copula models with upper tail dependence perform well in terms of MPLL and AIC. The UL-distorted copula provides a better fit than its copula base in terms of the MPLL. AIC penalized a model for additional parameters. Two extra parameters are inoculated into the UL-distorted copula model. Partly due to the fact that a smaller sample size leads to a smaller likelihood value, the BB1 copula model is the winner in terms of AIC for fitting the crisis-period data.

For the post-crisis data, based on

Table 4, the t-copula of the Elliptical class and the BB1 copula of the Archimedean class perform well. Just as for the crisis-period data, the Clayton and Frank copulas fit the data poorly in comparison with other copula models in the table. However, there is a sizable improvement in MPLL and AIC for the UL-Clayton and UL-Galambos copula models, which, in a way, reflects the simulation study results. The UL-distorted copula model outperforms its base copula in terms of MPLL. In terms of the AIC, the UL-BB1 copula model of four parameters offers no improvement over its base copula. The rest of the UL-distorted copula models of three parameters deliver a better fit than its base copula in terms of AIC. Among the selected models, the UL-distorted t-copula model is the best performer.

For the crisis data, the respective estimates for upper and lower tail dependence coefficients are 0.27 and 0.57, based on the BB1 copula model. For the post-crisis data, they are 0.01 and 0.08 based on the UL-t-copula. The estimated Kendall’s tau coefficients resulting from top performers are close to the sample Kendall’s tau coefficients of 0.55 and 0.30, for crisis and post-crisis data, respectively.

The UL-distortion induced model is expected to enhance the model fit in terms of MPLL. However, in terms of AIC, due to the penalization for extra parameters, the UL-distortion induced copula may not perform as well as its base copula.

The Cramer-von Mises goodness-of-fit statistic (CvM) is conducted to test the adequacy of copula models in

Table 3. The CvM is calculated as the sum of square deviations between the empirical cdf and the estimated copula cdf. A bootstrap approach is used to approximate

p-values; see

Genest et al. (

2009) for details. For the two sample sizes of 209 and 1962, we computed the bootstrapped

p-value based on 1000 replications.

Table 5 reports the results. For example, for post-crisis data, fitting the UL-t model results in a CvM value of 0.0354 with a

p-value of almost 1 indicating the UL-t model is appropriate. While not all the base copulas chosen appear adequate, all the UL-distorted copula models provide an adequate fit based on Cramer-von Mises goodness-of-fit test.

9. Concluding Remarks

This research proposes a mechanism to construct a distortion function and explores the properties of the family of copulas induced by the unit Lomax distortion. Explicit expressions for the UL-Clayton, UL-Gumbel, UL-independence, UL-Frank, UL-Galambos, and UL-BB1 copulas are given. In addition to the limiting cases in the parameters, the tail behaviors including the dependence coefficients and orders are studied for the UL distorted copulas. Kendall’s tau formulas for the UL-Clayton, UL-Gumbel, and UL-Frank copulas are derived and used to investigate the concordance ordering. The maximum pseudo-likelihood estimation is employed to fit the copula model. The Cramer-von Mises goodness-of-fit statistic is conducted to evaluate the adequacy of copula models. As expected, the UL-distorted copula outperforms its base copula.

The construction mechanism described in

Section 2 utilizes a transformation of a nonnegative continuous random variable

Y to a variable

U, whose support is the unit interval. The paper considers the transformation of

where

Y is a Lomax random variable. One possible candidate for

Y is the Weibull random variable with cdf

. However, upon further calculations, the resulting distortion is not admissible. There are undoubtedly other employable transformations and nonnegative random variables. An example is the transformation,

of a Weibull random variable. We are currently examining this case. Distortion of multivariate copulas is more complicated and will be investigated further in a separate paper.