1. Introduction

The Global Financial Crisis (GFC) highlighted the major impact that troubled banks can have on global economies. The successful development of an economy, as noted by (

Gavurova et al. 2017), is dependent on the efficient and stable performance of its banks. This leads to the necessity for sound risk indicators for banks. These can be referred to as “stability indicators” (the term we use in this study) or “financial soundness indicators” as used by the International Monetary Fund 2018 (IMF). Such indicators, according to the IMF, provide insight into the health of a country’s financial institutions and support economic and financial stability analysis. Indicators should highlight weaknesses in the financial sector and assist in the formulation of macroeconomic policy (

Navajas and Thegeya 2013). The indicators can also be incorporated into wider stress testing, which is entrenched in Basel III and requires banks to undertake multifactor tests that capture historical extreme environments and plausible future market instability, thus helping to improve the banking sector’s ability to absorb financial and economic shocks.

There is a diverse range of potential stability indicators. The International Monetary Fund 2018 recommends 28 indicators (discussed further in

Section 2), covering a wide range of risks. While comprehensive, a large number of indicators can cause complexity difficulties when comparing overall financial stability across different banks or regions. The purpose of this research is to construct a comprehensive stability indicator (

CSI) that has the simplicity of only three factors (the 3Cs of

Creditworthiness,

Conditions and

Capital) but which can adequately compare banks so that problems can be promptly identified and addressed.

In formulating the model, several key requirements were considered. First, the model should be backwards and forwards looking. Second, risk should be identified through incorporating easy to access internal (bank) and external (market) factors which can be readily modelled by banks or at a regional regulator level. Third, the indicator must provide clear outcome categories which are not only pass/fail, but which also identify banks where improvements could be made. Fourth, it should be able to be applied uniformly across banks, but as no model can cover all circumstances, it should allow for judgement in the interpretation of results and implementation of remedial action.

As noted, our model incorporates 3Cs:

Creditworthiness,

Conditions and

Capital.

Creditworthiness is the internal bank factor which measures loan quality, which in our model is represented by nonperforming loans (NPL) to gross loans ratio.

Conditions (market conditions) are measured in our model by a (

Merton 1974) type model, which measures bank market asset value volatility. As market asset values should incorporate all available market information, this approach acts as a substitute for the analysis of a wide range of individual macroeconomic factors.

Capital is the banks’ safety net which absorbs adverse risk movements. These three factors are combined into a comprehensive stability indicator (

CSI), which is a

Leverage to Creditworthiness coverage ratio modified by market

Conditions. Results are categorised using a traffic light model, red (danger), orange (caution) or green (pass).

We show that these 3Cs explain 91% of bank failures in the United States. The

CSI is developed from these 3Cs using data over the 13 year period from 2005 to 2017, which includes the GFC. We then apply the

CSI to 20 US Banks and find that it achieves similar results to much more complex Federal Reserve tests in ranking the relative riskiness of these US banks. It should be emphasised that the

CSI model is a stability indicator, not a stress test. Stress tests are usually far more comprehensive undertakings which follow very specific procedures, and sometimes using multiple scenarios (see for example (

Montesi and Papiro 2018)). Therefore, the

CSI is not designed to replace comprehensive stress tests like the Federal Reserve tests. However, the

CSI can be a very useful ongoing indicator to regulators or banks of risk in periods between comprehensive tests, or for regulators to compare risk among a wider range of banks who have not been included in the comprehensive stress tests.

The key contribution and novelty of the model is in the new combination of variables considered and the way the model is integrated is into a new comprehensive stability indicator (

CSI). The above discussion has highlighted several benefits and improvements that the model can bring to existing solutions. First is the simplicity of the model, in that it focuses on a much narrower set of inputs (three) than used by most existing models which are discussed in

Section 2 (such as the 28 indicators of the International Monetary Fund). This makes it readily usable by banks in those situations noted in the above paragraph. Second, the combination of the three underlying variables provides a good prediction of bank failure (as discussed in

Section 5) and can achieve similar outcomes in classifying risky banks as much more complex solutions (as noted by the comparisons with the Dodd–Frank stress tests in

Section 6). Third, the benefit of the traffic light system component of the model is that it does not only provide pass/fail outcomes, but also highlights banks where caution (orange) is needed and where remedial action needs to be taken before the situation deteriorates.

Following this introduction,

Section 2 discusses existing stability indicators.

Section 3 sets out key principles of the

CSI model, while

Section 4 explains the rationale and methodology.

Section 5 describes our data and tests the appropriateness of the model.

Section 6 presents the results and

Section 7 concludes.

2. Existing Stability or Soundness Indicators

This section examines various existing indicators and shows how our proposed model differs from these.

In several studies, a multitude of indicators are applied to determine the financial soundness of banks. For example, the IMF (

International Monetary Fund 2018) have 28 financial soundness indicators for deposit institutions relating to aspects such as capital, nonperforming loans, liquidity, sectoral and geographic distribution, foreign exchange exposure and credit growth. (

Adrian and Brunnermeier 2016), include a wide range of variables into their ΔCoVaR measure of systemic risk, including macro-state indicators (such as market returns and volatility on various instruments) and internal indicators (relating to aspects such as leverage, maturity mismatch, size, growth and various asset and liability variables). The Bank of England (BOE) Risk Assessment Model (RAMSI) is another multi-factor model, which measures stresses for the ‘whole’ banking system and for individual banks (

Burrows et al. 2012). The US Federal Reserve (

US Federal Reserve 2018a) Dodd–Frank stress tests included 28 indicators in their analysis of 35 Bank Holding Companies, covering a range of macroeconomic and bank specific factors and found that, while losses may be experienced by the banks under severely adverse scenarios, none would fall below regulatory capital ratios, and were thus deemed to have passed the tests. The z-score (

Laeven and Levine 2009;

Lepetit and Strobel 2013;

Doumpos et al. 2015) includes capital to assets (leverage) and return on assets (ROA), a far lower number of indicators (two) than those of the IMF. Value at Risk (VaR), which measures maximum losses at a given level of confidence has become a predominant measure of risk among banks given its incorporation into Basel Regulatory requirements (see (

Fischer et al. 2018) for a comprehensive evaluation of VaR techniques). (

Powell 2017) compares small and large banks from Malaysia to the overall ASEAN region using NPLs and conditional distance to default CDD (a tail risk measure of default) to show that larger banks are generally of lower risk than smaller banks. Our proposed model differs substantially from all these approaches in the number of variables proposed and in our integration of the variables into a single comprehensive stability indicator (

CSI).

Many studies discuss the importance of macroeconomic factors in assessing bank risk. (

Borio et al. 2014), believe that micro (bank specific) and macro (system-wide) indicators should be used together, serving as a useful cross-check for each other. (

Drehmann et al. 2011) investigated a range of macroeconomic, market, and banking sector indicators as signals for the build-up and release of capital buffers. They found that credit to GDP ratios (deviation from their long-term average) were the most effective in signalling the need for capital build up, but that no single trigger was appropriate over all countries and time periods, and therefore some degree of judgment would be necessary when setting countercyclical buffers. (

Rösch and Scheule 2015) found that bank losses can be decomposed into fundamental and macroeconomic observable factors. (

Guha and Hiris 2002;

Joutz and Maxwell 2002;

Trüeck 2010;

Bellotti and Crook 2012) all incorporated macroeconomic factors into credit models.

While the above studies all highlight the importance of macroeconomic indicators, these can add a high level of complexity. (

Borio et al. 2014) states that where models are very complex, there is high potential for misspecification. Market variables have been viewed as an alternative to macroeconomic factors when assessing financial risk (

Allen and Powell 2009). A key premise is that market prices should incorporate all available information. Thus, if there are any economic or financial concerns in markets then these should be all (or largely) captured in market asset prices, alleviating the need to analyse individual macroeconomic factors.

The importance of the link between the market asset value volatility of banks (measured by models like the Merton structural model outlined later in this paper) and capital adequacy, was emphasised by the (

Bank of England 2008), who state that as default probabilities increased during the GFC, market participants placed greater weight on mark to market asset values, implying lower asset values and higher capital needs for banks. The link between market volatility and credit risk is highlighted by (

Bucher et al. 2013), who argue that volatility can drive the dynamics and stability of credit. Market based capital adequacy metrics have been found to be much more sensitive to risk factors than accounting/regulatory based capital models (

Hasana et al. 2015). (

Angelini et al. 2011) found market factors to dominate firm specific credit factors in times of crisis. (

Allen et al. 2015) found that a Merton type structural model which incorporated market asset value volatility was much more responsive to dynamic economic circumstances than macroeconomic or ratings-based models. The above discussion highlights that macroeconomic models and market models each have disadvantages and advantages, and that market models provide a plausible alternative to macroeconomic models.

A major point of departure of our study from prior studies who use a multitude of indicators is that we simplify this wide range of indicators to three core indicators, measuring the key areas of Capital, Creditworthiness and Conditions. Another key point of departure of our model is the amalgamation of these three indicators into a unique single overall comprehensive stability indicator (CSI), making it easy to compare diverse banks on a common basis, which indicator is then linked to simple traffic light colour zones red, orange and green, that not only indicate major problem areas (red) but also highlight areas where improvement could be made (orange). While the z-score mentioned in our prior discussion does have a single z-indicator, this includes a different set of variables (ROA and Capital) to our model. This Conditions variable is used as an alternative to the macroeconomic variables applied in many studies, based on the premise that market prices should incorporate all available macroeconomic information. In addition, a further advantage of our model compared to the other indicators above which primarily measure historical events, is that it incorporates a forward-looking stability factor which examines how the colour zones will change under distressed Conditions.

3. Key Principles of the Model

This section summarises the key principles used in the model for measuring bank safety. Further detail and motivation behind the choices is in

Section 4.

Forward and backward looking: The importance of looking forwards to future potential events in addition to backwards is highlighted by the Basel III regulations and by (

Paraschiv et al. 2015;

Li et al. 2018). Looking backwards involves an assessment of past factors causing banking distress, which provides guidance to potential future distress. Looking forwards involves a ‘what if’ approach which determines how well banks are placed to deal with future distressed

Conditions and usually involves simulation of shocks to macroeconomic, internal, and market variables. In our model, this means looking to the

past for guidance on how well banks are

currently placed to withstand potential

future shocks. Our model uses historical indicators (the variables from our 3Cs model mentioned below), to which we apply a distress factor (

DF) as shown under the parameters and definitions in

Section 4, to determine a bank’s resilience to a future distress scenario. Thus, as noted in

Section 2, a key benefit of our model is that it is forward looking, whereas many indicators examined in that section are primarily backward looking.

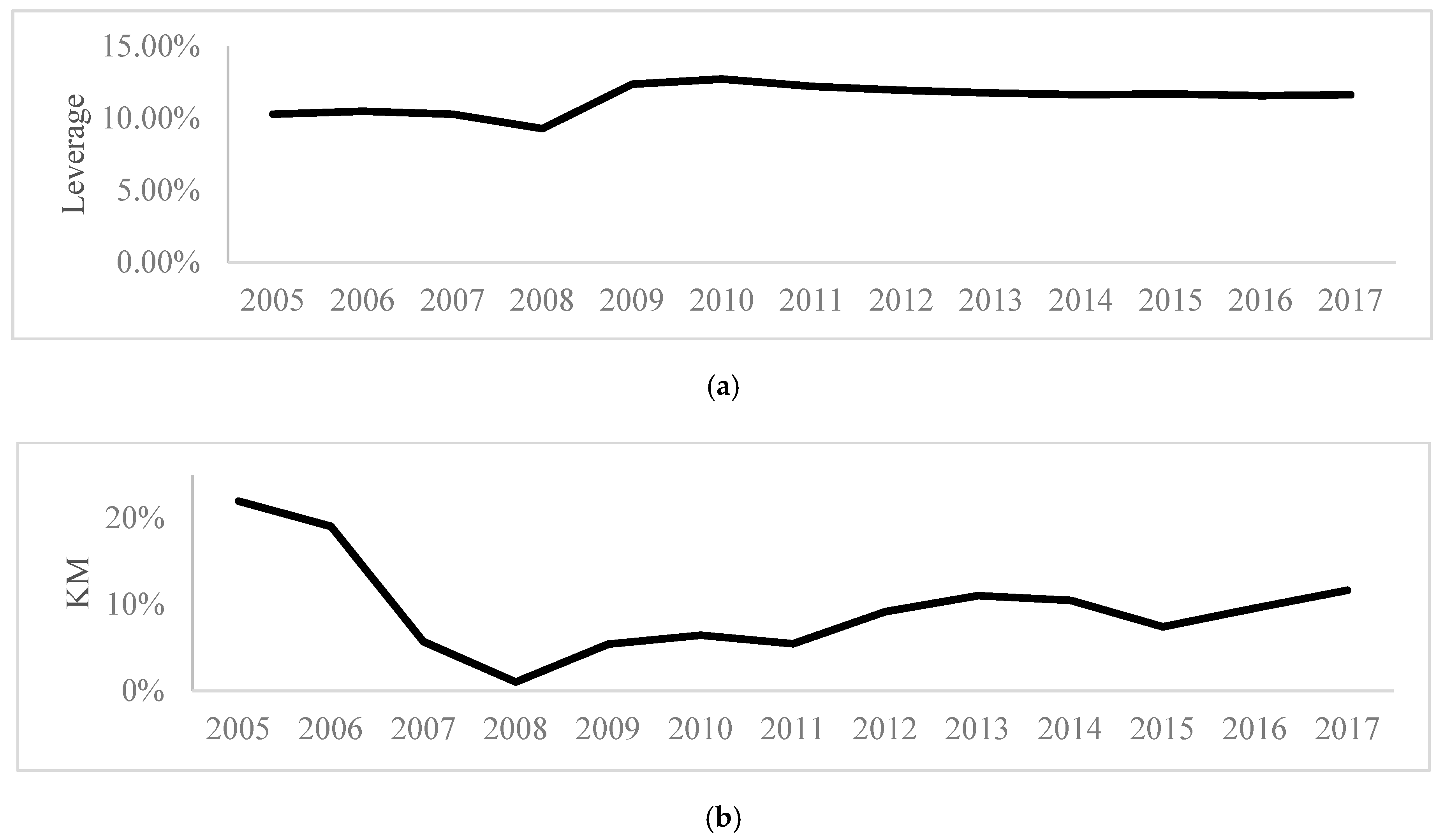

Core components: Our ‘3 Cs’ model assesses

Creditworthiness (of the underlying customers),

Conditions (the environment) and

Capital (the safety net). The first two factors can cause bank distress, while the third factor is a safety net for bank distress. As outlined in

Section 4, we explore two measures of

Capital. The first is a total capital to total assets ratio (as it has some similarities to regulatory leverage ratios, we will term this

Leverage) and the second is a capital ratio based on the market value of capital which we term

KM. These 3C factors are combined into a single overall comprehensive stability indicator (

CSI) per Equations (2) and (3) in

Section 4.2, making it easy to compare risk among banks.

Results classification: We use a traffic light system to categorise the results of our CSI (per Equation (3)), where red is danger (failed the adverse scenario), orange is caution (marginally passed, and situation needs closer scrutiny to determine potential improvements), and green is go (pass). This classification has the benefit over other stability indicators, in that not only does it provide clear easily understandable signals, it also highlights those banks where improvements can be made.

Simplicity and judgement: The stability indicators should be easy to implement and to understand and be as uniform as possible. Using only three core factors (as compared to multifactor models examined in

Section 2) has the benefit of simplicity, making the model readily useable among different banks. The argument for fewer or more factors in finance and economic models is not new. The Capital Asset Pricing Model, for example, proposes a single factor (Beta) to explain stock returns. The (

Fama and French 1992) three factor model found that the three factors of beta (exposure to market), size (small minus big) and value (book to market) can explain almost all the return of a stock portfolio. The benefits of fewer factors are reduced complexity and cost, and improved ease of use, thus enabling banks and regulators to readily benchmark financial health across diverse banks, and potentially between regions.

It should also be recognised that no set of rules can apply to all circumstances. Therefore, sound judgement should be applied in conjunction with the rules when considering the unique circumstances of individual banks.

4. Model Methodology and Motivation for Factor Choice

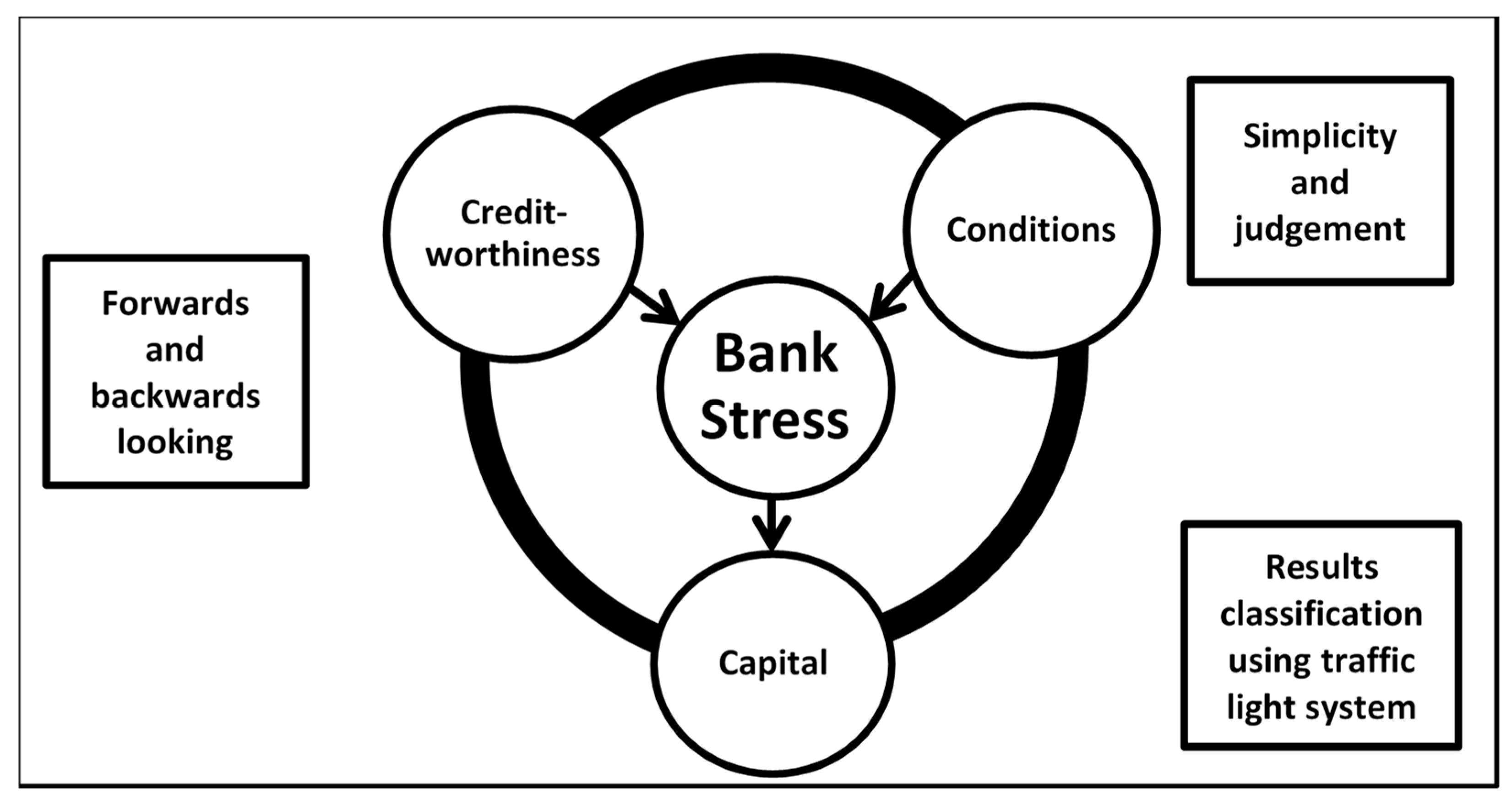

The model, (see

Figure 1), incorporates the principles outlined in

Section 3 and our 3Cs of

Creditworthiness,

Conditions and

Capital. The arrows for the causal factors of distress,

Creditworthiness and

Conditions, point towards bank distress. The other arrow points away from bank distress towards our distress relief factor,

Capital.

Choosing the factors involved some important considerations. The key objective is a model which applies a common approach across all banks, in order to benchmark them against each other, set a standard, and indicate where improvements are needed. The model is not intended to align microscopically with each banks’ unique circumstances, nor to replace bank specific models. Thus, a complex model with detailed criteria is not sought. Rather, simplicity and uniformity are paramount in the model which is why it is restricted to the three core factors of Creditworthiness, Conditions and Capital, combined into an overall comprehensive stability indicator (CSI).

4.1. The 3C Factors

This section focuses on firstly outlining each of the three factors and the rationale for their choice, and then secondly explaining how these are combined into an overall CSI.

The objective of the components of the model is to provide core measures of internal bank specific risk (measured by Creditworthiness), external market risk impacting on banks (measured by Conditions) and the protection or safety net that banks have against risk (measured by Capital).

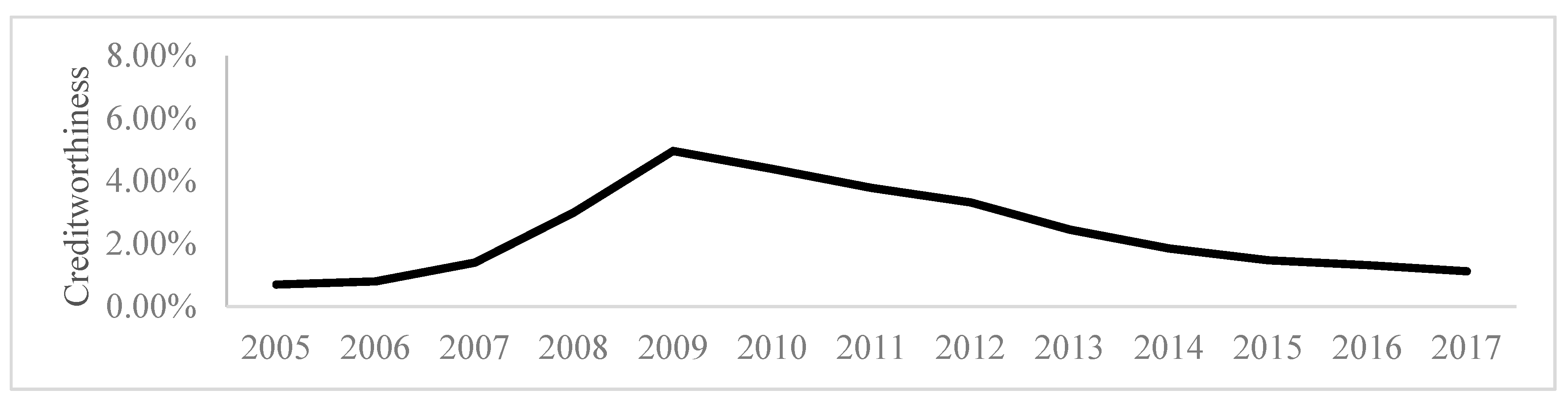

Creditworthiness is our internal credit risk factor, measured by NPL to total gross loans, with figures available via World Bank data at a US country level and from annual reports for individual banks. Credit risk was acknowledged as the leading source of risk for banks long before the GFC (

Basel Committee on Banking Supervision 2000). This was subsequently reinforced by the role that sub-prime and securitised loans played in the GFC. (

Alali and Romero 2012) and (

Kim and Lee 2019) find NPLs to be very informative in the prediction of bank failure. The importance of credit risk continues to be reinforced through the major role it plays in determining capital requirements under Basel III. Credit facilities typically represent around 80% of all assets in US banks (

US Federal Reserve 2018b), and around 80% of the risk weighted assets used in capital adequacy calculations of banks (as shown in their annual reports). We do not ignore the other risks, because, as we will see later, the threshold for our

CSI (Equation (3) in

Section 4.2) can be adjusted to incorporate the other 20% of risks like liquidity and operational risk.

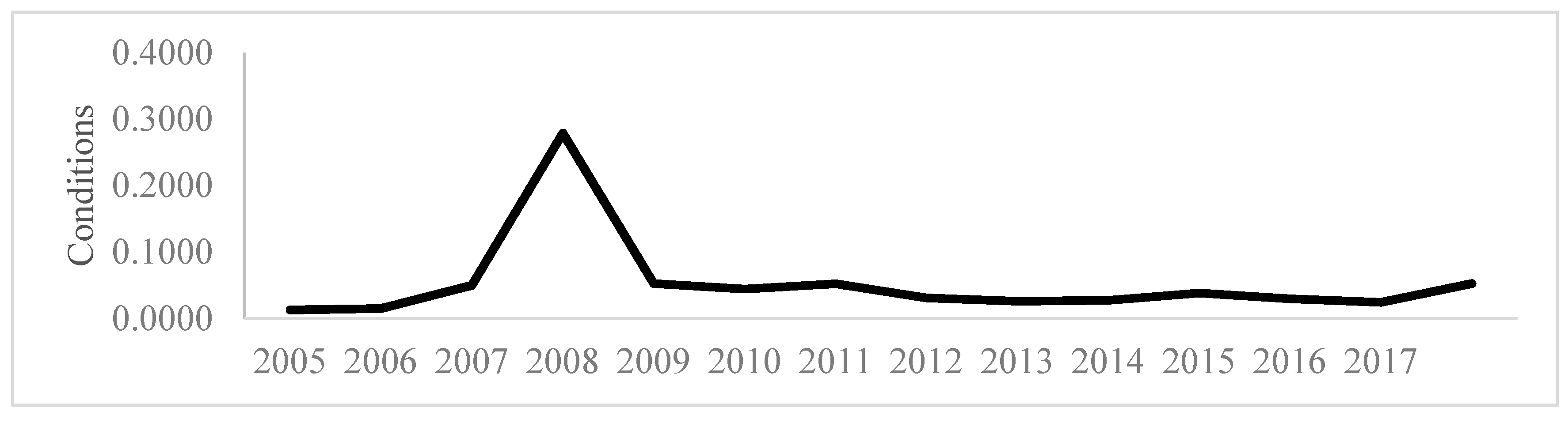

Conditions is our external factor. The importance incorporating of market-based variables into stability indicators was discussed in

Section 2. Our

Conditions variable is the market asset value volatility of banks (measured by the (

Merton 1974) structural model approach), which as, discussed in

Section 2, captures all conditions impacting on an entity at the aggregate level. As the (

Merton 1974) model is well documented, we only provide a brief summary of its key features here to assist the reader. Key components of the model are equity (

E), volatility of equity (

σE), market asset values of the firm (

A), debt (

F) and market asset value volatility (

σA) (

Conditions). The firm defaults when liabilities exceed assets. This equals the payoff of a call option on the firm’s value with strike price

F. If, at time

T, loans exceed assets, then the option will expire unexercised and the owners will default. The call option is in the money where

AT −

F > 0, and out the money where

AT −

F < 0. As

A −

F is a measure of the firm’s capital, in our model

A = F is where the lender has run out of capital. An increase in

Conditions risk indicates capital erosion, which needs to be restored, as noted by the BOE and IMF (see

Section 1). In calculating the

Conditions, we follow the (

Merton 1974) approach, as outlined in (

Bharath and Shumway 2008). An initial asset value and its volatility (

σA) is estimated in Equation (1):

Then a comprehensive iteration, convergence and correlation procedure is applied in order to estimate the market value of assets every day, and the standard deviation thereof, for each bank in our sample over the 13 year period. Any thin trading is compensated for using a moving average model as outlined by (

Miller et al. 1994).

Capital is our safety net. Capital buffers can help reduce banks’ systemic importance and their individual risk-taking (

Andries et al. 2018) and increase the resilience of banks (

Hossain et al. 2017). We use a total capital to total assets ratio rather than risk-weighted regulatory ratios. Many soundness or stability indicators and their incorporation into stress tests, assess whether the existing level of regulatory capital ratios can withstand shocks. However, the accuracy of the risk-weighting process, globally, has been hotly debated given that different internal models used by banks result in different risk-weightings. The (

Basel Committee on Banking Supervision 2014), attribute this problem to a mix of differences in the underlying risk and to different banking and supervisory practices. A further argument in favour of our use of an unweighted capital ratio is that the purpose of risk weighting is to apply favourable weightings to lower risk categories of loans, whereas our

Creditworthiness factor is based on NPLs which all fall into the high-risk category.

To illustrate the rationale behind the three factors chosen, consider the example of two countries (Australia and the US). Going into the GFC, the US had almost double the Leverage ratio of Australia (10.7% vs. 5.8%). Yet, the US had considerable losses and bank failures during the GFC, whereas Australian banks all remained profitable. The problem was that the US had treble the level of

Creditworthiness risk (4.0% vs. 1.7%) and almost four times the

Conditions risk (17.5% vs. 4.3%), leading to severe erosion of US bank market capital values, with poor ability to meet nonperforming loans. Thus, capital only tells part of the story of bank soundness. As noted by (

Flannery and Giacomini 2015), many large banks’ losses were absorbed by their governments during the GFC, despite these banks complying with Basel standards for “adequate” capital. It is the deterioration of

Creditworthiness and market

Conditions that leads to distress and losses for banks, which causes the need for capital buffers to absorb this risk. There is not necessarily a relationship between capital and default risk (

Bichsel and Blum 2007). Thus,

Leverage is not a preventative measure. It is the insurance policy―the safety net in the event of a fall. It is the quality of lending and market conditions that determine distress levels. Thus, in this study we examine distress using all these factors, i.e., the 3Cs of

Capital,

Creditworthiness and

Conditions.

4.2. The Comprehensive Stability Indicator

Once the 3Cs are calculated, our objective is to provide an overall measure of bank distress, by combining the factors into a single comprehensive stability indicator (CSI). This measures the extent to which Leverage, modified by changes in volatility in market asset values (Conditions) to derive the market value of capital KM, can cover Creditworthiness in the form of the NPL to gross loans ratio.

With the objective of ascertaining changes to CSI if distress is applied to the underlying variables, the model incorporates a distress factor (DF), which is the amount of distress applied to a particular scenario. Our zones of red, orange and green, have the objective of classifying CSI into different risk bands.

The model has the following parameters and definitions:

| Conditions | = market asset value volatility, per Equation (1) |

| Creditworthiness | = nonperforming loans to total gross loans |

| Leverage | = total capital to total assets ratio |

| KM | = market value of capital (per Equation (2), which measures Leverage based on the impact of a change in Conditions) |

| CSI | = Comprehensive stability indicator (Equation (3), which is Leverage to Creditworthiness, modified by changes in Conditions) |

| t | = time period (year), and thus Conditionst is Conditions for historical period t |

| tc | = current time period (i.e., if the most recent period in the sample is 2017, then Conditionstc is Conditions2017) |

| DF | = distress factor, which is the predetermined shock applied to a variable in a particular scenario. In our scenario in Section 6 we apply distress to current factors up to the 90% threshold (α = 0.90) level of historical experiences (e.g., the 90th percentile worst year in our sample). Our example analysis of the US banks that is undertaken in Section 6 shows that for Conditions this is 2.0 × the current Conditions level and that the associated Creditworthiness at that distressed Conditions level is 2.5 × the current Creditworthiness level. Thus, DFConditions0.90 = 2.0 and DFCreditworthinesss0.90 = 2.5. Therefore, Conditionsdistressed = Conditionstc × 2.0 and Creditworthinessdistressed = Creditworthinesstc × 2.5. |

| Zone | = red, orange, or green, as determined by Section 6.1.4. |

| Note: The above factors are developed using figures for the total US market to determine a uniform Distress Factor (DF). This DF is then applied to the 3Cs specific to each bank in the sample. |

The equations referred to above are as follows, assuming 2017 as the current year:

CSI serves as a financial stability indicator, measuring the extent to which Leverage, modified by changes in volatility in market asset values (Conditions), is able to cover Creditworthiness in the form of the NPL to gross loans ratio. As Creditworthiness risk increases, or as Leverage decreases, this coverage will reduce, indicating a reduction in the financial soundness of the firm. As economic and market conditions deteriorate (such as in 2008 at the height of the GFC), market asset values become more volatile, impacting on CSI. Thus, CSI2008 will be lower than CSI for other years in our sample, showing a deterioration in financial soundness, and a need to restore the Leverage of the firm. CSI is linked to colour bands red (danger), orange (caution) and green (pass).

5. Data and Testing the Appropriateness of the Model

This section outlines the data used in our modelling and undertakes regression testing of the appropriateness of the underlying factors of the model, prior to running and presenting the results of the full model in

Section 6. Our

CSI model requires data for

Leverage,

Creditworthiness and

Conditions, including daily share price data on all individual banks in the sample. The period examined in the

CSI model is from 2005 to 2017 which importantly, includes the 2008–2009 GFC period, as well as pre-GFC and post-GFC years. For

Leverage and for

Creditworthiness we use annual figures obtained from World Bank data at the country level, supplemented by data on individual banks obtained from Datastream and annual reports. The data we need to calculate

Conditions, using the methodology outlined in

Section 4 to derive the daily asset values, is also obtained from Datastream.

Because we compare our results to the sample of banks used in the Federal Reserve Stress Tests severely distressed scenario (35 banks in the 2018 tests), we only used banks in our sample which were included in those tests. Our data sample was further restricted to listed USA owned banks, in the Datastream US Banks index, and which had sufficient data available over the studied period. This gave us a sample of 20 Banks common to those from the Federal Reserve tests, including Ally, American Express, Bank of America, Bank of New York Mellon, BB&T, Capital One, Citigroup, Citizens, Discover, Fifth Third, Huntington, JP Morgan Chase, Key Corp, M&T, Morgan Stanley, Northern Trust, PNC, SunTrust, US Bancorp, and Wells Fargo. Between them, these 20 banks hold 67% of the total assets (which comprise mainly loan assets) of all US banks.

To test the appropriateness of our selected factors, we back-tested them against actual bank failures in the US, as obtained from FDIC (

Federal Deposit Insurance Corporation 2017). This initial test of ours included quarterly bank failure (

BF) figures for the entire US banking industry (as opposed to just our sample of 20 individual banks mentioned above), which amounted to a total of 581 failures for our studied period). Using ordinary least squares regression, we regressed these quarterly bank failure figures (

BF) against quarterly aggregated figures for the entire US banking industry for C

reditworthiness,

Conditions, and

Leverage (as defined for these three variables in

Section 4.2) obtained from a combination of World Bank and DataStream data for 20 years from 1998 to 2017, thus having 80 observations for each variable.

We tested a variety of lags, finding that no-lag for

Creditworthiness and

Leverage yielded the highest explanatory values, and for

Conditions (where each quarterly observation was a rolling figure of the volatility over the prior 12 months), a lag of three quarterly periods was the most explanatory. This supported the prior findings of (

Allen et al. 2015) that market factors can provide an early warning indicator of potential bank problems (in this case 9 months prior to the failure), and by the time problems actually occur, the market has moved on to new news.

The regression results are summarised in

Table 1. R

2, which measures the extent to which the factors can explain BF was found to be a high 91.2% for the multiple regression, with high (99%) significance for

Creditworthiness and

Conditions (lag ¾ year), and relatively lower (95%) significance for

Leverage. To test the additional value of each variable, we commence with our highest factor (

Creditworthiness at R

2 = 86.5%), then add the other variables. Adding

Conditions (lag ¾ year) (which on its own has an R

2 of 43.9%), increases the R

2 obtained by

Creditworthiness by a further 4.0% to 90.5% but

Leverage adds very little value to the explanation as seen by the very small increase in total R

2 of 0.7%. If we add the Credit to GDP variable recommended by Drehmann et al. in

Section 2 as a good indicator of capital buffers, (which on its own has an R

2 of 29.5%) we improve the R

2 of our multiple regression model only marginally to 92.1%. These figures re-enforce

Creditworthiness and

Conditions as important causal factors, and

Leverage as a non-causal factor, but as discussed, a safety net factor.

We found no evidence of high multicollinearity between the independent variables, which all had a low Variance Inflation Factor (VIF) of below 3. Having broadly established the significance of our underlying variables, we now undertake the full

CSI modelling, with the results presented in

Section 6.

7. Conclusions and Implications

Stability indicators are essential to understand the ability of banks to withstand adverse financial and economic shocks. This paper developed a CSI model which uses three single factors (3Cs), Creditworthiness, Conditions and Capital to capture the risk of banks. The 3Cs were shown to be strong determinants of bank failures and the CSI model demonstrated the capacity to achieve significantly similar risk ranking of banks to the much more complex Federal Reserve tests, with the added benefit of the traffic light system which highlighted banks that needed improvement (orange). While our model is based around specific parameters for assessing bank safety, we also highlighted the importance of exercising sound judgment in interpreting results and implementing remedial measures.

The CSI model has implications for both banks and regulators. It is usually only practical to undertake formal stress tests, with a high number of variables and scenarios, on a periodic basis and not all banks have sufficient modelling capacity to undertake the highly detailed and sophisticated modelling required. The simplicity of the CSI model in using only three factors, however, means that it can be readily used to measure risk between formal stress tests, or applied by banks and regulators to banks which are not included in the formal stress tests, or to compare financial distress across multiple entities or potentially across countries. This can help increase the frequency and coverage of the measurement of bank risk. The use of the CSI, coupled with the warning indicator (orange), can allow regulators and banks to identify risk at an early stage and implement contingency plans to address the risk, thus helping to avoid more serious circumstances such as the bankruptcy of individual banks or systemic financial crises.

In terms of potential future studies, the model could be applied to developing regions, who might not have the depth of data and systems required to undertake highly detailed and complex stress testing, but who could benefit from the application of the relatively simpler 3Cs-based CSI.