Parametric Conditions of High Financial Risk in the SME Sector

Abstract

:1. Introduction

2. The Financial Situation of SMEs

3. Financial Risk in SMEs

4. Methodology and Research Sample

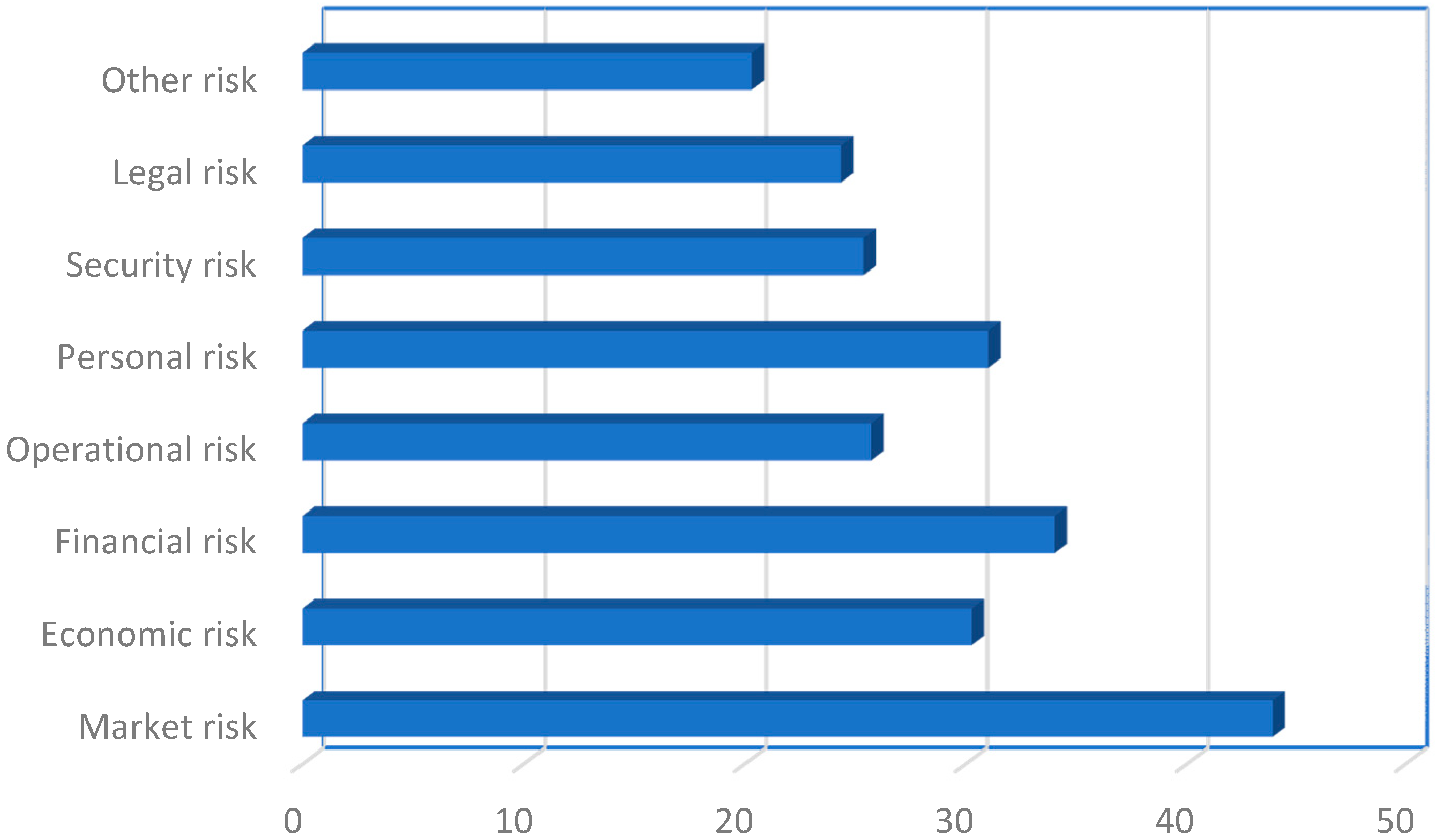

5. The Assessment of the Intensity of Financial Risk in the SME Sector

5.1. The Input Data of the Logit Model

- Does the size of the company affect the intensity of individual sources of financial risk?

- Does internationalization of SMEs affect the intensity of the perception of sources of financial risk?

- Does the operating time in the market affect the intensity of financial risk?

- Does experience in risk management affect the intensity of financial risk?

- Do the levels of sources of financial risk interdepend financially?

- Yn—dependent variable,

- x1, … x4—independent variables,

- B1, … B4—structural parameters of the model.

5.1.1. The Results of the Estimation of the Y1 Model

- The larger the company, the lower the probability of the occurrence of high risk.

- If the company operates in the international market, there is higher probability of the occurrence of high risk.

- The longer the company operates in the market, the higher the probability of the occurrence of high risk.

- If the company deals with risk management, the probability of the occurrence of high risk is lower.

5.1.2. The Results of the Estimation of the Y2 Model

- The larger the company, the lower the probability of the occurrence of high risk.

- If the company operates in the international market, the probability of the occurrence of high risk is higher.

- The longer the company operates in the market, the higher the probability of the occurrence of high risk.

- If the company deals with risk management, the probability of the occurrence of high risk is lower.

5.1.3. The Results of the Estimation of the Y3 Model

- The larger the company, the lower the probability of the occurrence of high risk.

- If the company operates in the international market, the probability of the occurrence of high risk is higher.

- The longer the company operates in the market, the higher the probability of the occurrence of high risk.

- If the company deals with risk management, the probability of the occurrence of high risk is lower.

5.1.4. The Results of the Estimation of the Y4 Model

- The larger the company, the lower the probability of the occurrence of high risk

- If the company operates in the international market, the probability of the occurrence of high risk is higher.

- The longer the company operates in the market, the higher the probability of the occurrence of high risk.

- If the company deals with risk management, the probability of the occurrence of high risk is lower.

6. Discussion on the Results

7. Conclusions

8. Limitations and Future Work

Author Contributions

Funding

Conflicts of Interest

References

- Altman, Edward I., Gabriele Sabato, and Nick Wilson. 2010. The value of non-financial information in small and medium-sized enterprise risk management. The Journal of Credit Risk 6: 1–33. [Google Scholar] [CrossRef]

- Amran, Azlan, Abdul Manaf Rosli Bin, and Bin Che Haat Mohd Hassan. 2009. Risk reporting: An exploratory study on risk management disclosure in Malaysian annual reports. Managerial Auditing Journal 24: 39–57. [Google Scholar] [CrossRef]

- Anton, Sorin Gabriel. 2019. Leverage and firm growth: An empirical investigation of gazelles from emerging Europe. International Entrepreneurship and Management Journal 15: 209–32. [Google Scholar] [CrossRef]

- Asikhia, Olalekan U. 2010. SMEs and Poverty alleviation in Nigeria: Marketing Resources and Capabilities Constraint. New England Journal of Entrepreneurship 13: 57–70. [Google Scholar] [CrossRef]

- Audretsch, David B., and Talat Mahmood. 1994. Firm selection and industry evolution: The post country performance of new firm. Journal of Evolutionary Economics 4: 243–60. [Google Scholar] [CrossRef]

- Banerjee, Ryan. 2014. SMEs, Financial Constraints and Growth. BIS Working Papers No 475. Basel, Switzerland: Monetary and Economic Department, Bank for International Settlements. [Google Scholar]

- Bartram, Söhnke M., Gregory W. Brown, and William Waller. 2015. How important is financial risk? Journal of Financial and Quantitative Analysis 50: 801–24. [Google Scholar] [CrossRef]

- Basle, Nuša, Polona Tominc, and Romana Korez-Vide. 2018. The impact of market knowledge on the internationalisation of small and medium-sized enterprises in Slovenia. European Journal of International Management 12: 334–50. [Google Scholar] [CrossRef]

- Beck, Thorsten, and Asli Demirguc-Kunt. 2006. Small and medium-size enterprises: Access to finance as a growth constraint. Journal of Banking & Finance 30: 2931–43. [Google Scholar] [CrossRef]

- Beck, Thorsten, Asli Demirguc-Kunt, and Ross Levine. 2005. SMEs, Growth, and Poverty: Cross-Country Evidence. Journal of Economic Growth 3: 199–229. [Google Scholar] [CrossRef]

- Belás, Jaroslav, Aleksandr Ključnikov, Sergej Vojtovič, and Monika Sobeková-Májková. 2015a. Approach of the SME Entrepreneurs to Financial Risk Management in Relation to Gender and Level of Education. Economics and Sociology 8: 33–42. [Google Scholar] [CrossRef]

- Belás, Jaroslav, Valer Demjan, Josef Habánik, Maria Hudáková, and Juraj Sipko. 2015b. The business environment of small and medium-sized enterprises in selected regions of the Czech Republic and Slovakia. E+M Ekonomie a Management 18: 95–110. [Google Scholar] [CrossRef]

- Bester, Helmut. 1987. The role of collateral in credit markets with imperfect information. European Economic Review 31: 887–99. [Google Scholar] [CrossRef]

- Białas, Andrzej. 2019. Cost-benefits aspects in risk management. Polish Journal of Management Studies 14: 28–39. [Google Scholar]

- Business Tech. 2016. Things You Need to Know about Small Businesses in South Africa. Available online: https://businesstech.co.za (accessed on 15 July 2019).

- Chavis, Larry W., Leora F. Klapper, and Inessa Love. 2011. Access to bank financing and new investment: Evidence from Europe. In The Economics of Small Businesses. Heidelberg: Physica-Verlag HD, pp. 115–32. [Google Scholar]

- Chiocchetti, Elena. 2018. Small- and medium-sized enterprises in a multilingual region: Best practices in multilingualism or missed opportunities? European Journal of International Management 12: 138–57. [Google Scholar] [CrossRef]

- Christopoulos, Andreas D., and Joshua G. Barratt. 2016. Credit risk findings for commercial real estate loans using the reduced form. Finance Research Letters 19: 228–34. [Google Scholar] [CrossRef]

- Ciechan-Kujawa, Marlena, and Katarzyna Goldmann. 2016. Analiza finansowa w ocenie ryzyka prowadzenia działalności gospodarczej w Polsce—Wyniki badań. Studia Ekonomiczne. Zeszyty Naukowe Uniwersytetu Ekonomicznego w Katowicach 268: 54–63. [Google Scholar]

- Danielak, Wiesław, Dominika Mierzwa, and Krzysztof Bartczak. 2017. Małe i średnie przedsiębiorstwa w Polsce. Szanse i zagrożenia rynkowe. Wroclaw: Exante, pp. 12–14. [Google Scholar]

- Djokic, Nenad, Aleksandar Grubor, Nikola Milicevic, and Viktorija Petrov. 2018. New Market Segmentation Knowledge in the Function of Bioeconomy Development in Serbia. Amfiteatru Economic 20: 700–16. [Google Scholar] [CrossRef]

- Edmiston, Kelly. 2007. The Role of Small and Large Businesses in Economic Development. SSRN Electronic Journal 92: 73–97. [Google Scholar] [CrossRef]

- Fajnzylber, Pablo, William F. Maloney, and Gabriel V. Montes-Roja. 2009. Releasing constraints to growth or pushing on a string? Polices and performance of Mexican micro firms. The Journal of Development Studies 45: 1027–47. [Google Scholar] [CrossRef]

- Forkuoh, Solomon Kwarteng, Emmanuel Affum-Osei, and Isaac Quaye. 2015. Informal Financial Services, a Panacea for SMEs Financing? A Case Study of SMEs in the Ashanti Region of Ghana. American Journal of Industrial and Business Management 5: 779–93. [Google Scholar] [CrossRef]

- Global Entrepreneurship Monitor (GEM). 2016. South African Report 2015/16. Available online: http://gemconsortium.org/report/49537 (accessed on 16 July 2019).

- Hawawini, Gabriel, and Claude Viallet. 2011. Finance for Executives, Managing for Value Creation. Mason: South-Western Cengage Learning. [Google Scholar]

- Hermelo, Francisco Diaz, and Roberto Vassolo. 2007. The Determinants of Firm’s Growth: An Empirical Examination. Revista Abante 10: 3–20. [Google Scholar]

- Honjo, Yuji, and Nobuyuki Harada. 2006. SME Policy, Financial Structure and Firm Growth: Evidence from Japan. Small Business Economics 27: 289–300. [Google Scholar] [CrossRef]

- Hudson, Edward, and Michael Evans. 2005. A Review of Research into Venture Capitalists’ Decision Making: Implications for Entrepreneurs, Venture Capitalists and Researchers. Journal of Economic and Social Policy 10: 1–18. [Google Scholar]

- Jindrichovska, Irena. 2013. Financial Management in SMEs. European Research Studies 16: 79–96. [Google Scholar]

- Kajüter, P. 2006. Risk disclosure of listed firms in Germany: A longitudinal study. Paper presented at the 10th Financial Reporting & Business Communication Conference, Cardiff Business School, Cardiff, UK, July 6–7. [Google Scholar]

- Kaszuba-Perz, Adriana, and Paweł Perz. 2010. Rola zarządzania ryzykiem w przedsiębiorstwie w obliczu wzrostu zewnętrznych czynników ryzyka. Finansowy Kwartalnik Internetowy “e-Finanse” 6: 53–63. [Google Scholar]

- Kmieć, Dorota. 2015. Zastosowanie modelu logitowego do analizy czynników wpływających na bezrobocie wśród ludności wiejskiej. Zeszyty Naukowe Szkoły Głównej Gospodarstwa Wiejskiego Ekonomika i Organizacja Gospodarki Żywnościowej 110: 33–42. [Google Scholar]

- Kongolo, Mukole. 2010. Job Creation Versus Job Shedding and the Role of SMEs in Economic Development. African Journal of Business Management 4: 2288–95. [Google Scholar]

- Kouvelis, Panos, and Wenhui Zhao. 2018. Who Should Finance the Supply Chain? Impact of Credit Ratings on Supply Chain Decisions. Manufacturing & Service Operations Management 20: 19–35. [Google Scholar] [CrossRef]

- Larsen, Povl, and Alan Lewis. 2007. How award winning SMEs Manage the barriers to innovation. Creativity and Innovation Management 16: 142–51. [Google Scholar] [CrossRef]

- Law, Siong Hook, Weng Chang Lee, and Nirvikar Singh. 2018. Revisiting the finance-innovation nexus: Evidence from a non-linear approach. Journal of Innovation & Knowledge 3: 143–53. [Google Scholar] [CrossRef]

- Lewicka, Beata. 2016. Czynniki wpływające na podjęcie decyzji o wyborze pożyczkodawcy przez osoby 50+. Annales Universitatis Mariae Curie-Sklodowska, Lublin Polonia 50: 290–310. [Google Scholar]

- Li, Xiumei. 2015. Accounting Problems and Countermeasures in SME. Paper presented at 2015 AASRI International Conference on Industrial Electronics and Applications (IEA), London, UK, June 27–28; pp. 656–58. [Google Scholar]

- Lukianchuk, Genrikh. 2015. The impact of enterprises risk management on firm performance of small and medium enterprises. European Scientific Journal 11: 408–27. [Google Scholar]

- Maksimov, Vladislav, Stephanie Lu Wang, and Yadong Luo. 2017. Reducing Poverty in the Least Developed Countries: The Role of Small and Medium Enterprises. Journal of World Business 52: 244–57. [Google Scholar] [CrossRef]

- Marcelino-Sádaba, Sara, Amaya Pérez-Ezcurdia, Angel M. Echeverría Lazcano, and Pedro Villanueva. 2014. Project risk management methodology for small firms. International Journal of Project Management 32: 327–40. [Google Scholar] [CrossRef]

- Margaretha, Farah, and Nina Supartika. 2016. Factors Affecting Profitability of Small Medium Enterprises (SMEs) Firm Listed in Indonesia Stock Exchange. Journal of Economics, Business and Management 4: 132–37. [Google Scholar] [CrossRef]

- Martin, Judith. 2017. Suppliers’ Participation in Supply Chain Finance Practices: Predictors and Outcomes. International Journal of Integrated Supply Management 11: 193–216. [Google Scholar] [CrossRef]

- Mateev, Miroslav, and Yanko Anastasov. 2010. Determinants of small and medium sized fast growing enterprises in Central and Eastern Europe: A panel data analysis. Financial Theory and Practice 34: 269–95. [Google Scholar]

- Memili, Esra, Hanqing Fang, James J. Chrisman, and Alfredo Massis. 2015. The Impact of Small and Medium Sized Family Firms on Economic Growth. Small Business Economics 4: 771–85. [Google Scholar] [CrossRef]

- Mentel, Grzegorz, Beata Szetela, and Manuela Tvaronaviciene. 2016. Qualifications of Managers vs. Effectiveness of Investment Funds in Poland. Economics & Sociology 9: 126–36. [Google Scholar] [CrossRef]

- Metrick, Andrew, and Ayako Yasuda. 2011. Venture Capital & the Finance of Innovation, 2nd ed. New York: Wiley. [Google Scholar]

- Meyer, Natanya, and Daniel Meyer. 2016. The relationship between the creation of an enabling environment and economic development: A comparative analysis of management at local government sphere. Polish Journal of Management Studies 14: 150–60. [Google Scholar] [CrossRef]

- Mikušová, Marie. 2017. To be or not to be a business responsible for sustainable development? Survey from small Czech businesses. Economic Research-Ekonomska Istraživanja 30: 1318–38. [Google Scholar]

- Mizla, Martin. 2013. Innovation paradoxes and SMEs. Przedsiębiorstwo i Region 5: 109–19. [Google Scholar]

- Moffett, Michael H., Arthur I. Stonehill, and David K. Eiteman. 2009. Fundamentals of Multinational Finance, 3rd ed. New York: Pearson Prentice Hall. [Google Scholar]

- Mrva, M., and P. Stachová. 2014. Regional development and support of SMEs—How university project can help. Procedia-Social and Behavioral Sciences 110: 617–26. [Google Scholar] [CrossRef]

- Mudiyanselage, Pradana, and Bandula Jayathilake. 2012. Risk management practices in small and medium enterprises: Evidence from Sri Lanka. International Journal of Multidisciplinary Research 2: 226–34. [Google Scholar]

- Neacsu, Marius, Silviu Negut, and Gheorghe Vlăsceanu. 2018. The impact of geopolitical risks on tourism. Amfiteatru Economic 12: 870–84. [Google Scholar] [CrossRef]

- Ojala, Arto, and Hannakaisa Isomäki. 2011. Entrepreneurship and small businesses in Russia: A review of empirical research. Journal of Small Business and Enterprise Development 18: 97–119. [Google Scholar] [CrossRef]

- Okpara, John O., and Pamela Wynn. 2007. Determinants of small business growth constraints in a Sub-Saharan African economy. Advanced Management Journal 72: 24. [Google Scholar]

- Oláh, Judit, Sándor Kovács, Zuzana Virglerova, Zoltán Lakner, Maria Kovacova, and József Popp. 2019. Analysis and Comparison of Economic and Financial Risk Sources in SMEs of the Visegrad Group and Serbia. Sustainability 11: 1853. [Google Scholar] [CrossRef]

- Olugbola, Seun Azeez. 2017. Exploring entrepreneurial readiness of youth and startup success components: Entrepreneurship training as a moderator. Journal of Innovation & Knowledge 2: 155–71. [Google Scholar] [CrossRef]

- Orinda, Reuben Atela, and Luther Otieno. 2017. Implication of Financial Challenges on Performance of Small and Medium Enterprises in Kisumu City, Kenya. International Journal of Business Quantitative Economics and Applied Management Research 3: 22–31. [Google Scholar]

- Pandaram, Atishwar, and Desmond U. Amosa. 2010. Family business concerns in Fiji: An empirical investigation. Pacific Economic Bulletin 25: 116–26. [Google Scholar]

- PARP. 2018. Raport o stanie sektora MSP w Polsce 2018. Warsaw: PARP. [Google Scholar]

- Popa, Alexandru-Emil, and Radu Ciobanu. 2014. The Financial factors that Inflauence the Profitability of SMEs. International Journal of Academic Research in Economics and Management Sciences 3: 177–85. [Google Scholar] [CrossRef]

- Rajapathirana, RP Jayani, and Yan Hui. 2018. Relationship between innovation capability, innovation type, and firm performance. Journal of Innovation & Knowledge 3: 44–55. [Google Scholar] [CrossRef]

- Saeidi, Sayedeh Parastoo, Saudah Sofian, Parvaneh Saeidi, Sayyedeh Parisa Saeidi, and Seyyed Alireza Saaeidi. 2015. How does corporate social responsibility contribute to firm financial performance? The mediating role of competitive advantage, reputation, and customer satisfaction. Journal of Business Research 68: 341–50. [Google Scholar] [CrossRef]

- SBA. 2017. SBA Fact Sheet for Serbia. Brussels: European Commission—DG Enterprise and Industry, Available online: https://ec.europa.eu/neighbourhoodenlargement/sites/near/files/serbia_sba_fs_2017.pdf&prev=search (accessed on 12 March 2019).

- Schumpeter, Joseph A. 1934. The Theory of Economic Development: An Inquiry into Profits, Capital, Credit, Interest, and the Business Cycle. New Brunswick: Transaction Books. [Google Scholar]

- Seo, Ji-Yong. 2017. A Study of Effective Financial Support for SMEs to Improve Economic and Employment Conditions: Evidence from OECD Countries. Managerial and Decision Economics 38: 432–42. [Google Scholar] [CrossRef]

- Shpak, Nestor, Oleg Sorochak, Maryana Hvozd, and Włodzimierz Sroka. 2018. Risk Evaluation of the Reengineering Projects: A Case Study Analysis. Scientific Annals of Economics and Business 65: 215–26. [Google Scholar] [CrossRef]

- Skowrońska, Anna, and Anna Tarnawa, eds. 2018. Raport o stanie sektora małych i średnich przedsiębiorstw w Polsce. Warsaw: PARP. [Google Scholar]

- Sozuer, Aytug, Gultekin Altuntas, and Fatih Semercioz. 2017. International entrepreneurship of small firms and their export market performance. European Journal of International Management 11: 365–82. [Google Scholar] [CrossRef]

- Statistics Poland. 2018. Wyniki finansowe przedsiębiorstw niefinansowych 21.03.2019 r. w 2018 roku, GUS. Available online: https://stat.gov.pl/download/gfx/portalinformacyjny/pl/defaultaktualnosci/5502/12/34/1/wyniki_finansowe_przedsiebiorstw_niefinansowych_w_2018_r.pdf (accessed on 12 March 2019).

- Statistics Poland. 2019. Methodological Report. Non-Nancial Enterprises Surveys. Warsaw: Statistics Poland, pp. 12–15. [Google Scholar]

- Stiglitz, Joseph E., and Andrew Weiss. 1981. Credit Rationing in Markets with Imperfect Information. The American Economic Review 71: 393–410. [Google Scholar]

- Stubelj, Igor, Primoz Dolenc, Roberto Biloslavo, Matjaz Nahtigal, and Suzana Laporšek. 2017. Corporate purpose in a small post-transitional economy: The case of Slovenia. Economic Research-Ekonomska Istraživanja 30: 818–35. [Google Scholar] [CrossRef]

- Thevaruban, Janaki Samuel. 2009. Small scale industries and its financial problems in Sri Lanka. Journal of Asia Entrepreneurship and Sustainability 5: 7–20. [Google Scholar]

- Toma, Sorin-George, Ana-Maria Grigore, and Paul Marinescu. 2014. Economic development and entrepreneurship. Procedia, Economics and Finance 8: 436–43. [Google Scholar] [CrossRef]

- Verbano, Chiara, and Karen Venturini. 2013. Managing risks in SMEs: A literature review and research agenda. Journal of Technology Management & Innovation 8: 186–97. [Google Scholar]

- Virglerová, Zuzana, Ludmila Kozubíková, and Sergej Vojtovic. 2016. Influence of selected factors on financial risk management in SMEs in the Czech Republic. Montenegrin Journal of Economics 12: 21. [Google Scholar] [CrossRef]

- Yang, Xuhui, and Ruoxi Zhang. 2013. Discussion on SME Financial Management Problems and Countermeasure. Paper presented at International Conference on Artificial Intelligence and Software Engineering (ICAISE 2013), Nanjing, China, August 23–25; pp. 107–11. [Google Scholar]

- Yang, Yang, Xuezheng Chen, Jing Gu, and Hamido Fujita. 2019. Alleviating Financing Constraints of SMEs through Supply Chain. Sustainability 11: 673. [Google Scholar] [CrossRef]

- Yartey, Charles Amo. 2011. Small business finance in Sub-Saharan Africa: The case of Ghana. Management Research Review 34: 172–85. [Google Scholar] [CrossRef]

- Yazdanfar, Darush, and Peter Ohman. 2015. Firm-Level Determinants of Job Creation by SMEs: Swedish Empirical Evidence. Journal of Small Business and Enterprise Development 4: 666–79. [Google Scholar] [CrossRef]

- Zeffane, Rachid, and Hana Zarooni. 2008. The influence of empowerment, commitment, job satisfaction and trust on perceived managers performance. International Journal of Business Excellence 1: 193–209. [Google Scholar] [CrossRef]

- Zhao, Shuying, and Mei Zeng. 2014. Theory of SMEs financial risk prevention and control, International Conference on Education. Paper presented at Management and Computing Technology (ICEMCT 2014), Tianjin, China, June 14–15; pp. 514–17. [Google Scholar]

- Zoghi, Farzaneh. 2017. Risk Management Practices and SMEs: An empirical study on Turkish SMEs. International Journal of Trade, Economics and Finance 8: 123–27. [Google Scholar] [CrossRef]

| Sources of Financial Risk | Intensity of Risk Sources | Insufficient Profit of the Company | Foreign Capital (High Share of Foreign Capital) | Unpaid Claims | Inability to Pay Obligations (Insolvency) |

|---|---|---|---|---|---|

| Size of the company | |||||

| micro- (up to 9 employees) | Low | 23.4 | 52 | 42.1 | 39 |

| High | 37.8 | 11.1 | 18.3 | 20.1 | |

| small (10–49 employees) | Low | 14.1 | 19.4 | 18.6 | 20.9 |

| High | 14.1 | 5.1 | 9.7 | 10 | |

| medium (50–249 employees) | Low | 2.0 | 9.7 | 6.1 | 5.8 |

| High | 7.9 | 2.6 | 4.7 | 4.2 | |

| Internationalization of the company | |||||

| Internationalization | Low | 38.5 | 80.3 | 64.7 | 63.8 |

| High | 60.2 | 18.1 | 33 | 33.4 | |

| No internationalization | Low | 1 | 0.9 | 1.9 | 1.9 |

| High | 0.3 | 0.9 | 0.3 | 0.8 | |

| Operating time in the market | |||||

| Up to 4 years in the market | Low | 17.1 | 38.8 | 29.9 | 30.6 |

| High | 27.6 | 6.6 | 14.9 | 15.9 | |

| Up to 5 years in the market | Low | 22.3 | 42.3 | 36.9 | 35.1 |

| High | 32.9 | 12.3 | 18.3 | 18.4 | |

| Risk management | |||||

| It does manage risk | Low | 18.4 | 28 | 25.7 | 22.8 |

| High | 17.7 | 6.6 | 11.1 | 12.1 | |

| It does not manage risk | Low | 21.2 | 53.1 | 41 | 42.9 |

| High | 42.8 | 12.3 | 22.2 | 22.3 | |

| Predictor | Variable Type | Variable Categories | Category Code |

|---|---|---|---|

| Size of the entity (X1) | Continuous variable | Micro (up to 10 employees) | 1 |

| Small (10–49 employees) | 2 | ||

| Medium (50–249 employees) | 3 | ||

| Operating time in the market (X2) | Continuous variable | Less than 1 year | 1 |

| 1–4 years | 2 | ||

| 5–9 years | 3 | ||

| More than 10 years | 4 | ||

| Activities of the company in the international market (X3) | Continuous variable | The company does not operate in the international market | 0 |

| The company has been operating in the international for less than 1 year | 1 | ||

| The company has been operating in the international market for 1–4 years | 2 | ||

| The company has been operating in the international market for 5–9 years | 3 | ||

| The company has been operating in the international market for more than 10 years | 4 | ||

| Risk management in the company (X4) | Continuous variable | Not identified | 0 |

| Yes, less than 1 year | 1 | ||

| Yes, 1–4 years | 2 | ||

| Yes, 5–9 years | 3 | ||

| Yes, more than 10 years | 4 |

| Chi-square test results | ||

| Chi-square | df | Sig. |

| 15.365 | 3 | 0.002 |

| Log likelihood value and peudo-R2 | ||

| −2 log likelihood | Cox-Snell R2 | Nagelkerke R2 |

| 390.629 | 0.049 | 0.43 |

| Hosmer-Lemeshow test | ||

| Chi-square | df | Sig. |

| 6.685 | 8 | 0.571 |

| Observed | Predicted | Percentage of Correct Classification | |

|---|---|---|---|

| Low Risk Intensity | High Risk Intensity | ||

| Low risk intensity | 26 | 93 | 21.8 |

| High risk intensity | 19 | 165 | 89.7 |

| General classification accuracy | 63 | ||

| Variables | B | Standard Error | Wald | df | Significance | Exp(B) |

|---|---|---|---|---|---|---|

| X1 | 0.234 | 0.170 | 1.901 | 1 | 0.168 | 1.264 |

| X2 | 0.026 | 0.148 | 0.030 | 1 | 0.862 | 1.026 |

| X3 | 0.218 | 0.073 | 8.970 | 1 | 0.003 | 1.243 |

| X4 | −0.226 | 0.084 | 7.295 | 1 | 0.007 | 0.798 |

| Constant | −0.150 | 0.537 | 0.078 | 1 | 0.780 | 0.861 |

| Chi-square test results | ||

| Chi-square | df | Sig. |

| 2.700 | 4 | 0.609 |

| Log likelihood value and peudo-R2 | ||

| −2 log likelihood | Cox-Snell R2 | Nagelkerke R2 |

| 332.852 | 0.008 | 0.012 |

| Chi-square test results | ||

| Chi-square | df | Sig. |

| 6.230 | 4 | 0.183 |

| Log likelihood value and peudo-R2 | ||

| −2 log likelihood | Cox-Snell R2 | Nagelkerke R2 |

| 452.870 | 0.017 | 0.024 |

| Chi-square test results | ||

| Chi-square | df | Sig. |

| 1.060 | 4 | 0.901 |

| Log likelihood value and peudo-R2 | ||

| −2 log likelihood | Cox-Snell R2 | Nagelkerke R2 |

| 459.599 | 0.003 | 0.004 |

© 2019 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Ślusarczyk, B.; Grondys, K. Parametric Conditions of High Financial Risk in the SME Sector. Risks 2019, 7, 84. https://doi.org/10.3390/risks7030084

Ślusarczyk B, Grondys K. Parametric Conditions of High Financial Risk in the SME Sector. Risks. 2019; 7(3):84. https://doi.org/10.3390/risks7030084

Chicago/Turabian StyleŚlusarczyk, Beata, and Katarzyna Grondys. 2019. "Parametric Conditions of High Financial Risk in the SME Sector" Risks 7, no. 3: 84. https://doi.org/10.3390/risks7030084

APA StyleŚlusarczyk, B., & Grondys, K. (2019). Parametric Conditions of High Financial Risk in the SME Sector. Risks, 7(3), 84. https://doi.org/10.3390/risks7030084