Three Different Ways Synchronization Can Cause Contagion in Financial Markets

Abstract

1. Introduction

2. Three Different Ways Synchronization Can Lead to Contagion in Financial Markets

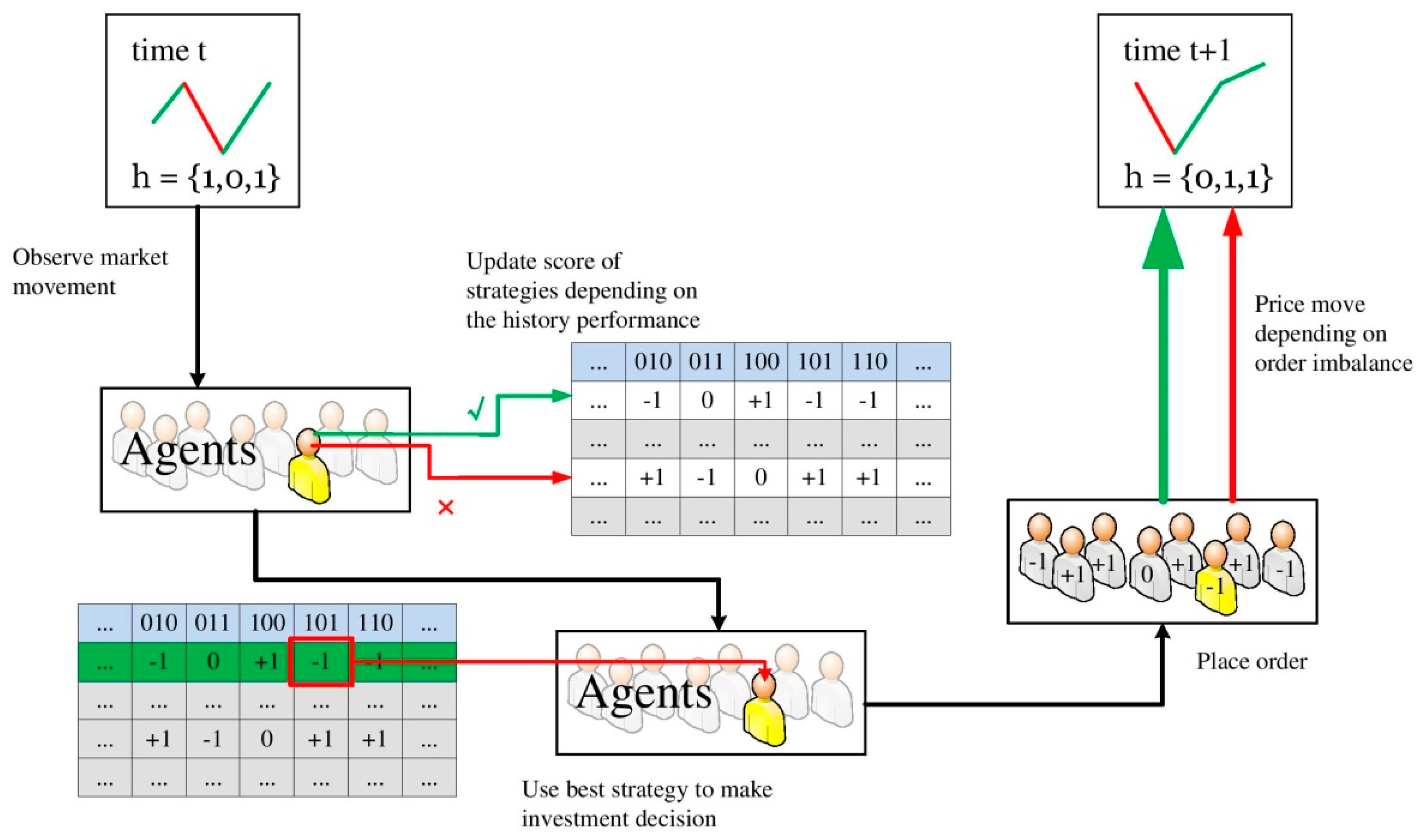

2.1. Synchronization through Indirect Interaction of Traders

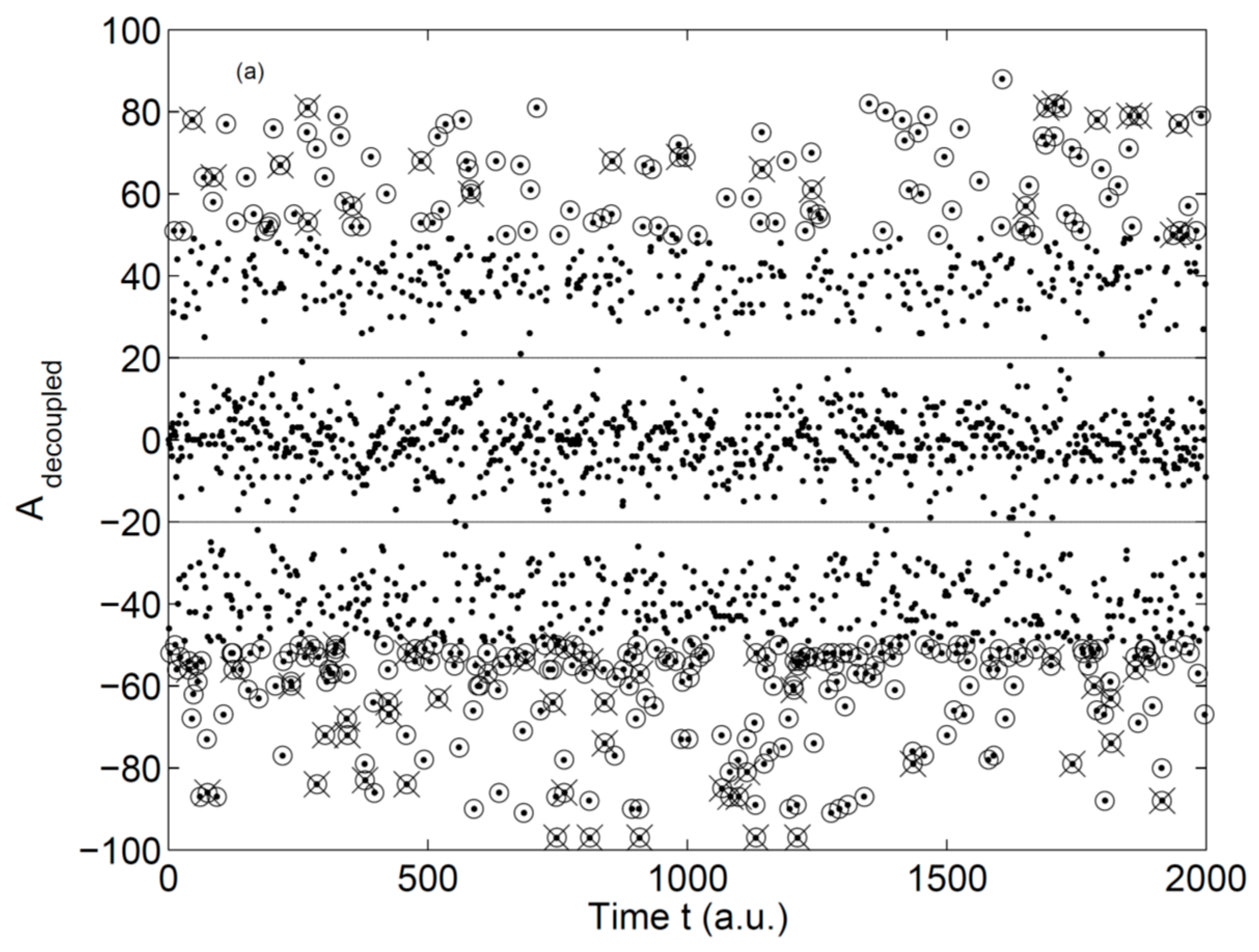

2.1.1. Synchronization through Indirect Interaction of Individuals: The First Level

2.1.2. Synchronization through Indirect Interaction of Groups of Individuals: The Second Level

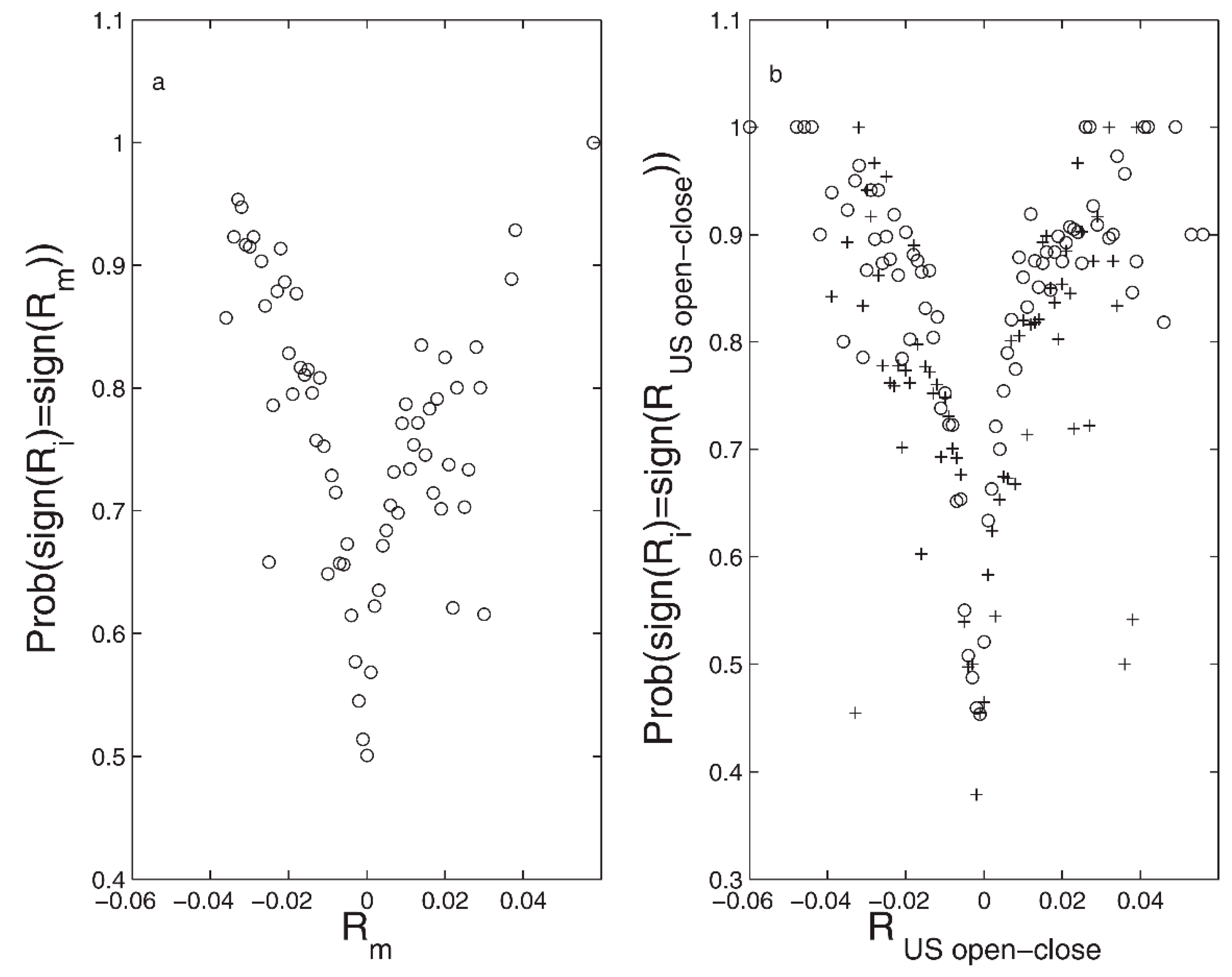

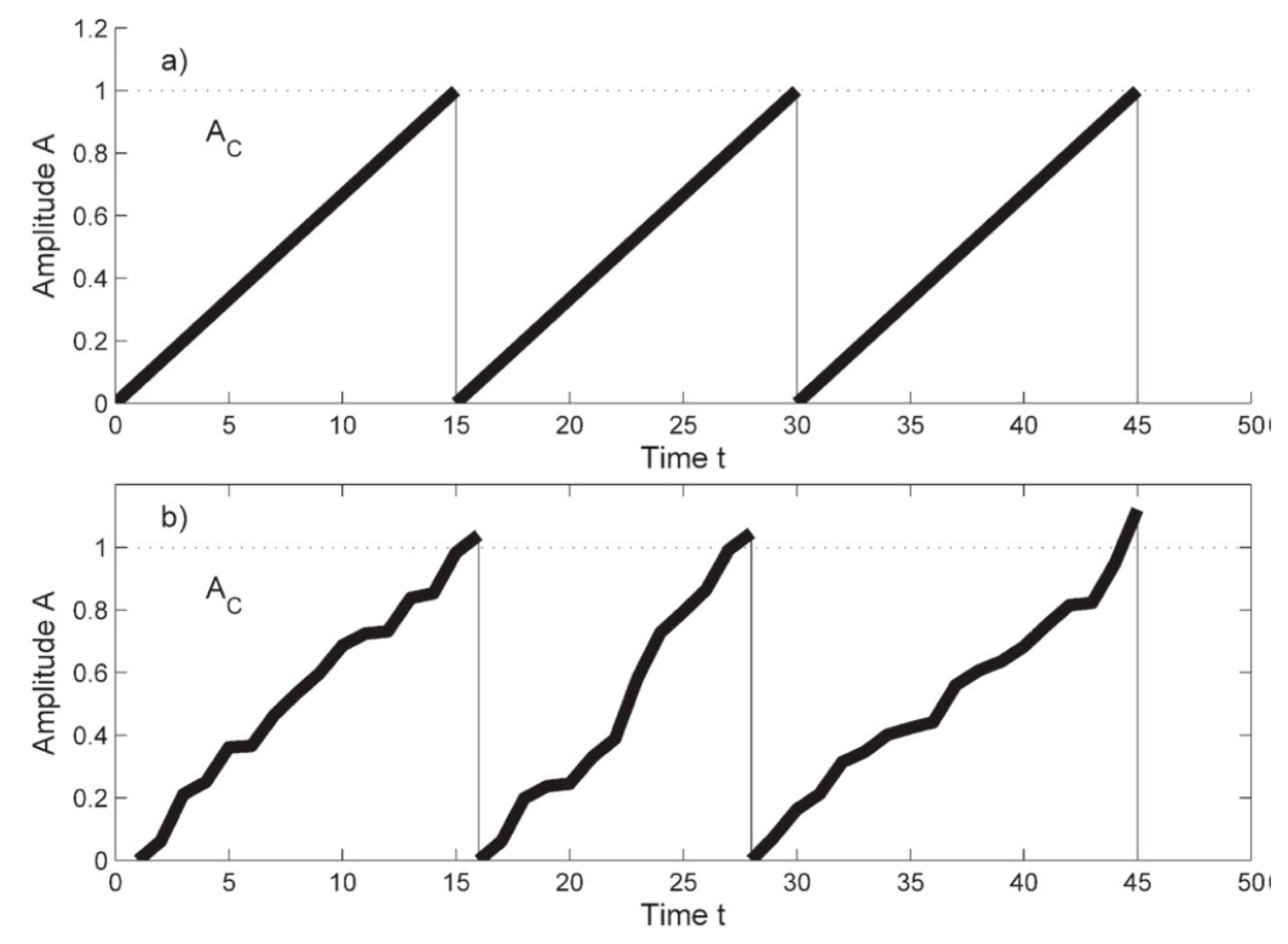

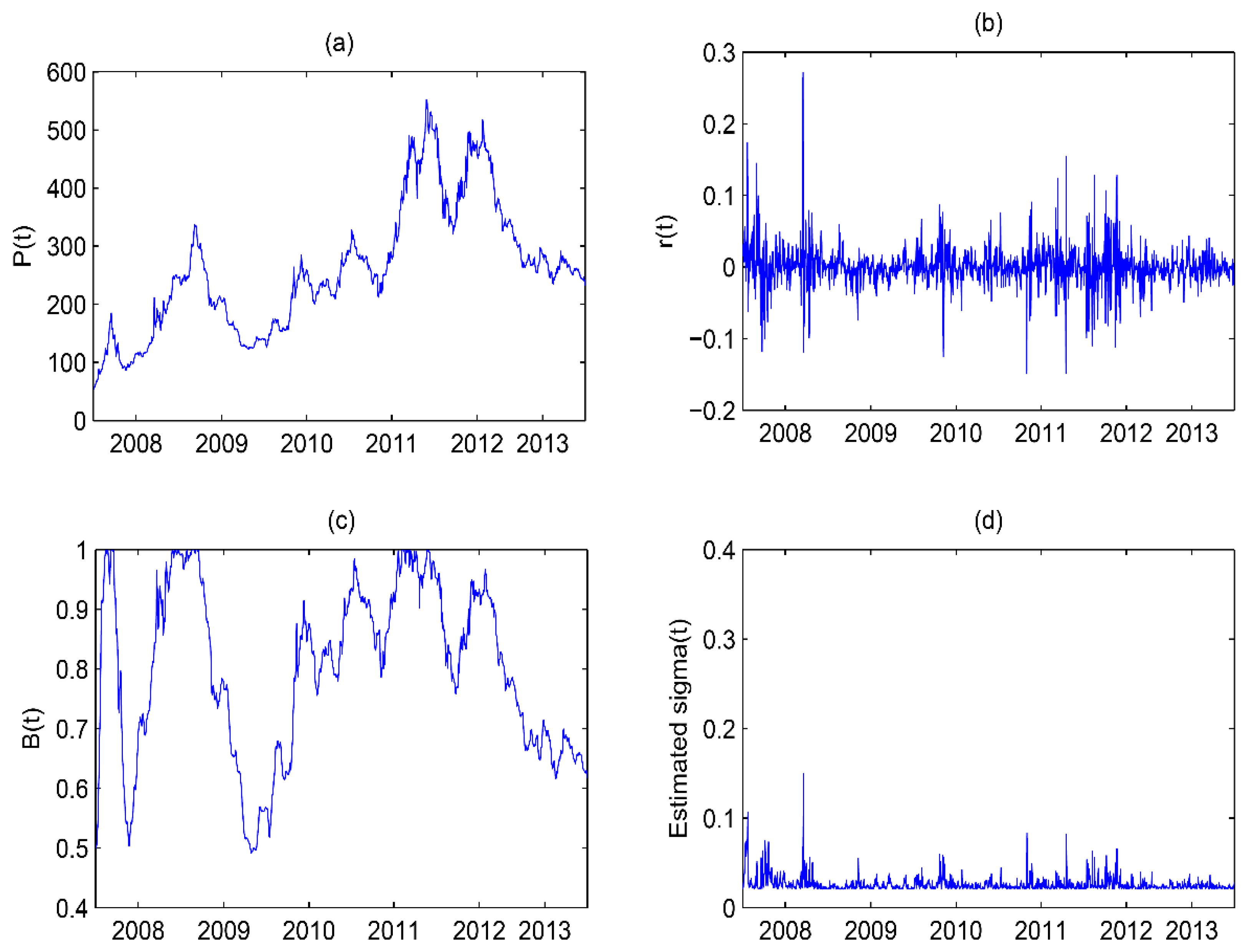

2.2. Synchronization through Direct Interaction of Traders

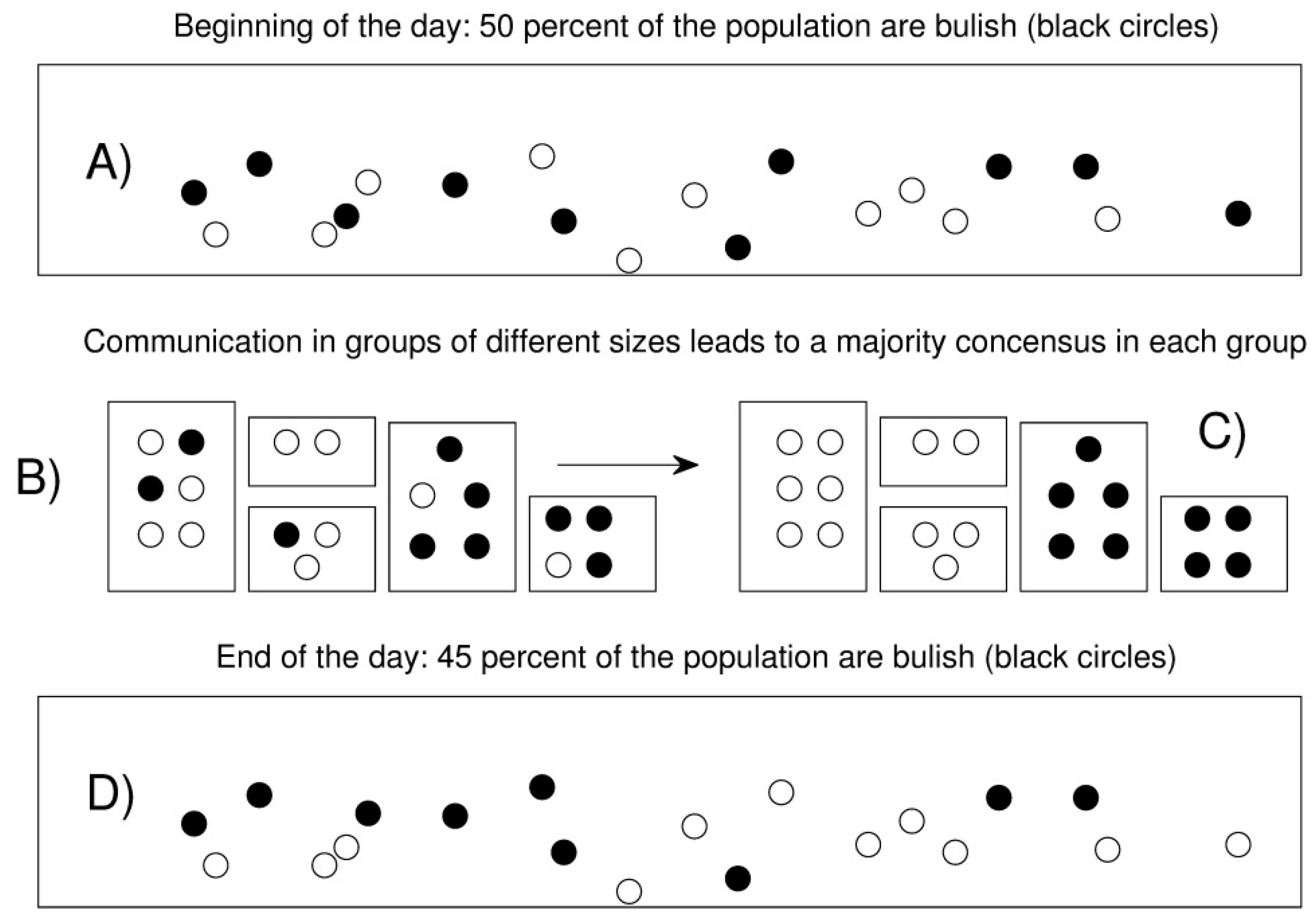

Synchronization through Direct Interaction of Individuals and Groups of Individuals: The First and Second Levels

3. Discussion

Author Contributions

Acknowledgments

Conflicts of Interest

References

- Abreu, Dilip, and Markus K. Brunnermeier. 2002. Synchronization risk and delayed arbitrage. Journal of Financial Economics 66: 341–60. [Google Scholar] [CrossRef]

- Abreu, Dilip, and Markus K. Brunnermeier. 2003. Bubbles and Crashes. Econometrica 71: 173–204. [Google Scholar] [CrossRef]

- Andersen, Jorgen Vitting, and Didier Sornette. 2003. The Dollar Game. European Physical Journal B 31: 141. [Google Scholar] [CrossRef]

- Andersen, Jorgen Vitting, and Didier Sornette. 2005. A mechanism for pockets of predictability in complex adaptive systems. Europhysics Letter 70: 697–703. [Google Scholar] [CrossRef]

- Andersen, Jørgen Vitting, Andrzej Nowak, Giulia Rotundo, Lael Parrott, and Sebastian Martinez. 2011. “Price-Quakes” Shaking the World’s Stock Exchanges. PLoS ONE 6: e26472. [Google Scholar] [CrossRef] [PubMed]

- Andersen, Jorgen Vitting, Ioannis Vrontos, Petros Dellaportas, and Serge Galam. 2014a. Communication impacting financial markets. Europhysics Letters 108: 28007. [Google Scholar] [CrossRef]

- Andersen, Jørgen Vitting, Ioannis Vrontos, Petros Dellaportas, and Serge Galam. 2014b. A Socio-Finance Model: Inference and Empirical Application. Available online: http://syrtoproject.eu/wp-content/uploads/2014/10/19 ATHENS3.pdf (accessed on 19 September 2018).

- Aymanns, Christoph, and Co-Pierre Georg. 2015. Contagious synchronization and endogenous network formation in financial networks. Journal of Banking & Finance 50: 273–85. [Google Scholar]

- Backus, David K., Patrick J. Kehoe, and Finn E. Kydland. 1992. International Real Business Cycles. Journal of Political Economy 100: 745–75. [Google Scholar] [CrossRef]

- Baxter, Marianne, and Michael A. Kouparitsas. 2005. Determinants of business cycle co-movement: A robust analysis. Journal of Monetary Economics 52: 113–57. [Google Scholar] [CrossRef]

- Bellenzier, Lucia, Jørgen Vitting Andersen, and Giulia Rotundo. 2016. Contagion in the world’s stock exchanges seen as a set of coupled oscillators. Economic Modelling 59: 224–36. [Google Scholar] [CrossRef]

- Bottani, Stephano. 1995. Pulse-coupled relaxation oscillators: From biological synchronization to self-organized criticality. Physical Review Letter 74: 4189–92. [Google Scholar] [CrossRef] [PubMed]

- Challet, Damien, and Yi-Cheng Zhang. 1997. Emergence of cooperation and organization in an evolutionary game. Physica A 246: 407–18. [Google Scholar] [CrossRef]

- Corral, Álvaro, Conrad J. Pérez, Albert Díaz-Guilera, and Alex Arenas. 1995. Self-Organized Criticality and Synchronization in a Lattice Model of Integrate-and-Fire Oscillators. Physical Review Letter 74: 118–21. [Google Scholar] [CrossRef] [PubMed]

- Dées, Stéphane, and Nico Zorell. 2011. Business Cycle Synchronization, Disentangling Trade and Financial Linkages. ECB Working Paper Series No. 1322. New York: Springer. [Google Scholar]

- Devenow, Andrea, and Ivo Welch. 1996. Rational herding in financial economics. European Economic Review 40: 3–5. [Google Scholar] [CrossRef]

- Frankel, Jeffrey A., and Andrew K. Rose. 1998. The Endogeneity of the Optimum Currency Area Criteria. Economic Journal 108: 1009–25. [Google Scholar] [CrossRef]

- Keynes, John Maynard. 1936. The General Theory of Employment, Interest and Money. London: Macmillan Publications. [Google Scholar]

- Kuramoto, Yoshiki. 1991. Collective synchronization of pulse-coupled oscillators and excitable units. Physica D Nonlinear Phenomena 50: 15–30. [Google Scholar] [CrossRef]

- Liu, Yi-Fang, Jørgen Vitting-Andersen, and Philippe de Peretti. 2016. Onset of Financial Instability Studied Via Agent-Based Models. In Systemic Risk Tomography: Signals, Measurement and Transmission Channels. Edited by Monica Billio, Loriana Pelizzon and Roberto Savona. London: ISTE Press Ltd. ISBN 9781785480850. [Google Scholar]

- Liu, Yi-Fang, J. V. Andersen, M. Frolov, and P. de Peretti. 2017. Experimental determination of synchronization in human decision-making. American Economic Review. preprint. [Google Scholar]

- Poledna, Sebastian, Stefan Thurner, Farmer J. Doyne, and John Geanakoplos. 2014. Leverage-induced systemic risk under Basle II and other credit risk policies. Journal of Banking & Finance 42: 199–212. [Google Scholar]

- Rey, Hélène. 2015. Dilemma not Trilemma: The Global Financial Cycle and Monetary Policy Independence. NBER Working Paper No. 21162. Cambridge: National Bureau of Economic Research. [Google Scholar]

- Spyrou, Spyros. 2013. Herding in financial markets: A review of the literature. Review of Behavioral Finance 5: 175–94. [Google Scholar] [CrossRef]

- Vitting Andersen, Jørgen, and Andrzej Nowak. 2013. An Introduction to Socio-Finance. Berlin: Springer. [Google Scholar]

| Price History | Prediction |

|---|---|

| 0 0 0 | 1 |

| 0 0 1 | −1 |

| 0 1 0 | 1 |

| 0 1 1 | 1 |

| 1 0 0 | −1 |

| 1 0 1 | −1 |

| 1 1 0 | 1 |

| 1 1 1 | 1 |

© 2018 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Massad, N.; Andersen, J.V. Three Different Ways Synchronization Can Cause Contagion in Financial Markets. Risks 2018, 6, 104. https://doi.org/10.3390/risks6040104

Massad N, Andersen JV. Three Different Ways Synchronization Can Cause Contagion in Financial Markets. Risks. 2018; 6(4):104. https://doi.org/10.3390/risks6040104

Chicago/Turabian StyleMassad, Naji, and Jørgen Vitting Andersen. 2018. "Three Different Ways Synchronization Can Cause Contagion in Financial Markets" Risks 6, no. 4: 104. https://doi.org/10.3390/risks6040104

APA StyleMassad, N., & Andersen, J. V. (2018). Three Different Ways Synchronization Can Cause Contagion in Financial Markets. Risks, 6(4), 104. https://doi.org/10.3390/risks6040104