State Space Models and the Kalman-Filter in Stochastic Claims Reserving: Forecasting, Filtering and Smoothing

Abstract

:1. Introduction

2. Development Triangles and the CL Method

- ⊳

- Cumulative payments of different accident years i are stochastically independent.

- ⊳

- There exist factors and variance parameters , such that for all and all , we have:

3. Prior Applications in Stochastic Claims Reserving

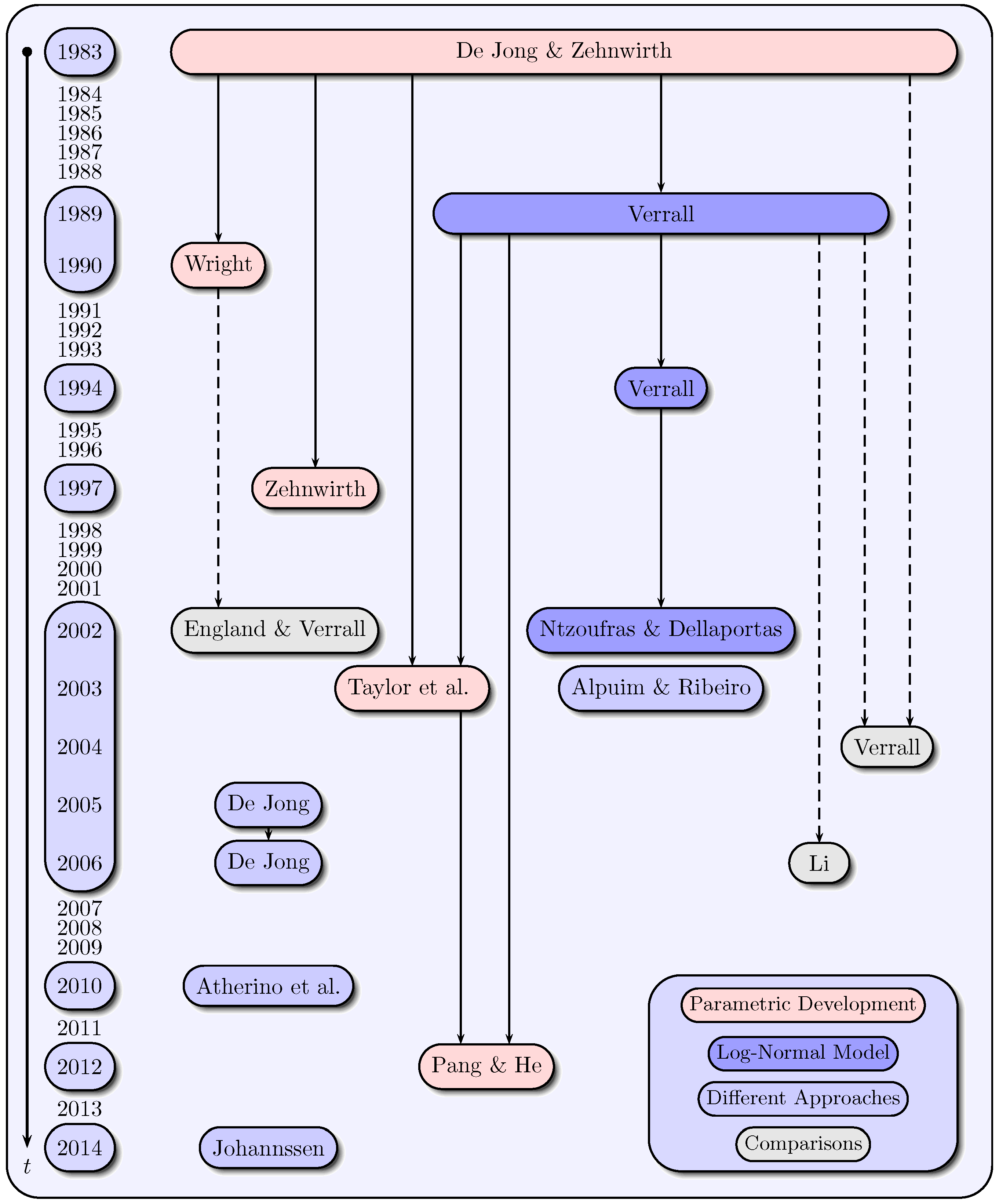

3.1. Chronology and Categorization of the Papers

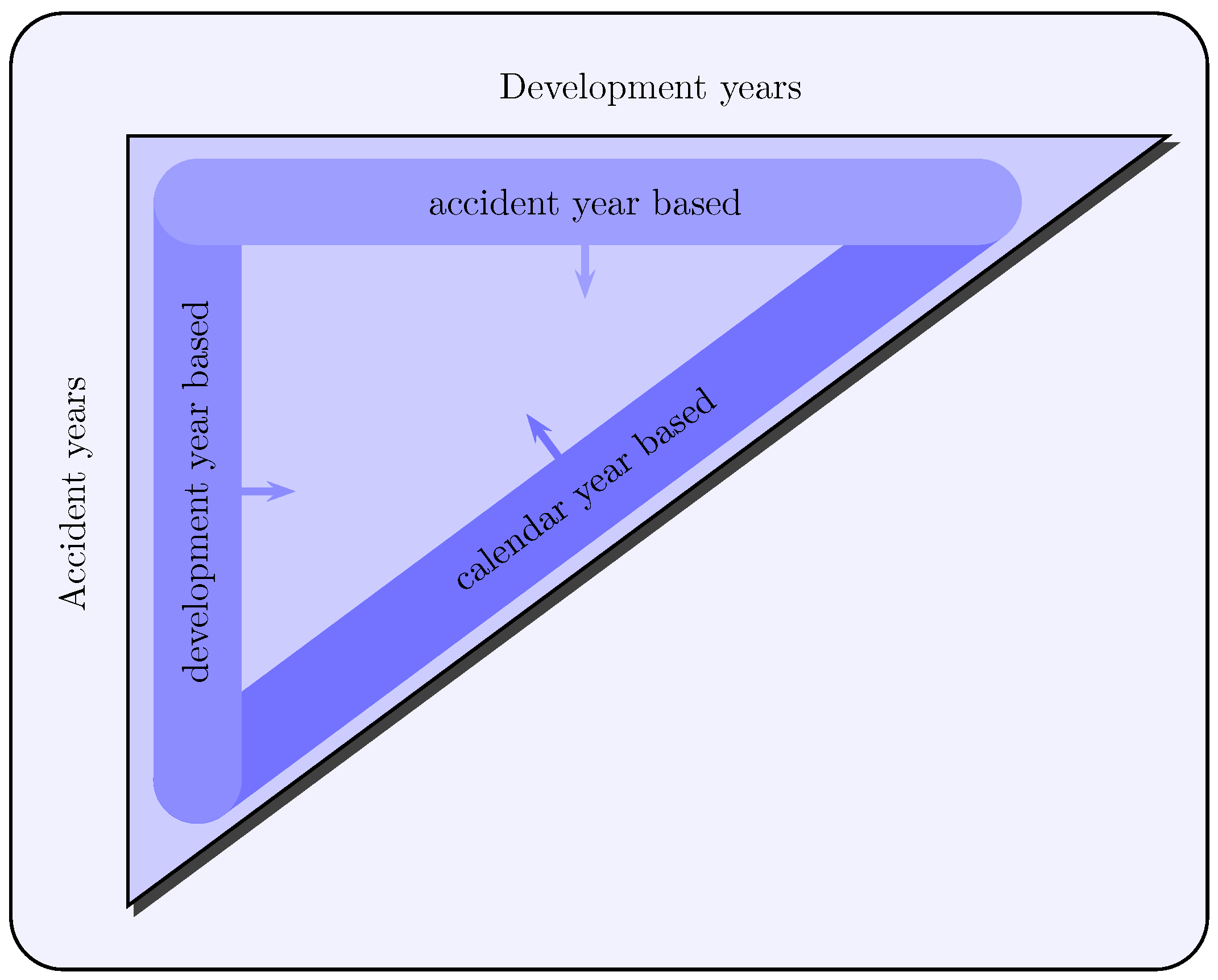

3.2. Modeling of Claims Development Data

3.3. Modeling Approaches of State Space Representations

- Annually-added observations build a new diagonal in the run-off triangle. Therefore, the calendar year approach corresponds to natural modeling of the claims data.

- The observations of the same calendar year are subjected to calendar year effects of the same level, such as the inflation factor or changes in legislation.

- As for estimating and forecasting, the recent observations should be weighted higher compared to past observations. This proposition is also consistent with the view of many authors such as Verrall (1994), Taylor (2000) or De Jong (2005) and De Jong (2006). Therefore, the use of the Kalman-filter is justified here. Its recursive and dynamic nature complies with this requirement especially in relation to the calendar year approach.

4. Scalar State Space Model for Cumulative Payments

4.1. Model Assumptions and Kalman Recursions

- ⊳

- There exist parameters and , such that:with for and .

- ⊳

- There exist parameters and , such that:with for and .

- ⊳

- The white noise processes and are uncorrelated and therefore satisfy for all , and .

- ⊳

- Cumulative payments of different accident years i are stochastically independent.

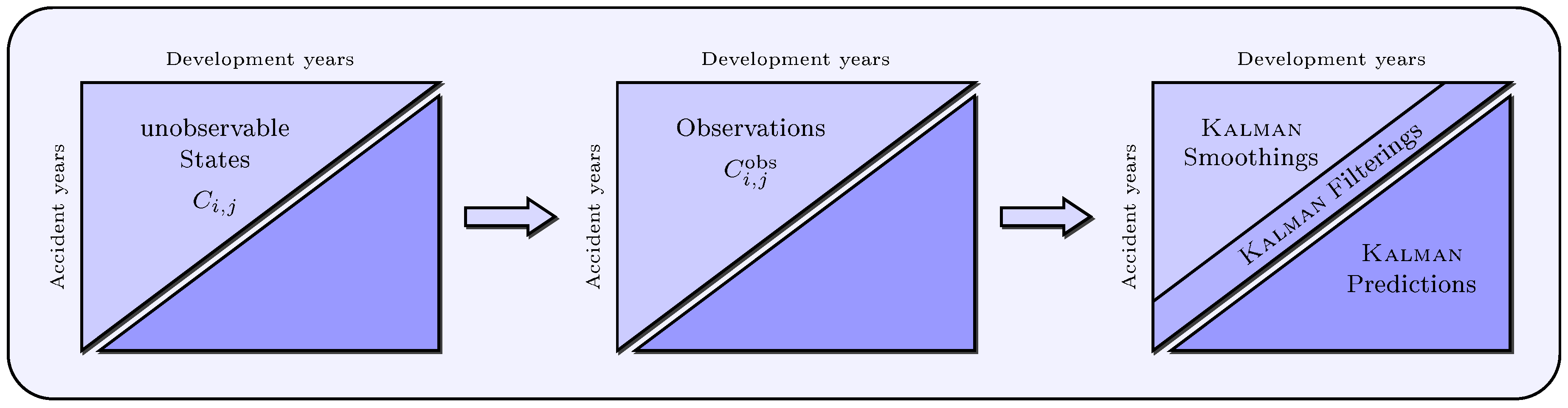

- To forecast future cumulative payments with for , (lower triangle) the corresponding Kalman predictions are required. The one-step predictor provides forecasts for the next calendar year , while the h-step predictor shall be used for forecasting cumulative payments in calendar years with .

- As for the underlying states of the observations in the upper triangle, the Kalman filterings (for ) and smoothings (for ) are useful to identify outliers in the observations and to replace them with smoothed or filtered observations, as well as to obtain an adjusted presentation of the observed quantities and to determine outlier effects. Another key application of smoothing and filtering is the determination of missing values in the upper run-off triangle (for example, resulting from a merger) to interpolate gaps in the data.

- We denote the one-step predictor by and its error variance by for , as well as the h-step predictor by and its error variance by for . The superscript (P) stands for “prediction” and the subscript indicates the cell () or () in the lower triangle, for which we predict cumulative payments.

- We denote the filtering by and its error variance by for , as well as the smoothings by and their error variances by for . The superscript (F) or (S) stands for “filtering” or “smoothing”, and the subscript indicates the ()-cell in the upper triangle, for which we filter or smooth cumulative payments.

- The Kalman gain represents the relative importance of the innovation with respect to the prior predictor . The higher the covariance between the innovation and the state to be predicted and/or the lower the variance of the innovation, the higher the trust in the new observation and therefore the higher the Kalman gain.

- Due to the fact that there is no observation after the recent calendar year, and therefore no innovation , the covariance is equal to zero for . This implies that the Kalman gain is equal to zero in the h-step recursions.

- Since the Kalman smoother is a backwards recursive algorithm and its initializations and are values of the last filtering recursion, the smoothings and filterings are identical for the current calendar year .

4.2. Determination of Kalman Reserves and MSEP

5. Empirical Applications

5.1. Applications of Scalar State Space Model

5.2. Empirical Comparison of Selected Models

6. Conclusions

Acknowledgments

Author Contributions

Conflicts of Interest

Appendix A. Proof of Theorem 1

Appendix A.1. One-Step Predictors and Error Variances

Appendix A.2. h-Step Predictors and Error Variances

Appendix A.3. Filtering Predictors and Error Variances

Appendix A.4. Fixed-Interval Smoothing Predictors and Error Variances

References

- Alpuim, Teresa, and Isabel Ribeiro. 2003. A State Space Model for Run-Off Triangles. Applied Stochastic Models in Business and Industry 19: 105–20. [Google Scholar] [CrossRef]

- Atherino, Rodrigo, Adrian Pizzinga, and Cristiano Fernandes. 2010. A row-wise Stacking of the Runoff Triangle: State Space Alternatives for IBNR Reserve Prediction. ASTIN Bulletin 40: 917–46. [Google Scholar]

- Brockwell, Peter J., and Richard A. Davis. 2006. Time Series: Theory and Methods, 2nd ed. New York: Springer. [Google Scholar]

- Chima-Okereke, Chibisi. 2013. A practical Approach to Claims Reserving using State Space Models with Growth Curves. Paper presented at the R in Insurance Conference 2013, London, UK, July 15. [Google Scholar]

- De Jong, Piet. 2005. State Space Models in Actuarial Science. Paper presented at the Second Brazilian Conference on Statistical Modelling in Insurance, Institute of Mathematics and Statistics, University of São Paulo, Maresias, Brazil, August 28–September 3. [Google Scholar]

- De Jong, Piet. 2006. Forecasting Runoff Triangles. North American Actuarial Journal 10: 28–38. [Google Scholar] [CrossRef]

- De Jong, Piet, and Ben Zehnwirth. 1983. Claims Reserving, State-Space Models and the Kalman Filter. Journal of the Institute of Actuaries 110: 157–81. [Google Scholar] [CrossRef]

- England, Peter D., and Richard J. Verrall. 2002. Stochastic Claims Reserving in General Insurance. British Actuarial Journal 8: 443–518. [Google Scholar] [CrossRef]

- Frees, Edward W. 2010. Regression Modeling with Actuarial and Financial Applications. Cambridge: Cambridge University Press. [Google Scholar]

- Johannssen, Arne. 2016. Stochastische Schadenreservierung unter Verwendung von Zustandsraummodellen und des Kalman-Filters. Hamburg: Dr. Kovac. [Google Scholar]

- Kaas, Rob, Marc Goovaerts, Jan Dhaene, and Michel Denuit. 2009. Modern Actuarial Risk Theory—Using R, 2nd ed. Berlin: Springer. [Google Scholar]

- Kalman, Rudolf E. 1960. A New Approach to Linear Filtering and Prediction Problems. Trans. of the ASME—Journal of Basic Engineering (Series D) 82: 35–45. [Google Scholar] [CrossRef]

- Kremer, Erhard. 1982. IBNR-Claims and the Two-Way Model of ANOVA. Scandinavian Actuarial Journal 1982: 47–55. [Google Scholar] [CrossRef]

- Li, Jackie. 2006. Comparison of Stochastic Reserving Methods. Australian Actuarial Journal 12: 489–569. [Google Scholar]

- Mack, Thomas. 1993. Distribution-free Calculation of the Standard Error of Chain Ladder Reserve Estimates. ASTIN Bulletin 23: 213–25. [Google Scholar] [CrossRef]

- McGuire, Gráinne. 2007. Building a Reserving Robot. Paper presented at the Biennial Convention 2007, Institute of Actuaries of Australia, Christchurch, New Zealand, September 23–26. [Google Scholar]

- Ntzoufras, Ioannis, and Petros Dellaportas. 2002. Bayesian Modelling of Outstanding Liabilities incorporating Claim Count Uncertainty. North American Actuarial Journal 6: 113–28. [Google Scholar] [CrossRef]

- Pang, Liyan, and Siqi He. 2012. The Application of State-Space Model in Outstanding Claims Reserve. Paper presented at the 2012 International Conference on Information Management, Innovation Management and Industrial Engineering (ICIII), Sanya, China, October 20–21; pp. 271–74. [Google Scholar]

- Shumway, Robert H., and David S. Stoffer. 1982. An Approach to Time Series Smoothing and Forecasting using the EM Algorithm. Journal of Time Series Analysis 3: 253–64. [Google Scholar] [CrossRef]

- Shumway, Robert H., and David S. Stoffer. 2010. Time Series Analysis and Its Applications (With R Examples), 3rd ed. New York: Springer. [Google Scholar]

- Taylor, Greg C. 2000. Loss Reserving: An Actuarial Perspective. Boston: Kluwer Academic Publishers. [Google Scholar]

- Taylor, Greg C., and Frank R. Ashe. 1983. Second Moments of Estimates of Outstanding Claims. Journal of Econometrics 23: 37–61. [Google Scholar] [CrossRef]

- Taylor, Greg C., and Gráinne McGuire. 2008. Robotic Reserving. GIRO Convention 2013, Italy. [Google Scholar]

- Taylor, Greg C., Gráinne McGuire, and Alan Greenfield. 2003. Loss Reserving: Past, Present and Future. Research Paper No. 109. Melbourne: University of Melbourne. [Google Scholar]

- Van Wouwe, Martine, Tim Verdonck, and Kristel Van Rompay. 2009. Application of Classical and Robust Chain-Ladder Methods: Results for the Belgian Non-Life Business. Global Business and Economics Review 11: 99–115. [Google Scholar] [CrossRef]

- Verdonck, Tim, and Michiel Debruyne. 2011. The Influence of Individual Claims on the Chain-Ladder Estimates: Analysis and Diagnostic Tool. Insurance: Mathematics and Economics 48: 85–98. [Google Scholar] [CrossRef]

- Verdonck, Tim, and Martine Van Wouwe. 2011. Detection and Correction of Outliers in the Bivariate Chain-Ladder Method. Insurance: Mathematics and Economics 49: 188–93. [Google Scholar] [CrossRef]

- Verdonck, Tim, Martine Van Wouwe, and Jan Dhaene. 2009. A Robustification of the Chain-Ladder Method. North American Actuarial Journal 13: 280–98. [Google Scholar] [CrossRef]

- Verrall, Richard J. 1989. A State Space Representation of the Chain Ladder Linear Model. Journal of the Institute of Actuaries 116: 589–610. [Google Scholar] [CrossRef]

- Verrall, Richard J. 1994. A Method for Modelling Varying Run-off Evolutions in Claims Reserving. ASTIN Bulletin 24: 325–32. [Google Scholar] [CrossRef]

- Verrall, Richard J. 2004. Kalman Filter, Reserving Methods. In Encyclopedia of Actuarial Science. Edited by J. L. Teugels and B. Sundt. Chichester: John Wiley & Sons, vol. 1, pp. 952–55. [Google Scholar]

- Wright, Thomas S. 1990. A Stochastic Method for Claims Reserving in General Insurance. Journal of the Institute of Actuaries 117: 677–731. [Google Scholar] [CrossRef]

- Wüthrich, Mario V., and Michael Merz. 2008. Stochastic Claims Reserving Methods in Insurance. Chichester: John Wiley & Sons. [Google Scholar]

- Zehnwirth, Ben. 1997. Kalman Filters with Applications to Loss Reserving. Insurance: Mathematics and Economics 20: 149–218. [Google Scholar]

| Accident | Development Year j | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Year i | 0 | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 |

| 0 | 357848 | 1124788 | 1735330 | 2218270 | 2745596 | 3319994 | 3466336 | 3606286 | 3833515 | 3901463 |

| 1 | 352118 | 1236139 | 2170033 | 3353322 | 3799067 | 4120063 | 4647867 | 4914039 | 5339085 | |

| 2 | 290507 | 1292306 | 2218525 | 3235179 | 3985995 | 4132918 | 4628910 | 4909315 | ||

| 3 | 310608 | 1418858 | 2195047 | 3757447 | 4029929 | 4381982 | 4588268 | |||

| 4 | 443160 | 1136350 | 2128333 | 2897821 | 3402672 | 3873311 | ||||

| 5 | 396132 | 1333217 | 2180715 | 2985752 | 3691712 | |||||

| 6 | 440832 | 1288463 | 2419861 | 3483130 | ||||||

| 7 | 359480 | 1421128 | 2864498 | |||||||

| 8 | 376686 | 1363294 | ||||||||

| 9 | 344014 | |||||||||

| 3.4906 | 1.7473 | 1.4574 | 1.1739 | 1.1038 | 1.0863 | 1.0539 | 1.0766 | 1.0177 | 1.0014 |

| Accident | Development Year j | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Year i | 0 | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 |

| 0 | 357846 | 1088646 | 1724703 | 2344677 | 2801926 | 3216482 | 3460558 | 3608732 | 3849709 | 3907933 |

| 1 | 352118 | 1245805 | 2202664 | 3283457 | 3811445 | 4186179 | 4624394 | 4910422 | 5318601 | 5412740 |

| 2 | 290510 | 1218431 | 2204841 | 3256998 | 3888722 | 4213313 | 4619217 | 4892887 | 5267683 | 5360921 |

| 3 | 310611 | 1301186 | 2304955 | 3558299 | 4046805 | 4374444 | 4652591 | 4903365 | 5278963 | 5372401 |

| 4 | 443156 | 1255658 | 2103481 | 2949026 | 3444357 | 3845121 | 4176955 | 4402093 | 4739293 | 4823179 |

| 5 | 396131 | 1303545 | 2175261 | 3073819 | 3659435 | 4039284 | 4387874 | 4624381 | 4978608 | 5066730 |

| 6 | 440830 | 1384198 | 2411162 | 3494015 | 4101625 | 4527373 | 4918086 | 5183170 | 5580201 | 5678971 |

| 7 | 359483 | 1455238 | 2750622 | 4008757 | 4705880 | 5194350 | 5642622 | 5946760 | 6402282 | 6515602 |

| 8 | 376686 | 1344075 | 2348503 | 3422708 | 4017917 | 4434977 | 4817715 | 5077390 | 5466318 | 5563072 |

| 9 | 344014 | 1200815 | 2098185 | 3057894 | 3589662 | 3962269 | 4304213 | 4536210 | 4883683 | 4970125 |

| Accident | Development Year j | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Year i | 0 | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 |

| 0 | 2 | 36142 | 10627 | 103512 | 5778 | |||||

| 1 | 0 | 69865 | 23473 | 3617 | 20484 | |||||

| 2 | 73875 | 13684 | 97273 | 9693 | 16428 | |||||

| 3 | 117672 | 199148 | 7538 | |||||||

| 4 | 4 | 24852 | 28190 | |||||||

| 5 | 1 | 29672 | 5454 | 32277 | ||||||

| 6 | 2 | 8699 | ||||||||

| 7 | 113876 | |||||||||

| 8 | 0 | 19219 | ||||||||

| 9 | 0 | |||||||||

| i | Scalar State Space Model | Verrall (1989) | ||||

| Reserve | Reserve | |||||

| 1 | 73655 | 167499 | 227.4% | 143834 | 72675 | 50.5% |

| 2 | 451606 | 221667 | 49.1% | 465847 | 166438 | 35.7% |

| 3 | 784133 | 270524 | 34.5% | 673175 | 194229 | 28.9% |

| 4 | 949868 | 317331 | 33.4% | 1060794 | 266228 | 25.1% |

| 5 | 1375018 | 366006 | 26.6% | 1479407 | 339755 | 23.0% |

| 6 | 2195841 | 422159 | 19.2% | 2218738 | 487975 | 22.0% |

| 7 | 3651104 | 507337 | 13.9% | 3287633 | 735669 | 22.4% |

| 8 | 4199778 | 662654 | 15.8% | 4517179 | 1040596 | 23.0% |

| 9 | 4626111 | 797161 | 17.2% | 4570683 | 1167068 | 25.5% |

| aggr. | 18307113 | 1376670 | 7.5% | 18417290 | 2627190 | 14.3% |

| Alpuim and Ribeiro (2003) | Atherino et al. (2010) | |||||

| Reserve | Reserve | |||||

| 1 | 66860 | 161177 | 241.1% | 78904 | 18385 | 23.3% |

| 2 | 321421 | 227246 | 70.7% | 433790 | 75046 | 17.3% |

| 3 | 551625 | 278017 | 51.0% | 663312 | 90874 | 13.7% |

| 4 | 1243900 | 322745 | 25.9% | 891774 | 107013 | 12.0% |

| 5 | 1535502 | 422709 | 27.5% | 1336361 | 144327 | 10.8% |

| 6 | 2356440 | 625125 | 26.5% | 2009913 | 207021 | 10.3% |

| 7 | 2817779 | 1667381 | 59.2% | 2919587 | 303637 | 10.4% |

| 8 | 4472888 | 1448251 | 32.4% | 3810769 | 411563 | 10.8% |

| 9 | 4942889 | 763241 | 15.4% | 4726935 | 571959 | 12.1% |

| aggr. | 18309304 | 1637284 | 8.9% | 16871345 | 1197865 | 7.1% |

| Li (2006) | BF Method | |||||

| Reserve | Reserve | |||||

| 1 | 101374 | 54755 | 54.0% | 104097 | 117241 | 112.6% |

| 2 | 457788 | 178242 | 38.9% | 516462 | 218187 | 42.2% |

| 3 | 651123 | 198744 | 30.5% | 780602 | 255401 | 32.7% |

| 4 | 1035739 | 271135 | 26.2% | 1083378 | 284276 | 26.2% |

| 5 | 1473338 | 360715 | 24.5% | 1561405 | 334286 | 21.4% |

| 6 | 2190410 | 522967 | 23.9% | 2395405 | 409247 | 17.1% |

| 7 | 3442432 | 808061 | 23.5% | 4312331 | 550065 | 12.8% |

| 8 | 4269816 | 1054731 | 24.7% | 4706870 | 560833 | 11.9% |

| 9 | 5027791 | 1425522 | 28.4% | 5088393 | 578565 | 11.4% |

| aggr. | 18649811 | 2809220 | 15.1% | 20548942 | 1220525 | 5.9% |

| CL Method | ODP Model | |||||

| Reserve | Reserve | |||||

| 1 | 94634 | 75535 | 79.8% | 94634 | 110100 | 116.3% |

| 2 | 469511 | 121700 | 25.9% | 469511 | 216043 | 46.0% |

| 3 | 709638 | 133551 | 18.8% | 709638 | 260872 | 36.8% |

| 4 | 984889 | 261412 | 26.5% | 984889 | 303550 | 30.8% |

| 5 | 1419459 | 411028 | 29.0% | 1419459 | 375014 | 26.4% |

| 6 | 2177641 | 558356 | 25.6% | 2177641 | 495378 | 22.7% |

| 7 | 3920301 | 875430 | 22.3% | 3920301 | 789961 | 20.2% |

| 8 | 4278972 | 971385 | 22.7% | 4278972 | 1046514 | 24.5% |

| 9 | 4625811 | 1363385 | 29.5% | 4625811 | 1980101 | 42.8% |

| aggr. | 18680856 | 2447618 | 13.1% | 18680856 | 2945661 | 15.8% |

© 2017 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Chukhrova, N.; Johannssen, A. State Space Models and the Kalman-Filter in Stochastic Claims Reserving: Forecasting, Filtering and Smoothing. Risks 2017, 5, 30. https://doi.org/10.3390/risks5020030

Chukhrova N, Johannssen A. State Space Models and the Kalman-Filter in Stochastic Claims Reserving: Forecasting, Filtering and Smoothing. Risks. 2017; 5(2):30. https://doi.org/10.3390/risks5020030

Chicago/Turabian StyleChukhrova, Nataliya, and Arne Johannssen. 2017. "State Space Models and the Kalman-Filter in Stochastic Claims Reserving: Forecasting, Filtering and Smoothing" Risks 5, no. 2: 30. https://doi.org/10.3390/risks5020030

APA StyleChukhrova, N., & Johannssen, A. (2017). State Space Models and the Kalman-Filter in Stochastic Claims Reserving: Forecasting, Filtering and Smoothing. Risks, 5(2), 30. https://doi.org/10.3390/risks5020030