Abstract

Optimal forms of reinsurance policies have been studied for a long time in the actuarial literature. Most existing results are from the insurer’s point of view, aiming at maximizing the expected utility or minimizing the risk of the insurer. However, as pointed out by Borch (1969), it is understandable that a reinsurance arrangement that might be very attractive to one party (e.g., the insurer) can be quite unacceptable to the other party (e.g., the reinsurer). In this paper, we follow this point of view and study forms of Pareto-optimal reinsurance policies whereby one party’s risk, measured by its value-at-risk (VaR), cannot be reduced without increasing the of the counter-party in the reinsurance transaction. We show that the Pareto-optimal policies can be determined by minimizing linear combinations of the s of the two parties in the reinsurance transaction. Consequently, we succeed in deriving user-friendly, closed-form, optimal reinsurance policies and their parameter values.

1. Introduction

Reinsurance is a transaction whereby one insurance company (the reinsurer) agrees to indemnify another insurance company (the reinsured, cedent or primary company) against all or part of the loss that the latter sustains under a policy or policies that it has issued. For this service, the ceding company pays the reinsurer a premium, and there are many premium calculation principles (e.g., [1,2]; see also [3,4]).

Mathematically, let X be the loss for an insurer from a policy or a group of policies. Assume that under a reinsurance treaty, a reinsurer covers the ceded part of the loss, say , where , for a premium . The primary insurer’s retained loss is denoted by . Commonly-used forms of reinsurance treaties are the excess-of-loss treaty, where with deductible level (attaching point) ; and the quota-share treaty, where with a constant (share) .

Optimal forms of reinsurance have been studied extensively in the literature. Most of the results obtained are from the cedent’s point of view. That is, the question asked is: for a given premium principle, what is the optimal functional form and/or parameter values of the ceded function f, such that the cedent’s expected utility is maximized or its risk minimized? For example, by maximizing the cedent’s expected utility, Arrow [5] concluded that “given a range of alternative possible reinsurance contracts, the reinsured would prefer a policy offering complete coverage beyond a deductible.” Borch [6] showed that for a fixed premium and expected reinsurance payments, the variance of the cedent’s losses is minimized by the excess-of-loss reinsurance policy. In recent years, various solutions to the optimal reinsurance problem have been obtained where the value-at-risk (VaR) and the tail-value-at-risk (TVaR) have been used to measure the cedent’s risk level (e.g., [7,8,9,10,11,12,13] and the references therein).

Borch [14] argues that “there are two parties to a reinsurance contract, and that an arrangement which is very attractive to one party may be quite unacceptable to the other.” However, as pointed out by [15], optimal forms of ceded functions considering both the cedent and the reinsurer had scarcely been discussed until quite recently. For example, Ignatov et al. [16] study the optimal reinsurance contracts under which the finite horizon joint survival probability of the two parties is maximized. Kaishev and Dimitrova [17] derive explicit expressions for the probability of joint survival up to a finite time of the cedent and the reinsurer, under an excess of loss reinsurance contract with a limiting and a retention level. Golubin [18] studies the problem of designing the Pareto-optimal reinsurance policy by maximizing a weighted average of the expected utility of the insurer and the reinsurer. Dimitrova and Kaishev [19] introduce an efficient frontier type approach to setting the limiting and the retention levels, based on the probability of joint survival. Cai et al. [20] analyse the optimal reinsurance policies that maximize the joint survival probability and the joint profitable probability of the two parties and derive sufficient conditions for optimal reinsurance contracts within a wide class of reinsurance policies and under a general reinsurance premium principle. Using the results of [20], Fang and Qu [21] derive optimal retentions of combined quota-share and excess-of-loss reinsurance that maximize the joint survival probability of the two parties. Cai et al. [22] study the optimal forms of reinsurance policies that minimize the convex combination of the s of the cedent and the reinsurer under two types of constraints that describe the interests of the two parties. For the determination of the optimal excess of loss contract considering the dependency between the losses of the insurer and the reinsurer, we refer to [23] and the references therein.

A closely-related problem to optimal reinsurance is the so-called optimal transfer of risks among partners, where everybody’s interests are considered simultaneously. The usual approach is to identify Pareto-optimal treaties, whereby no agent can be made better off without making another agent worse off. For results in this area, we refer to, e.g., [6,7,24,25] and the references therein.

In this paper, we determine Pareto-optimal reinsurance policies under which one party’s risk, measured by its VaR, cannot be reduced without increasing that of the other party in the reinsurance contract. We consider two classes of ceded functions:

and:

Note the inclusion , which has been verified by [13]. Furthermore, for every both f and are Lipschitz continuous, and they are comonotonic.

The requirements that the ceded function f is non-decreasing and that the bounds hold for all x are needed in and to avoid the moral hazard problem in reinsurance. The additional requirement of the convexity of f in essentially requires that approaches infinity linearly when and thus disallows the popular layered reinsurance policies. Nevertheless, this class includes the important quota-share and the excess-of-loss reinsurance policies. Note also that both classes are of interest in the more general context of economic theory with two agents having conflicting interests. Optimal reinsurance problems with admissible classes and have been studied extensively in the literature, and we refer to [13] for an informative review.

For simplicity of discussion, we assume that the reinsurance premiums are determined by the expected premium principle:

where is the safety loading. Hence, the cedent’s total loss becomes:

and the reinsurer’s total loss under the reinsurance contract is:

In this paper, we use VaR to measure the insurer’s and reinsurer’s risk level. A natural starting point for measuring the (joint) risk of the cedent and the reinsurer is a bivariate risk measure, such as the bivariate ([26]) of the pair and . However, since the ceded loss and the retained loss are comonotonic (see [27,28] for a very detailed discussion of the concept of comonotonicity with applications), the set of values of the bivariate s of and is determined by values of the univariate of and . Therefore, the Pareto-optimal reinsurance policies could be determined by minimizing a linear combination of the univariate s of and . We note in this regard that the optimization criterion of minimizing linear combinations of the risks of the cedent and the reinsurer was adopted by [7,22]. Our arguments provide an additional economic meaning to such criteria.

Although VaR is not sub-additive in general, it was shown that it is sub-additive in the deep right tail in many cases of interest (e.g., [29]). General results related to optimal forms of reinsurance (risk exchanges) using the so-called distortion risk measures exist in the literature, and we refer to [7,8,25]. The distortion risk measures are very general and include VaR, TVaR and proportional hazards transforms as special cases. The feature of the current paper is that we extend the geometric approach of [12] to our optimization problem that considers the interests of the two parties. The geometric proofs facilitate intuition and enable us to avoid lengthy and complex mathematical arguments. We derive closed-form and user-friendly formulas for the optimal reinsurance policies and thus provide a convenient route for practical implementation of our results.

The rest of the paper is organized as follows. Section 2 provides preliminaries and shows (cf. [25]) that the form of Pareto-optimal reinsurance policies can be determined by minimizing linear combinations of the cedent’s and the reinsurer’s risks. In Section 3 and Section 4, we determine optimal reinsurance forms and derive the corresponding optimal parameters when the feasible classes of ceded functions are and , respectively. There, we also provide illustrative numerical examples. Section 5 provides further insights regarding the results of our numerical examples. Section 6 concludes the paper.

2. Preliminaries

Let and denote the cumulative distribution function (c.d.f.) and the survival function of X, respectively. Furthermore, let and denote the c.d.f.’s of and , respectively. Then, the individual s of the cedent and the reinsurer under the reinsurance contract are:

and:

respectively. To consider the risk of both the cedent and the reinsurer, we propose to use the bivariate lower orthant introduced by [26], which is:

For any ceded function , the random variables and are comonotonic, and so:

Therefore, when the “joint” risk of the cedent and the reinsurer is measured by their bivariate lower orthant VaR, one could work with the marginal VaRs of and , instead of the much more complicated joint VaR.

In the following, we assume that the probability levels in the VaRs used by the cedent and the reinsurer are possibly different, say and , respectively, and then determine the Pareto-optimal reinsurance policies (ceded functions f) in the sense that one party’s risk, measured by its VaR, cannot be reduced without increasing the other party’s VaR. Mathematically, let denote a ceded function in an admissible set , such as or . Let the corresponding cedent’s and reinsurer’s total losses under the ceded function be denoted by and , respectively. Then, is a Pareto-optimal reinsurance policy if there is no ceded function belonging to the admissible set , such that:

and:

with at least one of the inequalities being strict. To find the Pareto-optimal reinsurance policies, we utilize the following proposition.

Proposition 1.

All Pareto-optimal reinsurance policies f in , , can be determined by solving the problem:

where .

Proof.

Similar to the discussion on page 90 of [30], one method to find Pareto-optimal decisions is to choose two positive constants and find:

Without loss of generality, we set and with . In more detail, let g be a function belonging to and minimizing (2), then there cannot exist in any function such that and with at least one of the inequalities being strict, because otherwise, we would have:

This is a contradiction to the assumed property of function g.

Furthermore, for any two ceded functions , the family of ceded functions defined by is a subset of and satisfies:

and:

Equation (3) is satisfied because:

where the last equality is due to the fact that and are non-decreasing functions of the same random variable X and therefore comonotonic. Similarly, Equation (4) is satisfied. Therefore, Condition C on page 90 of [30] is satisfied, and we conclude that all Pareto-optimal reinsurance policies in can be found by solving Problem (2). ☐

In view of Proposition 1, throughout the rest of this paper, we seek optimal reinsurance policies by solving the optimization problem:

for , which is equivalent to minimizing:

As shown by [13], we have , and every function is Lipschitz-continuous and, hence, continuous. Consequently (e.g., [27]), for every , we have and thus, with and , the optimization problem becomes:

Since we allow , the relationships between the probability levels and , as well as need to be discussed. Namely, we have the following observations:

- If and , then . Thus,

- when , the solution to Problem (6) is for all x;

- when , the solution is ;

- when , the objective function is always zero.

- If and , then and . Thus,

- when , the optimal ceded function is ;

- when , the form of the optimal ceded function is similar to the case when , with only the risk and the profit of the cedent considered (the solution for the latter case can be found in Case 2 of Section 3.2 and Section 4.2 below);

- when , the optimal ceded function is .

- If and , then and . Thus,

- when , the solution to Problem (6) is for all x;

- when , the form of the optimal ceded function is similar to the case when , with only the risk and the profit of the reinsurer being considered (the solution for the latter case can be found in Case 3 of Section 3.2 and Section 4.2 below).

- when , the optimal ceded function is for all x.

Throughout the rest of this paper, we only consider the optimal forms of reinsurance policies under the conditions and .

Now, we are ready to determine the optimal forms of f, the task that makes up the contents of the following two sections. Namely, in Section 3, we consider the case when the admissible set of ceded functions is and in Section 4 when the admissible set is . As noted earlier, both classes are of interest in the broad context of economic theory, with the class being more relevant to reinsurance policies. Nevertheless, the class includes the important quota share and excess-of-loss reinsurance policies that provide natural reference points for analysing the optimal reinsurance policies in .

3. Optimal Reinsurance Policies When

In this section, we determine optimal insurance policies under the condition that which means that f is convex and non-decreasing and the retained loss function is non-decreasing. These conditions are also assumed by [11,12], where they in fact require that f is Lipschitz-continuous (cf., e.g., Section 2 of [13]) and that linearly tends to infinity when .

3.1. Functional Form of the Ceded Function

Here, we determine the functional form of the solution to the minimization problem:

We subdivide our following analysis into three cases.

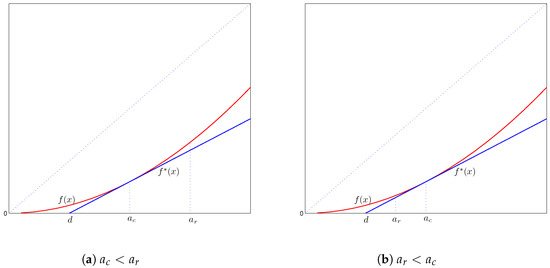

3.1.1. Case 1:

In this case, the coefficients in front of and on the right-hand side of Equation (7) are positive, and the coefficient in front of is negative. Thus, for any ceded function f, we determine the functional form of an optimal ceded function , such that and:

This requires and also the entire function to be as small as possible.

As we see from Figure 1, the convexity of f implies that the above requirements are satisfied by the ceded function:

where and are any constants. Since the slope of f should not exceed one, we must have .

Figure 1.

Optimal ceded functions in : Case 1.

Remark 1.

It is clear from the above proof that the result for the optimal form of reinsurance policy is valid as long as whenever for all x. Obviously, this condition is satisfied by the distortion premium calculation principle (e.g., [2]), which has been assumed in, for example [8,25], among others. For a discussion of the validity of this condition in the case of the weighted premium calculation principle, we refer to [3]. In the current paper, we adopt the simplest expectation premium principle (Equation (1)) for the simplicity of presentation.

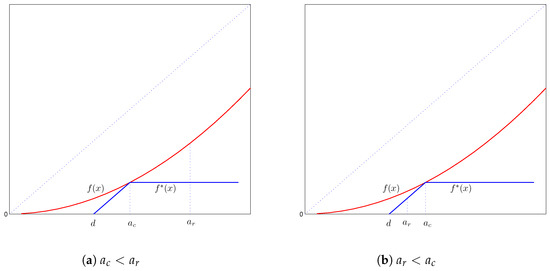

3.1.2. Case 2:

In this case, the coefficient in front of on the right-hand side of Equation (7) is positive, and those in front of and are negative. Therefore, to solve Problem (7), for any ceded function f, we search for a function , such that and:

which requires and also the entire function to be as large as possible.

As we see from Figure 2, the convexity of f implies that the above requirements are satisfied by the ceded function:

where can be any constant.

Figure 2.

Optimal ceded functions in : Case 2.

3.1.3. Case 3:

In this case, Problem (7) simplifies to:

Since f is non-decreasing, we have that when , then Problem (10) is solved by any ceded function , which is constant on the interval . Since has to be convex, this in turn requires to be constant on . Since , we conclude that any function in with on is Pareto-optimal.

When , then because the slope of the ceded function is no more than one, Problem (10) is solved by , which increases at the rate of one in the interval , which in turn requires to increase at the rate of one for all because of the convexity assumption. In summary, any function in with on is Pareto-optimal.

When , the objective function is constant.

3.2. Parameter Values of the Optimal Ceded Function

When , then the optimal ceded function is given by Equation (8) for which the parameters c and d need to be determined. When , then the optimal ceded function is given by Equation (9) for which the parameter η needs to be determined. We accomplish these tasks below by subdividing our considerations into four cases.

3.2.1. Case 1: and

In this case, the optimal ceded function is given by Equation (8) with , and optimization Problem (7) becomes:

where:

Following [11,12], we use the notations:

Theorem 1.

Under the conditions and , the optimal ceded function is with the following parameters:

- 1.

- and when and ;

- 2.

- is any constant and when and ;

- 3.

- and when and ;

- 4.

- is any constant and when and .

If none of the above conditions are satisfied, then for all x.

Proof.

We only prove Part (1) because the proofs of the other parts are similar. To minimize function over , we first take the derivative of with respect to d and have:

which is an increasing function in d. Consequently, the function is convex in d. Since , the derivative is negative at and is equal to zero at . It is easy to show that if and only if . Then, the condition indicates that , and so, the deductible level minimizes the function when .

Next, setting , we have:

Because by assumption, is minimized at . Overall, assuming , function is minimized at . Noting that , we obtain the desired result. ☐

Remark 2.

We have the following observations:

- When , then only the cedent is considered. In this case, and when . Therefore, when , then for all x, and the primary insurance company will not purchase any reinsurance policy. This result agrees with those derived by [11,12].

- When , then , and the optimal value of c is zero. Therefore, for all x.

- The value of in the excess-of-loss reinsurance policy does not depend on the choice of β whenever .

3.2.2. Case 2: and

In this case, the optimal ceded function is given by Equation (8) with . The order between d and is not, however, determined. Therefore, the optimization problem is:

where:

which is a continuous function in c and d. Note, however, that the left-hand derivative is not equal to the right-hand derivative . With the additional notations:

we have the following theorem.

Theorem 2.

Under the conditions and , the optimal ceded function is with the following parameters:

- and when and ;

- is any constant and when and ;

- and when , and ;

- is any constant and when , and ;

- and when and ;

- is any constant and when and ;

- and when and ;

- is any constant and when and .

If none of the conditions above are satisfied, then for all x.

Proof.

We prove Parts (1), (3) and (5) only, because the proofs of the other parts are similar.

Part (1):

The derivative of with respect to d is given by:

Assuming , we have that is increasing in . The condition ensures that is negative at , increases to zero at and becomes positive for . Therefore, the objective function is minimized at . At , the derivative is given by Formula (11). Therefore, as in the proof of Theorem 1, the condition ensures that is minimized at .

Part (3):

When , the derivative is negative for and positive for . Therefore, the function is minimized at , assuming . Next, since:

and by assumption, the function is minimized at with Noting that , the desired result follows.

Part (5):

Since , the assumption implies . Therefore, the derivative is negative for , equal to zero at and positive afterwards. Therefore, the objective function is minimized at . Note that the condition implies Furthermore, since:

and by assumption, the objective function is minimized at when . Noting that , the desired result follows. ☐

Remark 3.

We have the following observations:

- When , then and . Thus, the result is exactly the same as in the first bullet at the end of Case 1 above. The value of makes no difference here because only the cedent’s risk is considered when .

- When , then , and . Therefore, Parts (1) and (3) of Theorem 2 apply. We have:

3.2.3. Case 3: and

Taking the derivative of with respect to η, we have:

where . Therefore, achieves its minimum at when the quantity on the right-hand side of Equation (12) is negative. Otherwise, the minimum is at . Consequently, we have the following theorem.

Theorem 3.

Under the conditions and , the optimal ceded function is:

with the parameter:

Remark 4.

A few observations follow:

- When , then . In this case, and the optimal reinsurance policy is

- When and only the reinsurer’s risk is considered, Theorem 3 holds with .

3.2.4. Case 4: and

Taking the derivative of with respect to η, we get:

which yields the following theorem.

Theorem 4.

Under the conditions and , the optimal ceded function is:

with the parameter:

Note that Theorems 3 and 4 are quite similar, with the role of in the former theorem played by in the latter one.

3.3. An Illustrative Example

In this section, we construct a numerical example to illustrate the Pareto optimality of the reinsurance policies that we derived above. Specifically, we assume that the loss variable X follows the exponential distribution with the survival function for . Let the safety loading parameter be . Then, , and . We discuss two scenarios.

3.3.1. Scenario A: and

In this case, and . Applying Theorems 1 and 3, we have:

When , then:

When , then:

for any constant . The values of versus are reported in Table 1.

Table 1.

VaRs of the cedent and the reinsurer when .

We have the following observations:

- For , the insurer is “more important”. As a result, it retains the “good” risk in the layer of losses and cedes the rest. For , the reinsurer is “more important”, and it assumes the risk above . As a result, the chance of a payment is so small that its VaR does not increase; it actually reduces to because of the collected premium. For , no agreement is reached between the two parties.

- From Table 1, we see that when β gets larger and the cedent becomes increasingly important, then decreases, whereas increases.

- When and , the optimal ceded functions are only partially specified, and the risk of the two parties varies in some range. For example, when , then is maximized by choosing because the cedent is choosing a maximal ceded function and paying a maximal reinsurance premium (within the partially-specified optimal ceded functions). However, its does not reduce with such a high deductible value. On the other hand, is minimized with , within the partially-specified optimal ceded functions.

3.3.2. Scenario B: and

In this case, we have and . Applying Theorems 2 and 4, we have:

When ,

where can be any constant. The values of versus are reported in Table 2.

Table 2.

VaRs of the cedent and the reinsurer when .

4. Optimal Reinsurance Policy When

In this section, we determine optimal reinsurance policies when , that is when both f and the retained loss function are non-decreasing. Comparing this situation with the earlier , we can now deal with non-convex ceded functions, such as for any retention level . Mathematically, the problem becomes:

As pointed out in the Introduction, solutions to similar problems exist in the literature, and we refer to [7,8,25] for details and further references. Our contribution in this paper is to generalize the geometric arguments of [12] to the situation when the interests of both the cedent and the reinsurer are taken into account, and we do so in such a way that allows us to avoid lengthy mathematical arguments and consequently helps us to gain useful intuition. In addition, for all scenarios considered, we are able to provide explicit recipes for determining optimal reinsurance policies.

In Section 4.1 below, we derive optimal forms of ceded functions, and in Section 4.2, we determine parameter values of the optimal functions. Section 4.3 contains an illustrative numerical example, which is a continuation of that of Section 3.3. Throughout the rest of this section, we assume and .

4.1. Functional Form of the Ceded Function

We have subdivided our considerations into three cases.

4.1.1. Case 1:

Similarly to Case 1 of Section 3.1.1, we determine the functional form of the ceded function in the following manner. For any , we seek , such that and:

This requires , as well as the entire function to be as small as possible for a fixed value of .

As we see from Figure 3, because f is non-decreasing with a slope not exceeding one, the aforementioned requirements are satisfied by the function:

where can be any constant. The optimal value of d will be determined in Section 4.2 below. In reinsurance jargon, the above specified optimal form of the reinsurance policy is for the reinsurer to provide coverage over the layer .

Figure 3.

Optimal ceded functions in : Case 1.

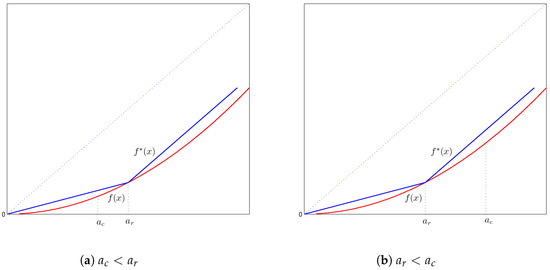

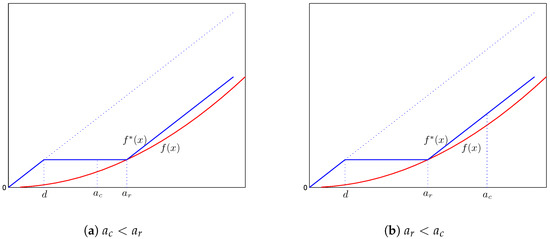

4.1.2. Case 2:

Similarly to Case 2 of Section 3.1.1, since the coefficients in front of and in objective Function (15) are negative, the optimal reinsurance policy is found by seeking , such that and:

As we see from Figure 4, these requirements are satisfied by the function:

where can be any constant. Hence, the optimal form of the reinsurance policy is for the reinsurer to provide a coverage except for the layer . In other words, the insurer retains losses in the layer .

Figure 4.

Optimal ceded functions in : Case 2.

4.1.3. Case 3:

In this case, the minimization problem (15) simplifies to:

When , because the ceded function is non-decreasing, this requires to be constant on the interval . Therefore, any function in with on , where is a constant, is Pareto-optimal.

When , because the slope of the ceded function cannot exceed one, the function increases at the rate of one on the interval . Therefore, any function in with on is Pareto-optimal.

Finally, when , then the objective function is always constant.

4.2. Parameter Values of the Optimal Ceded Function

In this section, we obtain parameter values of the optimal ceded functions that we derived in Section 4.1. Four cases are considered separately.

4.2.1. Case 1: and

Let:

and:

Theorem 5.

Under the conditions and , the optimal ceded function is with the parameter:

- 1.

- when ;

- 2.

- when .

In addition, when , then for all x.

4.2.2. Case 2: and

Let:

and

We calculate the derivative:

which is an increasing function in d, and so, we have the following theorem.

Theorem 6.

Under the conditions and , the optimal ceded function is with the parameter:

- 1.

- when ;

- 2.

- when ;

- 3.

- when and ;

- 4.

- when .

If none of the above conditions are satisfied, then for all x.

Proof.

We use similar arguments to those in Theorem 2. We illustrate them here by proving Part (1) only. When , the derivative reaches zero at and then remains positive for . Therefore, reaches its minimum at . With this, we conclude the proof of Theorem 6. ☐

4.2.3. Case 3: and

With the function given by Equation (17), optimization Problem (15) reduces to:

where the objective function is:

Thus:

which leads us to the following theorem, whose proof is similar to that of Theorem 3 and thus omitted.

Theorem 7.

Under the conditions and , the optimal ceded function is:

with the parameter:

- 1.

- when ;

- 2.

- when ;

- 3.

- when and ;

- 4.

- when and ;

- 5.

- when .

If none of the above conditions are satisfied, then for all x.

4.2.4. Case 4: and

Thus,

which gives us the following theorem.

Theorem 8.

Under the conditions and , the optimal ceded function is:

with the parameter:

- 1.

- when ;

- 2.

- when ;

- 3.

- when .

If none of the above conditions are satisfied, then for all x.

4.3. The Illustrative Example Continued

In this subsection, we continue the illustrative example of Section 3.3, but now assume that the admissible class of ceded functions is .

4.3.1. Scenario A: and

Applying Theorems 5 and 7, we have:

When , then:

where can be any constant.

The values of versus are reported in Table 3.

Table 3.

VaRs of the cedent and the reinsurer when .

We have the following observations:

- Since the cedent and the reinsurer have more choices when , their VaRs under the optimal reinsurance policy are lower than the corresponding ones under . In particular, the reinsurer’s risk is reduced significantly even when .

- For , the reinsurer assumes the “good” risk in the layer , as well as losses greater than . The former layer creates profit, and the latter layer does not contribute to its VaR because the chance of penetration is too small compared with the probability level used in its VaR.

- For , the insurer retains the “good” risk in the layer , as well as the losses greater than . The former layer creates profit, and the latter layer does not contribute to its VaR because the chance of penetration is too small compared with the probability level used in its VaR.

4.3.2. Scenario B: and

Applying Theorems 6 and 8, we have:

When ,

where can be any constant. The values of versus are reported in Table 4.

Table 4.

VaRs of the cedent and the reinsurer when .

5. A Numerical Comparison of the Optimal Reinsurance Policies in and

In Section 3.3 and Section 4.3, we derived the Pareto-optimal reinsurance policies in and , respectively. In this section, we compare the two cases.

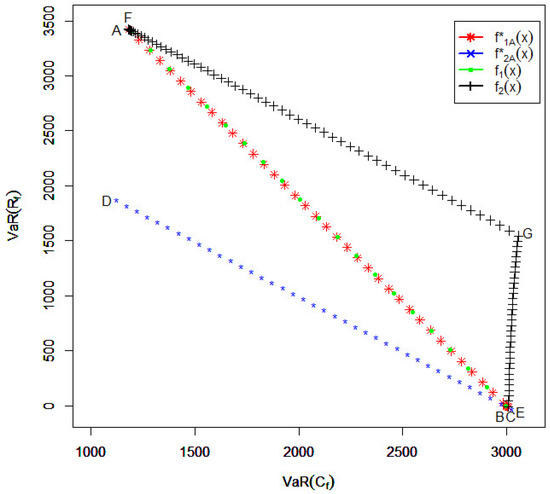

In Figure 5, we depict and obtained for Scenario A with the proportional reinsurance when a varies from zero to one and also with the excess-of-loss reinsurance when the deductible level d varies from zero to . The following can be concluded from the figure.

Figure 5.

VaRs of the cedent and the reinsurer under different policies: Scenario A.

- The efficient frontier for the s of the two parties with is represented by the path from to and then to . Note that the points between A and B represent the VaRs of the two parties resulting from the optimal policies obtained with . The points between B and C represent the VaRs of the two parties resulting from the optimal policies obtained with .

- The efficient frontier for the VaRs of the two parties when is represented by the path from to .

- For the quota-share reinsurance with where a ranges from zero to one, the VaRs of the two parties go from B to . When , the quota-share reinsurance policy is quite close to the efficient frontier.

- For the excess-of-loss reinsurance with d ranging from zero to , the VaRs of the two parties go along the path with .

From Figure 5, we conclude that if the reinsurer worries about the right-hand tail more than the primary insurer (), then the difference between the efficient frontiers obtained for and is significant. This means that the convexity requirement in the definition of is quite restrictive to the reinsurer, and the coverage with an upper limit (which is not allowed in ) is valuable. In the case when the convexity of the ceded function must be required, quota-share policies are quite efficient.

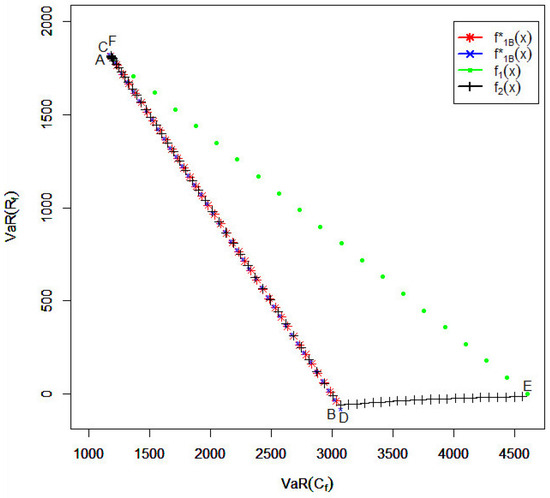

In Figure 6, we compare and obtained for Scenario B with the quota-share reinsurance policies when a ranges from zero to one and the excess-of-loss reinsurance policies when the deductible d ranges from zero to .

Figure 6.

VaRs of the cedent and the reinsurer under different policies: Scenario B.

In particular, we observe the following:

- The efficient frontier for the VaRs of the two parties with is represented by the path from to .

- The efficient frontier for the VaRs of the two parties when is represented by the path from to . In fact, it can algebraically be shown that the path from B to A is actually a part of the path from D to C. That is, by allowing , the efficient frontier is extended from the path to the path .

- For the quota-share reinsurance with the parameter a ranging from zero to one, the VaRs of the two parties are represented by the path from to . We see that when , the quota-share reinsurance policies are not efficient.

- For the excess-of-loss reinsurance with the parameter d ranging from zero to , the VaRs of the two parties change along the path . We see that setting is quite efficient, whereas setting is not.

From Figure 6, we conclude that if the primary insurer worries about the right-hand tail more than the reinsurer (), then the excess-of-loss policies with the deductible level ranging from to provide a good part of the efficient frontier. The quota-share policies are in general inefficient.

6. Conclusions

In this paper, we have extended the geometric approach of [12] to obtain the optimal reinsurance policies accommodating both the cedent’s and the reinsurer’s interests. Specifically, we have derived the forms of optimal reinsurance functions and also specified their parameter values within two classical sets of admissible ceded functions. We have adopted the same value-at-risk measure for assessing risks of the two parties, but at possibly different probability levels. Illustrative numerical examples have been constructed to illuminate our theoretical findings and their practical implications.

Acknowledgments

We are indebted to two anonymous reviewers for comments and suggestions that helped us to improve the paper. The research has been supported by the Natural Sciences and Engineering Research Council (NSERC) of Canada.

Author Contributions

Three authors contributed equally to this work.

Conflicts of Interest

The authors declare no conflict of interest.

References

- M. Denuit, J. Dhaene, M. Goovaerts, and R. Kaas. Actuarial Theory for Dependent Risks: Measures, Orders and Models. New York, NY, USA: John Wiley & Sons, 2006. [Google Scholar]

- V.R. Young. “Premium principles.” Encycl. Actuar. Sci., 2004. [Google Scholar] [CrossRef]

- E. Furman, and R. Zitikis. “Weighted premium calculation principles.” Insur.: Math. Econ. 42 (2008): 459–465. [Google Scholar] [CrossRef]

- E. Furman, and R. Zitikis. “Weighted pricing functionals with applications to insurance: An overview.” N. Am. Actuar. J. 13 (2009): 483–496. [Google Scholar] [CrossRef]

- K.J. Arrow. “Optimal insurance and generalized deductibles.” Scand. Actuar. J., 1974, 1–42. [Google Scholar] [CrossRef]

- K. Borch. “Reciprocal reinsurance treaties.” Astin Bull. 1 (1960): 170–191. [Google Scholar] [CrossRef]

- A.V. Asimit, A.M. Badescu, and A. Tsanakas. “Optimal risk transfers in insurance groups.” Eur. Actuar. J. 3 (2013): 159–190. [Google Scholar] [CrossRef]

- H. Assa. “On optimal reinsurance policy with distortion risk measures and premiums.” Insur.: Math. Econ. 61 (2015): 70–75. [Google Scholar] [CrossRef]

- C. Bernard, and W. Tian. “Optimal reinsurance arrangements under tail risk measures.” J. Risk Insur. 76 (2009): 709–725. [Google Scholar] [CrossRef]

- J. Cai, and K.S. Tan. “Optimal retention for a stop-loss reinsurance under the VaR and CTE risk measures.” Astin Bull. 37 (2007): 93–112. [Google Scholar] [CrossRef]

- J. Cai, K.S. Tan, C. Weng, and Y. Zhang. “Optimal reinsurance under VaR and CTE risk measures.” Insur.: Math. Econ. 43 (2008): 185–196. [Google Scholar] [CrossRef]

- K.C. Cheung. “Optimal reinsurance revisited—A geometric approach.” Astin Bull. 40 (2010): 221–239. [Google Scholar] [CrossRef]

- Y. Chi, and K.S. Tan. “Optimal reinsurance under VaR and CVaR risk measures: A simplified approach.” Astin Bull. 41 (2011): 487–509. [Google Scholar]

- K. Borch. “The optimal reinsurance treaty.” Astin Bull. 5 (1969): 293–297. [Google Scholar] [CrossRef]

- W. Hürlimann. “Optimal reinsurance revisited—Point of view of cedent and reinsurer.” Astin Bull. 41 (2011): 547–574. [Google Scholar]

- Z.G. Ignatov, V.K. Kaishev, and R.S. Krachunov. “Optimal retention levels, given the joint survival of cedent and reinsurer.” Scand. Actuar. J., 2004, 401–430. [Google Scholar]

- V.K. Kaishev, and D.S. Dimitrova. “Excess of loss reinsurance under joint survival optimality.” Insur.: Math. Econ. 39 (2006): 376–389. [Google Scholar] [CrossRef]

- A. Golubin. “Pareto-optimal insurance policies in the models with a premium based on the actuarial value.” J. Risk Insur. 73 (2006): 469–487. [Google Scholar] [CrossRef]

- D.S. Dimitrova, and V.K. Kaishev. “Optimal joint survival reinsurance: An efficient frontier approach.” Insur.: Math. Econ. 47 (2010): 27–35. [Google Scholar] [CrossRef]

- J. Cai, Y. Fang, Z. Li, and G.E. Willmot. “Optimal reciprocal reinsurance treaties under the joint survival probability and the joint profitable probability.” J. Risk Insur. 80 (2013): 145–168. [Google Scholar] [CrossRef]

- Y. Fang, and Z. Qu. “Optimal combination of quota-share and stop-loss reinsurance treaties under the joint survival probability.” IMA J. Manag. Math. 25 (2014): 89–103. [Google Scholar] [CrossRef]

- J. Cai, C. Lemieux, and F. Liu. “Optimal reinsurance from the perspectives of both an insurer and a reinsurer.” Astin Bull. 46 (2016): 815–849. [Google Scholar] [CrossRef]

- A. Castañer, and M.M. Claramunt. “Optimal stop-loss reinsurance: A dependence analysis.” Hacet. J. Math. Stat. 2 (2016): 497–519. [Google Scholar] [CrossRef]

- K.K. Aase. “Perspectives of risk sharing.” Scand. Actuar. J., 2002, 73–128. [Google Scholar] [CrossRef]

- M. Ludkovski, and V.R. Young. “Optimal risk sharing under distorted probabilities.” Math. Financ. Econ. 2 (2009): 87–105. [Google Scholar] [CrossRef]

- P. Embrechts, and G. Puccetti. “Bounds for functions of multivariate risks.” J. Multivar. Anal. 97 (2006): 526–547. [Google Scholar] [CrossRef]

- J. Dhaene, M. Denuit, M.J. Goovaerts, R. Kaas, and D. Vyncke. “The concept of comonotonicity in actuarial science and finance: Theory.” Insur.: Math. Econ. 31 (2002): 3–33. [Google Scholar] [CrossRef]

- J. Dhaene, M. Denuit, M.J. Goovaerts, R. Kaas, and D. Vyncke. “The concept of comonotonicity in actuarial science and finance: Applications.” Insur.: Math. Econ. 31 (2002): 133–161. [Google Scholar] [CrossRef]

- J. Daníelsson, B.N. Jorgensen, G. Samorodnitsky, M. Sarma, and C.G. de Vries. “Fat tails, VaR and subadditivity.” J. Econ. 172 (2013): 283–291. [Google Scholar] [CrossRef]

- H.U. Gerber. An Introduction to Mathematical Risk Theory. Philadelphia, PA, USA: Huebner Foundation for Insurance Education, 1979. [Google Scholar]

© 2017 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license ( http://creativecommons.org/licenses/by/4.0/).