1. Introduction

General interest towards non-parametric thinking has increased over the last few years. One example is density estimation under shape constraints instead of requiring the membership of a parametric family. Here, a particularly robust alternative to parametric tests is provided by searching for the best fitting log-concave density. Another example is the mean excess plot that aims at distinguishing light and heavy tails.

Throughout the paper, we consider i.i.d. random variables with common distribution F having density f and tail . Then, X is (right) heavy-tailed if for all and light-tailed otherwise. The density f is log-concave, if , where is a concave function. If is convex, then f is log-convex. This paper aims to illustrate that light-tailed asymptotic behaviour is associated with log-concave densities. Likewise, log-convexity seems to be connected to heavy-tailed behaviour. One can use the connection to assess potential heavy-tailedness by searching for patterns that are typically present among distributions with log-concave or log-convex densities.

Log-concavity is a widely studied topic in its own right [

1,

2]. There also exists substantial literature regarding its connections to probability theory and statistics [

3,

4]. Several papers concentrate on the statistical estimation of density functions assuming log-concavity [

5,

6]. This is due to the fact that log-concavity provides desirable statistical properties for estimators. For instance, maximum likelihood estimation becomes applicable and the estimate is unique. The topic is discussed in detail in the beginning of [

7]. Unfortunately, much less emphasis seems to be put on verification of the log-concavity property itself. Specifically, it seems to be relatively little studied if it is feasible that the sample be generated by a log-concave distribution. See, for example [

8,

9].

A distribution with a log-concave density

f is necessarily light-tailed. In contrast,

f is log-convex in the tail in the standard examples of heavy tails such as regular variation, the lognormal distribution and Weibull case

with

. An important class of heavy-tailed distributions are the subexponential ones defined by

. The intuition underlying this definition is the principle of a single big jump:

is large if one of

is large, whereas the other remains typical. This then motivates

being close to 1. In contrast, the folklore is that

contribute equally to

with light tails. We are not aware of general rigorous formulations of this principle, but it is easily verified in explicit examples like a gamma or normal

F (see further below) and, for a large number of summands rather than just 2, it is supported by conditioned limit theorems (see e.g., ([

10] (VI.5))). However, it was recently shown in [

4] that these properties of

R hold in greater generality and that asymptotic properties of the corresponding conditioned random variable

provide a sharp borderline between log-convexity and log-concavity.

In this paper, we provide a wider perspective in terms of both sharper and more general limit results and of the usefulness for visual statistical data exploration. To this end, we propose a feature based nonparametric test. It can be used as a visual aid in identification of log-concavity or heavy-tailed behaviour. It complements earlier ways to detect signs of heavy-tailedness such as the mean excess plot [

11]. Further tests based on probabilistic features have been previously utilised in e.g., [

12,

13,

14].

2. Background

A property holds

eventually, if there exists a number

so that the property holds in the set

. Standard asymptotic notation is used for limiting statements. These and basic properties of regularly varying functions with parameter

α, denoted RV(

α), can be recalled from e.g., [

15].

We note that the principle of a single big jump relates to the fact that joint distributions of independent random variables concentrate probability mass to different regions. For example, a distribution with tail function

satisfies

for

and

for

, as

. We refer to [

16,

17,

18,

19] for related work in this direction. It is shown in Lemma 1.2 of [

4] that log-concavity or log-concavity of the density is closely related to the occurrence of the principle of a single big jump. A further observation in this direction is the following lemma. It states that contour lines of joint densities of independent variables behave differently for log-concave and log-convex densities, and thereby leads naturally to different concentrations of probability mass of joint densities (recall that a contour line corresponding to a value

of joint density

is the set of points in the plane defined as

).

Lemma 1. Suppose

and

are i.i.d. unbounded non-negative random variables. Assume further that they have a common twice differentiable density function

f of the form

where

h is a strictly increasing function.

If f is log-concave (log-convex), then, for any fixed , there exists a convex (concave) function defining a contour line of corresponding to p such that for all .

Lemma 1 implies that log-convex and log-concave densities cause maximal points of joint densities to accumulate into different regions in the plane. Log-convex densities tend to put probability mass near the axis, while log-concave densities have a tendency to concentrate mass near the graph of the identity function. The exponential density is the limiting case where all contour lines are straight lines. More generally, for , where is an integration constant, the contour lines are circles for , straight lines for , and parabolas for .

3. Theoretical Results

The emphasis of the paper is on the mathematical formulation of the connection between log-convexity and the principle of a single big jump. However, some additional theoretical results are provided concerning convergence rates of the conditional ratio defined in Equation (

3). These rates, or estimates for the rates, are obtained in some standard distribution classes. Their proofs are mainly based on sharp asymptotics of subexponential distributions obtained in [

20,

21,

22]. Recall that some main classes of such distributions are RV

, meaning regularly varying ones, where

with

and

are slowly varying, Weibull tails with

for some

, and lognormal tails which are close to the case

of

for

and some

; we refer in the following to this class as

lognormal type tails.

3.1. Convergence Properties

Define the function

by

It can be viewed as a generalisation of the function

considered in [

4] and has the same interpretation as in the case with densities: if both

and

contribute equally to the sum

, then

g should eventually obtain values close to 0; similarly, if only one of the variables tends to be the same magnitude as the whole sum, then

g is close to 1 for large

d. Note also that

g is scale independent in the sense that

for all

. Due to this property, two or more samples can be standardised to have, say, equal means in order to obtain graphs on the same scale.

In Proposition 1, sharp asymptotic forms of g are exhibited in some classes of distributions.

Proposition 1. The following convergence rates hold for

g defined in Equation (

3).

Let

X be RV

with

, eventually decreasing density

f. Then,

Let

X be Weibull distributed with

. Then,

Let

X be of lognormal type. Then,

Remark 1. In the case of Weibull and lognormal distributions, the implication is that

converges to 1 at a larger rate than their associated hazard rates tend to zero. In addition, inspection of the proof shows

This implies that the actual convergence rate can not be substantially larger than in the regularly varying case, where the leading term is explicitly identified.

The light-tailed case appears to be more difficult to study than the heavy-tailed case. Difficulty arises mainly from the lack of good asymptotical approximations for probabilities of the form when decays much faster than . Interestingly, the full asymptotic form of g can be recovered in the special case of the normal distribution if we allow X to obtain negative values.

Proposition 2. Suppose that

X is normally distributed with

and

. Then,

The following theorem can be used to assess if a sample is coming from a source with log-concave density. It can be seen as a natural continuation as well as a generalisation to [

4].

Theorem 1. Assume the density

f is twice differentiable and eventually log-concave. Then,

Similarly, if

f is eventually log-convex, then

4. Statistical Application: Visual Test

Suppose

is a sequence of i.i.d. vectors whose components are also i.i.d. One can formulate the empirical counterpart of Quantity (

3) by setting

where

and

is the indicator function of the event

A.

Remark 2. Equation (

9) requires as input a two-dimensional sequence of random variables. One can form such a sequence from a real valued i.i.d. source

using any pairing of the

. Obvious examples are to take

to take the set

as all pairings of the

or as a randomly sampled subset of these

pairings. If the data is truly i.i.d, this should not have any effect on the outcome.

4.1. Examples and Applications

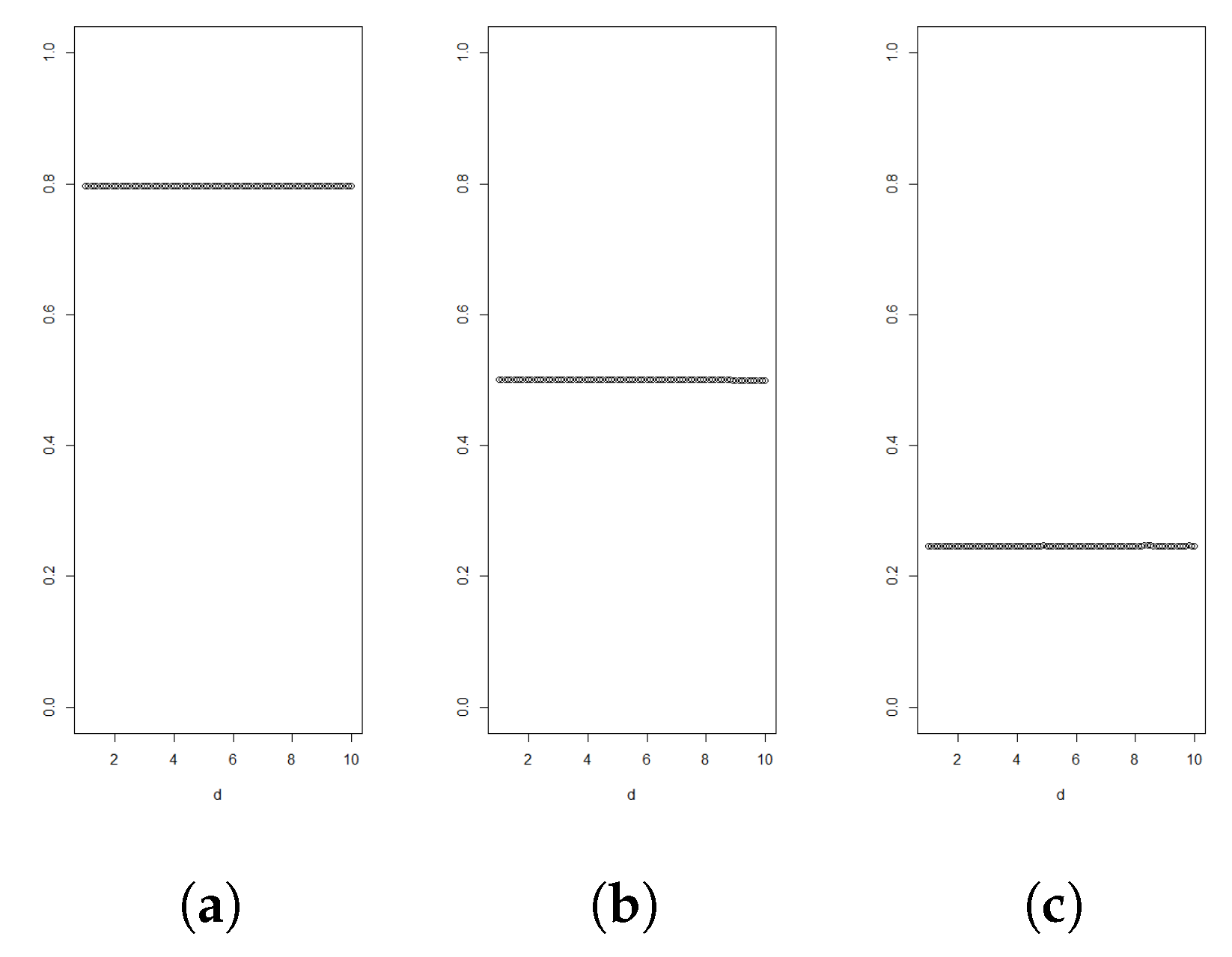

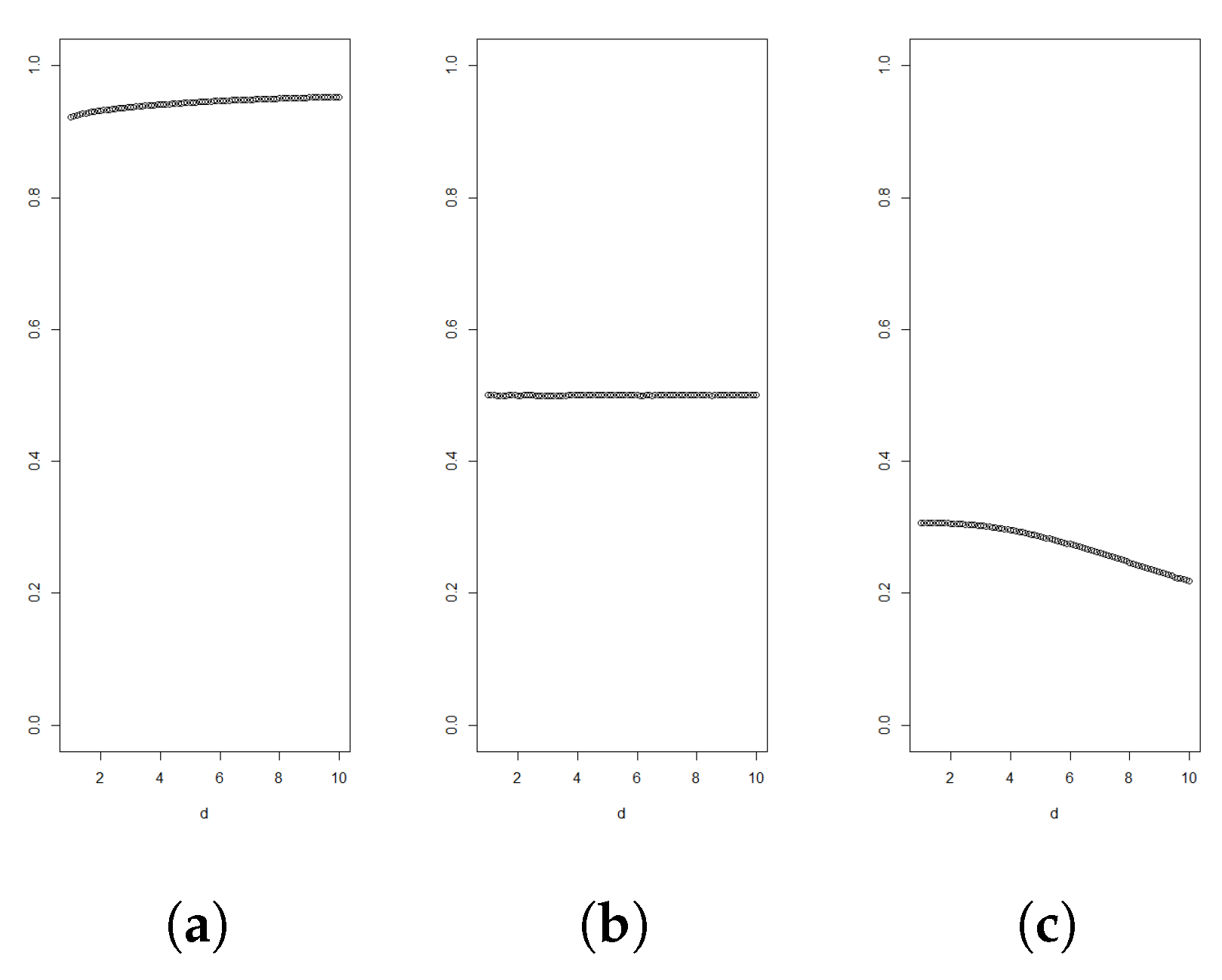

A graph of

as function of

d can be used to determine if the data support the density being log-concave or light-tailed behaviour. According to Theorem 1, the graph should then stay below

.

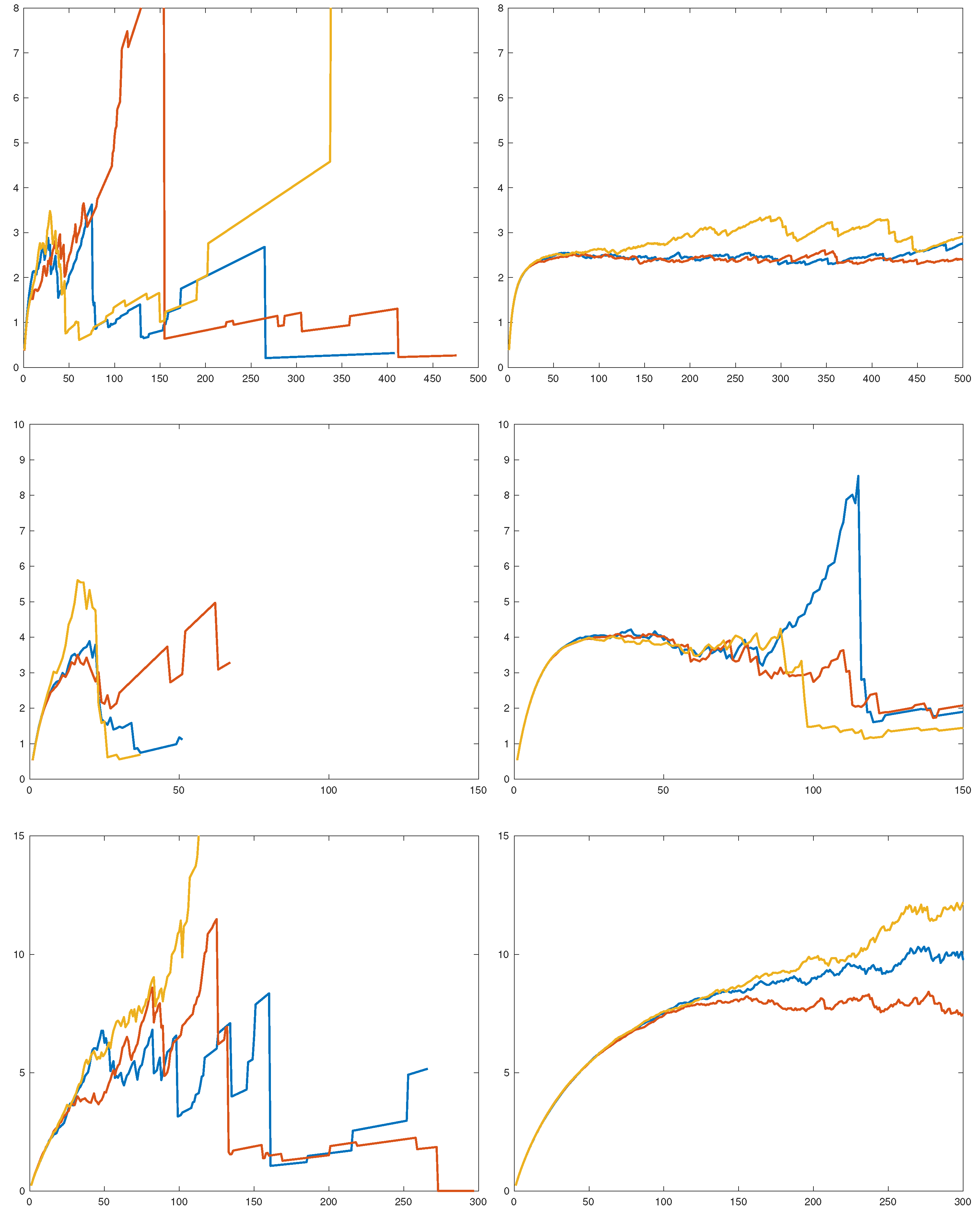

Figure 1,

Figure 2,

Figure 3 and

Figure 4 illustrate such graphs using experimental data.

The test method is visual. A similar idea has been used at least in the classical mean excess plot, where one visually assesses if the tail excess in the sample points is increasing at the level, as is the case for heavy tails.

4.2. Finer Diagnostics

The idea of plotting as a function of d was introduced as a graphical test for distinguishing between heavy-tailed and log-concave light tailed distributions. It seems reasonable to ask if the plot can be used for finer diagnostics, in particular to further specify the tail behaviour of F when F was found to be heavy-tailed. Such an idea would be based on the rate of convergence of to 1.

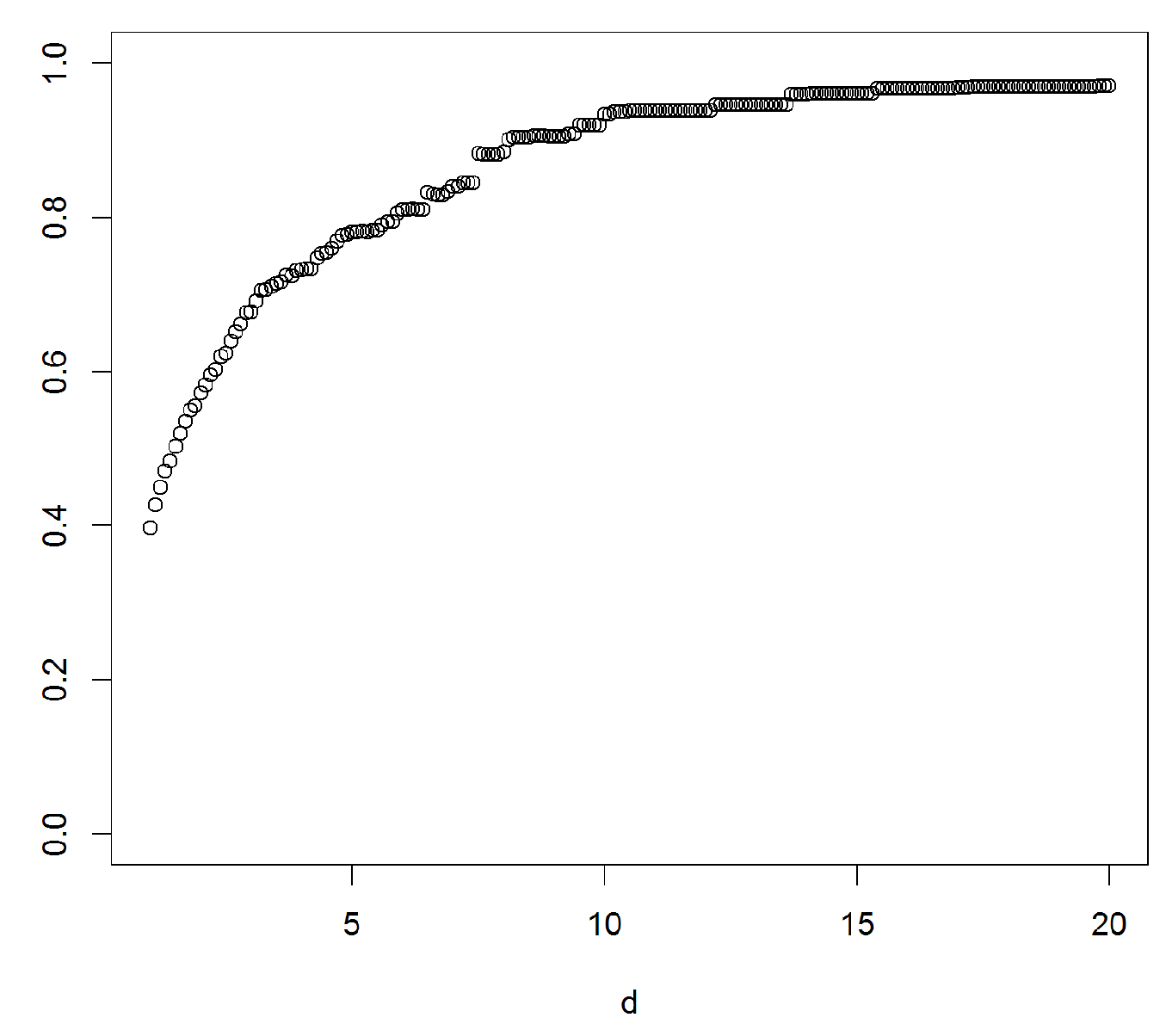

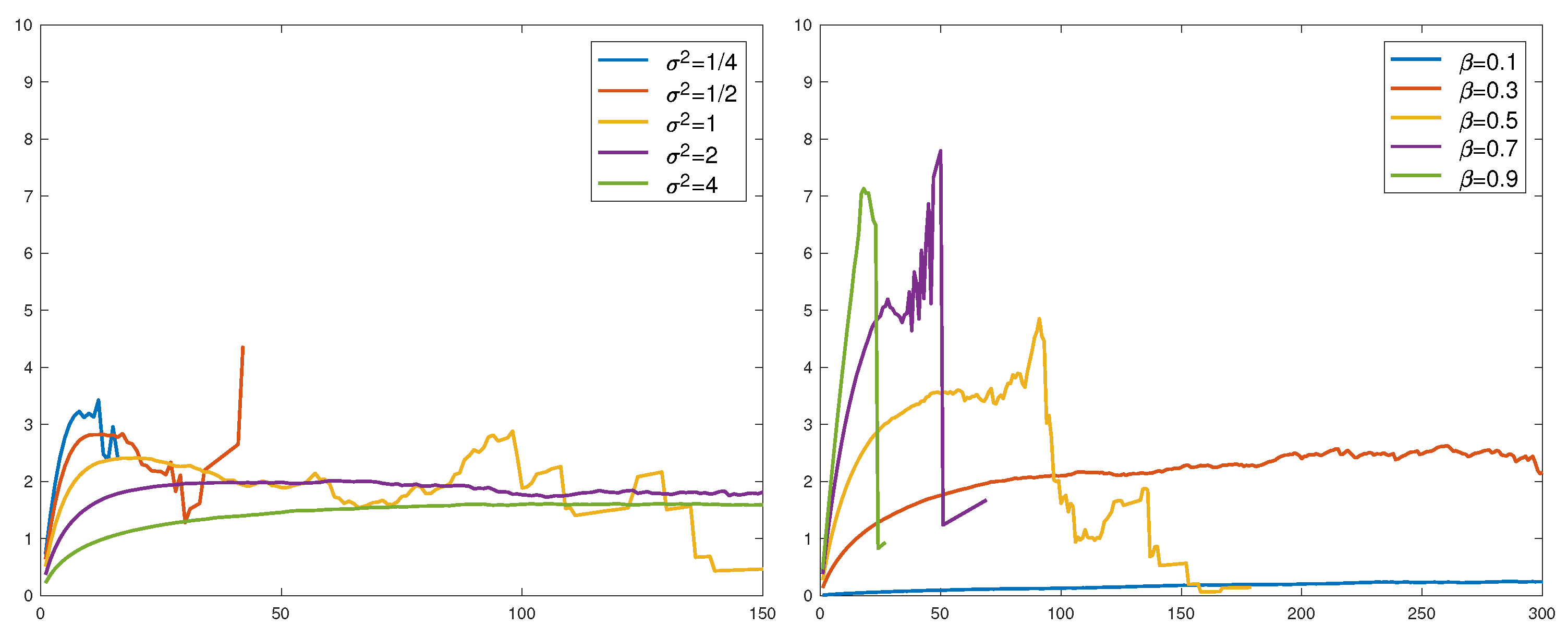

To gain some preliminary insight, we simulated

and

i.i.d pairs of r.v.’s

from an

F which was either RV(1.5), lognormal(0,1) or Weibull(0.4). The results are in

Figure 5 as plots of

, with three runs in each subfigure.

A first conclusion is that a sample size of is grossly insufficient for drawing conclusions about the way in which approaches 1—random fluctuations take over long before a systematic trend is apparent. The sample size is presumably unrealistic in most cases, but even for this, the picture is only clear in the RV case. Here, seems to have a limit c, as it should be, and the plot is in good agreement with the value 2.4 = of c predicted by Proposition 1.

Whether a limit exists in the lognormal or Weibull case is less clear. The results of Proposition 1 are less definite here, but, actually, a heuristic argument suggests that the limit

c should exist and be

. To this end, let

be the order statistics. According to subexponential theory (see, in particular, [

25]),

are asymptotically independent given

, with

having asymptotic distribution

F and

being of the form

with

, and

E as in the proof of Proposition 1. For large

d, this gives

In the lognormal or Weibull case, one has and so . Taking expectations gives the conjecture.

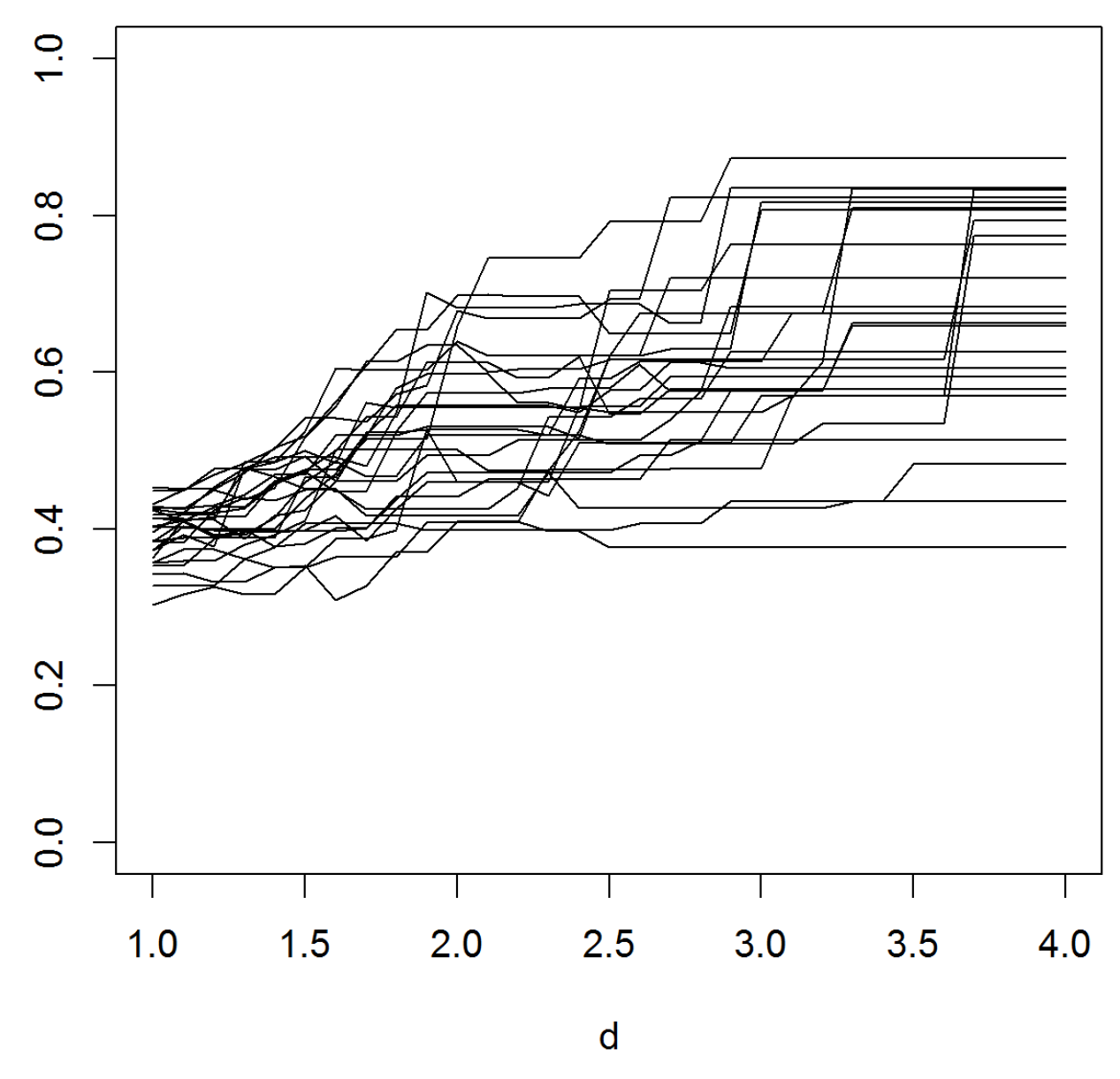

For the Weibull,

, and the

part of

Figure 5 is rather inconclusive concerning the conjecture. We did one more run with

over a range of parameters (the variance

of

for the lognormal and

β for the Weibull). All

were normalized to have mean 1 so that the conjecture would assert convergence to

. This is not seen in the results in

Figure 6. Large values of

and small values of

β could appear to give convergence, but not to 2.

It should be noted that the heuristics give the correct result in the RV case. Namely, here we can take

and

. This easily gives

so that Quantity (

10) is approximately

, as rigorously verified in Proposition 1.

The overall conclusion is that the finer diagnostic value of the method is quite limited, and restricted to RV and sample sizes which may be unrealistically large in many contexts.

5. Proofs

Proof of Lemma 1. Suppose

h is concave and

. The contour line corresponding to value

p is formed as the set of points

that satisfy

, or equivalently

For any such pair

one can solve Equation (

11) for

y to obtain

Firstly,

is convex as the inverse of an increasing concave function. Secondly, the composition of an increasing convex function and a convex function remains convex. Thus, as a function of

x, Expression (

12) defines a convex function when

. Thus, one can define

.

If h is convex, the proof is analogous. ☐

The following technical lemma is needed in the proof of Proposition 1. It applies to Pareto, Weibull and lognormal type distributions. Indeed, condition (

13) follows from Proposition 1.2; (ii) of [

21] and further needed assumptions are easily verified apart from strong subexponentiality, which is known to hold in the mentioned examples.

Lemma 2. Suppose

and

are non-negative i.i.d. variables with a common density

f, where the hazard rate

is eventually decreasing with

. Assume further that

If in addition

, then

Proof. Equality (

13) implies subexponentiality of

. Writing

and observing that the nominator on the right-hand side is of order

proves Equation (

14) since

by subexponentiality.

On the other hand, writing

gives

Since we know from Equation (

16) that the leading term tending to zero must be

, Equation (

15) holds. ☐

Proof of Proposition 1. Suppose

X is regularly varying with index

α. In light of Lemma 2, we only need to establish

The contribution to the l.h.s of Equation (

17) from

is of order

for any

and

. Thus, it can be neglected. We are left with estimating

We will bound this quantity from above and below, assuming .

Now, given

,

is approximately distributed as

for large

x where

. Hence, dominated convergence gives

Here, the error terms and are of order . The latter error comes from Taylor expansion of function around point . The fact that f is assumed eventually decreasing guarantees that , when .

Secondly, for the lower bound, we have that

As before, we get

for error terms

and

of order

.

Repeating the argument with arbitrarily small

and combining the upper and lower estimates allows one to deduce

as

, which proves the claim.

Suppose then that

X is Weibull distributed. Now assumptions of Lemma 2 are satisfied with

. Since

for some

depending on

α, we only need to find the order of

In fact, proceeding similarly as in the regularly varying case, it can be seen that Quantity (

18) equals

It is known that

, where

, converges in distribution to a standard exponential variable, as

. Because

, it holds for

that

(the interchange of expectation and convergence is justified by dominated convergence). In addition, the same error term can be used for any

y.

Thus, Quantity (

19) can be written as

Now, using the definition of

from Lemma 2 with Equality (

15), we get

and

since

Equation (

20) follows from the fact that conditionally to

, all probability mass concentrates near small values of

.

Gathering estimates and using Equation (

14) of Lemma 2 yields

This shows Equation (

4), and Equation (

5) can be obtained using similar calculations with

. ☐

Proof of Proposition 2. Note first that

and

are independent in the normal case. Denote

so that

. Let

be the mean excess function of

Z (inverse hazard rate). It is then standard that

is of order

and that

converges in distribution to a standard exponential. Writing

it follows in the same way as in the proof or Proposition 1 that the r.h.s. of Equation (

21) is

. This proves the claim. ☐

Proof of Theorem 1. Suppose

f is log-concave and twice differentiable. Since

it suffices to show that, for a fixed

z, it holds that

where

In fact, by symmetry, one only needs to show

It is known from the proof of Proposition 2.1 of [

4] that

is increasing in

. Since

is non-negative and integrates to one over interval

, there exists a number

such that

when

and

when

. Therefore,

which proves Inequality (

23). Generally, if

f is log-concave and twice differentiable in the set

, then

is increasing in the set

. The difference from the presented calculation vanishes in the limit

, and thus Inequality (

7) holds.

If

f is eventually log-convex, the proof is analogous and Inequality (

8) holds. ☐