Modeling Exchange Rate Volatility in India in Relation to COVID-19 and Lockdown Stringency: A Wavelet Coherence and Quantile Causality Approach

Abstract

1. Introduction

2. Literature Review

3. Data and Empirical Methodology

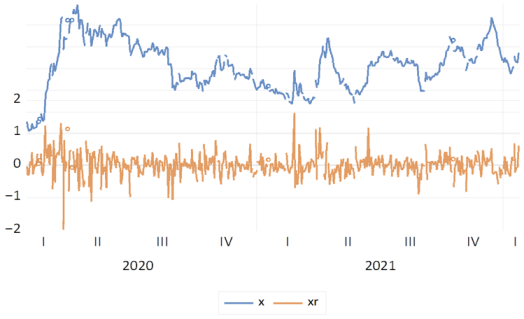

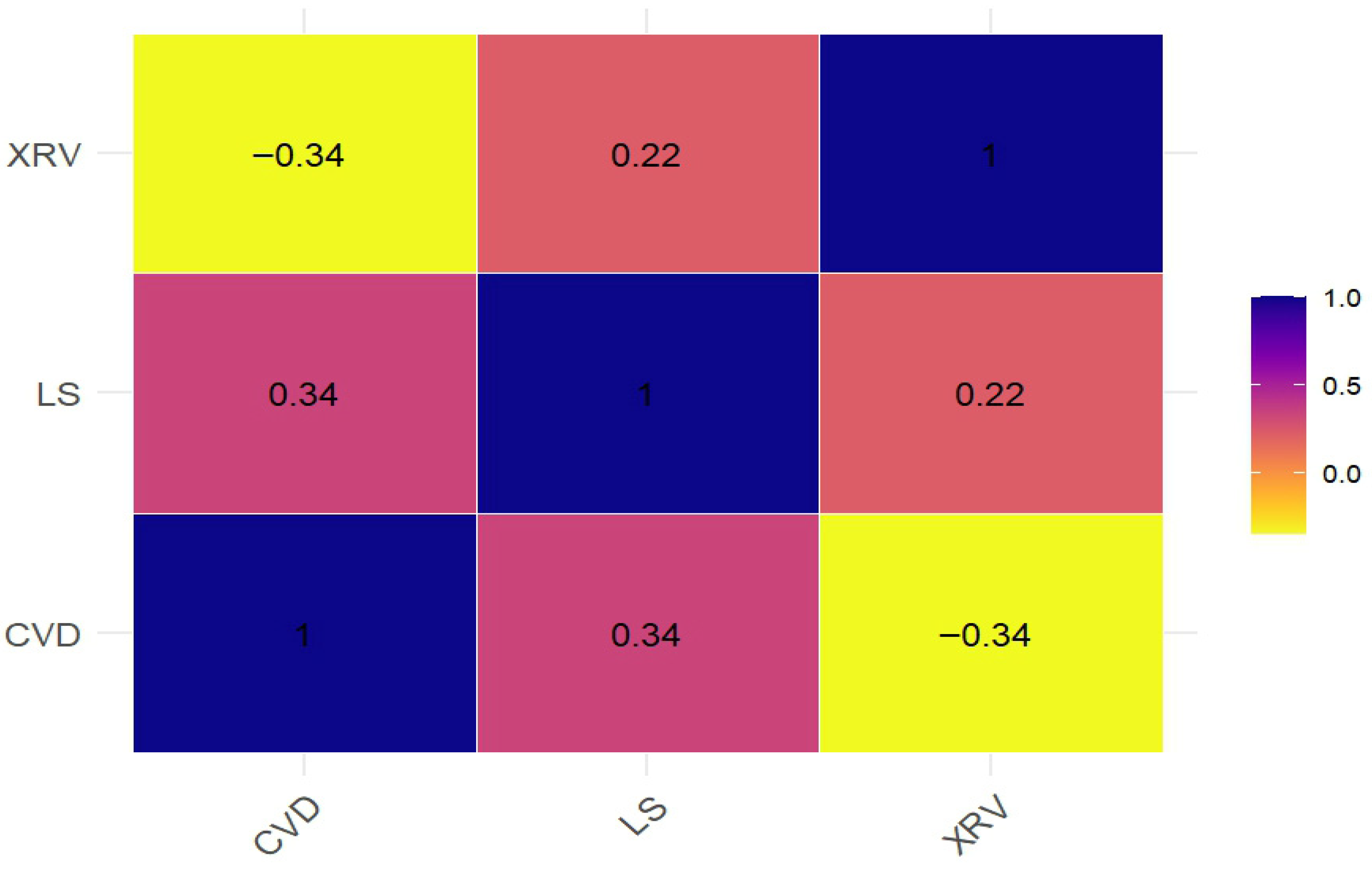

3.1. Data

3.2. Empirical Methodology

3.3. Hybrid Non-Parametric Quantile Causality Approach

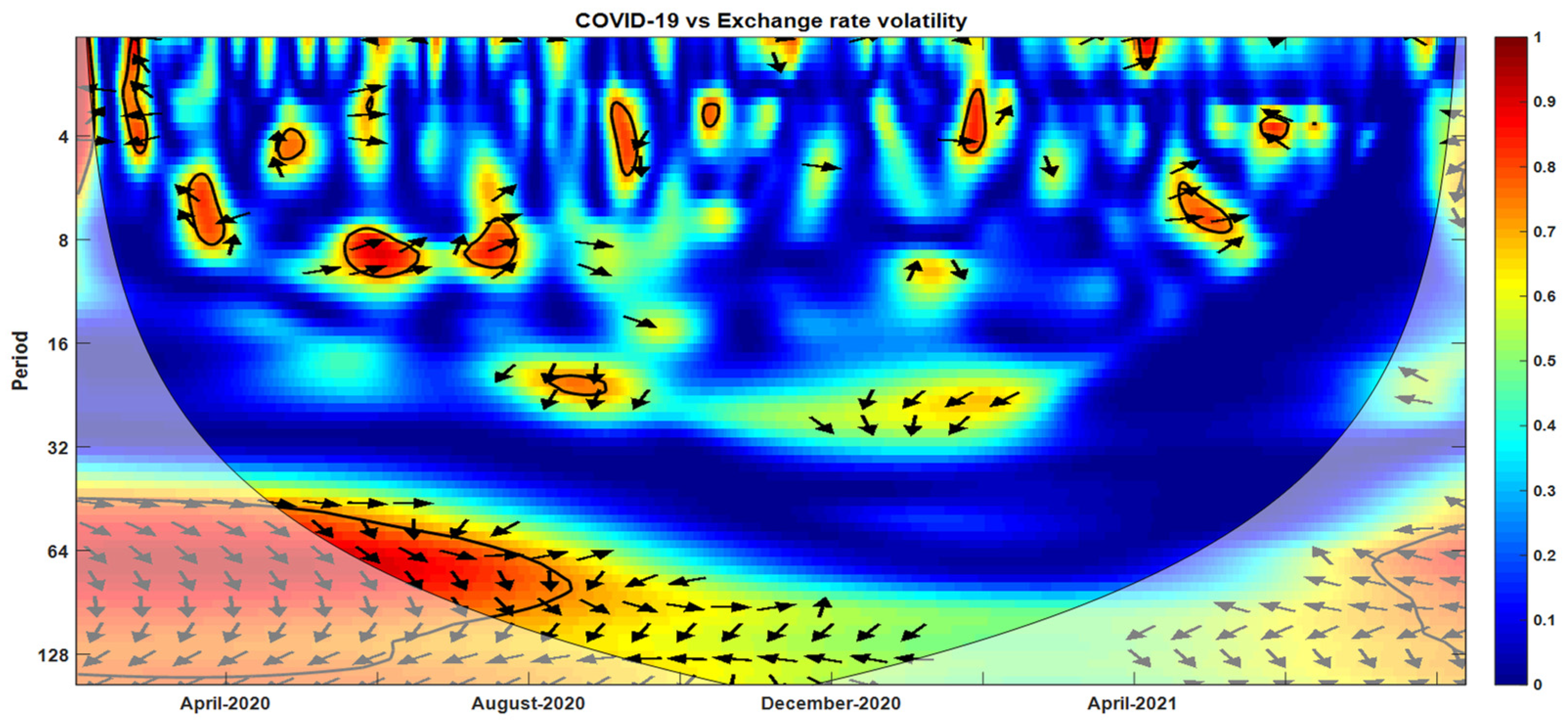

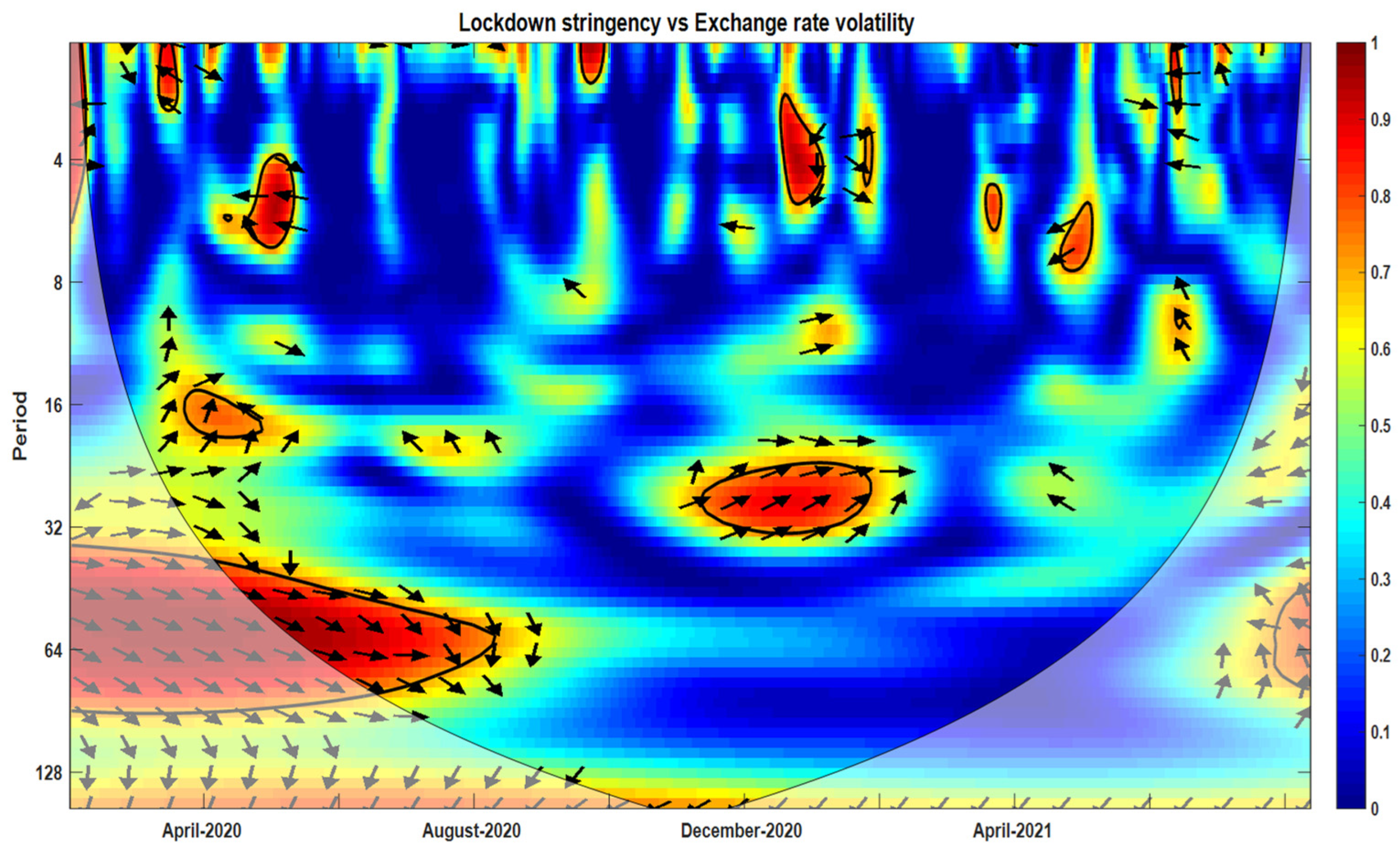

4. Results and Discussions

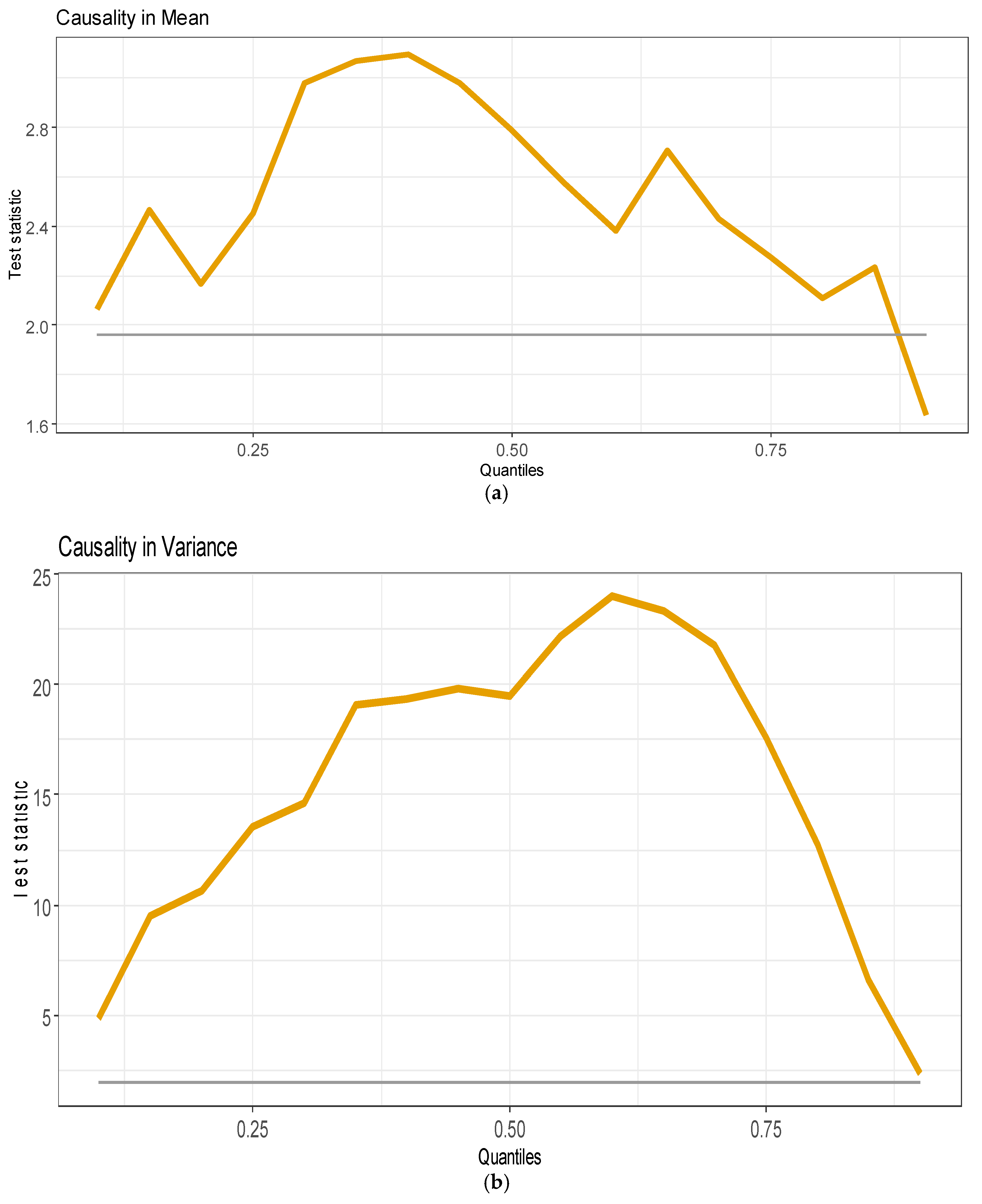

- Robustness Analysis 1: Troster–Granger Causality in Quantiles

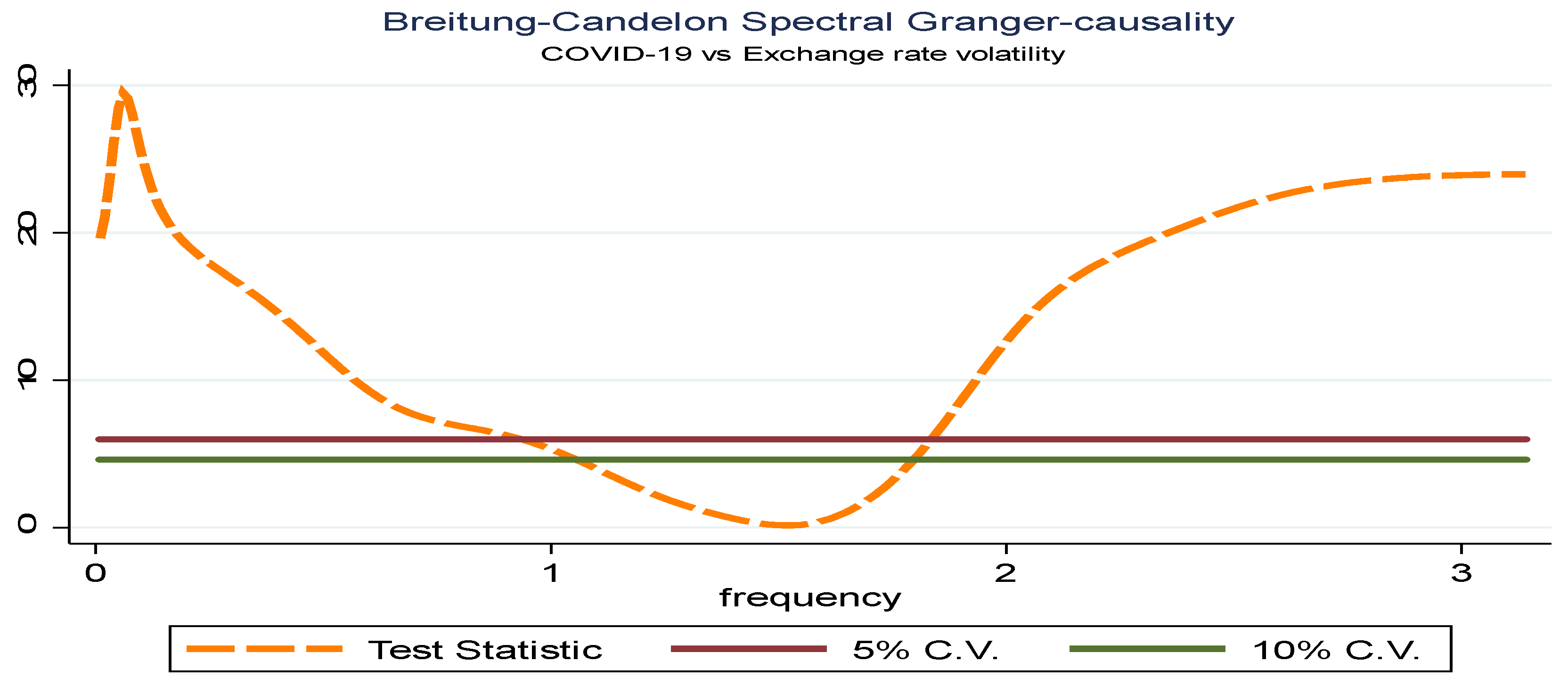

- Robustness Analysis 2: Breitung–Candelon Spectral Causality

5. Conclusions

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

Appendix A

| Variable | Coefficient | Std. Error | z-Statistic | Prob. |

|---|---|---|---|---|

| C | 0.0002 | 0.0166 | 0.0134 | 0.9893 |

| XR (−1) | 0.0007 | 0.0539 | 0.0140 | 0.9888 |

| Variance Equation | ||||

| C | 0.0157 | 0.0058 | 2.7284 | 0.0064 |

| RESID (−1)2 | 0.0959 | 0.0259 | 3.7081 | 0.0002 |

| GARCH (−1) | 0.7788 | 0.0687 | 11.3362 | 0.0000 |

| R-squared | −0.0007 | Mean dependent var | 0.0095 | |

| Adjusted R-squared | −0.0029 | S.D. dependent var | 0.3567 | |

| S.E. of regression | 0.3573 | Akaike info criterion | 0.7120 | |

| Sum squared resid | 58.2031 | Schwarz criterion | 0.7570 | |

| Log likelihood | −158.0378 | Hannan–Quinn criter. | 0.7297 | |

| Durbin–Watson stat | 2.0825 | |||

| 1 | We have used mean imputation for some missing values in the data by taking insights from the work of Maheswari et al. (2019). |

References

- Abedin, Mohammad Zoynul, Mahmudul Hasan Moon, M. Kabir Hassan, and Petr Hajek. 2021. Deep learning-based exchange rate prediction during the COVID-19 pandemic. Annals of Operations Research 345: 1335–86. [Google Scholar] [CrossRef]

- Aggarwal, Shobhit, Samarpan Nawn, and Amish Dugar. 2021. What caused global stock market meltdown during the COVID pandemic–Lockdown stringency or investor panic? Finance Research Letters 38: 101827. [Google Scholar] [CrossRef]

- Amar, Amine Ben, Fateh Belaid, Adel Ben Youssef, Benjamin Chiao, and Khaled Guesmi. 2021. The unprecedented reaction of equity and commodity markets to COVID-19. Finance Research Letters 38: 101853. [Google Scholar] [CrossRef]

- Atri, Hanen, Saoussen Kouki, and Mohamed imen Gallali. 2021. The impact of COVID-19 news, panic and media coverage on the oil and gold prices: An ARDL approach. Resources Policy 72: 102061. [Google Scholar] [CrossRef]

- Balcilar, Mehmet, David Roubaud, Gizem Uzuner, and Mark E. Wohar. 2021. Housing sector and economic policy uncertainty: A GMM panel VAR approach. International Review of Economics & Finance 76: 114–26. [Google Scholar] [CrossRef]

- Balcilar, Mehmet, Rangan Gupta, Christian Pierdzioch, and Mark E. Wohar. 2017. Do terror attacks affect the dollar-pound exchange rate? A nonparametric causality-in-quantiles analysis. The North American Journal of Economics and Finance 41: 44–56. [Google Scholar] [CrossRef]

- Banerjee, Indrajit, Atul Kumar, and Rupam Bhattacharyya. 2020. Examining the Effect of COVID-19 on Foreign Exchange Rate and Stock Market--An Applied Insight into the Variable Effects of Lockdown on Indian Economy. arXiv arXiv:2006.14499. [Google Scholar]

- Beckmann, Joscha, and Robert Czudaj. 2022. Price-Exchange Rate Link?—The Role. In Applications in Energy Finance: The Energy Sector, Economic Activity, Financial Markets and the Environment. New York: Springer, p. 27. [Google Scholar]

- Benzid, Lamia, and Kaouther Chebbi. 2020. The impact of COVID-19 on exchange rate volatility: Evidence through GARCH model. SSRN Electronic Journal. [Google Scholar] [CrossRef]

- Bollerslev, Tim. 1987. A conditionally heteroskedastic time series model for speculative prices and rates of return. The Review of Economics and Statistics 69: 542–547. [Google Scholar] [CrossRef]

- Broock, W. A., José Alexandre Scheinkman, W. Davis Dechert, and Blake LeBaron. 1996. A test for independence based on the correlation dimension. Econometric Reviews 15: 197–235. [Google Scholar] [CrossRef]

- Celık, Sibel. 2012. The more contagion effect on emerging markets: The evidence of DCC-GARCH model. Economic Modelling 29: 1946–59. [Google Scholar] [CrossRef]

- Cheung, Calista, Jerome Lyons, Bethany Madsen, Sarah Miller, and Saarah Sheikh. 2021. The Bank of Canada COVID-19 Stringency Index: Measuring Policy Response Across Provinces. No. 2021-1. Ottawa: Bank of Canada. [Google Scholar]

- Chowdhury, Kushal Banik, and Bhavesh Garg. 2022. Has COVID-19 intensified the oil price–exchange rate nexus? Economic Analysis and Policy 76: 280–98. [Google Scholar] [CrossRef]

- De, Indranil, Soumyadip Chattopadhyay, Hippu Salk Kristle Nathan, and Kingshuk Sarkar. 2022. COVID-19 Pandemic, Public Policy, and Institutions in India. London: Routledge. [Google Scholar]

- Dimitriou, Dimitrios, Dimitris Kenourgios, and Theodore Simos. 2013. Global financial crisis and emerging stock market contagion: A multivariate FIAPARCH–DCC approach. International Review of Financial Analysis 30: 46–56. [Google Scholar] [CrossRef]

- Feng, Gen-Fu, Hao-Chang Yang, Qiang Gong, and Chun-Ping Chang. 2021. What is the exchange rate volatility response to COVID-19 and government interventions? Economic Analysis and Policy 69: 705–19. [Google Scholar] [CrossRef]

- Ge, Yong, Wen-Bin Zhang, Haiyan Liu, Corrine W. Ruktanonchai, Maogui Hu, Xilin Wu, Yongze Song, Nick W. Ruktanonchai, Wei Yan, Eimear Cleary, and et al. 2022. Impacts of worldwide individual non-pharmaceutical interventions on COVID-19 transmission across waves and space. International Journal of Applied Earth Observation and Geoinformation 106: 102649. [Google Scholar] [CrossRef]

- Gharib, Cheima, Salma Mefteh-Wali, and Sami Ben Jabeur. 2021. The bubble contagion effect of COVID-19 outbreak: Evidence from crude oil and golda markets. Finance Research Letters 38: 101703. [Google Scholar] [CrossRef]

- Grinsted, Aslak, John C. Moore, and Svetlana Jevrejeva. 2004. Application of the cross wavelet transform and wavelet coherence to geophysical time series. Nonlinear Processes in Geophysics 11: 561–66. [Google Scholar] [CrossRef]

- Grossmann, Alexander, and Jean Morlet. 1984. Decomposition of Hardy functions into square integrable wavelets of constant shape. SIAM Journal on Mathematical Analysis 15: 723–36. [Google Scholar] [CrossRef]

- Gulzar, Saqib, Ghulam Mujtaba Kayani, Hui Xiaofen, Usman Ayub, and Amir Rafique. 2019. Financial cointegration and spillover effect of global financial crisis: A study of emerging Asian financial markets. Economic Research-Ekonomska Istraživanja 32: 187–218. [Google Scholar] [CrossRef]

- Ha, Jongrim, M. Marc Stocker, and Hakan Yilmazkuday. 2020. Inflation and exchange rate pass-through. Journal of International Money and Finance 105: 102187. [Google Scholar] [CrossRef]

- Hoshikawa, Takeshi, and Taiyo Yoshimi. 2021. The Effect of the COVID-19 Pandemic on S outh K orea’s Stock Market and Exchange Rate. The Developing Economies 59: 206–22. [Google Scholar] [CrossRef] [PubMed]

- Hossain, Md Emran, Soumen Rej, Mohammad Razib Hossain, Arunava Bandyopadhyay, Riffat Ara Zannat Tama, and Assad Ullah. 2023. Energy mix with technological innovation to abate carbon emission: Fresh evidence from Mexico applying wavelet tools and spectral causality. Environmental Science and Pollution Research 30: 5825–46. [Google Scholar] [CrossRef]

- Huang, Wenli, and Yuqi Zheng. 2020. COVID-19: Structural changes in the relationship between investor sentiment and crude oil futures price. Energy Research Letters 1: 1–4. [Google Scholar] [CrossRef]

- Hung, Ngo Thai, Linh Thi My Nguyen, and Xuan Vinh Vo. 2022. Exchange rate volatility connectedness during COVID-19 outbreak: DECO-GARCH and Transfer Entropy approaches. Journal of International Financial Markets, Institutions and Money 81: 101628. [Google Scholar] [CrossRef]

- Islam, Nazrul, Stephen J. Sharp, Gerardo Chowell, Sharmin Shabnam, Ichiro Kawachi, Ben Lacey, Joseph M. Massaro, Ralph B. D’Agostino, and Martin White. 2020. Physical distancing interventions and incidence of coronavirus disease 2019: Natural experiment in 149 countries. BMJ 370: m2743. [Google Scholar] [CrossRef]

- Iyke, Bernard Njindan. 2021. The disease outbreak channel of exchange rate return predictability: Evidence from COVID-19. In Research on Pandemics. London: Routledge, pp. 145–65. [Google Scholar]

- Jamal, Aamir, and Mudaser Ahad Bhat. 2022. COVID-19 pandemic and the exchange rate movements: Evidence from six major COVID-19 hot spots. Future Business Journal 8: 17. [Google Scholar] [CrossRef]

- Jeong, Kiho, Wolfgang K. Härdle, and Song Song. 2012. A consistent nonparametric test for causality in quantile. Econometric Theory 28: 861–87. [Google Scholar] [CrossRef]

- Kasman, Saadet, Gülin Vardar, and Gökçe Tunç. 2011. The impact of interest rate and exchange rate volatility on banks’ stock returns and volatility: Evidence from Turkey. Economic Modelling 28: 1328–34. [Google Scholar] [CrossRef]

- Klose, Jens. 2023. European exchange rate adjustments in response to COVID-19, containment measures and stabilization policies. Economic Modelling 128: 106494. [Google Scholar] [CrossRef]

- Maheswari, K., P. Packia Amutha Priya, S. Ramkumar, and M. Arun. 2019. Missing data handling by mean imputation method and statistical analysis of classification algorithm. In EAI International Conference on Big Data Innovation for Sustainable Cognitive Computing: BDCC 2018. Cham: Springer International Publishing, pp. 137–49. [Google Scholar]

- Mensi, Walid, Ahmet Sensoy, Xuan Vinh Vo, and Sang Hoon Kang. 2020. Impact of COVID-19 outbreak on asymmetric multifractality of gold and oil prices. Resources Policy 69: 101829. [Google Scholar] [CrossRef] [PubMed]

- Narayan, Paresh Kumar. 2020. Has COVID-19 changed exchange rate resistance to shocks? Asian Economics Letters 1: 1–4. [Google Scholar] [CrossRef]

- Narayan, Paresh Kumar. 2022. Understanding exchange rate shocks during COVID-19. Finance Research Letters 45: 102181. [Google Scholar] [CrossRef] [PubMed]

- Nishiyama, Yoshihiko, Kohtaro Hitomi, Yoshinori Kawasaki, and Kiho Jeong. 2011. A consistent nonparametric test for nonlinear causality—Specification in time series regression. Journal of Econometrics 165: 112–27. [Google Scholar] [CrossRef]

- Obstfeld, Maurice, and Kenneth Rogoff. 1996. Foundations of International Macroeconomics. Cambridge, MA: MIT Press. [Google Scholar]

- Rajput, Himadri, Rahil Changotra, Prachi Rajput, Sneha Gautam, Anjani R. K. Gollakota, and Amarpreet Singh Arora. 2021. A shock like no other: Coronavirus rattles commodity markets. Environment, Development and Sustainability 23: 6564. [Google Scholar] [CrossRef] [PubMed]

- Rao, Amar, Mansi Gupta, Gagan Deep Sharma, Mandeep Mahendru, and Anirudh Agrawal. 2022. Revisiting the financial market interdependence during COVID-19 times: A study of green bonds, cryptocurrency, commodities and other financial markets. International Journal of Managerial Finance 18: 725–55. [Google Scholar] [CrossRef]

- Salisu, Afees A., Juncal Cuñado, and Rangan Gupta. 2022. Geopolitical risks and historical exchange rate volatility of the BRICS. International Review of Economics & Finance 77: 179–90. [Google Scholar] [CrossRef]

- Sharif, Arshian, Chaker Aloui, and Larisa Yarovaya. 2020. COVID-19 pandemic, oil prices, stock market, geopolitical risk and policy uncertainty nexus in the US economy: Fresh evidence from the wavelet-based approach. International Review of Financial Analysis 70: 101496. [Google Scholar] [CrossRef]

- Sharma, Gagan Deep, Aviral Kumar Tiwari, Mansi Jain, Anshita Yadav, and Burak Erkut. 2021. Unconditional and conditional analysis between COVID-19 cases, temperature, exchange rate and stock markets using wavelet coherence and wavelet partial coherence approaches. Heliyon 7: e06181. [Google Scholar] [CrossRef]

- Sharma, Gagan Deep, Muhammad Shahbaz, Sanjeet Singh, Ritika Chopra, and Javier Cifuentes-Faura. 2023. Investigating the nexus between green economy, sustainability, bitcoin and oil prices: Contextual evidence from the United States. Resources Policy 80: 103168. [Google Scholar] [CrossRef]

- Syahri, Alfi, and Robiyanto Robiyanto. 2020. The correlation of gold, exchange rate, and stock market on Covid-19 pandemic period. Jurnal Keuangan dan Perbankan 24: 350–62. [Google Scholar] [CrossRef]

- Syed, Aamir Aijaz, Sahar Loukil, Azza Béjaoui, and Ahmed Jeribi. 2025. Dual perspectives on market spillovers: G7 indices with S&P 500 versus AI-driven integration. Quality & Quantity, 1–34. [Google Scholar] [CrossRef]

- Tang, Pan, Tiantian Tang, and Chennuo Lu. 2024. Predicting systemic financial risk with interpretable machine learning. The North American Journal of Economics and Finance 71: 102088. [Google Scholar] [CrossRef]

- Torrence, Christopher, and Gilbert P. Compo. 1998. A practical guide to wavelet analysis. Bulletin of the American Meteorological Society 79: 61–78. [Google Scholar] [CrossRef]

- Wang, Yijun, Meiyun Wei, Usman Bashir, and Chao Zhou. 2022. Geopolitical risk, economic policy uncertainty and global oil price volatility—An empirical study based on quantile causality nonparametric test and wavelet coherence. Energy Strategy Reviews 41: 100851. [Google Scholar] [CrossRef]

- Wei, Na, Wen-Jie Xie, and Wei-Xing Zhou. 2022. Robustness of the international oil trade network under targeted attacks to economies. Energy 251: 123939. [Google Scholar] [CrossRef]

- Wei, Zhixi, Yu Luo, Zili Huang, and Kun Guo. 2020. Spillover effects of RMB exchange rate among B&R countries: Before and during COVID-19 event. Finance Research Letters 37: 101782. [Google Scholar] [CrossRef] [PubMed]

- Wu, Wanshan, Lijun Wang, Yaman Omer Erzurumlu, Giray Gozgor, and Gaoju Yang. 2022. Effects of country and geopolitical risks on income inequality: Evidence from emerging economies. Emerging Markets Finance and Trade 58: 4218–30. [Google Scholar] [CrossRef]

- Yilanci, Veli, and Ugur Korkut Pata. 2023. COVID-19, stock prices, exchange rates and sovereign bonds: A wavelet-based analysis for Brazil and India. International Journal of Emerging Markets 18: 4968–86. [Google Scholar] [CrossRef]

| XRV | CVD | SRI | |

|---|---|---|---|

| Mean | 0.009 | 14.706 | 69.113 |

| Median | 0.013 | 16.185 | 70.830 |

| Maximum | 1.609 | 17.493 | 100.000 |

| Minimum | −1.957 | 1.099 | 10.190 |

| Std. Dev. | 0.357 | 3.961 | 19.280 |

| Skewness | 0.016 | −2.080 | −1.285 |

| Kurtosis | 6.611 | 6.547 | 4.932 |

| Jarque–Bera | 249.387 | 571.705 | 197.805 |

| Probability | 0.000 | 0.000 | 0.000 |

| At Level | At First Difference | ||||||

|---|---|---|---|---|---|---|---|

| XRV | CVD | SRI | d (XRV) | d (CVD) | d (SRI) | ||

| With Constant | t-Statistic | −22.2734 | −6.4488 | −3.2037 | t-Statistic | −14.4389 | −3.2233 |

| Prob. | 0.0000 | 0.0000 | 0.0204 | Prob. | 0.0000 | 0.0193 | |

| *** | *** | ** | *** | ** | |||

| With Constant and Trend | t-Statistic | −22.2697 | −10.9102 | −3.4571 | t-Statistic | −14.4233 | −5.9962 |

| Prob. | 0.0000 | 0.0000 | 0.0454 | Prob. | 0.0000 | 0.0000 | |

| *** | *** | ** | *** | *** | |||

| Without Constant and Trend | t-Statistic | −22.2825 | 0.5043 | −0.0004 | t-Statistic | −14.4544 | −2.8740 |

| Prob. | 0.0000 | 0.8241 | 0.6820 | Prob. | 0.0000 | 0.0040 | |

| *** | *** | *** | |||||

| At Level | At First Difference | ||||||

|---|---|---|---|---|---|---|---|

| XRV | LCVD | SRI | XRV | d (XRV) | d (LCVD) | d (SRI) | |

| With Constant | −22.2891 | −6.7233 | −3.2300 | −22.2891 | −23.8347 | −20.8154 | −20.3918 |

| 0.0000 | 0.0000 | 0.0189 | 0.0000 | 0.0001 | 0.0000 | 0.0000 | |

| *** | *** | ** | *** | *** | *** | *** | |

| −22.2884 | −4.0026 | −3.3744 | −22.2884 | −23.2112 | −21.3558 | −20.3851 | |

| With Constant and Trend | 0.0000 | 0.0092 | 0.0561 | 0.0000 | 0.0001 | 0.0000 | 0.0000 |

| *** | *** | * | *** | *** | *** | *** | |

| Without Constant and Trend | −22.2966 | 1.5481 | −0.1799 | −22.2966 | −232.6243 | −19.8961 | −20.4010 |

| 0.0000 | 0.9704 | 0.6210 | 0.0000 | 0.0001 | 0.0000 | 0.0000 | |

| *** | *** | *** | *** | *** | |||

| Dimension | COVID | Lockdown Stringency | Exchange Rate Volatility | |||

|---|---|---|---|---|---|---|

| BDS Statistic | Prob. | BDS Statistic | Prob. | BDS Statistic | Prob. | |

| 2 | 0.208 | 0.000 | 0.201 | 0.000 | 0.014 | 0.000 |

| 3 | 0.355 | 0.000 | 0.339 | 0.000 | 0.028 | 0.000 |

| 4 | 0.458 | 0.000 | 0.433 | 0.000 | 0.036 | 0.000 |

| 5 | 0.530 | 0.000 | 0.495 | 0.000 | 0.043 | 0.000 |

| 6 | 0.581 | 0.000 | 0.535 | 0.000 | 0.042 | 0.000 |

| Quantiles | XRV | COVID | XRV | LS | COVID | |

|---|---|---|---|---|---|---|

| [0.05; 0.95] | 0.004 | 0.004 | 0.018 | 0.075 | 0.190 | 0.004 |

| 0.05 | 0.004 | 0.004 | 0.050 | 0.093 | 0.226 | 0.004 |

| 0.10 | 0.004 | 0.004 | 0.050 | 0.050 | 0.136 | 0.004 |

| 0.15 | 0.004 | 0.004 | 0.054 | 0.036 | 0.104 | 0.004 |

| 0.20 | 0.004 | 0.004 | 0.068 | 0.043 | 0.161 | 0.004 |

| 0.25 | 0.004 | 0.004 | 0.050 | 0.068 | 0.211 | 0.004 |

| 0.30 | 0.004 | 0.004 | 0.068 | 0.043 | 0.065 | 0.004 |

| 0.35 | 0.014 | 0.004 | 0.047 | 0.086 | 0.161 | 0.007 |

| 0.40 | 0.620 | 0.004 | 0.756 | 0.043 | 0.179 | 0.047 |

| 0.45 | 0.004 | 0.656 | 0.039 | 0.022 | 0.097 | 0.090 |

| 0.50 | 0.004 | 0.004 | 0.036 | 0.061 | 0.168 | 0.004 |

| 0.55 | 0.004 | 0.004 | 0.054 | 0.211 | 0.301 | 0.004 |

| 0.60 | 0.004 | 0.004 | 0.032 | 0.115 | 0.315 | 0.004 |

| 0.65 | 0.004 | 0.004 | 0.043 | 0.100 | 0.308 | 0.004 |

| 0.70 | 0.004 | 0.004 | 0.057 | 0.122 | 0.305 | 0.004 |

| 0.75 | 0.004 | 0.004 | 0.054 | 0.133 | 0.294 | 0.004 |

| 0.80 | 0.004 | 0.004 | 0.014 | 0.237 | 0.301 | 0.004 |

| 0.85 | 0.004 | 0.004 | 0.036 | 0.269 | 0.305 | 0.004 |

| 0.90 | 0.004 | 0.004 | 0.039 | 0.312 | 0.305 | 0.065 |

| 0.95 | 0.075 | 0.125 | 0.401 | 0.441 | 0.201 | 0.634 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Syed, A.A.; Ullah, A.; Grima, S.; Abdul Kamal, M.; Sood, K. Modeling Exchange Rate Volatility in India in Relation to COVID-19 and Lockdown Stringency: A Wavelet Coherence and Quantile Causality Approach. Risks 2025, 13, 182. https://doi.org/10.3390/risks13090182

Syed AA, Ullah A, Grima S, Abdul Kamal M, Sood K. Modeling Exchange Rate Volatility in India in Relation to COVID-19 and Lockdown Stringency: A Wavelet Coherence and Quantile Causality Approach. Risks. 2025; 13(9):182. https://doi.org/10.3390/risks13090182

Chicago/Turabian StyleSyed, Aamir Aijaz, Assad Ullah, Simon Grima, Muhammad Abdul Kamal, and Kiran Sood. 2025. "Modeling Exchange Rate Volatility in India in Relation to COVID-19 and Lockdown Stringency: A Wavelet Coherence and Quantile Causality Approach" Risks 13, no. 9: 182. https://doi.org/10.3390/risks13090182

APA StyleSyed, A. A., Ullah, A., Grima, S., Abdul Kamal, M., & Sood, K. (2025). Modeling Exchange Rate Volatility in India in Relation to COVID-19 and Lockdown Stringency: A Wavelet Coherence and Quantile Causality Approach. Risks, 13(9), 182. https://doi.org/10.3390/risks13090182