1. Introduction

The rapid diffusion of digital technologies has redrawn the contours of entrepreneurship, radically altering how small and medium-sized enterprises (SMEs) discover, create and capture value. Cloud computing, platform-based business models, automation and data-driven analytics now enable even the smallest firms to operate globally, orchestrate intricate supply chains and monetise intangible assets at previously unattainable scale. Yet these same technologies also embed SMEs in complex sociotechnical systems that expose them to novel hazards, cyber breaches, algorithmic opacity, sudden API or policy changes, and heightened regulatory scrutiny over data privacy and artificial intelligence. For today’s entrepreneurs, opportunity recognition and risk navigation are no longer sequential tasks but intertwined competencies: seizing digital advantage demands a simultaneous capacity to sense, evaluate and mitigate platform-centric risks.

At the heart of this dual mandate lies entrepreneurial intention (EI), the motivational precursor that translates perceptions, attitudes and beliefs into venture creation. Decades of research grounded in the Theory of Planned Behaviour (TPB) have affirmed the central role of attitudes, social norms and perceived behavioural control; more recent work has unpacked how self-efficacy, digital literacy and risk tolerance shape EI in volatile settings. Nevertheless, we know far less about the interactive influence of digital transformation on these cognitive mechanisms. Specifically, how do varying levels of platform affordances and perceived platform risk (PPR) amplify or dampen the effect of entrepreneurial self-efficacy (SE) on the intention to launch digital ventures? This question is especially salient in post-crisis or digitally lagging economies, where institutional fragility magnifies both the promise and peril of digitalisation.

This was compounded by COVID-19. Where forced shutdowns emerged, forced supply chain disruptions and concurrent shifts in consumer demand happened instantaneously, and SMEs were encouraged to digitize to go online during lockdown expanding the pace of digitalization yet increasing their own risk for cybercrime, accessibility challenges, compliance failures. Policymakers intervened with generous subsidization for digitized training opportunities; however, anecdotally, many owner-managers remain still torn, they know they must digitize to survive but succumb to conceding control to faceless online intermediaries and/or forfeiting unseen sunk costs. Assessing this uncertainty warrants a consideration of risk transformation as well as present day associations with platform affordance and readiness to digitize. By incorporating these dimensions, the study responds to a pressing need for models that reflect the hybrid nature of digital entrepreneurship, where behavioural intent is shaped not only by internal traits but also by the perceived design and governance of external technological infrastructures.

Addressing this gap, the present study develops and tests an integrative model that links digital readiness, perceived platform affordances (PPA), financial risk tolerance (FRT) and entrepreneurial knowledge (EK) with digital entrepreneurial intention (DEI), while treating perceived platform risk as both a direct deterrent and a moderator of the SE-DEI relationship. We ground our hypotheses in TPB, Entrepreneurial Risk-Taking Theory and Affordance Theory, then evaluate them using Partial Least Squares Structural Equation Modelling (PLS-SEM) on survey data from 428 Greek SMEs, an ideal empirical setting given Greece’s acute economic volatility, rapid post-crisis digital catch-up and high SME density. This setting also offers an opportunity to generalize findings to other digitally evolving but institutionally uncertain economies.

The study makes three principal contributions. First, it extends the entrepreneurial-intention literature by explicitly theorizing platform affordances and risks as distinct, technology-specific antecedents, thereby moving beyond generic notions of environmental uncertainty. Second, it provides fresh empirical evidence on how perceived risk dynamically conditions the motivational power of self-efficacy, enriching both TPB and risk-taking theory. Third, it offers actionable insights for entrepreneurs, platform operators and regulators intent on fostering resilient digital ecosystems, namely, that bolstering digital literacy and transparency can spur entrepreneurial dynamism only if concurrent measures reduce platform-level vulnerabilities. In synthesizing these strands, we illuminate the cognitive-contextual calculus through which SME decision-makers convert digital disruption into entrepreneurial opportunity or retreat from it.

2. Theoretical Foundations and Literature Review

2.1. Theory of Planned Behaviour and Entrepreneurial Self-Efficacy

Entrepreneurial intention research is grounded most visibly in Ajzen’s Theory of Planned Behaviour (TPB) (

Ajzen 1991), which positions intention as a function of attitudes, subjective norms, and perceived behavioural control. A long lineage of empirical work confirms that the attitudes and self-efficacy of prospective entrepreneurs powerfully shape new-venture intentions; see, for example, the seminal validation by

Kolvereid and Isaksen (

2006) and the more recent synthesis by

Liu and Peng (

2025), both of which underline how favourable attitudes and strong confidence translate into purposeful startup behaviour.

Fei and Liu (

2023) review these classic intention models and emphasize that risk appraisal though not always explicit in TPB, often lurks behind an individual’s feeling of behavioural control.

Leal et al. (

2025) provide a recent bibliometric overview of entrepreneurial ecosystems and knowledge management, highlighting the emerging role of digital capabilities in shaping entrepreneurial intention within ecosystem contexts. In short, personal efficacy and risk perception evolve together to govern entrepreneurial choice.

Digitisation reshapes the foundational TPB antecedents by overlaying them with technology-specific possibilities and perils. Evidence from SME research demonstrates that stronger digital literacy and organizational readiness enhance perceived behavioural control, enabling owner-managers to identify and pursue opportunities that would otherwise remain obscure (

Arnim and Mrożewski 2020).

Taken together, prior TPB-based studies confirm that intention is shaped by attitudes, norms, and perceived behavioural control, but they often overlook how digital transformation alters these antecedents. In particular, the combined effects of digital literacy and entrepreneurial self-efficacy on intention remain underexplored in volatile SME contexts. Addressing this gap, our model incorporates digital literacy and self-efficacy as core TPB-driven predictors of digital entrepreneurial intention. Accordingly, we hypothesize that:

H1. Entrepreneurial self-efficacy (SE) positively influences digital entrepreneurial intention (DEI).

H3. Digital literacy (DL) positively influences DEI.

2.2. Entrepreneurial Risk-Taking Theory and Financial Risk Tolerance

At the same time, digitalisation magnifies uncertainty. Entrepreneurial Risk-Taking Theory from

Knight’s (

1921) seminal risk uncertainty dichotomy to the refined treatment by

McMullen and Shepherd (

2006) warns that incalculable hazards can immobilize otherwise capable entrepreneurs. In digital arenas, opaque algorithm updates, surging cyberattacks and fluid regulatory dictates render perceived platform risk (PPR) a potent brake. Empirical evidence reveals that while financial risk tolerance (FRT) nudges entrepreneurs toward digital ventures, elevated PPR suppresses intention and can erode the empowering effect of self-efficacy (

Ma and Zhou 2024). Recent contributions further highlight this tension in the digital age. For example,

Suanpong et al. (

2025) examine how cognitive and motivational drivers interact with open innovation dynamics, while

Liu and Peng (

2025) confirm that environmental support continues to shape entrepreneurial intention in digitally evolving economies.

Zhao (

2024) empirically examines determinants of perceived risk in fintech adoption, demonstrating how nuanced risk dimensions, such as data privacy and platform volatility, can significantly alter adoption intentions, reinforcing the importance of platform-specific risk in entrepreneurial decision-making. These recent studies reinforce the timeliness of investigating digital entrepreneurial intention under conditions of heightened uncertainty.

While Risk-Taking Theory clarifies why financial risk tolerance fosters entrepreneurial intention, it rarely accounts for platform-specific risks such as cyber threats or policy opacity. The literature suggests that these contextualized risks may not only directly deter entrepreneurial intention but also condition the motivational power of self-efficacy. This motivates our inclusion of perceived platform risk both as a direct predictor and as a moderator of the efficacy intention relationship.

Accordingly, we hypothesize that:

H2. Financial risk tolerance (FRT) positively influences DEI.

H5. Perceived platform risk (PPR) negatively influences DEI.

H7. Perceived platform risk (PPR) weakens the positive relationship between SE and DEI.

2.3. Affordance Theory and Perceived Platform Affordances

At the ecosystem level, digital infrastructures confer platform-bound affordances elastic scalability, granular data visibility, algorithmic reach that can either accelerate or impede entrepreneurial momentum (

Autio and Cao 2019). Affordance Theory (

Gibson 1977;

Leonardi 2011) emphasizes that the critical factor is not the artefact itself but the actor’s interpretation of its action possibilities. Empirical studies confirm that such perceived affordances flow directly into entrepreneurial evaluations, fuelling optimism about achieving scale and creativity online (

Shahab et al. 2019;

Peng et al. 2023).

Awad and Martín-Rojas (

2024) find that in SMEs, digital transformation enhances resilience when mediated by organizational learning and innovation, a dynamic that aligns with affordance theory by illustrating how promise of digital tools must be matched with capacity to absorb and act.

Garrido-Moreno et al. (

2024) similarly affirm that innovation and resilience serve as key dynamic capabilities in turbulent environments, with social media and digital tools driving collaborative innovation and organizational adaptability.

Although affordance research demonstrates that entrepreneurs act on perceived digital possibilities, prior models seldom integrate these insights with TPB and risk perspectives. By positioning perceived platform affordances as a distinct technological antecedent of entrepreneurial intention, our study addresses this fragmentation and connects opportunity recognition to behavioural motivation in digital settings.

Accordingly, we hypothesize that:

H4. Perceived platform affordances (PPA) positively influence DEI.

2.4. Integrating Risk and Affordances into TPB: Toward a Research Gap

Although scholars increasingly knit these studies together, thorough integrative models remain scarce. Recent investigations into COVID-accelerated digitalisation highlight the importance of digital maturity, skilled human capital and strategic road maps in boosting self-efficacy while dampening perceived risk (

Yang 2023;

Zhang et al. 2022). Leadership style, institutional support, and organizational culture further shape risk perceptions and opportunity recognition (

Liu 2024;

Schwarzmüller et al. 2018). Meta-analytic evidence confirms that self-efficacy mediates many of these contextual influences (

Wu 2019), while complementary studies note that severe risk perceptions can override even strong efficacy beliefs (

Wang and Huang 2019;

Lie et al. 2022).

Despite these insights, two gaps remain prominent. First, few studies simultaneously test technology-related affordances and risks alongside the cognitive and financial facets of intention in SME samples. Second, although scholars theorize that PPR moderates the link between entrepreneurial self-efficacy and intention, quantitative evidence is scarce particularly in volatile economies where platform dependency is high (

Dai et al. 2023).

Miah et al. (

2025) provides a critical review of the evolution of digital entrepreneurial ecosystems over time, offering insights into how evolving ecosystem architecture shapes opportunity recognition and resource mobilization for SMEs.

Adam et al. (

2025) explores the effectiveness of digital entrepreneurial ecosystems in low-income student contexts, reinforcing the call for inclusive ecosystem-based models that support entrepreneurial capacity in under-resourced settings.

In summary, prior research highlights three distinct but interrelated drivers of entrepreneurial intention: cognitive resources (TPB/self-efficacy), risk orientation (Risk-Taking Theory/financial tolerance vs. perceived platform risk), and technological opportunities (Affordance Theory/platform affordances). However, no prior study has integrated these perspectives into a unified model tested on SMEs in volatile economies. By combining them, we respond to this gap.

Accordingly, we hypothesize that:

H6. Entrepreneurial knowledge (EK) positively influences DEI.

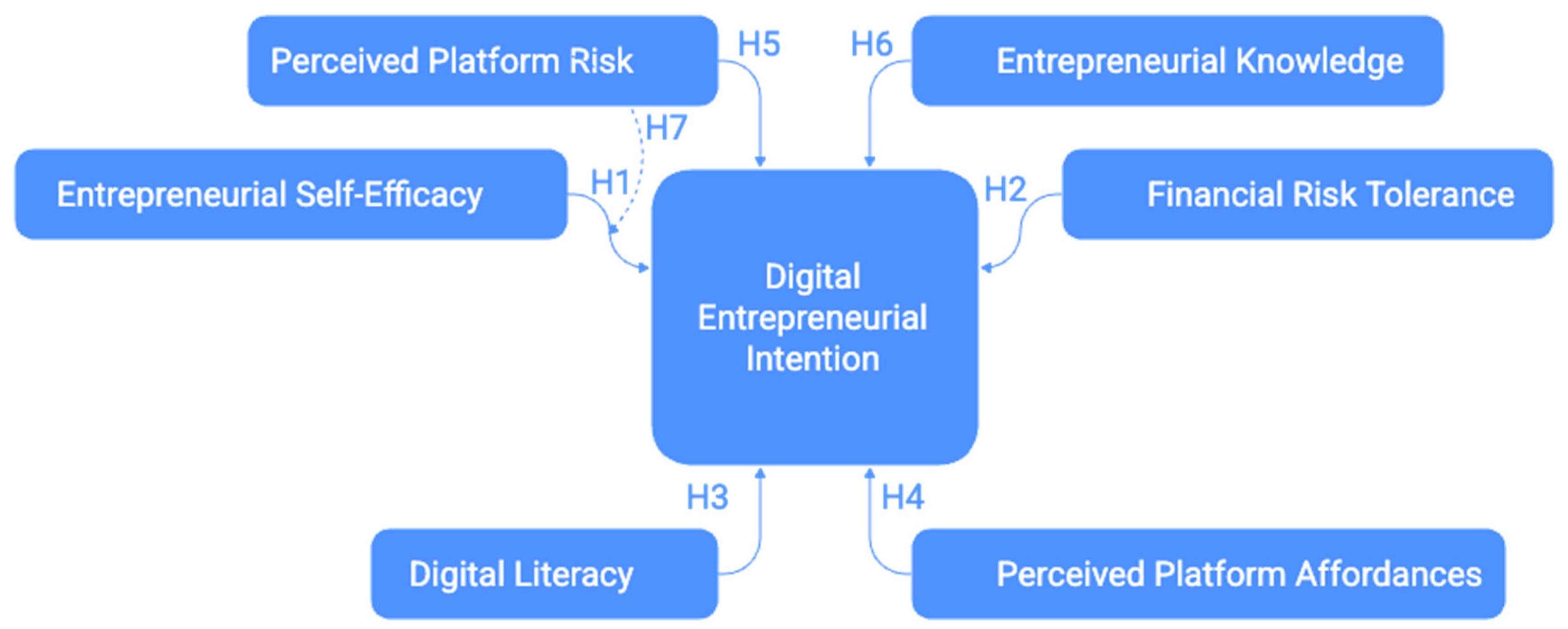

The present study addresses both gaps. We conceptualize digital entrepreneurial intention (DEI) as the outcome of three intertwined forces: individual cognitive capability (entrepreneurial self-efficacy and knowledge), digital-technical capability (literacy and perceived platform affordances), and risk posture (financial risk tolerance and perceived platform risk). By integrating TPB, Risk-Taking Theory, and Affordance Theory, we propose that stronger self-efficacy, higher risk tolerance, greater digital literacy, richer perceptions of platform affordances, and deeper entrepreneurial knowledge each propel DEI, whereas heightened platform risk dampens it. Moreover, we argue that PPR conditions the power of self-efficacy: when perceived risk is high, even confident entrepreneurs hesitate.

The conceptual model reflecting these hypothesized relationships is presented in

Figure 1.

3. Methodology

This investigation adopts a quantitative, cross-sectional design to test the theorized links among psychological, technological, and risk-related antecedents of digital entrepreneurial intention (DEI) in SMEs. By deploying a structured survey and analyzing responses with Partial Least Squares Structural Equation Modelling (PLS-SEM), the study seeks both explanatory and predictive insight into how owner-managers translate digital opportunities and risks into entrepreneurial motivation.

3.1. Sample and Data Collection

The empirical setting comprises 428 small and medium-sized enterprises located across Greece’s major commercial regions. Respondents, owners or senior decision-makers, were drawn from tourism, retail, IT services, manufacturing, and related sectors. These sectors were selected because they represent the backbone of the Greek SME economy and are highly exposed to digital transformation. Tourism and retail rely heavily on digital platforms for visibility and transactions, IT services embody technological change directly, while manufacturing is increasingly digitized through supply chains and automation. Together, they provide a representative yet diverse sample of digitalisation pathways.

Although EU criteria define SMEs as firms with fewer than 250 employees and turnover below €50 million (or a €43 million balance-sheet total), Greek businesses tend to be considerably smaller in practice; the sample therefore reflects the country’s characteristic micro- and small-firm composition. Participants were recruited through regional chambers of commerce, industry associations, and LinkedIn entrepreneurship groups. LinkedIn was chosen as the primary digital recruitment channel because it provides direct access to SME owners and managers in a professional setting, unlike other social networks (e.g., Facebook or Instagram), which often lack professional targeting and increase the risk of non-representative respondents. Snowball sampling was employed because broad SME registries are limited in Greece, and access to owner-managers through formal databases is restricted. This approach, widely used in SME research, maximized sectoral and geographic coverage while ensuring respondents were relevant decision-makers. After piloting the questionnaire with 30 managers to refine clarity and length, the main survey was fielded between September 2024 and May 2025 using convenience and snowball techniques that maximized geographic and sectoral coverage. In accordance with GDPR requirements, all participants were informed of the purpose of the study, assured of anonymity, and provided informed consent prior to data collection.

3.2. Measures and Instrumentation

All latent variables were operationalised with multi-item Likert scales (1 = “strongly disagree,” 5 = “strongly agree”) adapted from well-established sources. Entrepreneurial self-efficacy (SE) relied on five items from

Zhao et al. (

2005) financial risk tolerance (FRT) used four items developed by

Nguyen et al. (

2016). Four indicators of digital literacy (DL) were taken from

Park et al. (

2020). Perceived platform affordances (PPA) were captured with four items centred on editability, anonymity, association, and visibility, adapted from

Oz et al. (

2023). Entrepreneurial knowledge (EK) drew on three statements from

Roxas et al. (

2008). Perceived platform risk (PPR) covering performance, privacy/security, financial, and regulatory threats followed

Phamthi et al. (

2024). This multidimensional operationalization was selected to capture uncertainty specific to platform-dependent entrepreneurship. While appropriate for this context, we acknowledge that uncertainty may manifest differently across industries and that alternative measures (e.g., longitudinal volatility indices) could enrich future studies. Digital entrepreneurial intention (DEI) was assessed with five items sourced from

Vu et al. (

2024). Demographic and firm-level controls (gender, age, education, firm size, sector, prior entrepreneurial experience) were included to partial out extraneous variance. Full wording of every indicator appears in

Appendix A.

3.3. Data Analysis Procedure

Data were analyzed with SmartPLS 4, a variance-based SEM technique well suited to prediction-oriented models, complex nomological nets, and non-normal data distributions (

Hair et al. 2019). The procedure began with assessment of the reflective measurement model: internal consistency was gauged via Cronbach’s alpha and composite reliability, convergent validity by average variance extracted (AVE), and discriminant validity by the heterotrait–monotrait (HTMT) ratio. Once satisfactory psychometric properties were confirmed, the structural model was evaluated. Path significance and effect sizes (f

2) were obtained through bootstrapping with 5000 re-samples; model fit was judged using the Standardized Root Mean Square Residual (SRMR) and the Normed Fit Index (NFI). The study also estimated an interaction term to test whether perceived platform risk moderates the SE → DEI relationship, applying the product-indicator approach recommended for reflective constructs.

To address common-method variance, Harman’s single-factor test and full collinearity variance-inflation factors (VIFs) were calculated, neither of which indicated bias; all VIFs fell well below the 3.3 threshold. Multicollinearity among predictors was likewise negligible. Altogether, this methodological strategy provides a rigorous basis for examining how cognitive, financial, and technological factors jointly shape digital entrepreneurial intention in resource-constrained SME settings.

4. Results

Before reporting the main construct-level analysis, we present the sample characteristics in

Table 1. The sample included 428 SME owners and senior decision-makers across sectors such as tourism, retail, IT services, and manufacturing. A slight majority were male (56.3%), with the most common age groups being 35–44 (30.8%) and 45–54 (26.2%), reflecting the dominant entrepreneurial age range in Greece. Educational attainment was relatively high, with nearly three-quarters of respondents holding a university or postgraduate degree. Sectoral representation was well balanced, and 65% of participants reported prior entrepreneurial experience indicating the sample’s appropriateness for examining digitally mediated entrepreneurial behaviour and risk-related intentions.

We next examine (i) descriptive statistics and inter-construct correlations, (ii) measurement-model evaluation, (iii) structural-model assessment including the moderation test and (iv) additional robustness and predictive-validity checks.

4.1. Descriptive Statistics and Correlations

Table 2 presents the means, standard deviations, and Pearson correlations for all latent variable composites. The mean construct scores range from 3.05 (Perceived Platform Risk) to 3.97 (Perceived Platform Affordances), indicating moderate-to-high endorsement of digital entrepreneurship–related attitudes among surveyed SME decision-makers. As hypothesized, Digital Entrepreneurial Intention (DEI) exhibits a statistically significant positive correlation with Entrepreneurial Self-Efficacy (SE) (*r* = 0.53) and Perceived Platform Affordances (PPA) (*r* = 0.58), and a significant negative correlation with Perceived Platform Risk (PPR) (*r* = −0.29). Critically, no correlation coefficient between any pair of constructs exceeds an absolute value of |0.65|, confirming discriminant validity and minimizing multicollinearity concerns for subsequent path analysis.

The highest mean score (PPA = 3.97) reflects strong agreement among respondents that digital platforms enable innovation and operational efficiency. Conversely, the lowest mean (PPR = 3.05) signals moderate concerns about platform-related risks. The correlation matrix reveals that PPA demonstrates the strongest association with DEI (*r* = 0.58), emphasizing the pivotal role of opportunity recognition in driving entrepreneurial intent. The negative correlation between PPR and DEI (*r* = −0.29) aligns with risk-aversion principles, where perceived threats inhibit action. All inter-construct correlations fall below the |0.65| threshold, satisfying Fornell-Larcker criteria for discriminant validity and indicating distinct measurement of each latent variable.

4.2. Measurement Model Evaluation

Convergent validity was rigorously assessed using standardized indicator loadings, composite reliability (CR), and average variance extracted (AVE). All standardized loadings exceeded the 0.70 threshold, CR values ranged from 0.84 to 0.93, and all AVE values were above 0.55 (

Table 3), thus meeting recommended psychometric standards (

Hair et al. 2019). These results confirm that items coherently reflect their respective latent constructs and that each construct captures substantial variance in its indicators.

Discriminant validity was confirmed with two convergent checks. First, the Fornell–Larcker test held: the square root of each construct’s AVE exceeded its correlations with all other constructs. Second, every heterotrait–monotrait (HTMT) ratio fell below the conservative 0.85 ceiling, affirming clear conceptual and empirical separation among latent variables.

Common-method variance (CMV) was examined via the full-collinearity variance-inflation factor (VIF) technique. The highest VIF recorded was 2.41, well under the 3.3 threshold—indicating that CMV poses no substantive threat to the results.

4.3. Structural Model Assessment

Table 4 summarizes the outcomes of the structural model estimation and hypothesis tests. Model adequacy within the PLS-SEM framework was judged with two core indices: the Standardized Root Mean Square Residual (SRMR) and the Normed Fit Index (NFI). An SRMR of 0.054 lies comfortably beneath the 0.08 benchmark set by

Henseler et al. (

2014), signifying a close match between model-implied and observed covariances. Likewise, an NFI of 0.91 surpasses the 0.90 criterion advanced by

Bentler and Bonett (

1980), corroborating the model’s internal consistency and explanatory soundness.

Bootstrapping with 5000 resamples verified that every hypothesized linkage (H1–H6) is significant at

p < 0.001, underscoring the sturdiness of the structural pathways.

Table 4 details the standardized path coefficients (β), t-statistics,

p-values and

Cohen’s (

1988) f

2 effect sizes.

The structural model accounts for 63 percent of the variance in Digital Entrepreneurial Intention (DEI) (R

2 = 0.63), a magnitude that exceeds the conventional benchmark for “large” explanatory power (

Cohen 1988). In practical terms, this indicates that the combined influence of cognitive appraisals (entrepreneurial self-efficacy and knowledge), financial dispositions (risk tolerance), and technology-specific perceptions (digital literacy, platform affordances, and platform risk) captures nearly two-thirds of what motivates SME decision-makers to pursue digital ventures. Predictive validity is equally compelling: the Stone-Geisser blindfolding test yields Q

2 = 0.46, comfortably above the 0.35 threshold that denotes strong out-of-sample relevance (

Hair et al. 2019). Together, these indices confirm that the model is not only statistically robust but also practically useful for anticipating entrepreneurial behaviour in digitally turbulent contexts.

Perceived Platform Affordances (PPA) emerge as the most potent positive driver of DEI (β = 0.31, f

2 = 0.116). Entrepreneurs who regard digital platforms as vehicles for visibility, scalability, and creative control are markedly more inclined to launch or expand digital ventures, a pattern that dovetails with Affordance Theory’s assertion that perceived action possibilities energize behaviour (

Leonardi 2011). Close behind is Entrepreneurial Self-Efficacy (SE) (β = 0.28, f

2 = 0.090), reinforcing the Theory of Planned Behaviour’s claim that perceived behavioural control is pivotal for intention formation. Digital Literacy (DL) and Financial Risk Tolerance (FRT) also contribute meaningfully (β = 0.19 and β = 0.16, respectively), but their smaller effect sizes highlight that competence and risk appetite, while necessary, are insufficient unless paired with strong affordance perceptions and self-belief. Entrepreneurial Knowledge (EK) exerts a more modest yet significant influence (β = 0.14, f

2 = 0.034), suggesting its value may lie in indirectly bolstering self-efficacy and opportunity recognition, consistent with prior findings (

Ribeiro and Fernandes 2020).

Conversely, Perceived Platform Risk (PPR) exerts a dampening effect on DEI (β = −0.12, f2 = 0.028). Even when opportunity cues are abundant and self-confidence is high, apprehensions about data breaches, sudden algorithm changes, or policy opacity can curtail entrepreneurial drive. For platform designers and policymakers, this underscores the strategic importance of risk-mitigation measures ranging from clearer terms of service to robust cybersecurity protocols in unlocking latent entrepreneurial potential.

The moderated analysis deepens this picture. Employing a two-stage reflective interaction (SE × PPR) within the PLS-SEM framework reveals a significant negative moderation (β = −0.11, t = 3.46, p < 0.001), fully supporting H7. In essence, the motivational boost conferred by high self-efficacy diminishes as perceived platform risk rises. This nuance complicates the typical reading of TPB, showing that perceived behavioural control is context-contingent rather than uniformly positive. It also extends Entrepreneurial Risk-Taking Theory by demonstrating that risk perceptions not only act directly on intention but also condition the efficacy–intention pathway. The practical implication is clear: initiatives that bolster self-efficacy (e.g., training, mentoring) will yield their highest returns when accompanied by efforts to reduce perceived platform vulnerabilities.

Overall, the structural and interaction effects confirm that DEI is a multifaceted construct shaped by the dynamic interplay of individual cognition, technological opportunity, and contextual risk. The high R2 and Q2 values testify to the model’s explanatory and predictive strength, while the moderation results highlight the importance of addressing both capability building and risk governance in policies aimed at fostering digital entrepreneurship.

4.4. Robustness and Additional Analyses Multi-Group Analysis

Robustness checks were conducted to ensure that the structural model’s conclusions are not artefacts of sampling idiosyncrasies. A multi-group analysis (MGA) first compared path estimates across gender (male versus female) and across firm size (micro versus small/medium enterprises). None of the between-group differences reached statistical significance, indicating that the pattern of relationships uncovered in the full sample is stable across these key demographic and organizational strata. To further probe stability, a 1000-run permutation procedure was applied; every primary path coefficient retained significance at the p < 0.05 level, providing an additional safeguard against Type I error due to sampling variability. Model fit remained reassuringly strong: the Standardized Root Mean Square Residual (SRMR) held at 0.054, comfortably below the conservative 0.08 benchmark and identical to the value observed in the main analysis, signalling that the model-implied correlations align closely with their empirical counterparts. Finally, predictive validity was gauged with the PLS predict routine using 10-fold cross-validation. Across all Digital Entrepreneurial Intention (DEI) manifest variables, the partial least-squares predictions displayed lower root-mean-square error (RMSE) than those produced by a linear regression benchmark, underscoring the model’s superior out-of-sample accuracy. Taken together, these supplementary tests reinforce the central finding that the interplay of digital capability, entrepreneurial cognition, and risk perception provides a consistently powerful explanation of DEI, while perceived platform risk functions both as a direct deterrent and as a contextual governor of self-efficacy’s motivational force.

5. Discussion, Conclusions, and Implications

The present study set out to clarify how cognitive resources, technological opportunity structures, and risk perceptions jointly shape the digital entrepreneurial intentions (DEI) of SME owner-managers in a volatile, platform-centric economy. By integrating Ajzen’s Theory of Planned Behaviour (

Ajzen 1991), Entrepreneurial Risk-Taking Theory (

Knight 1921;

McMullen and Shepherd 2006), and Affordance Theory (

Gibson 1977;

Leonardi 2011), the research demonstrates that these three lenses are not merely complementary: they are mutually dependent in explaining why some decisionmakers feel both willing and able to translate digital transformation into entrepreneurial action.

Entrepreneurial self-efficacy (SE) emerged as a robust positive driver of DEI, reaffirming TPB’s assertion that perceived behavioural control lies at the heart of intentional behaviour. Our findings extend TPB by showing that SE does not act in isolation: digital literacy (DL) and financial risk tolerance (FRT) also exert independent, significant effects, forming what we term a “triad of action confidence.” This suggests that TPB’s perceived behavioural control should be reconceptualized in digital contexts as a multidimensional construct shaped simultaneously by cognitive, technical, and financial resources.

For example, a Greek SME manager confident in her digital skills (DL) and her ability to manage uncertain financial returns (FRT) is more likely to view herself as capable of launching a platform-based venture. This practical scenario illustrates how TPB’s traditional variables translate into the lived experience of entrepreneurs in volatile economies.

Consistent with classical notions of entrepreneurial risk (

Knight 1921), FRT positively shapes intention, confirming that an appetite for uncertainty remains a sine qua non of venturing. However, the significant negative role of perceived platform risk (PPR) demonstrates that in digital ecosystems, “risk” extends beyond financial exposure to encompass privacy, cyber-security, and regulatory dimensions. This expands Risk-Taking Theory by highlighting that risk tolerance alone is insufficient when threats are systemic and externally imposed.

Consider an SME owner who tolerates financial fluctuations but fears sudden platform policy changes or data breaches. Our results show that such concerns can override willingness to act, even when FRT is high. This context-specific insight underscores how digital risk modifies traditional entrepreneurial risk frameworks.

Perceived platform affordances (PPA) display the single largest path coefficient in the structural model, empirically corroborating Affordance Theory’s claim that actors respond to perceived rather than objective technological possibilities. We extend this theory by showing that affordance perceptions interact with digital literacy: entrepreneurs with stronger DL are better able to identify and leverage PPA, leading to higher DEI. Thus, skills sharpen the interpretive lens through which opportunities become actionable.

For instance, a small tourism SME that can use digital platforms to showcase services globally (visibility affordance) may be more inclined to internationalize, provided its managers possess the literacy to interpret and act on these opportunities. This demonstrates how affordance perception translates into concrete entrepreneurial pathways.

Synthesizing these strands yields a dual-process account of digital venturing. Cognitive-motivational assets (SE, EK) provide the “can-do” impetus, while affordance recognition furnishes the “should-do” opportunity frame. Risk appraisal then acts as a gatekeeper: when platform risk is low, cognitive resources translate smoothly into intention; when risk is high, the same resources are partially neutralized. This finding confirms the need to extend TPB with risk-sensitive boundary conditions and demonstrates that Affordance Theory cannot be fully understood without accounting for risk-based moderators.

The empirical setting, Greek SMEs in a post-crisis, rapidly digitizing economy, adds situational depth to the analysis. An explained variance of 63 per cent in DEI (

Cohen 1988) attests that the integrated model captures the main psychological and contextual forces at play where institutional volatility and platform dependency coexist. For economies with similar profiles (e.g., Southern Europe, Southeast Asia, Latin America), the findings suggest that capability-building programs must be paired with systemic risk-reduction measures if they are to stimulate digital entrepreneurship effectively.

For practising entrepreneurs, digital literacy should be viewed less as a purely technical skill and more as an interpretive lens through which platform affordances become visible and actionable. Our results suggest that accelerators and universities should integrate training modules that combine technical literacy with scenario-based risk calibration. For example, teaching SME owners how to exploit social media visibility affordances while simultaneously rehearsing responses to potential data-privacy breaches can increase both efficacy and realism.

Governmental issuance of clear, stable, digital-regulatory policies that alleviate regulatory concern will strengthen national SME ecosystems and reduce platform risk. In exchange, however, platforms need to be transparent about their activities informing users about algorithm changes, establishing revenue shares that will not unexpectedly change, and issuing transferable guarantees of data privacy. The study suggests that such interventions are not abstract ideals but urgent necessities: in contexts like Greece, where SMEs dominate the economy and digital catch-up is rapid, uncertainty over platform governance can paralyze otherwise confident entrepreneurs. Ultimately, by explicitly linking empirical results back to TPB, Risk-Taking Theory, and Affordance Theory, and by situating implications in the lived context of SMEs in volatile economies, the contribution of this study becomes more compelling for both academic and practitioner audiences.

Several constraints temper these conclusions. The cross-sectional design limits causal inference; longitudinal panels are needed to observe the intention-to-action pipeline and the temporal evolution of platform risk. Although diagnostic tests suggest minimal common-method bias, behavioural indicators, such as verified platform usage or actual venture registrations, would strengthen external validity. Second, the measurement of uncertainty was restricted to perceived platform risk, which, although validated, may not capture all forms of entrepreneurial uncertainty. Future studies should triangulate with alternative measures of uncertainty to enhance robustness. Generalisability beyond Greece requires multi-country replications across varied regulatory settings. Future work might also deploy experiments that manipulate affordance salience or risk cues, and adopt mixed-methods designs that weave survey insights with digital-trace analytics.

Digital transformation is a double-edged phenomenon: platform affordances amplify entrepreneurial opportunity, yet platform dependency magnifies perceived risk. By empirically demonstrating how self-efficacy, digital competence, risk tolerance, affordance perception, and platform risk coalesce to predict entrepreneurial intention and by revealing that platform risk can blunt the motivational power of self-confidence this study refines both theory and practice. Theoretically, it extends TPB with risk-sensitive boundary conditions, broadens Risk-Taking Theory to encompass platform-specific uncertainties, and validates Affordance Theory by demonstrating how perceived action possibilities translate into intention only when risk is managed. Practically, it shows that building SME resilience requires not just digital skills training but also systemic interventions that stabilize digital infrastructures and reduce uncertainty.

In volatile economies such as Greece, the take-home message is clear: entrepreneurial confidence alone will not translate into digital venture creation unless risk governance keeps pace with capability development. Balanced interventions that raise competence, illuminate opportunity, and contain perceived risk are essential if the promise of digital entrepreneurship is to be fully realized.