1. Introduction

The rapid evolution of the cryptocurrency market has transformed global finance, challenging conventional risk frameworks and prompting new questions around portfolio construction and systemic stability. As digital assets mature into a distinct and investable asset class, institutional and retail investors are increasingly drawn to their potential for high returns, diversification, and technological disruption. However, the structural diversity of the crypto ecosystem, spanning foundational Layer 1 blockchains (e.g., BTC, ETH), decentralized finance (DeFi) tokens (e.g., UNI), algorithmic stablecoins (e.g., Dai), and governance infrastructure tokens (e.g., MKR), complicates risk assessment and asset allocation decisions. This study sought to bridge these two challenges by examining how return-based systemic interdependencies influence both risk propagation and optimal portfolio strategies.

This study was motivated by the growing institutionalization of digital assets and the need to understand how systemic risk propagates within the cryptocurrency ecosystem. Recent crises such as the collapses of Terra-LUNA (

Lee et al. 2023;

Santiago et al. 2025;

Briola et al. 2023) and FTX (

Bouri et al. 2023;

Khan et al. 2025;

Esparcia et al. 2024) exposed latent fragilities in crypto markets and sparked significant liquidity stress, volatility, and contagion effects. These events undermined investor confidence and highlighted the limitations of traditional risk measures in capturing crypto-specific dynamics (

Barkai et al. 2024). Notably, the idiosyncratic reactions of different asset types, e.g., stablecoins acting as temporary safe havens (

Łęt et al. 2023;

Hoang et al. 2024) or Ethereum’s growing role in DeFi and non-fungible tokens (NFTs) post-COVID-19 (

Katsiampa et al. 2022), emphasize the need for asset-specific and dynamic analysis.

Despite growing research on crypto volatility and spillovers (

Ugolini et al. 2023;

Kumar et al. 2022;

Yousaf and Yarovaya 2022), a lack of empirical consensus persists on how various crypto segments behave under stress and contribute to systemic risk. Stablecoins, for instance, exhibit asymmetric spillover behaviors, receiving shocks from Layer 1 assets such as BTC and ETH, but not vice versa (

Thanh et al. 2023). Moreover, the tail-risk interdependence among cryptoassets has been shown to intensify during crisis episodes, yet the network structure of these interdependencies remains underexplored (

Xu et al. 2021;

Liao et al. 2024). To address this gap, this study employed the Extended Joint Connectedness Approach (

Balcilar et al. 2021), embedded in a Time-Varying Parameter Vector Autoregression (TVP-VAR) model, to evaluate the systemic structure of interconnectedness (measured through return-based shock transmission) across five representative cryptocurrency assets. These included BTC and ETH (Layer 1 base protocols), UNI (a DeFi token), Dai (a stablecoin), and MKR (a governance and infrastructure token). This selection reflects both horizontal (intra-layer) and vertical (inter-layer) systemic linkages, capturing the foundational architecture of the crypto-financial ecosystem. To guide the analysis, we posed the following testable hypothesis: “Stablecoins such as DAI act as net absorbers of systemic return shocks, while governance and DeFi tokens, particularly MKR and UNI, serve as net transmitters of return-based risk, especially during periods of market stress.” This hypothesis offers a conceptual framework for interpreting the dynamic roles of different asset classes within the cryptocurrency network. The analysis focused on three central research questions: (i) How do connectedness patterns change over time across different segments of the cryptocurrency ecosystem? (ii) Which digital assets act as net transmitters or absorbers of systemic risk, particularly during stress periods? (iii) How can dynamic connectedness measures inform optimal portfolio allocation in crypto markets?

This study makes several important contributions to the literature. First, it is one of the few studies to jointly model the transmission of returns across a diverse set of functional crypto assets using the TVP-VAR-based Extended Joint Connectedness Approach. Second, it evaluated how these dynamic connectedness patterns can inform evidence-based portfolio allocation, using multivariate strategies including Minimum Connectedness Portfolios. Third, by contextualizing the empirical findings to major crypto-specific disruptions and macro-financial shocks, the study offers practical insights for crypto-native funds, institutional allocators, and risk managers. Finally, including stablecoins and governance tokens expands the scope of systemic risk analysis beyond high-cap Layer 1 assets, offering a more holistic view of the crypto-financial system.

The empirical findings indicated that while Maker and Uniswap act as dominant transmitters of systemic risk, Bitcoin and Ethereum consistently emerged as net receivers, absorbing shocks from the broader crypto network. Dai reinforced its role as a persistent volatility absorber, which is consistent with its stablecoin design and defensive characteristics. The Total Connectedness Index (TCI) exhibited substantial time variation, peaking during significant events such as the FTX collapse and recovering thereafter, signaling renewed structural reintegration. Pairwise and net directional connectedness metrics revealed dynamic systemic hierarchies, with governance and DeFi tokens exerting increasing influence, particularly under stress. Regarding portfolio construction, the Minimum Variance strategies heavily favored Dai, while the Minimum Correlation and Minimum Connectedness strategies promoted more balanced allocations, favoring UNI, MKR, and BTC. Connectedness-based portfolios delivered superior cumulative returns and better crisis resilience than traditional variance-minimizing approaches.

The remainder of the paper is organized as follows.

Section 2 presents the literature review.

Section 3 describes the data and methodology.

Section 4 discusses the empirical results, including dynamic connectedness analysis and portfolio optimization.

Section 5 concludes with the key takeaways and implications for market participants and regulators.

4. Empirical Findings

4.1. Average Connectedness

Table 2 illustrates the static average connectedness among the five cryptocurrency assets.

Table 2 indicates a moderately interconnected cryptocurrency system, with a Total Connectedness Index (TCI) of 52.43, indicating that more than half of each asset’s forecast error variance could be explained by shocks from the other assets on average. Ethereum (ETH) emerged as the most influential transmitter (TO = 77.39), followed closely by Bitcoin (BTC = 68.13). However, BTC and ETH were net receivers (NET = −3.63 and −1.82, respectively), suggesting that while they significantly impacted the others, they were still largely shaped by broader system dynamics, consistent with their foundational roles.

Uniswap (UNI) was the leading net transmitter (NET = 5.15), highlighting its systemic impact, particularly on DeFi-related flows. Maker (MKR) also played a net transmitter role (NET = 4.66), consistent with its governance-based influence in the DAI ecosystem. In contrast, Dai (DAI) acted as a net receiver (NET = −4.36), with low TO and FROM values, reinforcing its defensive role as a stablecoin.

The NPDC scores supported these roles: UNI (3.00) and MKR (4.00) led in pairwise influence, while DAI (0.00) remained passive. These findings validate the heterogeneity of systemic roles across asset types, with infrastructure and DeFi tokens acting as amplifiers of volatility. At the same time, stablecoins offered dampening effects, consistent with the recent findings by

Łęt et al. (

2023) and

Thanh et al. (

2023) regarding the safe haven behavior of stablecoins.

4.2. Dynamic Connectedness Analysis

Figure 1 illustrates the evolution of the Total Connectedness Index (TCI) among the five key crypto assets Bitcoin (BTC), Ethereum (ETH), Uniswap (UNI), Dai (DAI), and Maker (MKR) over the period from October 2021 to March 2025. The TCI quantifies the extent to which forecast error variance in each asset is attributable to shocks from other assets in the network, thereby serving as a proxy for systemic risk and market integration.

Figure 1 indicates pronounced time variation in systemic connectedness among the five selected cryptocurrencies. The TCI initially peaked in late 2021 and early 2022, reflecting elevated systemic interdependence during high market enthusiasm, institutional inflows, and synchronized macroeconomic developments. A steady decline followed, reaching its lowest levels in early 2024, coinciding with the aftermath of the FTX collapse and broader market disruptions linked to liquidity crises and stablecoin instability. This fragmentation of crypto linkages is consistent with findings by

Bouri et al. (

2023) and

Galati et al. (

2024), who showed that tail risk and contagion surged around the FTX event, particularly affecting altcoins and DeFi tokens. The subsequent rebound in connectedness in late 2023 reflects renewed structural integration, possibly driven by regulatory developments, the recovery of DeFi protocols, and improving investor sentiment. This aligns with the findings of

Esparcia et al. (

2024) and

Khan et al. (

2025), who documented dynamic spillover reversals as market participants reassessed risks and returns in the wake of major disruptions. The observed resurgence in TCI suggests that, while fragile in the face of systemic shocks, crypto markets exhibit an underlying tendency toward re-integration as structural uncertainty is resolved.

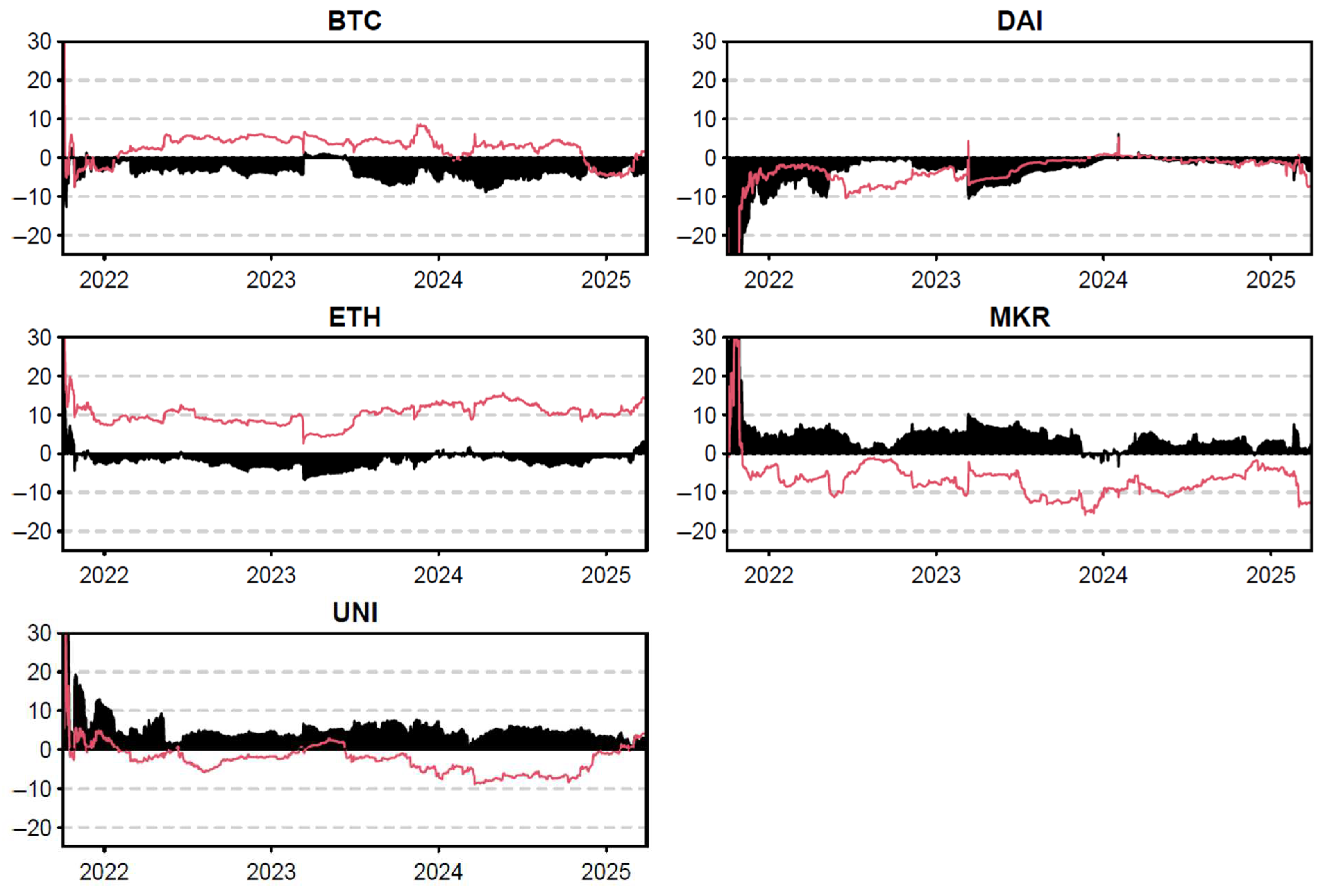

4.3. Variation in Net Total Directional Connectedness over Time

Figure 2 illustrates the variation in the net total directional connectedness (NTDC) of the five key crypto assets over time, capturing their roles as systemic shock transmitters or receivers across different market conditions.

Across most of the sample, Ethereum (ETH) and Bitcoin (BTC) acted as net receivers of systemic shocks, as reflected by persistently negative, black-shaded values. ETH, in particular, exhibited a prolonged absorber role, suggesting that it is more responsive to shocks originating from other crypto assets rather than transmitting them, despite its critical position in the DeFi and smart contract ecosystem. BTC showed a similar absorptive pattern, especially post-2022, likely due to its anchoring role as a macro crypto asset that reacts to ecosystem-wide shifts rather than initiating them. This pattern is consistent with the findings from

Xu et al. (

2021), who identified Bitcoin as a net systemic risk receiver and Ethereum as a more active emitter. However, their roles may vary under different market regimes.

Ahelegbey et al. (

2021) further classified BTC as a “giver” of tail contagion under extreme stress but a general stabilizer in standard periods, supporting our interpretation of its post-2022 behavior.

Uniswap (UNI) presented a mixed profile. While it began the sample period as a notable net shock transmitter, especially during the initial DeFi volatility surge, it transitioned into a largely neutral role post-2023. This suggests that UNI’s influence on systemic risk diminished, potentially due to market maturation or declining speculative interest in DeFi tokens during later periods.

Ugolini et al. (

2023) found strong within-market spillovers in DeFi but suggested that their cross-asset transmission declines as market structures mature, supporting UNI’s shift toward neutrality. Similarly,

Yousaf and Yarovaya (

2022) reported that while DeFi assets initially exhibit volatility spillovers and their integration with traditional markets remains weak, allowing for decoupling over time.

Maker (MKR), functioning at the intersection of governance and infrastructure for the DAI stablecoin, displayed prolonged transmitter behavior throughout the sample. The black-shaded region remained consistently positive, indicating MKR’s systemic influence. This likely stemmed from its central role in decentralized collateralized lending and its governance of the DAI peg mechanism. MKR’s positive NTDC values intensified during periods of elevated volatility, such as during stablecoin stress or broader DeFi adjustments. This is in line with the findings of

Kristoufek (

2021), who emphasized the endogenous demand linkages between stablecoins and collateral tokens like MKR, and those of

Thanh et al. (

2023), who showed that shocks to infrastructure-related tokens (like USDC governance frameworks) propagate strongly across stablecoins.

Dai (DAI) exhibited a consistently negative Net Total Directional Connectedness (NTDC) profile, confirming its role as a systemic shock absorber throughout the sample period. As shown in

Figure 2, the black-shaded area remained predominantly below zero, frequently ranging between −5% and −10%, including during major stress episodes such as the FTX collapse in late 2022. This persistent negative positioning demonstrates DAI’s defensive characteristics and its relative insulation from propagating systemic shocks, reinforcing its utility as a stabilizing asset within crypto portfolios.

Łęt et al. (

2023) support this finding, showing that stablecoins are often safe havens during BTC and ETH volatility shocks.

Hoang et al. (

2024) also provided evidence of strong price-volume correlation between stablecoins and Bitcoin, but demonstrated that DAI, while algorithmic, reacted more passively than its USD-backed peers, corroborating its risk-absorbing behavior.

The patterns of

Figure 2 indicate the heterogeneity of systemic roles within the crypto asset ecosystem. Governance tokens like MKR appeared to act as structural influencers, while foundational assets like ETH and BTC absorbed more than they transmit. Stablecoins, notably DAI, reinforced their reputation as volatility absorbers, while DeFi tokens like UNI evolved toward neutrality as the sector matured. These conclusions are also echoed in

Barkai et al. (

2024), who emphasized the importance of differentiating systemic roles when designing portfolio hedging strategies in crypto markets.

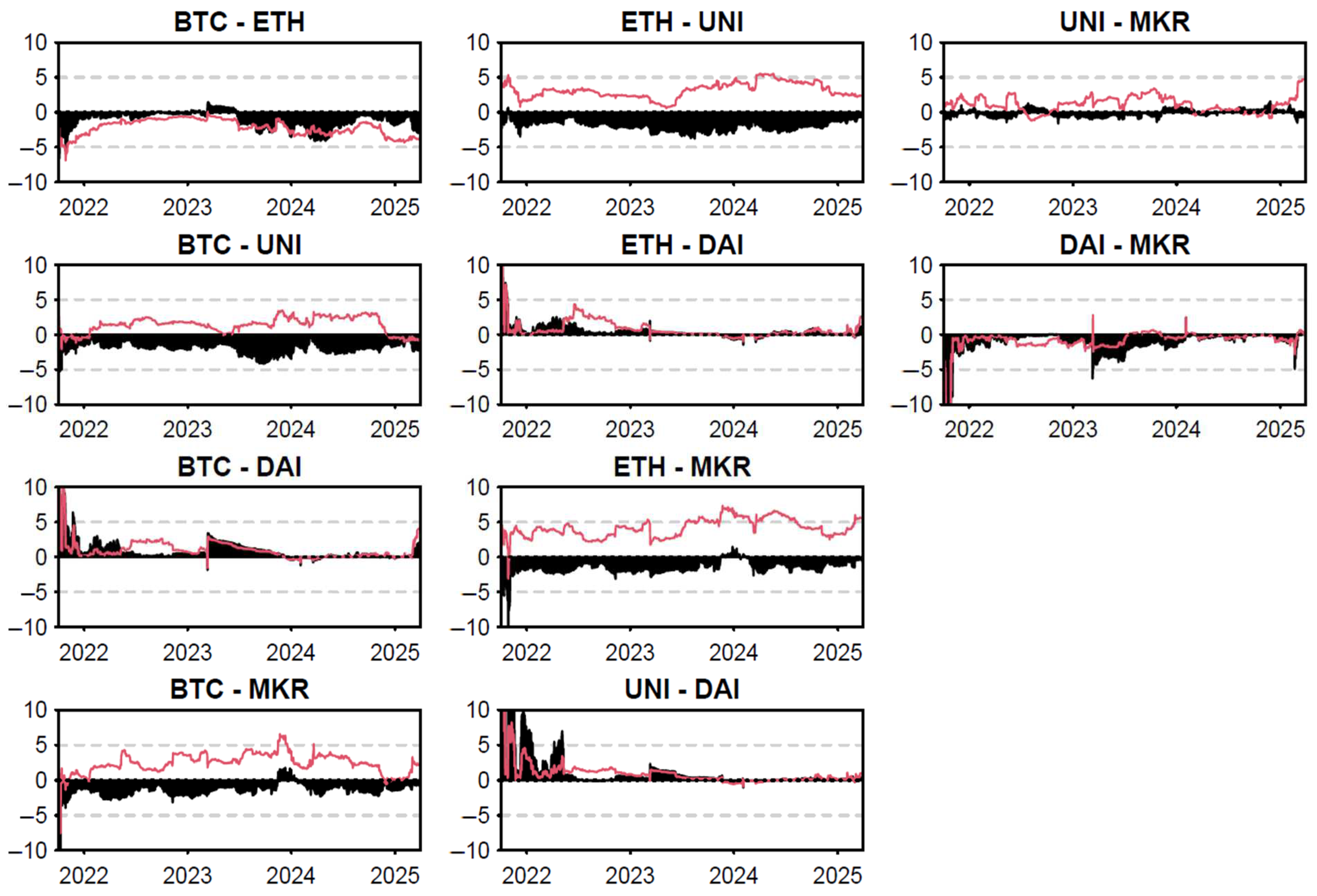

4.4. Variation in Net Pairwise Directional Connectedness over Time

Figure 3 illustrates the temporal evolution of bilateral net spillovers across the key cryptocurrencies.

Figure 3 indicates that Ethereum (ETH) was a net receiver of shocks from UNI and MKR, contrary to expectations about its dominance. This suggests that, despite its foundational role in the DeFi ecosystem, ETH often absorbs return spillovers from application-layer tokens, particularly during periods of innovation or governance stress. This finding echoes the decentralized propagation structure observed in

Ugolini et al. (

2023). Likewise, Bitcoin (BTC) consistently acted as a net receiver across nearly all pairs (BTC–ETH, BTC–UNI, BTC–MKR, and BTC–DAI), underscoring its function as a macro crypto asset that responds to systemic trends rather than initiating them. This absorptive behavior aligns with the findings of

Barkai et al. (

2024), who documented BTC’s tendency to reflect broader ecosystem shocks, especially under tail-risk conditions.

In contrast, Maker (MKR) emerged as a dominant transmitter of systemic shocks, particularly in the ETH–MKR and UNI–MKR relationships. This reflects MKR’s role in governing the DAI ecosystem and managing collateralized debt positions, reinforcing its top-down influence within the crypto-financial architecture. The ETH–MKR link further supports insights from

Hoang et al. (

2024), who highlighted ETH’s dependence on MKR’s governance mechanisms during periods of stablecoin stress. The UNI–MKR panel showed that Maker (MKR) consistently transmitted shocks to Uniswap (UNI), particularly in the Extended Joint Connectedness framework (black-shaded area), with MKR emerging as a persistent net risk source across most of the sample. This pattern moderately intensified toward the end of the sample, highlighting MKR’s governance-linked influence, especially during protocol-level uncertainty. While the red line (standard DY12) suggested some periods of net transmission from UNI to MKR, the joint connectedness measure indicated that MKR dominated the directional relationship. The DAI–MKR panel indicated that DAI consistently absorbed shocks from MKR, as evidenced by the persistently negative values shaded in black. This systemic pattern reflects the design structure of the MakerDAO ecosystem

1, where DAI’s stability is contingent on the collateral governance managed by MKR holders. During major stress episodes, such as early 2022 (following Terra) and late 2024 (likely tied to liquidity or governance turbulence), the transmission from MKR to DAI intensified, with DAI bearing the downstream return spillovers. This directional relationship highlights a governance-induced systemic hierarchy in which Maker acts as a transmitter of risk to both infrastructure tokens (e.g., UNI) and stablecoins (e.g., DAI).

DAI, as expected, functioned predominantly as a net receiver, especially in pairs like BTC–DAI and UNI–DAI. Its persistent negative net pairwise connectedness confirmed its reputation as a return spillovers buffer, consistent with the stabilizing role of stablecoins documented in

Łęt et al. (

2023) and

Thanh et al. (

2023).

Overall, the results emphasize that shock propagation in crypto markets is highly directional and role-dependent. Governance tokens like MKR drive systemic spillovers, while base-layer assets such as ETH and BTC frequently absorb them. Stablecoins like DAI retain their defensive posture, and DeFi tokens like UNI exhibit transient transmitter roles that fade as the sector matures. These findings reinforce the growing complexity of systemic interlinkages in the digital asset ecosystem.

4.5. Multivariate Portfolio Weights

Table 3 presents the distribution of optimal portfolio weights across the five selected crypto assets (BTC, ETH, UNI, DAI, and MKR) under three distinct allocation strategies: a Minimum Variance Portfolio (MVP), Minimum Correlation Portfolio (MCP), and Minimum Connectedness Portfolio (MCoP). Each strategy was evaluated in terms of the average portfolio weight (mean), standard deviation (σ), 5% and 95% quantiles (confidence bounds), hedging effectiveness (HE), and statistical significance (

p-value).

The MVP strategy assigned nearly the entire portfolio weight to DAI (99%), reflecting its minimal return spillovers and strong shock-absorbing properties. While BTC, ETH, UNI, and MKR receive negligible or zero weights under MVP, their HE scores remained perfect (1.00), implying no variance reduction need due to zero allocation. DAI, despite being the dominant holding, yielded a slightly negative HE (−0.11), suggesting limited diversification benefit under this scheme.

In contrast, the MCP strategy offered more balanced diversification. DAI still received the highest average weight (42%), but BTC, UNI, MKR, and ETH also received non-trivial allocations. UNI stood out with the highest HE (0.84), followed by MKR (0.80) and ETH (0.68), suggesting that these assets contribute significantly to correlation-based diversification. DAI, however, had a highly negative HE (−265.34), potentially due to its inverse correlation effects outweighing the diversification gains. DAI, however, had a highly negative HE (−265.34), indicating that its inclusion under correlation-based optimization not only failed to reduce portfolio risk but may have inadvertently magnified it. This counterintuitive result is supported by

Table 1, which shows that DAI exhibited an exceptionally low standard deviation (0.016), extreme kurtosis (319.53), and skewness (−5.497), along with statistically significant Q(20) and Q

2(20) values. These characteristics suggest that while DAI is stable during normal periods, it may exhibit sharp, infrequent deviations during market stress, thereby providing limited hedging value against assets with higher variance or asymmetric tail behavior. In practical terms, DAI’s apparent “stability” masks its nonlinear jump behavior and weak co-movement with other assets, which undermines its utility in correlation-sensitive strategies. Although it received a sizable portfolio weight under the MCP and MCoP due to its low return spillovers, the resulting HE values suggest that it failed to meaningfully reduce portfolio variance when systemic or correlated risks dominated.

The MCoP strategy also promoted diversification but emphasized minimizing systemic spillovers by allocating weights based on the joint connectedness matrix. DAI maintained a substantial weight (39%), followed by MKR (21%), UNI (20%), and BTC (19%), while ETH received only a marginal allocation (2%). Similar to the MCP strategy, UNI and MKR exhibited strong hedging effectiveness (HE = 0.81 and 0.77, respectively), affirming their value in mitigating network-driven risk. DAI again recorded the lowest HE (−308.34), reinforcing that despite its role as a systemic shock absorber, its contribution to hedging performance becomes counterproductive in connectedness-optimized portfolios. This reflects a paradox: while DAI’s low return spillovers justifies a significant weight under traditional variance-based schemes (MVP), its limited responsiveness to dynamic contagion reduces its effectiveness when the goal is to mitigate spillovers from other crypto assets. In essence, DAI’s defensive stability during normal conditions may impair the portfolio’s adaptability during crisis episodes, especially in a highly interconnected system where rapid information diffusion and co-movement dominate. Thus, its high weight does not translate into meaningful risk reduction under joint connectedness frameworks, as reflected by the negative HE.

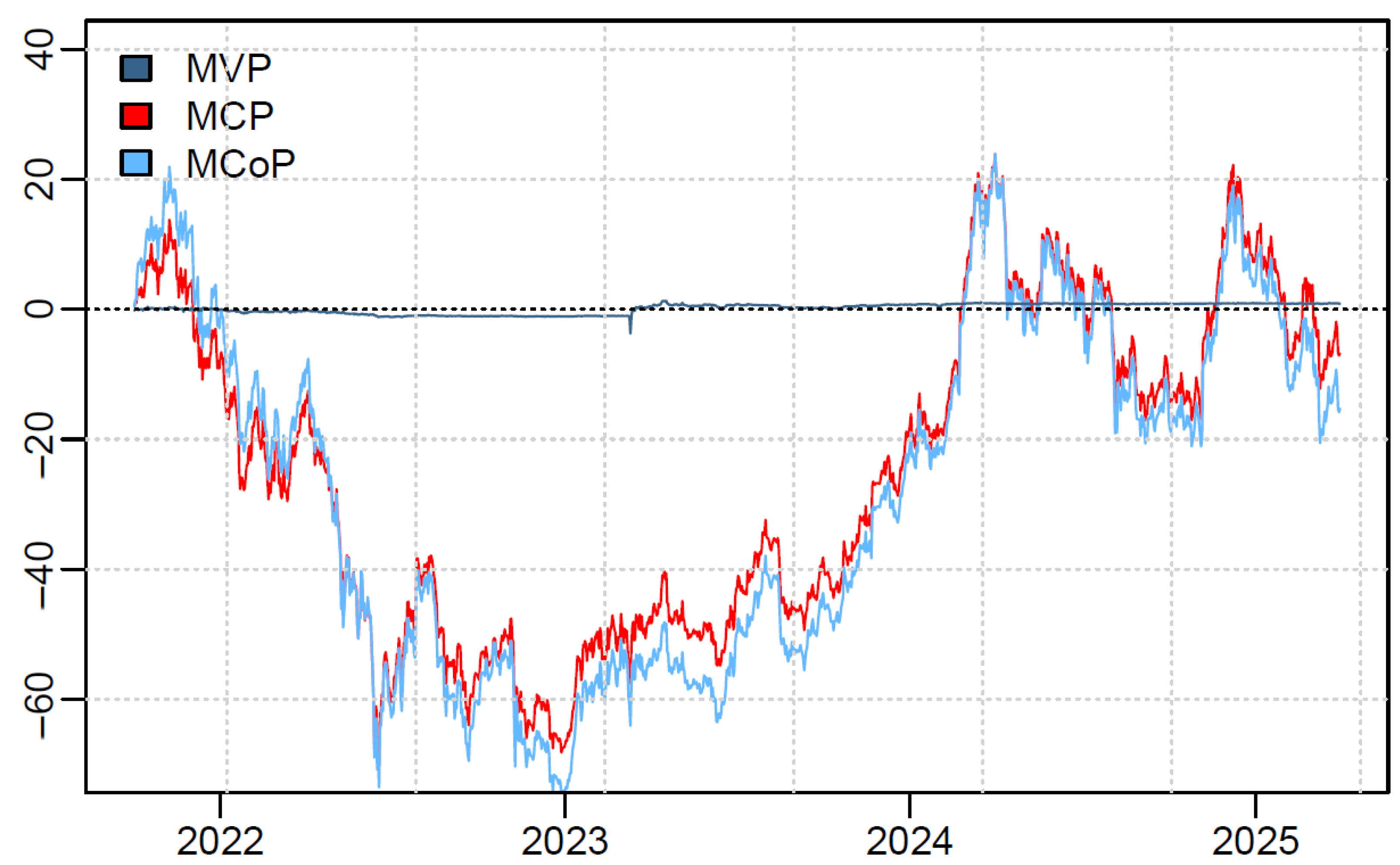

Figure 4 illustrates the evolution of the cumulative returns for the three portfolio strategies. The Minimum Variance Portfolio (MVP) is represented in dark blue, the Minimum Correlation Portfolio (MCP) in red, and the Minimum Connectedness Portfolio (MCoP) in light blue.

Figure 4 highlights the superior performance of the MCoP and MCP strategies compared to the traditional MVP approach. Connectedness-based portfolios (especially MCP) experienced steeper recoveries during market rebounds in 2023–2024 and demonstrated stronger resilience during major downturns like the FTX collapse (late 2022) and crypto deleveraging phases. In contrast, while less volatile, the MVP strategy lagged significantly in capturing upward momentum, particularly after early 2023. This result reinforces the relevance of network-based diversification in crypto portfolios. The MCoP strategy explicitly minimized systemic spillovers and consistently delivered more robust risk-adjusted returns by mitigating contagion during crisis episodes and capitalizing on structural shifts. These findings echo those of

Antonakakis et al. (

2020) and

Balcilar et al. (

2021), who demonstrated the hedging advantages of incorporating connectedness into portfolio construction under high volatility regimes.

4.6. Robustness Check

To ensure the reliability of our empirical findings, we conducted robustness checks focusing on model specification sensitivity. First, we assessed lag sensitivity by re-estimating the Extended Joint Connectedness model using alternative lag orders (nlag = 2 and nlag = 3) instead of the baseline specification (nlag = 1). The resulting directional and net connectedness patterns remained broadly consistent across these specifications, suggesting that the choice of lag length did not drive our conclusions regarding dynamic spillover channels. Second, we evaluated the effect of varying the forgetting factors in the TVP-VAR framework. Specifically, we tested values of kappa1 and kappa2 of 0.96 and 0.995, respectively, in place of the default 0.99. The total connectedness index (TCI) and net pairwise directional connectedness (NPDC) exhibited stable trajectories across these parameter settings, indicating that our model is not unduly sensitive to the choice of prior decay rates. Overall, these robustness checks confirmed that the study’s core findings are structurally sound and not artifacts of specific modeling assumptions. The full results are available upon request due to space constraints.

5. Conclusions

This study assessed the dynamic interdependencies and portfolio implications in the cryptocurrency ecosystem by analyzing five key assets: BTC, ETH, UNI, DAI, and MKR. Using the Extended Joint Connectedness Approach within a TVP-VAR framework, significant heterogeneity in systemic behavior was found across the asset classes. MKR and UNI emerged as consistent net transmitters of shocks, underlining their role in governance and DeFi infrastructure as key channels of systemic risk. In contrast, BTC and ETH, despite their foundational importance, essentially functioned as net receivers, reflecting their macro nature and responsiveness to system-wide dynamics. Stablecoins such as DAI acted as persistent absorbers of shocks, reinforcing their role as safe havens during periods of heightened market stress.

From a portfolio strategy standpoint, incorporating systemic information through correlation and connectedness-based allocation methods (MCP and MCoP) yielded superior performance compared to traditional variance-minimization techniques. While DAI was favored in the Minimum Variance Portfolio for its low volatility, its hedging effectiveness was significantly diminished in strategies prioritizing interdependence. Instead, assets such as UNI and MKR demonstrated substantial diversification value under connectedness-aware frameworks, suggesting that they can serve as effective components for risk mitigation in structurally complex crypto portfolios.

These findings carry important implications for investors, regulators, and DeFi protocol designers. For crypto asset managers and institutional investors, portfolio construction should go beyond conventional risk-return tradeoffs and account for the growing systemic roles of digital assets. Incorporating dynamic connectedness measures allows for greater resilience during episodes of contagion, offering a framework that is better suited to the non-linear and event-driven nature of crypto markets. For policymakers, the results highlight the necessity of differentiated regulatory oversight that reflects each asset’s function within the financial architecture. Assets like MKR, which exert outsized influence through governance channels, warrant particular attention. Similarly, the defensive role of stablecoins demonstrates the importance of transparent reserve mechanisms and robust algorithmic design to preserve market confidence. Finally, for developers and DeFi protocol architects, the systemic behavior of governance tokens and their impact on network stability calls for continued innovation in collateral management, risk control, and cross-protocol coordination.

While this study provides valuable insights into the systemic connectedness and strategic allocation in crypto markets, it is subject to certain limitations. The analysis focused on a selected set of five representative cryptocurrencies, which, although diverse in function, may not capture the full complexity of the broader digital asset ecosystem, including emerging sectors such as NFTs, liquid staking tokens, or real-world asset (RWA)-linked protocols. Additionally, the TVP-VAR model assumes linear interdependencies, which may not fully reflect the non-linear or regime-switching dynamics often observed during extreme market conditions. Future research could expand the asset universe, incorporate macro-financial linkages, or apply machine learning and non-parametric models to capture tail-risk dynamics more effectively. Examining the impact of regulatory announcements, cross-border capital flows, or blockchain-specific developments on connectedness patterns could be promising avenues for further exploration.