The Russia–Ukraine Conflict and Stock Markets: Risk and Spillovers

Abstract

1. Introduction

2. Literature Review

2.1. Commodities and Financial Markets

2.2. Russia–Ukraine Conflict and Commodity Prices

2.3. Geopolitical Risk and Conflicts

3. Materials and Methods

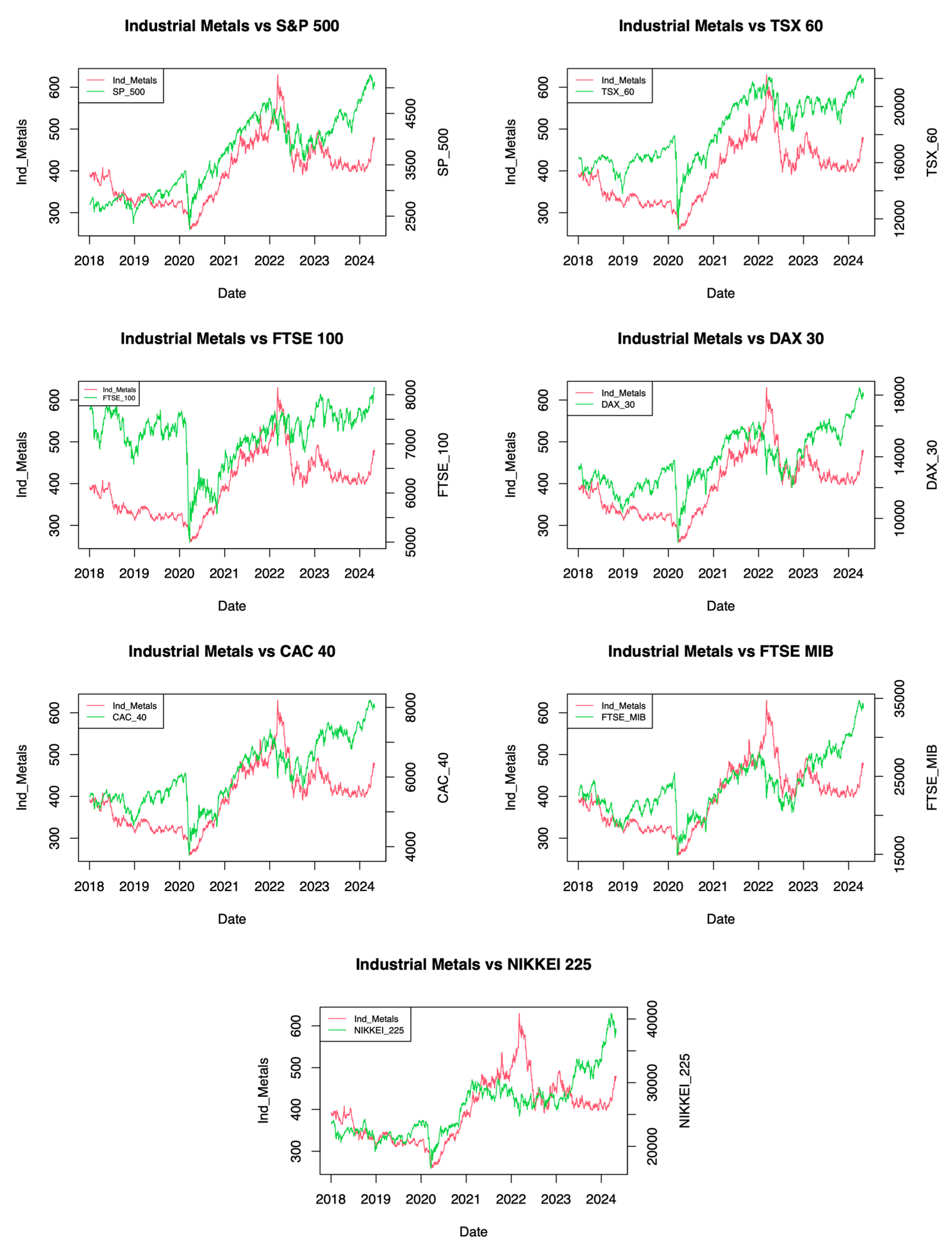

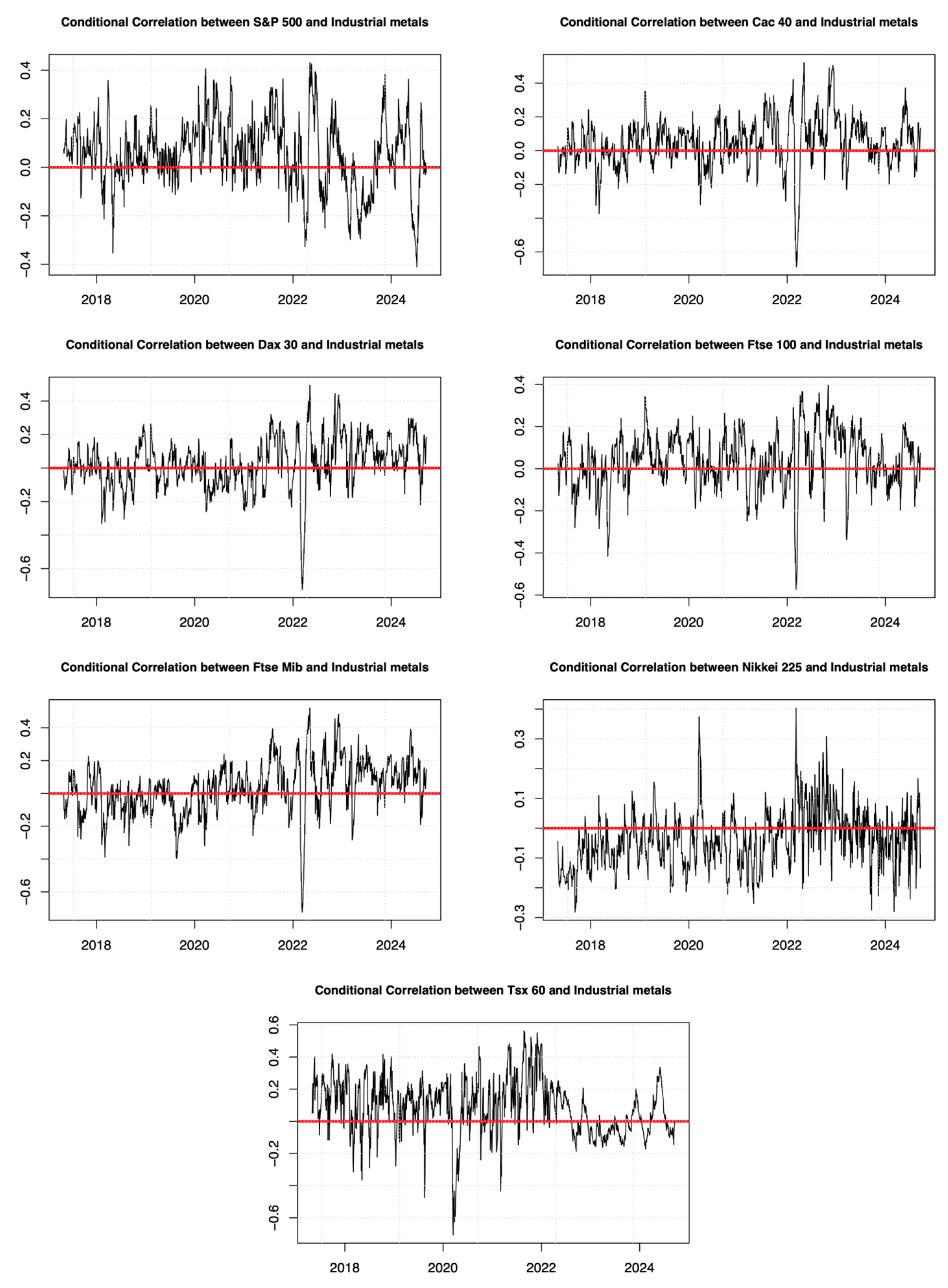

4. Results

5. Conclusions

Practical Implications

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

| 1 | Available online: www.usda.gov (accessed on 1 April 2025). |

| 2 | Cfr. Available online: www.oec.world/en (accessed on 1 April 2025). |

References

- Adekoya, Oluwasegun B., Mahdi G. Asl, Johnson A. Oliyide, and Parviz Izadi. 2023. Multifractality and cross correlation between the crude oil and the European and non-European stock markets during the Russia-Ukraine war. Resources Policy 80: 103134. [Google Scholar] [CrossRef]

- Ahmed, Abdullahi D., and Rui Huo. 2021. Volatility transmissions across international oil market, commodity futures and stock markets: Empirical evidence from China. Energy Economics 93: 104741. [Google Scholar] [CrossRef]

- Ahmed, Shaker, Mostafa M. Hasan, and Md R. Kamal. 2023. Russia-Ukraine crisis: The effects on the European stock market. European Financial Management 29: 1078–118. [Google Scholar] [CrossRef]

- Al-Yahyaee, Khamis Hamed, Walid Mensi, Ahmet Sensoy, and Sang Hoon Kang. 2019. Energy, precious metals and GCC stock markets: Is there any risk spillover? Pacific-Basin Finance Journal 56: 45–70. [Google Scholar] [CrossRef]

- Biswas, Priti, Prachi Jain, and Debasish Maitra. 2024. Are shocks in the stock markets driven by commodity markets? Evidence from Russia-Ukraine war. Journal of Commodity Markets 34: 100387. [Google Scholar] [CrossRef]

- Boldanov, Rustam, Degiannakis Stavros, and George Filis. 2016. Time-varying correlation between oil and stock market volatilities: Evidence from oil-importing and oil-exporting countries. International Review of Financial Analysis 48: 209–20. [Google Scholar] [CrossRef]

- Boubaker, Heni, and Ali Raza Syed. 2017. A wavelet analysis of mean and volatility spillovers between oil and BRICS stock markets. Energy Economics 64: 105–17. [Google Scholar] [CrossRef]

- Boubaker, Sabri, John W. Goodell, Dharen K. Pandey, and Vineeta Kumari. 2022. Heterogeneous impacts of wars on global equity markets: Evidence from the invasion of Ukraine. Finance Research Letters 48: 102934. [Google Scholar] [CrossRef]

- Boungou, Whelsy, and Alhonita Yatie. 2022. The impact of the Ukraine-Russia war on world stock market returns. Economics Letters 215: 110516. [Google Scholar] [CrossRef]

- Bouri, Elie, Anshul Jain, P. C. Biswal, and David Roubaud. 2017. Cointegration and nonlinear causality amongst gold, oil, and the Indian stock market: Evidence from implied volatility indices. Resources Policy 52: 201–6. [Google Scholar] [CrossRef]

- Burns, Christopher B., and Daniel L. Prager. 2024. Do agricultural swaps co-move with equity markets? Evidence from the COVID-19 crisis. Journal of Commodity Markets 34: 100405. [Google Scholar] [CrossRef]

- Chancharat, Surachai, and Parichat Sinlapates. 2023. Dependencies and dynamic spillovers across crude oil and stock markets throughout the COVID-19 pandemic and Russia-Ukraine conflict: Evidence from the ASEAN+6. Finance Research Letters 57: 104249. [Google Scholar] [CrossRef]

- Chen, Shengming, Ahmed Bouteska, Taimur Sharif, and Mohammad Z. Abedin. 2023. The Russia- Ukraine war and energy market volatility: A novel application of the volatility ratio in the context of natural gas. Resources Policy 85: 103792. [Google Scholar] [CrossRef]

- Choi, Sun-Yong. 2022. Evidence from a multiple and partial wavelet analysis on the impact of geopolitical concerns on stock markets in North-East Asian countries. Finance Research Letters 46: 102465. [Google Scholar] [CrossRef]

- Chortane, Sana G., and Dharen K. Pandey. 2022. Does the Russia-Ukraine war lead to currency asymmetries? A US dollar tale. The Journal of Economic Asymmetries 26: e00265. [Google Scholar] [CrossRef]

- Creti, Anna, Marc Joets, and Valerie Mignon. 2013. On the links between stock and commodity markets’ volatility. Energy Economics 37: 16–28. [Google Scholar] [CrossRef]

- Deng, Jing, Zheng, Huike, and Xiaoyun Xing. 2023. Dynamic spillover and systemic importance of global clean energy companies: A tail risk network perspective. Finance Research Letters 55: 103990. [Google Scholar] [CrossRef]

- Engle, Robert F., and Kenneth F. Kroner. 1995. Multivariate simultaneous generalized ARCH. Econometric Theory 11: 122–50. [Google Scholar] [CrossRef]

- Estrada, Mario A. R., and Evangelos Koutronas. 2022. The impact of the Russian Aggression against Ukraine on the Russia-EU trade. Journal of Policy Modelling 44: 599–616. [Google Scholar] [CrossRef]

- Ewing, Bradley T., and Farooq Malik. 2016. Volatility spillovers between oil prices and the stock market under structural breaks. Global Finance Journal 29: 12–23. [Google Scholar] [CrossRef]

- Hanif, Waqas, Sinda Hadhri, and Rim El Khoury. 2024. Quantile spillovers and connectedness between oil shocks and stock markets of the largest oil producers and consumers. Journal of Commodity Markets 34: 100404. [Google Scholar] [CrossRef]

- Hsu, Shu-Han, Chwen Sheu, and Jiho Yoon. 2021. Risk spillovers between cryptocurrencies and traditional currencies and gold under different global economic conditions. The North American Journal of Economics and Finance 57: 101443. [Google Scholar] [CrossRef]

- Inacio, C. M. C, L. Khristoufek, and S. A. David. 2023. Assessing the impact of the Russia-Ukraine war on energy prices: A dynamic cross-correlation analysis. Physica A: Statistical Mathematics and its Application 626: 129084. [Google Scholar] [CrossRef]

- Izzeldin, Marwan, Yaz G. Muradoglu, Vasileios Pappas, Athina Petropoulou, and Sheeja Sivaprasad. 2023. The impact of the Russia-Ukrainian war on global financial markets. International Review of Financial Analysis 87: 102598. [Google Scholar] [CrossRef]

- Jebabli, Ikram, Mohamed Arouri, and Frederic Teulon. 2014. On the effects of world stock market and oil price shocks on food prices: An empirical investigation based on TVP-VAR models with stochastic volatility. Energy Economics 45: 66–98. [Google Scholar] [CrossRef]

- Jude, Octavian, Avraham Turgeman, Claudiu Botoc, and Laura Raisa Milos. 2023. Volatility and spillover effects between Central-Eastern European stock markets and energy markets: An emphasis on crisis periods. Energies 16: 6159. [Google Scholar] [CrossRef]

- Karamti, Chiraz, and Ahmed Jeribi. 2023. Stock markets from COVID-19 to the Russia-Ukraine crisis: Structural breaks in interactive effects panels. The Journal of Economic Asymmetries 28: e00340. [Google Scholar] [CrossRef]

- Katsiampa, Paraskevi, Larisa Yarovaya, and Damian Zieba. 2022. High-frequency connectedness between Bitcoin and other top-traded crypto assets during the COVID-19 crisis. Journal of International Financial Markets, Institutions and Money 79: 101578. [Google Scholar] [CrossRef]

- Khalfaoui, Rabeh, Giray Gozgor, and John W.Goodell. 2023. Impact of Russia-Ukraine war attention on cryptocurrency: Evidence from quantile dependence analysis. Finance Research Letters 52: 103365. [Google Scholar] [CrossRef]

- Li, Hang, and Ewa Majerowska. 2008. Testing stock market linkages for Poland and Hungary: A multivariate GARCH approach. Research in International Business and Finance 22: 247–66. [Google Scholar] [CrossRef]

- Lo, Gaye-Del, Isaac Marcelin, Theophile Bassene, and Babacar Sen. 2022. The Russo-Ukrainian war and financial markets: The role of dependence on Russian commodities. Finance Research Letters 50: 103194. [Google Scholar] [CrossRef]

- Malik, Farooq, and Bradley T. Ewing. 2009. Volatility transmission between oil prices and equity sector returns. International Review of Financial Analysis 18: 95–100. [Google Scholar] [CrossRef]

- Malik, Farooq, and Shawkat Hammoudeh. 2007. Shock and volatility transmission in the oil, US and Gulf equity markets. International Review of Economics and Finance 16: 357–68. [Google Scholar] [CrossRef]

- Manelli, Alberto, Roberta Pace, and Maria Leone. 2024. Russia-Ukraine conflict, commodities and stock market: A quantile VAR analysis. Journal of Risk and Financial Management 17: 29. [Google Scholar] [CrossRef]

- McAleer, Michael. 2019. What they did not tell you about algebraic non- existence, mathematical (ir-)regularity and (non-)asymptotic properties of the full BEKK dynamic conditional covariance model. Journal of Risk and Financial Management 12: 66. [Google Scholar] [CrossRef]

- Mensi, Walid, Makram Beljid, Adel Boubaker, and Shunsuke Managi. 2013. Correlations and volatility spillovers across commodity and stock markets: Linking energies, food, and gold. Economic Modelling 32: 15–22. [Google Scholar] [CrossRef]

- Mhadhbi, Khalil, and Ines Guelbi. 2024. Oil price volatility and MENA stock markets: A comparative analysis of oil exporters and importers. Engineering Proceedings 68: 63. [Google Scholar] [CrossRef]

- Micallef, Josep, Simon Grima, Jonathan Spiteri, and Ramona Rupeiga-Apoga. 2023. Assessing the causality relationship between the geopolitical risk index and the agricultural commodity markets. Risks 11: 84. [Google Scholar] [CrossRef]

- Obi, Pat, Freshia Waweru, and Moses Nyangu. 2023. An event study on the reaction of equity and commodity markets to the onset of Russia-Ukraine conflict. Journal of Risk and Financial Management 16: 256. [Google Scholar] [CrossRef]

- Paientko, Tatiana, and Stanley Amakude. 2024. Interconnected markets: Unveiling volatility spillovers in commodities and energy markets through BEKK-GARCH modelling. Analytics 3: 11. [Google Scholar] [CrossRef]

- Qureshi, Anum, Muhammad S. Rizwan, Ghufran Ahmad, and Dawood Ashraf. 2022. Russia- Ukraine war and systemic risk: Who is taking the heat? Finance Research Letters 48: 103036. [Google Scholar] [CrossRef]

- Rigobon, Roberto, and Brian Sack. 2005. The effects of war risk on US financial markets. Journal of Banking & Finance 29: 1769–89. [Google Scholar] [CrossRef]

- Rossi, Fabrizio, Yinan Ni, Antonio Salvi, Yanfei Sun, and Richard J. Cebula. 2025. Energy supply shock on European stock markets: Evidence from the Russia-Ukraine war. Journal of Risk and Financial Management 18: 223. [Google Scholar] [CrossRef]

- Sun, Meihong, and Chao Zhang. 2022. Comprehensive analysis of global stock market reactions to the Russia-Ukraine war. Applied Economics Letters 30: 2673–80. [Google Scholar] [CrossRef]

- Umar, Zaghum, Onur Polat, Sun-Yong Choi, and Tamara Teplova. 2022. The impact of the Russia- Ukraine conflict on the connectedness of financial markets. Finance Research Letters 48: 102976. [Google Scholar] [CrossRef]

- Wang, Zhengzhong, Shuihan Liu, Yunjie Wei, and Shouyang Wang. 2023. Estimating the impact of the outbreak of wars on financial assets: Evidence from Russia-Ukraine conflict. Heliyon 9: e21380. [Google Scholar] [CrossRef] [PubMed]

- Wu, Feng-Lin, Xu-Dong Zhan, Jia-Qi Zhou, and Ming-Hui Wang. 2023. Stock market volatility and Russia-Ukraine conflict. Finance Research Letters 55: 103919. [Google Scholar] [CrossRef]

- Yousaf, Imran, Ritesh Patel, and Larisa Yarovaya. 2022. The reaction of G20+ stock markets to the Russia-Ukraine conflict “black-swan” event: Evidence from event study approach. Journal of Behavioral and Experimental Finance 35: 100723. [Google Scholar] [CrossRef]

- Zapata, Hector O., Junior E. Betanco, Maria Bampasidou, and Michael Diliberto. 2023. A cyclical phenomenon among stock and commodity markets. Journal of Risk and Financial Management 16: 320. [Google Scholar] [CrossRef]

| Industrial Metals | S&P 500 | CAC 40 | DAX 30 | FTSE 100 | FTSE MIB | NIKKEI 225 | TSX 60 | |

|---|---|---|---|---|---|---|---|---|

| Pre-conflict period | ||||||||

| Mean | 0.000421 | 0.000477 | 0.000205 | 0.000131 | 0.000028 | 0.000188 | 0.000238 | 0.000322 |

| Median | 0.000997 | 0.000950 | 0.000805 | 0.000676 | 0.000565 | 0.001080 | 0.000558 | 0.000701 |

| Min | −0.041141 | −0.127652 | −0.130983 | −0.130548 | −0.115100 | −0.185411 | −0.062735 | −0.142523 |

| Max | 0.037335 | 0.089683 | 0.080560 | 0.104142 | 0.086670 | 0.085495 | 0.077313 | 0.120824 |

| Std. Dev. | 0.010308 | 0.012634 | 0.012162 | 0.012527 | 0.010857 | 0.013771 | 0.011975 | 0.012600 |

| Skewness | −0.223230 | −1.078688 | −1.390866 | −1.005327 | −1.254439 | −2.606204 | −0.165413 | −1.942948 |

| Kurtosis | 1.102909 | 19.800764 | 18.079030 | 17.031155 | 17.937187 | 34.138188 | 4.602859 | 37.151085 |

| ARCH (1) | 38.41 *** | 513.3 *** | 308.88 *** | 309.8 *** | 337.59 *** | 188.57 *** | 247.77 *** | 439.29 *** |

| ADF | −10.303 * | −9.7595 * | −10.364 * | −9.9697 * | −9.8835 * | −9.8005 * | −10.699 * | −9.6354 * |

| PP | −1235.4 * | −1580.0 * | 1279.9 * | −1325.3 * | −1283.5 * | −1467.9 * | −1194.5 * | −1552.3 * |

| Conflict period | ||||||||

| Mean | −0.000241 | 0.000450 | 0.000155 | 0.000386 | 0.000160 | 0.000412 | 0.000616 | 0.000089 |

| Median | −0.000503 | 0.000324 | 0.000462 | 0.000788 | 0.000655 | 0.001205 | 0.001193 | 0.000677 |

| Min | −0.399970 | −0.044199 | −0.050928 | −0.045083 | −0.039554 | −0.064384 | −0.132340 | −0.386700 |

| Max | 0.051553 | 0.054952 | 0.068827 | 0.076231 | 0.038991 | 0.067143 | 0.097365 | 0.429100 |

| Std. Dev. | 0.012847 | 0.011302 | 0.010840 | 0.010926 | 0.008286 | 0.012222 | 0.013443 | 0.010777 |

| Skewness | 0.149999 | −0.213895 | 0.095715 | 0.164184 | −0.443935 | −0.514601 | −1.155454 | −0.123633 |

| Kurtosis | 0.819535 | 1.815172 | 4.038147 | 4.966490 | 3.586071 | 3.852535 | 19.125727 | 0.981081 |

| ARCH (1) | 35.826 *** | 61.497 *** | 58.85 *** | 68.715 *** | 46.399 *** | 48.385 *** | 208.29 *** | 31.733 *** |

| ADF | −8.7360 * | −8.031 * | −9.106 * | −8.9336 * | −9.0784 * | −8.8466 * | −9.1072 * | −8.1595 * |

| PP | 589.45 * | −600.05 * | −637.81 * | −654.37 * | −639.46 * | −651.02 * | −629.8 * | 513.92 * |

| All sample | ||||||||

| Mean | 0.000199 | 0.000468 | 0.000188 | 0.000220 | 0.000074 | 0.000266 | 0.000370 | 0.000241 |

| Median | 0.000573 | 0.000839 | 0.000751 | 0.000686 | 0.000598 | 0.001124 | 0.000765 | 0.000681 |

| Min | −0.041141 | −0.127652 | −0.130983 | −0.130548 | −0.115124 | −0.185411 | −0.132340 | −0.142523 |

| Max | 0.051532 | 0.089683 | 0.080560 | 0.104142 | 0.086668 | 0.085494 | 0.097365 | 0.120824 |

| Std. Dev. | 0.011259 | 0.012183 | 0.011715 | 0.011991 | 0.010035 | 0.013249 | 0.012504 | 0.011994 |

| Skewness | 0.051864 | −0.842501 | −0.986369 | −0.707076 | −1.126306 | −2.049338 | −0.589316 | −1.494488 |

| Kurtosis | 4.100390 | 18.335310 | 17.657690 | 17.400500 | 19.690950 | 29.871490 | 14.314150 | 32.581880 |

| ARCH (1) | 12.017 *** | 66.288 *** | 61.502 *** | 56.907 *** | 47.486 *** | 23.912 *** | 37.926 *** | 70.001 *** |

| ADF | −11.952 * | −11.97 * | 12.059 * | −11.507 * | −12.648 * | −11.728 * | −12.14 * | −11.678 * |

| PP | −1829.3 * | −2193.3 * | −1934.9 * | −1999.5 * | −1928.4 * | −2155.1 * | −1820.9 * | −2105.9 * |

| S&P 500 | CAC 40 | DAX 30 | FTSE 100 | FTSE MIB | NIKKEI 225 | TSX 60 | |

|---|---|---|---|---|---|---|---|

| Pre-Conflict period | |||||||

| 0.000932 *** (0.000198) | 0.000412 (0.000259) | 0.000131 (0.000818) | 0.000199 (0.000225) | 0.000187 (0.000897) | 0.000238 (0.000780) | 0.000640 ** (0.000208) | |

| 0.000443 * (0.000254) | 0.000453 (0.000292) | 0.000420 (0.000732) | 0.000313 (0.000285) | 0.000420 (0.000745) | 0.000420 (0.000722) | 0.000344 (0.000288) | |

| 0.002038 *** (0.000144) | 0.002656 *** (0.000195) | 0.002425 *** (0.000214) | 0.001947 *** (0.000212) | 0.002271 *** (0.000353) | 0.001757 *** (0.000246) | 0.001513 ** (0.000000) | |

| 0.000265 (0.000602) | 0.000117 (0.000539) | −0.000018 (0.000490) | −0.000052 (0.000450) | −0.000718 * (0.000375) | −0.000184 (0.000481) | −0.002583 (0.001581) | |

| 0.000805 ** (0.000295) | 0.00105 *** (0.000306) | 0.000974 *** (0.000273) | 0.000884 ** (0.000276) | 0.00703 * (0.003647) | 0.00068 (0.000424) | 0.000044 (0.079566) | |

| 0.477125 *** (0.024824) | 0.397075 *** (0.022769) | 0.248345 *** (0.013741) | 0.339856 *** (0.021700) | 0.324287 *** (0.016164) | 0.2997 *** (0.018796) | 0.329386 *** (0.018007) | |

| 0.013072 (0.014332) | −0.012004 (0.019700) | −0.006322 (0.017304) | 0.004099 (0.020577) | −0.013669 (0.015066) | 0.025684* (0.015322) | −0.03899 *** (0.010735) | |

| 0.005319 (0.021517) | −0.008312 (0.027756) | −0.017312 (0.026949) | −0.058627* (0.026843) | −0.09947 *** (0.028135) | −0.017555 (0.035263) | −0.085019 * (0.033802) | |

| 0.129196 *** (0.015864) | 0.152716 *** (0.019498) | 0.146488 *** (0.018505) | 0.142234 *** (0.017716) | 0.149383 *** (0.018009) | 0.115195 *** (0.016977) | 0.246299 *** (0.026678) | |

| 0.867723 *** (0.012532) | 0.887588 *** (0.012706) | 0.914812 *** (0.009424) | 0.917039 *** (0.011912) | 0.926274 *** (0.009790) | 0.944292 *** (0.007380) | 0.925816 *** (0.012632) | |

| −0.004278 (0.008278) | 0.00509 (0.011619) | −0.000355 (0.008608) | −0.000712 (0.010280) | 0.006175 (0.005613) | −0.007397 (0.006663) | −0.005378 (0.008525) | |

| −0.001193 (0.013192) | 0.000073 (0.016723) | 0.005765 (0.013656) | 0.009225 (0.009744) | 0.027668 ** (0.009785) | 0.002815 (0.010138) | 0.084901 *** (0.020278) | |

| 0.988548 *** (0.003670) | 0.982952 *** (0.005315) | 0.944857 *** (0.004410) | 0.98637 *** (0.004144) | 0.984124 *** (0.004456) | 0.990506 *** (0.003631) | 0.939349 *** (0.013201) | |

| Conflict period | |||||||

| 0.000882 * (0.000357) | 0.000155 (0.000970) | 0.000386 (0.000976) | 0.000599 * (0.000278) | 0.000412 (0.001092) | 0.000770 * (0.000452) | 0.000447 (0.000403) | |

| −0.000038 (0.000475) | −0.000214 (0.001191) | −0.000214 (0.001185) | 0.000097 (0.000495) | −0.000214 (0.001203) | −0.000158 (0.000476) | 0.000161 (0.000483) | |

| 0.000692 * (0.000373) | 0.002077 *** (0.000910) | 0.001887 ** (0.000623) | 0.002742 *** (0.000351) | 0.002134 ** (0.000692) | 0.00724 *** (0.000733) | 0.001001 * (0.000526) | |

| 0.001519 (0.001075) | (0.000449) −0.001994 * | −0.002454 * (0.001285) | −0.000562 (0.000723) | −0.002448 * (0.001364) | −0.000934 (0.000757) | 0.000493 (0.000769) | |

| 0.000043 (0.032258) | 0.000029 (0.051327) | 0.000074 (0.036132) | 0.000058 *** (0.000006) | 0.000074 (0.038561) | 0.000931 * (0.000368) | 0.000786 * (0.000463) | |

| 0.239505 *** (0.033321) | 0.294564 *** (0.030298) | 0.275781 *** (0.031202) | 0.365234 *** (0.035502) | 0.296038 *** (0.030533) | 0.440371 *** (0.030632) | 0.121669 *** (0.033555) | |

| 0.144036 *** (0.042105) | −0.081358 * (0.038830) | −0.082829 * (0.039540) | −0.079175 (0.060940) | −0.079279 * (0.037208) | −0.019333 (0.031364) | 0.000623 (0.040557) | |

| −0.029121 (0.026728) | −0.000839 (0.032285) | −0.02798 (0.040002) | 0.012166 (0.022383) | −0.020163 (0.044669) | −0.003968 (0.057589) | 0.092725 ** (0.028402) | |

| 0.140238 *** (0.029444) | 0.166886 *** (0.035256) | 0.184543 *** (0.038646) | 0.107813 *** (0.028065) | 0.178072 *** (0.038571) | 0.154985 *** (0.027005) | 0.128802 *** (0.028919) | |

| 0.968915 *** (0.008171) | 0.928262 *** (0.016098) | 0.937212 *** (0.016589) | 0.853594 *** (0.029314) | 0.92969 *** (0.017462) | 0.679542 *** (0.061425) | 0.981529 *** (0.009307) | |

| −0.022463 * (0.011523) | 0.003776 (0.014266) | −0.001807 (0.016304) | −0.020982 (0.031472) | −0.002344 (0.015787) | 0.034071 (0.031024) | 0.008500 (0.011400) | |

| −0.01083 (0.009006) | 0.043007 *** (0.012669) | 0.055884 *** (0.015771) | 0.029976 * (0.011606) | 0.063812 *** (0.017464) | 0.032467 (0.033593) | −0.02126 *** (0.005821) | |

| 0.97517 *** (0.008987) | 0.972661 *** (0.009480) | 0.962952 *** (0.011010) | 0.992609 *** (0.006349) | 0.964865 *** (0.011513) | 0.980959 *** (0.007400) | 0.988436 *** (0.004677) | |

| All sample | |||||||

| 0.000819 *** (0.000187) | 0.000187 (0.000618) | 0.000220 (0.000632) | 0.000309 * (0.000182) | 0.000266 (0.000699) | 0.000370 (0.000659) | 0.000401 * (0.000199) | |

| 0.000237 (0.000249) | 0.000199 (0.000634) | 0.000199 (0.000632) | 0.000292 (0.000247) | 0.000199 (0.000643) | 0.000199 (0.000636) | 0.000379 (0.000259) | |

| 0.001788 *** (0.000125) | 0.002682 *** (0.000163) | 0.002496 *** (0.000185) | 0.002373 *** (0.000175) | 0.002667 *** (0.000281) | 0.002832 *** (0.000209) | 0.001765 *** (0.000261) | |

| 0.000587 (0.000380) | −0.000080 (0.000327) | −0.00029 (0.000311) | −0.000044 (0.000309) | −0.000733 ** (0.000261) | −0.000351 (0.000296) | −0.002098 ** (0.000556) | |

| 0.000524 (0.000424) | 0.000850 *** (0.000183) | 0.000821 ** (0.000180) | 0.000755 ** (0.000178) | 0.000517 *** (0.000165) | 0.000409 (0.000490) | 0.000031 (0.031162) | |

| 0.421262 *** (0.019651) | 0.394089 *** (0.019549) | 0.352301 *** (0.017238) | 0.369148 *** (0.018890) | 0.339094 *** (0.015745) | 0.351992 *** (0.012847) | 0.326777 *** (0.013627) | |

| 0.013048 (0.011701) | −0.018261 (0.015690) | −0.015491 (0.014410) | −0.002559 (0.018760) | −0.024884 * (0.013392) | 0.023621* (0.012809) | −0.034057 ** (0.010607) | |

| 0.000913 (0.001571) | 0.003122 (0.018082) | −0.016970 (0.018201) | −0.004426 (0.017136) | −0.084520 ** (0.022768) | −0.048644 * (0.026862) | −0.067997 ** (0.021913) | |

| 0.133501 *** (0.012029) | 0.147907 *** (0.013676) | 0.146321 *** (0.013866) | 0.142185 *** (0.013210) | 0.160414 *** (0.014706) | 0.124506 *** (0.013263) | 0.208552 *** (0.021440) | |

| 0.898193 *** (0.008994) | 0.886489 *** (0.010896) | 0.909475 *** (0.008924) | 0.892333 *** (0.011391) | 0.912720 *** (0.010138) | 0.906497 *** (0.007214) | 0.926534 *** (0.008788) | |

| −0.003138 (0.005877) | 0.005015 (0.008941) | 0.001639 (0.007025) | −0.001647 (0.010228) | 0.009130 (0.005710) | −0.008156 (0.007031) | 0.007149 (0.005643) | |

| −0.009368 (0.006749) | 0.005303 (0.008486) | 0.006609 (0.006932) | 0.004861 (0.006023) | 0.029500 ** (0.006823) | 0.011097 (0.006765) | 0.051524 *** (0.009569) | |

| 0.988669 *** (0.002226) | 0.985952 *** (0.002804) | 0.986496 *** (0.002712) | 0.987759 *** (0.002502) | 0.982593 *** (0.003400) | 0.990665 *** (0.002375) | 0.962434 *** (0.007983) | |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Leone, M.; Manelli, A.; Pace, R. The Russia–Ukraine Conflict and Stock Markets: Risk and Spillovers. Risks 2025, 13, 130. https://doi.org/10.3390/risks13070130

Leone M, Manelli A, Pace R. The Russia–Ukraine Conflict and Stock Markets: Risk and Spillovers. Risks. 2025; 13(7):130. https://doi.org/10.3390/risks13070130

Chicago/Turabian StyleLeone, Maria, Alberto Manelli, and Roberta Pace. 2025. "The Russia–Ukraine Conflict and Stock Markets: Risk and Spillovers" Risks 13, no. 7: 130. https://doi.org/10.3390/risks13070130

APA StyleLeone, M., Manelli, A., & Pace, R. (2025). The Russia–Ukraine Conflict and Stock Markets: Risk and Spillovers. Risks, 13(7), 130. https://doi.org/10.3390/risks13070130