Stock Market Hype: An Empirical Investigation of the Impact of Overconfidence on Meme Stock Valuation

Abstract

1. Introduction

2. Theoretical Framework

3. Data and Methodology

3.1. Data

3.2. Investor Overconfidence Metrics

3.2.1. The Variations in Trading Volume

3.2.2. Measures of Excessive Trading

3.2.3. The Turnover Rate

3.2.4. Increase in the Number of Outstanding Shares

3.3. Methodology

4. Results

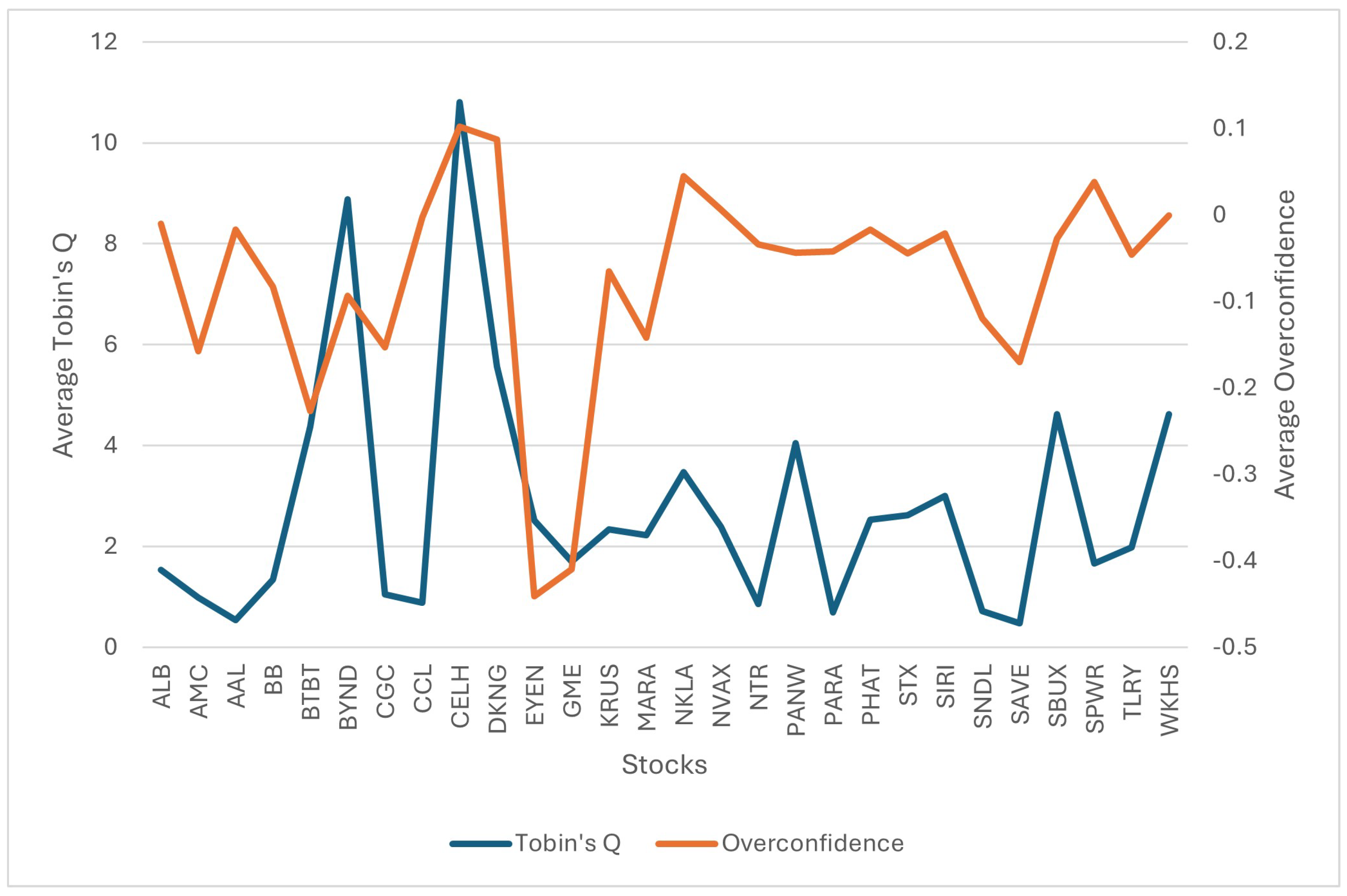

4.1. Descriptive Statistics and Correlations

4.2. Discussion of Empirical Results Related to Overconfidence and Meme Stock Valuation

4.3. Robustness and Sensitivity Analysis

4.3.1. Alternative Overconfidence Proxies and Firm Valuation

4.3.2. Dynamic System Generalized Method of Moments (GMM) Regression

5. Conclusions

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

| 1 | The empirical results obtained in this study are consistent with theoretical expectations drawn from behavioral finance and Prospect Theory (Barberis et al. 1998; Kahneman 1979). The statistically significant positive relationship between certain overconfidence proxies and meme stock valuation suggests that investor behavior in this segment deviates from standard rational expectations. These findings support the argument that overconfident investors tend to overestimate their own knowledge and predictive power, leading to mispricing through excessive trading and persistent speculative activity. Prospect Theory helps us explain this tendency, particularly the inclination of investors to become risk-seeking in the domain of losses and to anchor decisions to perceived reference points. Prior research has shown that this behavior often results in the continued holding of overvalued assets and a reluctance to realize losses (Aljifri 2023; Barber and Odean 1999; Bouteska and Regaieg 2020). The presence of such dynamics in the meme stock space, as evidenced by our findings, shows the crucial role of behavioral factors in shaping valuation. This contribution aligns with existing literature (Aloosh et al. 2023; d’Addona and Khanom 2022; Philander 2023), which emphasizes the influence of sentiment and overconfidence in amplifying market anomalies, particularly in online retail-driven trading environments. |

| 2 | While proxies such as changes in trading volume and turnover may be sensitive to short-term fluctuations, their repeated validation in the behavioral finance literature supports their use in capturing persistent investor traits like overconfidence. By employing a panel dataset and robust estimation techniques, including fixed-effects and dynamic system GMM models, we mitigate the influence of transitory noise and unobserved firm-specific effects. This approach enables a more accurate identification of the enduring role of overconfidence in meme stock valuation (see Aljifri 2023; Bouteska and Regaieg 2020; Statman et al. 2006; Trejos et al. 2019). |

| 3 | Available at https://www.quiverquant.com/scores/memestocks, accessed on 18 June 2024. |

| 4 | Although Equation (9) is expressed in first differences for notational clarity and consistency with Aljifri (2023), the model is estimated using the system GMM approach proposed by Blundell and Bond (1998) through the xtabond2 command in Stata Standard Edition 18. This estimation procedure automatically handles the transformation of variables and simultaneously estimates equations in levels and differences using appropriate instruments. |

References

- Adebambo, Biljana Nikolic, and Xuemin Yan. 2018. Investor overconfidence, firm valuation, and corporate decisions. Management Science 64: 5349–69. [Google Scholar] [CrossRef]

- Aljifri, Ruqayya. 2023. Investor psychology in the stock market: An empirical study of the impact of overconfidence on firm valuation. Borsa Istanbul Review 23: 93–112. [Google Scholar] [CrossRef]

- Al-Najjar, Basil, and Aspioni Anfimiadou. 2012. Environmental policies and firm value. Business Strategy and the Environment 21: 49–59. [Google Scholar] [CrossRef]

- Aloosh, Arash, Hyung-Eun Choi, and Samuel Ouzan. 2023. The tail wagging the dog: How do meme stocks affect market efficiency? International Review of Economics & Finance 87: 68–78. [Google Scholar]

- Alsabban, Soleman, and Omar Alarfaj. 2020. An empirical analysis of behavioral finance in the saudi stock market: Evidence of overconfidence behavior. International Journal of Economics and Financial Issues 10: 73. [Google Scholar] [CrossRef]

- Arellano, Manuel, and Olympia Bover. 1995. Another look at the instrumental variable estimation of error-components models. Journal of Econometrics 68: 29–51. [Google Scholar] [CrossRef]

- Arellano, Manuel, and Stephen Bond. 1991. Some tests of specification for panel data: Monte carlo evidence and an application to employment equations. The review of Economic Studies 58: 277–97. [Google Scholar] [CrossRef]

- Bag, Dinabandhu. 2022. Valuation and Volatility. Berlin/Heidelberg: Springer. [Google Scholar]

- Barber, Brad, and Terrance Odean. 1999. Do investors trade too much. American Economic Review 89: 262. [Google Scholar]

- Barberis, Nicholas, Andrei Shleifer, and Robert Vishny. 1998. A model of investor sentiment. Journal of Financial Economics 49: 307–43. [Google Scholar] [CrossRef]

- Bhojraj, Sanjeev, Robert J Bloomfield, Youngki Jang, and Nir Yehuda. 2021. Cost structure, operating leverage, and cds spreads. The Accounting Review 96: 79–105. [Google Scholar] [CrossRef]

- Blundell, Richard, and Stephen Bond. 1998. Initial conditions and moment restrictions in dynamic panel data models. Journal of Econometrics 87: 115–43. [Google Scholar] [CrossRef]

- Bouteska, Ahmed, and Boutheina Regaieg. 2020. Loss aversion, overconfidence of investors and their impact on market performance evidence from the us stock markets. Journal of Economics, Finance and Administrative Science 25: 451–78. [Google Scholar] [CrossRef]

- Brown, Gregory W., and Michael T Cliff. 2005. Investor sentiment and asset valuation. The Journal of Business 78: 405–40. [Google Scholar] [CrossRef]

- Buchanan, Bonnie, Cathy Xuying Cao, and Chongyang Chen. 2018. Corporate social responsibility, firm value, and influential institutional ownership. Journal of Corporate Finance 52: 73–95. [Google Scholar] [CrossRef]

- Chen, Roger C. Y., and Chen-Hsun Lee. 2017. The influence of csr on firm value: An application of panel smooth transition regression on taiwan. Applied Economics 49: 3422–34. [Google Scholar] [CrossRef]

- Chin, Audrey Lim Li. 2012. Psychological biases and investor behaviour: Survey evidence from malaysian stock market. International Journal of Social Science, Economics and Arts 2: 67–73. [Google Scholar]

- Costola, Michele, Matteo Iacopini, and Carlo RMA Santagiustina. 2021. On the “mementum” of meme stocks. Economics Letters 207: 110021. [Google Scholar] [CrossRef]

- d’Addona, Stefano, and Najrin Khanom. 2022. Estimating tail-risk using semiparametric conditional variance with an application to meme stocks. International Review of Economics & Finance 82: 241–60. [Google Scholar]

- Daniel, Kent, David Hirshleifer, and Avanidhar Subrahmanyam. 1998. Investor psychology and security market under-and overreactions. The Journal of Finance 53: 1839–85. [Google Scholar] [CrossRef]

- Diamond, Douglas W., and Zhiguo He. 2014. A theory of debt maturity: The long and short of debt overhang. The Journal of Finance 69: 719–62. [Google Scholar] [CrossRef]

- Fang, Vivian W., Thomas H. Noe, and Sheri Tice. 2009. Stock market liquidity and firm value. Journal of Financial Economics 94: 150–69. [Google Scholar] [CrossRef]

- Feng, Zifeng, and Zhonghua Wu. 2018. Technology investment, firm performance and market value: Evidence from banks. Paper presented at Community Banking in the 21st Century Research and Policy Conference, St. Louis, MO, USA, October 3–4. [Google Scholar]

- Flannery, Mark J. 1994. Debt maturity and the deadweight cost of leverage: Optimally financing banking firms. The American Economic Review 84: 320–31. [Google Scholar]

- Ghoul, Sadok El, Omrane Guedhami, and Yongtae Kim. 2017. Country-level institutions, firm value, and the role of corporate social responsibility initiatives. Journal of International Business Studies 48: 360–85. [Google Scholar] [CrossRef]

- Glaser, Markus, Thomas Langer, and Martin Weber. 2013. True overconfidence in interval estimates: Evidence based on a new measure of miscalibration. Journal of Behavioral Decision Making 26: 405–17. [Google Scholar] [CrossRef]

- Gompers, Paul, Joy Ishii, and Andrew Metrick. 2003. Corporate governance and equity prices. The Quarterly Journal of Economics 118: 107–56. [Google Scholar] [CrossRef]

- Graham, John R., Campbell R. Harvey, and Hai Huang. 2009. Investor competence, trading frequency, and home bias. Management Science 55: 1094–106. [Google Scholar] [CrossRef]

- Gujarati, Damodar N., and Dawn C. Porter. 2009. Panel data regression models. In Basic Econometrics. New York: McGraw-Hill/Irwin. Available online: https://cbpbu.ac.in/userfiles/file/2020/STUDY_MAT/ECO/1.pdf (accessed on 24 June 2025).

- Hassan, Omaima A.G. 2018. The impact of voluntary environmental disclosure on firm value: Does organizational visibility play a mediation role? Business Strategy and the Environment 27: 1569–82. [Google Scholar] [CrossRef]

- Ho, Chi Ming. 2013. Private information, overconfidence and intraday trading behaviour: Empirical study of the taiwan stock market. Applied Financial Economics 23: 325–45. [Google Scholar] [CrossRef]

- Huang, Jiayu, Yifan Wang, Yaojun Fan, and Hexuan Li. 2022. Gauging the effect of investor overconfidence on trading volume from the perspective of the relationship between lagged stock returns and current trading volume. International Finance 25: 103–23. [Google Scholar] [CrossRef]

- Kahneman, Daniel. 1979. Prospect theory: An analysis of decisions under risk. Econometrica 47: 278. [Google Scholar] [CrossRef]

- Karolyi, G. Andrew. 1993. A bayesian approach to modeling stock return volatility for option valuation. Journal of Financial and Quantitative Analysis 28: 579–94. [Google Scholar] [CrossRef]

- Mushinada, Venkata Narasimha Chary, and Venkata Subrahmanya Sarma Veluri. 2018. Investors overconfidence behaviour at bombay stock exchange. International Journal of Managerial Finance 14: 613–32. [Google Scholar] [CrossRef]

- Parhi, Shiba Prasad, and Manas Kumar Pal. 2022. Impact of overconfidence bias in stock trading approach: A study of high net worth individual (hni) stock investors in India. Benchmarking: An International Journal 29: 817–34. [Google Scholar] [CrossRef]

- Parveen, Shagufta, Zoya Wajid Satti, Qazi Abdul Subhan, and Sana Jamil. 2020. Exploring market overreaction, investors’ sentiments and investment decisions in an emerging stock market. Borsa Istanbul Review 20: 224–35. [Google Scholar] [CrossRef]

- Philander, Kahlil S. 2023. Meme asset wagering: Perceptions of risk, overconfidence, and gambling problems. Addictive Behaviors 137: 107532. [Google Scholar] [CrossRef]

- Qadri, Syed Usman, and Mohsin Shabbir. 2014. An empirical study of overconfidence and illusion of control biases, impact on investor’s decision making: An evidence from ISE. European Journal of Business and Management 6: 38–44. [Google Scholar]

- Shternshis, Andrey, and Piero Mazzarisi. 2024. Variance of entropy for testing time-varying regimes with an application to meme stocks. Decisions in Economics and Finance 47: 1–44. [Google Scholar] [CrossRef]

- Smith, William Roth. 2024. “We like the stock!”: Partial organizing, latency, and communicative contestations of actorhood in r/wallstreetbets. Western Journal of Communication 88: 861–86. [Google Scholar] [CrossRef]

- Statman, Meir, Steven Thorley, and Keith Vorkink. 2006. Investor overconfidence and trading volume. The Review of Financial Studies 19: 1531–65. [Google Scholar] [CrossRef]

- Strahilevitz, Michal Ann, Terrance Odean, and Brad M Barber. 2011. Once burned, twice shy: How naive learning, counterfactuals, and regret affect the repurchase of stocks previously sold. Journal of Marketing Research 48: S102–S120. [Google Scholar] [CrossRef]

- Tekçe, Bülent, and Neslihan Yılmaz. 2015. Are individual stock investors overconfident? evidence from an emerging market. Journal of Behavioral and Experimental Finance 5: 35–45. [Google Scholar] [CrossRef]

- Trejos, Cristian, Adrian van Deemen, Yeny E. Rodríguez, and Juan M. Gomez. 2019. Overconfidence and disposition effect in the stock market: A micro world based setting. Journal of Behavioral and Experimental Finance 21: 61–69. [Google Scholar] [CrossRef]

- Trinugroho, Irwan, and Roy Sembel. 2011. Overconfidence and excessive trading behavior: An experimental study. International Journal of Business and Management 6: 147. [Google Scholar] [CrossRef]

- Villalonga, Belen, and Raphael Amit. 2006. How do family ownership, control and management affect firm value? Journal of Financial Economics 80: 385–417. [Google Scholar] [CrossRef]

- Xia, Tian, Zhengwei Wang, and Kunpeng Li. 2014. Financial literacy overconfidence and stock market participation. Social Indicators Research 119: 1233–45. [Google Scholar] [CrossRef]

- Yousaf, Imran, Linh Pham, and John W. Goodell. 2023. The connectedness between meme tokens, meme stocks, and other asset classes: Evidence from a quantile connectedness approach. Journal of International Financial Markets, Institutions and Money 82: 101694. [Google Scholar] [CrossRef]

- Yung, Kenneth, and Yi Jian. 2017. Effects of the shareholder base on firm behavior and firm value in china. International Review of Economics & Finance 49: 370–85. [Google Scholar]

- Zahera, Syed Aliya, and Rohit Bansal. 2018. Do investors exhibit behavioral biases in investment decision making? A systematic review. Qualitative Research in Financial Markets 10: 210–51. [Google Scholar] [CrossRef]

| No. | Ticker | Company Name | No. | Ticker | Company Name |

|---|---|---|---|---|---|

| 1 | ALB | Albemarle Corporation (USA) | 16 | NVAX | Novavax Inc (USA) |

| 2 | AMC | AMC Entertainment Holdings Inc (USA) | 17 | NTR | Nutrien Ltd. (Canada) |

| 3 | AAL | American Airlines Group Inc. (USA) | 18 | PANW | Palo Alto Networks, Inc. (USA) |

| 4 | BB | BlackBerry Limited (Canada) | 19 | PARA | Paramount Global (USA) |

| 5 | BTBT | Bit Digital, Inc. (USA) | 20 | PHAT | Phathom Pharmaceuticals Inc (USA) |

| 6 | BYND | Beyond Meat, Inc. (USA) | 21 | STX | Seagate Technology Holdings (USA) |

| 7 | CGC | Canopy Growth Corporation (Canada) | 22 | SIRI | Sirius XM Holdings, Inc (USA) |

| 8 | CCL | Carnival Corporation (USA) | 23 | SNDL | Sundial Growers Inc. (Canada) |

| 9 | CELH | Celsius Holdings, Inc. (USA) | 24 | SAVE | Spirit Airlines, Inc. (USA) |

| 10 | DKNG | DraftKings Inc. (USA) | 25 | SBUX | Starbucks Corp (USA) |

| 11 | EYEN | Eyenovia, Inc. (USA) | 26 | SPWR | SunPower Corporation (USA) |

| 12 | GME | GameStop Corp. (USA) | 27 | TLRY | Tilray Brands, Inc. (USA) |

| 13 | KRUS | Kura Sushi USA, Inc. (USA) | 28 | WKHS | Workhorse Group, Inc (USA) |

| 14 | MARA | MARA Holdings, Inc. (USA) | |||

| 15 | NKLA | Nikola Corporation (USA) |

| Variables | Definition | Source |

|---|---|---|

| Tobin’s Q ratio (Tobin’sQ) | Calculated as the ratio of a firm’s market value (DWEV) to its assets’ replacement cost (DWTA), giving an indication of how much the market values a firm relative to its assets. | Refinitiv Eikon Datastream |

| Market capitalization (MarketCap) | Total market value of a firm’s outstanding shares, which is calculated as the product of share price and the number of shares outstanding. | Refinitiv Eikon Datastream |

| Return on assets (ROA) | Net profit as a percentage of total assets (%). | Refinitiv Eikon Datastream |

| Leverage Ratio (Leverage) | Ratio between total debt and total assets. | Refinitiv Eikon Datastream |

| Historical 90-day volatility | Measures the past 90-day price volatility of the firm. | Refinitiv Eikon Datastream |

| Investor overconfidence () | Change in trading volume. | Refinitiv Eikon Datastream |

| Panel A: Descriptive statistics | ||||||||

|---|---|---|---|---|---|---|---|---|

| Variable | N | Mean | Median | Sth | Min | Max | Skewness | Kurtosis |

| Tobin’sQ | 672 | 2.798 | 1.653 | 3.873 | −0.034 | 29.645 | 3.809 | 20.337 |

| MarketCap (M) | 672 | 14.946 | 3.405 | 28.210 | 0.002 | 140.300 | 2.834 | 10.620 |

| ROA | 672 | −0.167 | −0.068 | 0.332 | −1.952 | 0.263 | −1.764 | 7.608 |

| Leverage | 672 | 0.345 | 0.281 | 0.305 | 0.000 | 1.854 | 1.552 | 6.743 |

| Volatility | 672 | 0.760 | 0.670 | 0.476 | 0.023 | 5.641 | 2.808 | 22.122 |

| 672 | −0.075 | −0.003 | 0.649 | −5.472 | 0.974 | −3.409 | 23.178 | |

| et | 672 | 0.243 | 0.189 | 0.194 | 0.001 | 0.974 | 1.742 | 6.014 |

| etd | 672 | 0.247 | 0.197 | 0.193 | −0.065 | 0.974 | 1.704 | 5.991 |

| etm | 672 | 0.226 | 0.181 | 0.208 | −0.386 | 0.974 | 1.355 | 5.711 |

| turnover | 672 | 2.556 | 0.990 | 7.280 | 0.002 | 158.732 | 15.516 | 319.333 |

| iso | 672 | 0.179 | 0.002 | 1.110 | 0 | 19.794 | 11.941 | 176.364 |

| Panel B: Pairwise correlations | ||||||||

| Tobin’sQ | MarketCap (M) | ROA | Leverage | Volatility | ||||

| Tobin’sQ | 1 | |||||||

| MarketCap | 0.0603 | 1 | ||||||

| ROA | 0.0006 | 0.1139 *** | 1 | |||||

| Leverage | −0.1054 *** | 0.0427 | 0.0318 | 1 | ||||

| Volatility | 0.0906 ** | −0.2878 *** | −0.2763 *** | −0.1383 *** | 1 | |||

| Panel C: Correlation of overconfidence proxies | ||||||||

| et | etd | etm | turnover | iso | ||||

| 1 | ||||||||

| et | 0.3534 *** | 1 | ||||||

| etd | 0.3601 *** | 0.9778 *** | 1 | |||||

| etm | 0.3745 *** | 0.904 *** | 0.909 *** | 1 | ||||

| turnover | 0.0799 ** | 0.2097 *** | 0.2132 *** | 0.1955 *** | 1 | |||

| iso | −0.0816 ** | 0.0802 ** | 0.0862 ** | −0.0395 | −0.0432 | 1 | ||

| Variable | Model |

|---|---|

| MarketCap | 0.0111 *** |

| (0.00334) | |

| ROA | 0.357 |

| (0.249) | |

| Leverage | −1.292 *** |

| (0.306) | |

| Volatility | 0.677 |

| (0.446) | |

| Overconfidence | 0.534 *** |

| (0.146) | |

| Constant | 2.663 *** |

| (0.368) | |

| Observations | 672 |

| 0.089 | |

| 15.54 *** | |

| F-value | 14.93 *** |

| Stocks | 28 |

| Variables | (1) | (2) | (3) | (4) | (5) |

|---|---|---|---|---|---|

| MarketCap | 0.0110 *** | 0.0110 *** | 0.0113 *** | 0.0112 *** | 0.0134 *** |

| (0.00351) | (0.00351) | (0.00334) | (0.00336) | (0.00304) | |

| ROA | 0.469 * | 0.477 * | 0.486 * | 0.460 | 0.352 |

| (0.265) | (0.270) | (0.254) | (0.308) | (0.246) | |

| Leverage | −1.188 *** | −1.183 *** | −1.185 *** | −1.210 *** | −1.309 *** |

| (0.266) | (0.265) | (0.279) | (0.293) | (0.303) | |

| Volatility | 0.719 | 0.709 | 0.629 | 0.846 | 0.818 * |

| (0.544) | (0.553) | (0.491) | (0.570) | (0.457) | |

| Alt. Overconfidence: | |||||

| et | 0.483 | ||||

| (1.373) | |||||

| etd | 0.529 | ||||

| (1.398) | |||||

| etm | 1.013 | ||||

| (0.937) | |||||

| turnover | −0.00507 | ||||

| (0.0255) | |||||

| iso | −0.0342 ** | ||||

| (0.0142) | |||||

| Constant | 2.459 *** | 2.453 *** | 2.412 *** | 2.496 *** | 2.574 *** |

| (0.330) | (0.326) | (0.323) | (0.375) | (0.349) | |

| Observations | 672 | 672 | 672 | 672 | 672 |

| 0.083 | 0.083 | 0.084 | 0.082 | 0.086 | |

| 15.36 *** | 15.12 *** | 15.95 *** | 96.08 *** | 29.89 *** | |

| F-value | 18.03 *** | 18.29 *** | 18.41 *** | 21.85 *** | 21.79 *** |

| Stocks | 28 | 28 | 28 | 28 | 28 |

| Variables | (1) | (2) | (3) | (4) | (5) | |

|---|---|---|---|---|---|---|

| LΔ.Tobin’s Q | −0.135 | −0.153 | −0.140 | −0.138 | −0.128 | −0.119 |

| (0.107) | (0.102) | (0.101) | (0.099) | (0.096) | (0.098) | |

| .MarketCap | 0.033 | 0.033 | 0.028 | 0.027 | 0.027 | 0.020 |

| (0.035) | (0.032) | (0.036) | (0.025) | (0.032) | (0.031) | |

| .ROA | 3.071 | 2.490 | 2.990 | 2.940 | 3.584 | 3.876 |

| (2.038) | (2.431) | (1.957) | (2.040) | (2.152) | (2.366) | |

| .Leverage | 0.716 | 0.419 | 0.698 | 0.539 | 1.210 | 1.286 |

| (1.793) | (1.470) | (1.443) | (1.120) | (2.630) | (1.774) | |

| .Volatility | 0.756 | 0.748 | 0.680 | 0.719 | 0.683 | 0.716 |

| (0.496) | (0.575) | (0.592) | (0.448) | (0.442) | (0.545) | |

| Overconfidence: | ||||||

| .tv | 0.174 | |||||

| (0.271) | ||||||

| .et | 0.565 | |||||

| (0.956) | ||||||

| .etd | 0.461 | |||||

| (1.120) | ||||||

| .etm | 0.320 | |||||

| (0.828) | ||||||

| .Turnover | 0.033 ** | |||||

| (0.012) | ||||||

| .iso | −0.001 | |||||

| (0.002) | ||||||

| Constant | −0.102 ** | −0.095 ** | −0.099 ** | −0.092 * | −0.101 ** | −0.097 ** |

| (0.043) | (0.042) | (0.045) | (0.045) | (0.045) | (0.043) | |

| Observations | 616 | 616 | 616 | 616 | 616 | 616 |

| Number of stocks | 28 | 28 | 28 | 28 | 28 | 28 |

| F-value | 3.931 *** | 5.914 *** | 4.818 *** | 3.400 *** | 27.78 *** | 4.034 *** |

| AR(1) test (p-value) | 0.0582 | 0.0650 | 0.0607 | 0.0585 | 0.0571 | 0.0526 |

| AR(2) test (p-value) | 0.630 | 0.537 | 0.588 | 0.569 | 0.649 | 0.671 |

| Hansen test (p-value) | 0.577 | 0.702 | 0.666 | 0.691 | 0.588 | 0.709 |

| Sargan test (p-value) | 0.149 | 0.109 | 0.106 | 0.167 | 0.262 | 0.207 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Ahadzie, R.M.; Junior, P.O.; Woode, J.K.; Daugaard, D. Stock Market Hype: An Empirical Investigation of the Impact of Overconfidence on Meme Stock Valuation. Risks 2025, 13, 127. https://doi.org/10.3390/risks13070127

Ahadzie RM, Junior PO, Woode JK, Daugaard D. Stock Market Hype: An Empirical Investigation of the Impact of Overconfidence on Meme Stock Valuation. Risks. 2025; 13(7):127. https://doi.org/10.3390/risks13070127

Chicago/Turabian StyleAhadzie, Richard Mawulawoe, Peterson Owusu Junior, John Kingsley Woode, and Dan Daugaard. 2025. "Stock Market Hype: An Empirical Investigation of the Impact of Overconfidence on Meme Stock Valuation" Risks 13, no. 7: 127. https://doi.org/10.3390/risks13070127

APA StyleAhadzie, R. M., Junior, P. O., Woode, J. K., & Daugaard, D. (2025). Stock Market Hype: An Empirical Investigation of the Impact of Overconfidence on Meme Stock Valuation. Risks, 13(7), 127. https://doi.org/10.3390/risks13070127