Implicit Prioritization of Life Insurance Coverage: A Study of Policyholder Preferences in a Danish Pension Company

Abstract

1. Introduction

2. Setup and Formulation of the Problems

2.1. Central Problem

2.2. Special Case

3. Implicit Priority

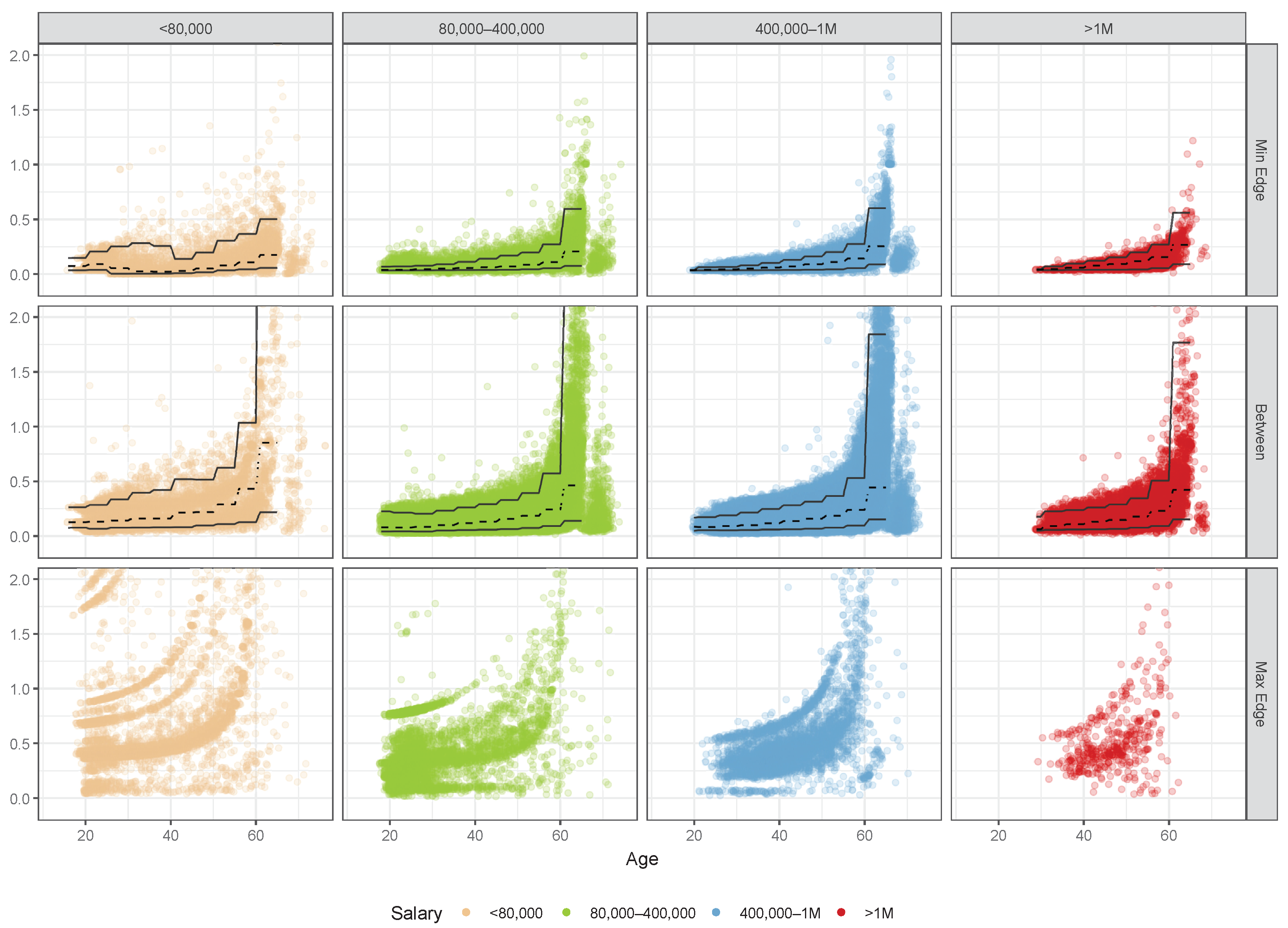

- In the first scenario, we consider the currently chosen life insurance payout to be the optimal life insurance coverage. We calculate backward to determine the following: ‘If this life insurance coverage were optimal for the insured, what weight would correspond to the insured’s valuation of it?’ In other words, we aim to understand how the insured values this life insurance payout relative to their intermediate money consumption, thereby understanding the factor and the policyholder’s appreciation for under- or over-insurance while noting that itself plays a role in f, as defined in (11). We denote the weight from this scenario .

- The second scenario extends the special case explained in the previous Section 2.2. If, instead of the current life insurance coverage, the insured had the complete coverage equivalent to their human capital, g, we determine the weight, , that would correspond to the insured’s valuation of this coverage. In other words, we aim to understand how the insured would value complete coverage relative to their intermediate consumption in this scenario. Serving as a reference to the examination of appreciation the policyholder has for over- or under-insurance, as this is exactly the value placed on the consumption of bequest if the policyholder had complete coverage. We denote the weight from this scenario .

4. Numerical Analysis

4.1. Assumptions and Descriptions

- For the coverage level, it is assumed that all coverages must be at the minimum or maximum limit for the policyholder to be noted as being at the respective limit.

- The policyholder is cumulatively noted as “Recommendation Viewed” if at least one of the policies has received a recommendation.

- The policyholder is noted as “Custom Life Insurance Benefit” if this is the case for at least one of the policies.

- The policyholder is noted as “Broker-Assisted” if this is the case for at least one of the policies.

4.2. Benchmark

4.3. Results and Discussion

- Extra information can shed light on some outliers, and their implicit prioritization might indicate a deliberate and sensible choice.

- For some, it might be essential to ensure the policyholder is aware of the prioritization of their life insurance coverage and how they compare to similar policyholders.

5. Conclusions and Future Work

Funding

Data Availability Statement

Acknowledgments

Conflicts of Interest

Appendix A

| 1 | Available online: https://www.finanstilsynet.dk/finansielle-temaer/forsikring-og-pension/levetidsmodel (accessed on 1 December 2024). |

References

- Arrow, Kenneth J. 1973. Essays in the Theory of Risk-Bearing, 1970. Chicago, Markham and Amsterdam: North-Holland Pub. Co. [Google Scholar]

- Asmussen, Søren, and Mogens Steffensen. 2020. Risk and Insurance. Berlin and Heidelberg: Springer. [Google Scholar]

- Azar, Samih Antoine. 2006. Measuring relative risk aversion. Applied Financial Economics Letters 2: 341–45. [Google Scholar] [CrossRef]

- Barseghyan, Levon, Francesca Molinari, Ted O’Donoghue, and Joshua C. Teitelbaum. 2013. The nature of risk preferences: Evidence from insurance choices. American Economic Review 103: 2499–529. [Google Scholar] [CrossRef]

- Barsky, Robert B., F. Thomas Juster, Miles S. Kimball, and Matthew D. Shapiro. 1997. Preference parameters and behavioral heterogeneity: An experimental approach in the health and retirement study. The Quarterly Journal of Economics 112: 537–79. [Google Scholar] [CrossRef]

- Burgaard, Johan, and Mogens Steffensen. 2020. Eliciting risk preferences and elasticity of substitution. Decision Analysis 17: 314–29. [Google Scholar] [CrossRef]

- Cohen, Alma, and Liran Einav. 2007. Estimating risk preferences from deductible choice. American Economic Review 97: 745–88. [Google Scholar] [CrossRef]

- Conine, Thomas E., Michael B. McDonald, and Maurry Tamarkin. 2017. Estimation of relative risk aversion across time. Applied Economics 49: 2117–24. [Google Scholar] [CrossRef]

- Duarte, Isabel, Diogo Pinheiro, Alberto A. Pinto, and Stanley R. Pliska. 2014. Optimal life insurance purchase, consumption and investment on a financial market with multi-dimensional diffusive terms. Optimization 63: 1737–60. [Google Scholar] [CrossRef]

- Falden, Debbie, and Mogens Steffensen. 2024. Calibration of Risk Aversion to Real Pension Asset Allocation. Available at SSRN 4898823. Available online: https://ssrn.com/abstract=4898823 (accessed on 1 December 2024).

- Hambel, Christoph, Holger Kraft, Lorenz S. Schendel, and Mogens Steffensen. 2017. Life insurance demand under health shock risk. Journal of Risk and Insurance 84: 1171–202. [Google Scholar] [CrossRef]

- Holt, Charles A., and Susan K. Laury. 2002. Risk aversion and incentive effects. American Economic Review 92: 1644–55. [Google Scholar] [CrossRef]

- Koijen, Ralph S. J., Stijn Van Nieuwerburgh, and Motohiro Yogo. 2016. Health and mortality delta: Assessing the welfare cost of household insurance choice. The Journal of Finance 71: 957–1010. [Google Scholar] [CrossRef]

- Kraft, Holger, and Mogens Steffensen. 2008a. Optimal Consumption and Insurance: A Continuous-time Markov Chain Approach. ASTIN Bulletin 38: 231–57. [Google Scholar] [CrossRef]

- Kraft, Holger, and Mogens Steffensen. 2008b. The policyholder’s static and dynamic decision making of life insurance and pension payments. Blätter der DGVFM 29: 211–44. [Google Scholar] [CrossRef]

- Merton, Robert C. 1969. Lifetime portfolio selection under uncertainty: The continuous-time case. The Review of Economics and Statistics 51: 247–57. [Google Scholar] [CrossRef]

- Merton, Robert C. 1971. Optimal portfolio and consumption rules in a continuous-time model. Journal of Economic Theory 3: 373–413. [Google Scholar] [CrossRef]

- Pliska, Stanley R., and Jinchun Ye. 2007. Optimal life insurance purchase and consumption/investment under uncertain lifetime. Journal of Banking & Finance 31: 1307–19. [Google Scholar]

- Pratt, John W. 1976. Risk aversion in the small and in the large. Econometrica 44: 420. [Google Scholar] [CrossRef]

- Richard, Scott F. 1975. Optimal consumption, portfolio and life insurance rules for an uncertain lived individual in a continuous time model. Journal of Financial Economics 2: 187–203. [Google Scholar] [CrossRef]

- Shen, Yang, and Jiaqin Wei. 2016. Optimal investment-consumption-insurance with random parameters. Scandinavian Actuarial Journal 2016: 37–62. [Google Scholar] [CrossRef]

- Steffensen, Mogens, and Julie Bjørner Søe. 2023. Optimal consumption, investment, and insurance under state-dependent risk aversion. ASTIN Bulletin: The Journal of the IAA 53: 104–28. [Google Scholar] [CrossRef]

- Tang, Siqi, Sachi Purcal, and Jinhui Zhang. 2018. Life insurance and annuity demand under hyperbolic discounting. Risks 6: 43. [Google Scholar] [CrossRef]

- Wakker, Peter P. 2008. Explaining the characteristics of the power (crra) utility family. Health Economics 17: 1329–44. [Google Scholar] [CrossRef] [PubMed]

- Yaari, Menahem E. 1965. Uncertain lifetime, life insurance, and the theory of the consumer. Review of Economic Studies 32: 137–50. [Google Scholar] [CrossRef]

- Zhang, Jinhui, Sachi Purcal, and Jiaqin Wei. 2021. Optimal life insurance and annuity demand under hyperbolic discounting when bequests are luxury goods. Insurance: Mathematics and Economics 101: 80–90. [Google Scholar] [CrossRef]

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Søe, J.B. Implicit Prioritization of Life Insurance Coverage: A Study of Policyholder Preferences in a Danish Pension Company. Risks 2025, 13, 103. https://doi.org/10.3390/risks13060103

Søe JB. Implicit Prioritization of Life Insurance Coverage: A Study of Policyholder Preferences in a Danish Pension Company. Risks. 2025; 13(6):103. https://doi.org/10.3390/risks13060103

Chicago/Turabian StyleSøe, Julie Bjørner. 2025. "Implicit Prioritization of Life Insurance Coverage: A Study of Policyholder Preferences in a Danish Pension Company" Risks 13, no. 6: 103. https://doi.org/10.3390/risks13060103

APA StyleSøe, J. B. (2025). Implicit Prioritization of Life Insurance Coverage: A Study of Policyholder Preferences in a Danish Pension Company. Risks, 13(6), 103. https://doi.org/10.3390/risks13060103