Abstract

This study endeavors to explore the shock-transmission mechanism between Trade Policy Uncertainty (TPU) and the volatility inherent in the Gulf Cooperation Council (GCC) Islamic stock markets by employing the novel Quantile Vector Auto Regression (QVAR) with “Extended Joint” and “Frequency” domain connectedness technique. Overall findings indicated a U-shaped pattern in the shock-transmission mechanism with the higher TPU shocks transmitted towards Islamic stock market volatility at the extreme quantiles and in the long term. The “Extended Joint” QVAR connectedness approach highlights that, in bearish and moderate-volatility conditions (τ = 0.05, 0.50), diversifying portfolios across less shock-prone equity markets like Qatar and UAE can mitigate risk exposure to TPU shocks. Specific economies receiving higher TPU shocks, like Bahrain, Kuwait, and Saudi Arabia, should implement strategic frameworks, including trade credit insurance and currency hedging, for risk reduction in trade policy shocks during the bearish and moderate-volatility conditions. Conversely, Qatar and Kuwait show the least transmission of error variance from TPU during higher-volatility conditions (τ = 0.95). Moreover, the application of the Frequency-domain QVAR technique underscores the need for short-term speculators to exercise increased vigilance during bearish and bullish volatile periods, as TPU shocks can exert a more substantial influence on the Islamic equity market volatility of Bahrain, Oman, Kuwait, and Saudi Arabia. Long-term investors may need to tailor their asset-allocation strategies by increasing allocations to more stable assets that are less susceptible to TPU shocks, such as Qatar, during bearish (τ = 0.05), moderate (τ = 0.50), and bullish (τ = 0.95) volatility.

1. Introduction

The United States finds itself entangled in numerous trade conflicts involving both allies and adversaries. Simultaneously, it is actively engaged in negotiations or terminations of trade agreements with a multitude of trading counterparts (Nantembelele et al. 2023). The influence of the trade war shock on U.S. equity markets can be delineated through two primary mechanisms. Firstly, the growth news channel, influencing shareholders’ growth prospects, and secondly, the mechanism of risk premium, which adjusts risk appetite amid economic uncertainty (Chen et al. 2023). Trade wars, as observed, are marked by the U.S. implementing tariffs and quotas on imports, provoking retaliatory measures from affected nations, and holding the potential for future TPU escalations (Suwanprasert 2022). Noteworthy findings suggest that 2019 witnessed the slowest global growth since the 2008 global financial crisis, attributed to the surge in Trade Policy Uncertainty within the United States (Caldara et al. 2020).

In May 2019, the United States augmented tariffs on Chinese commodities valued at $200 billion, escalating the rates from 10% to 25%. This adjustment was a response to the escalating trade tensions, as reported in the “World Economic Outlook” news release by the International Monetary Fund (IMF) (International Monetary Fund 2019). Subsequently, China’s reaction resulted in a downgrade of growth projections for both China and developing Asian countries. This development aligns with expectations regarding the global economic repercussions stemming from heightened trade tensions and the associated confidence effects (Bonga-Bonga and Mpoha 2024; Lea 2019). Remarkably, extant scholarly literature has not delved into the intricate dynamics of the shock-transmission mechanism that interconnects the volatility of Islamic stock markets within the GCC nations with the uncertainty shocks emanating from U.S. trade policy.

The impetus to scrutinize the transmission of shocks between GCC financial market volatility and U.S. trade policy uncertainties is substantiated in various instances. In 2015, the “Joint Comprehensive Plan of Action” regarding Iran’s nuclear program had repercussions on the economic connections between the United States and the GCC (Khodadadi 2018). From 2014 to 2016, considerable oil price oscillations influenced both trade policies (Song et al. 2023) and the oil-dependent economies of Gulf nations. In the year 2017, a diplomatic discord unfolded when numerous Gulf countries, such as Bahrain, Egypt, Saudi Arabia, and the UAE, terminated their connections with Qatar (Selmi and Bouoiyour 2020). Simultaneously, the Trump administration imposed global-scale trade regulations in the same year, including tariffs on steel and aluminum (Caldara et al. 2020). The Abraham Accords, facilitating the normalization of relations between Israel, the UAE, and Bahrain, exert indirect impacts on regional trade dynamics within the Gulf Cooperation Council. The global pandemic, starting its impact in late 2019, led to far-reaching economic consequences (Suleman et al. 2023b). Against this backdrop, the articulation of U.S. politicians’ prospective trade policies during the presidential election campaign added complexity to potential alterations in Trade Policy Uncertainty (TPU), exacerbating existing uncertainties (Noland 2018). In reaction to Saudi Arabia’s current resolution to reduce its oil production, legislators affiliated with the Democratic Party have purposed for a cessation of armaments relocations and military support to the country. This decision is seen as a diplomatic rebuff to the United States and is anticipated to result in increased expenses for Western countries (Mueller 2022).

A contraction in the export market results in a diminished pool of exporters, leading to a decrease in capital accumulation (Caldara et al. 2020). The TPU shocks can alter demand dynamics, favoring domestically produced items and disrupting imports to the U.S. from other nations (Yu et al. 2023). The expectation of heightened TPU, manifested as anticipated future tariff increases, affects various economic indicators, including inflationary pressure, fluctuations in currency rates (Byrne et al. 2008), and instability in equity markets (He et al. 2021). Caldara et al. (2019) argue that elevated TPU shocks result in enduring adverse consequences on financial investments and global economic activity. Bloom (2014) posits that increased TPU may prompt businesses to postpone investments, reduce employment, and undermine investor confidence and expenditure, ultimately slowing down global economic activity. Additionally, Nantembelele et al. (2023) demonstrated how tariff increases led to trade diversion and creation for emerging economies, concurrently exerting a detrimental impact on trade volume and economic development in both the U.S. and China.

Motivated by the previously mentioned discoveries, the first objective is to reconnoiter the dynamic process of shock propagation between Trade Policy Uncertainty (TPU) shocks originating from the United States and the fluctuation in Sharia-compliant stock markets within Gulf Cooperation Council (GCC) member nations. This examination encompasses various quantiles, specifically assessing the TPU shock transmission towards bullish, moderate, and bearish stock volatility conditions, alongside varying degrees of TPU intensity. A second objective is to explore the dynamic shock-transmission mechanism between TPU and the conditional volatility of Islamic stock markets in the GCC region across different quantiles and frequency wavelengths, considering both short- and long-term time periods. This research holds significance in guiding financial market participants in the GCC region in strategic asset allocation. Analyzing the impact of TPU shocks on stock market volatility under diverse conditions and time frames provides valuable insights for both short-term speculators and long-term shareholders to adjust their investment strategies judiciously. In the prevailing context of unpredictable international trade dynamics, confirming the connection between trade uncertainty and volatility within Islamic stock markets takes on heightened significance. This is particularly crucial, given the context of the bilateral trade association between the GCC and the U.S. The comprehension of the dynamic interplay between Islamic stock return volatility and TPU is particularly advantageous for exporters, importers, speculators, and long-term shareholders in making well-informed investment decisions across a spectrum of stock market volatility conditions and investment time horizons.

This study advances the existing literature in different manners. Firstly, in the existing literature, previous studies have predominantly focused on the symmetrical shock-transmission mechanisms between equity market returns and U.S. economic policy uncertainty (Smales 2020; Hu et al. 2024; Shi and Wang 2023), as well as the transmission of shocks between emerging and developed financial markets and U.S. financial system stress (Altınkeski et al. 2024). However, a notable gap exists in the exploration of the dynamic shock-transmission mechanism between TPU and the volatility of Islamic financial markets in GCC member economies. Previous investigations have predominantly concerted on the symmetrical shock propagation mechanisms between TPU shocks originating from the U.S. and the equity returns of either the U.S. or China. Notably, certain studies have highlighted the deleterious repercussions of TPU on the U.S. stock market equity premium (Li et al. 2022) and its capacity to significantly impact stock liquidity and increase the stock price crash risk in China, thereby diminishing the risk-taking initiative of financial institutions (Hu et al. 2024). More recently, He et al. (2021) employed the symmetrical TYP-VAR and found that U.S. trade policy shocks have favorable effects on U.S. stock market returns while negatively affecting China’s equity market indices. Similarly, according to Crowley et al. (2018), Chinese companies exhibit a reduced likelihood of entering new markets in the presence of elevated TPU shocks. Additionally, Bianconi et al. (2021) observed that, despite the absence of evidence indicating compensation for undertaking such risk, recent studies have demonstrated significant tangible consequences of TPU shocks on trade, employment, and investment. Secondly, this study employs Quantile Vector Auto Regression (QVAR) with the “Extended Joint” connectedness framework by Cunado et al. (2023) to explore the extreme shock transmission between TPU and conditional volatility in GCC Sharia-compliant financial markets. An enhanced standardization strategy improves the precision of results in this upgraded connectedness method (Cunado et al. 2023). This sets it apart from GVAR-based “joint” connectedness (Lastrapes and Wiesen 2021), traditional GVAR connectedness (Diebold and Yilmaz 2009, 2012), and TYP-VAR connectedness methods (Antonakakis et al. 2020), incorporating a normalization method based on . In contrast to “joint” connectedness approach of Lastrapes and Wiesen (2021), the “Extended Joint” approach captures the network of “net pairwise dynamic connectedness”, estimating a graphical representation of shock transmitters and absorbers across quantiles. However, QVAR with “Extended Joint” connectivity does not investigate shock transmission over different frequency wavelengths (higher and lower). In order to tackle this, we combine the frequency-domain connectedness technique developed by Baruník and Křehlík (2018) with the conventional QVAR methodology of Ando et al. (2022) and Chatziantoniou et al. (2021), adhering to the methodological criteria provided by Chatziantoniou et al. (2022). Given divergent results over short- and long-term periods, strategic portfolio diversification benefits both long-term investors and short-term speculators. Under various volatility scenarios (quantiles) and time durations (higher and lower frequencies), diversification helps distribute risk, potentially mitigating negative effects of trade policy uncertainty.

The choice to employ quantile domain connectedness approaches is grounded in the recognition that relying solely on conditional mean model results and the informational content of low-frequency variables provides inadequate support for exploring robust and credible connectedness patterns among financial variables (Iacopini et al. 2023). Considering the potential for substantial fluctuations in the cause-and-effect connection between the tails of the distribution and its central region, it is crucial to acknowledge that the conditional mean signifies just a single element of the conditional distribution across various quantiles (Benkraiem et al. 2018; Suleman et al. 2022). This acknowledgment aligns with the understanding that structural breakdowns are now widely acknowledged as an integral aspect of time series in the economy (Demirer et al. 2018). Such breakdowns are frequently associated with significant international events, such as TPU (Hau et al. 2022). The identification of an asymmetric or uneven shock-transmission mechanism between TPU and conditional risk in financial markets (Hau et al. 2022) may be attributed to the ensuing nonlinearities in the dynamics of time series data.

The findings based upon the Extended Joint QVAR connectedness approach suggested that during the bearish and moderate conditional volatility conditions , investors should consider diversifying their portfolios by spreading investments across different asset classes and financial markets of different geographic region that showed lower shock-reception capability from TPU shocks. This includes the financial markets of Qatar and U.A.E. to reduce risk exposure to TPU as these markets received lower error variances from TPU. The specific economies like Kuwait, Bahrain, and Saudi Arabia should establish policy guidelines and a strategic framework for businesses to access risk-mitigation tools such as trade credit insurance and currency hedging to reduce exposure to trade policy shocks during the bearish and moderate-equity market conditional risk. However, during the bullish conditional risk conditions (), economies receiving the higher TPU shocks, such as UAE, Bahrain, and Saudi Arabia, should develop and maintain real-time monitoring systems to promptly detect and respond to shifts in trade policy uncertainty, enabling proactive risk-mitigation measures. Moreover, ethical investment strategies adhering to Sharia principles should be crafted considering the specific volatility conditions in Islamic financial markets. To illustrate, during periods of lower volatility (quantiles), the conditional volatility in the Islamic financial markets of Qatar and U.A.E exhibited the smallest error variances resulting from TPU shocks. Conversely, in times of higher volatility (bullish conditions), TPU shocks led to the least transmission of error variance in the conditional volatility of Qatar and Kuwait. Therefore, GCC investors should consider the bearish, bullish, and moderate fluctuations in equity market conditional volatility when developing hedging strategies to mitigate the impact of heightened TPU shocks. Meanwhile, speculators in the GCC region should evaluate investment opportunities based on bearish, bullish, and moderate-equity market volatility trends and integrate quantile-based hedging techniques into their forecasting models to better predict the adverse effects of TPU shocks.

The justification for an intensified transmission of TPU shocks to the GCC stock markets stems from the substantial influence of global economic expansion on the profitability of companies and government revenue within these nations. The financial outcomes in question are primarily shaped by variables such as oil prices and exports. A myriad of international macroeconomic linkages, encompassing cross-border trade, foreign direct investments, and monetary policies, collectively contribute to the dissemination of information, as delineated by scholarly works (Crowley et al. 2018; Bao et al. 2022). Given the GCC economies’ fixed exchange rates to the US dollar, necessitating spillover of shocks from US trade policies, a consequential relationship emerges with the potential shocks in US market. As a result, various mechanisms come into operation, and fluctuations in U.S. and other global stock markets may exert an influence on the volatility of the GCC Sharia-compliant stock market, as articulated in academic research. This underscores the imperative for a nuanced comprehension of the intricate dynamics at play and their implications for the transmission of TPU shocks in GCC stock markets.

Furthermore, the Extended Joint QVAR connectedness approach indicates that the TPU shocks from the U.S. at higher quantiles affected the conditional volatility in Bahrain, Oman, U.A.E, and Saudi Arabia more adversely as compared with median and bearish quantiles . In 2018, Trump imposed international tariffs on aluminum and steel, which saw a reduction towards the end of his presidency (Sachdev and Rao 2025). However, Biden reinstated them in February 2021 due to concerns about their adverse effects on American sectors and trade clarity1. Despite strong U.S.-U.A.E. diplomatic ties and the crucial role of steel and aluminum trade for both economies and national security, the U.S.-U.A.E. Business Council opposed the imposed levies (U.S.-U.A.E. Business Council 2024). Moreover, trade conflicts notably affect Arab nations’ economies, evident in the decline of oil prices since March 2018 despite supply shocks from oil embargoes with Venezuela and Iran. Oil prices fell from approx. $68 per barrel in May 2018 to approx. $55 per barrel in August 2019.

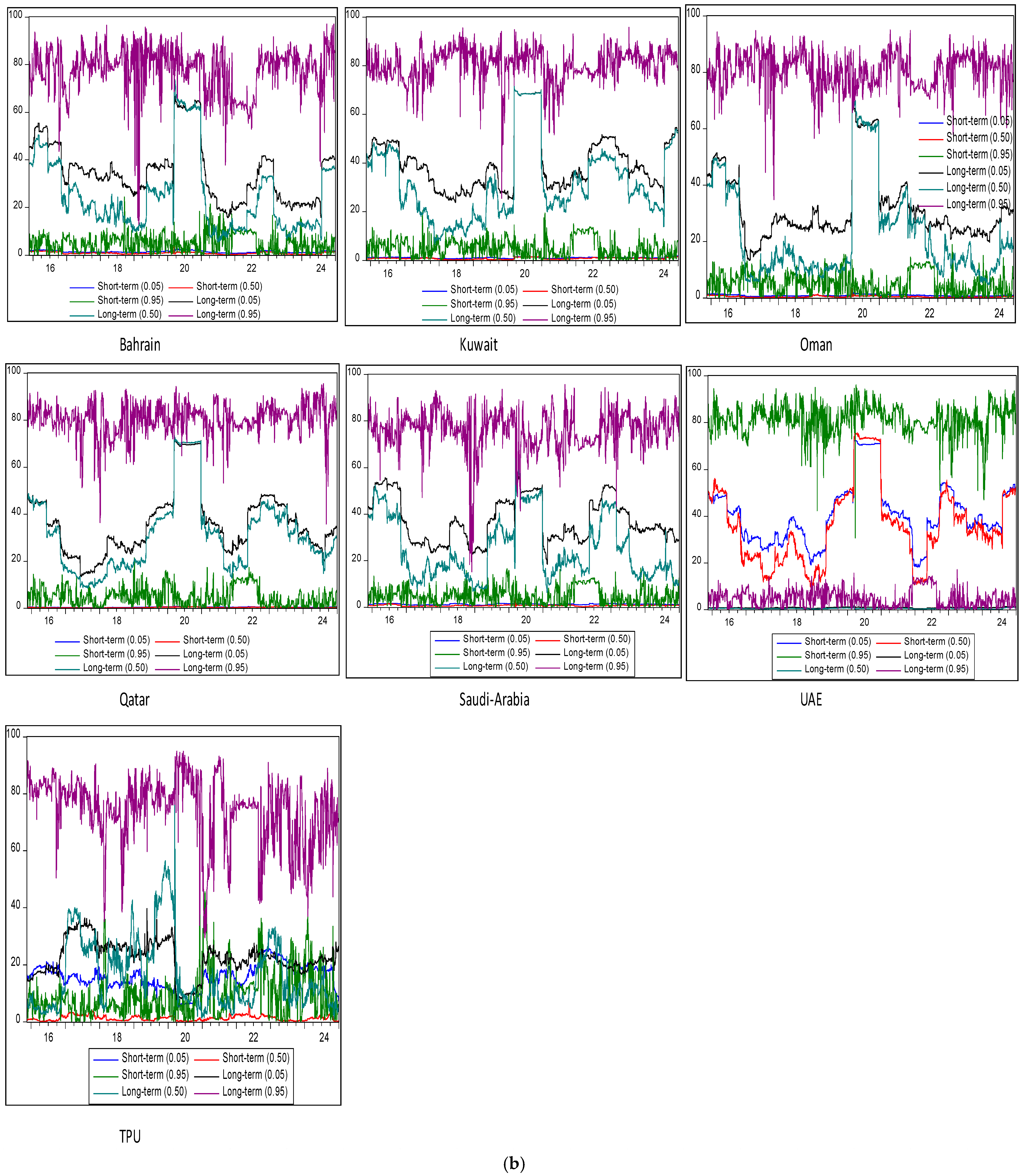

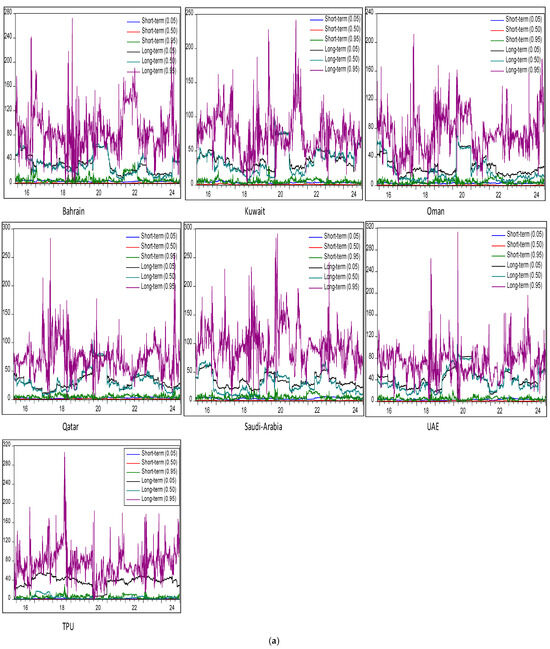

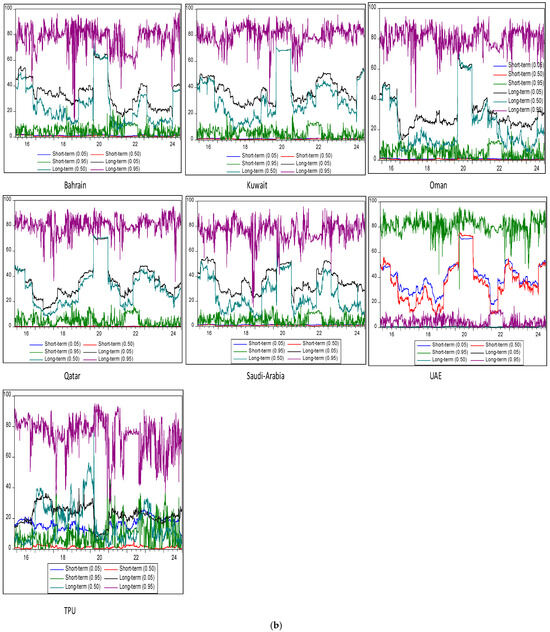

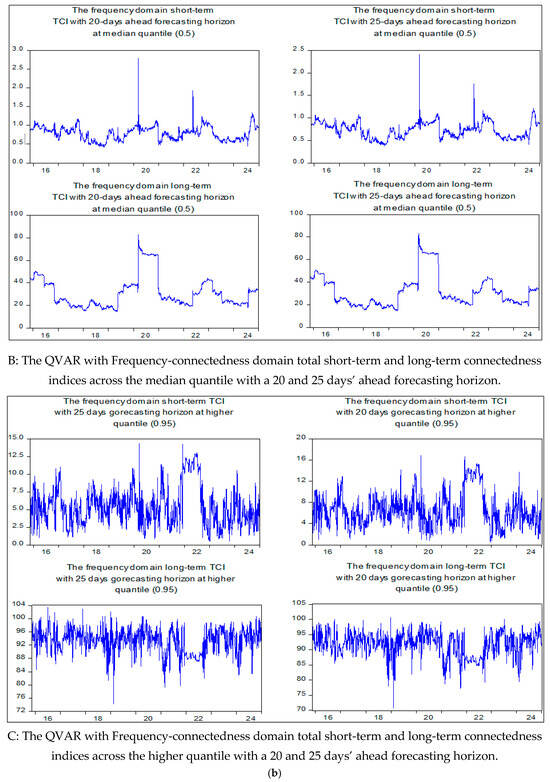

Moreover, our findings, which relied on the frequency-based QVAR technique, also purpose several applied insinuations. In the short term, especially at extreme higher and lower quantiles , TPU shocks result in the most substantial propagations of shocks in the conditional volatility of Bahrain, Oman, Kuwait, and Saudi Arabia. For instance, at lower (higher) quantiles, TPU shocks led to the highest forecast error variances of 0.28%, 0.20%, 0.18%, and 0.28% (0.89%, 0.81%, 0.82%, and 0.80%) in the conditional volatility of Bahrain, Oman, Kuwait, and Saudi Arabia’s Sharia-compliant financial markets, respectively. This underlines the necessity for risk managers and short-term speculators to exercise increased vigilance during bearish and bullish conditional risk periods, as TPU shocks can exert a more substantial and immediate influence on the financial market volatility in Bahrain, Oman, Kuwait, and Saudi Arabia. It may necessitate adjustments in their risk-management and portfolio strategies accordingly. Whereas long-term investors should incorporate periodic portfolio rebalancing into their investment strategy. Rebalancing can help maintain a desired risk-return profile by adjusting portfolio allocations and investing in Sharia-compliant financial markets of Qatar as the conditional risk of the financial market of Qatar received the lowest spillover of shocks from TPU during the bearish, bullish, and moderate conditional risk conditions. Furthermore, during the bullish volatility conditions, the equity market of Qatar also received the lowest error variances from the TPU shocks in the short term. Long-term investors may need to adjust their asset-allocation strategies by reducing exposure to Sharia-compliant financial markets in Bahrain, Oman, and Saudi Arabia during periods of bearish volatility, as well as limit their investments in Bahrain and the UAE’s equity markets during phases of heightened conditional risk (higher quantiles). Conversely, they may consider increasing their allocations to more stable assets, such as Qatar’s Sharia-compliant financial market, to enhance portfolio resilience. These findings highlight the critical role of strategic asset allocation, a fundamental principle in modern portfolio theory.

The paper’s structure is as follows: Section 2 explores the economic rationale for extreme shock transmission between TPU and financial markets. Section 3 and Section 4 cover data aspects and the chosen research methodology. Section 5 discusses research findings and their practical implications, and Section 6 concludes with remarks and proposes future research directions.

2. Literature Review

Transmission Mechanism Between Trade Policy Uncertainty (TPU) Shocks and Financial Markets

The fortification of global financial sector integration is facilitated through the establishment of free trade zones, which possess the capacity to diffuse trade shocks emanating from a specific region to other global regions (Bloom 2009). The indeterminate decisions and fluctuations arising from U.S. economic policy, particularly within the domain of trade, exert a profound influence on the global economic landscape (Caldara et al. 2020; Li et al. 2022). Dées and Saint-Guilhem (2011) affirm that, relative to other developed nations, shocks originating in the United States yield more pronounced spillover effects towards emerging economies. Owing to their interconnections with the United States via international trade, a majority of the world’s economies are highly vulnerable to trade-related uncertainties (Nantembelele et al. 2023). For instance, Fink and Schüler (2015) have emphasized that financial stress shocks emanating from the United States may adversely affect the structured economic dynamics of developing nations. Moreover, when financial stress shocks transpire, emerging economies endure consequences akin to those witnessed in the actual economy of the United States. However, no effort is made to explore the dynamic shock propagation between TPU and GCC financial market volatility.

The TPU (Trade Policy Uncertainty) has the potential to exert adverse effects on financial markets through various channels. The initial avenue involves exporters’ or importers’ perspectives, as elucidated by Li et al. (2022). Taking the instance of a GCC-listed firm primarily engaged in exports, an escalation in tariffs by a foreign nation, such as the United States, could result in a downturn in performance for the company. This downturn is attributable to increased prices and the loss of a pricing advantage. The second channel pertains to investor sentiment, wherein heightened TPU levels prompt market participants to lower their expectations, possibly inducing a state of panic (Li et al. 2022). Bianconi et al. (2021) posit that industries more susceptible to TPU experience more pronounced declines in stock values during periods of uncertainty, with greater variability in returns observed at significant policy announcement dates. According to Brennan (1991), stock prices, guided by the rational asset-pricing theory, are determined by the discounted value of the stream of future dividends. Consequently, adjustments to discount parameters or future return expectations resulting from TPU shocks lead to increased variances, amplifying the excess volatility of the equity market.

Research by Li et al. (2023) utilizing an ordinary least squares regression framework reveals an inverse correlation between TPU and financial investment by businesses in the Chinese environment. This suggests that firms tend to decrease financial investment in periods of heightened trade policy uncertainty. Additionally, Hu et al. (2024) delve into the exploration of diverse shock-transmission channels through which TPU impacts the risk-taking initiatives of the banking industry in China. The overall findings suggest that TPU shocks diminish the bank’s capacity to assume additional risk, influencing liquidity, stock market risk, and equity market indicators. Increased credit spreads and risk premiums, business investment delays, and consumer postponement of durable goods purchases due to the trade uncertainty can all contribute to a decline in economic activity (Baker et al. 2022). Furthermore, Baker et al. (2016) discover that changes in U.S. economic policy are linked to increased stock market volatility as well as decreased investment and employment in industries like infrastructure and finance that are sensitive to policy. According to Handley and Limão (2017), the reduction of ambiguity over future trade policy enhances economic development, and TPU restricts export investment. In a similar vein, Caldara et al. (2020) contend that higher TPU lowers economic activity and investment. According to Crowley et al. (2018), a rise in TPU increases the risk that businesses would leave export markets and decreases their likelihood of entering new international markets. Therefore, there is a tendency for trade policy shocks to increase the volatility of the equities market.

Trade Policy Uncertainty (TPU) exerts a notable influence on the macroeconomic landscape and the market economy, introducing challenges for financial institutions in accurately forecasting market dynamics and policy landscapes. The imprecise nature of TPU hampers the ability of enterprises to anticipate and plan for market fluctuations and navigate policy environments effectively (Handley and Limão 2017; Caldara et al. 2020). Notably, research by Hu et al. (2024) suggests that the impact of TPU shocks in the United States may exacerbate the financial vulnerabilities of micro-entities, thereby contributing to heightened volatility in financial markets. This underscores a diminishing predictability in U.S. trade policy over recent years. This decrease in predictability is attributed to the Trump administration’s departure from the multilateral norms established by the World Trade Organization (WTO) to advance its own policy objectives in trade relations with its partners (Hopewell 2021). Consequently, the economy is exposed to frequent and novel TPU shocks, stemming from the WTO’s inability to enforce its regulations and its diminishing commitment to the global trading system (Hopewell 2021). In light of these circumstances, this study represents the inaugural attempt to investigate the correlation between financial market volatility and the transmission of severe shocks originating from U.S. TPU disruptions.

3. Data with Descriptive Statistics

3.1. Data

We analyze the aggregated daily conditional volatility series of Islamic stock markets to investigate the transmission dynamics of trade policy uncertainty shocks in both the temporal and frequency domains toward the stock markets governed by Sharia law in the Gulf Cooperation Council (GCC) nations. The conditional volatility series of GCC stock markets are extracted through GARCH (1,1) approach with the Generalized Error Distribution (GED) term. The appropriate model in-between GARCH (1,1) with a student’s t and GED term is selected according to the log-likelihood, AIC, SC, and HQ values. The data-collection period spans from 1 February 2015 to 1 January 2025, aligning with the temporal parameters specified in the study conducted by Li et al. (2022). The selection of this time frame is contingent upon the availability of data pertaining to Sharia-compliant equities markets in the GCC region, encompassing Saudi Arabia, Bahrain, Kuwait, Qatar, the UAE, and Oman, accessible through https://www.spglobal.com.

The daily Sharia-compliant equity market index data for Bahrain (https://www.spglobal.com/spdji/en/indices/equity/sp-bahrain-bmi-shariah/, accessed on 5 January 2025), Kuwait (https://www.spglobal.com/spdji/en/indices/equity/sp-kuwait-bmi-shariah/#overview, accessed on 5 January 2025), Qatar (https://www.spglobal.com/spdji/en/indices/equity/sp-qatar-bmi-shariah/#overview, accessed on 5 January 2025), the UAE (https://www.spglobal.com/spdji/en/indices/equity/sp-united-arab-emirates-bmi-shariah/#overview, accessed on 5 January 2025), and Saudi Arabia (https://www.spglobal.com/spdji/en/indices/equity/sp-saudi-arabia-largemidcap-shariah-index/#overview, accessed on 5 January 2025) are first converted into their natural logarithmic returns before estimating the Generalized Autoregressive Conditional Heteroscedasticity (GARCH (1,1)) model, incorporating both a student’s t-distribution and the Generalized Error Distribution (GED). Additionally, the GARCH (1,1) estimates under both distributional assumptions are compared, and the most suitable model is selected based on the highest log-likelihood value and the lowest Akaike Information Criterion (AIC), Schwarz Criterion (SC), and Hannan–Quinn (HQ) values. An extensive daily data set covering a decade (2015 towards 2025) encapsulates significant global trade incidents. These encompass the Brexit referendum, the November 2016 U.S. presidential election, and the trade intimidation against Mexico in 2017 following President Trump’s induction. Additionally, in this day-to-day data set covering 2014 to 2022, vital international trade incidents are integrated. These involve U.S. government discussions on heightened import tariffs in middle of 2017, the imposition of U.S. tariffs on the importation of industrial metals, i.e., aluminum and steel in March 2018, the imposition of taxes on Chinese goods starting 1 July 2018, and the U.S. equity market crash by the end of 2018. Furthermore, noteworthy events such as increased tariff intimidations against Mexico in mid-2019, the systematic distortion in global supply chain network due to the outbreak of COVID-19 virus (Suleman et al. 2023b), and the Russian invasion of Ukraine in early 2022 are also included in this expanded time frame, spanning from 2015 to 2025.

In order to explore the time- and frequency-domain shock spillovers between Trade Policy Uncertainty (TPU) and GCC stock market conditional volatility, we utilize the TPU metric calculated by Caldara et al. (2020). By monitoring the frequency of trade policy and uncertainty phrases in major newspapers, Caldara et al. (2020) create a daily aggregated U.S. Trade Policy Uncertainty (TPU) Index. The TPU indices hits elevated levels after 2016 during U.S. trade conflicts, particularly with China and Mexico. It first spiked following Nixon and Ford’s reforms to trade regulations, then it rose again due to tensions with Japan and NAFTA negotiations during 1990s. Three TPU metrics are constructed by Caldara et al. (2020) using tariff data, company earnings call, and press publicity. Firm-level and aggregate statistics support the conclusion that growing TPU lowers the capital expenditure, investing activities and thereby adversely affecting the economic development. These impacts are explained using a two-country general equilibrium model, which demonstrates how investing activities and economic growth are dampened by trade policy shifts and uncertainty about future trade tariffs (Sheikh et al. 2024). Several world-renowned newspapers, such as The Boston Globe, Chicago Tribune, The Guardian, Los Angeles Times, The New York Times, The Wall Street Journal, and The Washington Post, are incorporated for the estimation of TPU index through computerized phrase searching (Tabash et al. 2024). Normalization to 100 for a one-percent share, the metric represents the daily percentage of publications highlighting TPU (see Caldara et al. 2019; Caldara et al. 2020). In the existing literature, Sheikh et al. (2024) also utilized the similar metric of TPU by Caldara et al. (2020) for the shock-transmission mechanism between uncertainties in trade policies and Australian Islamic, Sustainable, and conventional financial system.

For this research article regarding the impact of TPU shocks on the GCC Islamic stock market conditional volatility, the daily TPU Index covers the period from 1 February 2015 to 1 January 2025 in order to assess the TPU effect on the volatility of the GCC stock market. The daily data on TPU is downloaded from https://www.matteoiacoviello.com/tpu.htm, accessed on 5 January 2025. Incorporating daily data on TPU index estimated by Caldara et al. (2020) provides an additional rationale for constraining the data range to the specific period from 1 February 2015 to 1 January 2025. On the other hand, international financial markets were impacted due to the trade policy instability resulting from the trade conflict between the U.S. and other countries (Yu et al. 2023). According to Nantembelele et al. (2023), changes in U.S. trade policy with China have presented difficulties for emerging Sub-Saharan nations. Moreover, the US Federal Reserve Department emphasizes the negative impact of TPU on international markets, citing economic contraction as a primary factor. Taking cues from this insight, we have chosen to incorporate TPU measure of Caldara et al. (2020) into our analysis. This decision is driven by the acknowledgment of the measure’s relevance in assessing the adverse effects of Trade Policy Uncertainty (TPU) on global economic conditions (see Caldara et al. 2019).

In order to extract the conditional variance series of Sharia-compliant equity market indices of Bahrain, Kuwait, Oman, U.A.E, Saudi Arabia, and Qatar, we utilized the equation () for the naturally logarithmically returns of the equity market indices. Whereas, and Ln are the return of the Islamic equity markets of the GCC region and the naturally logarithmic transformation. Whereas, and are the prices at a time and . Furthermore, in order to extract the conditional variance series of Sharia-compliant equity market returns of Bahrain, Kuwait, Oman, U.A.E, Saudi Arabia, and Qatar, we utilize the Generalized Autoregressive Conditional Heteroscedastic approach (GARCH (1,1)) by Bollerslev (1986) with a student’s t and Generalized Error Distribution (). The GARCH (1,1) framework with a student’s t distribution is best suited for capturing fat-tailed behavior in stock market data and is used when financial returns show heavy tails, or more extreme returns than a normal distribution. The student’s t GARCH (1,1) technique works best when returns exhibit even more substantial shocks. However, GARCH (1,1) with the GED term, on the other hand, incorporates both fat-tailed and thin-tailed behavior based on its form parameter. In cases when the return distribution is not too fat-tailed but nevertheless deviates from normality, the GARCH (1,1) technique with the GED term can offer a suitable fit. Therefore, if the GARCH model with a student’s t distribution performs worse, it suggests that the data does not exhibit extreme tail behavior as strongly as expected. In cases where shocks or severe returns are less frequent but still occur, the GED distribution is more effective in capturing volatility than a student’s t. The mean (Equation (1)) and variance (Equation (2)) equations of the GARCH (1,1) model with a student’s t and GED distributions can be expressed as follows:

In the above equation, and are the return series of GCC Islamic stock markets and constant term. Whereas, is the autoregressive coefficient and estimates the lag effects of 1 day prior effect of returns () on the present-day dynamics. is characterized as error term.

In the above equation, is the variance series of Sharia-compliant equity market returns GCC economies at a time t and is the constant term. Whereas, captures past squared error affect and characterized as ARCH effect. Furthermore, captures the prior day variance effect and characterized as GARCH parameter. is the lagged innovation term and is the GARCH parameter and estimates the effect of one period lagged variances (past variance effect). The in Equation (2) captures the one period lag effect of the conditional variances on the present dynamics of conditional variance of the individual GCC member economies (Bahrain, Oman, Qatar, UAE, Saudi Arabia, and Kuwait). Therefore, the GARCH (1,1) model captures long-term persistence through the GARCH term ( and short-term volatility clustering is captured through the ARCH effect (.

3.2. Descriptive Statistics

Table 1a presents the descriptive statistics of the natural logarithms of equity market indices for the Gulf Cooperation Council (GCC) member economies, namely Bahrain, Kuwait, Oman, Qatar, and the United Arab Emirates (UAE). Additionally, Table 1a provides the descriptive statistics of Trade Policy Uncertainty (TPU), which is incorporated in this study to analyze the impact of quantile-domain TPU-driven shocks on GCC Sharia-compliant equity markets across different frequency horizons (long-term and short-term). Table 1b reports the descriptive statistics of the natural logarithms of the return series for GCC member economies. According to Table 1a, the equity market indices of Qatar, Oman, and Kuwait exhibit the highest average values of 7.43, 6.55, and 6.54, respectively, compared to the remaining GCC Sharia-compliant stock market indices. Furthermore, the Islamic stock market indices of Kuwait, Bahrain, and Saudi Arabia display the highest standard deviation values of 0.277, 0.271, and 0.263, respectively, indicating greater volatility with frequent upward and downward fluctuations in market prices compared to the other GCC economies. Moreover, Table 1b reveals that the Sharia-compliant equity market returns of Bahrain and Kuwait exhibit the highest average values of 0.00016 and 0.00015, respectively, exceeding those of the other GCC member economies, including Saudi Arabia (0.00014), Qatar (−0.00009), Oman (−0.00026), and the UAE (0.00006). Additionally, Table 1b highlights that the logarithmically transformed return series of Bahrain and the UAE exhibit the highest standard deviation values (SD) of 0.0124 and 0.0103, respectively, followed by Saudi Arabia (0.0096) and Qatar (0.0094). This indicates frequent fluctuations in Sharia-compliant equity market returns due to deviations from the mean return values. Lastly, Table 1b also demonstrates that the Sharia-compliant equity market returns of Kuwait and the UAE exhibit higher excess kurtosis values, reflecting a leptokurtic distribution of returns, which suggests the presence of extreme outliers in the data.

Table 1.

(a) The descriptive statistics of the naturally logarithmically transformed stock market indices of GCC member economies. (b) The descriptive statistics of the naturally logarithmically transformed return series of the stock market indices of GCC member economies.

The student’s t distribution is therefore ideally suited for simulating severe occurrences and significant equity market disruptions as it explicitly takes these hefty tails into consideration. When financial returns exhibit excessive kurtosis (see Table 1b), fat tails are present, indicating that extreme returns—both positive and negative—occur more frequently than they would under a normal distribution. Table 1b also shows that the excess kurtosis values of Kuwait (137.37) and UAE (36.41) are exponentially higher as compared with the excess kurtosis values of Bahrain (13.19), Oman (9.87), and Saudi Arabia (14.57). Therefore, GARCH (1,1) with the Generalized Error Distribution (GED) term can handle both thicker and lighter tails, the GED distribution is more adaptable than the normal distribution. GED’s shape parameter enables it to adapt to varying tail thickness levels, which makes it useful for capturing return distribution fluctuations. GARCH models with a student’s t and GED aid in more precisely modeling times of high and low volatility since financial returns frequently show volatility clustering.

Table 2 demonstrates that the GARCH (1,1) model with a Generalized Error Distribution (GED) is more suitable for estimating the conditional volatility series of Sharia-compliant equity market returns in Bahrain, Kuwait, Oman, Qatar, the UAE, and Saudi Arabia compared to the GARCH (1,1) model with a student’s t-distribution. The appropriateness of the GARCH (1,1) model with GED is determined based on its lower Akaike Information Criterion (AIC), Schwarz Information Criterion (SIC), and Hannan–Quinn Criterion (HQ) values, as well as its higher log-likelihood values relative to the GARCH (1,1) model with a student’s t-distribution (see Table 2). Thus, even though the Islamic stock market returns of GCC member economies exhibit fat-tailed distributions, the GARCH (1,1) model with GED remains the more appropriate choice when AIC and SIC values are lower and the log-likelihood is higher than that of the GARCH (1,1) model with a student’s t-distribution. This superiority is due to the model’s ability to effectively accommodate both thicker and thinner tails and its greater adaptability to varying tail densities. Additionally, Table 2 indicates that both the ARCH and GARCH terms in the GARCH (1,1) model with GED are statistically significant and positive, with their combined sum remaining below 1. This suggests that the GARCH (1,1) model with GED term satisfies covariance stationarity conditions, exhibits stable dynamics, and ensures that conditional variances revert to their long-term mean, reinforcing the mean-reverting nature of volatility with no evidence of indefinite persistence. Furthermore, the significance of the ARCH and GARCH terms confirms the presence of volatility clustering, where small changes are likely to be followed by small changes and large changes by large changes.

Table 2.

The coefficients of GARCH (1,1) approach with student’s t and Generalized Error Distribution (GED).

Table 2 also indicates that the ARCH term () for Sharia-compliant equity market returns in Bahrain (0.12) and Saudi Arabia (0.10), as estimated using the GARCH (1,1) model with a Generalized Error Distribution (GED), is higher than that of the other GCC member economies. This suggests a strong impact of past squared shocks on current volatility dynamics, as past squared return shocks contribute to greater short-term volatility spikes. Conversely, the significantly higher GARCH parameter () value of 0.9136 for Qatari equity market returns as compared with rest of the GCC member economies’ stock returns highlights the pronounced influence of past variances on the present-day dynamics of conditional variance in Qatar’s Sharia-compliant equity market (see Table 2). Moreover, the higher GARCH coefficient values of 0.82, 0.85, 0.91, 0.86, 0.87, and 0.84 for Bahrain, Oman, Qatar, Kuwait, the UAE, and Saudi Arabia, respectively, compared to the corresponding ARCH coefficients, indicate that the one-period lagged effect of conditional variances exerts a stronger influence on present-day conditional variances than past squared return shocks. This suggests that volatility takes a longer time to stabilize following a shock, potentially leading to lower mean reversion. Furthermore, across all GCC equity markets, the ARCH effect is significantly weaker than the GARCH effect, implying that volatility exhibits a smoother pattern and does not spike sharply in response to short-term shocks.

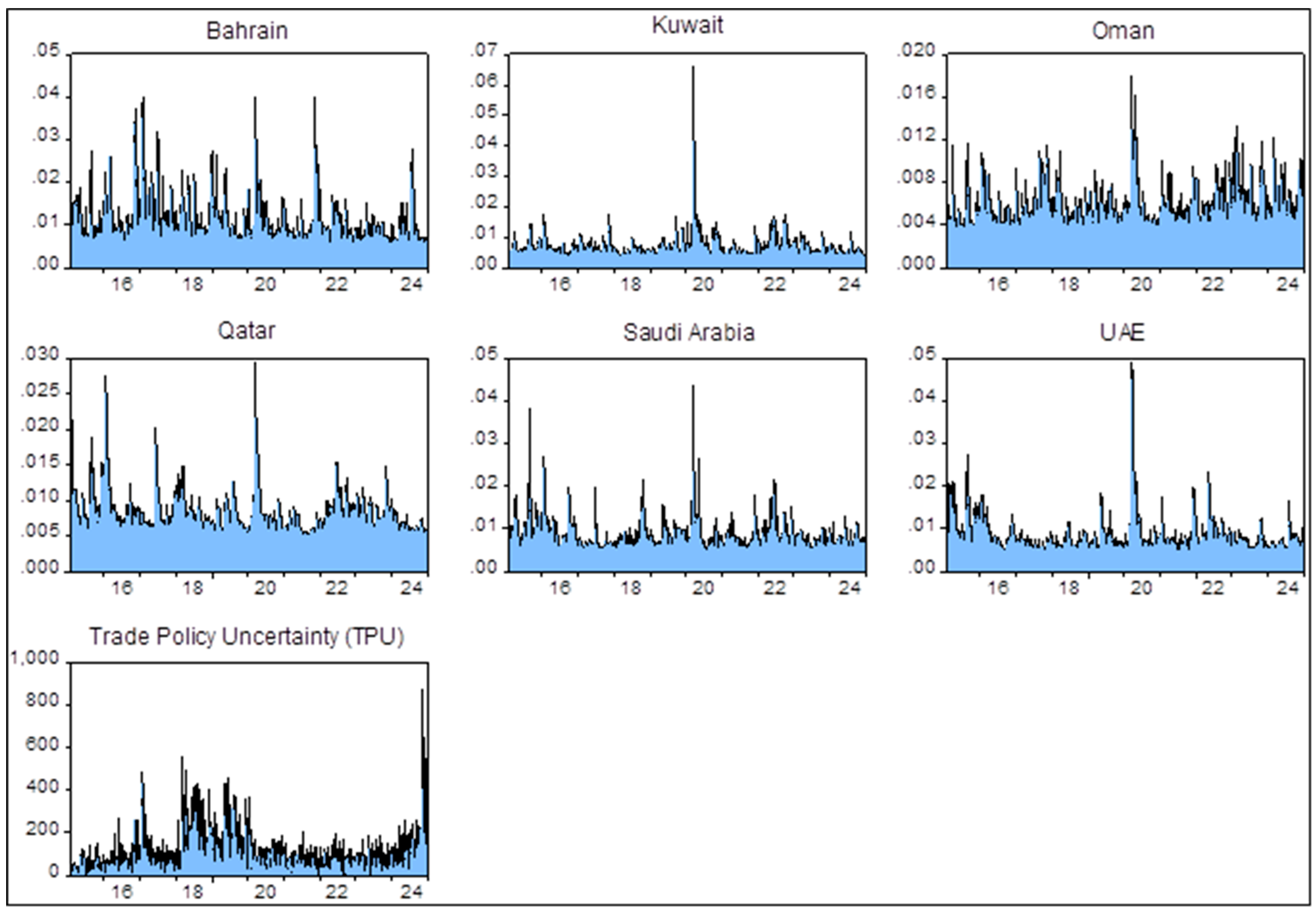

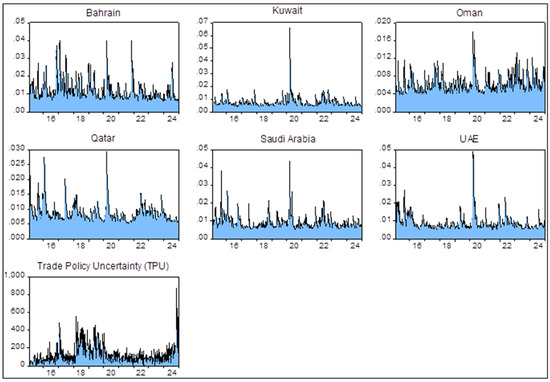

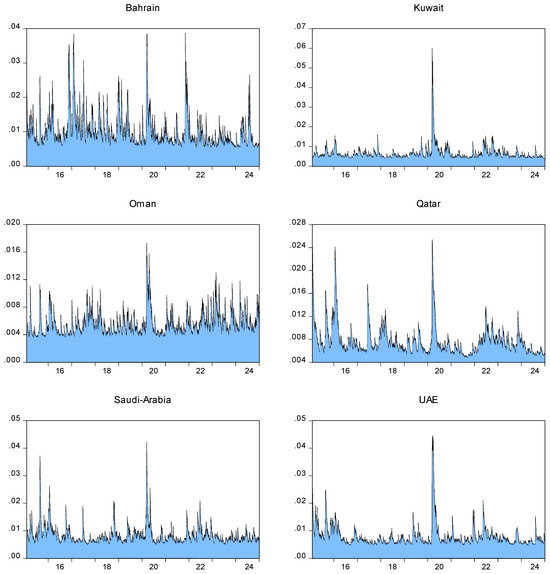

Table 3 provides an overview of the descriptive statistical characteristics of the conditional volatility in Sharia-compliant equity markets of GCC member economies (specifically, Bahrain, Kuwait, Oman, Qatar, Saudi Arabia, and the UAE). Furthermore, Table 3 also highlights that the average Trade Policy Uncertainty (TPU) remains elevated at 86.39, with a substantial standard deviation (SD) value of 79.39. Figure 1 illustrates a continuous escalation in TPU from 2015 through the end of 2017, with an additional rise in uncertainty indices related to trade policy observed in 2018. Figure 1 also illustrates that the conditional risk in Islamic stock markets across all member economies of the GCC experienced frequent increments during the corresponding time intervals. This phenomenon can be ascribed to diverse factors, including oscillations in oil prices from 2015 to 2016 and the diplomatic rift within the GCC in 2017. During this event, multiple GCC member economies severed diplomatic relations with Qatar, potentially affecting regional trade dynamics. Another factor that played a role is the Joint Comprehensive Plan of Action agreement, which removed specific economic sanctions on Iran. This, in turn, had an impact on trade dynamics and geopolitical situations within the GCC concerning the United States.

Table 3.

Descriptive statistics of the Islamic stock market conditional volatility of GCC member economies.

Figure 1.

Graphical representation of Trade Policy Uncertainty (TPU) and conditional volatility series of GCC Sharia-compliant Islamic financial markets estimated through GARCH (1,1) with GED term.

Figure 1 also discloses that TPU experienced a sharp increase during the COVID-19 epidemic, and a similar pattern of heightened variability is noticeable in the conditional volatility sequences of all GCC Islamic financial markets during the COVID-19. According to Table 3, the highest mean conditional volatility of 0.016 is exhibited by Bahrain followed by Saudi Arabia, UAE, and Qatar with the average conditional volatility values of 0.0085, 0.0084, and 0.0082, respectively. Whereas, Figure 1 also shows that these economies (Bahrain, Saudi Arabia, UAE, and Qatar) experienced the higher conditional risk as compared with Kuwait and Oman with the upside variation in volatilities increases during the COVID-19 time. Shareholders should manage risk by diversifying investment portfolio across countries with relatively lower volatility, such as Kuwait and Oman. This approach can help spread risk and reduce exposure to extreme market movements in specific Islamic countries.

Table 3 also shows that all the Sharia-compliant GCC financial markets possess higher excess kurtosis due to the presence of extreme outliers, and this may signify the presence of extreme risk for faith-based investors of GCC region. Additionally, the utilization of a quantile-centric methodology to explore the dynamic shock-transmission process between TPU and conditional risk in financial markets is supported by the presence of a leptokurtic scattering in the conditional volatility series of Islamic stock markets of all GCC member economies. This is further reinforced by the dismissal of the null hypothesis in the Jacque–Berra (JB) test statistics (refer to Table 3) concerning data normality. We also utilize the BDS test of Brock et al. (1996) to assess whether time series data demonstrate non-linearity and non-randomness. The results, outlined in Table 4, offer proof contradicting the null hypothesis that conditional volatility series estimated through GARCH (1,1) with GED term of all Islamic stock markets are distributed independently and uniformly. The BDS test statistics validate this assertion, as the associated p-values are below the 1% significance threshold. As a result, the BDS test estimates in Table 4 discloses the presence of non-linearity or deviations from randomness.

Table 4.

BDS test of non-linearity for Islamic stock market volatility of GCC-member economies.

This suggests that conventional connectedness methods based upon traditional symmetrical VAR approaches for shock-transmission mechanism between TPU and GCC Islamic financial market risk would not be suitable for analysis (Kayani et al. 2024; Sheikh et al. 2024). Accordingly, Suleman et al. (2022) have also suggested that the null hypothesis of the BDS test, which presumes independence and identical distribution of data points, be rejected due to the prevalence of non-linearly trend in financial time series data (see Table 4). As a result, using quantile-based VAR connectedness is more suited in these situations. This serves as a compelling impetus to reconnoiter the mechanism of extreme dynamic shock propagation between TPU and the volatility associated with Sharia-compliant financial markets of all GCC-member economies.

4. Methodology

We examine the recently formulated “Extended Joint” framework for quantile-based vector auto-regression (QVAR) developed by Cunado et al. (2023) to uncover the dynamic shock-transmission mechanism between TPU and the GCC Islamic financial market’s conditional risk. This Extended Joint QVAR connectedness approach produces more precise results by utilizing an enhanced normalization strategy (Cunado et al. 2023). The incorporation of a normalization technique based on the well-established goodness-of-fit metric distinguishes this unique feature from both the joint-connectedness (Lastrapes and Wiesen 2021) and the initial-connectedness measures (Diebold and Yilmaz 2009, 2012). Although Markov regime switching vector auto-regression (MS-VAR) and Threshold vector auto-regression (T-VAR) approaches are intended to identify nonlinearity through threshold effects or regime flips, they frequently need substantial assumptions on the quantity and kind of thresholds or regimes. Choosing the right threshold value or the right number of regimes may often be difficult and result in the model’s correct specification. By looking at impacts at various quantiles, the QVAR technique naturally takes nonlinearity into account without specifying regimes, which lowers the possibility of misspecification and produces a more reliable analysis. Clustering of volatility and fat-tailed distributions are characteristics of financial markets. The QVAR approach is ideally suited to capture the tail dependencies and diverse consequences of shocks, especially when paired with an Extended Joint spillover technique. Because it sheds light on how severe market moves spread across several markets, this is essential for risk management and policymaking. In severe quantile behavior, MS-VAR and TVAR may not provide the same degree of granularity, although being helpful in capturing some nonlinear aspects. Additionally, Nawaz et al. (2020) highlighted that lower quantiles, such as τ = 0.05, indicate bearish circumstances in stock market returns, whereas higher quantiles (τ = 0.95) and median quantiles (τ = 0.50) indicate bullish and moderate market conditions, respectively. Our selection of quantiles, τ = 0.05, τ = 0.95, and τ = 0.50, to denote bearish, bullish, and moderate circumstances in the volatility of the Islamic financial market, respectively, is in line with research conducted by Cunado et al. (2023), Pal and Mitra (2016), and Iacopini et al. (2023).

Apart from QVAR with “Extended Joint” connectedness approach of Cunado et al. (2023), which only explore the shock transmission between TPU and GCC stock market risk across the overall time horizon, we also employ the connectedness between TPU and GCC stock markets’ conditional volatility by using the Quantile Vector Auto-Regression (QVAR) with the “frequency domain” connectedness technique, originally developed by Chatziantoniou et al. (2022). Our objective is to examine the propagation patterns of severe TPU shocks across various quantiles and investment horizons, encompassing both short and long time frames. To establish the Frequency-domain QVAR connectedness method, Chatziantoniou et al. (2022) integrated the frequency connectedness methodology presented by Baruník and Křehlík (2018) with the classical quantile-based VAR strategy outlined by Chatziantoniou et al. (2021) and Ando et al. (2022). This amalgamation of methodologies allows for a comprehensive analysis of the interconnectedness of severe TPU shocks, offering insights into their dynamics across different quantiles and time horizons. However, it is crucial to emphasize that the foundational frequency connectivity method developed by Baruník and Křehlík (2018) demonstrates sensitivity to unusual outcomes and fails to account for the transmission of shocks at different quantiles, as underscored by Chatziantoniou et al. (2022). Additionally, it lacks the capability to address the transmission of bearish, moderate, and bullish extreme shocks between TPU and GCC Islamic stock market risk across various frequency levels, encompassing both short- and long-term investment periods. Hence, to thoroughly capture the interconnection measures between TPU and the risk in the Islamic financial market at diverse frequencies and quantiles, we also employ the Frequency-domain QVAR approach proposed by Chatziantoniou et al. (2022).

Additionally, unlike MS-VAR or TVAR, which typically partition data into discrete regimes, QVAR with the Frequency-domain connectedness approach provides a continuous view of the dynamics from the center to the tails of the distribution across varied investment horizon (long- and short-term). This enables a more nuanced understanding of how extreme events (e.g., market crashes or booms) impact volatility spillovers across varied quantiles () and investment horizons (long- and short-term). Therefore, returns on GCC equity markets frequently show asymmetry and large tails. Since QVAR does not rely on the normalcy assumption and may adjust to different tail densities, its quantile-based estimate makes it inherently resistant to such traits. On the other hand, even while MS-VAR and TVAR can simulate nonlinear behavior, they can have trouble capturing the entire spectrum of tail behaviors without the need for complicated model structures or further modifications. Moreover, by estimating effects at various quantiles, QVAR with “Extended Joint” and “Frequency”-domain-connectedness models are intended to study relationships over the whole conditional distribution and across different investment horizons. Unlike the MS-VAR and TVAR approaches, this implies that without imposing the data into arbitrary regimes, they may show how extreme events (tail behaviors) vary from more normal (central) settings. The continuous character of financial market dynamics may be oversimplified by MS-VAR or TVAR approaches, which divide the data into discrete regimes or segments based on threshold values.

The Frequency-domain QVAR framework proves to be resilient against outliers when compared to the conventional connectedness approach (Diebold and Yilmaz 2012; Lastrapes and Wiesen 2021; Asadi et al. 2023). Thus, the Frequency-domain QVAR technique allows for the identification of temporal-frequency patterns in both the positive and negative extremes of the data distribution. As noted by Londono (2019), significant insights into both favorable and unfavorable occurrences can be extracted by examining the lower quantile (τ = 0.10) and upper quantile (τ = 0.90). Essentially, concentrating on these extreme quantiles enables a more sophisticated comprehension of the variety of results and possible equity market volatility conditions in the context under study (Suleman et al. 2022). Baruník and Křehlík (2018) define high-frequency connectivity as a condition where shocks have a momentary and transient impact on network variables. In contrast, low-frequency connectivity results from shocks that profoundly alter the network’s structure and have a lasting effect on the variables (Suleman et al. 2023b).

4.1. QVAR Model

As stated in White et al. (2015), we first evaluate a quantile vector auto-regression, or QVAR(p), that may be written up as below:

In the given equation, the variables and refer to vectors representing endogenous variables, each having dimensions of K × 1. τ is a symbol used to represent a specific quantile in a statistical distribution, and it can take on values between 0 and 100 to indicate the percentage position of that quantile within the data set. The lag length of the QVAR model is denoted by p. The coefficient matrix of the QVAR model, denoted as , has dimensions K × K, and the conditional mean vector, denoted as μ(τ), has dimensions K × 1. The error vector is a K × 1 matrix and is linked to a variance-covariance matrix Σ(τ) with dimensions K × K. The temporal breadth is represented by the letter T. When transitioning from QVAR (p) to QVAR (∞), the global theorem is applied as follows: .

The computation of the “Generalized Forecast Error Variance Decomposition” (GFEVD)2 is carried out for an impending time horizon consisting of H steps. The progenitors of this decomposition methodology, namely Koop et al. (1996) and Pesaran and Shin (1998), employed it to demonstrate the transmission of a shock in series j towards series i (see Cunado et al. 2023). Concurrently, a vector comprised of zeros, with a solitary value of one at the th position, is denoted as .

Furthermore, the comprehensive directional “FROM” connectivity, encompassing the error variance (shocks) propagations from all other markets to a market i. Therefore, the directional “FROM” spillover of error variances gauges the extent to which the network influences market i; and the directional “TO” aspect, addressing the degree to which market i influences the pre-established network of variables , can be ascertained in the following manner:

Moreover, the assessment of NET directional connectedness can be derived using the formula: . In this context, a positive value for signifies that series i exerts a stronger influence on other series than it is influenced by them (Asadi et al. 2023). Conversely, a negative value suggests that series i is more impacted by other series than it influences them. Consequently, series i is labeled as a net receiver of shocks when < 0 and as a net transmitter of shocks when > 0.

4.2. QVAR with “Extended Joint” Connectedness Measure of Cunado et al. (2023)

We utilize an integrated approach of Cunado et al. (2023) that combines the “Extended Joint” connectedness method developed by Balcilar et al. (2021) and the standard QVAR approach introduced by Chatziantoniou et al. (2021) and Ando et al. (2022) into an “Extended Joint” based QVAR connectedness framework. This extension involves the use of an improved normalization method, which enhances the accuracy and precision of connectedness measurements. Specifically, is introduced as a mathematical representation of the impact that each variable in the network has on series . This helps to quantify the influence of all variables in the network on a specific series , providing insights into the interconnectedness and shock propagation dynamics within the structured QVAR system. This is mathematically expressed as follows,

Within this framework, takes the form of a rectangular matrix sized K × (K − 1), originating from the adjustment of an identity matrix through the exclusion of its th column. The vector ϵ∀ ≠ i, t + 1 represents a collection of unexpected developments at time t + 1 across all series except i, forming a vector with dimensions K − 1. Following this, we progress to calculate the joint interconnectedness index, using the ensuing formula:

This falls between zero and one, which is different from the Total Connectedness Index (TCI) in the original technique, as noted by Gabauer (2021) and Chatziantoniou et al. (2021). As an important continuation of the work of Balcilar et al. (2021) and Cunado et al. (2023), on the other hand, uses numerous scale factors to determine correlations between gSOT and jSOT.

The determination of the aggregate “NET” directional impact, the net pairwise directional connectedness (NPDC) indices utilized for network visualization, and the comprehensive directional transmission of perturbations emanating from variable i to all other variables is facilitated through the application of Equations (14), (15), and (16), correspondingly.

4.3. Frequency-Domain QVAR of Chatziantoniou et al. (2022) for Short- and Long-Term Connectedness Under Extreme and Medium Market Conditions

The combination of the VAR methodology based on quantiles, as introduced by Chatziantoniou et al. (2021), and the frequency-connectedness approach suggested by Baruník and Křehlík (2018), was accomplished by Chatziantoniou et al. (2022). This led to the development of the approach known as frequency-based quantile connectedness. Stiassny (1996) formulated the spectral decomposition method, establishing a framework for exploring connectivity in this field. The analysis initiates with the examination of the frequency response function, represented as Ψ() = , where i denotes the imaginary unit (√−1), and ω signifies the frequency. Subsequently, focus is shifted to the spectral density of at a specific frequency, ω. The Fourier transformation of the QVMA (∞) representation is then applied to describe this spectral density.

Crucially, the Frequency-based Generalized Forecast Error Variance Decomposition (GFEVD) arises from combining spectral density with the GFEVD. Similar to the temporal domain, there is a need to normalize the frequency-based GFEVD, which can be articulated as follows:

The segment of the spectrum of series i at a specific frequency ω that can be linked to a shock in series j is denoted by the symbol . This serves as a unique indicator for that frequency band. Instead of evaluating connectedness at an individual frequency, Chatziantoniou et al. (2022) aggregate all frequencies within a specified range, denoted as d = (a, b), where both a and b fall within the range of (−π, π), and a is less than b (d = (a, b): a, b ∈ (−π, π), a < b).

From this juncture, we have the capability to calculate the same connectedness metrics outlined in Diebold and Yılmaz (2012). However, it is crucial to note that in this particular context, these metrics are associated with frequency-connectedness measures. These metrics offer valuable perspectives on the transmission of impacts within specific frequency ranges identified as d.

In this instance, we examine two frequency intervals (d1 and d2) signifying short-term and long-term investment time frames. The initial span covers 1 to 5 days, defined as d1 = (π∕5, π), while the subsequent range extends from 5 days onwards, designated as d2 = (0, π∕5]. Consequently, we compute the directional (TO, FROM, and NET) frequency-based connectedness approach for both short-term and long-term periods within the quantile-based VAR system. Therefore, , and depict directional connectedness in the short term, while , and illustrate directional connectedness in the long term. The directional transmissions denoted as illustrate the propagation of shocks towards all other markets “” while signifies the transmission of shocks received by market “” due to innovations in market “”. The NET is expressed as the discrepancy between “” and “”. Ultimately, Chatziantoniou et al. (2022) demonstrate the integration of the frequency domain connectedness approach, as introduced by Baruník and Křehlík (2018), with the metrics in the time domain quantile connectedness purposed by (Ando et al. 2022).

The total connectedness metrics are equivalent to the summation of the corresponding frequency-connectedness metrics. It is important to note that all these connectedness measures are reliant on a particular quantile, denoted as τ.

5. Results with Practical Implications

5.1. Analysis of Overall Time Domain QVAR Extended Joint Connectedness Between TPU and GCC Islamic Financial Market Volatility

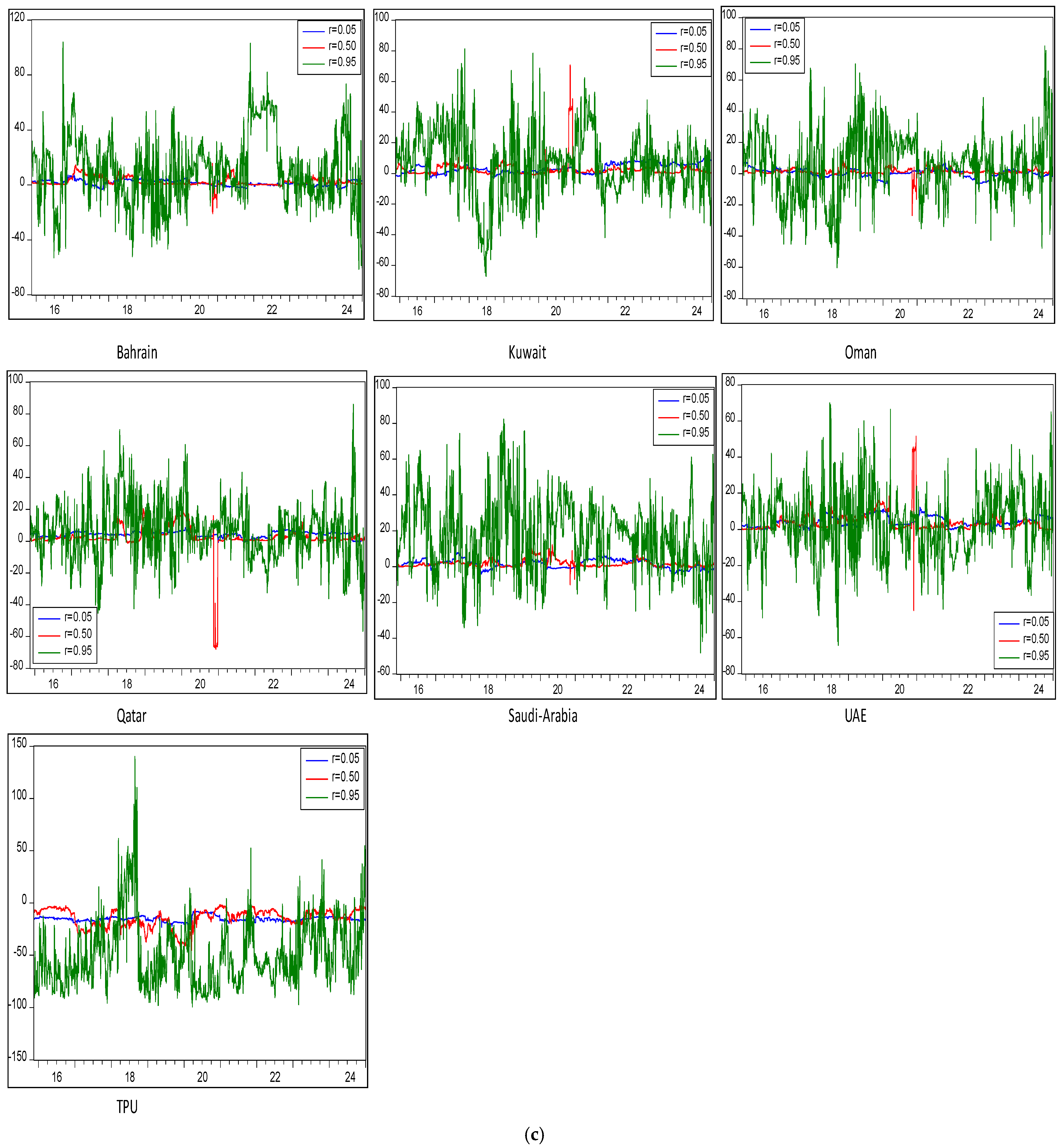

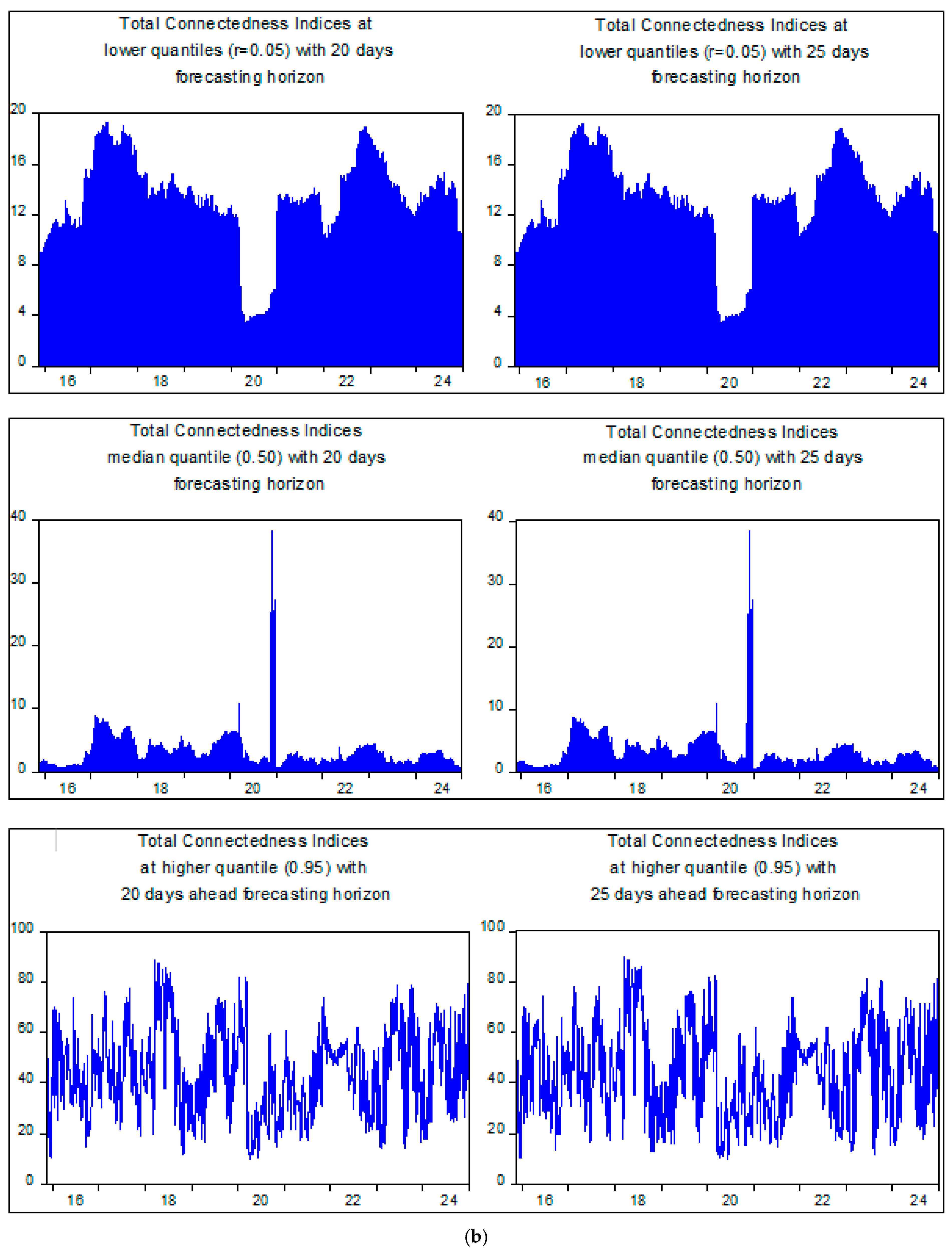

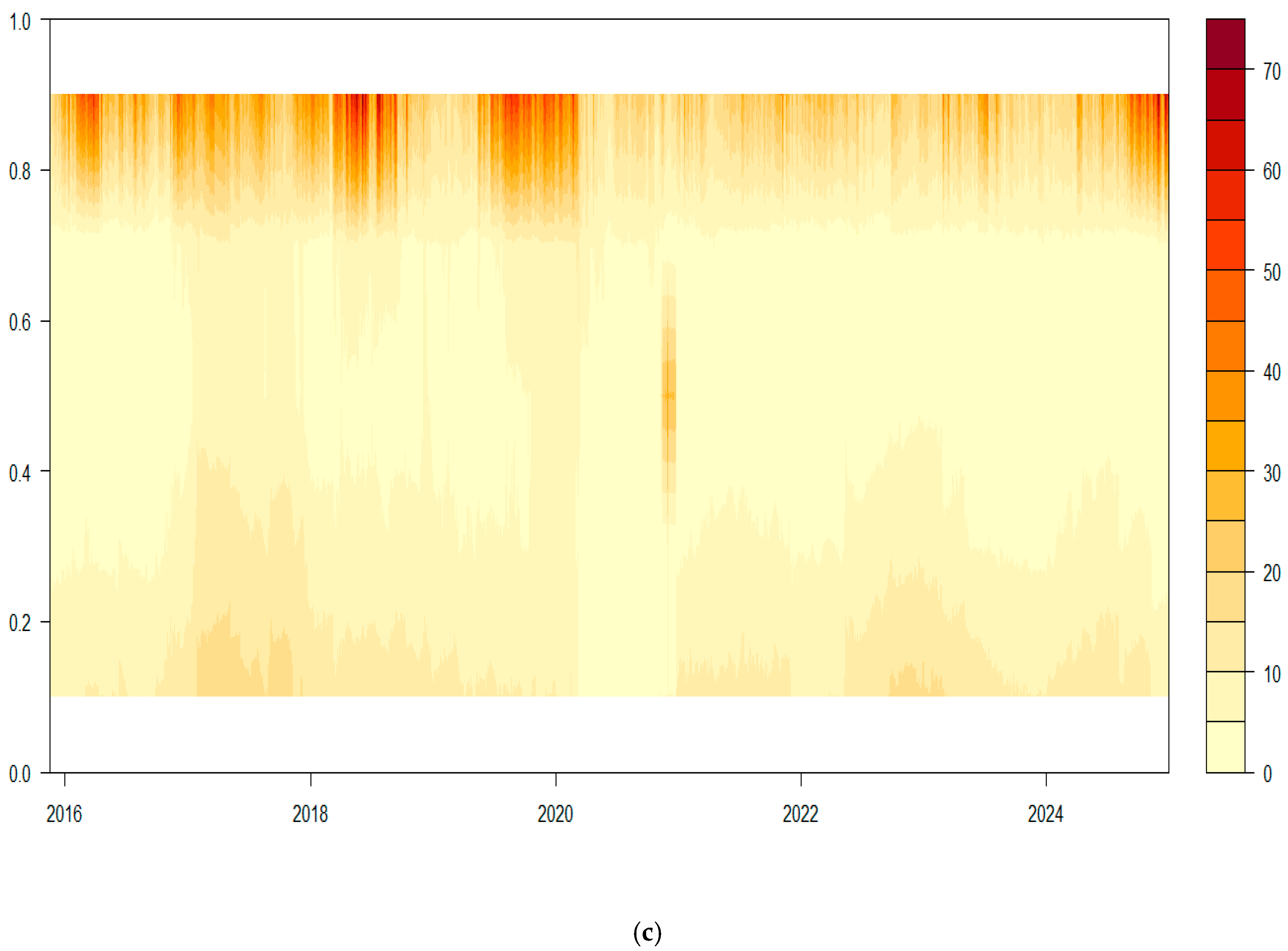

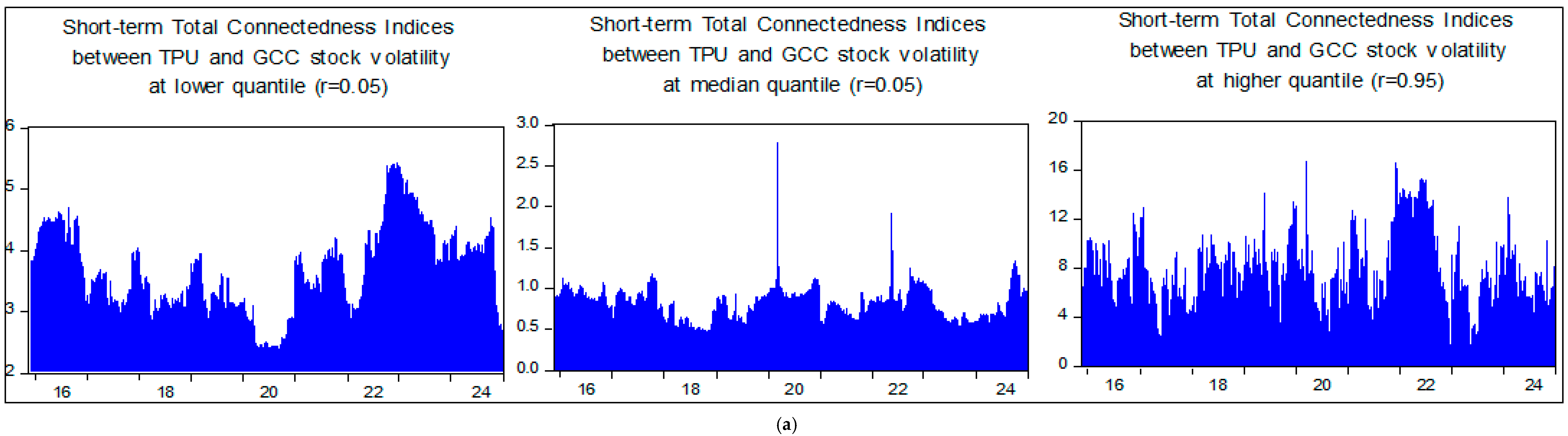

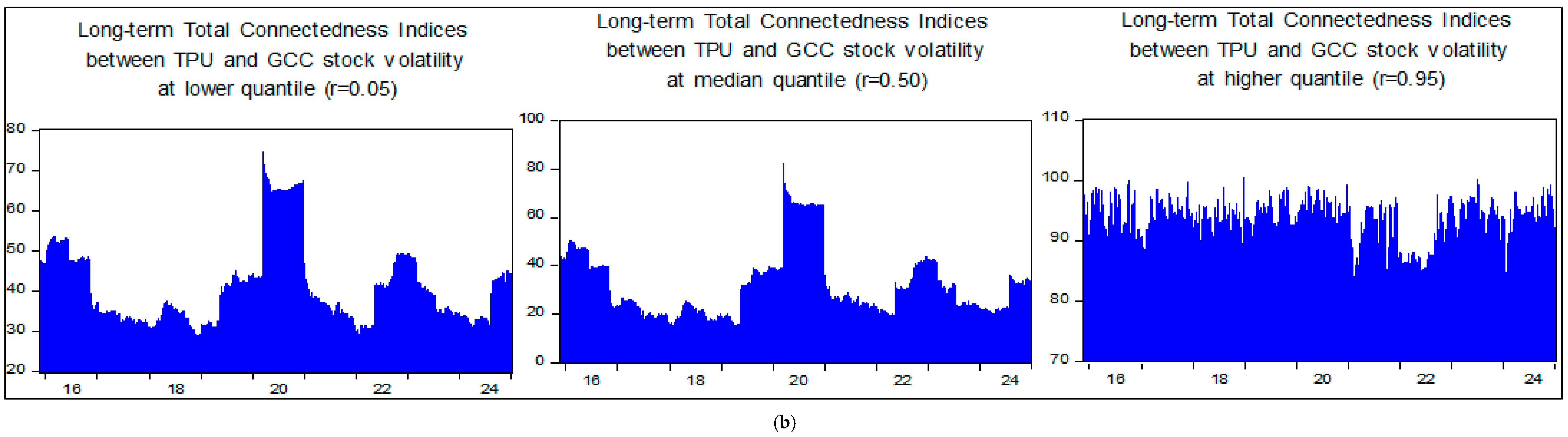

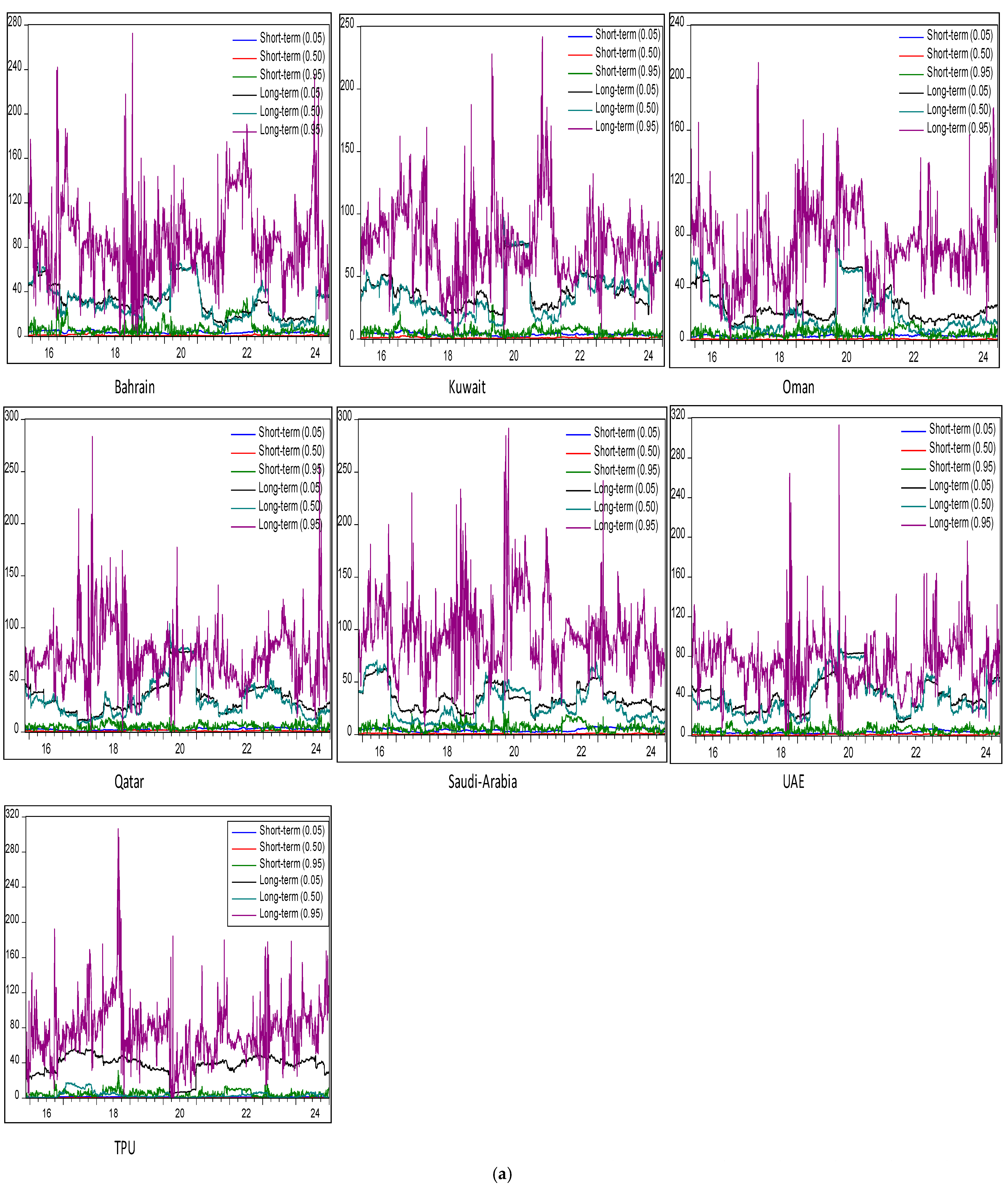

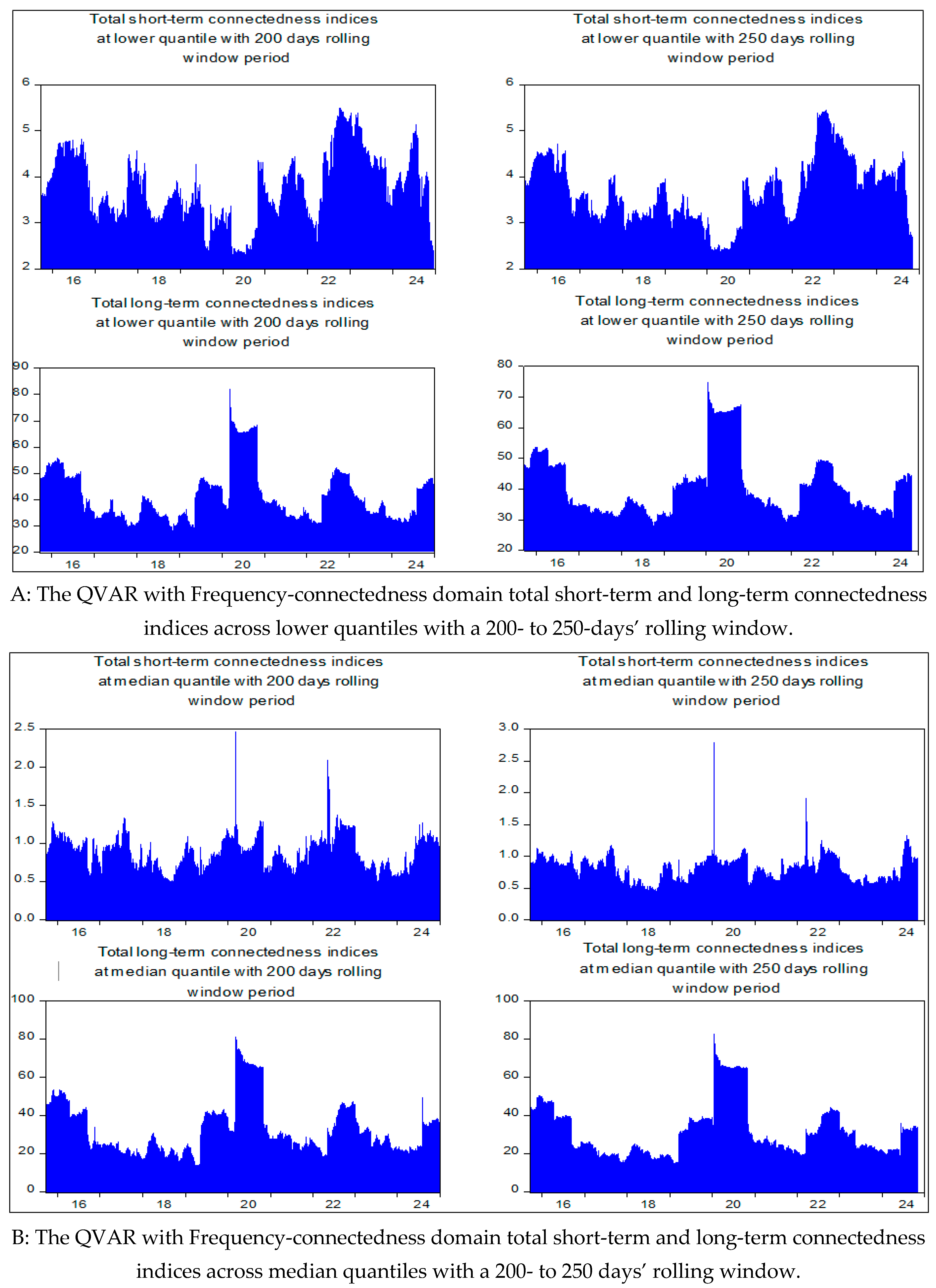

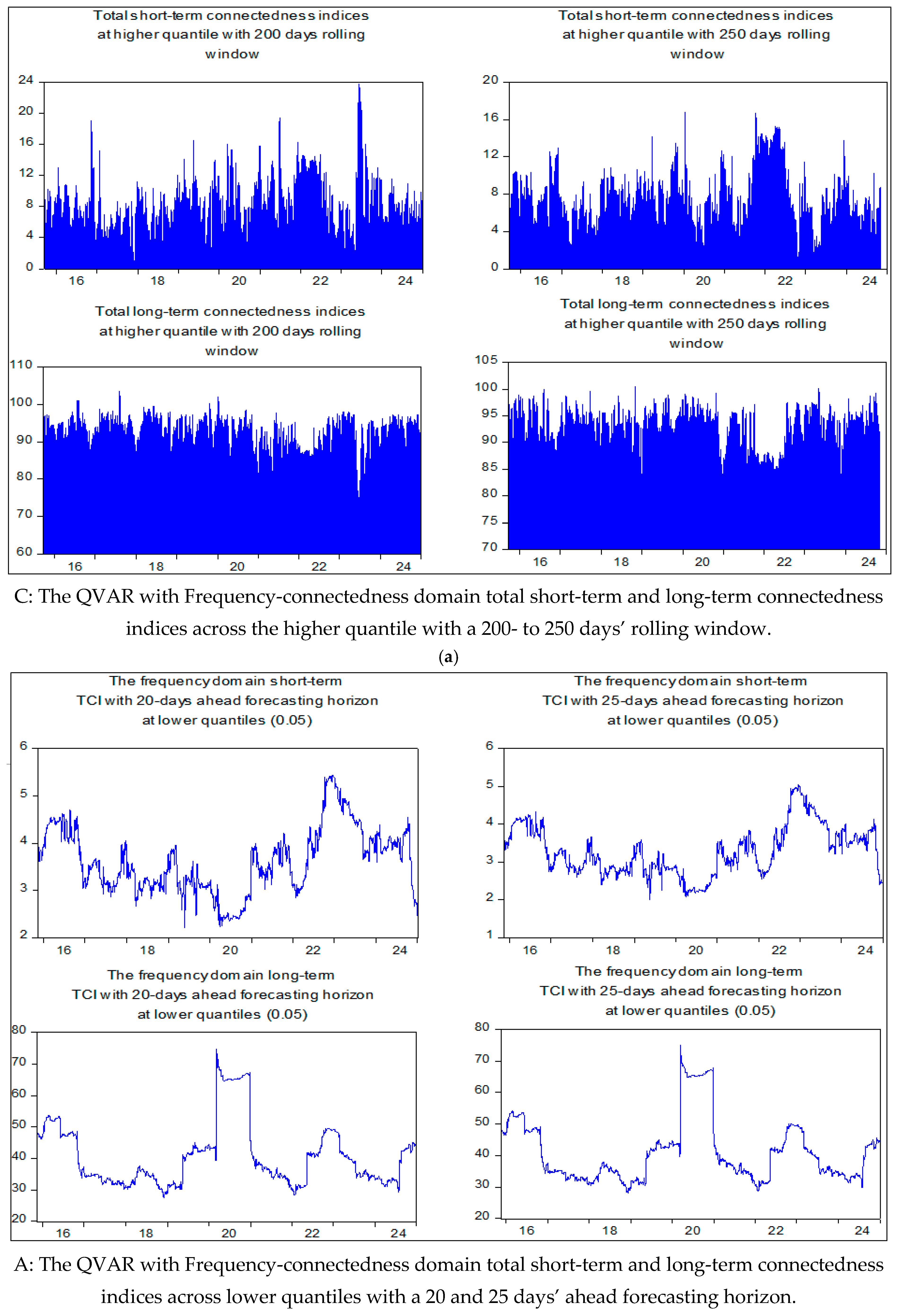

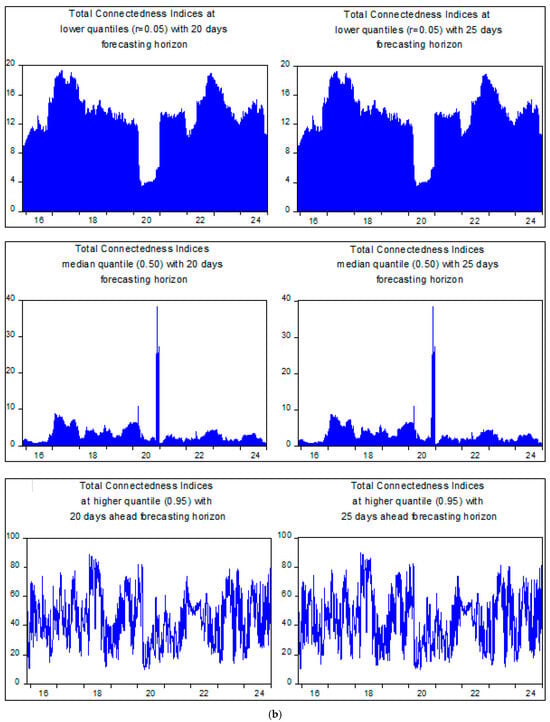

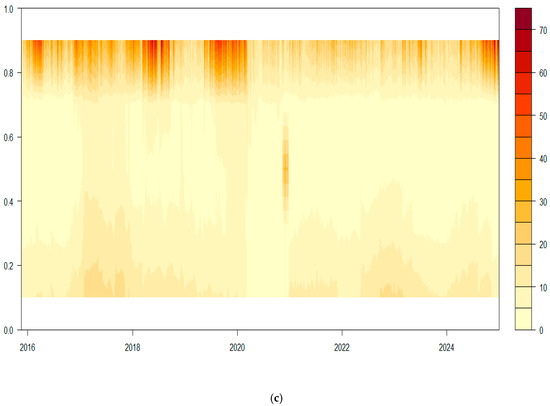

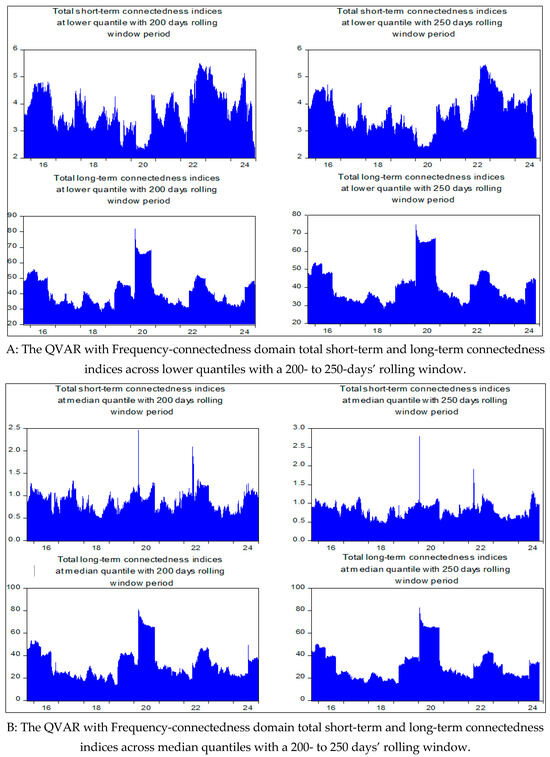

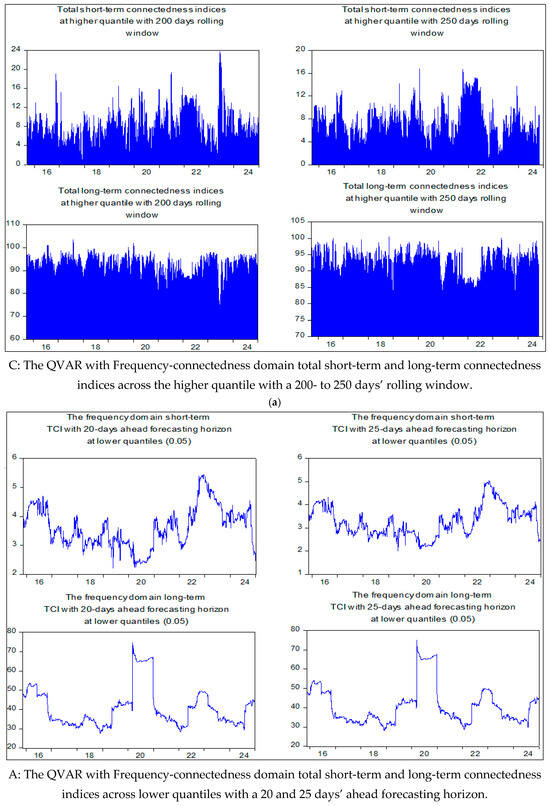

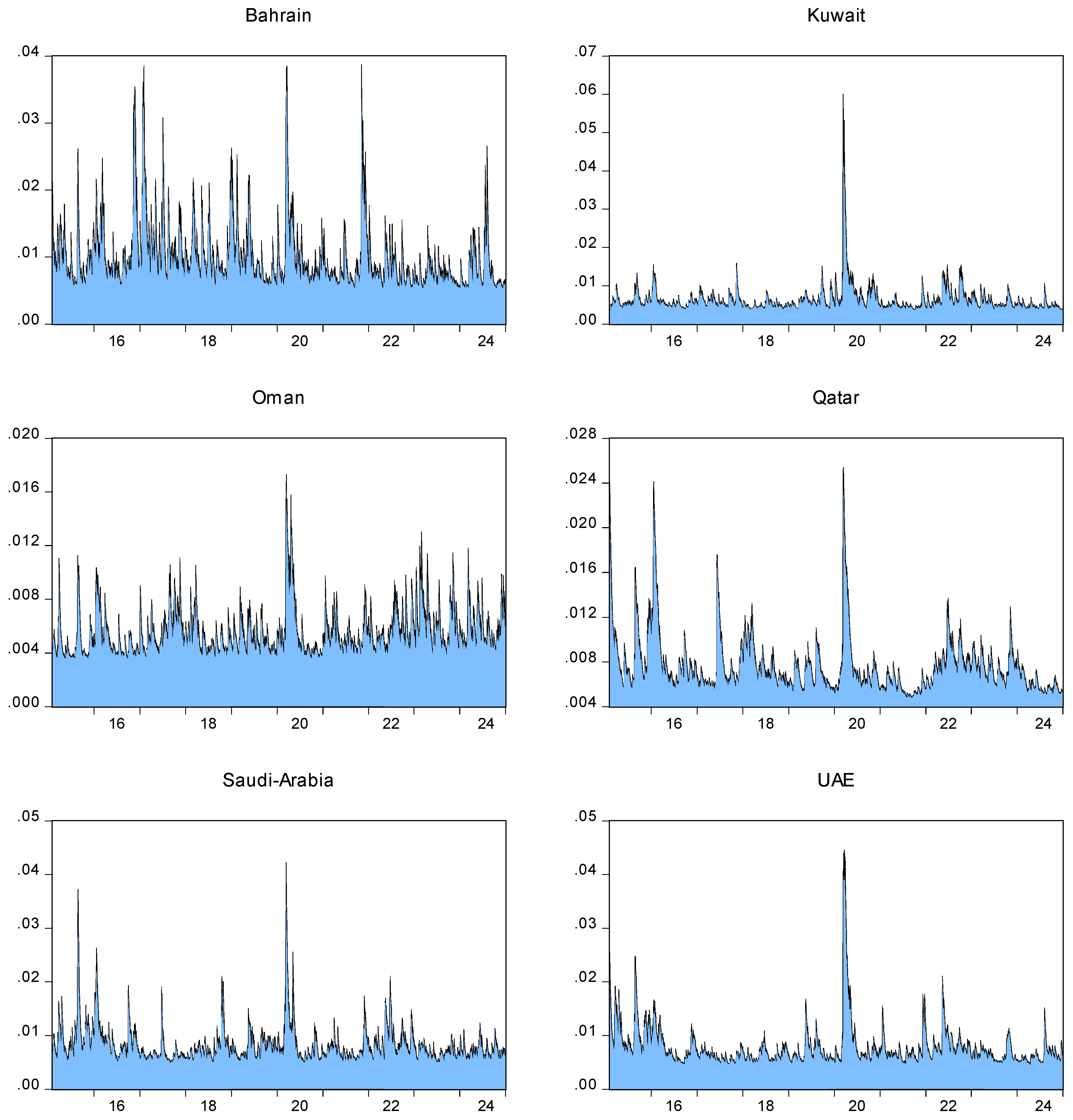

This study sheds light on the complex interplay between TPU and conditional volatility within the GCC’s Islamic financial markets at various quantiles ( by using the QVAR-based “Extended Joint” connectedness approach by Cunado et al. (2023). The findings presented in Table 5 and Figure 2 reveal an average and time-varying Total Connectedness Index (TCI), respectively varying in intensity depending on financial market volatility and TPU quantiles (. Table 5 also delves into the specifics, quantifying the average directional (TO, FROM, and NET) spillovers between TPU and conditional volatility at different points on the volatility spectrum—bearish, moderate, and bullish. Figure 3a–c, on the other hand, offers a visual representation of time varying directional TO, FROM, and NET spillover of shocks between TPU and GCC Islamic financial markets’ volatility fluctuations over time, highlighting the dynamic nature and interconnectedness. On the contrary, our findings are consistent with results reported by Bouri et al. (2021), as they have highlighted that the connectedness between conventional financial assets remain heterogeneous across quantiles and overall aggregated forecast error variance propagation is intensified at higher quantiles. Ando et al. (2022) also examined the quantile domain shock propagation mechanism between credit risk and explore that the shock propagation between credit risk is higher in magnitude at extreme quantiles as compared with median quantile.

Table 5.

QVAR-based Extended Joint connectedness between Islamic stock market volatility of GCC member economies and Trade Policy Uncertainty (TPU).

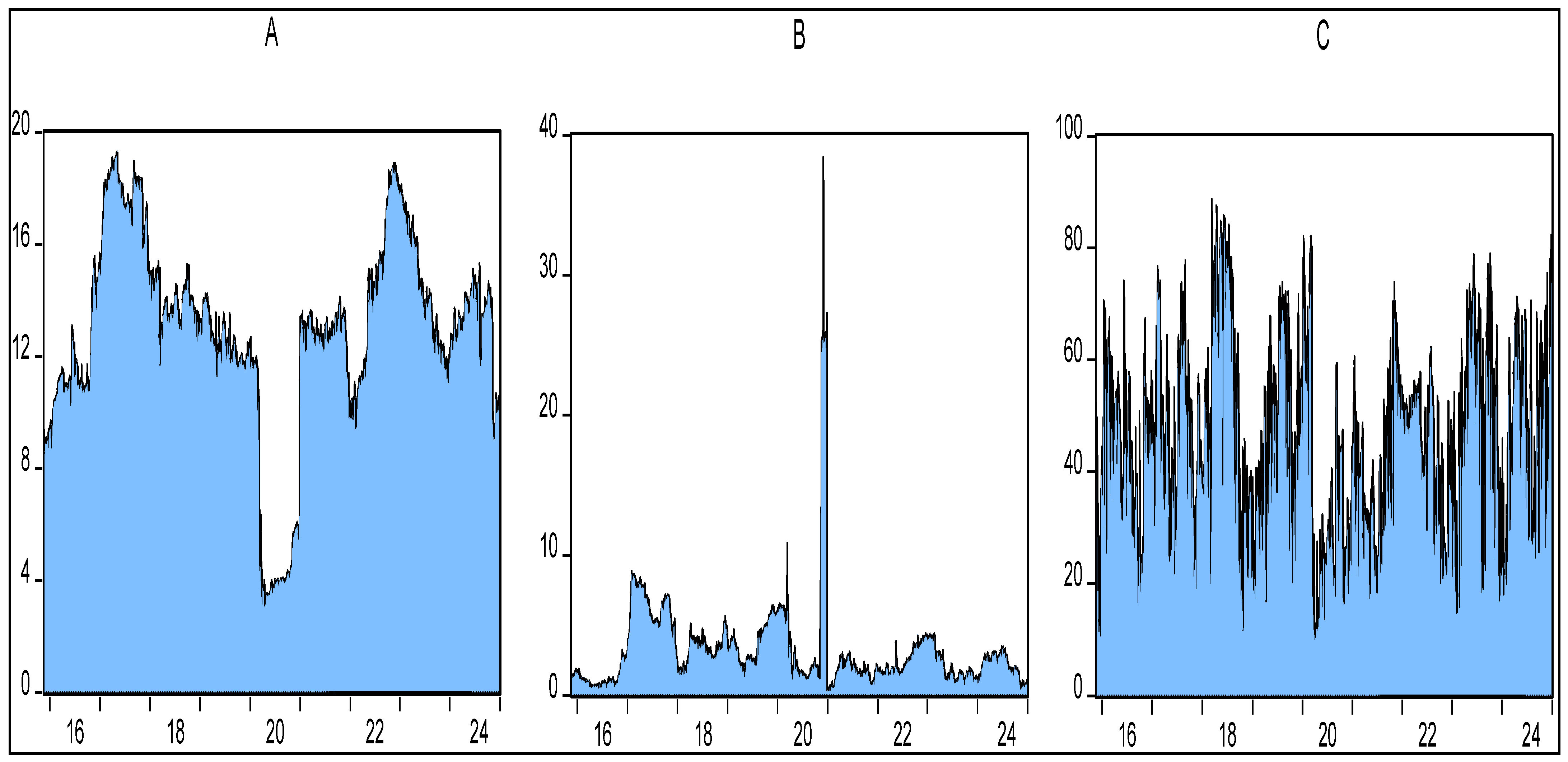

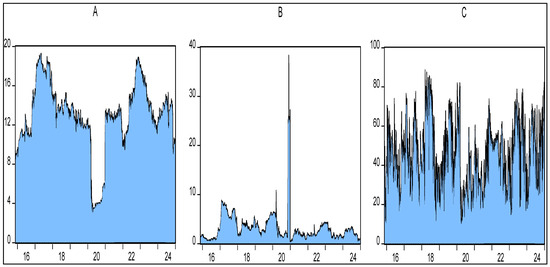

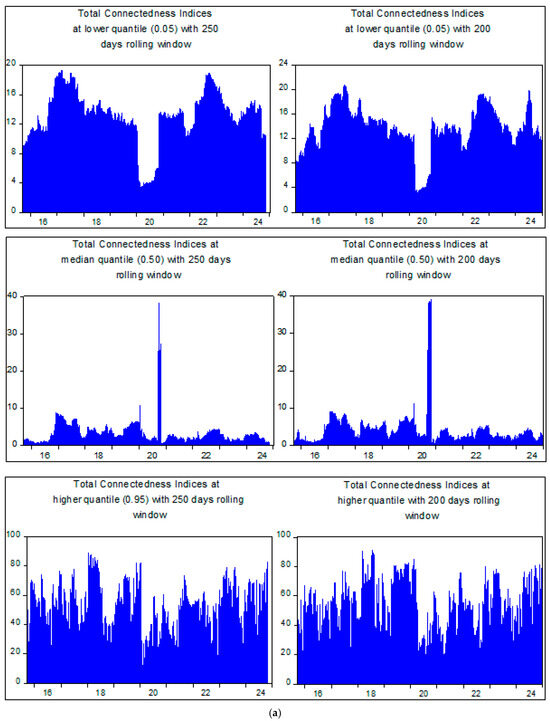

Figure 2.

Total connectedness index between GCC stock market conditional risk and trade policy uncertainty at lower (A), median (B), and higher (C) quantiles by utilizing the QVAR-based Extended Joint connectedness approach.

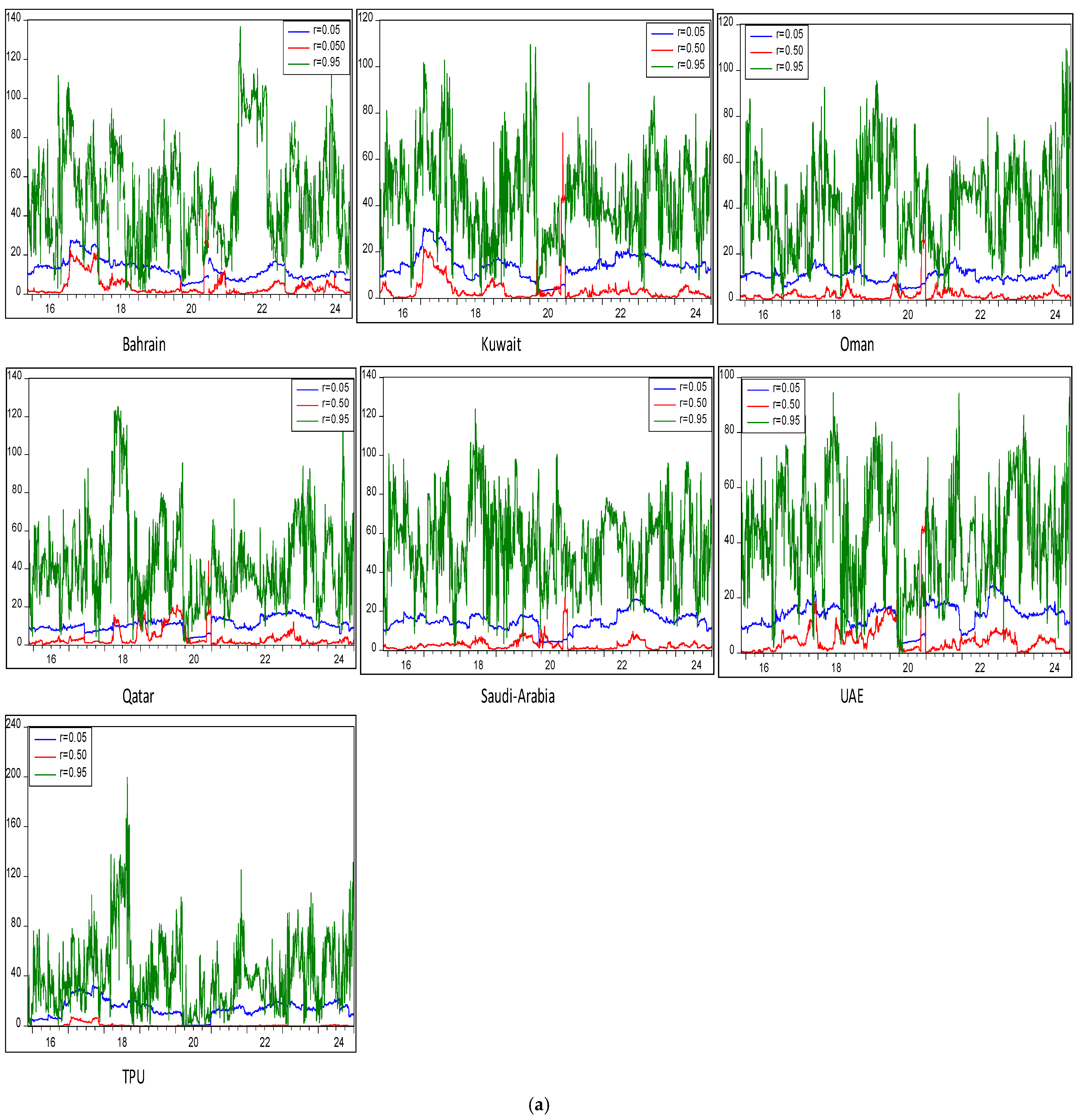

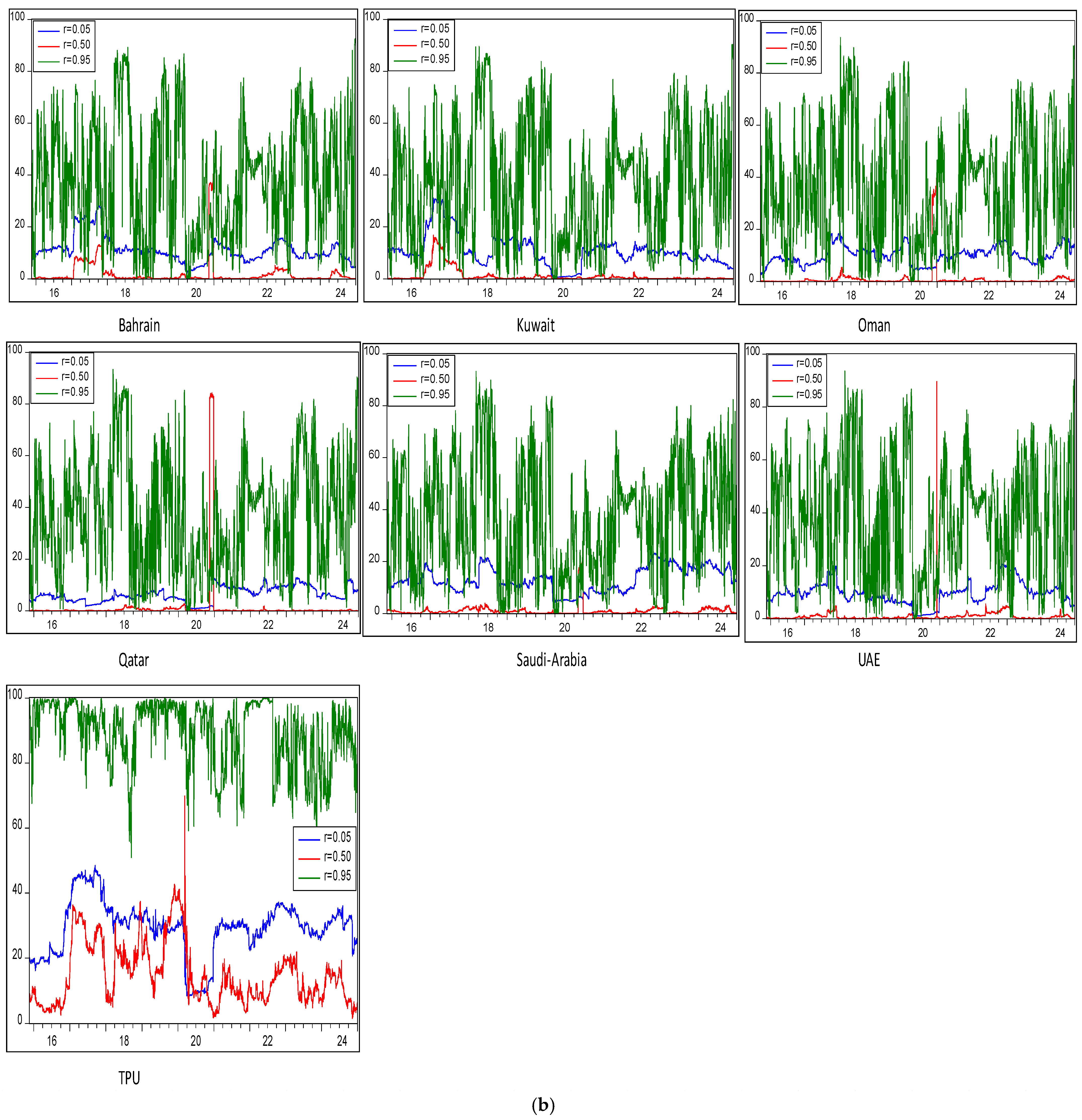

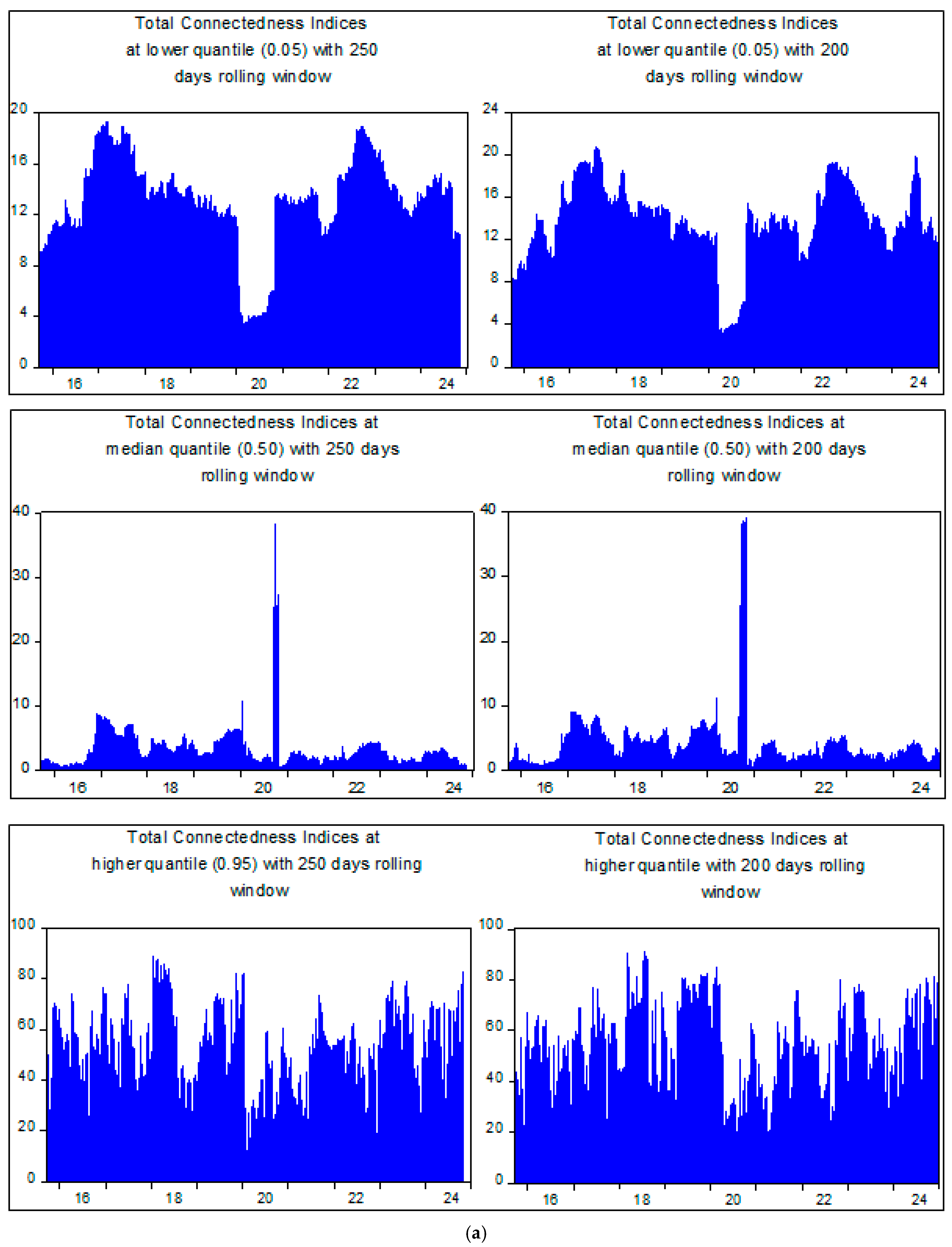

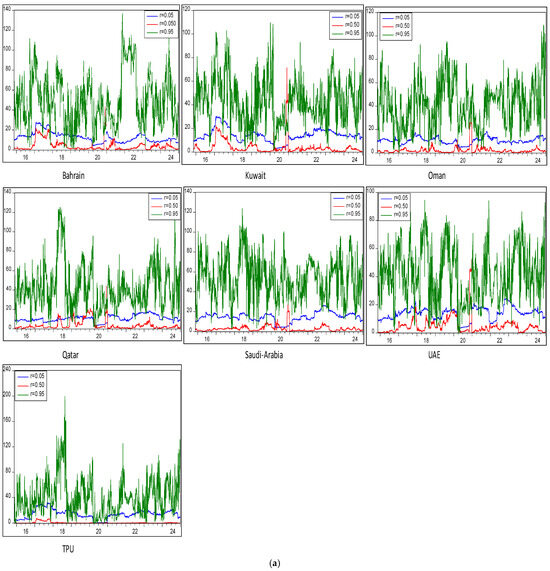

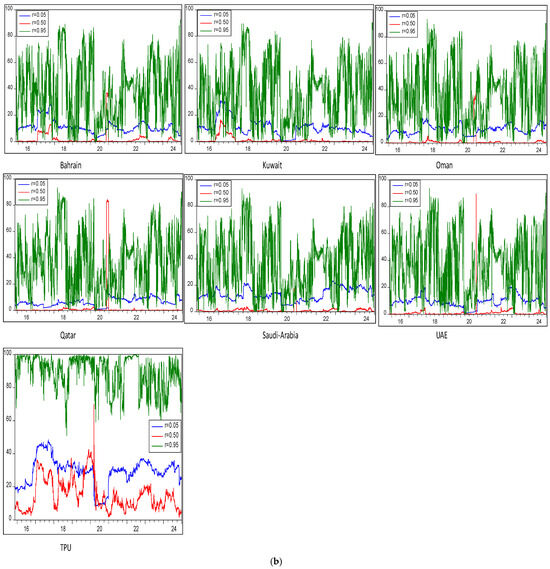

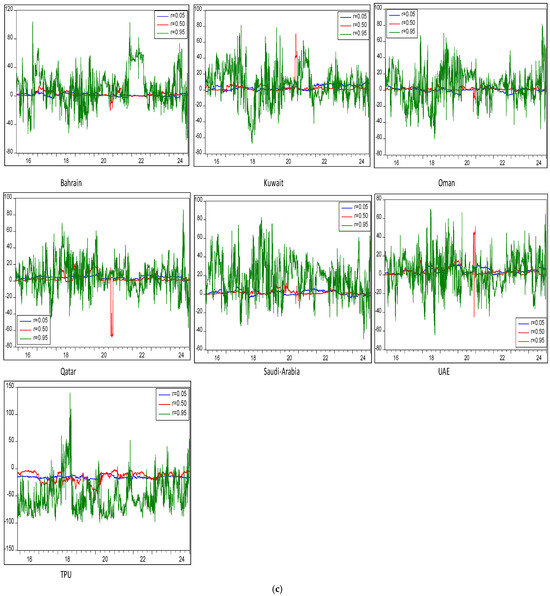

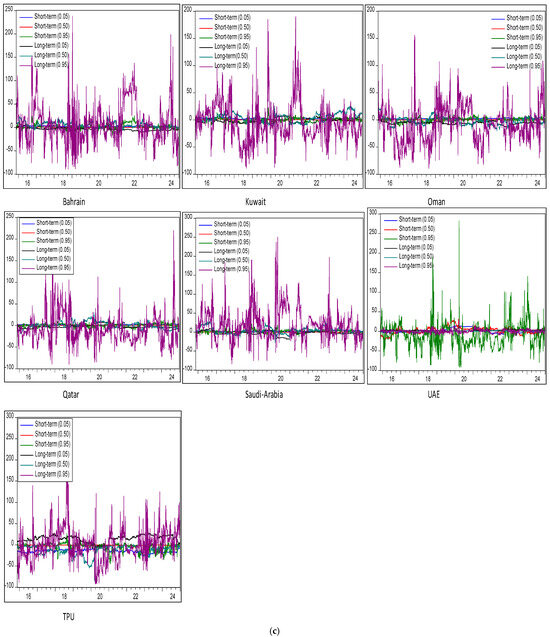

Figure 3.

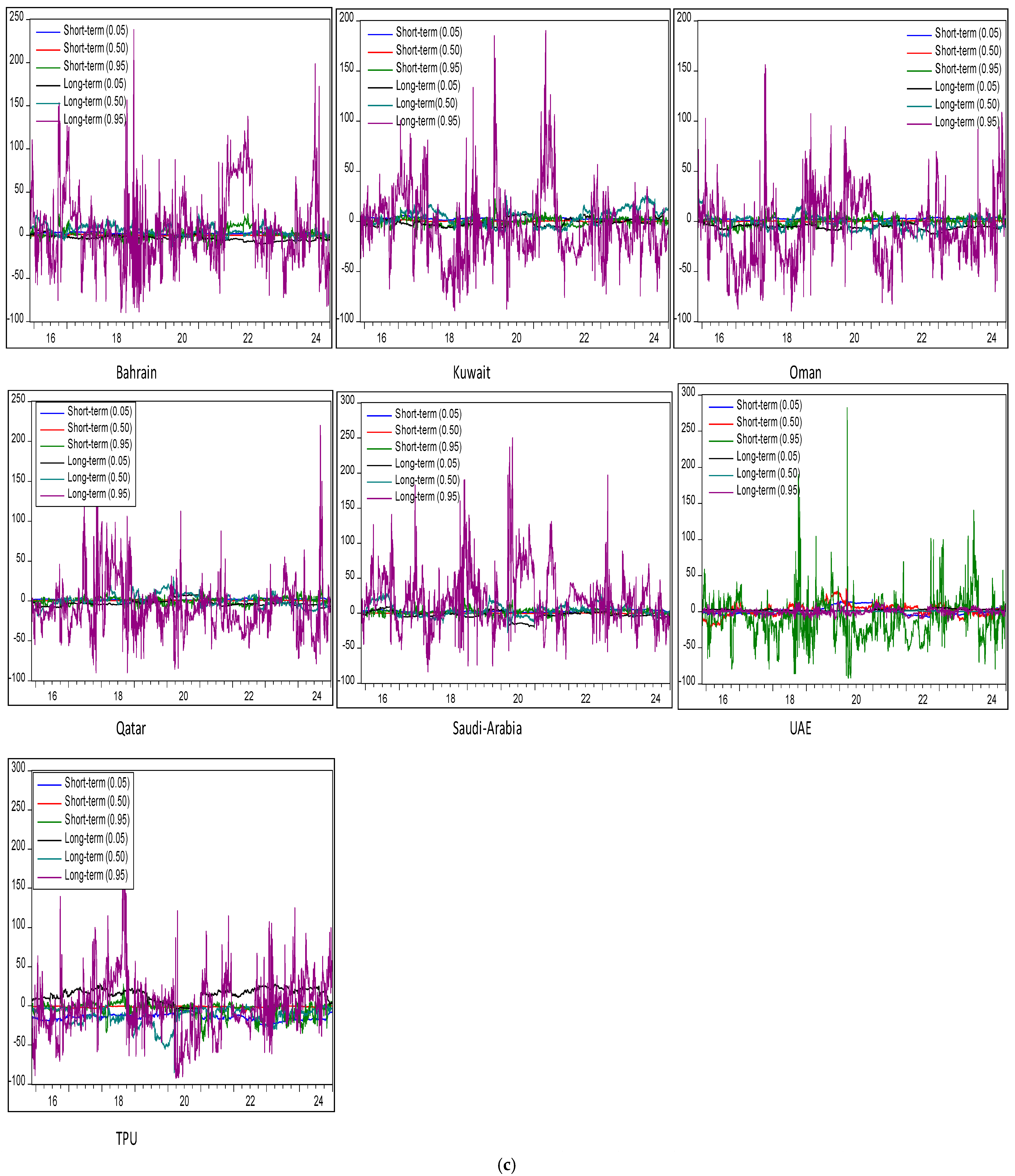

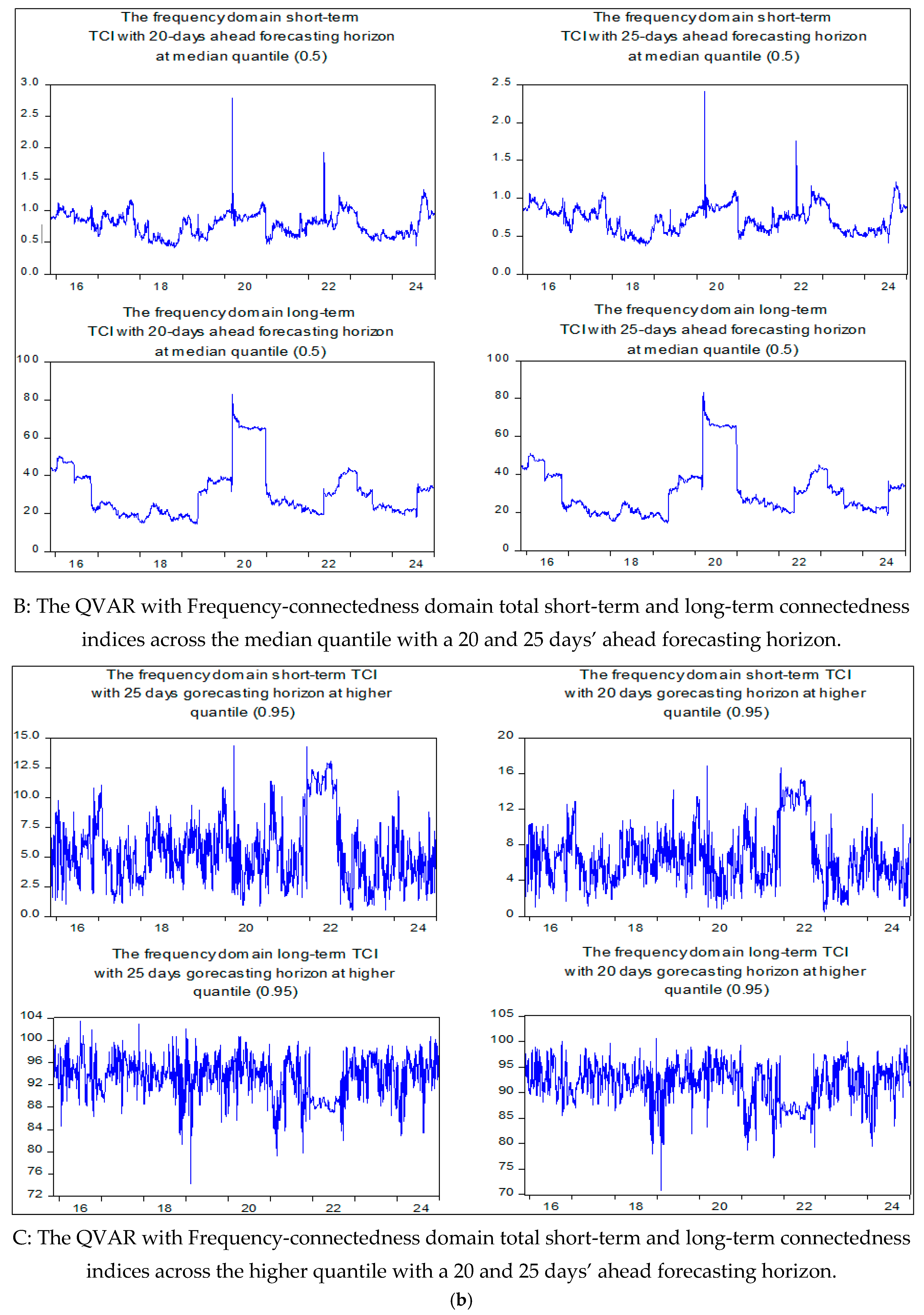

(a) Transmission of shocks from a variable “” “TO” all other variables “” due to the own shocks by utilizing the QVAR-based Extended Joint connectedness approach for GCC Islamic stock market conditional volatility and TPU shocks. (b) Transmission of shocks “FROM” all other variables “” towards the variable “” by utilizing the QVAR-based Extended Joint connectedness approach for GCC Islamic stock market conditional volatility and TPU. (c) “NET” transmission of shocks between Trade Policy Uncertainty (TPU) and GCC Islamic stock market risk by utilizing the QVAR-based Extended Joint connectedness approach for GCC stock market conditional volatility and TPU.

As per the QVAR “Extended Joint connectedness” estimates in Table 5, the propagation of total forecast error variances from Trade Policy Uncertainty (TPU) to the conditional volatility of GCC Islamic financial markets amounts to 14.03% at lower quantiles (τ = 0.05). However, during periods of bullish financial market volatility (τ = 0.95), TPU uncertainty contributes significantly more, transmitting 40.87% of error variances to the conditional risk of all GCC Islamic markets. These findings highlight the heterogeneity in the transmission of forecast error variances from TPU to GCC conditional risk across bearish and bullish quantiles. Recognizing the varying impact of TPU across quantiles suggests that investors should develop tailored investment strategies that align with different market scenarios, ensuring their portfolios are resilient in the face of shifting trade policies and Islamic financial market volatility conditions. On the contrary, our findings are consistent with results reported by Bouri et al. (2021), as they have highlighted that the connectedness between conventional financial assets remain heterogeneous across quantiles and overall aggregated forecast error variance propagation is intensified at higher quantiles. Ando et al. (2022) also examined the quantile domain shock propagation mechanism between credit risk and explored that the shock propagation between credit risk is higher in magnitude at extreme quantiles as compared with the median quantile.

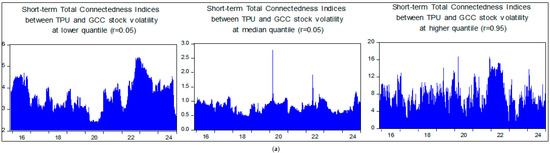

Additionally, Figure 2 visually illustrates that the cumulative forecast error variances resulting from the complete transmission of shocks within the QVAR system exhibit an escalating pattern at significantly higher quantiles in contrast to lower and median quantiles. The rise in the degree of interdependence and the uneven propagation of shocks between Trade Policy Uncertainty (TPU) and financial market volatility contradicts the results of Chatziantoniou et al. (2021). Their use of the conventional time domain QVAR approach revealed consistent interconnectedness between sustainable financial assets at both higher and lower quantiles, leading them to assert that the connectedness is symmetrical.

Investors and portfolio managers may need to reconsider traditional diversification strategies, as the nature of interconnectedness and shock transmission between TPU and GCC Islamic financial market risk appears to vary across different quantiles. Depending on the asymmetry observed, portfolio diversification may need to be adjusted to account for potential heterogeneous effects of TPU on Islamic assets within GCC region. Investors may need to focus on tail risk management to protect their portfolios against extreme TPU events that could lead to intensified GCC Sharia-compliant financial market volatility. Moreover, at the higher quantiles, trade policy uncertainty contributes to heightened investor uncertainty and risk aversion. Investors may exhibit increased prudence and a diminished inclination to expose themselves to high-risk assets, particularly those prevalent in the financial markets of the Gulf Cooperation Council (GCC). Such caution could potentially lead to capital outflows, declining asset valuations, and the propagation of additional shocks affecting the conditional risk (volatility) of the Islamic equity markets.

The economies of GCC nations are highly sensitive to fluctuations in commodity prices, especially oil (Cheikh et al. 2021). Trade policy uncertainty can contribute to increased volatility in global commodity markets (Mei and Xie 2022). If trade policies create uncertainty about future oil demand or supply conditions, it can lead to fluctuations in oil prices, directly impacting the financial markets of GCC countries. Moreover, trade policy uncertainty can influence foreign direct investment decisions. GCC countries have attracted substantial foreign investment, and any uncertainty in trade policies may deter investors. The GCC economies are closely tied to global economic conditions. If major trading partners experience economic slowdowns due to trade policy shifts, it can negatively impact demand for GCC exports and overall economic activity, affecting Islamic financial market volatility. Moreover, trade policy uncertainty can lead to fluctuations in currency rates (Yu et al. 2023). GCC economies often peg their currencies to the U.S. dollar, and any significant vacillations in global trade policies can influence the value of the U.S. dollar. Currency volatility can impact trade balances, inflation, and interest rates, influencing financial market performance (Suleman et al. 2022). Therefore, central banks of respective economies should adjust fiscal and monetary policies to mitigate the TPU shocks on their Islamic financial system at the time of bullish financial market conditional volatility and TPU.

Table 5 also reveals that a shock in TPU has the most pronounced impact, accounting for 3.18% of error variances in forecasting 20-day ahead conditional volatility in Saudi Arabia. Following this, we observe contributions of 2.9% and 2.78% of error variances in the conditional equity market risk for Bahrain and Oman, respectively, particularly at lower quantiles (τ = 0.05). In contrast, during higher quantiles (τ = 0.95) or when the market experiences bullish volatility conditions, a TPU shock yields a more significant impact, contributing 7.28%, 6.86%, and 6.85% of error variances to the conditional risk in the Sharia-complaint equity markets of Bahrain, Saudi Arabia, and UAE, respectively, surpassing the influence on the rest of the GCC Sharia-compliant financial market. The findings indicate that TPU transmits error variances differently to the conditional risk of all GCC Islamic financial markets during both bearish and bullish conditional volatility conditions, with a more intense and substantial impact at higher extreme quantiles (see Table 5). Moreover, the transmission of error variances from TPU to the conditional risk of GCC Sharia-compliant financial markets is notably reduced at moderate quantiles (τ = 0.50) in comparison to both lower (τ = 0.05) and higher (τ = 0.95) quantiles. This not only suggests asymmetry but also supports the adoption of the QVAR approach, carrying practical implications for investors in the GCC Islamic financial markets.

Firstly, during the bearish conditional volatility conditions , investors should consider diversifying their portfolios by spreading investments across different asset classes and financial markets of different geographic regions that showed lower shock-reception capability from TPU shocks. This includes the financial markets of Qatar and UAE to reduce risk exposure to trade policy uncertainty, as these markets received lower error variances from TPU during bearish Islamic equity market volatility trend. Secondly, specific economies like Oman, Kuwait, Bahrain, and Saudi Arabia should establish policy guidelines and a strategic framework for businesses to access risk-mitigation tools such as trade credit insurance and currency hedging to reduce exposure to trade policy shocks during the bearish market conditional risk. This is generally due to the fact that conditional risk of the equity market returns of these economies experienced the highest contributions of shocks from TPU during bearish volatility conditions. However, during the bullish conditional risk conditions (), economies receiving the higher TPU shocks such as UAE, Bahrain, and Saudi Arabia should develop and maintain real-time monitoring systems to promptly detect and respond to shifts in trade policy uncertainty, enabling proactive risk-mitigation measures. Moreover, these economies should also encourage collaboration between governments and businesses to formulate policies that support economic stability in the face of trade policy shocks. This includes open communication channels and coordinated efforts in order to maintain resilience against adverse trade policy shocks at times of higher financial market risk and bearish equity market returns. Thirdly, ethical investment strategies adhering to Sharia principles should be crafted considering the specific volatility conditions in Islamic financial markets. To illustrate, during periods of lower volatility (quantiles), the conditional volatility in the Islamic financial markets of Qatar and UAE exhibited the smallest error variances resulting from TPU shocks. Conversely, in times of higher volatility (bullish conditions), TPU shocks led to the least transmission of error variance in the conditional volatility of Qatar and Kuwait. Therefore, financial market conditional volatility of Qatar experienced the lowest TPU shocks during the bearish, bullish, and moderate volatility conditions, and GCC fund managers should include the Sharia-complaint Qatari stocks in their portfolio to hedge against the fluctuating TPU shocks across varied quantiles.

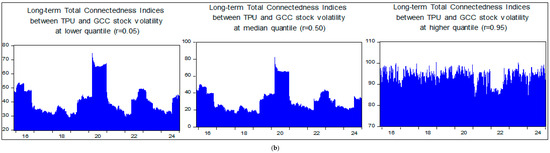

In accordance with Figure 2, aligning with the aforementioned observations, the Total Connectedness Index (TCI) at the extreme quantiles—specifically, lower (τ = 0.05) and higher (τ = 0.95)—exhibit a comparable trend, markedly surpassing the median quantile (τ = 0.50) in a statistically significant manner. Additionally, Table 5 presents that the cumulative forecast error variances arising from shock transmission across the entirety of the system at lower and higher quantiles amount to 12.87% and 40.90%, respectively. In contrast, the total aggregated forecast error variances at the median quantile stand at 3.14%. This underscores the asymmetrical connectedness arising from the differing transmission of shocks during extreme conditions of conditional risk and trade uncertainty, in contrast to the conditions of moderate financial market volatility and trade uncertainty shocks. Furthermore, Figure 3a, Figure 3b, and Figure 3c highlight the directional “TO”, “FROM”, and “NET” directional spillover of shocks at multiple quantiles, respectively.

Figure 3a demonstrates that at the tails of the distribution, encompassing both lower and upper quantiles, a shock in TPU exhibits a noticeable increase in the transmission of error variances compared to the median quantile, influencing GCC Islamic financial market volatility. This suggests potential asymmetry in the transmission of TPU shocks across different quantiles. The heightened transmission of TPU shocks affecting the volatility in all GCC Islamic financial markets was observed in the early stages of 2015 and 2016 at higher quantiles (see Figure 3a). This trend persisted consistently throughout 2016, intensified toward the end of 2017, and became particularly pronounced during the period impacted by the COVID-19 pandemic, especially at higher quantiles (see Figure 3a). Figure 3b visually depicts that the conditional volatility in all GCC Islamic financial markets experienced the most substantial forecast error variances from both each other and TPU shocks during bearish conditional risk conditions (lower quantiles represented in blue) compared to median quantiles (red-colored line). This pattern held true within the 2015–2018 period and throughout the COVID-19 era. Conversely, the volatility of all GCC Islamic financial markets also exhibited heightened susceptibility to volatility shocks originating within these markets and from TPU in the higher quantiles (represented by the green-colored line) during the intermediate period between 2015 and 2016, the latter half of 2017, and the entire duration of the COVID-19 crisis. Moreover, mirroring the observed directional TO (Figure 3a) and FROM (Figure 3b) spillover patterns, Figure 2 illustrates that the overall time varying interconnection measures, referred to as TCI, between the conditional risk of GCC Islamic equity markets and TPU remained elevated from 2015 through 2017, as well as in the middle of 2018 and throughout the COVID-19 period, particularly at higher quantile levels compared to lower and median levels.

The substantial amplification of shock propagation can be attributed to the heightened trade uncertainty in 2016, marked by active U.S. participation in discussions concerning the Trans-Pacific Partnership (TPP), a substantial trade agreement (Chodor 2019). A pivotal shift in trade policy materialized with the formal withdrawal of the United States from the Trans-Pacific Partnership (TPP) in January 2017 (ALJAZEERA 2017). Concurrently, U.S. trade tensions with China were escalating, marked by disputes over intellectual property rights and taxes (Bown 2019). The passing of Justice Antonin Scalia in February 2016 (Liptak et al. 2016) resulted in a vacancy on the Supreme Court, raising concerns about its potential impact on trade-related cases and laws (Carmon 2016). The uncertainty intensified as candidates outlined future trade policies during the U.S. presidential election campaign (Noland 2018), further complicating the outlook for potential TPU changes. The initiation of the North American Free Trade Agreement (NAFTA) renegotiation in May 2017 introduced additional trade uncertainty, as the outcome became less predictable (Alschner et al. 2018). Moreover, the disruption within the global supply chain network due to the COVID-19 pandemic (Ding et al. 2021) further compounded the impact of TPU, potentially exacerbating volatility in Islamic financial markets. In the midst of the heightened uncertainty brought about by the pandemic, investors found themselves responding to rapidly changing conditions, attempting to analyze risks (Ftiti et al. 2021). This complex environment could contribute to abrupt market volatility, driven by ambiguity surrounding trade policy, tariffs, and international relations. Consequently, the heightened Trade Policy Uncertainty (TPU) had a more pronounced impact, leading to increased error variances to the conditional risk of Sharia-compliant financial markets during COVID-19. The global impact of the COVID-19 pandemic is expected to result in a substantial and enduring decline in worldwide economic output, exhibiting varied outcomes across countries and regions (Chudik et al. 2021).