On the Curvature of the Bachelier Implied Volatility

Abstract

1. Introduction

2. Revision of the Literature

3. Statement of the Problem and Notation

- That is, v represents the future average volatility.

- .

- denotes the price of an European call option under the classical Bachelier model with constant volatility , current stock price x, time to maturity strike price k, and interest rate . That is,withwhere N is the cumulative distribution function and the probability density function of the standard normal random variable.denotes the Bachelier differential operator with volatilityIt is well known that

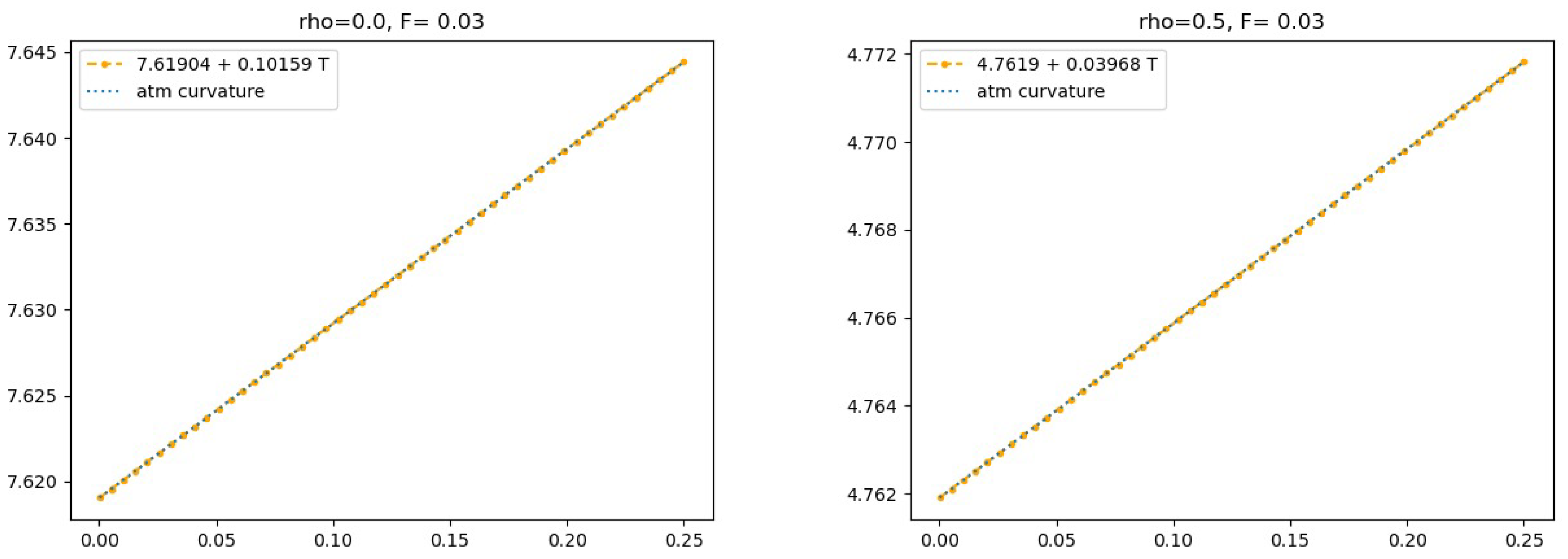

- The Bachelier implied volatility of a call option with strike k and market price is the unique volatility parameter one should put in the Bachelier formula to obtain the price . That is, the quantity , such thatwhere denotes the asset price. Note that if ,At the same time, due to the definition of the Black–Scholes implied volatility,(see Choi (2022)). Further results on the difference between the Black–Scholes and the Bachelier implied volatilities can be found in Schachermayer and Teichmann (2008).

4. Basic Concepts of Malliavin Calculus

Basic Definitions

5. Some Previous Results

6. The Curvature in the Uncorrelated Case

- (H1)

- .

- (H2)

- There exist two positive constants , such that .

- (H3)

- There exist two constants and , such that, for ,

- (H4)

- The termhas a finite limit as

7. The Correlated Case

- (H1’)

- belongs to , there exists a positive constant C, and , such that, for

- (H2’)

- Hypotheses (H1’) and (H2) hold and, for everyandhave a finite limit as

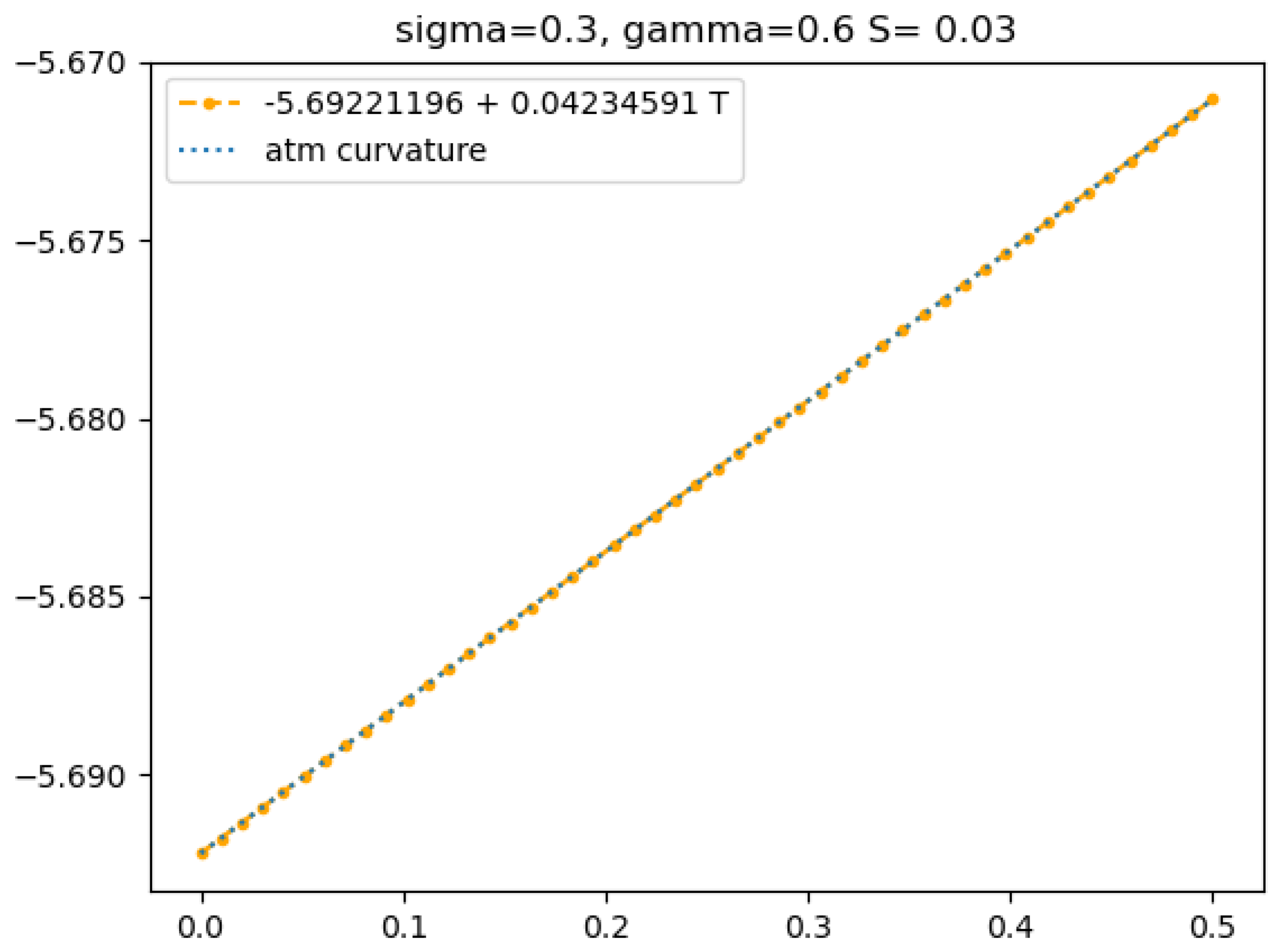

8. Examples

9. Conclusions

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

References

- Alòs, Elisa, and David García-Lorite. 2023. Malliavin Calculus in Finance. Theory and Practice, 2nd ed. London: Chapman and Hall. [Google Scholar]

- Alòs, Elisa, and Jorge A. León. 2017. On the curvature of the smile in stochastic volatility models. SIAM Journal on Financial Mathematics 8: 373–99. [Google Scholar] [CrossRef]

- Alòs, Elisa, Eulalia Nualart, and Makar Pravosud. 2023. On the Implied Volatility of Asian Options Under Stochastic Volatility Models. Applied Mathematical Finance 30: 249–74. [Google Scholar] [CrossRef]

- Bachelier, Louis. 1900. Théorie de la spéculation. Annales scientifiques de l’École Normale Supérieure. Paris: Société Mathématique de France, Série 3, Tome 17. [Google Scholar]

- Choi, Jaehyuk, Minsuk Kwak, Chyng Wen Tee, and Yumeng Wang. 2022. A Black–Scholes user’s guide to the Bachelier model. Journal of Futures Markets 42: 959–80. [Google Scholar] [CrossRef]

- Gatheral, Jim. 2006. The Volatility Surface. A Practitioner’s Guide. New York: John Wiley and Sons. [Google Scholar]

- Hagan, Patrik, Andrew Lesniewski, and Diana Woodward. 2002. Managing Smile Risk. Wilmott Magazine 1: 84–102. [Google Scholar]

- Medvedev, Alexei, and Oliver Scaillet. 2007. Approximation and calibration of short-term implied volatilities under jump-diffusion stochastic volatility. Review of Financial Studies 20: 427–59. [Google Scholar] [CrossRef]

- Nualart, David. 2006. Probability and its Applications. In The Malliavin Calculus and Related Topics, 2nd ed. Berlin: Springer. [Google Scholar]

- Nualart, David, and Étienne Pardoux. 1988. Stochastic calculus with anticipating integrands. Probability Theory and Related Fields 78: 535–81. [Google Scholar] [CrossRef]

- Schachermayer, Walter, and Josef Teichmann. 2008. How close are the option pricing formulas of bachelier and black–merton–scholes? Mathematical Finance 18: 155–70. [Google Scholar] [CrossRef]

- Terakado, Satoshi. 2019. On the Option Pricing Formula Based on the Bachelier Model. Available online: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3428994 (accessed on 24 October 2024).

| / | 0.1 | 0.25 | 0.4 | 0.55 | 0.7 |

|---|---|---|---|---|---|

| −0.5 | 0.104/0.104 | 0.651/0.651 | 1.667/1.667 | 3.152/3.151 | 5.105/5.104 |

| −0.3 | 0.144/0.144 | 0.901/0.901 | 2.307/2.307 | 4.362/4.361 | 7.067/7.064 |

| 0.0 | 0.167/0.167 | 1.042/1.042 | 2.667/2.667 | 5.043/5.042 | 8.17/8.167 |

| 0.3 | 0.144/0.144 | 0.901/0.901 | 2.307/2.307 | 4.362/4.361 | 7.067/7.064 |

| 0.5 | 0.104/0.104 | 0.651/0.651 | 1.667/1.667 | 3.152/3.151 | 5.105/5.104 |

| / | 0.01 | 0.015 | 0.02 | 0.025 | 0.03 |

|---|---|---|---|---|---|

| 0.1 | −0.248/−0.248 | −0.372/−0.372 | −0.496/−0.496 | −0.62/−0.619 | −0.744/−0.743 |

| 0.2 | −0.331/−0.331 | −0.496/−0.496 | −0.661/−0.661 | −0.827/−0.827 | −0.992/−0.992 |

| 0.3 | −0.33/−0.33 | −0.495/−0.495 | −0.66/−0.66 | −0.825/−0.825 | −0.99/−0.99 |

| 0.4 | −0.291/−0.291 | −0.437/−0.437 | −0.583/−0.583 | −0.729/−0.729 | −0.875/−0.874 |

| 0.5 | −0.241/−0.241 | −0.361/−0.361 | −0.481/−0.481 | −0.601/−0.601 | −0.722/−0.722 |

| 0.6 | −0.19/−0.19 | −0.285/−0.285 | −0.379/−0.379 | −0.474/−0.474 | −0.569/−0.569 |

| 0.7 | −0.145/−0.145 | −0.217/−0.217 | −0.29/−0.29 | −0.362/−0.362 | −0.434/−0.434 |

| 0.8 | −0.108/−0.108 | −0.161/−0.161 | −0.215/−0.215 | −0.269/−0.269 | −0.323/−0.323 |

| 0.9 | −0.078/−0.078 | −0.117/−0.117 | −0.156/−0.156 | −0.195/−0.195 | −0.234/−0.234 |

| 0.95 | −0.066/−0.066 | −0.099/−0.099 | −0.132/−0.132 | −0.165/−0.165 | −0.198/−0.198 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Alòs, E.; García-Lorite, D. On the Curvature of the Bachelier Implied Volatility. Risks 2025, 13, 27. https://doi.org/10.3390/risks13020027

Alòs E, García-Lorite D. On the Curvature of the Bachelier Implied Volatility. Risks. 2025; 13(2):27. https://doi.org/10.3390/risks13020027

Chicago/Turabian StyleAlòs, Elisa, and David García-Lorite. 2025. "On the Curvature of the Bachelier Implied Volatility" Risks 13, no. 2: 27. https://doi.org/10.3390/risks13020027

APA StyleAlòs, E., & García-Lorite, D. (2025). On the Curvature of the Bachelier Implied Volatility. Risks, 13(2), 27. https://doi.org/10.3390/risks13020027