Dynamic Connectedness Among Key Financial Markets and the Role of Policy Uncertainty: A Quantile-Based Approach

Abstract

1. Introduction

2. Literature Review

2.1. Evolution of Financial Market Connectedness

2.2. Carry Trades and Cross-Market Interdependencies

2.3. Policy Uncertainty and Market Connectedness

2.4. Market Conditions and Regime-Dependent Spillovers

3. Methodology

4. Data and Empirical Analysis

4.1. Data Description, Sources and Statistics

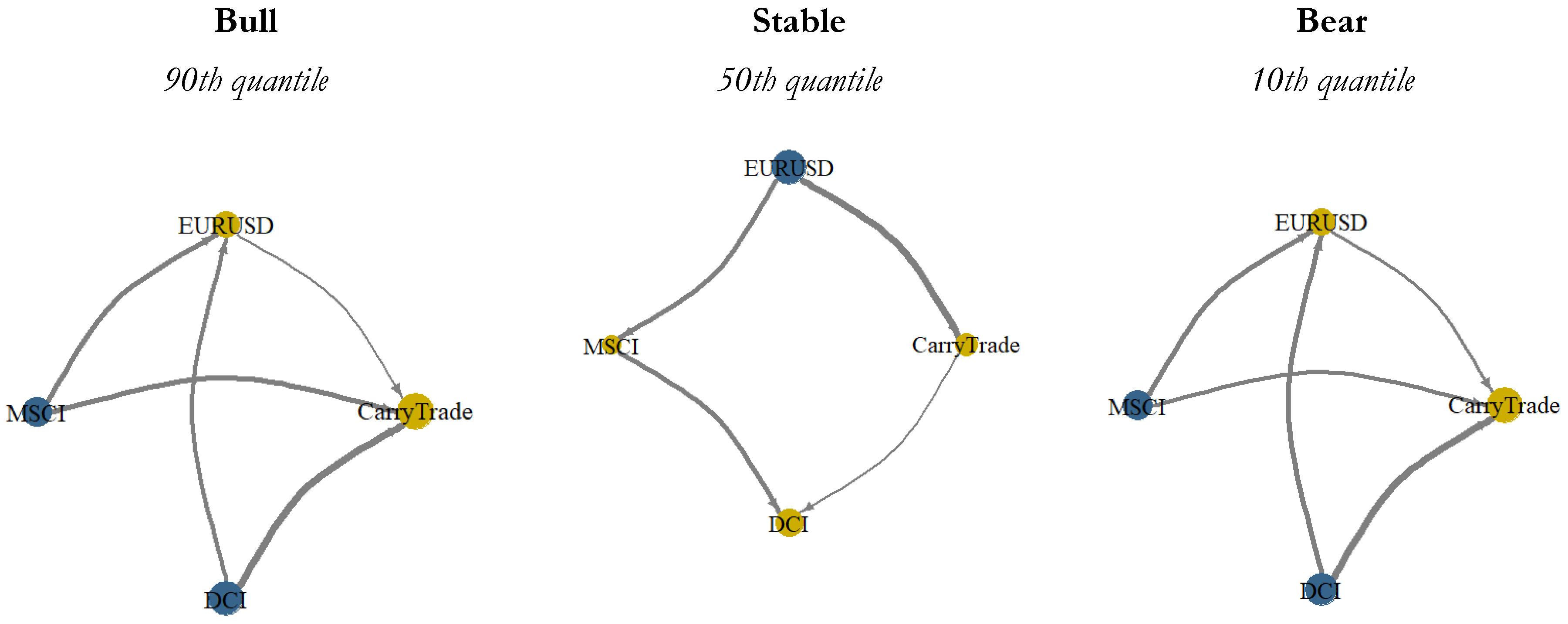

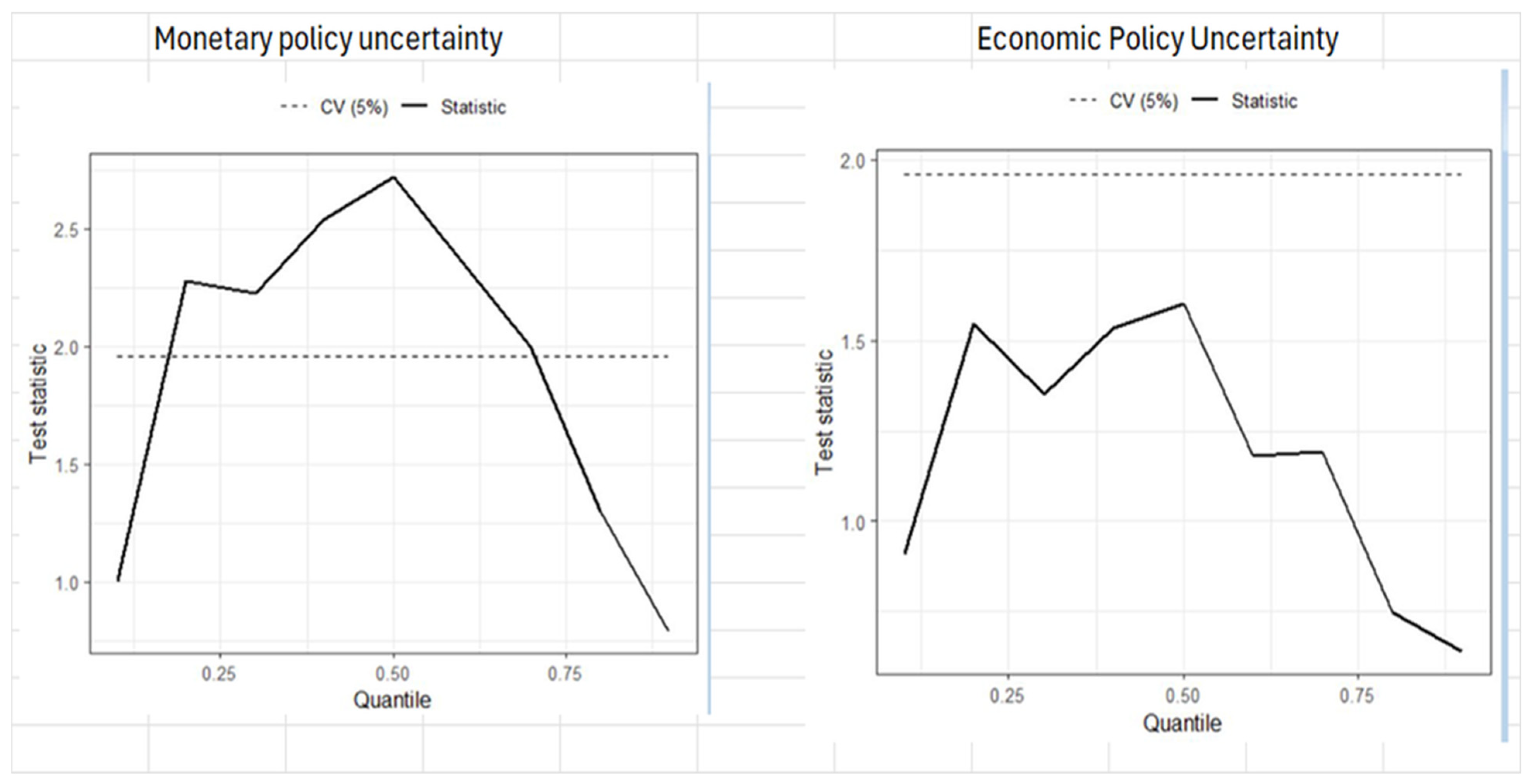

4.2. Quantile Connectedness Spillover

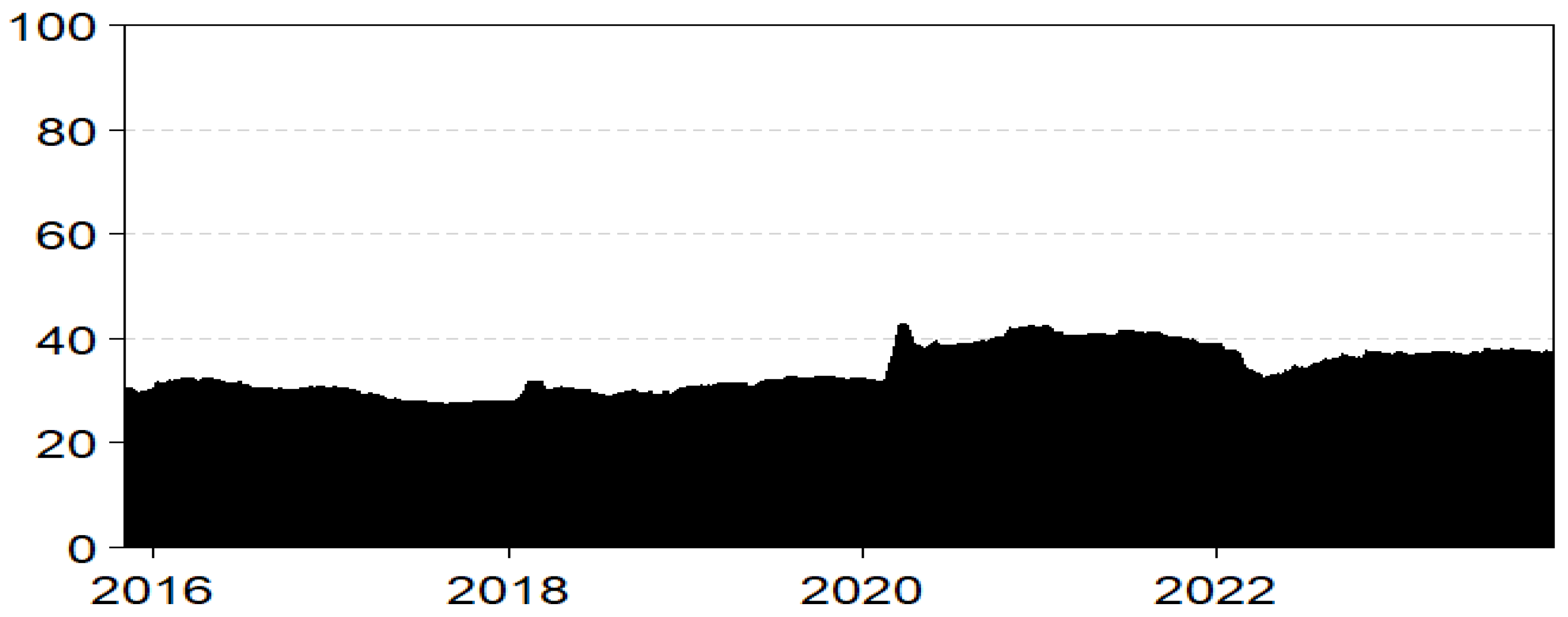

4.3. Dynamic Total Connectedness and Spillover Among Key Financial Markets

5. Conclusions and Policy Recommendations

5.1. Conclusions

5.2. Policy Recommendations

Funding

Data Availability Statement

Conflicts of Interest

References

- Abankwa, Samuel, and Lloyd P. Blenman. 2021. Measuring liquidity effects on carry trade across currencies and regimes. Journal of Multinational Financial Management 60: 100683. [Google Scholar] [CrossRef]

- Aftab, Muhammad, and Kate Phylaktis. 2022. Economic integration and exchange market pressure in a policy uncertain world. Journal of International Money and Finance 128: 102701. [Google Scholar] [CrossRef]

- Ando, Tomohiro, Matthew Greenwood-Nimmo, and Yongcheol Shin. 2018. Quantile Connectedness: Modelling tail behaviour in the topology of financial networks. Management Science 68: 23377–3174. [Google Scholar] [CrossRef]

- Anyikwa, Izunna, and Andrew Phiri. 2023. Connectedness and spillover between African equity, commodity, foreign exchange and cryptocurrency markets during the COVID-19 and Russia-Ukraine conflict. Future Business Journal 9: 48. [Google Scholar] [CrossRef]

- Awosusi, Abraham Ayobamiji. 2025. How do economic policy uncertainty, climate policy uncertainty and US monetary policy uncertainty shape investors’ sentiment in the green market? Applied Economics, 1–19. [Google Scholar] [CrossRef]

- Baker, Malcolm, and Jeffrey Wurgler. 2007. Investor sentiment in the stock market. Journal of Economic Perspectives 21: 129–52. [Google Scholar] [CrossRef]

- Baker, Scott R., Nicholas Bloom, and Steven J. Davis. 2016. Measuring Economic Policy Uncertainty. The Quarterly Journal of Economics 131: 1593–636. [Google Scholar] [CrossRef]

- Balcilar, Mehmet, Rangan Gupta, and Christian Pierdzioch. 2016. Does uncertainty move the gold price? New evidence from a nonparametric causality-in-quantiles test. Resources Policy 49: 74–80. [Google Scholar] [CrossRef]

- Baruník, Jozef, and Tomáš Křehlík. 2018. Measuring the frequency dynamics of financial connectedness and systemic risk. Journal of Financial Econometrics 16: 271–96. [Google Scholar] [CrossRef]

- Bekaert, Geert, Campbell R. Harvey, and Angela Ng. 2005. Market integration and contagion. Journal of Business 78: 39–69. [Google Scholar] [CrossRef]

- Bonga-Bonga, Lumengo, and Alain Kabundi. 2011. Monetary policy action and inflation in South Africa: An empirical analysis. African Finance Journal 13: 25–37. [Google Scholar]

- Bonga-Bonga, Lumengo, and Muhammad Khalique. 2025. The Dynamic Relationship Between Digital Currency and Other Financial Assets in Developed and Emerging Markets. International Journal of Financial Studies 13: 205. [Google Scholar] [CrossRef]

- Bonga-Bonga, Lumengo, and Sefora Motena Rangoanana. 2022. Carry trade and capital market returns in South Africa. Journal of Risk and Financial Management 15: 498. [Google Scholar] [CrossRef]

- Buraschi, Andrea, and Claudio Tebaldi. 2024. Financial contagion in network economies and asset prices. Management Science 70: 484–506. [Google Scholar] [CrossRef]

- Burnside, Craig, Martin Eichenbaum, and Sergio Rebelo. 2011. Carry trade and momentum in the currency market. Annual Review of Financial Economics 3: 511–35. [Google Scholar] [CrossRef]

- Cheung, Yan-Leung, Yin-Wong Cheung, and Angela W. W. He. 2012. Yen carry trades and stock returns in target currency countries. Japan and the World Economy 24: 174–83. [Google Scholar] [CrossRef]

- Diebold, Francis X., and Kamil Yilmaz. 2009. Measuring financial asset return and volatility spillovers, with application to global equity markets. The Economic Journal 119: 158–71. [Google Scholar] [CrossRef]

- Diebold, Francis X., and Kamil Yilmaz. 2012. Better to give than to receive: Predictive directional measurement of volatility spillovers. International Journal of Forecasting 28: 57–66. [Google Scholar] [CrossRef]

- Dinh, Le Quoc, Tran Thi Kim Oanh, and Nguyen Thi Hong Ha. 2025. Financial stability and sustainable development: Perspectives from fiscal and monetary policy. International Journal of Finance and Economics 30: 1724–41. [Google Scholar] [CrossRef]

- Eichholtz, Piet, Ronald Huisman, and Remco C. J. Zwinkels. 2015. Fundamentals or trends? A long-term perspective on house prices. Applied Economics 47: 3681–92. [Google Scholar] [CrossRef]

- Fasanya, O. Ismail, Oluwasegun B. Adekoya, and Abiodun M. Adetokunbo. 2021. On the connection between oil and global foreign exchange markets: The role of economic policy uncertainty. Resources Policy 72: 102110. [Google Scholar] [CrossRef]

- Frijns, Bart, Esther Koellen, and Thorsten Lehnert. 2008. On the determinants of portfolio choice. Journal of Economic Behaviour and Organisation 66: 373–86. [Google Scholar] [CrossRef]

- Fung, Hung-Gay, Yiuman Tse, and Lin Zhao. 2013. Are stock markets in Asia related to the carry trade? Pacific-Basin Financial Journal 25: 200–17. [Google Scholar] [CrossRef]

- Georg, Co-Pierre. 2013. The effect of the interbank network structure on contagion and common shocks. Journal of Banking and Finance 37: 2216–28. [Google Scholar] [CrossRef]

- Husted, Lucas, John Rogers, and Bo Sun. 2020. Monetary policy uncertainty. Journal of Monetary Economics 115: 20–36. [Google Scholar] [CrossRef]

- Istrefi, K., and S. Mouabbi. 2021. Subjective monetary policy uncertainty. European Economic Review 132: 103657. [Google Scholar]

- Kocaarslan, Baris. 2024. Dynamic spillovers between oil market, monetary policy, and exchange rate dynamics in the U.S. Finance Research Letters 69: 106137. [Google Scholar] [CrossRef]

- Kurov, Alexander, and Raluca Stan. 2018. Monetary policy uncertainty and the market reaction to macroeconomic news. Journal of Banking and Finance 86: 127–42. [Google Scholar] [CrossRef]

- Lee, Hsiu-Chuan, and Shu-Lien Chang. 2013. Spillovers of currency carry trade returns, market risk sentiment, and U.S. market returns. North American Journal of Economics and Finance 26: 197–216. [Google Scholar] [CrossRef]

- Long, Trinh Quang, Lan Hoang Nguyen, and Peter J. Morgan. 2024. Dynamic connectedness of financial stress across advanced and emerging economies: Evidence from time and frequency domains. The Singapore Economic Review 69: 751–91. [Google Scholar] [CrossRef]

- Luo, Changqing, Yi Qu, Yaya Su, and Liang Dong. 2024. Risk spillover from international crude oil markets: Evidence from extreme events and U.S. North American Journal of Economics and Finance 70: 102041. [Google Scholar] [CrossRef]

- Menkhoff, Lukas, Lucio Sarno, Maik Schmeling, and Anderas Schrimpf. 2012. Carry trades and global foreign exchange volatility. The Journal of Finance 67: 681–718. [Google Scholar] [CrossRef]

- Nefzi, Nourhaine, and Abir Melki. 2023. Volatility transmitter or receiver? Investigating dynamic connectedness between the carry trade and financial markets. Borsa Istanbul Review 23: 748–58. [Google Scholar] [CrossRef]

- Oliyide, Johnson A., Oluwasegun B. Adekoya, Mohamed Marie, and Mamdouh Abdulaziz Saleh Al-Faryan. 2023. Green finance and commodities: Cross-market connectedness during different COVID-19 episodes. Resources Policy 85: 103916. [Google Scholar] [CrossRef]

- Özçelebi, Oguzhan, and Oguzhan Kang. 2024. Extreme connectedness and network across financial assets and commodity futures markets. The North American Journal of Economics and Finance 69: 102099. [Google Scholar] [CrossRef]

- Pavlova, Ivelina, and Maria De Boyrie. 2014. Carry Trades and Sovereign CDS Spreads: Evidence from Asia-Pacific Markets. The Journal of Futures Markets 35: 1067–87. [Google Scholar] [CrossRef]

- Reboredo, Juan Carlos, Andrea Ugolini, and Jose Arreola Hernandez. 2021. Dynamic spillovers and network structure among commodity, currency, and stock markets. Resources Policy 74: 102266. [Google Scholar] [CrossRef]

- Suh, Sangwon. 2019. Unexploited currency carry trade profit opportunity. Journal of International Financial Markets, Institutions and Money 58: 236–54. [Google Scholar] [CrossRef]

- Wang, Xiao, Xiao Xie, Yihua Chen, and Borui Zhao. 2021. Machine learning approach to forecasting carry trade returns. Applied Economics Letters 29: 1199–204. [Google Scholar] [CrossRef]

- Wu, Baoxiu, and Qing Wang. 2025. Cross-asset contagion and risk transmission in global financial networks. The North American Journal of Economics and Finance 80: 102511. [Google Scholar] [CrossRef]

- Wu, Hao, Huiming Zhu, Fei Huang, and Weifang Mao. 2023. How does economic policy uncertainty drive time-frequency connectedness across commodity and financial markets? North American Journal of Economics and Finance 64: 101865. [Google Scholar] [CrossRef]

- Yao, Xiaoyang, Wei Le, Xiaolei Sun, and Jianping Li. 2020. Financial stress dynamics in China: An interconnectedness perspective. International Review of Economics and Finance 68: 217–38. [Google Scholar] [CrossRef]

| Carry Trade | EURUSD | MSCI | DCI | |

|---|---|---|---|---|

| Min | −3.538 | −3.771 | −13.29 | −11.43 |

| Mean | 0.036 | −0.0026 | 0.137 | 0.1142 |

| Max | 2.732 | 4.0859 | 10.417 | 8.3353 |

| Standard deviation | 0.9116 | 1.0342 | 2.3602 | 2.4650 |

| Skewness | −0.316 | 0.0893 | −0.834 | −0.8122 |

| Kurtosis | 0.6410 | 1.2441 | 6.9054 | 2.84627 |

| JB test | 14.698 | 28.675 | 899.33 | 191.97 |

| Q(20) | 29.027 | 22.234 | 9.11 | 25.893 |

| Q(20) probability | 0.087 | 0.169 | 0.328 | 0.981 |

| Variable | t-Statistic |

|---|---|

| Carry trade | −6.8873 *** |

| EUR/USD | −6.5435 *** |

| MSCI | −7.9685 *** |

| DCI | −5.6478 *** |

| Carry Trade | EUR/USD | MSCI | DCI | FROM | |

|---|---|---|---|---|---|

| Carry Trade | 63.08 | 6.48 | 13.32 | 17.13 | 36.92 |

| EURUSD | 4.69 | 48.05 | 25.56 | 21.70 | 51.95 |

| MSCI | 9.89 | 22.17 | 42.69 | 25.25 | 57.31 |

| DCI | 12.06 | 18.71 | 24.54 | 44.69 | 55.31 |

| TO | 26.64 | 47.36 | 63.41 | 64.08 | 201.49 |

| NET | −10.29 | −4.59 | 6.10 | 8.77 | 67.16/50.37 |

| Carry Trade | EURUSD | MSCI | DCI | FROM | |

|---|---|---|---|---|---|

| Carry Trade | 62.45 | 33.84 | 2.51 | 1.20 | 37.55 |

| EURUSD | 31.59 | 57.88 | 7.85 | 2.67 | 42.12 |

| MSCI | 2.93 | 9.60 | 70.34 | 17.13 | 29.66 |

| DCI | 1.85 | 2.64 | 18.90 | 76.61 | 23.39 |

| TO | 36.37 | 46.08 | 29.27 | 21.01 | 132.72 |

| NET | −1.18 | 3.96 | −0.39 | −2.39 | 44.24/33.18 |

| Carry Trade | EURUSD | MSCI | DCI | FROM | |

|---|---|---|---|---|---|

| Carry Trade | 60.08 | 6.54 | 13.62 | 19.76 | 39.92 |

| EURUSD | 4.42 | 47.23 | 25.68 | 22.67 | 52.77 |

| MSCI | 10.44 | 22.39 | 42.10 | 25.07 | 57.90 |

| DCI | 14.93 | 19.22 | 25.18 | 40.66 | 59.34 |

| TO | 29.79 | 48.15 | 64.48 | 67.50 | 209.92 |

| NET | −10.13 | −4.62 | 6.59 | 8.16 | 69.97/52.48 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Bonga-Bonga, L. Dynamic Connectedness Among Key Financial Markets and the Role of Policy Uncertainty: A Quantile-Based Approach. Risks 2025, 13, 228. https://doi.org/10.3390/risks13120228

Bonga-Bonga L. Dynamic Connectedness Among Key Financial Markets and the Role of Policy Uncertainty: A Quantile-Based Approach. Risks. 2025; 13(12):228. https://doi.org/10.3390/risks13120228

Chicago/Turabian StyleBonga-Bonga, Lumengo. 2025. "Dynamic Connectedness Among Key Financial Markets and the Role of Policy Uncertainty: A Quantile-Based Approach" Risks 13, no. 12: 228. https://doi.org/10.3390/risks13120228

APA StyleBonga-Bonga, L. (2025). Dynamic Connectedness Among Key Financial Markets and the Role of Policy Uncertainty: A Quantile-Based Approach. Risks, 13(12), 228. https://doi.org/10.3390/risks13120228