Volatility Spillovers and Market Decoupling: Evidence from BRICS and China’s Green Sector

Abstract

1. Introduction

2. Theoretical Foundations

2.1. The Mechanisms of Green Investments

2.2. Turbulence, Spillovers, and Global Interconnectedness

3. Methodology

3.1. Materials and Methods

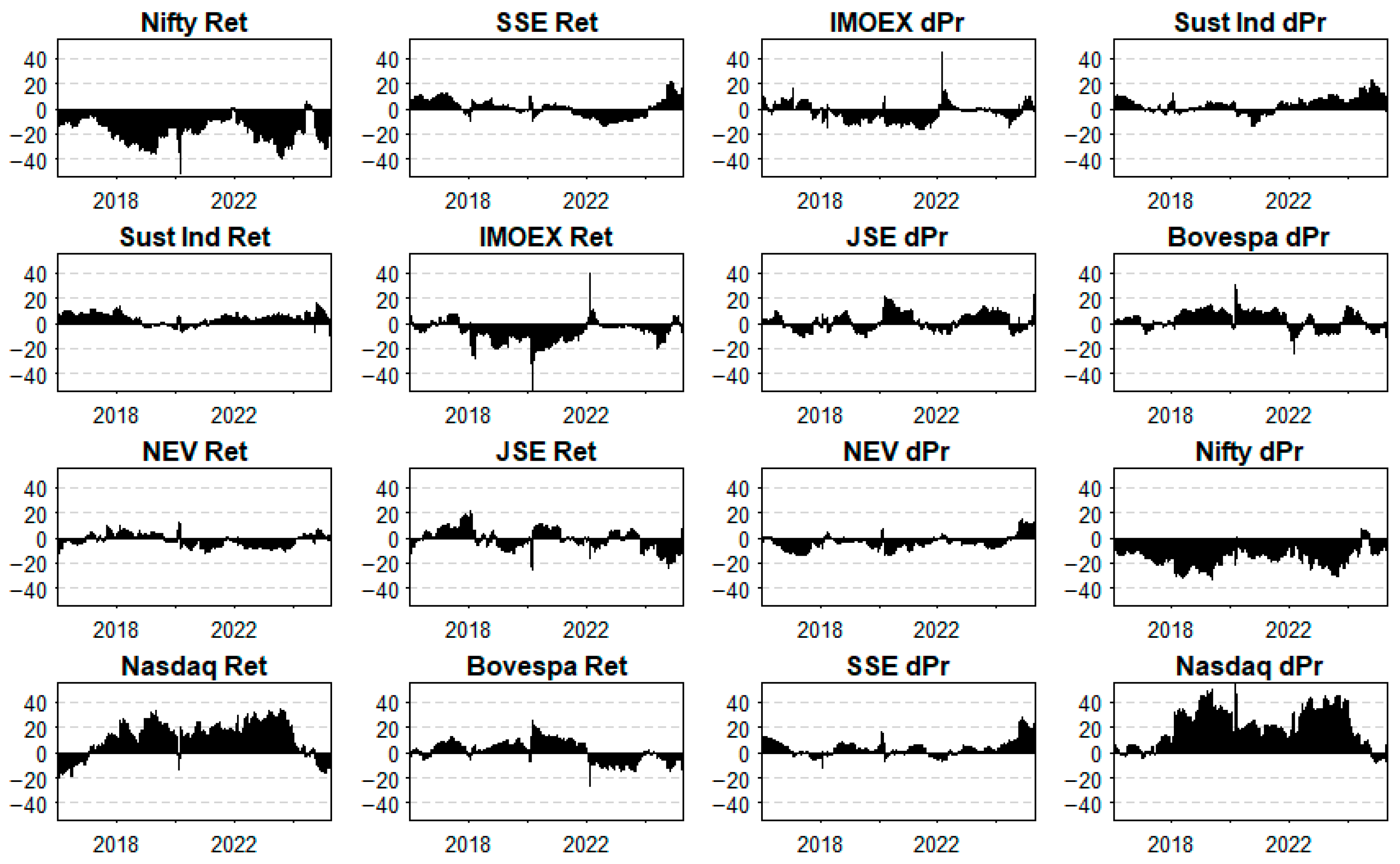

3.1.1. Markets and Variables (ΔPrice and Returns)

3.1.2. Summary Statistics and Stationarity Checks

3.1.3. BVAR Model with Minnesota Ridge Prior

4. Results

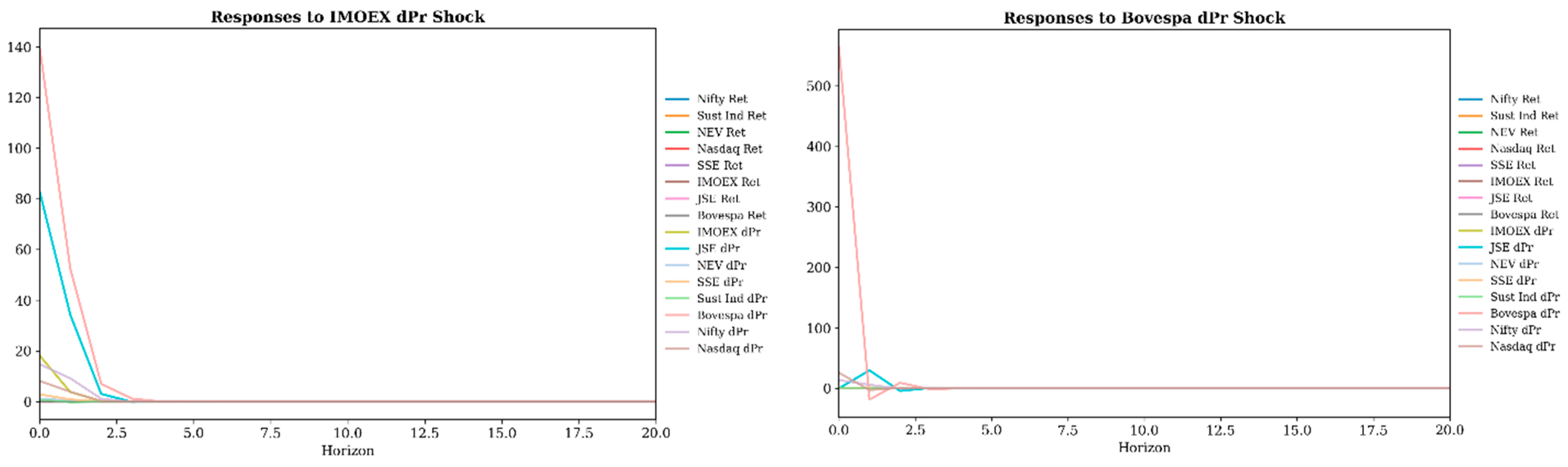

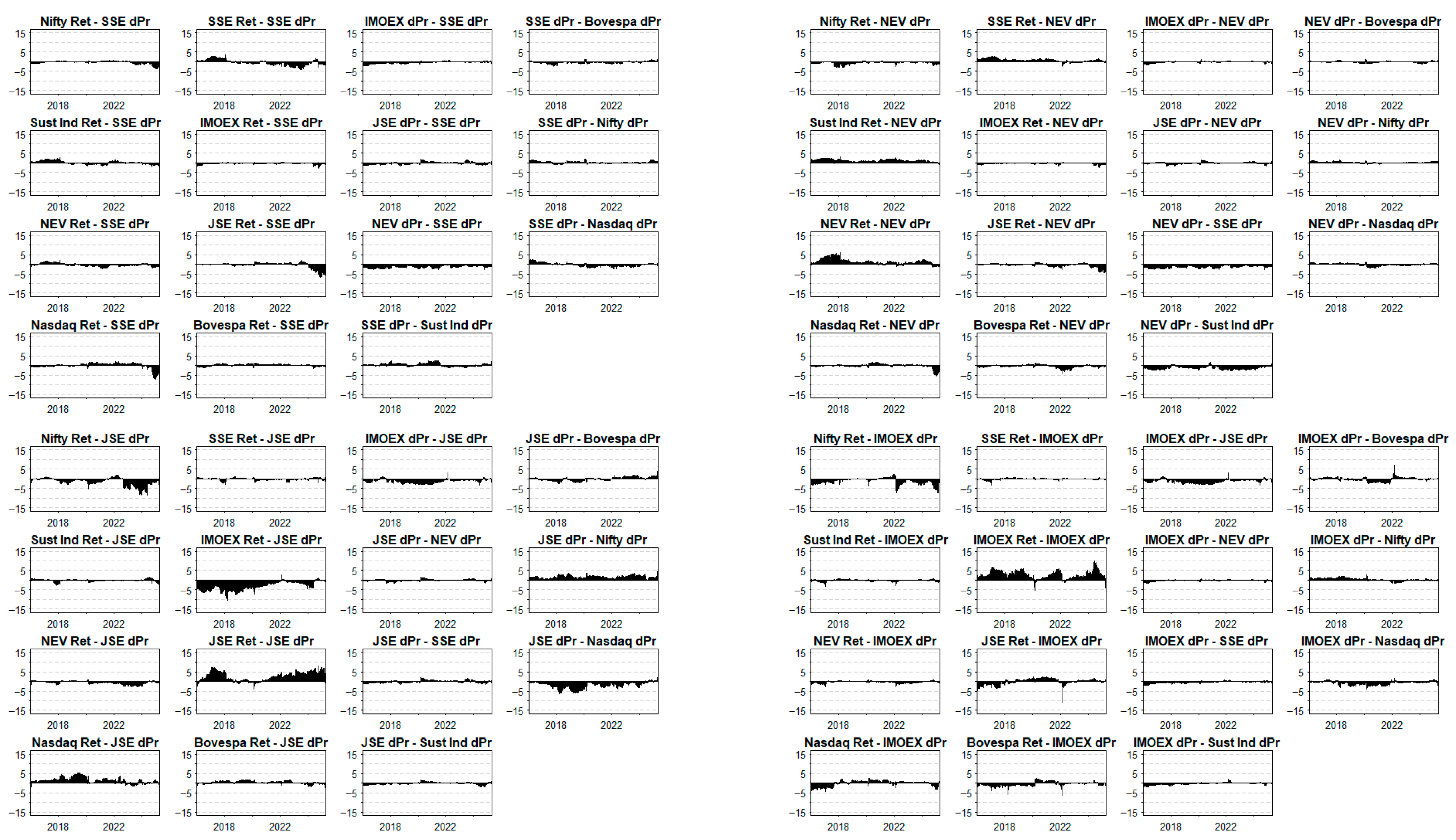

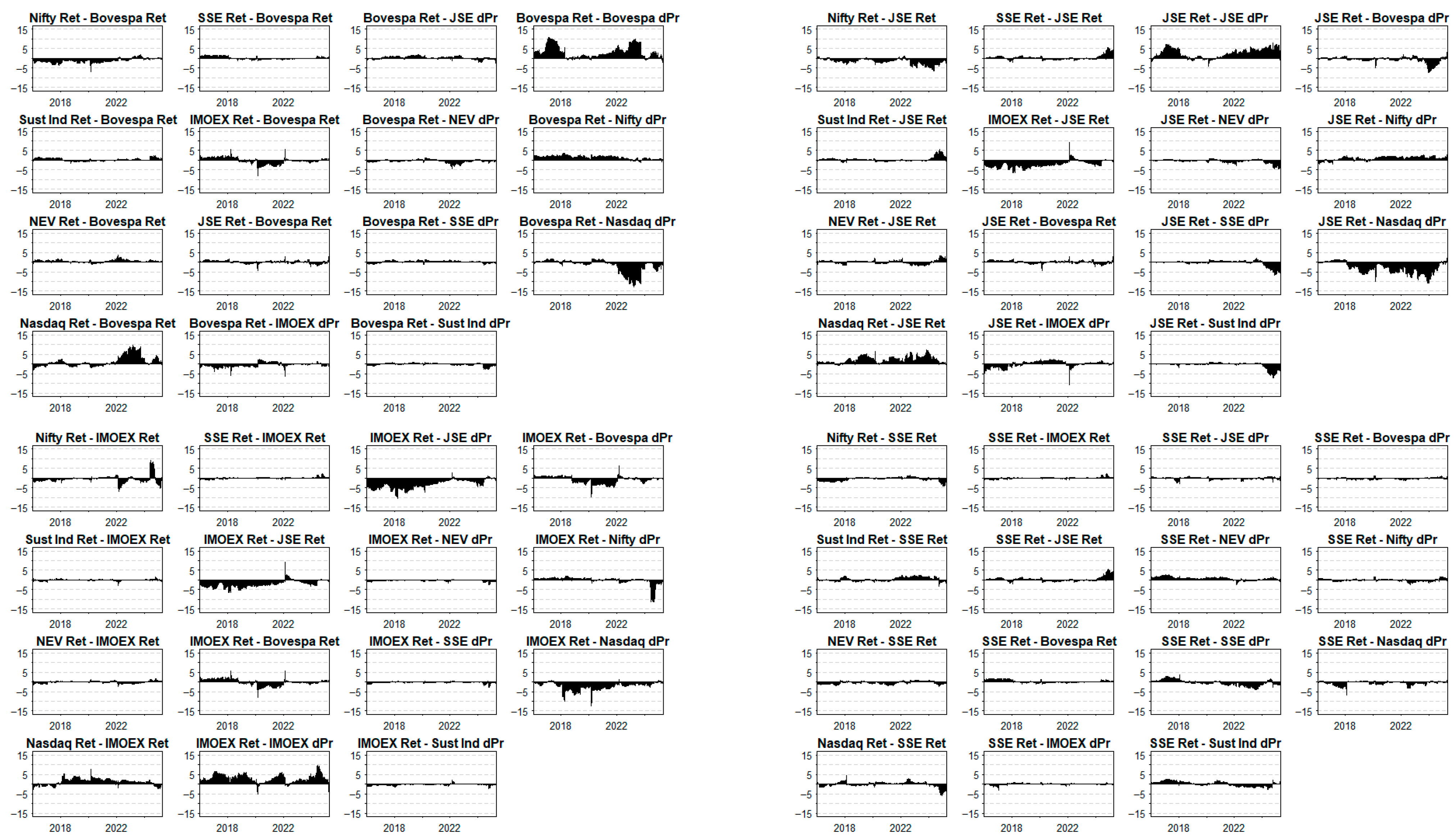

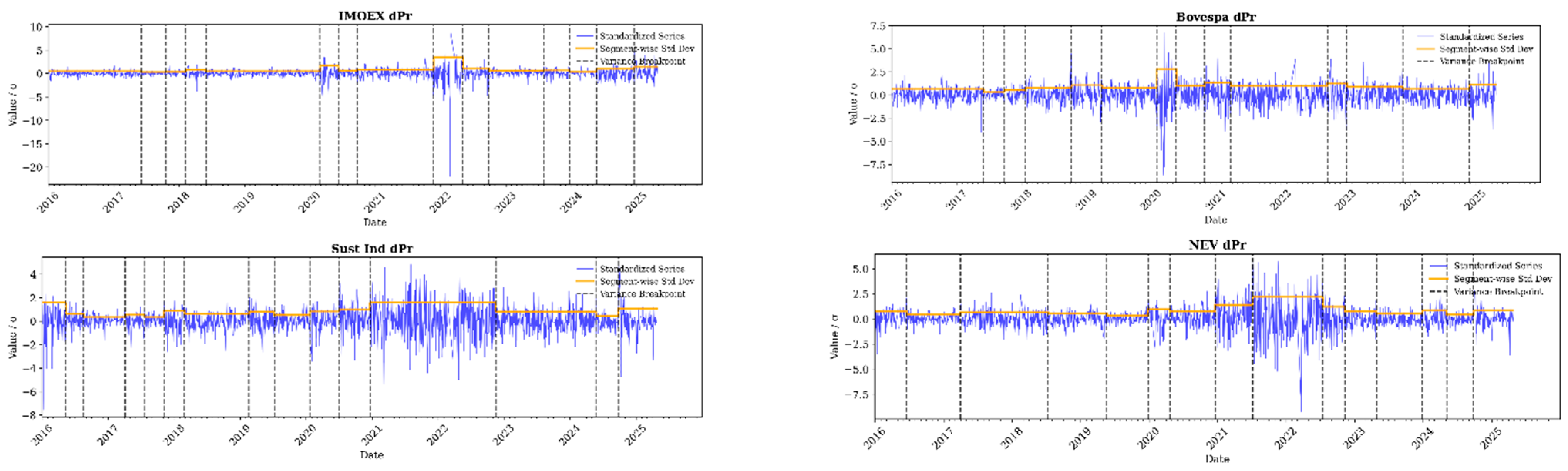

4.1. Dynamic Interconnectedness Based on BVAR with Minnesota Ridge Prior

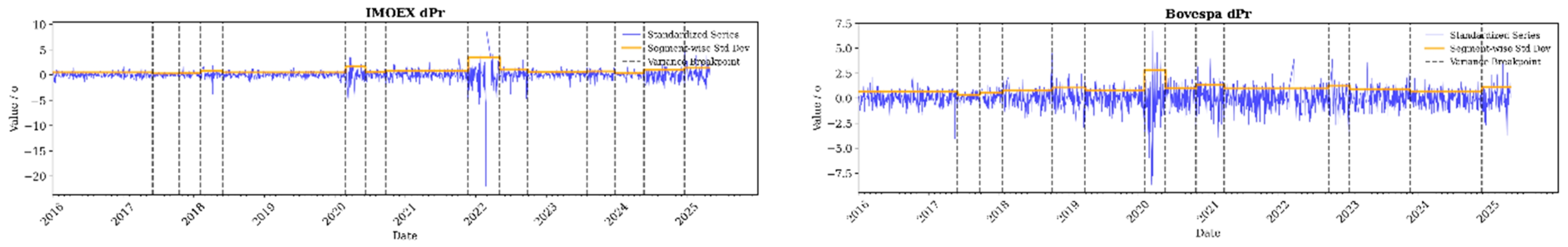

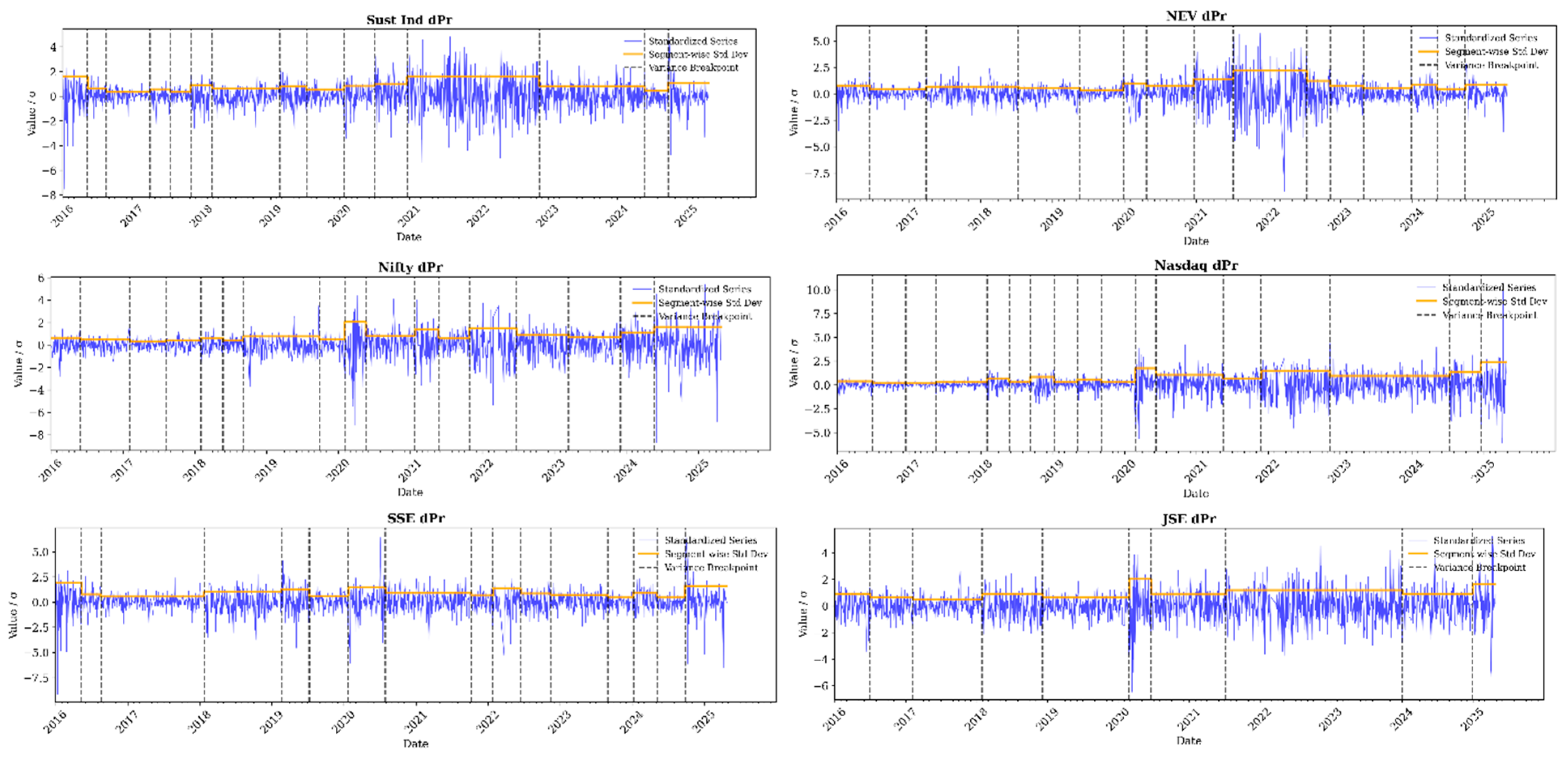

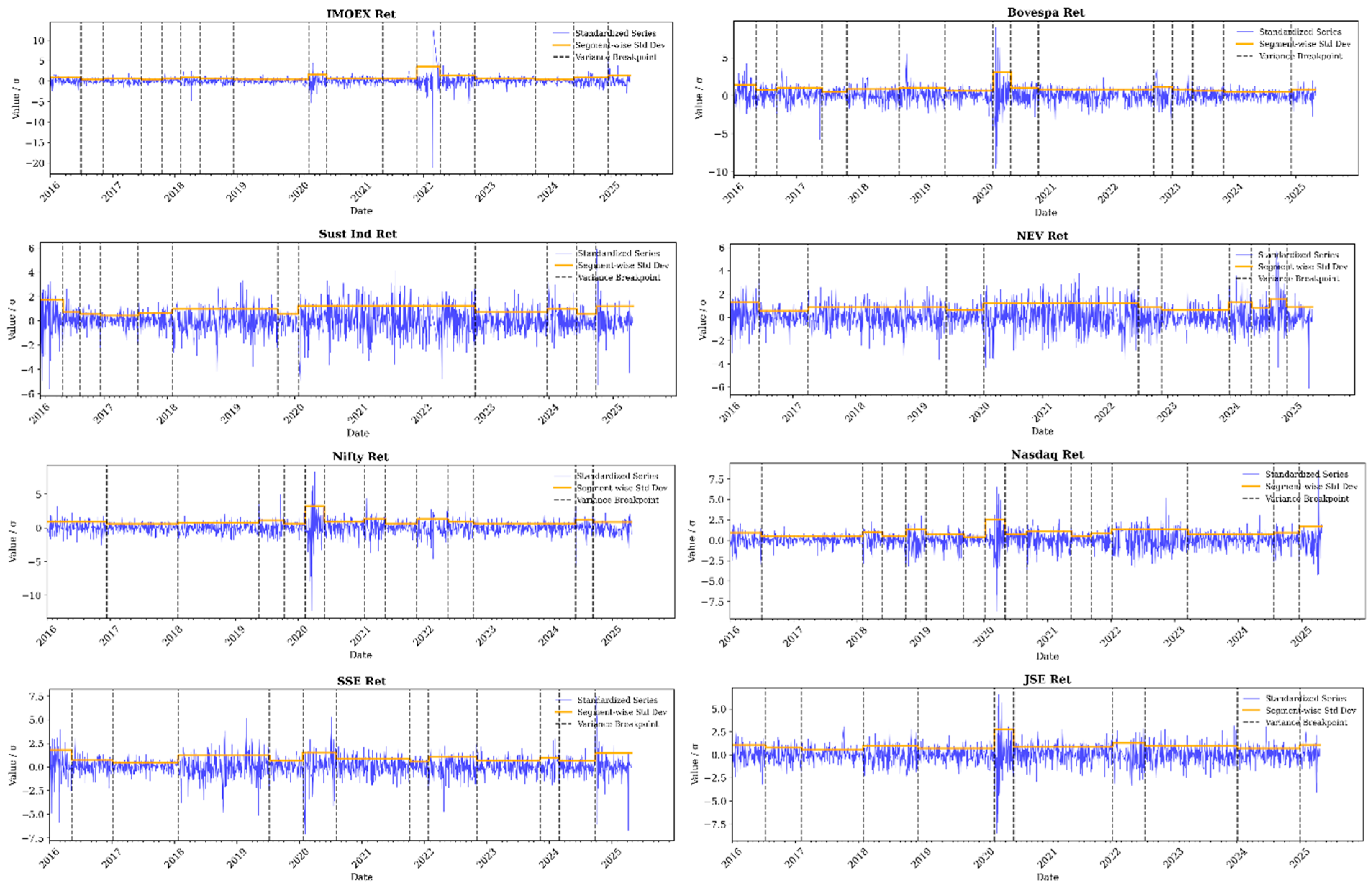

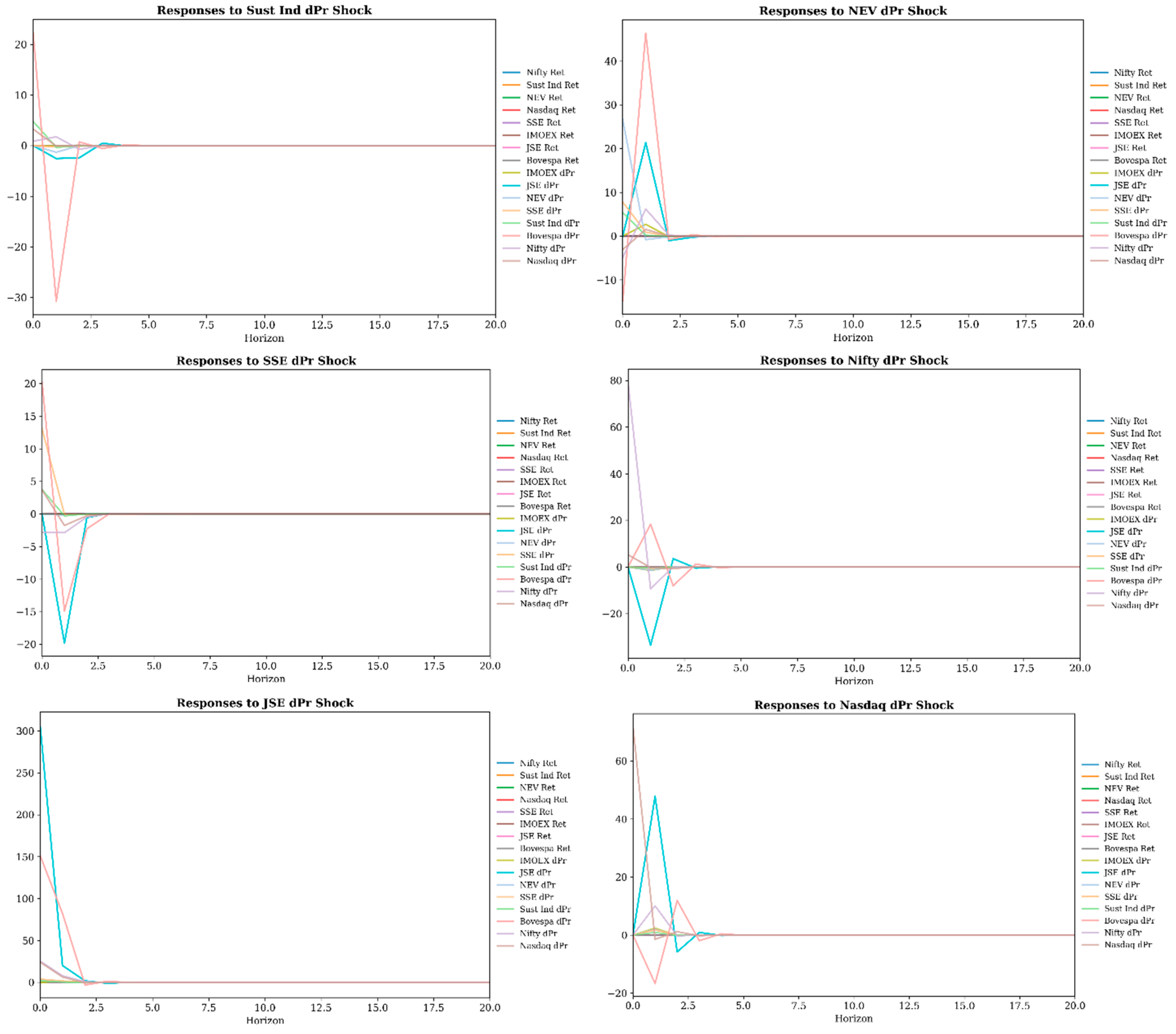

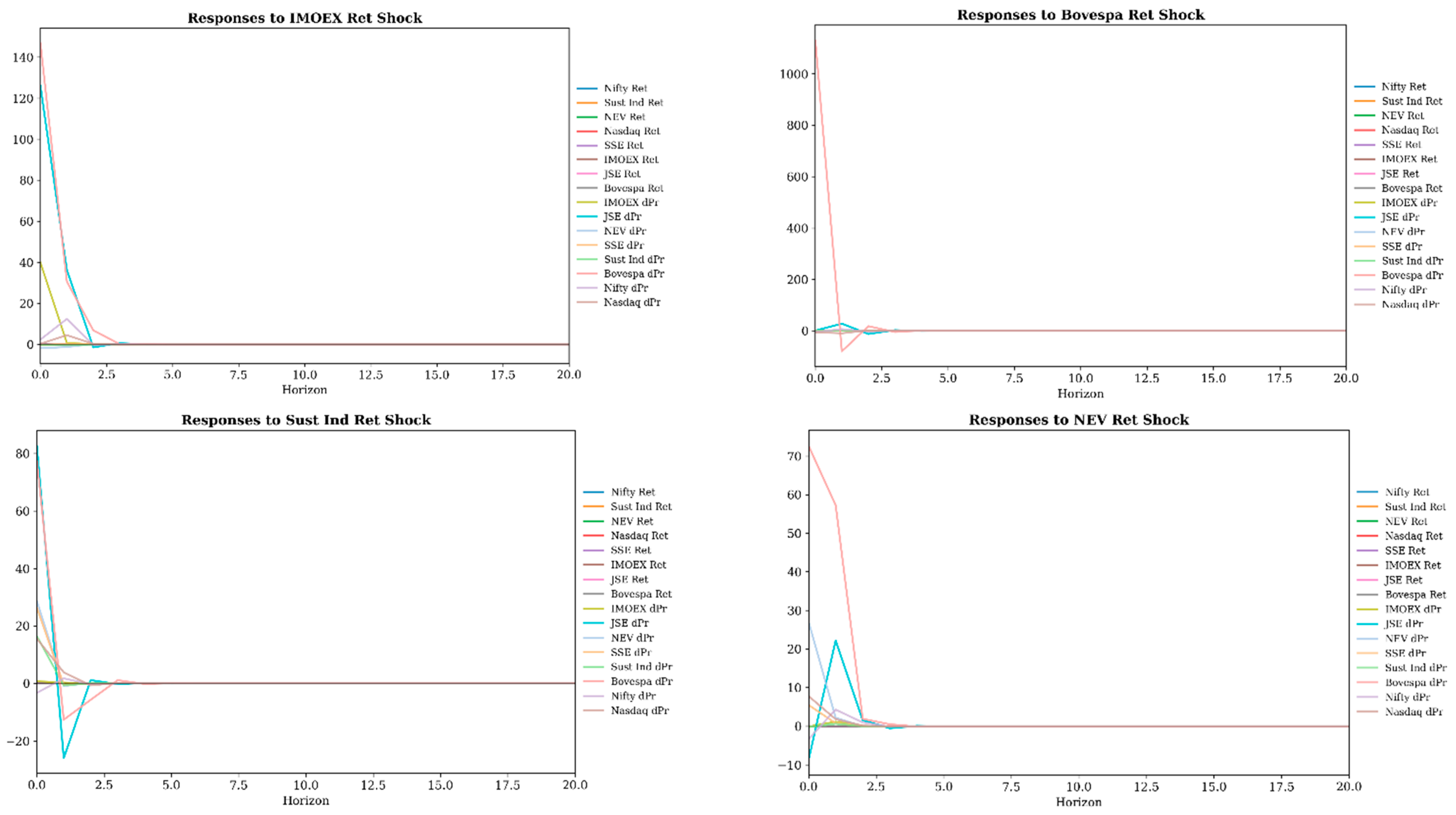

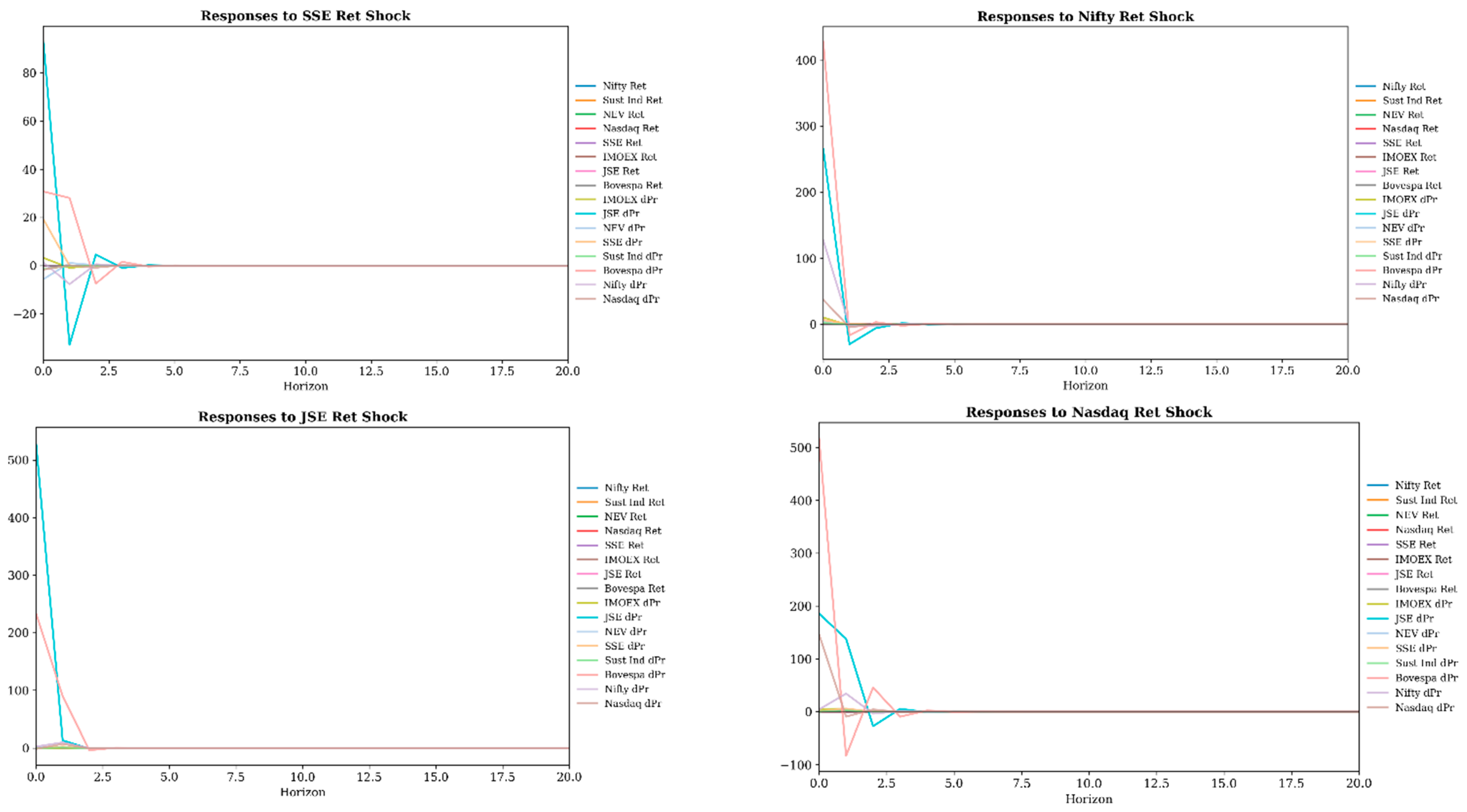

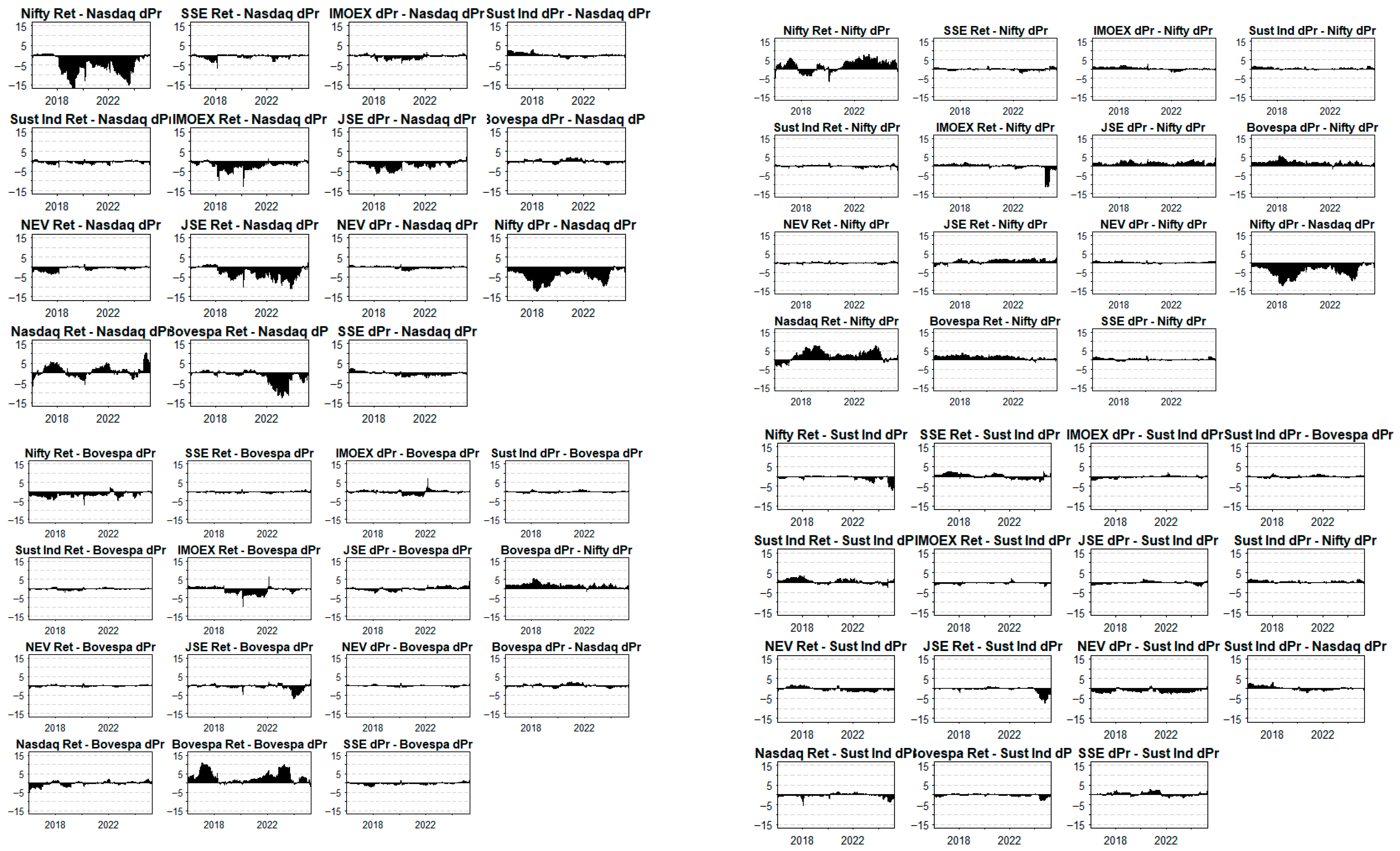

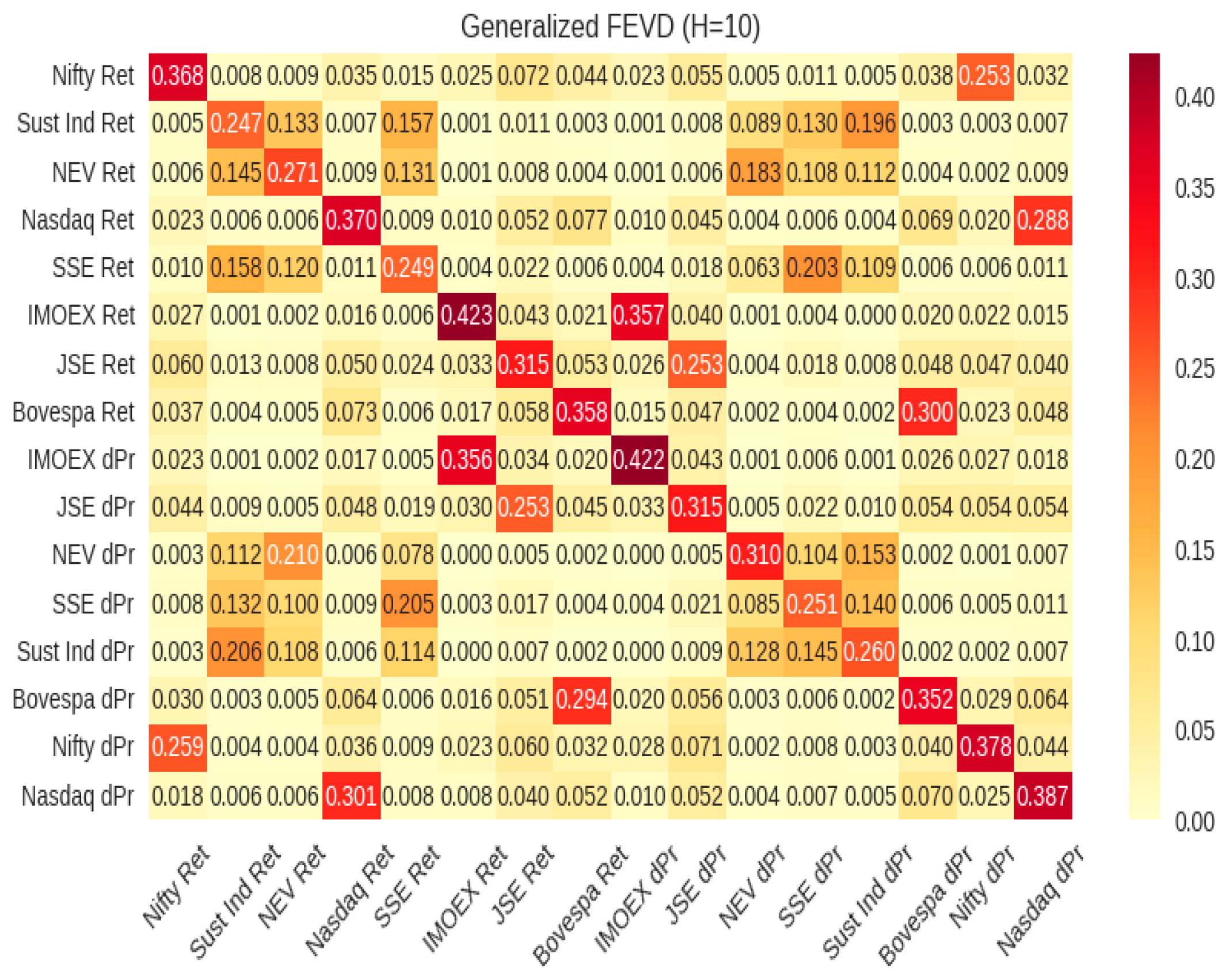

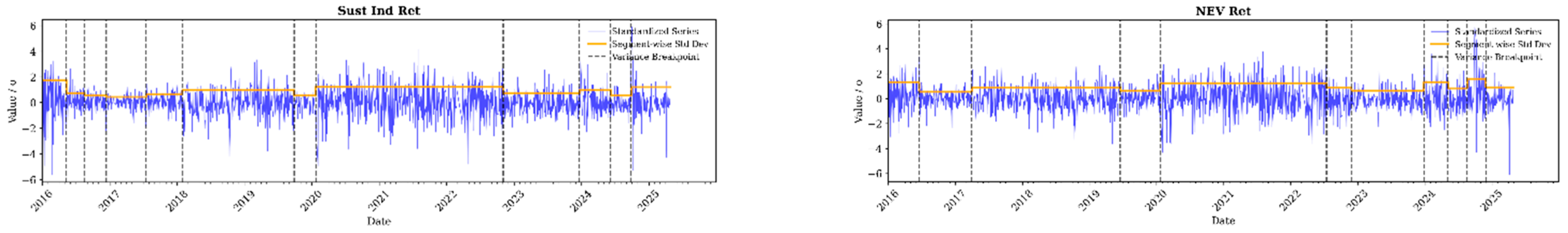

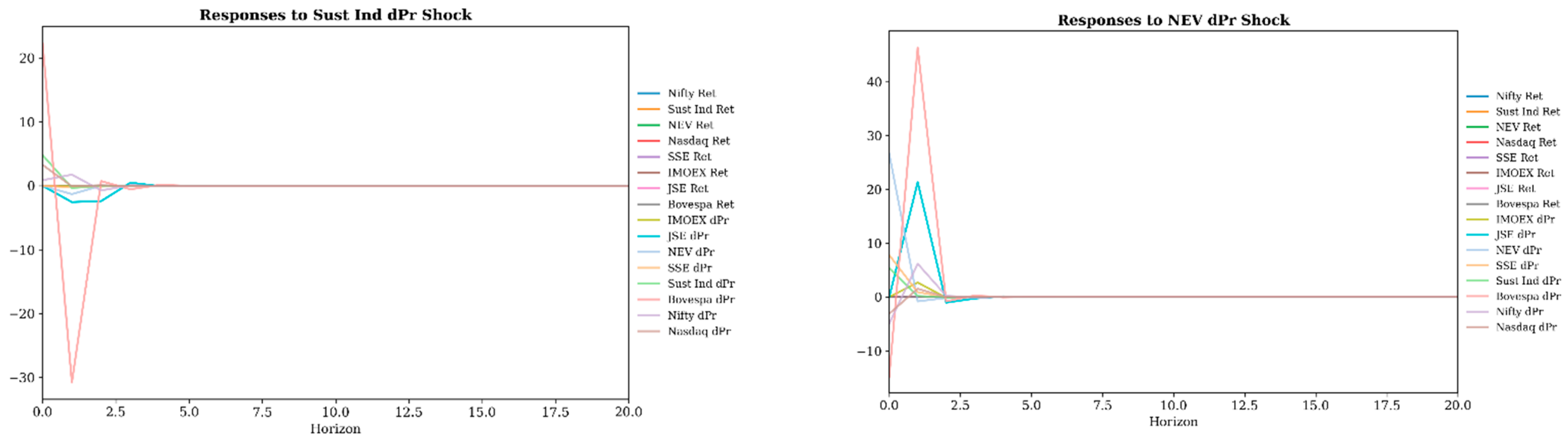

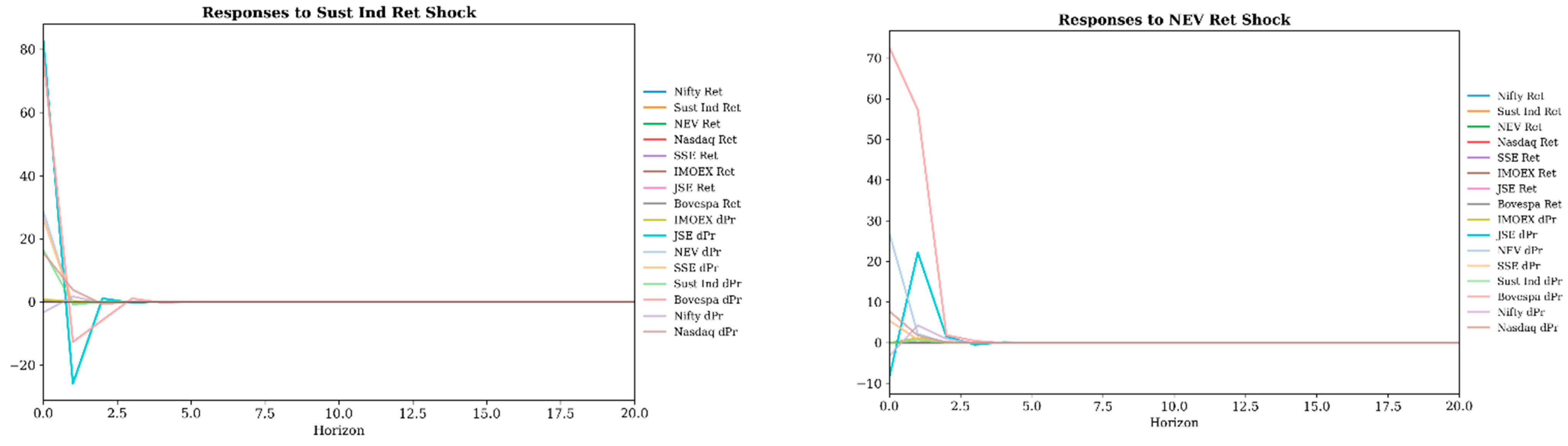

4.2. Variance Breakpoint and Impulse Response Function Analysis

4.3. Dynamic Connectedness with TVP-VAR Model

5. Discussion

6. Theoretical Contribution

7. Practical Contributions

8. Conclusions

9. Limitations

Author Contributions

Funding

Institutional Review Board Statement

Data Availability Statement

Conflicts of Interest

Appendix A

| Series | Price | p-Value (Price) | KPSS (Returns) | p-Value (Returns) | KPSS Stat (ΔPrice) | p-Value (ΔPrice) |

|---|---|---|---|---|---|---|

| Nifty | 19.212 | 0.01 | 0.059164 | 0.1 | 0.10553 | 0.1 |

| Sust Ind | 8.1715 | 0.01 | 0.21924 | 0.1 | 0.18432 | 0.1 |

| NEV | 3.879 | 0.01 | 0.24713 | 0.1 | 0.18601 | 0.1 |

| Nasdaq | 18.356 | 0.01 | 0.034778 | 0.1 | 0.050348 | 0.1 |

| SSE | 2.2627 | 0.01 | 0.048519 | 0.1 | 0.034646 | 0.1 |

| IMOEX | 8.5217 | 0.01 | 0.10445 | 0.1 | 0.072801 | 0.1 |

| JSE | 17.54 | 0.01 | 0.052421 | 0.1 | 0.067909 | 0.1 |

| Bovespa | 17.475 | 0.01 | 0.29388 | 0.1 | 0.049065 | 0.1 |

| Series | FROM | TO | NET |

|---|---|---|---|

| Nasdaq Ret | 62.9842 | 68.7036 | 5.7195 |

| Sust Ind Ret | 75.2634 | 80.757 | 5.4936 |

| JSE Ret | 68.5316 | 73.3046 | 4.773 |

| JSE ΔPr | 68.4846 | 72.942 | 4.4574 |

| Nasdaq ΔPr | 61.342 | 65.4918 | 4.1498 |

| Bovespa ΔPr | 64.7984 | 68.8895 | 4.0912 |

| SSE Ret | 75.1135 | 79.1573 | 4.0439 |

| SSE ΔPr | 74.8972 | 78.428 | 3.5308 |

| Bovespa Ret | 64.1479 | 65.8745 | 1.7266 |

| Sust Ind ΔPr | 73.9818 | 75.0604 | 1.0786 |

| NEV Ret | 72.9537 | 72.3506 | −0.6031 |

| IMOEX ΔPr | 57.7779 | 53.1984 | −4.5796 |

| IMOEX Ret | 57.6627 | 52.7991 | −4.8636 |

| Nifty Ret | 63.1846 | 55.6447 | −7.5399 |

| Nifty ΔPr | 62.2176 | 51.8665 | −10.3511 |

| NEV ΔPr | 68.9809 | 57.8538 | −11.1271 |

| Gamma | Average Log Score | Evaluations |

|---|---|---|

| 5 | −23.4133 | 940 |

| 2 | −23.4128 | 940 |

| 1 | −23.4126 | 940 |

| 0.5 | −23.4132 | 940 |

| 0.2 | −23.4196 | 940 |

| 0.1 | −23.4338 | 940 |

References

- Alsahlawi, Abdulaziz Mohammed, Kaouther Chebbi, and Mohammed Abdullah Ammer. 2021. The impact of environmental sustainability disclosure on stock return of Saudi listed firms: The moderating role of financial constraints. International Journal of Financial Studies 9: 4. [Google Scholar] [CrossRef]

- Antonakakis, Nikolaos, David Gabauer, and Rangan Gupta. 2019. International monetary policy spillovers: Evidence from a time-varying parameter vector autoregression. International Review of Financial Analysis 65: 101382. [Google Scholar] [CrossRef]

- Araújo, Deborah. 2025. Brazil and China Sign Billion-Dollar Deals to Explore Lithium and Rare Earths in South America, Challenging U.S. Dominance in the Energy Transition. CPG. Available online: https://en.clickpetroleoegas.com.br/Brazil-and-China-sign-billion-dollar-agreements-to-explore-lithium-and-rare-earths-in-South-America-and-challenge-US-dominance-in-the-energy-transition-dsca00/ (accessed on 19 October 2025).

- Baruník, Jozef, Evžen Kočenda, and Lukáš Vácha. 2016. Volatility spillovers across petroleum markets. The Energy Journal 37: 136–58. [Google Scholar] [CrossRef]

- Bhuyan, Rafiqul, Mohammad G. Robbani, Bakhtear Talukdar, and Ajeet Jain. 2016. Information transmission and dynamics of stock price movements: An empirical analysis of BRICS and US stock markets. International Review of Economics & Finance 46: 180–95. [Google Scholar] [CrossRef]

- Busse, Jeffrey A., and T. Clifton Green. 2002. Market efficiency in real time. Journal of Financial Economics 65: 415–37. [Google Scholar] [CrossRef]

- Chan, Bonnie Y. 2025. How China is Helping Power the World’s Green Transition. World Economic Forum. Available online: https://www.weforum.org/stories/2025/01/why-china-matters-to-the-worlds-green-transition/ (accessed on 9 June 2025).

- Chițimiea, Andreea, Mihaela Minciu, Andreea-Mariana Manta, Carmen Nadia Ciocoiu, and Cristina Veith. 2021. The drivers of green investment: A bibliometric and systematic review. Sustainability 13: 3507. [Google Scholar] [CrossRef]

- Coudert, Virginie, Karine Hervé, and Pierre Mabille. 2015. Internationalization versus regionalization in the emerging stock markets. International Journal of Finance & Economics 20: 16–27. [Google Scholar]

- Dev, Rhea. 2025. Trump’s Paris agreement withdrawal risks global crisis. Green Left 1423: 12. [Google Scholar]

- Diebold, Francis X., and Kamil Yilmaz. 2012. Better to give than to receive: Predictive directional measurement of volatility spillovers. International Journal of Forecasting 28: 57–66. [Google Scholar] [CrossRef]

- Ding, Xiaowei, Darko B. Vuković, Boris I. Sokolov, Natalia Vukovic, and Yali Liu. 2024. Enhancing ESG performance through digital transformation: Insights from China’s manufacturing sector. Technology in Society 79: 102753. [Google Scholar] [CrossRef]

- Ding, Xiuying, and Xuemei Liu. 2023. Renewable energy development and transportation infrastructure matters for green economic growth? Empirical evidence from China. Economic Analysis and Policy 79: 634–46. [Google Scholar] [CrossRef]

- Duggan, Niall, Juan Carlos Ladines Azalia, and Marek Rewizorski. 2022. The structural power of the BRICS (Brazil, Russia, India, China and South Africa) in multilateral development finance: A case study of the New Development Bank. International Political Science Review 43: 495–511. [Google Scholar] [CrossRef]

- Fama, Eugene F. 1970. Efficient capital markets: A review of theory and empirical work. The Journal of Finance 25: 383–417. [Google Scholar] [CrossRef]

- Fefelov, Dmitrii, Elena Rogova, and Darko Vukovic. 2025. Assessing the financial interconnectedness between China and Russia: A dynamic approach. Journal of the New Economic Association 67: 110–37. [Google Scholar] [CrossRef]

- Galbraith, John W., and Serguei Zernov. 2009. Extreme dependence in the NASDAQ and S&P 500 composite indexes. Applied Financial Economics 19: 1019–28. [Google Scholar]

- Gao, Yang, Chengjie Zhao, Bianxia Sun, and Wandi Zhao. 2022. Effects of investor sentiment on stock volatility: New evidences from multi-source data in China’s green stock markets. Financial Innovation 8: 77. [Google Scholar] [CrossRef] [PubMed]

- Global Times. 2024. GT Voice: BRICS’ Green Devt Offers New Path for Global Energy Transition. Global Times. Available online: https://www.globaltimes.cn/page/202410/1321691.shtml (accessed on 5 June 2025).

- Green, Jemma, and Peter Newman. 2017. Disruptive innovation, stranded assets and forecasting: The rise and rise of renewable energy. Journal of Sustainable Finance & Investment 7: 169–87. [Google Scholar]

- Ha, Le Thanh. 2024. A wavelet analysis of dynamic connectedness between geopolitical risk and renewable energy volatility during the COVID-19 pandemic and Ukraine-Russia conflicts. Environmental Science and Pollution Research 31: 17994–8009. [Google Scholar] [CrossRef]

- Handley, Kyle, Fariha Kamal, and Ryan Monarch. 2025. Rising import tariffs, falling exports: When modern supply chains meet old-style protectionism. American Economic Journal: Applied Economics 17: 208–38. [Google Scholar] [CrossRef]

- He, Zheng, Zhengkai Liu, Congzhi Zhang, and Yuanjun Zhao. 2025. How do carbon pricing spillover effects impact green asset price volatility? An empirical study based on the TVP-VAR-DY model. Economic Analysis and Policy 85: 2162–79. [Google Scholar] [CrossRef]

- Investing.com. 2025. Investing.com. Available online: https://www.investing.com/ (accessed on 5 June 2025).

- Jiang, George J., Eirini Konstantinidi, and George Skiadopoulos. 2012. Volatility spillovers and the effect of news announcements. Journal of Banking & Finance 36: 2260–73. [Google Scholar] [CrossRef]

- Khalfaoui, Rabeh, Mohamed Boutahar, and Heni Boubaker. 2015. Analyzing volatility spillovers and hedging between oil and stock markets: Evidence from wavelet analysis. Energy Economics 49: 540–49. [Google Scholar] [CrossRef]

- Lin, Boqiang, and Zhizhou Tan. 2023. Exploring arbitrage opportunities between China’s carbon markets based on statistical arbitrage pairs trading strategy. Environmental Impact Assessment Review 99: 107041. [Google Scholar] [CrossRef]

- Lin, Jiun-Da. 2023. Explaining the quality of green bonds in China. Journal of Cleaner Production 406: 136893. [Google Scholar] [CrossRef]

- Liu, Min, Tongji Guo, Weiying Ping, and Liangqing Luo. 2023. Sustainability and stability: Will ESG investment reduce the return and volatility spillover effects across the Chinese financial market? Energy Economics 121: 106674. [Google Scholar] [CrossRef]

- Lòpez-Villavicencio, Antonia, and Marc Pourroy. 2022. Fed’s policy changes and inflation in emerging markets: Lessons from the taper tantrum. Journal of Money, Credit and Banking 54: 1099–121. [Google Scholar] [CrossRef]

- Lundgren, Amanda Ivarsson, Adriana Milicevic, Gazi Salah Uddin, and Sang Hoon Kang. 2018. Connectedness network and dependence structure mechanism in green investments. Energy Economics 72: 145–53. [Google Scholar] [CrossRef]

- McMillan, David G., and Alan EH Speight. 2010. Return and volatility spillovers in three euro exchange rates. Journal of Economics and Business 62: 79–93. [Google Scholar] [CrossRef]

- Mensi, Walid, Muhammad Shafiullah, Xuan Vinh Vo, and Sang Hoon Kang. 2021. Volatility spillovers between strategic commodity futures and stock markets and portfolio implications: Evidence from developed and emerging economies. Resources Policy 71: 102002. [Google Scholar] [CrossRef]

- Mensi, Walid, Xuan Vinh Vo, Hee-Un Ko, and Sang Hoon Kang. 2023. Frequency spillovers between green bonds, global factors and stock market before and during COVID-19 crisis. Economic Analysis and Policy 77: 558–80. [Google Scholar] [CrossRef] [PubMed]

- Myllyvirta, Lauri, Qi Qin, and Chengcheng Qiu. 2025. Analysis: Clean Energy Contributed a Record 10% of China’s GΔPRGΔPR in 2024. Centre of Research on Energy and Clean Air. Available online: https://energyandcleanair.org/analysis-clean-energy-contributed-a-record-10-of-chinas-gdp-in-2024/ (accessed on 19 October 2025).

- OECD. 2024. Climate Adaptation Investment Framework. Green Finance and Investment. Paris: OECD Publishing. [Google Scholar] [CrossRef]

- Papathanasiou, Spyros, and Drosos Koutsokostas. 2024. A trade-off between sustainability ratings and volatility in portfolio hedging strategies. International Journal of Banking, Accounting and Finance 14: 370–406. [Google Scholar] [CrossRef]

- Reuters. 2025. Chinese EV Maker Hozon Enters Bankruptcy Proceedings, State Media Reports. Reuters. Available online: https://www.reuters.com/legal/litigation/chinese-ev-maker-hozon-enters-bankruptcy-proceedings-state-media-reports-2025-06-20/ (accessed on 19 October 2025).

- Shen, Chen, Shenglan Li, Xiaopeng Wang, and Zhongju Liao. 2020. The effect of environmental policy tools on regional green innovation: Evidence from China. Journal of Cleaner Production 254: 120122. [Google Scholar] [CrossRef]

- Sher, Azmat, An Haizhong, Muhammad Kaleem Khan, and Judit Sági. 2024. Chinese stock market integration with developed world: A portfolio diversification analysis. Heliyon 10: e29413. [Google Scholar] [CrossRef]

- Siddique, Md Abubakar, Haitham Nobanee, Md Bokhtiar Hasan, Gazi Salah Uddin, and Md Nahiduzzaman. 2024. Is investing in green assets costlier? Green vs. non-green financial assets. International Review of Economics & Finance 92: 1460–81. [Google Scholar] [CrossRef]

- Tateishi, Shohei, Hidetoshi Matsui, and Sadanori Konishi. 2010. Nonlinear regression modeling via the lasso-type regularization. Journal of statistical planning and inference 140: 1125–34. [Google Scholar] [CrossRef]

- The United Nations. 2015. Transforming our World: The 2030 Agenda for Sustainable Development. Available online: https://sdgs.un.org/2030agenda (accessed on 20 October 2024).

- Vukovic, Darko, Kseniya A. Lapshina, and Moinak Maiti. 2019. European Monetary Union bond market dynamics: Pre & post crisis. Research in International Business and Finance 50: 369–80. [Google Scholar] [CrossRef]

- Vukovic, Darko B., Edin Hanic, and Hasan Hanic. 2017. Financial integration in the European Union-the impact of the crisis on the bond market. Equilibrium. Quarterly Journal of Economics and Economic Policy 12: 195–210. [Google Scholar] [CrossRef]

- Wang, Jialu, Shekhar Mishra, Arshian Sharif, and Huangen Chen. 2024. Dynamic spillover connectedness among green finance and policy uncertainty: Evidence from QVAR network approach. Energy Economics 131: 107330. [Google Scholar] [CrossRef]

- Wind Terminal. 2025. Wind Terminal. Available online: https://www.wind.com.cn/mobile/WFT/en.html (accessed on 10 February 2025).

- World Economic Forum. 2021. These Countries Are Leading the Way on a Post-Pandemic Green Recovery. World Economic Forum. Available online: https://www.weforum.org/stories/2021/04/countries-leading-post-pandemic-green-recovery/ (accessed on 10 September 2025).

- Ye, Siya, Haomin Zhang, and Qiao Lou. 2025. Dynamic Volatility Spillovers among Green Bonds, Green Stocks and Carbon Markets under the COVID-19: Evidence from China. American Journal of Industrial and Business Management 15: 41–70. [Google Scholar] [CrossRef]

- Yilmaz, Kamil. 2010. Return and volatility spillovers among the East Asian equity markets. Journal of Asian Economics 21: 304–13. [Google Scholar] [CrossRef]

- Yiming, Wang, Liu Xun, Muhammad Umair, and Assilova Aizhan. 2024. COVID-19 and the transformation of emerging economies: Financialization, green bonds, and stock market volatility. Resources Policy 92: 104963. [Google Scholar] [CrossRef]

- Yuan, Xi, Meng Qin, Yifan Zhong, and Moldovan Nicoleta-Claudia. 2023. Financial roles in green investment based on the quantile connectedness. Energy Economics 117: 106481. [Google Scholar] [CrossRef]

- Yue, Mengdi, and Christoph Nedopil. 2025. China Green Finance Status and Trends 2024–2025. Brisbane: Griffith Asia Institute, Griffith University. Shanghai: Green Finance & Development Center, FISF Fudan University. [Google Scholar]

- Zhou, En, and Xinyu Wang. 2024. Who are the receivers and transmitters of volatility spillovers: Oil, clean energy, and green and non-green cryptocurrency markets. Environmental Science and Pollution Research 31: 5735–61. [Google Scholar] [CrossRef] [PubMed]

- Zhou, Xiangyi, Weijin Zhang, and Jie Zhang. 2012. Volatility spillovers between the Chinese and world equity markets. Pacific-Basin Finance Journal 20: 247–70. [Google Scholar] [CrossRef]

| Variable Name | Description |

|---|---|

| Nifty ΔPr | Nifty 50 Index (ΔPrice) |

| Nifty Ret | Nifty 50 Index (Returns) |

| Sust Ind ΔPr | SSE Sustainable Industry Index (ΔPrice) |

| Sust Ind Ret | SSE Sustainable Industry Index (Returns) |

| NEV ΔPr | SSE New Energy Vehicles Index (ΔPrice) |

| NEV Ret | SSE New Energy Vehicles Index (Returns) |

| Nasdaq ΔPr | Nasdaq Composite (ΔPrice) |

| Nasdaq Ret | Nasdaq Composite (Returns) |

| SSE ΔPr | SSE Composite (ΔPrice) |

| SSE Ret | SSE Composite (Returns) |

| IMOEX ΔPr | IMOEX Index (ΔPrice) |

| IMOEX Ret | IMOEX Index (Returns) |

| JSE ΔPr | FTSE/JSE South Africa Comprehensive (ΔPrice) |

| JSE Ret | FTSE/JSE South Africa Comprehensive (Returns) |

| Bovespa ΔPr | Bovespa Index (ΔPrice) |

| Bovespa Ret | Bovespa Index (Returns) |

| Tests | Mean | Variance | Skewness | Ex. Kurtosis |

|---|---|---|---|---|

| Nifty ΔPr | 8.634 | 25,521.015 | −0.849 | 8.942 |

| Nifty Ret | 0.001 | 0.000 | −1.112 | 21.399 |

| Bovespa ΔPr | 49.376 | 2,216,707.735 | −0.865 | 10.643 |

| Bovespa Ret | 0.001 | 0.000 | −0.497 | 15.278 |

| IMOEX ΔPr | 0.686 | 2165.954 | −5.904 | 132.587 |

| IMOEX Ret | 0.000 | 0.000 | −4.137 | 121.413 |

| JSE ΔPr | 22.162 | 549,543.809 | −0.202 | 3.573 |

| JSE Ret | 0.000 | 0.000 | −0.416 | 7.781 |

| SSE ΔPr | −0.005 | 1428.392 | −0.826 | 9.87 |

| SSE Ret | 0.000 | 0.000 | −0.407 | 7.852 |

| Nasdaq ΔPr | 6.628 | 29,922.818 | −0.038 | 10.77 |

| Nasdaq Ret | 0.001 | 0.000 | −0.137 | 9.795 |

| Sust Ind ΔPr | −0.053 | 351.658 | −0.338 | 5.124 |

| Sust Ind Ret | 0.000 | 0.000 | −0.214 | 3.398 |

| NEV ΔPr | −0.037 | 2368.14 | −0.15 | 8.698 |

| NEV Ret | 0.000 | 0.000 | 0.109 | 2.646 |

| Model | Lag | JB Test (p-Value) | Ljung–Box Test (p-Value) | ARCH-LM Test (p-Value) |

|---|---|---|---|---|

| ΔPr + Ret 2016–2025 | 1 | 0 | 0.720619 | 0 |

| 5 | 0 | 0.0547 | 0 | |

| 10 | 0 | 0.0142 | 0 |

| Variable | NET | NPT |

|---|---|---|

| Nifty ΔPr | −8.07 | 15.00 |

| Nifty Ret | −8.09 | 1.00 |

| Sust Ind ΔPr | 3.87 | 12.00 |

| Sust Ind Ret | 3.97 | 13.00 |

| NEV ΔPr | −1.91 | 10.00 |

| NEV Ret | −1.66 | 11.00 |

| Nasdaq ΔPr | −0.14 | 2.00 |

| Nasdaq Ret | −2.68 | 2.00 |

| SSE ΔPr | 5.55 | 15.00 |

| SSE Ret | 5.43 | 14.00 |

| IMOEX ΔPr | −1.92 | 7.00 |

| IMOEX Ret | −2.84 | 4.00 |

| Bovespa ΔPr | 0.56 | 5.00 |

| Bovespa Ret | −0.69 | 5.00 |

| JSE ΔPr | 6.40 | 9.00 |

| JSE Ret | 2.25 | 8.00 |

| Period | Important Breaks/Trends | Events and Causes |

|---|---|---|

| 2016–2017 | Overall interconnectedness starts a long-term gradual decrease. A steady downward move in total interconnectedness in 2017. | A period of relative stabilization after local crises. Commodity market downsizing. Recession and political instability in Brazil and South Africa. The early anticipation of trade wars. |

| 2018 | End of a stable regime for Chinese stocks. Interconnectedness stabilizes around 68% after prolapse in 2017. | Geopolitical tensions caused by the escalation of the US–China trade wars. |

| 2020 | A huge, synchronized shock to all the markets. Sharp variance breaks detected across all the indices. TCI peaks at 81.4%. | The massive economic and policy uncertainty caused by the global pandemics and associated lockdowns. Coincided with the global dollar squeeze. |

| 2020–2022 | Post-shock, volatility stabilizes at a significantly higher level than the pre-pandemic period for most markets (Nasdaq, Bovespa). | Persistent high volatility due to ongoing pandemic, supply chain disruptions, and shifting economic policies. The regime shift in 2022 coincides with Chinese industrial policy recalibration and U.S. tariff announcements. |

| 2022 | Shift to a lower volatility regime for NEV; spillover patterns from Sustainable Industry index change directions. | Market maturation, policy changes, and potential reassessment of green sector’s growth valuations after a boom period. |

| 2023 | Total interconnectedness reaches its lowest point (62.5%). | Market divergency due to divergent economic and political policies. |

| 2024–2025 | A moderate upward move. | Geopolitical and climate uncertainty. |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Vuković, D.B.; Fefelov, D.L.; Frömmel, M.; Rogova, E.M. Volatility Spillovers and Market Decoupling: Evidence from BRICS and China’s Green Sector. Risks 2025, 13, 222. https://doi.org/10.3390/risks13110222

Vuković DB, Fefelov DL, Frömmel M, Rogova EM. Volatility Spillovers and Market Decoupling: Evidence from BRICS and China’s Green Sector. Risks. 2025; 13(11):222. https://doi.org/10.3390/risks13110222

Chicago/Turabian StyleVuković, Darko B., Dmitrii Leonidovich Fefelov, Michael Frömmel, and Elena Moiseevna Rogova. 2025. "Volatility Spillovers and Market Decoupling: Evidence from BRICS and China’s Green Sector" Risks 13, no. 11: 222. https://doi.org/10.3390/risks13110222

APA StyleVuković, D. B., Fefelov, D. L., Frömmel, M., & Rogova, E. M. (2025). Volatility Spillovers and Market Decoupling: Evidence from BRICS and China’s Green Sector. Risks, 13(11), 222. https://doi.org/10.3390/risks13110222