The Business Cycle’s Impact on Volatility Forecasting: Recapturing Intrinsic Jump Components

Abstract

1. Introduction

Data Description and Case–Control Study

2. Methodology and Model Setting

2.1. Realized Volatility, Bi-Power Variation, Jumps, and Stages of the Business Cycle

2.2. Upside and Downside Realized Semivariance and State of the Business Cycle

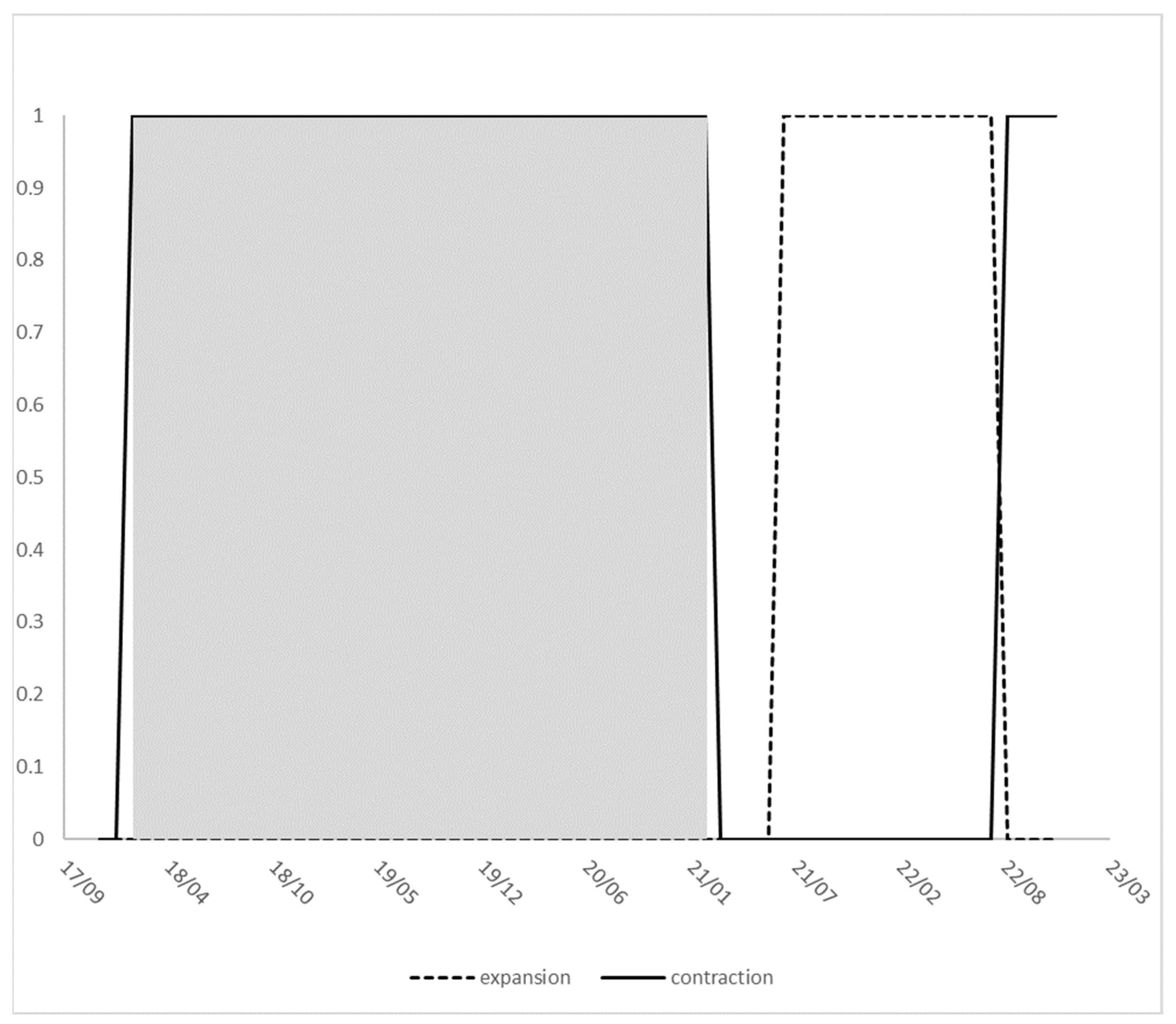

3. Data Description and Business Cycle Detection

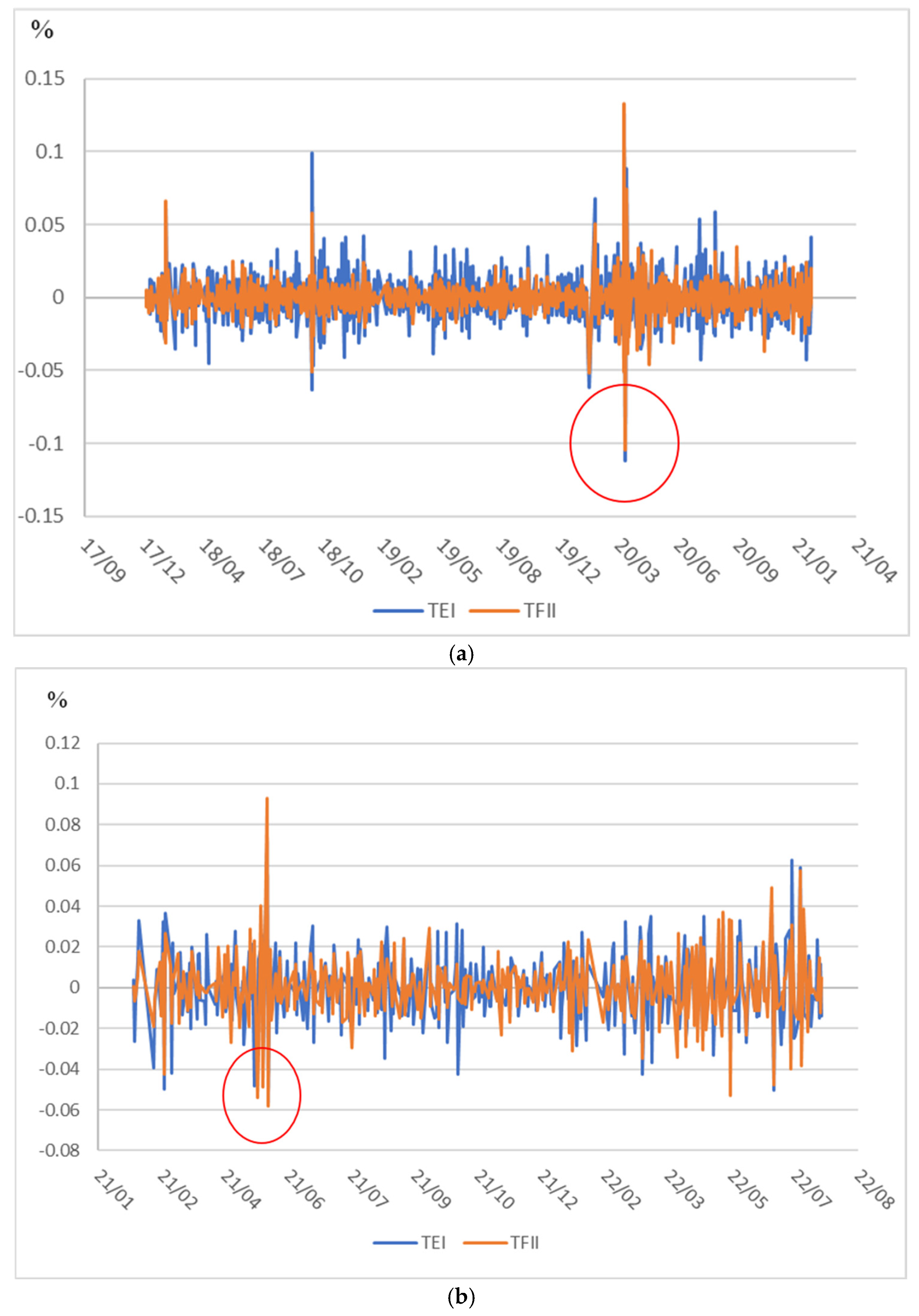

Shock Scenario Design During the COVID-19 Insurance Event

4. Empirical Results

4.1. Examining Jumps in Economic Contraction/Expansion

4.2. HAR-RV Type Model with a Latent Variable

4.2.1. Realized Volatility, Jumps, and BC Effects

4.2.2. Realized Volatility, Asymmetric Jumps, and Stages of the Business Cycle

4.2.3. RV, Asymmetric Jumps, Leverage Effects, and States of the Business Cycle

5. Conclusions

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

Appendix A

| Variable | Mean | Std Dev | Min | Max |

|---|---|---|---|---|

| RJ | 7.54 × 10−7 | 4.39 × 10−6 | 0 | 8.33 × 10−5 |

| RV | 1.39 × 10−5 | 3.03 × 10−5 | 9.74 × 10−7 | 0.000386 |

| BV | 1.45 × 10−5 | 3.25 × 10−5 | 1.16 × 10−6 | 0.000446 |

| CSV+ | 3.68 × 10−6 | 9.48 × 10−6 | 1.16 × 10−7 | 0.00025 |

| CSV− | 5.08 × 10−6 | 1.70 × 10−5 | 2.81 × 10−7 | 0.00025 |

| JSV+ | 2.91 × 10−6 | 3.57 × 10−7 | 0 | 0.000169 |

| JSV− | 4.29 × 10−6 | 6.39 × 10−7 | 0 | 0.00025 |

| Variable | Mean | Std Dev | Min | Max |

|---|---|---|---|---|

| RJ | 1.55 × 10−6 | 4.82 × 10−6 | 0 | 6.01 × 10−5 |

| RV | 3.24 × 10−5 | 6.26 × 10−5 | 2.09 × 10−6 | 0.001048 |

| BV | 3.41 × 10−5 | 6.74 × 10−5 | 1.63 × 10−6 | 0.001109 |

| CSV+ | 0.000646 | 0.008806 | −0.04904 | 0.031407 |

| CSV− | 8.20 × 10−6 | 1.76 × 10−5 | 5.83 × 10−7 | 0.000176 |

| JSV+ | 9.90 × 10−6 | 3.00 × 10−5 | 7.20 × 10−7 | 0.000433 |

| JSV− | 7.40 × 10−6 | 1.74 × 10−5 | 0 | 0.000174 |

| 1 | Since the GDP cycle has a longer duration, the TMI is used instead of Taiwan’s GDP. |

| 2 | In December 2020, Taiwan Fire & Marine Insurance Co., Ltd. sold more than 4 million units of the COVID-19 insurance policy, and the claim settlement amounted to as high as TWD 1.96 billion. This batch of insurance expired at the end of January 2022, and they no longer sold the COVID-19 insurance policy (a small shock). However, the other insurance companies observed consumers’ strong willingness to purchase the COVID-19 insurance and successively launched similar types of COVID-19 insurance in 2022, which caused many insurance companies to have huge losses with a total compensation of approximately TWD 169.3 billion (a huge shock). |

| 3 | Between 2018 and 2022, the TEI and TFII represented approximately 55–60% and 10–12%, respectively, of the Taiwan Stock Exchange Capitalization Weighted Stock Index, ranking first and second in market weight. |

References

- Andersen, Torben G., and Tim Bollerslev. 1998. Answering the skeptics: Yes, standard volatility models do provide accurate forecasts. International Economic Review 39: 885–905. [Google Scholar] [CrossRef]

- Andersen, Torben G., Tim Bollerslev, and Dobrislav Dobrev. 2007a. No-arbitrage semi-martingale restrictions for continuous-time volatility models subject to leverage effects, jumps and IID noise: Theory and testable distributional implications. Journal of Econometrics 138: 125–80. [Google Scholar] [CrossRef]

- Andersen, Torben G., Tim Bollerslev, and Francis X. Diebold. 2007b. Roughing it up: Including jump components in the measurement, modeling, and forecasting of return volatility. Review of Economics and Statistics 89: 701–20. [Google Scholar] [CrossRef]

- Audrino, Francesco, and Yumei Hu. 2016. Volatility forecasting: Downside risk, jumps, and leverage effect. Econometrics 4: 8. [Google Scholar] [CrossRef]

- Barndorff-Nielsen, Ole E. 2006. Econometrics of testing for jumps in financial economics using bipower variation. Journal of Financial Econometrics 4: 1–30. [Google Scholar] [CrossRef]

- Barndorff-Nielsen, Ole E., and Neil Shephard. 2004. Econometric analysis of realized covariation: High frequency based covariance, regression, and correlation in financial economics. Econometrica 72: 885–925. [Google Scholar] [CrossRef]

- Barndorff-Nielsen, Ole E., Sebastian Kinnebrock, and Neil Shephard. 2010. Measuring downside risk: Realized semivariance. In Volatility and Time Series Econometrics: Essays in Honor of Robert F. Engle. Edited by T. Bollerslev, J. Russell and M. Watson. Oxford: Oxford University Press, pp. 117–36. [Google Scholar]

- Bollerslev, Tim, and Haibin Zhou. 2006. Volatility puzzles: A simple framework for gauging return-volatility regressions. Journal of Econometrics 131: 123–50. [Google Scholar] [CrossRef]

- Bollerslev, Tim, Viktor Todorov, and Liuren Xu. 2015. Tail risk premia and return predictability. Journal of Financial Economics 118: 113–34. [Google Scholar] [CrossRef]

- Boubaker, Sabri, Sami Karim, Muhammad A. Naeem, and Gagan D. Sharma. 2023. Financial markets, energy shocks, and extreme volatility spillovers. Energy Economics 126: 107031. [Google Scholar] [CrossRef]

- Boyd, John H., Jian Hu, and Ravi Jagannathan. 2005. The stock market’s reaction to unemployment news: Why bad news is usually good for stocks. Journal of Finance 60: 649–72. [Google Scholar] [CrossRef]

- Bu, Ruochen, Razi Hizmeri, Mamunur Izzeldin, Alan Murphy, and Yue Wu. 2023. The contribution of jump signs and activity to forecasting stock price volatility. Journal of Empirical Finance 73: 182–204. [Google Scholar] [CrossRef]

- Buncic, Daniel, and Kristina Gisler. 2017. The role of jumps and leverage in forecasting volatility in international equity markets. Journal of International Money and Finance 74: 92–114. [Google Scholar] [CrossRef]

- Clements, Adam, and Daniel P. A. Preve. 2021. A practical guide to harnessing the HAR volatility model. Journal of Banking & Finance 126: 106095. [Google Scholar] [CrossRef]

- Çelik, Serhat, and Halil Ergin. 2014. Volatility forecasting using high frequency data: Evidence from stock markets. Economic Modelling 36: 176–90. [Google Scholar] [CrossRef]

- Dew-Becker, Ian, and Stefano Giglio. 2016. Asset pricing in the frequency domain: Theory and empirics. Review of Financial Studies 29: 2029–68. [Google Scholar] [CrossRef]

- Franco, Romulo J. G., and Dennis S. M. Mapa. 2014. Analyzing the dynamics of gross domestic product growth: A mixed frequency model approach. Theoretical and Practical Research in Economic Fields 6: 5–8. [Google Scholar] [CrossRef]

- Giudici, Paolo, and Paolo Pagnottini. 2019. High frequency price change spillovers in bitcoin exchange markets. Risks 7: 111. [Google Scholar] [CrossRef]

- Halling, Michael, Jiaping Yu, and Josef Zechner. 2016. Leverage dynamics over the business cycle. Journal of Financial Economics 122: 21–41. [Google Scholar] [CrossRef]

- Hamilton, James D. 1989. A new approach to the economic analysis of nonstationary time series and the business cycle. Econometrica 57: 357–84. [Google Scholar] [CrossRef]

- Hamilton, James D., and Gang Lin. 1996. Stock market volatility and the business cycle. Journal of Applied Econometrics 11: 573–93. [Google Scholar] [CrossRef]

- Heinlein, Ronald, and Giorgio M. Lepori. 2022. Do financial markets respond to macroeconomic surprises? Evidence from the UK. Empirical Economics 62: 2329–71. [Google Scholar] [CrossRef]

- Karanasos, Menelaos, and Savvana Yfanti. 2020. On the macro-drivers of realized volatility: The destabilizing impact of UK policy uncertainty across Europe. European Journal of Finance 26: 1043–65. [Google Scholar] [CrossRef]

- Li, Xiaofeng, Yunjie Liao, Xiaoyuan Lu, and Fangxiao Ma. 2022. An oil futures volatility forecast perspective on the selection of high-frequency jump tests. Energy Economics 75: 101750. [Google Scholar] [CrossRef]

- Liang, Chun, Yifan Li, Fangxiao Ma, and Yu Wei. 2021. Global equity market volatilities forecasting: A comparison of leverage effects, jumps, and overnight information. International Review of Financial Analysis 75: 101750. [Google Scholar] [CrossRef]

- Liang, Chun, Yunjie Liao, Fangxiao Ma, and Bin Zhu. 2022. United States oil fund volatility prediction: The roles of leverage effect and jumps. Empirical Economics 63: 45–68. [Google Scholar] [CrossRef]

- Liu, Likun, and Zhuang Pan. 2020. Forecasting stock market volatility: The role of technical variables. Economic Modelling 84: 55–65. [Google Scholar] [CrossRef]

- Maki, Daiki, and Yuta Ota. 2021. Impacts of asymmetry on forecasting realized volatility in Japanese stock markets. Economic Modelling 94: 178–90. [Google Scholar] [CrossRef]

- Marcucci, Josè. 2005. Forecasting stock market volatility with regime-switching GARCH models. Studies in Nonlinear Dynamics & Econometrics 9: 1–53. [Google Scholar] [CrossRef]

- Nuno, Galo, and Charles Thomas. 2017. Bank leverage cycles. American Economic Journal: Macroeconomics 9: 32–72. [Google Scholar] [CrossRef]

- Patton, Andrew J., and Kevin Sheppard. 2015. Good volatility, bad volatility: Signed jumps and the persistence of volatility. Review of Economics and Statistics 97: 683–97. [Google Scholar] [CrossRef]

- Qu, Haoyu, Qiang Duan, and Meng Niu. 2018. Modeling the volatility of realized volatility to improve volatility forecasts in electricity markets. Energy Economics 74: 333–41. [Google Scholar] [CrossRef]

- Souček, Michal, and Natalia Todorova. 2014. Realized volatility transmission: The role of jumps and leverage effects. Economics Letters 122: 47–51. [Google Scholar] [CrossRef]

- Tong, Chen, Zhen Huang, Tao Wang, and Chen Zhang. 2023. The effects of economic uncertainty on financial volatility: A comprehensive investigation. Journal of Empirical Finance 73: 369–89. [Google Scholar] [CrossRef]

- Tran, Minh P.-B., and Duc H. Vo. 2023. Asia-Pacific stock market return and volatility in the uncertain world: Evidence from the nonlinear autoregressive distributed lag approach. PLoS ONE 18: e0285279. [Google Scholar] [CrossRef]

- Xu, Jing, and Sen Wang. 2017. High frequency volatility forecasting considering jump and persistent leverage. Journal of Statistics & Management Systems 20: 345–59. [Google Scholar] [CrossRef]

- Yi, Chang D. 2019. Volatility and Z-type jumps of Euro exchange rates using outlying weighted quarticity statistics in the 2010s. Journal of Korea Trade 23: 110–26. [Google Scholar] [CrossRef]

- Yu, Xiaoyun, Yifan Huang, and Kai Xiao. 2021. Global economic policy uncertainty and stock volatility: Evidence from emerging economies. Journal of Applied Economics 24: 416–40. [Google Scholar] [CrossRef]

- Zeng, Qing, Xiaoyuan Lu, Ting Li, and Lin Wu. 2022. Jumps and stock market variance during the COVID-19 pandemic: Evidence from international stock markets. Finance Research Letters 47: 102548. [Google Scholar] [CrossRef]

- Zhang, Yu J., and Hong Zhang. 2023. Volatility forecasting of crude oil market: Which structural change based GARCH models have better performance? Energy Journal 44: 175–94. [Google Scholar] [CrossRef]

| BC Effect | Large Shock | Net Effect | Case | BC Effect | Small Shock | Net Effect | Case | ||

|---|---|---|---|---|---|---|---|---|---|

| Contraction | Contraction | ||||||||

| up-jump | 0 | -- | -- | up-jump | 0 | - | - | (c) | |

| down-jump | -- | -- | ---- | down-jump | -- | - | --- | (d) | |

| Expansion | Expansion | ||||||||

| up-jump | ++ | -- | 0 | (a) | up-jump | ++ | - | + | |

| down-jump | - | -- | --- | (b) | down-jump | - | - | -- | |

| contraction | 0.271 | 0.008 | 0.044 |

| expansion | 0.264 | 0.016 | 0.048 |

| Contraction | Expansion | |

|---|---|---|

| 0.0016 | 0.0024 | |

| 0.0001 | 0.0002 | |

| 0.0000 | −0.0001 |

| Regression Coefficients | Contraction | Expansion |

|---|---|---|

| −1.588 *** | −2.727 *** | |

| 0.246 *** | 0.319 *** | |

| 0.507 *** | 0.466 ** | |

| 0.116 | −0.037 | |

| −0.010 * | 0.003 |

| Model 2-1 | Model 2-2 | Case | Case | |||

|---|---|---|---|---|---|---|

| Contraction | Expansion | Contraction | Expansion | |||

| −4.1512 *** | −3.8979 *** | 1.8710 ** | 1.5864 | |||

| 0.2819 *** | 0.1909 *** | 0.0227 | (c) | −0.0004 | (a) | |

| 0.2884 *** | 0.3186 *** | 0.0494 | (d) | 0.1626 ** | (b) | |

| 0.3600 *** | (c) | 0.4248 *** | (a) | |||

| 0.5972 *** | (d) | 0.3431 *** | (b) | |||

| 0.0038 | 0.0423 | 0.0045 | (c) | 0.0542 | (a) | |

| 0.0089 | 0.0049 | 0.0100 | (d) | 0.0132 | (b) | |

| R2 | 0.2043 | 0.1851 | 0.3450 | 0.2687 | ||

| Adjusted R2 | 0.1997 | 0.1761 | 0.3393 | 0.2565 | ||

| Model 3-1 | Model 3-2 | |||

|---|---|---|---|---|

| Contraction | Expansion | Contraction | Expansion | |

| −5.9785 *** | −5.3284 *** | −0.2653 | −0.6854 | |

| 0.2583 *** | 0.1412 * | 0.0277 | −0.0096 | |

| 0.1942 *** | 0.2856 *** | 0.3451 *** | 0.3361 *** | |

| −0.0010 | 0.1558 *** | |||

| 0.5123 *** | 0.2979 *** | |||

| 0.0081 | 0.0470 | 0.0078 | 0.0559 * | |

| 0.0028 | −0.0057 | 0.0051 | 0.0025 | |

| 56.0609 *** | 48.8531 *** | 43.9546 *** | 44.1281 *** | |

| 28.2129 ** | 19.8264 ** | 29.0156 *** | 17.3063 ** | |

| R2 | 0.3098 | 0.3139 | 0.4186 | 0.3697 |

| Adujst R2 | 0.3038 | 0.3024 | 0.4118 | 0.3556 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Chen, S.-N.; Hsu, P.-P. The Business Cycle’s Impact on Volatility Forecasting: Recapturing Intrinsic Jump Components. Risks 2025, 13, 221. https://doi.org/10.3390/risks13110221

Chen S-N, Hsu P-P. The Business Cycle’s Impact on Volatility Forecasting: Recapturing Intrinsic Jump Components. Risks. 2025; 13(11):221. https://doi.org/10.3390/risks13110221

Chicago/Turabian StyleChen, Son-Nan, and Pao-Peng Hsu. 2025. "The Business Cycle’s Impact on Volatility Forecasting: Recapturing Intrinsic Jump Components" Risks 13, no. 11: 221. https://doi.org/10.3390/risks13110221

APA StyleChen, S.-N., & Hsu, P.-P. (2025). The Business Cycle’s Impact on Volatility Forecasting: Recapturing Intrinsic Jump Components. Risks, 13(11), 221. https://doi.org/10.3390/risks13110221