4.1. VIX Shocks and Spillovers to BRICS+ Equity Markets

The Granger-causality results (

Table A1) reveal a highly interconnected global financial network in which shocks propagate rapidly across emerging-market equities, regional indices, and U.S. interest-rate indicators. At the center of this network lies VIX, functioning both as a barometer and a generator of global risk. Notably, BSE30, BVSP, and TASI exert significant influence on VIX, indicating that risk transmission is not unidirectional from advanced to emerging markets and that volatility can also originate within major emerging economies. Once activated, VIX becomes an active transmitter of shocks: it significantly affects SSE, BSE30, JTOPI, TASI, ADX, EGX30, and T10Y3M, confirming its dual role as both a receiver and an amplifier of global risk within the U.S.—BRICS+ interconnected system.

Cross-market equity spillovers reinforce this view of deep integration. As shown by the Granger-causality results, SSE responds not only to VIX but also to shocks from BSE30, BVSP, JTOPI, and TASI, underscoring China’s exposure to both regional neighbors and distant emerging markets. BVSP, in turn, transmits significant impulses to RTSI, highlighting a South–South transmission channel within the BRICS sphere. This pattern is in line with findings by

Gnagne et al. (

2024), who show that BRICS markets increasingly act as transmitters of systemic risk. BSE30 stands out as both vulnerable and influential: it is affected by VIX, SSE, BVSP, ADX, T5YIE, and T10Y3M, yet also propagates shocks to BVSP and TASI. This dual role reflects India’s growing integration in global capital markets and its sensitivity to both equity and macro-financial shocks, consistent with the evidence presented by

Kumar and Dua (

2024), who document how U.S. yield dynamics interact with capital flows to BRICS and reinforce cross-market dependence.

Regional dynamics in Asia, Africa, and the Middle East further demonstrate the global reach of these spillovers. South Africa’s JTOPI is affected by VIX, SSE, BSE30, BVSP, ADX, T5YIE, and T10Y3M, which reflects strong financial exposure to both global volatility conditions and U.S. monetary policy signals. Saudi Arabia’s TASI responds to volatility shocks from VIX, SSE, and BSE30, while Abu Dhabi’s ADX is influenced by both global and regional factors, including VIX, T5YIE, and TASI, as well as BRICS indices such as BVSP and BSE30. North Africa is integrated as well, with Egypt’s EGX30 shaped by shocks from VIX, JTOPI, ADX, and T5YIE. Importantly, the results confirm the existence of reverse spillovers: together with BSE30, JTOPI, TASI, and ADX, EGX30 feeds directly into U.S. five-year inflation expectations, confirming a feedback channel from emerging markets to U.S. financial conditions rather than a purely unidirectional dependence.

Finally, the U.S. yield curve is far from insulated. T10Y3M is significantly influenced by VIX, BSE30, JTOPI, TASI, and ADX, indicating that global equity dynamics and Middle Eastern markets shape U.S. monetary policy expectations. Similarly, T5YIE reacts to spillovers from BRICS+ markets, suggesting that inflation expectations in the United States embed external risk factors transmitted through financial globalization. Taken together, T5YIE and T10Y3M function not only as conduits of domestic fundamentals but also as receivers of international equity shocks, confirming the existence of bidirectional shock transmission between the United States and BRICS+ financial systems.

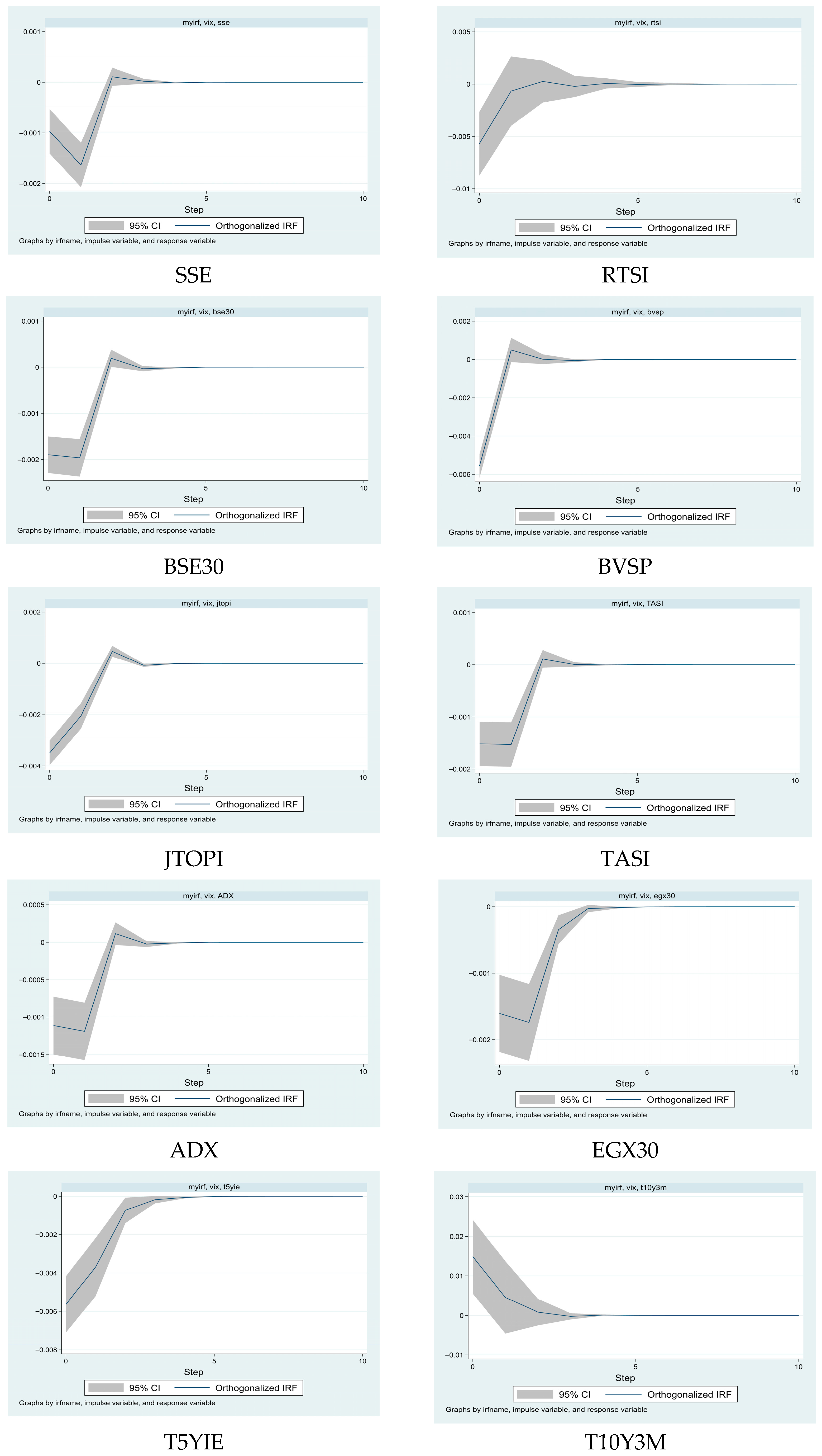

The IRFs provide further insights into the short-run dynamics of VIX shocks (

Figure 1). SSE exhibits an immediate and sharp decline, followed by a rapid reversal within one to two periods, which aligns with the view that Chinese markets absorb external volatility swiftly through state-driven liquidity injections and targeted policy interventions. RTSI shows the most volatile response, with a sluggish return to equilibrium over three periods, reflecting its structural vulnerability to global risk sentiment and commodity dependence. BSE30 also reacts negatively but with a smaller magnitude, stabilizing more quickly than RTSI, indicating that India, while financially integrated, maintains a relatively stronger market shock-absorption capacity due to diversified capital flows and macroprudential buffers.

BVSP and JTOPI both register sharp negative responses to VIX shocks, though the effects dissipate rapidly. For BVSP, the shock is absorbed within a few periods, while JTOPI’s smaller amplitude suggests greater resilience, possibly due to a higher share of domestic institutional investors and lower exposure to speculative capital flows. Similar short-lived declines are also evident for TASI, ADX, and EGX30, confirming that Gulf and North African markets are exposed to volatility spillovers, although the effects remain transitory and do not generate persistent contagion dynamics within the regional markets.

Turning to U.S. financial indicators, T5YIE exhibits a modest increase following a VIX shock, whereas T10Y3M steepens sharply, reflecting flight-to-safety flows into long-term Treasuries. Both effects dissipate within two to three periods, highlighting the resilience of U.S. markets and the anchoring of inflation expectations even under heightened global uncertainty. Overall, these results lend strong support to H1, confirming that global volatility shocks captured by the VIX are transmitted across BRICS+ equity markets and U.S. yields, albeit with heterogeneous intensity and short-lived persistence. The time-path behavior of these dynamics underscores the dominance of short-horizon contagion mechanisms over longer-term structural spillovers. The detailed VAR regression results underlying these responses are presented in

Supplementary Table S1.

4.2. GPRD Shocks and Spillovers to BRICS+ Equity Markets

The Granger-causality results (

Table A2) point to a densely interconnected global financial system in which equity markets across Asia, Latin America, the Middle East, and North Africa transmit shocks both among themselves and toward U.S. interest-rate expectations. By contrast, GPRD occupies a largely peripheral position, consistent with evidence from

Zhang and Hamori (

2022), who find that geopolitical risk plays a secondary role compared to financial indicators. However, its effects should not be underestimated, as

Çepni et al. (

2023) show that BRICS carry trades are highly responsive to geopolitical uncertainty, suggesting that such shocks may influence capital flows and risk premia through specific channels, even if their aggregate role remains limited. Within this framework, SSE emerges as a key receiver of shocks from BSE30, BVSP, and JTOPI, underscoring its sensitivity to both regional and global equity conditions, a result aligned with

Wen et al. (

2022), who highlight heterogeneous but persistent transmission patterns in BRICS. Additionally, the role of geopolitical risk may operate indirectly through exchange rate movements and trade balances, as documented by

Ekanayake and Dissanayake (

2022) document that exchange rate volatility shapes U.S. trade with BRICS, reinforcing the broader view that uncertainty can transmit through multiple economic channels

RTSI responds significantly to impulses from BVSP and T5YIE, highlighting the combined influence of Latin American markets and U.S. rate expectations. BSE30 is affected by BVSP, JTOPI, ADX, T5YIE, and T10Y3M, reflecting its dual exposure to emerging-market peers and U.S. monetary policy signals. BVSP, in turn, is shaped by ADX, EGX30, and T5YIE, revealing strong transmission channels from the Middle East and North Africa as well as sensitivity to U.S. real yields.

JTOPI exhibits the broadest global integration, reacting to SSE, BSE30, BVSP, TASI, ADX, T5YIE, and T10Y3M, thereby acting as a conduit that links major emerging equity markets with U.S. bond dynamics. Within the Gulf, TASI is influenced by BSE30, BVSP, JTOPI, and ADX, while ADX itself responds to SSE, BSE30, BVSP, and T5YIE. EGX30 is affected by JTOPI and T5YIE, anchoring North Africa to both South African equity conditions and U.S. real yields.

Feedback effects into U.S. rates are pronounced. T5YIE is driven by BSE30, BVSP, ADX, and EGX30, while T10Y3M responds to BSE30, JTOPI, TASI, ADX, and T5YIE. These findings indicate that U.S. yield expectations incorporate external financial conditions transmitted through BRICS+ equity markets, demonstrating that U.S. yield expectations are shaped not only by domestic fundamentals but also by international equity markets.

The IRFs provide further insight into the short-run dynamics of GPRD shocks (

Figure 2). For T5YIE, a positive shock to geopolitical risk generates an immediate increase of about 0.02, heightened risk aversion and a temporary repricing of inflation expectations. The effect, however, quickly reverses, falling below zero by the second day and returning to baseline within five days, consistent with the transitory nature of geopolitical shocks. Similarly, T10Y3M jumps to about 0.04 on impact, steepening the yield curve, but reverts to baseline within three days as markets reassess growth and monetary policy expectations. These patterns indicate that U.S. bond markets internalize geopolitical shocks rapidly and efficiently, preventing the emergence of prolonged contagion.

Across equity markets, RTSI, BVSP, JTOPI, EGX30, TASI, and BSE30 exhibit immediate negative responses to a GPRD shock, consistent with the view that heightened geopolitical tensions depress short-term performance by increasing uncertainty and risk premia. These effects are transitory, with most indices reverting to equilibrium within a few days. BVSP and JTOPI, in particular, rebound rapidly, suggesting that although these markets are sensitive to geopolitical risk, they do not experience persistent dislocations and are able to absorb external shocks through rapid price adjustments and liquidity recovery.

For ADX and SSE, the IRFs reveal a short-lived increase followed by a sharp decline below zero, with both indices stabilizing around baseline within four days. The response is consistent with expectations, as geopolitical shocks tend to dampen equity valuations. However, the limited magnitude and duration of these responses indicate that these markets possess effective absorption mechanisms, likely supported by domestic policy interventions, market regulation frameworks, and liquidity buffers that prevent volatility amplification.

The evidences indicates that GPRD shocks generate short-term volatility in U.S. yields and BRICS+ equity markets, but the effects are rapidly absorbed and lack persistence. For investors, this suggests that while geopolitical events may temporarily affect bond pricing and equity valuations, long-term portfolio strategies should remain anchored in fundamentals rather than transient risk episodes. For policymakers, the results highlight the importance of robust institutional frameworks and adequate liquidity buffers that enable financial systems to absorb geopolitical shocks without major disruptions. Overall, the results support H2 by confirming that BRICS+ markets participate in global shock transmission, although geopolitical risk generates weaker and less persistent spillovers compared to VIX. The detailed VAR regression results underlying these responses are presented in

Supplementary Table S2.

4.3. T5YIE Shocks and Spillovers to BRICS+ Equity Markets

The Granger-causality results point to a complex and tightly interconnected global financial system in which emerging-market equities and U.S. interest-rate measures are strongly interlinked (

Table A3). The SSE is significantly affected by shocks from BSE30, BVSP, and JTOPI, underscoring that developments in major emerging markets propagate swiftly across regions. The RTSI is shaped by impulses from BVSP and T5YIE, suggesting that both Latin American equity dynamics and T5YIE influence Russian equities, consistent with the evidence that commodity-linked economies display heightened sensitivity to U.S. macro-financial shocks.

BSE30 responds to a wide set of drivers, including SSE, BVSP, JTOPI, TASI, ADX, and T5YIE, highlighting its high degree of global financial integration and vulnerability to shifts in U.S. monetary policy. BVSP is shaped primarily by EGX30 and T5YIE, reflecting both South–South linkages and the centrality of U.S. yield expectations for Latin American equities, in line with

Gao et al. (

2024). JTOPI emerges as a major transmission hub, absorbing shocks from SSE, BSE30, BVSP, TASI, ADX, and T5YIE, thereby connecting African equities with both Asian markets and U.S. interest-rate conditions.

In the Gulf, TASI is significantly affected by T5YIE, BSE30, BVSP, JTOPI, and ADX, underscoring the strong interdependence of Gulf markets with both emerging equities and T5YIE.

Balli et al. (

2021) show that U.S. uncertainties drive spillovers into international markets; our findings extend this evidence by demonstrating that T5YIE acts as a critical transmission channel for Gulf markets. Similarly, ADX responds to SSE, BSE30, BVSP, and T5YIE, illustrating the influence of both U.S. yields and Asian markets in shaping regional dynamics. EGX30 reacts to JTOPI and T5YIE, confirming North Africa’s exposure to African equity shocks and U.S. real yields through integrated financial and trade linkages.

These results are consistent with

Panda et al. (

2023), who show that BRICS equity markets are highly sensitive to both inflation dynamics and broader macroeconomic fundamentals. By incorporating T5YIE as a forward-looking measure of T5YIE, our analysis extends this literature and demonstrates that BRICS+ markets are not only driven by domestic inflation but also by international monetary policy signals.

Kumar and Dua (

2024) argue that higher U.S. Treasury yields reduce foreign portfolio investment inflows into BRICS economies. However, our findings reveal heterogeneous responses across BRICS+ markets: some markets, such as BVSP and JTOPI, display quick adjustments, indicating partial resilience to U.S. monetary tightening through regional capital reallocation and market depth effects.

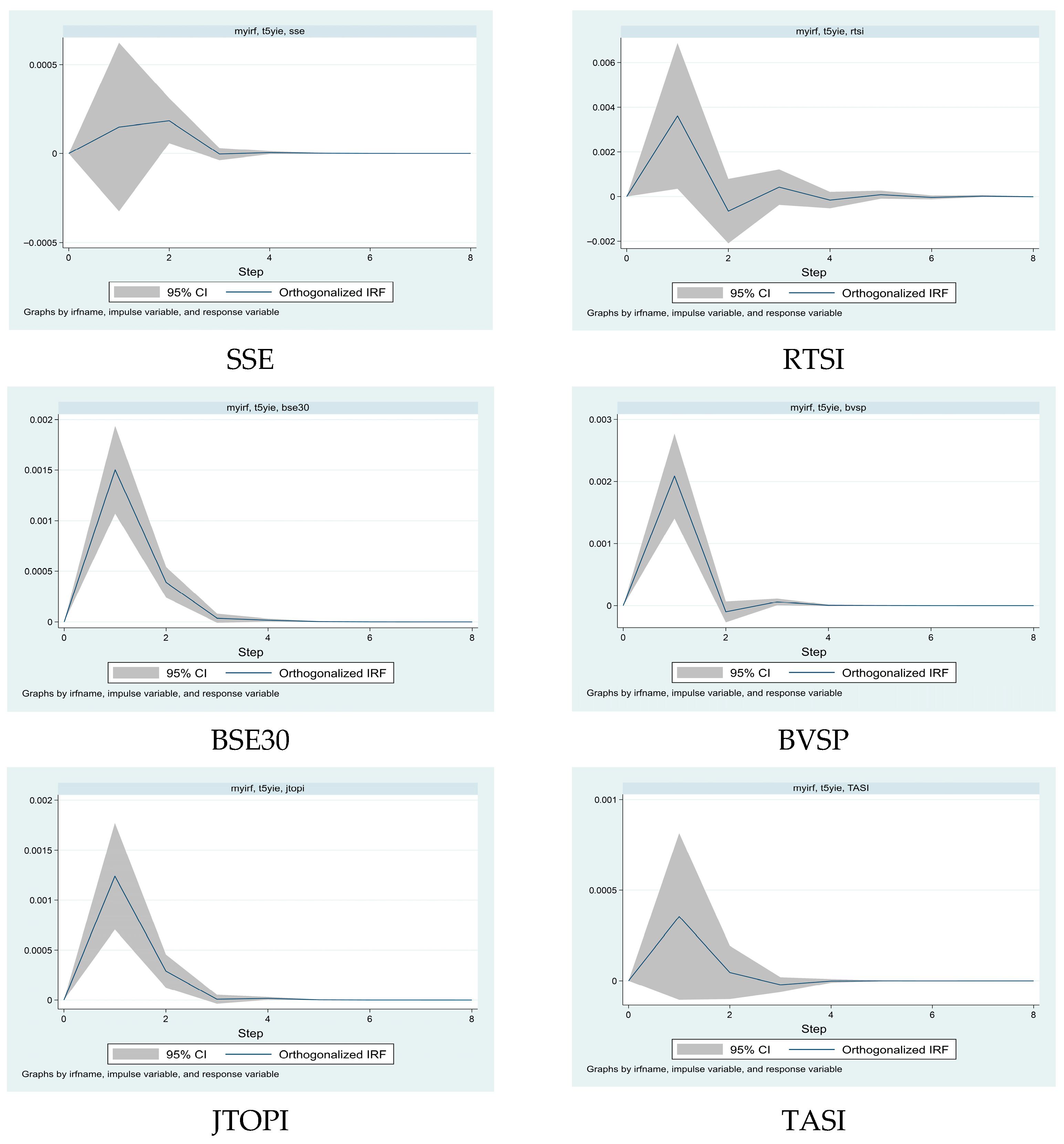

The IRFs provide further insight into the transmission of T5YIE shocks (

Figure 3). JTOPI exhibits the strongest immediate response: following a positive T5YIE shock, the index rises sharply on impact, indicating that higher T5YIE can temporarily boost returns in highly integrated markets through anticipations of stronger nominal growth and capital inflows. The effect is statistically significant yet short-lived, dissipating within three days, a pattern consistent with rapid arbitrage activity and efficient adjustment to global macro-financial signals.

Other BRICS+ markets exhibit heterogeneous responses. SSE and TASI display small and statistically insignificant reactions, suggesting that domestic policy frameworks and regional conditions buffer them from global inflation shocks. In contrast, BSE30, BVSP, and ADX record more pronounced but temporary positive responses, all converging to baseline within three days. This pattern indicates that although equity valuations across emerging economies are sensitive to T5YIE, the adjustment remains swift and non-persistent, reflecting underlying market resilience.

From an economic perspective, these results suggest that T5YIE shocks function primarily as short-term signals for equity markets rather than as persistent drivers of valuation. Highly integrated economies such as South Africa, India, and Brazil display more immediate and pronounced reactions, whereas markets with stronger domestic anchors such as China and the Gulf states exhibit more muted responses. For investors, this implies that opportunities arising from inflation expectation surprises are transitory. For policymakers, the findings underscore the importance of credible monetary policy frameworks and well-developed bond markets in mitigating volatility spillovers, consistent with recent evidence on the stabilizing role of TIPS during periods of heightened uncertainty. Overall, the evidence lends support to H2 by demonstrating that U.S. macro financial indicators, in particular inflation expectations, constitute significant channels of shock transmission to BRICS+ markets, even though the associated effects remain short lived and exhibit limited persistence. The detailed VAR regression results underlying these responses are presented in

Supplementary Table S3.

4.4. T10Y3M Shocks and Spillovers to BRICS+ Equity Markets

The Granger-causality analysis (

Table A4) highlights a highly interconnected global financial system in which shocks from emerging-market equities, Gulf markets, and U.S. interest-rate measures propagate rapidly across regions, consistent with the view that yield-curve dynamics function as global risk transmission mechanisms. SSE is significantly influenced by BSE30, BVSP, and JTOPI, confirming its exposure to both Asian and Latin American developments. RTSI is primarily driven by BVSP, pointing to a South–South transmission channel, while BSE30 absorbs impulses from BVSP, JTOPI, ADX, and T10Y3M itself, underscoring its dual sensitivity to emerging-market peers and U.S. bond-market dynamics. BVSP, in turn, is shaped by EGX30, reflecting strong cross-regional financial linkages between Latin America and North Africa.

JTOPI emerges as a central hub, responding to SSE, BSE30, BVSP, TASI, ADX, and T10Y3M, which underscores Africa’s position as an intermediary between Asian, Middle Eastern, and U.S. markets. In the Gulf, TASI is driven by BSE30, BVSP, JTOPI, and ADX, while ADX itself reacts to SSE, BSE30, and BVSP. EGX30 receives impulses from JTOPI and ADX, reinforcing the role of Africa–Gulf linkages in transmitting financial shocks across regions. Finally, T10Y3M is influenced by BSE30, TASI, ADX, and EGX30, confirming that global equity developments feed directly back into U.S. interest-rate expectations. These results are consistent with evidence that yield-curve movements embed international spillovers from equity markets and commodity markets alike. In particular,

Umar et al. (

2022) demonstrate that oil price shocks significantly affect the level, slope, and curvature of the U.S. yield curve across different time horizons, highlighting T10Y3M as both a receiver and transmitter of global shocks.

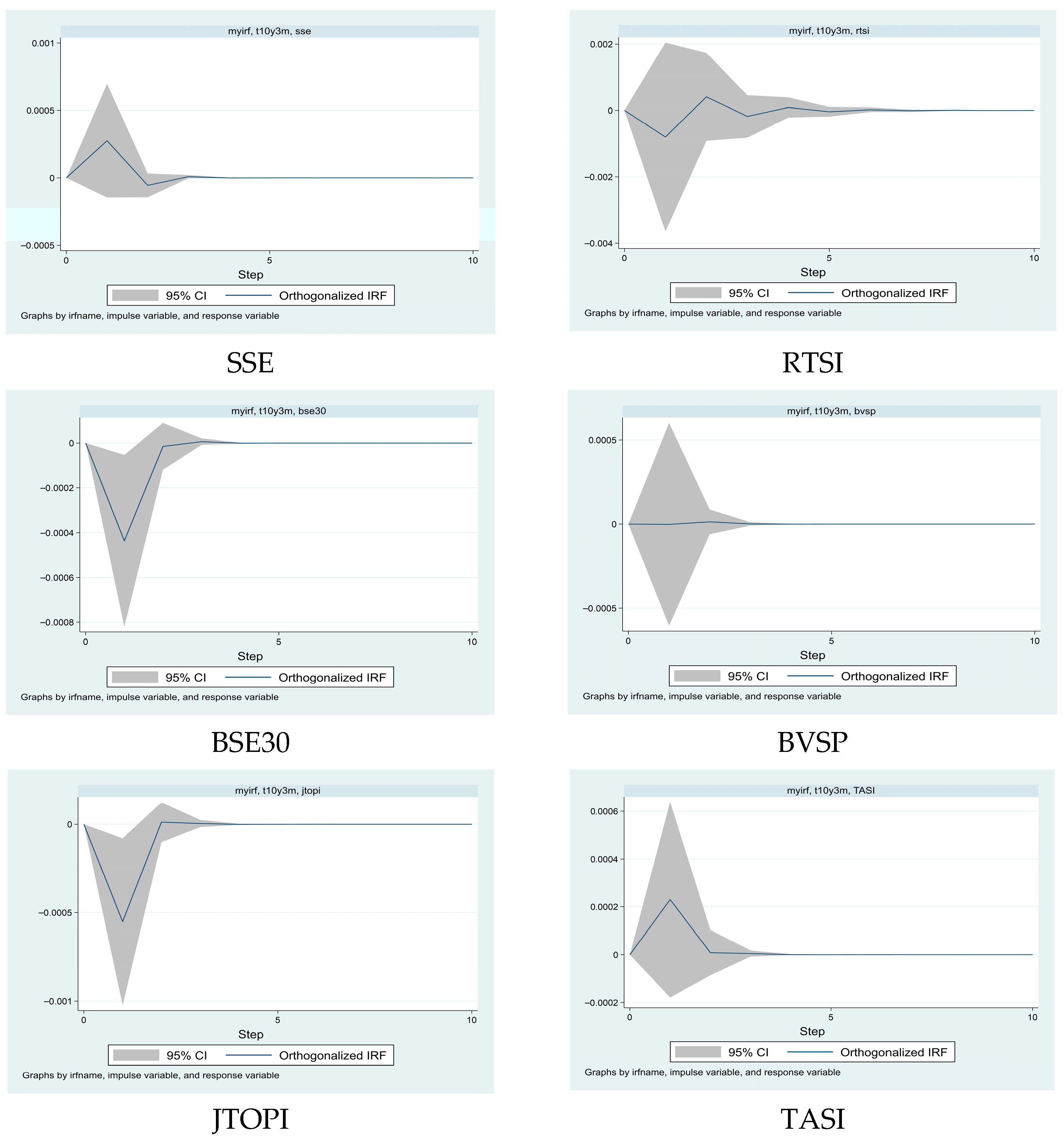

The IRFs (

Figure 4) provide further insights into how BRICS+ markets absorb T10Y3M shocks. For SSE and TASI, the responses are positive on impact, peaking within the first day before quickly reverting to zero. This short-lived reaction suggests temporary portfolio rebalancing toward emerging markets, possibly driven by yield differentials or delayed equity repricing in response to shifts in the U.S. term structure. By contrast, BSE30, RTSI, and JTOPI register immediate and sharp negative reactions. Similar to the quantile-based network analysis of

Rehman et al. (

2025), these findings suggest that tighter U.S. financial conditions tend to trigger equity outflows and raise risk premia in emerging markets. However, the declines dissipate within a few days across all markets, indicating rapid adjustment without long-term dislocation.

For ADX, EGX30, and BVSP, the responses are statistically insignificant, indicating that U.S. term-spread shocks do not exert persistent influence across all emerging markets equally. This heterogeneous impact reflects differences in market openness, depth of financial integration, macroeconomic stability, and the role of domestic institutional investors, supporting the view that sensitivity to U.S. yield-curve movements varies significantly across BRICS+ economies.

Taken together, these results suggest that U.S. term-spread shocks generate short-term volatility across BRICS+ equities, but the effects are neither uniform nor persistent. Highly integrated economies such as India, South Africa, and Russia are most vulnerable, while Gulf and North African markets exhibit greater resilience. For investors, this implies that yield-curve movements create tactical but temporary risks for equity portfolios. For policymakers, the findings highlight the importance of monitoring spillovers from U.S. bond markets, as domestic monetary conditions can be influenced by external equity dynamics. Overall, the evidence reinforces H2 by showing that U.S. yield-curve dynamics represent a key channel of macro-financial transmission to BRICS+ markets, although the resulting spillovers are predominantly short lived. The detailed VAR regression results underlying these responses are presented in

Supplementary Table S4.