Understanding Reverse Mortgage Acceptance in Spain with Explainable Machine Learning and Importance–Performance Map Analysis

Abstract

1. Introduction

- RQ1: What is the explanatory and predictive capacity of the TPB-based model developed in this paper?

- RQ2: What are the constructs or variables that require greater attention for the successful development of RMs in Spain?

2. Literature Review

2.1. Life-Cycle Models and Theory of Planned Behavior in the Modelización of the Acceptance of Reverse Mortgages

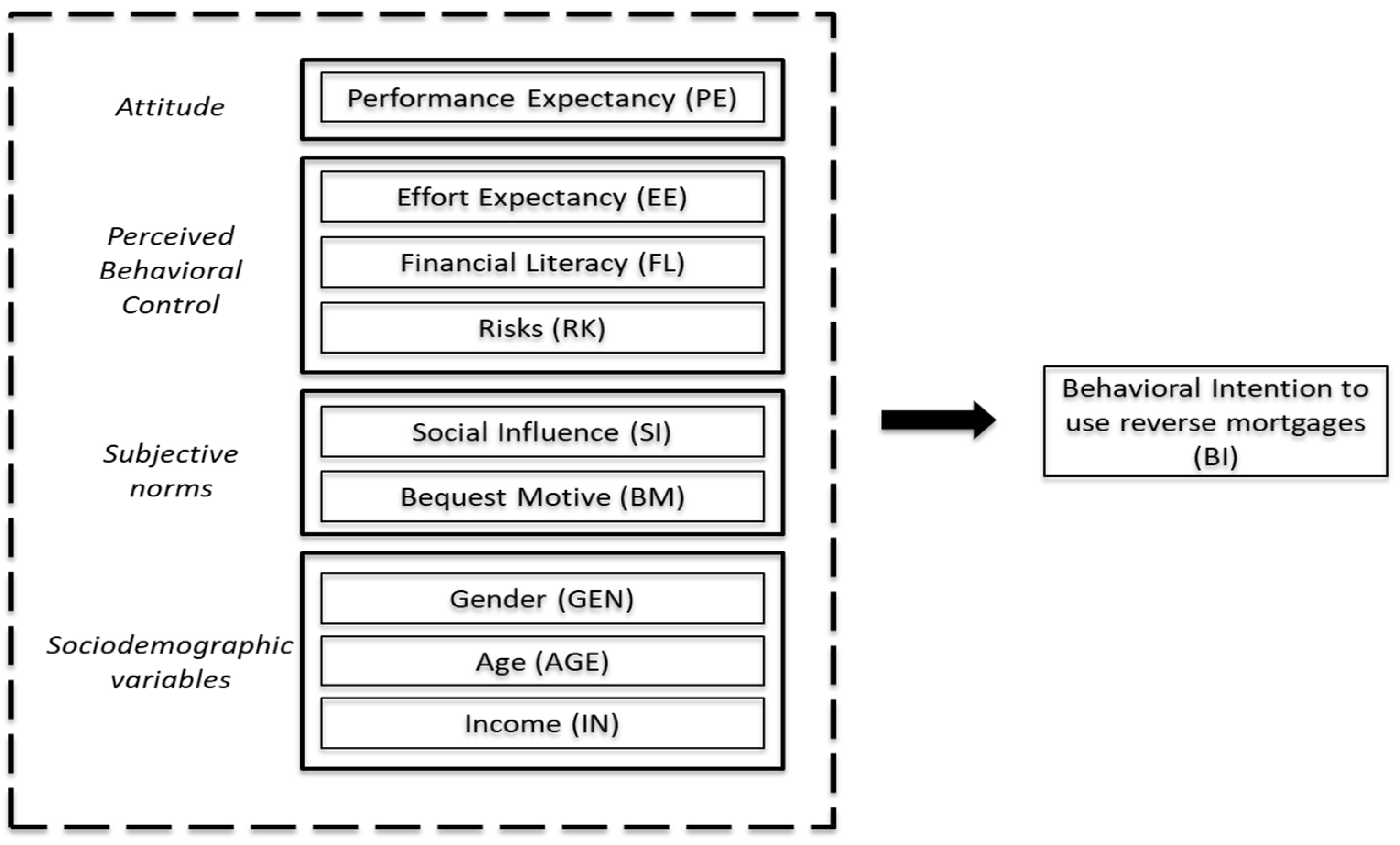

2.2. A TPB Modeling of Reverse Mortgage Acceptance

2.3. Attitude Factor: Performance Expectancy

2.4. Perceived Behavioral Control Factors: Effort Expectancy, Financial Literacy and Risks

2.5. Subjective Norms Factors: Social Influence and Bequest Motive

3. Results

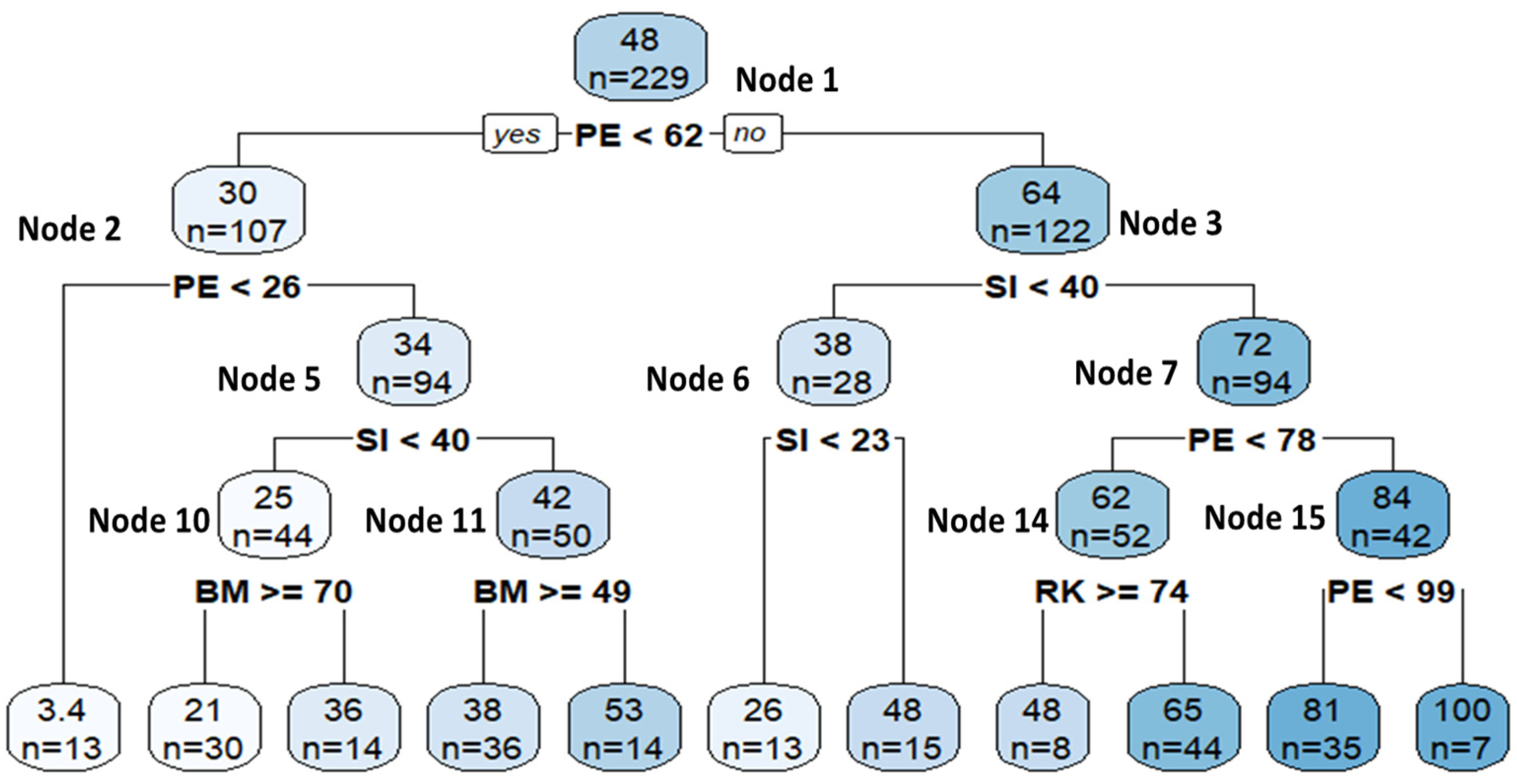

3.1. Analysis of Research Question 1

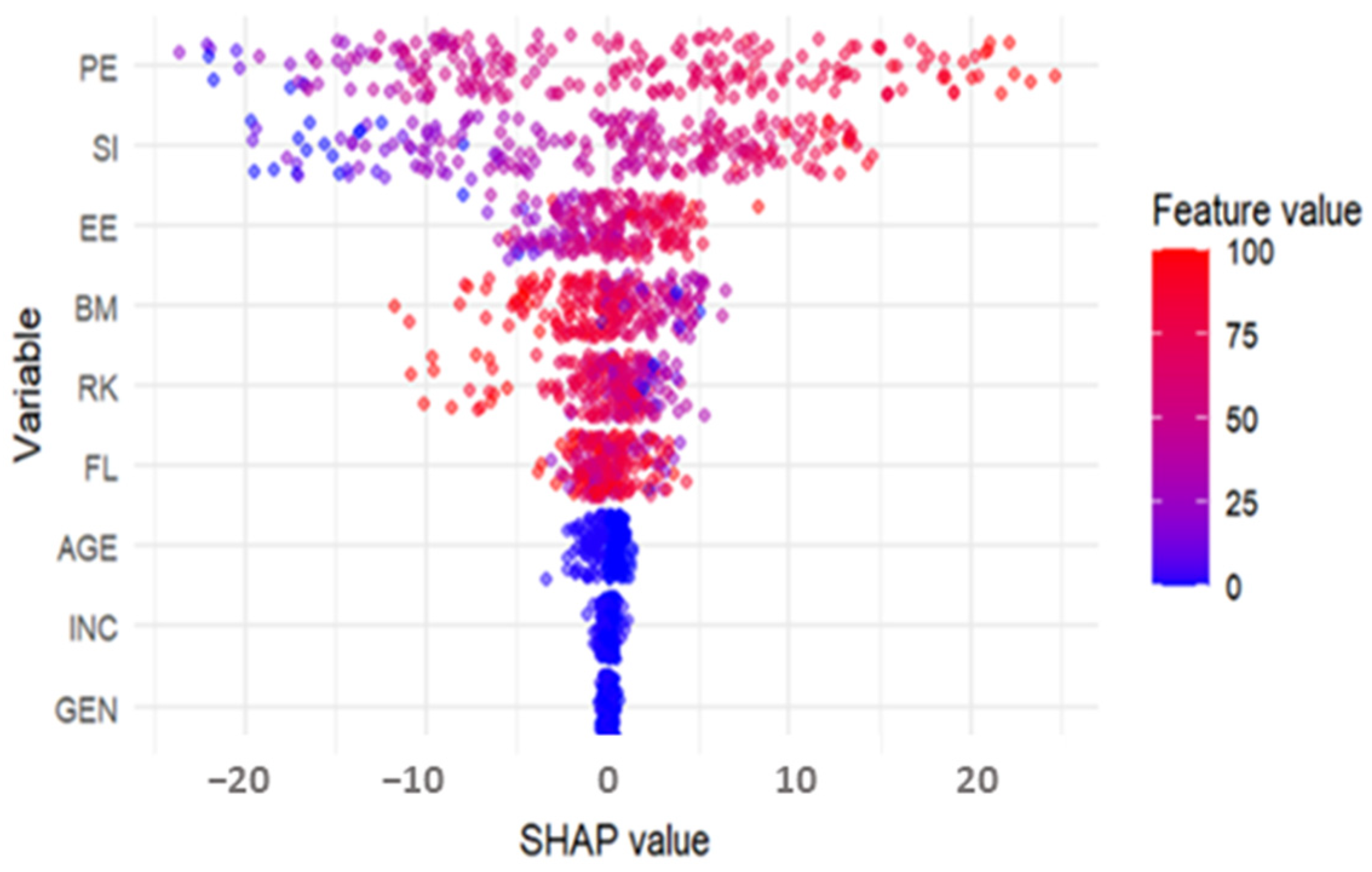

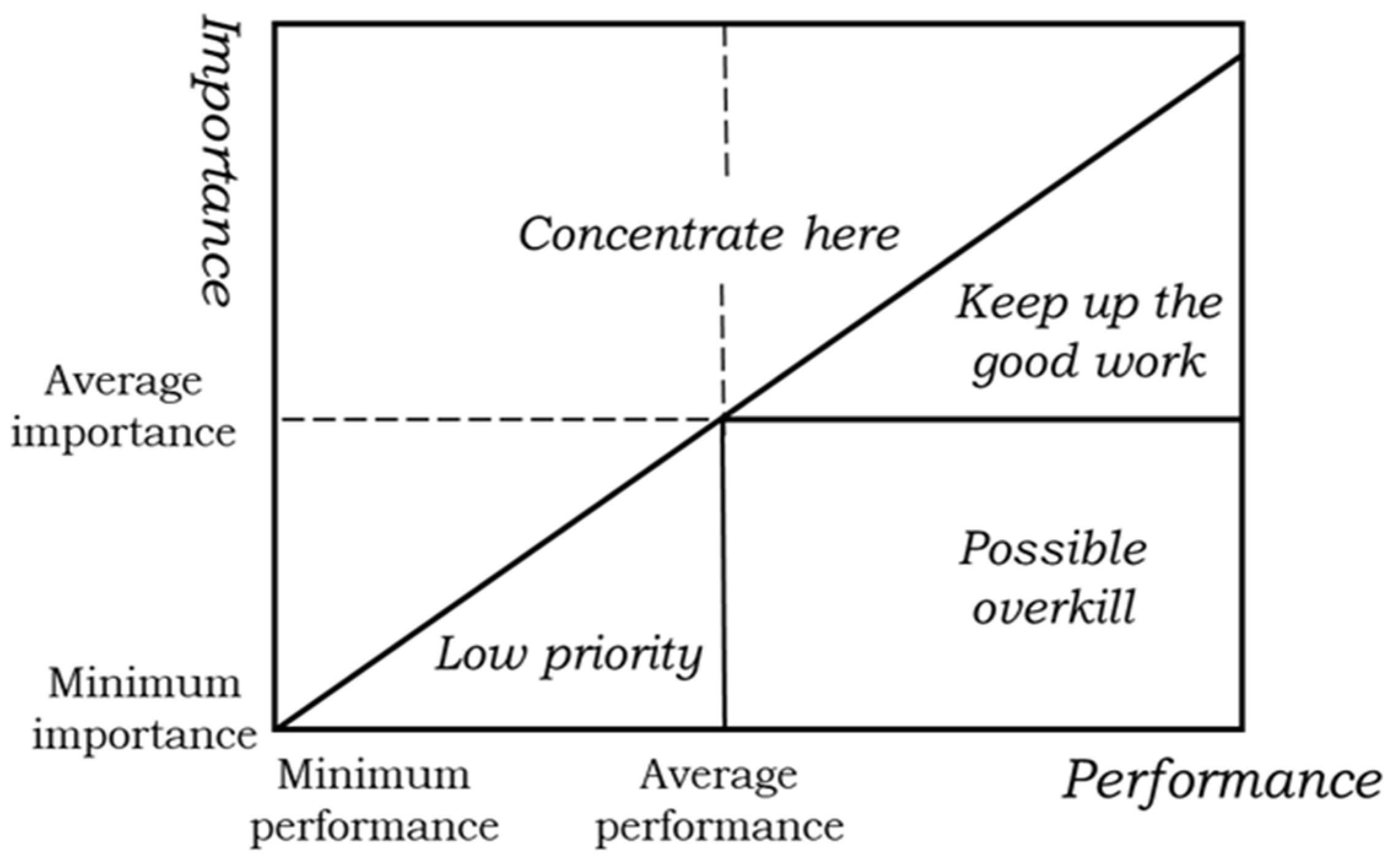

3.2. Analysis of Research Question 2

4. Discussion

4.1. General Considerations

4.2. Theoretical and Analytical Implications

4.3. Practical Findings of This Paper

- Information campaigns should emphasize how RMs can enhance quality of life in old age, maintain consumption levels, reduce dependence on family or public assistance, and provide financial stability without leaving the home. While generic financial literacy has not proven especially relevant for product acceptance, a deeper understanding of the relationship between inflation, interest rates, and housing values can ultimately help contextualize the usefulness of RMs (Ilan and Mugerman 2025).

- Online tools that allow users to simulate how their disposable income would vary according to RM type, age, and property value can help translate the product’s theoretical benefits into tangible personal advantages. In this regard, robo-advisors supported by artificial intelligence represent a particularly promising tool (Ilan and Mugerman 2025).

- Designing more flexible and user-friendly RM products could help increase demand by reducing contractual complexity, offering payout options better aligned with diverse household needs, and enhancing transparency in costs and risks (Hanewald et al. 2020).

- Market frictions need to be reduced to attain more appealing prices for borrowers and lenders. For example, in the United States, provisions such as the limited liability rules embedded in RM contracts and the uniform pricing applied regardless of regional housing risks act as significant barriers both for borrowers (who may perceive a lower net value) and for the sustainability of the program itself (Davidoff 2015). Similar barriers are also present in the Spanish context, particularly through inheritance laws.

- Sharing experiences of individuals who have successfully used RMs can demystify the product and strengthen confidence in its utility, particularly among older adults who value relatable, concrete examples. Such narratives emphasize the usefulness of RMs in addressing liquidity constraints during retirement and covering medical or care-related expenses (Hanewald et al. 2020).

- Awareness campaigns targeting subjective norms could be particularly effective if backed by trusted advisors. To ensure this trust, training programs for financial advisors and notaries are essential, providing continuous education on RM functioning, advantages, limitations, and suitable client profiles so they can offer accurate and reliable guidance (Baulkaran and Jain 2024; Ilan and Mugerman 2025).

- Institutional endorsement initiatives, such as the involvement of public institutions or consumer associations as guarantors of RM transparency, could legitimize the product and help counteract social skepticism (Hanewald et al. 2020).

- Designing hybrid products that allow for partial repayment options or clauses guaranteeing a minimum residual value for heirs, making the product more acceptable for those who prioritize inheritance.

- Promoting intergenerational financial planning incentives: Regulations could grant tax benefits if part of the RM proceeds is allocated to investment funds or life insurance policies in the heirs’ names.

- Intergenerational campaigns: Because RM adoption decisions often involve family members, campaigns aimed at children and heirs (framing the RM as a family planning solution rather than a threat to inheritance) could reduce resistance.

- Reframing the concept of legacy: Campaigns could broaden the notion of legacy to include not only material inheritance but also emotional well-being, independence, and the absence of a financial burden on children. This more holistic perspective may help soften psychological resistance to using housing wealth.

5. Materials and Methods

5.1. Sampling

5.2. Sample and Sociodemographic Profile

5.3. Factors Measurement

5.4. Data Analysis

6. Conclusions

6.1. Principal Takeaways

6.2. Limitations and Future Research Directions

Author Contributions

Funding

Institutional Review Board Statement

Data Availability Statement

Conflicts of Interest

Abbreviations

| AGE | Age |

| BI | Behavioral Intention |

| BM | Bequest Motive |

| DTR | Decision Tree Regression |

| EE | Effort Expectancy |

| FL | Financial Literacy |

| GEN | Gender |

| IPMA | Importance–Performance Map Analysis |

| IN | Income |

| PE | Performance Expectancy |

| RF | Random Forest |

| RK | Risk |

| RM | Reverse Mortgage |

| SHAP | Shapley Additive Explanations |

| SI | Social Influence |

| TPB | Theory of Planned Behavior |

Appendix A. English Wording of Items Used in This Paper

- Behavioral Intention (BI)

- BI1: I would consider the possibility of applying for a reverse mortgage in the future if circumstances require it.

- BI2: I am receptive to incorporating a reverse mortgage into my long-term retirement planning.

- Performance Expectancy (PE)

- PE1: I regard reverse mortgages as a valuable financial resource for individuals in retirement.

- PE2: I believe that obtaining a reverse mortgage could assist in preserving my lifestyle throughout retirement.

- PE3: I think reverse mortgages offer effective support for managing personal finances during later life.

- PE4: In my view, a reverse mortgage would enhance my access to financial resources during retirement.

- Effort Expectancy (EE)

- EE1: I find reverse mortgages to be relatively simple to grasp and operate.

- EE2: The application procedure for a reverse mortgage appears to be clear and manageable.

- EE3: I feel confident in my ability to oversee the process involved in using a reverse mortgage.

- EE4: I am assured of my capacity to handle a reverse mortgage without major complications.

- Financial Literacy (FL)

- FL1: I consider myself to be well-informed in financial matters.

- FL2: I am capable of making sound financial decisions with confidence.

- Risk (RK)

- RK1: I associate reverse mortgages with considerable financial risk.

- RK2: I view reverse mortgages as involving excessive uncertainty.

- RK3: I am uneasy about the possible negative outcomes linked to reverse mortgages.

- Social Influence (SI)

- SI1: My social circle would likely support my decision to pursue a reverse mortgage.

- SI2: Individuals whose perspectives I respect consider reverse mortgages to be a beneficial option for retirees.

- Bequest Motive (BM)

- BM1: I feel a strong desire to pass on assets to my descendants.

- BM2: Ensuring that I leave an inheritance is a central goal in my life.

- BM3: I perceive that utilizing a reverse mortgage might interfere with my intention to leave wealth to my heirs.

References

- Abalo, Javier, Jesús Varela, and Vicente Manzano. 2007. Importance values for Importance–Performance Analysis: A formula for spreading out values derived from preference rankings. Journal of Business Research 60: 115–21. [Google Scholar] [CrossRef]

- Ajzen, Icek. 1991. The theory of planned behavior. Organizational Behavior and Human Decision Processes 50: 179–211. [Google Scholar] [CrossRef]

- Alai, Daniel H., Hua Chen, Daniel Cho, Katja Hanewald, and Michael Sherris. 2014. Developing Equity Release Markets: Risk Analysis for Reverse Mortgages and Home Reversions. North American Actuarial Journal 18: 217–41. [Google Scholar] [CrossRef]

- Alhazeem, Ensaf, Anas Alsobeh, and Bilal Al-Ahmad. 2024. Enhancing Software Engineering Education through AI: An Empirical Study of Tree-Based Machine Learning for Defect Prediction. Paper presented at the 25th Annual Conference on Information Technology Education, New York, NY, USA, October 10–12; pp. 153–56. [Google Scholar] [CrossRef]

- Arias-Oliva, Mario, Jorge Pelegrín-Borondo, Kiyoshi Murata, and Stéphanie Gauttier. 2023. Conventional vs. disruptive products: A wearables and insideables acceptance analysis: Understanding emerging technological products. Technology Analysis and Strategic Management 35: 12. [Google Scholar] [CrossRef]

- Ashok, Shruthi, and Madhu Vij. 2020. Exploring the determinants of reverse mortgage purchase decision: Evidence from India. Journal of Internet Banking and Commerce 25: 369. [Google Scholar]

- Atance, David, Ana Debón, and Iván De La Fuente. 2021. Hipoteca Inversa: Impacto del Riesgo de Longevidad en el Caso Español. Madrid: Anales del Instituto de Actuarios Españoles, pp. 135–59. [Google Scholar] [CrossRef]

- Atance, David, Ana Debón, and Iván De La Fuente. 2024. Valuation of reverse mortgages in the Spanish market for foreign residents. Technological and Economic Development of Economy 30: 46–73. [Google Scholar] [CrossRef]

- Banco de España. 2023. Guía Sobre la Hipoteca Inversa. Available online: https://www.bde.es/f/webbde/Secciones/Publicaciones/Folletos/Ficheros/GUIA.pdf (accessed on 10 September 2025).

- Banco de España. 2024. Informe Anual 2023. Available online: https://www.bde.es/f/webbe/SES/Secciones/Publicaciones/PublicacionesAnuales/InformesAnuales/23/Fich/InfAnual_2023.pdf (accessed on 10 September 2025).

- Bartsch, Florian, Florian Buhlmann, Karolin Kirschenmann, and Carolin Schmidt. 2021. Is There a Need for Reverse Mortgages in Germany? Empirical Evidence and Policy Implications. Discussion Paper Series, No. 31. Available online: https://hdl.handle.net/10419/236738 (accessed on 10 September 2025).

- Baulkaran, Vishaal, and Pawan Jain. 2024. Home equity and retirement funding: Challenges and opportunities. Global Finance Journal 61: 100969. [Google Scholar] [CrossRef]

- Bisquerra Alzina, Rafel, and Núria Pérez-Escoda. 2015. Les escales de Likert poden augmentar en sensibilitat? REIRE Revista d’Innovació i Recerca en Educació 8: 129–47. [Google Scholar] [CrossRef]

- Boj, Eva, Maria Mercè Claramunt, and Xavier Varea. 2022. Reverse mortgage and financial sustainability. Technological and Economic Development of Economy 28: 872–92. [Google Scholar] [CrossRef]

- Bongini, Paola, and Doriana Cucinelli. 2019. University students and retirement planning: Never too early. International Journal of Bank Marketing 37: 775–97. [Google Scholar] [CrossRef]

- Breiman, Leo. 2001. Random forests. Machine Learning 45: 5–32. [Google Scholar] [CrossRef]

- Caser. 2024. Situación del Ahorro y la Inversión en España: Informe Ejecutivo. Available online: https://www.caser.es/documents/473773/16053307/1732183763860_caser%20pensiones%202024%20low.pdf (accessed on 10 September 2025).

- Chen, Hong-Ming, and Jing-Yi Chen. 2024. Structural analysis of reverse mortgages in Taiwan. Humanities and Social Sciences Communications 11: 1204. [Google Scholar] [CrossRef]

- Cheung, Gordon W, Helena D. Cooper-Thomas, Rebecca S. Lau, and Linda C. Wang. 2024. Reporting reliability, convergent and discriminant validity with structural equation modeling: A review and best-practice recommendations. Asia Pacific Journal of Management 41: 745–83. [Google Scholar] [CrossRef]

- Choinière-Crèvecoeur, Ismael, and Pierre-Carl Michaud. 2023. Reverse mortgages and financial literacy. Journal of Financial Literacy and Wellbeing 1: 79–102. [Google Scholar] [CrossRef]

- Chung, Doohee, Pilwon Jeong, Donghwan Kwon, and Hyunsoo Han. 2023. Technology acceptance prediction of robo-advisors by machine learning. Intelligent Systems with Applications 18: 200197. [Google Scholar] [CrossRef]

- Costa-Font, Joan, Joan Gil, and Oscar Mascarilla. 2010. Housing wealth and housing decisions in old age: Sale and reversion. Housing Studies 25: 375–95. [Google Scholar] [CrossRef]

- Cuc, Lavinia Denisa, Dana Rad, Teodor Florin Cilan, Bogdan Cosmin Gomoi, Cristina Nicolaescu, Robert Almași, Simona Dzitac, Florin Lucian Isac, and Ionut Pandelica. 2025. From AI Knowledge to AI Usage Intention in the Managerial Accounting Profession and the Role of Personality Traits—A Decision Tree Regression Approach. Electronics 14: 1107. [Google Scholar] [CrossRef]

- Daptardar, Ashish, and Chandan Dasgupta. 2014. Reverse mortgage in the Indian housing market: A review. International Journal of Management & Business Studies 4: 18–20. [Google Scholar]

- Davidoff, Thomas. 2015. Can ‘High Costs’ Justify Weak Demand for the Home Equity Conversion Mortgage? Review of Financial Studies 28: 2364–98. [Google Scholar] [CrossRef]

- Davidoff, Thomas, Patrick Gerhard, and Thomas Post. 2017. Reverse mortgages: What homeowners (don’t) know and how it matters. Journal of Economic Behavior & Organization 133: 151–71. [Google Scholar] [CrossRef]

- De Andrés Sánchez, Jorge, and Laura González-Vila Puchades. 2020. Enhanced annuities as a complement to the public retirement pension: Analysis of their implementation in Spain. Revista Galega de Economía 29: 1–19. [Google Scholar] [CrossRef]

- De Andrés-Sánchez, Jorge, and Laura González-Vila Puchades. 2023. Combining fsQCA and PLS-SEM to assess policyholders’ attitude towards life settlements. European Research on Management and Business Economics 29: 100220. [Google Scholar] [CrossRef]

- De Andrés-Sánchez, Jorge, and Laura González-Vila Puchades. 2025. Longevity risk and annuitisation decisions in the absence of special-rate life annuities. Risks 13: 37. [Google Scholar] [CrossRef]

- De Andrés-Sánchez, Jorge, Laura González-Vila Puchades, and Mario Arias-Oliva. 2023. Factors influencing policyholders’ acceptance of life settlements: A technology acceptance model. Geneva Papers on Risk and Insurance—Issues and Practice 48: 941–67. [Google Scholar] [CrossRef]

- Dillingh, Rik, Henriëtte Prast, Mariacristina Rossi, and Cesira Urzi Brancati. 2013. The Psychology and Economics of Reverse Mortgage Attitudes: Evidence from the Netherlands. CentER Discussion Paper Series, No. 135. Available online: https://ideas.repec.org/p/crp/wpaper/135.html (accessed on 10 September 2025).

- Dillingh, Rik, Henriëtte Prast, Mariacristina Rossi, and Cesira Urzi Brancati. 2017. Who wants to have their home and eat it too? Interest in reverse mortgages in the Netherlands. Journal of Housing Economics 38: 25–37. [Google Scholar] [CrossRef]

- Dragos, Simona Laura, Cristian Mihai Dragos, and Gabriela Mihaela Muresan. 2020. From intention to decision in purchasing life insurance and private pensions: Different effects of knowledge and behavioural factors. Journal of Behavioral and Experimental Economics 87: 101555. [Google Scholar] [CrossRef]

- Faqih, Khaled M. S. 2016. An empirical analysis of factors predicting the behavioral intention to adopt Internet shopping technology among non-shoppers in a developing country context: Does gender matter? Journal of Retailing and Consumer Services 30: 140–64. [Google Scholar] [CrossRef]

- Faul, Franz, Edgard Erdfelder, Axel Buchner, and Albert-Georg Lang. 2009. Statistical power analyses using G*Power 3.1: Tests for correlation and regression analyses. Behavior Research Methods 41: 1149–60. [Google Scholar] [CrossRef] [PubMed]

- Fornero, Elsa, Mariacristina Rossi, and Maria Cesira Urzí Brancati. 2016. Explaining why, right or wrong, (Italian) households do not like reverse mortgages. Journal of Pension Economics & Finance 15: 180–202. [Google Scholar] [CrossRef]

- Gallego-Losada, Rocío, Antonio Montero-Navarro, José-Luis Rodríguez-Sánchez, and Thais González-Torres. 2022. Retirement planning and financial literacy, at the crossroads: A bibliometric analysis. Finance Research Letters 44: 102109. [Google Scholar] [CrossRef]

- Gavilán, Ángel. 2023. El Sistema Público de Pensiones y los Principales Retos del Envejecimiento Poblacional. Banco de España. Available online: https://www.bde.es/f/webbe/GAP/Secciones/SalaPrensa/IntervencionesPublicas/DirectoresGenerales/economia/Arc/IIPP-2023-05-25-gavilan.pdf (accessed on 10 September 2025).

- González-Vila Puchades, Laura, Maite Mármol Jiménez, Sara Solanilla Blanco, and Xavier Varea Soler. 2025. Do reverse mortgages reduce poverty rates among older adults living alone in Spain? Analysing their overall and gender-specific effects. Social Indicators Research. [Google Scholar] [CrossRef]

- Gotman, Anne. 2011. Towards the end of bequest? The life cycle hypothesis sold to seniors. Civitas: Journal of Social Sciences 11: 93–114. [Google Scholar] [CrossRef]

- Griffin, Barbara, David Loe, and Beryl Hesketh. 2012. Using proactivity, time discounting, and the theory of planned behavior to identify predictors of retirement planning. Educational Gerontology 38: 877–89. [Google Scholar] [CrossRef]

- Hair, Joseph F., Jeffrey J. Risher, Marko Sarstedt, and Christian M. Ringle. 2019. When to use and how to report the results of PLS-SEM. European Business Review 31: 2–24. [Google Scholar] [CrossRef]

- Hanewald, Katja, Hazel Bateman, Hanming Fang, and Shang Wu. 2020. Is there a demand for reverse mortgages in China? Evidence from two online surveys. Journal of Economic Behavior and Organization 178: 29–55. [Google Scholar] [CrossRef]

- Hastings, Justine, Brigitte C. Madrian, and William L. Skimmyhorn. 2013. Financial literacy, financial education, and economic outcomes. Annual Review of Economics 5: 347–73. [Google Scholar] [CrossRef] [PubMed]

- Hauff, Jeanette C., Anders Carlander, Tommy Gärling, and Giani Nicolini. 2020. Retirement financial behaviour: How important is being financially literate? Journal of Consumer Policy 43: 543–64. [Google Scholar] [CrossRef]

- Helmdag, Jan, and Niko Väänänen. 2025. Financial sustainability above all else? Drivers and types of pension reform recommendations in EU socio-economic governance. JCMS: Journal of Common Market Studies 63: 1236–58. [Google Scholar] [CrossRef]

- Hoekstra, Joris, and Kess Dol. 2021. Attitudes towards housing equity release strategies among older home owners: A European comparison. Journal of Housing and the Built Environment 36: 1347–66. [Google Scholar] [CrossRef]

- Ilan, Mordechai, and Yevgeny Mugerman. 2025. Misguided mortgage choices: Financial literacy, inflation expectations, and borrowing decisions. Journal of Behavioral and Experimental Finance 35: 100740. [Google Scholar] [CrossRef]

- Imani, Mehdi, Ali Beikmohammadi, and Hamid Reza Arabnia. 2025. Comprehensive analysis of Random Forest and XGBoost performance with SMOTE, ADASYN, and GNUS under varying imbalance levels. Technologies 13: 88. [Google Scholar] [CrossRef]

- Instituto Nacional de Estadística. 2024. Encuesta de Condiciones de Vida. Base 2004. Vivienda. Hogares por Régimen de Tenencia de la Vivienda y Edad y Sexo de la Persona de Referencia. Available online: https://www.ine.es/jaxiT3/Tabla.htm?t=4583&L=0 (accessed on 10 September 2025).

- Knaack, Peter, Margaret Miller, and Fiona Stewart. 2020. Reverse Mortgages, Financial Inclusion, and Economic Development: Potential Benefit and Risks. World Bank Policy Research Working Paper Series. No. 9134. Available online: https://hdl.handle.net/10986/33290 (accessed on 10 September 2025).

- Kuhn, Max, and Kjell Johnson. 2013. Over-fitting and model tuning. In Applied Predictive Modeling. New York: Springer, pp. 61–92. [Google Scholar] [CrossRef]

- Kwong, Koon Shing, Jing Rong Goh, and Ting Lin Collin Chua. 2024. Enhancing sell-type home reversion products for retirement financing. Risks 12: 22. [Google Scholar] [CrossRef]

- Kwong, Koon Shing, Jing Rong Goh, Jordan Jie Xin Lee, and Ting Lin Collin Chua. 2025. Redesigning home reversion products to empower retirement for Singapore’s public flat owners. Risks 13: 23. [Google Scholar] [CrossRef]

- Liengaard, Benjamin Dybro, Pratyush Nidhi Sharma, G. Tomas M. Hult, Morten Berg Jensen, Marko Sarstedt, Joseph F. Hair, and Christian M. Ringle. 2021. Prediction: Coveted, yet forsaken? Introducing a cross-validated predictive ability test in partial least squares path modeling. Decision Sciences 52: 362–92. [Google Scholar] [CrossRef]

- Loh, Wei-Yin. 2011. Classification and regression trees. Wiley Interdisciplinary Reviews: Data Mining and Knowledge Discovery 1: 14–23. [Google Scholar] [CrossRef]

- Lundberg, Scott M., and Su-In Lee. 2017. A unified approach to interpreting model predictions. Advances in Neural Information Processing Systems 30: 4765–74. [Google Scholar]

- Lusardi, Annamaria, and Olivia S. Mitchell. 2017. How ordinary consumers make complex economic decisions: Financial literacy and retirement readiness. Quarterly Journal of Finance 7: 1750008. [Google Scholar] [CrossRef]

- Meneses Cerón, Luis Ángel, Jaime Andrés Carabalí Mosquera, Jorge Eduardo Frías Navarrete, Zoraida Ramírez Gutiérrez, and Jefferson Muñoz Vargas. 2024. Analysis, modelling, and financial perspectives of reverse mortgage implementation in Colombia. Heliyon 10: e31214. [Google Scholar] [CrossRef]

- Mohammed, Mohammed Ishaq, and Noralfishah Sulaiman. 2017. Determinants of reverse mortgage use intention: A theoretical framework. International Research Journal of Management and Commerce 4: 153–178. [Google Scholar]

- Mohammed, Mohammed Ishaq, and Noralfishah Sulaiman. 2018. Determinants of reverse mortgage usage in Malaysia. Real Estate Management and Valuation 26: 5–23. [Google Scholar] [CrossRef]

- Mohammed, Mohammed Ishaq, Noralfishah Sulaiman, and Dahiru Adamu. 2018. Dimensionality and reliability of the determinants of reverse mortgage use intention. Path of Science 4: 1013–23. [Google Scholar] [CrossRef]

- Moulton, Sharron, Carla Loibl, and Daniel Haurin. 2017. Reverse mortgage motivations and outcomes: Insights from survey data. Cityscape 19: 73–98. [Google Scholar]

- Muralidharan, D. R., and R. Soundara Raja. 2022. Impact of perception and attitude on behavioural intention towards reverse mortgage loans: A study on senior citizens in Bangalore City. Journal of Emerging Technologies and Innovative Research 9: 67–76. [Google Scholar]

- Musa, Haruna, Nor Hayati Binti Ahmad, and Alias Mat Nor. 2024. Extending the Theory of Planned Behavior in financial inclusion participation model—evidence from an emerging economy. Cogent Economics & Finance 12: 2306536. [Google Scholar] [CrossRef]

- Mussa, Abeba, Meeghan Rogers, and Xu Zhang. 2023. Financial capability across generations and technology. Financial Services Review 30: 4. [Google Scholar] [CrossRef]

- Nakajima, Makoto, and Irina Telyukova. 2017. Reverse mortgage loans: A quantitative analysis. The Journal of Finance 72: 911–50. [Google Scholar] [CrossRef]

- Nosi, Costanza, Antonella D’Agostino, Margherita Pagliuca, and Carlo Alberto Pratesi. 2017. Securing retirement at a young age: Exploring the intention to buy longevity annuities through an extended version of the theory of planned behavior. Sustainability 9: 1069. [Google Scholar] [CrossRef]

- OECD. 2023. Pensions at a Glance 2023: OECD and G20 Indicators. Paris: OECD Publishing. [Google Scholar] [CrossRef]

- Pahuja, Anuraj, and Rinku Sanjeev. 2016. Reverse mortgage: An empirical study in Indian perspective. International Journal of Banking, Risk and Insurance 4: 2. [Google Scholar]

- Probst, Phiplipp, Marvin N. Wright, and Anne-Laure Boulesteix. 2019. Hyperparameters and tuning strategies for random forest. WIREs Data Mining and Knowledge Discovery 9: e1301. [Google Scholar] [CrossRef]

- Rad, Dana, Lavinia Denisia Cuc, Gabriel Croitoru, Bogdan Cosmin Gomoi, Luminita Mazuru, Raluca Simina Bilți, Sergiu Rusu, Maria Sinaci, and Florentina Simona Barbu. 2025. Modeling investment decisions through decision tree regression—A behavioral finance theory approach. Electronics 14: 1505. [Google Scholar] [CrossRef]

- Rania, Francesco. 2025. Reverse mortgages and pension sustainability: An agent-based and actuarial approach. Risks 13: 147. [Google Scholar] [CrossRef]

- Rasmussen, David W., Isaac F. Megbolugbe, and Barbara A. Morgan. 1995. Using the 1990 Public Use Microdata Sample to estimate potential demand for reverse mortgage products. Journal of Housing Research 6: 1–23. [Google Scholar]

- R Development Core Team. 2025. R: A Language and Environment for Statistical Computing. Vienna. Available online: http://www.R-project.org/ (accessed on 10 September 2025).

- Richter, Nikole Franziska, and Ana Alina Tudoran. 2024. Elevating theoretical insight and predictive accuracy in business research: Combining PLS-SEM and selected machine learning algorithms. Journal of Business Research 173: 114453. [Google Scholar] [CrossRef]

- Ringle, Christian M., and Marko Sarstedt. 2016. Gain more insight from your PLS-SEM results. Industrial Management & Data Systems 116: 1865–86. [Google Scholar] [CrossRef]

- Rozenkowska, Katarzyna. 2023. Theory of planned behavior in consumer behavior research: A systematic literature review. International Journal of Consumer Studies 47: 2670–700. [Google Scholar] [CrossRef]

- She, Long, Ratneswary Rasiah, Marc Aul Weissmann, and Harpaljit Kaur. 2024. Using the Theory of Planned Behaviour to explore predictors of financial behaviour among working adults in Malaysia. FIIB Business Review 13: 118–35. [Google Scholar] [CrossRef]

- Simón-Moreno, Héctor. 2019. The regulation of reverse mortgages as a source of income in retirement: Policy options and legal drivers. Journal of Housing and the Built Environment 34: 1005–22. [Google Scholar] [CrossRef]

- Sparks, Paul, Carol A. Guthrie, and Richard Shepherd. 1997. The dimensional structure of the perceived behavioral control construct. Journal of Applied Social Psychology 27: 418–38. [Google Scholar] [CrossRef]

- Stupak, Thompson. 2024. How Much Data Is Required to Train ML Models in 2024? Available online: https://www.akkio.com/post/how-much-data-is-required-to-train-ml (accessed on 10 September 2025).

- Whait, Robert B., Braam Lowies, Peter Rossini, Stanley McGreal, and Bill Dimovski. 2019. The reverse mortgage conundrum: Perspectives of older households in Australia. Habitat International 94: 102073. [Google Scholar] [CrossRef]

| Mean (Item) | Median (Item) | SD (Item) | Factor Loading | CA | CR | AVE | Mean (Construct) | |

|---|---|---|---|---|---|---|---|---|

| Behavioral intention (BI) | 0.92 | 0.96 | 0.92 | 48 | ||||

| BI1 | 5.1 | 5 | 3.0 | 0.96 | ||||

| BI2 | 4.6 | 5 | 3.0 | 0.96 | ||||

| Performance expectancy (PE) | 0.89 | 0.92 | 0.75 | 61 | ||||

| PE1 | 6.5 | 7 | 2.2 | 0.73 | ||||

| PE2 | 5.9 | 6 | 2.5 | 0.91 | ||||

| PE3 | 5.7 | 6 | 2.5 | 0.93 | ||||

| PE4 | 6.4 | 7 | 2.4 | 0.89 | ||||

| Effort expectancy (EE) | 0.84 | 0.89 | 0.67 | 58 | ||||

| EE1 | 6.0 | 6 | 2.3 | 0.80 | ||||

| EE2 | 5.4 | 5 | 2.1 | 0.78 | ||||

| EE3 | 5.2 | 5 | 2.5 | 0.88 | ||||

| EE4 | 6.7 | 7 | 2.5 | 0.83 | ||||

| Financial literacy (FL) | 0.91 | 0.96 | 0.92 | 72 | ||||

| FL1 | 7.2 | 8 | 2.1 | 0.96 | ||||

| FL2 | 7.2 | 7 | 2.0 | 0.96 | ||||

| Risk (RK) | 0.85 | 0.91 | 0.77 | 61 | ||||

| RK1 | 5.8 | 6 | 2.5 | 0.88 | ||||

| RK2 | 6.0 | 6 | 2.4 | 0.87 | ||||

| RK3 | 6.6 | 7 | 2.4 | 0.88 | ||||

| Social influence (SI) | 0.79 | 0.90 | 0.82 | 47 | ||||

| SI1 | 4.6 | 5 | 2.8 | 0.90 | ||||

| SI2 | 4.7 | 5 | 2.5 | 0.91 | ||||

| Bequest motive (BM) | 0.80 | 0.88 | 0.70 | 69 | ||||

| BM1 | 7.9 | 9 | 2.4 | 0.85 | ||||

| BM2 | 5.6 | 6 | 2.7 | 0.81 | ||||

| BM3 | 6.7 | 7 | 2.8 | 0.86 | ||||

| BI | PE | EE | FL | RK | SI | BM | GEN | AGE | INC | |

|---|---|---|---|---|---|---|---|---|---|---|

| BI | 0.96 | |||||||||

| PE | 0.70 ** | 0.87 | ||||||||

| EE | 0.46 ** | 0.42 ** | 0.82 | |||||||

| FL | 0.17 * | 0.20 ** | 0.39 ** | 0.96 | ||||||

| RK | −0.40 ** | −0.32 ** | −0.49 ** | −0.19 ** | 0.88 | |||||

| SI | 0.67 ** | 0.55 ** | 0.59 ** | 0.29 ** | −0.48 ** | 0.908 | ||||

| BM | −0.25 ** | 0.00 | −0.04 | 0.10 | 0.19 ** | −0.25 ** | 0.84 | |||

| GEN | 0.08 | 0.18 | 0.01 | 0.16 | −0.08 | 0.01 | −0.03 | 1 | ||

| AGE | −0.14 * | −0.03 | 0.03 | −0.11 | −0.01 | −0.01 | 0.04 | 0.07 | 1 | |

| INC | 0.04 | 0.04 | 0.04 | 0.12 | −0.02 | 0.13 * | 0.05 | 0.08 | −0.15 * | 1 |

| N1 | N2 | N3 | N5 | N6 | N7 | N10 | N11 | N14 | N15 |

|---|---|---|---|---|---|---|---|---|---|

| PE < 62 | PE < 26 | SI < 40 | SI < 40 | SI < 23 | PE < 78 | BM ≥ 70 | BM ≥ 49 | RK ≥ 74 | PE < 99 |

| EE < 55 | EE < 20 | EE < 48 | PE < 45 | PE < 65 | EE < 75 | FL ≥ 45 | BM ≥ 94 | RK ≥ 5 | |

| FL < 70 | BM < 24 | FL < 32 | EE < 64 | EE < 32 | FL < 83 | SI < 97 | |||

| RK ≥ 58 | RK ≥ 81 | RK ≥ 74 | FL ≥ 85 | RK ≥ 50 | |||||

| SI < 50 | BM ≥ 72 | RK < 75 | SI < 70 | ||||||

| GEN < 1 | INC < 1 | BM ≥ 80 | BM ≥ 8 |

| Fit Accuracy | Predictive Accuracy | |||||

|---|---|---|---|---|---|---|

| Method | R2 | RMSE | MAE | Q2 | RMSE | MAE |

| DTR | 69.3% | 15.969 | 12.312 | 41.3% | 21.7 | 17.2 |

| RF | 91.7% | 8.307 | 6.727 | 55.7% | 18.9 | 15.4 |

| Difference (RF-DTR) | 22.4% | −7.662 | −5.585 | 14.4% ** | −2.8 ** | −1.8 ** |

| Differences in SHAPs (Row Minus Column) | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Mean Absolute SHAP | EE | FL | RK | SI | BM | GEN | AGE | INC | ||

| PE | 9.72 | PE | 7.42 | 8.59 | 8.02 | 2.46 | 7.22 | 9.56 | 8.99 | 9.52 |

| EE | 2.29 | EE | 1.17 | 0.60 | −4.96 | −0.20 | 2.13 | 1.57 | 2.09 | |

| FL | 1.13 | FL | −0.57 | −6.13 | −1.37 | 0.97 | 0.40 | 0.93 | ||

| RK | 1.69 | RK | −5.56 | −0.80 | 1.53 | 0.97 | 1.50 | |||

| SI | 7.25 | SI | 4.76 | 7.09 | 6.53 | 7.06 | ||||

| BM | 2.49 | BM | 2.34 | 1.77 | 2.30 | |||||

| GEN | 0.16 | GEN | −0.56 | −0.04 | ||||||

| AGE | 0.72 | AGE | 0.52 | |||||||

| INC | 0.20 | INC | ||||||||

| Variable | Responses |

|---|---|

| Gender | Men (55.15%), Female (44.85%) |

| Age | ≤50 years (24.89%); ≥51 and ≤60 years (48.47%); ≥61 and ≤65 years (14.85%); ≥66 years (11.79%) |

| Monthly income | Less than €3000 (22.27%); Between €3000 and €4999 (32.75%); At least €5000 (36.68%); Not answered (8.30%) |

| Academic degree | Primary or secondary education (16.16%); University education (83.84%) |

| Marital status | Married or in a civil partnership (73.36%); Never married, divorced, or widowed (25.33%); Not answered (1.31%) |

| Number of children | No child (20.96%); one child (16.16%); two children (51.53%); three or more children (10.92%) |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2025 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Andrés-Sánchez, J.d.; González-Vila Puchades, L. Understanding Reverse Mortgage Acceptance in Spain with Explainable Machine Learning and Importance–Performance Map Analysis. Risks 2025, 13, 212. https://doi.org/10.3390/risks13110212

Andrés-Sánchez Jd, González-Vila Puchades L. Understanding Reverse Mortgage Acceptance in Spain with Explainable Machine Learning and Importance–Performance Map Analysis. Risks. 2025; 13(11):212. https://doi.org/10.3390/risks13110212

Chicago/Turabian StyleAndrés-Sánchez, Jorge de, and Laura González-Vila Puchades. 2025. "Understanding Reverse Mortgage Acceptance in Spain with Explainable Machine Learning and Importance–Performance Map Analysis" Risks 13, no. 11: 212. https://doi.org/10.3390/risks13110212

APA StyleAndrés-Sánchez, J. d., & González-Vila Puchades, L. (2025). Understanding Reverse Mortgage Acceptance in Spain with Explainable Machine Learning and Importance–Performance Map Analysis. Risks, 13(11), 212. https://doi.org/10.3390/risks13110212