European Non-Performing Exposures (NPEs) and Climate-Related Risks: Country Dimensions

Abstract

1. Introduction

2. Literature Review

3. Data and Methodology

3.1. Sample

3.2. The Model

3.3. Robustness Check

4. Conclusions

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

References

- Acharya, Viral V., and Sascha Steffen. 2020. The Risk of Being a Fallen Angel and the Corporate Dash for Cash in the Midst of COVID. The Review of Corporate Finance Studies 9: 430471. [Google Scholar] [CrossRef]

- Acharya, Viral V., Richard Berner, Robert Engle, Hyeyoon Jung, Johannes Stroebel, Xuran Zeng, and Yihao Zhao. 2023. Climate Stress Testing. Annual Review of Financial Economics 15: 291–326. [Google Scholar] [CrossRef]

- Baldwin, Richard E., and Beatrice Weder. 2020. Economics in the Time of COVID-19. London: CEPR Press. [Google Scholar]

- Battiston, Stefano, Antoine Mandel, and Irene Monasterolo. 2021. Financing a Net Zero Economy: The Consequences of Physical Climate Risk for Banks. Ceres. pp. 1–78. Available online: https://subscriber.politicopro.com/f/?id=0000017b-c24b-d1a4-a17f-ea5fd0330000 (accessed on 9 August 2024).

- Battiston, Stefano, Antoine Mandel, Irene Monasterolo, Franziska Schütze, and Gabriele Visentin. 2017. A Climate Stress-Test of the Financial System. Nature Climate Change 7: 283–88. [Google Scholar] [CrossRef]

- Breitenstein, Miriam, Duc Khuong Nguyen, and Thomas Walther. 2021. Environmental hazards and risk management in the financial sector: A systematic literature review. Journal of Economic Surveys 35: 512–38. [Google Scholar] [CrossRef]

- Brunetti, Celso, Benjamin Dennis, Dylan Gates, Diana Hancock, David Ignell, Elizabeth K. Kiser, Gurubala Kotta, Anna Kovner, Richard J. Rosen, and Nicholas K. Tabor. 2021. Climate Change and Financial Stability. Washington, DC: Board of Governors of the Federal Reserve System, March 19. [Google Scholar] [CrossRef]

- Burke, Marshall, Solomon M. Hsiang, and Edward Miguel. 2015. Global Non-Linear Effect of Temperature on Economic Production. Nature 527: 235–39. [Google Scholar] [CrossRef]

- Campbell, John Y., and Robert J. Shiller. 1988. The Dividend-Price Ratio and Expectations of Future Dividends and Discount Factors. The Review of Financial Studies 1: 195–228. [Google Scholar] [CrossRef]

- Chabot, Miia, and Jean Louis Bertrand. 2023. Climate Risks and Financial Stability: Evidence from the European Financial System. Journal of Financial Stability 69: 101190. [Google Scholar] [CrossRef]

- Colacito, Riccardo, Bridget Hoffmann, and Toan Phan. 2019. Temperature and Growth: A Panel Analysis of the United States. Journal of Money, Credit and Banking 51: 313–68. [Google Scholar] [CrossRef]

- Committee on Banking Supervision. 2017. Guidelines. Prudential Treatment of Problem Assets-Definitions of Non-Performing Exposures and Forbearance. Basel: Committee on Banking Supervision, pp. 1–45. ISBN 9789291974887. Available online: https://www.bis.org/bcbs/publ/d403.htm (accessed on 17 May 2024).

- Committee on Banking Supervision. 2021. Climate-Related Financial Risks—Measurement Methodologies. Basel: Committee on Banking Supervision. ISBN 9789292549718. Available online: https://www.bis.org/bcbs/publ/d518.htm (accessed on 20 June 2022).

- Cornelli, Giulio, Jon Frost, Leonardo Gambacorta, P. Raghavendra Rau, Robert Wardrop, Tania Fintech Ziegler, and Big Tech Credit. 2023. Drivers of the Growth of Digital Lending. Journal of Banking & Finance 148: 106742. [Google Scholar] [CrossRef]

- Čihák, Martin, Aslı Demirgüç-Kunt, Erik Feyen, and Ross Levine. 2012. Benchmarking Financial Systems around the World. No. WPS6175. Washington, DC: The World Bank. Available online: http://documents.worldbank.org/curated/en/868131468326381955/Benchmarking-financial-systems-around-the-world (accessed on 24 May 2024).

- Delis, Manthos D., Kathrin de Greiff, Maria Iosifidi, and Steven Ongena. 2024. Being Stranded with Fossil Fuel Reserves? Climate Policy Risk and the Pricing of Bank Loans. Financial Markets, Institutions & Instruments 33: 239–65. [Google Scholar] [CrossRef]

- Dell, Melissa, Benjamin F. Jones, and Benjamin A. Olken. 2012. Temperature Shocks and Economic Growth: Evidence from the Last Half Century. American Economic Journal: Macroeconomics 4: 66–95. [Google Scholar] [CrossRef]

- Demirgüç-Kunt, Asli, Alvaro Pedraza, and Claudia Ruiz-Ortega. 2021. Banking Sector Performance during the COVID-19 Crisis. Journal of Banking & Finance 133: 106305. [Google Scholar] [CrossRef]

- Deschênes, Olivier, and Michael Greenstone. 2007. The Economic Impacts of Climate Change: Evidence from Agricultural Output and Random Fluctuations in Weather. American Economic Review 97: 354–85. [Google Scholar] [CrossRef]

- Di Febo, Elisa, and Eliana Angelini. 2023. The Impact of the Carbon Footprint in European Loans of the Economic Activities. Proceedings of The International Conference on Advanced Research in Management, Economics and Accounting 1: 1–15. [Google Scholar] [CrossRef]

- Dietz, Simon, Alex Bowen, Charlie Dixon, and Philip Gradwell. 2016. ‘Climate Value at Risk’ of Global Financial Assets. Nature Climate Change 6: 676–79. [Google Scholar] [CrossRef]

- Dunz, Nepomuk, Asjad Naqvi, and Irene Monasterolo. 2021. Climate Sentiments, Transition Risk, and Financial Stability in a Stock-Flow Consistent Model. Journal of Financial Stability 54: 100872. [Google Scholar] [CrossRef]

- D’Orazio, Paola, Tobias Hertel, and Fynn Kasbrink. 2022. No Need to Worry? Estimating the Exposure of the German Banking Sector to Climate-Related Transition Risks. Ruhr Economic Papers #946. Essen: Leibniz-Institut für Wirtschaftsforschung. [Google Scholar] [CrossRef]

- European Central Bank. 2020. Guide on Climate-Related and Environmental Risks. Frankfurt am Main: European Central Bank, pp. 1–54. [Google Scholar]

- European Central Bank. 2021a. Climate-Related Risk and Financial Stability. ECB/ESRB Project Team on Climate Risk Monitoring. Frankfurt am Main: European Central Bank. [Google Scholar]

- European Central Bank. 2021b. The State of Climate and Environmental Risk Management in the Banking Sector. Frankfurt am Main: European Central Bank. [Google Scholar] [CrossRef]

- Faiella, Ivan, and Luciano Lavecchia. 2020. Questioni Di Economia e Finanza (Occasional Papers)—The Carbon Footprint of Italian Loans. Banca d’Italia 557: 1–26. [Google Scholar]

- Fama, Eugene F., and Kenneth R. French. 1988. Dividend Yields, and Expected Stock Returns. Journal of Financial Economics 22: 3–25. [Google Scholar] [CrossRef]

- Farnè, Matteo, and Angelos Vouldis. 2024. Do Retail-Oriented Banks Have Less Non-Performing Loans? Journal of Economic Asymmetries 29: e00358. [Google Scholar] [CrossRef]

- Kaufmann, Daniel, Aart Kraay, and Massimo Mastruzzi. 2010. The Worldwide Governance Indicators. Methodology and Analytical Issues. Washington, DC: The World Bank. [Google Scholar]

- Klomp, Jeroen, and Jakob De Haan. 2014. Bank Regulation, the Quality of Institutions, and Banking Risk in Emerging and Developing Countries: An Empirical Analysis. Emerging Markets Finance and Trade 50: 19–40. [Google Scholar] [CrossRef]

- Kolstad, Charles D., and Frances C. Moore. 2020. Estimating the Economic Impacts of Climate Change Using Weather Observations. Review of Environmental Economics and Policy 14: 1–24. [Google Scholar] [CrossRef]

- KPMG. 2019. EBA Guidelines on Management of Non-Performing and Forborne Exposures, 2–3. Available online: https://assets.kpmg.com/content/dam/kpmg/ie/pdf/2019/03/ie-eba-guidelines-on-non-performing-exposures.pdf (accessed on 17 May 2024).

- KPMG. 2023. Quarterly KPMG SSM Insights Newsletter—July Edition. Available online: https://assets.kpmg.com/content/dam/kpmg/xx/images/2023/07/kpmg-ssm-insights.pdf (accessed on 15 May 2024).

- Mankiw, N. Gregory, David Romer, and Matthew D. Shapiro. 1985. An Unbiased Reexamination of Stock Market Volatility An Unbiased Reexamination of Stock Market Volatility Recommended Citation Recommended Citation. Journal of Finance 40: 677–87. [Google Scholar] [CrossRef]

- Oguntuase, Oluwaseun James. 2020. Climate Change, Credit Risk and Financial Stability. Banking and Finance 12: 1–17. [Google Scholar]

- Pancotto, Livia, Owain ap Gwilym, and Jonathan Williams. 2024. The Evolution and Determinants of the Non-Performing Loan Burden in Italian Banking. Pacific Basin Finance Journal 84: 102306. [Google Scholar] [CrossRef]

- Ranger, Nicola, Olivier Mahul, and Irene Monasterolo. 2022. Assessing Financial Risks from Physical Climate Shocks: A Framework for Scenario Generation. Washington, DC: World Bank Group. [Google Scholar]

- Spornberger, Simon. 2021. Banks Must Accelerate Efforts to Tackle Climate Risks, ECB Supervisory Assessment Shows. Frankfurt: European Central Bank, November 22. [Google Scholar]

- Tran, Son, Dat Nguyen, and Liem Nguyen. 2022. Concentration, Capital, and Bank Stability in Emerging and Developing Countries. Borsa Istanbul Review 22: 1251–59. [Google Scholar] [CrossRef]

- Vicente-Serrano, Sergio M., Santiago Beguería, and Juan I. López-Moreno. 2010. A Multiscalar Drought Index Sensitive to Global Warming: The Standardized Precipitation Evapotranspiration Index. Journal of Climate 23: 1696–718. [Google Scholar] [CrossRef]

- Westcott, Mark, John Ward, Paul Sayers, and David Bresch. 2019. Physical Risk Framework: Understanding the Impacts of Climate Change on Real Estate Lending and Investment Portfolios. Cambridge: University of Cambridge Institute for Sustainability Leadership. Available online: www.cisl.cam.ac.uk/climatewise (accessed on 17 May 2024).

- World Economic Forum. 2022. The Global Risks Report 2022. Cologny: World Economic Forum. [Google Scholar]

- Yuen, Mui Kuen, Thanh Ngo, Tu D. Q. Le, and Tin H. Ho. 2022. The Environment, Social and Governance (ESG) Activities and Profitability under COVID-19: Evidence from the Global Banking Sector. Journal of Economics and Development 24: 345–64. [Google Scholar] [CrossRef]

- Zhang, Dayong, Yalin Wu, Qiang Ji, Kun Guo, and Brian Lucey. 2024. Climate Impacts on the Loan Quality of Chinese Regional Commercial Banks. Journal of International Money and Finance 140: 102975. [Google Scholar] [CrossRef]

- Zhang, Dengjun. 2021. How Environmental Performance Affects Firms’ Access to Credit: Evidence from EU Countries. Journal of Cleaner Production 315: 128294. [Google Scholar] [CrossRef]

- Zhang, Xingmin, Shuai Zhang, and Liping Lu. 2022. The Banking Instability and Climate Change: Evidence from China. Energy Economics 106: 105787. [Google Scholar] [CrossRef]

| Country | |

|---|---|

| Austria | AU |

| Belgium | BEL |

| Germany | DE |

| Spain | ESP |

| Finland | FIN |

| France | FRA |

| Greece | GRE |

| Ireland | IRL |

| Italy | ITA |

| Luxemburg | LUX |

| Netherland | NET |

| Portugal | PORT |

| Sweden | SWE |

| Dependent Variable | |

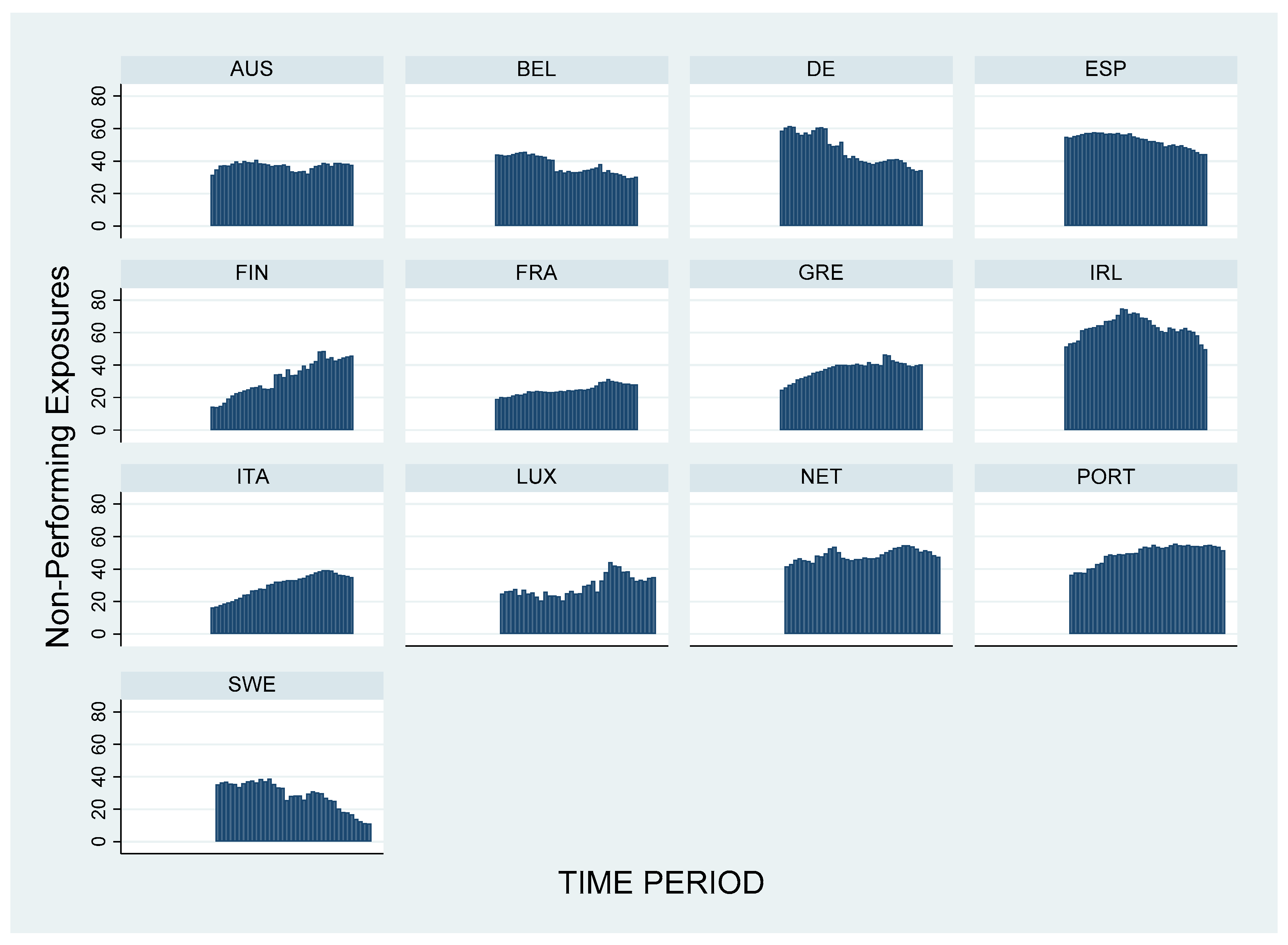

| NPEs | Gross forborne non-performing loans and advances [% of total gross non-performing loans and advances] |

| Independent Variables | |

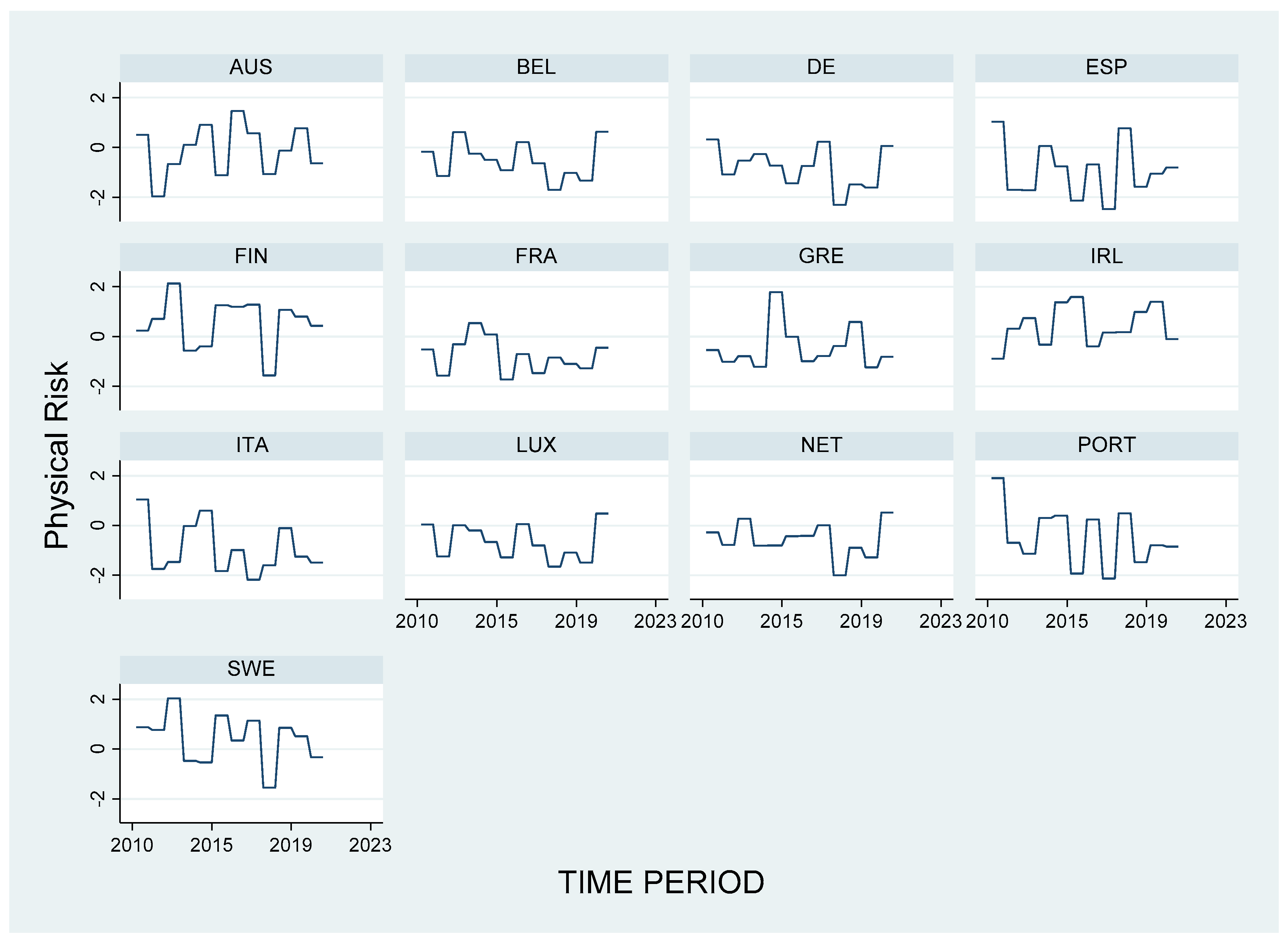

| PhyR | Physical Risk: Standardised Precipitation Evapotranspiration Index (SPEI) |

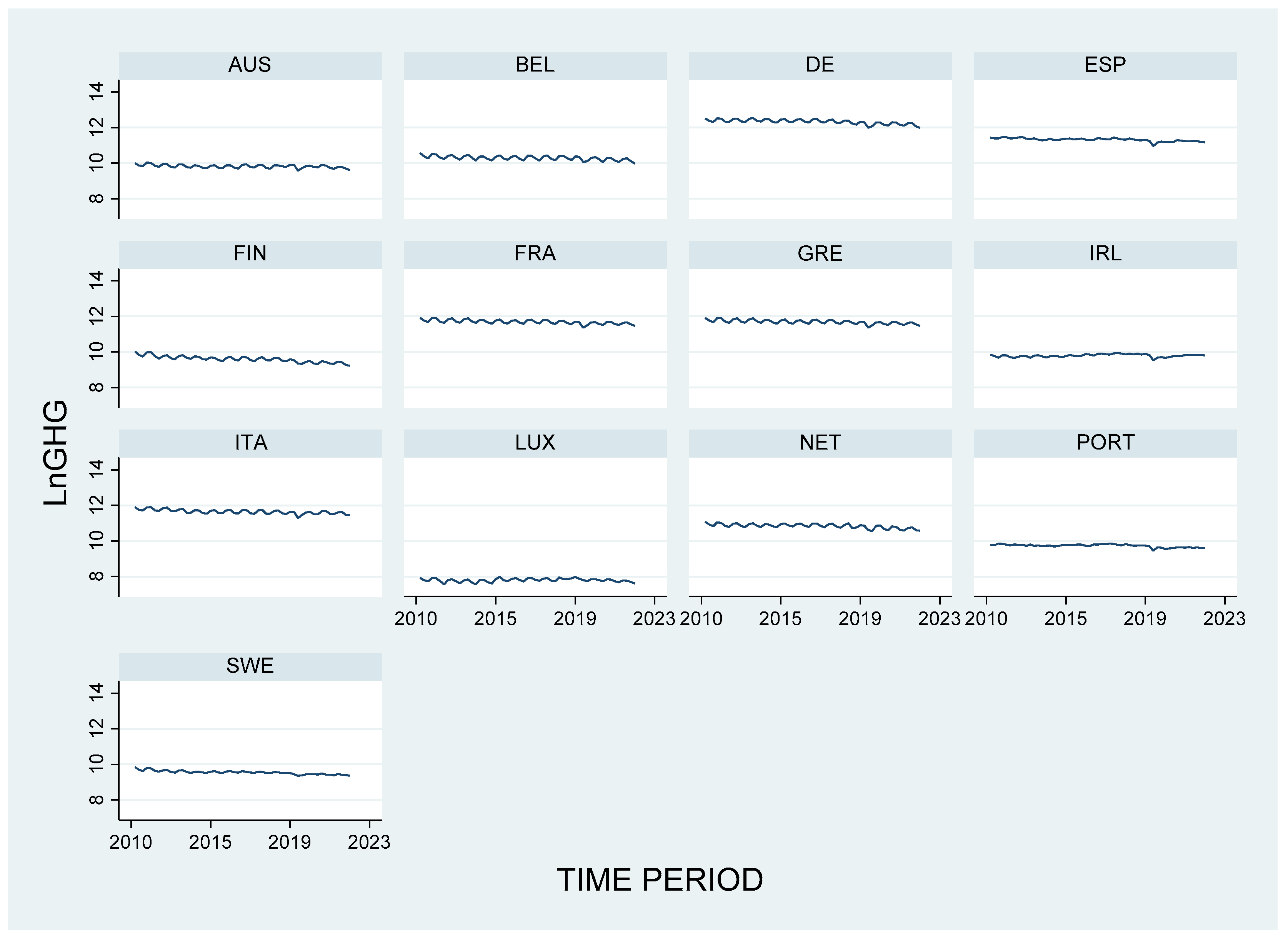

| TranR | Transition Risk: Logatrith natural of the Greenhouse Gas Emissions |

| LGR | Loans Growth Rate |

| GDP | Gross Domestic Product Growth Rate |

| UnEmp | Unemployment, total (% of total labor force) |

| VCA | Voice and Accountability Percentile |

| GhgRLP | Interaction Variable: Ln Greenhouse Gas Emissions × Rule of Law Percentile |

| Instrumental Variable | |

| CR3 | Banking concentration |

| Robustness Check | |

| Covid | Dummy variable 1 = 2020, 2021, 2022 |

| Variable | Mean | Std. Dev. | Min | Max |

|---|---|---|---|---|

| NPEs | 10.028 | 12.715 | 11.239 | 74.721 |

| LGR | 0.2097 | 2.3811 | −11.32744 | 35.7450 |

| TranR | 10.4654 | 1.2105 | 7.55298 | 12.5360 |

| GDP | 0.382 | 0.780 | −0.93 | 1.82 |

| PhyR | −0.3670 | 1.0045 | −2.473475 | 2.1355 |

| VCA | 90.2003 | 8.3219 | 68.07512 | 99.5305 |

| UnEmp | 9.1955 | 5.2797 | 3.1 | 27.686 |

| CR3 | 71.8183 | 16.0219 | 33.17041 | 98.2282 |

| GhgRLP | 906.971 | 125.14 | 641.126 | 1167.903 |

| (1) | |

|---|---|

| VARIABLES | Robust |

| L.PhyR | 0.711 ** |

| (0.332) | |

| L.TranR | 15.245 *** |

| (5.777) | |

| L.VCA | 0.936 *** |

| (0.195) | |

| L.LGR | 0.018 |

| (0.154) | |

| L.GDP | 0.505 |

| (0.535) | |

| L.UnEmp | −0.646 ** |

| (0.276) | |

| GhgRLP | −0.038 ** |

| (0.016) | |

| Covid | 1.306 |

| (3.269) | |

| Constant | −163.104 *** |

| (56.520) | |

| R-squared | 0.843 |

| Quarterly FE | YES |

| Country FE | YES |

| Wu–Hausman Test | 1.76 |

| p-value | 0.1850 |

| (2) | (3) | |

|---|---|---|

| VARIABLES | Robust | Robust |

| L.PhyR | 0.612 * | |

| (0.330) | ||

| L.TranR | 10.103 * | |

| (5.588) | ||

| L.VCA | 0.920 ** | 1.021 *** |

| (0.125) | (0.188) | |

| L.LGR | 0.051 | −0.006 |

| (0.163) | (0.152) | |

| L.GDP | 0.603 | 0.294 |

| (0.544) | (0.499) | |

| L.UnEmp | −0.608 ** | −0.526 ** |

| (0.278) | (0.253) | |

| GhgRLP | −0.031 * | −0.036 ** |

| (0.016) | (0.015) | |

| Covid | 2.572 | 0.508 |

| (3.157) | (3.454) | |

| Constant | −20.195 | −123.380 ** |

| (21.555) | (53.996) | |

| R-squared | 0.839 | 0.824 |

| Quarterly FE | YES | YES |

| Country FE | YES | YES |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Di Febo, E.; Angelini, E.; Le, T. European Non-Performing Exposures (NPEs) and Climate-Related Risks: Country Dimensions. Risks 2024, 12, 128. https://doi.org/10.3390/risks12080128

Di Febo E, Angelini E, Le T. European Non-Performing Exposures (NPEs) and Climate-Related Risks: Country Dimensions. Risks. 2024; 12(8):128. https://doi.org/10.3390/risks12080128

Chicago/Turabian StyleDi Febo, Elisa, Eliana Angelini, and Tu Le. 2024. "European Non-Performing Exposures (NPEs) and Climate-Related Risks: Country Dimensions" Risks 12, no. 8: 128. https://doi.org/10.3390/risks12080128

APA StyleDi Febo, E., Angelini, E., & Le, T. (2024). European Non-Performing Exposures (NPEs) and Climate-Related Risks: Country Dimensions. Risks, 12(8), 128. https://doi.org/10.3390/risks12080128