The Role of Longevity-Indexed Bond in Risk Management of Aggregated Defined Benefit Pension Scheme

Abstract

1. Introduction and Motivation

2. Model Assumptions and Notations

2.1. The Pension Model

- : Actuarial liability at time t, that is, the level of reserve to be detained by the pension fund and fixed by the chosen funding method, which is the liability part of the pension plan;

- : Fund at time t, which is the market value of assets covering the actuarial liability (asset part);

- : Unfunded actuarial liability at time t, which is the difference between the actuarial liability (reserve that we should have) and the fund (reserve that we really have). This amount can be positive (deficit or underfunding) or negative (surplus or overfunding);

- : Benefits promised to affiliates at time t;

- : Contribution rate at time t;

- : Normal cost at time t;

- : Supplementary contribution rate, which satisfies ;

- : Percentage of promised benefits accumulated up to age , ; hence, we have and . We assume that M is differentiable;

- : The probability density of M;

- : Technical rate of actualization;

- : Force of mortality, which is defined by , where is the future residual lifetime of a life who survives to age x.

2.2. The Financial Market

3. DB Pension Fund Management with Investment of the Longevity Bond

3.1. Risk-Neutral Valuation of Liabilities

3.2. The Wealth Process and Optimization Problem

4. Special Case: DB Pension Fund Management with Investment of Zero-Coupon Bond

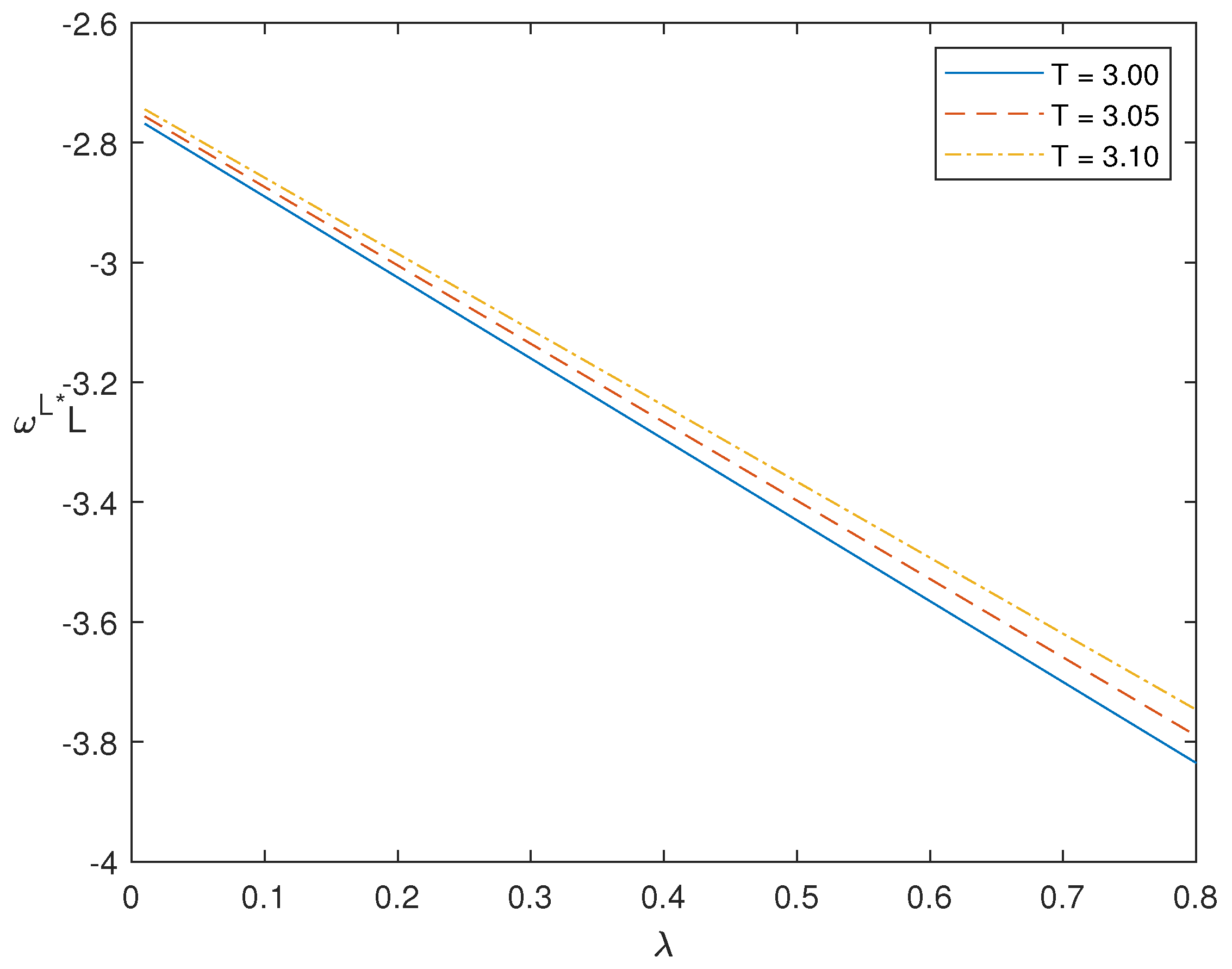

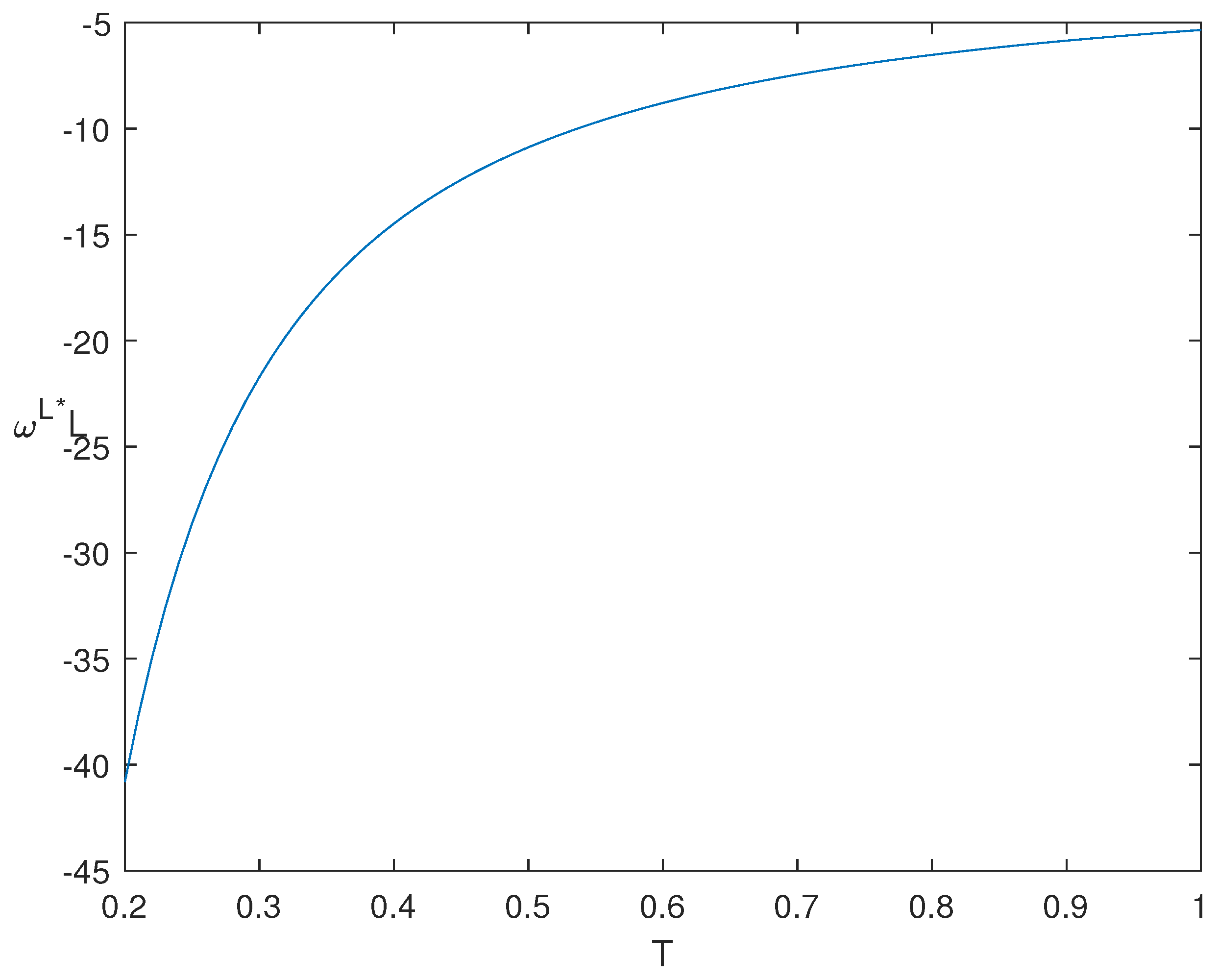

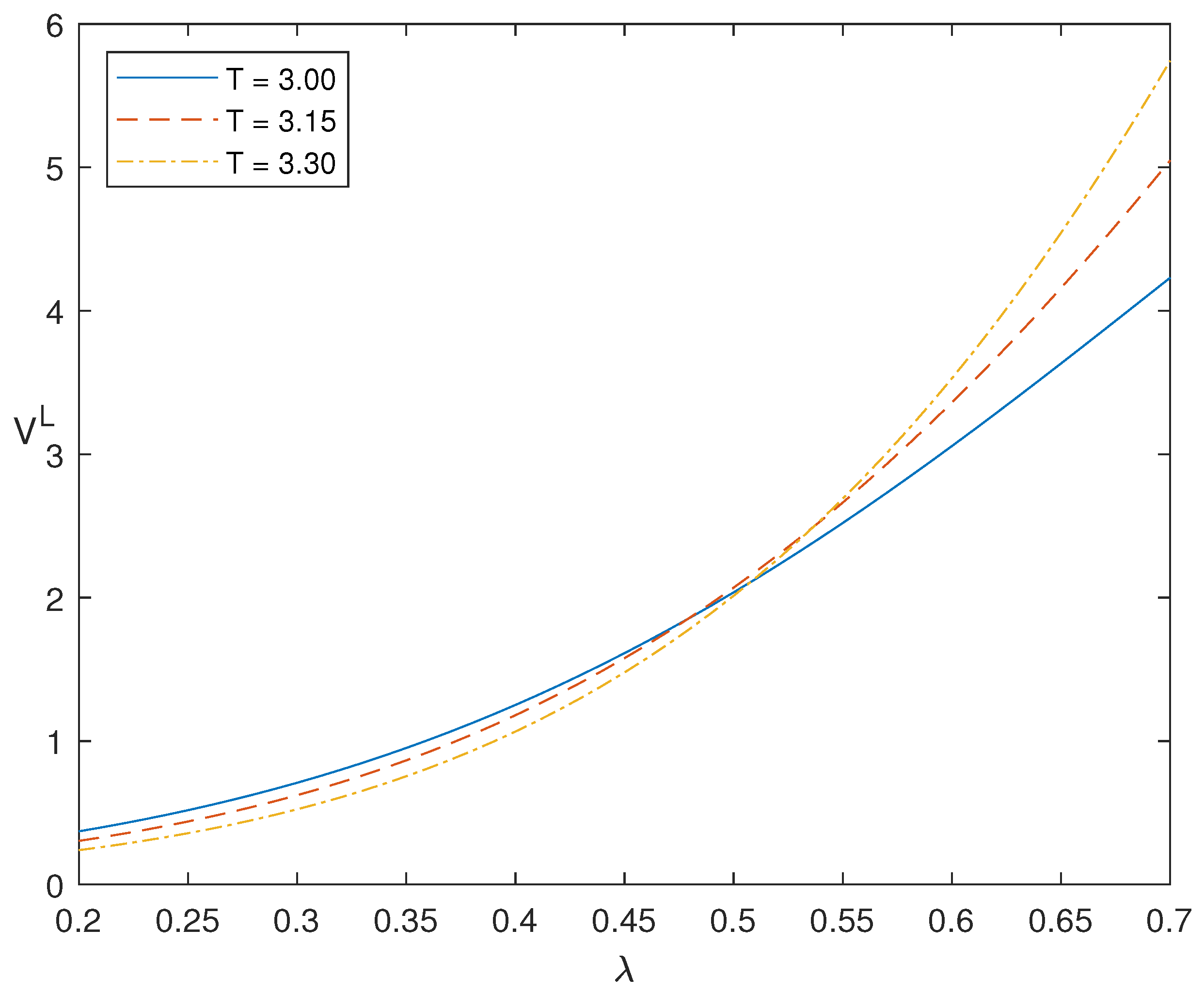

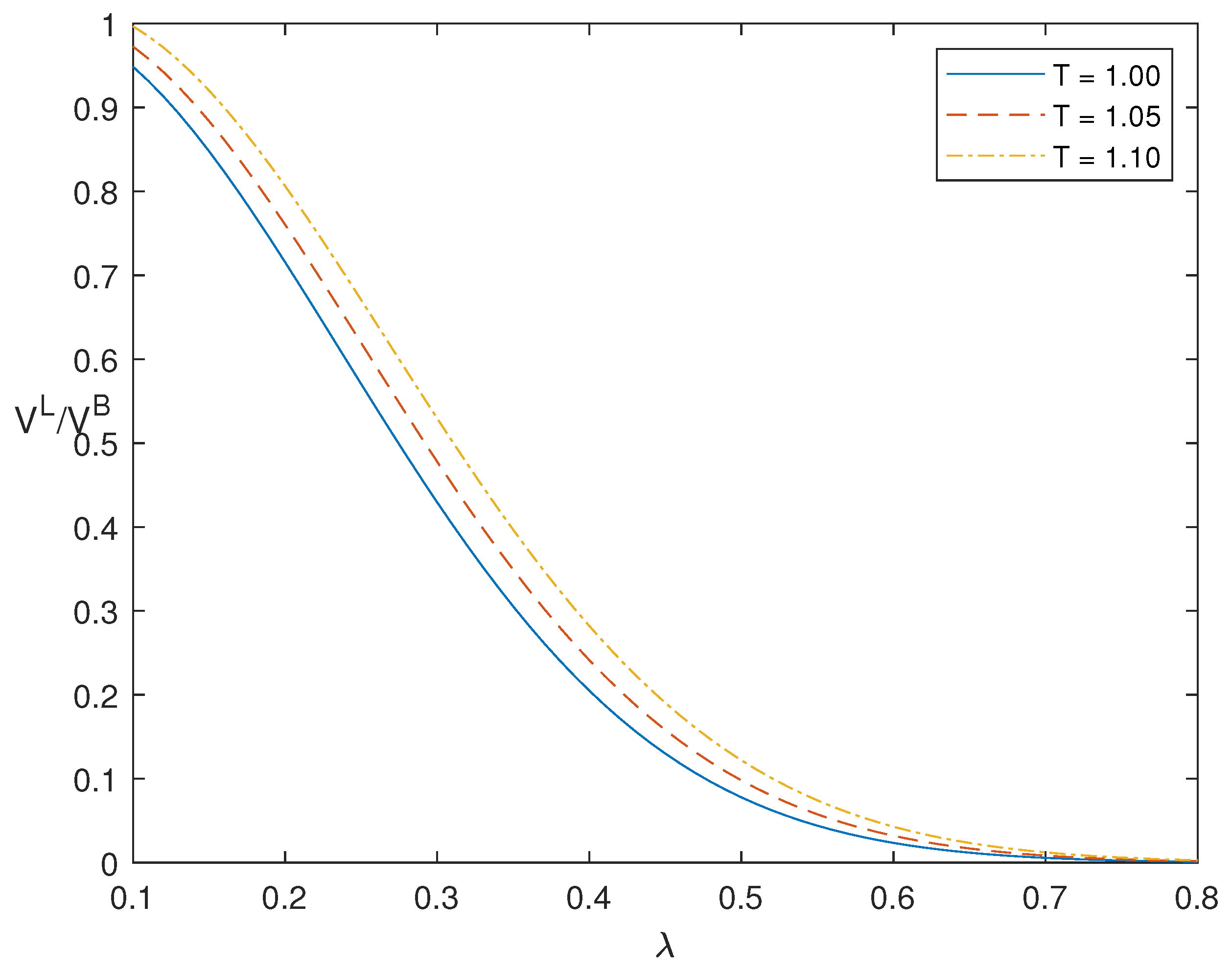

5. Sensitivity Analysis

6. Conclusions

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

Abbreviations

| DC | Defined contribution |

| DB | Defined benefit |

| HJB | Hamilton–Jacobi–Bellman |

| SDE | Stochastic differential equation |

| PDE | Partial differential equation |

Appendix A

References

- Barbarin, Jérôme. 2008. Heath-Jarrow-Morton modelling of longevity bonds and the risk minimization of life insurance portfolios. Insurance: Mathematics and Economics 43: 41–55. [Google Scholar] [CrossRef]

- Bauer, Daniel, Matthias Börger, and Jochen Ruß. 2010. On the pricing of longevity-linked securities. Insurance: Mathematics and Economics 46: 139–49. [Google Scholar] [CrossRef]

- Berstein, Solange, and Marco Morales. 2021. The role of a longevity insurance for defined contribution pension systems. Insurance: Mathematics and Economics 76: 233–40. [Google Scholar] [CrossRef]

- Biagini, Francesca, Thorsten Rheinländer, and Jan Widenmann. 2013. Hedging mortality claims with longevity bonds. ASTIN Bulletin 43: 123–57. [Google Scholar] [CrossRef]

- Blake, David, and Andrew J. G. Cairns. 2021. Longevity risk and capital markets: The 2019–2020 update. Insurance: Mathematics and Economics 99: 395–439. [Google Scholar]

- Blake, David, Andrew J. G. Cairns, and Kevin Dowd. 2006. Living with mortality: Longevity bonds and other mortality-linked securities. British Actuarial Journal 12: 153–97. [Google Scholar] [CrossRef]

- Bravo, Jorge M., and João Pedro Vidal Nunes. 2021. Pricing longevity derivatives via Fourier transforms. Insurance: Mathematics and Economics 96: 81–97. [Google Scholar] [CrossRef]

- Broeders, Dirk, Roel Mehlkopf, and Annick van Ool. 2021. The economics of sharing macro-longevity risk. Insurance: Mathematics and Economics 99: 440–58. [Google Scholar] [CrossRef]

- Chen, An, Hong Li, and Mark B. Schultze. 2023. Optimal longevity risk transfer under asymmetric information. Economic Modelling 120: 106179. [Google Scholar] [CrossRef]

- Cox, Samuel H., Yijia Lin, Ruilin Tian, and Jifeng Yu. 2013. Managing capital market and longevity risks in a defined benefit pension plan. The Journal of Risk and Insurance 80: 585–619. [Google Scholar] [CrossRef]

- Fleming, Wendell H., and Halil Mete Soner. 1993. Controlled Markov Processed and Viscosity Solutions. New York: Springer. [Google Scholar]

- Guan, Guohui, and Zongxia Liang. 2014. Optimal management of DC pension plan in a stochastic interest rate and stochastic volatility framework. Insurance: Mathematics and Economics 57: 58–66. [Google Scholar] [CrossRef]

- Guan, Guohui, Jiaqi Hu, and Zongxia Liang. 2022. Robust equilibrium strategies in a defined benefit pension plan game. Insurance: Mathematics and Economics 106: 193–217. [Google Scholar] [CrossRef]

- Han, Nan-Wei, and Mao-Wei Hung. 2017. Optimal consumption, portfolio, and life insurance policies under interest rate and inflation risks. Insurance: Mathematics and Economics 73: 54–67. [Google Scholar] [CrossRef]

- Josa-Fombellida, Ricardo, and Juan Pablo Rincón-Zapatero. 2004. Optimal risk management in defined benefit stochastic pension funds. Insurance: Mathematics and Economics 34: 489–503. [Google Scholar] [CrossRef]

- Josa-Fombellida, Ricardo, and Juan Pablo Rincón-Zapatero. 2010. Optimal asset allocation for aggregated defined benefit pension funds with stochastic interest rates. European Journal of Operational Research 201: 211–21. [Google Scholar] [CrossRef]

- Kort, Jan, and Michel H. Vellekoop. 2017. Existence of optimal consumption strategies in markets with longevity risk. Insurance: Mathematics and Economics 72: 107–21. [Google Scholar]

- Leung, Melvern, Man Chung Fung, and Colin O’Hare. 2018. A comparative study of pricing approaches for longevity instruments. Insurance: Mathematics and Economics 82: 95–116. [Google Scholar] [CrossRef]

- Liang, Xiaoqing, Lihua Bai, and Junyi Guo. 2014. Optimal time-consistent portfolio and contribution selection for defined benefit pension schemes under mean-variance criterion. The ANZIAM Journal 56: 66–90. [Google Scholar] [CrossRef]

- Liu, Zilan, Huanying Zhang, and Lei He. 2023. Optimal assets allocation and benefit adjustment strategy with longevity risk for target benefit pension plans. Journal of Industrial and Management Optimization 19: 3931–51. [Google Scholar] [CrossRef]

- Menoncin, Francesco. 2008. The role of longevity bonds in optimal portfolios. Insurance: Mathematics and Economics 42: 343–58. [Google Scholar] [CrossRef]

- Menoncin, Francesco, and Luca Regis. 2017. Longevity-linked assets and pre-retirement consumption/portfolio decisions. Insurance: Mathematics and Economics 76: 75–86. [Google Scholar] [CrossRef]

- Ng, Kenneth Tsz Hin, and Wing Fung Chong. 2023. Optimal investment in defined contribution pension schemes with forward utility preferences. Insurance: Mathematics and Economics 114: 192–211. [Google Scholar] [CrossRef]

- Rong, Ximin, Cheng Tao, and Hui Zhao. 2023. Target benefit pension plan with longevity risk and intergenerational equity. ASTIN Bulletin 53: 84–103. [Google Scholar] [CrossRef]

- Wills, Samuel, and Michael Sherris. 2010. Securitization, structuring and pricing of longevity risk. Insurance: Mathematics and Economics 46: 173–85. [Google Scholar] [CrossRef]

- Yao, Haixiang, Zhou Yang, and Ping Chen. 2013. Markowitz’s mean-variance defined contribution pension fund management under inflation: A continuous-time model. Insurance: Mathematics and Economics 53: 851–63. [Google Scholar] [CrossRef]

- Yong, Jiongmin, and Xun Yu Zhou. 1999. Stochastic Controls: Hamiltonian Systems and HJB Equations. New York: Springer. [Google Scholar]

- Zhang, Xiaoyi. 2018. The role of longevity bond in DC pension plan during both accumulation and decumulation phases. Chinese Journal of Engineering Mathematics 37: 347–69. [Google Scholar]

- Zhu, Nan, and Daniel Bauer. 2014. A cautionary note on natural hedging of longevity risk. North American Actuarial Journal 18: 104–15. [Google Scholar] [CrossRef]

| a | b | |||||||||

|---|---|---|---|---|---|---|---|---|---|---|

| 1 | 1 | 0.5 | 0.1 | 0.3 | 0.5 | −0.5 | 0.3 | 0.0015 | 0.03 | 0.05 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2024 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Zhang, X.; Li, Y.; Guo, J. The Role of Longevity-Indexed Bond in Risk Management of Aggregated Defined Benefit Pension Scheme. Risks 2024, 12, 49. https://doi.org/10.3390/risks12030049

Zhang X, Li Y, Guo J. The Role of Longevity-Indexed Bond in Risk Management of Aggregated Defined Benefit Pension Scheme. Risks. 2024; 12(3):49. https://doi.org/10.3390/risks12030049

Chicago/Turabian StyleZhang, Xiaoyi, Yanan Li, and Junyi Guo. 2024. "The Role of Longevity-Indexed Bond in Risk Management of Aggregated Defined Benefit Pension Scheme" Risks 12, no. 3: 49. https://doi.org/10.3390/risks12030049

APA StyleZhang, X., Li, Y., & Guo, J. (2024). The Role of Longevity-Indexed Bond in Risk Management of Aggregated Defined Benefit Pension Scheme. Risks, 12(3), 49. https://doi.org/10.3390/risks12030049