A Systematic Literature Review of the Risk Landscape in Fintech

Abstract

1. Introduction

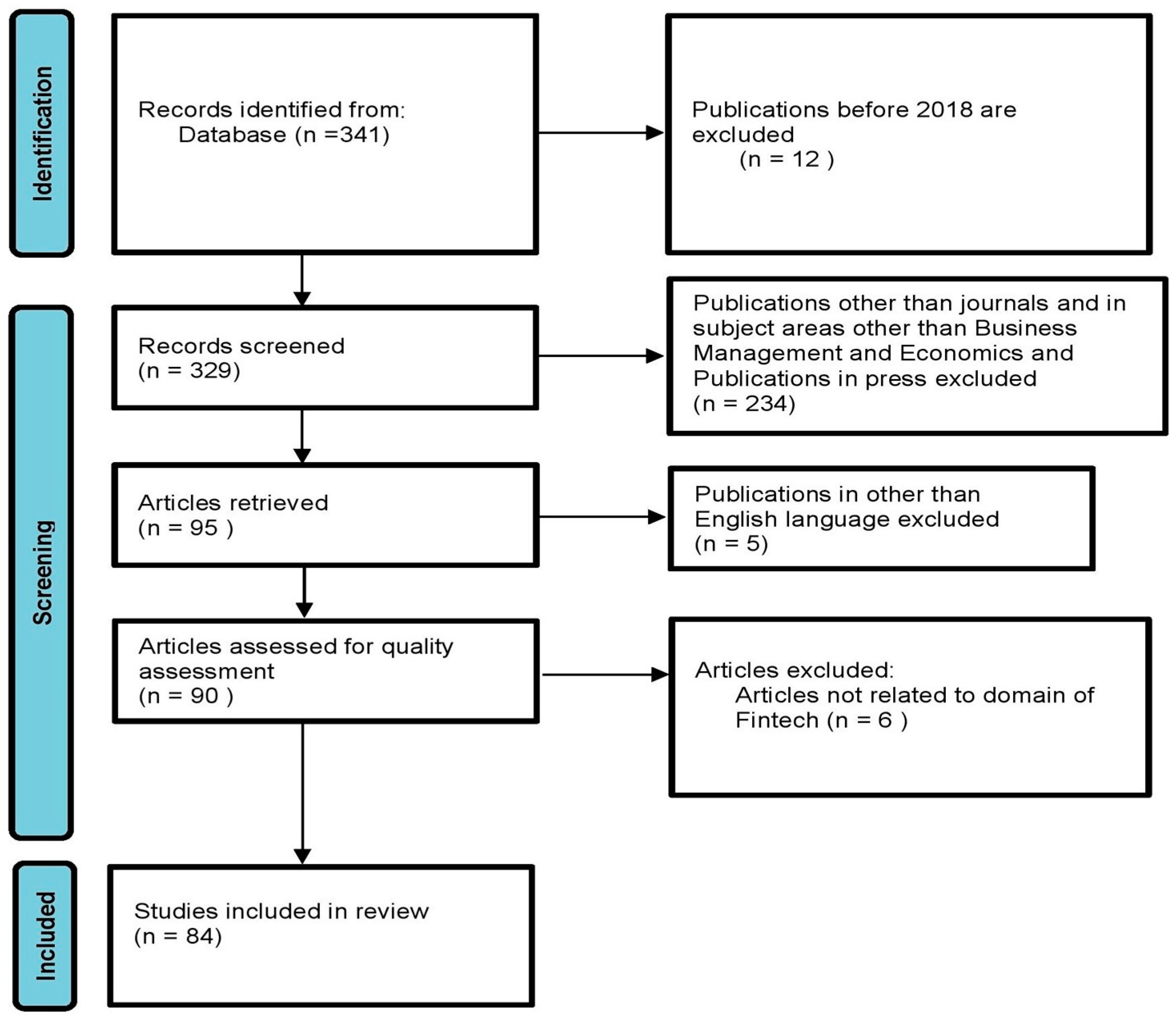

2. Risk Landscape in Fintech

3. Materials and Methods

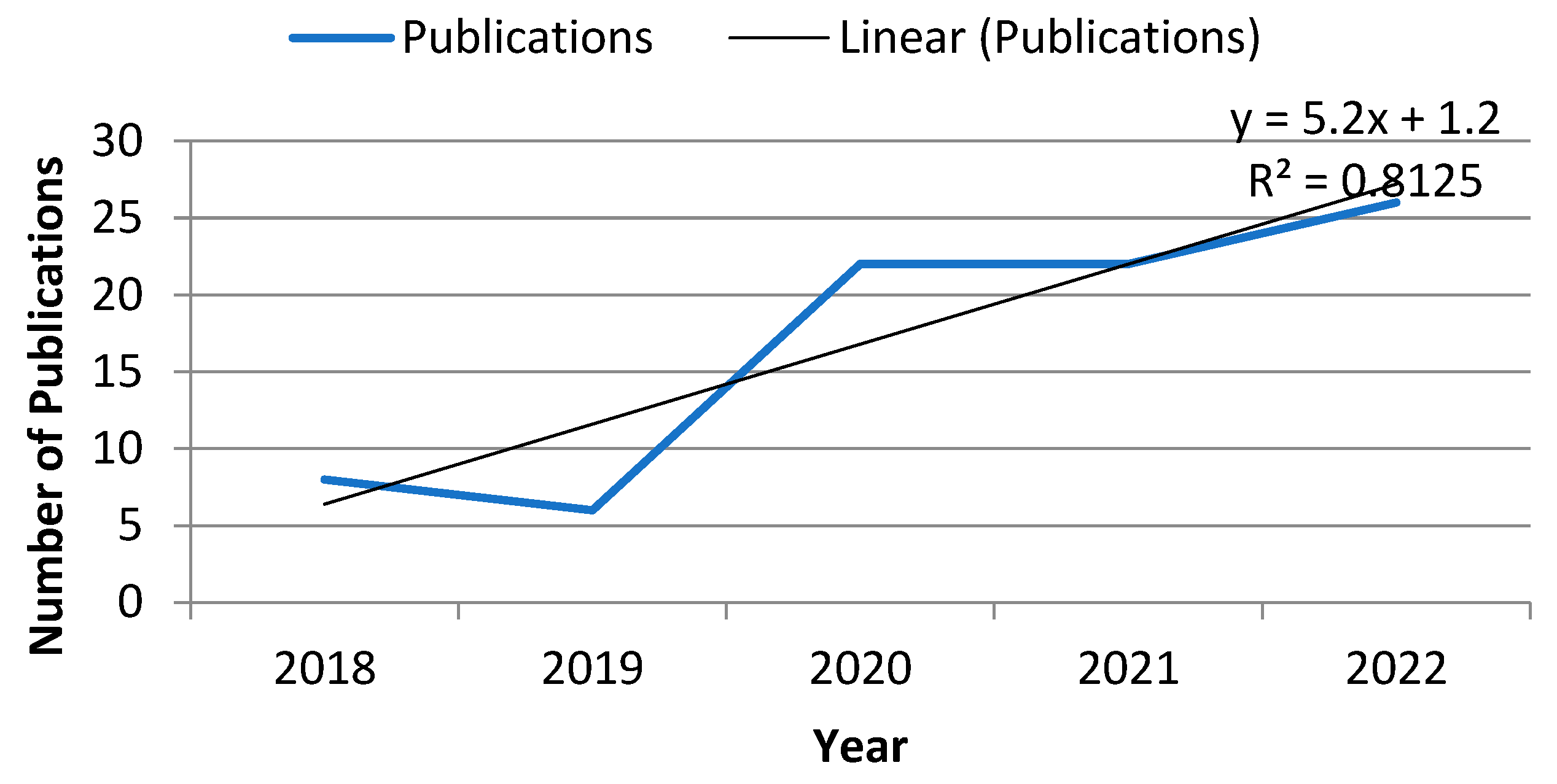

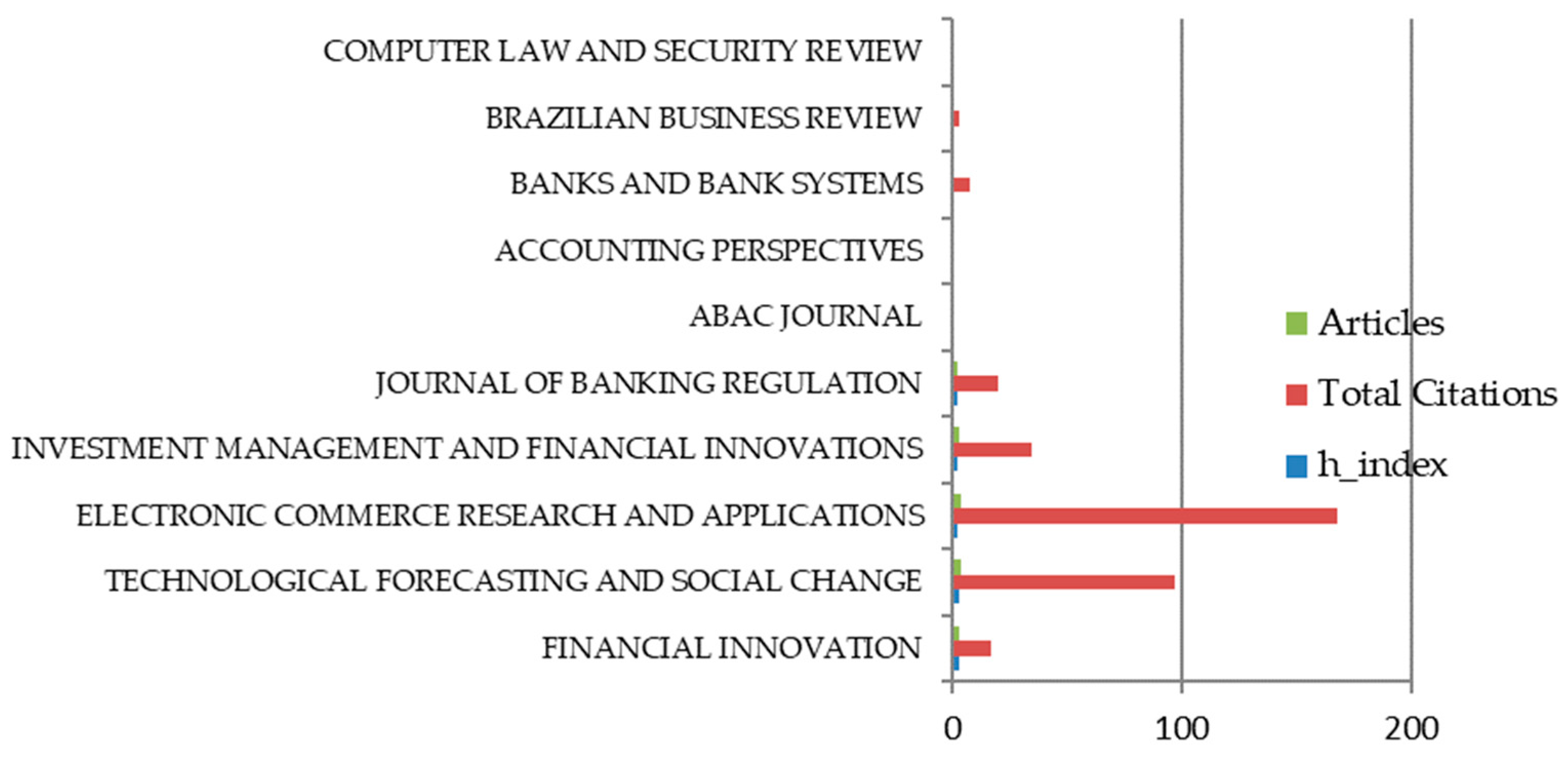

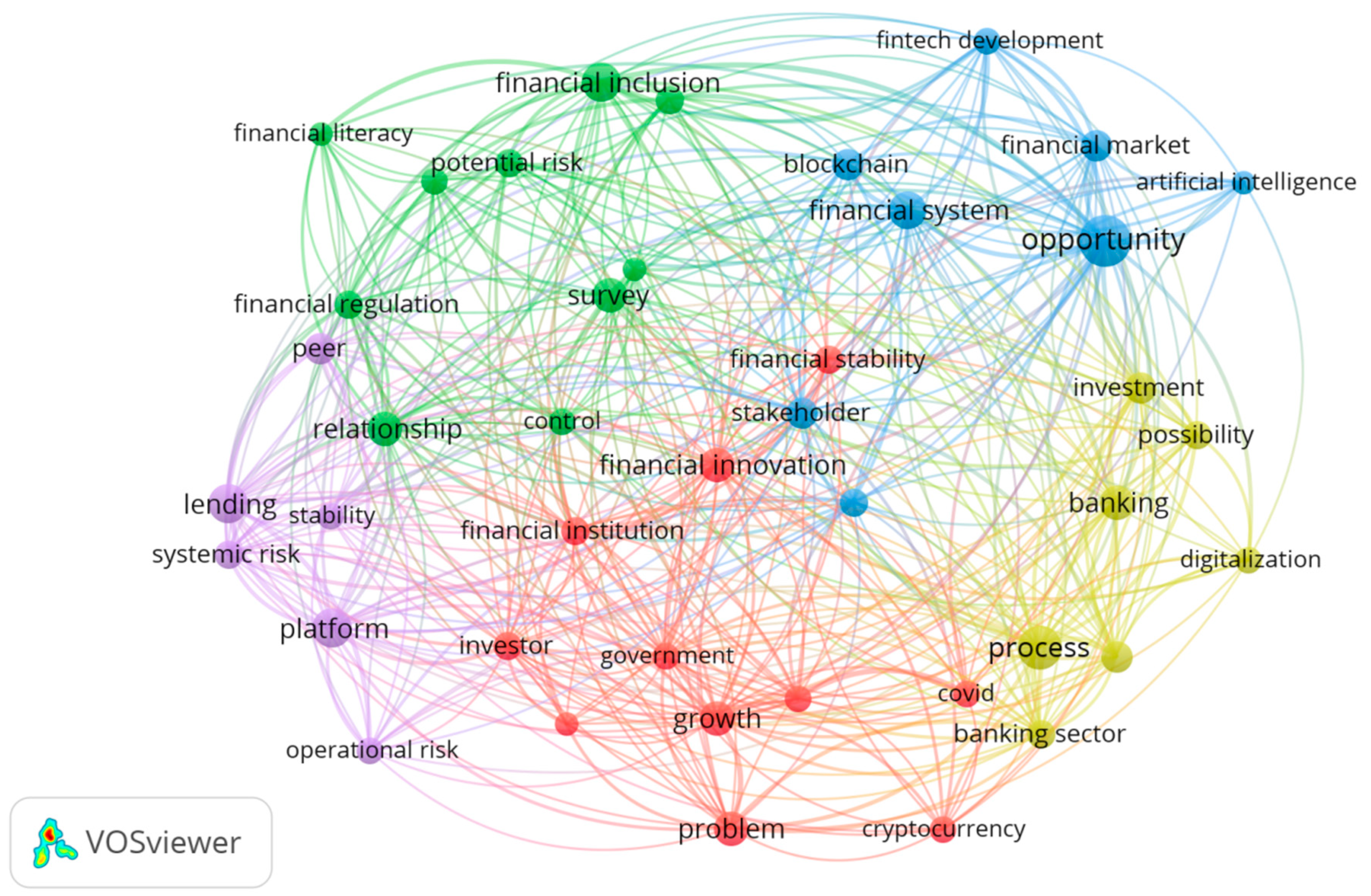

4. Bibliometric Analysis

5. Content Analysis

- Cluster 1: Role and Risks of Financial Innovations during pandemic (Red)

- Cluster 2: Risks of Financial Inclusion (Green)

- Cluster 3: Opportunities and Challenges for Fintech Development (Blue)

- Cluster 4: Risks of Fintech in Banking (Yellow)

- Cluster 5: Occurrence of Systematic and Operational Risks in Fintech (Purple)

6. Conclusions

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

References

- Akartuna, Eray Arda, Shane D. Johnson, and Amy Thornton. 2022. Preventing the Money Laundering and Terrorist Financing Risks of Emerging Technologies: An International Policy Delphi Study. Technological Forecasting and Social Change 179: 121632. [Google Scholar] [CrossRef]

- Al Nawayseh, Mohammad K. 2020. Fintech in COVID-19 and beyond: What Factors Are Affecting ‘Customers’ Choice of Fintech Applications? Journal of Open Innovation: Technology, Market, and Complexity 6: 153. [Google Scholar] [CrossRef]

- Alshari, Hussein Ahmed, and M. A. Lokhande. 2022. The Impact of Demographic Factors of ‘Clients’ Attitudes and Their Intentions to Use FinTech Services on the Banking Sector in the Least Developed Countries. Cogent Business and Management 9. [Google Scholar] [CrossRef]

- Arkanuddin, Mohammad Fahmi, Ferdinand D. Saragih, and Bernardus Yuliarto Nugroho. 2021. The Key Role of the Financial Regulation in Fintech Ecosystem: A Model Validation. Estudios de Economia Aplicada 39. [Google Scholar] [CrossRef]

- Ashta, Arvind, and Heinz Herrmann. 2021. Artificial Intelligence and Fintech: An Overview of Opportunities and Risks for Banking, Investments, and Microfinance. Strategic Change 30: 211–22. [Google Scholar] [CrossRef]

- Azarenkova, Galyna, Iryna Shkodina, Borys Samorodov, Maksym Babenko, and Iryna Onishchenko. 2018. The Influence of Financial Technologies on the Global Financial System Stability. Investment Management and Financial Innovations 15: 229–38. [Google Scholar] [CrossRef]

- Bavoso, Vincenzo. 2020. The Promise and Perils of Alternative Market-Based Finance: The Case of P2P Lending in the U.K. Journal of Banking Regulation 21: 395–409. [Google Scholar] [CrossRef]

- Belozyorov, Sergey, Olena Sokolovska, and Young Sik Kim. 2020. Fintech as a Precondition of Transformations in Global Financial Markets. Foresight and STI Governance 14: 23–35. [Google Scholar] [CrossRef]

- Bhatnagar, Mukul, Ercan Özen, Sanjay Taneja, Simon Grima, and Ramona Rupeika-Apoga. 2022. The Dynamic Connectedness between Risk and Return in the Fintech Market of India: Evidence Using the GARCH-M Approach. Risks 10: 209. [Google Scholar] [CrossRef]

- Boulianne, Emilio, and Mélissa Fortin. 2020. Risks and Benefits of Initial Coin Offerings: Evidence from Impak Finance, a Regulated ICO. Accounting Perspectives 19: 413–37. [Google Scholar] [CrossRef]

- Bu, Ya, Hui Li, and Xiaoqing Wu. 2022. Effective Regulations of FinTech Innovations: The Case of China. Economics of Innovation and New Technology 31: 751–69. [Google Scholar] [CrossRef]

- Chaudhry, Sajid M., Rizwan Ahmed, Toan Luu Duc Huynh, and Chonlakan Benjasak. 2022. Tail Risk and Systemic Risk of Finance and Technology (FinTech) Firms. Technological Forecasting and Social Change 174. [Google Scholar] [CrossRef]

- Clemente, Gian Paolo, and Pierpaolo Marano. 2020. The Broker Model for Peer-to-Peer Insurance: An Analysis of Its Value. The Geneva Papers on Risk and Insurance—Issues and Practice 45: 457–81. [Google Scholar] [CrossRef]

- Das, Sanjiv R. 2019. The Future of Fintech. Financial Management 48: 981–1007. [Google Scholar] [CrossRef]

- Demirgüç-Kunt, Asli, Leora Klapper, Dorothe Singer, Saniya Ansar, and Jake Hess. 2020. The Global Findex Database 2017: Measuring Financial Inclusion and Opportunities to Expand Access to and Use of Financial Services. World Bank Economic Review 34: S2–S8. [Google Scholar] [CrossRef]

- Duran, Randall E., and Paul Griffin. 2021. Smart Contracts: Will Fintech Be the Catalyst for the next Global Financial Crisis? Journal of Financial Regulation and Compliance 29: 104–22. [Google Scholar] [CrossRef]

- Eskindarov, M. A., V. V. Maslennikov, and O. V. Maslennikov. 2019. Risks and Chances of the Digital Economy in Russia. Finance: Theory and Practice 23: 6–17. [Google Scholar] [CrossRef]

- Fabris, Nikola. 2022. Impact of COVID-19 Pandemic on Financial Innovation, Cashless Society, and Cyber Risk. Economics 10: 73–86. [Google Scholar] [CrossRef]

- Ferrari, Ms Valeria. 2022. The Platformisation of Digital Payments: The Fabrication of Consumer Interest in the E.U. FinTech Agenda. Computer Law and Security Review 45. [Google Scholar] [CrossRef]

- Gao, Yu, Shih-Heng Yu, Ming Chen, and Yih-Chearng Shiue. 2020. A 2020 Perspective on the Performance of the P2P Finance Industry in China. Electronic Commerce Research and Applications 40: 100940. [Google Scholar] [CrossRef]

- Gąsiorkiewicz, Lech, Jan Monkiewicz, and Marek Monkiewicz. 2020. Technology-Driven Innovations in Financial Services: The Rise of Alternative Finance. Foundations of Management 12: 137–50. [Google Scholar] [CrossRef]

- Gejke, Cecilia. 2018. A New Season in the Risk Landscape: Connecting the Advancement in Technology with Changes in Customer Behaviour to Enhance the Way Risk Is Measured and Managed. Journal of Risk Management in Financial Institutions 11: 148–55. [Google Scholar]

- Gozman, Daniel, and Leslie Willcocks. 2019. The Emerging Cloud Dilemma: Balancing Innovation with Cross-Border Privacy and Outsourcing Regulations. Journal of Business Research 97: 235–56. [Google Scholar] [CrossRef]

- Guo, Yi-Ming, Zhen-Ling Huang, Ji Guo, Hua Li, Xing-Rong Guo, and Mpeoane Judith Nkeli. 2019. Bibliometric Analysis on Smart Cities Research. Sustainability 11: 3606. [Google Scholar] [CrossRef]

- Hollanders, Marc. 2020. Page 315 Practice Papers Fintech and Financial Inclusion: Opportunities Challengesfintech and Financial Inclusion: Opportunities and Challenges. Journal of Payments Strategy and Systems 14: 315–25. [Google Scholar]

- Hsu, Sara, Jianjun Li, and Hong Bao. 2021. P2P Lending in China: Role and Prospects for the Future. Manchester School 89: 526–40. [Google Scholar] [CrossRef]

- Hua, Xiuping, and Yiping Huang. 2021. Understanding ‘China’s Fintech Sector: Development, Impacts and Risks. European Journal of Finance 27: 321–33. [Google Scholar] [CrossRef]

- Huang, Robin Hui, Demin Yang, and Ferdinand Fai Yang Loo. 2020. The Development and Regulation of Cryptoassets: Hong Kong Experiences and a Comparative Analysis. European Business Organization Law Review 21: 319–47. [Google Scholar] [CrossRef]

- Irwin, Angela S. M., and Caitlin Dawson. 2019. Following the Cyber Money Trail: Global Challenges When Investigating Ransomware Attacks and How Regulation Can Help. Journal of Money Laundering Control 22: 110–31. [Google Scholar] [CrossRef]

- Jain, Ruchika, and Rajni Bansal. 2022. Fintech: Driving force for social good. The Management Accountant Journal 57: 67–70. [Google Scholar] [CrossRef]

- Jamil, Ainul Huda, Zuraidah Mohd Sanusi, Najihah Marha Yaacob, Yusarina Mat Isa, and Tarjo Tarjo. 2022. The Covid-19 Impact on Financial Crime and Regulatory Compliance in Malaysia. Journal of Financial Crime 29: 491–505. [Google Scholar] [CrossRef]

- Jangir, Kshitiz, Vikas Sharma, Sanjay Taneja, and Ramona Rupeika-Apoga. 2022. The Moderating Effect of Perceived Risk on ‘Users’ Continuance Intention for FinTech Services. Journal of Risk and Financial Management 16: 21. [Google Scholar] [CrossRef]

- Jonker, Nicole, and Anneke Kosse. 2022. The Interplay of Financial Education, Financial Inclusion and Financial Stability and the Role of Big Tech. Contemporary Economic Policy 40: 612–35. [Google Scholar] [CrossRef]

- Kaigorodova, Gulnara, Alfiya Mustafina, Guzel Pyrkova, Mariola Grzebyk, and Larisa Belinskaja. 2021. Digitalization of the Insurance Business: Systematization of Net Effects through the Example of Russia. Insurance Markets and Companies 12: 32–42. [Google Scholar] [CrossRef]

- Kakinuma, Yosuke. 2022. Financial Literacy and Quality of Life: A Moderated Mediation Approach of Fintech Adoption and Leisure. International Journal of Social Economics 49: 1713–26. [Google Scholar] [CrossRef]

- Kaur, Balijinder, Sood Kiran, Simon Grima, and Ramona Rupeika-Apoga. 2021. Digital Banking in Northern India: The Risks on Customer Satisfaction. Risks 9: 209. [Google Scholar] [CrossRef]

- Khiaonarong, Tanai, and Terry Goh. 2020. Fintech and Payments Regulation: An Analytical Framework. Journal of Payments Strategy and Systems 14: 157–71. [Google Scholar] [CrossRef]

- Kijkasiwat, Ploypailin. 2021. Opportunities and Challenges for Fintech Startups: The Case Study of Thailand. ABAC Journal 41: 41–60. [Google Scholar]

- Lanfranchi, Davide, and Laura Grassi. 2022. Examining Insurance ‘Companies’ Use of Technology for Innovation. The Geneva Papers on Risk and Insurance—Issues and Practice 47: 520–37. [Google Scholar] [CrossRef]

- Li, Cangshu. 2022. Quantitative Measurement and Analysis of FinTech Risk in China. Economic Research-Ekonomska Istrazivanja 35: 2596–614. [Google Scholar] [CrossRef]

- Lu, Baile, Shuai Hao, Michael Pinedo, and Yuqian Xu. 2021. Frontiers in Service Science: Fintech Operations-an Overview of Recent Developments and Future Research Directions. Service Science 13: 19–35. [Google Scholar] [CrossRef]

- Luo, Di, Tapas Mishra, Larisa Yarovaya, and Zhuang Zhang. 2021. Investing during a Fintech Revolution: Ambiguity and Return Risk in Cryptocurrencies. Journal of International Financial Markets, Institutions and Money 73. [Google Scholar] [CrossRef]

- Macchiavello, Eugenia. 2018. Financial-Return Crowdfunding and Regulatory Approaches in the Shadow Banking, FinTech and Collaborative Finance Era. European Company and Financial Law Review 14: 662–722. [Google Scholar] [CrossRef]

- Mallekoote, Piet M., and Suren K. Balraadjsing. 2022. Oversight and Risk Man Age Ment of Pay Ments Schemes. Journal of Risk Management in Financial Institutions 15: 418–28. [Google Scholar]

- Mamonov, Stanislav, and Ross Malaga. 2018. Success Factors in Title III Equity Crowdfunding in the United States. Electronic Commerce Research and Applications 27: 65–73. [Google Scholar] [CrossRef]

- Mascarenhas, Artur, Cristiane Perpétuo, Erika Barrote, and Maria Perides. 2021. The Influence of Perceptions of Risks and Benefits on the Continuity of Use of Fintech Services. Brazilian Business Review 18: 1–21. [Google Scholar] [CrossRef]

- Mbeng, Elisabeth Reine Debora, Qun Liang Song, and Elisabetta Raparelli. 2021. A Bibliometric Analysis on How Feed-In Tariff Played A Key Role in the Development of Renewable Energy in China. 28. Available online: https://www.researchgate.net/publication/353515450_A_BIBLIOMETRIC_ANALYSIS_ON_HOW_FEED-IN_TARIFF_PLAYED_A_KEY_ROLE_IN_THE_DEVELOPMENT_OF_RENEWABLE_ENERGY_IN_CHINA (accessed on 13 December 2022).

- Miglo, Anton. 2022. Choice between IEO and ICO: Speed vs. Liquidity vs. Risk. FinTech 1: 276–93. [Google Scholar] [CrossRef]

- Milian, Eduardo Z., Mauro de M. Spinola, and Marly M. de Carvalho. 2019. Fintechs: A Literature Review and Research Agenda. Electronic Commerce Research and Applications 34. [Google Scholar] [CrossRef]

- Mishchenko, Svitlana, Svitlana Naumenkova, Volodymyr Mishchenko, and Dmytro Dorofeiev. 2021. Innovation Risk Management in Financial Institutions. Investment Management and Financial Innovations 18: 190–202. [Google Scholar] [CrossRef]

- Murinde, Victor, Efthymios Rizopoulos, and Markos Zachariadis. 2022. The Impact of the FinTech Revolution on the Future of Banking: Opportunities and Risks. International Review of Financial Analysis 81: 102103. [Google Scholar] [CrossRef]

- Muryanto, Yudho Taruno, Dona Budi Kharisma, and Anjar Sri Ciptorukmi Ciptorukmi Nugraheni. 2022. Prospects and Challenges of Islamic Fintech in Indonesia: A Legal Viewpoint. International Journal of Law and Management 64: 239–52. [Google Scholar] [CrossRef]

- Nabilou, Hossein. 2020. Testing the Waters of the Rubicon: The European Central Bank and Central Bank Digital Currencies. Journal of Banking Regulation 21: 299–314. [Google Scholar] [CrossRef]

- Nigmonov, Asror, and Syed Shams. 2021. COVID-19 Pandemic Risk and Probability of Loan Default: Evidence from Marketplace Lending Market. Financial Innovation 7: 83. [Google Scholar] [CrossRef] [PubMed]

- Ozili, Peterson K. 2018. Impact of Digital Finance on Financial Inclusion and Stability. Borsa Istanbul Review 18: 329–40. [Google Scholar] [CrossRef]

- Ozili, Peterson K. 2021a. Financial Inclusion Research around the World: A Review. Forum for Social Economics 50: 457–79. [Google Scholar] [CrossRef]

- Ozili, Peterson K. 2021b. Has Financial Inclusion Made the Financial Sector Riskier? Journal of Financial Regulation and Compliance 29: 237–55. [Google Scholar] [CrossRef]

- Page, Matthew J., Joanne E. McKenzie, Patrick M. Bossuyt, Isabelle Boutron, Tammy C. Hoffmann, Cynthia D. Mulrow, Larissa Shamseer, Jennifer M. Tetzlaff, Elie A. Akl, Sue E. Brennan, and et al. 2021. The PRISMA 2020 Statement: An Updated Guideline for Reporting Systematic Reviews. BMJ 372. [Google Scholar] [CrossRef]

- Pantielieieva, Kseniia, Natalia Tretiak, Yuliia Zhezherun, Svitlana Zaporozhets, Nataliya Rogova, and Nataliia Pantielieieva. 2022. Current Stage of Formation of the Financial Intermediation Ecosystem in the Context of Digitalization. Ekonomski Pregled 73: 215–39. [Google Scholar] [CrossRef]

- Prasolov, Valeriy, Seymur Hajiyev, Zarema Sharifyanova, and Yuliia Diachkova. 2020. Supply Chain in Insurance of High-Tech Companies: Formation Characteristics. International Journal of Supply Chain Management 9: 519–26. [Google Scholar]

- Pu, Ruihui, Deimante Teresiene, Ina Pieczulis, Jie Kong, and Xiao-Guang Yue. 2021. The Interaction between Banking Sector and Financial Technology Companies: Qualitative Assessment—A Case of Lithuania. Risks 9: 21. [Google Scholar] [CrossRef]

- Rupeika-Apoga, Ramona, and Stefan Wendt. 2021. FinTech in Latvia: Status Quo, Current Developments, and Challenges Ahead. Risks 9: 181. [Google Scholar] [CrossRef]

- Rupeika-Apoga, Ramona, and Stefan Wendt. 2022. FinTech Development and Regulatory Scrutiny: A Contradiction? The Case of Latvia. Risks 10: 167. [Google Scholar] [CrossRef]

- Rupeika-Apoga, Ramona, Kristine Petrovska, and Larisa Bule. 2022. The Effect of Digital Orientation and Digital Capability on Digital Transformation of SMEs during the COVID-19 Pandemic. Journal of Theoretical and Applied Electronic Commerce Research 17: 669–85. [Google Scholar] [CrossRef]

- Ryu, Hyun-Sun. 2018. What Makes Users Willing or Hesitant to Use Fintech?: The Moderating Effect of User Type. Industrial Management and Data Systems 118: 541–69. [Google Scholar] [CrossRef]

- Saba, Irum, Rehana Kouser, and Imran Sharif Chaudhry. 2019. FinTech and Islamic Finance-Challenges and Opportunities. Review of Economics and Development Studies 5: 581–890. [Google Scholar] [CrossRef]

- Saliba, Brandon, Jonathan Spiteri, and Dominic Cortis. 2022. Insurance and Wearables as Tools in Managing Risk in Sports: Determinants of Technology Take-up and Propensity to Insure and Share Data. The Geneva Papers on Risk and Insurance—Issues and Practice 47: 499–519. [Google Scholar] [CrossRef]

- Salisu, Afees A., Abdulsalam Abidemi Sikiru, and Philip C. Omoke. 2022. COVID-19 Pandemic and Financial Innovations. Quality & Quantity. [Google Scholar] [CrossRef]

- Šapkauskienė, Alfreda, and Ingrida Višinskaitė. 2020. Initial Coin Offerings (ICOs): Benefits, Risks and Success Measures. Entrepreneurship and Sustainability Issues 7: 1472–83. [Google Scholar] [CrossRef]

- Thakor, Anjan V. 2020. Fintech and Banking: What Do We Know? Journal of Financial Intermediation 41: 100833. [Google Scholar] [CrossRef]

- Tritto, Angela, Yujia He, and Victoria Amanda Junaedi. 2020. Governing the Gold Rush into Emerging Markets: A Case Study of ‘Indonesia’s Regulatory Responses to the Expansion of Chinese-Backed Online P2P Lending. Financial Innovation 6. [Google Scholar] [CrossRef]

- van Eck, Nees Jan, and Ludo Waltman. 2012. VOSviewer Manual. Leiden: Univeristeit Leiden, p. 54. [Google Scholar]

- Varma, Parminder, Shivinder Nijjer, Kiran Sood, Simon Grima, and Ramona Rupeika-Apoga. 2022. Thematic Analysis of Financial Technology (Fintech) Influence on the Banking Industry. Risks 10: 186. [Google Scholar] [CrossRef]

- Vučinić, Milena. 2020. Fintech and Financial Stability Potential Influence of FinTech on Financial Stability, Risks and Benefits. Journal of Central Banking Theory and Practice 9: 43–66. [Google Scholar] [CrossRef]

- Vučinić, Milena, and Radoica Luburić. 2022. Fintech, Risk-Based Thinking and Cyber Risk. Journal of Central Banking Theory and Practice 11: 27–53. [Google Scholar] [CrossRef]

- Wei, Lu, Yuqi Deng, Jie Huang, Chen Han, and Zhongbo Jing. 2022. Identification and Analysis of Financial Technology Risk Factors Based on Textual Risk Disclosures. Journal of Theoretical and Applied Electronic Commerce Research 17: 590–612. [Google Scholar] [CrossRef]

- Wu, Wuqing, Dongliang Xu, Yue Zhao, and Xinhai Liu. 2020. Do Consumer Internet Behaviours Provide Incremental Information to Predict Credit Default Risk? Economic and Political Studies 8: 482–99. [Google Scholar] [CrossRef]

- Xia, Yufei, Yinguo Li, Lingyun He, Yixin Xu, and Yiqun Meng. 2021. Incorporating Multilevel Macroeconomic Variables into Credit Scoring for Online Consumer Lending. Electronic Commerce Research and Applications 49. [Google Scholar] [CrossRef]

- Yang, Dong, and Min Li. 2018. Evolutionary Approaches and the Construction of Technology-Driven Regulations. Emerging Markets Finance and Trade 54: 3256–71. [Google Scholar] [CrossRef]

- Yehorycheva, Svitlana, Iryna Fysun, Tetiana Hudz, Oksana Palchuk, and Natalia Boiko. 2020. Innovations in the Insurance Market of a Developing Country: Case of Ukraine. Investment Management and Financial Innovations 17: 175–88. [Google Scholar] [CrossRef]

- Zhang, Dehua. 2020. The Innovation Research of Contract Farming Financing Mode under the Block Chain Technology. Journal of Cleaner Production 270: 122194. [Google Scholar] [CrossRef]

- Zhao, Yang, and Xiaohui Chen. 2022. The Relationship between the Withdrawal of the Digital ‘Economy’s Innovators, Government Interventions, the Marketization Level and Market Size Based on Big Data. Journal of Enterprise Information Management 35: 1202–32. [Google Scholar] [CrossRef]

- Zveryakov, Mikhail, Victoria Kovalenko, Sergii Sheludko, and Elena Sharah. 2019. FinTech Sector and Banking Business: Competition or Symbiosis? Economic Annals-XXI 175: 53–57. [Google Scholar] [CrossRef]

| Type of Risk | Description | Sources |

|---|---|---|

| Cyber-security risk | The risk of information’s integrity, availability, or secrecy. | (Duran and Griffin 2021; Boulianne and Fortin 2020; Lanfranchi and Grassi 2022; Eskindarov et al. 2019; Mishchenko et al. 2021; Fabris 2022; Irwin and Dawson 2019; Vučinić and Luburić 2022; Kaigorodova et al. 2021) |

| Loss of Privacy and Data-rights | The danger of clients allowing fintech companies to access their bank account information to do tasks on their behalf. | (Hua and Huang 2021; Hollanders 2020; Saliba et al. 2022) |

| Financial Crimes and lack of investor protection | As it is simpler to assume false identities online, fintech channels are prone to far higher fraud rates. | (Jamil et al. 2022; Šapkauskienė and Višinskaitė 2020; Hollanders 2020) |

| High Cost | The high cost of digitalization restrains banks and insurers from using digital financial technologies. | (Kaigorodova et al. 2021) |

| Lack of Financial Literacy | Due to financial illiteracy, customers in developing countries fear using financial technologies and prefer traditional methods. | (Demirgüç-Kunt et al. 2020; Eskindarov et al. 2019; Kijkasiwat 2021; Ozili 2021a) |

| Systematic/Financial Stability Risk | Financial technologies lead to the instability of the entire financial system in an economy. | (Bavoso 2020; Azarenkova et al. 2018; Chaudhry et al. 2022; Li 2022; Khiaonarong and Goh 2020; Yang and Li 2018; Jonker and Kosse 2022; Mascarenhas et al. 2021; Alshari and Lokhande 2022; Nabilou 2020; Ozili 2018; Vučinić 2020; Gąsiorkiewicz et al. 2020; Thakor 2020; Das 2019) |

| Operational Risk | Fintech companies face the risk of inefficient internal systems, procedures, and personnel. | (Zhao and Chen 2022; Mascarenhas et al. 2021; Hsu et al. 2021; Wei et al. 2022; Gao et al. 2020) |

| Default Risk | Loan defaults are increased in digital lending as compared to traditional lending. | (Arkanuddin et al. 2021; Mallekoote and Balraadjsing 2022; Xia et al. 2021; Mascarenhas et al. 2021; Wu et al. 2020; Nigmonov and Shams 2021) |

| Lack of Interaction between Banking/Insurance and Fintech Companies | Banks and insurance companies face the challenges of digitalization while interacting with fintech companies. | (Pu et al. 2021; Yehorycheva et al. 2020; Zveryakov et al. 2019) |

| Volatility in Crypto-currencies | Huge volatility in crypto assets creates financial instability in the fintech industry. | (Huang et al. 2020; Boulianne and Fortin 2020; Luo et al. 2021; Miglo 2022) |

| Regulatory compliance and Legal risk | The Fintech industry requires strict adherence to laws and regulations due to its online functioning, but still, no specific laws prevail regulating this industry. | (Ryu 2018; Hua and Huang 2021; Bavoso 2020; Murinde et al. 2022; Gozman and Willcocks 2019; Clemente and Marano 2020; Boulianne and Fortin 2020; Kijkasiwat 2021; Milian et al. 2019; Bu et al. 2022) |

| Money Laundering and Finance Terrorism | Due to accessibility through the internet, criminals have developed advanced technologies for money laundering. | (Akartuna et al. 2022; Muryanto et al. 2022) |

| Country | Frequency |

|---|---|

| China | 40 |

| Ukraine | 18 |

| UK | 13 |

| Australia | 12 |

| USA | 9 |

| Italy | 6 |

| Poland | 5 |

| Canada | 4 |

| Indonesia | 4 |

| Lithuania | 4 |

| Affiliation | Articles |

|---|---|

| Banking Universities | 4 |

| Peking University | 4 |

| St. Petersburg State University | 3 |

| Vilnius University | 3 |

| Central University of Finance and Economics | 2 |

| Financial Universities | 2 |

| Jiangsu Normal University | 2 |

| Kharkiv Educational and Scientific Institute of Shei Banking University | 2 |

| Law School of Renmin University of China | 2 |

| Lviv Banking Institute of Banking University | 2 |

| Id | Term | Occurrences | Relevance Score | Link Strength | Cluster |

|---|---|---|---|---|---|

| 1 | access | 7 | 15.4286 | 28 | 2 |

| 2 | artificial intelligence | 5 | 6.8 | 20 | 3 |

| 3 | banking | 9 | 9.4444 | 39 | 4 |

| 4 | banking sector | 7 | 5.5714 | 36 | 4 |

| 5 | blockchain | 8 | 18.625 | 28 | 3 |

| 6 | control | 6 | 6.5 | 17 | 2 |

| 7 | covid | 6 | 7 | 20 | 1 |

| 8 | cryptoassets | 6 | 16.3333 | 19 | 1 |

| 9 | customer | 7 | 6.7143 | 28 | 3 |

| 10 | digitalization | 6 | 2.5 | 21 | 4 |

| 11 | financial inclusion | 11 | 9.5455 | 48 | 2 |

| 12 | financial innovation | 9 | 9.3333 | 41 | 1 |

| 13 | financial institution | 7 | 11.1429 | 34 | 1 |

| 14 | financial literacy | 5 | 6.4 | 21 | 2 |

| 15 | financial market | 8 | 7.25 | 29 | 3 |

| 16 | financial regulation | 7 | 13.5714 | 33 | 2 |

| 17 | financial stability | 7 | 4.8571 | 30 | 1 |

| 18 | financial system | 10 | 18.7 | 44 | 3 |

| 19 | fintech development | 6 | 8.8333 | 32 | 3 |

| 20 | government | 6 | 4 | 32 | 1 |

| 21 | growth | 9 | 6.3333 | 45 | 1 |

| 22 | implementation | 8 | 7.25 | 41 | 4 |

| 23 | information asymmetry | 5 | 10.4 | 17 | 1 |

| 24 | investment | 8 | 12.25 | 34 | 4 |

| 25 | investor | 7 | 8.2857 | 32 | 1 |

| 26 | lending | 11 | 4.3636 | 42 | 5 |

| 27 | new technology | 6 | 12 | 22 | 2 |

| 28 | operational risk | 6 | 3.3333 | 23 | 5 |

| 29 | opportunity | 16 | 15.0625 | 69 | 3 |

| 30 | pandemic | 6 | 6.8333 | 29 | 1 |

| 31 | peer | 8 | 5.25 | 26 | 5 |

| 32 | platform | 11 | 7.3636 | 46 | 5 |

| 33 | possibility | 7 | 9.4286 | 33 | 4 |

| 34 | potential risk | 7 | 7.4286 | 28 | 2 |

| 35 | practical implication | 5 | 1.8 | 23 | 2 |

| 36 | problem | 9 | 5.4444 | 35 | 1 |

| 37 | process | 13 | 5.6154 | 55 | 4 |

| 38 | relationship | 9 | 6.6667 | 40 | 2 |

| 39 | stability | 6 | 13 | 29 | 5 |

| 40 | stakeholder | 8 | 2.25 | 41 | 3 |

| 41 | survey | 9 | 17 | 28 | 2 |

| 42 | systemic risk | 7 | 10.4286 | 32 | 5 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Jain, R.; Kumar, S.; Sood, K.; Grima, S.; Rupeika-Apoga, R. A Systematic Literature Review of the Risk Landscape in Fintech. Risks 2023, 11, 36. https://doi.org/10.3390/risks11020036

Jain R, Kumar S, Sood K, Grima S, Rupeika-Apoga R. A Systematic Literature Review of the Risk Landscape in Fintech. Risks. 2023; 11(2):36. https://doi.org/10.3390/risks11020036

Chicago/Turabian StyleJain, Ruchika, Satinder Kumar, Kiran Sood, Simon Grima, and Ramona Rupeika-Apoga. 2023. "A Systematic Literature Review of the Risk Landscape in Fintech" Risks 11, no. 2: 36. https://doi.org/10.3390/risks11020036

APA StyleJain, R., Kumar, S., Sood, K., Grima, S., & Rupeika-Apoga, R. (2023). A Systematic Literature Review of the Risk Landscape in Fintech. Risks, 11(2), 36. https://doi.org/10.3390/risks11020036