Designing Stress Tests for UK Fast-Growing Firms and Fintech

Abstract

1. Introduction

2. Prudential Regulation Authority Review

2.1. Findings

2.2. Regulatory Developments

3. Prudential Supervision of UK Fintech

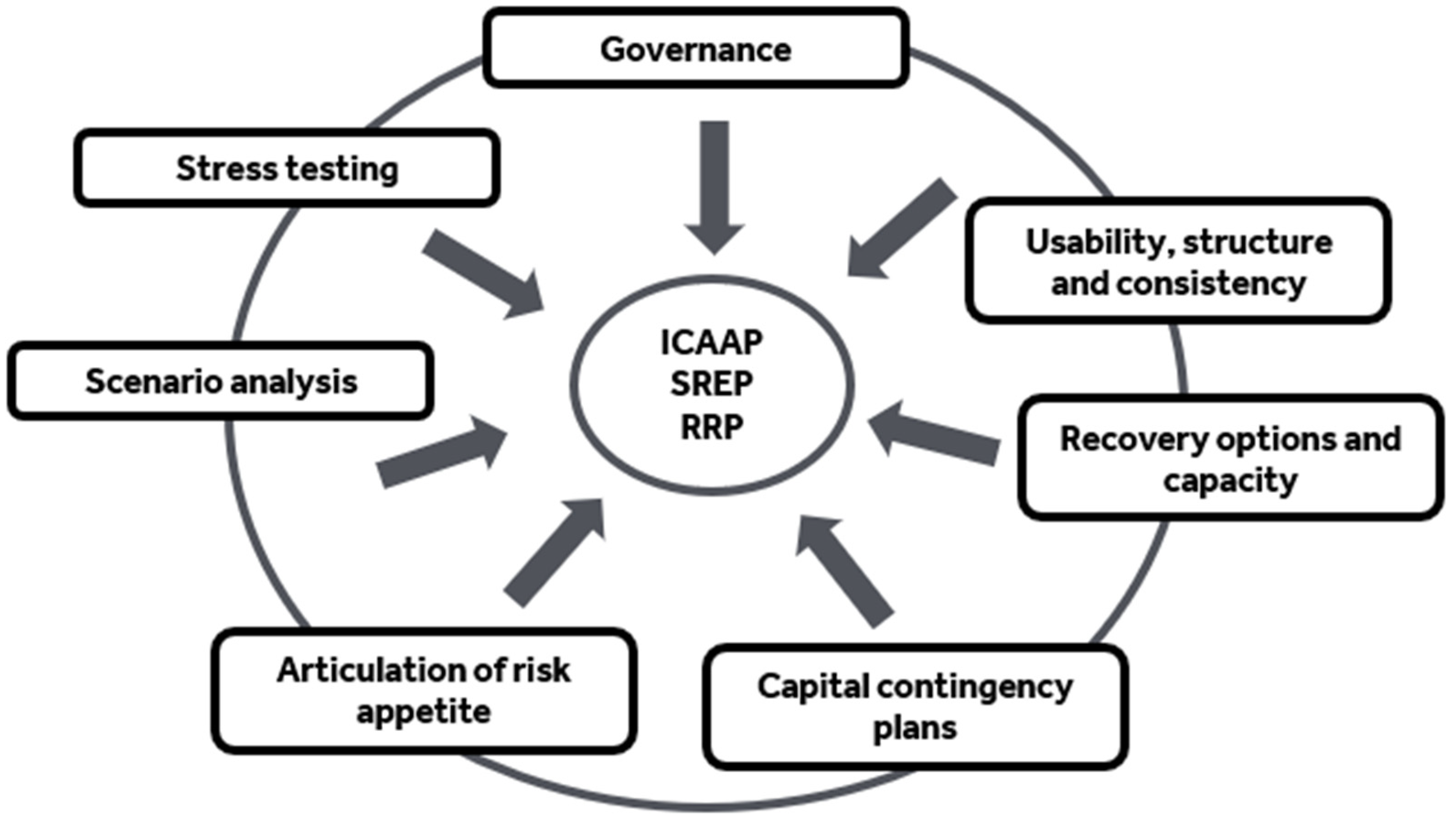

3.1. Internal Capital Adequacy Assessment Process

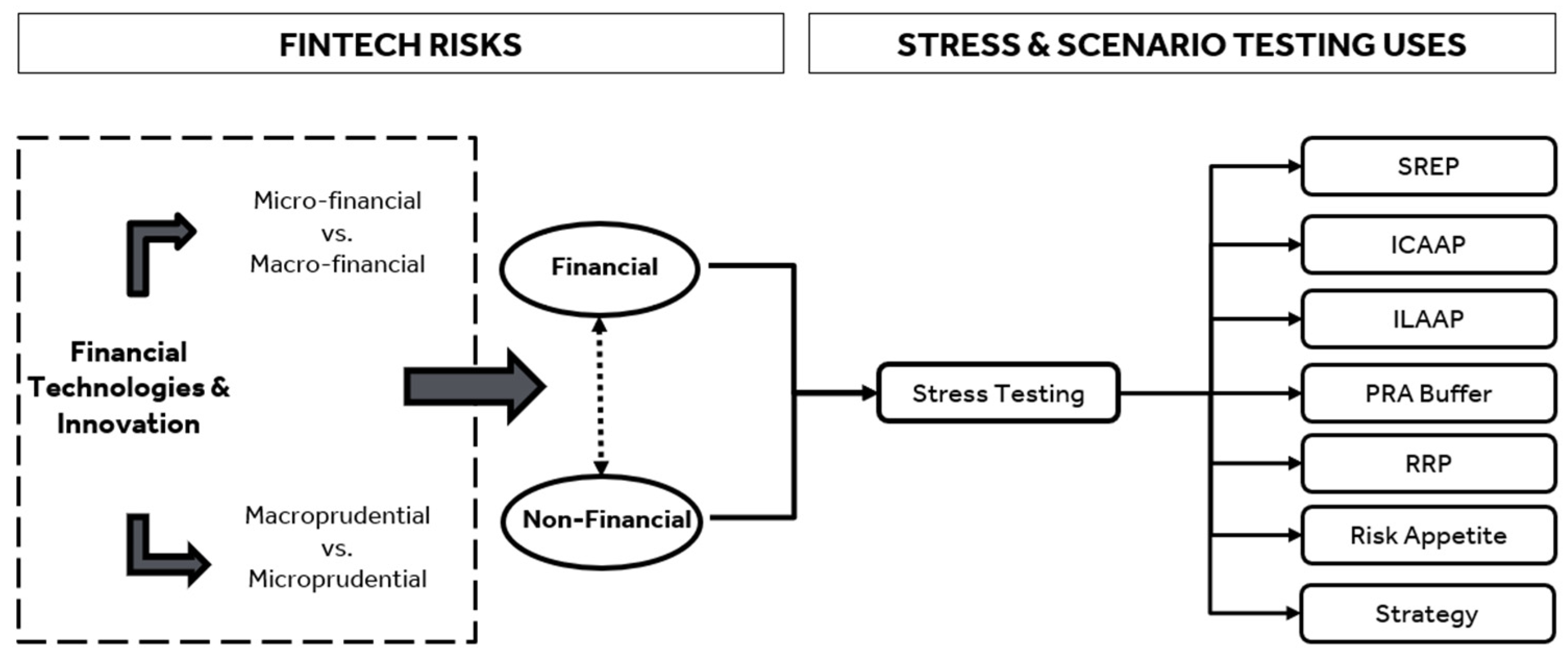

3.2. Stress Testing

3.3. Supervisory Review and Evaluation Process

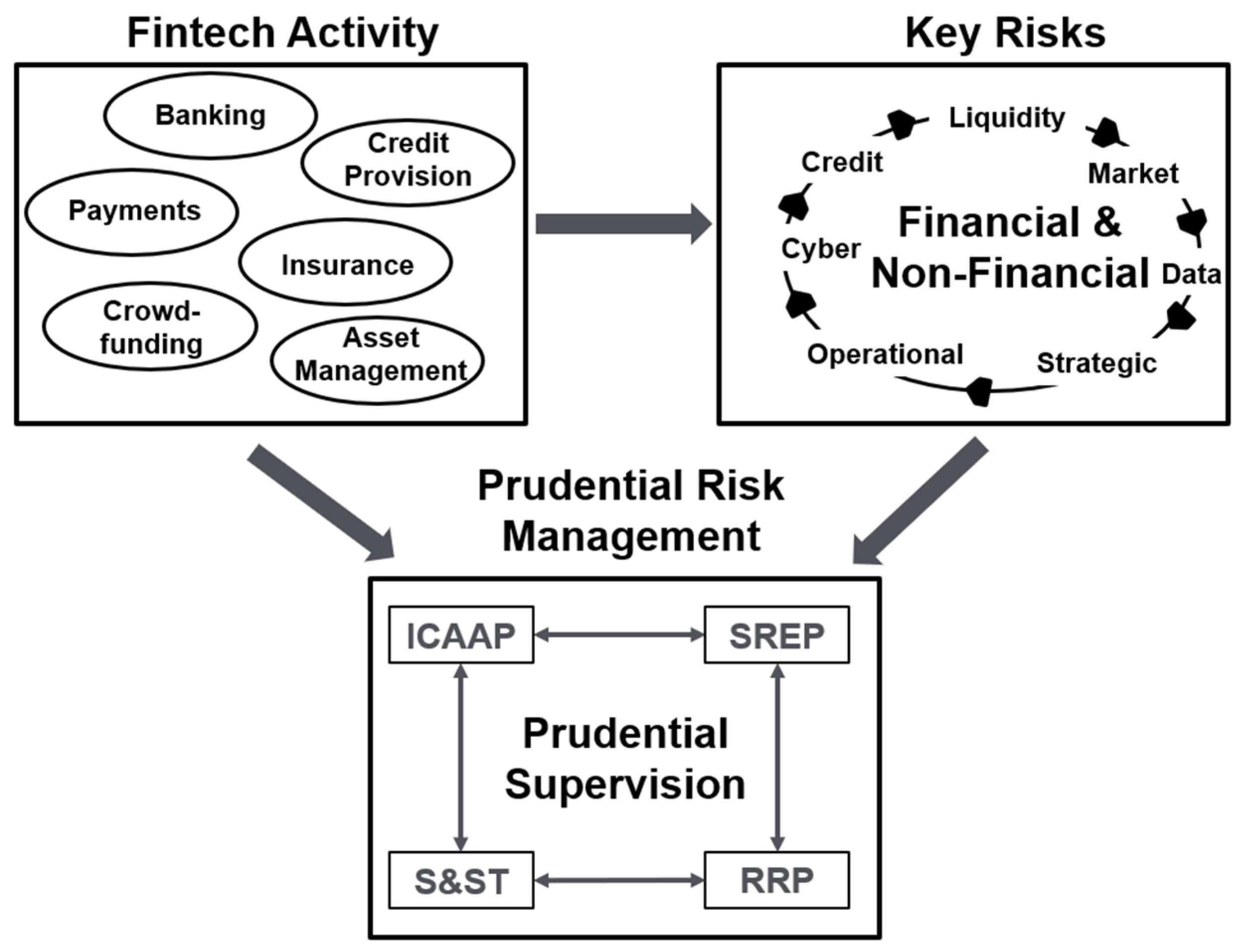

3.4. Prudential Risk Management of Fintech

3.5. Fintech Activity-Based Regulation

4. UK Fintech Regulation: Fit for Purpose?

5. Conclusions

Funding

Acknowledgments

Conflicts of Interest

| 1 | PRA’s consultation papers (CP) are published with request for input. After incorporating feedback received, an update is produced that is usually translated into the updated policy statements (PS) and supervisory statements (SS). |

| 2 | Bank of England’s guidance regarding stress testing with the regulatory prescribed scenarios is captured in further detail in Dent et al. (2016). |

| 3 | For more information regarding the PRA buffer calculation and guidance please see PRA’s Statement of Policy, section II: Pillar 2B (PRA 2020e, p. 25). |

| 4 | The stress impact that comprises the first of the three assessments of the PRA buffer refers “an assessment of the amount of capital firms should maintain to withstand a severe stress scenario” as in paragraph 9.3 of PRA’s Statement of Policy (PRA 2022). |

| 5 | The term ‘pragmatic’ SREP was first used by the European Central Bank and the European Banking Authority (EBA 2020; ECB 2020a, 2020b), with adjustments made based on COVID-19 developments in early 2020. In this context the ‘pragmatic’ SREP refers to understanding the risk management capabilities of the fintech, building on the key components of the SREP but managing expectations, in comparison with systemic and/or more mature institutions. |

| 6 | Regulation (EU) No 575/2013 of the European Parliament and of the Council of 26 June 2013 on prudential requirements for credit institutions and investment firms and amending Regulation (EU) No 648/2012 (OJ L 321, 26.6.2013) - CRR, Regulation (EU) 2019/876 of the European Parliament and of the Council of 20 May 2019 amending Regulation (EU) No 575/2013 as regards the leverage ratio, the net stable funding ratio, requirements for own funds and eligible liabilities, counterparty credit risk, market risk, exposures to central counterparties, exposures to collective investment undertakings (CIU), large exposures, reporting and disclosure requirements, and Regulation (EU) No 648/2012 – CRR II. |

| 7 | Directive 2013/36/EU of the European Parliament and of the Council of 26 June 2013 on access to the activity of credit institutions and the prudential supervision of credit institutions and investment firms, amending Directive 2002/87/EC and repealing Directives 2006/48/EC and 2006/49/EC (OJ L 176, 27.6.2013)—CRD, Directive (EU) 2019/878 of the European Parliament and of the Council of 20 May 2019 amending Directive 2013/36/EU as regards exempted entities, financial holding companies, mixed financial holding companies, remuneration, supervisory measures and powers and capital conservation measures—CRD V. |

| 8 | The recommendations denoted in bold and underlined refer to amendments of the actual PRA’s ICAAP guidance SS31/15 (PRA 2021c). |

| 9 | For further guidance on the SWD (not fintech/FGF specific) please see the Single Resolution Board guidance (SRB 2021) and BoE’s CP9/17 (PRA 2017). CP9/17 captures the regulatory expectations in relation to SWD with respect to recovery options and the firms’ recovery plans (PRA 2017), with more information captured in the SS19/13 (PRA 2018). |

| 10 | For more information about regulatory sandboxes with country examples please see IMF’s report (2019, p. 21). |

| 11 | |

| 12 | |

| 13 | Based on the PRA’s guidance (PRA 2020a), new banks refer to ‘firms that are in the ‘mobilisation stage’ (authorisation with restrictions) and those that have received authorisation without restrictions within the past 12 months, whereas growing banks refer to banks that are typically between 1 and 5 years post-authorisation without restrictions’. |

| 14 | Referring to data privacy, security, discontinuity of banking services, inappropriate marketing practices based on the Basel Committee of Banking Supervision (BCBS 2018, graph 6). |

| 15 | These are strategic and profitability risks, cyber-risk, high operational risk-systemic/idiosyncratic dimensions, third-party/verndom management risk linked to outsourcing, increased interconnectedness between financial parties, compliance risk inclusive of failure to protect consumers and data protection regulation, money laundering, liquidity risk and volatility of bank funding sources based on the (BCBS 2018, graph 6). |

| 16 | The definition of this risk denoted as ICT refers to the ‘risks of losses or potential loess related to the use of network information systems or communication technology, including breach of confidentiality, failure of systems, unavailability or lack of integrity of data and systems, and cyber risk’ (EC 2021a, 47 Article 1 20k 52). |

| 17 | |

| 18 | For further detial please see the published Pillar 3 disclosures and reports from ClearBank, Atom Bank, Monzo Bank and Starling Bank. |

| 19 | |

| 20 | For further information please see the study of Borio et al. (2022) that presents a comparison between AB regulation versus entity-based (EB) regulation under the aim of maintaining financial stability. |

| 21 | For the evolution of financial services with technological innovations and fintech solutions please see Figure 1 of IMF’s report (2019). |

| 22 | For a list of the key fintech products and services please see BCBS (2018, graph 1). |

| 23 | Note that conduct and fairness, competition and market development (Arner et al. 2015) are not examined in this paper. |

| 24 | Referring to recommendations 7 (‘safeguarding the financial system from evolving risks’), 8 (‘enhancing protection against cyber-risks’) and 9 (‘embracing digital regulation’) as in Van Steenis’ report (2019). |

| 25 | This refers to implementing recommendation 1.3 (p. 33) and 2.4 (p. 37) in particular, with recommendations 1 (p. 21) and 2 mainly (p. 35) (Kalifa 2021). |

| 26 | An example about policy cooperation regarding cyber security and cyber risks is the cyber resilience coordination centre (CRCC) (Doerr et al. 2022). |

References

- Aaron, Meyer, Francisco Rivadeneyra, and Samantha Sohal. 2017. Fintech: Is This Time Different? A Framework for Assessing Risks and Opportunities for Central Banks. Bank of Canada Staff Discussion Paper 2017–10, July 2017. Ottawa: Bank of Canada. [Google Scholar] [CrossRef]

- Anagnostopoulos, Ioannis. 2018. Fintech and regtech: Impact on regulators and banks. Journal of Economics and Business 100: 7–25. [Google Scholar] [CrossRef]

- Arner, Douglas, Jannos Barberis, and Ross Buckley. 2015. The Evolution of Fintech: A New Post-Crisis Paradigm? University of Hong Kong Faculty of Law Research Paper No. 2015/047, UNSW Law Research Paper No. 2016–62. Hong Kong: University of Hong Kong. [Google Scholar] [CrossRef]

- Atom Bank Plc Annual Report 2021/2022. 2022a. Available online: https://www.atombank.co.uk/~/docs/annual-report-21-22.pdf (accessed on 2 January 2023).

- Atom Bank Plc Pillar 3 Report 2021/2022. 2022b. Available online: https://www.atombank.co.uk/~/docs/pillar-3-disclosures-21-22.pdf (accessed on 2 January 2023).

- Barefoot, Jo Ann. 2020. Digitizing Financial Regulation: Regtech as a Solution for Regulatory Inefficiency and Ineffectiveness. M-RCBG Associate Working Paper Series No. 150. Cambridge: Mossavar-Rahmani Center for Business & Government Weil Hall, Harvard Kennedy School. Available online: https://www.hks.harvard.edu/sites/default/files/centers/mrcbg/files/AWP_150_final.pdf (accessed on 2 January 2023).

- BCBS. 2011. Basel III: A Global Regulatory Framework for More Resilience Banks and Banking Systems. December 2020 (rev June 2011). Basel: Basel Committee on Banking Supervision, Bank for International Settlements. [Google Scholar]

- BCBS. 2017. Basel III: Finalising Post-Crisis Reforms. Basel: Basel Committee on Banking Supervision, Bank for International Settlements, December. [Google Scholar]

- BCBS. 2018. Implications of Fintech Developments for Banks and Bank Supervisors. Sound Practices, February 2018. Basel: Basel Committee on Banking Supervision. [Google Scholar]

- Beaman, Melanie. 2019. Review and Findings: Fast Growing Firms. Dear CEO Letter, 12 June 2019. London: Prudential Regulation Authority, Bank of England. [Google Scholar]

- Beau, Dennis. 2022. Between Mounting Risks and Financial Innovation—The Fintech Ecosystem at a Crossroads. Speech by Mr Denis Beau, First Deputy Governor of the Bank of France, at the FinTech R: Evolution 2022, organised by France FinTech, Paris, 20 October 2022. Paris: Banque de France. [Google Scholar]

- Binham, Caroline, and Nicholas Megaw. 2019. Bank of England Finds UK Challenger Banks Cut Corners. Financial Times, June 14. [Google Scholar]

- Black, Julia. 2010. Financial Markets. In The Oxford Handbook of Empirical Legal Research. Edited by Peter Cane and Herbert Kritzer. Oxford: Oxford University Press. [Google Scholar]

- BoE. 2014. A Review of Requirements for Firms Entering into or Expanding in the Banking Sector: One Year on 7 July 2014. London: Financial Conduct Authority and Prudential Regulation Authority, Bank of England. [Google Scholar]

- BoE. 2016. New Bank Start-Up Unit Launched by the Financial Regulators. 20 January, Bank of England News Release. Available online: https://www.bankofengland.co.uk/-/media/boe/files/news/2016/january/new-bank-startup-unit-launched-by-the-financial-regulators.pdf (accessed on 8 November 2022).

- BoE. 2018. Stress Testing the UK Banking System: Key Elements of the 2018 Stress Test. London: Bank of England, March. [Google Scholar]

- BoE. 2019. New Economy, New Finance, New Bank. The Bank of England’s Response to the van Steenis Review on the Future of Finance. London: Bank of England. [Google Scholar]

- BoE. 2022. Regulatory Expectations. 9 February 2022, Prudential Regulation, New Bank Start-up Unit, Bank of England. Available online: https://www.bankofengland.co.uk/prudential-regulation/new-bank-start-up-unit/regulatory-expectations (accessed on 8 November 2022).

- Borio, Claudio, Stijn Claessens, and Nikola Tarashev. 2022. Entity-Based vs. Activity-Based Regulation: A Framework and Applications to Traditional Financial Firms and Big Techs. Bank for International Settlements, Financial Stability Institute, Occasional Paper No 19. Basel: Bank for International Settlements, Financial Stability Institute. [Google Scholar]

- Brown, Eric, and Dóra Piroska. 2022. Governing Fintech and Fintech as Governance: The Regulatory Sandbox, Riskwashing, and Disruptive Social Classification. New Political Economy 27: 19–32. [Google Scholar] [CrossRef]

- Carney, Mark. 2017. The Promise of FinTech—Something New Under the Sun? In Speech Given by Mark Carney Governor of the Bank of England Chair of the Financial Stability Board Deutsche Bundesbank G20 Conference on “Digitising Finance, Financial Inclusion and Financial Literacy. Wiesbaden 25 January 2017. London: Bank of England. [Google Scholar]

- Carstens, Agustín. 2021. Public Policy toward Big Techs in Finance. Speech at the Asia School of Business Conversations on Central Banking webinar “Finance as information”, 27 January. Basel: Bank for International Settlements. Available online: https://www.bis.org/speeches/sp210121.pdf (accessed on 8 November 2022).

- Carstens, Agustín, Stijn Claessens, Fernando Restoy, and Hyun Song Shin. 2021. Regulating Big Techs in Finance. Basel: Bank for International Settlements. [Google Scholar]

- ClearBank Pillar 3 Disclosure 2019. 2020. Available online: https://clear.bank/uploads/assets/ClearBank-Pillar-3-disclosure-2019.pdf (accessed on 2 January 2023).

- ClearBank Pillar 3 Disclosure 2020. 2021. Available online: https://clear.bank/uploads/assets/Clear.Bank-Pillar-3-disclosure-2020.pdf (accessed on 2 January 2023).

- ClearBank Annual Report and Accounts 2021. 2022a. Available online: https://clear.bank/uploads/assets/ClearBank-Annual-Report-2021.pdf (accessed on 2 January 2023).

- ClearBank Pillar 3 Disclosure 2021. 2022b. Available online: https://clear.bank/uploads/assets/ClearBank-Pillar-3-disclosure-2021.pdf (accessed on 2 January 2023).

- Crisanto, Juan Carlos, Johannes Ehrentraud, and Marcos Fabian. 2021. Big Techs in Finance: Regulatory Approaches and Policy Options. FSI Briefs No 12 March 2021. Basel: Financial Stability Institute, Bank for International Settlements. [Google Scholar]

- de la Mano, Miguel, and Jorge Padilla. 2018. Big Tech Banking. Available online: http://dx.doi.org/10.2139/ssrn.3294723 (accessed on 8 November 2022).

- Dent, Kieran, Ben Westwood, and Miguel Segoviano. 2016. Stress Testing of Banks: An Introduction. Bank of England, Quarterly Bulletin 2016 Q3. London: Bank of England, Quarterly Bulletin, pp. 130–43. [Google Scholar]

- Doerr, Sebastian, Leonardo Gambacorta, Thomas Leach, Bertrand Legros, and David Whyte. 2022. Cyber Risk in Central Banking. BIS Working Papers No 1039. Basel: Monetary and Economic Department, Bank for International Settlements. [Google Scholar]

- EBA. 2014. Guidelines on Common Procedures and Methodologies for the Supervisory Review and Evaluation Process (SREP). EBA/GL/2014/13, 19 December 2014. London: European Banking Authority. [Google Scholar]

- EBA. 2020. Final Report on the Pragmatic 2020 SREP. EBA/GL/2020/10, 23 July 2020. Paris: European Banking Authority. [Google Scholar]

- EBA. 2022. Final Report: Guidelines on Common Procedures and Methodologies for the Supervisory Review and Evaluation Process (SREP) and Supervisory stress Testing under Directive 2013/36/EU. EBA/GL/2022/03, 18 March 2022. Paris: European Banking Authority. [Google Scholar]

- EC. 2021a. Proposal for a Regulation of the European Parliament and of the Council Amending Regulation (EU) No 575/2013 as Regards Requirements for Credit Risk, Credit Valuation Adjustment Risk, Operational Risk, Market Risk and the Output Floor. Brussels, 27.10.2021, COM(2021) 664 final, 2021/0342 (COD). Brussels: European Commission. [Google Scholar]

- EC. 2021b. Proposal for a Directive of the European Parliament and of the Council Amending Directive 2013/36/EU as Regards Supervisory Powers, Sanctions, Third-Country Branches, and Environmental, Social and Governance Risks, and Amending Directive 2014/59/EU. Brussels, 27.10.2021, COM(2021) 663 Final, 2021/0341 (COD). Brussels: European Commission. [Google Scholar]

- ECB. 2020a. A pragmatic SREP Delivers Appropriate Supervision for the Crisis. Blog Post by Elizabeth McCaul, Member of the Supervisory Board of the ECB, 12 May 2020, European Central Bank. Available online: https://www.bankingsupervision.europa.eu/press/blog/2020/html/ssm.blog200512~0958bc57fc.en.html (accessed on 8 November 2022).

- ECB. 2020b. Taking a Pragmatic Approach to SREP. Supervision Newsletter, 13 May 2020, European Central Bank. Available online: https://www.bankingsupervision.europa.eu/press/publications/newsletter/2020/html/ssm.nl200513_2.en.html (accessed on 8 November 2022).

- ECB. 2022. The Supervisory Review and Evaluation Process. European Central Bank. Available online: https://www.bankingsupervision.europa.eu/banking/srep/html/index.en.html (accessed on 8 November 2022).

- Ehrentraud, Johannes, Jamie Lloyd Evans, Amélie Monteil, and Fernando Restoy. 2022. Big Tech Regulation: In Search of a New Framework. FSI Occasional Paper, No 20. Basel: Financial Stability Institute, Bank for International Settlements. [Google Scholar]

- Enria, Andrea. 2018. Designing a Regulatory and Supervisory Roadmap for FinTech. Speech by Andrea Enria, Chairperson of the European Banking Authority (EBA) at Copenhagen Business School 09 March 2018. Paris: European Banking Authority. [Google Scholar]

- Fáykiss, Péter, Dániel Papp, P. Péter Sajtos, and Ágnes Tőrös. 2018. Regulatory Tools to Encourage FinTech Innovations: The Innovation Hub and Regulatory Sandbox in International Practice. Financial and Economic Review 17: 43–67. [Google Scholar] [CrossRef]

- FCA. 2015. Regulatory sandbox. Financial Conduct Authority. Available online: https://www.fca.org.uk/publication/research/regulatory-sandbox.pdf (accessed on 8 November 2022).

- FPC. 2021. Financial Policy Summary and Record of the Financial Policy Committee Meeting on 11 March 2021. London: Bank of England. [Google Scholar]

- FSB. 2017. Financial Stability Implications from FinTech: Supervisory and Regulatory Issues That Merit Authorities’ Attention. Basel: Financial Stability Board, June 27. [Google Scholar]

- FSB. 2019. Decentralised Financial Technologies. Report on Financial Stability, Regulatory and Governance Implications. 6 June 2019. Basel: Financial Stability Board. [Google Scholar]

- FSB. 2022. FinTech and Market Structure in the COVID-19 Pandemic: Implications for Financial Stability. Basel: Financial Stability Board, March 21. [Google Scholar]

- Gerlach, Johannes, and Daniel Rugilo. 2019. The Predicament of Fintechs in the Environment of Traditional Banking Sector Regulation—An Analysis of Regulatory Sandboxes as a Possible Solution. Credit and Capital Markets 52: 323–73. [Google Scholar] [CrossRef]

- Gualandri, Elisabetta. 2012. Basel III, Pillar 2: The Role of Banks’ Internal Control Systems. In Crisis, Risk and Stability in Financial Markets. Edited by Juan Fernández de Guevara Radoselovic and José Pastor Monsálvez. London: Palgrave Macmillan Studies in Banking and Financial Institutions, Palgrave Macmillan. [Google Scholar]

- Hodson, Dermot. 2021. The politics of FinTech: Technology, regulation, and disruption in UK and German retail banking. Public Administration 99: 859–72. [Google Scholar] [CrossRef]

- IFRS 9 Financial Instruments. International Financial Reporting Standards (IFRS). 2022. Available online: https://www.ifrs.org/issued-standards/list-of-standards/ifrs-9-financial-instruments/ (accessed on 2 January 2023).

- IMF. 2018. The Bali Fintech Agenda. IMF policy paper. Washington, DC: International Monetary Fund. [Google Scholar]

- IMF. 2019. Fintech: The Experience So Far. IMF Policy Paper No. 2019/024. Washington, DC: International Monetary Fund. [Google Scholar]

- Kalifa, Ron. 2021. Kalifa Review of UK Fintech. Independent report on the UK Fintech sector by Ron Kalifa OBE, Policy Paper. London: HM Treasury. [Google Scholar]

- Magnuson, William. 2017. Regulating Fintech. Vanderbilt Law Review 71: 1167–226. [Google Scholar]

- Mnohoghitnei, Irinia, Simon Scorer, Kushali Shingala, and Oliver Thew. 2019. Embracing the Promise of Fintech. Topical Article, Quarterly Bulletin, 2019 Q1 1–13. London: Bank of England. [Google Scholar]

- Monzo Bank. 2020. Annual Report and Group Financial Statements. Available online: https://monzo.com/investor-information/ (accessed on 2 January 2023).

- Monzo Bank. 2021a. Annual Report and Group Financial Statements. Available online: https://monzo.com/docs/monzo-annual-report-2021.pdf (accessed on 2 January 2023).

- Monzo Bank. 2021b. Pillar 3 Disclosures. Available online: https://monzo.com/docs/monzo-pillar-3-2021.pdf (accessed on 2 January 2023).

- Monzo Bank. 2022. Pillar 3 Disclosures. Available online: https://monzo.com/docs/monzo-pillar-3-2022.pdf (accessed on 2 January 2023).

- New Bank Start-Up Unit. Bank of England. 2022. Available online: https://www.bankofengland.co.uk/prudential-regulation/new-bank-start-up-unit (accessed on 8 November 2022).

- Partington, Martin. 2010. Empirical Legal Research and Policy-making. In The Oxford Handbook of Empirical Legal Research. Edited by Peter Cane and Herbert Kritzer. Oxford: Oxford University Press. [Google Scholar]

- PRA. 2017. Recovery Planning. Consultation Paper CP9/17, June 2017. London: Prudential Regulation Authority, Bank of England. [Google Scholar]

- PRA. 2018. Resolution Planning. Supervisory Statement SS19/13, June 2018 (Updating January 2015). London: Prudential Regulation Authority, Bank of England. [Google Scholar]

- PRA. 2020a. Non-Systemic UK Banks: The Prudential Regulation Authority’s Approach to New and Growing Banks. Consultation Paper CP9/20, July 2020. London: Prudential Regulation Authority, Bank of England. [Google Scholar]

- PRA. 2020b. Recovery Planning. Supervisory Statement SS9/17, December 2020 (Updating July 2020). London: Prudential Regulation Authority, Bank of England. [Google Scholar]

- PRA. 2020c. Capital Requirements Directive V (CRD V). Consultation Paper, CP 12/20 (July 2020). London: Prudential Regulation Authority, Bank of England. [Google Scholar]

- PRA. 2020d. Capital Requirements Directive V (CRD V). Policy Statement, PS29/20 (December 2020). London: Prudential Regulation Authority, Bank of England. [Google Scholar]

- PRA. 2020e. The PRA’s Methodologies for Setting Pillar 2 Capital December 2020 (Updating February 2020). London: Statement of Policy, Prudential Regulation Authority, Bank of England. [Google Scholar]

- PRA. 2021a. Non-Systemic UK Banks: The Prudential Regulation Authority’s Approach to New and Growing Banks. Supervisory Statement SS3/21, April 2021. London: Prudential Regulation Authority, Bank of England. [Google Scholar]

- PRA. 2021b. Non-Systemic UK Banks: The Prudential Regulation Authority’s Approach to New and Growing Banks. Policy Statement PS8/21, April 2021. London: Prudential Regulation Authority, Bank of England. [Google Scholar]

- PRA. 2021c. The Internal Capital Adequacy Assessment Process (ICAAP) and the Supervisory Review and Evaluation Process (SREP). Supervisory Statement SS3/15, December 2021 (Updating April 2021). London: Prudential Regulation Authority, Bank of England. [Google Scholar]

- PRA. 2022. PRA Rulebook, Prudential Regulation Authority, Bank of England. Available online: https://www.prarulebook.co.uk/ (accessed on 8 November 2022).

- Proudman, James. 2018. Cyborg Supervision—The Application of Advanced Analytics in Prudential Supervision. Speech by James Proudman, Executive Director, UK Deposit Takers, given at workshop on research on bank supervision, 19 November 2018. London: Bank of England. [Google Scholar]

- Restoy, Fernando. 2021a. Fintech Regulation: How to Achieve a Level Playing Field. Occasional Paper No 17. London: Financial Stability Institute, Bank for International Settlements. [Google Scholar]

- Restoy, Fernando. 2021b. Regulating Fintech: Is an Activity-Based Approach the Solution? Speech to the Fintech Working Group at the European Parliament. June 16. Available online: https://www.bis.org/speeches/sp210616.htm (accessed on 8 November 2022).

- Revolut Ltd. 2021. Financial Statements for the Year Ending 31 December 2020. Available online: https://assets.revolut.com/pdf/Revolut%20Ltd%20Annual%20Report%20YE%202020.pdf (accessed on 2 January 2023).

- Ringe, Wolf-George, and Christopher Ruof. 2020. Regulating Fintech in the EU: The Case for a Guided Sandbox. European Journal of Risk Regulation 11: 604–29. [Google Scholar] [CrossRef]

- Rusch, Jonathan. 2022. The Financial Conduct Authority’s Challenge to Challenger Banks. Oxford Business Law Blog. May 2. Available online: https://www.law.ox.ac.uk/business-law-blog/blog/2022/05/financial-conduct-authoritys-challenge-challenger-banks (accessed on 8 November 2022).

- Sanchez-Graells, Albert. 2018. Economic analysis of law, or economically informed legal research. In Research Methods in Law, 2nd ed. Edited by Dawn Watkins and Mandy Burton. London: Routledge. [Google Scholar]

- Saporta, Vicky. 2018. Prudential Bank Regulation: Present and Future. Speech Given by Vicky Saporta, Executive Director for Prudential Policy, Bank of England, Westminster Business Forum Keynote Seminar: Building a Resilient UK Financial Sector—Next Steps for Prudential Regulation, Structural Reform and Mitigating Risks 4 July 2018. London: Bank of England. [Google Scholar]

- SRB. 2021. Solvent Wind-Down of Trading Books—Guidance for Banks 2022. Brussels: Single Resolution Board. [Google Scholar]

- Starling Bank 2016/17 Annual Report & Accounts. 2018a. Available online: https://www.starlingbank.com/docs/annual-reports/Starling-bank-annual-report-2016-17.pdf (accessed on 2 January 2023).

- Starling Bank 2017 Pillar 3 Disclosures Document. 2018b. Available online: https://www.starlingbank.com/docs/annual-reports/Pillar3-2018.pdf (accessed on 2 January 2023).

- Starling Bank 2017/18 Annual Report & Accounts. 2019a. Available online: https://www.starlingbank.com/docs/annual-reports/Starling-bank-annual-report-2017-18.pdf (accessed on 2 January 2023).

- Starling Bank 2018 Pillar 3 Disclosures Document. 2019b. Available online: https://www.starlingbank.com/docs/annual-reports/Pillar3-2019.pdf (accessed on 8 November 2022).

- Starling Bank 2018/19 Annual Report & Accounts. 2020. Available online: https://www.starlingbank.com/docs/annual-reports/Starling-Bank-Annual-Report-2018-19.pdf (accessed on 2 January 2023).

- Starling Bank 2019/2021 Annual Report & Accounts. 2021. Available online: https://www.starlingbank.com/docs/annual-reports/Starling-Bank-Annual-Report-2019-21.pdf (accessed on 2 January 2023).

- Starling Bank 2021/2022 Annual Report & Accounts. 2022a. Available online: https://www.starlingbank.com/docs/annual-reports/Starling-Bank-Annual-Report-2022.pdf (accessed on 2 January 2023).

- Starling Bank 2022 Pillar 3 Disclosures Document. 2022b. Available online: https://www.starlingbank.com/docs/annual-reports/Pillar3-2022.pdf (accessed on 2 January 2023).

- Strange, Nick. 2020. Resilience in a Time of Uncertainty. Speech by Nick Strange Given at OpRisk Europe. London: Bank of England. [Google Scholar]

- UNSGSA FinTech Working Group and CCAF. 2019. Early Lessons on Regulatory Innovations to Enable Inclusive FinTech. Innovation Offices, Regulatory Sandboxes, and RegTech. New York and Cambridge: Office of the United Nations Secretary-General’s Special Advocate for Inclusive Finance for Development (UNSGSA) and Cambridge Centre for Alternative Finance (CCAF). [Google Scholar]

- Van de Wiele, Willem. 2018. European FinTech: New Rules on the Way. Banking & Financial Services Policy Report 37: 16–31. [Google Scholar]

- Van Steenis, Huw. 2019. Future of Finance. Review on the Outlook for the UK Financial System: What It Means for the Bank of England. London: Bank of England. [Google Scholar]

- Weber, Rolf, and Rainer Baisch. 2018. FinTech—Eligible Safeguards to Foster the Regulatory Framework. Journal of International Banking Law and Regulation 33: 335–50. [Google Scholar]

- Zamil, Raihan, and Aaidan Lawson. 2022. Gatekeeping the Gatekeepers: When Big Techs and Fintechs Own Banks—Benefits, Risks and Policy Options. FSI Insights on policy implementation No 39. London: Financial Stability Institute, Bank for International Settlements. [Google Scholar]

- Zopa Group Limited Pillar 3 Disclosures Year Ended 31 December 2020. 2021. Available online: https://www.datocms-assets.com/23873/1658745471-2020-zopa-pillar-3-disclosures.pdf (accessed on 2 January 2023).

- Zopa Group Limited Annual Report 2021. 2022a. Available online: https://www.datocms-assets.com/23873/1658745950-zopa-group-annual-report-2021.pdf (accessed on 2 January 2023).

- Zopa Group Limited Pillar 3 Disclosures Year Ended 31 December 2021. 2022b. Available online: https://www.datocms-assets.com/23873/1658840398-20211231-pillar-3-disclosures.pdf (accessed on 2 January 2023).

| Capital 1 | Year 0 | Year 3 | Year 5 |

|---|---|---|---|

|

|

| |

| Chapter | Paragraph | Amended Guidance |

|---|---|---|

| 2 | 2.1 | Dynamic ICAAP, with more frequent updates in line with business model developments and changes in risk profile and risk appetite |

| 2.5 | Framework for stress testing, scenario analysis and capital management, agile and flexible to reflect the risk profile and nature of FGF/fintech | |

| 2.19 | Extension of regular stress testing of the business continuity plan in an appropriate and proportionate manner to the business, focusing on cyber and operational risks | |

| 3 | 3.4 | Explore sensitivities in the short- and medium-term business plans and how capital needs might change |

| 3.6 | Broad range of stress tests…at a firm-wide level for key financial and non-financial risks | |

| 3.7, 3.11 | Use the results of its stress testing and scenario analysis to support business strategy and setting risk appetite, evidencing senior management/board engagement and challenge | |

| 3.8, 3.13 | Stress tests and scenario analysis should be carried out more frequently than annually, ideally every time the business plans are updated, with scenario recalibration | |

| 3.9 | Short- and medium-term projection of capital resources and capital requirements for a 0–1 year, 1–3 year and 3–5 year horizon | |

| 3.16–3.20 | Simplified approach and quantification of Common Stress Scenarios and exploratory exercises from BoE: Annual Cyclical Scenario, Concurrent Solvency Stress Test |

| Element | Atom Bank | ClearBank | Monzo Bank | Revolut | Starling Bank | Zopa |

|---|---|---|---|---|---|---|

| Annual Report | Yes (2015) | Yes (2016) | Yes (2017) | Yes (2016) | Yes (2016) | Yes (2020) |

| Pillar 3 Report | Yes (2016) | Yes (2016) | Yes (2018) | No | Yes (2016) | Yes (2020) |

| ICAAP | Yes (2015) | Yes (2016) | Yes (2018) | No | Yes (2016) | Yes (2020) |

| ILAAP | Yes (2016) | Yes (2016) | Yes (2019) | No | Yes (2016) | Yes (2020) |

| RRP | Yes (2016) | Yes (2016) | Yes (2018) | No | Yes (2018) | Yes (2020) |

| S and ST | Yes (2015) | Yes (2016) | Yes (2018) | Yes (2020) | Yes (2016) | Yes (2020) |

| PRA Buffer (Pillar 2B) | Yes (2016) | Yes (2017) | Yes (2018) | No | Yes (2019) | Yes (2020) |

| Fintech | S and ST Highlights |

|---|---|

| Atom Bank | -Stress tests for retail credit risk, liquidity and funding risk, market risk and capital risk, as part of risk mitigation for principal risks (Atom Bank 2022a) -IFRS 9 scenarios presented in detail with their results and assumptions (Atom Bank 2022a) -Detailed liquidity stresses assumptions (Atom Bank 2022a) -Stress testing and scenario analysis included in risk management objectives and policies, and linked to recovery and resolution planning (Atom Bank 2022b) |

| Clear Bank | -Stress testing for how key risks are mitigated, focusing on financial risks (ClearBank 2022b) -Horizon (short-term and long-term) for scenarios for finding and liquidity risk is included (ClearBank 2022b) -Stress testing linked to the ICAAP, ILAAP and RRP exercises (ClearBank 2021) -Stress testing programme for principal risks and uncertainties (ClearBank 2020) -Stress testing referenced in corporate governance, part of the going concern statement, the directors’ statement, and in the roles and responsibilities of the Board Risk Committee (ClearBank 2022a) |

| Monzo Bank | -Stress testing and scenario modelling comprises a key element of the risk management approach (Monzo Bank 2020), part of the Risk and Control Reporting (Monzo Bank 2021a) -Stress tests used for capital risk, with scenarios and stress testing is analysed as part of mitigation and control for climate risk (Monzo Bank 2021a) -The business plan is stress tested, capturing external shocks, showing also the available management actions (Monzo Bank 2021a) -A reverse stress test of the business plan is reported, including specific scenarios, such as a cyber-attack, liquidity (ILAAP) a market and a combination of stresses is reported, showing the total impact in monetary terms, with stress testing for operational resilience and overall detailed assumptions (Monzo Bank 2021a) -Link of stress for capital and liquidity resilience and Pillar 2B and capital buffers is explained (Monzo Bank 2022), with liquidity stress testing and recovery plan (Monzo Bank 2021b) |

| Revolut | -Stress testing employed for the Interest Rate Risk on the Banking Book (IRRBB), capital and liquidity risk, market risk and model risk (Revolut Ltd. 2021) -Scenario analysis and stress testing are referenced but not explained in detail (Revolut Ltd. 2021) |

| Starling Bank | -Stress testing is used in strategic planning, risk appetite development and in the ICAAP and ILAAP, referenced in risk appetite statements for capital risk and in the counterparty risk and credit valuation adjustments (CVA) calculations (Starling Bank 2018b, 2019a, 2019b) -Stress testing is part of mitigating controls for liquidity and capital risk (Starling Bank 2018a) -Brexit risk and funding and liquidity risk scenarios are referenced (Starling Bank 2019a, 2019b) -Horizon of macroeconomic scenarios is presented, with forward looking element and forecast, for IFRS 9 as well (Starling Bank 2019a) -Extensive stress testing of different scenarios is the 4th component of the ERMF (Starling Bank 2019a), part of the Risk Management Process of the ERMF for mitigation of principal risks and uncertainties (Starling Bank 2021, 2022b) -Stress and scenario tests for market risk, operational resilience, COVID-19 impact, Pillar 2 Buffer calculation and for ECL are included (Starling Bank 2020) -Stress testing is referenced in going concern and directors’ statements (Starling Bank 2019a, 2020) -Stress testing and its components are detailed in the risk framework, including a sub-section for each of the Principal Risks, under Risk Mitigation, covering Credit Risks, Financial Risks (Liquidity and Funding, Market: Foreign Exchange, Interest Rate in the Banking Book-IRRBB, Capital), Operational Risks (for operational resilience), with their results and assumptions detailed in the financial statement notes (Starling Bank 2022a) |

| Zopa | -Link of stress testing with ICAAP, ILAAP, RRP and PRA buffer assessment is included, with the risk appetite development for capital and liquidity risk explained (Zopa Group 2021) -Stresses are used to test principal uncertainties with stress testing part of the risk culture (Zopa Group 2022a, 2022b) -Stress testing is used for to capture the financial risks from climate change (Zopa Group 2022a, 2022b) -Examination of scenario aligned to the BoE Solvency Stress Test is included, with detailed assumptions and results for ECL (Zopa Group 2022b) |

| Component | Proposal-Recommendations |

|---|---|

| Supervision |

|

| |

| |

| Regulation |

|

| |

| |

| |

| S and ST Activities |

|

| |

| |

| |

| |

|

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Pantos, S. Designing Stress Tests for UK Fast-Growing Firms and Fintech. Risks 2023, 11, 31. https://doi.org/10.3390/risks11020031

Pantos S. Designing Stress Tests for UK Fast-Growing Firms and Fintech. Risks. 2023; 11(2):31. https://doi.org/10.3390/risks11020031

Chicago/Turabian StylePantos, Stavros. 2023. "Designing Stress Tests for UK Fast-Growing Firms and Fintech" Risks 11, no. 2: 31. https://doi.org/10.3390/risks11020031

APA StylePantos, S. (2023). Designing Stress Tests for UK Fast-Growing Firms and Fintech. Risks, 11(2), 31. https://doi.org/10.3390/risks11020031