1. Introduction

The need to reach national goals and the sustainable development goals (SDGs) established by the United Nations imposes new requirements for assessing the performance of all economic actors. The UN General Assembly (

DESA 2019) recommends that Member States conduct regular and comprehensive voluntary national reviews (VNRs) to assess progress toward achieving the SDGs at the national and sub-national levels. Compiling a VNR involves assessing and monitoring the implementation and achievement of the SDGs and related national initiatives in the field of sustainable development. Among the new requirements for evaluating the performance of economic entities are the following: analysis of transparency, risk management (RM), protection against corruption and internal control processes, assessment of the validity of targets, and determination of what action needs to be taken to best achieve national goals and the SDGs (

Rana et al. 2019). The need to assess the content, quality, and accessibility of public services has necessitated the use of new tools in the organization of the budgetary process, including new approaches to the organization of state financial control. Regrettably, advanced methods and systems of management in the public sector have not yet been sufficiently developed and used in practice. This fact dictates the need to study the management mechanisms that have been successfully used and proven effective in the corporate sector (

Van Helden and Huijben 2014;

Van Helden and Uddin 2016). One of these is the controlling system, which represents a new form of management process that originally emerged in the private sector within the science of organizational management (

Van Helden and Reichard 2019). Here, it should be noted that the introduction of smart controlling (control) into the public sector is predetermined by one of the key directions of the departmental project of the Ministry of Finance of the Russian Federation (

Ministry of Finance of the Russian Federation 2021), which envisages the creation and implementation of a unified digital platform for a public finance control system by 2024. This will be based on a subsystem of state integrated information system known as “Electronic Budget”.

It can be stated that both the theoretical aspects of the system of control and the practical issues of its implementation and use in the public sector so far remain underdeveloped. The need to develop methodological support for assessing the performance of the public sector has been pointed out by such researchers as

Van Helden and Reichard (

2019),

Felício et al. (

2021),

Van Helden and Uddin (

2016), and

Garcia-Sanchez and Cuadrado-Ballesteros (

2016). The originality of this study lies in the attempt to develop a methodology for a risk-based approach to assessing the activities of the control bodies of the Russian Federation by assessing the contribution of each territorial body of the Federal Treasury (TBFT) to the economic growth of the country. A critical analysis of scientific publications shows that, currently, there is no research addressing the risk-based approach to assessing the work of internal state financial control bodies and their territorial branches, which is a gap of both theoretical and methodological nature. One of the 10 good governance principles recommended by the Council on Budget Management of the OECD Directorate of Public Administration and Territorial Development (

OECD 2015) is a risk-oriented approach to assessing the sustainability of the budgetary system and its fiscal risks. The need for risk assessment and management is enshrined in the documents of international organizations INTOSAI, IMF, and OECD, as well as the legal norms of financial law in the Russian Federation, which legally establish the need to identify and assess risks in public sector financial management.

The originality of our research lies in an attempt to develop a methodology for assessing the degree of impact the risk-based approach has on the achievement of national goals and the UN SDGs by the Federal Treasury. The main risks considered are the financial and budgetary risks of the TBFT associated with the effective and targeted use of budgetary funds in financial and economic activities and the execution of budgetary powers.

The hypothesis of this study is the assumption that the effectiveness of the Federal Treasury and its territorial bodies has an impact on the achievement of national goals and the UN SDGs.

The present study aims to develop a risk-based methodology for assessing the contribution of the TBFT to the achievement of the UN SDGs and national goals. The study consists of seven sections, namely Introduction, Literature Review, Methods, Results, Discussion, Conclusion, Managerial Implication, and Practical/Social Implications.

2. Literature Review

A substantial contribution to the development and modern understanding of controlling was made by German (continental) and American scientific schools. Representatives of the German scientific school consider controlling to be a function of corporate management systems and the public sector, believing that it operates as a form of management process in public organizations. Representatives of the German economic school (

Hahn 1996;

Kupper et al. 1990) developed tools for controlling and defined the principles of the functioning of controlling. The Anglo-American economic school considers controlling within the scientific concept of management control systems (MCS). The American scientific school has introduced the system of control through the direction of budgeting and a balanced scorecard (

Kaplan and Norton 1996,

2000). Both controlling models have been developed in world practice.

A review of the scientific literature showed that the theories and methodologies of controlling in the public sector are covered in relatively few works. Examples include the studies of

Van Helden and Reichard (

2019) and

Felício et al. (

2021). Their research is devoted to the introduction and effects of controlling in the public sector and to comparing the practice to the concept of new public management (NPM). Even though controlling is promising, researchers note the existence of only a very small body of research and publications in this area.

Van Helden and Uddin (

2016) and

Van Helden and Reichard (

2019), based on an analysis of a considerable number of sources on management accounting, management control, and management by results in the public sector (about 130 sources in the first article and more than 50 sources in the second article), point out the comparability of the results of research into certain aspects of management accounting, management control in the private sector, and results-based management in the public sector.

The relevance of using MCS to improve the performance of organizations in the non-profit sector and reduce the existence of a gap in the literature regarding the implementation of MCS in the public sector was pointed out by

Felício et al. (

2021),

Van Helden and Uddin (

2016), and

Vasyunina et al. (

2023). The authors agree that the introduction of MCS packages significantly increases labor productivity in the public administration sector.

To understand the goal-setting system of control in the public sector of the Russian Federation, we conducted a comparative analysis of the vision of the scientific community on the conceptual foundations of controlling.

Analysis shows that the functions of controlling as a subsystem of the overall management system have been consistently expanding and transforming. Initially, the employed concepts of controlling focused only on the accounting system (

Jackson 1949) and the goal of ensuring the financial performance of the economic entity (

Blazek et al. 2010). With the rise of computerization, controlling began to focus primarily on creating information systems and processing information for management decision making (

Anthony 1988;

Reichmann 1997). Further on, due to the development of project management and the advent of matrix organizational structures, the concepts of controlling focused on the coordination of management systems began to be considered (

Kupper 1997;

Hahn 1996;

Weber and Schäffer 2008;

Horvath 2019). Today, the risk-based approach is becoming more widespread.

Bracci et al. (

2022) emphasize that RM in public sector organizations has so far been carried out ad hoc and without proper integration into overall management accounting and control systems.

The expediency of applying RM tools in the public sector has been discussed in research articles for a relatively short time. The analysis of scientific publications shows that most of them are devoted to the study of the possibility of adapting the RM mechanisms used in the commercial sector to the peculiarities of the public sector. This assertion is supported by the findings of

Bracci et al. (

2022), whose structured literature review of 63 articles from the Scopus database from 1990–2018 reveals a lack of theoretical research and the limited explanatory power of most studies of RM in the public sector. As a result, the authors conclude that new scientific knowledge needs to be consolidated and that researchers must identify the main directions of future developments in this field, highlighting performance management as the main aspect which, as the authors determine, should play a key role in the dissemination of RM in public sector organizations.

Rana et al. (

2019), noting particular problems in RM in the public sector, argue that the integration of RM with the strategy and systems of performance assessment will improve the quality of managerial decisions and the efficiency of public organizations. Realizing the need to improve the quality of financial management in the public administration sector, the Ministry of Finance of the Russian Federation has been implementing the departmental project “Electronic SMART Control (Controlling) and Accounting for Public Finance for Management Decisions” since 2022. Its ambitious goal is to create a unified electronic AIS (automated information system) environment by 2024 for automated controlling and to introduce a controlling system based on a single digital platform by 2027. The goal of the project is to improve the efficiency and quality of management decisions. The implementation of the project involves a methodology for assessing the effectiveness of the activities of state organizations at all levels of government, including at the level of state financial control bodies.

The literature review shows that there is a limited number of studies on the methodology for assessing the effectiveness of territorial control bodies. The analyzed publications discuss methodological approaches to assessing the effectiveness of public administration in addressing specific issues. The research of individual scientists considers the issues of assessing the effectiveness of the transformation of the public sector as a result of privatization (

Revkuts et al. 2019), public administration efficiency (

Tambovtsev and Rozhdestvenskaya 2021), and the efficiency and performance of control and supervisory bodies (

Zyryanov and Kalmykova 2019). The literature review shows that there is a need to assess the activities of territorial internal state financial control bodies based on a risk-based approach. In our opinion, the effectiveness of government agencies should be assessed both in terms of the efficiency of spending budget funds and their contributions to the achievement of national development goals and the UN SDGs. The methodology recommended in the study allows us to assess the risk that individual TBFTs of the Russian Federation will fail to achieve these goals and make timely management decisions.

3. Methods

In our study of methodological approaches to assessing the activities of TBFTs of the Russian Federation, we employed systemic, process based, and risk-oriented approaches, statistical data analysis, and mathematical research methods.

The systemic approach was applied in the methodology of scientific research into controlling. This method allowed us to view controlling as an integrated complex of coordinated tools, techniques, algorithms, and procedures aimed at the coordination and maintenance of the main functions of managing the control body.

The process approach was used to substantiate the methodical approach to assessing the effectiveness of controlling based on a stage-by-stage realization of the strategic goals of the Federal Treasury through the aggregate system of the balanced indicators of its territorial bodies.

The system of balanced indicators was implemented in a way that considered what was needed to achieve the objectives of the economic entity through the interaction of the internal and external environment in four projections: “State Finance” (“Investors”), “Consumers” (“Clients”), “Internal functional and professional processes” (“Business processes”) and “Potential” (“Development”). To assess the attainment of target indicators for each projection, a mechanism of analytical support was developed. In particular, performance indicators for the projection “State Finance” were calculated through the indicator “overall assessment of the effectiveness of the execution of expenditures” (

), the calculation of which was carried out based on preliminary calculations: indicator of the effectiveness of the execution of the TBFT budget expenditures (

), quality coefficient of cost management (

), coefficient of the execution of expenditures of the budgets of financial responsibility of the functional and professional areas of the TBFT (

), as well as an overall assessment of the performance of the financial responsibility center (

) (

Table 1).

The recommended indicators allowed us to assess the effectiveness of budget funds allocated to TBFTs for the execution of budgetary powers. The methodology made it possible to assess the effectiveness of each TBFT both via the quantitative criterion of the use of budget funds () and using qualitative performance indicators (; ).

Performance indicators for the projection “Consumers” were calculated with consideration of the attainability of the strategic goal—“Improvement of the welfare of citizens”. In the proposed model, it is recommended that the growth in the welfare of citizens be measured using the growth rate of GRP for 2021 in the macroeconomic environment (K) and the level of TBFT’s contribution to the GRP growth of the study’s subject, the Russian Federation (G) (

Table 2).

The strategic goal of controlling for the “Processes” projection was associated with improving the effectiveness of the treasury system in executing the budgetary powers assigned to it. It was appropriate to calculate the achievement of this using performance and efficiency indicators (

Table 3).

Of substantial significance in reaching the strategic goals of the organization was the efficiency of the execution of powers by each worker (

Federal Treasury n.d.). The recommended methodology suggested the need to assess the performance of public servants working in TBFT in accordance with their contribution to solving the tasks at hand and the effectiveness of the use of their powers in solving tasks (

Table 4).

In this model, the worker’s contribution to solving the tasks () represents the planned amount of bonus payment the worker can receive if they achieve an optimum performance in using their powers in solving the tasks. The efficiency of the execution of powers () cannot exceed 1 and is established by the head of the functional or professional area based on the actual performance of the employee.

The risk-oriented approach, as a direction of the methodology of scientific research into controlling, was used to assess the contribution of TBFT to achieving strategic goals, national goals, and UN SDGs. In order to detect the risks of failure and achieve the strategic goals, the ranking of the subjects of the Russian Federation by the level of relative GRP growth was proposed. GRP growth rate by the constituent entities of the Russian Federation is calculated according to the formula:

Further, the minimum and maximum growth rates were selected from the list of arguments using the built-in functions of Excel. According to the calculations, , .

Then, the deviation of the minimum and maximum values from the average GRP growth rate was calculated for all constituent entities of the Russian Federation. The results showed that . Working in accordance with the methodology based on the constituent entities of the Russian Federation, we found that their GRP growth rate:

fell in the interval [0; 0.062]. This was attributed to the coefficient amounting to 1, i.e., the average level of contribution;

fell in the interval [−0.123; 0]. This was attributed to the coefficient of −0.5, i.e., the minimal contribution;

fell in the interval [0.062; 0,234]. This was attributed to the coefficient of 1.5, i.e., the maximum contribution.

Following that, the categories of the constituent entities of the Russian Federation were determined in accordance with the quality of TBFT’ performance of budgetary powers.

Thus, the level of contribution of TBFT to strategic development goals was calculated with consideration to the coefficients of growth of TBFT efficiency in the execution of budgetary powers and the module of the GRP growth coefficient of the corresponding constituent entity, adjusted for the coefficients of the quality of the execution of budgetary powers and the coefficient of the level of GRP growth rate. Given that the official website of the

Federal State Statistics Service (

n.d.) provided up-to-date information on the gross regional product for 2019 and earlier at the time of publication, the adjustment coefficients were calculated based on data for 2018–2019.

Within the framework of scientific research, this article proposes a system of control in the organizational structure of the Federal Treasury of the Russian Federation as a body of internal state financial control. Additionally, this study determines the relationships of the Treasury’s functional and professional areas at the federal, interregional, and territorial levels in the execution of its budgetary powers, focusing on the example of financial accounting and bookkeeping support through the coordination, accounting, control, and information functions (

Figure 1).

To assess the achievement of target indicators for the strategic goals of each projection of the balanced scorecard, analytical support and a process approach based on the phased implementation of the established goals are proposed (

Figure 2).

4. Results

The system of the interaction between functional and professional areas (execution of budgetary powers) presented in

Figure 2 presupposes both direct and indirect links; contributes to the development of a concept of the systemic management of accounting and analytical information, which serves as a basis for the extraction of data for the development of the system of control in organizing bookkeeping functions at different levels of Federal Treasury operations; and solves the main objectives of implementing an effective system of control, securing the targeted use of the budgetary funds of financial and economic activity of the economic entity, and achieving the effective execution of budgetary powers. The functional and professional areas of an economic entity interact through the functions of controlling: coordinating, accounting, control, and information. Let us give examples of interactions between types of support in functional and professional areas:

- −

Audit support. The department of internal financial control and audit interacts with other functional and professional areas through the control function, conducting audit activities to assess the reliability of internal financial control, the reliability of budget reporting, and the achievement of quality indicators of financial management.

- −

Accounting support. Accounting support interacts with other functional and professional areas through the accounting function, which coordinates the system of organizing accounting (financial), management, analytical reporting and planning information in the form of information, data, and indicators.

- −

Information support. The areas of privacy, security of information and the management of information infrastructure interact with other functional and professional areas through the information function, forming information channels for the management process, financial planning (budgeting), regulation, control, and management decision making.

- −

Personnel support. The areas of state civil service and personnel interact with other functional and professional areas through the coordination function by providing the economic entity with qualified personnel.

It should be noted here that the system of control is a link connecting the functional and professional areas of the operation of the Federal Treasury by means of the coordination, accounting, control, and information functions through the established balanced scorecard system, which provides for qualitative and quantitative assessment, the detection of the reasons of deviations, and the structural–logical analysis of the factors at play.

We suggest it would be expedient to introduce the system of control is expedient to be introduced, not only into the structure of the central apparatus of the Federal Treasury of the Russian Federation but also in its territorial bodies. The process of the introduction of controlling necessitates the use of the aggregate balanced scorecard system of TBFT as an instrument of controlling that provides effective managerial decisions aimed at achieving the established goals—the effective and targeted use of the budgetary funds of financial bodies and promotion of the economic activity of the economic entity. In turn, we advise that the aggregate balanced scorecard system be used for four projections: (1) The “State Finance” projection defines the aggregate indicator of the overall assessment of the effectiveness of the execution of expenditures for each TBFT, indicating the strategic goal of improving the efficiency and targeted use of budgetary funds. (2) The “Consumers” projection determines the indicator of the improvement of citizens’ welfare, focused on the strategic goal of achieving national goals and the goal of sustainable development through the efficient execution of budgetary powers. (3) Indicators of the “Processes” projection establish the need for the efficient performance of internal budgeting procedures to achieve the established goals of the TBFT. (4) The “Potential” projection is constructed based on the need to achieve performance indicators of budget authority through an effective system of employee motivation (KPI).

The proposed system represents the process of implementing the system of control in the TBFT, which presents “a direction of the methodology of the scientific study of controlling based on a set of interrelated and interacting processes of management and coordination of strategic planning, analysis, monitoring, informing, and internal control to improve the effectiveness of the state body and public organization”.

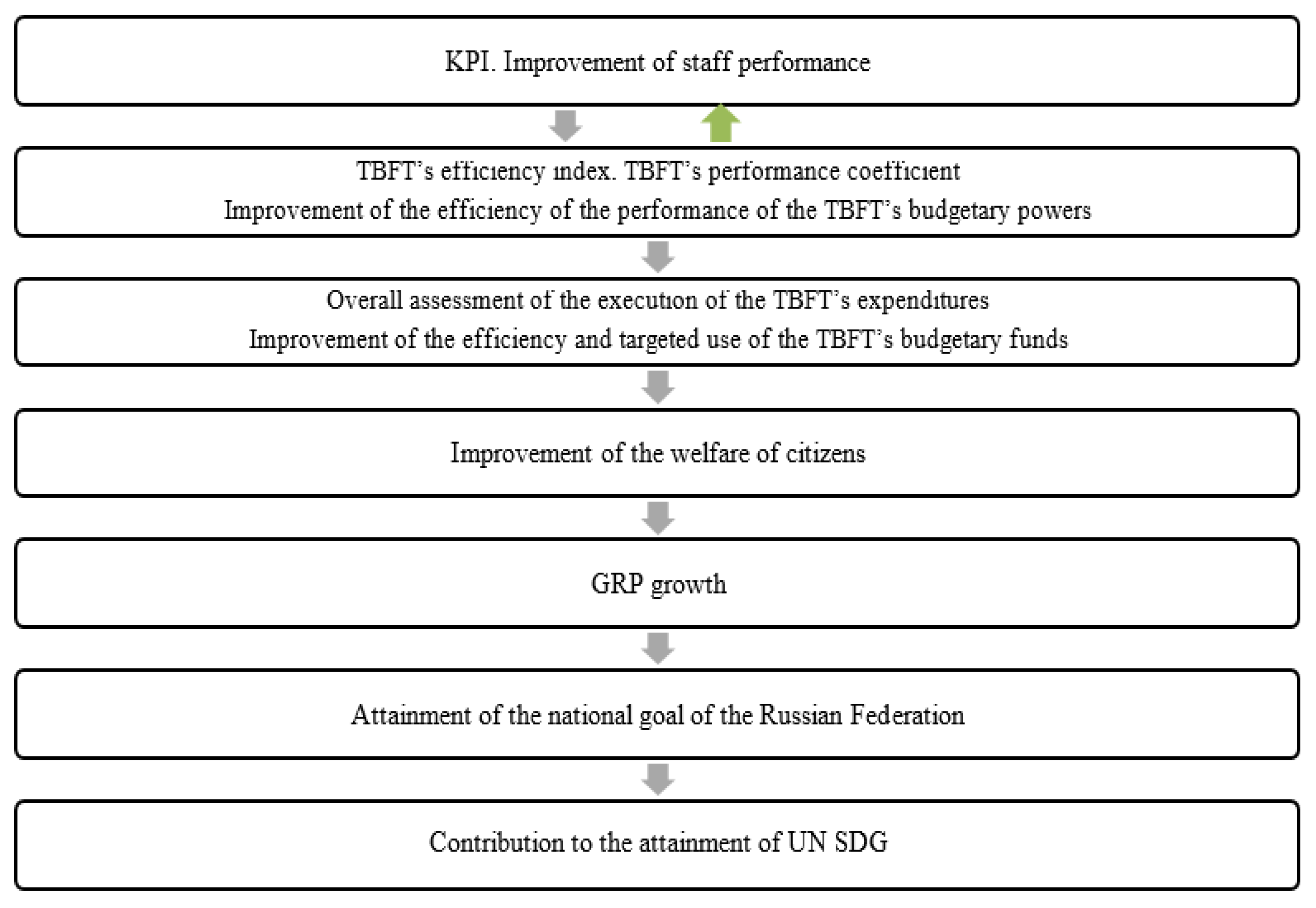

The process approach in controlling consists in the step-by-step implementation of the strategic goals of the Federal Treasury through an aggregate system of balanced indicators of its territorial bodies: (1) improvement of the performance of staff in the efficient execution of budgetary powers leads to the effective execution of expenditure in each TBFT; (2) effective execution of expenditure guarantees the effectiveness of executive authorities for the citizens, which leads to an increase in the welfare of citizens; (3) improvement of the welfare of citizens in the constituent entity of the Russian Federation is assessed through the value of gross regional product, the growth of which leads to the attainment of the national goal of the Russian Federation, namely, “making the Russian Federation one the world’s top five largest economies, ensuring economic growth rates above the world levels while maintaining macroeconomic stability, including inflation at a level no higher than 4 percent”; (4) attainment of the national goals of the Russian Federation contributes to achieving the global UN SDGs, specifically, “promoting sustained, inclusive and sustainable economic growth, full and productive employment and decent work for all”. To achieve these goals, we propose directions for assessing the recommended projections of the balanced scorecard system, which are shown in

Figure 3.

The calculation of the indicators presented in

Figure 3, proposed in the framework of the process approach (

Figure 2), is carried out according to the formulas given in

Table 1,

Table 2,

Table 3 and

Table 4 of the Methods section.

The methodology for calculating the contribution of the Federal Treasury body to the growth of the GDP of the Russian Federation, and, consequently, its contribution to the achievement of national goals and UN SDGs involves the calculation of aggregate, integral, and partial indicators for the strategic goals of each projection of the balanced scorecard. The logic of calculating the aggregate performance indicator for the projection “Public finance” (see the calculation mechanism in

Table 1) is associated with goal-setting for the controlling system—centered on the effective and targeted use of budgetary funds and the efficient execution of budgetary powers. In accordance with this, the object of assessment is the degree of optimality of the distribution of normative expenditures of the Federal Treasury between its territorial bodies in the context of functional and professional areas, as performed by the centers of financial responsibility (

Government of the Russian Federation 2004). The distribution of normative expenditures is carried out based on the needs of TBFT for resources for the effective execution of their budgetary powers and the achievement of established goals (

Federal Treasury n.d.).

The strategic goal in the “Consumers” projection is the improvement of the welfare of citizens of the Russian Federation. We argue that it is reasonable to calculate the contribution of TBFT to national goals and UN SDGs in this projection, considering the contribution of TBFT to the growth of GRP of the constituent entities of the Russian Federation (for the mechanism of calculation,

Table 2). In this, the calculation of the level of contribution made by TBFT uses the aggregate of the products of the coefficients of expenditure execution by the TBFT and the module of the GRP growth coefficient in the corresponding constituent entity of the Russian Federation, adjusted for the coefficient of the quality of execution of budgetary powers and the coefficient of GRP growth rate. Thus, the proposed mechanism implies a risk-oriented approach, which consists in the assessment of risks of not achieving strategic development goals as a result of the reduced quality of execution of budgetary powers.

To determine the adjustment coefficients, constituent entities of the Russian Federation are ranked by the level of the relative growth of GRP for the last two years, which is available for analysis on the official website of the Federal State Statistics Service (maximum contribution, average contribution, minimal contribution), as well as by the level of risk of decrease in the quality of execution of budgetary powers (high, medium, low). These criteria are in accordance with the analytical report on the results of the Federal Treasury’s analysis of the execution of budgetary powers by state (municipal) financial control bodies acting as executive authorities of the constituent entities of the Russian Federation (local administrations), which was approved by Order of the Ministry of Finance of Russia No. 263n of 31 December 2019. The results of the ranking of the constituent entities of the Russian Federation on the basis of the level of relative GRP growth, compiled to assign an adjustment coefficient, are presented in

Table A1 (see

Appendix A).

Table A1 is auxiliary and is necessary for calculating the adjustment coefficients (

Table 2), the calculation of which is provided for by the methodology recommended in the study for assessing the level of contribution of TBFT to the growth of GRP in the constituent entities of the Russian Federation.

Let us determine the smallest and largest value of the growth rate from the list of results. According to the calculations, , . Let us determine the deviation of the minimum and maximum values from the average growth rate of GRP for all subjects of the Russian Federation, where . According to the methodology of the subject of the Russian Federation, the growth rate:

is included in the interval (0; 0.062]—a coefficient of 1 is assigned, i.e., the average level of contribution (quality) is determined;

is included in the interval [−0.123; 0]—a coefficient of 0.5 is assigned, i.e., the lowest level of contribution (quality) is determined;

is included in the interval (0.062; 0.234]—a coefficient of 1.5 is assigned, i.e., the highest level of contribution (quality) is determined.

Thus, in the process of calculating the aggregate indicator of the contribution of TBFTs to the growth of the GDP of the Russian Federation, and, accordingly, their contribution to UN SDGs, calculated values of each TBFT are adjusted considering the coefficients characterizing the level of development and economic potential of the region, as well as the risk of a decrease in the quality of execution of budgetary powers. The proposed methodology, being a fundamentally new mechanism, makes it possible to evaluate the contribution of each TBFT to the achievement of national goals and UN SDGs and provides for the possibility of identifying the risks of failure to achieve strategic goals in relation to the quality of execution of budgetary powers by each TBFT.

5. Discussion

Analysis of data in

Table A1 suggests the need for a differentiated approach to assessing the performance of TBFTs in terms of determining their contribution to the country’s GDP and estimating the risk of the non-performance (insufficient performance) of their budgetary powers.

The results confirm the views of modern researchers on the feasibility of applying the principles and tools of controlling in the public sector. This thesis is confirmed by the results of the study

Garcia-Sanchez and Cuadrado-Ballesteros (

2016), who associate the use of new tools of public finance management with an increase in the efficiency of their use. In our study of the issues of improving the efficiency and performance of the Federal Treasury of Russia, we conclude the need to introduce controlling mechanisms in the entire organizational structure of the control body, which includes 89 TBFTs.

The proposed mechanism for calculating the indicators on the “Processes” projection allows for the assessment of the efficiency and performance in the use of budgetary funds by the functional and professional areas of operation of the TBFT in the execution of their budgetary powers. The results of our research into the application of the indicator of the motivational mechanism for TBFT employees based on the KPI system solve the issue of incentives for civil servants.

The obtained results advance the research of several scholars who devoted their studies to the issues of the introduction and development of RM in the public sector.

Bracci et al. (

2022) examined RM in the public sector as a “black box”, stressing the lack of theoretical research in this sphere. The authors identified efficiency management as the key direction of RM in the public sector.

Rana et al. (

2019) also called for further study of the problems of RM in the public sector and emphasized the need to motivate managers to implement cutting-edge practices and encourage relevant changes. The proposed methodology solves the problem of methodological support for assessing not only the efficiency but also the performance of a public organization, as well as the application of the motivational mechanisms of the KPI system, considering the risk-based approach.

As a research opportunity, we propose applying adjustment coefficients that allow for the assessment of the risks of not achieving strategic indicators based on the high, average, or low quality of the execution of budgetary powers.

Thus, there is so far no officially established method for assessing the effectiveness of territorial control bodies in achieving the goals of sustainable development at both the national and international levels. This supports the high relevance of the results of this study. The conducted analysis of empirical research on the investigated problem has made it possible to identify major trends and promising areas, as well as to develop a methodology for assessing the contribution of the TBFT to achieving the strategic development goals based on process and risk-oriented approaches.

6. Conclusions

To summarize the conducted research, the following main results need to be outlined. To evaluate the effectiveness of the implementation of controlling, the target indicators of the operation of control bodies need to be achieved. In this respect, the mechanism of controlling must focus on analyzing the achieved performance indicators in order to attain national goals and the UN SDGs.

The departmental program of the Ministry of Finance implemented in the Russian Federation on the introduction of electronic SMART control (controlling) of public finances is aimed at assessing and improving the quality of management decisions in the public administration sector. The introduction of the controlling system, as a new form of the management process, will be carried out not only in the organizational structure of the central office of the Federal Treasury, but also in its territorial bodies. In this regard, the issues of methodology for assessing the effectiveness of the TBFT and the contribution of each of them to the achievement of national goals and the SDGs are being updated. The method proposed in the work allows for solving this problem.

The method of calculating the contribution of TBFT to national goals and UN SDGs relies on process and risk-based approaches. The process approach presupposes the stage-by-stage implementation of the goals of the Federal Treasury and includes the following stages: an overall assessment of the effectiveness of the execution of expenditures of the TBFT’s budget; determination of the GRP growth rate of the Russian Federation in the macroeconomic environment; calculation of the efficiency and performance indicators of activities in the functional and professional areas for the reporting period; and calculation of the indicator of the performance of the government employees of TBFT based on the motivational mechanism of the KPI system. The process approach allows for the assessment of the contribution of each TBFT to the achievement of strategic development goals as it is based on a system of indicators that characterize not only the quality of execution of budgetary powers, but also the level of development and economic potential of the region. The proposed mechanism for ranking the subjects of the Russian Federation according to the level of relative growth in the gross regional product and the indicators for evaluating the efficiency of budget expenditures by responsibility centers in the functional and professional spheres make it possible to consider macroeconomic parameters and the contribution of each TBFT to the achievement of target indicators.

The risk-based approach makes it possible to assess the risks of not achieving the national goals and the UN SDGs. We propose to use adjusting coefficients as tools to assess the risks of failure to achieve strategic indicators in accordance with the high, medium, or low quality of execution of budgetary powers.

We consider the hypothesis proposed in the present study to be confirmed and believe that the mechanism presented in the paper will allow the Federal Treasury, as a federal executive body, to use the provided practical recommendations in evaluating the contribution of its territorial bodies to national goals and UN SDGs.

The limitations of the study are that the balanced scorecard system was built in accordance with the strategic goals of the Federal Treasury, the national goals of the Russian Federation, and the UN SDGs. The results of the study may become a basis for further scientific inquiry in the sphere of implementation and development of a controlling system in the public sector, as well as in expanding the risk-oriented approach to assessing the performance of TBFT. A promising direction for future research is the introduction of the recommended methodology into the ongoing departmental project “Electronic SMART control (controlling) and public finance accounting for management decisions”, implemented by the Ministry of Finance of the Russian Federation.

A limitation of the study is the lack of a unified digital environment to allow for the consolidation of accounting and reporting information for all TBFTs with macroeconomic indicators of the GRP of the corresponding territories.

7. Managerial Implication

The conducted research provides substantiation for the use of a risk-oriented approach in assessing the performance of TBFT of the Russian Federation. A process approach to achieving the strategic goals of the balanced scorecard is proposed. Finally, the study offers a mechanism for a comprehensive assessment of the performance of the Federal Treasury and its territorial bodies in functional and professional areas based on the quantitative and qualitative evaluation of the execution of expenditures of the budgets of responsibility centers in the functional and professional spheres.

The mechanism of control presented in the study allows the Federal Treasury, as a federal executive body, to use the provided practical recommendations on the development of a controlling system and the method for assessing the efficiency of budget expenditures via responsibility centers in the functional and professional spheres. The latter method presupposes the calculation of a set of indicators: the coefficient of execution of budget expenditures; overall assessment of the performance of the responsibility center; assessment of the efficiency of execution of budget expenditures; overall assessment of the effectiveness of the execution of budget expenditures; and a methodology for the comprehensive assessment of the effectiveness of the introduction of the controlling system into the activities of the Federal Treasury, its structural units (functional and professional areas), and the performance of each employee (through the KPI system).

8. Practical/Social Implications

To improve the efficiency of the state financial control system, the target indicators of the supervisory bodies must be achieved. In this context, the mechanism of control needs to be oriented towards the analysis of the performance indicators met to achieve the national goals and the goals of sustainable development. The results of the study prove the need for a risk-based process approach to assessing the operation of TBFT and their contribution to the growth of the country’s GDP through the assessment of the effectiveness of the execution of budgetary powers. Improved efficiency in the execution of budgetary powers leads to the effective execution of state expenditures, which guarantees the effectiveness of the executive branch and the welfare of Russian citizens. An improvement in citizens’ welfare will lead to the attainment of the national development goal of the Russian Federation, specifically “to make the Russian Federation one the world’s top five largest economies, ensure economic growth rates above the world levels while maintaining macroeconomic stability, including inflation at a level no higher than 4 percent”. In turn, the realization of Russia’s national goals will contribute to the achievement of the UN global SDGs, namely: Goal 8, “Decent work and economic growth”; Goal 10, “Reduced inequality”; and Goal 11, “Sustainable cities and communities”.