Market Reaction to Delisting Announcements in Frontier Markets: Evidence from the Vietnam Stock Market

Abstract

:1. Introduction

2. The Literature Review

3. Overview of the Vietnam Stock Market and Regulations on Delisting in Vietnam

- -

- The listed firm is canceled with the notification of the State Securities Commission (SSC) of Vietnam;

- -

- The listed firm suspends its main production and business activities for at least one year;

- -

- The listed firm has its registration certificate or operational license revoked;

- -

- The listed firm’s shares are not traded on a stock exchange for one year;

- -

- The firm’s stocks are not publicly traded within 90 days from the date that a listing is approved for trading by a stock exchange;

- -

- The listed firm in three consecutive years incurs losses, or total accumulated losses exceed the contributed charter capital, or the firm has negative equity in the latest audited annual;

- -

- The listed firm ceases to exist due to a reorganization, bankruptcy, or dissolution;

- -

- The auditing company refuses to perform an audit or to provide an opinion on the latest annual financial statements for the firm or to have an exceptional opinion regarding the annual financial statements for three consecutive years;

- -

- The listed firm has violated the deadline for annual financial statements submission for three consecutive years;

- -

- The SSC or the stock exchange determines that the listed firm used fraudulent documents in the application for listing;

- -

- The listed firm’s main business lines are suspended or banned;

- -

- The listed firm does not fulfill the listing requirements due to a merger, split, or other restructuring of firms;

- -

- The listed company violates the obligation of information disclosure or fails to successfully complete the firm’s financial obligations to the stock exchange.

4. Data and Methodology

4.1. Data

4.2. Research Methodology

5. Empirical Results

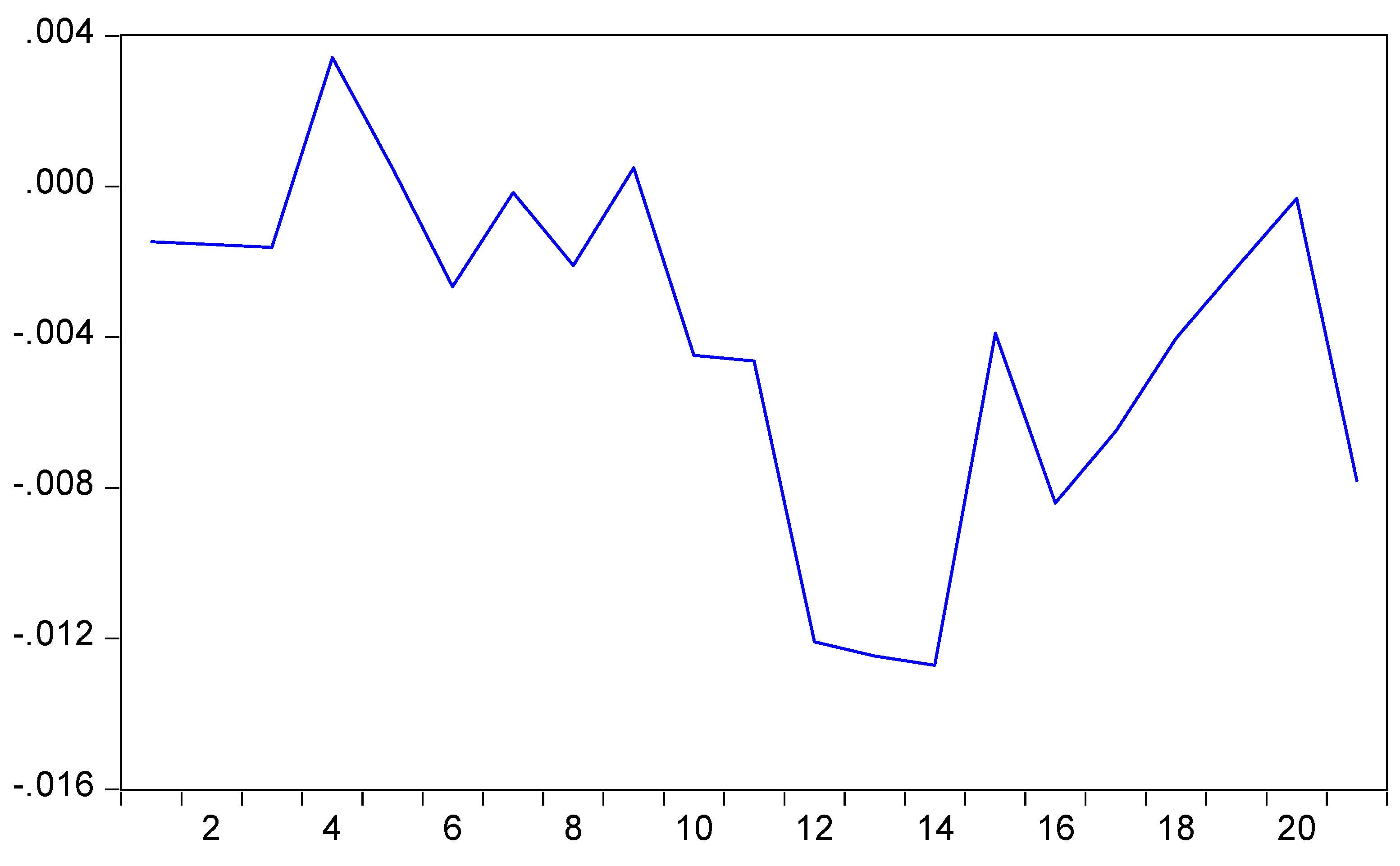

5.1. Descriptive Statistics of AR of Delisted Stocks

5.2. The Effects of the Delisting Announcement on Stock Returns

6. Conclusions

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

References

- Chandy, P. R., Salil K. Sarkar, and Niranjan Tripathy. 2004. Empirical evidence on the effects of delisting from the national market system. Journal of Economics and Finance 28: 46–55. [Google Scholar] [CrossRef]

- Eisdorfer, Assaf. 2008. Delisted firms and momentum profits. Journal of Financial Markets 11: 160–79. [Google Scholar] [CrossRef]

- Fama, Eugene F., and Kenneth R. French. 1993. Common risk factors in the returns on stocks and bonds. Journal of Financial Economics 33: 3–56. [Google Scholar] [CrossRef]

- Fidanza, Barbara. 2022. Common stock delisting: An empirical analysis of firms performance. International Business Research 15: 50–64. [Google Scholar] [CrossRef]

- Huynh, Thanh D., and Daniel R. Smith. 2017. Delisted stocks and momentum: Evidence from a new Australian dataset. Australian Journal of Management 42: 140–60. [Google Scholar] [CrossRef]

- Li, Mingsheng, Karen Liu, and Xiaorui Zhu. 2024. The effects of NASDAQ delisting on firm performance. Research in International Business and Finance 67: 102101. [Google Scholar] [CrossRef]

- Liu, Shinhua, and John D. Stow. 2005. The shareholder wealth effects of voluntary foreign delistings: An empirical analysis. Applied Financial Economics Letters 1: 199–204. [Google Scholar] [CrossRef]

- Loureiro, Gilberto, and Sónia Silva. 2020. The impact of cross-delisting from the US on firms’ financial constraints. Journal of Business Research 108: 132–46. [Google Scholar] [CrossRef]

- Loureiro, Gilberto, and Sónia Silva. 2022. Earnings management and stock price crashes post US cross-delistings. International Review of Financial Analysis 82: 1–17. [Google Scholar] [CrossRef]

- Macey, Jonathan, Maureen O’Hara, and David Pompilio. 2008. Down and out in the stock market: The law and economics of the delisting process. Journal of Law and Economics 51: 683–713. [Google Scholar] [CrossRef]

- Meera, Ahamed Kameel, Niranjan Tripathy, and Michael R. Redfearn. 2000. Wealth and liquidity effects of stock delistings: Empirical evidence from the stock exchanges of Singapore and Malaysia. Applied Financial Economics 10: 199–206. [Google Scholar] [CrossRef]

- Nguyen, Anh Thi Kim, Loc Dong Truong, and H. Swint Friday. 2022. Expiration-day effects of index futures in a frontier market: The case of Ho Chi Minh Stock Exchange. International Journal of Financial Studies 10: 3. [Google Scholar] [CrossRef]

- Park, Jinwoo, Kengo Shiroshita, Naili Sun, and Yun W. Park. 2018. Involuntary delisting in the Japanese stock market. Managerial Finance 44: 1155–71. [Google Scholar] [CrossRef]

- Park, Jinwoo, Posang Lee, and Yun W. Park. 2014. Information effect of involuntary delisting and informed trading. Pacific-Basin Finance Journal 30: 251–69. [Google Scholar] [CrossRef]

- Pfister, Matthias, and Rico von Wyss. 2010. Delistings of secondary listings: Price and volume effects. Financial Markets and Portfolio Management 24: 395–418. [Google Scholar] [CrossRef]

- Pour, Eilnaz Kashefi, and Meziane Lasfer. 2013. Why do companies delist voluntarily from the stock market? Journal of Banking & Finance 37: 4850–60. [Google Scholar] [CrossRef]

- Rogova, Elena, and Maria Belousova. 2021. Testing market reaction on stock market delisting in Russia. Journal of Corporate Finance Research 15: 14–27. [Google Scholar] [CrossRef]

- Sanger, Gary C., and James D. Peterson. 1990. An empirical analysis of common stock delistings. The Journal of Financial and Quantitative Analysis 25: 261–72. [Google Scholar] [CrossRef]

- Shumway, Tyler. 1997. The delisting bias in CRSP data. The Journal of Finance 52: 327–40. [Google Scholar] [CrossRef]

- Shumway, T., and V. A. Warther. 1999. The delisting bias in CRSP’s NASDAQ data and its implications for the size effect. The Journal of Finance 54: 2361–79. [Google Scholar] [CrossRef]

- Sun, Qian, Yuen-Kin Tang, and Wilson H. S. Tong. 2002. The impacts of mass delisting: Evidence from Singapore and Malaysia. Pacific-Basin Finance Journal 10: 333–51. [Google Scholar] [CrossRef]

- Truong, Loc Dong, Ger Lanjouw, and Robert Lensink. 2006. The impact of privatization on firm performance in a transition economy: The case of Vietnam. Economics of Transition 14: 349–89. [Google Scholar] [CrossRef]

- Truong, Loc Dong, Giang Ngan Cao, H. Swint Friday, and Nhien Tuyet Doan. 2023. Overreaction in a Frontier Market: Evidence from the Ho Chi Minh Stock Exchange. International Journal of Financial Studies 11: 58. [Google Scholar] [CrossRef]

- Truong, Loc Dong, Thai Xuan Le, and H. Swint Friday. 2022. The influence of information transparency and disclosure on the value of listed companies: Evidence from Vietnam. Journal of Risk and Financial Management 15: 345. [Google Scholar] [CrossRef]

- You, Leyuan, Ali M. Parhizgari, and Suresh Srivastava. 2012. Cross-listing and subsequent delisting in foreign markets. Journal of Empirical Finance 19: 200–16. [Google Scholar] [CrossRef]

| Trading Days | Observations | Minimum | Mean | Maximum | Standard Deviation |

|---|---|---|---|---|---|

| Pre-delisting announcement | |||||

| T − 10 | 118 | −0.0505 | −0.0015 | 0.0354 | 0.0158 |

| T − 9 | 118 | −0.0482 | −0.0015 | 0.0414 | 0.0176 |

| T − 8 | 118 | −0.0958 | −0.0016 | 0.0543 | 0.0200 |

| T − 7 | 118 | −0.0606 | 0.0034 | 0.0522 | 0.0173 |

| T − 6 | 118 | −0.0516 | 0.0005 | 0.0534 | 0.0186 |

| T − 5 | 118 | −0.0545 | −0.0027 | 0.0527 | 0.0208 |

| T − 4 | 118 | −0.0452 | −0.0002 | 0.0506 | 0.0186 |

| T − 3 | 118 | −0.1283 | −0.0021 | 0.0654 | 0.0216 |

| T − 2 | 118 | −0.0631 | −0.0005 | 0.0387 | 0.0176 |

| T − 1 | 118 | −0.0507 | −0.0045 | 0.0427 | 0.0164 |

| T0 | 118 | −0.0581 | −0.0046 | 0.0327 | 0.0188 |

| Post-delisting announcement | |||||

| T + 1 | 118 | −0.1069 | −0.0121 | 0.0401 | 0.0227 |

| T + 2 | 118 | −0.0785 | −0.0128 | 0.0815 | 0.0236 |

| T + 3 | 118 | −0.1759 | −0.0134 | 0.0634 | 0.0268 |

| T + 4 | 118 | −0.0547 | −0.0043 | 0.1381 | 0.0309 |

| T + 5 | 118 | −0.0592 | −0.0094 | 0.0632 | 0.0236 |

| T + 6 | 118 | −0.0915 | −0.0074 | 0.0447 | 0.0250 |

| T + 7 | 118 | −0.0796 | −0.0047 | 0.1729 | 0.0339 |

| T + 8 | 118 | −0.0610 | −0.0026 | 0.0603 | 0.0237 |

| T + 9 | 118 | −0.0467 | −0.0004 | 0.1053 | 0.0284 |

| T + 10 | 118 | −0.0787 | −0.0095 | 0.0598 | 0.0256 |

| Periods | Observations | Minimum | Mean | Maximum | Standard Deviation |

|---|---|---|---|---|---|

| Pre-delisting announcement periods | |||||

| [−1, −2] | 118 | −0.0746 | −0.0028 | 0.0685 | 0.0195 |

| [−1, −3] | 118 | −0.0731 | −0.0032 | 0.0562 | 0.0157 |

| [−1, −4] | 118 | −0.0733 | −0.0027 | 0.0414 | 0.0149 |

| [−1, −5] | 118 | −0.0586 | −0.0030 | 0.0395 | 0.0135 |

| [−1, −6] | 118 | −0.0523 | −0.0022 | 0.0442 | 0.0123 |

| [−1, −7] | 118 | −0.0536 | −0.0012 | 0.0477 | 0.0118 |

| [−1, −8] | 118 | −0.0549 | −0.0013 | 0.0491 | 0.0110 |

| [−1, −9] | 118 | −0.0425 | −0.0011 | 0.0518 | 0.0103 |

| [−1, −10] | 118 | −0.0340 | −0.0010 | 0.0537 | 0.0102 |

| Post-delisting announcement periods | |||||

| [+1, +2] | 118 | −0.0728 | −0.0123 | 0.0312 | 0.0181 |

| [+1, +3] | 118 | −0.0804 | −0.0124 | 0.0267 | 0.0162 |

| [+1, +4] | 118 | −0.0453 | −0.0103 | 0.0338 | 0.0144 |

| [+1, +5] | 118 | −0.0478 | −0.0099 | 0.0341 | 0.0140 |

| [+1, +6] | 118 | −0.0413 | −0.0093 | 0.0339 | 0.0132 |

| [+1, +7] | 118 | −0.0468 | −0.0086 | 0.0348 | 0.0129 |

| [+1, +8] | 118 | −0.0413 | −0.0078 | 0.0371 | 0.0122 |

| [+1, +9] | 118 | −0.0311 | −0.0070 | 0.0355 | 0.0113 |

| [+1, +10] | 118 | −0.0342 | −0.0070 | 0.0319 | 0.0110 |

| Trading Day | Observations | Mean (Median) | Trading Days | Mean (Median) | Differences in Mean (Median) between Two Trading Days | t-Statistic for Difference in Mean between Two Trading Days | z-Statistic for Difference in Median between Two Trading Days |

|---|---|---|---|---|---|---|---|

| T − 1 | 118 | −0.0045 (−0.0013) | T + 1 | −0.0121 *** (−0.0048) | −0.0076 (−0.0035) | 2.95 *** | 2.62 *** |

| T − 1 | 118 | −0.0045 (−0.0013) | T + 2 | −0.0128 *** (−0.0090) | −0.0083 (−0.0077) | 3.13 *** | 3.76 *** |

| T − 1 | 118 | −0.0045 (−0.0013) | T + 3 | −0.0134 *** (−0.0080) | −0.0089 (−0.0067) | 3.06 *** | 3.31 *** |

| T − 1 | 118 | −0.0045 (−0.0013) | T + 4 | −0.0043 (−0.0034) | 0.0002 (−0.0021) | 0.07 | 1.29 |

| T − 1 | 118 | −0.0045 (−0.0013) | T + 5 | −0.0094 *** (−0.0064) | −0.0049 (−0.0051) | 1.84 | 2.26 ** |

| T − 1 | 118 | −0.0045 (−0.0013) | T + 6 | −0.0074 *** (−0.0059) | −0.0029 (−0.0046) | 1.05 | 1.66 |

| T − 1 | 118 | −0.0045 (−0.0013) | T + 7 | −0.0047 (−0.0027) | −0.0002 (−0.0014) | 0.06 | 0.94 |

| T − 1 | 118 | −0.0045 (−0.0013) | T + 8 | −0.0026 (−0.0003) | 0.0019 (0.0010) | 0.70 | 0.77 |

| T − 1 | 118 | −0.0045 (−0.0013) | T + 9 | −0.0004 (−0.0014) | 0.0041 (−0.0001) | 1.32 | 0.26 |

| T − 1 | 118 | −0.0045 (−0.0013) | T + 10 | −0.0095 *** (−0.0040) | −0.0050 (−0.0027) | 1.74 | 1.75 |

| Pre-Delisting Periods | Observations | Mean (Median) | Post-Delisting Periods | Mean (Median) | Differences in Mean (Median) between Two Periods | t-Statistic for Difference in Mean between Two Periods | z-Statistic for Difference in Median between Two Periods |

|---|---|---|---|---|---|---|---|

| [−1, −2] | 118 | −0.0028 (−0.0002) | [+1, +2] | −0.0123 ** (−0.0101) | −0.0095 (−0.0099) | −3.86 *** | 4.57 *** |

| [−1, −3] | 118 | −0.0032 ** (−0.0013) | [+1, +3] | −0.0124 *** (−0.0115) | −0.0092 (−0.0102) | −4.43 *** | 4.84 *** |

| [−1, −4] | 118 | −0.0027 * (−0.0013) | [+1, +4] | −0.0103 *** (−0.0094) | −0.0076 (−0.0081) | −3.99 *** | 4.53 *** |

| [−1, −5] | 118 | −0.0030 ** (−0.0016) | [+1, +5] | −0.0099 *** (−0.0089) | −0.0069 (−0.0073) | −3.84 *** | 4.20 *** |

| [−1, −6] | 118 | −0.0022 * (−0.0009) | [+1, +6] | −0.0093 *** (−0.0069) | −0.0071 (−0.0060) | −4.33 *** | 4.72 *** |

| [−1, −7] | 118 | −0.0012 (−0.0007) | [+1, +7] | −0.0086 *** (−0.0070) | −0.0074 (−0.0063) | −4.59 *** | 4.93 *** |

| [−1, −8] | 118 | −0.0013 (−0.0006) | [+1, +8] | −0.0078 *** (−0.0060) | −0.0065 (−0.0054) | −4.31 *** | 4.78 *** |

| [−1, −9] | 118 | −0.0011 (−0.0009) | [+1, +9] | −0.0070 *** (−0.0048) | −0.0059 (−0.0039) | −4.16 *** | 4.26 *** |

| [−1, −10] | 118 | −0.0010 (−0.0009) | [+1, +10] | −0.0070 *** (−0.0053) | −0.0060 (−0.0044) | −4.34 *** | 4.20 *** |

| Bigger Firms | Smaller Firms | Differences in Mean (Median) between Two Groups | t-Statistic (z-Statistic) for Difference in Mean (Median) between Two Groups | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| Pre-Delisting Periods | Mean (Median) | Post-Delisting Periods | Mean (Median) | Differences in Mean (Median) between Two Periods | Pre-Delisting Periods | Mean (Median) | Post-Delisting Periods | Mean (Median) | Differences in Mean (Median) between Two Periods | ||

| [−1] | −0.0067 (−0.0016) | [+1] | −0.0066 (−0.0004) | 0.0001 (0.0012) | [−1] | −0.0058 (−0.0022) | [+1] | −0.0176 (−0.0127) | −0.0118 (−0.0105) | 0.0119 (0.0093) | 1.97 * (1.91) * |

| [−1, −2] | −0.0033 (−0.0014) | [+1, +2] | −0.0061 (−0.0031) | −0.0028 (−0.0017) | [−1, −2] | −0.0022 (0.0020) | [+1, +2] | −0.0184 (−0.0177) | −0.0162 (−0.0157) | 0.0134 (0.0140) | 3.05 *** (3.12) *** |

| [−1 −3] | −0.0030 (−0.0013) | [+1, +3] | −0.0063 (−0.0030) | −0.0033 (−0.0017) | [−1, −3] | −0.0034 (−0.0010) | [+1, +3] | −0.0185 (−0.0185) | −0.0151 (−0.0175) | 0.0118 (0.0158) | 3.09 *** (3.58) *** |

| [−1, −4] | −0.0013 (−0.0016) | [+1, +4] | −0.0041 (−0.0038) | −0.0028 (−0.0022) | [−1, −4] | −0.0040 (−0.0006) | [+1, +4] | −0.0165 (−0.0174) | −0.0125 (−0.0168) | 0.0097 (0.0146) | 2.77 *** (3.02) *** |

| [−1, −5] | −0.0014 (−0.0017) | [+1, +5] | −0.0043 (−0.0027) | −0.0029 (−0.0010) | [−1, −5] | −0.0046 (−0.0013) | [+1, +5] | −0.0155 (−0.0169) | −0.0109 (−0.0156) | 0.0080 (0.0146) | 2.37 ** (2.66) *** |

| [−1, −6] | −0.0004 (−0.0011) | [+1, +6] | −0.0043 (−0.0035) | −0.0039 (−0.0024) | [−1, −6] | −0.0040 (−0.0008) | [+1, +6] | −0.0144 (−0.0161) | −0.0104 (−0.0153) | 0.0065 (0.0129) | 2.17 ** (2.60) *** |

| [−1, −7] | 0.0010 (−0.0008) | [+1, +7] | −0.0033 (−0.0022) | −0.0043 (−0.0014) | [−1, −7] | −0.0034 (−0.0006) | [+1, +7] | −0.0139 (−0.0131) | −0.0105 (−0.0125) | 0.0062 (0.0111) | 2.11 ** (2.27) ** |

| [−1, −8] | 0.0005 (−0.0001) | [+1, +8] | −0.0029 (−0.0026) | −0.0034 (−0.0025) | [−1, −8] | −0.0030 (−0.0012) | [+1, +8] | −0.0127 (−0.0118) | −0.0097 (−0.0106) | 0.0063 (0.0081) | 2.21 ** (2.83) *** |

| [−1, −9] | 0.0009 (−0.0004) | [+1, +9] | −0.0024 (−0.0013) | −0.0033 (−0.0009) | [−1, −9] | −0.0031 (−0.0021) | [+1, +9] | −0.0115 (−0.0133) | −0.0084 (−0.0112) | 0.0051 (0.0103) | 1.92 * (2.68) *** |

| [−1, −10] | 0.0009 (−0.0007) | [+1, +10] | −0.0025 (−0.0013) | −0.0034 (−0.0006) | [−1, −10] | −0.0029 (−0.0022) | [+1, +10] | −0.0116 (−0.0105) | −0.0088 (−0.0083) | 0.0054 (0.0077) | 1.97 * (2.71) *** |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2023 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Truong, L.D.; Friday, H.S.; Ngo, T.M. Market Reaction to Delisting Announcements in Frontier Markets: Evidence from the Vietnam Stock Market. Risks 2023, 11, 201. https://doi.org/10.3390/risks11110201

Truong LD, Friday HS, Ngo TM. Market Reaction to Delisting Announcements in Frontier Markets: Evidence from the Vietnam Stock Market. Risks. 2023; 11(11):201. https://doi.org/10.3390/risks11110201

Chicago/Turabian StyleTruong, Loc Dong, H. Swint Friday, and Tran My Ngo. 2023. "Market Reaction to Delisting Announcements in Frontier Markets: Evidence from the Vietnam Stock Market" Risks 11, no. 11: 201. https://doi.org/10.3390/risks11110201

APA StyleTruong, L. D., Friday, H. S., & Ngo, T. M. (2023). Market Reaction to Delisting Announcements in Frontier Markets: Evidence from the Vietnam Stock Market. Risks, 11(11), 201. https://doi.org/10.3390/risks11110201