Abstract

The development of cloud technologies enables companies to actively implement technologies for cost management and risk reduction in their financial and economic activities. The use of cloud-based models of risk management in the financial and economic activities of the enterprise will help small and medium-sized companies in the agro-industrial sector in Russia to make structural and strategic changes, as well as discover new opportunities for business expansion. The purpose of the study is to develop models for cost management and reduction of risks in the financial and economic activities of companies based on the OLAP technology for application in Russian agro-industrial enterprises. The study employs a qualitative approach based on the case study methodology. The paper discloses and substantiates the authors’ conceptual model of a cost management system that allows executives to make decisions proceeding from four types of cost prices. The distinguishing feature of the management system is the use of a digital twin, which makes it possible to manage risks at the early stages of decision-making. The application of OLAP systems improves the quality of analysis and visualization methods as part of the cost management system. In addition, the study provides practical insight into how the applied model will help small and medium-sized agro-industrial enterprises to develop different business vision strategies based on cost reduction, manage the level of risk at the early stages of decision-making, and analyze information from a geographically dispersed logistics chain of divisions (production facilities, warehouses, stores).

1. Introduction

In the current economic conditions, Russian agro-industrial production is experiencing challenges in its development (Kashkovskii et al. 2019; Smartconsult 2022). This situation is caused by the delay in the development of its methodological and conceptual apparatus (Nardin and Nardina 2021), which is associated with the lack of efficiency in the organization of economic systems (Dokholyan et al. 2022), accounting and analytical support of management processes (Ordynskaya et al. 2021), and the construction of an optimal cost management system (Gladilina et al. 2022) that would make managers able to promptly respond to the changes in costs and manage them so as to achieve a financial maximum from production activities.

The growth of agricultural production in all countries and regions stems largely from the continuous increase in the cost of natural and material, and technical resources (Gerasimova et al. 2019). Material and technical resources for the development of agriculture are extremely limited, particularly in Russia (Nasonov 2018). While in 2021, according to statistics, global food prices rose at the highest rate in the last 10 years (FAO 2021), in 2022, the costs of producing and processing agricultural products climbed even further and had a significant impact on global food inflation (FAO 2022). For instance, the net revenue of the largest representative of the agro-industrial sector in Russia grew by 21%, EBITDA marginally increased by 1 point, and revenue growth was compensated by a corresponding increase in costs (Rusagro 2022). Rising food prices affect the world’s economic food security, threatening social instability in transitional economies (Gushchina and Babkina 2020). To reduce costs and manage risks, the executives of agro-industrial companies have to improve the efficiency of management by virtue of original methods and models supporting managerial decision-making focused on reducing costs. The novelty of our work lies in the description of the possibility of applying the cost management model. This model allows one to quickly, with the least effort from the company’s personnel, analyze (before making managerial decisions) and reduce the risks of the organization’s financial and economic activity using various formalized and non-formalized methods, bringing all information related to risks to each employee whose functional duties are related to decision-making. As the practice of work in the agro-industrial sector in Russia shows, due to the restrictions caused by the spread of COVID-19 and the special military operation in Ukraine, it is difficult for small and medium-sized enterprises to make informed decisions in the face of uncertainty. The lack of tools does not allow for quick adaptation, which leads to a disruption in the supply chain, increased costs, and reduced sales.

The purpose of the article is to propose a model using modern digital technologies for cost management and risk reduction in the financial and economic activities of small and medium-sized companies in the agricultural industry. Within the framework of Russian legislation, medium-sized enterprises include those in which the number of employees is from 101 to 150 people. Small businesses are those with up to 100 employees. The Government of Russia annually changes the allowable amount of proceeds from the sale of goods and services, which makes it possible to classify such enterprises as small or medium-sized (Federal Law 2007). In Russia, in contrast to international practice, small and medium-sized enterprises do not work in conjunction with large agro-industrial enterprises. Small and medium-sized agro-industrial formations almost completely perform all production, service, and other functions themselves, which is not always cost-effective and profitable (Voronin 2008). Of course, it is possible to independently develop a model and design software based on it that solves complex applied problems and implement it into the practice of small and medium-sized enterprises is only possible for large stakeholders (for example, companies with state participation that are interested in the development of the agro-industrial market). In this article, we have tried to answer the following research questions: (1) Which conceptual cost management model should be applied, and how should it be implemented? (2) What result can be achieved as a result of applying the model to reduce the level of costs and risks in the activities of enterprises in the agricultural industry?

In order to answer these questions, the study employs the qualitative approach relying on the case study methodology (Ciasullo et al. 2022). Given that Russia is a country that occupies large territories with a diverse climate and complicated logistics, we limit ourselves to studying one agro-industrial enterprise in the Moscow region. An important prerequisite for this study was the executives’ understanding of the need to implement cost management systems to establish coordination and improve the efficiency of decision-making within the company and develop a geographically diverse supply chain between suppliers, structural divisions of companies, partners, and consumers, as was necessary for us in developing our conceptual model.

Our conclusions disclose the potential for the application of the model of cost management with the use of cloud technologies and digital twins. Our data complement the existing literature based on the developed conceptual model of cost management. In particular, the model of cost management and risk reduction in the operation of an enterprise constitutes a mechanism (instrument) that allows obtaining information with different cost accounting methods. In addition, our study provides insight into how the proposed model implemented in a sophisticated digital product provides better connections and interaction within the company, both to understand its capabilities to implement a cost reduction strategy and to assess possible development risks (despite the financial constraints and entry barriers typically faced by small and medium-sized enterprises in Russia).

The remaining part of the paper is organized in the following manner. The next section presents a review of the literature on digital technologies in the agro-industrial sector used to reduce costs and risks, as well as an analysis of the limitations of their implementation in Russia. We pay special attention to the study of a promising direction for the use o cloud technologies and OLAP in economic, accounting, and analytical activities. Based on the analysis mainly of the content of articles, we identify the main cost management systems applied in Russia. Next, we present and discuss research methods and the results of the case study. In the end, the paper presents theoretical and practical conclusions and limitations.

2. Literature Review

2.1. Implementation of Digital Technologies in the Agro-Industrial Sector to Reduce Costs and Risks

Contemporary trends in management are geared toward digital approaches in agriculture and agro-industrial production. First and foremost, the introduction of digital technology is associated with the production of agricultural products. In particular, this concerns accurate automated quality control of agricultural products, robotic devices with sensors and radio frequency identifiers in animal production (Mironkina et al. 2020), the introduction of drones (Janteliyev et al. 2022), IT platforms, and devices (Dutbayev et al. 2020), or biotechnology such as gene editing or synthetic food production (Bakhtin et al. 2020). In the context of our study, however, we believe it necessary to note that digital technology is changing the way companies manage their businesses, helping them make decisions that improve the efficiency of their relationships with partners, suppliers, and other subjects (Matarazzo et al. 2020; Scuotto et al. 2017). Digitalization entails the improvement of business processes and reduces risk, thereby raising the company’s competitiveness (Rossato and Castellani 2020). According to PwC, digital solutions for the automation of management costs have reduced utility costs by 10–15% and the cost of maintenance staff by about 10–20%. (El-Jawhari et al. 2020). To develop this trend, in our opinion, it is necessary to implement cloud technologies in order to improve economic security and reduce risks for modern enterprises (Vyacheslavova et al. 2022). The implementation of cloud technologies consists of the use of powerful hardware and software and tools and methodologies that are beyond the reach of the technical characteristics of the computer. This allows expanding the business boundaries, thus getting the most profits and lowering the risks (Bekkalieva 2019). Cloud technologies are especially useful in creating decision-making systems associated with processing large volumes of information (such as cost accounting in a ramified distributed control system that combines production sites for processing agricultural and livestock products, warehouses, and logistics centers), which require modern computer hardware and sophisticated software (Sergeev 2021). As reported by McKinsey, agriculture is not among the leaders in the field of digitalization in Russia or in the world. The volume of the global market of cloud platforms and services for agriculture is estimated at USD 815 million, and in Russia—only USD 6 million (Hansen 2021). Although these technologies are not as widely used in Russia, their necessity is recognized by most business executives and representatives of government agencies (Tsenina et al. 2022). Together with intensifying competition in the agricultural industry, digitalization of production is becoming a mandatory requirement for all industries, including regional ones (small and medium-sized enterprises). Only agro-industrial enterprises that focus on modern digital technology will be able to solve the problems of cost reduction and effective risk management (Cueto et al. 2022). One of the key conditions for a company’s survival in the agro-industrial crisis is control over technological progress, provision of production transparency, and diagnostics of risks at the early stages of management decision-making (Maksimova et al. 2021).

We managed to collect little information on the reasons that prevent managers of agro-industrial enterprises from implementing OLAP (On-Line Analysis Processing) technologies to manage costs and diagnose risks of financial and economic activities of their enterprises since studies in this area are very scarce. Based on information available in open sources, Russia has several major hampering factors for modern cloud-based models of risk management in the financial and economic activities of enterprises.

First, the introduction of cloud technologies requires investment, while agro-industrial companies continue to depend on state support (Vaganova et al. 2021). Therefore, businesses, especially small and medium-sized, are waiting for government support measures, including those for the development of digital technology.

Second, implementation of a model of cost reduction and risk management in the financial and economic activities of an enterprise requires the correct choice and adherence to various scenarios of architectural solutions providing exactly the coefficient of readiness of IT infrastructures of different costs, which can lead each of the options to the required value of this parameter. In the development and introduction of these scenarios, an important aspect is ensuring the economic efficiency of the company (Bekkalieva 2019). Small and medium-sized enterprises are unable to hire their own specialists (Kritskaya 2022) to address the problems of developing systems for cost management and managerial decision-making. Therefore, the development of such technologies calls for joint efforts of agro-industrial enterprises and support from the state.

Third, companies in the agro-industrial sector often focus not on the reduction of costs through smart solutions but on getting subsidies from the federal or regional governments (Official Portal of the Government of the Rostov Region 2022) on utilities, animal feed and seeds, loans at reduced rates with partial financing (below the level of the Central Bank key rate). For executives, it is easier to lower employees’ salaries in a crisis through various gray hiring schemes (Zolotar n.d.) than to attempt to diagnose problems at the early stage of their emergence while trying to implement the innovative solutions developed for this purpose.

However, the crisis brought about by the COVID-19 pandemic (Litvinova 2022) and various geopolitical problems and upheavals (Kyriazis 2022) are unexpected or unpredictable events occurring outside the industry. Therefore, in our proposals, we proceed from the concept of sustainable development, recognizing that global events can have a major impact on the behavior of markets within the industry (United Nations 2008). For this reason, we believe that the current situation calls for a reconsideration of the established methodology and for a search for new innovative solutions. These solutions may come both from the state as revision and amendments of legislative acts and allocation of subsidies for agricultural development and from agricultural enterprises in the form of transformations and optimization of their accounting and analytical systems and production processes.

2.2. Use of Cloud Technologies and OLAP in Economic, Accounting, and Analytical Activities

At present, cloud technologies are gaining popularity in working with various types of information. The issues of the implementation and use of cloud services and technologies in economics, accounting, and analytical activities are explored by a wide range of scholars. V.A. Astafieva et al. (2016) argue for the implementation of cloud services in accounting and substantiates the effectiveness of this measure. The economic rationale for the transition of organizations to cloud services and technologies is provided by N.K. Bekkalieva (2019) also compared the cloud services available in the Russian market. That said, cloud environments can accommodate entire information systems.

Cloud technology is advisable to be used in the formation of the cost management system. Such a system will serve as a component of the accounting and analytical system, which will allow the user to solve a range of issues on management, control, and analysis of costs, even in remote access, to be included in the workflow from any location. The only necessary precondition in this is the ability to access the Internet from any kind of mobile device or desktop personal computer. The use of cloud technologies in the work of the accounting and analytical system in general, or the cost management system in particular, gives the company an opportunity to spend funds only on software (usually leased). All other costs are covered by the organization that provides cloud access and technical support services (Vyacheslavova et al. 2022).

We believe that to understand the nuances of the system of cost management and diagnostics of possible risks in the financial and economic activities of the organization, it is necessary to consider the technology by which they are implemented. In Western countries, which were the first to use computer-based audits, dynamic online analysis processing (OLAP) based on the creation of information systems showed a good social effect (Bo and Ye 2011). The concept of using OLAP systems to carry out the analysis of various processes was proposed by the author of the relational data model E.F. Codd et al. (1993). An OLAP system is an analytical system of the research type. Such a system allows working with large amounts of information and visually representing arrays of data in the form of various graphic images (reports, tables, charts). Over the past few years, OLAP systems have been used to identify trends in the development of any economic process and establish patterns of change and transformation.

The practice of the adoption of OLAP systems in the economy has spread rapidly among developed countries. In particular, China is moving from the traditional manual audit to the computerized auditing of accounts (Yanjun 2013). Accounting with a computerized audit information system in an information environment is much more complex than a manual ledger, so static stand-alone audit information systems based on digital copying of financial data are being developed. There emerged the practice of introducing digital twins into such control systems. A digital twin is a real representation of all components in the product lifecycle using physical data, virtual data, and the data of interaction between them (Tao et al. 2019). Research into the opportunities to use digital twins mainly focuses on production objects and processes but also begins to be actively used in business models (Silva et al. 2023). This allows us to propose the use of digital twins in the practice of creating a system of cost management and risk reduction in the agricultural industry. All the more so because the new model of creating a digital product using digital twins significantly reduces the time it takes to enter the market because of the product life cycle (Kosharnaya and Kosharny 2016). Therefore, we propose to use this practice in agro-industrial organizations to create a digital copy of the cost management system. Such a copy will be used by the company’s administrative apparatus to make decisions on costs before the actual operation of the system, thereby diagnosing possible risks at an early stage of decision-making.

2.3. Cost Management Systems

Studies in the field of transformation of accounting and analytical systems sprouted a long time ago. In 1993, E. Kasanen, K. Lukka, and A. Siitonen noted that the accounting system in modern economic conditions should contain an analytical unit and not only deal with the registration of the facts of economic activity but also perform analytical functions (Kasanen et al. 1993). Various researchers are actively engaged in the development of cost control and management methodology and the calculation of cost prices of products in the system of management accounting (Khoruzhy 2004; Khoruzhy et al. 2018). To summarize these studies, one of the key problems in cost management is the use of costs by the management apparatus in different contexts. For this reason, organizations need to calculate different types of cost prices to be used for different purposes.

The full cost price reflects the total set of costs of producing a product. This type of cost must necessarily be calculated and is used in forming accounting reports for financial accounting.

Estimated cost price is a variety of standard costs and is typically calculated by one-time orders and types of products (Gamtessa 2022).

Truncated cost price is calculated only according to variable costs, without regard to fixed costs. This type of cost price has been used in world practice for quite a long time. It comes from the direct costing system and is essential for making managerial decisions. The main condition when using the system of direct costing is the correct division (classification) of costs into fixed and variable.

Recently, agro-industrial enterprises in Russia started to pay more attention to target costing and kaizen costing systems. These systems give the management of the company a target cost of production (Nartey and van der Poll 2021).

The target costing system is not just a system of calculation but simultaneously serves as a full-fledged cost management system (Stadtherr and Wouters 2021). This system is oriented on the strategy of reducing costs and carrying out the processes of design, planning, and control in the production of new products, along with determining the target values of costs (target cost price) in specific economic conditions (Bock and Pütz 2017).

The kaizen costing system is rarely used as an independent system; most often, it is a continuation of the target costing system. Its main purpose is to achieve the cost parameters that were laid down during the design of products in the framework of the target costing system. The kaizen costing system begins to work during the production of the designed product. A more detailed comparison of the two methods is outlined in Table 1.

Table 1.

Comparative characteristics of target costing and kaizen costing.

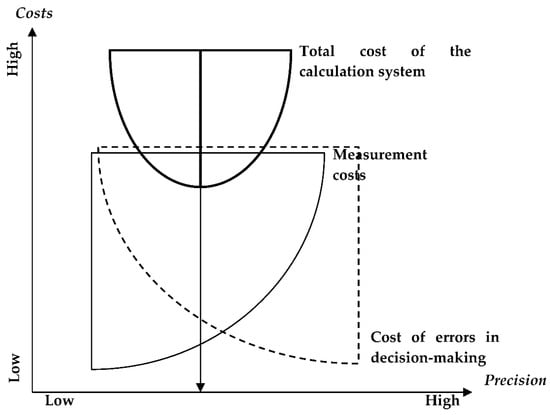

When making a decision to form a new cost management system, it is critical to compare the costs of operation of such a system with the costs of mistakes in managerial decision-making (Figure 1).

Figure 1.

Compromise in choosing the accuracy of the calculation system. Source: (Atkinson et al. 2019, p. 211).

The data given in Figure 1 demonstrate the application of the compromise approach in choosing between the precision and cost of the system for calculating the cost prices of produce.

Cloud-based cost accounting systems form different types of cost prices based on the distinguished objects of accounting and calculation, the grouping of costs by elements and items, and the methods used. Each type of cost has its own methodology of determination and the purpose of its further use by the management apparatus. These parameters need to be taken into consideration when introducing the model of cost management and risk reduction in the financial and economic activities of an agro-industrial enterprise based on the OLAP technology.

3. Results

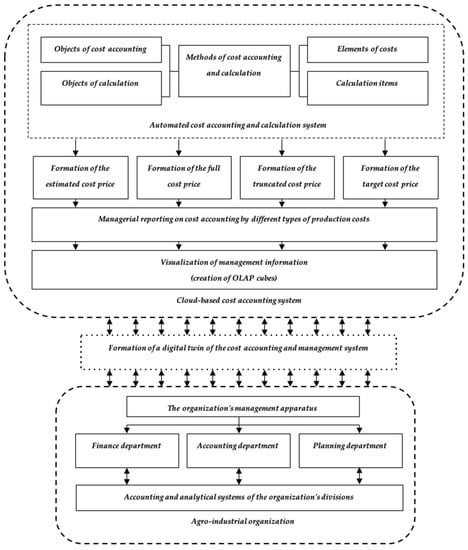

In Figure 2, we present our original model of the cost management system for the agro-industrial enterprise.

Figure 2.

Our model of the cost management system for an agro-industrial enterprise.

This model is divided into three sectors (a cloud-based cost accounting system, a digital twin of the cost accounting and management system, and the agro-industrial organization itself, represented by its accounting and analytical system). The data for the model will be collected from the cost accounting system used by the enterprise. The use of selected sectors will allow for the simulation of production processes. A virtual workflow can create different scenarios and show what will happen in different situations. This allows the company to develop the most efficient production method and thereby reduce costs. The process can be optimized using virtual product twins for each Kurochka division. Manufacturing will become safer, faster, and more efficient.

Thus, in this case, we calculate four different types of cost prices: the estimated, the full, the truncated, and the target. Based on this data, managerial reporting is developed, which contains several sections by the calculated types of cost prices. To make it convenient to work with reports and provide the leadership with only relevant information in a clear form, the system includes the element of “Visualization of management information”, which is to be realized by means of the OLAP system.

The generation of the digital twin of the cost accounting and management system enables the management apparatus to get acquainted with the parameters of such a system before its actual operation. This method also majorly reduces the system’s maintenance costs, as it provides for the analysis, adjustment, and optimization of the system (Purcell and Neubauer 2023). The results of the case study indicate that the organization’s executives need the system to be able to constantly exchange information between the cloud system and its accounting and analytical systems. In our model, the digital twins of the cost accounting and management system are subject to systematic adjustments, and in their content, they objectively correlate with the real state of affairs in the organization.

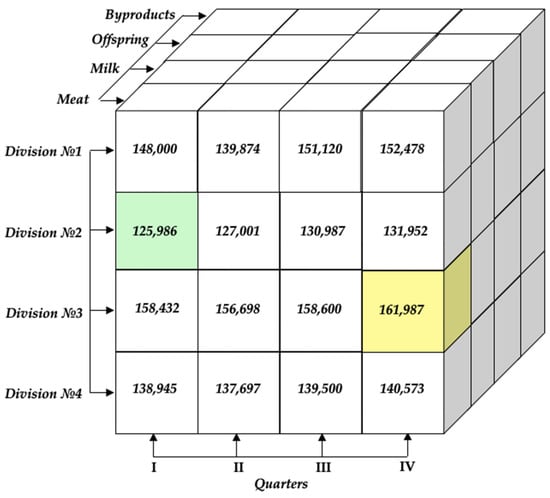

For a better understanding of the model, we utilized a four-dimensional OLAP cube. This cube allows management staff to obtain data on the value of the cost price of livestock products with details by product types and divisions included in the agro-industrial enterprise Kurochka in a visualized form. Moreover, the information is presented by quarters of the current fiscal year (Figure 3).

Figure 3.

OLAP cube with four dimensions based on the cost of livestock production in the agricultural enterprise Kurochka, thous. UA. Source: compiled by the authors.

In the above three-dimensional model, the yellow sector shows that in meat production, the maximum cost of meat production is observed in the fourth quarter of this year in Division 3, amounting to 161,987 UA. The green sector indicates the minimum cost price of meat, which is found in the first quarter of the year in Division 2 and reaches only 125,986 UA. The values for the remaining types of livestock products are also easy to visually compare and analyze by the divisions and quarters of the current fiscal year. Thus, the use of the OLAP cube offers company executives an opportunity to focus only on the relevant information and put away superfluous information. Solving this problem was quite an important objective of our study because the case study at Kurochka reveals that the managerial staff lack skills and knowledge to work with large volumes of information. The latter circumstance is caused by the company advocating for multilevel accounting and analytical systems that allow working effectively with large volumes of heterogeneous information.

In the meantime, OLAP technologies offer opportunities to form analytical maps and various types of managerial reports, which also provide for prompt analysis of various processes and assessment of the current state of an issue or an economic situation (Table 2). The presented analytical map of the cost price of livestock products shows more detailed information on the examined indicators with final cost price values by different quarters, types of products, and structural divisions. This form of an analytical map is more convenient for the managerial staff of Kurochka compared to the classical one (containing the entire array of information without search filters). This convenience owes to the fact that the map presents only the information sought by executives to assess a specific situation or make a managerial decision.

Table 2.

Analytical map of the cost of livestock production for the current fiscal year with details by quarters, thous. UA.

The proposed model of the cost accounting and management system in agro-industrial enterprises calculates four types of cost prices. Accordingly, the OLAP system is able to generate analytical registries with itemization by the types of cost price (Table 3) for each quarter of the fiscal year and for each type of product produced, both for individual divisions and for the organization as a whole.

Table 3.

Analytical registry of livestock products for the current fiscal year with details by the types of cost price, thous. UA.

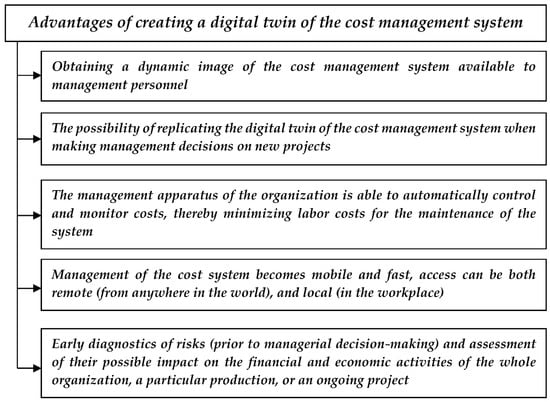

The conducted study gives grounds for identifying the advantages of the application of the developed model of cost management and risk reduction in the financial and economic activity of the organization based on OLAP technology and digital twins in the cost management system of Kurochka (Figure 4).

Figure 4.

The advantages of creating a digital twin of the cost management system in agricultural organizations. Source: compiled by the authors.

4. Methods

4.1. Research Approach

In accordance with the disclosed approach to the features of implementing a model of cost management and risk reduction in the financial and economic activities of the company, we chose the qualitative approach as the most fitting for the study of complex phenomena, given the lack of initial information and its heterogeneity and ambiguity (Nasonov 2018). Qualitative research methodology helps to understand the underlying causes, opinions, and motivations (Ciasullo et al. 2022). For the development of a structured information system, the most appropriate research strategy was deemed to be a qualitative case study (Sebera 2012). The findings obtained in qualitative research are more enlightening and extensive compared to quantitative research (Slepov et al. 2022) since they provide high digitalization. Thus, the strategy of qualitative research will be more effective for us in collecting information on the peculiarities of the implementation of the OLAP technology in agriculture for the development of the model and in obtaining feedback from the managers who make decisions in the company. However, we could not help but consider that this method does not allow the results to be extended to the entire industry and has a number of significant limitations inherent in qualitative research (Zielińska-Chmielewska et al. 2021). Therefore, we consider it necessary to clarify that the main objective of the study was to obtain qualitatively new knowledge about a particular object. In the conditions of limited resources available to us, on the one hand, and, on the other hand, the need to conduct a series of studies on this issue involving interested studies from other regions, we considered it necessary to publish the results obtained for discussion both among the scientific community and among interested agro-industrial specialists. For our study, we chose a critical instance case in the agribusiness industry, as described below.

4.2. Empirical Context and Case Selection

The present work contextualizes analysis in the agro-industrial sector for the production and processing of agricultural and livestock products. Due to the fact that Russia is a country that occupies a large territory with a diverse climate and complex logistical processes (Lochan et al. 2021), we should clarify that our study focuses on agricultural companies in the Moscow region. This region is distinguished by a large number of small and medium-sized businesses. Production and economic policies rely on production, most often in areas remote from urbanized regions. The raw materials are then processed, and the finished products are supplied to the Moscow market and the territories closest to it (Nekrasov and Sinitsyna 2021). Thus, such businesses are characterized by the distribution of production sites and warehouses, which, on the one hand, allows for savings in the production and storage of products and, on the other hand, requires a distributed network to manage them (Lochan et al. 2021). Additionally, the digital transformation of modern business models is creating new sales opportunities through online retail, which further complicates supply chains (Wolfert et al. 2017), including those for agro-industrial products.

In accordance with the purpose of the study, agricultural companies were selected randomly through the Yandex.ru search engine. Company web pages were selected by keywords (milk production, meat production, wholesale of meat, etc., related to agribusiness) in order to compile a sample of organizations for the subsequent selection of one company to participate in the study (Russo Spena and Mele 2020). Parameters for selection were the following: (I) production and sale of agro-industrial products; (II) the company operates in different markets including B2B and B2C; (III) the organization must have a territorially-distributed management system in the Moscow region (possibly including neighboring regions); and (IV) at least 5 years of operation since registration. We discovered 32 companies matching the determined criteria and contacted their executives via e-mail and then by phone and explained the goals and program of our study. Thus, the company selected for the study was the one that fitted the criteria and agreed to participate.

The company chosen by the aforementioned criteria is referred to by the pseudonym “Kurochka” to maintain confidentiality. Kurochka is a medium-sized company that is trying to grow into a large one. The enterprise was founded in the 2000s and engaged in the production of chicken meat and eggs. At the time of the study, the company was the production of meat (beef and chicken) and dairy products (milk, ryazhenka (fermented baked milk), yogurt, cottage cheese), selling calves and chickens and byproducts (eggs, fertilizers, feed, calfskin, and other products). Kurochka has four production sites (divisions), depending on the functional purpose. Thus, in Kurochka, the enterprise’s management structure and management functions are distributed in separate areas, products, and services provided by the company. Each division, separately or in coordination with other divisions, produces products and provides logistics and sales. The management of Kurochka expressed their desire to be the initiators of change in the industry and understands the need to create a cost reduction model and will provide the necessary information for this, confirming that the company is a suitable source of information for our case study.

The Moscow region is a large, industrialized region distinguished by its significant contribution to the country’s economy. The region ranks second in terms of population (7.7 million people as of 1 January 2020, or 5.2% of the total population). In 2019, farms of all categories produced 671 thousand tons of milk (102.2% of the 2018 level), 309.6 thousand tons of livestock and poultry for slaughter (100.2%), and 131.3 million chicken eggs (94%). Overall, agricultural production in the region increased by 9.7% in 2019 (Socio-economic Development of the Moscow Region in 2019 n.d.). However, the effects of the COVID-19 crisis and the severe restrictive measures imposed by government agencies to contain it have created a dramatic scenario around the world (Thanh et al. 2022). This situation has affected the development of the industry in the region. The increase in agricultural production in 2021 relative to 2020 was only 3.7% (Socio-Economic Development of the Moscow Region in 2021 n.d.).

In the face of production cutbacks, the executives of Kurochka decided on the need to introduce an information-analytical system of cost management and risk diagnostics. Analysis of both economic reports and sustainable development reports indicates that Kurochka will be able to respond to crisis situations better if such a system is in place due to, for instance, the calculation of various types of cost prices used for different purposes.

Thus, Kurochka was selected as an object of the case study over other agricultural enterprises that experience difficulties in implementing cost management systems using OLAP because it involves investment costs and requires the presence of professional staff skilled in working with such systems. Therefore, the management of the company is looking for a solution on how to implement new technologies in the management of the company.

4.3. Data Collection

Data were collected in January–February 2022 through both desk research and field analysis. The desk study was conducted using corporate reports, manuals, and brochures provided by the company via e-mail, which were not trade secrets. The field analysis consisted in analyzing the current cost management system applied at the enterprise together with 11 in-depth interviews (with the deputy general director, chief accountant, accountants, production director, information security manager, division heads, and development director; the general director was not interviewed in-depth due to his prolonged illness). The in-depth interviews were used to obtain information about the existing cost management system. Accounting for variable and fixed costs in the cost management model was determined based on the established methodology of the applied costing methods used in Russia. In our case, these are the method of determining the full cost, the method of determining the standard cost, “direct costing”, “target costing”, and “kaizen costing”. In particular, in the used methods of cost accounting and calculation, we allocated objects of calculation, objects of cost, elements of costs, and calculation items. The results obtained were used to understand the problems and shortcomings that arise in the work of information-analytical systems and ultimately to create a cost management model. The interviewer introduced themselves at the beginning of the interview and explained the purpose of the research. The interviewer presented open-ended questions outlined by the authors of the study. These questions concerned the respondents’ views and opinions on the research problem and the existing experience of the company: the cost management system, the costing system, risk assessment in the company, experience with cloud technology and OLAP; problems with the product range; the problems of company development highlighted by each respondent, the complications of integrating the management systems between the divisions.

The interviewer tried to interpret the answers and sought clarity and understanding throughout the interview. The interviewer was also able to make their own notes by recording respondents’ answers. These notes were included in a separate category. The interviews lasted an average of 30 min and were conducted in Russian. The respondents were informed that their answers would not be published in open sources or shared with other company employees for review. In order to clarify certain controversial issues, additional questions were asked to key respondents via e-mail.

4.4. Data Analysis

We transcripted the received records using the zapisano.org service. The collected data were classified by homogenous topics in order to improve the comparability of the information obtained. The process of analysis employed the triangulation method for the validity and reliability of the results of the empirical study (Kosharnaya and Kosharny 2016). The chosen method of data analysis is thematic analysis, which has the advantage of flexibility (Braun and Clarke 2019). The thematic analysis involves the analysis of transcribed conversations, which may be direct quotes or the interviewer’s paraphrasing of respondents’ general ideas, and the analysis of the company’s financial documents.

The answers provided concern the opportunities and problems in the field of cost management and risk reduction in the financial and economic activities of the company that contributes to or hinder the implementation of new technologies in management practice. Triangulation was performed through the triangulation of researchers (Denzin 1970) when several researchers are involved in a project. Each researcher participated in information processing, then each topic was discussed, and the information agreed upon by all participants in the study was added to the report. The process of triangulation has enabled us to increase the reliability of the interview data, in terms of how accurately it reflects the state of the company, as well as to improve the quality of the information obtained. All the results of the case study were recorded in the research report. Financial indicators were reported in units of account (UA) assuming the ratio of 1 USD = 55 UA.

5. Discussion

The Kurochka case study on the development of a cost management model using cloud services and digital twins demonstrates that the implementation of such a model currently constitutes a promising direction for enterprises in the agro-industrial sector.

We consider it necessary to separately highlight the results obtained in the conducted case study.

Previous research indicates that digitalization provides a circular exchange of knowledge between participants in real-time (Polese et al. 2018). In the context of our study, the implemented model will produce a dynamic image of the cost management system available to any management employee with access to the system. This will provide quick access to information on the maximum and minimum cost price of produce by each quarter and for each structural division. Ultimately, it will be easier for executives to make managerial decisions for the development of the business and the reduction of costs.

Furthermore, we believe that the effectiveness of managerial decisions on new projects also rises. This improvement is ensured by the opportunity to replicate the digital double of the cost management system (Kosharnaya and Kosharny 2016), which enables executives to diagnose risks at the early stages of decision-making. Moreover, the presented model provides more precision in predicting the state of processes in the company and more accurately calculates the economics of the project.

Nevertheless, it must be noted that the application of OLAP systems in our model entails both prospects and challenges. The difficulties relate to the training (Syzdykova et al. 2022) and the qualifications of the personnel working with the system and making the right information requests. For this reason, modern OLAP systems are supplied to organizations that already have databases with requests tailored to the specifics of the organization’s activities (Bolton et al. 2018). Furthermore, quite a vital factor in the formation of an OLAP system is the high quality of information supplied to this visualization and analysis system (Bimonte et al. 2021). The information must be complete and consistent, which depends on the effectiveness of the organization of the accounting and analytical system in general and the financial accounting system in particular (Bensalloua and Hamdadou 2021). To the prospects, we attribute the opportunities for expansion of our model, for instance, for energy consumption analysis (Boulil et al. 2014). Despite the popularity of studies in this area, we proceeded from the primary needs of the studied organization Kurochka. Given that the enterprise receives electricity subsidies from the state as part of the program to support Russian agricultural producers, the executives do not see finding special solutions to reduce electricity consumption as a priority. However, the company leaders also believe that in the future, it will become necessary to introduce these measures into practice and start working on the reduction of electricity costs and other general business expenses, as they recognize that the future belongs to those companies that will incorporate sustainability and planning into their operations (United Nations 2008).

Thus, we believe that the practical application of this model will allow the executives of agro-industrial companies to keep their finger on the pulse of all the economic processes in real-time from any place that has Internet access.

Our work also leads to some interesting theoretical and practical conclusions. In particular, the paper presents two theoretical implications. The first one (I) is that we, as the authors of this study, contribute to the existing literature through the development of a conceptual model of a cost management system for agricultural enterprises. This topic is currently actively explored in the context of technology development, yet further research is needed to cover the national specifics of the business. As far as we are aware, the present study is one of the first attempts to conceptualize international experience and to showcase the functional characteristics of the elements of the proposed cost management system as applied to the Russian experience. We urge other researchers to engage in the development of business process management technologies for agribusinesses with the possibility of their implementation not only by large agricultural enterprises but, more importantly, by medium and small businesses. This leads us to the second theoretical contribution (II), which suggests that the integration of various dimensions enhances the functioning of the model in general. The study justifies the use of OLAP systems for analysis and visualization as part of the cost management system within the model of cost management and risk reduction in financial and economic activities. Furthermore, we propose the use of digital twins for cost management in agro-industrial organizations. As this study shows, digital twins can significantly enhance the ability of enterprises to make proactive data-driven decisions, increase their efficiency, and eliminate potential problems and risks. If properly applied, they also offer an opportunity to work out “what if” scenarios, i.e., essentially experiment with the future (Gnezdova et al. 2020, p. 460).

As noted above, the paper also suggests practical conclusions, i.e., (I) we believe that our findings should be considered by representatives of the agriculture industry and government agencies that influence its development. In particular, we have developed analytical registries and cost price maps of agricultural products, which present relevant information with destabilization by a wide range of parameters necessary for prompt cost management. This demonstrates the points made in previous studies, namely the problem of cost management—the need for instruments that allow obtaining information in a way that considers various accounting methods. Organizations need to calculate different types of costs, which will be used for different purposes (Khoruzhy 2004; Khoruzhy et al. 2018).

Furthermore, (II) the paper emphasizes the paramount importance of applying the model of cost management and risk reduction of financial and economic activities of the organization based on intelligent interaction technologies. Essentially, this could become a lever for cooperation and competition for small and medium-sized enterprises operating in the agricultural business. In this vein, the importance of digitalization processes has also been demonstrated in companies working with geographically dispersed divisions that solve various tasks, including in the B2B and B2C formats: production, sales, and delivery of agro-industrial products.

6. Conclusions

Which conceptual cost management model should be applied, and how should it be implemented? What result can be achieved as a result of applying the model to reduce the level of costs and risks in the activities of enterprises in the agricultural industry?

Our conceptual model, realized in the form of a complex digital product, ensures closer connections and interaction within the company both for the understanding of its capabilities and for assessing the possible risks of its development (despite the financial limitations and barriers to entry faced by small and medium businesses). The implementation of our model allows the executives of Kurochka to develop business strategies based on cost minimization and provides an opportunity for the expansion of the business to other regions of Russia. Transaction costs of doing business for a geographically dispersed company are also reduced due to better knowledge of product characteristics and costs. This reduces business development risks, which is especially useful in the agri-food industry, where mistakes are very costly and take time, effort, and money to correct.

Despite the above-described contributions, our study is somewhat limited by the case study format, which does not allow for extrapolation. Identification of the features of applying the cost and risk management model for the financial and economic activities of an organization based on OLAP technology requires further study, considering the expansion of the size of companies, the presence of a larger number of divisions, and the territorial remoteness between them.

Therefore, we encourage researchers interested in the development of this topic to conduct similar case studies. Accumulated results of several case studies in other agribusiness enterprises located, for example, in southern Russia, where agriculture and food production are most developed, allow creating of a community management system model cost and obtaining results for validation and evaluation of the model.

Author Contributions

All authors have made equal contributions. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Data Availability Statement

Not applicable.

Acknowledgments

The research was carried out under the thematic Plan-assignment of the Russian State Agrarian University—Moscow Agricultural Academy named after K.A. Timiryazev by order of the Ministry of Agriculture of Russia at the expense of the federal budget in 2021.

Conflicts of Interest

The authors declare no conflict of interest.

References

- Astafieva, Valentina A., Tatyana M. Moiseeva, and Elena Vasilyevna Kovalchuk. 2016. Cloud technologies in accounting: Problems, risks, development. Eurasian Scientific Journal 11: 10–19. [Google Scholar]

- Atkinson, Anthony A., Rajiv D. Banker, Robert S. Kaplan, and S. Mark Young. 2019. Management Accounting. Trans. from English. St. Petersburg: Dialectics. [Google Scholar]

- Bakhtin, Pavel, Elena Khabirov, Ilya Kuzminov, and Thomas Thurner. 2020. The future of food production—A text-mining approach. Technology Analysis & Strategic Management 32: 516–28. [Google Scholar] [CrossRef]

- Bekkalieva, Natalia K. 2019. Effective pricing of cloud technologies in the company’s economic security system. Azimuth Scientific Research: Economics and Management 8: 83–85. [Google Scholar]

- Bensalloua, Charef Abdallah, and Djamila Hamdadou. 2021. Spatial OLAP and multicriteria integrated approach for decision support system: Application in agroforestry management. In Research Anthology on Decision Support Systems and Decision Management in Healthcare, Business, and Engineering. Edited by Management Association, Information Resources. Hershey: IGI Global, pp. 1114–42. [Google Scholar] [CrossRef]

- Bimonte, Sandro, Omar Boussaid, Michel Schneider, and Fabien Ruelle. 2021. Design and implementation of active stream data warehouses. In Research Anthology on Decision Support Systems and Decision Management in Healthcare, Business, and Engineering. Edited by Management Association, Information Resources. Hershey: IGI Global, pp. 288–311. [Google Scholar] [CrossRef]

- Bo, Zhao, and Xiaojun Ye. 2011. Research and implementation of OLAP performance test method. Journal of Computer Research and Development 48: 1951–59. [Google Scholar]

- Bock, Stefan, and Markus Pütz. 2017. Implementing value engineering based on a multidimensional quality-oriented control calculus within a target costing and target pricing approach. International Journal of Production Economics 183: 146–58. [Google Scholar] [CrossRef]

- Bolton, Ruth N., Janet R. McColl-Kennedy, Lilliemay Cheung, Andrew S. Gallan, Chiara Orsingher, Lars Witel, and Mohamed Zaki. 2018. Customer experience challenges: Bringing together digital, physical and social realms. Journal of Service Management 29: 776–808. [Google Scholar] [CrossRef]

- Boulil, Kamal, Sandro Bimonte, and Francois Pinet. 2014. Spatial OLAP integrity constraints: From UML-based specification to automatic implementation: Application to energetic data in agriculture. Journal of Decision Systems 23: 460–80. [Google Scholar] [CrossRef]

- Braun, Virginia, and Victoria Clarke. 2019. Reflecting on reflexive thematic analysis. Qualitative Research in Sport, Exercise and Health 11: 589–97. [Google Scholar] [CrossRef]

- Ciasullo, Maria Vincenza, Raffaella Montera, Francesco Mercuri, and Shame Mugova. 2022. When digitalization meets omnichannel in international markets: A case study from the agri-food industry. Administrative Sciences 12: 68. [Google Scholar] [CrossRef]

- Codd, Edgar F., Sharon B. Codd, and Clynch T. Salley. 1993. Providing OLAP to User-Analysts: An IT Mandate. Manchester: Hyperion Solutions Corporation. [Google Scholar]

- Cueto, Lavinia Javier, April Faith Deleon Frisnedi, Reynaldo Baculio Collera, Kenneth Ian Talosig Batac, and Casper Boongaling Agaton. 2022. Digital innovations in MSMEs during economic disruptions: Experiences and challenges of young entrepreneurs. Administrative Sciences 12: 8. [Google Scholar] [CrossRef]

- Denzin, Norman K. 1970. The Research Act: A Theoretical Introduction to Sociological Methods. Chicago: Aldine. [Google Scholar]

- Dokholyan, Sergey, Evgeniya O. Ermolaeva, Alexander S. Verkhovod, Elena V. Dupliy, Anna E. Gorokhova, Vyacheslav A. Ivanov, and Vladimir D. Sekerin. 2022. Influence of management automation on managerial decision-making in the agro-industrial complex. International Journal of Advanced Computer Science and Applications 13: 597–603. [Google Scholar] [CrossRef]

- Dutbayev, Yerlan, Nadira Sultanova, Vladimir Tsygankov, Rafiq Islam, and Nurlan Kuldybayev. 2020. A comparison study of biotic factor’s effect on photosynthesis processes of soybean by using multispeq device on photosynq.org platform. ARPN Journal of Engineering and Applied Sciences 15: 2627–30. [Google Scholar]

- El-Jawhari, Bashar, Harikrishna Mahadevan, and Omar Soub. 2020. Rethinking Cost to Drive Value for Your Organization. White Paper Series. vol. 1. PwC. Available online: https://www.pwc.com/m1/en/services/consulting/documents/rethinking-cost-drive-value-for-your-organisation-vol1.pdf (accessed on 2 September 2022).

- FAO. 2021. World Food and Agriculture–Statistical Yearbook 2021. Rome: FAO. [Google Scholar] [CrossRef]

- FAO. 2022. Food Price Index. Available online: https://www.fao.org/worldfoodsituation/foodpricesindex/en/ (accessed on 2 September 2022).

- Federal Law. 2007. No. 209-FZ. “On the development of small and medium-sized businesses in the Russian Federation”. July 24. Available online: http://www.consultant.ru/document/cons_doc_LAW_52144/ (accessed on 2 September 2022).

- Gamtessa, Samuel. 2022. Capacity utilization, factor substitution, and productivity growth in Canadian food processing sector. Agricultural and Food Economics 10: 21. [Google Scholar] [CrossRef]

- Gerasimova, Larisa Nikolaevna, Tatiana Martemyanova Mezentseva, Natalya Nikolaevna Parasotskaya, and Vera Valeryevna Dvoretskaya. 2019. Features of Environmental Cost Management. Amazonia Investiga 8: 609–15. [Google Scholar]

- Gladilina, Irina, Lyudmila Pankova, Svetlana Sergeeva, and Vladimir Kolesnik. 2022. The Effect of Using Information Technologies for Supporting Decision-Making in the Procurement Management of an Industrial Enterprise on Reducing Financial Costs. Indian Journal of Economics and Development 18: 367–73. [Google Scholar]

- Gnezdova, Julia V., Vera T. Grishina, Nadezhda V. Rebrikoya, Svetlana A. Kalugina, and Ibragim A. Ramazanov. 2020. Development of high technologies in industry in the context of globalization: Digital twins. Revista Inclusiones 7: 460–70. [Google Scholar]

- Gushchina, Elena G., and Darja I. Babkina. 2020. Assessment of the condition and instruments of the food security regulation of countries taking into account the inequality of their economic development and instability of the world trade in the conditions of a pandemic. Journal of Volgograd State University. Economics 22: 128–40. [Google Scholar] [CrossRef]

- Hansen, Chr. 2021. Five Reasons to Use Cloud Technology in the Dairy Industry. March 2. Available online: https://milknews.ru/spetsproekty/proekty-nashih-partnerov/hansen/hrhansen-chr-hansen_1037.html (accessed on 2 September 2022).

- Janteliyev, Dastan, Tair Julamanov, Bekzat Rsymbetov, Azamat Kaldybekov, and Yulduz Allaberganova. 2022. Increasing the level of management efficiency: Using unmanned aerial vehicles for monitoring pasture lands. Instrumentation Mesure Métrologie 21: 59–65. [Google Scholar] [CrossRef]

- Kasanen, Eero, Kari Lukka, and Arto Siitonen. 1993. The constructive approach in management accounting research. Journal of Management Accounting Research 5: 243–64. [Google Scholar]

- Kashkovskii, Vladimir G., Alevtina A. Plakhova, and Dmitry V. Kropachev. 2019. Features of the development of beekeeping in the Narym region of Russia. Advances in Animal and Veterinary Sciences 7: 50–59. [Google Scholar]

- Khoruzhy, Liudmila I. 2004. Problems of Theory, Methodology, Methodology and Organization of Management Accounting in Agriculture. Moscow: Finansy i statistika. [Google Scholar]

- Khoruzhy, Liudmila I., Vladimir M. Bautin, Yuriy N. Katkov, Elena I. Stepanenko, and Boris V. Lukyanov. 2018. Adaptive internal controls system for the accounting and analytics in the agrarian organizations. Espacios 39: 19. [Google Scholar]

- Kosharnaya, Galina B., and Valery P. Kosharny. 2016. Triangulation as a means ensuring validity of empirical study results. University Proceedibgs. Volga Region. Social Sciences. Sociology 2: 117–22. [Google Scholar] [CrossRef]

- Kritskaya, Marina. 2022. State Programmes to Support Small Businesses–2022. January 18. Available online: https://kontur.ru/articles/4710 (accessed on 2 September 2022).

- Kyriazis, Nikolaos A. 2022. Optimal Portfolios of National Currencies, Commodities and Fuel, Agricultural Commodities and Cryptocurrencies during the Russian-Ukrainian Conflict. International Journal of Financial Studies 10: 75. [Google Scholar] [CrossRef]

- Litvinova, Tatiana N. 2022. Risks of Entrepreneurship amid the COVID-19 Crisis. Risks 10: 163. [Google Scholar] [CrossRef]

- Lochan, Sergey A., Tatiana P. Rozanova, Valery V. Bezpalov, and Dmitry V. Fedyunin. 2021. Supply chain management and risk management in an environment of stochastic uncertainty (Retail). Risks 9: 197. [Google Scholar] [CrossRef]

- Maksimova, Tatiana P., Olga A. Zhdanova, and Tatiana G. Bondarenko. 2021. Effect of exogenous factors on transformation processes in the Russian agro-industrial complex. Bioscience Biotechnology Research Communications 14: 1913–18. [Google Scholar] [CrossRef]

- Matarazzo, Michela, Lara Penco, and Giorgia Profumo. 2020. How is digital transformation changing business models and internationalisation in made in Italy SMEs? Sinergie Italian Journal of Management 38: 89–107. [Google Scholar] [CrossRef]

- Mironkina, Alina, Sergei Kharitonov, Alexey Kuchumov, and Alexey Belokopytov. 2020. Digital technologies for efficient farming. IOP Conference Series: Earth and Environmental Science 578: 012017. [Google Scholar] [CrossRef]

- Nardin, Dmitry S., and Svetlana A. Nardina. 2021. Management of natural-anthropogenic complexes of rural territories in the context of the post-non-classical type of scientific rationality. Journal of Environmental Management and Tourism 12: 1242–47. [Google Scholar] [CrossRef]

- Nartey, Samuel Narh, and Huibrecht Margaretha van der Poll. 2021. Innovative management accounting practices for sustainability of manufacturing small and medium enterprises. Environment, Development and Sustainability 23: 18008–39. [Google Scholar] [CrossRef]

- Nasonov, Artur M. 2018. Modern methods for spatial modeling of the development of agriculture. Bulletin of the Moscow State Regional University. Series: Natural Sciences 3: 62–74. [Google Scholar]

- Nekrasov, Aleksey G., and Anna S. Sinitsyna. 2021. Digital conversion of life cycle processes transportation and logistics systems. In Global Challenges of Digital Transformation of Markets. Edited by Elena De la Poza and Sergey E. Barykin. New York: Nova Science Publishers, pp. 67–75. [Google Scholar]

- Official Portal of the Government of the Rostov Region. 2022. Financial Support to Agricultural Producers. Available online: https://www.donland.ru/activity/817/ (accessed on 2 September 2022).

- Ordynskaya, Marina E., Tatyana A. Silina, Lala E. Divina, Irina F. Tausova, and Saida A. Bagova. 2021. Functions of cost management systems in modern organizational management. Universal Journal of Accounting and Finance 9: 498–505. [Google Scholar] [CrossRef]

- Polese, Francesco, Sergio Barile, Francesco Caputo, Luca Carrubbo, and Leonard Waletzky. 2018. Determinants for value cocreation and collaborative paths in complex service systems: A focus on (smart) cities. Service Science 10: 397–407. [Google Scholar] [CrossRef]

- Purcell, Warren, and Thomas Neubauer. 2023. Digital twins in agriculture: A state-of-the-art review. Smart Agricultural Technology 3: 100094. [Google Scholar] [CrossRef]

- Rossato, Chiara, and Paola Castellani. 2020. The contribution of digitalisation to business longevity from a competitiveness perspective. The TQM Journal 32: 617–45. [Google Scholar] [CrossRef]

- Rusagro. 2022. ROS AGRO’s Financial Results for 6M. 2022 and Q2 2022. August 8. Available online: https://www.rusagrogroup.ru/fileadmin/files/reports/ru/pdf/_2Q22_RUS_PressRelease_RA.pdf (accessed on 2 September 2022).

- Russo Spena, Tiziana, and Cristina Mele. 2020. Practising innovation in the healthcare ecosystem: The agency of third-party actors. Journal of Business & Industrial Marketing 35: 390–403. [Google Scholar] [CrossRef]

- Scuotto, Veronica, Gabriele Santoro, Stefano Bresciani, and Manlio Del Giudice. 2017. Shifting intra-and inter-organizational innovation processes towards digital business: An empirical analysis of SMEs. Creativity and Innovation Management 26: 247–55. [Google Scholar] [CrossRef]

- Sebera, Martin. 2012. Selected Chapters on Methodology. Research Methods. Brno: Masaryk University. Available online: https://www.fsps.muni.cz/emuni/data/reader/book-9/04.html (accessed on 2 September 2022).

- Sergeev, Mikhail. 2021. Global Food Prices Are Falling behind Russian Prices. Inflation in Russia Could Exceed 6 per Cent Due to Higher Food Prices. June 6. Available online: https://www.ng.ru/economics/2021-06-06/4_8166_economics.html (accessed on 2 September 2022).

- Silva, Henrique, Tomás Moreno, António Almeida, António Lucas Soares, and Américo Azevedo. 2023. A digital twin platform-based approach to product lifecycle management: Towards a transformer 4.0. In Innovations in Industrial Engineering II. Icieng 2022. Lecture Notes in Mechanical Engineering. Cham: Springer, pp. 14–25. [Google Scholar] [CrossRef]

- Slepov, Vladimir A., Olga A. Grishina, Mikhail E. Kosov, Mikael E. Khoranyan, and Sergey A. Balandin. 2022. Modelo de dos parámetros de optimización del sistema tributario progresivo y su aplicabilidad [Two-parameter model of optimization of the progressive taxation system and its applicability]. Nexo Revista Científica 35: 412–24. [Google Scholar] [CrossRef]

- Smartconsult. 2022. New Sanctions against Russia: Impact on the Agricultural Machinery Market in 2022. March 22. Available online: https://marketing.rbc.ru/articles/13374/ (accessed on 2 September 2022).

- Socio-Economic Development of the Moscow Region in 2019. n.d. Available online: https://mef.mosreg.ru/download/document/7312051 (accessed on 2 September 2022).

- Socio-Economic Development of the Moscow Region in 2021. n.d. Available online: https://mef.mosreg.ru/download/document/10886569 (accessed on 2 September 2022).

- Stadtherr, Frank, and Marc Wouters. 2021. Extending target costing to include targets for R&D costs and production investments for a modular product portfolio—A case study. International Journal of Production Economics 231: 107871. [Google Scholar] [CrossRef]

- Syzdykova, Makhpal B., Talant D. Bimakhanov, Valentina V. Fursova, Maria A. Makhambetova, and Zharkynbek O. Abikenov. 2022. Position of higher education system graduates in the labor market: Search for new opportunities. Academic Journal of Interdisciplinary Studies 11: 50. [Google Scholar] [CrossRef]

- Tao, Fei, Fangyuan Sui, Ang Liu, Qinglin Qi, Meng Zhang, Boyang Song, Zirong Guo, Stephen C.-Y. Lu, and Andrew Y. C. Nee. 2019. Digital twin-driven product design framework. International Journal of Production Research 57: 3935–53. [Google Scholar] [CrossRef]

- Thanh, Pham Tien, Duong The Duy, and Pham Bao Duong. 2022. Disruptions to agricultural activities, income loss and food insecurity during the COVID-19 pandemic: Evidence from farm households in a developing country. Journal of Agribusiness in Developing and Emerging Economies 12: 531–47. [Google Scholar] [CrossRef]

- Tsenina, Ekaterina V., Tamara P. Danko, Vladimir M. Kiselev, Lyubov A. Chaykovskaya, Nikita D. Epstein, Ona Rauskiene, and Vladimir D. Sekerin. 2022. Cluster analysis of the expenditures for environmental and technological innovations in sustainable development policy formation. Journal of Environmental Management and Tourism 13: 63–74. [Google Scholar]

- United Nations. 2008. Achieving Sustainable Development and Promoting Development Cooperation. New York: United Nations Publications. Available online: https://www.un.org/en/ecosoc/docs/pdfs/fina_08-45773.pdf (accessed on 2 September 2022).

- Vaganova, Oksana V., Natalya E. Solovjeva, Ruslan M. Tamov, and Maria A. Panteleeva. 2021. Managing the Russian agro-industrial complex during the pandemic in the context of digitalization. Webology 18: 857–70. [Google Scholar] [CrossRef]

- Voronin, Boris Aleksandrovich. 2008. Razvitiye malogo i srednego predprinimatel’stva v agrarnoy sfere: Nauchno-pravovyye problemy [Development of small and medium-sized businesses in the agricultural sector: Scientific and legal problems]. Agrarnyy vestnik Urala 12: 86–88. [Google Scholar]

- Vyacheslavova, Olga F., Irina E. Parfenyeva, Tatyana A. Lartseva, Tatiana A. Levina, Oxana G. Savostikova, and Vladlena V. Matrosova. 2022. Desarrollo de criterios para la evaluación de personal en la contabilidad de producción de alta tecnología para el desarrollo de tecnología ddigital [Development of criteria for personnel assessment in high-tech production accounting for the development of digital technology]. REICE: Revista Electrónica De Investigación En Ciencias Económicas 10: 140–60. [Google Scholar]

- Wolfert, Sjaak, Lan Ge, Cor Verdouw, and Marc-Jeroen Bogaardt. 2017. Big data in smart farming—A review. Agricultural Systems 153: 69–80. [Google Scholar] [CrossRef]

- Yanjun, Tong. 2013. Study on computer audit based on OLAP technology. Journal of Digital Information Management 11: 409–17. [Google Scholar]

- Zielińska-Chmielewska, Anna, Dobrosława Mruk-Tomczak, and Anna Wielicka-Regulska. 2021. Qualitative Research on Solving Difficulties in Maintaining Continuity of Food Supply Chain on the Meat Market during the COVID-19 Pandemic. Energies 14: 5634. [Google Scholar] [CrossRef]

- Zolotar, Svetlana. n.d. A Third of Russians Are Paid Late and 16% Receive Their Wages in an Envelope: Avito Rabota Research. Available online: https://businesstory.ru/treti-rossijan-zaderzhivajut-zarplatu-a-16-poluchajut-ee-v-konverte-issledovanie-avito-rabota/ (accessed on 2 September 2022).

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).