Economic Value Added Research: Mapping Thematic Structure and Research Trends

Abstract

1. Introduction

2. Conceptualization of the Study

2.1. Emergence of Economic Value Added (EVA)

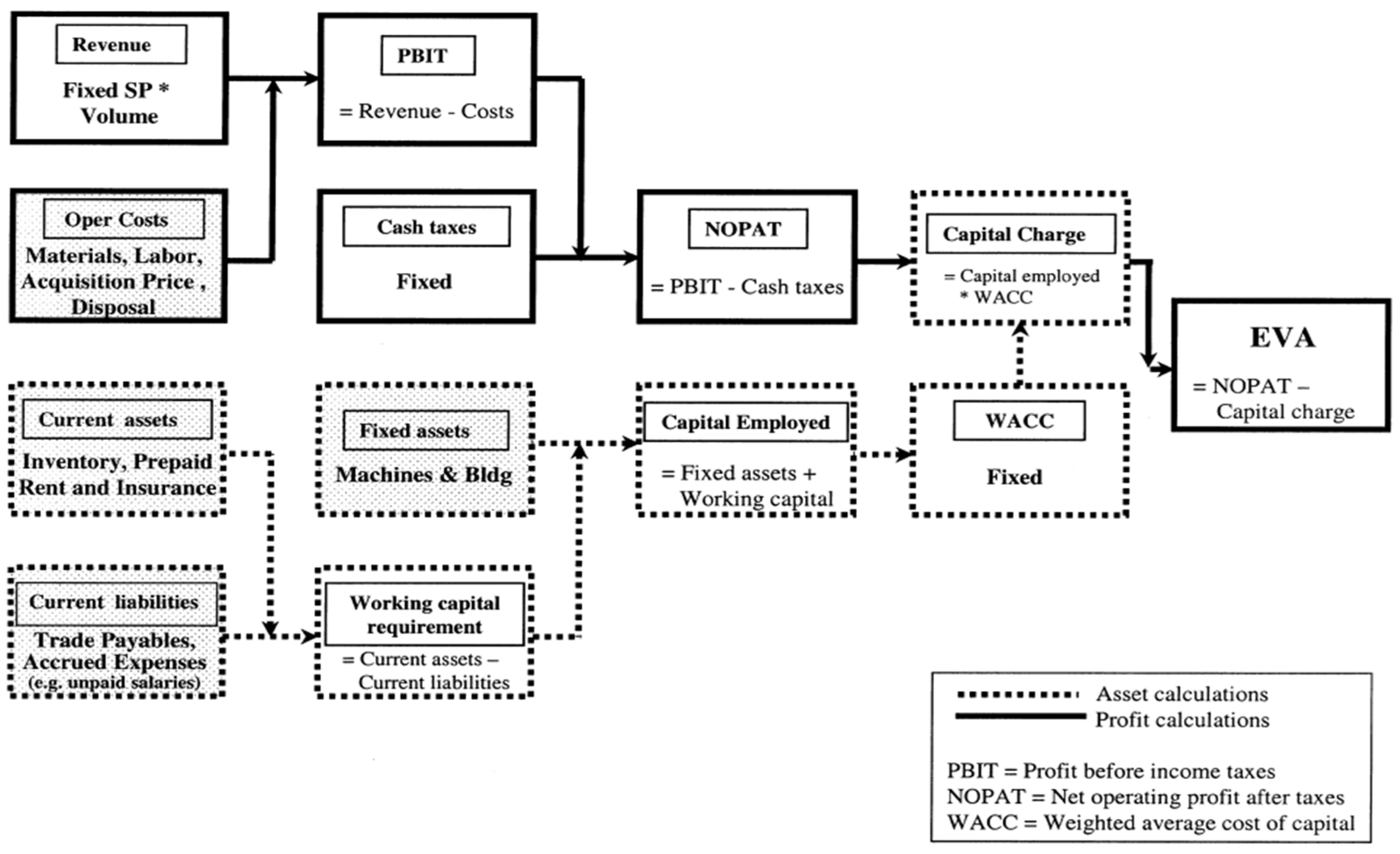

2.2. Concept of EVA

3. Methodology

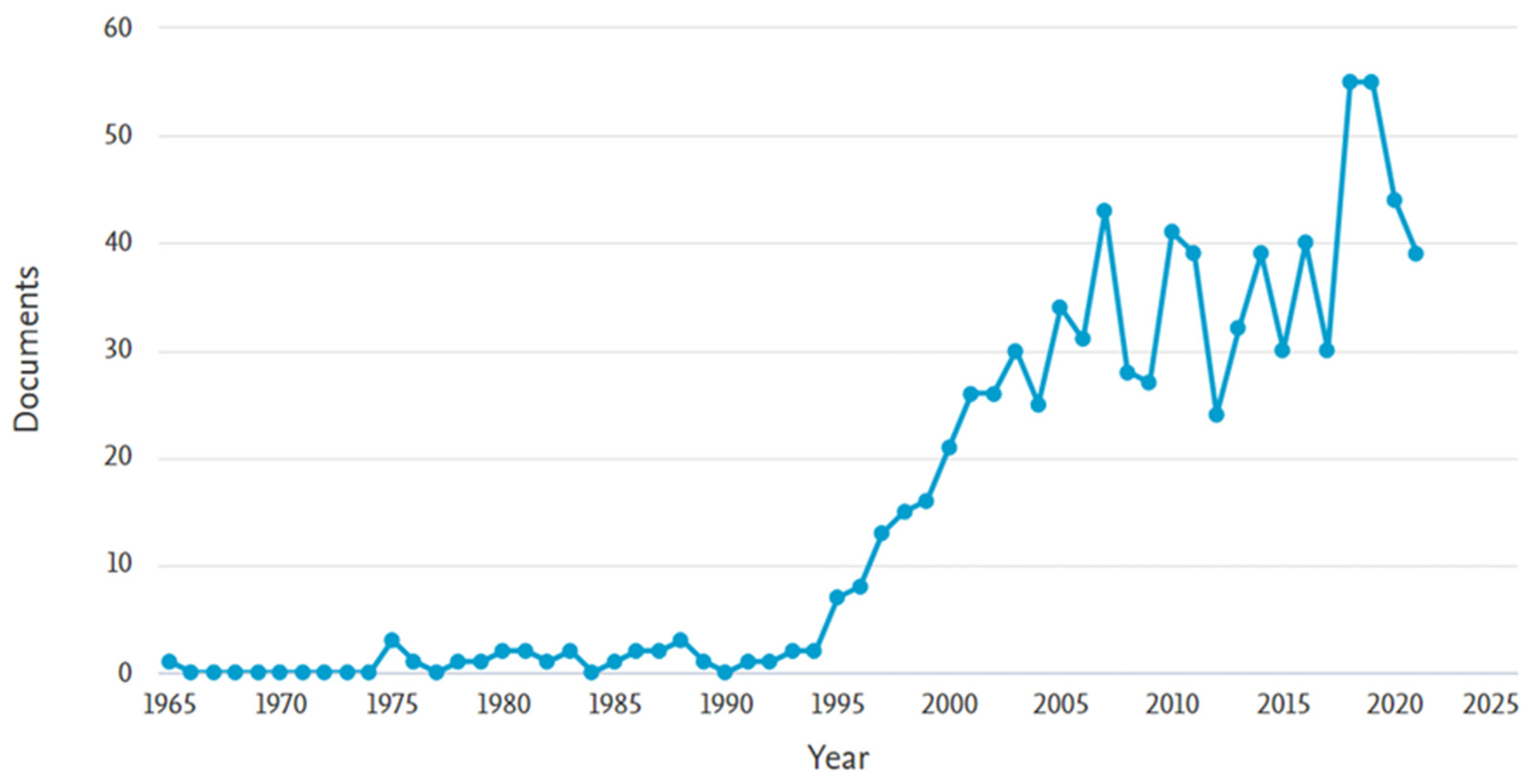

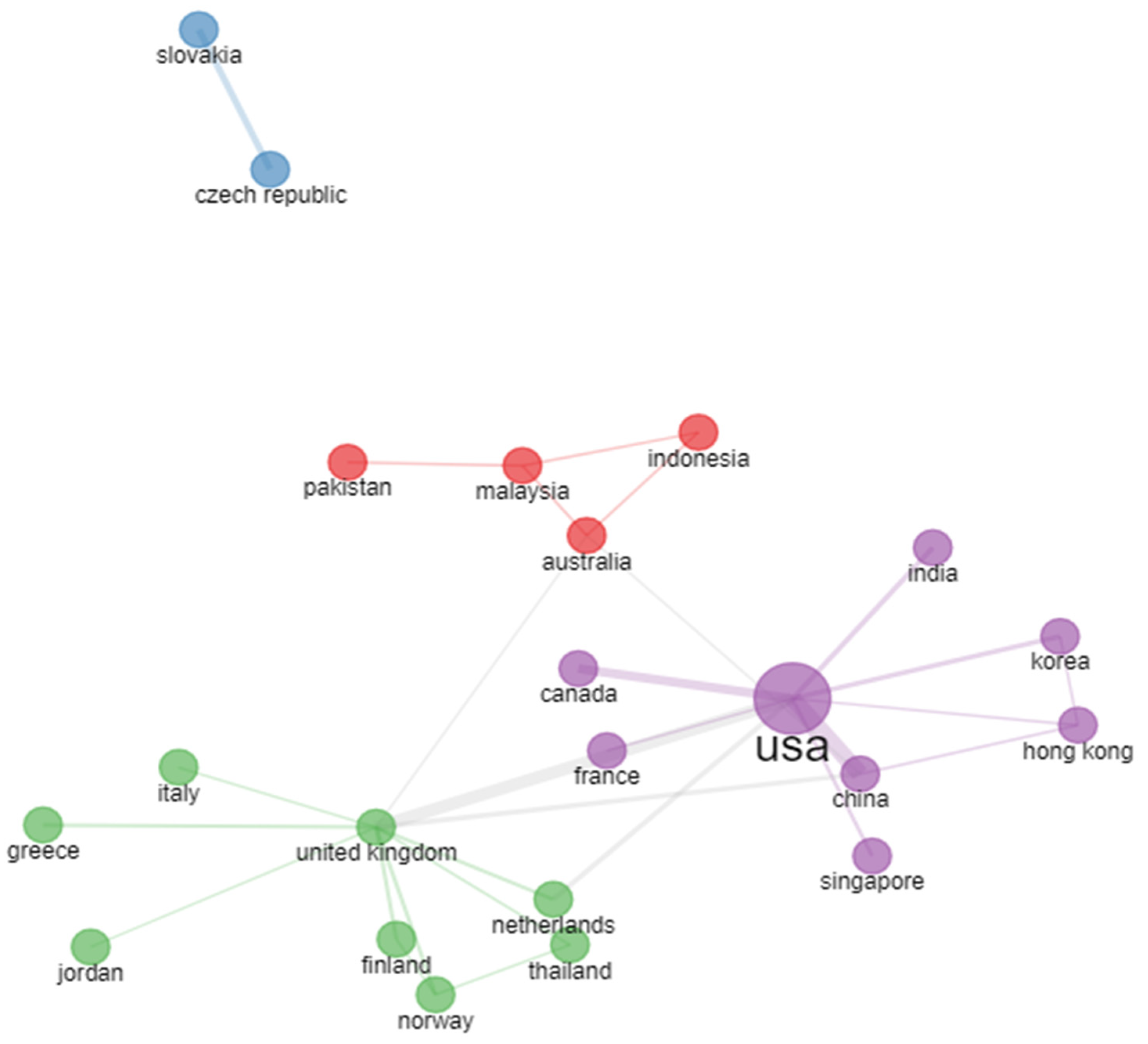

4. Analysis

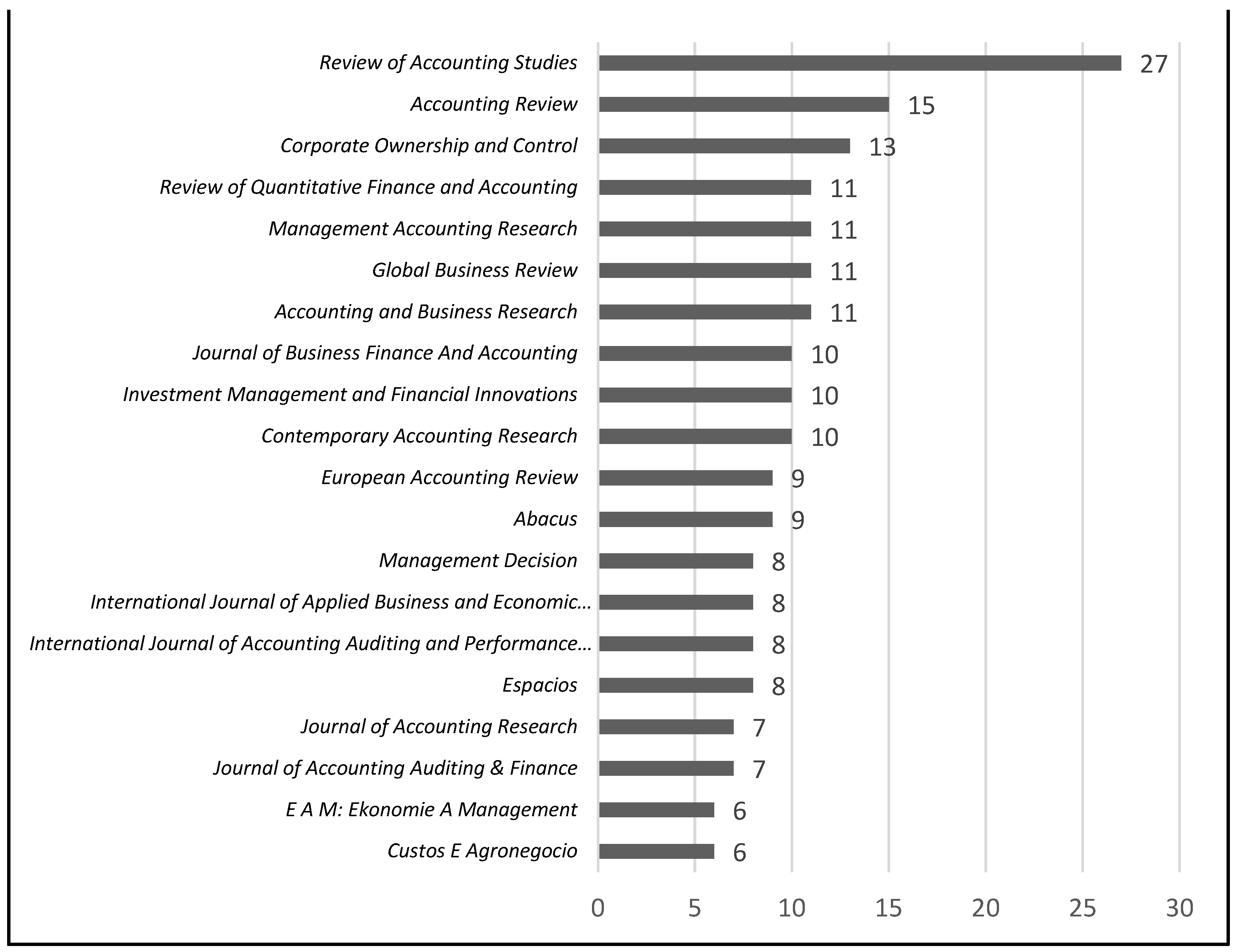

4.1. Leading Performing Publishing Outlets in the EVA Research Domain

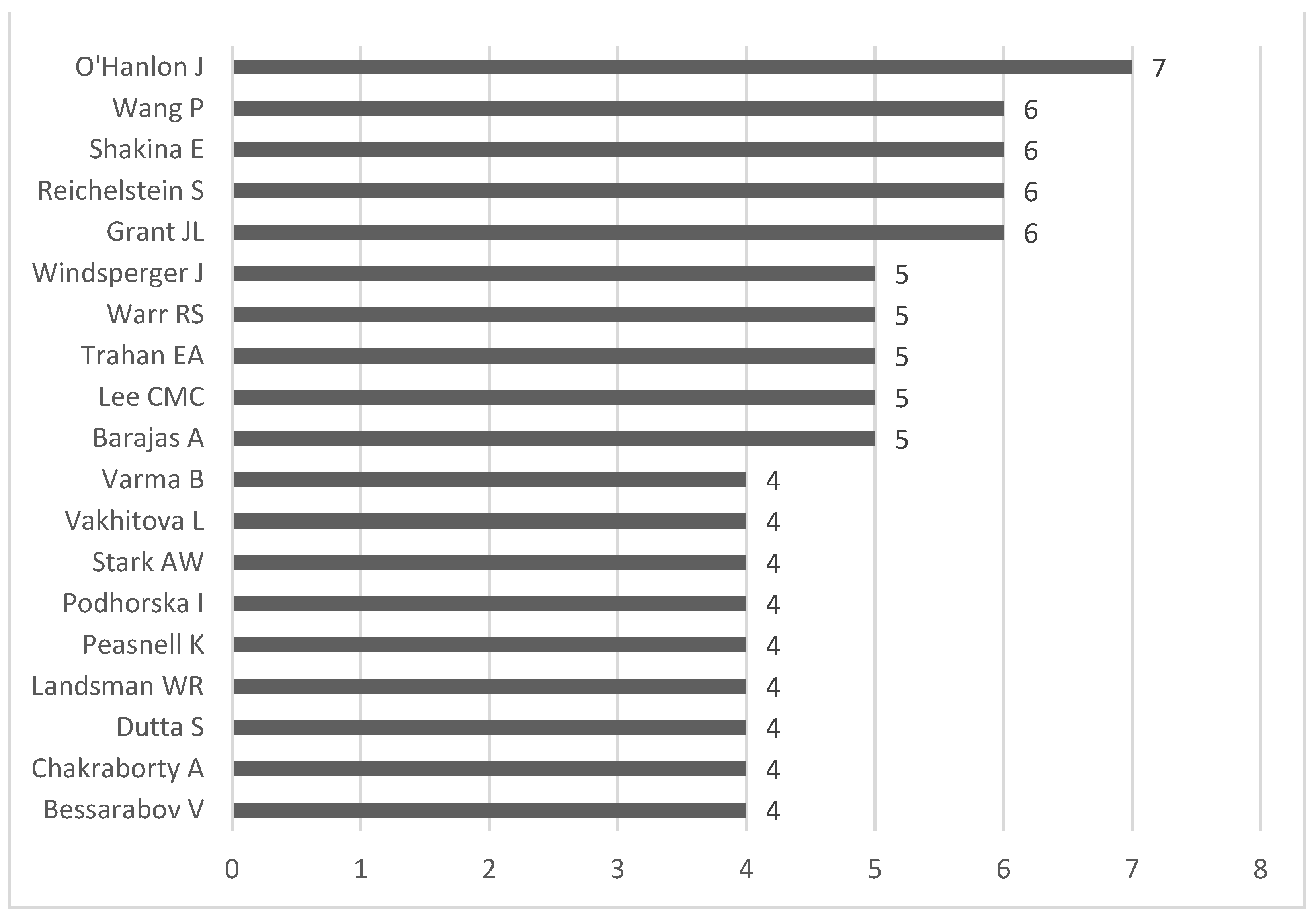

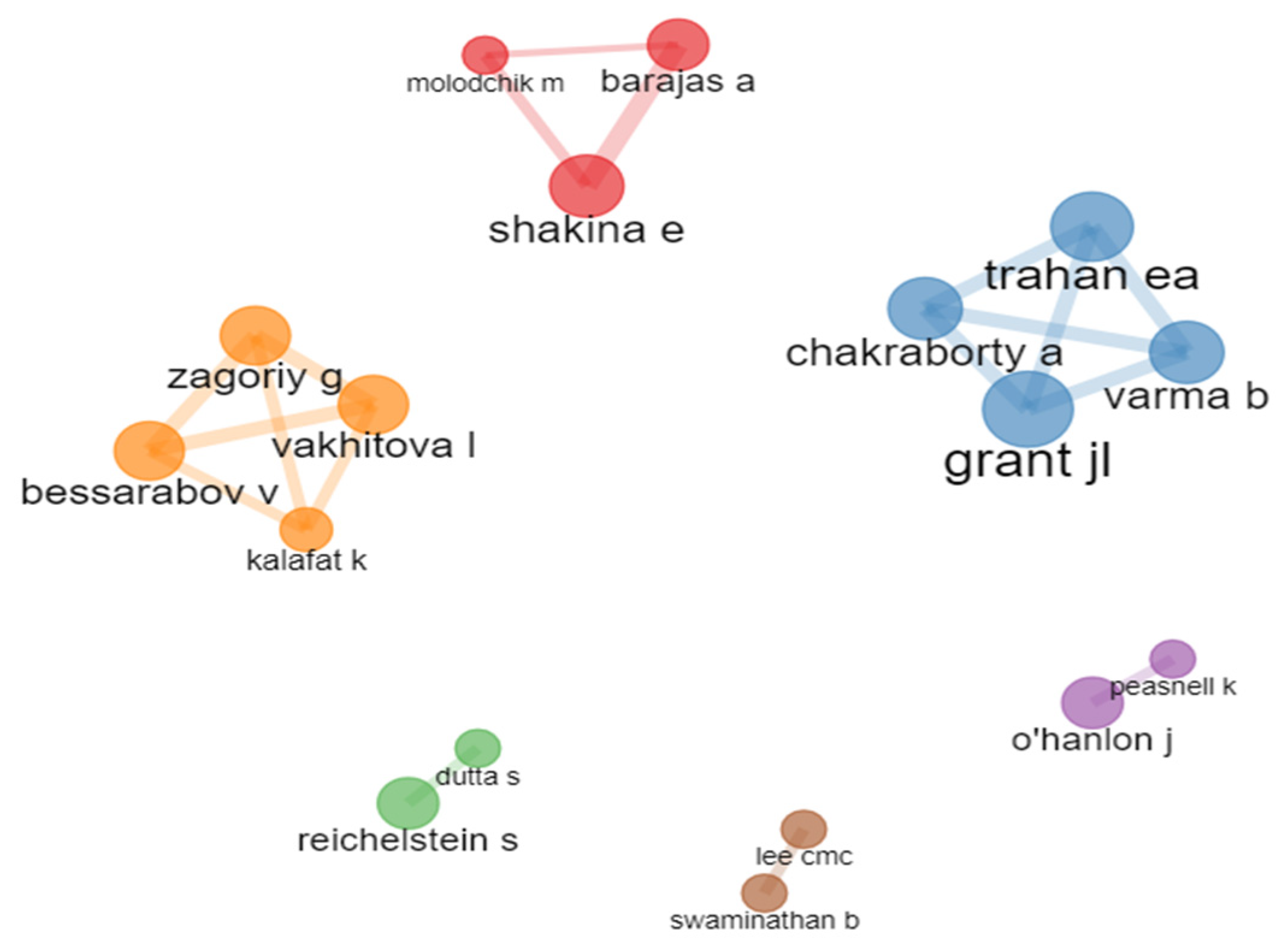

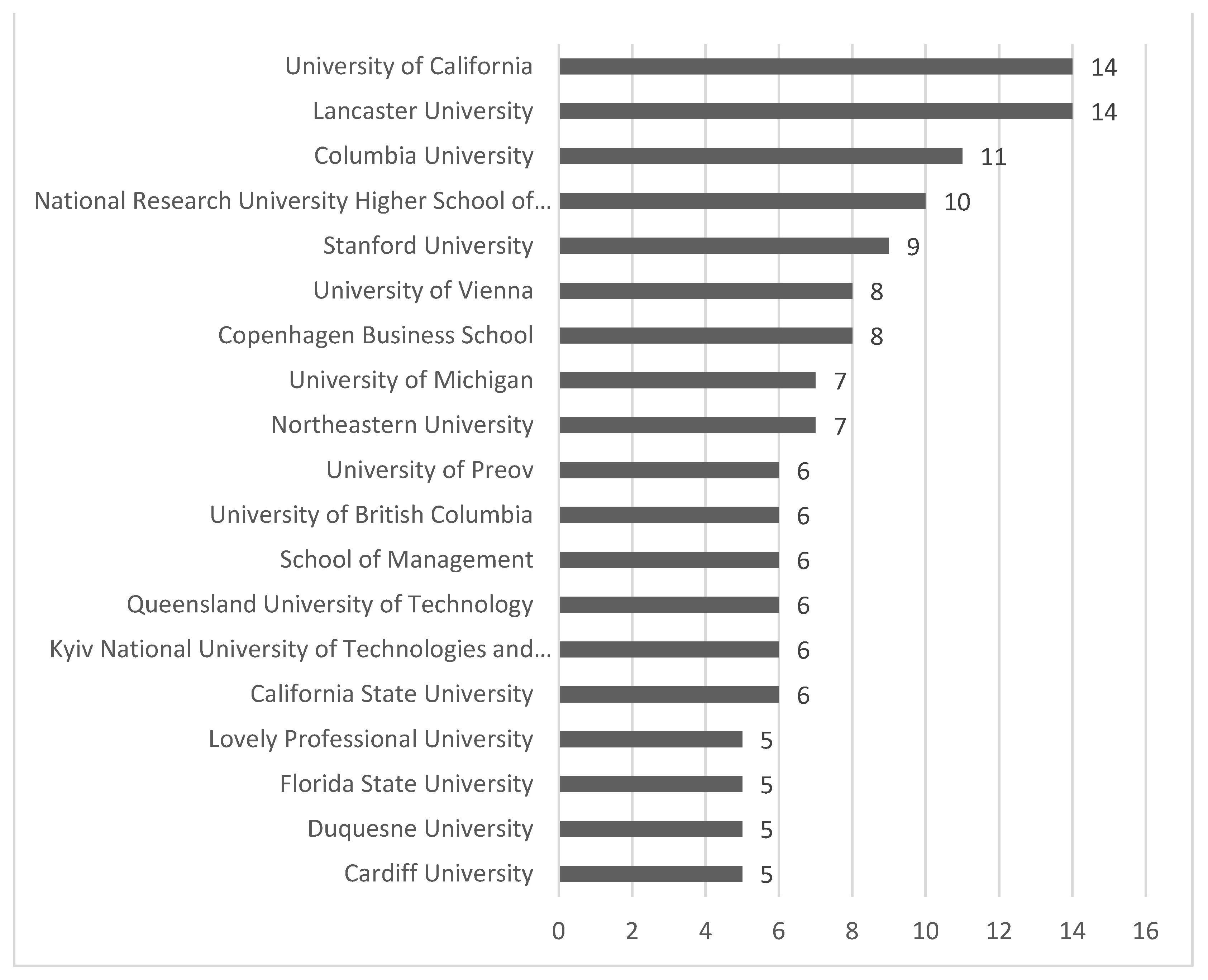

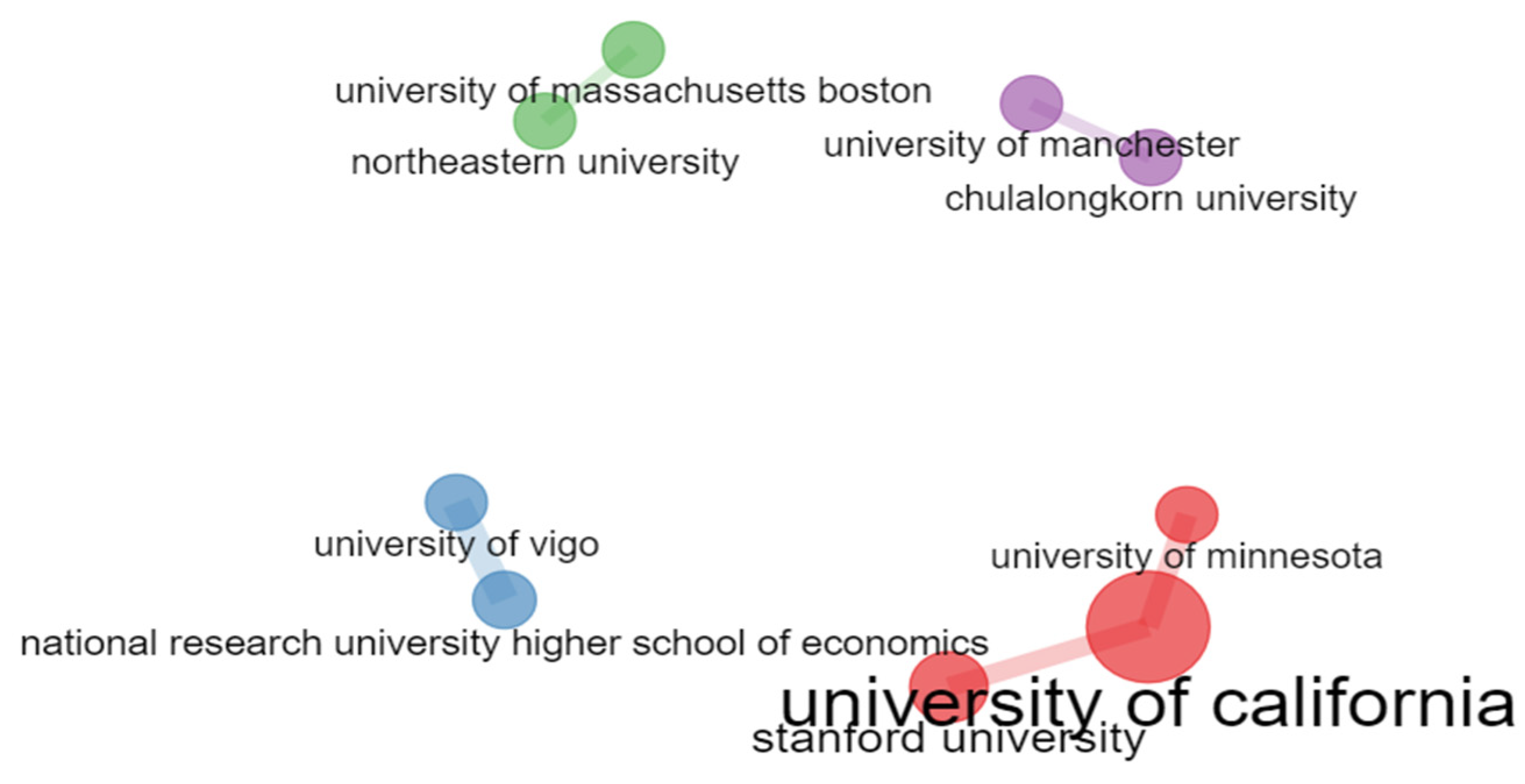

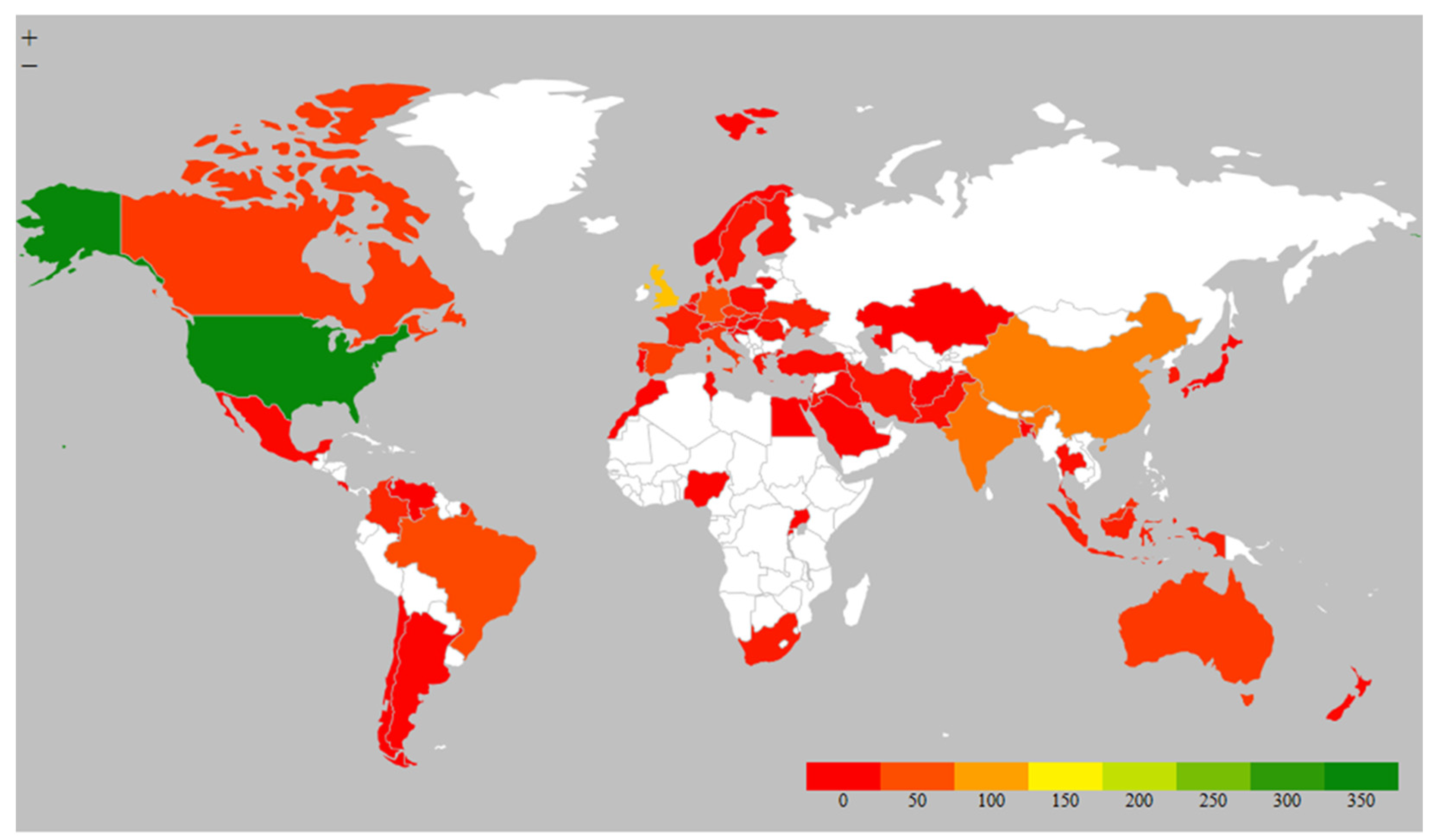

4.2. Leading Performing Authors and Institutions in the EVA Research Domain

5. Literature Review

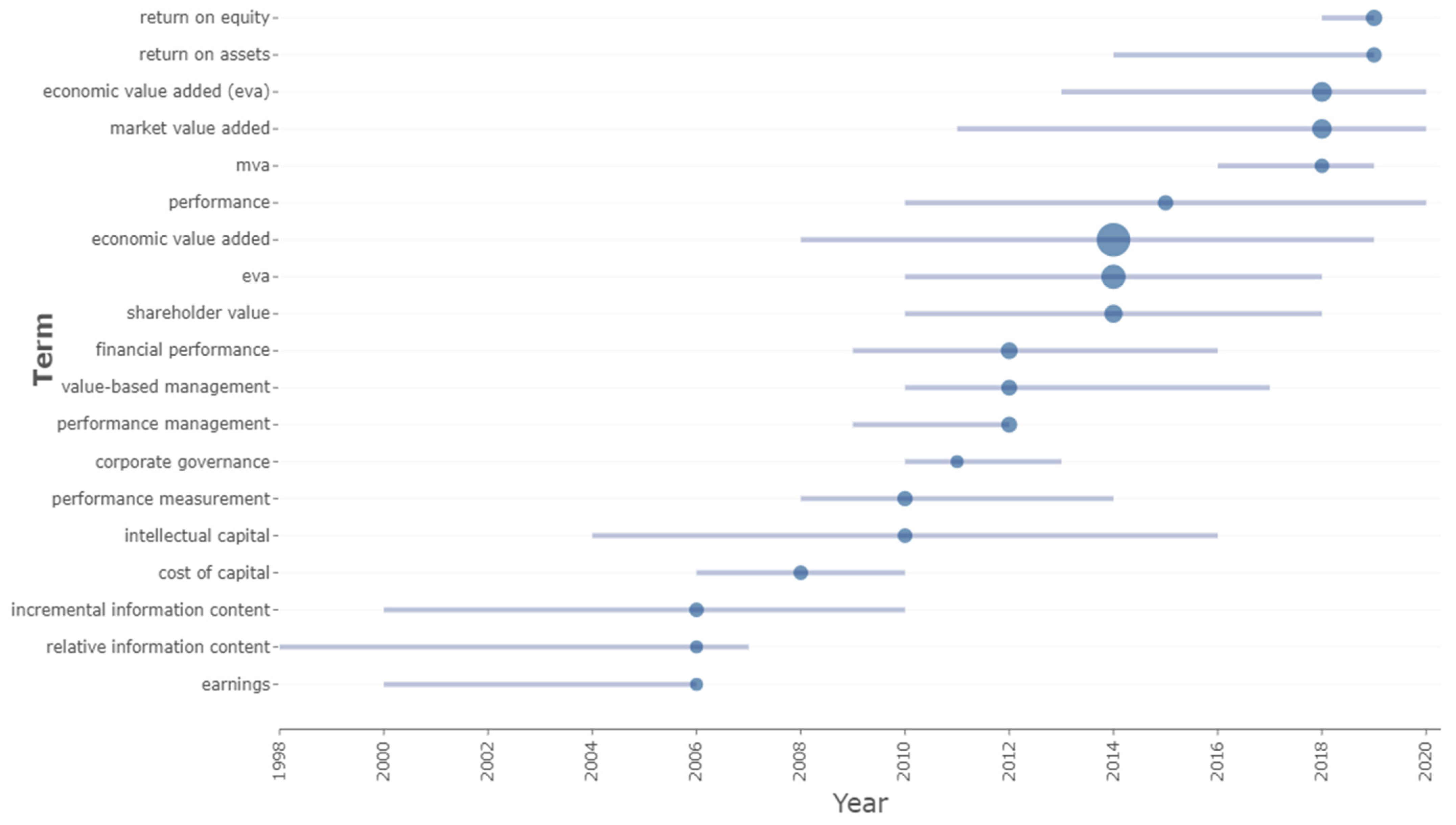

6. Keyword Analysis in EVA Research Domain

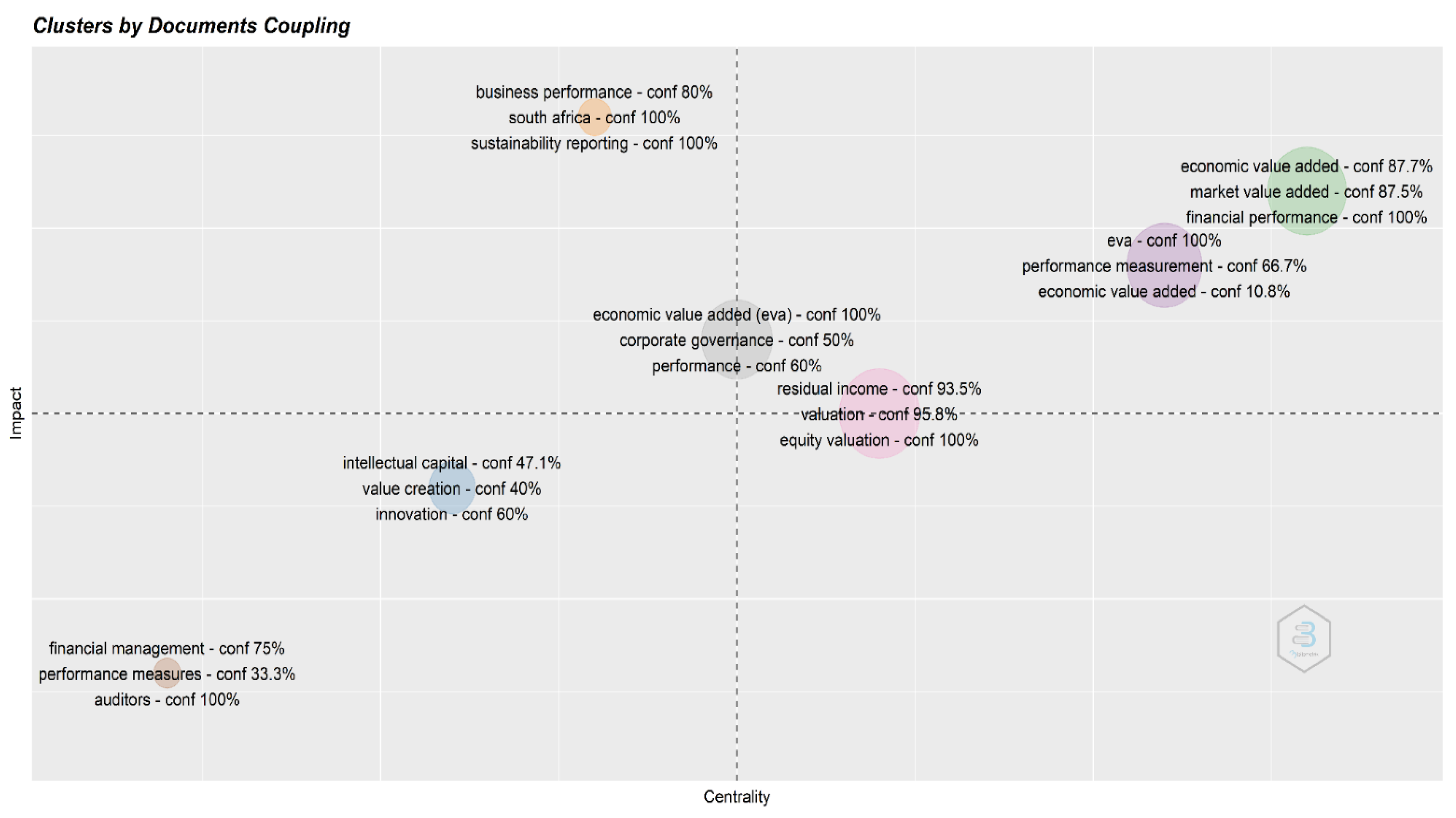

7. Analysis of Knowledge Clusters in the EVA Research Domain

7.1. Residual Income and Valuation

7.2. Financial Performance

7.3. Performance Management and Corporate Governance

8. Conclusions

9. Further Research Areas in EVA

10. Limitation

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Alcaide-Muñoz, Laura, Manuel Pedro Rodríguez-Bolívar, Manuel Jesús Cobo, and Enrique Herrera-Viedma. 2017. Analysing the scientific evolution of e-Government using a science mapping approach. Government Information Quarterly 34: 545–55. [Google Scholar] [CrossRef]

- Archambault, Éric, David Campbell, Yves Gingras, and Vincent Larivière. 2009. Comparing bibliometric statistics obtained from the Web of Science and Scopus. Journal of the American Society for Information Science and Technology 60: 1320–26. [Google Scholar] [CrossRef]

- Bacidore, Jeffrey M., John A. Boquist, Todd T. Milbourn, and Anjan V. Thakor. 1997. The search for the best financial performance measure. Financial Analysts Journal 53: 11–20. [Google Scholar] [CrossRef]

- Bennett, Stewart G. 1991. Quest for Value. New York: Harper Business. [Google Scholar]

- Bodie, Zvi, Alex Kane, and Alan Marcus. 2014. EBOOK: Investments-Global Edition. New York: McGraw Hill Education Europe, Middle East & Africa. [Google Scholar]

- Bontis, Nick, Nicola C. Dragonetti, Kristine Jacobsen, and Göran Roos. 1999. The knowledge toolbox: A review of the tools available to measure and manage intangible resources. European Management Journal 17: 391–402. [Google Scholar] [CrossRef]

- Brusco, Michael. 2022. Logistic regression via Excel spreadsheets: Mechanics, model selection, and relative predictor importance. INFORMS Transactions on Education 23: 1–11. [Google Scholar] [CrossRef]

- Chen, Shimin, and James L. Dodd. 2001. Operating income, residual income and EVA™: Which metric is more value relevant? Journal of Managerial Issues 13: 65–86. [Google Scholar]

- Clinton, B. Douglas, and Shimin Chen. 1998. Do new performance measures measure up? Strategic Finance 80: 38–43. [Google Scholar]

- Cobo, Manuel J., Antonio Gabriel López-Herrera, Enrique Herrera-Viedma, and Francisco Herrera. 2011. Science mapping software tools: Review, analysis, and cooperative study among tools. Journal of the American Society for Information Science and Technology 62: 1382–402. [Google Scholar] [CrossRef]

- Dechow, Patricia M., Amy P. Hutton, and Richard G. Sloan. 1999. An empirical assessment of the residual income valuation model. Journal of Accounting and Economics 26: 1–34. [Google Scholar] [CrossRef]

- Ding, Ying, Gobinda G. Chowdhury, and Schubert Foo. 2001. Bibliometric cartography of information retrieval research by using co-word analysis. Information Processing & Management 37: 817–42. [Google Scholar]

- Dobrowolski, Zbyslaw, Grzegorz Drozdowski, Mirela Panait, and Arkadiusz Babczuk. 2022. Can the economic value added Be used as the universal financial metric? Sustainability 14: 2967. [Google Scholar] [CrossRef]

- Dong, Ming, David Hirshleifer, Scott Richardson, and Siew Hong Teoh. 2006. Does investor misvaluation drive the takeover market? The Journal of Finance 61: 725–762. [Google Scholar] [CrossRef]

- Drucker, Peter F. 1995. The information executives truly need. Harvard Business Review 73: 54–62. [Google Scholar]

- Ehrbar, Al. 1999. Using EVA to measure performance and assess strategy. Strategy & Leadership 27: 20–24. [Google Scholar]

- Eugster, Florian, and Alexander F. Wagner. 2020. Value reporting and firm performance. Journal of International Accounting, Auditing and Taxation 40: 100319. [Google Scholar] [CrossRef]

- Fisher, Anne B. 1995. Creating Stockholder Wealth-Market Value Added. Fortune 132: 105–6. [Google Scholar]

- Foster, George, and S. Mark Young. 1997. Frontiers of management accounting research. Journal of Management Accounting Research 9: 63. [Google Scholar]

- Frankel, Richard, and Charles M. C. Lee. 1998. Accounting valuation, market expectation, and cross-sectional stock returns. Journal of Accounting and Economics 25: 283–319. [Google Scholar] [CrossRef]

- Gebhardt, William R., Charles M. Lee, and Bhaskaran Swaminathan. 2001. Toward an implied cost of capital. Journal of Accounting Research 39: 135–76. [Google Scholar] [CrossRef]

- Gode, Dan, and Partha Mohanram. 2003. Inferring the cost of capital using the Ohlson–Juettner model. Review of Accounting Studies 8: 399–431. [Google Scholar] [CrossRef]

- Guermat, Cherif, Ismail U. Misirlioglu, and Ahmed M. Al-Omush. 2019. The long-term effect of economic value added adoption on the firm’s business decision. Accounting Research Journal 32: 496–513. [Google Scholar] [CrossRef]

- Guide, V. Daniel, Jr., and Luk N. Van Wassenhove. 2001. Managing product returns for remanufacturing. Production and Operations Management 10: 142–55. [Google Scholar] [CrossRef]

- Haller, Axel, and Herve Stolowy. 1998. Value added in financial accounting: A comparative study between Germany and France. Advances in International Accounting 11: 23–51. [Google Scholar]

- Harzing, Anne-Wil, and Ron Van der Wal. 2009. A Google Scholar h-index for journals: An alternative metric to measure journal impact in economics and business. Journal of the American Society for Information Science and Technology 60: 41–46. [Google Scholar] [CrossRef]

- Hawawini, Gabriel, Venkat Subramanian, and Paul Verdin. 2003. Is performance driven by industry-or firm-specific factors? A new look at the evidence. Strategic Management Journal 24: 1–16. [Google Scholar] [CrossRef]

- Hillman, Amy J., and Gerald D. Keim. 2001. Shareholder value, stakeholder management, and social issues: What’s the bottom line? Strategic Management Journal 22: 125–39. [Google Scholar] [CrossRef]

- Jankalová, Miriam, and Jana Kurotová. 2019. Sustainability assessment using economic value added. Sustainability 12: 318. [Google Scholar] [CrossRef]

- Jones, Michael J., and Richard Slack. 2011. The Future of Financial Reporting 2011: Global Crisis and Accounting at a Crossroads. London: British Accounting and Finance Association. [Google Scholar]

- King, Adelaide W., and Carl P. Zeithaml. 2001. Competencies and firm performance: Examining the causal ambiguity paradox. Strategic Management Journal 22: 75–99. [Google Scholar] [CrossRef]

- Kumar, Satish, Neeraj Pandey, Weng Marc Lim, Akash Nil Chatterjee, and Nitesh Pandey. 2021. What do we know about transfer pricing? Insights from bibliometric analysis. Journal of Business Research 134: 275–87. [Google Scholar] [CrossRef]

- Lee, Charles M. C., James Myers, and Bhaskaran Swaminathan. 1999. What is the Intrinsic Value of the Dow? The Journal of Finance 54: 1693–741. [Google Scholar] [CrossRef]

- Lehn, Kenneth, and Anil K. Makhija. 1996. EVA and MVA as performance measures and signals for strategic change. Strategy and Leadership 1: 1–12. [Google Scholar] [CrossRef]

- Lo, Kin, and Thomas Lys. 2000. The Ohlson model: Contribution to valuation theory, limitations, and empirical applications. Journal of Accounting, Auditing & Finance 15: 337–67. [Google Scholar]

- Mäkeläinen, Esa, and Narcyz Roztocki. 1998. Economic Value Added (EVA) for Small Business. Retrieved from Evanomics. August 24. Available online: http://www.evanomics.com/download/evaspres.pdf (accessed on 18 September 2022).

- Marshal, A. 1890. The Principles of Economics; An Introductory Volume. Available online: https://eet.pixel-online.org/files/etranslation/original/Marshall,%20Principles%20of%20Economics.pdf (accessed on 16 September 2022).

- Matemane, Matwale R., and Rozane Wentzel. 2019. Integrated reporting and financial performance of South African listed banks. Banks and Bank Systems 14: 128–39. [Google Scholar] [CrossRef]

- Moro-Visconti, Roberto. 2022. Profitability and Value Creation. In Augmented Corporate Valuation. Cham: Palgrave Macmillan. [Google Scholar]

- Mukherjee, Debmalya, Weng Marc Lim, Satish Kumar, and Naveen Donthu. 2022. Guidelines for advancing theory and practice through bibliometric research. Journal of Business Research 148: 101–15. [Google Scholar] [CrossRef]

- O’Byrne, Stephen F. 1996. EVA and market value. Journal of Applied Corporate Finance 9: 116–26. [Google Scholar] [CrossRef]

- O’Hanlon, John, and Ken Peasnell. 1998. Wall Street’s contribution to management accounting: The Stern Stewart EVA® financial management system. Management Accounting Research 9: 421–44. [Google Scholar] [CrossRef]

- Obaidat, Ahmad N. 2019. Is economic value added superior to earnings and cash flows in explaining market value added? an empirical study. International Journal of Business, Accounting & Finance 13: 57–69. [Google Scholar]

- Otley, David. 1999. Performance management: A framework for management control systems research. Management Accounting Research 10: 363–82. [Google Scholar] [CrossRef]

- Otte, Evelien, and Ronald Rousseau. 2002. Social network analysis: A powerful strategy, also for the information sciences. Journal of information Science 28: 441–53. [Google Scholar] [CrossRef]

- Paul, Justin, Weng Marc Lim, Aron O’Cass, Andy W. Hao, and Stefano Bresciani. 2021. Scientific procedures and rationales for systematic literature reviews (SPAR-4-SLR). International Journal of Consumer Studies 45: 1–16. [Google Scholar] [CrossRef]

- Podlubny, Igor. 2005. Comparison of scientific impact expressed by the number of citations in different fields of science. Scientometrics 64: 95–99. [Google Scholar] [CrossRef]

- Polo, Andrés, Numar Peña, Dairo Muñoz, Adrian Cañón, and John Willmer Escobar. 2019. Robust design of a closed-loop supply chain under uncertainty conditions integrating financial criteria. Omega 88: 110–32. [Google Scholar] [CrossRef]

- Purkayastha, Amrita, Eleanaro Palmaro, Holly J. Falk-Krzesinski, and Jeroen Baas. 2019. Comparison of two article-level, field-independent citation metrics: Field-Weighted Citation Impact (FWCI) and Relative Citation Ratio (RCR). Journal of Informetrics 13: 635–64. [Google Scholar] [CrossRef]

- Reichelstein, Stefan. 1997. Investment decisions and managerial performance evaluation. Review of Accounting Studies 2: 157–80. [Google Scholar] [CrossRef]

- Shaked, Israel, Allen Michel, and Pierre Leroy. 1997. Creating Value through EVA-Myth or Reality. August 24. Available online: https://www.strategy-business.com/article/12756 (accessed on 12 September 2022).

- Sharma, Anil K., and Satish Kumar. 2010. Economic value added (EVA)-literature review and relevant issues. International Journal of Economics and Finance 2: 200–20. [Google Scholar] [CrossRef]

- Shil, Nikhil C. 2009. Performance measures: An application of economic value added. International Journal of Business and Management 4: 169–77. [Google Scholar] [CrossRef]

- Siniak, Nikolai, and Daniela K. Lozanoska. 2019. A review of the application of the concept of economic and smart sustainable value added (SSVA) in industries performance evaluations. Broad Research in Artificial Intelligence and Neuroscience 10: 129–36. [Google Scholar]

- Stewart, G. Bennett. 1991. The Quest for Value: A Guide for Senior Managers. New York: HarperCollins, Publishers Inc. [Google Scholar]

- Subedi, Meena, and Ali Farazmand. 2020. Economic value added (EVA) for performance evaluation of public organizations. Public Organization Review 20: 613–40. [Google Scholar] [CrossRef]

- Tanjung, Putri R., and Sely M. Wahyudi. 2019. Analysis the Effect Disclosure of Sustainability Report, Economic Value Added and Other Fundamental Factors of Companies on Company Value. International Journal of Academic Research in Accounting, Finance and Management Sciences 9: 237–49. [Google Scholar]

- Tripathi, Manju, Smita Kashiramka, and P. K. Jain. 2018. Social construction of linking executive compensation to EVA: A study on Indian corporates. Journal of Indian Business Research 11: 202–19. [Google Scholar] [CrossRef]

- Vrbka, Jaromir. 2020. The use of neural networks to determine value based drivers for SMEs operating in the rural areas of the Czech Republic. Oeconomia Copernicana 11: 325–46. [Google Scholar] [CrossRef]

- Wallace, James S. 1997. Adopting residual income-based compensation plans: Do you get what you pay for? Journal of Accounting and Economics 24: 275–300. [Google Scholar] [CrossRef]

- Wu, Dingming, Man Lung Yiu, Christian S. Jensen, and Gao Cong. 2011. Efficient continuously moving top-k spatial keyword query processing. Present at the 2011 IEEE 27th International Conference on Data Engineering, Hannover, Germany, April 11–16; pp. 541–52. [Google Scholar]

- Young, David. 1997. Economic value added: A primer for European managers. European Management Journal 15: 335–43. [Google Scholar] [CrossRef]

| Source Title | AJG Rating | ABDC Rating | h-Index | TC | NP | PY-Start | NP | Rank (TC/NP) | CPY | Rank (CPY) |

|---|---|---|---|---|---|---|---|---|---|---|

| Strategic Management Journal | 4* | A* | 2 | 2293 | 2 | 2001 | 1147 | 1 | 109 | 1 |

| Management Accounting Research | 3 | A* | 10 | 1399 | 11 | 1995 | 127 | 10 | 52 | 3 |

| Journal of Accounting Research | 4* | A* | 6 | 1319 | 7 | 2000 | 188 | 6 | 60 | 2 |

| Review of Accounting Studies | 4 | A* | 16 | 1098 | 26 | 1996 | 42 | 14 | 42 | 6 |

| Journal of Accounting and Economics | 4* | A* | 5 | 1091 | 5 | 1997 | 218 | 4 | 44 | 5 |

| Accounting Review | 4* | A* | 14 | 1004 | 15 | 2000 | 67 | 12 | 46 | 4 |

| Journal of Finance | 4* | A* | 2 | 718 | 2 | 1999 | 359 | 3 | 31 | 7 |

| European Management Journal | 2 | B | 4 | 602 | 4 | 1997 | 151 | 9 | 24 | 8 |

| Production and Operations Management | 4 | A* | 1 | 500 | 1 | 2001 | 500 | 2 | 24 | 9 |

| European Accounting Review | 3 | A* | 6 | 468 | 8 | 2001 | 59 | 13 | 22 | 10 |

| Contemporary Accounting Research | 4 | A* | 8 | 357 | 10 | 2001 | 36 | 17 | 17 | 11 |

| International Journal of Accounting Information Systems | 2 | A | 2 | 318 | 2 | 2001 | 159 | 7 | 15 | 12 |

| Journal of Management | 4* | A* | 1 | 303 | 2 | 1978 | 152 | 8 | 7 | 19 |

| Journal of Accounting, Auditing & Finance | 3 | A | 6 | 286 | 7 | 2000 | 41 | 16 | 13 | 13 |

| Journal of Business Finance and Accounting | 3 | A* | 8 | 254 | 10 | 1996 | 25 | 19 | 10 | 16 |

| Financial Analysts Journal | 3 | A | 5 | 211 | 5 | 1997 | 42 | 15 | 8 | 18 |

| R and D Management | 3 | A | 1 | 197 | 1 | 2006 | 197 | 5 | 12 | 14 |

| Journal of Financial and Quantitative Analysis | 4 | A* | 2 | 179 | 2 | 2002 | 90 | 11 | 9 | 17 |

| Accounting and Business Research | 3 | A | 7 | 176 | 10 | 1979 | 18 | 20 | 4 | 20 |

| Journal of Intellectual Capital | 2 | B | 5 | 172 | 6 | 2008 | 29 | 18 | 12 | 15 |

| Authors | h_Index | TC | NP | PY-Start | TC/NP | Rank (TC/NP) | CPY | Rank (CPY) |

|---|---|---|---|---|---|---|---|---|

| Hillman AJ | 1 | 1895 | 1 | 2001 | 1895 | 1 | 95 | 1 |

| Keim GD | 1 | 1895 | 1 | 2001 | 1895 | 1 | 95 | 1 |

| Lee CMC | 5 | 1541 | 5 | 1998 | 308 | 17 | 67 | 3 |

| Swaminathan B | 3 | 1081 | 3 | 1999 | 360 | 16 | 49 | 4 |

| Otley D | 3 | 879 | 3 | 1999 | 293 | 18 | 40 | 5 |

| Gebhardt WR | 1 | 786 | 1 | 2001 | 786 | 3 | 39 | 6 |

| Roos G | 2 | 512 | 2 | 1999 | 256 | 19 | 23 | 13 |

| Van Wassenhove LN | 1 | 500 | 1 | 2001 | 500 | 4 | 25 | 11 |

| Bontis N | 1 | 499 | 1 | 1999 | 499 | 6 | 23 | 15 |

| Dragonetti NC | 1 | 499 | 1 | 1999 | 499 | 6 | 23 | 15 |

| Jacobsen K | 1 | 499 | 1 | 1999 | 499 | 6 | 23 | 15 |

| Frankel R | 1 | 452 | 1 | 1998 | 452 | 8 | 20 | 17 |

| Dong M | 1 | 436 | 1 | 2006 | 436 | 11 | 29 | 9 |

| Hirshleifer D | 1 | 436 | 1 | 2006 | 436 | 11 | 29 | 9 |

| Richardson S | 1 | 436 | 1 | 2006 | 436 | 11 | 29 | 9 |

| Teoh SH | 1 | 436 | 1 | 2006 | 436 | 11 | 29 | 9 |

| Mohanram P | 3 | 433 | 3 | 2003 | 144 | 20 | 24 | 12 |

| Dechow PM | 1 | 400 | 1 | 1999 | 400 | 14 | 18 | 19 |

| Hutton AP | 1 | 400 | 1 | 1999 | 400 | 14 | 18 | 19 |

| Sloan RG | 1 | 400 | 1 | 1999 | 400 | 14 | 18 | 19 |

| Article | Authors & Year | Journal | TGC |

|---|---|---|---|

| Shareholder value, stakeholder management, and social issues: What’s the bottom line? | Hillman and Keim (2001) | Strategic Management Journal | 1895 |

| Performance management: A framework for management control systems research | Otley (1999) | Management Accounting Research | 858 |

| Toward an implied cost of capital | Gebhardt et al. (2001) | Journal of Accounting Research | 786 |

| Managing product returns for remanufacturing | Guide and Van Wassenhove (2001) | Production and Operations Management | 500 |

| The knowledge toolbox: A review of the tools available to measure and manage intangible resources | Bontis et al. (1999) | European Management Journal | 499 |

| Accounting valuation, market expectation, and cross-sectional stock returns | Frankel and Lee (1998) | Journal of Accounting and Economics | 452 |

| Does investor misvaluation drive the takeover market? | Dong et al. (2006) | Journal of Finance | 436 |

| An empirical assessment of the residual income valuation model | Dechow et al. (1999) | Journal of Accounting and Economics | 400 |

| Is performance was driven by industry–or firm-specific factors? A new look at the evidence | Hawawini et al. (2003) | Strategic Management Journal | 398 |

| Inferring the cost of capital using the Ohlson-Juettner model | Gode and Mohanram (2003) | Review of Accounting Studies | 363 |

| Article | Authors & Year | Journal | TLC |

|---|---|---|---|

| Accounting valuation, market expectation, and cross-sectional stock returns | Frankel and Lee (1998) | Journal of Accounting and Economics | 66 |

| An empirical assessment of the residual income valuation model | Dechow et al. (1999) | Journal of Accounting and Economics | 59 |

| What is the intrinsic value of the dow? | Lee et al. (1999) | Journal of Finance | 45 |

| Adopting residual income-based compensation plans: Do you get what you pay for? | Wallace (1997) | Journal of Accounting and Economics | 34 |

| Toward an implied cost of capital | Gebhardt et al. (2001) | Journal of Accounting Research | 32 |

| Wall Street’s contribution to management accounting: The Stern Stewart EVA® financial management system | O’Hanlon and Peasnell (1998) | Management Accounting Research | 27 |

| The search for the best financial performance measure | Bacidore et al. (1997) | Financial Analysts Journal | 27 |

| Investment decisions and managerial performance evaluation | Reichelstein (1997) | Review of Accounting Studies | 27 |

| Inferring the cost of capital using the Ohlson-Juettner model | Gode and Mohanram (2003) | Review of Accounting Studies | 20 |

| The Ohlson Model: Contribution to Valuation Theory, Limitations, and Empirical Applications | Lo and Lys (2000) | Journal of Accounting, Auditing and Finance | 19 |

| Cluster & Keywords | Cluster No. | Frequency | Centrality | Impact |

|---|---|---|---|---|

| Intellectual capital (47.1%), value creation (40%), and innovation (60%) | 1 | 15 | 0.076740303 | 2.320075525 |

| Economic value added (87.7%), market value added (87.5%), and financial performance (100%) | 2 | 135 | 0.26783151 | 3.015579838 |

| EVA (100%), performance measurement (66.7%), and economic value added (10.8%) | 3 | 106 | 0.257171546 | 2.86745628 |

| Business performance (80%), South Africa (100%), and sustainability reporting (100%) | 4 | 6 | 0.105958886 | 9.333333333 |

| Financial management (75%), performance measures (33.3%), and auditors (100%) | 5 | 4 | 0.060193845 | 0 |

| Residual income (93.5%), valuation (95.8%), and equity valuation (100%) | 6 | 150 | 0.167842498 | 2.760054716 |

| Economic value added (EVA) (100%), corporate governance (50%), and performance (60%) | 7 | 79 | 0.111283991 | 2.792080032 |

Disclaimer/Publisher’s Note: The statements, opinions and data contained in all publications are solely those of the individual author(s) and contributor(s) and not of MDPI and/or the editor(s). MDPI and/or the editor(s) disclaim responsibility for any injury to people or property resulting from any ideas, methods, instructions or products referred to in the content. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Tripathi, P.M.; Chotia, V.; Solanki, U.; Meena, R.; Khandelwal, V. Economic Value Added Research: Mapping Thematic Structure and Research Trends. Risks 2023, 11, 9. https://doi.org/10.3390/risks11010009

Tripathi PM, Chotia V, Solanki U, Meena R, Khandelwal V. Economic Value Added Research: Mapping Thematic Structure and Research Trends. Risks. 2023; 11(1):9. https://doi.org/10.3390/risks11010009

Chicago/Turabian StyleTripathi, Prasoon Mani, Varun Chotia, Umesh Solanki, Rahul Meena, and Vinay Khandelwal. 2023. "Economic Value Added Research: Mapping Thematic Structure and Research Trends" Risks 11, no. 1: 9. https://doi.org/10.3390/risks11010009

APA StyleTripathi, P. M., Chotia, V., Solanki, U., Meena, R., & Khandelwal, V. (2023). Economic Value Added Research: Mapping Thematic Structure and Research Trends. Risks, 11(1), 9. https://doi.org/10.3390/risks11010009