1. Introduction

According to Solvency II regulations, the insurer must be able to estimate the future claims reserves as accurately as possible. The insurer who operates in the non-life insurance business often does not know the amount of the final claims for the year of the accident at the end of that year. It depends on the business line in the non-life insurance industry or the time duration of a claims settlement. Delays can occur due to the time lag between the occurrence of the accident and the appearance of the consequences of the event. Therefore, a run-off triangle can be considered to arrange the claims reserves. Most important is to estimate the outstanding claims reserve. Various methods can be used, the most popular one is the classic chain-ladder method (

Verdonck et al. 2009).

“The chain ladder method is based on the assumption that the expectations underlying the columns and the rows in the run-off triangle are proportional” (

Verdonck et al. 2009). Since the early 1990s, several articles have been published to incorporate the simple chain ladder method into the statistical framework, and consideration has been given to stochastic models that generate a chain ladder algorithm (

Manolache 2019). Full stochastic models for the chain ladder method were published by (

Liu and Verrall 2010;

Mack 1993;

Murphy 1994;

Verdonck and Debruyne 2011;

Verdonck et al. 2009) and other authors. Extended versions of these models have also been created. For example, (

Peters et al. 2014) developed an extended class of model structures for the paid–incurred chain ladder models, where they developed exactly the Bayesian formulation of such models. (

Wuthrich 2017) extended the chain-ladder method for claims reserving to include information about the properties of individual claims applying a neural network model. “The chain ladder method should only be used for large portfolios where consistency of the estimates is more important than unbiasedness and where all entries into the incurred loss triangle are rather reliable (no big relative chance fluctuations and/or errors)” (

Bühlmann 2016, p. 7).

The Cape Cod method, which is also known as the Stanard–Buhlmann method, (

Bühlmann and Straub 1983;

Stanard 1985) was proposed to overcome some of the shortcomings of the chain ladder method (

Saluz 2015). The a priori loss ratio in the Cape Cod method “is calculated as the weighted average of the chain ladder ultimate loss ratios across all years with the used premium as the weights” (

Korn 2016, p. 1). Due to its simplicity and advantages over the chain ladder method, the Cape Cod method has become a proven method in practice (

Saluz 2015). The Cape Cod method is a special case of the Generalized Cape Cod Methods addressed by (

Gluck 1997;

Korn 2016;

Struzzieri et al. 1998).

One of the key decisions in estimating claims reserves is how to treat outliers. According to (

Embrechts and Wüthrich 2022, p. 5) outliers in insurance typically are not data errors but large financial claims that are an important pricing component. (

Verdonck and Van Wouwe 2011) proposed two techniques to detect and correct outliers in the bivariate chain-ladder method—the first technique was based on the bagplot to the bivariate dataset and the second one was the robust technique based on the MCD (Minimum Covariance Determinant). (

Avanzi et al. 2022) extended their approach and also applied two alternative robust bivariate chain-ladder techniques to treat outlier—the first one was based on the outlyingness and the second technique was based on bagdistance, which is derived from the bagplot.

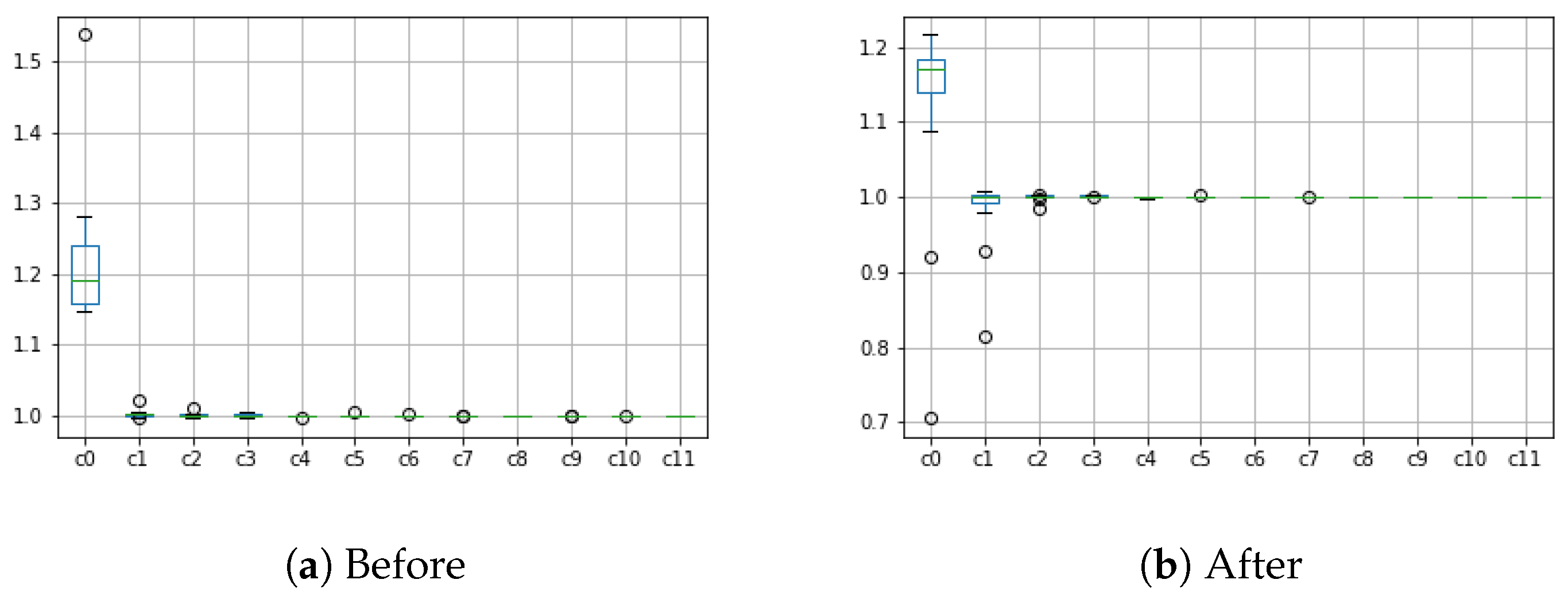

In relation to the above-mentioned, the objective of designing an in-house application (

Barlak 2021) for computing non-life reserves using well-defined deterministic and stochastic methods (

Avanzi et al. 2016;

Badounas and Pitselis 2020;

Brazauskas et al. 2009;

Peremans et al. 2018;

Verdonck and Van Wouwe 2011;

Verdonck et al. 2009), and challenges associated with the lack of person-specific data, lead us to the design of a new method to treat outliers in non-life development triangles. By applying properties of the heat equation, outliers could be treated without changing the whole triangle payments total sum. Furthermore, a bootstrap method using residuals could be applied in some cases where it was originally impossible.

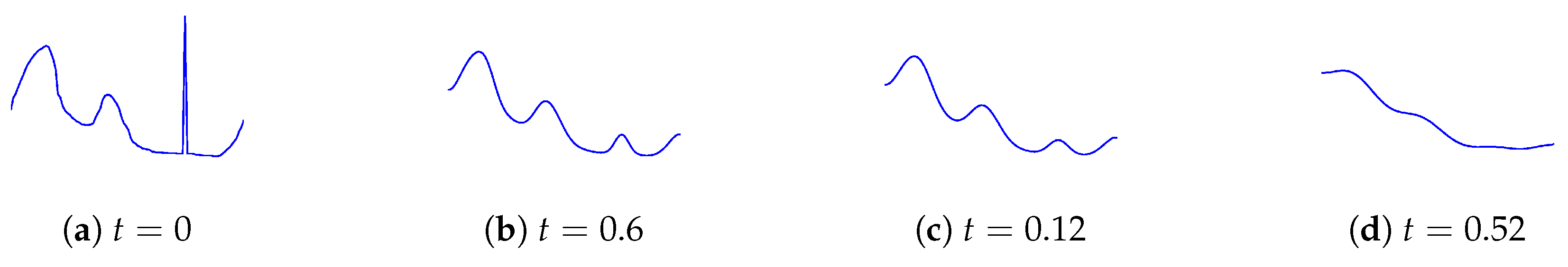

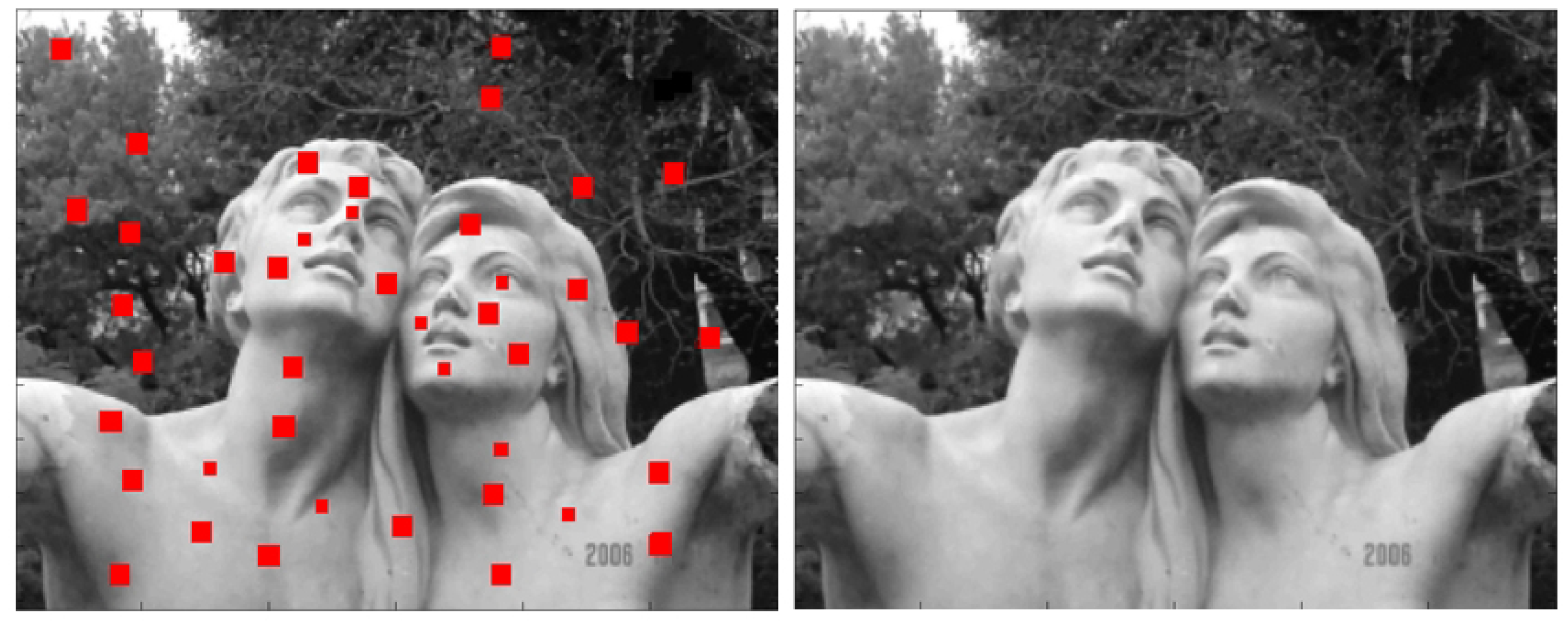

The heat equation is a partial differential equation that describes temperature changes in a given area over a period of time (

Gorguis and Chan 2008). The one-dimensional heat equation was first studied by Fourier at the beginning of the 19th century (

Cannon and Browder 1984). The heat equation has applications in various fields of science, one of the most important of them is the theory of heat conduction (

Widder 1976). It has also been used for image enhancement (

Black and Sapiro 1999;

Buades et al. 2006) or for a detection of a pollution problem (

El Badia and Ha-Duong 2002). (

Itkin et al. 2021) applied multi-layer heat equations when solving financial problems and developing efficient algorithms for pricing barrier options for time-dependent one-factor short-rate models. At present, we are not aware of the use of the heat equation to treat outliers in non-life development triangles. In this paper, we fill this gap by proposing a new method to treat outliers, which is based on a heat equation.

Based on the above, we set the aim of the paper to design a new method to treat outliers in non-life development triangles.

The remainder of the paper is structured as follows.

Section 2 outlines the theoretical basis of methods for the calculation of technical reserves. Selected Chain-ladder and Cape Cod deterministic methods (

Section 2.1.1) with their stochastic adjustments (

Section 2.1.2) and additional stochastic modification (

Cowell 2009) (

Section 2.1.3) are introduced in this section. Two different methods for treating outliers in 2-D (

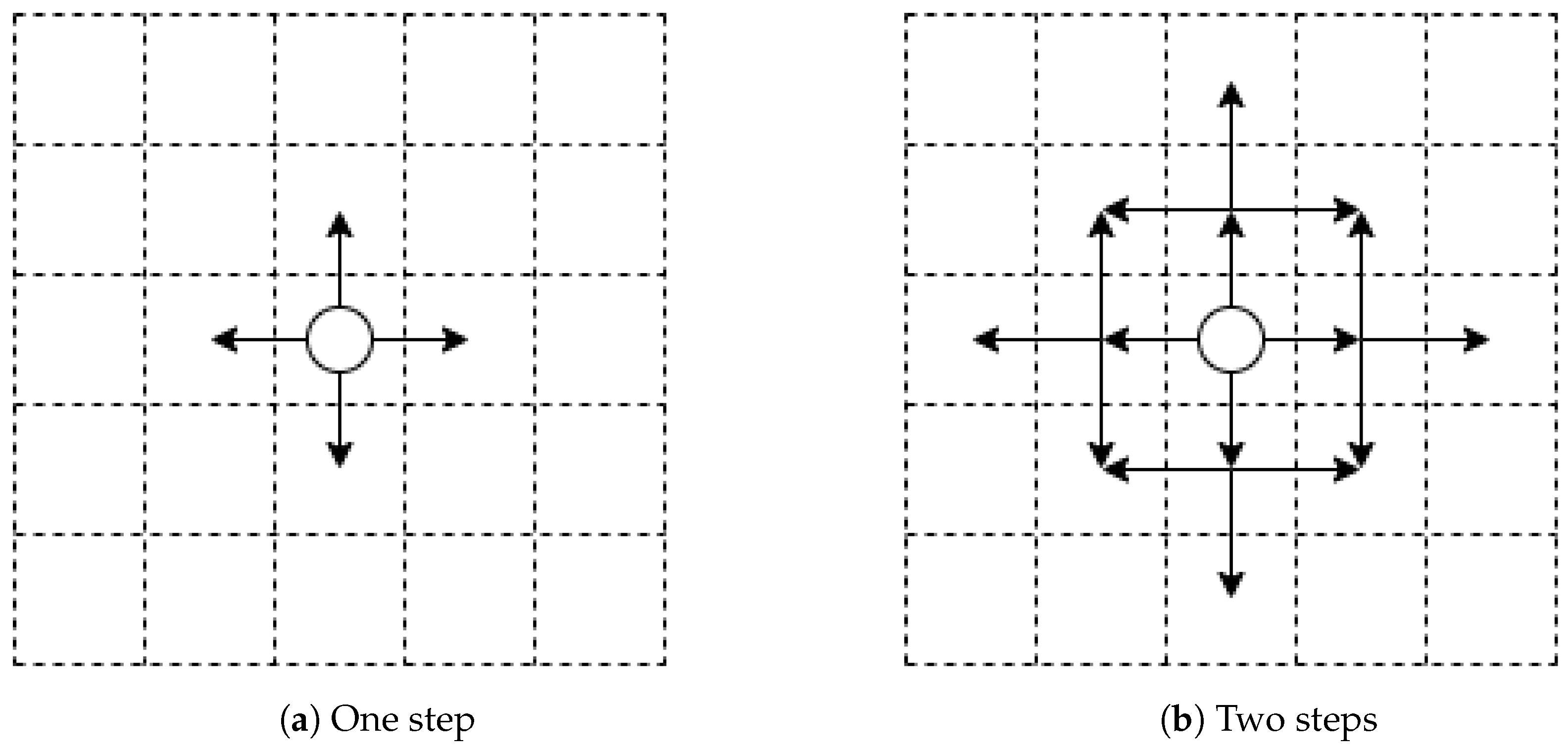

Section 2.4.1 and

Section 2.4.2) and an approach to the numerical solution of one- and two-dimensional heat equation (

Section 2.2 and

Section 2.3) constitute the core part of this research. Finally, a method for adjusting development factors to be greater than one (>1) without changing the total sum in a triangle row is proposed in this section, with description and real-world examples being presented.

Section 3 lists the results of the practical application of the heat equation when treating outliers in non-life development triangles.

Section 5 summarizes the essential conclusions resulting from the research and presents the significant findings.

4. Discussion

Current research on the removal of outliers in contaminated datasets for claims reserves is quite limited as the traditional methods are preferably applied. In the light of the most recent works published in this topic (

Avanzi et al. 2022b;

Badounas et al. 2022), our method takes on a different approach. First, outlying values are detected and smoothed by the heat equation application. The resulting development triangle could then be used as an input for any method without the need for its robustification.

The future work shall address the appropriate setting for the parameters of the numerical solution of the heat equation, such as the step length or the maximum number of steps. The current parameters are set as constants, which seems to be sufficient for the demonstration of the methodology.