1. Introduction

The celebrated Black and Black-Scholes-Merton models have been the benchmark for European options on currency exchange, interest rates, and equities since the inauguration of the trading on financial derivatives. However, empirical evidence has shown that the main drawback of these models is the assumption of constant volatility; the key parameter required in the calculation of option premia under such models. The volatility parameters induced from market data are in fact nonconstant across markets; dubbed as volatility smile.

The Stochastic

(SABR hereafter) model, suggested by Hagan, Lesniewski, and Woodward in

Hagan et al. (

2015), is one of the models, such as local volatility models, stochastic volatility models, and exponential Lévy type of models, etc, that attempts to capture the volatility smile effect. Furthermore, as opposed to local volatility models, in the SABR model the volatility smile moves in the same direction as the underlying with time, see

Hagan et al. (

2002).

The SABR model is depicted by the following system of stochastic differential equations (SDEs):

with

, where

denotes the forward price and

the instantaneous volatility.

and

are correlated Brownian motions with a constant correlation coefficient

. The SABR model is at times referred to as lognormal SABR when

. The SABR formula is an asymptotic expansion for the implied volatilities of call options with various strikes with small expiry times. For the reader’s convenience, we reproduce the SABR formula in the following. Let

be the implied volatility of a vanilla option struck at

K and time to expiry

. The SABR formula states

as the time to expiry

approaches 0. The function

D and the parameter

involved in (

3) are defined respectively as

and

Generally, the SABR formula is given one order higher, up to order

. Here we present only the zeroth order for our own purpose.

The geometry of the SABR model is isometrically diffeomorphic to the two-dimensional hyperbolic space, also known as the Poincaré plane. This isometry leads to a derivation of the SABR Formula (

3) based on an expression of the heat kernel, known as the McKean kernel, on Poincaré plane. In particular, the lowest order term in (

3) has a geometric interpretation. The function

D is the geodesic distance from the spot value

to the vertical line

in the upper half plane

. Hence, the lowest order term in (

3) is indeed the ratio between the absolute value of logmoneyness, i.e.,

, and the geodesic distance from

to the vertical line

in the upper half-plane. We refer readers interested in this topic to

Hagan et al. (

2015) for more detailed discussions. As expression for heat kernel on hyperbolic space is concerned, Ikeda and Matsumoto in

Ikeda and Matsumoto (

1999) provided a probabilistic approach and obtained, among other interesting results, a representation for the transition density of hyperbolic Brownian motion, i.e., the heat kernel over the Poincaré plane. See Theorem 2.1 in

Ikeda and Matsumoto (

1999) for details.

The aforementioned nice isometry between the SABR model and Poincaré plane breaks down if the volatility process, i.e., the

process in (

1), is driven by a fractional Brownian motion such as the second equation in (

6) considered in the paper. Moreover, due to the lack of Markovianity of fractional Brownian motions, thus the nonexistence of the forward and backward Kolmogorov equations, the classical asymptotic expansion approaches, such as the heat kernel or WKB expansion, are no longer applicable. In this regard, the probabilistic approach in

Ikeda and Matsumoto (

1999) is more applicable and tractable when dealing with processes driven by fractional Brownian motions.

The volatility process is generally conceived as behaving “fractionally” in that the driving noise is a fractional process, e.g., a fractional Brownian motion with a Hurst exponent other than a half. For a far from an exhaustive list, models that attempt to incorporate the fractional feature of volatility include: the ARFIMA model in

Granger and Joyeux (

1980) and the FIGARCH model

Baillie et al. (

1996) for discrete-time models; the long memory stochastic volatility model in

Comte and Renault (

1998) and the affine fractional stochastic volatility model in

Comte et al. (

2012) for continuous time models. Somewhat on the contrary, in a recent study in

Gatheral et al. (

2018), the Hurst exponent

H is estimated as being less than a half; thereby indicating antipersistency as opposed to the persistency of the volatility process. For a more detailed and in-depth consideration of this issue, we refer interested readers to the discussions in

Cont and Das (

2022) and

Rogers (

2019). It is also worth mentioning that generalizations of the Heston model to the fractional version have been considered in

El Euch and Rosenbaum (

2019) and

Guennoun et al. (

2018). Heston-related models are usually dealt with via the characteristic or moment-generating functions. However, in this paper, we take the approach following closely the methodology in

Ikeda and Matsumoto (

1999). As arbitrage in the modeling is concerned, we remark that, in contrast with the models discussed in for instance

Jarrow et al. (

2009) and

Mishura (

2008) within which the underlying prices were assumed driven by fractional Brownian motions, the model considered in the paper is free of arbitrage opportunity since it is the volatility process that is driven by a fractional Brownian motion while the underlying itself is still driven by a (correlated) Brownian motion.

In order to embed the empirically observed fractional feature of the volatility process into the classical SABR model, we suggest in this paper a fractional version of the SABR model as in (

6). Modulo a mean-reversion component, this model aligns with the model statistically tested in

Gatheral et al. (

2018). The main observation in

Gatheral et al. (

2018) is that in using the square root of the realized variance as a proxy for the instantaneous volatility, the logarithm of the volatility process behaves like a fractional Brownian motion in almost any time scale of frequency. The Hurst exponent

H inferred from the time series data is less than a half; indeed,

, see also

Cont and Das (

2022) and

Rogers (

2019). This observation of a small Hurst exponent in the volatility process analyzes the model as more technical and challenging from a stochastic analysis point of view. To our knowledge, most of the small time asymptotic expansions for processes driven by fractional Brownian motions have restrictions on the Hurst exponent

H of the driving fractional Brownian motion, mostly

. One of the advantages of the approach undertaken in the current paper is that it works without restriction on the Hurst exponent

H. The key ingredient is a representation in a Fourier space, which we call the bridge representation in

Section 2, for the joint density of log spot and volatility, see (

9).

A small time asymptotic expansion of the joint density is readily obtained from the bridge representation. The idea is to approximate the conditional expectation in the bridge representation by a judiciously chosen deterministic path since, conditioned on the initial and terminal points, at each point in time a Gaussian process will not wander too far away from its expectation. As long as an asymptotic expansion for the density of the underlying asset is available, obtaining an expansion for implied volatility is almost straightforward by basically comparing the coefficients with a similar expansion obtained by using the lognormal density on the Black or the Black-Scholes-Merton side.

The methodology of deriving the bridge representation (

9) can be generalized directly to obtain a bridge representation for the joint density multiple times; hence inducing a representation for finite-dimensional distributions of the fractional SABR model, see Theorem 4. Based on this bridge representation for finite-dimensional distributions,

Section 5 is devoted to a heuristic yet appealing derivation of the large deviations principle for the joint density of the fractional SABR model in small time. This large deviations principle in a sense can be regarded as defining a “geodesic distance” over the fractional SABR plane since, as we shall show in

Section 5, it recovers the energy functional on the Poincaré plane when

. We leave the rigorous proof of the large deviations principle in future work. An immediate consequence of this large deviation principle is the fractional SABR formula (to the lowest order) (

26) which recovers the classical SABR formula when

. The fractional SABR Formula (

26) pertains to the guiding principle that the lowest order term in the implied volatility expansion is given by the ratio between the absolute value of the logmoneyness and the geodesic distance to the vertical line

.

The rest of the paper is organized as follows. The fractional SABR model is specified and the bridge representation for joint density is shown in

Section 2.

Section 3 and

Section 4 provide small time asymptotic expansions of the joint density and of the implied volatilities respectively.

Section 5 presents the bridge representation for finite-dimensional distributions and the large deviations principle. Finally, the paper concludes in

Section 6 with discussions.

4. Small Time Approximation of Option Price and Implied Volatility

We derive in this section the small-time asymptotics of the premium of a call option and its associated implied volatility by applying the small-time asymptotics for the probability density obtained in

Section 3 when

. It is documented, for example, in

Ekström and Lu (

2015), that if the underlying asset is governed by an exponential Lévy model, the induced implied volatilities of non-ATM options may explode if jumps exist and the underlying process jumps towards the strike. As we shall see in the following, when

, the small time approximation of implied volatility also explodes; creating a jump-like behavior in the underlying process.

Let

be the logmoneyness,

t the time to expiry, and recall that

. Though equivalently, we shall be primarily working with the

process as in (

7) rather than the

process in (

6) hereafter. We write the price

C of a call as a function of

k and

t as

To evaluate the last integral, we approximate the joint density

p by the small time asymptotics obtained in Theorem 2, then, as

, apply Laplace asymptotic formula to the resulting integral. For the reader’s convenience, we provide proof in

Appendix A.2 a variation of the Laplace asymptotic formula that is tailored for our own use.

Lemma 2. Let . For out-of-money call options, i.e., , the call price has the following asymptotic as where is the minimizer Proof. The proof is a straightforward application of the Laplace asymptotic Formula (

A12) in Lemma A1. Let

and

. By using the asymptotic density (

14), consider

Applying the Laplace asymptotic Formula (

A12) to the lowest order term in the last expression yields

where, for fixed

t,

is the minimizer of the function

Since the objective function is continuous in

and it is a quadratic function in

x, it follows that

when

t is small enough, thereby

□

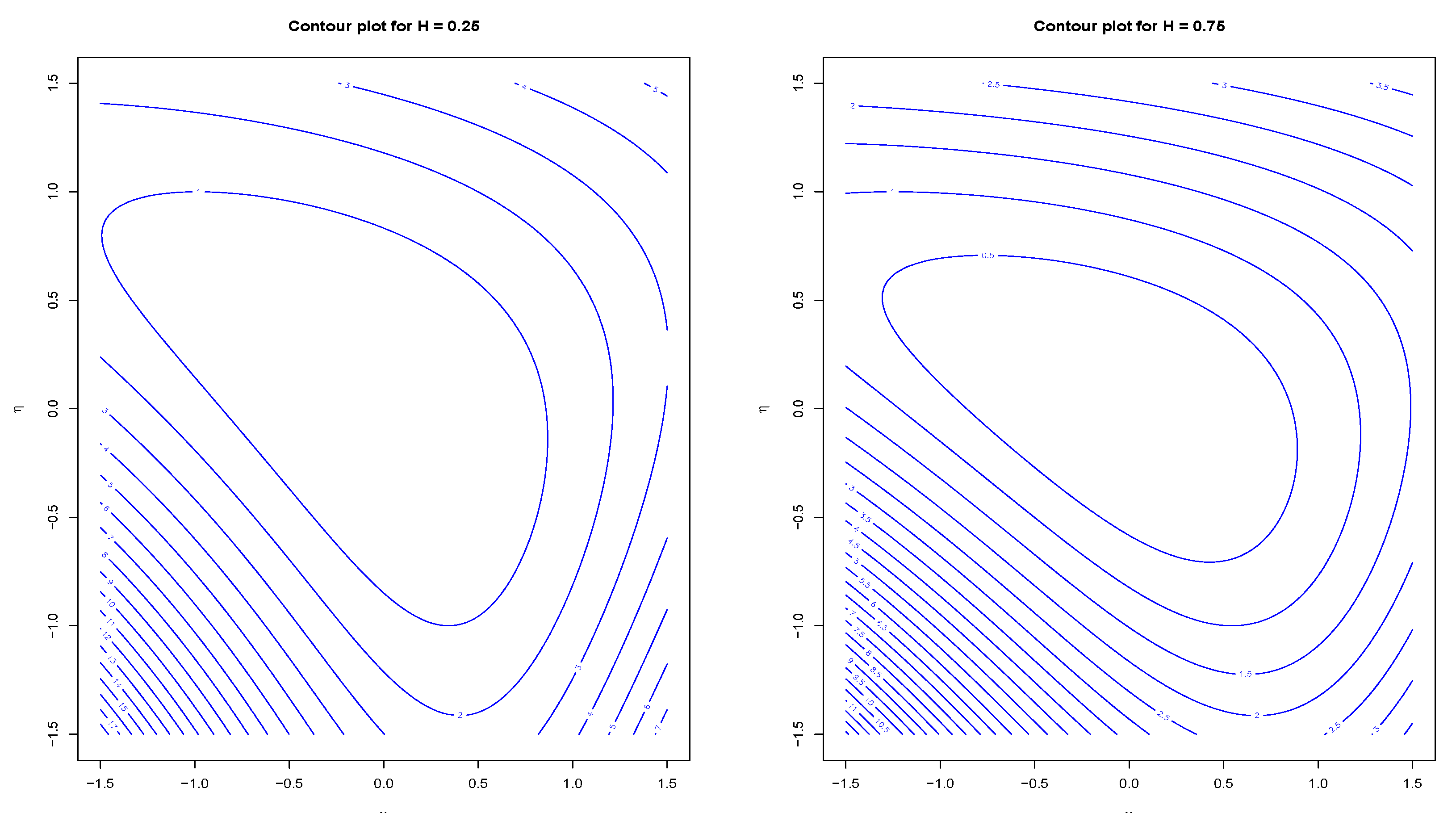

Remark 4. The plots in Figure 1 shows graphically the uniqueness of the minimal point for and . In these particular examples, the contours are convex in the half plane , which corresponds to the out-of-money calls. For out-of-money puts, , though the contours are not convex, the uniqueness of sustains. So long as we establish an asymptotic for the log price

for

, by using the following small time asymptotic for implied volatility in

Gao and Lee (

2014) or

Roper and Rutkowski (

2009)

an asymptotic formula for implied volatility follows immediately. We summarize the result in the following theorem but omitting its proof.

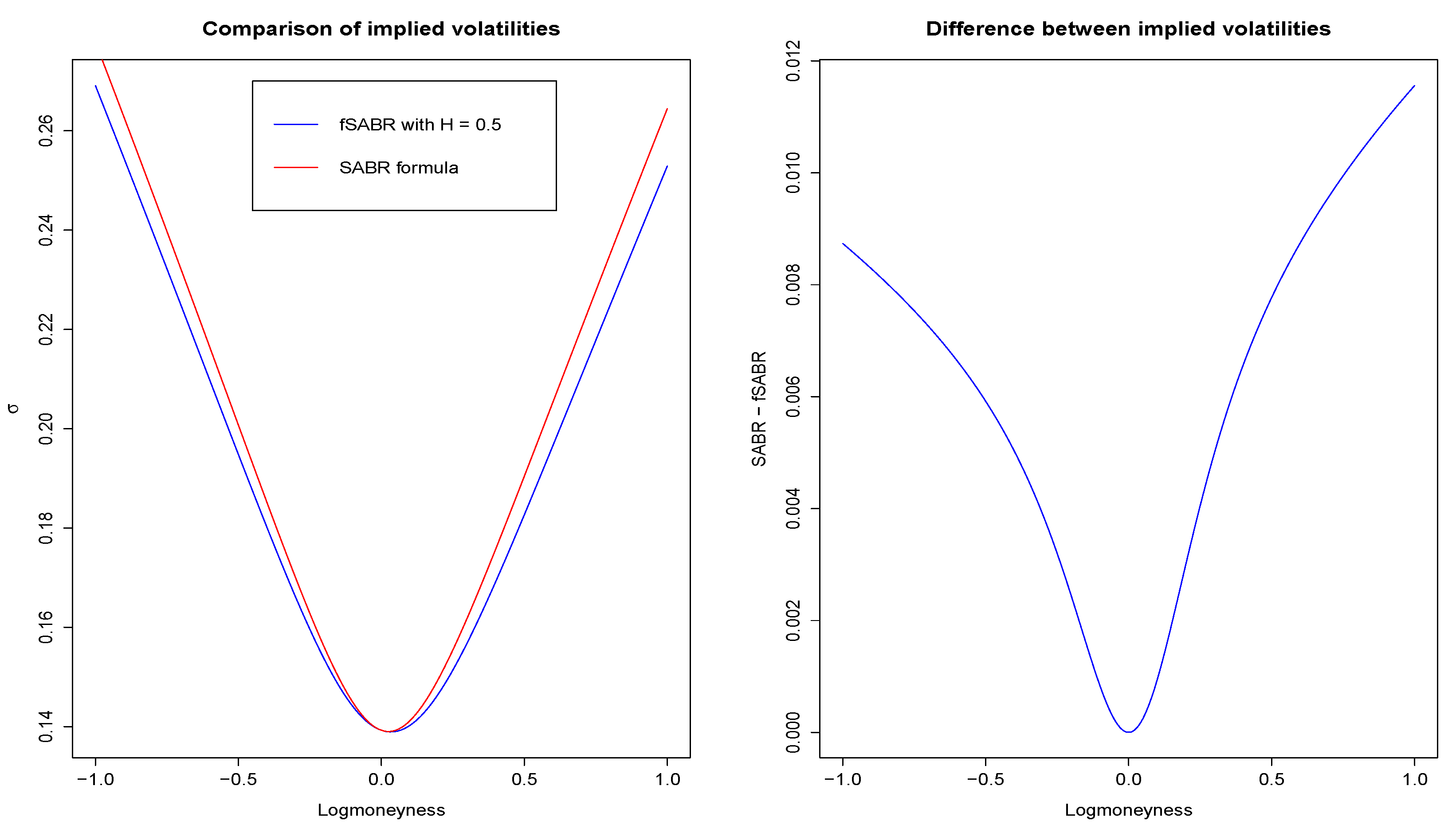

Theorem 3. Let and let be the log moneyness and . The implied volatility for out-of-money calls () has the following asymptotic in small time to expiryThe minimal point is given Lemma in 2. Remark 5. Note that (20) does not recover the SABR formula when . The derivation of the SABR formula relies heavily on the geometry and symmetry of the underlying SABR plane which is isometric to the Poincaré plane. Figure 2 shows the comparison between the two formulas with time to expiry . Parameters are chosen so as to reproduce the figures in Hagan et al. (2002). In this set of parameters, the maximal difference between the two approximate implied volatility curves is about 1% for logmoneyness . We conclude the section by remarking that, as time to expiry

t approaches zero, the approximate implied volatility

flattens out with

; whereas the whole surface

explodes with

except for the at-the-money option

.

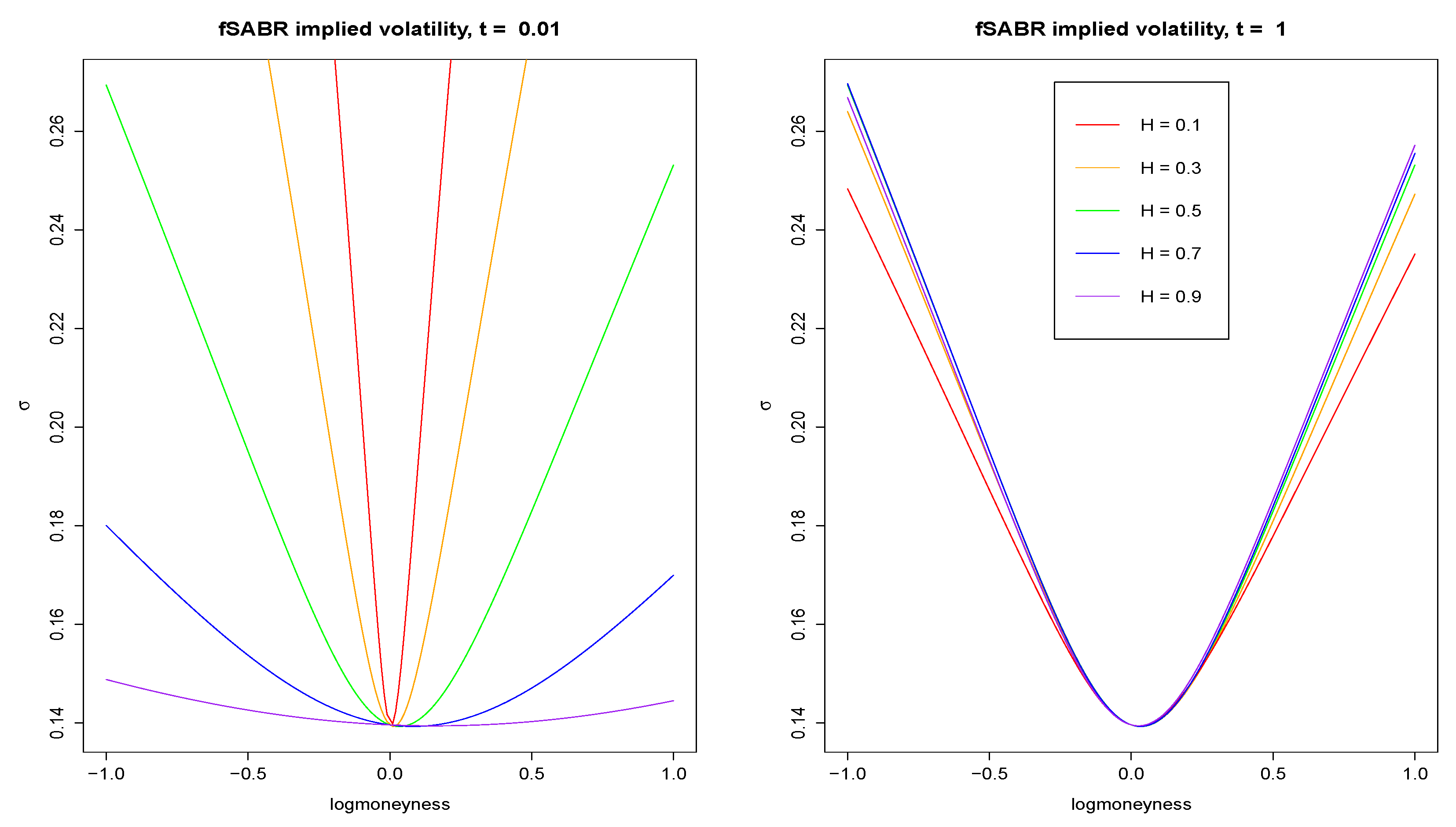

Figure 3 shows the plots of approximate implied volatilities

given in (

20) versus logmoneyness

k for time to expiry

and

respectively, and various Hurst exponents

H. As in

Figure 2, parameters are chosen as

,

, and

. The numerical determination of the

’s is relatively efficient since it is basically a one-dimensional optimization problem.

5. A Heuristic Large Deviation Principle

In this section, we provide a heuristic derivation of the sample path large deviation principle for

in small time by bootstrapping the bridge representation to multiperiod. For simplicity, we introduce the following vector notations.

Theorem 4. The multiperiod joint density p of has the following bridge representationwhere , , and for . Recall that . Proof. For any bounded measurable function

, consider the expectation

Let

,

and thus accordingly

,

. Note that, conditioned on

, the random variables

’s are independent normal with mean 0 and variance

. We calculate the conditional expectation as follows.

By applying the change of variables

thus

The integral (

22) becomes

since the Jacobian between

and

1. It follows that

This completes the proof of bridge representation (

21) since

f is arbitrary. □

To move onto a heuristic derivation of the sample path large deviation principle for

in small time, we take logarithm on both sides of (

21) and obtain

In the following, we ignore the last term on the right-hand side of (

23) and intuitively calculate the limits as

of the first two terms. Note that to the leading order we have

where

is the covariance matrix of

. We further discretize the autovariance

R of fractional Brownian motion as

where

denotes the upper triangular matrix

Thereby,

. Let

be the solution to the linear system

It follows that

Also in the limit as

, we obtain

.

On the other hand, for the first term on the right-hand side of (

23), we have

Note that conditioned on

, we have

as well as

It follows that the first term in (

23) has the limit

as

.

Putting the two limits together, we obtain heuristically for

that

where

satisfies the integral equation

for all

. We remark that (

24) should serve as the rate function for the sample path large deviation principle in small time for

. Moreover, one may define the “geodesic” from the initial point

to the terminal point

in the fSABR plane as the path

which minimizes the functional (

24), i.e.,

where again

is determined by solving the integral equation

Also, the minimizer can be regarded as the “geodesic” connecting

and

.

Remark 6. Note that is indeed determined by the inverse operator applied to . In particular, with this inverse operator reduces to the usual derivative. Thus, with ,The functional (24) becomesThe last expression is the energy functional (up to the constant factor ) associated with the Riemann metric . The diffusion process associated with this Riemann metric is governed by the SDEs where and are correlated Brownian motion with constant correlation ρ, which up to a linear transformation is the upper plane model of the Poincaré space. In other words, with , the functional (24) recovers the energy functional for the classical Poincaré space, which is isometric to the SABR plane. Lastly, with the aid of the sample path large deviation principle (

24), it is nearly a common practice, say by applying the Laplace asymptotic formula, to conclude that the log premium of an out-of-money call in small time has the asymptotic as

where

denotes the optimal path that minimizes the functional (

24) subject to the constraint

and

,

satisfy the integral Equation (

25). Thus, by applying (

19), an approximation of implied volatility in small time is readily obtained. We summarize the result in the following proposition which, with

, recovers the SABR Formula (

3). However, for

, the numerical implementation of (

26) is more involved than that of (

20) since, as opposed to a one dimensional optimization problem, it is subject to solving a two-dimensional constrained variational problem.

Proposition 1 (fSABR formula)

. Let be the log moneyness. The implied volatility in a small time to expiry has the asymptoticswhere is the minimizer of the variational problemwith and satisfyingfor . Notice that (26) recovers the SABR Formula (3) with .