On the Macroeconomic Conditions of West African Economies to External Uncertainty Shocks

Abstract

1. Introduction

2. Methodology

2.1. Multiple Wavelet Coherence

2.2. Wavelet Multiple

3. Data Sources and Description

Preliminary Analysis

4. Results and Discussion

4.1. Time–Frequency Domain

4.2. Frequency Domain

4.2.1. Bivariate Contemporary Correlation (BCC)

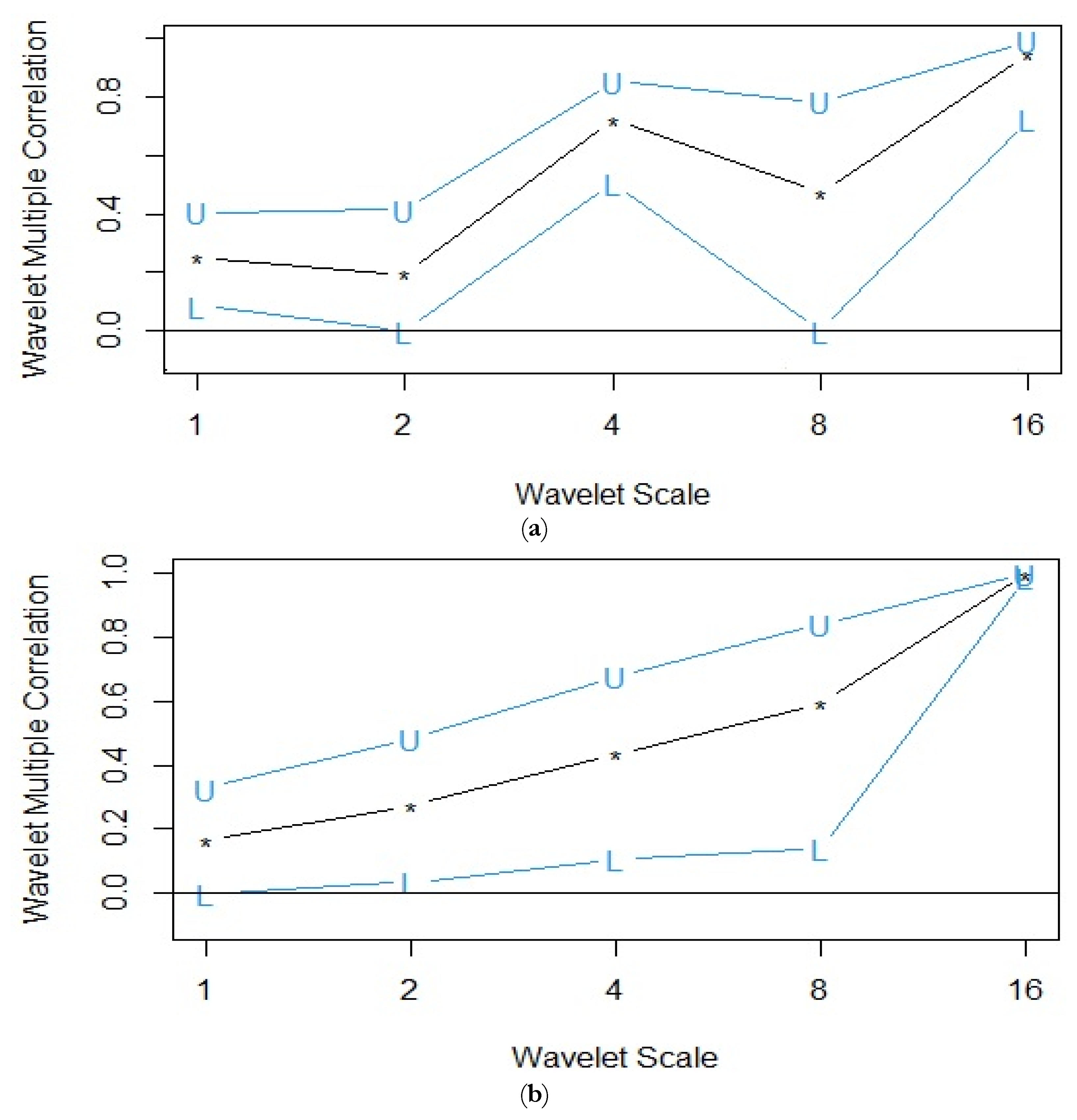

4.2.2. Wavelet Multiple Correlation (WMC)

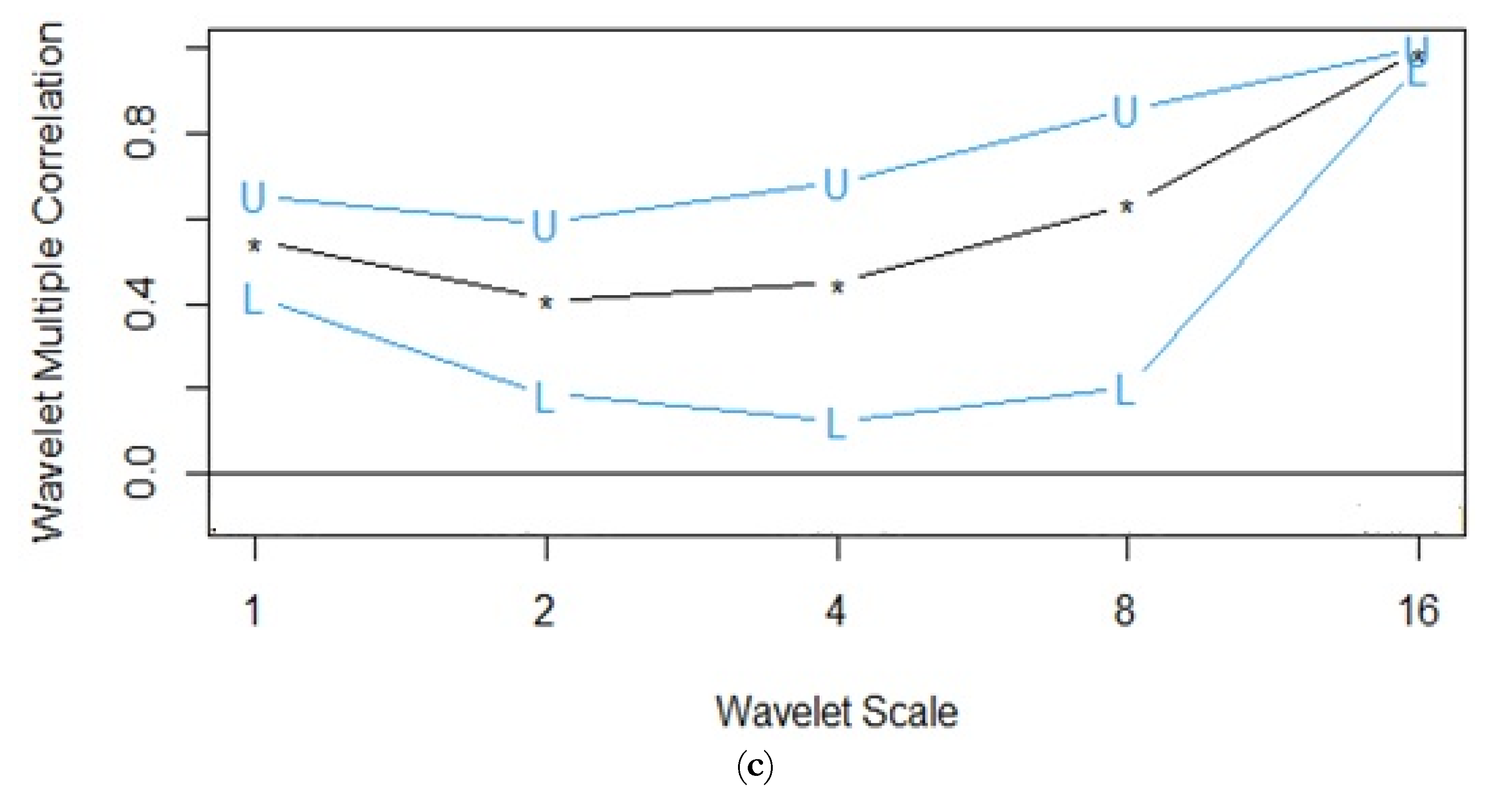

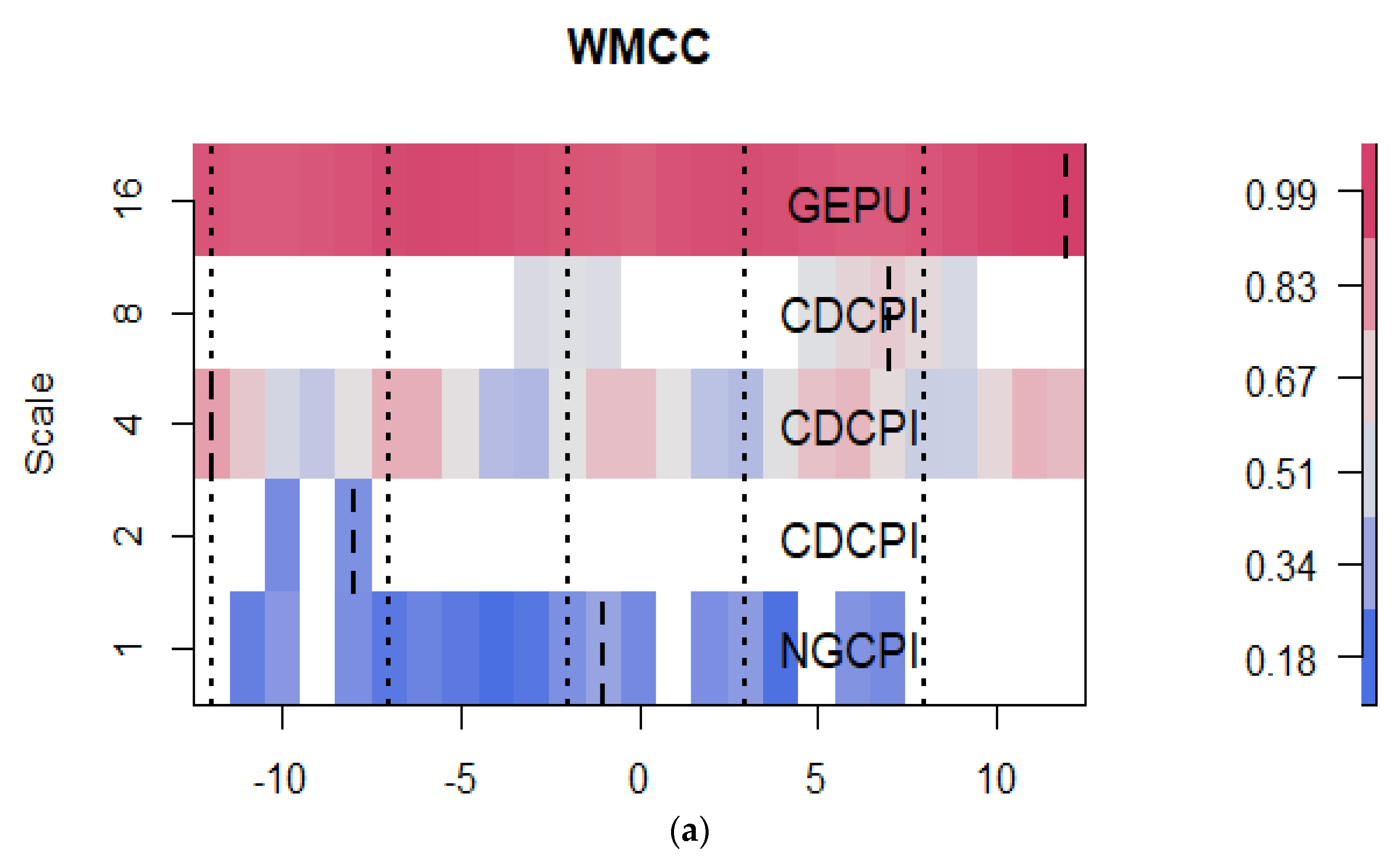

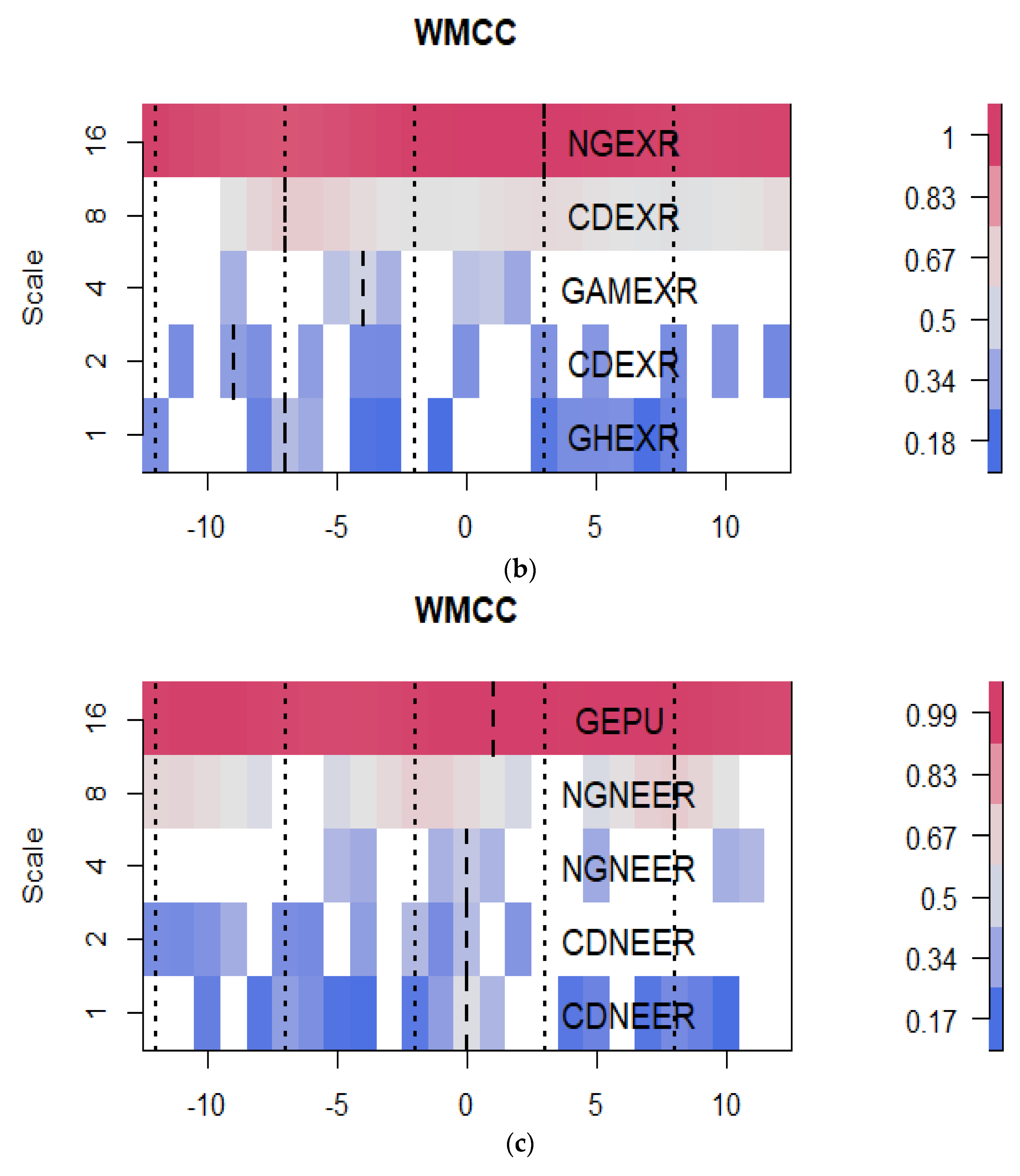

4.2.3. Wavelet Multiple Cross-Correlations (WMCC)

4.3. Robustness

5. Conclusions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Abban, Stanley. 2020. On the Computation and Essence of the Nominal Convergence Criteria for Africa Currency Union: ECOWAS in Perspective. MPRA_Paper. Available online: https://mpra.ub.uni-muenchen.de/id/eprint/100215 (accessed on 11 May 2020).

- Adam, Anokye M., and Daniel Ofori. 2017. Validity of International Fisher Effect in the West African Monetary Zone. Journal of Economic Cooperation and Development 38: 121–43. [Google Scholar]

- Adam, Anokye M., Daniel A. Agyapong, and Emmanuel N. Gyamfi. 2010. Dynamic macroeconomic convergence in the west Africa monetary Zone (WAMZ). International Business and Management 1: 31–40. [Google Scholar]

- Adam, Anokye M., Kwabena Kyei, Simiso Moyo, Ryan Gill, and Emmanuel N. Gyamfi. 2022. Similarities in Southern African Development Community (SADC) exchange rate markets structure: Evidence from the ensemble empirical mode decomposition. Journal of African Business 23: 516–30. [Google Scholar] [CrossRef]

- Adeboje, Oluwafemi Mathew, Abiodun Folawewo, and Adeniyi Jimmy Adedokun. 2022. Trade Integration, Growth and Employment in West Africa: Implications for African Continental Free Trade Area (Afcfta). Research Square. Available online: https://doi.org/10.21203/rs.3.rs-1031534/v1 (accessed on 1 March 2022). [CrossRef]

- Adu, Raymond, Ioannis Litsios, and Mark Baimbridge. 2019. Real exchange rate and asymmetric shocks in the West African Monetary Zone (WAMZ). Journal of International Financial Markets, Institutions and Money 59: 232–49. [Google Scholar] [CrossRef]

- Agyapong, Daniel, and Anokye M. Adam. 2012. Exchange Rate Behaviour: Implication for West African Monetary Zone. International Journal of Academic Research in Accounting, Finance and Management Sciences 2: 215–28. [Google Scholar]

- Agyei, Samuel Kwaku, Anokye Mohammed Adam, Ahmed Bossman, Oliver Asiamah, Peterson Owusu Junior, Roberta Asafo-Adjei, and Emmanuel Asafo-Adjei. 2022. Does volatility in cryptocurrencies drive the interconnectedness between the cryptocurrencies market? Insights from wavelets. Cogent Economics & Finance 10: 2061682. [Google Scholar]

- Alagidede, Paul, George Tweneboah, and Anokye M. Adam. 2008. Nominal exchange rates and price convergence in the West African monetary zone. International Journal of Business and Economics 7: 181. [Google Scholar]

- Alday, Sandra Seno. 2021. Regional integration and the regional risk paradox. European Management Journal. [Google Scholar] [CrossRef]

- Aloui, Chaker, Besma Hkiri, and Duc Khuong Nguyen. 2016. Real growth co-movements and business cycle synchronization in the GCC countries: Evidence from time-frequency analysis. Economic Modelling 52: 322–31. [Google Scholar] [CrossRef]

- Amoako, Gilbert K., Emmanuel Asafo-Adjei, Kofi Mintah Oware, and Anokye M. Adam. 2022. Do Volatilities Matter in the Interconnectedness between World Energy Commodities and Stock Markets of BRICS? Discrete Dynamics in Nature and Society 2022: 1030567. [Google Scholar] [CrossRef]

- Antonakakis, Nikolaos. 2012. Exchange return co-movements and volatility spillovers before and after the introduction of euro. Journal of International Financial Markets, Institutions and Money 22: 1091–109. [Google Scholar] [CrossRef]

- Antonakakis, Nikolaos, Ioannis Chatziantoniou, and David Gabauer. 2020. Refined measures of dynamic connectedness based on time-varying parameter vector autoregressions. Journal of Risk and Financial Management 13: 84. [Google Scholar] [CrossRef]

- Arouri, Mohamed El Hedi, and Philippe Foulquier. 2012. Financial market integration: Theory and empirical results. Economic Modelling 29: 382–94. [Google Scholar] [CrossRef]

- Asafo-Adjei, Emmanuel, Anokye M. Adam, and Patrick Darkwa. 2021a. Can crude oil price returns drive stock returns of oil producing countries in Africa? Evidence from bivariate and multiple wavelet. Macroeconomics and Finance in Emerging Market Economies, 1–19. [Google Scholar] [CrossRef]

- Asafo-Adjei, Emmanuel, Anokye M. Adam, Anthony Adu-Asare Idun, and Peace Y. Ametepi. 2022a. Dynamic Interdependence of Systematic Risks in Emerging Markets Economies: A Recursive-Based Frequency-Domain Approach. Discrete Dynamics in Nature and Society 2022: 1139869. [Google Scholar] [CrossRef]

- Asafo-Adjei, Emmanuel, Daniel Agyapong, S. K. Agyei, S. Frimpong, R. Djimatey, and Anokye. M. Adam. 2020. Economic Policy Uncertainty and Stock Returns of Africa: A Wavelet Coherence Analysis. Discrete Dynamics in Nature and Society, 1–8. [Google Scholar] [CrossRef]

- Asafo-Adjei, Emmanuel, Ebenezer Boateng, Zangina Isshaq, Anthony Adu-Asare Idun, Peterson Owusu Junior, and Anokye M. Adam. 2021b. Financial sector and economic growth amid external uncertainty shocks: Insights into emerging economies. PLoS ONE 16: e0259303. [Google Scholar] [CrossRef]

- Asafo-Adjei, Emmanuel, Siaw Frimpong, Peterson Owusu Junior, Anokye Mohammed Adam, Ebenezer Boateng, and Robert Ofori Abosompim. 2022b. Multi-Frequency Information Flows between Global Commodities and Uncertainties: Evidence from COVID-19 Pandemic. Complexity 2022: 6499876. [Google Scholar] [CrossRef]

- Baker, Scott R., Nicholas Bloom, and Steven J. Davis. 2016. Measuring economic policy uncertainty. The Quarterly Journal of Economics 131: 1593–636. [Google Scholar] [CrossRef]

- Balassa, Bela. 1964. The purchasing-power parity doctrine: A reappraisal. Journal of Political Economy 72: 584–96. [Google Scholar] [CrossRef]

- Balg, Basher Abdulla Mohamed. 2006. An Investigation into the Determinants of Exchange Rate Volatility. Doctoral dissertation, Newcastle University, Newcastle upon Tyne, UK. [Google Scholar]

- Bayoumi, T., and B. Eichengreen. 1992. Shocking Aspects of European Monetary Unification. NBER Working Papers 3949. Cambridge: National Bureau of Economic Research, Inc. [Google Scholar]

- Bayoumi, Tamim, and Barry Eichengreen. 1997. Ever closer to heaven? An optimum-currency-area index for European countries. European Economic Review 41: 761–70. [Google Scholar] [CrossRef]

- Beirne, John, and Jana Gieck. 2014. Interdependence and contagion in global asset markets. Review of International Economics 22: 639–59. [Google Scholar] [CrossRef]

- Berdiev, Aziz N., and Chun-Ping Chang. 2015. Business cycle synchronization in Asia-Pacific: New evidence from wavelet analysis. Journal of Asian Economics 37: 20–33. [Google Scholar] [CrossRef]

- Boateng, Ebenezer, Emmanuel Asafo-Adjei, Alex Addison, Serebour Quaicoe, Mawusi Ayisat Yusuf, and Anokye M. Adam. 2022. Interconnectedness among commodities, the real sector of Ghana and external shocks. Resources Policy 75: 102511. [Google Scholar] [CrossRef]

- Bossman, Ahmed, Peterson Owusu Junior, and Aviral Kumar Tiwari. 2022. Dynamic connectedness and spillovers between Islamic and conventional stock markets: Time-and frequency-domain approach in COVID-19 era. Heliyon 8: e09215. [Google Scholar] [CrossRef]

- Brunnermeier, Markus K., and Ricardo Reis. 2019. A Crash Course on the Euro Crisis (No. w26229). Cambridge: National Bureau of Economic Research. [Google Scholar]

- Caetano, José, Isabel Vieira, and António Caleiro. 2021. New Challenges for the Eurozone Governance. New York: Springer International Publishing. [Google Scholar]

- Caetano, Jose Manuel, and Antonio Bento Caleiro. 2018. On Business Cycles Synchronization: Some Directions for The Eurasia. Eurasian Journal of Economics and Finance 6: 13–33. [Google Scholar] [CrossRef]

- Cassel, Gustav. 1922. The World’s Monetary Problem. Bankers’ Magazine (1896–1943) 104: 71. [Google Scholar]

- Cheung, Yin-Wong, and Kon S. Lai. 1993. A fractional cointegration analysis of purchasing power parity. Journal of Business & Economic Statistics 11: 103–12. [Google Scholar]

- Cooley, Thomas F., and Edward C. Prescott. 1995. Frontiers of Business Cycle Research. Princeton: Princeton University Press, vol. 3. [Google Scholar]

- Dornbusch, Rudiger. 1988. Real exchange rates and macroeconomics: A selective survey. The Scandinavian Journal of Economics 91: 401–32. [Google Scholar] [CrossRef][Green Version]

- Doyle, Michael. 1997. Internationalism: Kant. Ways of War and Peace. New York: Norton. [Google Scholar]

- Ekpo, Akpan H. 2020. Economic integration in West Africa: A reconsideration of the evidence. In Regional Development in Africa. London: IntechOpen, p. 83. [Google Scholar]

- Enders, Walter. 2008. Applied Econometric Time Series. Hoboken: John Wiley & Sons. [Google Scholar]

- Engle, Robert F., III, Takatoshi Ito, and Wen-Ling Lin. 1988. Meteor Showers or Heat Waves? Heteroskedastic Intra-Daily Volatility in the Foreign Exchange Market. NBER Working Paper Series. Available online: https://www.nber.org/system/files/working_papers/w2609/w2609.pdf (accessed on 30 June 1988).

- Eregha, Perekunah B. 2019. Exchange rate, uncertainty and foreign direct investment inflow in West African monetary zone. Global Business Review 20: 1–12. [Google Scholar] [CrossRef]

- Fernández-Macho, Javier. 2012. Wavelet multiple correlation and cross-correlation: A multiscale analysis of Eurozone stock markets. Physica A: Statistical Mechanics and Its Applications 391: 1097–104. [Google Scholar] [CrossRef]

- Friedman, Milton. 1953. The Case for Flexible Exchange Rates. Essays in Positive Economics. Chicago: University of Chicago Press. [Google Scholar]

- Frimpong, Siaw, Emmauel N. Gyamfi, Zangina Ishaq, Samuel K. Agyei, Daniel Agyapong, and Anokye M. Adam. 2021. Can Global Economic Policy Uncertainty Drive the Interdependence of Agricultural Commodity Prices? Evidence from Partial Wavelet Coherence Analysis. Complexity 2021: 8848424. [Google Scholar] [CrossRef]

- Gammadigbe, Vigninou, and Sokhna Bousso Dioum. 2022. Monetary integration in West Africa: Are business cycles converging? African Development Review 34: 68–80. [Google Scholar] [CrossRef]

- Gulen, Huseyin, and Mihai Ion. 2016. Policy uncertainty and corporate investment. The Review of Financial Studies 29: 523–64. [Google Scholar] [CrossRef]

- Gyamfi, Emmanuel N., Anokye M. Adam, and Emily Frimpomaa Appiah. 2019. Macroeconomic convergence in the West African monetary zone: Evidence from rank tests. Economics and Business Letters 8: 191–98. [Google Scholar] [CrossRef]

- Hamilton, James Douglas. 2020. Modeling Time Series with Changes in Regime. In Time Series Analysis. Princeton: Princeton University Press, p. 677. [Google Scholar]

- Hendry, David F. 1995. Dynamic Econometrics. Oxford: Oxford University Press on Demand. [Google Scholar]

- Huynh, Toan Luu Duc. 2020. The effect of uncertainty on the precious metals market: New insights from Transfer Entropy and Neural Network VAR. Resources Policy 66: 101623. [Google Scholar] [CrossRef]

- Kahraman, Emre, and Gazanfer Ünal. 2016. Multiple wavelet coherency analysis and forecasting of metal prices. arXiv arXiv:1602.01960. [Google Scholar]

- Khmeleva, G. A., and T. Czegledy. 2021. Towards a new format of regional integration: Co-creation and application of technologies. In Current Achievements, Challenges and Digital Chances of Knowledge Based Economy. Cham: Springer, pp. 71–77. [Google Scholar]

- Krugman, Paul R., Kathryn M. Dominquez, and Kenneth Rogoff. 1998. It’s baaack: Japan’s slump and the return of the liquidity trap. Brookings Papers on Economic Activity 1998: 137–205. [Google Scholar] [CrossRef]

- McKinnon, Ronald I. 1963. Optimum currency areas. The American Economic Review 53: 717–25. [Google Scholar]

- Mogaji, Peter Kehinde. 2017. Evaluation of Macroeconomic Indicators and Dynamics for Monetary Integration of West Africa: The Case of the WAMZ. MPRA Paper No. 98943, Posted 13 Mar 2020 17:00 UTC. Available online: https://mpra.ub.uni-muenchen.de/98943/ (accessed on 28 June 2022).

- Moradi, Mahdi, Andrea Appolloni, Grzegorz Zimon, Hossein Tarighi, and Maede Kamali. 2021. Macroeconomic factors and stock price crash risk: Do managers withhold bad news in the crisis-ridden Iran market? Sustainability 13: 3688. [Google Scholar] [CrossRef]

- Mundell, R. A. 1961. A theory of optimum currency areas. The American Economic Review 51: 657–65. [Google Scholar]

- Ng, Eric. K., and Johnny C. Chan. 2012. Geophysical applications of partial wavelet coherence and multiple wavelet coherence. Journal of Atmospheric and Oceanic Technology 29: 1845–53. [Google Scholar] [CrossRef]

- Nikkinen, Jussi, Seppo Pynnönen, Mikko Ranta, and Sami Vähämaa. 2011. Cross-dynamics of exchange rate expectations: A wavelet analysis. International Journal of Finance & Economics 16: 205–17. [Google Scholar]

- Obstfeld, Maurice, and Kenneth S. Rogoff. 1998. Risk and exchange rates. NBER Working Paper Series, 6694. [Google Scholar] [CrossRef]

- Owusu Junior, Peterson, Anokye M. Adam, and George Tweneboah. 2017. Co-movement of real exchange rates in the West African Monetary Zone. Cogent Economics & Finance 5: 1351807. [Google Scholar]

- Owusu Junior, Peterson, Anokye M. Adam, Emmanuel Asafo-Adjei, Ebenezer Boateng, Zulaiha Hamidu, and Eric Awotwe. 2021. Time-Frequency domain analysis of investor fear and expectations in stock markets of BRIC economies. Heliyon 7: e08211. [Google Scholar] [CrossRef]

- Owusu Junior, Peterson, Baidoo Kwaku Boafo, Bright Kwesi Awuye, Kwame Bonsu, and Henry Obeng-Tawiah. 2018. Co-movement of stock exchange indices and exchange rates in Ghana: A wavelet coherence analysis. Cogent Business & Management 5: 1481559. [Google Scholar]

- Owusu Junior, Peterson, George Tweneboah, and Anokye M. Adam. 2019. Interdependence of major exchange rates in Ghana: A wavelet coherence analysis. Journal of African Business 20: 407–30. [Google Scholar] [CrossRef]

- Pérez-Rodríguez, Jorge V. 2006. The euro and other major currencies floating against the US dollar. Atlantic Economic Journal 34: 367–84. [Google Scholar] [CrossRef]

- Pinto, Brian. 1989. Black market premia, exchange rate unification, and inflation in Sub-Saharan Africa. The World Bank Economic Review 3: 321–38. [Google Scholar] [CrossRef]

- Polachek, Solomon William. 1980. Conflict and trade. Journal of Conflict Resolution 24: 55–78. [Google Scholar] [CrossRef]

- Rogoff, Kenneth. 1996. The purchasing power parity puzzle. Journal of Economic Literature 34: 647–68. [Google Scholar]

- Scott, Hal S. 2016. Connectedness and Contagion: Protecting the Financial System from Panics. Cambridge: MIT Press. [Google Scholar] [CrossRef]

- Shadlen, Kenneth C. 2005. Exchanging development for market access? Deep integration and industrial policy under multilateral and regional-bilateral trade agreements. Review of International Political Economy 12: 750–75. [Google Scholar] [CrossRef]

- Soares, Maria Joana. 2011. Business cycle synchronization and the Euro: A wavelet analysis. Journal of Macroeconomics 33: 477–89. [Google Scholar]

- Soares, Maria Joana, and Luís Aguiar-Conraria. 2014. Inflation rate dynamics convergence within the Euro. In International Conference on Computational Science and Its Applications. Cham: Springer, pp. 132–45. [Google Scholar]

- Tamakoshi, Go, and Shigeyuki Hamori. 2014. Co-movements among major European exchange rates: A multivariate time-varying asymmetric approach. International Review of Economics & Finance 31: 105–13. [Google Scholar]

- Tweneboah, George. 2019. Dynamic interdependence of industrial metal price returns: Evidence from wavelet multiple correlations. Physica A: Statistical Mechanics and its Applications 527: 121153. [Google Scholar] [CrossRef]

- Tweneboah, George, Peterson Owusu Junior, and Emmanuel K. Oseifuah. 2019. Integration of major african stock markets: Evidence from multi-scale wavelets correlation. Academy of Accounting and Financial Studies Journal 23: 1–15. [Google Scholar]

| Statistic | GEPU | ||

|---|---|---|---|

| Mean | 0.0052 | ||

| Std. dev. | 0.1769 | ||

| Skewness | 0.4998 | ||

| Kurtosis | 4.1119 | ||

| Jarque–Bera | 24.9618 *** | ||

| KPSS | 0.0769 | ||

| Country specific | CPI | EXR | NEER |

| Côte d’Ivoire | |||

| Mean | 0.0008 | 0.0000 | 0.0004 |

| Std. dev. | 0.0033 | 0.0100 | 0.0044 |

| Skewness | 0.6432 | −0.0168 | 0.0249 |

| Kurtosis | 7.9101 | 3.3004 | 3.5796 |

| Jarque–Bera | 287.6979 *** | 1.0205 | 3.7793 |

| KPSS | 0.2610 | 0.1005 | 0.0420 |

| Gambia | |||

| Mean | 0.0021 | 0.0026 | −0.0023 |

| Std. dev. | 0.0031 | 0.0144 | 0.0137 |

| Skewness | 1.8019 | −0.5964 | 0.8970 |

| Kurtosis | 18.5064 | 11.6988 | 11.4160 |

| Jarque–Bera | 2830.0380 *** | 860.8572 *** | 826.8640 *** |

| KPSS | 0.1594 | 0.1869 | 0.2417 |

| Ghana | |||

| Mean | 0.0051 | 0.0055 | −0.0053 |

| Std. dev. | 0.0060 | 0.0113 | 0.0128 |

| Skewness | 1.8796 | 0.1655 | 1.2627 |

| Kurtosis | 17.1587 | 14.9502 | 21.9801 |

| Jarque–Bera | 2396.3540 *** | 1595.9130 *** | 4093.9430 *** |

| KPSS | 0.3519 | 0.2277 | 0.2204 |

| Nigeria | |||

| Mean | 0.0040 | 0.0043 | −0.0040 |

| Std. dev. | 0.0061 | 0.0375 | 0.0376 |

| Skewness | 0.2809 | 14.5327 | −14.1077 |

| Kurtosis | 6.1244 | 226.3823 | 217.8888 |

| Jarque–Bera | 112.5313 *** | 566646.3000 *** | 524535.5000 *** |

| KPSS | 0.0327 | 0.1897 | 0.1690 |

| Scale | WMC “Lower” | Correlation | WMC “Upper” |

|---|---|---|---|

| CPI | |||

| 1 | 0.0855 | 0.2515 | 0.4038 |

| 2 | 0.0000 | 0.1931 | 0.4141 |

| 3 | 0.5041 | 0.7224 | 0.8539 |

| 4 | 0.0000 | 0.4730 | 0.7847 |

| 5 | 0.7221 | 0.9456 | 0.9904 |

| EXR | |||

| 1 | 0.0000 | 0.1660 | 0.3264 |

| 2 | 0.0342 | 0.2721 | 0.4809 |

| 3 | 0.1060 | 0.4335 | 0.6762 |

| 4 | 0.1386 | 0.5935 | 0.8416 |

| 5 | 0.9869 | 0.9977 | 0.9996 |

| NEER | |||

| 1 | 0.4160 | 0.5470 | 0.6557 |

| 2 | 0.1864 | 0.4083 | 0.5906 |

| 3 | 0.1227 | 0.4472 | 0.6853 |

| 4 | 0.2034 | 0.6350 | 0.8600 |

| 5 | 0.9574 | 0.9925 | 0.9987 |

| Scale | Localizations | Time Lag (Months) | Leading/Lagging Variable |

|---|---|---|---|

| CPI | |||

| 1 | 0.3346 | -1 | Nigeria |

| 2 | 0.2722 | -8 | Côte d’Ivoire |

| 3 | 0.8057 | -12 | Côte d’Ivoire |

| 4 | 0.6838 | 7 | Côte d’Ivoire |

| 5 | 0.9945 | 12 | GEPU |

| EXR | |||

| 1 | 0.4086 | -7 | Gha\na |

| 2 | 0.3107 | -9 | Côte d’Ivoire |

| 3 | 0.4960 | -4 | Gambia |

| 4 | 0.6874 | -7 | Côte d’Ivoire |

| 5 | 0.9984 | 3 | Nigeria |

| NEER | |||

| 1 | 0.5470 | 0 | Côte d’Ivoire |

| 2 | 0.4083 | 0 | Côte d’Ivoire |

| 3 | 0.4472 | 0 | Nigeria |

| 4 | 0.6839 | 8 | Nigeria |

| 5 | 0.9949 | 1 | GEPU |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Frimpong, S. On the Macroeconomic Conditions of West African Economies to External Uncertainty Shocks. Risks 2022, 10, 138. https://doi.org/10.3390/risks10070138

Frimpong S. On the Macroeconomic Conditions of West African Economies to External Uncertainty Shocks. Risks. 2022; 10(7):138. https://doi.org/10.3390/risks10070138

Chicago/Turabian StyleFrimpong, Siaw. 2022. "On the Macroeconomic Conditions of West African Economies to External Uncertainty Shocks" Risks 10, no. 7: 138. https://doi.org/10.3390/risks10070138

APA StyleFrimpong, S. (2022). On the Macroeconomic Conditions of West African Economies to External Uncertainty Shocks. Risks, 10(7), 138. https://doi.org/10.3390/risks10070138