Monitoring the Modern Experience of Financial Risk Management in Russia Based on Corporate Social Responsibility for Sustainable Development

Abstract

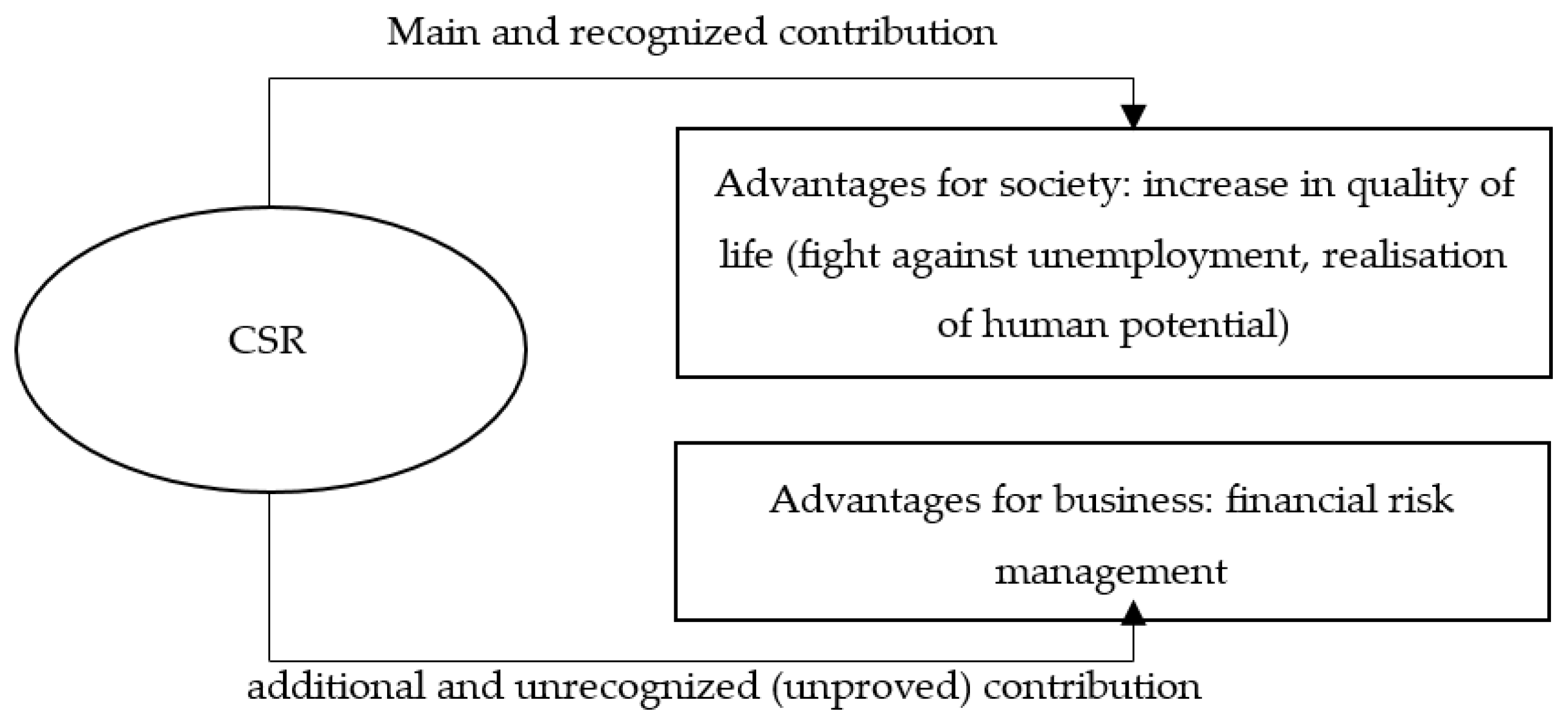

:1. Topicality, Aims and Scope

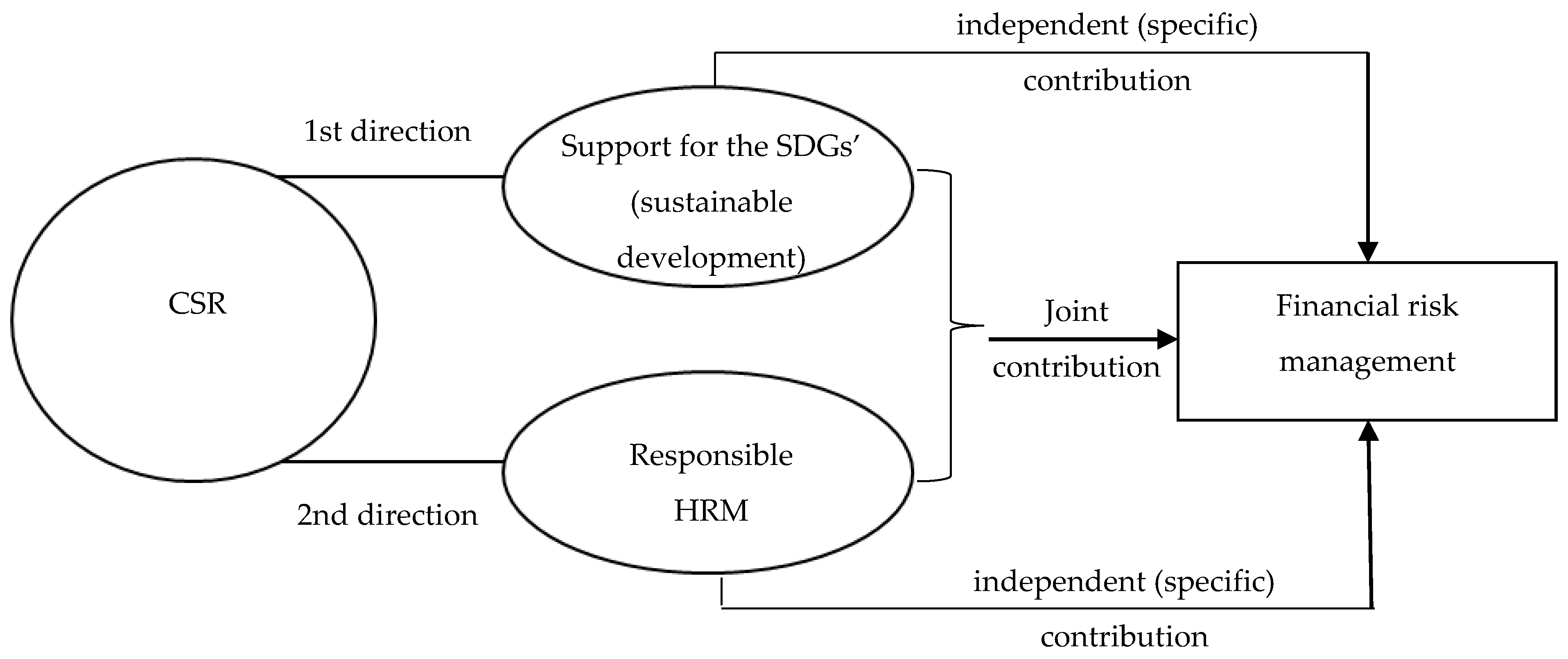

2. Theoretical Background

3. Data and Method

- -

- Index “responsibility and openness”, as the indicator of responsible HRM (csr1);

- -

- Index “vector of sustainable development”, as the indicator of support of the SDGs (csr2).

4. The Main Results

5. Discussion of Contribution to the Literature

6. Findings

Supplementary Materials

Author Contributions

Funding

Informed Consent Statement

Conflicts of Interest

References

- Akopova, Elena, Nataalia Przhedetskaya, Yuri Przhedetsky, and Kseniya Borzenko. 2020. Tendencies and Problems of Development of Marketing of Healthcare Organizations in Modern Russia. In Marketing of Healthcare Organizations: Technologies of Public-Private Partnership. Advances in Research on Russian Business and Management. Edited by E. G. Popkova. Charlotte: Information Age Publishing, Available online: https://www.infoagepub.com/products/Marketing-of-Healthcare-Organizations (accessed on 14 November 2021).

- Association of Clusters, Technological Parks and Special Economic Zones of Russia. 2021a. Russian Special Economic Zones: Business Navigator. Available online: https://akitrf.ru/oez/analiticheskie-materialy/ (accessed on 10 October 2021).

- Association of Clusters, Technological Parks and Special Economic Zones of Russia. 2021b. 6th Annual Review “Technological Parks of Russia”. Available online: https://akitrf.ru/technoparks/analiticheskie-materialy/ (accessed on 10 October 2021).

- Avom, Désiré, Aimé Kocou Dadegnon, and Charlemagne Babatoundé Igue. 2021. Does digitalization promote net job creation? Empirical evidence from WAEMU countries. Telecommunications Policy 45: 102215. [Google Scholar] [CrossRef]

- Awawdeh, Ala Eldin, Mohammed Ananzeh, Ahmad Ibrahiem El-khateeb, and Ahmad Aljumah. 2021. Role of green financing and corporate social responsibility (CSR) in technological innovation and corporate environmental performance: A COVID-19 perspective. China Finance Review International, ahead-of-print. [Google Scholar] [CrossRef]

- Bofinger, Yannik, Kim Heyden, and Björn Rock. 2022. Corporate social responsibility and market efficiency: Evidence from ESG and misvaluation measures. Journal of Banking and Finance 134: 106322. [Google Scholar] [CrossRef]

- Bognár, Ferenc, and Petra Benedek. 2021. Case study on a potential application of failure mode and effects analysis in assessing compliance risks. Risks 9: 164. [Google Scholar]

- Bouri, Elie, Riza Demirer, Rangan Gupta, and Jacobus Nel. 2021. Covid-19 pandemic and investor herding in international stock markets. Risks 9: 164. [Google Scholar] [CrossRef]

- Bristy, Humyra Jabeen, Janice How, and Peter Verhoeven. 2021. Gender diversity: The corporate social responsibility and financial performance nexus. International Journal of Managerial Finance 17: 665–86. [Google Scholar]

- Dakhli, Anissa. 2021. Does financial performance moderate the relationship between board attributes and corporate social responsibility in French firms? Journal of Global Responsibility 12: 373–99. [Google Scholar]

- Delmas, Magali, and Michael Toffel. 2004. Stakeholders and environmental management practices: An institutional framework. Business Strategy and The Environment 13: 209–22. [Google Scholar]

- Dosi, Giovanni, Mariacristina Piva, Maria Enrica Virgillito, and Maria Vivarelli. 2021. Embodied and disembodied technological change: The sectoral patterns of job-creation and job-destruction. Research Policy 50: 104199. [Google Scholar] [CrossRef]

- Farah, Tazerina, Jialong Li, Zhicheng Li, and Abul Shamsuddin. 2021. The non-linear effect of CSR on firms’ systematic risk: International evidence. Journal of International Financial Markets, Institutions and Money 71: 101288. [Google Scholar] [CrossRef]

- Forbes. 2021. Global 2000. Available online: https://www.forbes.com/lists/global2000/ (accessed on 16 February 2022).

- García-Sánchez, Isabel-Maria, Nazim Hussain, Cristina Aibar-Guzmán, and Beatriz Aibar-Guzmán. 2022. Assurance of corporate social responsibility reports: Does it reduce decoupling practices? Business Ethics, Environment and Responsibility 31: 118–38. [Google Scholar] [CrossRef]

- Geenen, Sara, and Mollie Gleiberman. 2021. Superfluous Jobs in Extractive Industries: The Usefulness/Uselessness of Job Creation after Dispossession. Work, Employment and Society. [Google Scholar] [CrossRef]

- Greig, Michael, Cory Searcy, and W. Patrick Neumann. 2021. The work environment in the context of corporate social responsibility reporting: Developing common terms for consistent reporting in organizations. Journal of Cleaner Production 328: 129513. [Google Scholar] [CrossRef]

- Ho, Jerry, Ting-Hsuan Chen, and Jia-Jin Wu. 2021. Are corporate social responsibility reports informative? Evidence from textual analysis of banks in China. China Finance Review International 12: 101–20. [Google Scholar] [CrossRef]

- Hoang, Bqc An, and Thi Thanh Huyen Tran. 2022. Corporate Social Responsibility Disclosure and Financial Performance of Construction Enterprises: Evidence from Vietnam. Lecture Notes in Civil Engineering 203: 1505–14. [Google Scholar] [CrossRef]

- Holzner, Christian, and Mario Larch. 2021. Convex vacancy creation costs and on-the-job search in a global economy. World Economy 45: 136–75. [Google Scholar] [CrossRef]

- Hsu, Feng-Jui, and Sheng-Hung Chen. 2021. US quantitative easing and firm’s default risk: The role of Corporate Social Responsibility (CSR). Quarterly Review of Economics and Finance 80: 650–64. [Google Scholar] [CrossRef]

- Hsu, Bo-Xiang, Yi-Min Chen, and Li-An Leann Chen. 2022. Corporate social responsibility and value-added in the supply chain: Model and mechanism. Technological Forecasting and Social Change 174: 121302. [Google Scholar] [CrossRef]

- Huang, Kaixing, Nicolas Sim, and Hong Zhao. 2020. Corporate social responsibility, corporate financial performance and the confounding effects of economic fluctuations: A meta-analysis. International Review of Financial Analysis 70: 101504. [Google Scholar] [CrossRef]

- Husted, Bryan. 2005. Risk management, real options, corporate social responsibility. Journal of Business Ethics 60: 175–83. [Google Scholar]

- Jo, Hoje, and Kwangwoo Park. 2020. Controversial Industries, Regional Differences, and Risk: Role of CSR. Asia-Pacific Journal of Financial Studies 49: 911–47. [Google Scholar] [CrossRef]

- Kalaitzoglou, Iordanis, Hui Pan, and Jacek Niklewski. 2021. Corporate social responsibility: How much is enough? A higher dimension perspective of the relationship between financial and social performance. Annals of Operations Research 306: 209–45. [Google Scholar]

- Karwowski, Mariusz, and Monika Raulinajtys-Grzybek. 2021. The application of corporate social responsibility (CSR) actions for mitigation of environmental, social, corporate governance (ESG) and reputational risk in integrated reports. Corporate Social Responsibility and Environmental Management 28: 1270–84. [Google Scholar] [CrossRef]

- Kharlanov, Alexey, Yuliya Bazhdanova, Teimuraz Kemkhashvili, and Natalia Sapozhnikova. 2022. The Case Experience of Integrating the SDGs into Corporate Strategies for Financial Risk Management Based on Social Responsibility (with the Example of Russian TNCs). Risks 10: 12. [Google Scholar] [CrossRef]

- Kludacz-Alessandri, Magdalena, and Małgorzata Cygańska. 2021. Corporate social responsibility and financial performance among energy sector companies. Energies 14: 6068. [Google Scholar] [CrossRef]

- Kolling, Camila, Jose Luis Duarte Ribeiro, and Janine Fleith de Medeiros. 2022. Performance of the cosmetics industry from the perspective of Corporate Social Responsibility and Design for Sustainability. Sustainable Production and Consumption 30: 171–85. [Google Scholar] [CrossRef]

- Kong, Xiaowei, Fan Jiang, and Ling Zhu. 2022. A business strategy, corporate social responsibility, and within-firm pay gap. Economic Modelling 106: 105703. [Google Scholar] [CrossRef]

- Kpognon, Koffi Delali, Henri Atangana Ondoa, Mamadou Bah, and Peter Asare-Nuamah. 2021. Fostering Labour Productivity Growth for Productive and Decent Job Creation in Sub-Saharan African Countries: The Role of Institutional Quality. Journal of the Knowledge Economy 2021: 1–31. [Google Scholar] [CrossRef]

- Krechowicz, Maria, and Katarzyna Kiliańska. 2021. Risk and opportunity assessment model for CSR initiatives in the face of coronavirus. Sustainability 13: 6177. [Google Scholar] [CrossRef]

- Laufer, William. 2003. Social accountability and corporate greenwashing. Journal of Business Ethics 43: 253–61. [Google Scholar]

- Liang, Yang. 2021. Job creation and job destruction: The effect of trade shocks on U.S. manufacturing employment. World Economy 44: 2908–48. [Google Scholar] [CrossRef]

- Lin, Woon Lin, Jo Ann Ho, Siew Imm Ng, and Chin Lee. 2020. Does corporate social responsibility lead to improved firm performance? The hidden role of financial slack. Social Responsibility Journal 16: 957–82. [Google Scholar]

- Lin, James Juichia, Chen-Yu Wang, and Che-Hui Cheng. 2021. How Does Financial Reporting Quality Relate to Corporate Social Responsibility Expenditures? An International Analysis. Review of Pacific Basin Financial Markets and Policies 24: 2150023. [Google Scholar] [CrossRef]

- Lisicki, Bartolomiej. 2021. Impairment of assets and market reaction during covid-19 pandemic on the example of WSE. Risks 9: 183. [Google Scholar]

- Lozano, Rodrigo. 2015. A holistic perspective on corporate sustainability drivers. Corporate Social Responsibility and Environmental Management 22: 32–44. [Google Scholar]

- Lu, Wenling, and Benjamin Yeo. 2020. Time-varying relations between seven dimensions of CSR and firm risk. Business and Professional Ethics Journal 39: 319–45. [Google Scholar] [CrossRef]

- Lu, Hao, Xiaoyu Liu, and Loren Falkenberg. 2020. Investigating the impact of corporate social responsibility (CSR) on risk management practices. Business & Society 61: 496–534. [Google Scholar]

- Lumbanraja, Anggita Doramia. 2021. A new direction to the sustainable development goals in job creation bill in indonesia. International Journal of Criminology and Sociology 10: 703–8. [Google Scholar] [CrossRef]

- Mackey, Tyson, Alison Mackey, Lisa Jones Christensen, and Jason Lepore. 2022. Inducing Corporate Social Responsibility: Should Investors Reward the Responsible or Punish the Irresponsible? Journal of Business Ethics 175: 59–73. [Google Scholar] [CrossRef]

- Malik, Mahfuja. 2015. Value-enhancing capabilities of CSR: A brief review of contemporary literature. Journal of Business Ethics 127: 419–38. [Google Scholar]

- Maqbool, Shafat, and Shabir A. Hurrah. 2021. Exploring the Bi-directional relationship between corporate social responsibility and financial performance in the Indian context. Social Responsibility Journal 17: 1062–78. [Google Scholar]

- Margolis, Joshua, and James Walsh. 2003. Misery loves companies: Rethinking social initiatives by business. Administrative Science Quarterly 48: 268–305. [Google Scholar]

- MOEX. 2022a. Index of Moscow Exchange “Responsibility and Openness” (Archive or Prices and Weights: 16 February 2022). Available online: https://www.moex.com/ru/index/MRRT/constituents/ (accessed on 16 February 2022).

- MOEX. 2022b. Index of Moscow Exchange “Vector of Sustainable Development” (Archive or Prices and Weights: 16 February 2022). Available online: https://www.moex.com/ru/index/MRSV/constituents/ (accessed on 16 February 2022).

- Mulia, Rezki Ananda, and Joni Joni. 2020. Corporate social responsibility (CSR) and risk-taking: Evidence from Indonesia. ACRN Journal of Finance and Risk Perspectives 8: 152–62. [Google Scholar] [CrossRef]

- Niu, Yingjie, Jinquiang Yang, Yaoyao Wu, and Siqi Zhao. 2022. Corporate social responsibility and dynamic liquidity management. Research in International Business and Finance 59: 101559. [Google Scholar] [CrossRef]

- Nyuur, Richard, Daniel Ofori, Majoreen Amankwah, and Kwame Amin Baffoe. 2022. Corporate social responsibility and employee attitudes: The moderating role of employee age. Business Ethics, Environment and Responsibility 31: 100–17. [Google Scholar] [CrossRef]

- Pasko, Oleh, Fuli Chen, Nelia Proskurina, Rong Mao, Viktoria Gryn, and Iryna Pushkar. 2021. Are corporate social responsibility active firms less involved in earnings management? Empirical evidence from China. Business: Theory and Practice 22: 504–16. [Google Scholar] [CrossRef]

- Petrovskaya, Maria, Vladimir Chaplyuk, Raju Mohammad Kamrul Alam, Md. Nazmul Hossain, and Ahmad S. Al Humssi. 2022. Covid 19 And Global Economic Outlook. In Current Problems of the World Economy and International Trade. Bingley: Emerald Publishing Limited, vol. 42. [Google Scholar]

- Popkova, Elena, and Bruno Sergi. 2021. Dataset Modelling of the Financial Risk Management of Social Entrepreneurship in Emerging Economies. Risks 9: 211. [Google Scholar] [CrossRef]

- Pündrich, Aline Pereira, Natalia Aguilar Delgado, and Luciano Barin-Cruz. 2021. The use of corporate social responsibility in the recovery phase of crisis management: A case study in the Brazilian company Petrobras. Journal of Cleaner Production 329: 129741. [Google Scholar] [CrossRef]

- Purwaningsih, Endang, and Suhaeri Muslikh. 2022. Innovation and supply chain orientation concerns toward job creation law in micro, small, and medium enterprises export-oriented products. Uncertain Supply Chain Management 10: 69–82. [Google Scholar] [CrossRef]

- Ram, Manish, Juan Carlos Osorio-Aravena, Arman Aghahosseini, Dmitrii Bogdanov, and Christian Breyer. 2022. Job creation during a climate compliant global energy transition across the power, heat, transport, and desalination sectors by 2050. Energy 238: 121690. [Google Scholar] [CrossRef]

- Rendon, Silvio. 2021. Job creation and investment in imperfect financial and labor markets. Applied Economic Analysis, ahead-of-print. [Google Scholar] [CrossRef]

- Rogulenko, Tatyana, Evgeniy Orlov, Oleg Smolyakov, Anna Bodiako, and Svetlana Ponomareva. 2021. Analytical methods to assess financial capacity in face of innovation projects risks. Risks 9: 171. [Google Scholar]

- Sadiq, Muhammad, Sakkarin Nonthapot, Shafi Mohamad, Ooi Chee Keong, Syed Ehsanullah, and Nadeem Iqbal. 2021. Does green finance matter for sustainable entrepreneurship and environmental corporate social responsibility during COVID-19? China Finance Review International, ahead-of-print. [Google Scholar] [CrossRef]

- Santarcangelo, Vito, Muhammad Imran Tariq, Michele Di Lecce, Emilio Massa, Nicolo Montesano, Amtonio Notarnicola, Andrea Brandonisio, and Massimiliano Giacalone. 2022. Blockchain Fuzzy as Innovative Tool for the Certification of Corporate Social Responsibility. Smart Innovation, Systems and Technologies 253: 291–98. [Google Scholar] [CrossRef]

- Scully, Ben, and Thaabiso Moyo. 2021. Constructing Conflict: The Politics of Job Creation Policy, Precarious Work, and Citizenship in South Africa’s Construction Industry. Critical Sociology 2021: 08969205211035560. [Google Scholar] [CrossRef]

- Sharma, Rai Bahadur, Asha Sharma, Sajid Ali, and Jyoti Dadhich. 2021. Corporate social responsibility and financial performance: Evidence from manufacturing and service industry. Academic Journal of Interdisciplinary Studies 10: 301–7. [Google Scholar]

- Shukla, Akanksha, and Geetika. 2022. Impact of corporate social responsibility on financial performance of energy firms in India. International Journal of Business Governance and Ethics 16: 88–105. [Google Scholar] [CrossRef]

- Shukla, Akanksha, and Nimesh Geetika. 2022. Corporate Social Responsibility Measures: A Brief Review. Business Perspectives and Research 10: 101–20. [Google Scholar] [CrossRef]

- Sillaste, Galina Georgievna. 2019. Marxism and capitalism: Struggle and unity of oppositions in the context of social time. In Marx and Modernity: A Political and Economic Analysis of Social Systems Management. Advances in Research on Russian Business and Management. Edited by M. L. Alpidovskaya and E. G. Popkova. Charlotte: Information Age Publishing, pp. 185–98. Available online: https://www.infoagepub.com/products/Marx-and-Modernity (accessed on 14 November 2021).

- Sun, Yunpeng, and Ying Li. 2021. COVID-19 Outbreak and Financial Performance of Chinese Listed Firms: Evidence From Corporate Culture and Corporate Social Responsibility. Frontiers in Public Health 9: 710743. [Google Scholar] [CrossRef]

- Tong, Lijing, Wen Wen, Lu Xie, and Bin Wu. 2022. Do negative investor attitudes drive corporate social responsibility? Evidence from China. Business Ethics, Environment and Responsibility 31: 239–56. [Google Scholar] [CrossRef]

- Wen, Hui, and George Deltas. 2022. Global corporate social responsibility reporting regulation. Contemporary Economic Policy 40: 98–123. [Google Scholar] [CrossRef]

- Ye, Meng, Hongdi Wang, and Weisheng Lu. 2021. Opening the “black box” between corporate social responsibility and financial performance: From a critical review on moderators and mediators to an integrated framework. Journal of Cleaner Production 313: 127919. [Google Scholar] [CrossRef]

- Yuan, Tiezhen, Ji George Wu, Ni Qin, and Jian Xu. 2022. Being nice to stakeholders: The effect of economic policy uncertainty on corporate social responsibility. Economic Modelling 108: 105737. [Google Scholar] [CrossRef]

| Research Task | Research Method | Use of the Method |

|---|---|---|

| Determining the level of financial risks of Russian companies in the 2020–2021 period and the impact of CSR (in terms of the distinguished directions) on it | Horizontal analysis | Analysis of the change in the financial indicators of companies in 2020 compared with 2019, and in 2021 compared with 2020 |

| Correlation analysis | Assessment of the contribution of the directions of CSR to the change in the financial indicators of companies’ activity in the 2020–2021 period | |

| Modelling and measuring the contribution of CSR (in terms of the distinguished directions) to the reduction in the financial risks of Russian companies in 2020 | Regression analysis | Determining the dependence of the financial results of companies in 2020 on their implemented directions of CSR |

| Evaluating the perspective of the reduction in the financial risks of Russian companies for the 2022–2024 period based on CSR | Least-squares method | Evaluation (forecasting) of the consequences of an increase in CSR in each direction for the financial results of companies |

| Company | Sales (∆fr1) | Profits (∆fr2) | Assets (∆fr3) | Market Value (∆fr4) | ||||

|---|---|---|---|---|---|---|---|---|

| 2020/ 2019 | 2021/ 2020 | 2020/ 2019 | 2021/ 2020 | 2020/ 2019 | 2021/ 2020 | 2020/ 2019 | 2021/ 2020 | |

| Gazprom | 104.81 | −26.18 | −82.33 | −4158.15 | 1653.54 | −11.09 | −80.13 | 20.89 |

| Rosneft | 75.86 | −44.21 | −98.84 | −81.65 | −71.79 | −0.48 | −82.35 | 61.54 |

| LukOil | 90.33 | −38.26 | −92.26 | 2018.18 | −88.83 | −14.84 | −93.49 | 26.94 |

| Novatek | −74.94 | −27.27 | 1.71 | −93.01 | 1147.12 | −14.15 | −92.03 | 37.09 |

| Transneft | −14.88 | −12.80 | −82.05 | −25.00 | 1420.58 | −18.78 | −70.86 | 3.73 |

| Tatneft | −45.66 | −31.08 | −79.83 | −53.33 | 490.15 | −14.07 | −94.72 | 3.59 |

| Novolipetsk Steel | −37.77 | −8.91 | −90.05 | 8.33 | 332.65 | 2.06 | 4.59 | 100.96 |

| Polyus | n/a | 25.00 | n/a | −15.79 | n/a | −12.05 | n/a | 22.48 |

| Magnitogorsk Iron & Steel | −4.18 | −13.51 | −90.78 | −19.18 | 538.30 | −9.52 | −15.85 | 65.57 |

| Alrosa | −67.35 | n/a | −79.80 | n/a | 384.21 | n/a | 4.61 | n/a |

| Polymetal International | n/a | n/a | n/a | n/a | n/a | n/a | n/a | n/a |

| Estimate | Sales | Profits | Assets | Market Value |

|---|---|---|---|---|

| Arithmetic mean of growth (∆fr) | 2.91 | −77.14 | 645.10 | −57.80 |

| Coefficient of variation of growth (∆fr) | 2389.23 | −39.25 | 96.87 | −73.97 |

| Correlation between the arithmetic mean and the index “responsibility and openness” | 67.73 | −0.58 | −0.03 | −35.83 |

| Correlation between the arithmetic mean and the index “vector of sustainable development” | 48.58 | −5.75 | 17.02 | −8.89 |

| Estimate | Sales | Profits | Assets | Market Value |

|---|---|---|---|---|

| Arithmetic mean of growth (∆fr) | −19.69 | −268.84 | −10.33 | 38.09 |

| Coefficient of variation of growth (∆fr) | −104.29 | −598.79 | −66.32 | 84.53 |

| Correlation between the arithmetic mean and the index “responsibility and openness” | −41.79 | −17.87 | 0.84 | 2.23 |

| Correlation between the arithmetic mean and the index ““vector of sustainable development”” | −34.55 | −74.49 | 27.74 | 2.50 |

| Parameters of Regression Models | Regression Models | ||||||||

|---|---|---|---|---|---|---|---|---|---|

| fr1 | fr2 | fr3 | fr4 | ||||||

| Coefficients of Regression | T−Stat | Coefficients of Regression | T−Stat | Coefficients of Regression | T−Stat | Coefficients of Regression | T−Stat | ||

| Regression statistics | At constant | −96.16 | −1.03 | −20.30 | −1.83 | −423.05 | −2.42 | −32.80 | −0.98 |

| At csr1 | 5.59 | 2.07 | 0.63 | 1.96 | 4.70 | 0.93 | 1.88 | 1.94 | |

| At csr2 | 29.01 | 1.03 | 6.39 | 1.92 | 130.53 | 2.48 | 13.19 | 1.31 | |

| R−sq | 0.5882 | 0.6854 | 0.6405 | 0.6073 | |||||

| Significance F | 0.02874 | 0.0009794 | 0.016705 | 0.023763 | |||||

| Financial Risk | Manifestation of the Risk in Practice | Advantages of CSR for Financial Risk Management | |

|---|---|---|---|

| from Responsible HRM | from the Support of SDGs | ||

| SDG 4, SDG 5, SDG 8, SDG 10 | Other SDGs | ||

| Risk of reduction in sales | prevented in 2020; by −19.69% in 2021. | prevention in 2020 (r2 = 67.73%) | prevention in 2020 (r2 = 48.58%) |

| Risk of reduction in profit | by −77.14% in 2020; by −268.84% in 2021; | - | - |

| Risk of reduction in assets | prevented in 2020; by −10.33% in 2021; | reduction in 2021 (r2 = 0.84%) | prevention in 2020 (r2 = 17.02%) and reduction in 2021 (r2 = 27.74) |

| Risk of reduction in market value | by −57.80% in 2020; prevented in 2021. | prevention in 2021 (r2 = 2.23%) | prevention in 2021 (r2 = 2.50%) |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Berzon, N.I.; Novikov, M.M.; Pozharskaya, E.L.; Bakhturina, Y.I. Monitoring the Modern Experience of Financial Risk Management in Russia Based on Corporate Social Responsibility for Sustainable Development. Risks 2022, 10, 92. https://doi.org/10.3390/risks10050092

Berzon NI, Novikov MM, Pozharskaya EL, Bakhturina YI. Monitoring the Modern Experience of Financial Risk Management in Russia Based on Corporate Social Responsibility for Sustainable Development. Risks. 2022; 10(5):92. https://doi.org/10.3390/risks10050092

Chicago/Turabian StyleBerzon, Nikolai I., Maksim M. Novikov, Elena L. Pozharskaya, and Yulia I. Bakhturina. 2022. "Monitoring the Modern Experience of Financial Risk Management in Russia Based on Corporate Social Responsibility for Sustainable Development" Risks 10, no. 5: 92. https://doi.org/10.3390/risks10050092

APA StyleBerzon, N. I., Novikov, M. M., Pozharskaya, E. L., & Bakhturina, Y. I. (2022). Monitoring the Modern Experience of Financial Risk Management in Russia Based on Corporate Social Responsibility for Sustainable Development. Risks, 10(5), 92. https://doi.org/10.3390/risks10050092