The Application of the Soft Modeling Method to Evaluate Changes in Customer Behavior towards e-Commerce in the Time of the Global COVID-19 Pandemic

Abstract

:1. Introduction

2. Theoretical Background

2.1. Customer Behavior

- Demographic factors (age, gender, education, and size of household);

- Behavioral factors (buying habits—the frequency of shopping, preferred time and places of shopping, preferred form of payment, etc.);

- economic factors (inflation and change in the purchase power of consumers);

- psycho-social factors (lack of stability, feeling insecure, the financial situation, and the changes in the perception of this situation) (Lim et al. 2016, p. 404).

2.2. New Trends in Consumer Purchasing Behaviors during a Global Pandemic

- (a)

- Interested more in availability rather than buying (Madhukalya 2020);

- (b)

- The mobile phone is in first place amongst the ten most important devices they could not live without, which supports the development of online shops;

- (c)

- Considering buying behaviors, e-customers look for the best price and opinions about the product;

- (d)

- Exposed to the ROPO effect.

- More people than before shop online;

- New online skills are being learnt and developed;

- Online and contactless payment are more desired;

- Customers prefer omnichannel distribution;

- People spend more time at home, and therefore both home entertainment and home office will remain lifestyle patterns.

3. Research Methods and Findings

3.1. Research Methods

3.2. Research Findings

4. Discussion and Conclusions

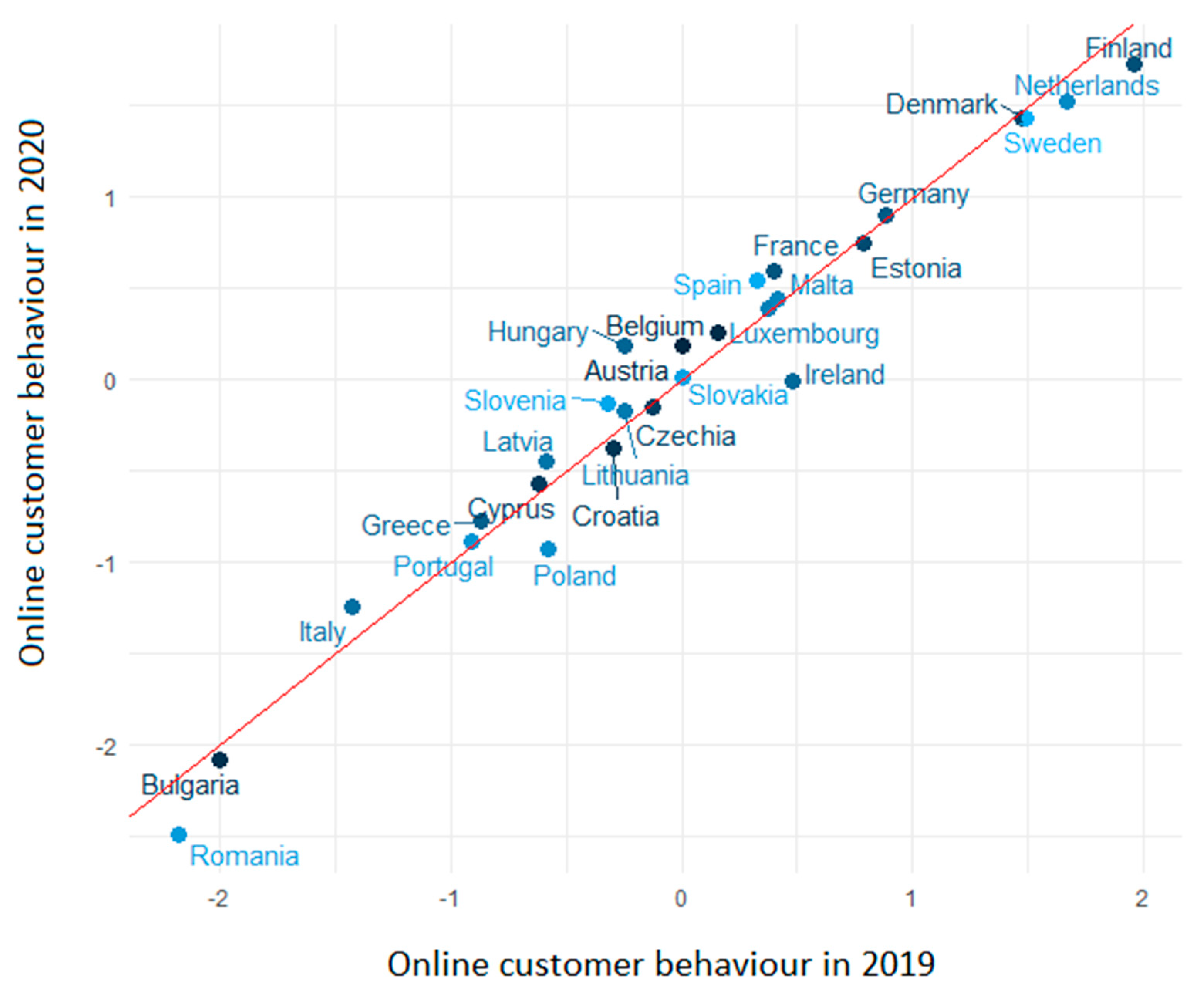

4.1. Discussion on Research Findings

- Denmark, Netherlands, Finland, and Sweden;

- Austria, Estonia, Spain, Luxemburg, Germany, Belgium, France, and Malta;

- Czechia, Lithuania, Slovenia, Croatia, Hungary, Slovakia, Poland, Greece, Portugal, Italy, Cyprus, and Latvia;

- Bulgaria and Romania.

4.2. Conclusions

4.3. Theoretical and Practical Contribution of the Study

4.4. Limitations of the Study and Future Research Directions

Author Contributions

Funding

Conflicts of Interest

References

- Accenture Report. 2020. How COVID-19 Will Permanently Change Consumer Behavior. Fast-Changing Consumer Behaviors Influence the Future of the CPG Industry. Available online: https://www.accenture.com/_acnmedia/pdf-123/accenture-covid19-pulse-survey-research-pov.pdf (accessed on 28 December 2021).

- Bilińska-Reformat, Katarzyna, and Magdalena Stefańska. 2016. Young Consumer’s Behaviors on Retail Market and Their Impact on Activities of Retail Chains. Business Excellence 10: 123. [Google Scholar]

- Crispel, Diane. 2021. Impact of COVID-19 on Consumer Behavior. GFK Report. Available online: https://www.gfk.com/blog/2020/04/report-impact-of-covid-19-on-consumer-behavior (accessed on 1 January 2022).

- Darden, William R., and Dub Ashton. 1974. Psychographic profiles of patronage preference groups. Journal of Retailing 50: 99–112. [Google Scholar]

- Davis, Fred D. 1989. Perceived usefulness, perceived ease of use, and user acceptance of information technology. MIS Quarterly 13: 319–40. [Google Scholar] [CrossRef] [Green Version]

- Devi, Manorama, Leena Das, and Moonty Baruah. 2019. Inclination towards Online Shopping-A Changing Trend among the Consumers. Journal of Economics, Management and Trade 25: 1–11. [Google Scholar] [CrossRef]

- Devkishin, Kripa Raj, Aftab Rizvi, and Vishwesh L. Akre. 2013. Analysis of factors affecting the online shopping behavior of consumers in U.A.E. Paper presented at International Conference on Current Trends in Information Technology (CTIT), Dubai, United Arab Emirates, December 11–12; pp. 220–25. [Google Scholar]

- Dewalska-Opitek, Anna. 2020. Dominant Business-to-Customer Relationships in the Era of COVID-19 Pandemic. Zeszyty Naukowe Wyższej Szkoły Humanitas. Zarządzanie, 87–102. [Google Scholar]

- Di Crosta, Adolfo, Irene Ceccato, Daniela Marchett, Pasquale La Malva, Roberta Maiella, Loreta Cannito, Mario Cipi, Nicola Mammarella, Riccardo Palumbo, Maria Cristina Verrocchio, and et al. 2021. Psychological factors and consumer behavior during the COVID-19 pandemic. PLoS ONE 16: e0256095. Available online: https://journals.plos.org/plosone/article?id=10.1371/journal.pone.0256095 (accessed on 20 December 2021). [CrossRef]

- Eger, Ludvík, Dana Egerová, and Michal Mičík. 2021. The effect of COVID-19 on consumer shopping behavior: Generational cohort perspective. Journal of Retailing and Consumer Services 61: 102542. [Google Scholar] [CrossRef]

- Fernandes, Nuno. 2020. Economic Effects of Coronavirus Outbreak (COVID-19) on the World Economy. Available online: http://dx.doi.org/10.2139/ssrn.3557504 (accessed on 28 December 2021).

- Fornell, Cleas, and William T. Robinson. 1983. Industrial organization and consumer satisfaction/dissatisfaction. Journal of Consumer Research 9: 403–12. [Google Scholar] [CrossRef]

- Howard, John A., and Jagdish N. Sheth. 1969. A Theory of Buyer Behavior. New York: Wiley. [Google Scholar]

- Hulland, John. 1999. Use of partial least squares (PLS) in strategic management research: A review of four recent studies. Strategic Management Journal 20: 195–204. [Google Scholar] [CrossRef]

- Jaciow, Magdalena, Robert Wolny, and Agata Stolecka-Makowska. 2013. E-consumer in Europe. Comparative Analysis of Behaviors. Gliwice: Helion SA Publishing Group. [Google Scholar]

- Joia, Luiz Antonio, and Manuela Lorenzo. 2021. Zoom in, zoom out: The impact of the COVID-19 pandemic in the classroom. Sustainability 13: 2531. [Google Scholar] [CrossRef]

- Jordan, Katie. 2020. How COVID-19 Is Impacting Boomers’ Shopping Behavior. Available online: https://nrf.com/blog/how-covid-19-impacting-boomers-shopping-behavior (accessed on 28 December 2021).

- Kar, Arpan Kumar. 2020. What affects usage satisfaction in mobile payments? Modelling user generated content to develop the “digital service usage satisfaction model”. Information Systems Frontiers 23: 1341–61. [Google Scholar] [CrossRef] [PubMed]

- Kardes, Frank, Thomas Cline, and Maria Cronley. 2011. Consumer Behavior Science and Practice, International ed. Southbank: South-Western Cengage Learning. [Google Scholar]

- Lim, Yi Jin, Abdullah Osman, Shahrul Nizam Salahuddin, Abdul Rachim Romle, and Safizal Abdullah. 2016. Factors Influencing Online Shopping Behavior: The Mediating Role of Purchase Intention. Procedia Economics and Finance 35: 401–10. [Google Scholar] [CrossRef] [Green Version]

- Loudon, David L., and Albert J. Della Bitta. 1993. Consumer Behavior: Concepts and Applications. New York: McGraw-Hill. [Google Scholar]

- Loxton, Mary, Robert Truskett, Brigitte Scarf, Laura Sindone, George Baldry, and Yinong Zhao. 2020. Consumer behavior during crises: Preliminary research on how coronavirus has manifested consumer panic buying, herd mentality, changing discretionary spending and the role of the media in influencing behavior. Journal of Risk Financial Management 13: 166. [Google Scholar] [CrossRef]

- Lysonski, Steven, Srini Durvasula, and Yiorgos Zotos. 1996. Consumer Decision-Making Styles: A Multi-Country Investigation. European Journal of Marketing 30: 10–27. [Google Scholar] [CrossRef] [Green Version]

- Madhukalya, Adwesha. 2020. Why millennials visit a store but buy online. Business Today. February 20. Available online: https://www.businesstoday.in/latest/economy-politics/story/why-millennials-visit-a-store-but-buy-online-250498-2020-02-20 (accessed on 2 January 2022).

- Mathur, Kaplana, and Arti Sharma. 2014. A study of online shopping habits of consumers in India. International Journal of Customer Relations 2: 23–28. [Google Scholar]

- Meyer, Susan. 2020. Understanding the COVID-19 Effect on Online Shopping Behavior. Available online: https://www.bigcommerce.com/blog/covid-19-ecommerce/#changes-in-revenue-across-ecommerce (accessed on 28 December 2021).

- Morard, Bernard, and Dimitri Simonin. 2016. Partial Least Squares Modeling in Marketing Research: A Tailor-Made Model of Wine e-Commerce Consumers in Switzerland. Journal of Economics, Business and Management 4: 410–17. [Google Scholar] [CrossRef]

- Pandey, Neena, and Abhipsa Pal. 2020. Impact of digital surge during COVID-19 pandemic: A viewpoint on research and practice. International Journal of Information Management 55: 102171. [Google Scholar]

- Pavlou, Paul A., and Lin Chai. 2002. What drives electronic commerce across cultures? A cross-cultural empirical investigation of the theory of planned behavior. Journal of Electronic Commerce Research 3: 240–53. [Google Scholar]

- Perło, Dorota. 2014. Modelowanie Zrównoważonego Rozwoju Regionów W Polsce. Białystok: Wydawnictwo Uniwersyteckie Trans Humana. [Google Scholar]

- Porto, Gabriela. 2021. The Age of Digital Payments Has Arrived. Available online: https://vtex.com/en/blog/trends/digital-payment-methods/ (accessed on 2 January 2022).

- Puttaiah, Mahesh H., Aakash Kiran Raverkar, and Evangelos Avramakis. 2020. All Change: How COVID-19 Is Transforming Consumer Behavior? Report of Swiss Re Institute, Zürich, Switzerland. Available online: https://www.swissre.com/institute/research/topics-and-risk-dialogues/health-and-longevity/covid-19-and-consumer-behaviour.html (accessed on 2 January 2022).

- Rajagopal. 2020. Development of Consumer Behavior. In Transgenerational Marketing: Evolution, Expansion, and Experience. Edited by Rajagopal. Cham: Springer International Publishing, pp. 163–94. [Google Scholar] [CrossRef]

- Reinartz, Werner, Manfred Krafft, and Weyne D. Hoyer. 2004. The customer relationship management process: Its measurement and impact on performance. Journal of Marketing Research 41: 293–305. [Google Scholar] [CrossRef]

- Report, Research and Markets. 2021. Global Online Payment Methods 2021: Post COVID-19. Available online: https://www.researchandmarkets.com/reports/5441234/global-online-payment-methods-2021-post-covid-19 (accessed on 28 December 2021).

- Rogowski, Józef. 1990. Modele Miękkie. Teoria I Zastosowanie w Badaniach Ekonomicznych. Białystok: Wydawnictwo Filii UW. [Google Scholar]

- Sahin, Sule, María del Carmen Boado-Penas, Corina Constantinescu, Julia Eisenberg, and Kira Henshaw. 2020. First Quarter Chronicle of COVID-19, An Attempt to Measure Governments’ Responses. Risks 8: 115. [Google Scholar] [CrossRef]

- Santosa, Allicia Deana, Nuryanti Taufik, Faizal Haris Eko Prabowo, and Mira Rahmawati. 2021. Continuance intention of baby boomer and X generation as new users of digital payment during COVID-19 pandemic using UTAUT2. Journal of Financial Services Marketing 26: 259–73. [Google Scholar] [CrossRef]

- Sassatelli, Roberta. 2007. Consumer Culture: History, Theory and Politics. Thousand Oaks: Sage. [Google Scholar]

- Shestak, Viktor, Dmitry Gura, Nina Khudyakova, Zaffar Ahmed Shaikh, and Yuri Bokov. 2020. Chatbot design issues: Building intelligence with the Cartesian paradigm. Evolutionary Intelligence 2020: 1–9. [Google Scholar] [CrossRef]

- Sheth, Jagdish N. 2021. A Theory of Byer Behavior. Available online: https://www.jagsheth.com/consumer-behavior/a-theory-of-buyer-behavior/ (accessed on 2 January 2022).

- Simon, Hermann. 2009. The crisis and customer behavior: Eight quick solutions. Journal of Customer Behavior 8: 177–86. [Google Scholar] [CrossRef]

- Solomon, Michael R. 2006. Consumer Behavior: A European Perspective, 3rd ed. Harlow: Prentice Hall. [Google Scholar]

- Steggals, Philip. 2021. The Psychology of Consumer Behavior: Habits That Are Set to Stick Post-Pandemic. Available online: https://www.thinkwithgoogle.com/intl/en-apac/consumer-insights/consumer-trends/consumer-behavior-psychology-post-pandemic (accessed on 22 November 2021).

- Sumarliah, Eli, Safeer Ullah Khan, and Ikram Ullah Khan. 2021. Online hijab purchase intention: The influence of the Coronavirus outbreak. Islam Market 12: 598–621. [Google Scholar] [CrossRef]

- Westbrook, Robert A., and William C. Black. 1985. A Motivation-Based Shopping Typology. Journal of Retailing 61: 78–103. [Google Scholar]

- WHO Coronavirus Disease Dashboard. 2020. Available online: https://covid19.who.int/ (accessed on 8 August 2020).

- Wold, Herman. 1980. Soft Modelling: Intermediate between Traditional Model Building and Data Analysis. Warsaw: Banach Centre Publications, vol. 6.1, pp. 333–46. [Google Scholar]

- Zhong, Qiwei, Yang Liu, Xiang Ao, Binbin Hu, Jinghua Feng, Jiayu Tang, and Qing He. 2020. Financial defaulter detection on online credit payment via multi-view attributed heterogeneous information network. Paper presented at Web Conference 2020, Taipei, Taiwan, April 20–24; pp. 785–95. [Google Scholar]

- Zierlein, Thorsten, Carina Garbe, Marie-Luise Freesemann, Leon Naumann, and Vera Maag. 2020. Impact of the COVID-19 Crisis on Short- and Medium-Term Customer Behavior. Deloitte.com. Available online: https://www2.deloitte.com/content/dam/Deloitte/de/Documents/consumer-business/Impact%20of%20the%20COVID19%20crisis%20on%20consumer%20behavior.pdf (accessed on 28 December 2021).

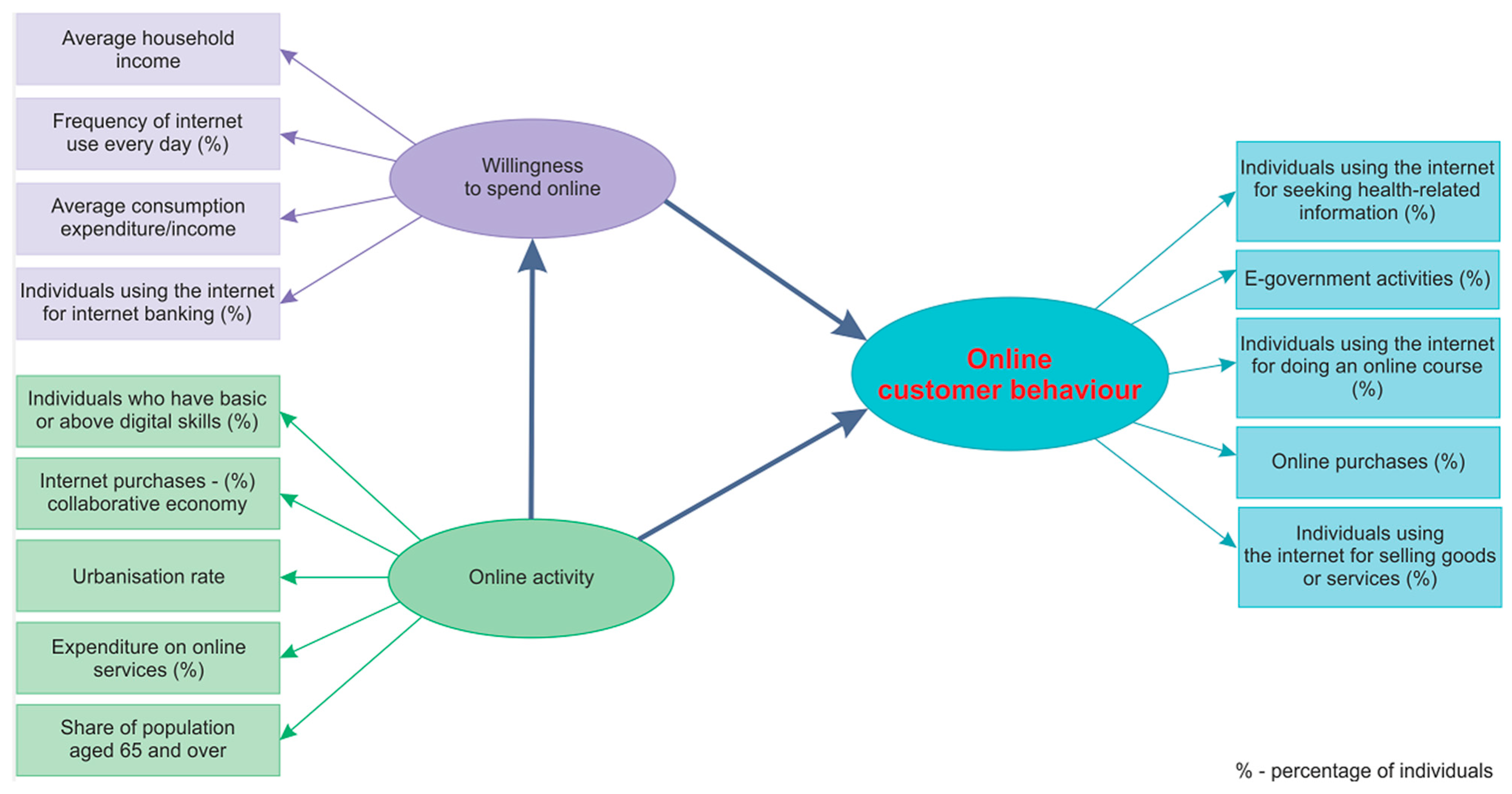

| Indicators | Latent Variables | Loading 2019 | Loading 2020 |

|---|---|---|---|

| Share of population aged 65 and over | Online activity | −0.15 | −0.11 |

| Individuals who have basic or better digital skills (%) | Online activity | 0.92 | 0.90 |

| Internet purchases—collaborative economy (%) | Online activity | 0.74 | 0.79 |

| Urbanization rate | Online activity | 0.45 | 0.68 |

| Expenditure on online services | Online activity | 0.97 | 0.96 |

| Individuals using the internet for internet banking (%) | Willingness to spend online | 0.92 | 0.92 |

| Frequency of internet use every day (percentage of individuals) | Willingness to spend online | 0.98 | 0.96 |

| Average household income | Willingness to spend online | 0.87 | 0.86 |

| Average consumption expenditure/income | Willingness to spend online | 0.39 | 0.46 |

| Individuals using the internet for selling goods or services (%) | Online customer behavior | 0.85 | 0.79 |

| Individuals using the internet for seeking health-related information (%) | Online customer behavior | 0.84 | 0.90 |

| Online purchases (percentage of individuals) | Online customer behavior | 0.94 | 0.92 |

| E-government activities (%) | Online customer behavior | 0.87 | 0.87 |

| Individuals using the internet for doing an online course (%) | Online customer behavior | 0.83 | 0.73 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Dewalska-Opitek, A.; Bilińska, K.; Cierpiał-Wolan, M. The Application of the Soft Modeling Method to Evaluate Changes in Customer Behavior towards e-Commerce in the Time of the Global COVID-19 Pandemic. Risks 2022, 10, 62. https://doi.org/10.3390/risks10030062

Dewalska-Opitek A, Bilińska K, Cierpiał-Wolan M. The Application of the Soft Modeling Method to Evaluate Changes in Customer Behavior towards e-Commerce in the Time of the Global COVID-19 Pandemic. Risks. 2022; 10(3):62. https://doi.org/10.3390/risks10030062

Chicago/Turabian StyleDewalska-Opitek, Anna, Katarzyna Bilińska, and Marek Cierpiał-Wolan. 2022. "The Application of the Soft Modeling Method to Evaluate Changes in Customer Behavior towards e-Commerce in the Time of the Global COVID-19 Pandemic" Risks 10, no. 3: 62. https://doi.org/10.3390/risks10030062

APA StyleDewalska-Opitek, A., Bilińska, K., & Cierpiał-Wolan, M. (2022). The Application of the Soft Modeling Method to Evaluate Changes in Customer Behavior towards e-Commerce in the Time of the Global COVID-19 Pandemic. Risks, 10(3), 62. https://doi.org/10.3390/risks10030062