1. Introduction

The Islamic bond Sukuk is an emerging security, considered one of the growing commodities in the modern world. The system of Riba (interest) is forbidden in Islamic law; therefore, stakeholders in Muslim communities started thinking of a system that is free of interest. In recent years, Sukuk has emerged as a major Islamic financial security and as an alternative to conventional bonds. The first Sukuk was issued in 1990 in Malaysia and it turned out to be the first country to issue sovereign, corporate Sukuk. Auditing and Accounting Organization of Islamic Financial Institutions (AAOIFI) in 2003 declared Sukuk to be a “certificate of equal value representing undivided shares in ownership of tangible assets, and services in or ownership of the asset of a particular project or special investment activity”.

Sukuk are designed in a way that can earn returns for the investor. Islamic Finance Information Services (IFIS) highlights the importance of Sharia commodity and that the corporate Sukuk quickly becomes dominant as compared to sovereign Sukuk. Corporate Sukuk enhances an organization’s financing support (

Godlewski et al. 2013). Sukuk represent a certificate whose value is equal to the value of the underlying assets backing them. Sukuk holders take a certificate from the issuer of Sukuk. This certificate shows ownership and ensures the receipt of profit periodically for its bearer. These periodic profit payments can be in rental form through investing in the asset or profit-sharing process. After Sukuk reaches its maturity, the holder receives back their principal amount. Sukuk is present as different types in the market, that is, Mudharabah and Musharkah (partnership forms) Murabahah (cost-plus sales), Al-Wakalah and Ijarah (rental or lease agreement). Sukuk is analogous in structure to the conventional bond but ensures that fundraising must be according to Sharia. Three obligations must be met by a Sukuk to full fill Sharia: (a) ownership represented by certificate must be of tangible assets; (b) profit that is left after tax should be paid to investors, and (c) value of the asset at maturity must be equal to the current market price, not the previous price that was invested. The Sukuk market is growing rapidly but there is low liquidity in issuing of some Sukuk, which is an obstacle for its growth. This growth is affected because of not being accepted by the secondary trading mechanism. Therefore, it is necessary to develop a secondary market that performs efficiently and explains all the dynamics regarding the Sukuk spread.

AAOIFI sets standards that differentiate Sukuk from conventional bonds and securities, and Sukuk are not debt certificates. There has been a long-running debate about the differences between Sukuk and conventional bonds. Sukuk are similar to a conventional bond in some aspects, that is, they are traceable in traditional markets and get mature within a fixed period. Nevertheless, in the case of Sukuk, interest is forbidden while issuers of a conventional bond have to pay interest to inventors after a specified period. Furthermore, a person who issues Sukuk must share revenue profit and loss with investors. Having interest that involves benefits and risk results in a proportionate share of cash flow (

Godlewski et al. 2013). In the case of Islamic finance investment, a longer time period does not increase profit (

Ramasamy and Shanmugam Munisamy 2011). Because of default and uncertain situations, the due amount is not added to the principal in order to calculate compound interest. In this way, it is different from the conventional bond. Sukuk are asset-based (as per Islamic law), while conventional bonds are asset-backed. According to

Arundina et al. (

2015), there are Sukuk that are recently issued securities and the holder of the security might be affected by the variation in the price of underlying assets while those who invest in conventional bonds do not suffer from such issues.

Conventional bonds involved in trading, selling of debts, and loan lending are not permissible in Sharia. The profit that we receive in the case of a conventional bond is in the form of interest that is prohibited in Sharia. In order to recompense these returns, the profit we receive in Sukuk is in the form of rewards, not interest. Therefore, the emergence of Sukuk takes place in order to bridge the existing gap. It was noticed that Sukuk grow more rapidly as compared to a conventional bond. There is also a certain difference between Sukuk and conventional bonds. Sukuk always have an underlying asset and the bondholder and is given partial ownership of that underlying asset but the ownership of bond is a debt obligation. Underlying assets in the case of Sukuk must be Halal. We cannot put haram things (prohibited in Islam) as an underlying asset. Whenever the value of underlying assets increases, returns offer to the bondholders also increase or decrease. However, in the case of traditional bonds, the performance of the bond remains ineffective to bondholders. When the issuer of Sukuk offers a Sukuk bond in the secondary market it means he is selling the ownership of the asset that backed it while in the case of the conventional bond he is offering the debt.

Some scholars said that Sukuks are not according to Sharia as they do not follow these principles, and Islamic bonds and conventional bonds are very similar.

Wilson (

2008) mentioned that Sukuk are structured according to western securitization. So this raises the question of whether Sukuk is a different form of conventional bonds?

Wilson (

2008), suggested that Sukuk are formulated in a way that the profit earned by Sukuk should be equal to a conventional bond. However, the return from Sukuk is generated by an asset that is not backed by the periodic payment of interest. Contrary to that,

Cakir and Raei (

2007) contented that Sukuk are different from conventional bonds. When Sukuk are added into an investment strategy, the resulting portfolio outcome shows risk reduction benefits. Therefore, these are different from the conventional bond. Authors have suggested that risk reduction benefits can be achieved by issuing Sukuk instead of conventional bonds. So, the issuance of Sukuk as an alternative to conventional euro bonds can be beneficial for reducing risk.

Sukuk bond markets are beneficial for both investors and issuers (

Vishwanath and Azmi 2009). The underlying transaction is the foundation of Sukuk that causes the relationship between production and financial flows (inflows and outflows). Financial activities should be performed for productive purposes. Their focus must be financial projects instead of speculative tricks because exposure comes from the project and not from such possibilities. It is also essential to ensure stability. Exposure is a risk that investors face while doing a financial activity. As Sukuk is associated with risk; therefore, its exposure is high and exposes one significantly to exchange rate market risks, interest rate risk and even operational risk. Sukuk ensures an equal distribution of wealth. However, the Sukuk market is rising day by day. Basically, it is a market where bondholders pursue the bond investment until its maturity and are traded at a limited level in the secondary market (

Godlewski et al. 2013;

Alahouel and Loukil 2021). Now Sukuk offers special exchanges, that is, the first exchange is Dubai International Finance Exchange (DIFE), the second Market in Vienna and the Third Market Labuan Exchange in Malaysia (

Abdel-Khaleq and Richardson 2006;

Samitas et al. 2021;

Rahman et al. 2020). In western countries, England may come out as the primary bridge between Islamic finance and conventional means of capital. Recently, an initiative was taken to change the tax law that gave equal treatment to Sukuk as conventional bonds. However, the liquidity of the secondary market is assumed to develop slowly, with issuance rising and investors becoming more aware with the instrument.

The motivation of the study is to divert the intention of the investors towards the relationship among emerging markets, emerging Sukuk bonds markets and the implied volatilities indices from global and emerging economies. The study hopes to provide valuable guidelines for investors with religious beliefs so that they can invest according to their religious teachings. This study used a quantile regression approach in order to examine the financial uncertainty

1 relationship response of both the Islamic bond index

2 and the Sukuk bonds distribution of returns from growing and emerging markets

3 against an emerging market index

4. A Saudi Islamic Index is created for those who want to make investments according to Sharia principles with the intention to fully incorporate all the standards of purification related to business activities and dividends practices as per Sharia law. Quantile regression helps in assessing the co-movement

Mensi et al. (

2014) and causality effect

Reboredo and Naifar (

2017) along with the complete market situation analysis through quantile-based results such as low quantiles observe a slow-paced market growth, upper-quantiles observe a fast growth rate, etc.

This study is unique in a sense, as it measures financial uncertainty dynamics through Saudi index returns with related Sukuk bonds prices reflected onto the emerging market index. Moreover, it also analyzes how changes take place in dependency and causality between Sukuk price changes and economic and financial policy uncertainty over different quantiles. It uses three Sukuk bonds for its purpose, that is, Abu Dhabi, London and Kuala Lumpur, and examines their co-movement with the global volatility index and global emerging market index. The study uses daily data from 20 November 2017 to 12 June 2020. There are four types of empirical findings in this study, that is: (1) there is co-movement and causality in intermediate quintiles between the price of Sukuk and Saudi index; (2) co-movement and no causality between global volatility index and Sukuk; and (3) there is co-movement between the prices of Sukuk and emerging market index. This study shows that Sukuk is not independent of another bond and rather affect by just like other financial instruments.

2. Literature Review

A number of studies were conducted to exhibit stock market behavior that explains the variations of Sukuk returns.

Ryu et al. (

2017) conducted a study in order to examine what type of returns were obtained through co-movement of Sharia stocks such as Sukuk in Malaysian markets. They used the GARCH model (multivariate generalized autoregressive conditional heteroskedasticity) so that the one-way variation of Sharia stocks in the Sukuk bonds market could be assessed during the financial crisis. For UAE,

Mseddi and Naifar (

2013) in their empirical study explain the returns behavior of Sukuk to stock markets condition and microeconomic variables. For this purpose, they used a linear regression model The findings confirmed that slop trends and stock index returns seemed statistically significant.

Godlewski et al. (

2013) conducted a study to explain how stock markets behave for various types of Sukuk. They used a study sample with 131 types of Sukuk bonds of 43 companies of UAE, Bahrain, Indonesia, Kuwait, Malaysia, Qatar, Saudi Arabia and United Kingdom. Results show that there is a positive impact of Sukuk on the stock price of firms issuing ()Sukuk.

Aloui et al. (

2015), in their study, explain the co-movement of Islamic stocks and Sukuk in GCC nations and show that there is a positive relationship between these two.

Aloui et al. (

2015), in their study, examine the interconnection of Islamic stocks and Sukuk bonds finding a strong relationship among them. Also, the findings show that flight-to-quality can be seen more frequently in less risky Sukuk markets during financial turmoil.

Aloui et al. (

2015) explain the volatility of Islamic bonds and Sukuk in Gulf Corporation Council (GCC) countries by using the DCC (dynamic conditional correlation)-GARCH model. They found a negative correlation between Sukuk and Sharia stocks.

Naifar and Hammoudeh (

2016) conducted a study in which they explained how the returns of local Sukuk (in Malaysia, Saudi Arabia, and UAE) and the stock market in different conditions depend upon each other. There is an unequal dependency between Sukuk yield and the volatility of global or regional stock markets of Malaysia and UAE.

Bird and Yeung (

2012) used data from the Australian market to suggest that investors can be optimistic or pessimistic due to market uncertainty. During unpredictable conditions, inventors avoid making such choices that constantly have maximum expected utility.

Chordia et al. (

2005) took bond and stocks liquidity data (17 June 1991, to 31 December 1998) of the US and found that novelty in sock variations predicted a rise in the bid-ask spread of bonds.

Cremers et al. (

2008) added that option-implicit equity instability plays an important role in determining corporate bond spread.

Aslanidis and Christiansen (

2014) explain the parallel relationship of stock-bond quantile by using variables regarding market uncertainty, that is, the volatility index VIX in the US.

Bansal et al. (

2014) suggested that for Saudi Sukuk markets, equity-risk variations and flight-to-quality pricing can be an important source to grip the bond market dynamic during 1997.

Shin and Kim (

2015) conducted research in which they mentioned that after a crisis, investors from the Korean bond market need an extra default risk premium. It was because of increased uncertainty in financial markets. In the US bond market, equity volatility is considered a determinant to clarify volatility behavior.

In anticipation of the attention given recently to the research query related to the financial uncertainty at the domestic and global level, the second hypothesis is developed to evaluate the relationship of the Global volatility index with Sukuk prices of Abu Dhabi, London and Kuala Lumpur in the emerging market index. Uncertainty of volatility indexes is just like the unpredictable variations that have an effect on the economic development process.

Jeong (

2002) and

Billah et al. (

2022) mention that uncertainty could increase cost, decrease investment substantially (long-term) opportunities and reduce returns. There is evidence related to the impact of uncertainty on the overall firms’ performances and ultimately reduce their revenues, increases the costs factors and thus adversely impact investment policies (

Wang et al. 2014;

Ahmed and Elsayed 2019). Similar studies related to these variations in financial factors have been conducted for the US economy and the stock market indices of Asian, European and Sharia-based economies and found a dependency of US economic uncertainty on these indices’ price dynamics. Although past studies have established sound credibility and pointed out the dependency relationship between the Sukuk and conventional bond prices on stock market prices and macro-economic variables, there is hardly any evidence from quartile-based analyses of the financial uncertainty impact of Sukuk bonds prices on the emerging market stock market price dynamics. This further facilitates the investors and portfolio managers in earning profit from relevant strategies based on the decision-making process.

Research Hypothesis

Based on the review of the existing literature related to the topic, the following hypotheses were formulated.

Hypothesis 1. The Saudi Sukuk index and Sukuk bond prices both have a significant direct relationship and causal impact on emerging stock index prices.

Hypothesis 2. The global volatility index (VIX) as a financial uncertainty variable and Sukuk price dynamics both have a significant impact on the emerging stock index price dynamics.

Hypothesis 3. The emerging market volatility index (VXEEM)—as a financial uncertainty variable and Sukuk prices dynamics both have a significant impact on the emerging stock index price dynamics.

The first hypothesis was developed to analyze the relationship of the Saudi Sukuk index to emerging stock index prices and the Sukuk bonds prices of Abu Dhabi, London and Kuala Lumpur. The second hypothesis relates to the utilization of the Global volatility index as a proxy of the financial uncertainty and to check if the VIX index has a significant impact on the prices of the Sukuk bonds, which would imply that their use as a safe heaven investment in times of uncertainty will be limited. The third hypothesis was developed to evaluate the significant impact of volatility of the Sukuk index and Sukuk bonds prices on the emerging market index prices.

4. Empirical Results and Discussion

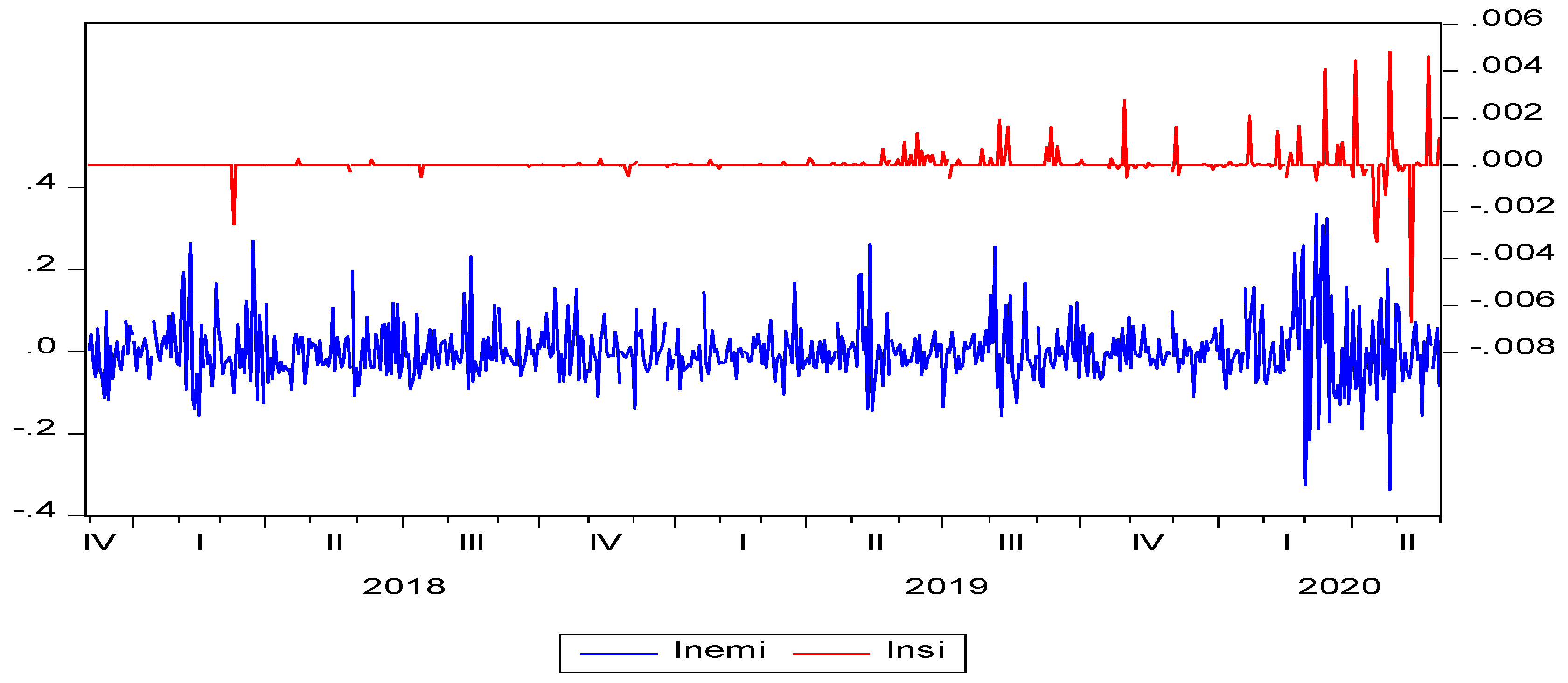

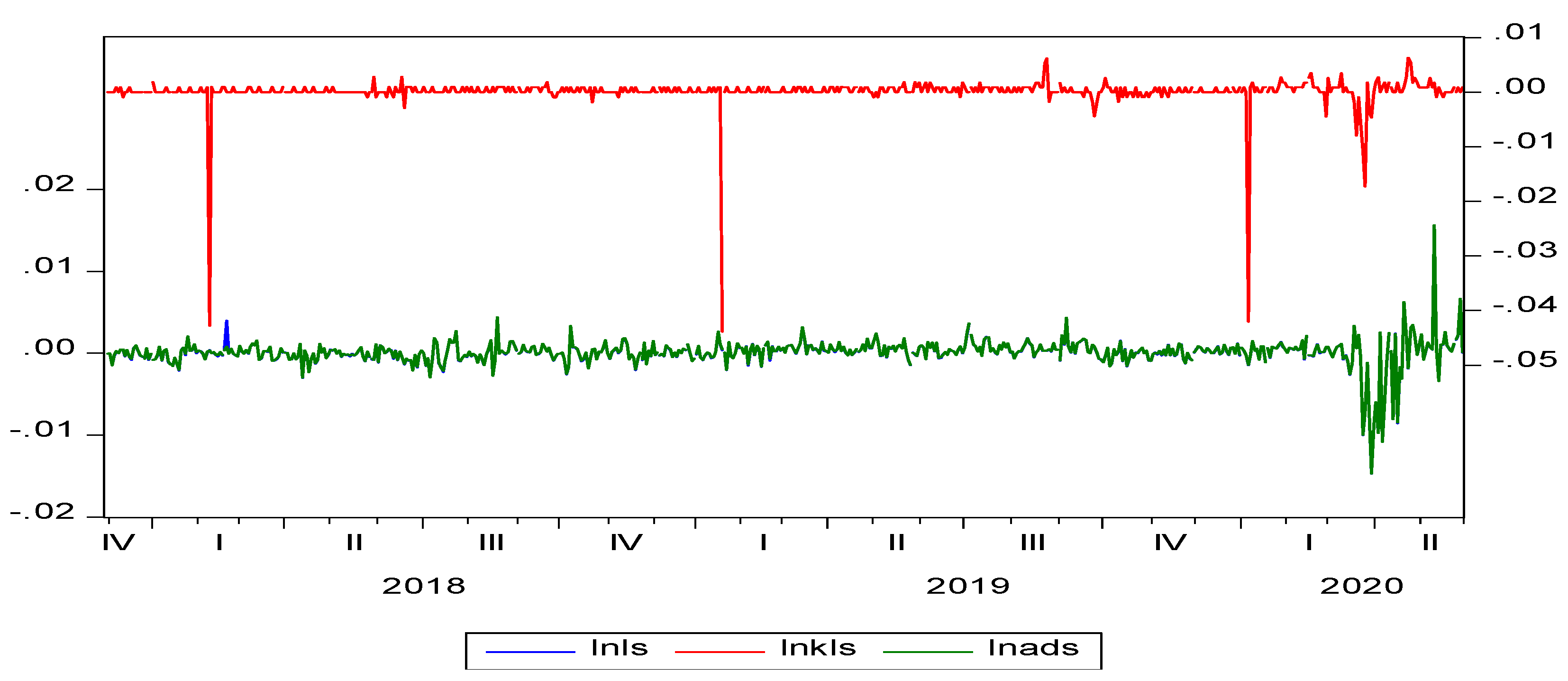

The study calculated the descriptive statistics given in

Table 1, which shows that the average calculated returns for the emerging market capital index are higher compared to the Saudi Sharia index and respective Sharia bonds. Higher average returns for the global volatility index are recorded for VIX compared to VXEEM. A fatter tail was also recorded for the Sharia index and respective Sharia bond returns as confirmed by their relative kurtosis values, among other contested variables. Next, the quantile regression analysis for the emerging market capital index was estimated with respect to the dynamic Sukuk index, Sukuk bonds and volatility indices. The following quantile-tau range from 0.05 to 0.95, as given in

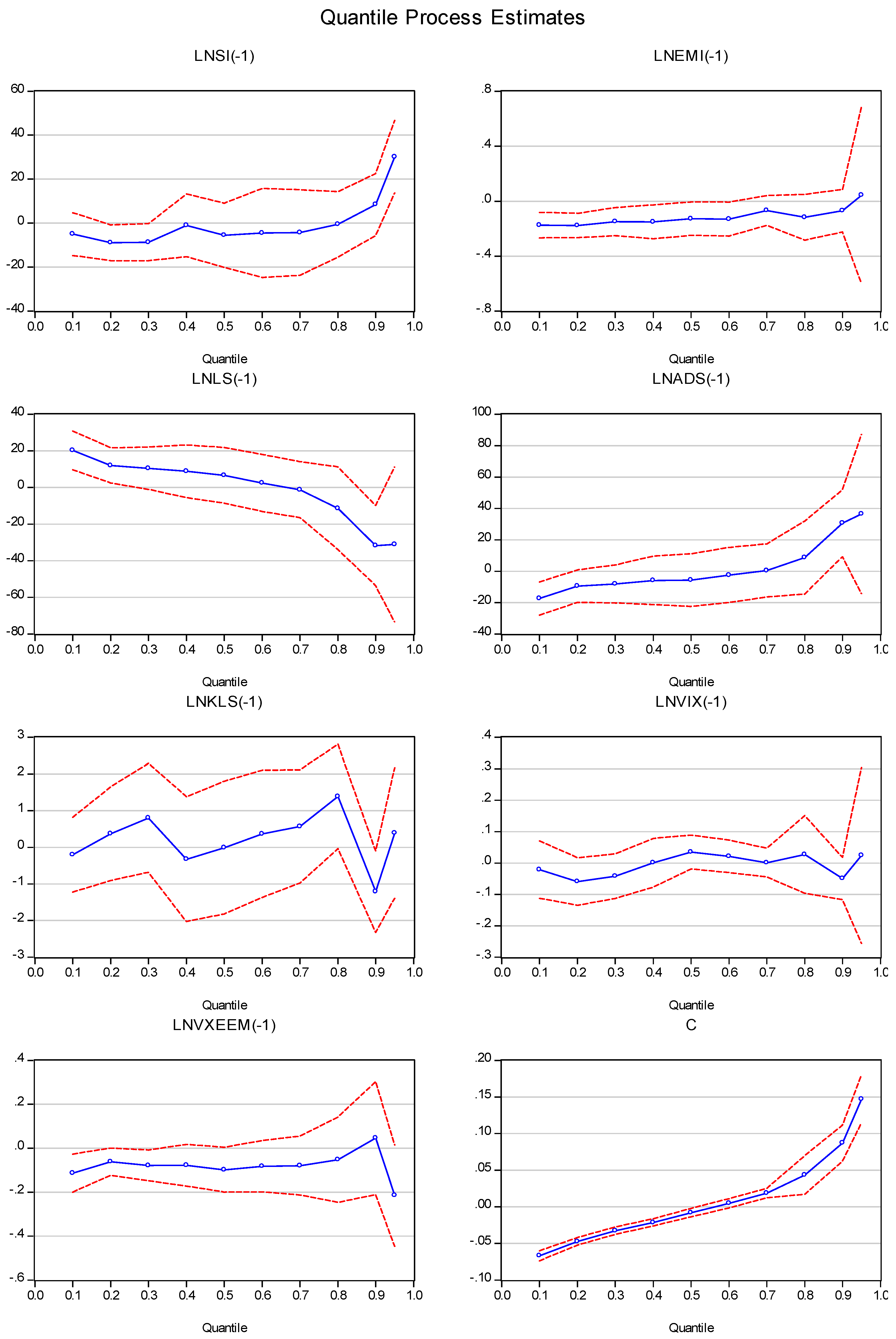

Table 2 and

Figure 4, explains the quantile regression estimated values for given parameters significant @ 95% confidence level. The values are present in graphs as dotted lines showing the impact of lagged parameter values for emerging market and Sharia indices, respective Sukuk bonds and the financial uncertainty indices.

From

Figure 4, it is clear that the estimated lagged coefficient values of slope get larger at the end of the tails for emerging market index, London Sukuk, Abu Dhabi Sukuk and the financial uncertainty indices distribution. The study results for the lagged values of the Sharia Index on the basis of Sukuk quantiles show that they react to extreme movements in the market. This is a good source of information for traders who intend to trade in the Islamic Sharia index since most of the time, the lagged quantile values of the Sukuk index are negative and similar to the return distribution of the market. This is also true for the lagged distributed quantiles values of Kulala Lumpur Sukuk bond returns, and it does have a tendency to react with the extreme variation in the market. The study results compare the emerging market index and the Saudi Sukuk index and found that there is no indication of co-moment among the two. This confirms that the traders can use the Islamic Sharia index as a hedging mechanism against the exited variations of the emerging stock index.

As far as financial uncertainty factors are concerned, the Sukuk index negatively relates to (VXEEM) volatility indicator for emerging markets. No significant response towards the sharp moments was found in the markets too. This is also true for the London Sukuk bond lagged quartile values. The study provides a comprehensive analysis to confirm the correlation between the Sukuk index, emerging market and financial uncertainty factors. It is observed that there is an indication of the negative causal effect of London Sukuk bond prices and the financial uncertainty factor, that is, the VXEEM volatility index on the Islamic Sharia Index. In terms of an initial co-moment perspective, the relationship between the Sukuk index with respective Islamic bonds and the emerging market index prices lagged coefficient values gives interesting results. For instance, it has been observed that the for the quartiles range between 5–25% there a positive co-moment observed between the Sukuk index, London and Abu Dhabi Sukuk bonds only except the Kulala Lumpur Sukuk. However, for the quartile range from median to 90%, there is an insignificant association between the Sukuk index and the emerging market index. There is a significant causal impact existed among the London, Abu Dhabi Sukuk, and emerging market lagged coefficient values which are significantly co-move with each other. Whereas, for the Kulala Lumpur Sukuk bond, lagged values confirm a significant negative casual impact on the emerging market index.

Similarly, the study observes the financial uncertainty impact on the Sukuk and emerging market indices and the given Sukuk bonds prices. When analyzing

Figure 4, the blue line indicates the quantile regression estimates of the regression parameters across the quantiles ranging from 0.05 to 0.95, and the red band depicts a 95% confidence interval for the quantile regression parameter estimates. The results are two-fold in this respect. Firstly, when seen through the VIX volatility indicator, it was found that there is no significant positive and negative causal effect on the Sukuk index return values. The respective quartile lagged values for the volatility index had a positive insignificant impact on the Sukuk indices starting initially up till the third quartile, except for the later portion, where it becomes negative. This shows the co-moment relationship among the two variables for the upper quartile portion. Next, for the emerging market volatility indicator, that is, VXEEM, there was found a positive causal impact on the Sukuk return values for the respective period. The results further confirm that there existed a co-moment among these two variables for the lower and middle quartile ranges.

During the period of study, no significant demand or supply shocks were discovered, which would have had a significant impact on the upward or downward movement of the Sukuk indices. In summary, the study suggests the following implications for the traders, first, the Sukuk index lagged quartile coefficient values show insignificant with relation to the emerging market capital index. This further reflects that the traders will be better off while trading with Sharia and emerging market indices through portfolio management. Under extreme market conditions, the financial uncertainty from the global volatility indicator, that is, (VIX) index perspective does not have a substantial impact on the Sharia index returns as well. However, the financial uncertainty does affect the portfolio based on the Sharia index while reflecting the emerging market volatility index such as (VXEEM). Moreover, the results show that there is a negative causal impact of the VXEEM index on the return lagged values of the Sukuk index, which is true for the Kulala Lumpur Sukuk too. Whereas there is a positive co-moment between the other Sukuk bonds like London and Abu Dhabi Sukuk bond lagged returns and the Sukuk index. This is useful for the traders and investors alike in relation to forecasting the Sukuk index returns from the past information exhibited by the Sharia bond prices returns. Hence, the use of the Sharia index and Sharia bond prices returns can be used for the hedging mechanism by the traders and investors who look for the safe heaven Sharia-based funds.

Based upon the statistical analysis of the present study, it can safely be assumed that the like conventional bonds, the Sukuk bonds can also be used for hedging purposes against the volatility in the emerging stock markets. Given that volatility in the merging market is usually higher than in developed or developing markets, which also serves as one of the major charms for the investors. One of the additional benefits of Sukuks over the conventional bonds relates to the fact that these bonds are in Shariah companies, thus they are of special interest to Muslim investors who do not want to invest in the interest-based securities. Besides this, one of the main restrictions of Shariah company investment relates to basic principles that forbid investments in Alcohol, arms or tobacco-based business, which may also attract investors who tend to favor ethical investments.

5. Conclusions, Limitation and Future Research

The rise in demand for the Sukuk market indices has given rise to many queries in relation to Sharia bond prices, returns, emerging market capital index and relative volatilities. Also, there is a need to address the issue related to evaluating the impact of Sharia bond prices returns, emerging market index, and other financial uncertainty factors and how they causally affected the Saudi Sukuk index as a global market for Sukuk based securities. To summarize, our research findings clearly indicate that investors at individual and institutional levels can benefit greatly by including Sukuk-based securities issued in the emerging markets. The inclusion of Sukuk-based securities will not only serve as a vital tool for diversification of risk but would also complement the existing portfolio comprising of emerging market securities. Even extreme market conditions represented by the VIX index (global volatility indicator) do not have a significant impact on the Sukuk index, while at the same time, the Sukuk index increases in tandem with the increase in global financial markets such as the FTSE. Given these unique attributes, Sukuk bonds can also be used for hedging instruments against conventional portfolios as well.

The study findings clearly explain the fact that the Sukuk lagged quartile values are sensitive to extreme market conditions and negative values similar to the market distribution. When compared with the global emerging market stock index, the results show no evidence of co-moments between the two. This shows further that the investor’s portfolio based on the Sukuk index and Sukuk bond prices cannot be affected by the resulting upside and downside moments in the stock market returns. Based on these results, investors and traders will be better off due to the existing co-movement between the Sukuk index returns, global market returns and the financial uncertainty indicators particularly the (VXEEM) volatility index for emerging markets. Sukuk bonds happen to be non-sensitive to these variables and thus are considered safe hedge funds for the diversification of portfolio and risk management purposes. Moreover, information about financial uncertainty factors’ co-movement and structures that exist between Sukuk bonds prices is vital to consider while diversifying the portfolio as well as in reducing risk.

Like all other research, this research also suffers from a few limitations. The main limitation of the research relates to the data set, as in the present research, the data set mainly comprises four-year data related to Sukuk indices, while in the future, researchers can extend the data set. Second, the present research mainly focuses on Sukuk securities, while in the future, researchers can include other Sharia-compliant securities along with Sukuks. Third, in the future, the researchers can use other econometric models to validate or reject the findings of the present research.