Financial Performance and Working Capital Management Practices in the Retail Sector: Empirical Evidence from South Africa

Abstract

1. Introduction

2. Review of Related Literature

2.1. Theoretical Literature

2.1.1. Working Capital Management Policy Framework

2.1.2. Working Capital Strategies

2.2. Empirical Literature Review

3. Data and Methodology

3.1. Sample Description and Data Sources

3.2. Model Specification

3.3. Diagnostic Tests

4. Empirical Results

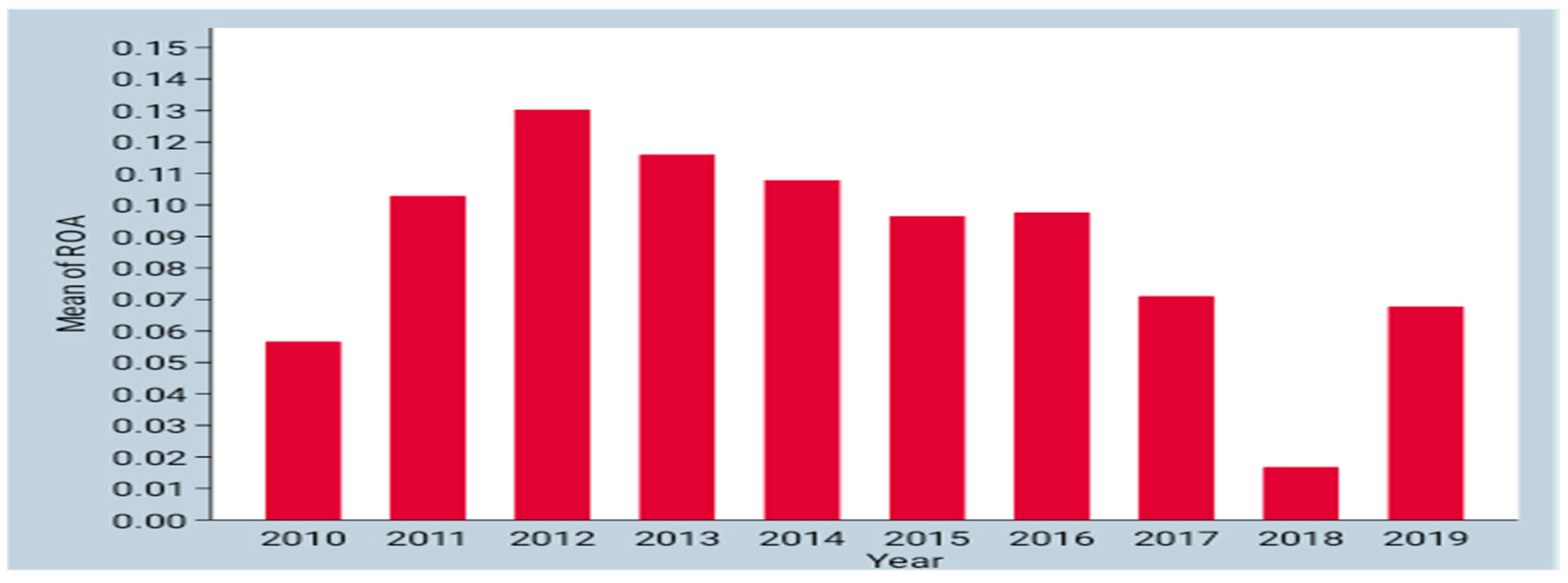

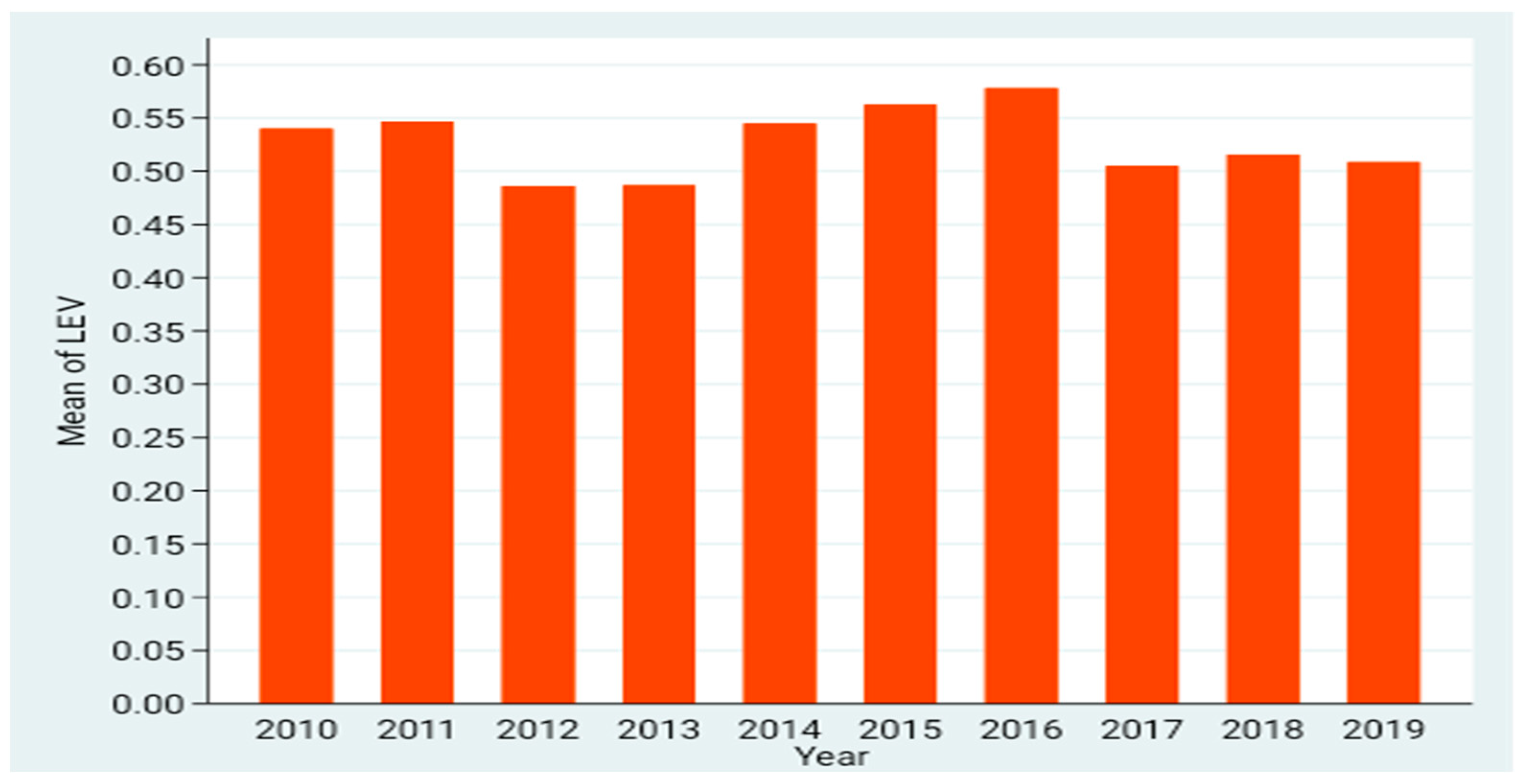

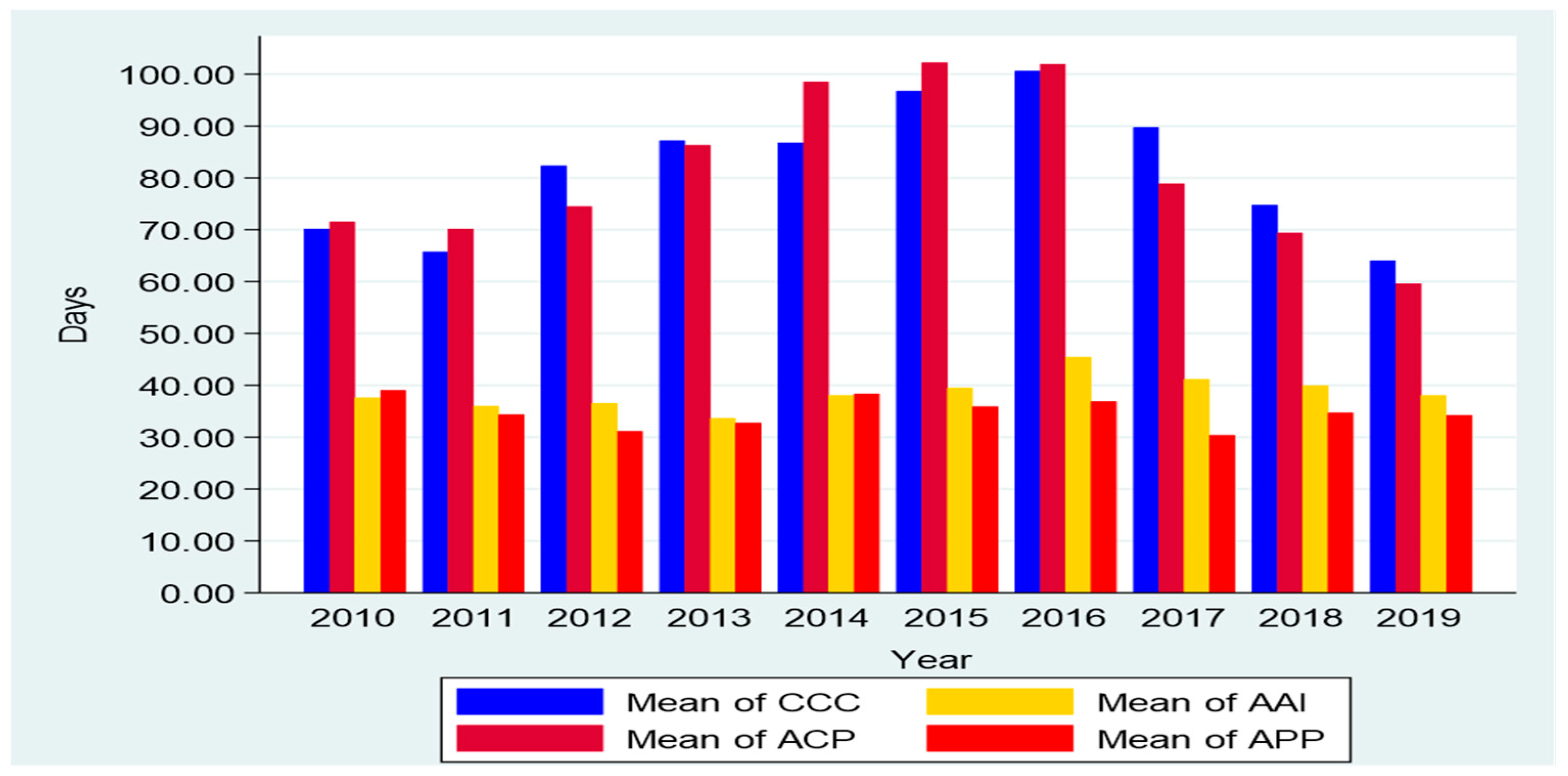

4.1. Descriptive Statistics

4.2. Empirical Findings

5. Conclusions

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

References

- Achode, Benjamin Malingu, and Gladys Rotich. 2016. Effects of accounts payable as source of financing on performance of listed manufacturing firms at the Nairobi Securities Exchange. International Journal of Research Studies in Agricultural Sciences 2: 24–32. [Google Scholar]

- Adam, Anokye M., Edward Quansah, and Seyram Kawor. 2017. Working capital management policies and returns of listed manufacturing firms in Ghana. Scientific Annals of Economics and Business 64: 255–69. [Google Scholar] [CrossRef]

- Afrifa, Godfred Adjapong, Venancio Tauringana, and Ishmael Tingbani. 2014. Working capital management and performance of listed SMEs. Journal of Small Business & Entrepreneurship 27: 557–78. [Google Scholar]

- Agha, Hasan. 2014. Impact of working capital management on profitability. European Scientific Journal 10: 374–81. [Google Scholar]

- Akbar, Ahsan, Minhas Akbar, Marina Nazir, Petra Poulova, and Samrat Ray. 2021. Does Working Capital Management Influence Operating and Market Risk of Firms? Risks 9: 201. [Google Scholar] [CrossRef]

- Aktas, Nihat, Ettore Croci, and Dimitris Petmezas. 2015. Is working capital management value-enhancing? Evidence from firm performance and investments. Journal of Corporate Finance 30: 98–113. [Google Scholar] [CrossRef]

- Al-Abass, Hassan Subhi. 2018. Effect of working capital management on profitability of cement sector listed companies. International Journal of Academic Research in Accounting, Finance and 125 Management Sciences 8: 137–42. [Google Scholar] [CrossRef]

- Aravind, M. 2016. Influence of working capital metrics on profitability: A critical examination on Indian manufacturing sector. Kelaniya Journal of Management 5: 58–80. [Google Scholar] [CrossRef]

- Besley, Scott, and Eugene F. Brigham. 2013. Principles of Finance. Boston: Cengage Learning. [Google Scholar]

- Breusch, Trevor S., and Adrian R. Pagan. 1980. The Lagrange multiplier test and its applications to model specification in econometrics. The Review of Eonomic Studies 47: 239–53. [Google Scholar] [CrossRef]

- Chang, Chong-Chuo, Tai-Yung Kam, Yu-Cheng Chang, and Chen-Chen Liu. 2019. Effects of the 2008 Financial Crisis on the Working Capital Management Policy of US Enterprises. International Journal of Business and Economics 18: 121–39. [Google Scholar]

- Chen, Chongyang, and Robert Kieschnick. 2018. Bank credit and corporate working capital management. Journal of Corporate Finance 48: 579–96. [Google Scholar] [CrossRef]

- Deloof, Marc. 2003. Does working capital management affect the profitability of Belgian firms? Journal of Business Finance & Accounting 30: 573–88. [Google Scholar]

- Dhole, Sandip, Sagarika Mishra, and Ananda Mohan Pal. 2019. Efficient working capital management, financial constraints, and firm value: A text-based analysis. Pacific-Basin Finance Journal 58: 101–212. [Google Scholar] [CrossRef]

- Enqvist, Julius, Michael Graham, and Jussi Nikkinen. 2014. The impact of working capital management on firm profitability in different business cycles: Evidence from Finland. Research in International Business and Finance 32: 36–49. [Google Scholar] [CrossRef]

- Fisher, Irving. 1930. The Theory of Interest as Determined by Impatience to Spend Income and Opportunity to Invest it. Bulletin of the American Mathematical Society 36: 783–84. [Google Scholar]

- García-Teruel, Pedro Juan, and Pedro Martínez-Solano. 2007. Effects of working capital management on SME profitability. International Journal of Managerial Finance 3: 164–77. [Google Scholar] [CrossRef]

- Garg, Ajay K., and Mr. Innocent Gumbochuma. 2015. Relationship between working capital management and profitability in JSE listed retail sector companies. Investment Management and Financial Innovations 12: 127–35. [Google Scholar]

- Gujarati, Damodar N. 2003. Basic Econometrics. New York: McGraw-Hill, pp. 363–69. [Google Scholar]

- Hausman, Jerry A. 1978. Specification tests in econometrics. Econometrica: Journal of the Econometric Society 46: 1251–71. [Google Scholar] [CrossRef]

- Irene, Awunya Rose, and Herick Ondigo. 2018. The effect of working capital management policies on financial performance of commercial and services sector firms listed at the Nairobi Securities Exchange. International Journal of Economics, Commerce and Management 5: 113–42. [Google Scholar]

- Kasozi, Jason. 2017. The effect of working capital management on profitability: A case of listed manufacturing firms in South Africa. Investment Management and Financial Innovations 14: 336–46. [Google Scholar] [CrossRef]

- Kraus, Alan, and Robert H. Litzenberger. 1973. A state-preference model of optimal financial leverage. The Journal of Finance 28: 911–22. [Google Scholar] [CrossRef]

- Kwenda, Farai. 2017. Working capital investment and firm value relationship: A non-linear perspective. Journal of Insurance and Financial Management 3: 44–65. [Google Scholar]

- Kwenda, Farai, and Ephraim Matanda. 2015. Working capital management in a liquidity constrained economy: A case of Zimbabwe Stock Exchange listed firms in the multiple currency era. Public and Municipal Finance 4: 55–65. [Google Scholar]

- Lazaridis, Ioannis, and Dimitrios Tryfonidis. 2006. Relationship between working capital management and profitability of listed companies in the Athens Stock Exchange. Journal of Financial Management and Analysis 19: 26–35. [Google Scholar]

- Louw, Elmarie, John Hall, and Leon Brümmer. 2016. Working capital management of South African retail firms. Journal of Economic and Financial Sciences 9: 545–60. [Google Scholar] [CrossRef][Green Version]

- Mabandla, Ndonwabile Zimasa. 2018. The Relationship between Working Capital Management and the Financial Performance of Listed Food and Beverage Companies in South Africa. Master’s dissertation, University of South Africa, Pretoria, South Africa. [Google Scholar]

- Makori, Daniel Mogaka, and Ambrose Jagongo. 2013. Working capital management and firm profitability: Empirical evidence from manufacturing and construction firms listed on Nairobi securities exchange, Kenya. International Journal of Accounting and Taxation 1: 1–14. [Google Scholar]

- Mehtap, Öner. 2016. The impact of working capital management on firm profitability: Empirical evidence from Borsa Istanbul. Siyaset, Ekonomi ve Yönetim Araştırmaları Dergisi 4: 63–79. [Google Scholar]

- Mengesha, Wobshet. 2014. Impact of Working Capital Management on Firms’ Performance: The Case of Selected Metal Manufacturing Companies in Addis Ababa, Ethiopia. Doctoral dissertation, Jimma University, Addis Ababa, Ethiopia. [Google Scholar]

- Moodley, Taryn, Mike Ward, and Chris Muller. 2017. The relationship between the management of payables and the return to investors. South African Journal of Accounting Research 31: 35–43. [Google Scholar] [CrossRef][Green Version]

- Morara, Kamanda, and Athenia Bongani Sibindi. 2021. Determinants of Financial Performance of Insurance Companies: Empirical Evidence Using Kenyan Data. Journal of Risk and Financial Management 14: 566. [Google Scholar] [CrossRef]

- Mukaddam, Shaa’ista, and Athenia Bongani Sibindi. 2020. Corporate governance quality and financial performance of retail firms: Evidence using South African data. Academy of Accounting and Financial Studies Journal 24: 1–15. [Google Scholar]

- Nyabuti, Winnie Mokeira, and Ondiek Benedict Alala. 2014. The relationship between working capital Management policy and financial performance of companies quoted at the Nairobi Securities Exchange, Kenya. International Journal of Economics, Finance and Management Sciences 2: 212–19. [Google Scholar] [CrossRef][Green Version]

- Paramasivan, C., and T. Subramanian. 2009. Financial Management. New Delhi: New Age International (Pty) Ltd. [Google Scholar]

- Raheman, Abdul, and Mohamed Nasr. 2007. Working capital management and profitability: Case of Pakistani firms. Review of Business Research Papers 3: 279–300. [Google Scholar]

- Rehn, Erick. 2012. Effects of Working Capital Management on Company Profitability: An Industry-Wise Study of Finnish and Swedish Public Companies. Master’s thesis, Department of Accounting, Hanken School of Economics, Helsinki, Finland. [Google Scholar]

- Rezaei, Marziyeh, and Mohammad Reza Pourali. 2015. The relationship between working capital management components and profitability: Evidence from Iran. European Online Journal of Natural and Social Sciences: Proceedings 4: 342–51. [Google Scholar]

- Samiloglu, Famil, and Ali İhsan Akgün. 2016. The relationship between working capital management and profitability: Evidence from Turkey. Business and Economics Research Journal 7: 1–14. [Google Scholar] [CrossRef]

- Sathyamoorthi, Christian J., Mogotsinyana Mapharing, and Popo Selinkie. 2018. The impact of working capital management on profitability: Evidence from the listed retail in Botswana. Applied Finance and Accounting 4: 82–94. [Google Scholar]

- Stats SA (Statistics South Africa). 2021. Retail Trade Statistics: First Quarter 2021. Available online: www.statssa.gov.za (accessed on 15 December 2021).

- Tanveer, Bagh, Muhammad Imran Nazir, Muhammad Asif Khan, Muhammad Atif Khan, and Sadaf Razzaq. 2016. The impact of working capital management on firms’ financial performance: Evidence from Pakistan. International Journal of Economics and Financial Issues 6: 1097–105. [Google Scholar]

- Temtime, Zelealem Tadesse. 2016. Relationship between Working Capital Management, Policies, and Profitability of Small Manufacturing Firms. Ph.D. dissertation, Walden University, Minneapolis, MN, USA. [Google Scholar]

- Ukaegbu, Ben. 2014. The significance of working capital management in determining firm: Evidence from developing economies in Africa. Research in International Business and Finance 31: 1–16. [Google Scholar] [CrossRef]

- Virkala, Ville. 2015. The Effect of Working Capital on Profitability in Computer and Electrical Industry. Master’s thesis, Aalto School of Business, Espoo, Finland. [Google Scholar]

- Yahaya, Adamu. 2016. Effects of working capital management on the financial performance of the pharmaceutical firms in Nigeria. International Journal of Economics, Commerce and Management 4: 349–67. [Google Scholar]

- Zimon, Grzegorz. 2020. Management strategies of working capital in polish services providing companies. WSEAS Transactions on Business and Economics 17: 225–30. [Google Scholar] [CrossRef]

- Zimon, Grzegorz, and Hossein Tarighi. 2021. Effects of the COVID-19 global crisis on the working capital management policy: Evidence from Poland. Journal of Risk and Financial Management 14: 169. [Google Scholar]

| Variables | Description | Measurement |

|---|---|---|

| ROA | Return on assets | |

| ROE | Return on equity | |

| NOPM | Net operating profit margin | |

| AAI | Average age of inventory | |

| ACP | Average collection period | |

| APP | Average payment period | |

| CCC | Cash conversion cycle | |

| SIZE | Firm size | |

| LEV | Leverage | |

| CR | Current ratio | |

| Ε | Error term | |

| I | Cross-sectional dimensions | |

| T | Time-series dimensions | |

| Β0, β1, β2, β3, β4, β5, β6, β7 | Regression coefficients |

| Variable | Mean | Median | Standard Deviation | Minimum | Maximum |

|---|---|---|---|---|---|

| NOPM | 0.0710 | 0.0634 | 0.2170 | −0.9644 | 0.6660 |

| ROA | 0.0863 | 0.0877 | 0.1260 | −0.5256 | 0.3312 |

| ROE | 0.2023 | 0.2169 | 0.2777 | −1.2907 | 2.1256 |

| CCC | 81.82 | 28.51 | 117.99 | −65.10 | 611.00 |

| ACP | 81.32 | 36.00 | 112.62 | 3.00 | 677.00 |

| AAI | 38.62 | 41.36 | 23.58 | 0 | 127.62 |

| APP | 34.81 | 33.00 | 19.40 | 0 | 103.00 |

| LEV | 0.5275 | 0.5550 | 0.2252 | 0.0900 | 0.9300 |

| CR | 2.06 | 1.34 | 1.45 | 0.53 | 6.82 |

| Dependent Variable | Pooled-OLS | Random-Effects | Fixed-Effects |

|---|---|---|---|

| NOPM | NOPM | NOPM | |

| ACP | −0.0019 *** (−6.24) | −0.0020 *** (−4.98) | −0.0024 *** (−4.21) |

| AAI | −0.0017 *** (−3.19) | −0.0022 *** (−3.17) | −0.0024 *** (−3.10) |

| APP | −0.0006 (−0.76) | −0.0014 * (−1.65) | −0.0013 (−1.51) |

| SIZE | 0.0169 ** (2.38) | 0.0160 (1.51) | 0.0007 (0.05) |

| LEV | −0.0480 (−0.44) | 0.0575 (0.50) | 0.1917 (1.57) |

| CR | 0.0798 *** (4.10) | 0.0561 *** (2.74) | 0.0260 (1.19) |

| Constant | −0.1524 (−1.46) | −0.0946 (−0.61) | 0.1497 (0.70) |

| Number | 140 | 140 | 140 |

| Adjusted R2 | 0.5476 | 0.5102 | 0.2450 |

| F-statistic | 6.06 *** |

| Dependent Variable | Pooled-OLS | Random-Effects | Fixed-Effects |

|---|---|---|---|

| ROA | ROA | ROA | |

| ACP | −0.0002 (−0.78) | 0.0002 (0.69) | −0.0024 *** (−4.21) |

| AAI | 0.0002 (0.62) | 0.0012 ** (2.05) | −0.0024 *** (−3.10) |

| APP | −0.0008 (−1.17) | −0.0010 (−1.52) | −0.0013 (−1.51) |

| SIZE | 0.0247 *** (4.14) | 0.0169 * (1.89) | 0.0007 (0.05) |

| LEV | −0.0141 (−0.15 | 0.0169 (0.18) | 0.1917 (1.57) |

| CR | 0.0431 *** (2.66) | 0.0286 * (1.68) | 0.0260 (1.19) |

| Constant | −0.3331 *** (−3.82) | −0.2540 * (−1.93) | 0.1497 (0.70) |

| Number | 140 | 140 | 140 |

| Adjusted R2 | 0.3070 | 0.2239 | 0.2450 |

| F-statistic | 6.06 *** |

| Dependent Variable | Pooled-OLS | Random-Effects | Fixed-Effects |

|---|---|---|---|

| ROE | ROE | ROE | |

| ACP | −0.0008 (−1.45) | −0.0007 (−1.45) | −0.0003 (−0.27) |

| AAI | −0.0010 (−0.90) | 0.0010 (0.15) | 0.0017 (1.01) |

| APP | −0.0037 ** (−2.29) | −0.0041 ** (−2.41) | −0.0042 ** (−1.51) |

| SIZE | 0.0452 *** (3.10) | 0.0464 ** (2.35) | 0.0430 (1.30) |

| LEV | 0.1708 (0.76) | −0.0730 (−0.31) | −0.2888 (−1.06) |

| CR | 0.0501 (1.27) | 0.0222 (0.52) | 0.0168 (0.34) |

| Constant | −0.4414 *** (−2.07) | −0.3144 (−1.09) | −0.2170 (−0.46) |

| Number | 140 | 140 | 140 |

| Adjusted R2 | 0.1412 | 0.1556 | 0.0854 |

| F-statistic | 1.82 *** |

| Dependent Variables | Independent Variables | Coefficient | Effect and Significance |

|---|---|---|---|

| ROA | AAI | −0.0024 *** | Negative *** |

| ACP | −0.0024 *** | Negative *** | |

| APP | −0.0013 | Negative | |

| ROE | AAI | 0.0017 | Positive |

| ACP | −0.0003 | Negative | |

| APP | −0.0042 ** | Negative ** | |

| NOPM | AAI | −0.0024 *** | Negative ** |

| ACP | −0.0024 *** | Negative ** | |

| APP | −0.0013 | Negative |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Mandipa, G.; Sibindi, A.B. Financial Performance and Working Capital Management Practices in the Retail Sector: Empirical Evidence from South Africa. Risks 2022, 10, 63. https://doi.org/10.3390/risks10030063

Mandipa G, Sibindi AB. Financial Performance and Working Capital Management Practices in the Retail Sector: Empirical Evidence from South Africa. Risks. 2022; 10(3):63. https://doi.org/10.3390/risks10030063

Chicago/Turabian StyleMandipa, Garikai, and Athenia Bongani Sibindi. 2022. "Financial Performance and Working Capital Management Practices in the Retail Sector: Empirical Evidence from South Africa" Risks 10, no. 3: 63. https://doi.org/10.3390/risks10030063

APA StyleMandipa, G., & Sibindi, A. B. (2022). Financial Performance and Working Capital Management Practices in the Retail Sector: Empirical Evidence from South Africa. Risks, 10(3), 63. https://doi.org/10.3390/risks10030063