The Risky-Opportunity Analysis Method (ROAM) to Support Risk-Based Decisions in a Case-Study of Critical Infrastructure Digitization

Abstract

:1. Introduction

1.1. Resilient and Sustainability of PSP Service Supply Chain

1.2. Risk and Resource Consumption Evolution in the Literature

2. Materials and Methods

2.1. Materials and Supporting Software Tools

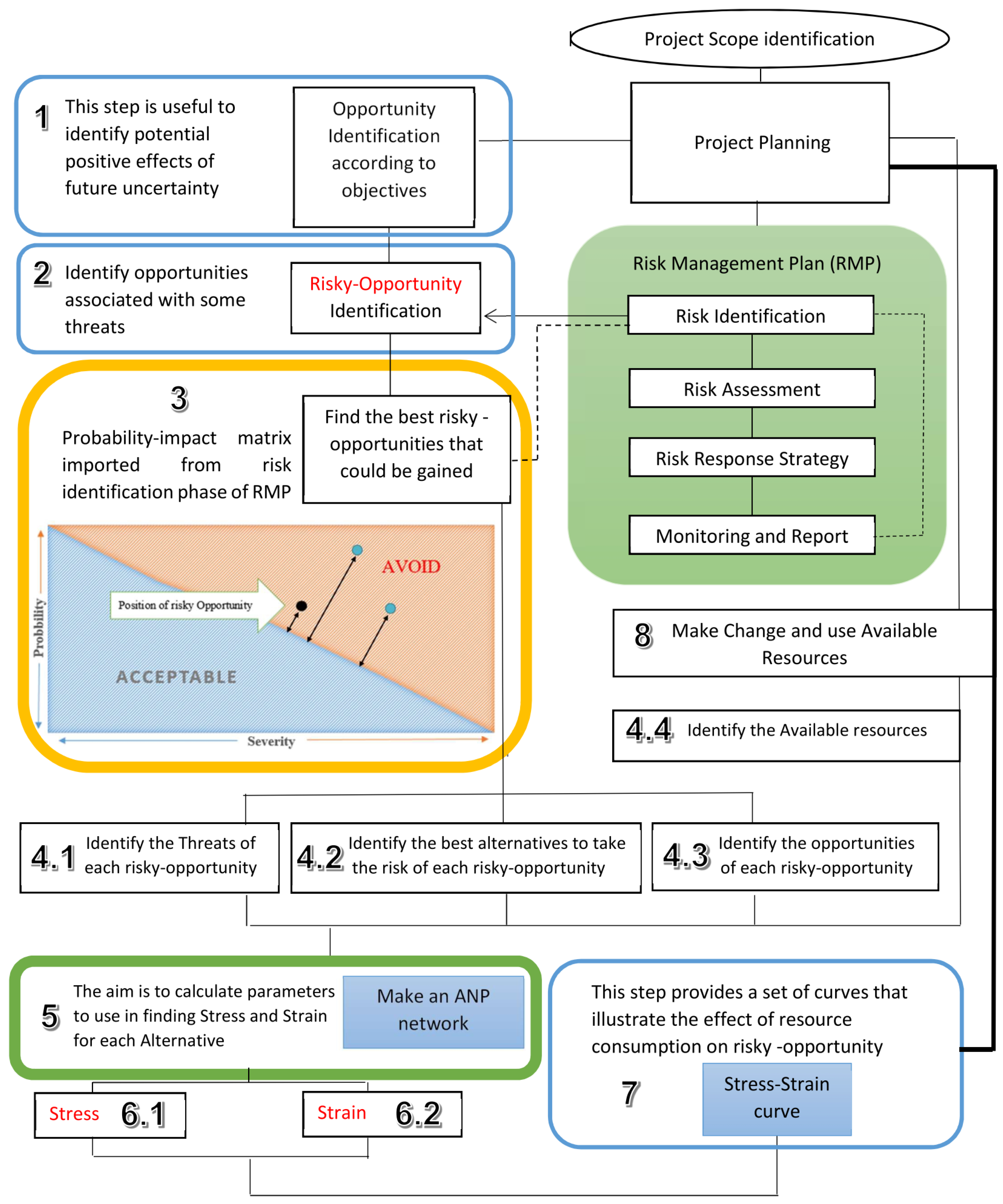

2.2. Outline of the Steps

- Implementation of the RO analysis method (ROAM) at the project level starts after defining the work breakdown structure (WBS) of the project. The first step is the definition of the main project objectives and scope, followed by clarifying the project sub-objectives, requirements, and required resources. In the case-study discussed here, the main project is digitalization of the PSP service supply chain and the sub-project is the transformation of the transaction report production into an eco-friendly method.

- The next step is to identify alternative solutions to the traditional thermal paper receipt.

- It is crucial to choose the feasible and most effective alternatives to continue the analysis. The following criteria will be employed to select the most advantageous alternatives:

- Economic criterion,

- Importance of achievement,

- Feasibility,

- Congruence.

- In this step the threats associated with the selected alternatives, which are defined as ROs, are identified. The output of this step is a probability-impact scheme for the threats and impacts of each RO.

- This step includes five sub-actions to calculate the required parameters through the ANP; the results are then employed in the next step in order to calculate Stress and Strain of the Alternatives.

- (a)

- Identify the decision criteria for ANP.

- (b)

- Clustering.

- (c)

- Identify relations between clusters, and between the elements of the clusters.

- (d)

- Construct the network.

- (e)

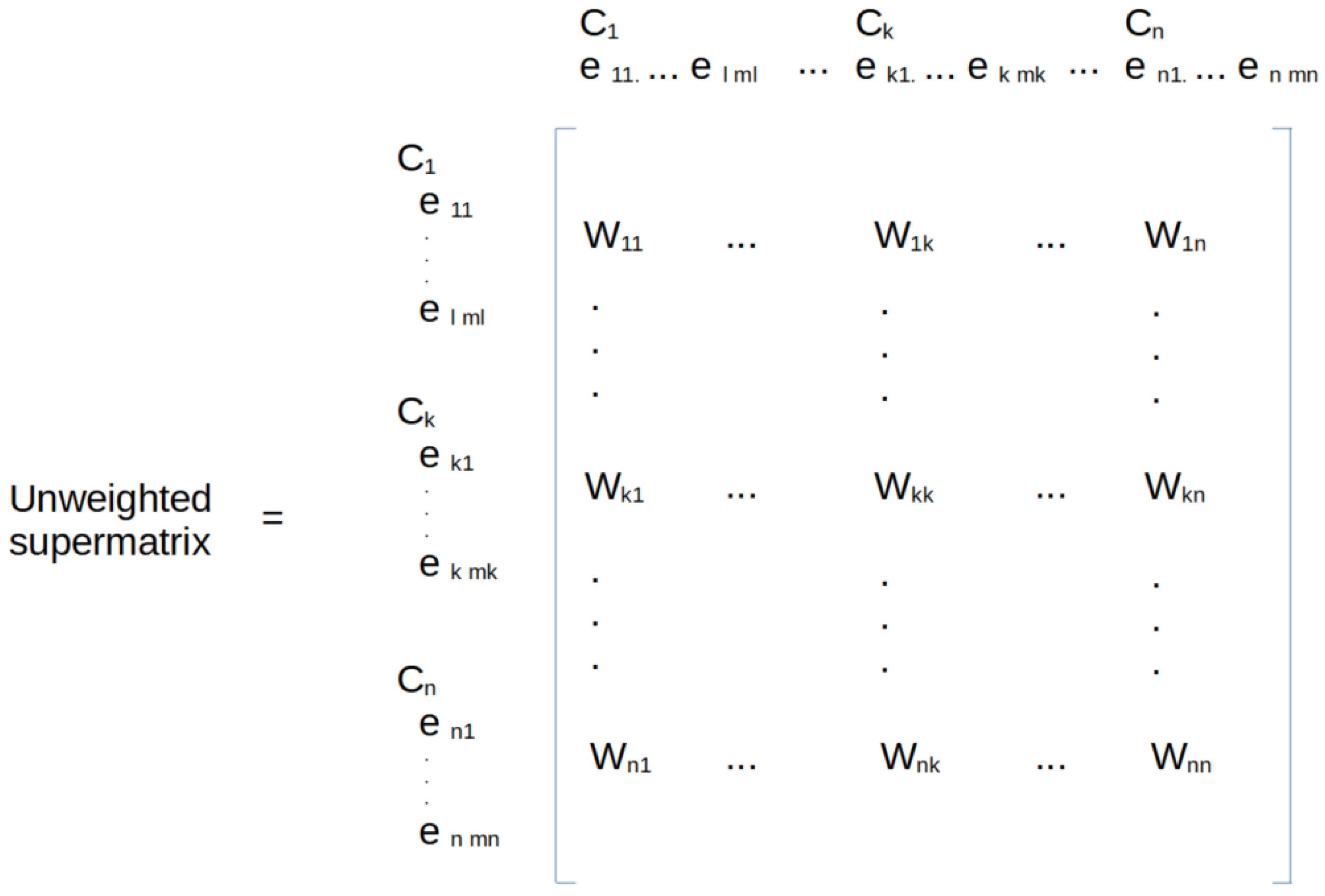

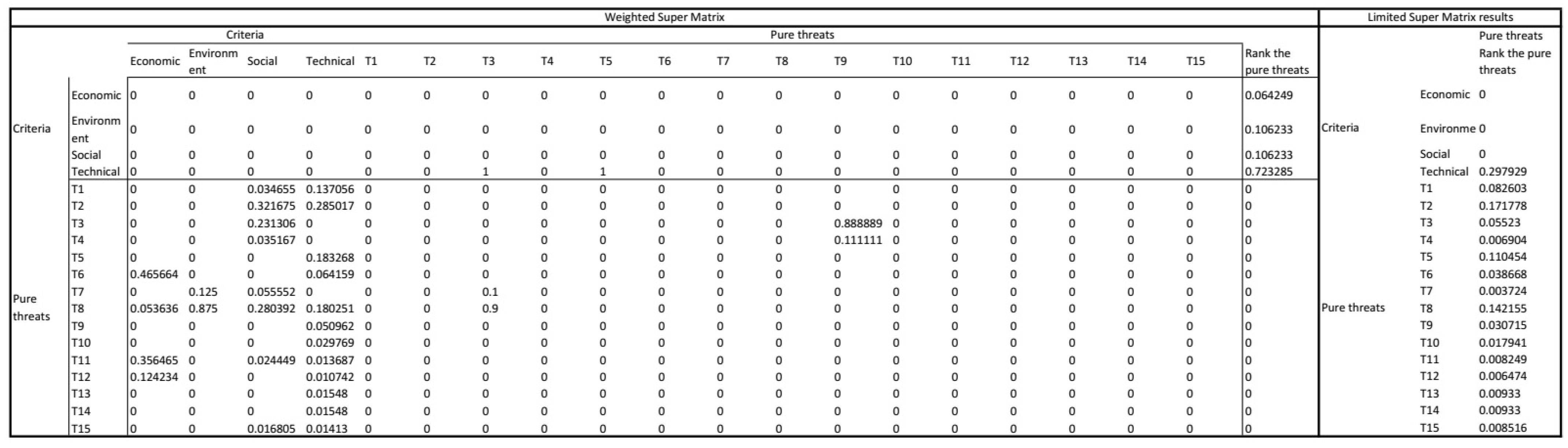

- Pairwise comparison matrices(PCMs) and solve the ANP Saaty (2004, 2005). In this paper Super Decision 3.2 was employed to calculate the overall priorities for the threat. The procedure of ANP can be summarized as follows (Barzilai 1997; Piantanakulchai 2005; Saaty and Vargas 2006):

- Construct a pairwise matrix through quantifying the preference of the DM using 9 scale ranking (Barzilai 1997). If n objects should be compared, the number of comparisons is

- If i represent the row number and j represents the column number of the matrix, the lower diagonal should be equal to ():It is crucial to have consistent judgements considering the whole comparisons in the above mentioned matrix (Alonso and Lamata 2006). Therefore, it is fundamental to check the Consistency Index (CI) of the matrix. The basic Consistency Ratio (CR) control is introduced by (Saaty 1980) using the following procedure:λmax is the largest eigenvalue.In Equation (3), k is the eigenvalue of a perfectly consistent matrix. In this stage, the RI (Random Consistency Index) is extracted from Table 2 and the CR is calculated (Equation (4)). The values of RI were obtained from 10,000 randomly generated PCMs (Thurstone 1927). Therefore the value of RI depends on the matrix order

- Construct the Unweighted Supermatrix Figure 2 of the network and then multiply the weights. In this study, the Super Decisions software was used to calculate the weights of the ANP method; therefore, all the calculations were performed by the software. Super Decisions follows the approach detailed by Saaty (2016).

- Raising the Weighted Supermatrix to the limiting power (l) the global priority vectors are obtained.In case of cyclicity effect, the Equation (6) is used

- This step includes two sub-actions.

- (a)

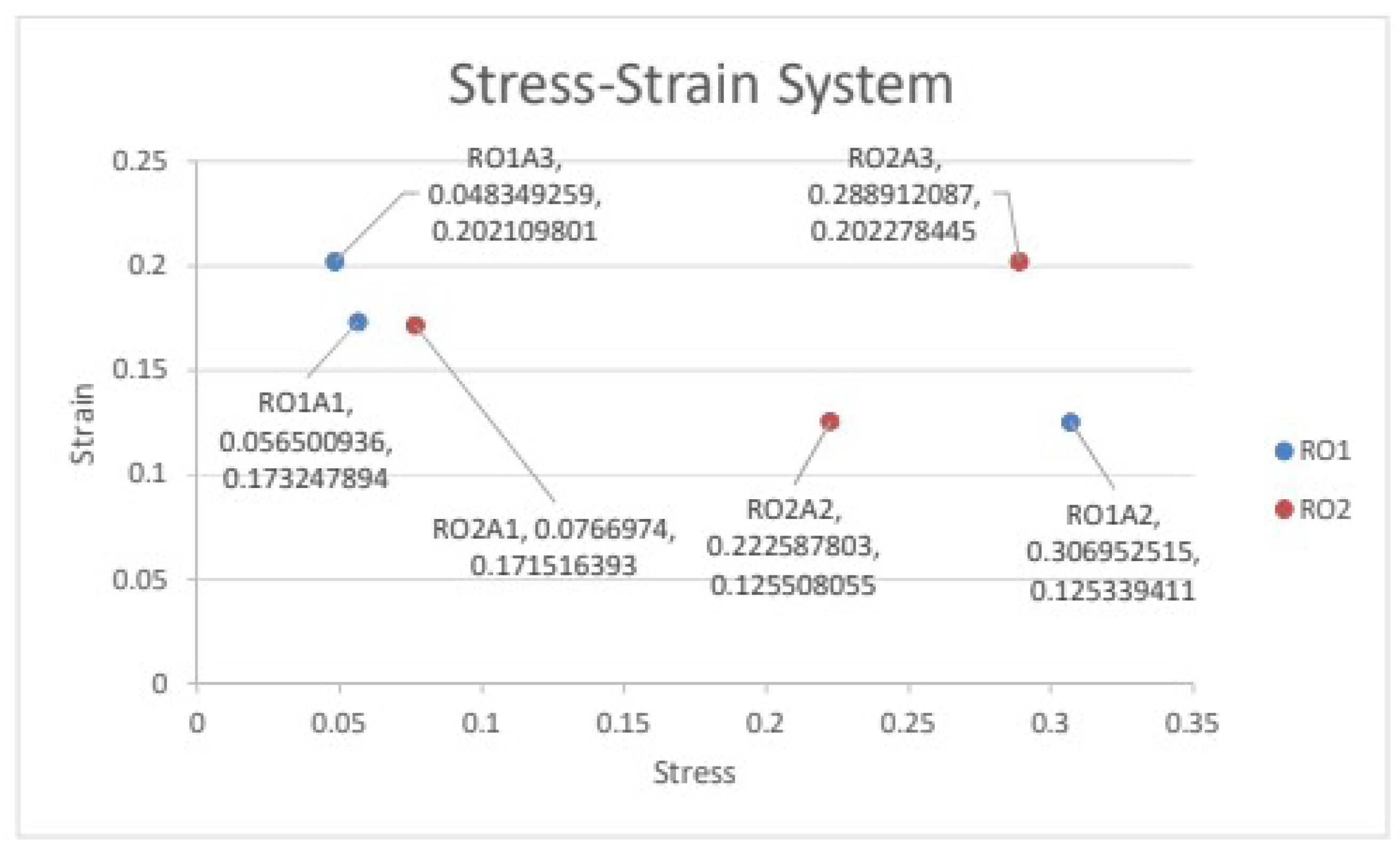

- Stress is calculated as follows:where:OW, the benefit subnetwork will calculate the weight of all of the pure opportunities for each alternative. To calculate the denominator of the stress of each alternative (Ai), the pure opportunities associated with that alternative will sum up and multiply to the alternative weight.AW, the opportunity subnetwork will calculate the weight of alternative-i (Ai) related to ROj according to the objectives.TW, the risk subnetwork will calculate the weight of all of the pure threats for each alternative. To calculate the numerator of stress for each alternative (Ai), the pure threats associated with that alternative will sum up and multiply to the cost weight.CW, the cost subnetwork will calculate the weight of alternative-i (Ai) related to ROj according to resource consumption.

- (b)

- Strain is calculated as follows:where:ARR, Available Required Resources to perform the activities of an alternativeBC, Basic Consumption, i.e., the resources needed by the cheapest alternative

- In the last assessment step, Stress and Strain of each alternative are used to find the position of the Ai in the Stress–Strain coordination system. Each alternative has a specific point in the space.

- After the assessment, a sub-project will be introduced in the form of an operation plan in order to meet the selected alternative work-package. The RO which is accepted through the ROAM is a way to change the original firm/project aims to exploit the benefits of such RO. The resources that are needed for taking the measures are already foreseen during the Strain calculation for the RO. Therefore, the project will be carried out consuming the estimated resources.

3. Outline of the Steps of the ROAM in the Case-Study

3.1. Goal of the Project

3.2. Identification of the Alternatives

3.3. Feasible Alternatives

- RO1 includes the e-Receipt methods:

- A1. SMS;

- A2. Email;

- A3. Application notification;

- RO2 includes the combination of e-Receipt and paper in case of transaction failure;

- A1. SMS or Print;

- A2. Email or Print;

- A3. Application notification or Print.

3.4. Probability-Impact

3.5. Parameters Calculation

3.5.1. Decision Criteria

3.5.2. Clustering

3.5.3. Relations

3.5.4. Network Construction

3.5.5. Pairwise Comparison

3.6. Stress and Strain Calculation

3.6.1. Stress

3.6.2. Strain

4. Results and Discussion

5. ROAM Implementation Highlights

- cases in which the four typical strategies (accept, reject, transfer, mitigate) is not the most effective strategy to deal with a risk, and a combination of measures is needed to exploit the pure benefits and avoid pure threats of a RO;

- cases where the decision-making methods should take into account the effect of changes in a company’s risk tolerance, according to different measures to respond to the risk, and the amount of resource consumption for each measure;

- cases where each alternative risk response is compared with other risks and the responses to them. ROAM allows the decision maker to compare different solutions for a risk that could imply different costs and different results if the risk is accepted;

- cases in which the decision maker prefers to consider different weights for different response strategies (most methods neglect the opportunities that can be seized by accepting the risk, and reject the risk after a simple comparison);

- cases where the decision maker is inclined to consider the company’s capability of change as a consequence of accepting risk.

6. Limitations and Future Research Directions

7. Conclusions

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

Appendix A. Future Issues

Appendix B. [C, O, B] Clusters

References

- Aghazadeh Ardebili, Ali. 2020. A Method to Support Risk Management and Resource Allocation in Projects Based on Risk Acceptance Strategy. Ph.D. dissertation, Department of Engineering and Architecture, University of Trieste, Trieste, Italy. [Google Scholar]

- Aghazadeh Ardebili, Ali, Elio Padoano, and Najmeh Rahmani. 2020. Waste reduction for green service supply chain—The case study of a payment service provider in iran. Sustainability 12: 1833. [Google Scholar] [CrossRef] [Green Version]

- Aghazadeh Ardebili, Ali, Elio Padoano, and Najmeh Rahmani. 2019. Providing green services—The case study of thermal paper waste and unnecessary transportations in the payment service. Paper presented at the 9th International Conference, PEM 2019, Trieste, Italy, October 3–4; pp. 103–114. [Google Scholar]

- Akilarasan, Muthumariappan, Sakthivel Kogularasu, Shen-Ming Chen, Tse-Wei Chen, and Bih-Show Lou. 2018. A novel approach to iron oxide separation from e-waste and bisphenol a detection in thermal paper receipts using recovered nanocomposites. RSC Advances 8: 39870–78. [Google Scholar] [CrossRef] [Green Version]

- Alban, Lis, Barbara Häsler, Gerdien van Schaik, and Simon Ruegg. 2020. Risk-based surveillance for meat-borne parasites. Experimental Parasitology 208: 107808. [Google Scholar] [CrossRef] [PubMed]

- Alonso, Jose Antonio, and Maria Teresa Lamata. 2006. Consistency in the analytic hierarchy process: A new approach. International Journal of Uncertainty, Fuzziness and Knowledge-Based Systems 14: 445–59. [Google Scholar] [CrossRef] [Green Version]

- Andersen, Kim Viborg, Roman Beck, Rolf T. Wigand, Niels Bjørn-Andersen, and Eric Brousseau. 2004. European e-commerce policies in the pioneering days, the gold rush and the post-hype era. Information Polity 9: 217–32. [Google Scholar] [CrossRef]

- Arva, Mihai-Catalin, Nicu Bizon, and Ovidiu-Constantin Novac. 2020. Electronic receipts using near-field communication protocol as a solution for thermal paper receipts. Paper presented at 12th International Conference on Electronics, Computers and Artificial Intelligence, ECAI 2020, Bucharest, Romania, June 25–27. [Google Scholar]

- Asenova, Darinka, William Stein, and Alasdair Marshall. 2011. An innovative approach to risk and quality assessment in the regulation of care services in Scotland. Journal of Risk Research 14: 859–79. [Google Scholar] [CrossRef]

- Azapagic, Adisa. 2003. Systems approach to corporate sustainability. Process Safety and Environmental Protection 81: 303–16. [Google Scholar] [CrossRef] [Green Version]

- Azapagic, Adisa. 2010. Chapter 7. Life cycle assessment as a tool for sustainable management of ecosystem services. Issues in Environmental Science and Technology 30: 140–68. [Google Scholar] [CrossRef]

- Barzilai, Jonathan. 1997. Deriving weights from pairwise comparison matrices. Journal of the Operational Research Society 48: 1226–32. [Google Scholar] [CrossRef]

- Bechtold, Ulrike, Daniela Fuchs, and Niklas Gudowsky. 2017. Imagining socio-technical futures—Challenges and opportunities for technology assessment. Journal of Responsible Innovation 4: 85–99. [Google Scholar] [CrossRef]

- Becker, Jarosław, Aneta Becker, and Wojciech Sałabun. 2017. Construction and use of the ANP decision model taking into account the experts’ competence. Procedia Computer Science 112: 2269–79. [Google Scholar] [CrossRef]

- Blos, Mauricio, Hui-Ming Wee, and Joshua Yang. 2010. Analysing the external supply chain risk driver competitiveness: A risk mitigation framework and business continuity plan. Journal of Business Continuity & Emergency Planning 4: 368–74. [Google Scholar]

- Bouzarour-Amokrane, Yasmina, Ayeley Tchangani, and François Pérès. 2012. Defining and measuring risk and opportunity in BOCR framework for decision analysis. Paper presented at the 9e International Conference of Modeling and Simulation— MOSIM’12, Bordeaux, France, June 6–8. [Google Scholar]

- Braun, Joe M., Kimberly Yolton, Kim N. Dietrich, Richard Hornung, Xiaoyun Ye, Antonia M. Calafat, and Bruce P. Lanphear. 2009. Prenatal bisphenol a exposure and early childhood behavior. Environmental Health Perspectives 117: 1945–52. [Google Scholar] [CrossRef] [PubMed]

- Burnaby, Priscilla, and Susan Hass. 2009. Ten steps to enterprise-wide risk management. Corporate Governance 9: 539–50. [Google Scholar] [CrossRef]

- Buyya, Rajkumar, Chee Shin Yeo, and Srikumar Venugopal. 2008. Market-oriented cloud computing: Vision, hype, and reality for delivering it services as computing utilities. Paper presented at 10th IEEE International Conference on High Performance Computing and Communications, Dalian, China, September 25–27; pp. 5–13. [Google Scholar]

- Buyya, Rajkumar, Chee Shin Yeo, Srikumar Venugopal, James Broberg, and Ivona Brandic. 2009. Cloud computing and emerging it platforms: Vision, hype, and reality for delivering computing as the 5th utility. Future Generation Computer Systems 25: 599–616. [Google Scholar] [CrossRef]

- Chen, Wenbo, and Ming Dong. 2018. Optimal resource allocation across related channels. Operations Research Letters 46: 397–401. [Google Scholar] [CrossRef]

- Choi, Jun Kyun, Jeong-Seok Park, Jee Hyung Lee, and Kyeong Seon Ryu. 2006. Key factors for e-commerce business success. Paper presented at 8th International Conference Advanced Communication Technology, ICACT 2006, Phoenix Park, Korea, February 20–22; vol. 3, pp. 1664–72. [Google Scholar]

- Conroy, Geoff, and Hossein Soltan. 1998. ConSERV, a project specific risk management concept. International Journal of Project Management 16: 353–66. [Google Scholar] [CrossRef]

- Domar, Evsey D., and Richard A. Musgrave. 1944. Proportional income taxation and risk-taking. The Quarterly Journal of Economics 58: 388–422. [Google Scholar] [CrossRef]

- Eduardsen, Jonas. 2018. Internationalisation through digitalisation: The impact of e-commerce usage on internationalisation in small-and medium-sized firms. In International Business in the Information and Digital Age. Volume 13 of Progress in International Business Research. Bingley: Emerald. [Google Scholar]

- Ehrlich, Shelley, Antonia M. Calafat, Olivier Humblet, Thomas Smith, and Russ Hauser. 2014. Handling of thermal receipts as a source of exposure to bisphenol a. JAMA 311: 859–60. [Google Scholar] [CrossRef]

- El-Bassiouny, Noha, Menatallah Darrag, and Nada Zahran. 2018. Corporate social responsibility (CSR) communication patterns in an emerging market. Journal of Organizational Change Management 31: 795–809. [Google Scholar] [CrossRef]

- Engelhard, Karl, and Christian Böhm. 2013. Security of supply chains from a service provider’s perspective. In Supply Chain Safety Management. Berlin and Heidelberg: Springer, pp. 167–78. [Google Scholar] [CrossRef]

- Glerup, Cecilie, and Maja Horst. 2014. Mapping ‘social responsibility’ in science. Journal of Responsible Innovation 1: 31–50. [Google Scholar] [CrossRef] [Green Version]

- Goel, Harsh, and Thota Venkat Narayana Rao. 2019. Data visualization in e-commerce an indispensable implementation in real world business scenario. International Journal of Scientific and Technology Research 8: 2447–50. [Google Scholar]

- Grant, Kellie, Jenni White, Jenny Martin, and Terry Haines. 2019. The costs of risk and fear: A qualitative study of risk conceptualisations in allied health resource allocation decision-making. Health, Risk & Society 21: 373–89. [Google Scholar] [CrossRef]

- Gravesteijn, Marianne, and Celeste P. M. Wilderom. 2018. Participative change toward digitalized, customer-oriented continuous improvements within a municipality. Journal of Organizational Change Management 31: 728–48. [Google Scholar] [CrossRef]

- Hetrick, James C. 1969. A formal model for long range planning 2 assessment of opportunity and risk. Long Range Planning 1: 54–65. [Google Scholar] [CrossRef]

- Hietala, Marika, and Robbe Geysmans. 2020. Social sciences and radioactive waste management: Acceptance, acceptability, and a persisting socio-technical divide. Journal of Risk Research 2020: 1–16. [Google Scholar] [CrossRef]

- Hillson, David. 2003. Effective Opportunity Management for Projects: Exploiting Positive Risk. Boca Raton: CRC Press. [Google Scholar]

- Holton, Judith A. 2020. Social movements thinking for managing change in large-scale systems. Journal of Organizational Change Management 33: 697–714. [Google Scholar] [CrossRef]

- Ivascu, Larisa, and Lucian-Ionel Cioca. 2014. Opportunity risk: Integrated approach to risk management for creating enterprise opportunities. Advances in Education Research 49: 77–80. [Google Scholar]

- Jamali, Gholamreza, Elham Karimi Asl, Sarfaraz Hashemkhani Zolfani, and Jonas Šaparauskas. 2017. Analysing larg supply chain management competitive strategies in iranian cement industries. E a M: Ekonomie a Management 20: 70–83. [Google Scholar]

- Jean-Jules, Joachim, and Ricardo Vicente. 2020. Rethinking the implementation of enterprise risk management (ERM) as a socio-technical challenge. Journal of Risk Research 24: 247–66. [Google Scholar] [CrossRef]

- Jedynak, Monika, Wojciech Czakon, Aneta Kuźniarska, and Karolina Mania. 2021. Digital transformation of organizations: What do we know and where to go next? Journal of Organizational Change Management 34: 629–52. [Google Scholar] [CrossRef]

- Ji, Guojun, and Caihong Zhu. 2008. Study on supply chain disruption risk management strategies and model. Paper presented at 2008 International Conference on Service Systems and Service Management, Melbourne, Australia, June 30–July 2; pp. 1–6. [Google Scholar] [CrossRef]

- Karimi, Iftekhar A. 2009. Chemical logistics—Going beyond intra-plant excellence. Computer Aided Chemical Engineering 27: 29–34. [Google Scholar]

- Khalilzadeh, Mohammad, Laleh Katoueizadeh, and Edmundas Kazimieras Zavadskas. 2020. Risk identification and prioritization in banking projects of payment service provider companies: An empirical study. Frontiers of Business Research in China 14: 1–27. [Google Scholar] [CrossRef]

- Kirudja, Charles Mugambi. 1978. Planning and Resource Allocation with Goal Programming in a Structured Management Decision Environment: The Case of an Ontario General Hospital. Ph.D. thesis, Western University, London, ON, Canada. [Google Scholar]

- Koczkodaj, Waldemar W. 1993. A new definition of consistency of pairwise comparisons. Mathematical and Computer Modelling 18: 79–84. [Google Scholar] [CrossRef]

- Krueger, Norris, Jr., and Peter R. Dickson. 1994. How believing in ourselves increases risk taking: Perceived self-efficacy and opportunity recognition. Decision Sciences 25: 385–400. [Google Scholar] [CrossRef]

- Lefcourt, Herbert M. 1965. Risk taking in negro and white adults. Journal of Personality and Social Psychology 2: 765–70. [Google Scholar] [CrossRef]

- Lenjani, Ali, Ilias Bilionis, Shirley J. Dyke, Chul Min Yeum, and Ricardo Monteiro. 2020. A resilience-based method for prioritizing post-event building inspections. Natural Hazards 100: 877–96. [Google Scholar] [CrossRef] [Green Version]

- Li, Yulong, Tao Wang, Xinyi Song, and Guijun Li. 2016. Optimal resource allocation for anti-terrorism in protecting overpass bridge based on ahp risk assessment model. KSCE Journal of Civil Engineering 20: 309–22. [Google Scholar] [CrossRef]

- Liu, Jian, Wei Yang, and Wan Liu. 2021. Adaptive capacity configurations for the digital transformation: A fuzzy-set analysis of chinese manufacturing firms. Journal of Organizational Change Management 34: 1222–41. [Google Scholar] [CrossRef]

- Ma, Dong Jun. 2013. E-commerce model research based on cloud service. Advanced Materials Research 605–607: 2534–37. [Google Scholar] [CrossRef]

- Mazareanu, Valentin Petru. 2011. Understanding risk management in small 7 steps. Revista Tinerilor Economisti 16: 75–80. [Google Scholar]

- Michalski, Grzegorz, Małgorzata Rutkowska-Podołowska, and Adam Sulich. 2017. Remodeling of FLIEM: The cash management in polish small and medium firms with full operating cycle in various business environments. In Efficiency in Business and Economics. Cham: Springer International Publishing, pp. 119–132. [Google Scholar] [CrossRef]

- Millet, Ido, and William C. Wedley. 2002. Modelling risk and uncertainty with the analytic hierarchy process. Journal of Multi-Criteria Decision Analysis 11: 97–107. [Google Scholar] [CrossRef]

- Mohammadi, Maryam Fazlollahi, Akbar Najafi, and Fatemeh Ahmadlo. 2015. Using the analytical network process (ANP) based on BOCR model to select the most suitable region for forestation with almond species. Nusantara Bioscience 7: 112–21. [Google Scholar] [CrossRef]

- Olsson, Rolf. 2007. In search of opportunity management: Is the risk management process enough? International Journal of Project Management 25: 745–52. [Google Scholar] [CrossRef]

- Pallaro, Estelle, Nachiappan Subramanian, Muhammad D. Abdulrahman, Chang Liu, and Kim Hua Tan. 2017. Review of sustainable service-based business models in the chinese truck sector. Sustainable Production and Consumption 11: 31–45. [Google Scholar] [CrossRef]

- Paterson, Jaclyn, Peter Berry, Kristie Ebi, and Linda Varangu. 2014. Health care facilities resilient to climate change impacts. International Journal of Environmental Research and Public Health 12: 13097–116. [Google Scholar] [CrossRef] [Green Version]

- Peker, Iskender, Birdogan Baki, Mehmet Tanyas, and Ilker Murat Ar. 2016. Logistics center site selection by ANP/BOCR analysis: A case study of turkey. Journal of Intelligent & Fuzzy Systems 30: 2383–2396. [Google Scholar] [CrossRef]

- Piantanakulchai, Mongkut. 2005. Analytic network process model for highway corridor planning. Paper presented at ISAHP, Honolulu, HI, USA, July 8–10; pp. 8–10. [Google Scholar]

- Pidgeon, Nick. 2014. Complexity, uncertainty and future risks. Journal of Risk Research 17: 1269–71. [Google Scholar] [CrossRef]

- Pidgeon, Nick. 2020. Engaging publics about environmental and technology risks: Frames, values and deliberation. Journal of Risk Research 24: 28–46. [Google Scholar] [CrossRef]

- Plesner, Ursula, and Elena Raviola. 2016. Digital technologies and a changing profession. Journal of Organizational Change Management 29: 1044–65. [Google Scholar] [CrossRef] [Green Version]

- Plesner, Ursula, Lise Justesen, and Cecilie Glerup. 2018. The transformation of work in digitized public sector organizations. Journal of Organizational Change Management 31: 1176–90. [Google Scholar] [CrossRef] [Green Version]

- Ritchie, Jane, Jane Lewis, Carol McNaughton Nicholls, and Rachel Ormston. 2003. Qualitative Research Practice: A Guide for Social Science Students and Researchers. Thousand Oaks: SAGE Publications. [Google Scholar]

- Saaty, Rozann W. 2016. Decision Making in Complex Environments. Hampshire and Burlington: Ashgate Publishing, Ltd. [Google Scholar]

- Saaty, Thomas L. 1980. The Analytic Hierarchy Process. New York: McGraw-Hill. [Google Scholar]

- Saaty, Thomas L. 2001. Fundamentals of the analytic hierarchy process. In The Analytic Hierarchy Process in Natural Resource and Environmental Decision Making. Edited by D. L. Schmoldt, J. Kangas, G. A. Mendoza and M. Pesonen. Managing Forest Ecosystems. Dordrecht: Springer, pp. 15–35. [Google Scholar] [CrossRef]

- Saaty, Thomas L. 2004. Decision making the analytic hierarchy and network processes (ahp/anp). Journal of Systems Science and Systems Engineering 13: 1–35. [Google Scholar] [CrossRef]

- Saaty, Thomas L. 2005. Making and validating complex decisions with the ahp/anp. Journal of Systems Science and Systems Engineering 14: 1–36. [Google Scholar] [CrossRef]

- Saaty, Thomas L. 2008. Decision making with the analytic hierarchy process. International Journal of Services Sciences 1: 83–98. [Google Scholar] [CrossRef] [Green Version]

- Saaty, Thomas L. 2015. A marijuana legalization model using benefits, opportunities, costs and risks (BOCR) analysis. International Journal of Strategic Decision Sciences 6: 1–11. [Google Scholar] [CrossRef]

- Saaty, Thomas L. 2016. The analytic hierarchy and analytic network processes for the measurement of intangible criteria and for decision-making. In Multiple Criteria Decision Analysis. New York: Springer, pp. 363–419. [Google Scholar] [CrossRef]

- Saaty, Thomas L., and Kirti Peniwati. 2013. Group Decision Making: Drawing Out and Reconciling Differences. Pittsburgh: RWS Publications. [Google Scholar]

- Saaty, Thomas L., and Luis G. Vargas. 2006. Decision Making with the Analytic Network Process. Berlin: Springer, vol. 282. [Google Scholar]

- Salama, Mostafa A., Nashwa El-Bendary, and Aboul Ella Hassanien. 2011. Towards secure mobile agent based e-cash system. Paper presented at the First International Workshop on Security and Privacy Preserving in e-Societies, Beirut, Lebanon, June 9–10; pp. 1–6. [Google Scholar]

- Schweizer, Pia-Johanna. 2019. Systemic risks—Concepts and challenges for risk governance. Journal of Risk Research 24: 78–93. [Google Scholar] [CrossRef]

- Sheffi, Yossi, and James B. Rice Jr. 2005. A supply chain view of the resilient enterprise. MIT Sloan Management Review 47: 41–48. [Google Scholar]

- Stasik, Agata, and Dariusz Jemielniak. 2021. Public involvement in risk governance in the internet era: Impact of new rules of building trust and credibility. Journal of Risk Research 2020: 1–17. [Google Scholar] [CrossRef]

- Steed, John C. 2000. Engineering project risk management. Engineering Management Journal 10: 43. [Google Scholar] [CrossRef]

- Tchangani, Ayeley Philippe. 2015. BOCR analysis: A framework for forming portfolio of developing projects. In Multiple Criteria Decision Making in Finance, Insurance and Investment. Edited by M. Al-Shammari and H. Masri. Multiple Criteria Decision Making. New York: Springer International Publishing, pp. 189–204. [Google Scholar] [CrossRef]

- Tchangani, Ayeley Philippe, and François Pérès. 2010. BOCR framework for decision analysis. IFAC Proceedings Volumes 43: 507–13. [Google Scholar] [CrossRef] [Green Version]

- Teger, Allan I., Dean G. Pruitt, Richard St Jean, and Gordon A. Haaland. 1970. A reexamination of the familiarization hypothesis in group risk taking. Journal of Experimental Social Psychology 6: 346–50. [Google Scholar] [CrossRef]

- Thurstone, Louis L. 1927. A law of comparative judgment. Psychological Review 34: 273. [Google Scholar] [CrossRef]

- Tulasi, Chavali Lakshmi, and A. Ramakrishna Rao. 2015. Resource allocation in project scheduling application of fuzzy AHP. Paper presented at the International Conference on Technology Business Management, Dubai, United Arab Emirates, March 23–25; pp. 512–21. [Google Scholar]

- ur Rehman, Shafiq, Jane Coughlan, and Zahid Halim. 2012. Usability based reliable and cashless payment system (RCPS). International Journal of Innovative Computing, Information and Control 8: 2747–59. [Google Scholar]

- Ullah, Asad, Madeeha Pirzada, Sarwat Jahan, Hizb Ullah, Naheed Turi, Waheed Ullah, Mariyam Fatima Siddiqui, Muhammad Zakria, Kinza Zafar Lodhi, and Muhammad Munir Khan. 2018. Impact of low-dose chronic exposure to bisphenol a and its analogue bisphenol b, bisphenol f and bisphenol s on hypothalamo-pituitary-testicular activities in adult rats: A focus on the possible hormonal mode of action. Food and Chemical Toxicology 121: 24–36. [Google Scholar] [CrossRef] [PubMed]

- van der A, Johannes G., and Dick T. H. M. Sijm. 2021. Risk governance in the transition towards sustainability, the case of bio-based plastic food packaging materials. Journal of Risk Research 24: 1639–51. [Google Scholar] [CrossRef]

- Vafaei, Nazanin, Rita A. Ribeiro, and Luis M. Camarinha-Matos. 2016. Normalization techniques for multi-criteria decision making: Analytical hierarchy process case study. Paper presented at the Doctoral Conference on Computing, Electrical and Industrial Systems, Costa de Caparica, Portugal, April 11–13; Cham: Springer, pp. 261–69. [Google Scholar]

- Vamvakas, Panagiotis, Eirini Eleni Tsiropoulou, and Symeon Papavassiliou. 2019. Risk-aware resource management in public safety networks. Sensors 19: 3853. [Google Scholar] [CrossRef] [Green Version]

- Vandenberg, Laura N., Russ Hauser, Michele Marcus, Nicolas Olea, and Wade V. Welshons. 2007. Human exposure to bisphenol a (BPA). Reproductive Toxicology 24: 139–77. [Google Scholar] [CrossRef]

- Waddock, Sandra, Greta M. Meszoely, Steve Waddell, and Domenico Dentoni. 2015. The complexity of wicked problems in large scale change. Journal of Organizational Change Management 28: 993–1012. [Google Scholar] [CrossRef]

- Wang, Dingwei, and Wai Hung Ip. 2009. Evaluation and analysis of logistic network resilience with application to aircraft servicing. IEEE Systems Journal 3: 166–73. [Google Scholar] [CrossRef]

- Ward, Stephen, and Chris Chapman. 2008. Stakeholders and uncertainty management in projects. Construction Management and Economics 26: 563–77. [Google Scholar] [CrossRef]

- Weber, Rolf H. 2010. Internet of things—New security and privacy challenges. Computer Law and Security Review 26: 23–30. [Google Scholar] [CrossRef]

- Wijnmalen, Diederik J. D. 2007. Analysis of benefits, opportunities, costs, and risks BOCR with the AHP, ANP: A critical validation. Mathematical and Computer Modelling 46: 892–905. [Google Scholar] [CrossRef]

- Winston, Andrew. 2014. Resilience in a hotter world. Harvard Business Review 92: 56–64. [Google Scholar]

- Wiratanaya, Gede Nyoman, Dwi Putra Darmawan, Lala M. Kolopaking, and Wayan Windia. 2015. Selection of beef production systems in bali: An analytical network with BOCR approach. Journal of Economics and Sustainable Development 6: 45–59. [Google Scholar]

- Zhou, Jian, Xiao-Hong Chen, Sheng-Dong Pan, Jun-Lin Wang, Yi-Bin Zheng, Jiao-Jiao Xu, Yong-Gang Zhao, Zeng-Xuan Cai, and Mi-Cong Jin. 2019. Contamination status of bisphenol a and its analogues (bisphenol s, f and b) in foodstuffs and the implications for dietary exposure on adult residents in zhejiang province. Food Chemistry 294: 160–70. [Google Scholar] [CrossRef] [PubMed]

| No | Term | Definition |

|---|---|---|

| 1 | Risky-Opportunity (RO) | First of all, it should be reaffirmed that some of the terms used here, such as ‘project’, ‘risk manag-ement, and ‘risk management plan’, are accepted definitions in the literature. However, ‘risky-opportunity’ (RO), which is used in this paper, does not mean an uncertain event with pure threats or an uncertain event with pure opportunities. ROs are future uncertain events that can have both positive and negative effects on the project objectives at the same time. |

| 2 | Main and Secondary Goals | In project management, the word ‘outcome’ signifies the results of a work package. The final outcomes are the deliverables of the project. Objectives and requirements are necessary to assess the quality of an outcome. For example, the outcome of the digitalization project is a service that passed all the service quality requirements and it is ready for functioning. The term ‘goal’ in this study is used in two ways. There are two kinds of goals for a new risk management plan. The main goal is to achieve the best outcomes for the project. All of the activities are planned and undertaken for this reason. In general, a risk management plan is followed to control future uncertain events so there will not be any deviation from the main goals. The secondary goals include achieving the objectives of the decision-maker (DM) even if it means going ahead with a RO and accepting the risks it may bring to the main project. This group of objectives should parallel the main project objectives. In short, it includes the objectives of a new decision, which was not originally a part of the main project but must be made for seizing some opportunities. |

| 3 | Risk Response | Risk response is the strategy whereby decision-makers plan how to deal with each risk they can foresee. The four kinds of response to risk are: avoid, mitigate, transfer, accept. |

| 4 | Pure Threats | The term Pure Threats of an RO stands for the disadvantages of the RO, which could cause possible deviations from the objectives associated with each alternative way of accepting the RO. |

| 5 | Pure Opportunities | ‘Pure Opportunities’ of an RO are the certain benefits that might be gained by accepting the RO regardless of the threats. The obtainment of such benefits is not affected by the threats of the RO. e.g., hiring a new contractor, the main goal in this method is taking advantage of RO by achieving these opportunities. |

| 6 | Alternative | The alternatives are the different actions that can be taken in order to accept the risk. Taking measures according to an alternative, the risk tolerance of the firm should be improved. For each alternative, the weights of an RO are calculated by means of ANP. |

| 8 | Stress | We use the term ‘Stress’ in a novel way in this study. The major difference between this term and the usual similar terms, such as risk, threat and hazard are that Stress quantitatively includes likely threats, costs, opportunities, and benefits of an event, which is going to be implemented in the new method based on risk acceptance. Thus, Stress is a novel index to show the relative importance of opportunities and benefits, of an alternative to the threats and costs of it to be able to accept an RO. Mathematically, Stress is the ratio of the weights of all threats times costs to the weights of the opportunities times benefits of an alternative. These weights are calculated by ANP in step 5 of the process (Figure 1). The Stress value changes if any changes affect the weights of the threats, costs, opportunities, or benefits: their weights indeed depend on the elements of each cluster during the project life-cycle. This makes the index dynamic as it is a parameter dependent on variables, it is different from the traditional static concept of risk. The Stress value will also change if the amount of resources required for the alternatives varies due to changes in the variables. |

| 9 | Resources | Any project will have an initial specific amount of resources to get work done successfully including people, capital, knowledge, and/or material goods. In this method, resources are the part of the resources for the whole project that can be employed to make the changes; that is, they can be allocated to the new alternatives in order to take advantage of the ROs. They may include human resources, budget shifts, assets, material resources including consumables, and time. |

| 10 | Basic consumption | Each alternative way to seize ROs implies performing new actions that consume a specific amount of resources. Basic consumption stands for the cheapest alternative; in other words, basic consumption is the sum of all of the resources needed to take the new actions which constitute the alternative with the lowest cost. The cheapest alternative will be used to calculate Strain of all the alternatives. |

| 11 | Strain | Strain is the ratio of the amount of resource consumption to basic consumption (see Equation (8)). A numerical example of Strain calculation for different alternatives is presented in Section 3. |

| Order | 1 | 2 | 3 | 4 | 5 | 6 | 7 | 8 | 9 | 10 |

| R.I. | 0 | 0 | 0.52 | 0.89 | 1.11 | 1.25 | 1.35 | 1.40 | 1.45 | 1.49 |

| No. | Threat Description | Criteria | ||||

|---|---|---|---|---|---|---|

| Issue | Threat | Soc. | Econ. | Env. | Tec. | |

| T1 | Security | Information accuracy | * | * | ||

| T2 | Cyber security | * | * | |||

| T3 | Service adoption | Purchaser | * | |||

| T4 | Vendor | * | ||||

| T5 | Availability | Purchaser | * | |||

| T6 | Vendor | * | * | |||

| T7 | Environment | Unnecessary shuttles | * | * | ||

| T8 | Thermal paper usage | * | * | * | * | |

| T9 | Service providing issues | Data transfer speed | * | |||

| T10 | Trouble shooting speed | * | ||||

| T11 | Infrastructure | Internet network (national) | * | * | * | |

| T12 | Internet connection | * | * | |||

| T13 | Telecommunication network issues | * | ||||

| T14 | Network data issues | * | ||||

| T15 | Mobile internet issues | * | * | |||

| Alternative | RO1A1 | RO1A2 | RO1A3 | RO2A1 | RO2A2 | RO2A3 |

|---|---|---|---|---|---|---|

| Stress | 2.488018 | 13.51665 | 2.129059 | 3.377369 | 9.801651 | 12.72224 |

| Normalized stress | 0.0565 | 0.3070 | 0.0483 | 0.0767 | 0.2226 | 0.2889 |

| ROs | Cost Calculation | Cost | Strain | Norm. |

|---|---|---|---|---|

| RO1A1 | [80 (cost of SMS in Iran in “Iranian Rial”) × 4 (length of the text message regarding the characters that are in the SMS is equal to 4 SMS in Persian) × 2 (for each transaction two SMS is required including customer and vendor) × 31,973 (Average tax in a specific macro zone regarding the results of Chapter 4)] + [2 (switch developer, POS developer) × DS × 160 h (establish new service)+ DS × 20 h (outsourcing coordination and maintenance)] | 88,462,720 | 1.382 | 0.1732 |

| RO1A2 | 2 (switch developer, POS develope_r) × DS × 160 h (implementation) | 64,000,000 | 1 | 0.1253 |

| RO1A3 | 2 (switch developer, POS developer) × DS × 160 h (establish new service) + DS × 196 h (application support service, CRM and cyber security measures) | 103,200,000 | 1.613 | 0.2021 |

| RO2A1 | [(80 × 4 × 2 × 30,457(successful tax in macro zone)) + Paper receipt price (26,000 (price of each role of the thermal paper) IR/(20 m (length of the role of the thermal paper)/4.5 cm (minimum of size)) = 58.5 IR) × 1472 (unsuccessful tax in macro zone)]+ [ 2 (switch developer, POS developer) × DS (Developer Salary per hour (DS) = average 40,000,000 IR/196 h = 200,000) × 160 h (stablish new service)+ DS × 20 h(maintenance per month)] | 87,578,592 | 1.368 | 0.1715 |

| RO2A2 | Paper receipt price × 1472 (unsuccessful tax in macro zone) + 2 (switch developer, POS developer) × DS × 160 h (stablish new service) + DS × 20 h (maintenance per month) | 64,086,112 | 1.001 | 0.1255 |

| RO2A3 | Paper receipt price × 1472 (unsuccessful tax in macro zone) + DS × 20 h (maintenance per month) × DS × 160 h (stablish new service) + 2 × DS × 196 h (application support service, CRM and cyber security measures) | 103,286,112 | 1.614 | 0.2023 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Ardebili, A.A.; Padoano, E.; Longo, A.; Ficarella, A. The Risky-Opportunity Analysis Method (ROAM) to Support Risk-Based Decisions in a Case-Study of Critical Infrastructure Digitization. Risks 2022, 10, 48. https://doi.org/10.3390/risks10030048

Ardebili AA, Padoano E, Longo A, Ficarella A. The Risky-Opportunity Analysis Method (ROAM) to Support Risk-Based Decisions in a Case-Study of Critical Infrastructure Digitization. Risks. 2022; 10(3):48. https://doi.org/10.3390/risks10030048

Chicago/Turabian StyleArdebili, Ali Aghazadeh, Elio Padoano, Antonella Longo, and Antonio Ficarella. 2022. "The Risky-Opportunity Analysis Method (ROAM) to Support Risk-Based Decisions in a Case-Study of Critical Infrastructure Digitization" Risks 10, no. 3: 48. https://doi.org/10.3390/risks10030048

APA StyleArdebili, A. A., Padoano, E., Longo, A., & Ficarella, A. (2022). The Risky-Opportunity Analysis Method (ROAM) to Support Risk-Based Decisions in a Case-Study of Critical Infrastructure Digitization. Risks, 10(3), 48. https://doi.org/10.3390/risks10030048