Calibrating FBSDEs Driven Models in Finance via NNs

Abstract

1. Introduction

2. Backward Stochastic Differential Equations

- , where is the space of -measurable random variables s.t.

- , where is the space of predictable process Y s.t.

- f is uniformly Lipschitz: there exists L s.t.for any .

Forward–Backward Stochastic Differential Equation

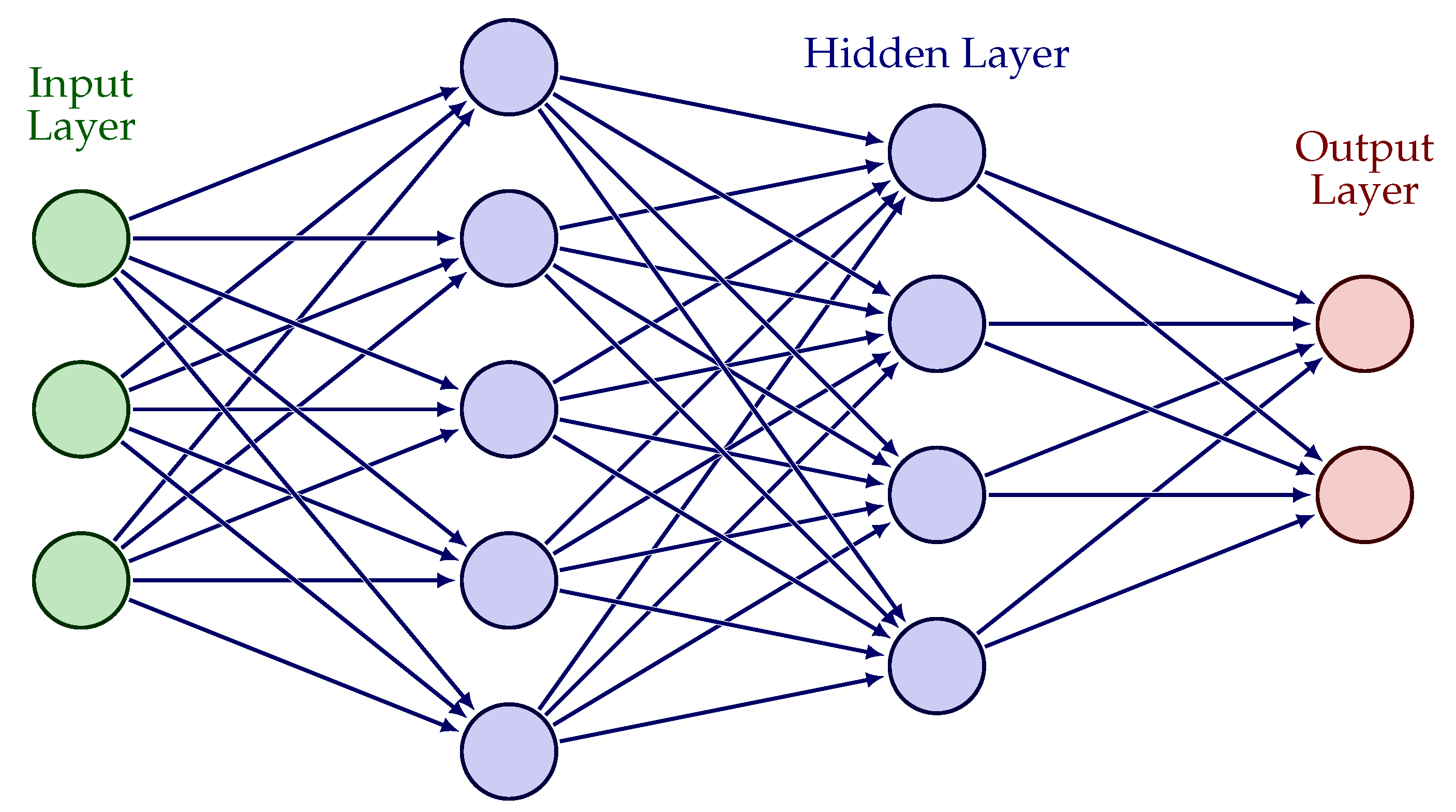

3. Neural Networks

- input layer composed by n units, where n is the number of network entrances (n is the dimension of the features’ vector);

- hidden layer with neurons and outputs connected with the inputs of the following layer;

- output layer composed by neurons that describe the network outputs;

- A set of directed and weighted edges (called w) that represent all possible connections among layers.

4. Solution of FBSDEs via NNs

5. Model Calibration via NN

5.1. Calibration Objective

5.2. Deep Calibration Procedure

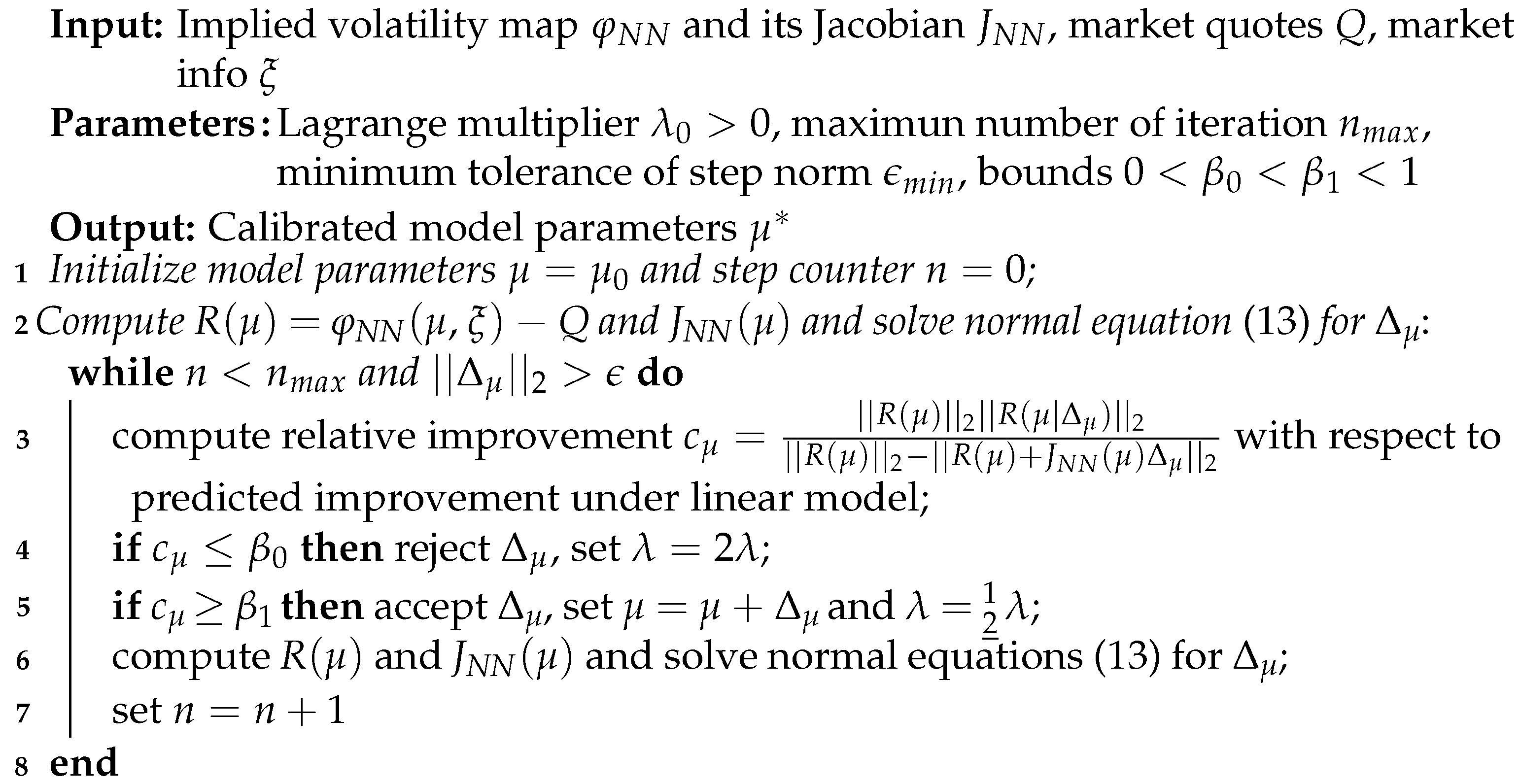

| Algorithm 1: Deep calibration algorithm |

|

6. Empirical Results

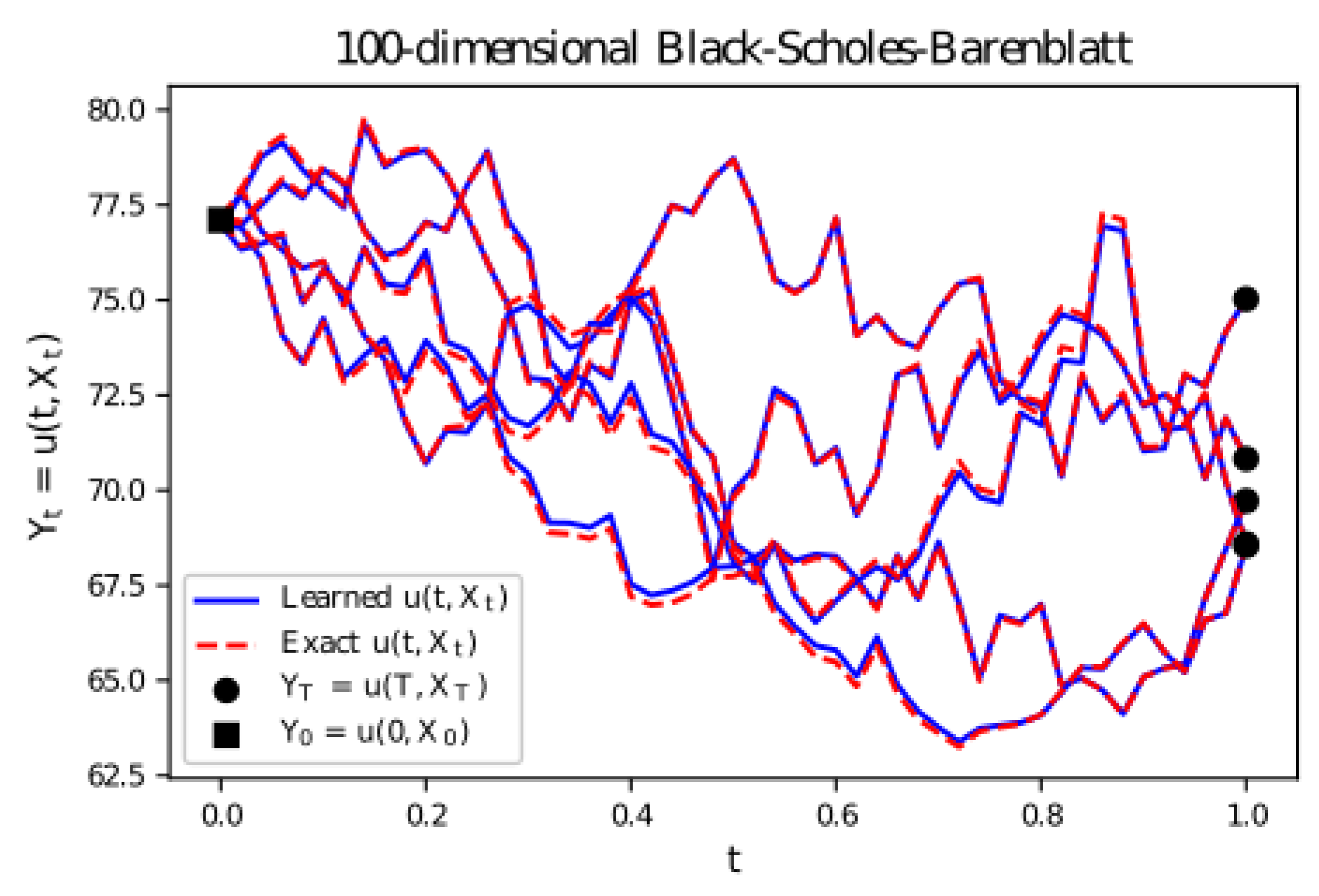

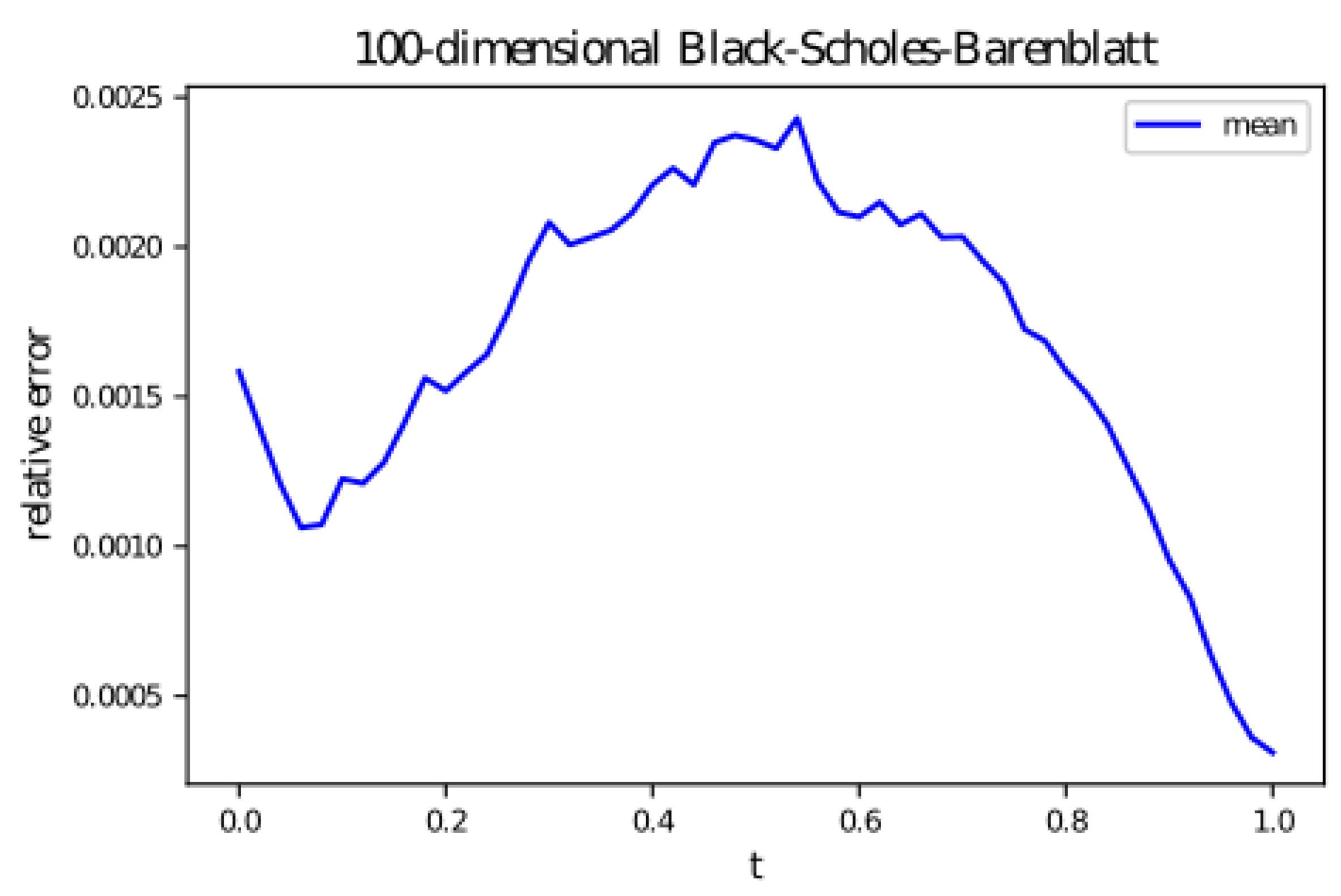

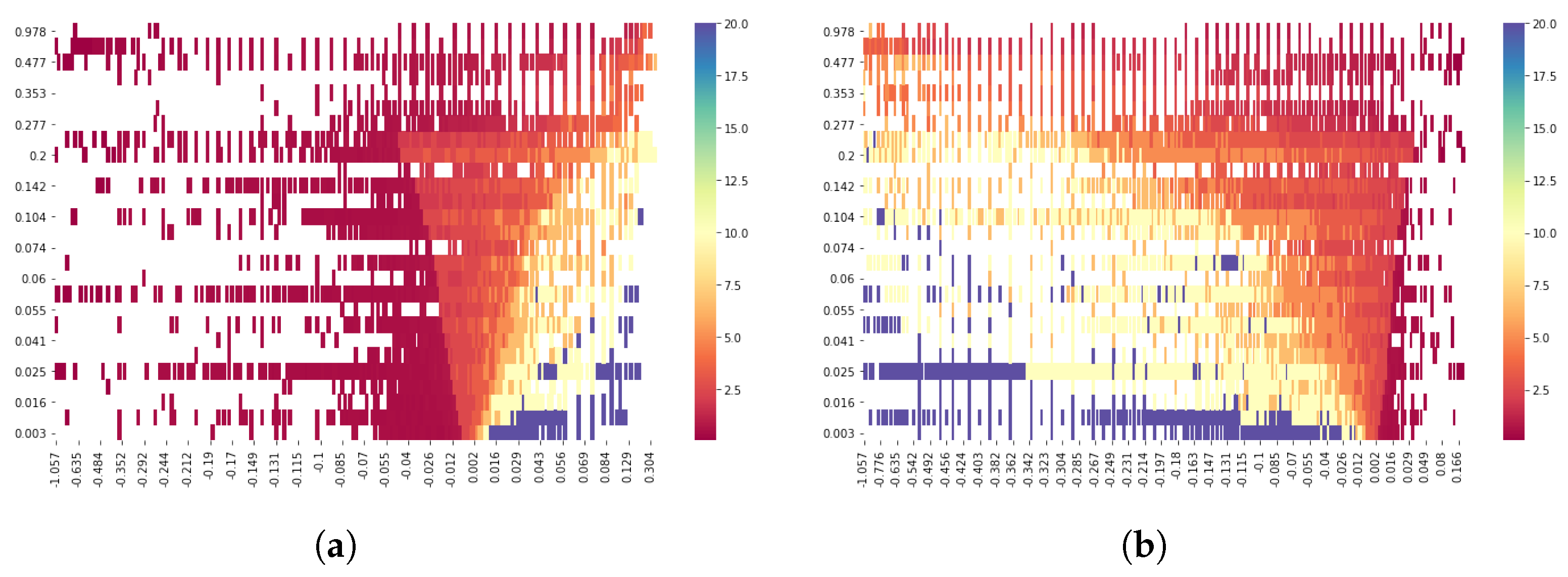

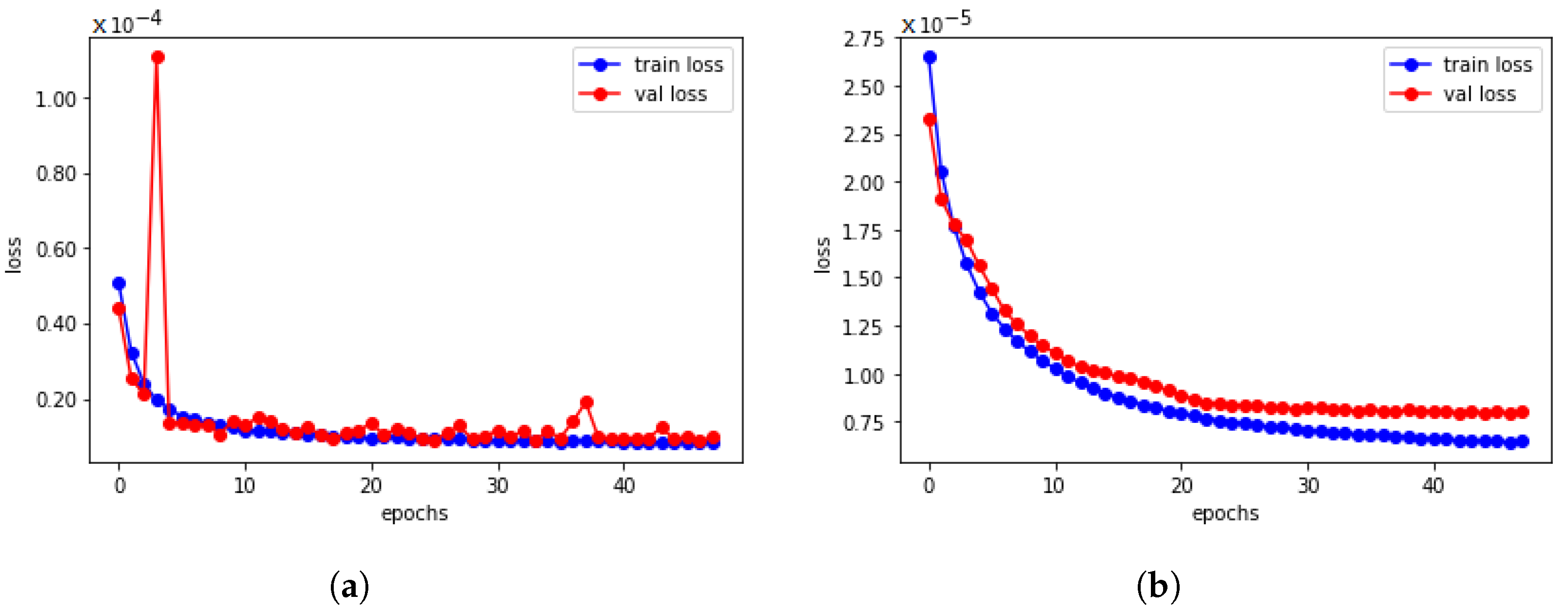

6.1. Black–Scholes–Barenblatt Equation

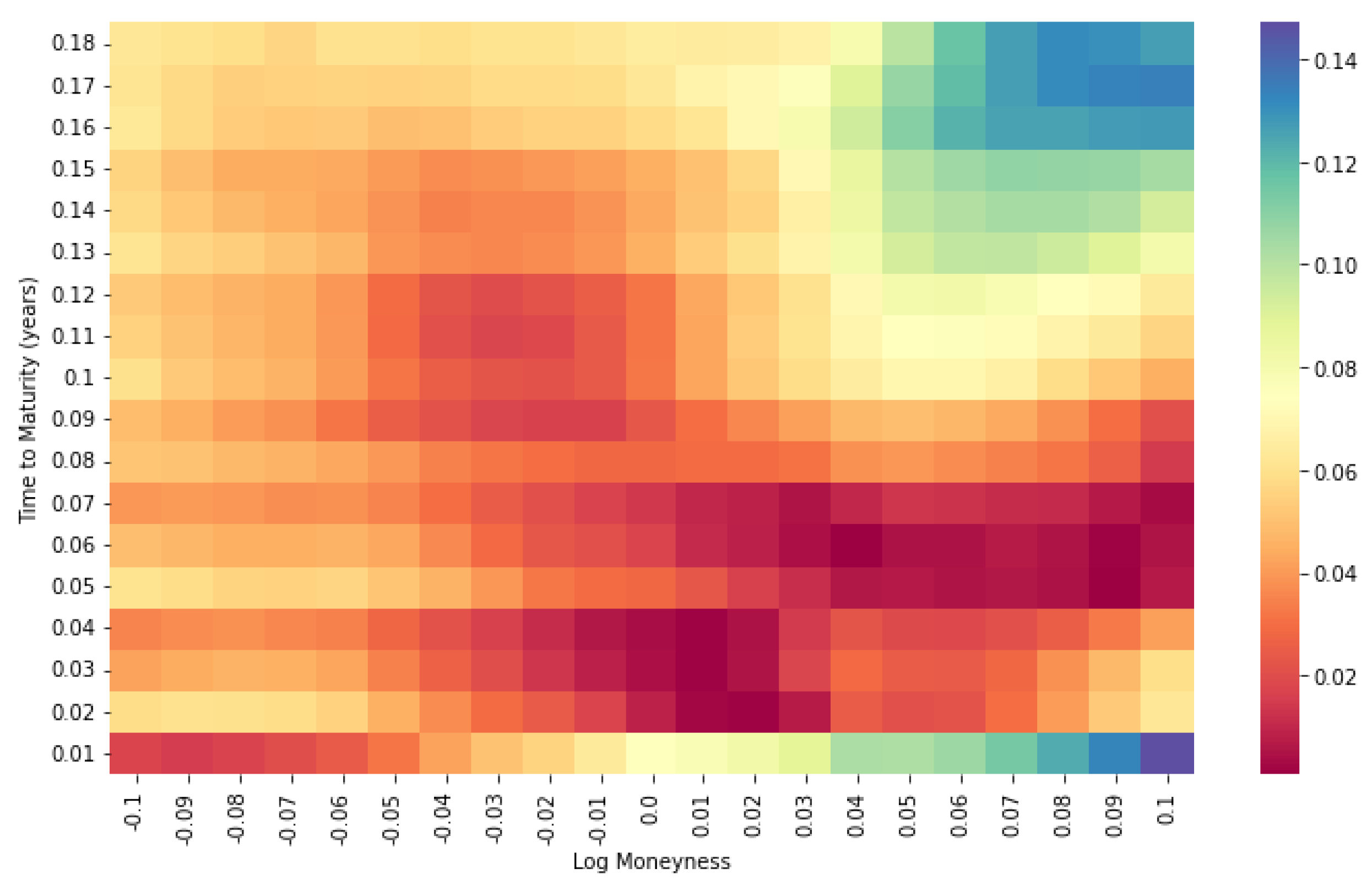

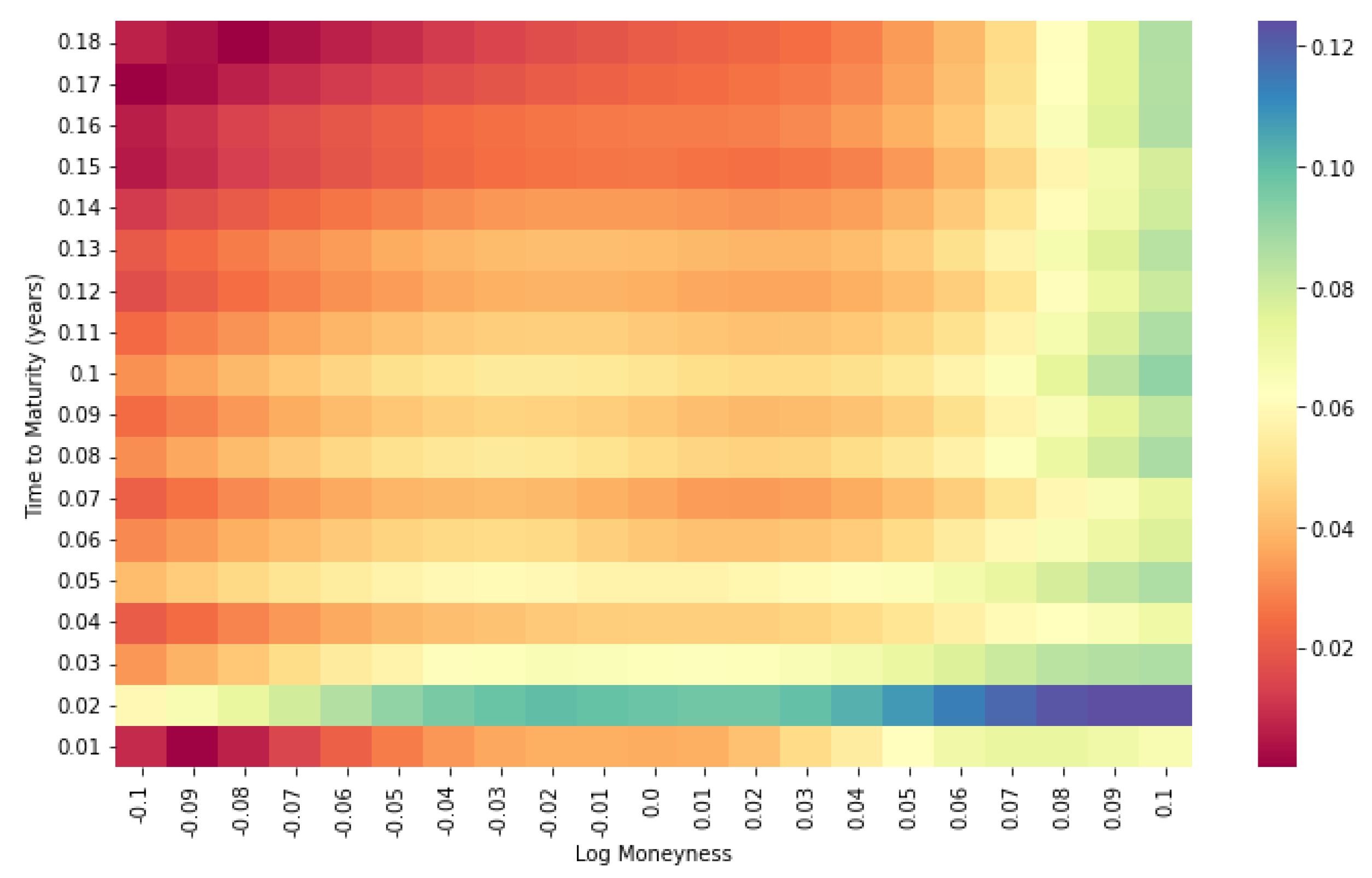

6.2. Heston Calibration via Neural Network

7. Conclusions

Author Contributions

Funding

Data Availability Statement

Conflicts of Interest

Appendix A. Notation

| W | Standard Brownian motion |

| , set of -valued progressively measurable | |

| processes Y s.t. | |

| space of continuous -semimartingale Y s.t. | |

| space of -adapted process in | |

| space of -measurable random variables s.t. | |

| space of predictable process Y s.t. |

Appendix B. Definition

- ;

- ,

- 1.

- X has independent increments, i.e., is independent of ,

- 2.

- a.s;

- 3.

- X has stationary increments, i.e., has a distribution that is independent of t;

- 4.

- it is continuous in probability, i.e., , ;

- 5.

- has cadlag trajectories, i.e., right continuous and with left limit defined everywhere.

| 1 | https://quantlib-python-docs.readthedocs.io/en/latest/, (accessed on 13 September 2022). |

References

- Abadi, Martín, Ashish Agarwal, Paul Barham, Eugene Brevdo, Zhifeng Chen, Craig Citro, Greg S. Corrado, Andy Davis, Jeffrey Dean, Matthieu Devin, and et al. 2016. Tensorflow: Large-scale machine learning on heterogeneous distributed systems. arXiv arXiv:1603.04467. [Google Scholar]

- Baydin, Atilim Gunes, Barak A. Pearlmutter, Alexey Andreyevich Radul, and Jeffrey Mark Siskind. 2018. Automatic differentiation in machine learning: A survey. Journal of Marchine Learning Research 18: 1–43. [Google Scholar]

- Bayer, Christian, and Benjamin Stemper. 2018. Deep calibration of rough stochastic volatility models. arXiv arXiv:1810.03399. [Google Scholar]

- Beck, Christian, Weinan E, and Arnulf Jentzen. 2019. Machine learning approximation algorithms for high-dimensional fully nonlinear partial differential equations and second-order backward stochastic differential equations. Journal of Nonlinear Science 29: 1563–619. [Google Scholar] [CrossRef]

- Bismut, Jean Michel. 1973. Conjugate convex functions in optimal stochastic control. Journal of Mathematical Analysis and Applications 44: 384–404. [Google Scholar] [CrossRef]

- Carleo, Giuseppe, and Matthias Troyer. 2017. Solving the quantum many-body problem with artificial neural networks. Science 355: 602–6. [Google Scholar] [CrossRef]

- Cybenko, George. 1989. Approximation by superpositions of a sigmoidal function. Mathematics of Control, Signals and Systems 2: 303–14. [Google Scholar] [CrossRef]

- El Karoui, Nicole, Shige Peng, and Marie Claire Quenez. 1997. Backward stochastic differential equations in finance. Mathematical Finance 7: 1–71. [Google Scholar] [CrossRef]

- Gatheral, Jim. 2011. The Volatility Surface: A Practitioner’s Guide. New York: John Wiley & Sons. [Google Scholar]

- Germain, Maximilien, Huyên Pham, and Xavier Warin. 2021. Neural networks-based algorithms for stochastic control and pdes in finance. arXiv arXiv:2101.08068. [Google Scholar]

- Han, Jiequn. 2016. Deep learning approximation for stochastic control problems. arXiv arXiv:1611.07422. [Google Scholar]

- Heston, Steven L. 1993. A closed-form solution for options with stochastic volatility with applications to bond and currency options. The Review of Financial Studies 6: 327–43. [Google Scholar] [CrossRef]

- Hochreiter, Sepp, and Jürgen Schmidhuber. 1997. Long short-term memory. Neural Computation 9: 1735–780. [Google Scholar] [CrossRef]

- Kingma, Diederik P., and Jimmy Ba. 2014. Adam: A method for stochastic optimization. arXiv arXiv:1412.6980. [Google Scholar]

- Li, Xinpeng, Yiqing Lin, and Weicheng Xu. 2019. On properties of solutions to black–scholes–barenblatt equations. Advances in Difference Equations 2019: 1–9. [Google Scholar] [CrossRef]

- Mao, Xuerong. 1995. Adapted solutions of backward stochastic differential equations with non-lipschitz coefficients. Stochastic Processes and Their Applications 58: 281–92. [Google Scholar] [CrossRef]

- Moré, Jorge J. 1978. The levenberg–Marquardt algorithm: Implementation and theory. In Numerical Analysis. Berlin: Springer, pp. 105–16. [Google Scholar]

- Pardoux, Etienne, and Shanjian Tang. 1999. Forward-backward stochastic differential equations and quasilinear parabolic pdes. Probability Theory and Related Fields 114: 123–50. [Google Scholar] [CrossRef]

- Raissi, Maziar. 2018. Forward-backward stochastic neural networks: Deep learning of high-dimensional partial differential equations. arXiv arXiv:1804.07010. [Google Scholar]

- Robbins, Herbert, and Sutton Monro. 1951. A Stochastic Approximation Method. The Annals of Mathematical Statistics 22: 400–7. [Google Scholar] [CrossRef]

- Rumelhart, David E., Geoffrey E. Hinton, and Ronald J. Williams. 1986. Learning representations by back-propagating errors. Nature 323: 533–36. [Google Scholar] [CrossRef]

- Sharma, Siddharth, Simone Sharma, and Anidhya Athaiya. 2020. Activation functions in neural networks. International Journal of Engineering Applied Sciences and Technology 04: 310–16. [Google Scholar] [CrossRef]

- Svozil, Daniel, Vladimir Kvasnicka, and Jiri Pospichal. 1997. Introduction to multi-layer feed-forward neural networks. Chemometrics and Intelligent Laboratory Systems 39: 43–62. [Google Scholar] [CrossRef]

- Wang, Xiaoqun. 2006. On the effects of dimension reduction techniques on some high-dimensional problems in finance. Operations Research 54: 1063–78. [Google Scholar] [CrossRef]

- Weinan, E, Martin Hutzenthaler, Arnulf Jentzen, and Thomas Kruse. 2019. On multilevel picard numerical approximations for high-dimensional nonlinear parabolic partial differential equations and high-dimensional nonlinear backward stochastic differential equations. Journal of Scientific Computing 79: 1534–71. [Google Scholar]

| Parameter | Marginal |

|---|---|

| Parameter | Theoretical | FCNN | LSTM |

|---|---|---|---|

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Di Persio, L.; Lavagnoli, E.; Patacca, M. Calibrating FBSDEs Driven Models in Finance via NNs. Risks 2022, 10, 227. https://doi.org/10.3390/risks10120227

Di Persio L, Lavagnoli E, Patacca M. Calibrating FBSDEs Driven Models in Finance via NNs. Risks. 2022; 10(12):227. https://doi.org/10.3390/risks10120227

Chicago/Turabian StyleDi Persio, Luca, Emanuele Lavagnoli, and Marco Patacca. 2022. "Calibrating FBSDEs Driven Models in Finance via NNs" Risks 10, no. 12: 227. https://doi.org/10.3390/risks10120227

APA StyleDi Persio, L., Lavagnoli, E., & Patacca, M. (2022). Calibrating FBSDEs Driven Models in Finance via NNs. Risks, 10(12), 227. https://doi.org/10.3390/risks10120227