Non-Performing Loans and Macroeconomics Factors: The Italian Case

Abstract

:1. Introduction

2. Literature Overview

Theoretical Hypothesis

3. Research Methodology

4. Data

5. Empirical Findings

Discussion of the Results

6. Conclusions

Funding

Data Availability Statement

Acknowledgments

Conflicts of Interest

Appendix A

Appendix A.1. Regression Results with Breaks

| Break Test | F-Statistic | Scaled F-Statistic | Critical Value ** |

|---|---|---|---|

| 0 vs. 1 * | 25.47 | 25.47 | 8.58 |

| 1 vs. 2 * | 92.68 | 92.68 | 10.13 |

| 2 vs. 3 * | 30.14 | 30.14 | 11.14 |

| 3 vs. 4 | 3.68 | 3.68 | 11.83 |

| Break dates: | |||

| Sequential | Repartition | ||

| 1 | 2011Q4 | 2011Q2 | |

| 2 | 2018Q2 | 2013Q3 | |

| 3 | 2013Q3 | 2018Q2 | |

| Variables | Coefficient | Std. Error | t-Statistic | p-Value |

|---|---|---|---|---|

| GDP | −0.443 | 0.238 | −1.861 | 0.072 |

| PD | −0.376 | 0.162 | −2.317 | 0.025 |

| UR | 0.023 | 0.005 | 4.328 | 0.000 |

| DR | 0.493 | 0.239 | 2.058 | 0.045 |

| dummy | −0.028 | 0.026 | −1.106 | 0.274 |

| c | 3.698 | 5.258 | 0.703 | 0.485 |

| Variables | Coefficient | Std. Error | t-Statistic | p-Value |

|---|---|---|---|---|

| GDP | −0.048 | 0.022 | −2.147 | 0.037 |

| PD | −0.043 | 0.008 | −4.988 | 0.000 |

| UR | 0.002 | 0.001 | 2.446 | 0.018 |

| DR | 0.056 | 0.022 | 2.468 | 0.017 |

| dummy | −0.003 | 0.002 | −1.187 | 0.241 |

| ECT | −0.114 | 0.044 | −2.576 | 0.013 |

Appendix A.2. The Johansen Test

| Hypothesized No. of CE(s) | Eigenvalue | Trace Statistics | 0.05 Critical Value |

|---|---|---|---|

| r = 0 | 0.588 | 90.85 * | 60.06 |

| r ≤ 1 | 0.379 | 48.27 * | 40.17 |

| r ≤ 2 | 0.291 | 25.39 * | 24.27 |

| r ≤ 3 | 0.169 | 8.93 | 12.32 |

| r ≤ 4 | 0.000 | 0.01 | 4.12 |

| 1 | There is no definition of a zombie firm, however it is recognized that these “firms are economically unviable and manage to survive by tapping into banks and capital markets” (Favara et al. 2021). |

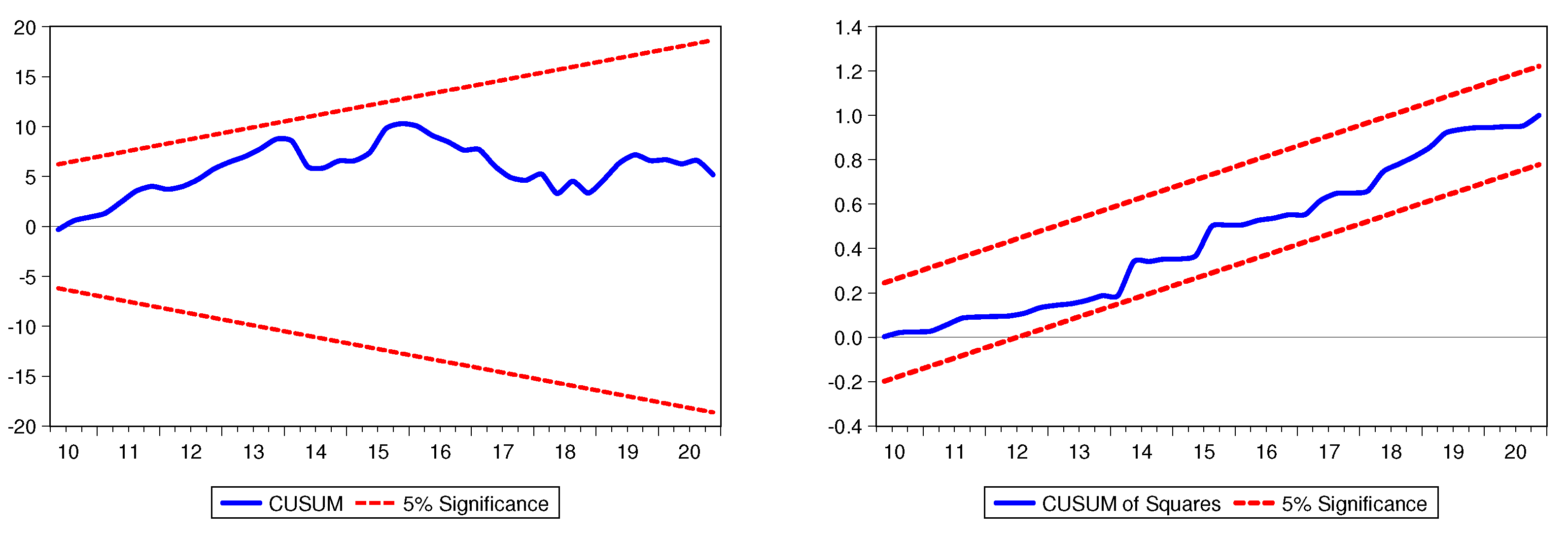

| 2 | To ensure the reliability of the empirical findings, we estimated the ARDL model with structural breaks in the Appendix A. As we can see, the results are perfectly in line with the base model, i.e., the econometric model is stable. |

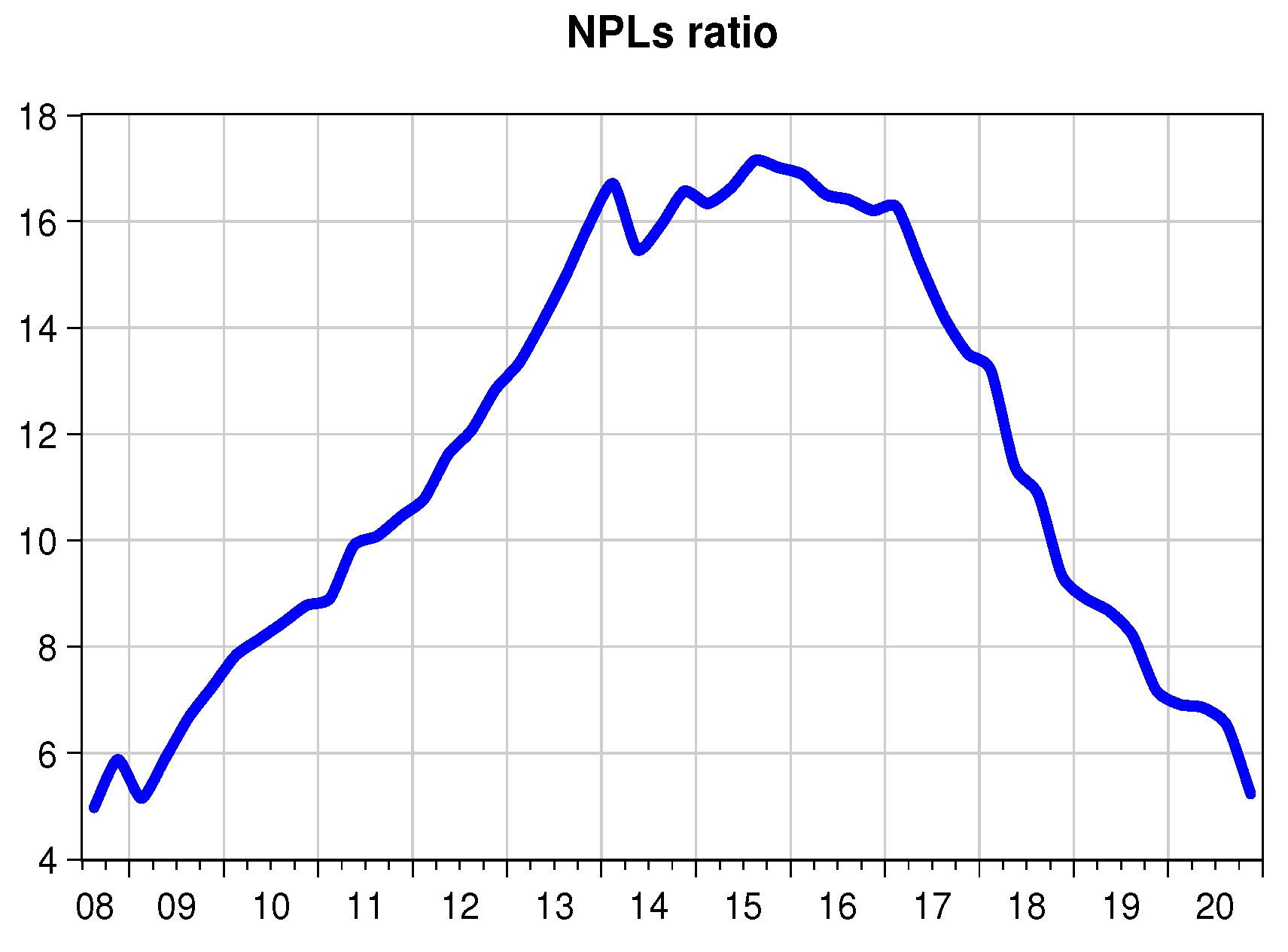

| 3 | The choice of the period analyzed is conditioned by the data available. NPLs at an aggregate Italian level are not always available continuously, hence we intended to use data from the CEIC. In this database, the 2008Q3 is the first available data. |

| 4 | Moreover, to test the long-run cointegration, we also estimate the Johansen Tests (Table A4 in Appendix A.2). The test suggests the existence of three cointegration relationships between NPLs, and the four macroeconomics factors. This implies that exists a long-run equilibrium relationship among the variables. |

| 5 | During the 2009–2010 years, the bank obtained a first recapitalization by the government in the form of 1.9 billion euros in bonds purchased by the government, namely the “Tremonti bonds” (Gandrud and Hallerberg 2017). |

| 6 | Speech by the Governor of the Bank of Italy Ignazio Visco at Italian Banking Association, Executive Committee Meeting Rome, 16 September 2020 (https://www.bancaditalia.it/pubblicazioni/interventi-governatore/integov2020/en-Visco-ABI-16092020.pdf?language_id=1, accessed on 1 December 2021). |

References

- Acharya, Viral V., Matteo Crosignani, Tim Eisert, and Christian Eufinger. 2020. Zombie Credit and (dis-) Inflation: Evidence from Europe. Technical Report. Cambridge: National Bureau of Economic Research. [Google Scholar]

- Aikman, David, Andrew G. Haldane, and Benjamin D. Nelson. 2015. Curbing the credit cycle. The Economic Journal 125: 1072–109. [Google Scholar] [CrossRef]

- Anastasiou, Dimitrios, Louri Helen, and Tsionas Mike. 2016. Determinants of non-performing loans: Evidence from euro-area countries. Finance Research Letters 18: 116–19. [Google Scholar]

- Anastasiou, Dimitrios, Helen Louri, and Mike Tsionas. 2019. Nonperforming loans in the euro area: Are core–periphery banking markets fragmented? International Journal of Finance & Economics 24: 97–112. [Google Scholar]

- Angelini, Paolo. 2018. Do High Levels of npls Impair Banks’ Credit Allocation? Technical Report. Rome: Bank of Italy. [Google Scholar]

- Ari, Anil, Sophia Chen, and Lev Ratnovski. 2021. The dynamics of non-performing loans during banking crises: A new database with post-covid-19 implications. Journal of Banking & Finance 133: 106140. [Google Scholar]

- Bahmani, Sahar, and Ali M. Kutan. 2010. How stable is the demand for money in emerging economies? Applied Economics 42: 3307–18. [Google Scholar] [CrossRef]

- Bai, Jushan, and Pierre Perron. 2003. Computation and analysis of multiple structural change models. Journal of Applied Econometrics 18: 1–22. [Google Scholar] [CrossRef] [Green Version]

- Beck, Roland, Petr Jakubik, and Anamaria Piloiu. 2015. Key determinants of non-performing loans: New evidence from a global sample. Open Economies Review 26: 525–50. [Google Scholar] [CrossRef]

- Bijsterbosch, Martin, and Matteo Falagiarda. 2015. The macroeconomic impact of financial fragmentation in the euro area: Which role for credit supply? Journal of International Money and Finance 54: 93–115. [Google Scholar] [CrossRef]

- Bofondi, Marcello, and Tiziano Ropele. 2011. Macroeconomic Determinants of Bad Loans: Evidence from Italian Banks. Bank of Italy Occasional Paper No 89. Rome: Bank of Italy. [Google Scholar]

- Bolognesi, Enrica, Cristiana Compagno, Stefano Miani, and Roberto Tasca. 2020. Non-performing loans and the cost of deleveraging: The italian experience. Journal of Accounting and Public Policy 39: 106786. [Google Scholar] [CrossRef]

- Brown, Robert L., James Durbin, and James M. Evans. 1975. Techniques for testing the constancy of regression relationships over time. Journal of the Royal Statistical Society: Series B (Methodological) 37: 149–63. [Google Scholar] [CrossRef]

- Bussoli, Candida, Vito Caputo, and Danilo Conte. 2020. Macroeconomic and bank-specific determinants of npls in europe: The role of branches and bank size. Bancaria 1: 22–43. [Google Scholar]

- Caballero, Ricardo J., Takeo Hoshi, and Anil K. Kashyap. 2008. Zombie lending and depressed restructuring in japan. American Economic Review 98: 1943–77. [Google Scholar] [CrossRef] [Green Version]

- Chaibi, Hasna, and Zied Ftiti. 2015. Credit risk determinants: Evidence from a cross-country study. Research in International Business and Finance 33: 1–16. [Google Scholar] [CrossRef]

- Cincinelli, Peter, and Domenico Piatti. 2017. Non performing loans, moral hazard & supervisory authority: The italian banking system. Journal of Financial Management, Markets and Institutions 1: 5–34. [Google Scholar]

- Espinoza, Mr Raphael A., and Ananthakrishnan Prasad. 2010. Nonperforming loans in the GCC Banking System and Their Macroeconomic Effects. Washington, DC: International Monetary Fund. [Google Scholar]

- Favara, Giovanni, Camelia Minoiu, and Ander Perez. 2021. Us Zombie Firms How Many and How Consequential? Technical Report. Washington, DC: Board of Governors of the Federal Reserve System (US). [Google Scholar]

- Foglia, Matteo, Abdelhamid Addi, and Eliana Angelini. 2021. The eurozone banking sector in the time of covid-19: Measuring volatility connectedness. Global Finance Journal 51: 100677. [Google Scholar] [CrossRef]

- Foglia, Matteo, and Eliana Angelini. 2019. An explorative analysis of italy banking financial stability. Economics Bulletin 39: 1294–308. [Google Scholar]

- Foglia, Matteo, and Eliana Angelini. 2021. The triple (t3) dimension of systemic risk: Identifying systemically important banks. International Journal of Finance & Economics 26: 7–26. [Google Scholar]

- Galand, Christophe, Wouter Dutillieux, and Emese Vallyon. 2017. Non-performing loans and state aid rules. European Economy-Banks, Regulation, and the Real Sector 1: 137–59. [Google Scholar]

- Gandrud, Christopher, and Mark Hallerberg. 2017. How Not to Create Zombie Banks: Lessons for Italy from Japan. Technical Report. Brussels: Bruegel Policy Contribution. [Google Scholar]

- Gaur, Dolly, and Dipti Ranjan Mohapatra. 2020. The nexus of economic growth, priority sector lending and non-performing assets: Case of indian banking sector. South Asian Journal of Business Studies 10: 70–90. [Google Scholar] [CrossRef]

- Ghosh, Amit. 2015. Banking-industry specific and regional economic determinants of non-performing loans: Evidence from us states. Journal of Financial Stability 20: 93–104. [Google Scholar] [CrossRef]

- Guo, Yawei, Jianping Li, Yehua Li, and Wanhai You. 2021. The roles of political risk and crude oil in stock market based on quantile cointegration approach: A comparative study in china and us. Energy Economics 97: 105198. [Google Scholar] [CrossRef]

- Hada, Teodor, Nicoleta Bărbuță-Mișu, Iulia Cristina Iuga, and Dorin Wainberg. 2020. Macroeconomic determinants of nonperforming loans of romanian banks. Sustainability 12: 7533. [Google Scholar]

- Haynes, Jonathan, Peter Hope, and Hugo Talbot. 2021. Non-Performing Loans–New Risks and Policies. Technical Report, Economic Governance Support Unit (EGOV) at the Request of the Committee on Economic and Monetary Affairs (ECON) (March). Strasbourg: European Parliament. [Google Scholar]

- Khan, Muhammad Asif, Asima Siddique, and Zahid Sarwar. 2020. Determinants of non-performing loans in the banking sector in developing state. Asian Journal of Accounting Research 5: 135–145. [Google Scholar] [CrossRef]

- Kirti, Divya. 2018. Lending Standards and Output Growth. Washington, DC: International Monetary Fund. [Google Scholar]

- Kjosevski, Jordan, and Mihail Petkovski. 2021. Macroeconomic and bank-specific determinants of non-performing loans: The case of baltic states. Empirica 48: 1009–28. [Google Scholar] [CrossRef]

- Kjosevski, Jordan, Mihail Petkovski, and Elena Naumovska. 2019. Bank-specific and macroeconomic determinants of non-performing loans in the republic of macedonia: Comparative analysis of enterprise and household npls. Economic Research-Ekonomska Istraživanja 32: 1185–203. [Google Scholar] [CrossRef]

- Konstantakis, Konstantinos N., Panayotis G. Michaelides, and Angelos T. Vouldis. 2016. Non performing loans (npls) in a crisis economy: Long-run equilibrium analysis with a real time vec model for greece (2001–2015). Physica A: Statistical Mechanics and Its Applications 451: 149–61. [Google Scholar] [CrossRef]

- La Torre, Mario, Gianfranco Vento, Helen Chiappini, and Giuseppe Lia. 2019. Cessione degli npls e reazione dei mercati: c’è un vuoto a rendere? Bancaria 3: 1–25. [Google Scholar]

- Laeven, Mr Luc, and Mr Fabian Valencia. 2018. Systemic Banking Crises Revisited. Washington, DC: International Monetary Fund. [Google Scholar]

- Louzis, Dimitrios P., Angelos T. Vouldis, and Vasilios L. Metaxas. 2012. Macroeconomic and bank-specific determinants of nonperforming loans in greece: A comparative study of mortgage, business and consumer loan portfolios. Journal of Banking & Finance 36: 1012–27. [Google Scholar]

- Mah, Jai S. 2000. An empirical examination of the disaggregated import demand of korea—The case of information technology products. Journal of Asian economics 11: 237–44. [Google Scholar] [CrossRef]

- Makri, Vasiliki, Athanasios Tsagkanos, and Athanasios Bellas. 2014. Determinants of non-performing loans: The case of eurozone. Panoeconomicus 61: 193–206. [Google Scholar] [CrossRef] [Green Version]

- Mishra, Aswini Kumar, Shikhar Jain, Mohammad Abid, and Manogna RL. 2021. Macro-economic determinants of non-performing assets in the indian banking system: A panel data analysis. International Journal of Finance & Economics 26: 3819–34. [Google Scholar]

- Nkusu, Ms Mwanza. 2011. Nonperforming Loans and Macrofinancial Vulnerabilities in Advanced Economies. Washington, DC: International Monetary Fund. [Google Scholar]

- Pesaran, M. Hashem, Yongcheol Shin, and Richard J. Smith. 2001. Bounds testing approaches to the analysis of level relationships. Journal of Applied Econometrics 16: 289–326. [Google Scholar] [CrossRef]

- Reinhart, Carmen M., and Kenneth S. Rogoff. 2011. From financial crash to debt crisis. American Economic Review 101: 1676–706. [Google Scholar] [CrossRef] [Green Version]

- Rinaldi, Laura, and Alicia Sanchis-Arellano. 2006. Household Debt Sustainability: What Explains Household Non-Performing Loans? An Empirical Analysis. Technical Report. Frankfurt: European Central Bank. [Google Scholar]

- Schularick, Moritz, and Alan M. Taylor. 2012. Credit booms gone bust: Monetary policy, leverage cycles, and financial crises, 1870–2008. American Economic Review 102: 1029–61. [Google Scholar] [CrossRef] [Green Version]

- Shambaugh, Jay C., Ricardo Reis, and Hélène Rey. 2012. The euro’s three crises. Brookings Papers on Economic Activity, 157–231. Available online: https://www.brookings.edu/wp-content/uploads/2012/03/2012a_Shambaugh.pdf (accessed on 1 December 2021). [CrossRef]

- Škarica, Bruna. 2014. Determinants of non-performing loans in central and eastern european countries. Financial Theory and Practice 38: 37–59. [Google Scholar] [CrossRef]

- Tanasković, Svetozar, and Maja Jandrić. 2015. Macroeconomic and institutional determinants of non-performing loans. Journal of Central Banking Theory and Practice 4: 47–62. [Google Scholar] [CrossRef] [Green Version]

- Zheng, Changjun, Probir Kumar Bhowmik, and Niluthpaul Sarker. 2020. Industry-specific and macroeconomic determinants of non-performing loans: A comparative analysis of ardl and vecm. Sustainability 12: 325. [Google Scholar] [CrossRef] [Green Version]

- Žunić, Amila, Kemal Kozarić, and Emina Žunić Dželihodžić. 2021. Non-performing loan determinants and impact of covid-19: Case of bosnia and herzegovina. Journal of Central Banking Theory and Practice 10: 5–22. [Google Scholar] [CrossRef]

| Variable | Abbr. | Unit | Source | Expected Sign |

|---|---|---|---|---|

| Non-performing loans | NPLs | per cent of total loans | CEIC Data | |

| Gross Domestic Products | GDP | log-level | OECD | − |

| Gross Public Debt | PD | log-level | Eurostat | + |

| Unemployment rate | UR | per cent | OECD | + |

| Domestic Credit | DC | log-level | ECB | +/− |

| NPL | GDP | PD | UR | DC | |

|---|---|---|---|---|---|

| Mean | 11.48 | 12.88 | 14.55 | 10.22 | 14.43 |

| Median | 11.12 | 12.89 | 14.58 | 10.55 | 14.44 |

| Maximum | 17.14 | 12.94 | 14.76 | 12.71 | 14.49 |

| Minimum | 4.97 | 12.71 | 14.31 | 6.71 | 14.35 |

| Std. Dev. | 4.02 | 0.03 | 0.11 | 1.73 | 0.04 |

| Skewness | −0.02 | −2.81 | −0.25 | −0.33 | −0.19 |

| Kurtosis | 1.55 | 15.92 | 2.12 | 1.88 | 1.59 |

| Jarque-Bera | 4.33 | 413.93 *** | 2.13 | 3.53 | 4.41 |

| VIF | 1.14 | 2.13 | 2.55 | 1.91 | |

| ADF | 0.66[0] | −3.91[0] ** | −1.39[5] | −0.68[0] | −2.48[0] |

| ADF | −6.15[0] *** | −9.81[1] *** | −9.66[3] *** | −6.68[0] *** | −6.78[0] *** |

| 10% | 5% | 2.50% | 1% | |||||

|---|---|---|---|---|---|---|---|---|

| F-Statistics | Lower Limit | Upper Limit | Lower Limit | Upper Limit | Lower Limit | Upper Limit | Lower Limit | Upper Limit |

| 12.03 | 2.45 | 3.52 | 2.86 | 4.01 | 3.25 | 4.49 | 3.74 | 5.06 |

| Variables | Coefficient | Std. Error | t-Statistic | p-Value |

|---|---|---|---|---|

| GDP | −0.456 | 0.249 | −1.831 | 0.073 |

| PD | −0.388 | 0.152 | −2.551 | 0.014 |

| UR | 0.024 | 0.004 | 5.615 | 0.000 |

| DR | 0.491 | 0.181 | 2.696 | 0.010 |

| c | 4.336 | 4.361 | 0.994 | 0.325 |

| Diagnostic test | LM[1] | LM[2] | HET | RESET |

| F-statistic | 1.881 | 1.215 | 0.563 | 1.944 |

| p-value | 0.177 | 0.306 | 0.727 | 0.171 |

| Variables | Coefficient | Std. Error | t-Statistic | p-Value |

|---|---|---|---|---|

| GDP | −0.051 | 0.015 | −3.361 | 0.001 |

| PD | −0.043 | 0.006 | −6.759 | 0.000 |

| UR | 0.003 | 0.001 | 3.299 | 0.002 |

| DC | 0.054 | 0.016 | 3.201 | 0.025 |

| ECT | −0.111 | 0.038 | −2.859 | 0.006 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the author. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Foglia, M. Non-Performing Loans and Macroeconomics Factors: The Italian Case. Risks 2022, 10, 21. https://doi.org/10.3390/risks10010021

Foglia M. Non-Performing Loans and Macroeconomics Factors: The Italian Case. Risks. 2022; 10(1):21. https://doi.org/10.3390/risks10010021

Chicago/Turabian StyleFoglia, Matteo. 2022. "Non-Performing Loans and Macroeconomics Factors: The Italian Case" Risks 10, no. 1: 21. https://doi.org/10.3390/risks10010021

APA StyleFoglia, M. (2022). Non-Performing Loans and Macroeconomics Factors: The Italian Case. Risks, 10(1), 21. https://doi.org/10.3390/risks10010021