The Case Experience of Integrating the SDGs into Corporate Strategies for Financial Risk Management Based on Social Responsibility (with the Example of Russian TNCs)

Abstract

:1. Introduction

- Studying the case experience of financial risk management of the largest Russian companies in the conditions of the COVID-19 crisis and performing an overview of their practice of integration of the SDGs and social responsibility into corporate strategies;

- Evaluating the success of financial risk management of the largest Russian companies amid the COVID-19 crisis;

- Determining the contribution of embedding the SDGs and social responsibility in corporate strategies to this success.

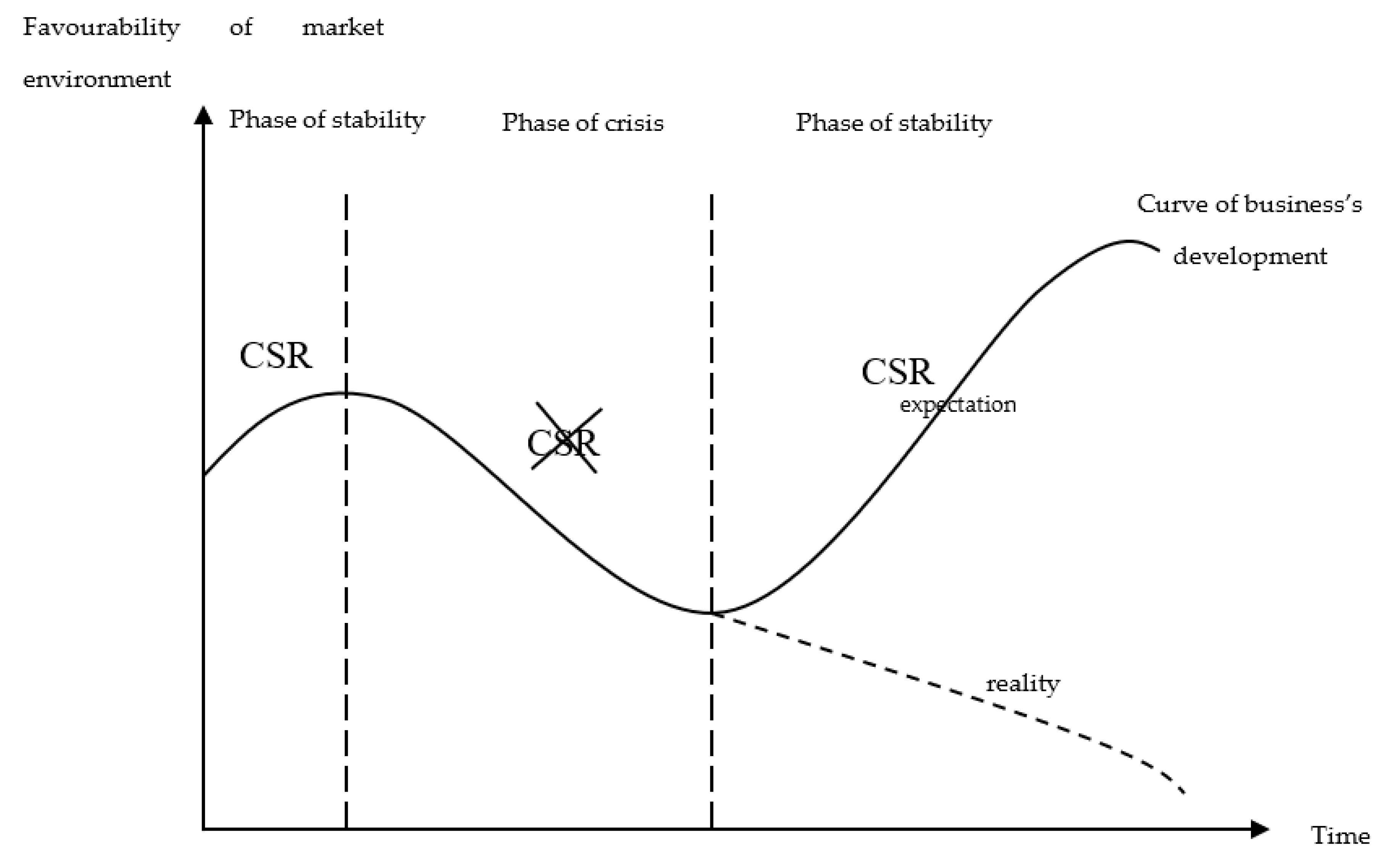

2. Theory

3. Methodology

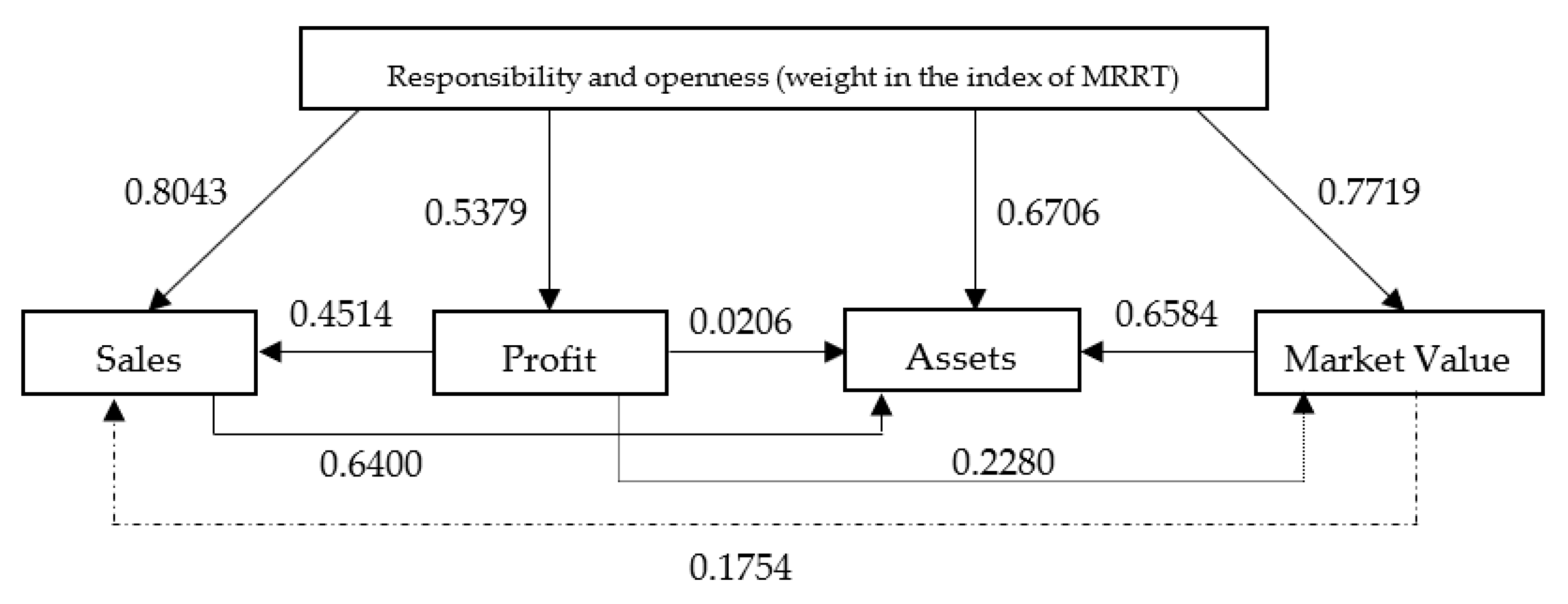

- FinRisk—change (growth) of the financial risk of a company (sales volume, profit, asset value, and market share—in isolation) in 2021 compared to 2020;

- i—constant;

- j—regression coefficient;

- CorpResp—company’s weight in the index “Responsibility and openness” (MRRT).

- −

- 1st step: aggregating the observed values of the variables (observed values, OV) in one table and calculating the sums for columns (totalcol) and lines (totallines) and the integral sum ITotal = ∑totalcol = ∑ totallines;

- −

- 2nd step: determining the expected values (expected values, EV) by the following formula: EV = totalcol * totallines/ITotal;

- −

- 3rd step: calculating Chi-square points by the following formula: (OV − EV) * 2/EV;

- −

- 4th step: calculating Chi-square as the integral sum of all Chi-square points: Chi-Square = ∑Chi-Square Points. Comparing the obtained value of Chi-square with the critical value of Chi-square for the given number of observations at the set significance level (0.05). Automatised calculation of Chi-test (P)Value by the MS Excel formula with the same name and its comparison with the significance level 0.05.

- If the obtained Chi-square exceeds (or equals) the critical value of Chi-square and, at the same time, the Chi-test (P)Value is below the significance level (0.05), the variables are dependent (correspond to each other, explain each other);

- In the opposite case, if the obtained Chi-square is below the critical value of Chi-square, and (which is not mandatory), at the same time, the Chi-test (P)Value exceeds (or equals) the significance level (0.05), the variables are independent (do not correspond to each other, do not explain each other).

4. Results

4.1. Case Experience of Financial Risk Management and CSR of the Largest Russian Companies in the Conditions of the COVID-19 Crisis—Testing Hypothesis H1

- Project to increase the population’s financial literacy, aimed at the growth of various social categories’ awareness of due payment during the COVID-19 pandemic;

- Project “Social account”, which allows for the remote execution and receipt of social assistance in the conditions of requirements of social distancing and self-isolation due to the COVID-19 pandemic;

- Project “BRIS ZKK”, which allows for the remote payment of utilities, which is especially urgent after the closure of places that receive such payments due to the lockdown amid the COVID-19 pandemic.

- Special corporate program of employees’ healthcare, which is especially topical and expanded during the COVID-19 pandemic;

- Implementation of corporate initiatives to increase labour safety and improve labour conditions, supplemented by the measures of provision of sanitation during the COVID-19 pandemic.

- Creation of new (additional) jobs (completely safe from a medical point of view) and support for employment in regions where the company’s branches are based in the conditions of the COVID-19 pandemic;

- Providing employees with expanded social guarantees (subsidies and payments), which was especially required in the lockdown period due to the COVID-19 pandemic.

4.2. Evaluation of the Successfulness of Financial Risk Management of the Largest Russian Companies Amid the COVID-19 Crisis—Testing Hypothesis H2

4.3. Analysis of the Contribution of Embedding the SDGs and CSR in the Corporate Strategies to the Success of Financial Risk Management—Testing Hypothesis H3

5. Discussion

6. Conclusions

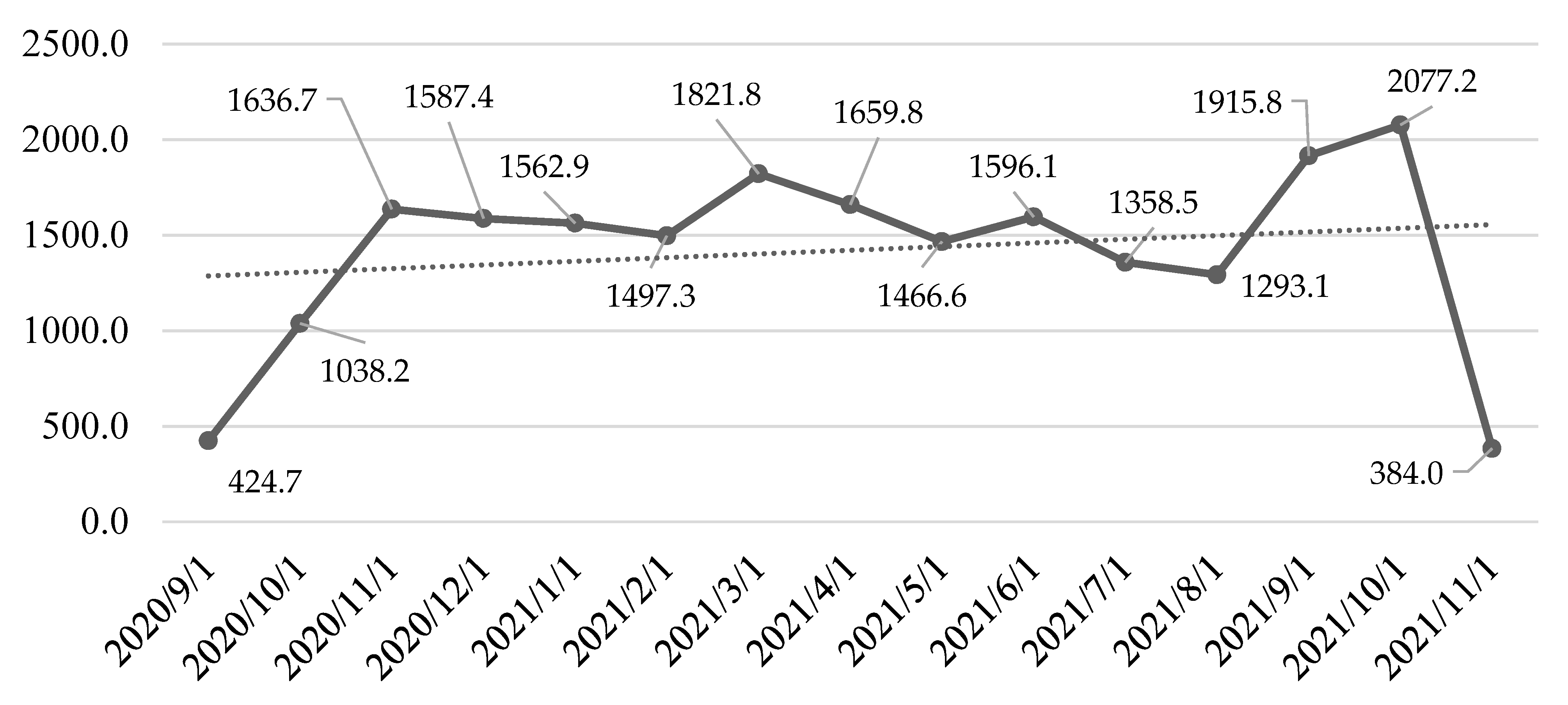

- The case experience of the financial risk management of the largest Russian companies amid the conditions of the COVID-19 crisis was studied, and an overview of their practices of embedding the SDGs and social responsibility in corporate strategies was performed. It was determined that October 2021 saw a record high level in the MRRT index (RUB 2077.2 billion), which exceeded the level of October 2020 (RUB 1038.2 billion) by 100.02%. Based on this, it was substantiated that SDGs are built in the corporate strategies of the largest Russian companies, and the level of their corporate social responsibility grew in the conditions of the COVID-19 crisis (in 2021 compared to 2020);

- The success of the financial risk management of the largest Russian companies amid the COVID-19 crisis was evaluated. It was established that the profit of the largest Russian companies grew by 90.25%, assets by 5926.69%, and market share by 39.14%. Based on this, it was proved that managing the financial business risks of the largest Russian companies in the conditions of the COVID-19 crisis was successful: most of the risks (apart from the risk of reduction of sales) reduced in 2021 as compared to 2021;

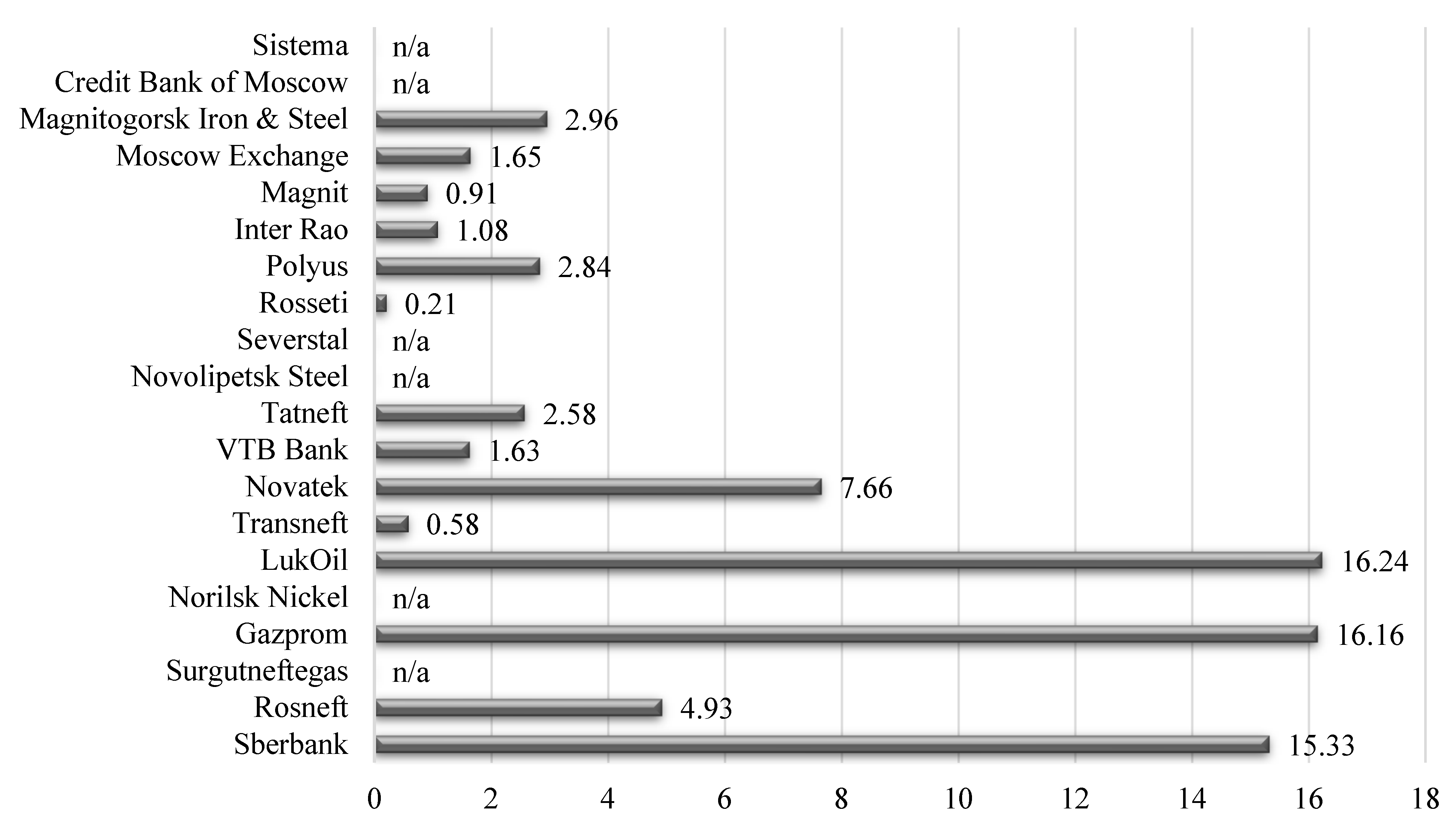

- The contribution of embedding the SDGs and social responsibility in corporate strategies to these successes was determined. It was found out that an increase in the company’s weight in the MRRT index by 1% led to an increase in their profit in the conditions of the COVID-19 crisis in 2021 by 38.69%, and the market value of their assets by 231,269%. Based on this, it was substantiated that the level of corporate social responsibility of the largest Russian companies determines the level of success of overcoming their financial risks (profit and value of assets).

Supplementary Materials

Author Contributions

Funding

Conflicts of Interest

Appendix A

| Company | Sales | Profit | Assets | Market Value | Responsibility and Openness (Weight in the Index of MRRT), % | Total for the Line |

|---|---|---|---|---|---|---|

| Sberbank | 47.30 | 10.40 | 486.90 | 85.70 | 15.33 | 645.63 |

| Rosneft | 70.80 | 2.00 | 207.50 | 77.70 | 4.93 | 362.93 |

| Surgutneftegas | 18.80 | 8.40 | 79.40 | 16.70 | 0.00 | 123.30 |

| Gazprom | 90.50 | −0.90 | 294.90 | 73.50 | 16.16 | 474.16 |

| Norilsk Nickel | 15.70 | 3.50 | 20.70 | 53.20 | 0.00 | 93.10 |

| LukOil | 71.50 | 209.70 | 81.50 | 52.30 | 16.24 | 431.24 |

| Transneft | 14.30 | 2.10 | 44.10 | 13.90 | 0.58 | 74.98 |

| Novatek | 9.60 | 0.90 | 27.90 | 58.40 | 7.66 | 104.46 |

| VTB Bank | 17.10 | 0.90 | 245.30 | 8.10 | 1.63 | 273.03 |

| Tatneft | 10.20 | 1.40 | 17.10 | 17.30 | 2.58 | 48.58 |

| Novolipetsk Steel | 9.20 | 1.30 | 9.90 | 20.90 | 0.00 | 41.30 |

| Severstal | 7.30 | 1.70 | 7.50 | 19.60 | 0.00 | 36.10 |

| Rosseti | 13.80 | 0.50 | 35.20 | 3.80 | 0.21 | 53.51 |

| Polyus | 5.00 | 1.60 | 7.30 | 26.70 | 2.84 | 43.44 |

| Inter Rao | 13.60 | 1.00 | 12.30 | 4.80 | 1.08 | 32.78 |

| Magnit | 21.50 | 0.50 | 13.00 | 6.90 | 0.91 | 42.81 |

| Moscow Exchange | 0.70 | 0.30 | 66.70 | 5.20 | 1.65 | 74.55 |

| Magnitogorsk Iron & Steel | 6.40 | 0.60 | 7.60 | 10.10 | 2.96 | 27.66 |

| Credit Bank of Moscow | 2.50 | 0.40 | 38.10 | 2.80 | 0.00 | 43.80 |

| Sistema | 9.60 | 0.10 | 19.20 | 4.70 | 0.00 | 33.60 |

| Total for the column | 455.40 | 246.40 | 1722.10 | 562.30 | 74.76 | 3060.96 |

| Company | Sales | Profit | Assets | Market Value | Responsibility and Openness (Weight in the Index of MRRT), % |

|---|---|---|---|---|---|

| Sberbank | 96.05 | 51.97 | 363.23 | 118.60 | 15.77 |

| Rosneft | 54.00 | 29.22 | 204.18 | 66.67 | 8.86 |

| Surgutneftegas | 18.34 | 9.93 | 69.37 | 22.65 | 3.01 |

| Gazprom | 70.54 | 38.17 | 266.76 | 87.10 | 11.58 |

| Norilsk Nickel | 13.85 | 7.49 | 52.38 | 17.10 | 2.27 |

| LukOil | 64.16 | 34.71 | 242.62 | 79.22 | 10.53 |

| Transneft | 11.16 | 6.04 | 42.18 | 13.77 | 1.83 |

| Novatek | 15.54 | 8.41 | 58.77 | 19.19 | 2.55 |

| VTB Bank | 40.62 | 21.98 | 153.61 | 50.16 | 6.67 |

| Tatneft | 7.23 | 3.91 | 27.33 | 8.92 | 1.19 |

| Novolipetsk Steel | 6.14 | 3.32 | 23.24 | 7.59 | 1.01 |

| Severstal | 5.37 | 2.91 | 20.31 | 6.63 | 0.88 |

| Rosseti | 7.96 | 4.31 | 30.10 | 9.83 | 1.31 |

| Polyus | 6.46 | 3.50 | 24.44 | 7.98 | 1.06 |

| Inter Rao | 4.88 | 2.64 | 18.44 | 6.02 | 0.80 |

| Magnit | 6.37 | 3.45 | 24.08 | 7.86 | 1.05 |

| Moscow Exchange | 11.09 | 6.00 | 41.94 | 13.69 | 1.82 |

| Magnitogorsk Iron & Steel | 4.12 | 2.23 | 15.56 | 5.08 | 0.68 |

| Credit Bank of Moscow | 6.52 | 3.53 | 24.64 | 8.05 | 1.07 |

| Sistema | 5.00 | 2.70 | 18.90 | 6.17 | 0.82 |

| Company | Sales | Profit | Assets | Market Value | Responsibility and Openness (Weight in the Index of MRRT), % |

|---|---|---|---|---|---|

| Sberbank | −1.02 | −1.60 | 0.68 | −0.55 | −0.06 |

| Rosneft | 0.62 | −1.86 | 0.03 | 0.33 | −0.89 |

| Surgutneftegas | 0.05 | −0.31 | 0.29 | −0.53 | −2.00 |

| Gazprom | 0.57 | −2.05 | 0.21 | −0.31 | 0.79 |

| Norilsk Nickel | 0.27 | −1.07 | −1.21 | 4.22 | −2.00 |

| LukOil | 0.23 | 10.08 | −1.33 | −0.68 | 1.08 |

| Transneft | 0.56 | −1.30 | 0.09 | 0.02 | −1.37 |

| Novatek | −0.76 | −1.79 | −1.05 | 4.09 | 4.00 |

| VTB Bank | −1.16 | −1.92 | 1.19 | −1.68 | −1.51 |

| Tatneft | 0.82 | −1.28 | −0.75 | 1.88 | 2.35 |

| Novolipetsk Steel | 0.99 | −1.22 | −1.15 | 3.51 | −2.00 |

| Severstal | 0.72 | −0.83 | −1.26 | 3.91 | −2.00 |

| Rosseti | 1.47 | −1.77 | 0.34 | −1.23 | −1.68 |

| Polyus | −0.45 | −1.08 | −1.40 | 4.69 | 3.35 |

| Inter Rao | 3.58 | −1.24 | −0.67 | −0.41 | 0.70 |

| Magnit | 4.75 | −1.71 | −0.92 | −0.25 | −0.26 |

| Moscow Exchange | −1.87 | −1.90 | 1.18 | −1.24 | −0.19 |

| Magnitogorsk Iron & Steel | 1.11 | −1.46 | −1.02 | 1.98 | 6.76 |

| Credit Bank of Moscow | −1.23 | −1.77 | 1.09 | −1.30 | −2.00 |

| Sistema | 1.84 | −1.93 | 0.03 | −0.48 | −2.00 |

| Company | Profit | Assets | Responsibility and Openness (Weight in the Index of MRRT), % | Total for the Line |

|---|---|---|---|---|

| Sberbank | 10.40 | 486.90 | 15.33 | 512.63 |

| Rosneft | 2.00 | 207.50 | 4.93 | 214.43 |

| Surgutneftegas | 8.40 | 79.40 | 0.00 | 87.80 |

| Gazprom | −0.90 | 294.90 | 16.16 | 310.16 |

| Norilsk Nickel | 3.50 | 20.70 | 0.00 | 24.20 |

| LukOil | 209.70 | 81.50 | 16.24 | 307.44 |

| Transneft | 2.10 | 44.10 | 0.58 | 46.78 |

| Novatek | 0.90 | 27.90 | 7.66 | 36.46 |

| VTB Bank | 0.90 | 245.30 | 1.63 | 247.83 |

| Tatneft | 1.40 | 17.10 | 2.58 | 21.08 |

| Novolipetsk Steel | 1.30 | 9.90 | 0.00 | 11.20 |

| Severstal | 1.70 | 7.50 | 0.00 | 9.20 |

| Rosseti | 0.50 | 35.20 | 0.21 | 35.91 |

| Polyus | 1.60 | 7.30 | 2.84 | 11.74 |

| Inter Rao | 1.00 | 12.30 | 1.08 | 14.38 |

| Magnit | 0.50 | 13.00 | 0.91 | 14.41 |

| Moscow Exchange | 0.30 | 66.70 | 1.65 | 68.65 |

| Magnitogorsk Iron & Steel | 0.60 | 7.60 | 2.96 | 11.16 |

| Credit Bank of Moscow | 0.40 | 38.10 | 0.00 | 38.50 |

| Sistema | 0.10 | 19.20 | 0.00 | 19.30 |

| Total for the column | 246.40 | 1722.10 | 74.76 | 2043.26 |

| Company | Profit | Assets | Responsibility and Openness (Weight in the Index of MRRT), % |

|---|---|---|---|

| Sberbank | 61.82 | 432.05 | 18.76 |

| Rosneft | 25.86 | 180.73 | 7.85 |

| Surgutneftegas | 10.59 | 74.00 | 3.21 |

| Gazprom | 37.40 | 261.41 | 11.35 |

| Norilsk Nickel | 2.92 | 20.40 | 0.89 |

| LukOil | 37.07 | 259.12 | 11.25 |

| Transneft | 5.64 | 39.43 | 1.71 |

| Novatek | 4.40 | 30.73 | 1.33 |

| VTB Bank | 29.89 | 208.88 | 9.07 |

| Tatneft | 2.54 | 17.77 | 0.77 |

| Novolipetsk Steel | 1.35 | 9.44 | 0.41 |

| Severstal | 1.11 | 7.75 | 0.34 |

| Rosseti | 4.33 | 30.27 | 1.31 |

| Polyus | 1.42 | 9.89 | 0.43 |

| Inter Rao | 1.73 | 12.12 | 0.53 |

| Magnit | 1.74 | 12.15 | 0.53 |

| Moscow Exchange | 8.28 | 57.86 | 2.51 |

| Magnitogorsk Iron & Steel | 1.35 | 9.41 | 0.41 |

| Credit Bank of Moscow | 4.64 | 32.45 | 1.41 |

| Sistema | 2.33 | 16.27 | 0.71 |

| Company | Profit | Assets | Responsibility and Openness (Weight in the Index of MRRT), % |

|---|---|---|---|

| Sberbank | −1.66 | 0.25 | −0.37 |

| Rosneft | −1.85 | 0.30 | −0.74 |

| Surgutneftegas | −0.41 | 0.15 | −2.00 |

| Gazprom | −2.05 | 0.26 | 0.85 |

| Norilsk Nickel | 0.40 | 0.03 | −2.00 |

| LukOil | 9.31 | −1.37 | 0.89 |

| Transneft | −1.26 | 0.24 | −1.32 |

| Novatek | −1.59 | −0.18 | 9.48 |

| VTB Bank | −1.94 | 0.35 | −1.64 |

| Tatneft | −0.90 | −0.08 | 4.69 |

| Novolipetsk Steel | −0.07 | 0.10 | −2.00 |

| Severstal | 1.06 | −0.07 | −2.00 |

| Rosseti | −1.77 | 0.33 | −1.68 |

| Polyus | 0.26 | −0.52 | 11.22 |

| Inter Rao | −0.85 | 0.03 | 2.11 |

| Magnit | −1.42 | 0.14 | 1.45 |

| Moscow Exchange | −1.93 | 0.31 | −0.69 |

| Magnitogorsk Iron & Steel | −1.11 | −0.38 | 12.50 |

| Credit Bank of Moscow | −1.83 | 0.35 | −2.00 |

| Sistema | −1.91 | 0.36 | −2.00 |

References

- Auer, Benjamin R. 2021. Implementation and profitability of sustainable investment strategies: An errors-in-variables perspective. Business Ethics, Environment and Responsibility 30: 619–38. [Google Scholar] [CrossRef]

- BankInform. 2021. Sotsial’nye proekty Sberbanka priznany luchshimi v strane [Social Projects of Sberbank Were Acknowledged the Best in the Country]. Available online: https://bankinform.ru/news/108091 (accessed on 11 November 2021).

- Bouri, Elie, Riza Demirer, Rangan Gupta, and Jacob Nel. 2021. COVID-19 pandemic and investor herding in international stock markets. Risks 9: 168. [Google Scholar] [CrossRef]

- Carroll, Archie B. 2021. Corporate social responsibility (CSR) and the COVID-19 pandemic: Organizational and managerial implications. Journal of Strategy and Management 14: 315–30. [Google Scholar] [CrossRef]

- Data World. 2021. Dataset “Forbes Global 2000 2008–2020”. Available online: https://data.world/aroissues/forbes-global-2000-2008-2019 (accessed on 11 November 2021).

- Drozdowski, Grzegorz, Joanna Rogozińska-Mitrut, and Jacek Stasiak. 2021. The empirical analysis of the core competencies of the company’s resource management risk. Preliminary study. Risks 9: 107. [Google Scholar] [CrossRef]

- Forbes. 2021. GLOBAL 2000: How the World’s Biggest Public Companies Endured The Pandemic. Available online: https://www.forbes.com/lists/global2000/#1754e1155ac0 (accessed on 11 November 2021).

- Gennaro, Alessandro. 2021. Insolvency risk and value maximization: A convergence between financial management and risk management. Risks 9: 105. [Google Scholar] [CrossRef]

- Goettsche, Max, Tobias Steindl, and Simon Gietl. 2016. Do customers affect the value relevance of sustainability reporting? Empirical evidence on stakeholder interdependence. Business Strategy and the Environment 25: 149–64. [Google Scholar] [CrossRef]

- Gonçalves, Tiago, Cristina Gaio, and Andre Ferro. 2021. Corporate social responsibility and earnings management: Moderating impact of economic cycles and financial performance. Sustainability 13: 9969. [Google Scholar] [CrossRef]

- Hichri, Abir, and Ltifi Moez. 2021. Corporate social responsibility and financial performance: Bidirectional relationship and the mediating effect of customer loyalty: Investigation in Sweden. Corporate Governance (Bingley) 21: 1495–518. [Google Scholar] [CrossRef]

- Hsiao, Hsiao-Fen, Tingyong Zhong, and Hasan Dincer. 2019. Analysing managers’ financial motivation for sustainable investment strategies. Sustainability 11: 3849. [Google Scholar] [CrossRef] [Green Version]

- Indriastuti, Maya, and Anis Chariri. 2021. The role of green investment and corporate social responsibility investment on sustainable performance. Cogent Business and Management 8: 1960120. [Google Scholar] [CrossRef]

- Jan, Naveed, Arodh Lal Karn, Zeyun Li, and Xiyu Liu. 2021. The relationship between corporate social responsibility reporting and firm performance and the moderating role of firm life cycle stages: Evidence from China. Sustainability 13: 10038. [Google Scholar] [CrossRef]

- Kalaitzoglou, Iordanis, Hui Pan, and Jacek Niklewski. 2021. Corporate social responsibility: How much is enough? A higher dimension perspective of the relationship between financial and social performance. Annals of Operations Research 306: 209–45. [Google Scholar] [CrossRef]

- Koseoglu, Nazil, Rowan Ellis, and Durba Biswas. 2021. Scenario-based life-cycle cost assessment to support sustainable investment in rural communal sanitation facilities: Application to a school-based sanitation facility. Journal of Water Sanitation and Hygiene for Development 11: 771–84. [Google Scholar] [CrossRef]

- Kurniatama, Gandang Ardi, Robiyanto Robiyanto, Gatot Sasongko, and Andrian Dolfriandra Huruta. 2021. Determinants of corporate social responsibility: Empirical evidence from sustainable and responsible investment index. Quality—Access to Success 22: 55–61. [Google Scholar]

- Kuvalin, Dmitry, Yulia Zinchenko, and Pavel Lavrinenko. 2020. Russian Enterprises at the End of 2019: Operating in Conditions of Economic Stagnation and Attitudes towards Corporate Social Responsibility. Studies on Russian Economic Development 31: 335–46. [Google Scholar] [CrossRef]

- Lisicki, Bartlomiej. 2021. Impairment of assets and market reaction during COVID-19 pandemic on the example of WSE. Risks 9: 183. [Google Scholar] [CrossRef]

- Miralles-Quirós, José Luis, María Mar Miralles-Quirós, and José Manuel Nogueira. 2020. Sustainable Development Goals and Investment Strategies: The Profitability of Using Five-Factor Fama-French Alphas. Sustainability 12: 1842. [Google Scholar] [CrossRef] [Green Version]

- Mohanty, Subhransu S. 2019. Does one model fit all in global equity markets? Some insight into market factor based strategies in enhancing alpha. International Journal of Finance and Economics 24: 1170–92. [Google Scholar] [CrossRef]

- Moscow Exchange. 2021. Index “Responsibility and Openness” (MRRT). Available online: https://www.moex.com/ru/index/MRRT/constituents/ (accessed on 11 November 2021).

- Popescu, Ioana-Stefania, Claudia Hitaj, and Enrico Benetto. 2021. Measuring the sustainability of investment funds: A critical review of methods and frameworks in sustainable finance. Journal of Cleaner Production 314: 128016. [Google Scholar] [CrossRef]

- Riaz, Sabahat, Mohamed Hisham Hanifa, and Fauzi Zainirs. 2021. Does foreign institutional equity participation instigate sustainable corporate investment efficiency? Evidence from emerging economies. Sustainability 13: 4190. [Google Scholar] [CrossRef]

- Rosneft. 2021. Sotsial’naya Politika [Social Policy]. Available online: https://www.rosneft.ru/Development/social/ (accessed on 11 November 2021).

- Sarwar, Golam, Cesario Mateus, and Natasa Todorovic. 2018. US sector rotation with five-factor Fama–French alphas. Journal of Asset Management 19: 116–32. [Google Scholar] [CrossRef]

- Sharma, Gagan Deep, Aviral Kumar Tiwari, Gaurav Talan, and Mansi Jain. 2021. Revisiting the sustainable versus conventional investment dilemma in COVID-19 times. Energy Policy 156: 112467. [Google Scholar] [CrossRef]

- Shields, Rachel, Samer Ajour El Zein, and Neus Vila Brunet. 2021. An analysis on the NASDAQ’s potential for sustainable investment practices during the financial shock from Covid-19. Sustainability 13: 3748. [Google Scholar] [CrossRef]

- Singh, Narinder Pal, Priya Makhija, and Elizabeth Chacko. 2021a. Sustainable investment and the COVID-19 effect—Volatility analysis of ESG index. International Journal of Sustainable Economy 13: 357–68. [Google Scholar] [CrossRef]

- Singh, Vikkram, Eduardo Roca, and Bin Li. 2021b. Effectiveness of policy interventions during financial crises in China and Russia: Lessons for the COVID-19 pandemic. Journal of Policy Modeling 43: 253–77. [Google Scholar] [CrossRef]

- Spitsin, Vladislav, Darko Vukovic, Sergey Anokhin, and Lubov Spitsina. 2021. Company performance and optimal capital structure: Evidence of transition economy (Russia). Journal of Economic Studies 48: 313–32. [Google Scholar] [CrossRef]

- Stojanović, Anđelka, Ivan Mihajlović, Natalia Safronova, Svilen Kunev, and Peter Schulte. 2021. The multi-criteria analysis of corporate social responsibility: A comparative study of Russia, Bulgaria and Serbia. Journal of Management and Organization, 1–21. [Google Scholar] [CrossRef]

- Sun, Yunpeng, and Ying Li. 2021. COVID-19 Outbreak and Financial Performance of Chinese Listed Firms: Evidence from Corporate Culture and Corporate Social Responsibility. Frontiers in Public Health 9. [Google Scholar] [CrossRef]

- Surgutneftegaz. 2021. Sotsial’naya Politika [Social Policy]. Available online: https://www.surgutneftegas.ru/responsibility/social_politics/ (accessed on 11 November 2021).

- Tanggamani, Vani, Azlan Amran, and Thurasamy Ramayah. 2020. The virtuous cycle of corporate social responsibility and corporate financial performance: The mediating role of firm reputation. Humanities and Social Sciences Letters 8: 62–77. [Google Scholar] [CrossRef]

- UN. 2021a. Sustainable Development Report 2020. The Sustainable Development Goals and COVID-19. Available online: https://sdgindex.org/reports/sustainable-development-report-2020/ (accessed on 11 November 2021).

- UN. 2021b. Sustainable Development Report 2021. The Decade of Action for the Sustainable Development Goals: Ranking. Available online: https://dashboards.sdgindex.org/rankings (accessed on 11 November 2021).

- UNCTAD. 2021. World Investment Report 2021. Investing in Sustainable Recovery. Available online: https://unctad.org/system/files/official-document/wir2021_overview_ru.pdf (accessed on 11 November 2021).

- UNDP. 2021. The SDGs in Action. Available online: https://www.undp.org/sustainable-development-goals (accessed on 11 November 2021).

- Varyash, Igor, Alexey Mikhaylov, Nikita Moiseev, and Kiril Aleshin. 2020. Triple bottom line and corporate social responsibility performance indicators for Russian companies. Entrepreneurship and Sustainability Issues 8: 313–29. [Google Scholar] [CrossRef]

- Yang, Chi-Lin, and Jung-Ho Lai. 2021. Influence of cross-listing on the relationship between financial leverage and R&D investment: A sustainable development strategy. Sustainability 13: 10341. [Google Scholar] [CrossRef]

- Zahoor, Zahid, Irfan Khan, and Fujun Hou. 2021. Clean energy investment and financial development as determinants of environment and sustainable economic growth: Evidence from China. Environmental Science and Pollution Research. [Google Scholar] [CrossRef] [PubMed]

- Zenghelis, Dimitri. 2021. Why sustainable, inclusive, and resilient investment makes for efficacious post-COVID medicine. Wiley Interdisciplinary Reviews: Climate Change 12: e708. [Google Scholar] [CrossRef]

- Zhao, Tianjiao, and Xiang Xiao. 2019. The impact of corporate social responsibility on financial constraints: Does the life cycle stage of a firm matter? International Review of Economics and Finance 63: 76–93. [Google Scholar] [CrossRef]

- Zhuravlyov, Vladimir, Tatyana Khudyakova, Natalia Varkova, Sergei Aliukov, and Svetlana Shmidt. 2019. Improving the strategic management of investment activities of industrial enterprises as a factor for sustainable development in a crisis. Sustainability 11: 6667. [Google Scholar] [CrossRef] [Green Version]

| Rank 2021 | Name | Sales | Profit | Assets | Market Value | ||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 2021 | 2020 | Growth *, % | 2021 | 2020 | Growth *, % | 2021 | 2020 | Growth *, % | 2021 | 2020 | Growth *, % | ||

| 51 | Sberbank | 47.3 | 47.6 | −0.6 | 10.4 | 10.6 | −1.9 | 486.9 | 0.4 | 118,656.1 | 85.7 | 59.9 | 43.1 |

| 99 | Rosneft | 70.8 | 126.9 | −44.2 | 2.0 | 10.9 | −81.7 | 207.5 | 208.5 | −0.5 | 77.7 | 48.1 | 61.5 |

| 309 | Surgutneftegas | 18.8 | 24.7 | −23.9 | 8.4 | 6.8 | 23.5 | 79.4 | 80.8 | −1.7 | 16.7 | 17.9 | −6.7 |

| 367 | Gazprom | 90.5 | 122.6 | −26.2 | −0.9 | 22.7 | −104.1 | 294.9 | 331.7 | −11.1 | 73.5 | 60.8 | 20.9 |

| 388 | Norilsk Nickel | 15.7 | 13.6 | 15.4 | 3.5 | 5.8 | −39.7 | 20.7 | 19.4 | 6.7 | 53.2 | 43.8 | 21.5 |

| 467 | LukOil | 71.5 | 116.3 | −38.5 | 209.7 | 9.9 | 2018.2 | 81.5 | 95.7 | −14.8 | 52.3 | 41.2 | 26.9 |

| 513 | Transneft | 14.3 | 16.4 | −12.8 | 2.1 | 2.8 | −25.0 | 44.1 | 54.3 | −18.8 | 13.9 | 13.4 | 3.7 |

| 530 | Novatek | 9.6 | 13.2 | −27.3 | 0.9 | 13.4 | −93.0 | 27.9 | 32.5 | −14.2 | 58.4 | 42.6 | 37.1 |

| 597 | VTB Bank | 17.1 | 23.0 | −25.7 | 0.9 | 2.9 | −68.9 | 245.3 | 249.8 | −1.8 | 8.1 | 6.1 | 32.8 |

| 751 | Tatneft | 10.2 | 14.8 | −31.1 | 1.4 | 3.0 | −53.3 | 17.1 | 19.9 | −14.1 | 17.3 | 16.7 | 3.6 |

| 861 | Novolipetsk Steel | 9.2 | 10.1 | −8.9 | 1.3 | 1.2 | 8.3 | 9.9 | 9.7 | 2.1 | 20.9 | 10.4 | 101.0 |

| 908 | Severstal | 7.3 | 7.9 | −7.6 | 1.7 | 1.4 | 21.4 | 7.5 | 7.0 | 7.1 | 19.6 | 10.1 | 94.1 |

| 944 | Rosseti | 13.8 | 15.9 | −13.2 | 0.5 | 1.2 | −54.5 | 35.2 | 43.5 | −19.1 | 3.8 | 3.5 | 8.6 |

| 1001 | Polyus | 5.0 | 4.0 | 25.0 | 1.6 | 1.9 | −15.8 | 7.3 | 8.3 | −12.0 | 26.7 | 21.8 | 22.5 |

| 1155 | Inter Rao | 13.6 | 16.0 | −15.0 | 1.0 | 1.3 | −23.1 | 12.3 | 12.4 | −0.8 | 4.8 | 5.0 | −4.0 |

| 1335 | Magnit | 21.5 | 21.2 | 1.4 | 0.5 | 0.1 | 210.2 | 13.0 | 15.3 | −15.0 | 6.9 | 5.1 | 35.3 |

| 1591 | Moscow Exchange | 0.7 | 0.7 | −1.5 | 0.3 | 0.3 | 11.2 | 66.7 | 64.9 | 2.8 | 5.2 | 3.7 | 40.5 |

| 1605 | Magnitogorsk Iron & Steel | 6.4 | 7.4 | −13.5 | 0.6 | 0.8 | −19.2 | 7.6 | 8.4 | −9.5 | 10.1 | 6.1 | 65.6 |

| 1779 | Credit Bank of Moscow | 2.5 | 2.3 | 8.7 | 0.4 | 0.1 | 170.1 | 38.1 | 39.0 | −2.3 | 2.8 | 2.2 | 27.3 |

| 1818 | Sistema | 9.6 | 10.2 | −5.9 | 0.1 | 0.4 | −77.8 | 19.2 | 20.3 | −5.4 | 4.7 | 1.9 | 147.4 |

| Analytical Procedure | Indicators | Sales | Profit (FinRisk1) | Assets (FinRisk2) | Market Value | |

|---|---|---|---|---|---|---|

| Regression statistics | Multiple R | 0.37 | 0.47 | 0.49 | 0.12 | |

| Number of observations | 20 | |||||

| df | 19 | |||||

| Constant | −7.96 | −54.39 | −2718.17 | 42.18 | ||

| Regression coefficient | −1.15 | 38.69 | 2312.69 | −0.81 | ||

| Analysis of reliability | Significance level | Significance F | 0.11 | 0.04 | 0.03 | 0.62 |

| F-test | Estimate F | 2.78 | 5.10 | 5.61 | 0.25 | |

| Critical F * | 4.41 | |||||

| Result | F-test is not passed | F-test is passed | F-test is passed | F-test is not passed | ||

| Student’s t-test | Estimate t | −1.67 | 2.26 | 2.37 | −0.50 | |

| Critical t * | 2.093 | |||||

| Result | t-test is not passed | t-test is passed | t-test is passed | t-test is not passed | ||

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Kharlanov, A.S.; Bazhdanova, Y.V.; Kemkhashvili, T.A.; Sapozhnikova, N.G. The Case Experience of Integrating the SDGs into Corporate Strategies for Financial Risk Management Based on Social Responsibility (with the Example of Russian TNCs). Risks 2022, 10, 12. https://doi.org/10.3390/risks10010012

Kharlanov AS, Bazhdanova YV, Kemkhashvili TA, Sapozhnikova NG. The Case Experience of Integrating the SDGs into Corporate Strategies for Financial Risk Management Based on Social Responsibility (with the Example of Russian TNCs). Risks. 2022; 10(1):12. https://doi.org/10.3390/risks10010012

Chicago/Turabian StyleKharlanov, Alexey S., Yuliya V. Bazhdanova, Teimuraz A. Kemkhashvili, and Natalia G. Sapozhnikova. 2022. "The Case Experience of Integrating the SDGs into Corporate Strategies for Financial Risk Management Based on Social Responsibility (with the Example of Russian TNCs)" Risks 10, no. 1: 12. https://doi.org/10.3390/risks10010012

APA StyleKharlanov, A. S., Bazhdanova, Y. V., Kemkhashvili, T. A., & Sapozhnikova, N. G. (2022). The Case Experience of Integrating the SDGs into Corporate Strategies for Financial Risk Management Based on Social Responsibility (with the Example of Russian TNCs). Risks, 10(1), 12. https://doi.org/10.3390/risks10010012