Risk Information in Non-Financial Disclosure

Abstract

1. Introduction

2. Literature Review

2.1. Risk Disclosure—Motives, Usefulness, and Determinants

2.2. Risk Disclosure—In Financial or Non-Financial Reporting

2.3. Risk in Non-Financial Disclosure—Standards and Formal Requirements

- “direct economic value generated and distributed,

- financial implications and other risks and opportunities due to climate change,

- defined benefit plan obligations and other retirement plans and finally,

- financial assistance received from the government”.

- “a description of the risk or opportunity and its classification as either physical, regulatory, or other;

- a description of the impact associated with the risk or opportunity;

- the financial implications of the risk or opportunity before action is taken;

- the methods used to manage the risk or opportunity;

- the costs of actions taken to manage the risk or opportunity”.

- “The specific source of risks and opportunities can be internal, external or, commonly, a mix of the two.

- ⚬

- External sources include those stemming from the external environment. Significant factors affecting the external environment include aspects of the legal, commercial, social, environmental and political context that affect the organization’s ability to create value in the short, medium or long term. They can affect the organization directly or indirectly (e.g., by influencing the availability, quality and affordability of a capital that the organization uses or affects).

- ⚬

- Internal sources include those stemming from the organization’s business activities. Key of them include: how the organization differentiates itself in the marketplace (e.g., through product differentiation, market segmentation, delivery channels and marketing); the extent to which the business model relies on revenue generation after the initial point of sale (e.g., extended warranty arrangements or network usage charges); how the organization approaches the need to innovate; how the business model has been designed to adapt to change, initiatives such as process improvement, employee training and relationships management.

- The organization’s assessment of the likelihood that the risk or opportunity will come to fruition and the magnitude of its effect if it does. This includes consideration of the specific circumstances that would cause the risk or opportunity to come to fruition. Such disclosure will invariably involve a degree of uncertainty.

- The specific steps being taken to mitigate or manage key risks or to create value from key opportunities, including the identification of the associated strategic objectives, strategies, policies, targets and key performance indicators”.

3. Materials and Methods

3.1. Sample and Data Collection

3.2. Methodology

Profitability),

- for the variable GRI Standard, we coded 1 if NFD was prepared according to GRI Standards, 0.5 if NFD was based on GRI Standards, and 0 if NFD was prepared according to non-GRI Standards (Polish Standards for Non-Financial Information, Polish Accounting Act, own rules);

- for variables Risk Topics Ratio, Size, and Profitability we applied the fuzzy set direct calibration method (Ragin 2007).

- consistency—the degree to which solution terms and the solution as a whole are subsets of the outcome (Rihoux and Ragin 2008):

- coverage—numeric expression for the empirical importance (sufficiency) and relevance (necessity) of a given condition (or a combination) for producing an outcome (Schneider and Wagemann 2012):

4. Results and Discussion

5. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Abdullah, Maizatulakma Zaleha Abdul Shukor, Zakiah Muhammadun Mohamed, and Azlina Ahmad. 2015. Risk Management Disclosure: A Study on the Effect of Voluntary Risk Management Disclosure toward Firm Value. Journal of Applied Accounting Research 16: 400–32. [Google Scholar] [CrossRef]

- Abraham, Santhosh, and Paul Cox. 2007. Analysing the Determinants of Narrative Risk Information in UK FTSE 100 Annual Reports. The British Accounting Review British Accounting Review 39: 227–48. [Google Scholar] [CrossRef]

- Abraham, Santhosh, and Philip J. Shrives. 2014. Improving the Relevance of Risk Factor Disclosure in Corporate Annual Reports. The British Accounting Review 46: 91–107. [Google Scholar] [CrossRef]

- Ahmed, Anwer S., Anne Beatty, and Bruce Bettinghus. 2004. Evidence on the efficiency of interest rate risk disclosures by commercial banks. The International Journal of Accounting 39: 223–51. [Google Scholar] [CrossRef]

- American Institute of Certified Public Accountants (AICPA). 1987. Report of the Task Force on Risks and Incertainties. New York: American Institute of Certified Public Accountants. [Google Scholar]

- American Institute of Certified Public Accountants (AICPA). 1994. Improving business reporting. In A Customer Focus. New York: American Institute of Certified Public Accountants. [Google Scholar]

- Allen, Matthew M. C., and Maria L. Allen. 2015. Companies Access to Finance, Co-Operative Industrial Relations, and Economic Growth: A Comparative Analysis of the States of South Eastern Europe. Research in International Business and Finance 33: 167–77. [Google Scholar] [CrossRef]

- Allini, Alessandra, Manes Rossi Francesca, and Hussainey Khaled. 2016. The Board’s Role in Risk Disclosure: An Exploratory Study of Italian Listed State-Owned Enterprises. Public Money and Management 36: 113–20. [Google Scholar] [CrossRef]

- Amran, Azlan, Abdul Manaf Rosli Bin, and Bin Che Haat Mohd Hassan. 2009. Risk reporting: An exploratory study on risk management disclosure in Malaysian annual reports. Managerial Auditing Journal 24: 39–57. [Google Scholar] [CrossRef]

- Atan, Ruhaya, Nurdin Enny Sutan Marahun, Wan Abdul Kadir Wan Hasnah, and Jusoff Kamaruzaman. 2010. Annual Risk Reporting of Listed Companies in Malaysia. Journal of Modern Accounting and Auditing 6: 26–38. [Google Scholar]

- Bagnoli, Mark, and Susan G. Watts. 2007. Financial reporting and supplemental voluntary disclosures. Journal of Accounting Research 45: 885–913. [Google Scholar] [CrossRef]

- Bakos, Levente, and Dănut Dumitru Dumitrașcu. 2021. Decentralized enterprise risk management issues under rapidly changing environments. Risks 9: 165. [Google Scholar] [CrossRef]

- Bao, Yang, and Anindya Datta. 2014. Simultaneously discovering and quantifying risk types from textual risk disclosures. Management Science 60: 1371–91. [Google Scholar] [CrossRef]

- Barth, Mary E., and Wayne R. Landsman. 2010. How Did Financial Reporting Contribute to the Financial Crisis? European Accounting Review 19: 399–423. [Google Scholar] [CrossRef]

- Bartoszewicz, Anna, and Anna Rutkowska-Ziarko. 2021. Practice of Non-Financial Reports Assurance Services in the Polish Audit Market—The Range, Limits and Prospects for the Future. Risks 9: 176. [Google Scholar] [CrossRef]

- Beretta, Sergio, and Saverio Bozzolan. 2004. A framework for the analysis of firm risk communication. International Journal of Accounting 39: 265–88. [Google Scholar] [CrossRef]

- Blei, David M., Andrew Y. Ng, and Michael I. Jordan. 2003. Latent Dirichlet Allocation. Journal of Machine Learning Research 3: 993–1022. [Google Scholar]

- Bravo, Franciso. 2017. Are Risk Disclosures an Effective Tool to Increase Firm Value? Managerial and Decision Economics 38: 1116–24. [Google Scholar] [CrossRef]

- Brown, Nerissa C., Richard M. Crowley, and W. Brooke Elliott. 2020. What Are You Saying? Using Topic to Detect Financial Misreporting. Journal of Accounting Research 58: 237–91. [Google Scholar] [CrossRef]

- Buckby, Sherrena, Gerry Gallery, and Jiacheng Ma. 2015. An analysis of risk management disclosures: Australian evidence. Managerial Auditing Journal 30: 812–69. [Google Scholar] [CrossRef]

- Cabedo, J. David, and José Miguel Tirado. 2004. The disclosure of risk in financial statements. Accounting Forum 28: 181–200. [Google Scholar] [CrossRef]

- Campbell, John L., Hsinchun Chen, Dan S. Dhaliwal, Hsin-Min Lu, and Logan B. Steele. 2014. The information content of mandatory risk factor disclosures in corporate filings. Review of Accounting Studies 19: 396–455. [Google Scholar] [CrossRef]

- Chen, Jennifer C., Dennis M. Patten, and Robin W. Roberts. 2008. Corporate charitable contributions: A corporate social performance or legitimacy strategy? Journal of Business Ethics 82: 131–44. [Google Scholar] [CrossRef]

- Cheung, Yan-Leung, Ping Jiang, and W. Weiqiang Tan. 2010. A Transparency Disclosure Index Measuring Disclosures: Chinese Listed Companies. Journal of Accounting Public Policy 29: 259–80. [Google Scholar] [CrossRef]

- CLARIN-PL. 2021. Available online: http://clarin-pl.eu/en/what-is-clarin (accessed on 10 September 2021).

- Cole, Cathy J., and Christopher L. Jones. 2004. The usefulness of MD & A disclosure in the retail industry. Journal of Accounting, Auditing and Finance 9: 361–88. [Google Scholar]

- Cormier, Denis, Michel Magnan, and Barbara Van Velthoven. 2005. Environmental dis- closure quality in large German companies: Economic incentives, public pressures or institutional conditions? The European Accounting Review 14: 3–39. [Google Scholar] [CrossRef]

- Cucari, Nicola. 2019. Qualitative Comparative Analysis in Corporate Governance Research: A Systematic Literature Review of Applications. Corporate Governance: The International Journal of Business in Society 19: 717–34. [Google Scholar] [CrossRef]

- de Villiers, Charl, Leonardo Rinaldi, and Jeffrey Unerman. 2014. Integrated reporting: Insights, gaps and an agenda for future research. Accounting, Auditing and Accountability Journal 27: 1042–67. [Google Scholar] [CrossRef]

- Deegan, Craig. 2000. Financial Accounting Theory. Sydney: McGraw-Hill Book Company. [Google Scholar]

- Deegan, Craig. 2002. Introduction: The legitimising effect of social and environmental disclosures—A theoretical foundation. Accounting, Auditing & Accountability Journal 15: 282–311. [Google Scholar]

- Deegan, Craig, Michaela Rankin, and John Tobin. 2002. An examination of the corporate social and environmental disclosures BHP from 1983–97: A test of legitimacy theory. Accounting, Auditing and Accountability Journal 15: 312–43. [Google Scholar] [CrossRef]

- Deloitte. 2021. Reporting of Non-Financial Information. Available online: https://www2.deloitte.com/content/dam/Deloitte/be/Documents/audit/DT-BE-reporting-of-non-financial-info.pdf (accessed on 3 November 2021).

- Deumes, Rogier. 2008. Corporate Risk Reporting: A Content Analysis of Narrative Risk Disclosures in Prospectuses. Journal of Business Communication 45: 120–57. [Google Scholar] [CrossRef]

- Deumes, Rogier, and W. Robert Knechel. 2008. Economic Incentives for Voluntary Reporting on Internal Risk Management and Control Systems. AUDITING: A Journal of Practice and Theory 27: 35–66. [Google Scholar] [CrossRef]

- Dobler, Michael, Kaouthar Lajili, and Daniel Zéghal. 2011. Attributes of corporate risk disclosure: An international investigation in the manufacturing sector. Journal of International Accounting Research 10: 1–22. [Google Scholar] [CrossRef]

- Domínguez, Luis Rodríguez, and Ligia Carolina Noguera Gámez. 2014. Corporate reporting on risks: Evidence from Spanish companies. Revista de Contabilidad 17: 116–29. [Google Scholar] [CrossRef]

- Drees, Johannes M., and Pursey Heugens. 2013. Synthesising and Extending Resource Dependence Theory: A Meta-Analysis. Journal of Management 39: 1666–98. [Google Scholar] [CrossRef]

- Dyer, Travis, Mark Lang, and Lorien Stice-Lawrence. 2017. The Evolution of 10-K Textual Disclosure: Evidence from Latent Dirichlet Allocation. Journal of Accounting and Economics 64: 221–45. [Google Scholar] [CrossRef]

- Dziwok, Ewa, and Marta Karaś. 2021. Systemic Illiquidity Noise-Based Measure—A Solution for Systemic Liquidity Monitoring in Frontier and Emerging Markets. Risks 9: 124. [Google Scholar] [CrossRef]

- Einhorn, Eti. 2005. The nature of the interaction between mandatory and voluntary disclosures. Journal of Accounting Research 43: 593–621. [Google Scholar] [CrossRef]

- Elamer, Ahmed A., Collins G. Ntim, Hussein A. Abdou, Alaa Mansour Zalata, and Mohamed Elmagrhi. 2019. The impact of multi-layer governance on bank risk disclosure in emerging markets: The case of Middle East and North Africa. Accounting Forum 43: 246–81. [Google Scholar] [CrossRef]

- Elshandidy, Tamer, Ian Fraser, and Khaled Hussainey. 2015. What drives mandatory and voluntary risk reporting variations across Germany, UK, and US? The British Accounting Review 47: 376–94. [Google Scholar] [CrossRef]

- Elshandidy, Tamer, Lorenzo Neri, and Yingxi Guo. 2018a. Determinants and impacts of risk disclosure quality: Evidence from China. Journal of Applied Accounting Research 19: 518–36. [Google Scholar] [CrossRef]

- Elshandidy, Tamer, Philip J. Shrives, Matt Bamber, and Santhosh Abraham. 2018b. Risk reporting: A review of the literature and implications for future research. Journal of Accounting Literature 40: 54–82. [Google Scholar] [CrossRef]

- Elzahar, Hany, and Khaled Hussainey. 2012. Determinants of Narrative Risk Disclosures in UK Interim Reports. The Journal of Risk Finance 13: 133–47. [Google Scholar] [CrossRef]

- European Union. 2014. Directive 2014/95/EU. Official Journal of the European Union 214: 1–9. [Google Scholar]

- Fainshmidt, Stav, Michael A. Witt, Ruth V. Aguilera, and Alain Verbeke. 2020. The Contributions of Qualitative Comparative Analysis (QCA) to International Business Research. Journal of International Business Studies 51: 455–66. [Google Scholar] [CrossRef]

- Fijałkowska, Justyna, and Beata Zyznarska-Dworczak. 2018. Sustainability reporting of Polish banks–A step towards greater accountability. Entrepreneurship and Management 19: 47–61. [Google Scholar]

- Fiss, Peer C. 2007. A Set-Theoretic Approach to Organizational Configurations. Academy of Management Review 32: 1180–98. [Google Scholar] [CrossRef]

- Frączkiewicz-Wronka, Aldona, Tomasz Ingram, Karolina Szymaniec-Mlicka, and Piotr Tworek. 2021. Risk Management and Financial Stability in the Polish Public Hospitals: The Moderating Effect of the Stakeholders’ Engagement in the Decision-Making. Risks 9: 87. [Google Scholar] [CrossRef]

- García-Sánchez, Isabel-Maria, Lazaro Rodríguez-Ariza, and Jose-Valeriano Frías-Aceituno. 2013. The cultural system and integrated reporting. International Business Review 22: 828–38. [Google Scholar] [CrossRef]

- Goloshchapova, Irina, Ser-Huang Poon, Matthew Pritchard, and Phil Reed. 2019. Corporate Social Responsibility Reports: Topic Analysis and Big Data Approach. The European Journal of Finance 25: 1637–54. [Google Scholar] [CrossRef]

- Gray, Rob, Reza Kouhy, and Simon Lavers. 1995. Corporate social and environmental reporting: A review of the literature and a longitudinal study of UK disclosure. Accounting, Auditing and Accountability Journal 8: 47–77. [Google Scholar] [CrossRef]

- Greckhamer, Thomas, Santi Furnari, Peer C. Fiss, and Ruth V. Aguilera. 2018. Studying Configurations with Qualitative Comparative Analysis: Best Practices in Strategy and Organization Research. Strategic Organization 16: 482–95. [Google Scholar] [CrossRef]

- GRI. 2021. Full set of GRI Standards 2021. Available online: https://www.globalreporting.org/how-to-use-the-gri-standards/resource-center/?g=0d615506-dac0-4f46-b75f-5d9bb3ccc675andid=13673 (accessed on 12 December 2021).

- GRI Material Topics. 2021. Available online: https://www.globalreporting.org/media/zauil2g3/public-faqs-universal-standards-_1-october.pdf (accessed on 12 December 2021).

- Guthrie, James, Francesca Manes Rossi, Rebecca Levy Orelli, and Giuseppe Nicolò. 2020. Investigating Risk Disclosures in Italian Integrated Reports. Meditari Accountancy Research 28: 1149–78. [Google Scholar] [CrossRef]

- Hadro, Dominika, Justyna Fijałkowska, Karolina Daszyńska-Żygadło, Ilze Zumente, and Svetlana Mjakuškina. 2021. What Do Stakeholders in the Construction Industry Look for in Non-Financial Disclosure and What Do They Get? Meditari Accountancy Research. Ahead-of-print. [Google Scholar] [CrossRef]

- Hassan, Mostafa Kamal. 2009. UAE Corporations-Specific Characteristics and Level of Risk Disclosure. Managerial Auditing Journal 24: 668–87. [Google Scholar] [CrossRef]

- Healy, Paul M., and Krishna G. Palepu. 2001. Information asymmetry, corporate disclosure, and the capital markets: A review of the empirical disclosure literature. Journal of Accounting and Economics 31: 405–40. [Google Scholar] [CrossRef]

- Heinle, Mirko S., and Kevin C. Smith. 2017. A Theory of Risk Disclosure. Review of Accounting Studies 22: 1459–91. [Google Scholar] [CrossRef]

- Hirschi, Stephan. 2021. Non-financial Reporting: Responsible, far-Sighted Management, PWC. Available online: https://www.pwc.ch/en/insights/disclose/23/non-financial-reporting-responsible-far-sighted-management.htmlv (accessed on 30 October 2021).

- Hope, Ole-Kristian, Danqi Hu, and Hai Lu. 2016. The benefits of specific risk-factor disclosures. Review of Accounting Studies 21: 1005–45. [Google Scholar] [CrossRef]

- Huang, Allen H., Reuven Lehavy, Amy Y. Zang, and Rong Zheng. 2018. Analyst Information Discovery and Interpretation Roles: A Topic Modeling Approach. Management Science 64: 2833–55. [Google Scholar] [CrossRef]

- Humphries, Andrew S., John Towriss, and Richard Wilding. 2007. A Taxonomy of Highly Interdependent, Supply Chain Relationships: The Use of Cluster Analysis. The International Journal of Logistics Management 18: 385–401. [Google Scholar] [CrossRef]

- Institute of Chartered Accountants in England and Wales (ICAEW). 2011. Reporting Business Risks: Meeting Expectations. London: Institute of Chartered Accountants of England and Wales. Available online: https://www.icaew.com/~/media/corporate/files/technical/financial%20reporting/information%20for%20better%20markets/ifbm/rbr%20final.ashx (accessed on 30 October 2021).

- International Framework (IIRF). 2021. January. Available online: https://www.integratedreporting.org/wp-content/uploads/2021/01/InternationalIntegratedReportingFramework.pdf (accessed on 30 October 2021).

- Jackson, Susan T. 2021. Risking Sustainability: Political Risk Culture as Inhibiting Ecology-Centered Sustainability. Risks 9: 186. [Google Scholar] [CrossRef]

- Jacobi, Carina, Wouter van Atteveldt, and Kasper Welbers. 2016. Quantitative Analysis of Large Amounts of Journalistic Texts Using Topic Modelling. Digital Journalism 4: 89–106. [Google Scholar] [CrossRef]

- Jaworska, Sylvia, and Anupam Nanda. 2018. Doing Well by Talking Good: A Topic Modelling-Assisted Discourse Study of Corporate Social Responsibility. Applied Linguistics 39: 373–99. [Google Scholar] [CrossRef]

- Jia, Jing, Lois Munro, and Sherrena Buckby. 2016. A finer-grained approach to assessing the “quality” (“quantity” and “richness”) of risk management disclosures. Managerial Auditing Journal 31: 770–803. [Google Scholar] [CrossRef]

- Jorgensen, Bjorn N., and Michael T. Kirschenheiter. 2003. Discretionary risk disclosures. The Accounting Review 78: 449–69. [Google Scholar] [CrossRef]

- Ketchen, David J., and Christopher L. Shook. 1996. The application of cluster analysis in strategic management research: An analysis and critique. Strategic Management Journal 17: 441–58. [Google Scholar] [CrossRef]

- Kettenring, Jon R. 2006. The Practice of Cluster Analysis. Journal of Classification 23: 3–30. [Google Scholar] [CrossRef]

- Khlif, Hichem, and Khaled Hussainey. 2016. The association between risk disclosure and firm characteristics: A meta-analysis. Journal of Risk Research 19: 181–211. [Google Scholar] [CrossRef]

- Kravet, T., and V. Muslu. 2013. Textual risk disclosures and investors risk perceptions. Review of Accounting Studies 18: 1088–122. [Google Scholar] [CrossRef]

- Lajili, Kaouthar, and Daniel Zéghal. 2005. A content analysis of risk management disclosure in Canadian annual reports. Canadian Journal of Administrative Sciences 22: 125–42. [Google Scholar] [CrossRef]

- Lehavy, Reuven, Feng Li, and Kenneth Merkley. 2011. The effect of annual report readability on analyst following and the properties of their earnings forecasts. The Accounting Review 86: 1087–115. [Google Scholar] [CrossRef]

- Leopizzi, Rossella, Antonio Iazzi, Andrea Venturelli, and Salvatore Principale. 2020. Nonfinancial Risk Disclosure: The “State of the Art” of Italian Companies. Corporate Social Responsibility and Environmental Management 27: 358–68. [Google Scholar] [CrossRef]

- Linsley, Philip M., and Michael J. Lawrence. 2007. Risk reporting by the largest UK companies: Readability and lack of obfuscation. Accounting, Auditing and Accountability Journal 20: 620–27. [Google Scholar] [CrossRef]

- Linsley, Philip, and Philip Shrives. 2000. Risk Management and Reporting Risk in the UK. Journal of Risk 3: 115–29. [Google Scholar] [CrossRef]

- Linsley, Philip, and Philip Shrives. 2005. Transparency and the Disclosure of Risk Information in the Banking Sector. Journal of Financial Regulation and Compliance 13: 205–14. [Google Scholar] [CrossRef]

- Linsley, Philip M., and Philip J. Shrives. 2006. Risk Reporting: A Study of Risk Disclosures in the Annual Reports of UK Companies. The British Accounting Review 38: 387–404. [Google Scholar] [CrossRef]

- Linsley, Philip M., Philip Shrives, and P. Kajuter. 2008. Risk reporting: Development, regulation and current practice. In International Risk Management: Systems, Internal Control and Corporate Governance. Edited by Margaret Woods, Peter Kajuter and Philip Linsley. London: Elsevier, pp. 185–207. [Google Scholar]

- Linsmeier, Thomas J., Daniel B. Thornton, Mohan Venkatachalam, and Michael Welker. 2002. The effect of mandated market risk disclosures on trading volume sensitivity to interest rate, exchange rate, and commodity price movements. The Accounting Review 77: 343–77. [Google Scholar] [CrossRef]

- Lukason, Oliver, and María-del-Mar Camacho-Miñano. 2019. Bankruptcy Risk, Its Financial Determinants and Reporting Delays: Do Managers Have Anything to Hide? Risks 7: 77. [Google Scholar] [CrossRef]

- Lyle, Matthew R., Jeffrey L. Callen, and Robert J. Elliott. 2013. Dynamic risk, accounting-based valuation and firm fundamentals. Review of Accounting Studies 18: 899–929. [Google Scholar] [CrossRef]

- Maggetti, Martino, and David Levi-Faur. 2013. Dealing with errors in QCA. Political Research Quarterly 2013: 198–204. [Google Scholar]

- Magnan, Michel, and Garen Markarian. 2011. Accounting, governance and the crisis: Is risk the missing link? European Accounting Review 20: 215–31. [Google Scholar] [CrossRef]

- Majerova, Ingrid, and Jan Nevima. 2017. The measurement of human development using the Ward method of cluster analysis. Journal of International Studies 10: 239–57. [Google Scholar] [CrossRef]

- Merkl-Davies, Doris M., Niamh M. Brennan, and Stuart J. McLeay. 2011. Impression Management and Retrospective Sense-Making in Corporate Narratives: A Social Psychology Perspective. Accounting, Auditing and Accountability Journal 24: 315–44. [Google Scholar] [CrossRef]

- Miihkinen, Antti. 2012. What drives quality of firm risk disclosure?: The impact of a national disclosure standard and reporting incentives under IFRS. The International Journal of Accounting 47: 437–468. [Google Scholar] [CrossRef]

- Miihkinen, Antti. 2013. The usefulness of firm risk disclosures under different firm riskiness, investor interest, and market conditions: New evidence from Finland. Advances in Accounting, Incorporating Advances in International Accounting 29: 312–31. [Google Scholar] [CrossRef]

- Mohobbot, Ali. 2005. Corporate Risk Reporting Practices in Annual Reports of Japanese Companies. Japanese Journal of Accounting 16: 113–33. [Google Scholar]

- Moolman, Jaco, Merwe Oberholzer, and Maxi Steyn. 2016. The effect of integrated reporting on integrated thinking between risk, opportunity and strategy and the disclosure of risks and opportunities. Southern African Business Review 20: 600–27. [Google Scholar] [CrossRef][Green Version]

- Oliveira, Jonas, Lúcia Lima Rodrigues, and Russell Craig. 2011. Risk-related disclosures by non-finance companies: Portuguese practices and disclosure characteristics. Managerial Auditing Journal. [Google Scholar] [CrossRef]

- Pérignon, Christophe, and Daniel R. Smith. 2010. The level and quality of Value-at-Risk disclosure by commercial banks. Journal of Banking and Finance 34: 362–77. [Google Scholar] [CrossRef]

- Punj, Girish, and David W. Stewart. 1983. Cluster analysis in marketing research: Review and suggestions for application. Journal of Marketing Research 20: 134–48. [Google Scholar] [CrossRef]

- Ragin, Charles C. 1987. The Comparative Method: Moving Beyond Qualitative and Quantitative Strategies. Berkley: University of California Press. [Google Scholar]

- Ragin, Charles C. 2007. Fuzzy Sets: Calibration versus Measurement. Methodology Volume of Oxford Handbooks of Political Science. Oxford: Oxford University, p. 2. [Google Scholar]

- Rajab, Bassam, and Morrison Handley Schachler. 2009. Corporate Risk Disclosure by UK Firms: Trends and Determinants. World Review of Entrepreneurship, Management and Sustainable Development 5: 224. [Google Scholar] [CrossRef]

- Rajgopal, Shivaram. 1999. The Risk Management of Everything: Rethinking the Politics of Uncertainty. London: Demos. [Google Scholar]

- Rihoux, Benoît, and Charles C. Ragin. 2008. Configurational Comparative Methods: Qualitative Comparative Analysis (QCA) and Related Techniques. London: SAGE Publications. [Google Scholar]

- Rubinson, Claude. 2019. Presenting Qualitative Comparative Analysis: Notation, Tabular Layout, and Visualization. Methodological Innovations 12: 205979911986211. [Google Scholar] [CrossRef]

- Saraçli, Sinan, Nurhan Doğan, and İsmet Doğan. 2013. Comparison of Hierarchical Cluster Analysis Methods by Cophenetic Correlation. Journal of Inequalities and Applications 2013: 203. [Google Scholar] [CrossRef]

- Schneider, Carsten Q., and Claudius Wagemann. 2012. Set-Theoretic Methods for the Social Sciences: A Guide to Qualitative Comparative Analysis. Cambridge: Cambridge University Press. [Google Scholar]

- Schonlau, Matthias. 2004. Visualizing non-hierarchical and hierarchical cluster analyses with clustergrams. Computational Statistics 19: 95–111. [Google Scholar] [CrossRef]

- Schrand, Catherine M., and John A. Elliott. 1998. Risk and Financial Reporting: A Summary of the Discussion at the 1997 AAA/FASB Conference. Accounting Horizons 12: 271–82. [Google Scholar]

- Securities and Exchange Commission (SEC). 2010. 17 CFR parts 211, 231 and 241 com- Mission Guidance Regarding Disclosure Related to Climate Change. Washington, DC: SEC. [Google Scholar]

- Seny Kan, Anderson Konan, Emmanuel Adegbite, Sami El Omari, and Mahamat Abdellatif. 2016. On the Use of Qualitative Comparative Analysis in Management. Journal of Business Research 69: 1458–63. [Google Scholar] [CrossRef]

- Serrasqueiro, Rogério Marques, and Tânia Sofia Mineiro. 2018. Corporate Risk Reporting: Analysis of Risk Disclosures in the Interim Reports of Public Portuguese Non-Financial Companies. Contaduria y Administracion 63: 1–15. [Google Scholar] [CrossRef]

- Sheraz, Muhammad, and Imran Nasir. 2021. Information-Theoretic Measures and Modeling Stock Market Volatility: A Comparative Approach. Risks 9: 89. [Google Scholar] [CrossRef]

- Shivaani, M. V., P. K. Jain, and Surendra S. Yadav. 2019. Development of a risk disclosure index and its application in an Indian context. Managerial Auditing Journal 35: 1–23. [Google Scholar] [CrossRef]

- Singleton-Green, Brian. 2012. Commentary: Financial reporting and financial stability: Causes and effects. Australian Accounting Review 22: 15–17. [Google Scholar] [CrossRef]

- Solomon, Jill Frances. 1999. Do institutional investors in the UK adopt a dual strategy for managing foreign exchange risk? The British Accounting Review 31: 205–24. [Google Scholar] [CrossRef]

- Solomon, Morton B., and Joe R. Cooper. 1990. Reporting on Internal Control: The SEC’s Proposed Rules. Journal of Accountancy 169: 56. [Google Scholar]

- Solomon, Jill Frances, Aris Solomon, Simon D. Norton, and Nathan L. Joseph. 2000. A conceptual framework for corporate risk disclosure emerging from the agenda for corporate governance reform. The British Accounting Review 32: 447–78. [Google Scholar] [CrossRef]

- Solomon, Jill Frances, Aris Solomon, Simon D. Norton, and Nathan. L. Joseph. 2011. Private climate change reporting: An emerging discourse of risk and opportunity? Accounting, Auditing and Accountability Journal 24: 1119–48. [Google Scholar] [CrossRef]

- Steurer, Reinhard. 2010. The role of governments in corporate social responsibility: Characterising public policies on CSR in Europe. Policy Sciences 43: 49–72. [Google Scholar] [CrossRef]

- Steurer, R. 2015. CSR and governments: Public policies on CSR in Europe. Corporate Social Responsibility 2015: 240. [Google Scholar]

- Steyn, Maxi. 2014. Organisational benefits and implementation challenges of mandatory integrated reporting: Perspectives of senior executives at South African listed companies. Sustainability Accounting, Management and Policy Journal 5: 476–503. [Google Scholar] [CrossRef]

- STOCKWATCH.PL. 2021. Available online: www.stockwatch.pl (accessed on 10 December 2021).

- Sundgren, Stefan, Juha Mäki, and Antonio Somoza-López. 2018. Analyst coverage, market liquidity and disclosure quality: A study of fair-value disclosures by European real estate companies under IAS 40 and IFRS 13. The International Journal of Accounting 53: 54–75. [Google Scholar] [CrossRef]

- Szczepankiewicz, Elżbieta I. 2011. Selected issues in effective implementation of the integrated risk management system in an organization. Zeszyty Naukowe Uniwersytetu Szczecińskiego. Finanse, Rynki Finansowe, Ubezpieczenia 49: 153–62. [Google Scholar]

- Szczepankiewicz, Elzbieta I. 2021. Identification of Going-Concern Risks in CSR and Integrated Reports of Polish Companies from the Construction and Property Development Sector. Risks 9: 85. [Google Scholar] [CrossRef]

- Szegö, Giorgio. 2002. Measure of risk. Journal of Banking and Finance 26: 1253–72. [Google Scholar] [CrossRef]

- Tan, Youchao, Cheng Colin Zeng, and Tamer Elshandidy. 2017. Risk disclosures, international orientation, and share price informativeness: Evidence from China. Journal of International Accounting, Auditing and Taxation 29: 81–102. [Google Scholar] [CrossRef]

- Terblanche, Wendy, and Charl De Villiers. 2019. The influence of integrated reporting and internationalization on intellectual capital disclosures. Journal of Intellectual Capital 20: 40–59. [Google Scholar] [CrossRef]

- Tirado-Beltrán, Jose Miguel, J. David Cabedo, and Dennis Esther Muñoz-Ramírez. 2020. Risk Disclosure and Cost of Equity: A Bayesian Approach. Revista CEA 6: 25–43. [Google Scholar] [CrossRef]

- Truant, Elisa, Laura Corazza, and Simone Scagnelli. 2017. Sustainability and Risk Disclosure: An Exploratory Study on Sustainability Reports. Sustainability 9: 636. [Google Scholar] [CrossRef]

- Ulupui, Igka, Yunika Murdayanti, Muhammad Yusuf, Indra Pahala, and Adam Zakaria. 2020. Integrated Reporting Disclosure and Its Implications on Investor Reactions. The Journal of Asian Finance, Economics, and Business 7: 433–44. [Google Scholar] [CrossRef]

- Vandemaele, Sigrid, Philip Vergauwen, and A. Michels. 2009. Management Risk Reporting Practices and Their Determinants: A Study of Belgian Listed Firms. Available online: http://hdl.handle.net/1942/9392 (accessed on 10 September 2021).

- Veltri, Stefania. 2020. Mandatory Non-Financial Risk-Related Disclosure. Berlin/Heidelberg: Springer. [Google Scholar]

- Venkatachalam, Mohan. 1996. Value-relevance of banks’ derivative disclosures. Journal of Accounting and Economics 22: 327–55. [Google Scholar] [CrossRef]

- Venturelli, Andrea, Fabio Caputo, Rossella Leopizzi, and Simone Pizzi. 2019. The State of Art of Corporate Social Disclosure before the Introduction of Non-Financial Reporting Directive: A Cross Country Analysis. Social Responsibility Journal 15: 409–23. [Google Scholar] [CrossRef]

- Verrecchia, Robert E. 1983. Discretionary disclosure. Journal of Accounting and Economics 5: 179–94. [Google Scholar] [CrossRef]

- Wagemann, Claudius, Jonas Buche, and Markus B. Siewert. 2016. QCA and Business Research: Work in Progress or a Consolidated Agenda? Elsevier Enhanced Reader. Journal of Business Research 69: 2531–40. [Google Scholar] [CrossRef]

- Walkowiak, Tomasz, and Piotr Malak. 2018. Polish Texts Topic Classification Evaluation. Paper presented at 10th International Conference on Agents and Artificial Intelligence, Madeira, Portugal, January 16–18; Portugal: SCITEPRESS-Science and Technology Publications, pp. 515–22. [Google Scholar] [CrossRef]

- Ward, Joe H., Jr. 1963. Hierarchical grouping to optimize an objective function. Journal of the American Statistical Association 58: 236–44. [Google Scholar] [CrossRef]

- Wong, Anson. 2013. Corporate sustainability through non-financial risk management. International Journal of Business Management 14: 575–66. [Google Scholar] [CrossRef]

- WSE. 2019. WSE Yearbook for 2018, Warsaw Stock Exchange. Available online: www.gpw.pl (accessed on 10 December 2021).

| Information Category | N | ||||

| All | 126 | ||||

| Industry | Finance | 3 | |||

| Oil & Energy | 9 | ||||

| Chemicals & Materials | 18 | ||||

| Industrials | 43 | ||||

| Consumer Goods | 27 | ||||

| Trade & Services | 13 | ||||

| Health Care | 5 | ||||

| Technology | 8 | ||||

| NFD Standard | non-GRI | 68 | |||

| GRI | 38 | ||||

| based on GRI | 20 | ||||

| Disclosure Type | MD&A Part | 57 | |||

| NFI Report | 50 | ||||

| CSR/Sustainability Report | 11 | ||||

| Integrated Report | 8 | ||||

| Statistic Measure | Mean | Median | Min | Max | St. Dev. |

| Total Assets (in thousands of EURO) | 680,200.83 | 219,904 | 1582.80 | 8,660,000 | 1,494,638.67 |

| ROA (Net Income/Assets) | 2.53% | 3.40% | −53.33% | 89.92% | 0.12 |

| Leverage (Debt/Equity) | 1.51 | 16.85 | −6.60 | 10.68 | 1.84 |

| No of Employees | 4395.22 | 1685 | 214 | 41,231 | 7212.24 |

| Age | 40 | 28 | 10 | 142 | 28.32 |

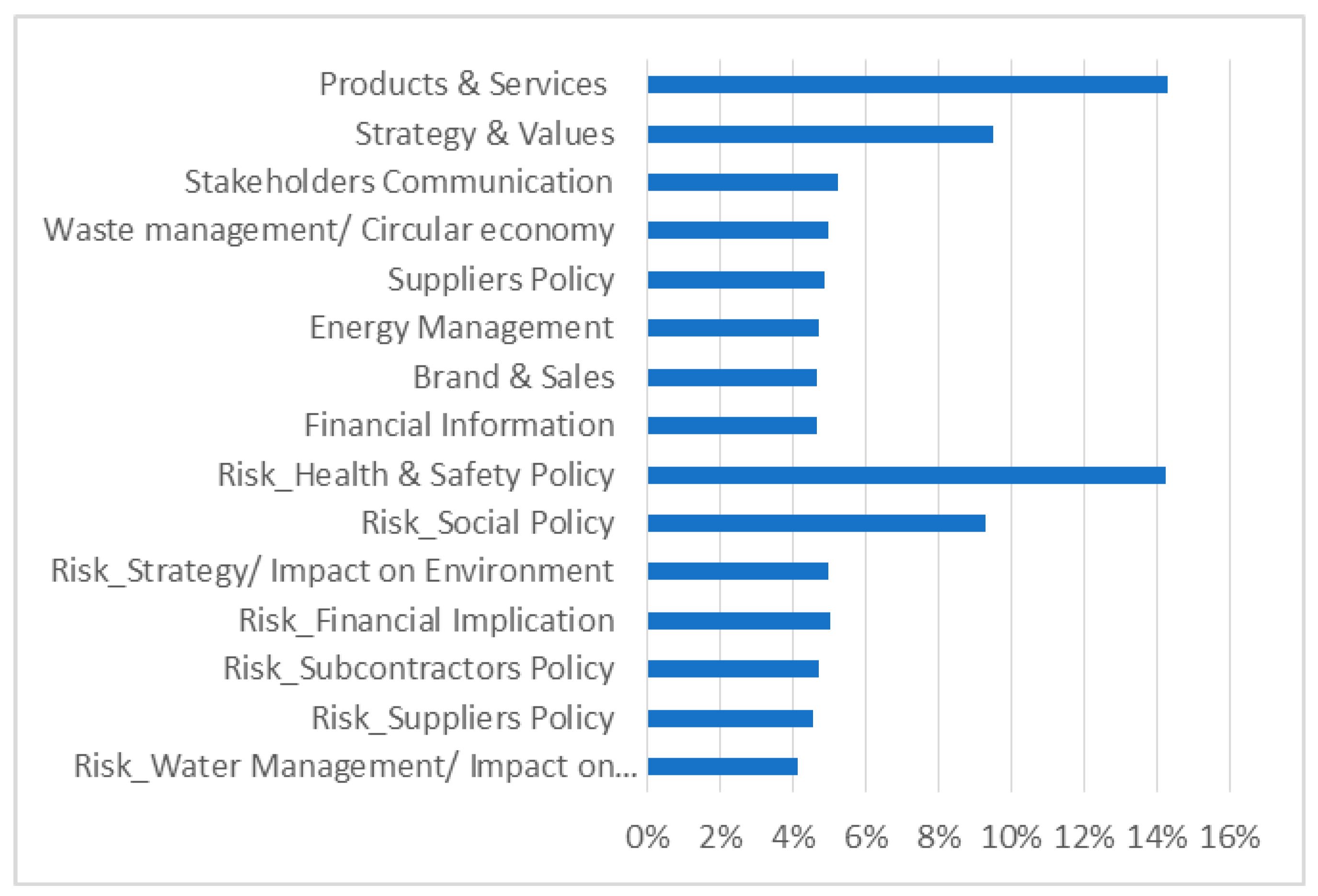

| Risk Topic | Ten Most Frequent Words within a Topic | Topic Share |

|---|---|---|

| Health & Safety Policy | Employee, protection, social, risk, procedure, safety, accident, policy, human, hazard | 30.17% |

| Social Policy | Employee, labor, activity, risk, environment, social, compliance, policy, ethics, protection | 20.08% |

| Strategy/Impact on environment | Production, mining, safety, metal, principle, design, risk, strategy, value, global | 10.67% |

| Financial Implication | Service, financial, risk, customer, network, result, management, operational, cost, obligation | 10.39% |

| Subcontractors’ Policy | Construction, realization, investment, work, risk, project, agreement, contract, service, subcontractor | 10.09% |

| Suppliers’ Policy | Product, work, system, employee, supplier, risk, indicator, market, client, ethics | 9.73% |

| Water management/Impact on environment | Activity, segment, environment, water, protection, production, metal, chemical, operation, risk | 8.87% |

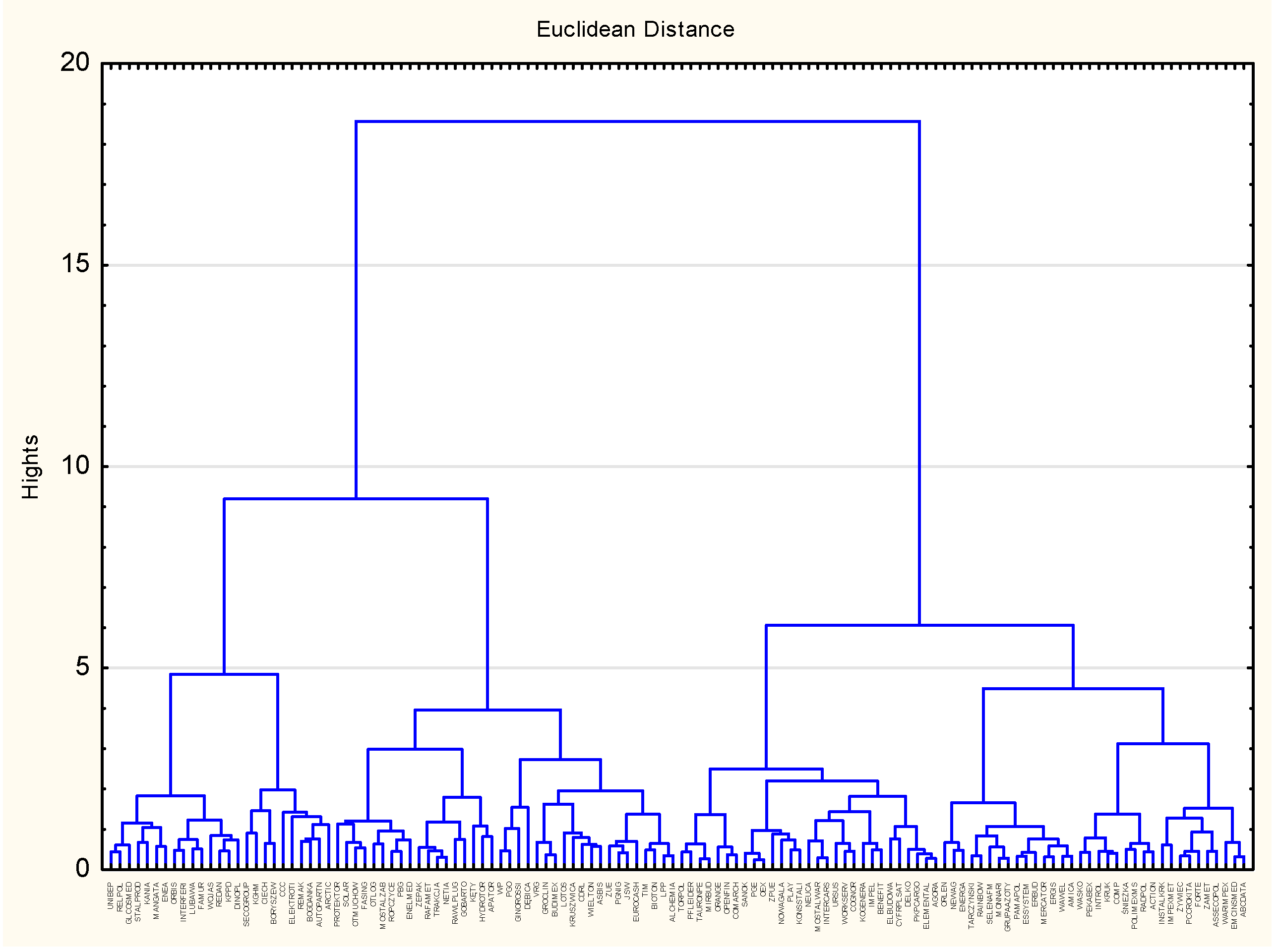

| Mean Values of Risk Topic Alpha | ||||||

|---|---|---|---|---|---|---|

| Risk Topic | All | Cluster 1 | Cluster 2 | Cluster 3 | Cluster 4 | p-Value |

| Health & Safety Policy | 1.24 | 1.96 | 1.28 | 1.16 | 0.71 | *** |

| Social Policy | 0.82 | 0.86 | 1.11 | 0.48 | 0.75 | *** |

| Strategy/Impact on Environment | 0.44 | 0.49 | 0.62 | 0.38 | 0.23 | ** |

| Financial Implication | 0.43 | 0.49 | 0.45 | 0.33 | 0.42 | * |

| Subcontractors’ Policy | 0.41 | 0.39 | 0.49 | 0.37 | 0.37 | |

| Suppliers’ Policy | 0.40 | 0.55 | 0.43 | 0.30 | 0.32 | *** |

| Water Management/Impact on Environment | 0.36 | 0.35 | 0.44 | 0.28 | 0.34 | ** |

| Sum | 4.10 | 5.09 | 4.82 | 3.30 | 3.14 | *** |

| No. of Companies | 126 | 25 | 38 | 29 | 34 | |

| Risk Topics Ratio | N | Mean | Variance | St. Dev. | |

|---|---|---|---|---|---|

| All | 126 | 0.4694 | 0.0041 | 0.0642 | |

| Industry | With high E&S risk | 26 | 0.4661 | 0.0048 | 0.0694 |

| With low E&S risk | 100 | 0.4829 | 0.0040 | 0.0628 | |

| NFD Standard | Non-GRI | 68 | 0.4755 | 0.0037 | 0.0609 |

| GRI | 38 | 0.4543 | 0.0053 | 0.0729 | |

| Based on GRI | 20 | 0.4787 | 0.0031 | 0.0558 | |

| Disclosure Type | MD&A part | 57 | 0.4591 | 0.0045 | 0.0673 |

| CSR report | 69 | 0.4783 | 0.0037 | 0.0609 | |

| Variable | Consistency | Coverage |

|---|---|---|

| GRI Standard | 0.40 | 0.47 |

| CSR Report | 0.57 | 0.47 |

| High E&S Risk Industry | 0.20 | 0.45 |

| Size | 0.74 | 0.66 |

| Profitability | 0.78 | 0.73 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Fijałkowska, J.; Hadro, D. Risk Information in Non-Financial Disclosure. Risks 2022, 10, 11. https://doi.org/10.3390/risks10010011

Fijałkowska J, Hadro D. Risk Information in Non-Financial Disclosure. Risks. 2022; 10(1):11. https://doi.org/10.3390/risks10010011

Chicago/Turabian StyleFijałkowska, Justyna, and Dominika Hadro. 2022. "Risk Information in Non-Financial Disclosure" Risks 10, no. 1: 11. https://doi.org/10.3390/risks10010011

APA StyleFijałkowska, J., & Hadro, D. (2022). Risk Information in Non-Financial Disclosure. Risks, 10(1), 11. https://doi.org/10.3390/risks10010011