Estimation of Maximum Potential Losses for Digital Banking Transaction Risks Using the Extreme Value-at-Risks Method

Abstract

:1. Introduction

2. Literature Overview

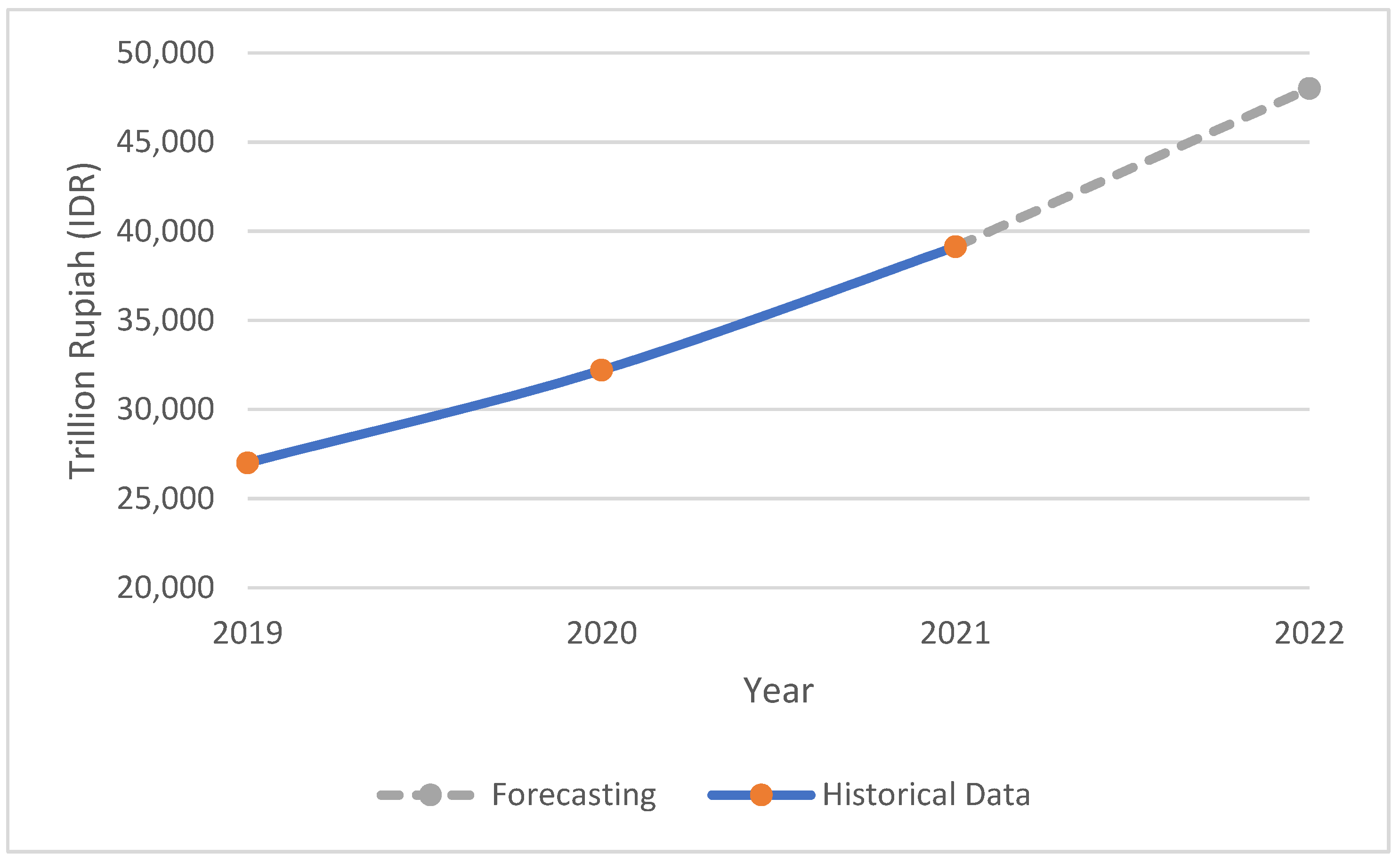

2.1. Digital Banking Transaction

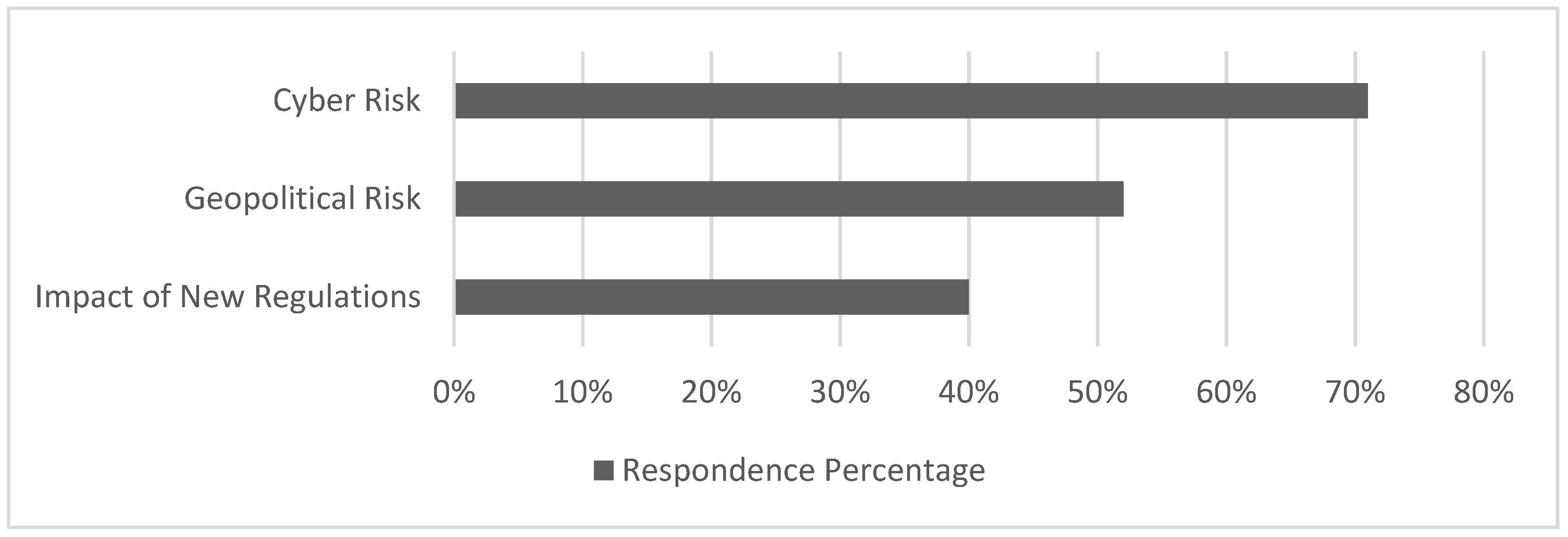

2.2. Digital Banking Transaction Risks

2.3. Operational Risk

2.4. Measurement of Operational Risk Based on the Basel Standard

3. Materials and Methods

3.1. Materials

3.2. Methods

3.2.1. Maximum Entropy Bootstrapping (MEBoot)

3.2.2. Threshold

3.2.3. Extreme Value Theory (EVT)

3.2.4. Peaks-Over-Threshold (POT)

3.2.5. Generalized Pareto Distribution (GPD)

3.2.6. Extreme Value-at-Risk (EVaR) Method

4. Results

4.1. Determination of Threshold and Extreme Data through the MEBoot Process

4.2. Goodness-of-Fit of Extreme Data to the GPD

4.3. Estimation of the GPD Parameter

4.4. Estimation of Maximum Potential Losses

5. Discussion

6. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

References

- Abbate, Donato, Elise Gourier, and Walter Farkas. 2009. Operational risk quantification using extreme value theory and copulas: From theory to practice. The Journal of Operational Risk 4: 1–24. [Google Scholar] [CrossRef] [Green Version]

- Aebi, Vincent, Gabriele Sabato, and Markus Schmid. 2012. Risk Management, Corporate Governance, and Bank Performance in the Financial Crisis. Journal of Banking & Finance 36: 3213–26. [Google Scholar]

- AlAbdullah, Fadhel, Fahad H. Alshammari, Rami Alnaqeib, Hamid A. Jalab, Aos. A. Zaidan, and Bahaa. B. Zaidan. 2010. Analytical Study on Internet Banking System. Journal of Computing 2: 140–46. [Google Scholar]

- Bank for International Settlements. 2016. Regulatory Consistency Assessment Programme (RCAP)—Assessment of Basel III Risk-Based Capital Regulations—Indonesia. Basel: The BIS Media, Available online: https://www.bis.org/bcbs/publ/d394.pdf (accessed on 20 October 2021).

- Bank Indonesia. 2020. Annual Report Bank Indonesia. Available online: https://www.bi.go.id/id/publikasi/laporan/Documents/Laporan_Keuangan_Tahunan_BI_Tahun-2020.pdf (accessed on 15 October 2021).

- Baran, Jaroslav, and Jiri Witzany. 2011. A Comparison of EVT and Standard VaR Estimations. Bulletin of the Czech Econometric Society 19: 1–27. Available online: http://ces.utia.cas.cz/bulletin/index.php/bulletin/article/view/185 (accessed on 15 October 2021). [CrossRef]

- Beccalli, Elena. 2007. Does IT investment improve bank performance? Evidence from Europe. Journal of Banking & Finance 31: 2205–30. [Google Scholar]

- Belás, Jaroslav, Michal Korauš, Felix Kombo, and Antonín Korauš. 2016. Electronic Banking Security and Customer Satisfaction Incommercial Banks. Journal Security Sustainable 5: 411–22. [Google Scholar]

- Boudt, Kris, Peter Carl, and Brian G. Peterson. 2013. Asset allocation with conditional value-at-risk budgets. The Journal of Risk 15: 39–68. [Google Scholar] [CrossRef]

- BRI. 2020. Annual Report BRI. Available online: https://bri.co.id/documents/20123/56786/Annual%20Report%20BRI%202020%20ver%20Indonesia.pdf (accessed on 12 October 2021).

- Carbo-Valverde, Santiago, Pedro Cuadros-Solas, and Francisco Rodríguez-Fernández. 2020a. A Machine Learning Approach to the Digitalization of Bank Customers: Evidence from Random and Causal Forests. PLoS ONE 15: e0240362. [Google Scholar] [CrossRef]

- Carbo-Valverde, Santiago, Pedro J. Cuadros-Solas, and Francisco Rodríguez-Fernández. 2020b. The Effect of Banks’ IT Investments on the Digitalization of their Customers. Global Policy 11: 9–17. [Google Scholar] [CrossRef] [Green Version]

- Casaló, Luis V., Carlos Flavián, and Miguel Guinalíu. 2007. The Role of Security, Privacy, Usability and Reputation in the Development of Online Banking. Online Information Review 31: 583–603. [Google Scholar] [CrossRef]

- Churchill, Craig Farren. 2013. Making Insurance Work for Microfinance Institutions: A Technical Guide to Develop and to Deliver Microinsurance. Geneva: International Labour Organization. [Google Scholar]

- Cividino, Sirio, Gianluca Egidi, Ilaria Zambon, and Andrea Colantoni. 2019. Evaluating the Degree of Uncertainty of Research Activities in Industry 4.0. Future Internet 11: 196. [Google Scholar] [CrossRef] [Green Version]

- Dinçer, Hasan, Anton Lisin, Gözde Gülseven Ubay, and Çağatay Çağlayan. 2021. Identifying the Best Financing Sources for Renewable Energy Companies in Latin American Countries. Contributions to Management Science Book Series. Cham: Springer. [Google Scholar] [CrossRef]

- DTCC. 2017. DTCC Systemic Risk Barometer 2017 Q1. Available online: https://www.dtcc.com/news/2017/may/22/dtcc-systemic-risk-barometer-survey-reveals-increased-concerns-over-cyber-risk (accessed on 30 September 2021).

- Efron, Bradley. 1982. The Jacknife, the Bootstrap and Other Resampling Plans. Stanford: National Science Foundation, Division of Biostatistics. [Google Scholar]

- Esterhuysen, Jánel, Paul Styger, and Gary Van Vuuren. 2008. Calculating Operational Value-at-Risk in a Retail Bank. South Adrican Journal of Economic and Management Sciences 11: 1–16. [Google Scholar] [CrossRef] [Green Version]

- Ferreira, Suné, and Zandri Dickason-Koekemoer. 2019. A conceptual model of operational risk events in the banking sector. Cogent Economics & Finance 7: 1706394. [Google Scholar] [CrossRef]

- Ferreira, Ana, and Laurens De Haan. 2015. On the block maxima method in extreme value theory: PWM estimators. The Annals of Statistics 43: 276–98. [Google Scholar] [CrossRef] [Green Version]

- Gambrah, Priscilla Serwaa Nkyira, and Traian Adrian Pirvu. 2014. Risk Measures and Portfolio Optimization. Journal of Risk and Financial Management 7: 113–29. [Google Scholar] [CrossRef] [Green Version]

- Gilli, Manfred, and Evis Këllezi. 2006. An Application of Extreme Value Theory for Measuring Financial Risk. Society for Computational Economics 27: 207–28. [Google Scholar] [CrossRef] [Green Version]

- Gomes, M. Ivette, and Armelle Guillou. 2015. Extreme Value Theory and Statistics of Univariate Extremes: A Review. International Statistical Review 83: 263–292. Available online: https://onlinelibrary.wiley.com/doi/abs/10.1111/insr.12058 (accessed on 5 October 2021). [CrossRef] [Green Version]

- Government of Indonesia. 2000. Law No. 30. Available online: https://peraturan.bpk.go.id/Home/Details/45002 (accessed on 27 September 2021).

- He, Zhaozhao. 2015. Rivalry, Market Structure and Innovation: The Case of Mobile Banking. Review of Industrial Organization 47: 219–42. [Google Scholar] [CrossRef] [Green Version]

- Hernández-Murillo, Rubén, Gerard Llobet, and Roberto Fuentes. 2010. Strategic Online Banking Adoption. Journal of Banking & Finance 34: 1650–63. [Google Scholar]

- Hubbert, Simon. 2012. Essential Mathematics for Market Risk Management. Hoboken: John Wiley & Sons Ltd. [Google Scholar]

- Iman, Shrestha. 2020. Changes in Technological Payment Systems in Banking Sector of India. International Journal of Advanced Science and Technology 29: 2911–21. Available online: http://sersc.org/journals/index.php/IJAST/article/view/22976 (accessed on 2 October 2021).

- Institute of International Finance. 2017. The Future of Risk Management in the Digital Era. McKinsey & Company Report. Washington, DC: Institute of International Finance. [Google Scholar]

- Jang-Jaccard, Julian, and Surya Nepal. 2014. A survey of emerging threats in cybersecurity. Journal of Computer and System Sciences 80: 973–93. [Google Scholar] [CrossRef]

- Jocković, Jelena. 2012. Quantile estimation for the generalized pareto distribution with application to finance. Yugoslav Journal of Operations Research 22: 297–311. [Google Scholar] [CrossRef]

- Kang, Suyeon, and Jongwoo Song. 2017. Parameter and quantile estimation for the generalized Pareto distribution in peaks over threshold framework. Journal of the Korean Statistical Society 46: 487–501. [Google Scholar] [CrossRef]

- Keister, Todd, and James McAndrews. 2009. Why Are Banks Holding So Many Excess Reserves? Federal Reserve Bank of New York Staff Reports, No. 380. New York: Federal Reserve Bank of New York. [Google Scholar]

- Lubis, Alexander, Constantinos Alexiou, and Joseph G. Nellis. 2019. Payment System Innovations and Financial Intermediation: The Case Of Indonesia. ADBI (Asian Development Bank Institute) Working Paper Series. Tokyo: ADBI. [Google Scholar]

- Makarov, Mikhail. 2007. Applications of exact extreme value theorem. The Journal of Operational Risk 2: 115–20. Available online: https://evmtech.com/wp-content/uploads/2013/02/Exact-EVT.pdf (accessed on 5 October 2021). [CrossRef] [Green Version]

- Mbama, Cajetan Ikechukwu, Patrick Ezepue, Lyuba Alboul, and Martin Beer. 2018. Digital banking, customer experience and financial performance. Journal of Research in Interactive Marketing 12: 432–51. [Google Scholar] [CrossRef] [Green Version]

- Mikhaylov, Alexey Yu. 2021. Development of Friedrich von Hayek’s theory of private money and economic implications for digital currencies. Terra Economicus 19: 53–62. [Google Scholar] [CrossRef]

- Mishra, Mayank. 2020. Evolution of the Invisible bank: How Partnerships with FinTechs Are Driving Digital Innovation. Journal of Digital Banking 5: 36–40. Available online: https://hstalks.com/article/5804/evolution-of-the-invisible-bank-how-partnerships-w/ (accessed on 2 October 2021).

- Muteba Mwamba, John, and Isaah Mhlanga. 2013. Extreme Conditional Value at Risk: A Coherent Scenario for Risk Management. München: Munich Personal RePEc Archive. [Google Scholar]

- Mwamba, John W. Muteba, Shawkat Hammoudeh, and Rangan Gupta. 2017. Financial tail risks in conventional and Islamic stock markets: A comparative analysis. Pacific-Basin Finance Journal 42: 60–82. [Google Scholar] [CrossRef] [Green Version]

- Nethravathi, Rao, Periyapatna Sathyanarayana, Gokarna Vidya Bai, Cristi Spulbar, Mendon Suhan, Ramona Birau, Toni Calugaru, Iqbal Thonse Hawaldar, and Abdullah Ejaz. 2020. Business intelligence appraisal based on customer behaviour profile by using hobby based opinion mining in India: A case study. Economic Research-Ekonomska Istraživanja 33: 1889–908. [Google Scholar] [CrossRef]

- Ojeniyi, Joseph A., Elizabeth O. Edward, and Shafii M. Abdulhamid. 2019. Security Risk Analysis in Online Banking Transactions: Using Diamond Bank as a Case Study. International Journal of Education and Management Engineering 9: 1–14. [Google Scholar] [CrossRef]

- Ortiz, Roberto, Mauricio Contreras, and Cristhian Mellado. 2021. Improving the volatility of the optimal weights of the Markowitz model. Economic Research-Ekonomska Istraživanja, 1–23. [Google Scholar] [CrossRef]

- Rahman, Ashiqur, Zoltan Rozsa, and Martin Cepel. 2018. Trade Credit and Bank Finance—Evidence from the Visegrad Group. Journal of Competitiveness 10: 132–48. [Google Scholar] [CrossRef] [Green Version]

- Rydman, Max. 2008. Application of the Peaks-Over-Threshold Method on Insurance Data. Project Report. Uppsala: Uppsala University. [Google Scholar]

- Sarma, Gunajit, and Pranav Kumar Singh. 2010. Internet Banking: Risk Analysis and Applicability of Biometric Technology for Authentication. International Journal of Pure and Applied Sciences and Technology 1: 67–78. [Google Scholar]

- Sathyanarayana. 2014. Risk Management in E-Banking Sector—An Analytical Study. European Scientific Journal 1: 357–60. Available online: https://eujournal.org/index.php/esj/article/view/4104/3937 (accessed on 15 October 2021).

- Survey on Financial Inclusion and Access (SOFIA). 2017. Understanding ‘People’s Use of Financial Services in Indonesia; Jakarta: Indonesian Ministry of National Development Planning (BAPPENAS). Available online: https://www.bappenas.go.id/files/6415/1668/2623/SOFIA_Report_May_2017_low_res.pdf (accessed on 18 October 2021).

- Susanto, Aries, Younghoon Chang, and Youngwook Ha. 2016. Determinants of Continuance Intention to Use the Smartphone Banking Services: An Extension to the Expectation-Confirmation Model. Industrial Management and Data Systems 116: 508–52. Available online: https://www.cjournal.cz/files/300.pdf (accessed on 2 October 2021). [CrossRef]

- Tanase, Rareş D., and Răzvan Serbu. 2010. Operational Risk and E-Banking. Bulletin of the Transilvania University of Braşov: Economic Sciences 3: 327. [Google Scholar]

- van Schalkwyk, Garth J., and Peter J. Witbooi. 2017. A Model for Bank Reserves Versus Treasuries under Basel III. Applied Stochastic Models in Business and Industry 33: 237–47. [Google Scholar]

- Vinod, Hrishikesh D., and Javier López-de-Lacalle. 2009. Maximum Entropy Bootstrap for Time Series: The MEBoot R Package. Journal of Statistical Software 29: 1–19. [Google Scholar] [CrossRef] [Green Version]

- Williams, R., J. D. Van Heerden, and W. J. Conradie. 2018. Value at Risk and Extreme Value Theory: Application To The Johannesburg Securities Exchange. Studies in Economics and Econometrics 42: 87–114. [Google Scholar] [CrossRef]

- Yanagawa, Eiichiro. 2020. Technology-driven Next-Gen Corporate Banking: Trends and Implications in APAC and Japan. Journal of Digital Banking 5: 61–82. [Google Scholar]

- Yao, Fengge, Hongmei Wen, and Jiaqi Luan. 2013. CVaR measurement and operational risk management in commercial banks according to the peak value method of extreme value theory. Mathematical and Computer Modelling 58: 15–27. [Google Scholar] [CrossRef]

- Yoon, Hyun Shik, and Linsey M. Barker Steege. 2013. Development of a quantitative model of the impact of customers’ personality and perceptions on Internet banking use. Computers in Human Behavior 29: 1133–41. [Google Scholar] [CrossRef]

- Zabala Aguayo, Francisco, and Beata Ślusarczyk. 2020. Risks of Banking Services’ Digitalization: The Practice of Diversification and Sustainable Development Goals. Sustainability 12: 4040. [Google Scholar] [CrossRef]

- Zhao, Xu, Zhongxian Zhang, Weihu Cheng, and Pengyue Zhang. 2019. A New Parameter Estimator for the Generalized Pareto Distribution under the Peaks over Threshold Framework. Mathematics 7: 406. [Google Scholar] [CrossRef] [Green Version]

- Zhu, Xiaoqian, Jianping Li, and Dengsheng Wu. 2019. Should the Advanced Measurement Approach for Operational Risk be Discarded? Evidence from the Chinese Banking Industry. Review of Pacific Basin Financial Markets and Policies 22: 1950007. [Google Scholar] [CrossRef]

| Authors | Titles | Methods | Risks (Variables) |

|---|---|---|---|

| Gilli and Këllezi (2006) | An Application of Extreme Value Theory for Measuring Financial Risk | Extreme value theory, value-at-risk, expected shortfall | Market risk, financial series, daily returns of some financial portfolios |

| Esterhuysen et al. (2008) | Calculating Operational Value-at-Risk in a Retail Bank | Operational value-at-risk, advanced measurement approach, standardized approach | Operational losses data in the retail bank, gross income, net interest income |

| Yao et al. (2013) | CVaR Measurement and Operational Risk Management in Commercial Banks According to the Peak Value Method of the Extreme Value Theory | Conditional value-at-risk, peak value method, extreme value theory | Operational risks, losses data of commercial banks |

| van Schalkwyk and Witbooi (2017) | A Model for Bank Reserves Versus Treasuries under Basel III | Portfolio diversification, stochastic optimal control | Deposit risk, cumulative cost, net cash flows in a bank |

| This work | The Estimation of Maximum Potential Losses of Digital Banking Transactions Risks Using the Extreme Value-at-Risks Method | Extreme value-at-risk, portfolio approach | Operational risks, digital banking transactions risks |

| Risk Type | Resample | Lots of Data | Lots of Extreme Data | Threshold (IDR) |

|---|---|---|---|---|

| Downtime | 10 | 1230 | 123 | IDR81,080,836,365 |

| Timeout | 10 | 1230 | 123 | IDR64,806,050,343 |

| (a) | |||||

| Kolmogorov–Smirnov Test | |||||

| Sample Size | 123 | ||||

| Statistic | 0.0599 | ||||

| p-Value | 0.74642 | ||||

| 0.2 | 0.1 | 0.05 | 0.02 | 0.01 | |

| Critical Value | 0.09675 | 0.11207 | 0.12245 | 0.13687 | 0.14688 |

| Reject? | No | No | No | No | No |

| (b) | |||||

| Kolmogorov–Smirnov Test | |||||

| Sample Size | 123 | ||||

| Statistic | 0.09628 | ||||

| p-Value | 0.19151 | ||||

| 0.2 | 0.1 | 0.05 | 0.02 | 0.01 | |

| Critical Value | 0.09675 | 0.11207 | 0.12245 | 0.13687 | 0.14688 |

| Reject? | No | No | No | No | No |

| Descriptive Statistics | (Timeout Risks) | (Downtime Risks) |

|---|---|---|

| Data | 123 | 123 |

| Mean | 118,715,100,522.2 | 116,326,654,020.561 |

| Standard Deviation | 54,110,542,295.94 | 43,314,723,866.9 |

| Sample Variance | 2.927950787 × 1025 | 1.876165303 × 1021 |

| Kurtosis | 0.263336436495423 | 3.67055481773892 |

| Skewness | 1.16545766227375 | 2.01686434554239 |

| Minimum | 65,183,178,591.0188 | 81,410,403,286.1475 |

| Maximum | 286,932,960,062.233 | 278,181,957,858.857 |

| Sum | 1,4601,957,364,231 | 14,308,178,444,528.9 |

| Parameter | Timeout Risk | Downtime Risk |

|---|---|---|

| Shape Parameter | −0.4513410383432 | −0.367209611440187 |

| Scale Parameter | 118,715,100,522.203 | 116,326,654,020.561 |

| Risk | EVaR | Weight of Risks |

|---|---|---|

| Timeout Risk | IDR135,465,044,269 | 0.4708 |

| Downtime Risk | IDR152,268,681,535 | 0.5292 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2022 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Saputra, M.P.A.; Sukono; Chaerani, D. Estimation of Maximum Potential Losses for Digital Banking Transaction Risks Using the Extreme Value-at-Risks Method. Risks 2022, 10, 10. https://doi.org/10.3390/risks10010010

Saputra MPA, Sukono, Chaerani D. Estimation of Maximum Potential Losses for Digital Banking Transaction Risks Using the Extreme Value-at-Risks Method. Risks. 2022; 10(1):10. https://doi.org/10.3390/risks10010010

Chicago/Turabian StyleSaputra, Moch Panji Agung, Sukono, and Diah Chaerani. 2022. "Estimation of Maximum Potential Losses for Digital Banking Transaction Risks Using the Extreme Value-at-Risks Method" Risks 10, no. 1: 10. https://doi.org/10.3390/risks10010010

APA StyleSaputra, M. P. A., Sukono, & Chaerani, D. (2022). Estimation of Maximum Potential Losses for Digital Banking Transaction Risks Using the Extreme Value-at-Risks Method. Risks, 10(1), 10. https://doi.org/10.3390/risks10010010