Time-Varying Comovement of Foreign Exchange Markets: A GLS-Based Time-Varying Model Approach

Abstract

1. Introduction

2. Model

2.1. Exchange Rate Dynamics and Cointegration

2.2. The Vector Error-Correction Model

2.3. The Time-Varying VEC Model

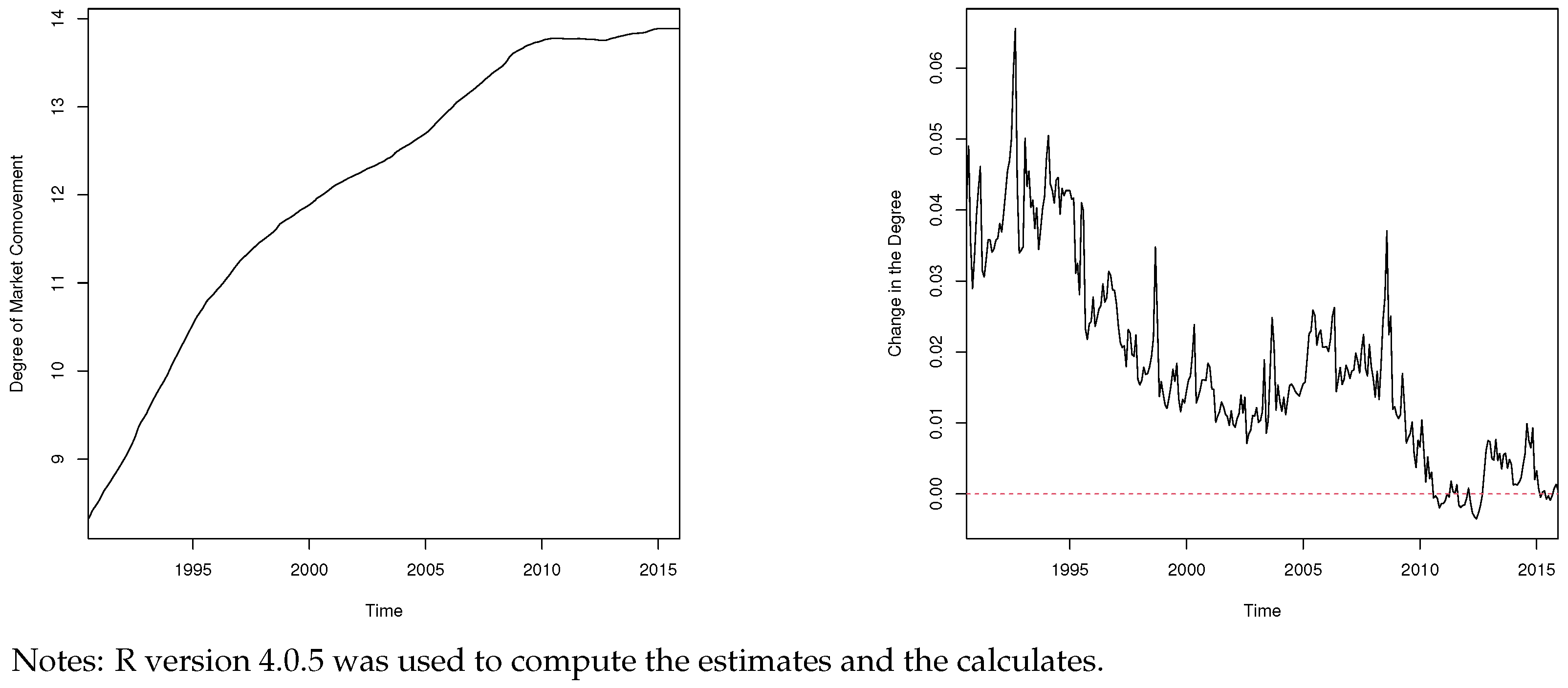

2.4. The Degree of Market Comovement

2.5. Confirming Our Assumption of Constant Cointegrating Vectors

3. Data

4. Empirical Results

4.1. Preliminaries

4.2. The Time-Varying Model

5. Concluding Remarks

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Acknowledgments

Conflicts of Interest

Abbreviations

| ADF | Augmented Dickey-Fuller |

| GLS | Generalized least squares |

| MAIC | modified Akaike information criterion |

| MBIC | Modified Bayesian information criterion |

| MCMC | Markov chain Monte Carlo |

| OLS | Ordinary least squares |

| STAR | Smooth transition autoregressive |

| TV-VEC | time-varying vector error correction |

| VEC | Vector error correction |

Appendix A. Vector Error-Correction Model

Appendix B. Parameter Constancy Test

Appendix C. Time-Varying VEC Model

Appendix D. Degree of Market Comovement

References

- Baillie, R.T.; Bollerslev, T. Common Stochastic Trends in a System of Exchange Rates. J. Financ. 1989, 44, 167–181. [Google Scholar] [CrossRef]

- Diebold, F.X.; Gardeazabal, J.; Yilmaz, K. On Cointegration and Exchange Rate Dynamics. J. Financ. 1994, 49, 727–735. [Google Scholar] [CrossRef]

- Engel, C.; Nelson, C.M.; West, K.D. Exchange Rate Models Are Not As Bad As You Think. NBER Macroecon. Annu. 2007, 22, 381–441. [Google Scholar] [CrossRef]

- Engel, C.; West, K.D. Exchange Rates and Fundamentals. J. Political Econ. 2005, 113, 485–517. [Google Scholar] [CrossRef]

- Ito, M.; Noda, A.; Wada, T. International Stock Market Efficiency: A Non-Bayesian Time-Varying Model Approach. Appl. Econ. 2014, 46, 2744–2754. [Google Scholar] [CrossRef]

- Fama, E.F. Efficient Capital Markets: A Review of Theory and Empirical Work. J. Financ. 1970, 25, 383–417. [Google Scholar] [CrossRef]

- Kapetanios, G.; Shin, Y.; Snell, A. Testing for a Unit Root in the Nonlinear STAR Framework. J. Econom. 2003, 112, 359–379. [Google Scholar] [CrossRef]

- Clarida, R.H.; Sarno, L.; Taylor, M.P.; Valente, G. The Out-of-Sample Success of Term Structure Models as Exchange Rate Predictors: A Step Beyond. J. Int. Econ. 2003, 60, 61–83. [Google Scholar] [CrossRef]

- Engel, C. A Note of Cointegration and International Capital Market Efficiency. J. Int. Money Financ. 1996, 15, 657–660. [Google Scholar] [CrossRef]

- Hansen, B.E. Testing for Parameter Instability in Linear Models. J. Policy Model. 1992, 14, 517–533. [Google Scholar] [CrossRef]

- Hansen, B.E. Tests for Parameter Instability in Regressions with I (1) Processes. J. Bus. Econ. Stat. 1992, 10, 321–335. [Google Scholar]

- Ito, M.; Noda, A.; Wada, T. An Alternative Estimation Method of a Time-Varying Parameter Model. arXiv 2017, arXiv:1707.06837. [Google Scholar]

- Qu, Z. Searching for Cointegration in a Dynamic System. Econom. J. 2007, 10, 580–604. [Google Scholar] [CrossRef]

- Juselius, K. The Cointegrated VAR Model: Methodology and Applications; Oxford University Press: Oxford, UK, 2006. [Google Scholar]

- Elliott, G.; Rothenberg, T.J.; Stock, J.H. Efficient Tests for an Autoregressive Unit Root. Econometrica 1996, 64, 813–836. [Google Scholar] [CrossRef]

- Ng, S.; Perron, P. Lag Length Selection and the Construction of Unit Root Tests with Good Size and Power. Econometrica 2001, 69, 1519–1554. [Google Scholar] [CrossRef]

- Johansen, S. Statistical Analysis of Cointegration Vectors. J. Econ. Dyn. Control. 1988, 12, 231–254. [Google Scholar] [CrossRef]

- Johansen, S. Estimation and Hypothesis Testing of Cointegration Vectors in Gaussian Vector Autoregressive Models. Econometrica 1991, 59, 1551–1580. [Google Scholar] [CrossRef]

- Newey, W.K.; West, K.D. A Simple, Positive Semi-Definite, Heteroskedasticity and Autocorrelation Consistent Covariance Matrix. Econometrica 1987, 55, 703–708. [Google Scholar] [CrossRef]

- Hansen, H.; Johansen, S. Some Tests for Parameter Constancy in Cointegrated VAR-Models. Econom. J. 1999, 2, 306–333. [Google Scholar] [CrossRef]

- Clark, T.; McCracken, M. Advances in Forecast Evaluation. In Handbook of Economic Forecasting; Elliott, G., Timmermann, A., Eds.; Elsevier: Amsterdam, The Netherlands, 2013; Volume 2B. [Google Scholar]

- Lütkepohl, H. New Introduction to Multiple Time Series Analysis; Springer: Berlin, Germany, 2005. [Google Scholar]

- Beveridge, S.; Nelson, C.R. A New Approach to Decomposition of Economic Time Series Into Permanent and Transitory Components with Particular Attention to Measurement of the ‘Business Cycle’. J. Monet. Econ. 1981, 7, 151–174. [Google Scholar] [CrossRef]

| Mean | SD | Min | Max | ADF-GLS | Lags | ||||

|---|---|---|---|---|---|---|---|---|---|

| Level | |||||||||

| 1 | 308 | ||||||||

| 1 | |||||||||

| 1 | |||||||||

| 1 | |||||||||

| ** | 1 | ||||||||

| ** | 1 | ||||||||

| First Difference | |||||||||

| *** | 0 | 307 | |||||||

| *** | 0 | ||||||||

| *** | 0 | ||||||||

| *** | 0 | ||||||||

| *** | 0 | ||||||||

| *** | 0 |

| Eigenvalues | Max Eigen | Trace | |

|---|---|---|---|

| None | 0.1352 | 44.45 ** | 100.19 * |

| At most 1 | 0.0826 | 26.39 | 55.74 |

| Difference | |||||||

| Level | |||||||

| Constant | |||||||

| *** | |||||||

| WQ | SQ | |||

|---|---|---|---|---|

| Test Stats | 8.55 *** | 10.81 *** | 8.55 *** | 15.94 *** |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (https://creativecommons.org/licenses/by/4.0/).

Share and Cite

Ito, M.; Noda, A.; Wada, T. Time-Varying Comovement of Foreign Exchange Markets: A GLS-Based Time-Varying Model Approach. Mathematics 2021, 9, 849. https://doi.org/10.3390/math9080849

Ito M, Noda A, Wada T. Time-Varying Comovement of Foreign Exchange Markets: A GLS-Based Time-Varying Model Approach. Mathematics. 2021; 9(8):849. https://doi.org/10.3390/math9080849

Chicago/Turabian StyleIto, Mikio, Akihiko Noda, and Tatsuma Wada. 2021. "Time-Varying Comovement of Foreign Exchange Markets: A GLS-Based Time-Varying Model Approach" Mathematics 9, no. 8: 849. https://doi.org/10.3390/math9080849

APA StyleIto, M., Noda, A., & Wada, T. (2021). Time-Varying Comovement of Foreign Exchange Markets: A GLS-Based Time-Varying Model Approach. Mathematics, 9(8), 849. https://doi.org/10.3390/math9080849