1.1. Overview

The federal government of Canada published “The pan-Canadian approach to pricing Carbon Pollution” in October 2016 aiming at reducing green house gas (GHG) emissions by taxing fossil fuels. There are two carbon tax systems mentioned in it: an explicit price-based system and a cap-and-trade system. The cap-and-trade system gives each company limit tradable allowance for GHG emission, while the explicit price-based system sets a tax price for a fixed carbon emission. In Alberta, we are using the explicit price-based system and the current Carbon levy is

per tonne. However, Tombe (2017) [

1] found that household electricity bills were expected to rise by

when the Carbon levy increased in 2018. Moreover, this tax is going to affect poor households which could increase inequalities in turn (Ambasta and Buonocore, 2018 [

2]). This all indicates that this price is imperfect and a correct pricing method is needed for Albertan residents.

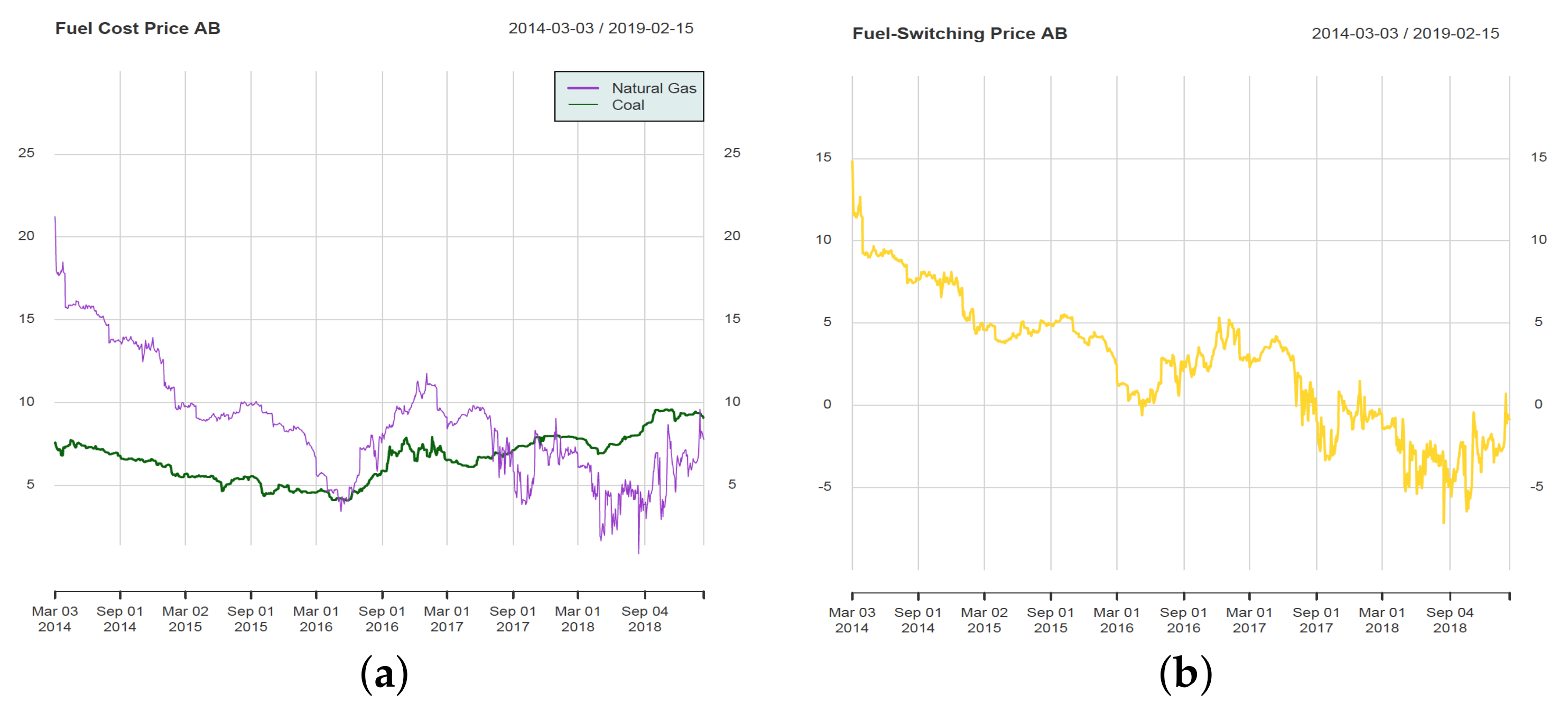

Electricity prices are effected by factors such as weather conditions, economic growth, political principles and fuel-switching (Sjim et al., 2006 [

3]; Seifert et al., 2008 [

4]; Carmona et al., 2009 [

5]), where the fuel-switching is the only one that is controllable by the company itself. The term fuel-switching means specifically that for any power plant that is coal fired or gas fired, the company can switch based on price and produce the same quantities of electricity. Since coal price is cheaper than natural gas price but nearly twice as polluting as gas (Arora and Taylor 2014 [

6]), we are able to consider potentials of GHG emissions reduction through fuel-switching (Erik Delarue, William D’haeseleer 2006 [

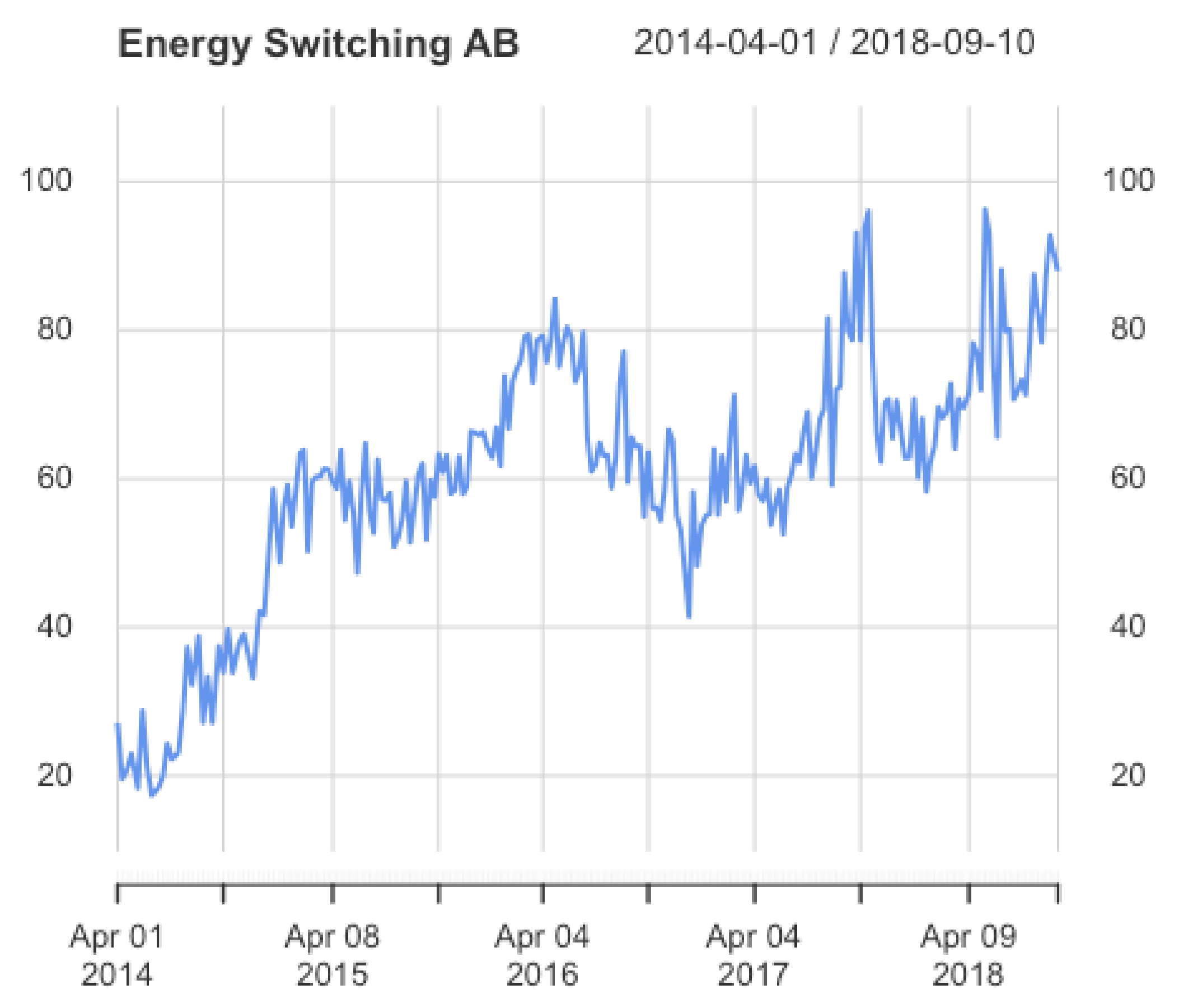

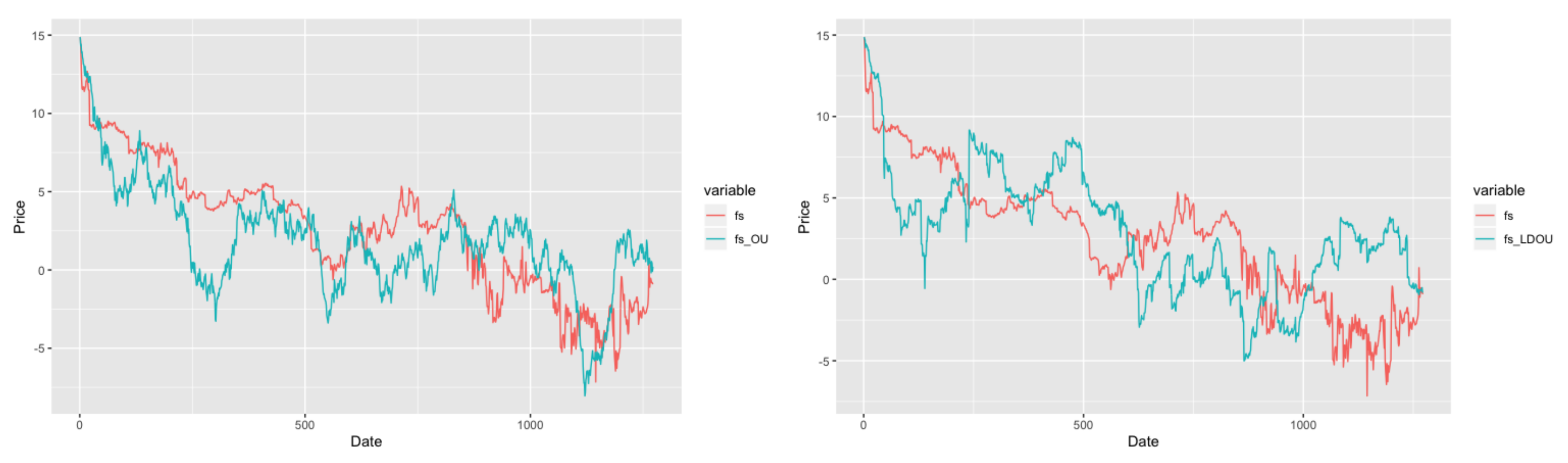

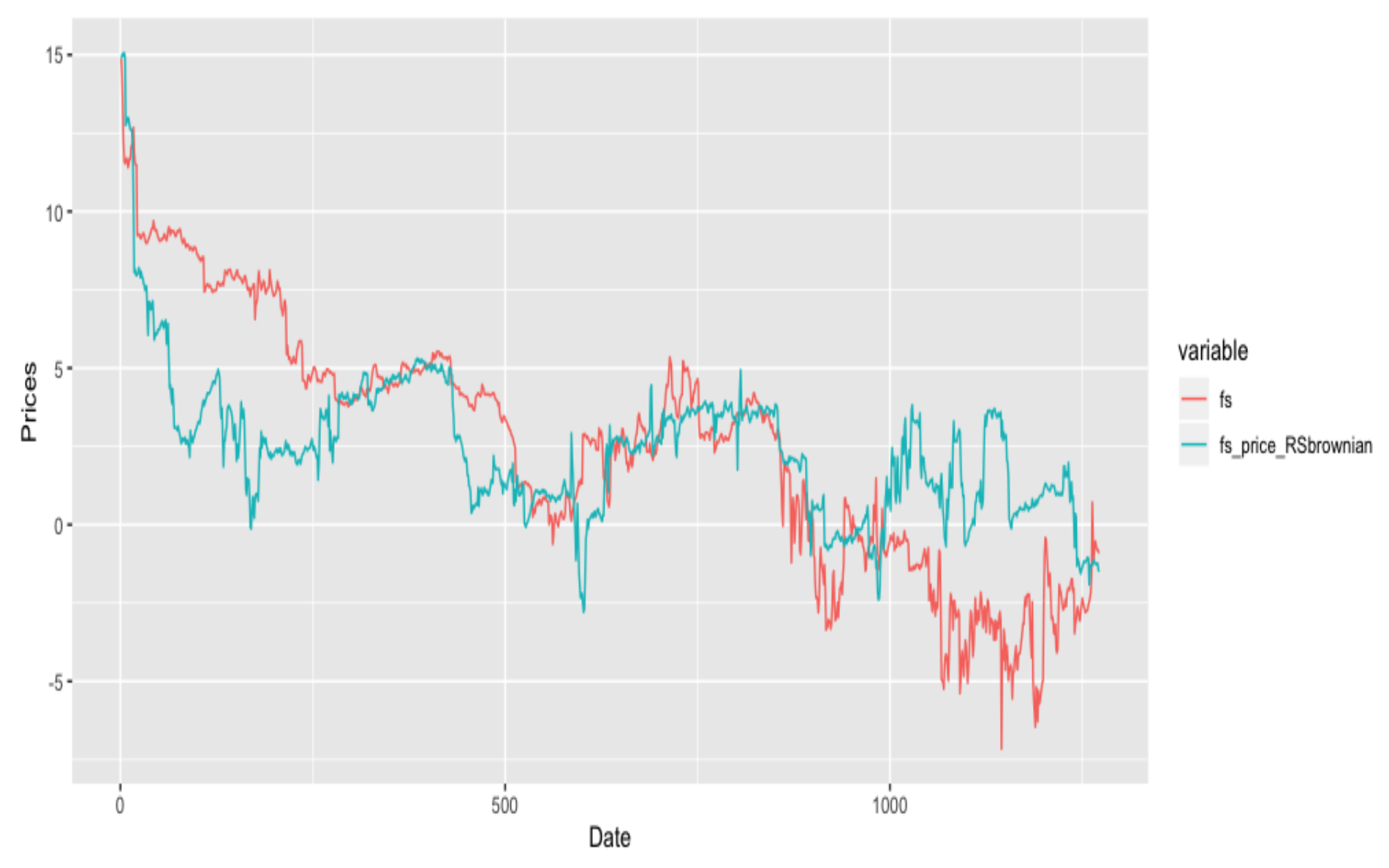

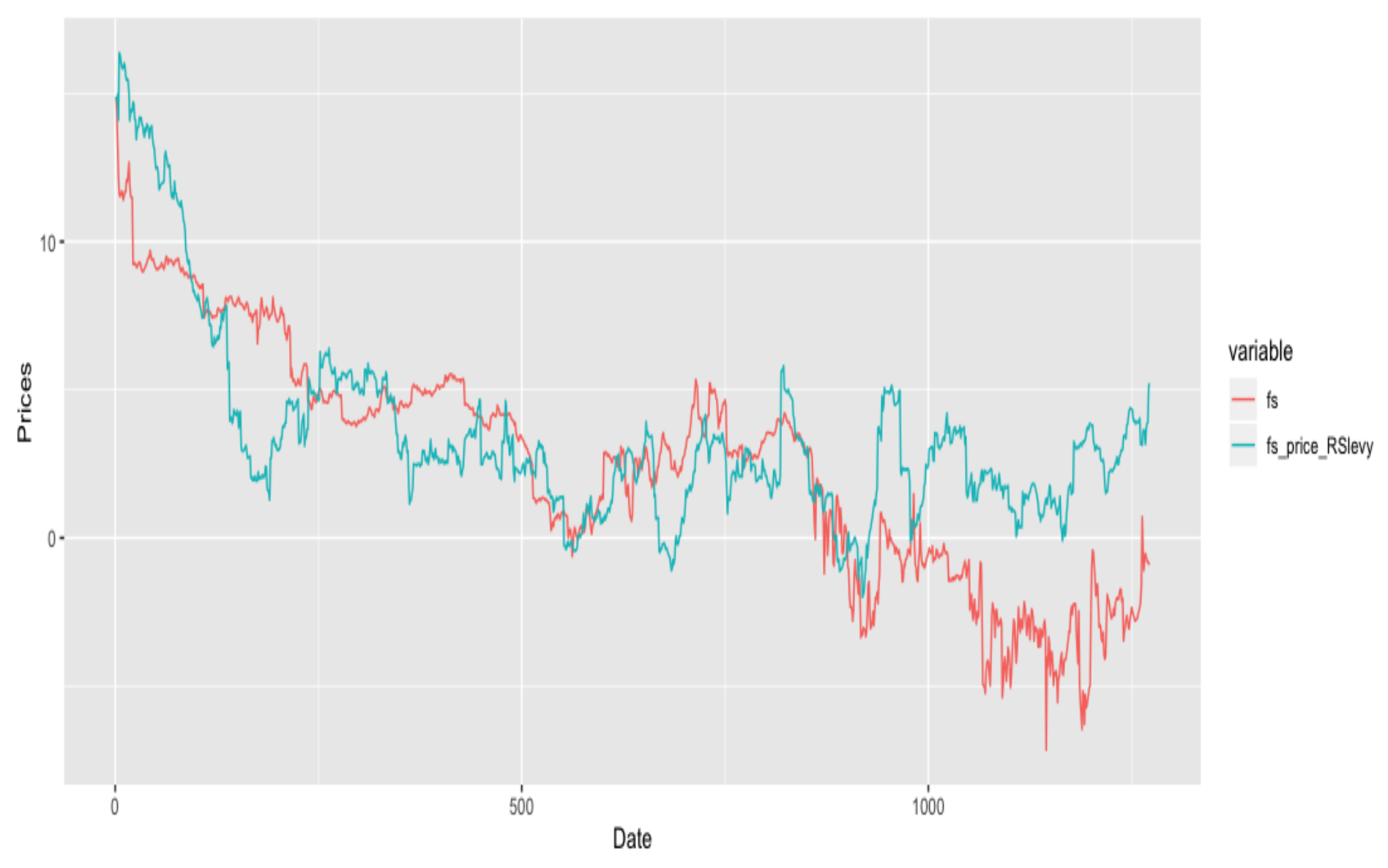

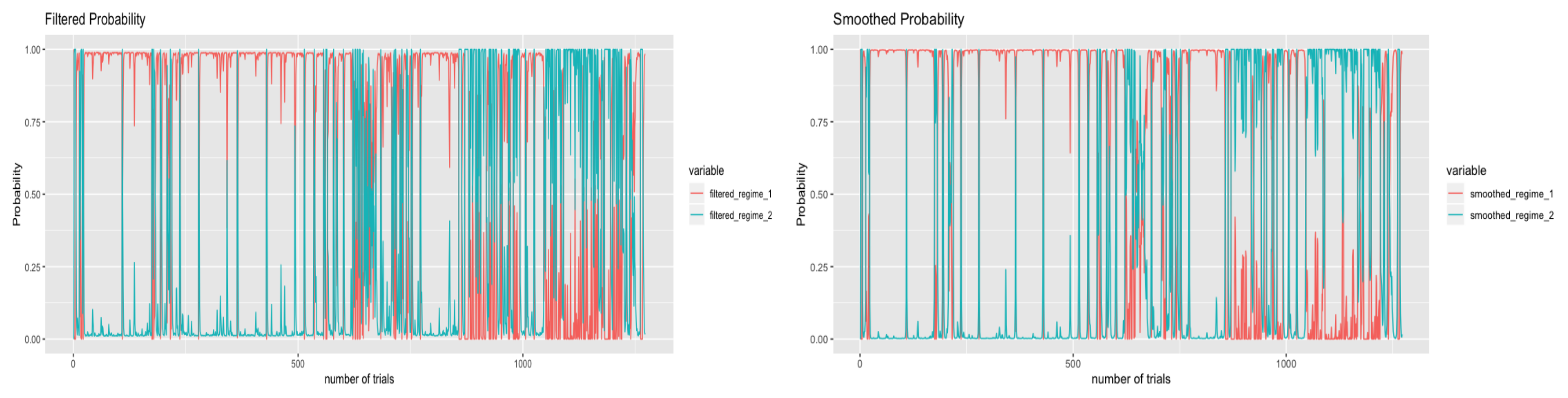

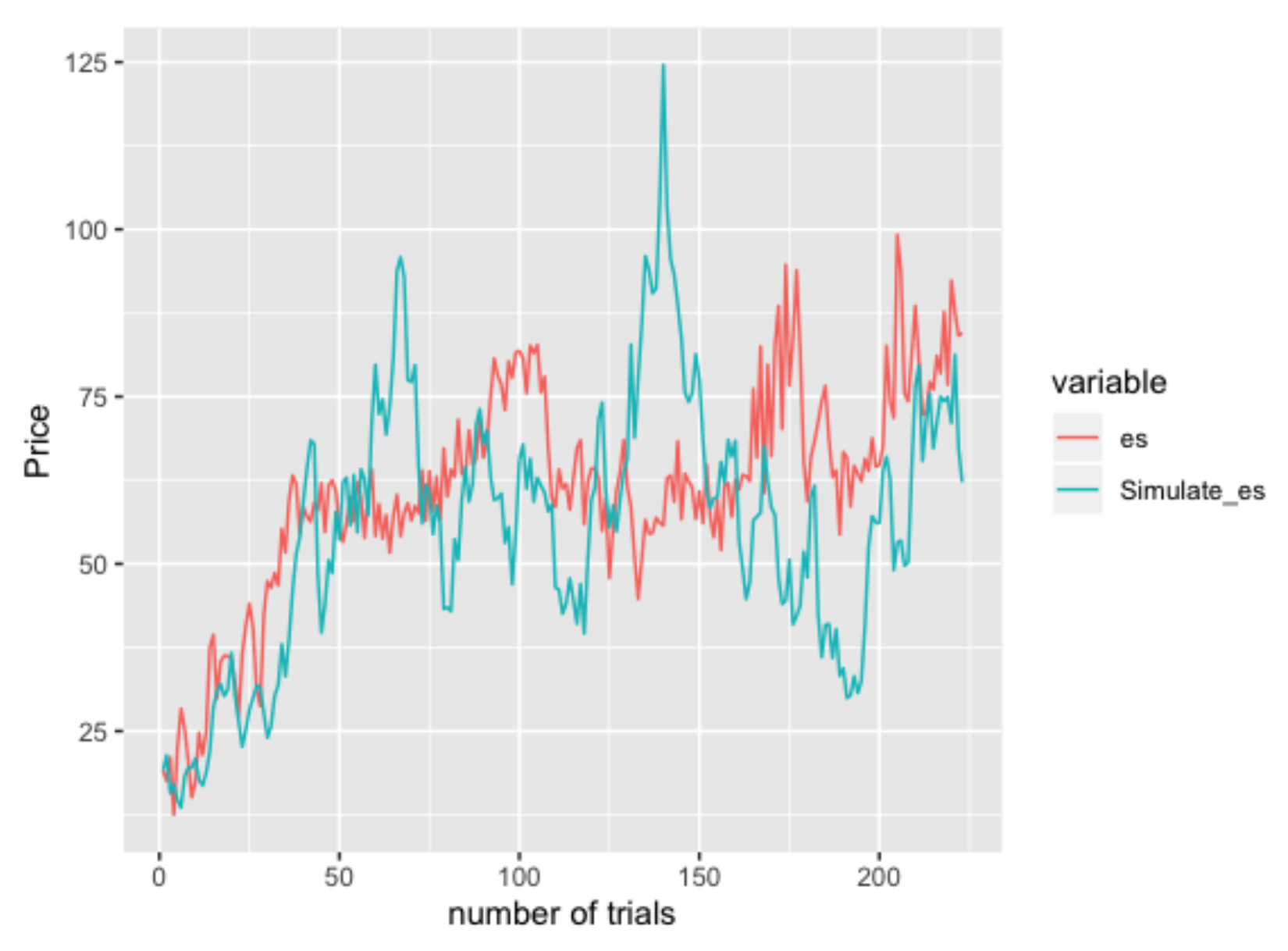

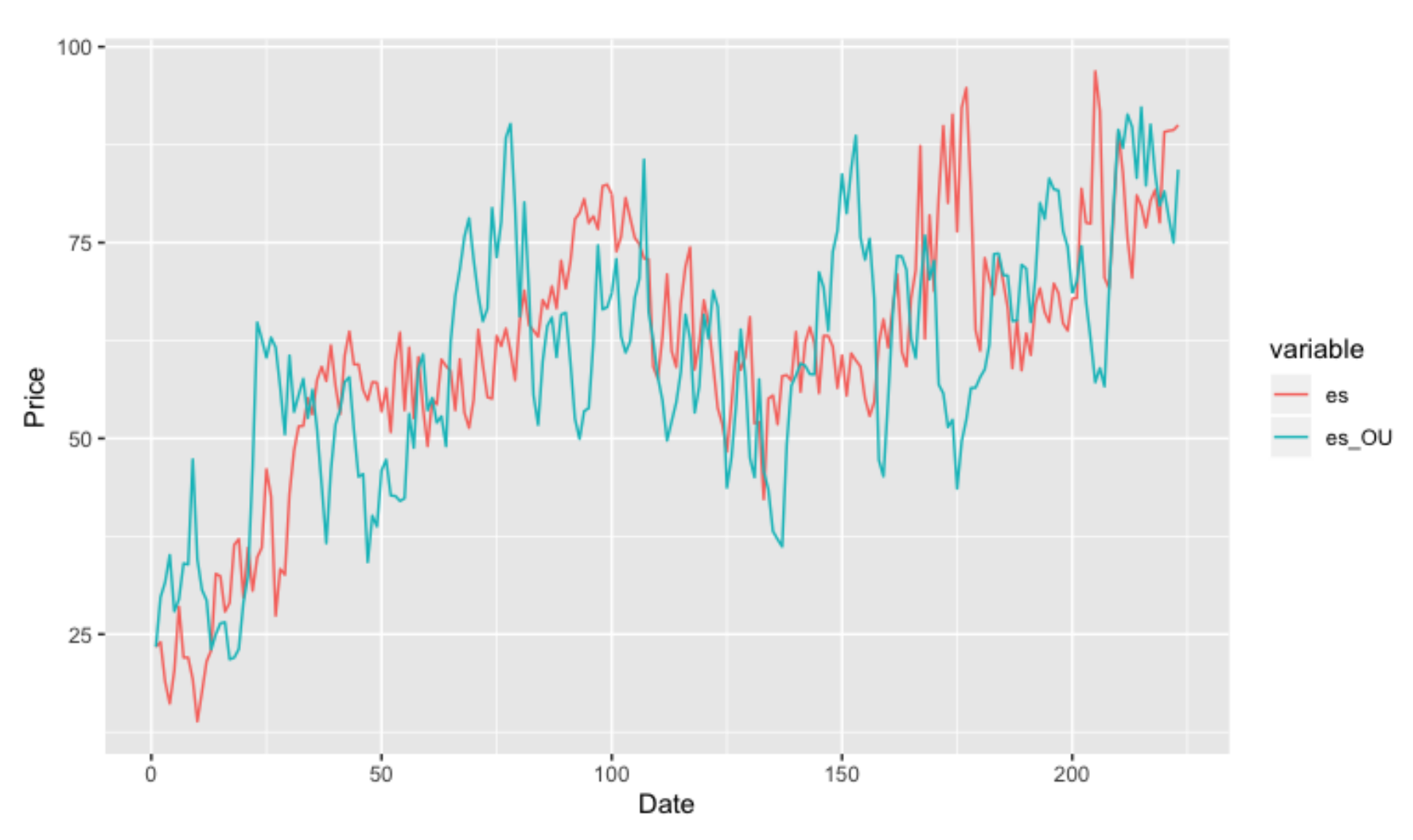

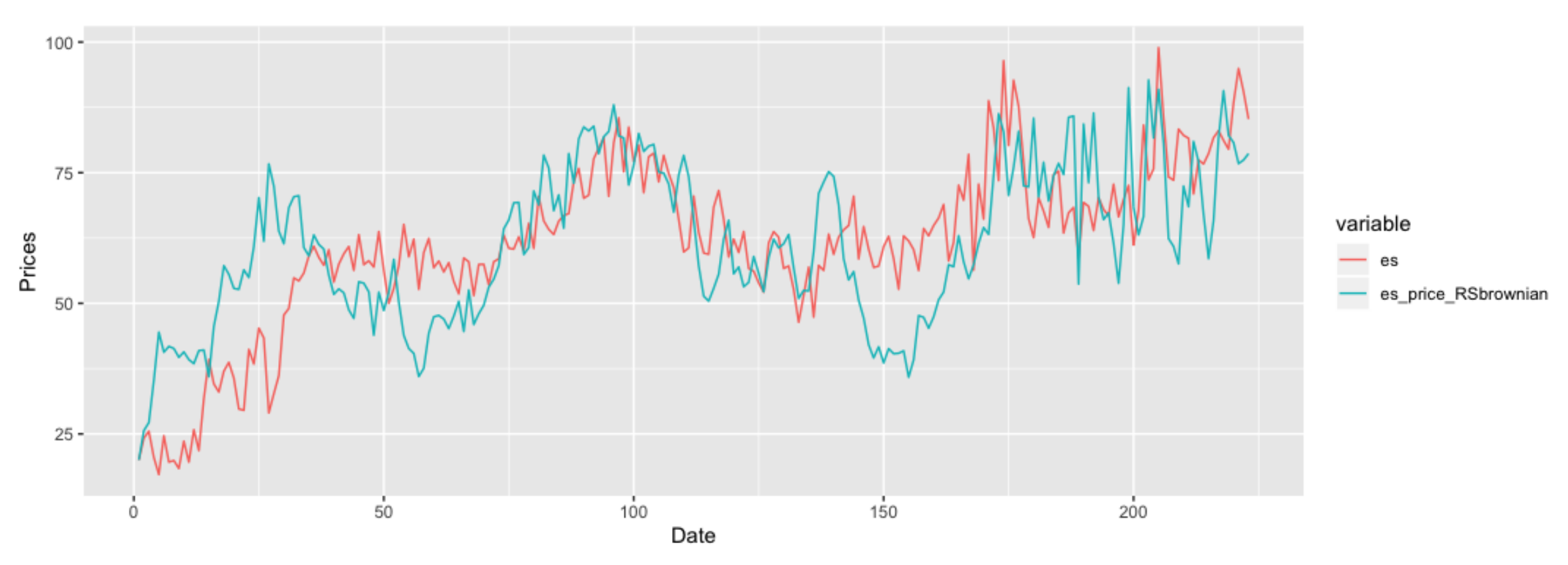

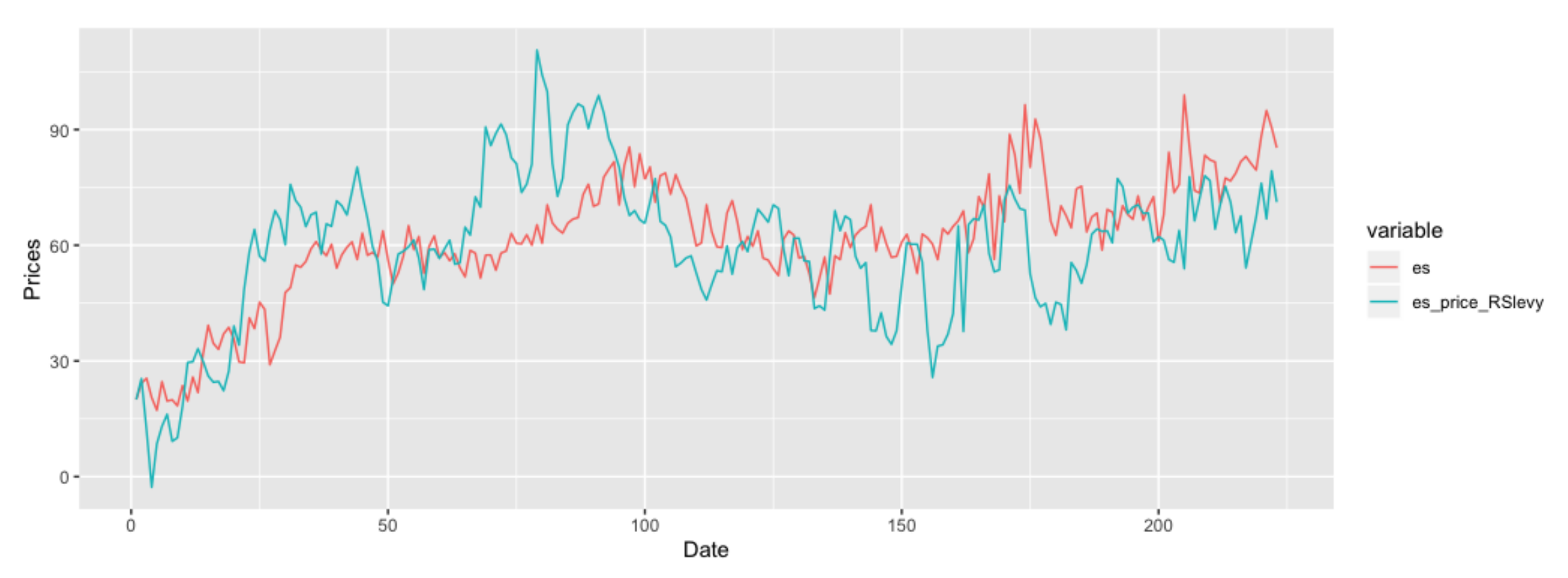

7]). This paper introduces a fuel-switching price, which explains how to switch from coal to natural gas when producing electricity, and how this can apply to the Albertan energy market. In the Albertan market, there are examples of power plant companies which are working on fuel switching, such as Transalta’s Coal-to-Gas Conversions Project and Capital Power’s Repowering Genesee Project. We also introduce an energy-switching price which considers a power switch from natural gas to wind. Moreover, note that this paper focuses on different jump and regime-switching mean-reverting stochastic models, where the financial and economic meanings and their applications will be discussed in another paper. We model these two prices using five mean-reverting processes and including regime-switching processes, such as the Lévy-driven Ornstein–Uhlenbeck process and inhomogeneous geometric motion. The estimation of these processes is based on multiple procedures such as maximum likelihood estimation and the expectation-maximization algorithm. This paper also justifies previous results applied to the Albertan energy market showing that the jump modelling technique is needed when modelling fuel-switching data. Finally, the novelty of the paper lies not only in giving a promising conclusion on the necessity of introducing regime-switching models to the fuel-switching data, but also in showing that regime-switching models are better fitted to the data.

This paper is based on several projects and ideas, first introduced in Arrigoni et al., 2019 [

8], and then extended in Lu 2020 [

9] to consider more stochastic models for fuel-switching and energy-switching prices. We consider inhomogeneous geometric Brownian motion and generate its parameter estimation procedure by using change of time method from Swishchuk 2008 [

10]. We also consider the regime-switching models and the original Lévy-driven models. Unlike previous models with a constant volatility, the regime-switching model assumes that the volatility is changing according to each regime and they can switch the value between regimes. The regime-switching models generally consider a business cycle behind our data, with different regimes modelled by a Markov chain that represents different stages in a business cycle. Furthermore, in reality, the volatility often has a high and low value and this feature can be captured by the regime-switching model. Such models have been widely used in economics and finance after Hamilton first introduced them in 1989, and it is useful to model a different volatilities using financial data (Yang et al., 2016 [

11], Bai and Wu 2018 [

12], Stübinger and Endres 2019 [

13]). Finally, we aim at finding a more accurate continuous time model by considering regime-switching and non-negative properties of the prices.

We note that option valuations of futures contracts with negative underlying prices were studied in Swishchuk et al., 2020 [

14].

1.2. Literature Review

There are many papers that have studied fuel-switching before and there are two main papers we are going to review. First, Goutte and Chevalier 2015 [

15] introduced an estimation methodology for Lévy-driven Ornstein–Uhlenbeck processes and applied them on the fuel-switching price in the European market. They also defined a calculation formula to fuel-switching price based on power plants efficiency, fuel price, emissions factor and etc. They mainly concluded that the political decisions impact the jumping nature of the process and enhance our understanding of emission reduction through power systems that could be achieved in the EU Emissions Trading System (EU-ETS). We are going to introduce the fuel-switching price below.

As we discussed before, the fuel-switching price should stimulate companies to reduce GHG in a profitable way. Hence, this price starts from defining the marginal cost of each fuel without a carbon cost:

where FC represents fuel cost and

is the power plant’s efficiency. In this paper, we do not account for any cost that is related to regulatory cost, maintenance, labour force cost, etc and we follow the same definitions mentioned in Goutte and Chevalier 2015 [

15]. Thus, here, the total/average cost for one kWh power generation is equal only to fuel cost. Further, the marginal cost defined here is different from the classic definition of marginal cost which is the change in the total cost that arises when one unit of production is incremented by one. The power plant’s efficiency is considered as an average efficiency, so the marginal cost is actually only affected by the fuel cost. Next, if we have carbon cost such as carbon tax or allowance price, the equation changes to:

where EF is the emission factor, which depends on the fuel and the amount of fuel burnt, and EC is the emission cost. For simplicity, we do not consider any cost. Now, the fuel switching happens when generated from other fuel is cheaper, so to define the minimum cost for a switch to occur, we need to let

, which turns out as solving the emission cost inside this equation:

Thus, when the EU Allowance price is lower than this price, generating electricity from coal is cheaper than natural gas and vice versa. Later, they used this price in the European market and modelling it by a jump mean reverting model. They conclude that jump modelling techniques should included when modelling fuel-switching price.

The paper by Arrigoni et al. 2019 [

8] introduces this method to the Albertan energy market, and based on the difference situations between the Albertan and European energy markets, they also introduced an energy-switching price as a ‘future’ fuel-switching price which considers a fuel-switching between natural gas and wind. They then also present their ideas as poster in the 42nd International Association for Energy Economics (IAEE) Annual Conference [

16]. This is more meaningful because coal to natural gas is a switch to cleaner energy, while natural gas to wind is a switch to renewable energy. Later, similar to Goutte et al., 2015 [

15], they modelled these two prices using Levy-driven Ornstein–Uhlenbeck process and standard Ornstein–Uhlenbeck process, and concluded that jump modelling techniques is needed.

The paper by Fargos et al., 2021 [

17] offers new insights into the risk of carbon leakage and industrial relocation in case of asymmetric climate policies, and provides an improved understanding of the sectoral and regional structure of leakage, as well as policy measures to mitigate the adverse impacts on industrial competitiveness. Regarding the existing literature, this paper goes beyond it by considering: (1) assessing for the first time the competitiveness impacts of the ambitious EU Green Deal targets towards climate neutrality (no green house gas emission) by mid-century, (2) using an advanced version of the leading GEM-E3-FIT model (which is a multi-regional, multi-sectoral, recursive dynamic computable general equilibrium (CGE) model) with an enhanced representation of energy system and technologies required for net-zero transition. Here net-zero transition is brought out by Global Future Council of the World Economic Forum, which represents reducing global greenhouse gas emissions to ‘net zero’ by 2050, (3) exploring the impacts of first-mover coalitions conceptualizing the most recent climate policy announcements of EU and China aiming to achieve carbon neutrality (i.e., achieving net zero carbon dioxide emissions by balancing carbon dioxide emissions) by mid-century, thus ensuring high policy relevance of the analysis and (4) assessing the cost-effectiveness of border carbon adjustment (BCA) mechanism in preventing carbon leakage and supporting the European Emissions-Intensive and Trade-Exposed (EITE) industries, as suggested by the EU Green Deal.

The paper by Montenegro et al. (2021) [

18] reviews the recent literature on the model-based methods utilized for policy analyses in the areas of economics, energy systems, and environmental damages. It also explores ways in which these models and methodologies depict distributional impacts, the main indicators obtained from their results, shortcomings of each modelling methodology, and suggest improvements for future research. Georgescu-Roegen (1971) [

19] mentioned that it could generate a reverse or duel case if using the temporal borders of economic process method, that two identical technologies could have two different productivities or marginal cost after several years.

This paper is organized as follows. In

Section 2, we introduce the economic background and fuel-switching data used in this paper.

Section 3 described the parameters estimation procedures for five stochastic models considered in this paper and introduced in

Appendix A.

Section 4 gives the empirical results obtained by applying the models from

Appendix A to the data introduced in

Section 2.

Section 5 provides model comparison based on AIC and BIC, and cross-validation methods. The Conclusion is given in

Section 6.

Appendix A discusses five mean-reverting stochastic models which are used in this paper.