Abstract

Open banking (OB) is an emerging business field in the financial sector, which relies on intensive collaboration between banks and non-banking service providers. However, how to evaluate OB business partners from multiple perspectives for banks is underexplored. Therefore, this study proposed a hybrid decision model with supports from seasoned domain experts. This study also adopts a domestic bank from Taiwan and four non-banking service providers to illustrate the hybrid approach with the confidence-weighted fuzzy assessment technique. The proposed model might be the first attempt to explore the OB adoption strategy by the novel approach. However, its limitations are the presumed independent relationship among the factors of this hybrid model. Additionally, the results hinge upon domain experts’ knowledge. In practice, the research findings identify the relative importance of banks’ crucial factors to select OB strategic partners, which provide managerial insights and valuable guidance for the banking sector.

1. Introduction

Through advanced digital technology, various industries and diverse services can now be integrated into a single platform. On one side, the adoption of digital platform business models can, in turn, enhance the competitive advantage of a business through operation optimization, data sharing and transaction convenience [1]. On the other side, conservative financial institutes are reluctant to share their valuable customer information with other businesses for reasons such as regulations, information security and customer privacy. Therefore, most of the digital platforms developed by financial institutes apply only to their own business groups’ products or services.

However, this circumstance has changed when the Revised Payment Service Directive (PSD2) was launched in January 2018 [2]. Under PSD2, financial institutes in the EU were requested to share their customer data with other service providers. Consequently, in recent years, the pressure of sharing customer data with other businesses has spread throughout the financial industry, which has become an irresistible global trend [3].

In recent years, to follow the trend, the innovative open banking (OB) is then becoming a twilight for the banking industry because it not only promotes transaction security and data sharing but also improves efficiency and convenience—both of which are critical for serving customers in this digital era [4]. OB is a cross-industry collaboration model that consists of banking and non-banking members providing a series of financial products and services. Additionally, members of this model utilize innovative open technology platforms to serve potential customers by sharing information, knowledge, business environments and customer data [5].

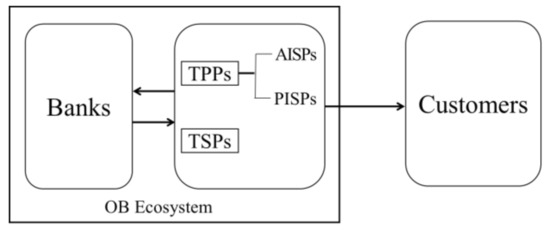

The banking and non-banking members form a financial ecosystem comprising users’ banks, financial technology companies (FinTechs) and customers (Figure 1). According to the UK Open Banking Implementation Entity (OBIE), an OB ecosystem can be classified into the three categories [6]: (1) account providers, including banks, mortgage companies and payment companies; (2) third party providers (TPPs), including account information service providers (AISPs) and payment initiation service providers (PISPs) and (3) technical service providers (TSPs). In this study, we focus on evaluating TPPs for banks to develop OB business.

Figure 1.

Open banking (OB) ecosystem.

Within the OB context, consumers are empowered to control their own financial information. Furthermore, with the consent of consumers, account providers and TPPs are capable to access consumers’ financial data in exchange for better financial products and services [7]. Additionally, most of these products and services are served through open application interfaces (Open APIs) that are mainly developed by TPPs [8], which may categorize their domains in telecomm, e-commerce, integrated instant messaging platform, payment and others. Nevertheless, financial institutes undertake substantial risk when adopting an innovative business model [9]. The banking sector is under strict regulation and monitored by authorities; there are various concerns to collaborate with new partners to devise innovative services. Therefore, selecting alliance partners is a critical issue for financial institutes to manage risks and enhance their competitive advantage while adopting OB.

However, only limited studies have paid attention to OB adoption, particularly the topic of selecting alliance partners to improve competitive advantage. At present, the majority of relevant OB literature seems to focus on regulation and technology issues. Therefore, a gap exists in the literature on creating value and enhancing competitive advantage for financial institutes after adoption of the OB business model. In addition, OB emphasizes providing better customer experience by applying APIs to exchange data between banks and non-banking businesses [7]. While adopting OB, it is a challenge for traditional banks to select ideal TPP partners to complement the deficiencies in the innovation service, and to increase service value, market share and competitive advantage [10].

In sum, the banking literature is underdeveloped in the practical financial domain to assist traditional banks to select appropriate TPPs. To reach this goal, the current study has the following objectives. First, the current study constructs a decision model to assist traditional banks in assessing their competitive advantage while adopting OB. Second, by adopting the decision model, banks may select apt TPPs to provide superior OB services. Through collaboration with TPPs, new OB products and services can enhance brand value and market share, which, in turn, can increase the bank’s long-term competitive advantage.

However, to meet this goal, decision-makers (DMs) have to consider multiple aspects (e.g., the technology issues, fast-changing external environment and internal management) while complying with relevant regulations. Therefore, to achieve the aims mentioned above, the present study employs the multiple criteria decision-making (MCDM) approach to construct a decision model for traditional banking to evaluate OB business partners. In this context, MCDM can help DMs construct decision models with multi-hierarchy factors in a complex environment [11,12]. The current study makes two main contributions to the finance literature. First, it develops an OB adoption model for banks’ top management teams to assessing their competitive advantages while devising OB services. Second, it provides a practical example of applying the decision model to evaluate suitable TPPs to increase their competitiveness.

In the following sections, we discuss the criteria of OB adoption, describe the research method and data analysis, present a practical case example, discuss managerial implications and provide recommendations for future research.

2. Literature Review

2.1. Introduction to Open Banking

According to Open Banking Europe (OBE) [13], OB refers to “how banks can make data and services available via APIs to authorized service providers or third parties who act on behalf of the customer who owns the account”. OB plays a promising role because it facilitates financial innovation under the widespread use of machine-facilitated support to provide customers with enhanced user experiences [14].

2.1.1. Development of Open Banking

The financial industry is a conservative industry. The last major change in the global financial service industry dates back to the 1980s when the German Federal Post Office introduced digital finance [15]. Between 1980 and 2018, only banks and government agencies were authorized to perform payment transactions. However, as Internet technology and e-commerce become a part of everyday life, consumer demand for digital financial services has grown steadily. This demand was not met until the European Union launched the PSD2 in 2018. The PSD2 regulations grant nonbank companies (i.e., TPPs) in the European Economic Area access to some customer account information and, with customers’ consent, the ability to make payments. The OB service prototype was thus established.

2.1.2. State of Global OB Development

To ensure that banks are no longer the only institutions holding financial information while facilitating digital technology development, the UK government demanded in 2016 that major banks should begin releasing open information by 2018 [16]. In the same year, the Competition and Markets Authority established the Open Banking Implementation Entity (OBIE) and issued the open API standards.

In September 2020, OB user number exceeded two million [17]. In 2016, the EU founded OBE to help its payment service providers and other TPPs to meet the PSD2, and, then, the OBE announced API protocols [18]. Owing to the favorable environment created by the EU, 410 TTPs have been registered by September 2020 in the European Economic Area, where UK (189), Germany (36) and Sweden (28) have the most TPPs [19].

In Asia, the Monetary Authority of Singapore (MAS) and Association of Banks in Singapore co-launched the API Playbook in 2016, providing banks and TPPs with safety rules and standards to follow when developing APIs. Additionally, thus, the APIs in Singapore facilitates data exchange and communication between banks and FinTech companies [20]. The Australian government requires major banks and all banks to start offering OB services by 2020 and 2022, respectively [21].

In China, OB emerges as tech giants engage in market competition. For example, Ant Financial (subsidiaries of Alibaba, an e-commerce platform) and Tencent analyze user behavior and offer OB-related services on both e-commerce and instant messaging platforms. Currently, Ant Financial and Tencent play significant roles in the global TPP market [22]. In Hong Kong, the authority released the Open API Framework to ensure that OB can be implemented by 2021 [23]. In Japan, the Financial Service Agency encouraged banks to sign collaboration contracts with at least one TPP by 2020 [24].

In Taiwan, OB is implemented after product and service information, account information and transactions (i.e., a three-phase approach) are made accessible [25]. By the third quarter of 2020, Taiwan had completed Phase II, registering eight banks and six TPPs and offering 18 APIs that allow consumers to search for account information and apply to banks for financial products and services [25].

2.1.3. OB-Related Research and Major Discoveries

OB is an innovative financial service created for the financial industry to meet regulations for consumer information control. Related studies in the field of OB have mostly focused on OB technology and regulations and have rarely examined how banks manage OB and relevant consumer behavior and banking strategies. Concerning OB technology, Borgogno and Colangelo [26] claim that OB APIs are the most suitable tools to satisfy the banking industry’s demands because of their compliance with data portability, technological practicality and PSD2. In terms of security, Wang et al. [27] propose that blockchain technology can solve security- and privacy-related problems for OB.

Concerning studies related to OB regulations, Wolters and Jacobs [28] investigate how regulations equalize among payment service market development, transaction security and confidentiality. Their analysis results indicate that the PSD2 and regulations prioritize payment service market development over transaction security and privacy issues. Thus, the aforementioned researchers suggest that banks, payment service providers and authorities should coestablish legal norms to ensure transaction security and protect consumer privacy [28].

In terms of consumer behavior, Shaikh et al. [29] conclude that mobile banking app user-behavior is driven by their product knowledge, usefulness of the app and ease of use. Dratva [30] explores OB from the views of platform technology and PSD2, declaring to promote OB successfully in the electronic markets, consumers must perceive OB as a highly convenient and trustworthy service.

2.2. Critical Factors of Adopting OB to Strengthen Competitiveness

Technology, organization and environment (TOE) are the three aspects in TOE framework that organizations often consider when adopting innovative technology [31]. Zhu et al. [32] observe that these three factors influence organizations’ intention to adopt innovative technology. Since most banks lack experience incorporating TPPs on open APIs, based on the OB ecosystem proposed by the OBIE, this study devises a research model that integrates the TOE framework with the “superintendency and regulation” dimension for modeling. The four dimensions are explained in the following subsections.

2.2.1. Superintendency and Regulation

Financial innovation’s primary goals are to provide new products and services, increase market share, and elevate business performance [33]. However, excessive financial innovation leads to financial crises [34]. The presence of adequate financial regulations can shield the financial industry from such concerns and engender financial market stability and prosperity [35].

On the other hand, government-support programs and tax incentives can considerably assist TPPs and FinTech start-ups in lowering operational costs [36]. Nevertheless, innovative businesses may violate current rules during the early stages [37]. This requires them to lobby the authorities to amend existing laws or promulgate special regulations. Otherwise, certain innovative service providers would be constrained or even excluded. In summary, whether the OB ecosystems or TPPs can meet government requirements is a critical concern in OB business.

2.2.2. Technology

OB operations are generally performed through APIs [16]. Therefore, the quality of API technologies is crucial to elevating the competitive advantage of financial institutes. Since financial services are strictly concerned with customer data security and privacy, particularly in the era of rampant cybercrimes, Internet security has become an essential topic [38]. Additionally, authenticated APIs enable consumers, banks, TPPs and businesses to communicate and transmit data safely [39]. Moreover, digital technology and automation techniques support the growth of PayTech (payment technology) businesses, such as mobile payments, mobile wallets, mobile money and cryptocurrency [40]. Therefore, banks that collaborate innovative PayTechs with their service platforms may provide high security and convenience benefits to their customers [3].

Furthermore, OB operations entail TPPs accessing customers’ financial account information from their financial account providers and carrying out various payments. Therefore, identity authentication is crucial in OB operations [40]. In this viewpoint, identity authentication and Internet security are critical to online banking users [38,40].

Additionally, OB provides real-time services in which clients can obtain account or transaction information from their account providers or TPPs in the OB ecosystems [20,38], which implies that data transmitted between banking and non-banking institutes on the APIs must be compatible and interoperable [26]. Furthermore, the new OB systems must operate smoothly and integrate adequately with the banks’ legacy systems to ensure stability and reliability [38].

2.2.3. Environment

In the TOE framework, the environment dimension refers to the industry, competitors, service providers and legal environment that businesses must confront [41]. Baker [41] affirms that the fierce competition and members in the value chain affect business innovation. Thus, before implementing OB, traditional banks should analyze the market competition and OB potential market scale to figure out future profit margins [42]. To develop potential markets and increase profits, traditional banks form alliances with banking and non-banking companies [43].

Besides, traditional banks that may utilize digital platforms to offer new service channels should plan to integrate both the original and API channels [38] to prevent the channel cannibalization effect [44]. Thus, as the banks obtaining potential customers by developing new API channels, it is also essential to retain existing customers.

2.2.4. Organization

According to the TOE framework, the organizational context includes organizational size and scope, internal resources, human resources quality and internal communication procedures [32,41]. As to internal communication procedures, the top management has the authority to control and allocate internal and human resources during OB’s adoption. Therefore, OB adoption’s success depends on top management’s support to reform the organization, reconcile resistance to change, and resolve organization conflicts [45].

The adoption of OB services requires banks to increase setup costs, including infrastructure cost, hardware and software facilities cost, recruiting technological HR cost and training cost [46]. As to operational expenditure, it is a critical indicator of market performance after adopting OB [46]. Many studies reported that e-banking increases the usage of automation banking services and operations, which causes operational efficiency and cost reduction [46]. Del Gaudio et al. [47] indicate that information and communication technology can increase bank–customer transaction frequency, lower transaction costs, and reduce the number of bank branches, which then diminish banks’ operational costs.

On the other hand, adopting OB services must also consider human resource allocation and the switching cost of transforming incumbent systems to new systems [48]. In addition to monetary expenditure during the transition process, switching cost also includes users’ resistance to new technology [49]. Frizzo-Barker et al. [48] discover that 80% of adoption barriers are due to the switching process. Furthermore, banks must also account for risk management when adopting the OB service [50]. Risks that pertain to new OB systems include cyber fraud, embezzlement, new system failure and cyberattacks [50].

2.3. Applications of MCDM Methods on Selecting TPPs

The model proposed in this study is constructed by revising the TOE framework. Although the revised framework features only four dimensions, the total involved factors are not few. Since DMs often need to make decisions in dynamic environments with multiple conflicting objectives, this study selects the MCDM approach for modeling [51].

Typical MCDM methods include the analytical hierarchy process (AHP) [52], analytic network process (ANP) [53], decision-making and trial evaluation laboratory (DEMATEL) [12], DEMATEL-based ANP (DANP) [54], best–worst method (BWM) [55], VlseKriterijuska Optimizacija I Komoromisno Resenje (VIKOR) [56], the technique for order performance by similarity to ideal solution (TOPSIS) [57] and fuzzy sets incorporated evaluations [58,59]. MCDM is used in various domains such as corporate governance [12,60], risk assessment [61], financial management [53] and transportation decisions [62]. Accordingly, this study applied the MCDM approach to solve the addressed problem.

3. Research Methods

This study proposed a hybrid MCDM model to explore the complicated OB adoption strategy for the Taiwanese banking sector. A hybrid approach that integrates the BWM, modified-VIKOR and fuzzy evaluation is devised to collect domain experts’ knowledge to model this challenging problem. Compared with other MCDM methods, the BWM has the advantage to reduce experts’ judgment fatigue (fewer pairwise comparisons), and the modified-VIKOR method may use different parameters to test the robustness of the ranking result. The research flow involves the following steps: (1) form the framework of this decision model, (2) retrieve experts’ experience by the BWM questionnaire and fuzzy evaluations on alternatives and (4) aggregate alternatives’ performances by the modified-VIKOR method [51].

In the first stage, we referred to OB related research to identify a pool of criteria for experts to select. We applied the Delphi method to obtain the crucial dimensions and criteria for forming the BWM questionnaire during the interactions with experts. The details of this case study will be reported in the next section.

This study adopted the BWM to collect experts’ knowledge to fulfill the evaluation procedures. Compared with the other well-known MCDM methods (e.g., AHP, ANP or DEMATEL-based ANP (DANP)), the BWM requires fewer pairwise comparisons from domain experts. However, it has to assume the independent relationship among its criteria, also its limitation. A brief introduction of the BWM is in Section 3.1, and the details can found in [63,64].

3.1. Best–Worst Method (BWM)

The MCDM approach has been prevailing in business and technology research for decades [65]. Owing to the complexity involved in practical problems, decision makers (DMs) often have to confront multiple conflicting (or competing) factors to make a compromised decision. The mainstream problem in MCDM research is to make a selection or ranking decision based on the preference or knowledge of DM(s), and this type of problem is also termed as multiple attribute decision-making (MADM) research. In general, the additive type (in here, is a linear aggregator) of the MADM problem can be denoted as Equation (1):

where , and denote the m-th alternative, the n-th criterion and the relative weight (importance or influence) of the n-th criterion, respectively. Additionally, is the performance score of the m-th alternative on the n-th criterion, and .

Various MADM methods were proposed to obtain W for a MADM problem. However, based on the bounded rationality theory [66], DM would encounter difficulty to identify the relative importance of all involved criteria clearly while n is too large (e.g., larger than 7 or more). Therefore, the pairwise comparison approach was created to resolve this issue. However, the prevailing AHP or ANP method requires DM(s) to conduct at least pairwise comparisons to calculate W, which might cause hindrance for domain experts to fill a lengthy questionnaire in practice. Therefore, BWM proposed a more efficient method to collect experts’ opinions (or knowledge). The required steps to adopt BWM are as follows.

First, we define a decision matrix D as Equation (2) to explain the pairwise comparison as a MADM problem. Since most MADM problems comprise two layers: (1) dimension and (2) criterion (associated with a dimension) layers, we assumed that there are p dimensions and n criteria of a decision problem. Thus, D comprises of submatrices in Equation (2). By assuming the independence relationship among the dimensions, we may further simplify the needed pairwise comparisons by obtaining the importance of each dimension and the relative weights of criteria under each dimension.

Take the subdecision matrix for instance, it denotes that there are criteria in dimension 1 (i.e., , and the associated criteria are ,…,). Among the criteria, the relative importance of the best criterion over the i-th one () can be regarded as a secondary comparison: , where denotes the importance of the best criterion and the importance of the i-th criterion), and the relative importance of the j-th criterion () over the worst one is: ( denotes the importance of the worst criterion).

Second, the procedures to obtain relative importance of each dimension or the relative weight of each criterion in a dimension are similar. In here, we take the case of how to obtain the relative weights (importance of strength) of the criteria in to explain BWM. Researchers have to collect opinions from a DM and form two preference vectors: (i.e., best-to-others) and (i.e., others-to-worst). To do so, BWM presumes that a DM can identify the best and worst criteria as two references. Additionally, the importance scale is the same as the one in AHP or ANP, ranges from 9 to .

Third, BWM applies the concept of linear programming to calculate the optimal/estimated weights (i.e., ,…,) of to . Since each pair of or is denoted as or respectively, a linear solution that minimize the maximum absolute differences of and for all k can be defined as Equation (3), where :

By solving Equation (3), the relative weights of to can be obtained. Similarly, the relative importance of the p dimensions (i.e., ,…,) or the criteria in a different dimension can be obtained. The final weight of each criterion can be calculated by () to have the final weight of the i-th criterion in the j-th dimension. Besides, Rezaei [63] proposed a measure for the consistency ratio of each linear programming result (refer Equation (3)).

3.2. Modified-VIKOR Aggregator

Once a MADM problem obtains the relative weights of all criteria (i.e., W in Equation (1)), it needs to collect the performance scores of each alternative (from to in Equation (1)) and aggregates the scores on each criterion for all alternatives. Most linear aggregators, such as the simple additive weighting (SAW) method, aggregate the weighted performance scores for each alternative; the higher the better. On the other side, VIKOR takes another approach to aggregate the weighted “performance gaps” for each alternative, the lower the better.

The conventional VIKOR method adopts the best and worst scores of a group of alternatives to calculate the performance gaps for all alternatives. This approach sometimes might yield unwanted ranking reversion [51]. Therefore, the modified-VIKOR avoids this potential issue by assigning the ideal (or termed as the aspiration level) and the worst scores on each criterion (among a group of alternatives) to calculate performance gaps. The modified-VIKOR can be regarded as a predefined Lp-metric for conducting compromise programming.

Assume that there are m alternatives and n criteria of a MADM problem, and is the performance score of the i-th () alternative on the j-th () criterion. In the present study, the relative weight of each criterion can be obtained by BWM, denoted as . Then the Lp-metric indicates the aggregated performance gap of alternative r on all criteria, shown in Equation (4).

In Equation (4), and denote the ideal and the worst performance scores on the i-th criterion, and is the performance score of alternative r on the i-th criterion. The ideal and the worst performance scores in each criterion are defined as “10” and “0” respectively. However, to retrieve the imprecise knowledge of domain experts for this evolving OB problem, we proposed a confidence-based fuzzy evaluation to acquire performance scores, which will be explained in Section 3.3.

The modified-VIKOR method relies on three indices to conduct the final ranking: S, R and Q. While and , the compromise programming may derive and , respectively. In modified-VIKOR, and denote the weighted average performance gap and the maximal weighted performance gap among all the criteria for alternative r. The modified-VIKOR relies on the synthesized Q index to make the final ranking, which is defined as: , where may be applied as a sensitivity analysis to see the influence of R for the overall ranking.

3.3. Confidence-Weighted Fuzzy Assessment

Since OB adoption strategy is an emerging and evolving topic, even domain experts might not have full confidence in its evaluation in all aspects. Thus, we proposed the confidence-weighted fuzzy assessment technique [67] for this study. The key benefit of using the fuzzy assessment is to capture the semantic opinions from experts. In other words, we assumed that it would be more intuitive and more comfortable for experts to indicate their views as “Good”, “Mediocre” or “Bad” than providing an exact figure between 0 and 10.

The most widely adopted fuzzy triangular membership function is incorporate to individualize each expert’s semantic scales. Furthermore, the defuzzified assessment figures will be multiplied with each expert’s confidence on each criterion for each alternative. The details will be provided in Section 4 with discussions.

4. Exemplary Case Study and Discussions

This study adopted a domestic bank (E.Sun Bank) in Taiwan to illustrate the hybrid MCDM evaluation approach. E.Sun Bank has 139 branches, and its registered capital is USD 87.82 billion, ranked as the 8th among 36 banks in Taiwan [68]. The bank’s operational performance is well-recognized by domestic and international institutions. It has been included in Dow Jones’ sustainability index for six consecutive years until 2020 and rated as the top performed bank by the Taiwan Banking Bureau.

To form an OB adoption evaluation model for E.Sun Bank, we invited domain experts from the banking or FinTech sectors and senior consultants from a reputable international institution. All the experts have over 10 years’ working experience in the related fields. The number of participated experts in each stage is not the same, based on their availability. The involved experts in different stages of surveys are summarized in Table 1.

Table 1.

Summary of experts’ background.

After two rounds of discussions with the experts, we devised and collected the Delphi questionnaires from nine experts in the first stage. The questionnaire contains more than 30 criteria from previous research, and the present study identified 14 criteria with a higher than 85% consensus rate in four dimensions. The definitions of those 14 criteria and the associated dimensions are summarized in Table 2.

Table 2.

Dimensions and Criteria of the best–worst method (BWM) model.

In the second stage, eight experts participated in the survey. Refer to Equations (2) and (3), the eight experts’ opinions formed the best-to-others (BO) and others-to-worst (OW) vectors for the four dimensions (in Table 3) and the associated criteria (in Table 4), respectively. In this BWM survey, we adopted the pairwise comparison scale from [63]; the relative importance of one criterion over the others ranges from 1/9 (the least important) to 9 (the most important).

Table 3.

Best-to-others (BO) and others-to-worst (OW) vectors of the four dimensions.

Table 4.

BO and OW criteria vectors in the four dimensions.

All the BWM analytical results passed the consistency check [64]. The eight experts’ averaged dimensional weights were multiplied with the associated averaged criteria weights (or called “local weights”) to form the global weights, reported in Table 5.

Table 5.

BWM model’s local and global weights.

The experts recommended four plausible TPPs from different fields, namely Taiwan Mobile (T), momo e-Shop (M), Line (L) and JKOPay (J) as the potential strategic partners (alternatives) for E.Sun Bank. The first company T engages in mobile telecom and fixed network services, which accounts for 24.30% market share in Taiwan [69]. M is a leading domestic e-commerce retailer, which also owns TV and catalog shopping businesses. L is the most prevailing instant messaging platform in Taiwan, which offers various services in its integrated APP. Last, company J is the second largest mobile payment service provider in Taiwan. In addition, E.Sun Bank is not controlled by any consortiums, which is more flexible to forge a strategic collaboration with TPPs that have deep ties with consortiums (e.g., momo e-Shop). The four TPPs’ backgrounds are summarized in Table 6.

Table 6.

Four third party providers’ (TPPs’) background.

In Table 5, environment (D3) is the most crucial dimension (i.e., 38.26%), and the top three important criteria are financial regulations (C1), potential market scale (C7) and rapid services delivery (C9), respectively. Those are the primary practical contribution.

In the third stage, five experts participated the assessments of the four TPPs. The experts were requested to rate each alternative’s relative attractiveness on each criterion to enhance the long-term competitiveness of E.Sun Bank while developing the OB service in Taiwan. We conducted two types of assessments: the crisp (1–10) and fuzzy ones (from low to high, three grades). In addition, we extended the conventional fuzzy assessments into the confidence-weighted ones.

During the Delphi survey stage, several experts revealed that they might not have full confidence in all aspects of the assessments of those TPPs’ attractiveness on each criterion. This acknowledgment led us to the confidence-weighted fuzzy evaluations. Four of the five experts are from one prominent international consulting firm, and they are familiar with the local banking sector and well-known TPPs of Taiwan. The five experts’ semantic scales of “Low (L)”, “Middle (M)” and “High (H)” are reported in Appendix A (Table A1) in the form of the fuzzy triangular membership function. Additionally, their confidence-weighted fuzzy assessments for the four TPPs are in Table A2.

We also applied two aggregators—the simple additive weighting (SAW) and the modified VIKOR—with the BWM weights to form the final evaluations. The BWM+SAW model’s evaluations are in Table 7, and the BWM+VIKOR model’s assessment in Table 8. Additionally, the conventional fuzzy assessment indicated the same ranking order as the confidence-weighted one.

Table 7.

BWM+ simple additive weighting (SAW) model.

Table 8.

BWM+VlseKriterijuska Optimizacija I Komoromisno Resenje (VIKOR) model.

In Table 8, by setting as 0.95, 0.90 and 0.85, all revealed the same ranking order: ; this could be deemed a sensitivity analysis, which suggests the validity and robustness of the findings. By adopting the hybrid MCDM approach, Line (L) is recommended as the best OB business collaboration partner for E.Sun Bank.

5. Conclusions

The present study bridges the gap between existing research and practical obstacles banks face in adopting OB. This study provides a holistic framework, including superintendency and regulation (D1), technology (D2), environment (D3) and organization (D4), to model this complex issue.

A major finding is that environment (D3) is the most critical dimension, which partially explains why most banks in Taiwan hesitate to invest in the OB business. Only eight of 36 banks have registered OB business until late 2020. One of the possible reasons might be the lack of understanding of OB from the public. Besides, though many studies [16,38,39,40] emphasized the technological aspect of implement OB, the BWM result indicates that domain experts deem it the least essential.

The contributions of this study are threefold, two in practical insights the other relates to the novelty of the hybrid MCDM approach:

- (1)

- The seasoned domain experts helped identify the crucial criteria and their relative importance on evaluating OB partners for the banking sector;

- (2)

- The top three criteria for banks to consider OB are: financial regulations (C1), potential market scale (C7) and rapid services delivery (C9);

- (3)

- The confidence-weighted fuzzy assessment revealed consistent ranking results as the other conventional ones, which may reflect the confidence level of an expert’s judgment on each evaluation. This hybrid approach contains originality and novelty in retrieving experts’ knowledge.

In Section 4, we adopted E.Sun Bank as an exemplary case and chose four plausible TPPs to conduct the analyses. E.Sun Bank is among the minority banks that have registered the OB business in Taiwan. Its devotion to adopting FinTech is widely recognized. The proposed hybrid approach (with multiple experiments) suggested consistent ranking order for E.Sun Bank. This approach has shown its potential on decision aids for the banking sector to choose their OB strategic partners.

Despite the practical insights brought by this study, it still has limitations. First, the BWM weighting method presumes the independent relationship among criteria, which might be enhanced by other MCDM methods. Second, both the SAW and VIKOR are linear aggregators, future research may consider non-linear ones to capture the synergy among the variables. Third, the fewer pairwise comparisons required by the BWM sometimes might cause an unwanted ranking reversal. It is recommended to conduct multiple sensitivity analyses to reduce this risk. Last, the validity of the findings hinges upon the experience and knowledge of the experts.

Author Contributions

Conceptualization, K.-Y.S., A.K.D., J.-Y.H.; methodology, K.-Y.S.; validation, K.-Y.S.; investigation, A.K.D., J.-Y.H.; resources, J.-Y.H.; data curation, A.K.D.; writing—original draft preparation, A.K.D., K.-Y.S.; writing—review and editing, K.-Y.S.; visualization, K.-Y.S.; supervision, T.M.-Y.L.; project administration, K.-Y.S., T.M.-Y.L. All authors have read and agreed to the published version of the manuscript.

Funding

This research received no external funding.

Institutional Review Board Statement

Not applicable.

Informed Consent Statement

Not applicable.

Data Availability Statement

All calculations required data are available in the text.

Acknowledgments

We are grateful for the help from a group of senior consultants from PwC Consulting in Taipei and all the domain experts’ valuable opinions.

Conflicts of Interest

The authors declare no conflict of interest.

Glossary of the Acronyms

| Acronyms | Full Names |

| OB | Open Banking |

| PSD2 | Revised Payment Service Directive |

| FinTech | Financial Technology |

| OBIE | Open Banking Implementation Entity |

| TPPs | Third Party Providers |

| AISPs | Account Information Service Providers |

| PISPs | Payment Initiation Service Providers |

| TSPs | Technical Service Providers |

| Open APIs | Open Application Interfaces |

| DMs | Decision-Makers |

| MCDM | Multiple Criteria Decision-Making |

| OBE | Open Banking Europe |

| MAS | Monetary Authority of Singapore |

| TOE | Technology, Organization, and Environment |

| PayTech | Payment Technology |

| AHP | Analytical Hierarchy Process |

| ANP | Analytic Network Process |

| DEMATEL | Decision-Making and Trial Evaluation Laboratory |

| DANP | DEMATEL-Based ANP |

| BWM | Best–Worst Method |

| VIKOR | VlseKriterijuska Optimizacija I Komoromisno Resenje |

| TOPSIS | Technique for Order Performance by Similarity to Ideal Solution |

| MADM | Multiple Attribute Decision-Making |

| SAW | Simple Additive Weighting |

| BO | Best-to-Others |

| OW | Others-to-Worst |

Appendix A. Fuzzy Assessments

Table A1.

Triangular fuzzy membership functions of the five experts.

Table A1.

Triangular fuzzy membership functions of the five experts.

| Expert 1 | Expert 2 | Expert 3 | Expert 4 | Expert 5 | |

|---|---|---|---|---|---|

| High (H) | (0.7, 1.0,1.0) | (0.7, 0.9, 0.9) | (0.7, 1.0,1.0) | (0.7, 1.0,1.0) | (0.8, 1.0,1.0) |

| Moderate (M) | (0.3, 0.6, 0.9) | (0.4, 0.6, 0.8) | (0.2, 0.5, 0.8) | (0.2, 0.5, 0.8) | (0.6, 0.7, 0.8) |

| Low (L) | (0.0, 0.0, 0.5) | (0.0, 0.0, 0.5) | (0.0, 0.0, 0.3) | (0.0, 0.0, 0.3) | (0.0, 0.0, 0.6) |

Table A2.

Confidence-based fuzzy assessments for the four TPPs (Expert 1).

Table A2.

Confidence-based fuzzy assessments for the four TPPs (Expert 1).

| C1 | C2 | C3 | C4 | C5 | C6 | C7 | C8 | C9 | C10 | C11 | C12 | C13 | C14 | |

| T | H | M | M | H | H | H | H | H | H | H | H | M | M | H |

| 50% | 70% | 70% | 80% | 80% | 60% | 90% | 80% | 90% | 80% | 80% | 60% | 70% | 70% | |

| M | H | H | H | M | H | H | H | H | H | H | H | M | M | H |

| 50% | 60% | 90% | 80% | 80% | 70% | 90% | 90% | 90% | 90% | 80% | 60% | 70% | 70% | |

| L | M | L | H | H | H | H | H | H | M | H | H | H | M | M |

| 70% | 60% | 90% | 70% | 80% | 80% | 90% | 80% | 90% | 80% | 80% | 60% | 70% | 80% | |

| J | L | M | H | L | M | M | M | M | M | M | M | M | M | M |

| 80% | 70% | 70% | 60% | 70% | 70% | 90% | 80% | 70% | 80% | 80% | 60% | 80% | 80% | |

| (Expert 2) | ||||||||||||||

| C1 | C2 | C3 | C4 | C5 | C6 | C7 | C8 | C9 | C10 | C11 | C12 | C13 | C14 | |

| T | M | H | H | H | H | H | M | H | H | H | H | M | M | L |

| 50% | 70% | 80% | 90% | 80% | 90% | 55% | 80% | 70% | 70% | 80% | 55% | 45% | 40% | |

| M | H | M | H | H | M | M | H | H | H | H | H | H | M | L |

| 70% | 50% | 70% | 70% | 50% | 50% | 80% | 70% | 90% | 90% | 90% | 80% | 60% | 50% | |

| L | H | H | M | M | M | M | H | M | H | H | H | H | M | M |

| 90% | 80% | 50% | 50% | 50% | 50% | 80% | 60% | 70% | 80% | 90% | 80% | 60% | 50% | |

| J | L | L | L | M | M | M | L | M | M | M | L | L | H | H |

| 20% | 20% | 40% | 40% | 50% | 50% | 40% | 40% | 40% | 50% | 30% | 40% | 80% | 70% | |

| (Expert 3) | ||||||||||||||

| C1 | C2 | C3 | C4 | C5 | C6 | C7 | C8 | C9 | C10 | C11 | C12 | C13 | C14 | |

| T | M | M | L | L | M | M | H | M | M | M | L | H | M | M |

| 60% | 60% | 50% | 50% | 70% | 70% | 70% | 70% | 70% | 60% | 50% | 40% | 40% | 40% | |

| M | M | M | L | L | L | L | H | M | M | H | L | M | M | M |

| 60% | 60% | 50% | 50% | 60% | 60% | 65% | 65% | 70% | 60% | 50% | 40% | 40% | 40% | |

| L | M | M | H | H | M | H | H | H | H | H | H | M | H | H |

| 50% | 50% | 80% | 80% | 80% | 80% | 80% | 80% | 70% | 65% | 65% | 40% | 60% | 60% | |

| J | L | L | H | H | H | H | H | H | H | H | H | H | H | H |

| 50% | 50% | 80% | 80% | 80% | 80% | 80% | 80% | 80% | 70% | 65% | 40% | 60% | 60% | |

| (Expert 4) | ||||||||||||||

| C1 | C2 | C3 | C4 | C5 | C6 | C7 | C8 | C9 | C10 | C11 | C12 | C13 | C14 | |

| T | M | M | M | H | H | M | H | M | M | M | H | H | M | M |

| 60% | 80% | 70% | 90% | 80% | 90% | 50% | 60% | 90% | 60% | 50% | 60% | 50% | 30% | |

| M | L | M | M | L | L | L | M | M | M | M | M | H | M | M |

| 60% | 70% | 70% | 50% | 70% | 70% | 50% | 50% | 50% | 60% | 50% | 60% | 50% | 30% | |

| L | H | H | H | M | M | M | H | H | H | H | H | H | M | M |

| 70% | 40% | 80% | 60% | 80% | 80% | 60% | 90% | 80% | 80% | 50% | 80% | 70% | 30% | |

| J | H | L | H | M | M | M | M | H | H | M | H | L | H | H |

| 85% | 20% | 75% | 40% | 60% | 60% | 20% | 80% | 50% | 40% | 30% | 30% | 50% | 20% | |

| (Expert 5) | ||||||||||||||

| C1 | C2 | C3 | C4 | C5 | C6 | C7 | C8 | C9 | C10 | C11 | C12 | C13 | C14 | |

| T | M | M | M | L | M | M | H | L | H | L | L | L | M | M |

| 90% | 70% | 80% | 90% | 80% | 70% | 80% | 80% | 90% | 80% | 80% | 80% | 80% | 80% | |

| M | L | L | L | L | L | L | M | M | M | M | M | M | M | M |

| 90% | 90% | 90% | 80% | 90% | 90% | 90% | 90% | 90% | 90% | 90% | 90% | 80% | 80% | |

| L | H | M | H | H | H | M | H | L | L | L | L | L | M | M |

| 80% | 90% | 90% | 90% | 90% | 90% | 90% | 90% | 80% | 90% | 90% | 90% | 80% | 80% | |

| J | H | H | M | M | M | M | L | M | L | L | L | L | M | M |

| 90% | 90% | 70% | 80% | 70% | 80% | 90% | 80% | 90% | 70% | 70% | 70% | 80% | 80% | |

References

- Aneesh, Z.; Grilo, A. The emergence of digital platforms: A conceptual platform architecture and impact on industrial engineering. Comput. Ind. Eng. 2019, 136, 546–555. [Google Scholar] [CrossRef]

- Payment Services Directive: Frequently Asked Questions. Available online: https://ec.europa.eu/commission/presscorner/detail/en/MEMO_15_5793 (accessed on 23 October 2020).

- Polasik, M.; Huterska, A.; Iftikhar, R.; Mikula, Š. The impact of Payment Services Directive 2 on the PayTech sector development in Europe. J. Econ. Behav. Organ. 2020, 178, 385–401. [Google Scholar] [CrossRef]

- Mansfield-Devine, S. Open banking: Opportunity and danger. Comput. Fraud. Secur. 2016, 10, 8–13. [Google Scholar] [CrossRef]

- Open Banking... So What? Available online: https://www.pwc.com/it/en/industries/banking/future-open-banking.html (accessed on 28 June 2020).

- Get Started. Available online: https://www.openbanking.org.uk/providers/ (accessed on 8 October 2020).

- What is Open Banking? Available online: https://www.openbanking.org.uk/ (accessed on 8 October 2020).

- Premchand, A.; Choudhry, A. Open Banking & APIs for Transformation in Banking. In Proceedings of the 2018 International Conference on Communication (IEEE), Computing and Internet of Things (IC3IoT), Chennai, India, 15–17 February 2018. [Google Scholar] [CrossRef]

- Yip, A.W.H.; Bocken, N.M.P. Sustainable business model archetypes for the banking industry. J. Clean. Prod. 2018, 174, 150–169. [Google Scholar] [CrossRef]

- Bouncken, R.B.; Fredrich, V.; Kraus, S.; Ritala, P. Innovation alliances: Balancing value creation dynamics, competitive intensity and market overlap. J. Bus. Res. 2020, 22, 240–247. [Google Scholar] [CrossRef]

- Huang, J.Y.; Shen, K.Y.; Shieh, J.C.P.; Tzeng, G.H. Strengthen financial holding companies’ business sustainability by using a hybrid corporate governance evaluation model. Sustainability 2019, 11, 582. [Google Scholar] [CrossRef]

- Shen, K.Y.; Zavadskas, E.K.; Tzeng, G.H. Updated discussions on “hybrid multiple criteria decision-making methods: A review of applications for sustainability issues”. Ekon. Istraz. 2018, 31, 1437–1452. [Google Scholar] [CrossRef]

- Our Scope. Available online: https://www.openbanking-europe.eu/who-we-are/ (accessed on 9 October 2020).

- Atzori, M.; Koutrika, G.; Pes, B.; Tanca, L. Special issue on “Data exploration in the web 3.0 age”. Future Gener. Comput. Syst. 2020, 112, 1177–1197. [Google Scholar] [CrossRef]

- The History of Open Banking. Available online: https://knowledge.fintecsystems.com/en/blog/the-history-of-open-banking (accessed on 20 October 2020).

- Background to Open Banking. Available online: https://www.openbanking.org.uk/about-us/ (accessed on 8 October 2020).

- Real Demand for Open Banking as User Numbers Grow to More Than Two Million. Available online: https://www.openbanking.org.uk/about-us/latest-news/real-demand-for-open-banking-as-user-numbers-grow-to-more-than-two-million/ (accessed on 8 October 2020).

- Open Banking Europe: Security & Identification Standards for APIs & Communications. Available online: https://www.openbankingeurope.eu/media/1943/oasis-obe-api-identification-and-security-standards-for-apis-and-communications.pdf (accessed on 20 February 2021).

- Number and Type of TPPs Per Country. Available online: https://www.openbankingeurope.eu/media/1841/tpp-map-september.pdf (accessed on 23 October 2020).

- ABS-MAS Financial World: Finance-as-a-Service API Playbook; Monetary Authority of Singapore: Singapore, 2016; pp. 6–16.

- Open Banking. Available online: https://www.ausbanking.org.au/policy/the-future/open-banking/ (accessed on 2 October 2020).

- The Global Open Banking Report 2020–Beyond Open Banking, Into the Open Finance and Open Data Economy. Available online: https://thepaypers.com/reports/the-global-open-banking-report-2020-beyond-open-banking-into-the-open-finance-and-open-data-economy/r1244913 (accessed on 27 November 2020).

- Hong Kong Monetary Authority. Open API Framework for the Hong Kong Banking Sector; Hong Kong Monetary Authority: Hong Kong, 2018; pp. 3–24. [Google Scholar]

- Open Banking around the World: Towards a Cross-Industry Data Sharing Ecosystem. Available online: https://www2.deloitte.com/tw/en/pages/financial-services/articles/open-banking-around-the-world.html (accessed on 23 October 2020).

- iThome News Report (in Chinese). Available online: https://www.ithome.com.tw/news/137909 (accessed on 12 September 2020).

- Borgogno, O.; Colangelo, G. Data sharing and interoperability: Fostering innovation and competition through APIs. Comput. Law Secur. Rev. 2019, 35. [Google Scholar] [CrossRef]

- Wang, H.; Ma, S.; Dai, H.N.; Imran, M.; Wang, T. Blockchain-based data privacy management with nudge theory in Open Banking. Future Gener. Comput. Syst. 2020, 110, 812–823. [Google Scholar] [CrossRef]

- Wolters, P.T.J.; Jacobs, B.P.F. The security of access to accounts under the PSD2. Comput. Law Secur. Rev. 2019, 35, 29–41. [Google Scholar] [CrossRef]

- Shaikh, A.A.; Alharthi, M.D.; Alamoudi, H.O. Examining key drivers of consumer experience with (non-financial) digital services?—An Exploratory study. J. Retail. Consum. Serv. 2020, 55, 102073. [Google Scholar] [CrossRef]

- Dratva, R. Is open banking driving the financial industry towards a true electronic market? Electron. Mark. 2020, 30, 65–67. [Google Scholar] [CrossRef]

- Nam, D.; Lee, J.; Lee, H. Business analytics adoption process: An innovation diffusion perspective. Int. J. Inf. Manag. 2019, 49, 411–423. [Google Scholar] [CrossRef]

- Zhu, K.; Kraemer, K.L.; Xu, S.; Dedrick, J. Information technology payoff in e-business environments: An international perspective on value creation of e-business in the financial services industry. J. Manag. Inform. Syst. 2004, 21, 17–54. [Google Scholar] [CrossRef]

- Yang, M.; He, Y. How does the stock market react to financial innovation regulations? Financ. Res. Lett. 2019, 30, 259–265. [Google Scholar] [CrossRef]

- Van Loo, R. Making innovation more competitive: The case of FinTech. UCLA Law Rev. 2018, 65, 232–279. [Google Scholar]

- Fratzscher, M.; König, P.J.; Lambert, C. Credit provision and banking stability after the Great Financial Crisis: The role of bank regulation and the quality of governance. J. Int. Money Finan. 2016, 66, 113–135. [Google Scholar] [CrossRef]

- Buffart, M.; Croidieu, G.; Kim, P.H.; Bowman, R. Even winners need to learn: How government entrepreneurship programs can support innovative ventures. Res. Policy 2020, 49, 104052. [Google Scholar] [CrossRef]

- Chik, W.B. ‘Customary Internet-ional Law’: Creating a body of customary law for cyberspace. Part 1: Developing rules for transitioning custom into law. Comput. Law Secur. Rev. 2010, 26, 3–22. [Google Scholar] [CrossRef]

- Shah, M.H.; Siddiqui, F.A. Organisational critical success factors in adoption of e-banking at the Woolwich Bank. Int. J. Inf. Manag. 2006, 26, 442–456. [Google Scholar] [CrossRef]

- Yu, W.; Ding, Z.; Liu, L.; Wang, X.; Crossley, R.D. Petri Net-based Methods for analyzing structural security in e-commerce business processes. Futur. Gener. Comp. Syst. 2020, 109, 611–620. [Google Scholar] [CrossRef]

- Choi, H.; Park, J.; Kim, J.; Jung, Y. Consumer preferences of attributes of mobile payment services in South Korea. Telemat. Inform. 2020, 51, 101397. [Google Scholar] [CrossRef]

- Baker, J. The technology–organization–environment framework. Information Systems Theory: Explaining and Predicting Our Digital Society; Dwivedi, Y.K., Wade, M.R., Schneberger, S.L., Eds.; Springer: New York, NY, USA, 2012; Volume 1, pp. 231–245. [Google Scholar]

- Sengupta, A.; Sena, V. Impact of open innovation on industries and firms—A dynamic complex systems view. Technol. Forecast. Soc. Chang. 2020, 159, 120199. [Google Scholar] [CrossRef]

- Markovic, S.; Jovanovic, M.; Bagherzadeh, M.; Sancha, C.; Sarafinovska, M.; Qiu, Y. Priorities when selecting business partners for service innovation: The contingency role of product innovation. Ind. Mark. Manag. 2020, 88, 378–388. [Google Scholar] [CrossRef]

- Sharma, D.; Pandey, S.K.; Chandwani, R.; Pandey, P.; Joseph, R. Internet channel cannibalization and its influence on salesperson performance outcomes in an emerging economy context. J. Retail. Consum. Serv. 2018, 45, 179–189. [Google Scholar] [CrossRef]

- Piderit, S.K. Rethinking resistance and recognizing ambivalence: A multidimensional view of attitudes toward an organizational change. Acad. Manag. Rev. 2000, 25, 783–794. [Google Scholar] [CrossRef]

- He, D.; Ho, C.Y.; Xu, L. Risk and return of online channel adoption in the banking industry. Pac. Basin Financ. J. 2020, 60, 101268. [Google Scholar] [CrossRef]

- Del Gaudio, B.L.; Porzio, C.; Sampagnaro, G.; Verdoliva, V. How do mobile, internet and ICT diffusion affect the banking industry? An empirical analysis. Eur. Manag. J. 2020. [Google Scholar] [CrossRef]

- Frizzo-Barker, J.; Chow-White, P.A.; Adams, P.R.; Mentanko, J.; Ha, D.; Green, S. Blockchain as a disruptive technology for business: A systematic review. Int. J. Inf. Manag. 2020, 51, 102029. [Google Scholar] [CrossRef]

- Kim, H.W. The effects of switching costs on user resistance to enterprise systems implementation. IEEE Trans. Eng. Manag. 2011, 58, 471–482. [Google Scholar] [CrossRef]

- Stamoulis, D.; Kanellis, P.; Martakos, D. An approach and model for assessing the business value of e-banking distribution channels: Evaluation as communication. Int. J. Inf. Manag. 2002, 22, 247–261. [Google Scholar] [CrossRef]

- Opricovic, S.; Tzeng, G.H. Compromise solution by MCDM methods: A comparative analysis of VIKOR and TOPSIS. Eur. J. Oper. Res. 2004, 156, 445–455. [Google Scholar] [CrossRef]

- Bakioglu, G.; Atahan, A.O. AHP integrated TOPSIS and VIKOR methods with pythagorean fuzzy sets to prioritize risks in self-driving vehicles. Appl. Soft. Comput. 2020, 99, 106948. [Google Scholar] [CrossRef]

- Shen, K.Y.; Tzeng, G.H. A decision rule-based soft computing model for supporting financial performance improvement of the banking industry. Soft Comput. 2015, 19, 859–874. [Google Scholar] [CrossRef]

- Shen, K.Y.; Yan, M.R.; Tzeng, G.H. Combining VIKOR-DANP model for glamor stock selection and stock performance improvement. Knowl. Based Syst. 2014, 58, 86–97. [Google Scholar] [CrossRef]

- Gupta, H.; Barua, M.K. Identifying enablers of technological innovation for Indian MSMEs using best-worst multi criteria decision making method. Technol. Forecast. Soc. Chang. 2016, 107, 69–79. [Google Scholar] [CrossRef]

- Feng, Y.; Hong, Z.; Tian, G.; Li, Z.; Tan, J.; Hu, H. Environmentally friendly MCDM of reliability-based product optimisation combining DEMATEL-based ANP, interval uncertainty and Vlse Kriterijumska Optimizacija Kompromisno Resenje (VIKOR). Inf. Sci. 2018, 442‒443, 128–144. [Google Scholar] [CrossRef]

- Nouri, F.A.; Esbouei, S.K.; Antucheviciene, J. A Hybrid MCDM approach based on fuzzy ANP and fuzzy TOPSIS for technology selection. Informatica 2015, 26, 369–388. [Google Scholar] [CrossRef]

- Joshi, B.P.; Gegov, A. Confidence levels q-rung orthopair fuzzy aggregation operators and its applications to MCDM problems. Int. J. Intell. Syst. 2020, 35, 125–149. [Google Scholar] [CrossRef]

- Kilic, H.S.; Zaim, S.; Delen, D. Development of a hybrid methodology for ERP system selection: The case of Turkish Airlines. Decis. Support. Syst. 2014, 66, 82–92. [Google Scholar] [CrossRef]

- Wang, Y.L.; Shen, K.Y.; Huang, J.Y.; Luarn, P. Use of a refined corporate social responsibility model to mitigate information asymmetry and evaluate performance. Symmetry 2020, 12, 1349. [Google Scholar] [CrossRef]

- Chang, T.W.; Lo, H.W.; Chen, K.Y.; Liou, J.J. A novel FMEA model based on rough BWM and rough TOPSIS-AL for risk assessment. Mathematics 2019, 7, 874. [Google Scholar] [CrossRef]

- Camargo Pérez, J.; Carrillo, M.H.; Montoya-Torres, J.R. Multi-criteria approaches for urban passenger transport systems: A literature review. Ann. Oper. Res. 2015, 226, 69–87. [Google Scholar] [CrossRef]

- Rezaei, J. Best-worst multi-criteria decision-making method. Omega 2015, 53, 49–57. [Google Scholar] [CrossRef]

- Rezaei, J. Best-worst multi-criteria decision-making method: Some properties and a linear model. Omega 2016, 64, 126–130. [Google Scholar] [CrossRef]

- Zavadskas, E.K.; Turskis, Z.; Kildienė, S. State of art surveys of overviews on MCDM/MADM methods. Technol. Econ. Dev. Econ. 2014, 20, 165–179. [Google Scholar] [CrossRef]

- Simon, H.A. Bounded rationality in social science: Today and tomorrow. Mind Soc. 2000, 1, 25–39. [Google Scholar] [CrossRef]

- Fenton, N.; Wang, W. Risk and confidence analysis for fuzzy multicriteria decision making. Knowl. Based Syst. 2006, 19, 430–437. [Google Scholar] [CrossRef]

- Financial Institutes Information. Available online: https://www.banking.gov.tw/ch/home.jsp?id=60&parentpath=0,4&mcustomize=FscSearch_BankType.jsp&type=1 (accessed on 14 February 2021).

- 2020Q3 Mobile Telecommunication Statistics. Available online: https://www.ncc.gov.tw/chinese/gradation.aspx?site_content_sn=4160&is_history=0 (accessed on 1 January 2021).

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).