Spillover and Drivers of Uncertainty among Oil and Commodity Markets

Abstract

1. Introduction

2. Literature Review

2.1. Oil and Commodity Markets

2.2. Global Factors and Commodity Markets

3. Methodology

3.1. Diebold and Yilmaz Transmission Approach

3.2. Causality Tests

3.2.1. Linear Causality Test

3.2.2. Nonlinear Causality Tests

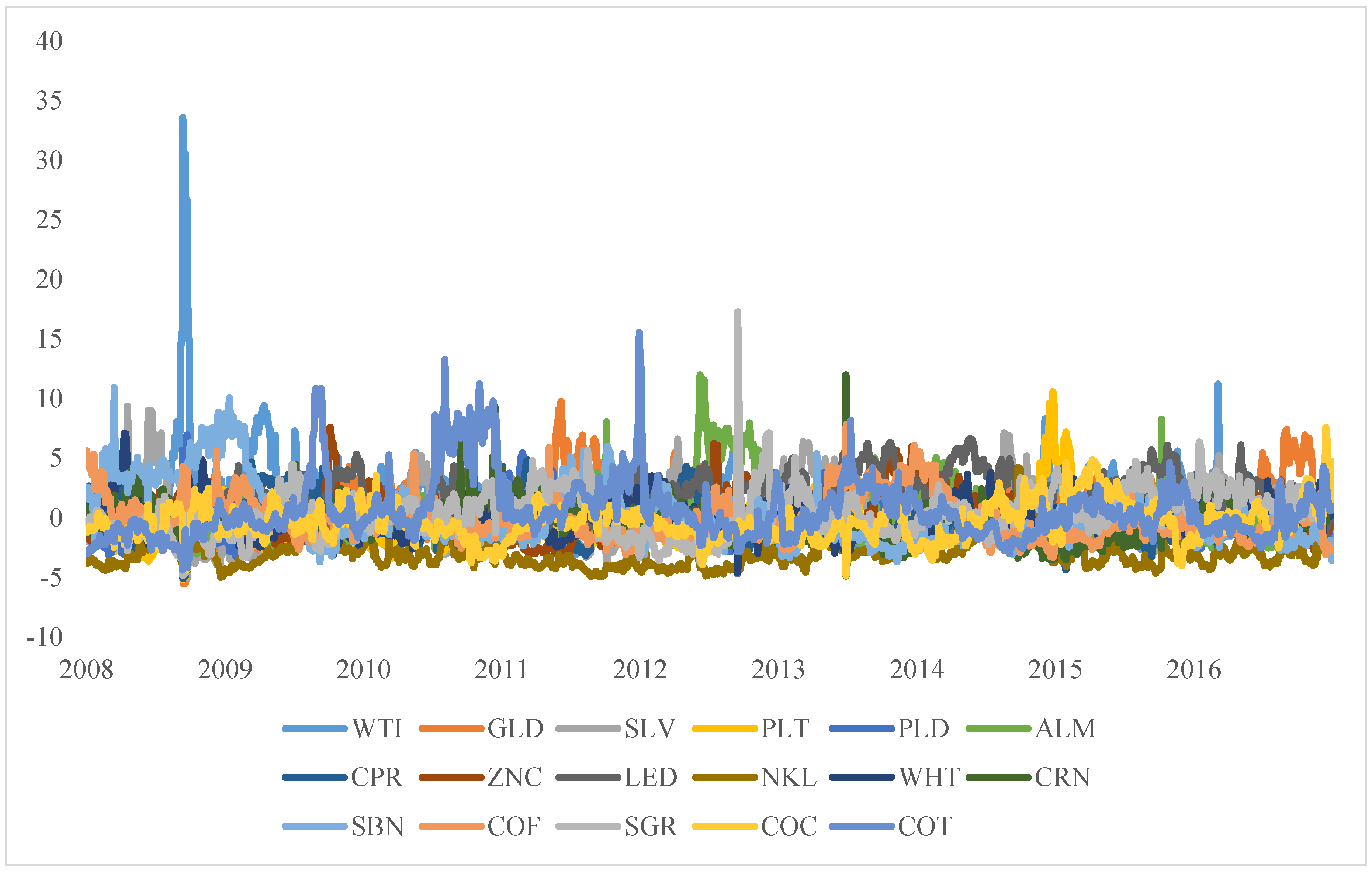

4. Data and Summary Statistics

5. Empirical Findings

5.1. Transmission between Oil and Other Commodity Uncertainties

5.2. Impact of Global Factors

6. Conclusions

Author Contributions

Funding

Institutional Review Board Statement

Informed Consent Statement

Data Availability Statement

Conflicts of Interest

References

- Aloui, R.; Aïssa, M.S.B.; Nguyen, D.K. Global financial crisis, extreme interdependences, and contagion effects: The role of economic structure? J. Bank. Financ. 2011, 35, 130–141. [Google Scholar] [CrossRef]

- Cheng, I.H.; Xiong, W. Financialization of commodity markets. Annu. Rev. Financ. Econ. 2014, 6, 419–441. [Google Scholar] [CrossRef]

- Mensi, W.; Beljid, M.; Boubaker, A.; Managi, S. Correlations and volatility spillovers across commodity and stock markets: Linking energies, food, and gold. Econ. Model. 2013, 32, 15–22. [Google Scholar] [CrossRef]

- Shahzad, S.J.H.; Raza, N.; Roubaud, D.; Hernandez, J.A.; Bekiros, S. Gold as safe haven for G-7 stocks and bonds: A Revisit. J. Quant. Econ. 2019, 17, 885–912. [Google Scholar] [CrossRef]

- Rehman, M.U.; Shahzad, S.J.H.; Uddin, G.S.; Hedström, A. Precious metal returns and oil shocks: A time varying connectedness approach. Resour. Policy 2018, 58, 77–89. [Google Scholar] [CrossRef]

- Shahzad, S.J.H.; Naifar, N.; Hammoudeh, S.; Roubaud, D. Directional predictability from oil market uncertainty to sovereign credit spreads of oil-exporting countries: Evidence from rolling windows and crossquantilogram analysis. Energy Econ. 2017, 68, 327–339. [Google Scholar] [CrossRef]

- Baumeister, C.; Kilian, L. Do oil price increases cause higher food prices? Econ. Policy 2014, 29, 691–747. [Google Scholar] [CrossRef]

- Malik, F.; Umar, Z. Dynamic connectedness of oil price shocks and exchange rates. Energy Econ. 2019, 84, 104501. [Google Scholar] [CrossRef]

- Jain, A.; Ghosh, S. Dynamics of global oil prices, exchange rate and precious metal prices in India. Resour. Policy 2013, 38, 88–93. [Google Scholar] [CrossRef]

- Hooker, M.A. Are oil shocks inflationary? Asymmetric and nonlinear specifications versus changes in regime. J. Money Credit Bank. 2002, 34, 540–561. [Google Scholar] [CrossRef]

- Hammoudeh, S.; Yuan, Y. Metal volatility in presence of oil and interest rate shocks. Energy Econ. 2008, 30, 606–620. [Google Scholar] [CrossRef]

- Shahzad, S.J.H.; Raza, N.; Balcilar, M.; Ali, S.; Shahbaz, M. Can economic policy uncertainty and investors sentiment predict commodities returns and volatility? Resour. Policy 2017, 53, 208–218. [Google Scholar] [CrossRef]

- Pal, D.; Mitra, S.K. Time-frequency contained co-movement of crude oil and world food prices: A wavelet-based analysis. Energy Econ. 2017, 62, 230–239. [Google Scholar] [CrossRef]

- Lucotte, Y. Co-movements between crude oil and food prices: A post-commodity boom perspective. Econ. Lett. 2016, 147, 142–147. [Google Scholar] [CrossRef]

- Nazlioglu, S. World oil and agricultural commodity prices: Evidence from nonlinear causality. Energy Policy 2011, 39, 2935–2943. [Google Scholar] [CrossRef]

- Pal, D.; Mitra, S.K. Interdependence between crude oil and world food prices: A detrended cross-correlation analysis. Phys. A Stat. Mech. Appl. 2018, 492, 1032–1044. [Google Scholar] [CrossRef]

- Zhang, C.; Qu, X. The effect of global oil price shocks on China’s agricultural commodities. Energy Econ. 2015, 51, 354–364. [Google Scholar] [CrossRef]

- Ahmadi, M.; Behmiri, N.B.; Manera, M. How is volatility in commodity markets linked to oil price shocks? Energy Econ. 2016, 59, 11–23. [Google Scholar] [CrossRef]

- Balli, F.; Naeem, M.A.; Shahzad, S.J.H.; De Bruin, A. Spillover network of commodity uncertainties. Energy Econ. 2019, 81, 914–927. [Google Scholar] [CrossRef]

- Diebold, F.X.; Liu, L.; Yilmaz, K. Commodity Connectedness; NBER Working Paper No. 23685; National Bureau of Economic Research: Cambridge, MA, USA, 2017. [Google Scholar]

- Kang, S.H.; McIver, R.; Yoon, S.M. Dynamic spillover effects among crude oil, precious metal, and agricultural commodity futures markets. Energy Econ. 2017, 62, 19–32. [Google Scholar] [CrossRef]

- Kang, S.H.; Tiwari, A.K.; Albulescu, C.T.; Yoon, S.M. Exploring the time-frequency connectedness and network among crude oil and agriculture commodities V1. Energy Econ. 2019, 84, 104543. [Google Scholar] [CrossRef]

- Tiwari, A.K.; Nasreen, S.; Shahbaz, M.; Hammoudeh, S. Time-frequency causality and connectedness between international prices of energy, food, industry, agriculture and metals. Energy Econ. 2019, 85, 104529. [Google Scholar] [CrossRef]

- Umar, Z.; Nasreen, S.; Solarin, S.A.; Tiwari, A.K. Exploring the time and frequency domain connectedness of oil prices and metal prices. Resour. Policy 2019, 64, 101516. [Google Scholar] [CrossRef]

- Huang, X.; An, H.; Gao, X.; Hao, X.; Liu, P. Multiresolution transmission of the correlation modes between bivariate time series based on complex network theory. Phys. A Stat. Mech. Appl. 2015, 428, 493–506. [Google Scholar] [CrossRef]

- Sari, R.; Hammoudeh, S.; Ewing, B.T. Dynamic relationships between oil and metal commodity futures prices. Geopolit. Energy 2007, 29, 2–13. [Google Scholar]

- Albulescu, C.T.; Demirer, R.; Raheem, I.D.; Tiwari, A.K. Does the US economic policy uncertainty connect financial markets? Evidence from oil and commodity currencies. Energy Econ. 2019, 83, 375–388. [Google Scholar] [CrossRef]

- Fang, L.; Chen, B.; Yu, H.; Xiong, C. The effect of economic policy uncertainty on the long-run correlation between crude oil and the US stock markets. Financ. Res. Lett. 2018, 24, 56–63. [Google Scholar] [CrossRef]

- De Boyrie, M.E.; Pavlova, I. Equities and commodities comovements: Evidence from emerging markets. Glob. Econ. J. 2018, 18, 20170075. [Google Scholar] [CrossRef]

- Badshah, I.; Demirer, R.; Suleman, T. The effect of economic policy uncertainty on stock-commodity correlations and its implications on optimal hedging. Energy Econ. 2019, 84, 104553. [Google Scholar] [CrossRef]

- Kanjilal, K.; Ghosh, S. Dynamics of crude oil and gold price post 2008 global financial crisis—New evidence from threshold vector error-correction model. Resour. Policy 2017, 52, 358–365. [Google Scholar] [CrossRef]

- Poncela, P.; Senra, E.; Sierra, L.P. Common dynamics of nonenergy commodity prices and their relation to uncertainty. Appl. Econ. 2014, 46, 3724–3735. [Google Scholar] [CrossRef]

- Jebabli, I.; Arouri, M.; Teulon, F. On the effects of world stock market and oil price shocks on food prices: An empirical investigation based on TVP-VAR models with stochastic volatility. Energy Econ. 2014, 45, 66–98. [Google Scholar] [CrossRef]

- Batten, J.A.; Szilagyi, P.G.; Wagner, N.F. Should emerging market investors buy commodities? Appl. Econ. 2015, 47, 4228–4246. [Google Scholar] [CrossRef]

- Prokopczuk, M.; Stancu, A.; Symeonidis, L. The economic drivers of commodity market volatility. J. Int. Money Financ. 2019, 98, 102063. [Google Scholar] [CrossRef]

- Diebold, F.X.; Yılmaz, K. On the network topology of variance decompositions: Measuring the connectedness of financial firms. J. Econom. 2014, 182, 119–134. [Google Scholar] [CrossRef]

- Granger, C.W. Investigating causal relations by econometric models and cross-spectral methods. Econom. J. Econom. Soc. 1969, 37, 424–438. [Google Scholar] [CrossRef]

- Péguin-Feissolle, A.; Teräsvirta, T. A General Framework for Testing the Granger Noncausality Hypothesis; SSE/EFI Working Paper Series in Economics and Finance No. 343; Stockholm School of Economics: Stockholm, Sweden, 1999. [Google Scholar]

- Ahmadi, M.; Manera, M.; Sadeghzadeh, M. Global oil market and the US stock returns. Energy 2016, 114, 1277–1287. [Google Scholar] [CrossRef]

- Campiche, J.L.; Bryant, H.L.; Richardson, J.W.; Outlaw, J.L. Examining the evolving correspondence between petroleum prices and agricultural commodity prices. In American Agricultural Economics Association Annual Meeting, Portland, OR, USA, 29 July–1 August; American Agricultural Economics Association: Austin, TX, USA, 2007. [Google Scholar]

- Cha, K.S.; Bae, J.H. Dynamic impacts of high oil prices on the bioethanol and feedstock markets. Energy Policy 2011, 39, 753–760. [Google Scholar] [CrossRef]

- Ciner, C.; Gurdgiev, C.; Lucey, B.M. Hedges and safe havens: An examination of stocks, bonds, gold, oil and exchange rates. Int. Rev. Financ. Anal. 2013, 29, 202–211. [Google Scholar] [CrossRef]

- Hammoudeh, S.M.; Yuan, Y.; McAleer, M. Shock and volatility spillovers among equity sectors of the Gulf Arab stock markets. Q. Rev. Econ. Financ. 2009, 49, 829–842. [Google Scholar] [CrossRef]

- Juvenal, L.; Petrella, I. Speculation in the oil market. J. Appl. Econom. 2015, 30, 621–649. [Google Scholar] [CrossRef]

- Kristoufek, L.; Janda, K.; Zilberman, D. Correlations between biofuels and related commodities before and during the food crisis: A taxonomy perspective. Energy Econ. 2012, 34, 1380–1391. [Google Scholar] [CrossRef]

- Nazlioglu, S.; Erdem, C.; Soytas, U. Volatility spillover between oil and agricultural commodity markets. Energy Econ. 2013, 36, 658–665. [Google Scholar] [CrossRef]

- Zhang, D.; Broadstock, D.C. Global financial crisis and rising connectedness in the international commodity markets. Int. Rev. Financ. Anal. 2020, 68, 101239. [Google Scholar] [CrossRef]

- Youssef, M. Do oil prices and financial indicators drive the herding behavior in commodity markets? J. Behav. Financ. 2020, 1–5. [Google Scholar] [CrossRef]

- Rehman, M.U.; Vo, X.V. Energy commodities, precious metals and industrial metal markets: A nexus across different investment horizons and market conditions. Resour. Policy 2021, 70, 101843. [Google Scholar] [CrossRef]

- Dutta, A.; Bouri, E.; Roubaud, D. Nonlinear relationships amongst the implied volatilities of crude oil and precious metals. Resour. Policy 2019, 61, 473–478. [Google Scholar] [CrossRef]

- Zhang, Y.J.; Wei, Y.M. The crude oil market and the gold market: Evidence for cointegration, causality and price discovery. Resour. Policy 2010, 35, 168–177. [Google Scholar] [CrossRef]

- Bildirici, M.E.; Turkmen, C. Nonlinear causality between oil and precious metals. Resour. Policy 2015, 46, 202–211. [Google Scholar] [CrossRef]

- Aloui, R.; Gupta, R.; Miller, S.M. Uncertainty and crude oil returns. Energy Econ. 2016, 55, 92–100. [Google Scholar] [CrossRef]

- Degiannakis, S.; Filis, G.; Panagiotakopoulou, S. Oil price shocks and uncertainty: How stable is their relationship over time? Econ. Model. 2018, 72, 42–53. [Google Scholar] [CrossRef]

- Pastor, L.; Veronesi, P. Uncertainty about government policy and stock prices. J. Financ. 2012, 67, 1219–1264. [Google Scholar] [CrossRef]

- Sari, R.; Uzunkaya, M.; Hammoudeh, S. The relationship between disaggregated country risk ratings and stock market movements: An ARDL approach. Emerg. Mark. Financ. Trade 2013, 49, 4–16. [Google Scholar] [CrossRef]

- Reboredo, J.C.; Ugolini, A. The impact of downward/upward oil price movements on metal prices. Resour. Policy 2016, 49, 129–141. [Google Scholar] [CrossRef]

- Wang, Y.; Wu, C. Forecasting energy market volatility using GARCH models: Can multivariate models beat univariate models? Energy Econ. 2012, 34, 2167–2181. [Google Scholar] [CrossRef]

- Handley, K.; Limao, N. Trade and investment under policy uncertainty: Theory and firm evidence. Am. Econ. J. Econ. Policy 2015, 7, 189–222. [Google Scholar] [CrossRef]

- Rogoff, K. Oil and the Global Economy; Manuscript; Harvard University: Cambridge, MA, USA, 2006; pp. 1–46. [Google Scholar]

- Bouoiyour, J.; Selmi, R.; Hammoudeh, S.; Wohar, M.E. What are the categories of geopolitical risks that could drive oil prices higher? Acts or threats? Energy Econ. 2019, 84, 104523. [Google Scholar] [CrossRef]

- Ordu-Akkaya, B.M.; Soytas, U. Unconventional monetary policy and financialization of commodities. N. Am. J. Econ. Financ. 2018, 51, 100902. [Google Scholar] [CrossRef]

- Büyükşahin, B.; Robe, M.A. Speculators, commodities and cross-market linkages. J. Int. Money Financ. 2014, 42, 38–70. [Google Scholar] [CrossRef]

- Robe, M.A.; Wallen, J. Fundamentals, derivatives market information and oil price volatility. J. Futures Mark. 2016, 36, 317–344. [Google Scholar] [CrossRef]

- Murray, D. Geopolitical Risk and Commodities: An Investigation. Glob. Commod. Appl. Res. Dig. 2018, 3, 95–106. [Google Scholar]

- Liu, J.; Ma, F.; Tang, Y.; Zhang, Y. Geopolitical risk and oil volatility: A new insight. Energy Econ. 2019, 84, 104548. [Google Scholar] [CrossRef]

- Koop, G.; Pesaran, M.H.; Potter, S.M. Impulse response analysis in nonlinear multivariate models. J. Econom. 1996, 74, 119–147. [Google Scholar] [CrossRef]

- Pesaran, H.H.; Shin, Y. Generalized impulse response analysis in linear multivariate models. Econ. Lett. 1998, 58, 17–29. [Google Scholar] [CrossRef]

- Péguin-Feissolle, A.; Strikholm, B.; Teräsvirta, T. Testing the Granger noncausality hypothesis in stationary nonlinear models of unknown functional form. Commun. Stat. Simul. Comput. 2013, 42, 1063–1087. [Google Scholar] [CrossRef]

- Bams, D.; Blanchard, G.; Honarvar, I.; Lehnert, T. Does oil and gold price uncertainty matter for the stock market? J. Empir. Financ. 2017, 44, 270–285. [Google Scholar] [CrossRef]

- Baker, S.R.; Bloom, N.; Davis, S.J. Measuring economic policy uncertainty. Q. J. Econ. 2016, 131, 1593–1636. [Google Scholar] [CrossRef]

- Caldara, D.; Iacoviello, M. Measuring geopolitical risk. In International Finance Discussion Papers 1222; Board of Governors of the Federal Reserve System: Washington, DC, USA, 2018; pp. 1–47. [Google Scholar]

- Ji, Q.; Bouri, E.; Roubaud, D.; Shahzad, S.J.H. Risk spillover between energy and agricultural commodity markets: A dependence-switching CoVaR-copula model. Energy Econ. 2018, 75, 14–27. [Google Scholar] [CrossRef]

- Shahzad, S.J.H.; Hernandez, J.A.; Al-Yahyaee, K.H.; Jammazi, R. Asymmetric risk spillovers between oil and agricultural commodities. Energy Policy 2018, 118, 182–198. [Google Scholar] [CrossRef]

- Tang, K.; Xiong, W. Index investment and the financialization of commodities. Financ. Anal. J. 2012, 68, 54–74. [Google Scholar] [CrossRef]

- Batten, J.A.; Kinateder, H.; Szilagyi, P.G.; Wagner, N.F. Hedging stocks with oil. Energy Econ. 2019, 93, 104422. [Google Scholar] [CrossRef]

- Aboura, S.; Chevallier, J. Volatility returns with vengeance: Financial markets vs. commodities. Res. Int. Bus. Financ. 2015, 33, 334–354. [Google Scholar] [CrossRef]

- Silvennoinen, A.; Thorp, S. Financialization, crisis and commodity correlation dynamics. J. Int. Financ. Mark. Inst. Money 2013, 24, 42–65. [Google Scholar] [CrossRef]

- Yoon, S.M.; Al Mamun, M.; Uddin, G.S.; Kang, S.H. Network connectedness and net spillover between financial and commodity markets. N. Am. J. Econ. Financ. 2019, 48, 801–818. [Google Scholar] [CrossRef]

- Buyuksahin, B.; Robe, M.A. Does ‘Paper Oil’ Matter? Energy Markets’ Financialization and Equity-Commodity Co-Movements. Energy Markets’ Financialization and Equity-Commodity Co-Movements. 2011. Available online: https://ssrn.com/abstract=1855264 (accessed on 10 July 2020).

- Bekaert, G.; Harvey, C.R.; Lundblad, C.T.; Siegel, S. What segments equity markets? Rev. Financ. Stud. 2011, 24, 3841–3890. [Google Scholar] [CrossRef]

- Cheng, I.H.; Kirilenko, A.; Xiong, W. Convective risk flows in commodity futures markets. Rev. Financ. 2014, 19, 1733–1781. [Google Scholar] [CrossRef]

- Coudert, V.; Gex, M. Does risk aversion drive financial crises? Testing the predictive power of empirical indicators. J. Empir. Financ. 2008, 15, 167–184. [Google Scholar] [CrossRef]

| Abbreviation | Mean | Std. Dev. | JB | ADF | PP | |

|---|---|---|---|---|---|---|

| Crude oil WTI | WTI | 1.87 | 1.42 | 13,915.90 *** | −3.66 *** | −4.31 *** |

| Gold | GLD | 5.15 | 2.85 | 10,078.38 *** | −5.47 *** | −5.61 *** |

| Silver | SLV | 7.88 | 3.69 | 8085.54 *** | −5.12 *** | −4.45 *** |

| Platinum | PLT | 4.00 | 1.65 | 16,150.18 *** | −14.35 *** | −12.29 *** |

| Palladium | PLD | 2.41 | 2.59 | 17,149.21 *** | −6.37 *** | −5.06 *** |

| Aluminum | ALM | 0.63 | 0.94 | 147,332.80 *** | −6.36 *** | −22.20 *** |

| Copper | CPR | 0.31 | 0.28 | 1,282,594.00 *** | −5.04 *** | −8.32 *** |

| Zinc | ZNC | 0.72 | 0.52 | 741,914.00 *** | −7.49 *** | −14.49 *** |

| Lead | LED | 0.66 | 0.51 | 589,331.20 *** | −14.79 *** | −15.00 *** |

| Nickel | NKL | 0.52 | 0.45 | 1,130,079.00 *** | −14.40 *** | −15.91 *** |

| Wheat | WHT | 2.02 | 1.83 | 153,832.00 *** | −7.20 *** | −5.58 *** |

| Corn | CRN | 2.42 | 1.69 | 15,834.98 *** | −8.89 *** | −8.73 *** |

| Soybean | SBN | 2.33 | 1.43 | 14,194.39 *** | −9.93 *** | −9.65 *** |

| Coffee | COF | 0.58 | 0.37 | 302,365.70 *** | −12.50 *** | −6.71 *** |

| Sugar | SGR | 3.67 | 2.11 | 4089.68 *** | −7.54 *** | −5.07 *** |

| Cocoa | COC | 1.27 | 0.63 | 212,745.00 *** | −4.37 *** | −9.40 *** |

| Cotton | COT | 4.50 | 2.68 | 12,522.60 *** | −5.83 *** | −7.52 *** |

| US EPU | EPU | 115.3 | 71.04 | 3810.31 *** | −7.96 *** | −35.98 *** |

| US GPR | GPR | 85.19 | 60.89 | 14,001.98 *** | −9.86 *** | −39.30 *** |

| VIX | VIX | 21.05 | 9.98 | 6251.38 *** | −2.92 ** | −3.87 *** |

| MSCI World | MSCI | 0.004 | 1.15 | 6912.08 *** | −34.90 *** | −43.06 *** |

| TED Spread | TED | 0.448 | 0.50 | 36,716.87 *** | −2.97 ** | −3.27 ** |

| USD index | USD | 0.012 | 0.54 | 444.18 *** | −47.65 *** | −47.65 *** |

| From WTI | From All Uncertainties | To WTI | To All Uncertainties | Net Spillover WTI | Net Spillover All Uncertainties | |

|---|---|---|---|---|---|---|

| Panel A: Full sample (January 2007 to December 2016) | ||||||

| WTI | 68.767 | 1.952 | 68.767 | 2.128 | 0.000 | 0.176 |

| GLD | 0.901 | 2.333 | 1.343 | 2.694 | −0.441 | 0.361 |

| SLV | 0.854 | 1.361 | 8.237 | 5.198 | −7.383 | 3.836 |

| PLT | 4.743 | 1.843 | 0.324 | 0.651 | 4.419 | −1.192 |

| PLD | 5.214 | 2.105 | 8.292 | 3.081 | −3.078 | 0.976 |

| ALM | 3.117 | 2.110 | 0.067 | 1.541 | 3.049 | −0.568 |

| CPR | 3.825 | 2.249 | 3.674 | 3.847 | 0.151 | 1.598 |

| ZNC | 1.112 | 2.418 | 0.372 | 1.493 | 0.740 | −0.925 |

| LED | 2.947 | 2.830 | 0.270 | 4.167 | 2.677 | 1.337 |

| NKL | 2.040 | 5.801 | 0.783 | 0.409 | 1.257 | −5.391 |

| WHT | 0.660 | 2.084 | 0.628 | 2.459 | 0.032 | 0.375 |

| CRN | 1.528 | 2.590 | 2.389 | 2.518 | −0.860 | −0.072 |

| SBN | 2.275 | 2.430 | 0.645 | 2.035 | 1.630 | −0.395 |

| COF | 1.259 | 2.429 | 1.116 | 0.914 | 0.144 | −1.514 |

| SGR | 0.731 | 1.699 | 0.246 | 2.490 | 0.486 | 0.791 |

| COC | 2.088 | 1.784 | 2.742 | 1.987 | −0.654 | 0.204 |

| COT | 0.756 | 1.952 | 0.106 | 2.357 | 0.650 | 0.404 |

| Panel B: Global financial crisis (GFC) (January 2008–June 2009) | ||||||

| WTI | 51.759 | 3.015 | 51.759 | 3.709 | 0.000 | 0.694 |

| GLD | 0.240 | 2.549 | 0.439 | 2.192 | −0.199 | −0.357 |

| SLV | 0.625 | 2.828 | 1.908 | 2.879 | −1.283 | 0.051 |

| PLT | 6.723 | 3.816 | 0.105 | 1.538 | 6.618 | −2.279 |

| PLD | 4.820 | 2.197 | 7.294 | 3.753 | −2.474 | 1.556 |

| ALM | 5.900 | 2.547 | 0.332 | 1.291 | 5.568 | −1.255 |

| CPR | 0.221 | 2.623 | 0.811 | 2.699 | −0.591 | 0.076 |

| ZNC | 0.281 | 2.099 | 0.190 | 2.118 | 0.091 | 0.019 |

| LED | 0.332 | 3.158 | 0.509 | 4.405 | −0.177 | 1.247 |

| NKL | 0.481 | 4.447 | 1.810 | 3.586 | −1.329 | −0.861 |

| WHT | 24.671 | 3.760 | 6.656 | 2.870 | 18.015 | −0.890 |

| CRN | 4.305 | 3.467 | 4.058 | 2.559 | 0.247 | −0.908 |

| SBN | 5.537 | 2.859 | 3.435 | 2.581 | 2.102 | −0.278 |

| COF | 1.077 | 2.433 | 6.606 | 3.035 | −5.529 | 0.603 |

| SGR | 0.208 | 1.880 | 0.875 | 1.829 | −0.667 | −0.052 |

| COC | 2.578 | 2.757 | 9.109 | 6.788 | −6.531 | 4.031 |

| COT | 1.340 | 3.007 | 4.104 | 1.612 | −2.764 | −1.396 |

| EPU | GPR | VIX | MSCI World | TED | USD | |||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Stat | p-Value | Stat | p-Value | Stat | p-Value | Stat | p-Value | Stat | p-Value | Stat | p-Value | |

| Panel A: Full sample (January 2007 to December 2016) | ||||||||||||

| A1: H0: Global factoroverall spillovers | ||||||||||||

| Linear | 3.5477 | 0.4707 | 4.7576 | 0.4462 | 4.5276 | 0.2098 | 0.5812 | 0.7478 | 2.3654 | 0.0509 | 2.5673 | 0.2770 |

| Taylor-based | 1.6579 | 0.1908 | 1.2495 | 0.2869 | 1.2478 | 0.2885 | 2.3481 | 0.0708 | 1.1532 | 0.2830 | 1.6840 | 0.0710 |

| ANN-based | 1.0184 | 0.4159 | 0.7018 | 0.6706 | 0.5621 | 0.7292 | 1.1202 | 0.3478 | 1.0622 | 0.3794 | 1.1660 | 0.3235 |

| A2: H0: Global factorspillover FROM crude oil TO the other markets | ||||||||||||

| Linear | 5.5983 | 0.3473 | 3.8061 | 0.5777 | 5.5512 | 0.0623 | 0.6598 | 0.8826 | 19.7149 | 0.0006 | 9.7011 | 0.0458 |

| Taylor-based | 2.3048 | 0.0986 | 3.7839 | 0.0229 | 59.8155 | 0.0000 | 13.4252 | 0.0000 | 15.7838 | 0.0001 | 39.6647 | 0.0000 |

| ANN-based | 0.2405 | 0.9752 | 1.1624 | 0.3212 | 28.7543 | 0.0000 | 5.3966 | 0.0000 | 46.4748 | 0.0000 | 6.8233 | 0.0000 |

| A3: H0: Global factorspillover FROM other markets TO crude oil | ||||||||||||

| Linear | 9.1587 | 0.0573 | 7.1653 | 0.2086 | 3.0813 | 0.2142 | 1.0881 | 0.5804 | 1.3590 | 0.7152 | 0.4477 | 0.5034 |

| Taylor-based | 2.2803 | 0.0585 | 12.9045 | 0.0000 | 1.8653 | 0.1138 | 0.9563 | 0.4686 | 0.9021 | 0.3423 | 2.2701 | 0.0595 |

| ANN-based | 0.9870 | 0.4388 | 2.3820 | 0.0199 | 0.8297 | 0.5284 | 1.3938 | 0.2132 | 6.6518 | 0.0000 | 3.3619 | 0.0050 |

| Panel B: Global financial crisis (GFC) (January 2008–June 2009) | ||||||||||||

| B1: H0: Global factoroverall spillovers | ||||||||||||

| Linear | 1.6207 | 0.1841 | 1.3578 | 0.2554 | 1.0625 | 0.3649 | 0.9882 | 0.3208 | 0.0313 | 0.8596 | 0.1472 | 0.7015 |

| Taylor-based | 2.4224 | 0.0905 | 0.5475 | 0.5790 | 0.0825 | 0.7741 | 1.9579 | 0.1628 | 1.4666 | 0.2269 | 1.5912 | 0.2082 |

| ANN-based | 2.7466 | 0.0287 | 1.3996 | 0.2342 | 0.5213 | 0.7202 | 5.3718 | 0.0013 | 5.8258 | 0.0033 | 0.4788 | 0.6201 |

| B2: H0: Global factorspillover FROM crude oil TO the other markets | ||||||||||||

| Linear | 2.3023 | 0.0767 | 1.7942 | 0.1477 | 1.5400 | 0.2037 | 0.4954 | 0.6857 | 2.2322 | 0.1360 | 1.0346 | 0.3772 |

| Taylor-based | 0.4639 | 0.6293 | 0.3813 | 0.6833 | 2.7720 | 0.0970 | 2.9639 | 0.0325 | 28.1361 | 0.0000 | 8.4097 | 0.0000 |

| ANN-based | 1.1195 | 0.3475 | 2.4767 | 0.0445 | 1.1649 | 0.3265 | 0.5222 | 0.7594 | 0.3314 | 0.7182 | 0.5033 | 0.7334 |

| B3: H0: Global factorspillover FROM other markets TO crude oil | ||||||||||||

| Linear | 0.6159 | 0.4330 | 2.3182 | 0.0998 | 1.2820 | 0.2802 | 3.4551 | 0.0638 | 0.7287 | 0.3938 | 0.3681 | 0.5444 |

| Taylor-based | 0.5880 | 0.4438 | 2.0656 | 0.1286 | 0.4847 | 0.4869 | 2.2490 | 0.1074 | 1.3217 | 0.2515 | 0.0032 | 0.9549 |

| ANN-based | 1.1663 | 0.3130 | 2.2859 | 0.0790 | 2.0375 | 0.0893 | 1.6793 | 0.1716 | 2.3566 | 0.0966 | 0.0016 | 0.9984 |

| EPU | GPR | VIX | MSCI World | TED | USD | |||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Stat | p-Value | Stat | p-Value | Stat | p-Value | Stat | p-Value | Stat | p-Value | Stat | p-Value | |

| H0: Global factorspillover FROM crude oil TO gold | ||||||||||||

| Linear | 0.8710 | 0.4996 | 5.9034 | 0.0000 | 0.4699 | 0.7990 | 2.6677 | 0.0461 | 2.6953 | 0.0444 | 4.2863 | 0.0000 |

| Taylor-based | 1.0077 | 0.3883 | 2.8133 | 0.0602 | 14.7280 | 0.0001 | 2.0662 | 0.0440 | 2.3609 | 0.1245 | 11.8387 | 0.0000 |

| ANN-based | 1.8283 | 0.1206 | 2.4489 | 0.0168 | 14.3010 | 0.0000 | 5.3515 | 0.0000 | 29.6800 | 0.0000 | 1.7658 | 0.1166 |

| H0: Global factorspillover FROM crude oil TO silver | ||||||||||||

| Linear | 0.4969 | 0.7788 | 5.0657 | 0.0001 | 0.5336 | 0.7510 | 17.7453 | 0.0000 | 6.2423 | 0.0003 | 0.3372 | 0.7984 |

| Taylor-based | 1.5600 | 0.2104 | 17.2247 | 0.0000 | 94.1650 | 0.0000 | 4.3676 | 0.0001 | 0.4990 | 0.4800 | 16.5499 | 0.0000 |

| ANN-based | 6.3265 | 0.0000 | 0.6425 | 0.7209 | 43.7637 | 0.0000 | 11.1924 | 0.0000 | 16.2032 | 0.0000 | 9.2562 | 0.0000 |

| H0: Global factorspillover FROM crude oil TO platinum | ||||||||||||

| Linear | 1.9520 | 0.0577 | 1.3830 | 0.1896 | 1.4211 | 0.1918 | 2.0527 | 0.0452 | 0.7224 | 0.6530 | 1.9196 | 0.1045 |

| Taylor-based | 1.7888 | 0.1472 | 51.0005 | 0.0000 | 13.2123 | 0.0003 | 2.3438 | 0.0293 | 24.3331 | 0.0000 | 15.7756 | 0.0000 |

| ANN-based | 0.9138 | 0.4549 | 14.6384 | 0.0000 | 6.7743 | 0.0000 | 1.7125 | 0.1141 | 29.6308 | 0.0000 | 1.9994 | 0.0758 |

| H0: Global factorspillover FROM crude oil TO palladium | ||||||||||||

| Linear | 0.2511 | 0.9091 | 0.3723 | 0.8679 | 1.7082 | 0.1291 | 3.8372 | 0.0093 | 4.5799 | 0.0033 | 7.5449 | 0.0000 |

| Taylor-based | 1.5862 | 0.2049 | 3.5119 | 0.0300 | 11.0566 | 0.0009 | 4.2593 | 0.0003 | 0.2601 | 0.6101 | 10.4737 | 0.0000 |

| ANN-based | 0.3651 | 0.9227 | 1.0353 | 0.4040 | 20.6270 | 0.0224 | 1.4707 | 0.1843 | 15.1390 | 0.0000 | 1.1743 | 0.3193 |

| H0: Global factorspillover FROM crude oil TO aluminum | ||||||||||||

| Linear | 0.2244 | 0.9249 | 1.7043 | 0.1300 | 0.8615 | 0.5061 | 1.1713 | 0.3213 | 1.7553 | 0.1350 | 1.6876 | 0.1501 |

| Taylor-based | 5.8399 | 0.0030 | 7.7639 | 0.0054 | 66.5353 | 0.0000 | 1.9649 | 0.0673 | 4.6179 | 0.0317 | 6.9828 | 0.0000 |

| ANN-based | 11.0410 | 0.0000 | 10.4251 | 0.0000 | 22.0219 | 0.0000 | 6.7283 | 0.0000 | 28.7855 | 0.0000 | 6.7615 | 0.0000 |

| H0: Global factorspillover FROM crude oil TO copper | ||||||||||||

| Linear | 1.3666 | 0.2059 | 0.9077 | 0.5249 | 0.3165 | 0.9287 | 2.7122 | 0.0056 | 1.0560 | 0.3912 | 8.9293 | 0.0000 |

| Taylor-based | 0.1401 | 0.8693 | 1.2701 | 0.2810 | 27.8830 | 0.0000 | 3.0288 | 0.0060 | 17.0333 | 0.0000 | 8.9347 | 0.0000 |

| ANN-based | 0.3411 | 0.9352 | 0.5291 | 0.8131 | 9.7717 | 0.0000 | 3.2895 | 0.0032 | 16.6486 | 0.0000 | 2.4563 | 0.0314 |

| H0: Global factorspillover FROM crude oil TO zinc | ||||||||||||

| Linear | 1.2261 | 0.2939 | 1.5267 | 0.1779 | 0.2293 | 0.9499 | 0.5766 | 0.6796 | 0.4732 | 0.7554 | 0.9708 | 0.4506 |

| Taylor-based | 3.5515 | 0.0288 | 0.0449 | 0.9561 | 21.1715 | 0.0000 | 1.8860 | 0.3667 | 0.0202 | 0.8871 | 8.4231 | 0.0000 |

| ANN-based | 3.8907 | 0.0087 | 0.6393 | 0.6344 | 11.6719 | 0.0000 | 3.4005 | 0.0024 | 28.0229 | 0.0000 | 3.1977 | 0.0070 |

| H0: Global factorspillover FROM crude oil TO lead | ||||||||||||

| Linear | 1.5391 | 0.1381 | 0.9741 | 0.4481 | 1.0533 | 0.3913 | 3.5789 | 0.0008 | 1.2507 | 0.2649 | 9.0142 | 0.0000 |

| Taylor-based | 7.3626 | 0.0007 | 0.1307 | 0.7178 | 13.4060 | 0.0003 | 1.8092 | 0.0935 | 1.3220 | 0.2504 | 0.4673 | 0.9431 |

| ANN-based | 2.7422 | 0.0272 | 1.0137 | 0.3855 | 2.1832 | 0.0535 | 0.6743 | 0.6705 | 25.6573 | 0.0000 | 0.2808 | 0.9238 |

| H0: Global factorspillover FROM crude oil TO nickel | ||||||||||||

| Linear | 3.1023 | 0.0029 | 1.8810 | 0.0684 | 0.5805 | 0.7724 | 5.5338 | 0.0000 | 2.8659 | 0.0055 | 2.4901 | 0.0414 |

| Taylor-based | 0.4995 | 0.6069 | 2.7478 | 0.0975 | 4.3340 | 0.0017 | 1.7599 | 0.1035 | 0.6584 | 0.4176 | 2.5119 | 0.0015 |

| ANN-based | 0.5692 | 0.6353 | 16.5900 | 0.0000 | 12.4093 | 0.0000 | 6.9391 | 0.0000 | 33.3496 | 0.0000 | 3.4895 | 0.0038 |

| H0: Global factorspillover FROM crude oil TO wheat | ||||||||||||

| Linear | 0.9868 | 0.4322 | 1.7429 | 0.1069 | 0.1421 | 0.9906 | 0.7651 | 0.5749 | 0.6987 | 0.6244 | 5.4851 | 0.0000 |

| Taylor-based | 3.1870 | 0.0744 | 0.2953 | 0.7443 | 25.0459 | 0.0000 | 0.6512 | 0.6893 | 0.1733 | 0.6772 | 23.5971 | 0.0000 |

| ANN-based | 0.4808 | 0.6183 | 0.7006 | 0.5915 | 15.0613 | 0.0000 | 3.6814 | 0.0012 | 54.6548 | 0.0000 | 8.2629 | 0.0000 |

| H0: Global factorspillover FROM crude oil TO corn | ||||||||||||

| Linear | 1.4560 | 0.2009 | 1.3021 | 0.2599 | 0.4638 | 0.8034 | 0.0887 | 0.7658 | 1.4749 | 0.2289 | 0.9274 | 0.4469 |

| Taylor-based | 3.5315 | 0.0294 | 0.6393 | 0.4240 | 25.6121 | 0.0000 | 0.8283 | 0.5478 | 20.4587 | 0.0000 | 15.2950 | 0.0000 |

| ANN-based | 6.1555 | 0.0004 | 0.3717 | 0.7734 | 8.6047 | 0.0000 | 0.7207 | 0.6329 | 7.8646 | 0.0000 | 6.2589 | 0.0000 |

| H0: Global factorspillover FROM crude oil TO soybean | ||||||||||||

| Linear | 1.3427 | 0.2343 | 2.0056 | 0.0747 | 4.2398 | 0.0003 | 2.3241 | 0.0304 | 1.2152 | 0.2950 | 2.7128 | 0.0038 |

| Taylor-based | 13.8969 | 0.0000 | 56.4882 | 0.0000 | 16.4555 | 0.0001 | 2.6895 | 0.0297 | 18.4894 | 0.0000 | 8.3412 | 0.0000 |

| ANN-based | 17.6759 | 0.0000 | 28.4296 | 0.0000 | 0.8032 | 0.5473 | 1.2743 | 0.2657 | 16.1131 | 0.0000 | 0.3351 | 0.8919 |

| H0: Global factorspillover FROM crude oil TO coffee | ||||||||||||

| Linear | 1.1418 | 0.3351 | 1.7509 | 0.1052 | 2.0131 | 0.0605 | 1.1059 | 0.3310 | 1.8247 | 0.1211 | 5.8454 | 0.0000 |

| Taylor-based | 0.3265 | 0.7215 | 18.0011 | 0.0000 | 2.7338 | 0.0984 | 13.2656 | 0.0000 | 2.7315 | 0.0985 | 13.0944 | 0.0000 |

| ANN-based | 0.1419 | 0.9349 | 1.3030 | 0.2718 | 1.8020 | 0.1092 | 2.2906 | 0.0330 | 28.7761 | 0.0000 | 4.2095 | 0.0008 |

| H0: Global factorspillover FROM crude oil TO sugar | ||||||||||||

| Linear | 1.4452 | 0.1932 | 0.4330 | 0.6486 | 0.3649 | 0.9015 | 0.1485 | 0.7000 | 1.8081 | 0.1434 | 2.2569 | 0.0210 |

| Taylor-based | 1.0333 | 0.3560 | 7.4875 | 0.0063 | 2.4626 | 0.1167 | 1.4398 | 0.1955 | 17.5637 | 0.0000 | 5.5602 | 0.0000 |

| ANN-based | 0.4111 | 0.7451 | 2.6129 | 0.0497 | 2.0800 | 0.0651 | 0.5306 | 0.7854 | 5.8831 | 0.0000 | 0.9720 | 0.4334 |

| H0: Global factorspillover FROM crude oil TO cocoa | ||||||||||||

| Linear | 1.5819 | 0.1762 | 3.6625 | 0.0026 | 2.9011 | 0.0128 | 1.6173 | 0.2035 | 1.5922 | 0.2036 | 5.3742 | 0.0000 |

| Taylor-based | 0.2980 | 0.7423 | 89.8838 | 0.0000 | 12.0045 | 0.0005 | 0.6071 | 0.7249 | 2.2374 | 0.1348 | 8.8683 | 0.0000 |

| ANN-based | 3.2166 | 0.0220 | 21.6909 | 0.0000 | 10.1997 | 0.0000 | 4.7777 | 0.0001 | 13.5966 | 0.0000 | 3.3364 | 0.0053 |

| H0: Global factorspillover FROM crude oil TO cotton | ||||||||||||

| Linear | 2.0676 | 0.0436 | 2.0425 | 0.0464 | 0.6190 | 0.7407 | 2.8635 | 0.0055 | 1.1970 | 0.3006 | 9.9179 | 0.0000 |

| Taylor-based | 5.0514 | 0.0065 | 6.3274 | 0.0120 | 223.8052 | 0.0000 | 8.8553 | 0.0000 | 128.4767 | 0.0000 | 18.7563 | 0.0000 |

| ANN-based | 6.8771 | 0.0001 | 1.4842 | 0.2169 | 94.0210 | 0.0000 | 7.9605 | 0.0000 | 58.8682 | 0.0000 | 7.3980 | 0.0000 |

| EPU | GPR | VIX | MSCI World | TED | USD | |||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Stat | p-Value | Stat | p-Value | Stat | p-Value | Stat | p-Value | Stat | p-Value | Stat | p-Value | |

| H0: Global factorspillover FROM crude oil TO gold | ||||||||||||

| Linear | 4.4579 | 0.0354 | 0.0248 | 0.8748 | 1.5567 | 0.2129 | 3.5815 | 0.0592 | 4.9691 | 0.0264 | 0.1937 | 0.6601 |

| Taylor-based | 0.1232 | 0.7258 | 0.3159 | 0.5745 | 2.3378 | 0.1274 | 1.4502 | 0.2295 | 4.7641 | 0.0299 | 0.3339 | 0.7164 |

| ANN-based | 0.2373 | 0.7889 | 0.9207 | 0.3994 | 6.6471 | 0.0015 | 2.0564 | 0.1062 | 4.1544 | 0.0167 | 0.0185 | 0.9817 |

| H0: Global factorspillover FROM crude oil TO silver | ||||||||||||

| Linear | 3.3127 | 0.0695 | 1.0051 | 0.3167 | 0.8032 | 0.3707 | 7.9639 | 0.0050 | 2.0013 | 0.1580 | 0.9704 | 0.3252 |

| Taylor-based | 1.7354 | 0.1888 | 0.2433 | 0.6222 | 0.3360 | 0.5626 | 4.1434 | 0.0427 | 1.9444 | 0.1643 | 2.2424 | 0.1081 |

| ANN-based | 2.1174 | 0.1222 | 0.9729 | 0.3793 | 14.4260 | 0.0000 | 4.7816 | 0.0029 | 3.1676 | 0.0248 | 0.3190 | 0.7271 |

| H0: Global factorspillover FROM crude oil TO platinum | ||||||||||||

| Linear | 1.1630 | 0.2815 | 0.0331 | 0.8558 | 0.9920 | 0.3199 | 5.7417 | 0.0170 | 0.2809 | 0.5964 | 0.9070 | 0.3415 |

| Taylor-based | 0.2885 | 0.5916 | 0.2016 | 0.6538 | 2.0944 | 0.1489 | 0.0770 | 0.7816 | 0.5691 | 0.4513 | 0.5036 | 0.6049 |

| ANN-based | 1.1515 | 0.3176 | 0.6518 | 0.5219 | 3.5038 | 0.0314 | 0.1728 | 0.9147 | 2.9054 | 0.0563 | 0.2601 | 0.7712 |

| H0: Global factorspillover FROM crude oil TO palladium | ||||||||||||

| Linear | 0.0013 | 0.9711 | 4.2638 | 0.0396 | 2.3240 | 0.0993 | 0.7904 | 0.3745 | 1.8784 | 0.1542 | 0.5071 | 0.6027 |

| Taylor-based | 0.6660 | 0.4151 | 5.4104 | 0.0207 | 1.0176 | 0.3139 | 3.5006 | 0.0624 | 0.2558 | 0.6134 | 0.8411 | 0.5000 |

| ANN-based | 0.0749 | 0.9279 | 3.7166 | 0.0255 | 0.6453 | 0.5865 | 1.1465 | 0.3307 | 5.0888 | 0.0019 | 0.8479 | 0.4687 |

| H0: Global factorspillover FROM crude oil TO aluminum | ||||||||||||

| Linear | 1.1744 | 0.3101 | 3.5215 | 0.0305 | 0.8762 | 0.4172 | 0.7334 | 0.4810 | 0.1741 | 0.8403 | 0.4021 | 0.6692 |

| Taylor-based | 0.1152 | 0.8912 | 0.8317 | 0.4364 | 1.0421 | 0.3082 | 0.9555 | 0.3859 | 0.0002 | 0.9894 | 1.1176 | 0.3484 |

| ANN-based | 2.0870 | 0.1021 | 2.0881 | 0.1020 | 3.8217 | 0.0104 | 1.3113 | 0.2659 | 0.3463 | 0.7918 | 1.5545 | 0.2007 |

| H0: Global factorspillover FROM crude oil TO copper | ||||||||||||

| Linear | 0.1889 | 0.8279 | 0.9894 | 0.3728 | 2.5380 | 0.0803 | 3.3991 | 0.0660 | 0.5871 | 0.5564 | 2.4518 | 0.0875 |

| Taylor-based | 0.2542 | 0.7757 | 0.5865 | 0.5569 | 0.1972 | 0.6573 | 1.2961 | 0.2559 | 1.9775 | 0.1607 | 0.3123 | 0.8696 |

| ANN-based | 1.2786 | 0.2819 | 1.9588 | 0.1204 | 0.8161 | 0.4858 | 1.9088 | 0.1283 | 0.4726 | 0.7016 | 0.2778 | 0.8414 |

| H0: Global factorspillover FROM crude oil TO zinc | ||||||||||||

| Linear | 2.9735 | 0.0523 | 0.7906 | 0.4543 | 2.9779 | 0.0521 | 1.0800 | 0.3406 | 2.0918 | 0.1249 | 0.3088 | 0.7345 |

| Taylor-based | 1.9094 | 0.1501 | 0.0836 | 0.9198 | 27.0131 | 0.0000 | 0.3987 | 0.6716 | 15.0899 | 0.0001 | 0.3293 | 0.8582 |

| ANN-based | 7.7015 | 0.0001 | 1.4391 | 0.2316 | 14.9703 | 0.0000 | 1.0547 | 0.3793 | 15.5111 | 0.0000 | 0.0397 | 0.9894 |

| H0: Global factorspillover FROM crude oil TO lead | ||||||||||||

| Linear | 0.9604 | 0.3837 | 1.8877 | 0.1528 | 2.7977 | 0.0622 | 0.4284 | 0.6519 | 0.5804 | 0.5601 | 0.8206 | 0.4409 |

| Taylor-based | 1.6344 | 0.1969 | 1.1500 | 0.3181 | 20.6166 | 0.0000 | 1.0624 | 0.3470 | 1.3575 | 0.2449 | 0.6314 | 0.5953 |

| ANN-based | 3.0892 | 0.0275 | 1.4262 | 0.2353 | 11.6298 | 0.0000 | 0.1239 | 0.9738 | 2.0109 | 0.1126 | 0.3142 | 0.8151 |

| H0: Global factorspillover FROM crude oil TO nickel | ||||||||||||

| Linear | 0.5950 | 0.5521 | 1.0394 | 0.3547 | 1.0425 | 0.3536 | 1.7596 | 0.1735 | 1.3775 | 0.2534 | 0.1764 | 0.8383 |

| Taylor-based | 0.1266 | 0.8811 | 0.1267 | 0.8810 | 6.9483 | 0.0088 | 1.6785 | 0.1885 | 0.0448 | 0.8326 | 0.1095 | 0.9545 |

| ANN-based | 0.3130 | 0.8160 | 0.2319 | 0.8741 | 2.1721 | 0.0915 | 1.0371 | 0.3883 | 1.4059 | 0.2413 | 1.0813 | 0.3574 |

| H0: Global factorspillover FROM crude oil TO wheat | ||||||||||||

| Linear | 2.1073 | 0.1230 | 0.4236 | 0.6550 | 0.5032 | 0.6803 | 0.1343 | 0.8744 | 1.3753 | 0.2540 | 0.1110 | 0.8950 |

| Taylor-based | 0.1436 | 0.8663 | 0.6182 | 0.5397 | 7.2289 | 0.0076 | 0.6362 | 0.5300 | 7.9758 | 0.0051 | 1.0394 | 0.3947 |

| ANN-based | 0.9423 | 0.4206 | 0.3033 | 0.8230 | 2.1252 | 0.0778 | 0.3164 | 0.8669 | 9.4944 | 0.0000 | 0.3717 | 0.7735 |

| H0: Global factorspillover FROM crude oil TO corn | ||||||||||||

| Linear | 2.2643 | 0.1053 | 0.7066 | 0.4939 | 1.5678 | 0.2098 | 1.1141 | 0.3293 | 2.8131 | 0.0613 | 1.0090 | 0.3655 |

| Taylor-based | 0.1390 | 0.8703 | 0.0573 | 0.9443 | 3.9452 | 0.0480 | 0.3415 | 0.7110 | 0.1936 | 0.6602 | 1.1388 | 0.3384 |

| ANN-based | 2.3449 | 0.0731 | 0.5699 | 0.6353 | 4.9415 | 0.0023 | 0.2803 | 0.8906 | 6.2476 | 0.0004 | 1.1939 | 0.3123 |

| H0: Global factorspillover FROM crude oil TO soybean | ||||||||||||

| Linear | 2.1177 | 0.1217 | 2.758 | 0.0647 | 2.3294 | 0.0987 | 0.2983 | 0.7423 | 2.1196 | 0.1215 | 1.1597 | 0.3147 |

| Taylor-based | 2.2474 | 0.1075 | 1.7454 | 0.1764 | 25.7614 | 0.0000 | 0.4707 | 0.6251 | 6.3435 | 0.0123 | 1.5713 | 0.1820 |

| ANN-based | 3.8891 | 0.0095 | 2.2871 | 0.0788 | 9.8874 | 0.0000 | 0.4177 | 0.7958 | 4.1339 | 0.0069 | 0.4854 | 0.6927 |

| H0: Global factorspillover FROM crude oil TO coffee | ||||||||||||

| Linear | 0.5948 | 0.5522 | 1.1347 | 0.3226 | 0.3914 | 0.5319 | 0.2807 | 0.7554 | 3.6825 | 0.0260 | 2.7715 | 0.0638 |

| Taylor-based | 0.1268 | 0.8810 | 0.6092 | 0.5445 | 0.2305 | 0.6316 | 1.0686 | 0.3448 | 14.6356 | 0.0002 | 2.8780 | 0.0232 |

| ANN-based | 0.4277 | 0.7333 | 0.6272 | 0.5980 | 8.5501 | 0.0002 | 0.1777 | 0.9498 | 5.5274 | 0.0011 | 1.2700 | 0.2849 |

| H0: Global factorspillover FROM crude oil TO sugar | ||||||||||||

| Linear | 2.8093 | 0.0615 | 0.3586 | 0.6989 | 1.5528 | 0.2130 | 0.2193 | 0.8032 | 1.5069 | 0.2229 | 1.6879 | 0.1863 |

| Taylor-based | 1.6930 | 0.1858 | 1.2182 | 0.2973 | 24.7171 | 0.0000 | 0.0105 | 0.9895 | 11.7511 | 0.0007 | 5.6850 | 0.0001 |

| ANN-based | 4.7279 | 0.0031 | 1.5323 | 0.2063 | 12.7856 | 0.0000 | 0.2252 | 0.9242 | 9.6734 | 0.0000 | 2.0541 | 0.1065 |

| H0: Global factorspillover FROM crude oil TO cocoa | ||||||||||||

| Linear | 3.8810 | 0.0214 | 2.3738 | 0.0945 | 4.9707 | 0.0074 | 2.6543 | 0.0716 | 6.8363 | 0.0012 | 1.3764 | 0.2537 |

| Taylor-based | 0.2158 | 0.8060 | 6.2279 | 0.0023 | 6.0169 | 0.0148 | 0.1717 | 0.8423 | 1.2591 | 0.2628 | 1.2514 | 0.2853 |

| ANN-based | 0.1607 | 0.9227 | 6.4393 | 0.0003 | 3.1426 | 0.0257 | 0.1923 | 0.9423 | 15.0651 | 0.0000 | 1.4380 | 0.2319 |

| H0: Global factorspillover FROM crude oil TO cotton | ||||||||||||

| Linear | 1.4136 | 0.2445 | 2.3660 | 0.0952 | 0.1440 | 0.8659 | 1.9120 | 0.1492 | 1.4759 | 0.2298 | 0.2480 | 0.7805 |

| Taylor-based | 2.9424 | 0.0543 | 1.3251 | 0.2674 | 14.6169 | 0.0002 | 0.7717 | 0.4632 | 21.7886 | 0.0000 | 1.8506 | 0.1031 |

| ANN-based | 8.6847 | 0.0000 | 1.3205 | 0.2679 | 8.9606 | 0.0000 | 1.0227 | 0.3958 | 10.7312 | 0.0000 | 1.2016 | 0.3095 |

| EPU | GPR | VIX | MSCI World | TED | USD | |||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Stat | p-Value | Stat | p-Value | Stat | p-Value | Stat | p-Value | Stat | p-Value | Stat | p-Value | |

| H0: Global factorspillover FROM gold market TO crude oil | ||||||||||||

| Linear | 2.5463 | 0.0376 | 1.2626 | 0.2771 | 1.2216 | 0.2960 | 1.1192 | 0.3266 | 2.4369 | 0.0875 | 0.4159 | 0.7416 |

| Taylor-based | 3.6286 | 0.0267 | 0.8308 | 0.3621 | 6.4024 | 0.0115 | 0.4488 | 0.8462 | 9.0302 | 0.0027 | 1.0979 | 0.3556 |

| ANN-based | 2.5192 | 0.0564 | 0.4024 | 0.7513 | 2.8510 | 0.0143 | 0.8978 | 0.4955 | 3.9610 | 0.0014 | 0.3678 | 0.8709 |

| H0: Global factorspillover FROM silver TO crude oil | ||||||||||||

| Linear | 0.7789 | 0.5648 | 1.7541 | 0.1188 | 0.6988 | 0.6506 | 0.2830 | 0.5948 | 4.4819 | 0.0114 | 0.3974 | 0.7549 |

| Taylor-based | 2.7037 | 0.0672 | 1.5391 | 0.2149 | 14.6086 | 0.0001 | 0.4105 | 0.8725 | 2.7730 | 0.0960 | 1.6356 | 0.0754 |

| ANN-based | 2.3208 | 0.0734 | 1.9355 | 0.1217 | 7.9589 | 0.0000 | 2.0167 | 0.0602 | 1.4527 | 0.2022 | 2.9420 | 0.0119 |

| H0: Global factorspillover FROM platinum TO crude oil | ||||||||||||

| Linear | 0.7078 | 0.6175 | 1.4582 | 0.2001 | 1.4059 | 0.2187 | 0.6327 | 0.4264 | 0.3246 | 0.8617 | 0.2408 | 0.9153 |

| Taylor-based | 0.3349 | 0.7154 | 1.4555 | 0.2278 | 2.8752 | 0.0901 | 0.0446 | 0.7756 | 1.7180 | 0.1901 | 0.3453 | 0.9806 |

| ANN-based | 1.0272 | 0.3794 | 2.1926 | 0.0870 | 1.1101 | 0.3528 | 0.5376 | 0.7800 | 2.0508 | 0.0688 | 0.4528 | 0.8115 |

| H0: Global factorspillover FROM palladium TO crude oil | ||||||||||||

| Linear | 0.7236 | 0.5757 | 3.5128 | 0.0036 | 1.6055 | 0.1550 | 0.5220 | 0.4700 | 0.5014 | 0.4789 | 0.2229 | 0.9695 |

| Taylor-based | 7.2218 | 0.0007 | 4.6478 | 0.0312 | 0.0020 | 0.9646 | 1.0360 | 0.3997 | 0.2323 | 0.6299 | 1.8908 | 0.0268 |

| ANN-based | 1.4444 | 0.2280 | 1.8862 | 0.1298 | 2.9725 | 0.0111 | 1.0107 | 0.4164 | 1.7862 | 0.1123 | 2.3967 | 0.0353 |

| H0: Global factorspillover FROM aluminum TO crude oil | ||||||||||||

| Linear | 0.5298 | 0.7539 | 0.4175 | 0.8369 | 0.4439 | 0.8180 | 1.3064 | 0.2709 | 1.7434 | 0.1750 | 0.1824 | 0.9084 |

| Taylor-based | 1.8429 | 0.1747 | 0.8167 | 0.3662 | 5.0610 | 0.0246 | 0.5378 | 0.7798 | 5.9429 | 0.0149 | 0.2138 | 0.9986 |

| ANN-based | 0.3483 | 0.7060 | 0.5521 | 0.6467 | 0.6926 | 0.6291 | 0.6287 | 0.7074 | 4.0515 | 0.0012 | 0.7231 | 0.6061 |

| H0: Global factorspillover FROM copper TO crude oil | ||||||||||||

| Linear | 0.8401 | 0.4995 | 0.3255 | 0.8979 | 2.8305 | 0.0148 | 0.9063 | 0.3412 | 0.9703 | 0.3790 | 0.4408 | 0.7238 |

| Taylor-based | 0.0645 | 0.7996 | 3.0005 | 0.0834 | 24.9853 | 0.0000 | 0.0256 | 0.8730 | 11.2288 | 0.0008 | 2.7059 | 0.0670 |

| ANN-based | 5.0885 | 0.0062 | 2.7896 | 0.0617 | 24.1857 | 0.0000 | 2.6963 | 0.0677 | 28.8469 | 0.0000 | 3.0171 | 0.0491 |

| H0: Global factorspillover FROM zinc TO crude oil | ||||||||||||

| Linear | 0.5857 | 0.7110 | 0.4593 | 0.8067 | 0.2659 | 0.9319 | 0.5594 | 0.5716 | 0.5590 | 0.5718 | 1.9098 | 0.1257 |

| Taylor-based | 0.4094 | 0.5223 | 0.1434 | 0.7050 | 14.7733 | 0.0000 | 0.0001 | 0.9912 | 6.3992 | 0.0115 | 0.9289 | 0.3951 |

| ANN-based | 1.5976 | 0.2026 | 0.1820 | 0.8336 | 11.0464 | 0.0000 | 3.1605 | 0.0426 | 25.4532 | 0.0000 | 1.3158 | 0.2685 |

| H0: Global factorspillover FROM lead TO crude oil | ||||||||||||

| Linear | 0.3251 | 0.8613 | 0.1421 | 0.9824 | 1.4028 | 0.2400 | 0.2741 | 0.6006 | 0.1933 | 0.8243 | 0.5681 | 0.6360 |

| Taylor-based | 1.0661 | 0.3019 | 2.9192 | 0.0877 | 15.8192 | 0.0001 | 0.8060 | 0.3694 | 2.0017 | 0.1573 | 0.6943 | 0.4995 |

| ANN-based | 1.6191 | 0.1983 | 0.2438 | 0.7836 | 10.7244 | 0.0000 | 2.1816 | 0.1131 | 1.2114 | 0.2980 | 0.9628 | 0.3820 |

| H0: Global factorspillover FROM nickel TO crude oil | ||||||||||||

| Linear | 0.7725 | 0.5429 | 0.8914 | 0.4858 | 1.6156 | 0.1522 | 1.2158 | 0.2966 | 2.0001 | 0.1354 | 0.4759 | 0.6991 |

| Taylor-based | 0.1222 | 0.7267 | 0.0130 | 0.9094 | 0.1454 | 0.7030 | 1.3066 | 0.2531 | 0.0499 | 0.8233 | 1.1939 | 0.3032 |

| ANN-based | 0.8022 | 0.4485 | 0.4846 | 0.6160 | 7.4321 | 0.0006 | 1.0629 | 0.3456 | 0.2938 | 0.7455 | 1.7040 | 0.1822 |

| H0: Global factorspillover FROM wheat TO crude oil | ||||||||||||

| Linear | 2.2945 | 0.0570 | 3.9294 | 0.0015 | 1.1774 | 0.3176 | 0.0112 | 0.9159 | 2.0341 | 0.1309 | 0.3019 | 0.8240 |

| Taylor-based | 0.0509 | 0.8215 | 5.1311 | 0.0236 | 0.4847 | 0.4864 | 8.4515 | 0.0000 | 10.1655 | 0.0015 | 2.1873 | 0.0082 |

| ANN-based | 0.9839 | 0.3740 | 5.0694 | 0.0064 | 1.7740 | 0.1699 | 0.8199 | 0.5543 | 9.5223 | 0.0000 | 2.0154 | 0.0735 |

| H0: Global factorspillover FROM corn TO crude oil | ||||||||||||

| Linear | 1.4668 | 0.2095 | 0.4252 | 0.8314 | 0.4319 | 0.8266 | 2.5221 | 0.0804 | 1.0694 | 0.3433 | 0.5874 | 0.6232 |

| Taylor-based | 1.2311 | 0.2673 | 0.5975 | 0.4396 | 14.2624 | 0.0002 | 3.9372 | 0.0473 | 5.4339 | 0.0198 | 6.7727 | 0.0012 |

| ANN-based | 2.8177 | 0.0600 | 0.0336 | 0.9669 | 8.8246 | 0.0002 | 1.8167 | 0.1628 | 5.2883 | 0.0051 | 7.2035 | 0.0008 |

| H0: Global factorspillover FROM soybean TO crude oil | ||||||||||||

| Linear | 0.1230 | 0.9873 | 2.5602 | 0.0255 | 0.7850 | 0.5603 | 0.0000 | 0.9952 | 0.8804 | 0.3482 | 0.7356 | 0.5306 |

| Taylor-based | 1.4787 | 0.2241 | 4.1616 | 0.0415 | 3.1446 | 0.0763 | 2.0225 | 0.0595 | 0.0921 | 0.7615 | 1.6979 | 0.0551 |

| ANN-based | 0.3691 | 0.6914 | 5.3245 | 0.0012 | 1.8706 | 0.0963 | 2.6492 | 0.0146 | 1.1160 | 0.3496 | 1.8952 | 0.0920 |

| H0: Global factorspillover FROM coffee TO crude oil | ||||||||||||

| Linear | 1.3738 | 0.2403 | 1.0921 | 0.3625 | 0.2994 | 0.9134 | 0.2563 | 0.6127 | 0.1107 | 0.9539 | 1.0771 | 0.3574 |

| Taylor-based | 0.0849 | 0.7708 | 0.3653 | 0.6941 | 2.3349 | 0.1266 | 0.5752 | 0.7504 | 0.0005 | 0.9815 | 0.8890 | 0.5577 |

| ANN-based | 0.1296 | 0.8784 | 0.3762 | 0.9166 | 0.3557 | 0.8788 | 1.4022 | 0.2099 | 1.1146 | 0.3504 | 0.4008 | 0.8485 |

| H0: Global factorspillover FROM sugar TO crude oil | ||||||||||||

| Linear | 0.5325 | 0.7519 | 0.4831 | 0.7891 | 1.2370 | 0.2888 | 6.1503 | 0.0022 | 0.3019 | 0.7394 | 0.5316 | 0.6606 |

| Taylor-based | 0.5101 | 0.4752 | 1.6402 | 0.2004 | 3.4481 | 0.0081 | 7.9170 | 0.0000 | 11.1397 | 0.0009 | 0.9147 | 0.5368 |

| ANN-based | 0.0966 | 0.9079 | 1.2609 | 0.2836 | 4.1431 | 0.0009 | 4.3244 | 0.0002 | 4.5370 | 0.0004 | 0.1373 | 0.9837 |

| H0: Global factorspillover FROM cocoa TO crude oil | ||||||||||||

| Linear | 0.4491 | 0.7732 | 0.2735 | 0.9278 | 0.8575 | 0.5089 | 0.0021 | 0.9636 | 0.5331 | 0.5868 | 0.1782 | 0.9112 |

| Taylor-based | 0.0805 | 0.7766 | 1.2954 | 0.2740 | 13.9516 | 0.0002 | 0.4328 | 0.8574 | 14.1409 | 0.0002 | 2.5138 | 0.0015 |

| ANN-based | 0.1527 | 0.8584 | 0.5708 | 0.7802 | 1.6207 | 0.1511 | 0.9953 | 0.4266 | 14.1446 | 0.0000 | 0.2949 | 0.9159 |

| H0: Global factorspillover FROM cotton TO crude oil | ||||||||||||

| Linear | 1.3833 | 0.2370 | 0.4944 | 0.7807 | 0.8120 | 0.5408 | 4.5693 | 0.0104 | 1.1853 | 0.3057 | 0.3463 | 0.7919 |

| Taylor-based | 0.5274 | 0.4678 | 1.4633 | 0.2265 | 16.7058 | 0.0000 | 4.6880 | 0.0093 | 14.5232 | 0.0001 | 1.3881 | 0.2355 |

| ANN-based | 1.8427 | 0.1586 | 11.0690 | 0.0000 | 7.3390 | 0.0007 | 1.7160 | 0.1616 | 10.8483 | 0.0000 | 1.1197 | 0.3398 |

| EPU | GPR | VIX | MSCI World | TED | USD | |||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Stat | p-Value | Stat | p-Value | Stat | p-Value | Stat | p-Value | Stat | p-Value | Stat | p-Value | |

| H0: Global factorspillover FROM gold TO crude oil | ||||||||||||

| Linear | 6.6873 | 0.0014 | 0.0247 | 0.9756 | 0.2400 | 0.7868 | 1.8050 | 0.1659 | 0.5736 | 0.5640 | 4.8294 | 0.0085 |

| Taylor-based | 0.1286 | 0.8793 | 0.2749 | 0.7599 | 1.6639 | 0.1981 | 0.3293 | 0.7197 | 0.4903 | 0.4844 | 2.6751 | 0.0475 |

| ANN-based | 0.8151 | 0.4864 | 0.2228 | 0.8805 | 0.2954 | 0.8287 | 1.1327 | 0.3413 | 0.4107 | 0.7455 | 2.8753 | 0.0365 |

| H0: Global factorspillover FROM silver TO crude oil | ||||||||||||

| Linear | 2.6290 | 0.1057 | 0.9477 | 0.3309 | 3.3334 | 0.0687 | 0.1356 | 0.8732 | 0.2525 | 0.7770 | 0.3792 | 0.6847 |

| Taylor-based | 0.6202 | 0.4316 | 1.2191 | 0.2705 | 1.9467 | 0.1640 | 0.2889 | 0.7493 | 0.3641 | 0.5467 | 0.2170 | 0.8846 |

| ANN-based | 1.1167 | 0.3288 | 0.4303 | 0.6507 | 1.2893 | 0.2771 | 1.4085 | 0.2312 | 0.1389 | 0.9367 | 0.4174 | 0.7406 |

| H0: Global factorspillover FROM platinum TO crude oil | ||||||||||||

| Linear | 0.3482 | 0.7062 | 1.6547 | 0.1991 | 3.2449 | 0.0724 | 1.2931 | 0.2562 | 0.0294 | 0.8638 | 0.1801 | 0.6715 |

| Taylor-based | 0.3748 | 0.6878 | 0.3281 | 0.5672 | 1.1185 | 0.2911 | 0.0369 | 0.8478 | 0.0492 | 0.8247 | 0.0285 | 0.8660 |

| ANN-based | 0.4594 | 0.7109 | 0.6075 | 0.5454 | 0.9215 | 0.3991 | 1.6897 | 0.1694 | 0.0537 | 0.9478 | 0.1460 | 0.8641 |

| H0: Global factorspillover FROM palladium TO crude oil | ||||||||||||

| Linear | 7.2474 | 0.0074 | 0.3978 | 0.5286 | 1.8911 | 0.1699 | 1.5476 | 0.2142 | 9.9311 | 0.0018 | 0.2689 | 0.6044 |

| Taylor-based | 14.6447 | 0.0002 | 0.3344 | 0.5635 | 1.1237 | 0.2900 | 1.5659 | 0.2118 | 1.8037 | 0.1803 | 0.4062 | 0.5244 |

| ANN-based | 2.8239 | 0.0610 | 2.5265 | 0.0817 | 1.1371 | 0.3222 | 2.3562 | 0.0721 | 3.3952 | 0.0349 | 0.3290 | 0.7199 |

| H0: Global factorspillover FROM aluminum TO crude oil | ||||||||||||

| Linear | 0.1509 | 0.6979 | 0.3782 | 0.5389 | 2.0756 | 0.1505 | 0.1627 | 0.6869 | 0.6246 | 0.4298 | 0.3378 | 0.5614 |

| Taylor-based | 0.3149 | 0.5751 | 0.0935 | 0.7600 | 0.8588 | 0.3548 | 0.0054 | 0.9414 | 0.2392 | 0.6252 | 0.0800 | 0.7775 |

| ANN-based | 0.3807 | 0.6837 | 0.8067 | 0.4474 | 2.3810 | 0.0943 | 1.5627 | 0.1986 | 0.2801 | 0.7559 | 0.2642 | 0.7680 |

| H0: Global factorspillover FROM copper TO crude oil | ||||||||||||

| Linear | 5.1042 | 0.0244 | 0.2301 | 0.6318 | 10.2814 | 0.0015 | 0.2774 | 0.5987 | 1.6092 | 0.2054 | 0.4268 | 0.5140 |

| Taylor-based | 0.3529 | 0.5530 | 0.4680 | 0.4945 | 2.6273 | 0.1061 | 0.0225 | 0.8809 | 0.6680 | 0.4144 | 0.0332 | 0.8555 |

| ANN-based | 3.9242 | 0.0208 | 0.0975 | 0.9071 | 2.7403 | 0.0662 | 1.3369 | 0.2626 | 0.4576 | 0.6333 | 0.5546 | 0.5749 |

| H0: Global factorspillover FROM zinc TO crude oil | ||||||||||||

| Linear | 0.0289 | 0.8651 | 0.1891 | 0.6639 | 0.6399 | 0.5279 | 0.1286 | 0.8794 | 1.1737 | 0.3103 | 0.4065 | 0.6663 |

| Taylor-based | 0.0552 | 0.8145 | 0.0225 | 0.8808 | 0.7578 | 0.3847 | 0.2044 | 0.8153 | 0.0045 | 0.9466 | 0.2369 | 0.8706 |

| ANN-based | 0.0179 | 0.9822 | 0.0813 | 0.9219 | 0.5549 | 0.6452 | 0.5052 | 0.7319 | 0.9641 | 0.4100 | 0.9860 | 0.3997 |

| H0: Global factorspillover FROM lead TO crude oil | ||||||||||||

| Linear | 2.3690 | 0.0949 | 2.9176 | 0.0553 | 1.8486 | 0.1588 | 0.3329 | 0.7170 | 4.1145 | 0.0171 | 0.6111 | 0.5433 |

| Taylor-based | 1.4634 | 0.2332 | 0.3759 | 0.6870 | 8.2337 | 0.0044 | 0.6839 | 0.5055 | 1.1119 | 0.2925 | 1.9047 | 0.1290 |

| ANN-based | 2.1089 | 0.0993 | 0.8872 | 0.4481 | 3.3878 | 0.0185 | 4.1859 | 0.0026 | 3.9248 | 0.0091 | 1.6112 | 0.1869 |

| H0: Global factorspillover FROM nickel TO crude oil | ||||||||||||

| Linear | 0.2796 | 0.5972 | 0.0959 | 0.7570 | 1.7964 | 0.1673 | 1.2845 | 0.2780 | 0.1098 | 0.8960 | 2.4834 | 0.0848 |

| Taylor-based | 0.0211 | 0.8845 | 6.5693 | 0.0109 | 1.1743 | 0.2794 | 2.4563 | 0.0876 | 0.0201 | 0.8874 | 1.0595 | 0.3667 |

| ANN-based | 0.0313 | 0.9692 | 1.2095 | 0.2999 | 0.4496 | 0.7178 | 1.8882 | 0.1126 | 2.0077 | 0.1130 | 0.6990 | 0.5533 |

| H0: Global factorspillover FROM wheat TO crude oil | ||||||||||||

| Linear | 7.9421 | 0.0004 | 0.1987 | 0.8199 | 3.6339 | 0.0273 | 5.9703 | 0.0028 | 6.7822 | 0.0013 | 1.9061 | 0.1501 |

| Taylor-based | 8.4740 | 0.0003 | 0.1377 | 0.8714 | 21.2606 | 0.0000 | 2.5399 | 0.0807 | 34.8651 | 0.0000 | 5.9021 | 0.0006 |

| ANN-based | 3.7853 | 0.0109 | 0.5091 | 0.6763 | 6.2896 | 0.0004 | 0.8162 | 0.5157 | 14.4067 | 0.0000 | 0.7274 | 0.5364 |

| H0: Global factorspillover FROM corn TO crude oil | ||||||||||||

| Linear | 0.2648 | 0.6071 | 0.5532 | 0.4575 | 2.4653 | 0.1172 | 0.0150 | 0.9851 | 0.4998 | 0.6071 | 1.7389 | 0.1771 |

| Taylor-based | 0.0856 | 0.7700 | 0.0788 | 0.7791 | 1.0193 | 0.3135 | 0.0133 | 0.9869 | 0.2400 | 0.6246 | 0.5134 | 0.6733 |

| ANN-based | 0.4800 | 0.6193 | 0.0079 | 0.9922 | 0.8873 | 0.4129 | 0.5566 | 0.6944 | 0.7599 | 0.5174 | 1.6821 | 0.1710 |

| H0: Global factorspillover FROM soybean TO crude oil | ||||||||||||

| Linear | 0.4129 | 0.5209 | 0.5817 | 0.4461 | 0.6305 | 0.4277 | 0.0245 | 0.8757 | 0.1987 | 0.6560 | 5.4783 | 0.0198 |

| Taylor-based | 0.0214 | 0.8838 | 0.3379 | 0.5615 | 2.0935 | 0.1490 | 0.6002 | 0.4391 | 0.0611 | 0.8049 | 3.1554 | 0.0767 |

| ANN-based | 0.0224 | 0.9778 | 1.4816 | 0.2290 | 3.0569 | 0.0486 | 0.9054 | 0.4389 | 3.6536 | 0.0271 | 2.1741 | 0.1156 |

| H0: Global factorspillover FROM coffee TO crude oil | ||||||||||||

| Linear | 6.5146 | 0.0111 | 0.2425 | 0.6227 | 1.8421 | 0.1755 | 2.4073 | 0.1216 | 0.2300 | 0.6318 | 0.4226 | 0.5160 |

| Taylor-based | 2.7819 | 0.0965 | 0.1289 | 0.7198 | 2.2772 | 0.1324 | 0.1551 | 0.6940 | 0.0804 | 0.7770 | 0.2366 | 0.6271 |

| ANN-based | 4.6430 | 0.0104 | 0.2977 | 0.7428 | 1.7828 | 0.1700 | 1.5496 | 0.2019 | 1.9644 | 0.1420 | 0.1717 | 0.8423 |

| H0: Global factorspillover FROM sugar TO crude oil | ||||||||||||

| Linear | 0.7557 | 0.3852 | 6.1963 | 0.0132 | 0.8153 | 0.3671 | 6.3019 | 0.0125 | 3.4366 | 0.0645 | 0.6683 | 0.4142 |

| Taylor-based | 0.0858 | 0.7697 | 1.3323 | 0.2494 | 4.0137 | 0.0461 | 14.9712 | 0.0001 | 11.5562 | 0.0000 | 0.3172 | 0.5737 |

| ANN-based | 0.2788 | 0.7569 | 1.6590 | 0.1922 | 1.1815 | 0.3083 | 4.3115 | 0.0054 | 28.5011 | 0.0000 | 0.0586 | 0.9431 |

| H0: Global factorspillover FROM cocoa TO crude oil | ||||||||||||

| Linear | 0.0727 | 0.7876 | 0.2634 | 0.6081 | 0.0244 | 0.8760 | 0.5758 | 0.4484 | 1.0869 | 0.2978 | 0.7312 | 0.3930 |

| Taylor-based | 0.0964 | 0.7565 | 0.0368 | 0.8480 | 1.4858 | 0.2239 | 0.0778 | 0.7805 | 1.5105 | 0.2201 | 0.0005 | 0.9814 |

| ANN-based | 0.4809 | 0.6187 | 0.0175 | 0.9827 | 1.9466 | 0.1446 | 0.4400 | 0.7245 | 9.2613 | 0.0001 | 1.5288 | 0.2186 |

| H0: Global factorspillover FROM cotton TO crude oil | ||||||||||||

| Linear | 2.2028 | 0.1386 | 1.1079 | 0.2932 | 4.7976 | 0.0291 | 0.3255 | 0.5686 | 1.1729 | 0.2795 | 1.0565 | 0.3047 |

| Taylor-based | 0.2793 | 0.5976 | 0.2568 | 0.6127 | 1.6092 | 0.2056 | 0.0048 | 0.9451 | 0.4275 | 0.5138 | 0.0003 | 0.9869 |

| ANN-based | 0.8714 | 0.4195 | 0.5370 | 0.5851 | 1.6214 | 0.1994 | 1.0831 | 0.3566 | 0.4615 | 0.6308 | 0.2908 | 0.7479 |

Publisher’s Note: MDPI stays neutral with regard to jurisdictional claims in published maps and institutional affiliations. |

© 2021 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Naeem, M.A.; Farid, S.; Nor, S.M.; Shahzad, S.J.H. Spillover and Drivers of Uncertainty among Oil and Commodity Markets. Mathematics 2021, 9, 441. https://doi.org/10.3390/math9040441

Naeem MA, Farid S, Nor SM, Shahzad SJH. Spillover and Drivers of Uncertainty among Oil and Commodity Markets. Mathematics. 2021; 9(4):441. https://doi.org/10.3390/math9040441

Chicago/Turabian StyleNaeem, Muhammad Abubakr, Saqib Farid, Safwan Mohd Nor, and Syed Jawad Hussain Shahzad. 2021. "Spillover and Drivers of Uncertainty among Oil and Commodity Markets" Mathematics 9, no. 4: 441. https://doi.org/10.3390/math9040441

APA StyleNaeem, M. A., Farid, S., Nor, S. M., & Shahzad, S. J. H. (2021). Spillover and Drivers of Uncertainty among Oil and Commodity Markets. Mathematics, 9(4), 441. https://doi.org/10.3390/math9040441