1. Introduction

In statistics, variance (Var) is a fundamental descriptor of variability [

1], dispersion, or spread. Variance is a measure of how data points differ from one another with respect to a specific characteristic, and each score is compared to the centermost value of the set [

2]. This distinctive attribute has gained sufficient relevance in the literature such that, after the mean, variance is the second most frequently used measure to summarize the distribution of a random variable [

3]. However, the calculation of variance implies squared deviations which, in some cases, are difficult to interpret and apply when considered independently. In these scenarios, the application of the squared root to the result of the variance, which is the standard deviation (SD), is suggested [

4]. The SD is the most widely used measure of variability and, given its formulation, it gives more weight to larger deviations than to smaller deviations [

5].

Variability measures and, in particular, variance [

6], have been proven to be effective in decision-making problems. Variance measures in probabilistic feasible scenarios allow for the construction of models that aid in the assessment of a wide range of problems, including economic forecast techniques [

7,

8], expected utility economic issues [

9], organizational management [

10], risk-return organizational management [

10], and risk-return organizational management analyses [

11]. Variance measures are relevant in financial decision-making. For example, when an associated probability vector is included, a set of payoff setups can be constructed to aid in the selection of the most adequate option, such as in portfolio selection [

12], risk premiums [

13], and stock forecasting [

14]. However, some real-world scenarios face problems such as a lack of information, or incomplete and subjective information. When information is not adequate for the construction of probability vectors, we need to assess decision-making problems by considering uncertainty.

In recent decades, interesting advances in the modeling of decision making in uncertainty have been made, and the seminal work of fuzzy set theory [

15] has opened up new paths for the evaluation of scenarios where historic data are not available and robust mathematical techniques based on multiple valued logic are required [

16]. Moreover, the decision sciences expanded [

17] when the classic operation of the weighted average began to include preliminary rankings based on the attitudinal criteria of stakeholders. As a result, the ordered weighted average (OWA) operator was introduced [

18]. In the literature, a wide range of aggregation operators have appeared [

19], aiming to assess complex problems where different strings of information need to be included in the model. These operators include the induced OWA operator [

20], the uncertain OWA operator [

21], the generalized and induced generalized OWA operators [

22], the ordered weighted geometric averaging operators [

23], and the generalized ordered weighted logarithmic averaging operators [

24].

Yager [

25] proposed the study of variance as an aid for decision-making in uncertain environments. The inclusion of variability measures in decision-making problems [

26] introduces new approaches for the assessment of portfolio selection problems [

27], enables the possibility of selecting the alternative with the highest expected value from the range of options with the lowest inherent variance [

25,

28], and allows the generation of new approaches to allocate resources [

29] based on minimal variance models [

30] applied (for example, to personnel selection assessments) [

31]. The addition of variance in the formulation of OWA operators returns a parametrized family of operators between the minimum and the maximum variance [

1]. This extends decision making processes in uncertainty and offers a wider spectrum of analyzed data. These results are especially relevant in financial decision making processes where, in the case of the payoffs being equal or highly similar, an option for the selection is the one having the minimum variance [

28]. The integration of variance can be widely applied in different scenarios where aggregation operators have proven to be efficient such as in economics, engineering, soft computing, the earth sciences, etc. [

17,

32]. Thus, the inclusion of variance in further aggregation operators is of particular interest.

Zhou and Chen [

24] introduced the concept of generalized ordered weighted logarithmic aggregation (GOWLA) operators. Their proposal is based on an optimal deviation model, and its solid foundation widens the toolset for the analysis of phenomena in a variety of scenarios (for examples, see an approach to a human-resource based problem [

24], financial decision making assessments [

33], and multi-region decision-making problems [

34]). Some developments in logarithmic averaging operators include generalized logarithmic proportional averaging operators [

35], generalized ordered weighted logarithmic harmonic averaging operators [

36], ordered weighted logarithmic distance operators [

37], a generalized ordered weighted hybrid logarithm averaging operators [

33], and continuous generalized ordered weighted logarithm aggregation operators [

38]. As the family and applications of GOWLA operators continues to expand, the inclusion variance in its formulation results is interesting since it widens the study of the available data, thereby offering more information for robust decision-making approaches.

The objective of this paper is to introduce some variance logarithmic averaging operators and describe their formulation, characterization, and application. Our aim is to introduce a complementary set of tools for the assessment of decision-making problems in complex real-world scenarios when selecting logarithmic averaging operators for the aggregation of information is required. The study of variance in the logarithmic aggregation operators broadens the representation of analyzed data, giving decision makers additional information regarding the studied phenomena. This is of special interest as OWA applications continues to expand to several fields of knowledge such as in health [

39], productivity [

40], and social [

41] and price forecasting analysis [

42].

The remainder of the paper is organized as follows.

Section 2 of the manuscript presents the main theories that support this study.

Section 3 introduces variance ordered weighted averaging (Var-GOWLA) operators, and discusses its properties and families.

Section 4 presents the induced Var-GOWLA operators, which are designed to extend the representation of the complex attitudinal character of the decision makers.

Section 5 presents an illustrative example of the application of the introduced operators. Lastly,

Section 6 details the concluding comments of the study.

4. Variance Induced Ordered Weighted Logarithmic Aggregation Operators

An induced vector is an interesting tool to study when controlling the order of the aggregated arguments. In [

20], the basic notion of an induced mechanism for the OWA was first introduced. Motivated by further developments, such as the induced generalized OWA operator [

53] and the induced generalized ordered weighted logarithmic averaging operators [

54], in this paper the variance induced ordered weighted logarithmic averaging (Var–IOWLA) operator and the variance induced generalized ordered weighted logarithmic averaging (Var–IGOWLA) operator were studied.

4.1. Variance Induced Ordered Weighted Logarithmic Averaging Operators

A Var-IOWLA operator is an extension of the Var-OWLA operator, and the main distinctive difference of this arrangement is the previous ordered induced step that allows an additional consideration of information. In this case, the previous mechanism affects the aggregation of the arguments, allowing for a wider representation of diverse phenomena.

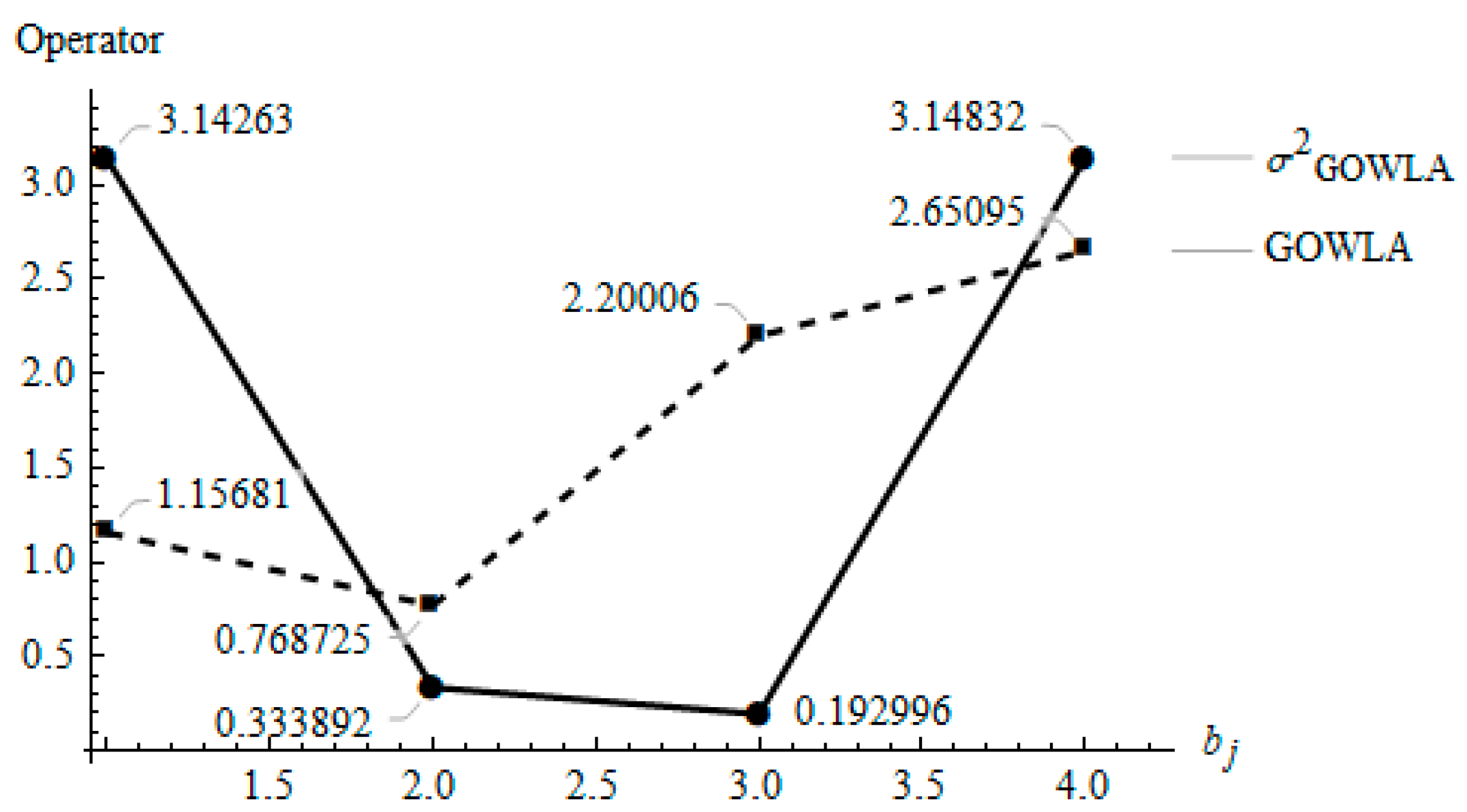

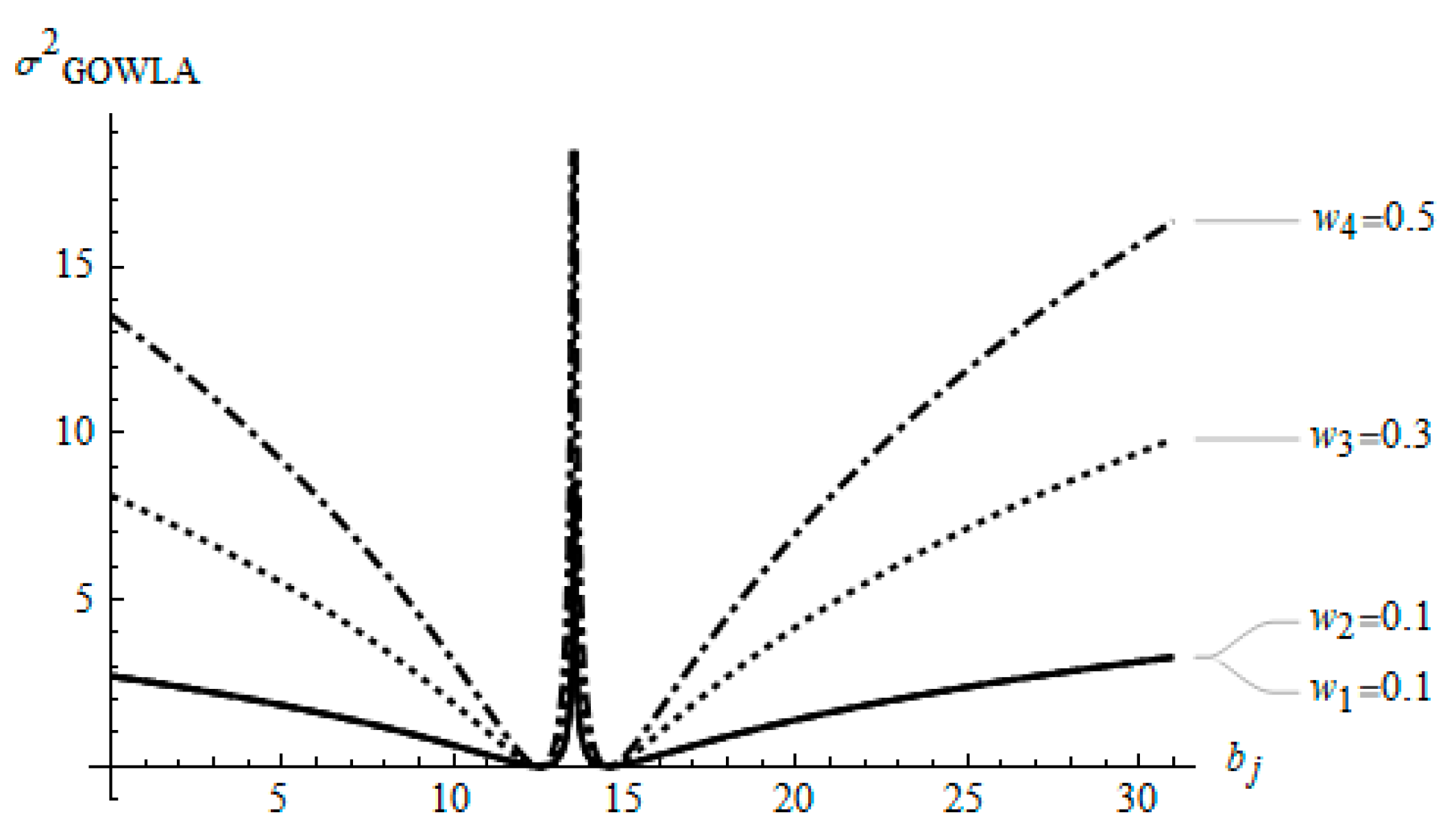

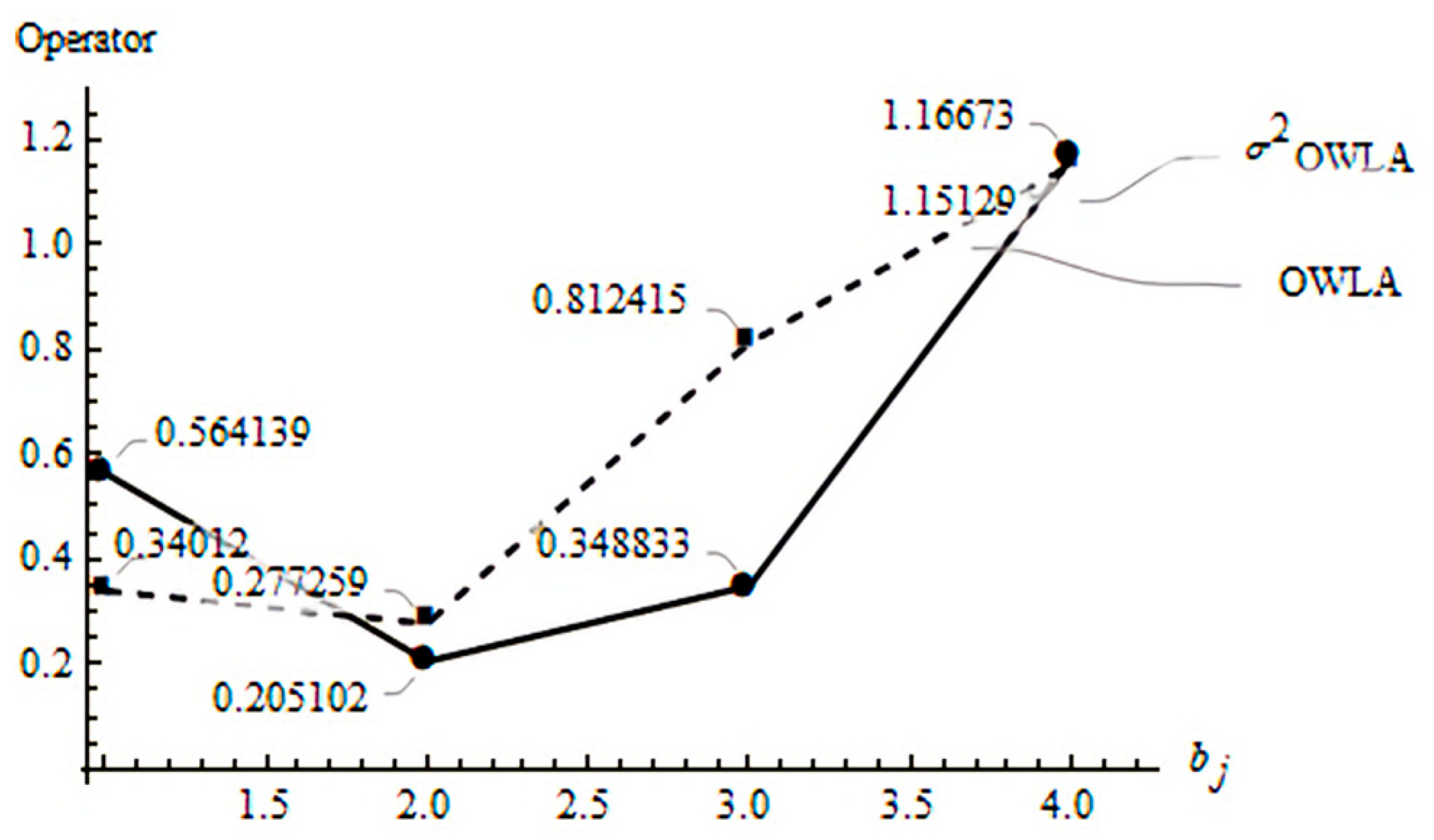

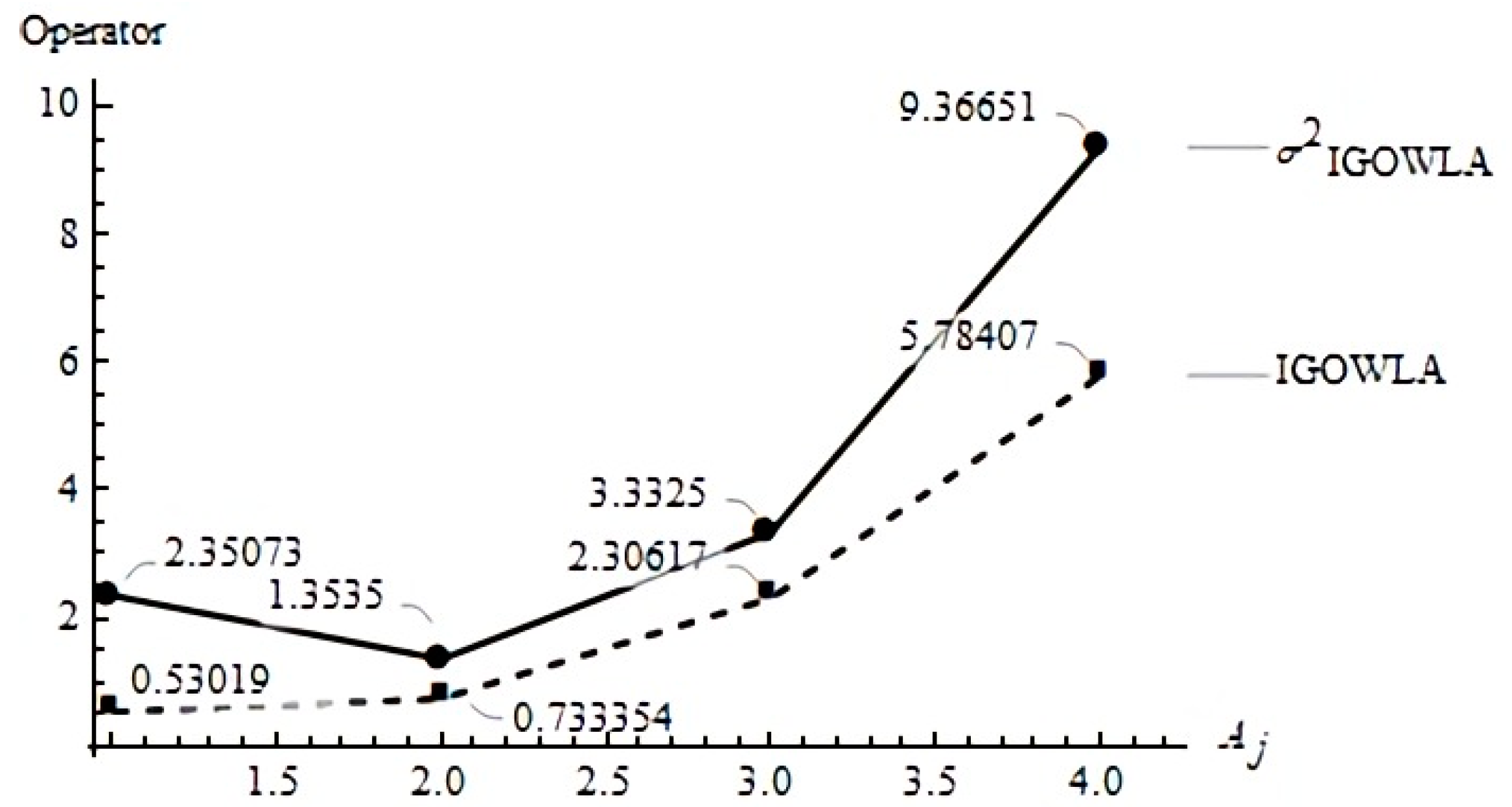

Definition 8. This operator is defined by a characteristic weighting vector W, bounded to values between 0 and 1 such that the sum of all is equal to 1. The formula representing this operator is:whereis the result ofand,is thearguments arranged following the decreasing order of the induced set ofvariables.is the argument variables and is the IOWLA operator. Example 4. Introducing the set of conditions in Example 1 and a vector, using (16), we obtain: Figure 5 presents a graph of the resulting points for the IOWLA and

based on the corresponding conditions.

4.2. Variance Induced Generalized Ordered Weighted Logarithmic Averaging Operators

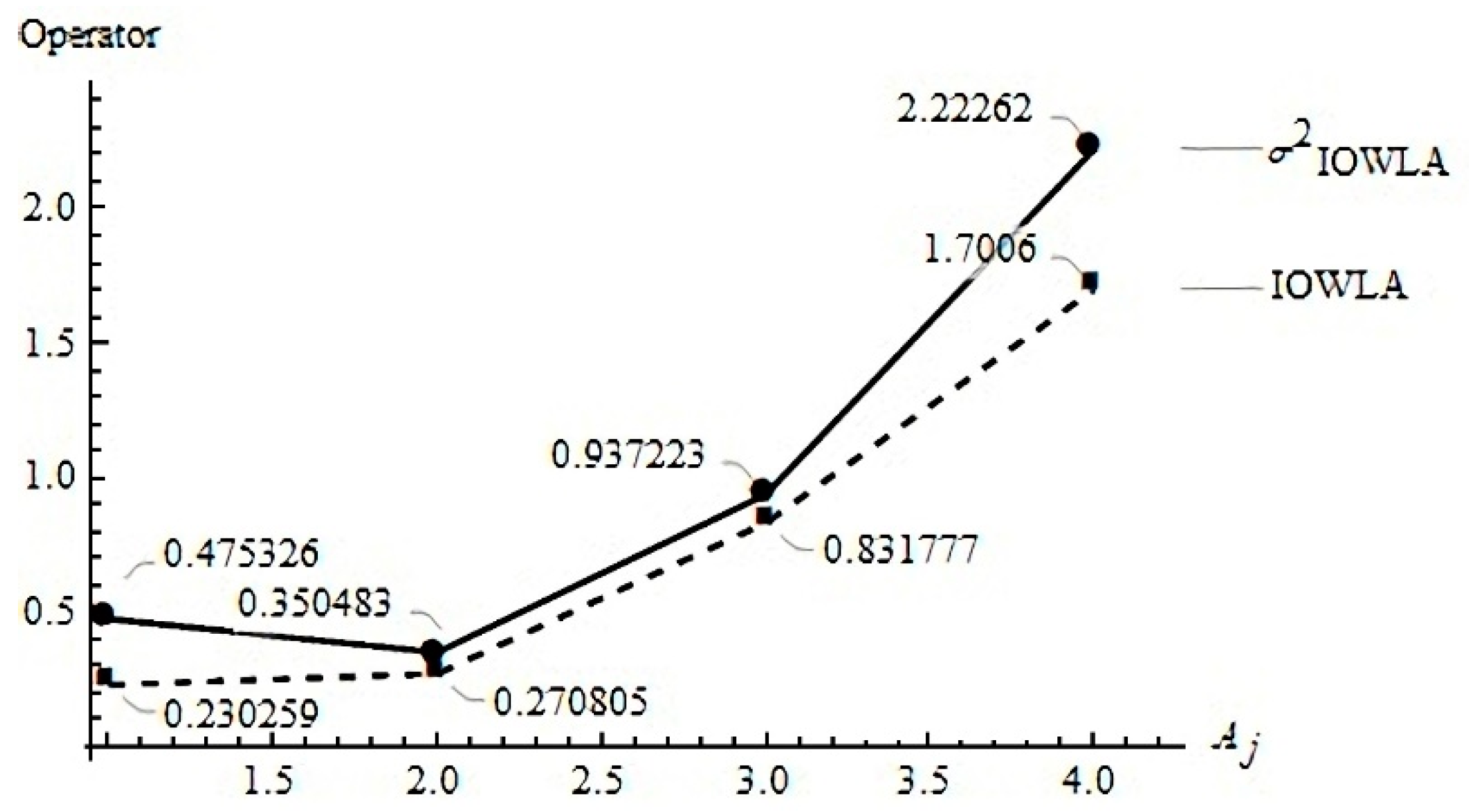

A Var-IGOWLA operator is a generalization of the Var-IOWLA operator. The proposed difference for this case is the λ vector, which, following the proposed generalizations in the previous section, allows for the construction of wider formulations.

Definition 9. A Var-IGOWLA operator with a weighting vector W, constrained to values between 0 and 1 and being the sum of all to 1, can be represented by:whereis the result of and,is the array ofin adecreasing way dictated by the induced variables,is the argument variable,and is the result of the corresponding IGOWLA operator. Example 5. Taking the arguments proposed in Example 1, an inducing vector , and, then by using (17): Please observe the behavior of the resulting operators following the established conditions in

Figure 6.

4.3. Variance Ordered Weighted Logarithmic Averaging Operators and Quasi-Artihmetic Means

An interesting generalization of the

operator is the extension by quasi-arithmetic means [

53,

55]. These extensions allow for wider representations of problems by introducing a function describing diverse possibilities for development. In this section, we study the construction of the quasi-

and quasi-

operators.

Definition 10. A quasi-operator with a weighting vector W of dimensionis a mapping, such that,, and a strictly monotonic continuous function, following: Please observe thatcorresponds to, andis the corresponding argumentordered in a decreasing way andis the OWLA operator calculation.

If there is a need for a customized position of the arguments to be included in the formulation, an order induced vector should be included. In this case, such representation would have as the result .

Definition 11. Aquasi-operator of n with dimensionis in fact a charting that includes a W vector of possible weights that strictly conserves the characteristic , and, and a U vector of order inducing variables, such that:whereis a strictly monotonic continuous function.

As defined before, is the result of with Zj ≥ 1, and is the corresponding argument to be aggregated in a decreasing way by the decreasing influence of the variables; finally, is the IOWLA operator of the arguments.

These formulations share some interesting particular cases, such as when all the weights of the are the same (i.e., ), then the operator becomes the quasi-variance induced ordered logarithmic averaging operator. If the strictly monotonic function , the transforms into the operator. In the case that , we obtain the variance induced ordered weighted harmonic logarithmic averaging () operator. When , the operator is simply the variance induced ordered weighted logarithmic averaging operator. Similarly, when , the operator is the variance induced ordered weighted quadratic logarithmic averaging operator . If the function presents a cubic distribution, then we obtain the variance induced ordered weighted cubic logarithmic averaging () operator. In such cases that and , a variance induced ordered weighted logarithmic geometric averaging operator is produced. Finally, for , the largest and , the lowest values of the dispersion are correspondingly obtained. Please note that all the particular cases mentioned above for the operators are also applicable for the operators.

5. Variance Generalized Ordered Weighted Logarithmic Averaging Operators and Heavy Operators

In the case that a traditional bounded average (i.e., between minimum and maximum values) does not accurately represent the assessed problem, we might opt to use heavy ordered weighted averages [

56]. These types of operators are often used when strong over or under estimations of the aggregation process are required.

Definition 12. A Var-GHOWLA operator of dimension is a mappingdefined by an associate weighting vectorof dimensionsuch thatand, according to the following formula:whereis the result of,are the argument variablesin descending order. Hereis the resulting GOWLA operator,is a parameter such that, and.

The distinctive difference of the Var-GHOWLA is the unbounded

W weighting vector, that according to the literature [

57] can further represent extreme and complex scenarios or the over estimation of the weights, due to the influence of a decision-maker.

Example 6. Taking the arguments proposed in Example 1, , and W = (0.12, 0.14, 0.36, 0.6) then by (20): Please observe that the

W weighting vector sum is 1.22. This over representation of the weights tries to include heavily complex scenarios. Following [

57], a wider representation of this overly weighted scenarios can be constructed when the heavy operator follows

and

A particularity of the above-mentioned operator results when the ordering process is not carried out. In this scenario, a Var-GHWLA operator is obtained. Here, there is not a defined ordering process in the arguments. This operator follows the next formulation:

Definition 13. A Var-GHWLA operator is an application ofdimension constituted by an associate weighting vectorsuch that and , according to:whereis the result of. Here is the resulting GWLA operator and , also.

Example 7. Taking the arguments proposed in Example 1, , and W = (0.12, 0.14, 0.36, 0.6) then by (21): Further representations of the heavy logarithmic variance operators can include the induced vectors. The induced values can furtherly introduce complex configurations of the aggregation operation that model the attitude of the decision makers. The induced vector forces the mechanism of the aggregation to follow a strict order. In this case, a specific representation of the induced vector can be included in the formulation.

Definition 14. A Var-IGHOWLA operator that includes a weighting vector W, such that and , is obtained by:whereis the result of and,is the set of following a decreasing way by the induced variables ,are argument variables,and is the result of the corresponding IGOWLA operator including the specific arguments of the aggregation. Example 8. Following the data proposed in Example 1, a W = (0.12, 0.14, 0.36, 0.6) and the vector in Example 5, and, then, according to (22): The heavy ordered weighted averaging operators have been designed to represent widely complex real-life scenarios. These might include natural disasters, highly volatile markets, or world health issues such as pandemics. Some examples and applications are available in the literature. In incentive decision making problems [

58], the heavy weighting vector aggregates the decision maker’s incentives to enlarge or shrink the expected result and heavy aggregations in enterprise risk management [

59], where diverse strategies are generated, analyzed and compared, according to the decision-makers attitude.

6. Var-GOWLA Operators and the Selection of Stocks

The variance logarithmic operators have been designed to extend decision-making when using the logarithmic families of OWA operators, and the proposed mechanisms are particularly interesting when applied to finance in the selection of investment analyses in uncertain conditions. Yager [

25] introduced the concept of variance to the OWA operators as a tool for analyzing not only the expected payoff of a series of options but also the variability of the alternatives. In our case, the Var-GOWLA operators serve the same purpose and widen the information that a decision maker may need to select the best option from a range of possibilities. In general, an application of the logarithmic operators, including the variance for the extension of the visualization, adheres to the following steps:

Step 1. Consider a collection of investment stock exchange options and obtain their closing price returns for a set of periods. These sets comprise an matrix.

Step 2. The closing price returns P require a further calculation to be fully comparable. In this case, we propose a simple calculation of the change such that . From here, a limited set of and periods should be established, such that the analyses of the returns focus on those options that yield the largest benefit.

Step 3. The simple mean and variance are common methods for the traditional evaluation of stock performance. However, decision-making under ignorance (i.e., when the uncertainty of the assessed problem is not of a probabilistic nature or when the attitudinal characteristics of the decision makers must be included in the problem), additional tools for the appropriate assessment of financial decisions are required. For this reason, the collection of specific information from the decision maker is expected. First, a weighting vector representing the attitudinal character with respect to the vector P is required. If the decision maker requires a specific configuration of the weighting of certain periods of time, collect an order induced vector that correctly represents the attitudinal complexity of the phenomena.

Step 4. Solve for a selected range of operators, including the generalized ordered weighted averaging (GOWLA) operators as described in (4) and some traditional operators as the mean, and solve for the operators as described in (7).

Step 5. Generate a ranking of the selected options and their results and assess a decision-making approach such that a clear selection of the chosen stock option is visualized.

Illustrative Example

The raw data included in this numerical example are retrieved from information published in the stock market for diverse assets. In the present section, we propose an illustrative example using monthly real stock data of certain equities published for Mexican companies.

Step 1. Assume that an investor would like to select the most adequate stock in which to invest. The possible set of

A options include

BIMBO A (BIMBO),

America Movil SAB de CV (AMXL),

ALFA A (ALFAA),

CEMEX CPO (CEMEXCPO),

Financiero Banorte (GFNORTEO),

Alsea (ALSEA),

Aeromexico (AEROMEX), and

Herdez (HERDEZ). The selection of the stock is based on the maximum benefit with the lowest dispersion for monthly returns

P during the period from January 2018 to January 2020.

Table 2 presents the monthly close returns

matrix of the selected companies for the corresponding period.

Step 2. The decision maker will make the final selection based on the maximum benefit with the lowest dispersion for

C = 10 periods of positive yields of the selected stocks.

Table 3 includes the corresponding

C periods to be analyzed.

Step 3. A W weighting vector of W (0.25, 0.23, 0.1, 0.09, 0.08, 0.07, 0.06, 0.05, 0.04, 0.03) for the representation of the attitudinal characteristic of the decision maker is included. Please note that this is a rather optimistic orientation. Furthermore, the decision maker would like to include an additional perspective to the problem, in this case the optimistic characterization for some specific months of the year. For this, we include an induced weighting vector of U (10, 9, 8, 1, 2, 3, 4, 5, 6, 7).

Step 4. With these set values, we can now solve for GOWLA and

operators and contrast the results with those of certain traditional and other uncertainty-oriented proposed methods.

Table 4 shows the resulting payoff of the selected stocks based on the GOWLA operator and certain other methods.

Table 5 presents the resulting aggregation of the dispersion based on the proposed

operators.

Step 5. The decision of selecting an asset could be given by the highest payoff, the lowest dispersion of the data, or a combination of both.

Table 6 presents the ranking of the selected stocks depending on the highest payoff.

Table 7 shows the ranking of the stocks by the minimum dispersion of their information.

The results vary depending on the operator utilized for the analysis. However, some operators match in the ranking of the selected equities. When analyzing the payoffs of the selected stocks in combination with their variance, the results vary significantly. In general, the stock with the highest payoff is given by either GFNORTEO or ALFAA. However, the dispersion of these stocks is the highest, resulting in these stocks being the last position of the ranking for the majority of the operators. When selecting a stock, low dispersion is preferred. Therefore, the decision should include the results of the lowest variance, and depending on the operator selected, this can vary over diverse options. If both criteria are considered and the GOWLA operator is considered, then CEMEXCPO is the selected option for the conditions established. Please observe the generated plot for CEMEXCPO analyzed with the GOWQLA and

operators in

Figure 7.

7. Conclusions

In this paper we have analyzed some variance logarithmic averaging operators. Variance is one of the most common dispersion measures and has been included as part of the ordered weighted average operators’ toolset since 1996. Some of the advantages of including variance as a dispersion measure in OWA operators include the additional information given to decision makers to generate informed choices between diverse alternatives. The benefits of using the logarithmic averaging operators and the introduced variance dispersion measures are wider representation of complex problems, the ability to consider the attitudinal characters of the decision makers, the logarithmic properties of the operators, and the wide-ranging set of configurations that the proposed generalizations allow.

In general, two families of variance aggregation operators are proposed, the variance generalized ordered weighted averaging

) operators and the induced variance ordered weighted averaging (

operators. The Var-GOWLA is a proposition based on the optimal deviation model introduced by [

24] and the inclusion of dispersion measures developed by [

25]. Here, its properties, particular cases, and some families are studied. Moreover, the Var-IGOWLA operator is also introduced. In this case, the ordering of the elements depends on the included inducing vector, which allows wider representations of diverse problems and, specifically, the customization of the analyses depending on the decision maker’s points of view.

The introduced variance tools in the logarithmic averaging operators are designed to extend the decision-making process by allowing the possibility of having an additional measure to model a specific problem. The characteristic design of the and the operators can be applied to a variety of problems in engineering, statistics, and economics. However, it is particularly interesting in financial decision-making. In this paper, an illustrative example including real-world financial information is proposed. This case analyses eight equities from the Mexican financial markets. The monthly closing price for ten positive return months is retrieved and analyzed with traditional, ordered weighted averaging operators and logarithmic averaging operators, and this analysis includes its dispersion measures. The objective, here, is to rank the performance of the equities based on the expected payoff of the identified data points and its dispersion. The results conclude that the payoff ranking is equal to some studies’ equities. However, the dispersion measures show varying results, depending on the operator utilized.

This paper studies extended tools for decision-making under ignorance and uncertainty and when subjective information or the attitudinal characters of stakeholders must be modeled. The implications of this research can directly improve decision-making when using a combined view of the logarithmic averaging operators and introducing dispersion measures. Further research is required, especially to strengthen the benefits of the logarithmic properties of the introduced operators, the specifications that result in the most appropriate selection of these operators [

60], and the inclusion of the variance and other modeling tools including fuzzy and interval numbers, distances, and Bonferroni approaches (among other models).