Patent Litigation, Competitive Dynamics, and Stock Market Volatility

Abstract

1. Introduction

- Patent infringement lawsuits filed against the same enterprise: Acer filed several patent infringement lawsuits against HP in less than one year. On 7 March 2007, Acer filed patent infringement lawsuits on processor-chip and DVD-editing technology; later, on 19 April, Acer filed lawsuits pertaining to resolution and information transmission.

- Patent lawsuits filed against several enterprises within a short time: Phison filed several patent infringement lawsuits pertaining to SD cards, solid state drives, and USB flash disks against RITEK and PNY Technologies, Asia Pacific Limited.

- The plaintiff and the defendant of a patent lawsuit sue each other within a short time: Within six months, Macronix and Spansion filed patent lawsuits against each other. On 15 August 2013, Macronix filed a patent lawsuit against Spansion for NOR flash; afterward, Spansion filed a patent lawsuit against Macronix for flash memory.

- Several enterprises file patent infringement lawsuits against the same enterprise within a short time: In 2012, HTC was sued by Eastman Kodak for infringement involving the electronic products and parts of patented image technologies and by Pragmatus AV for patented technologies of tablets, cell phones, and related products.

2. Literature Review

2.1. Dynamic Competition

2.2. Dynamic Coopetition

3. Sample and Methodology

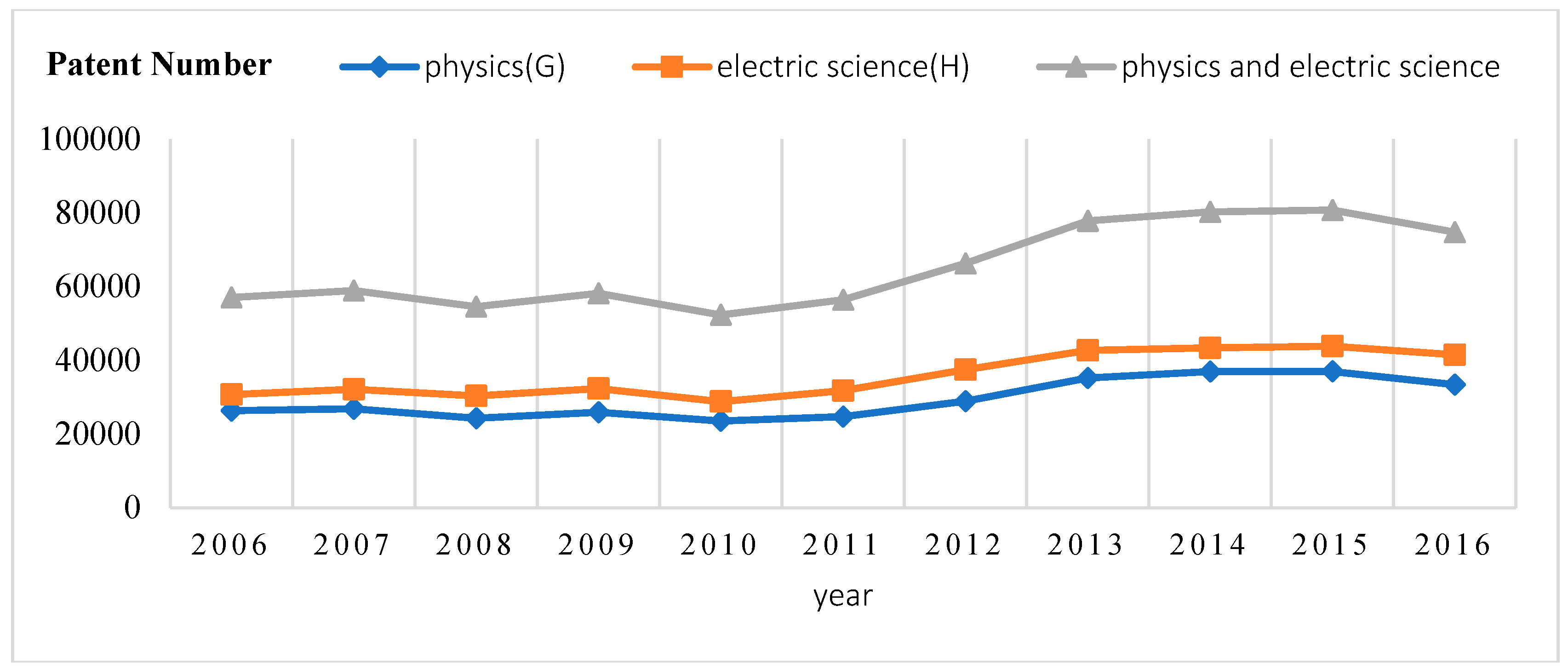

3.1. Sample Collection

3.2. Index Measurement

3.3. Asymmetric General Autoregressive Conditional Heterogeneous Variation

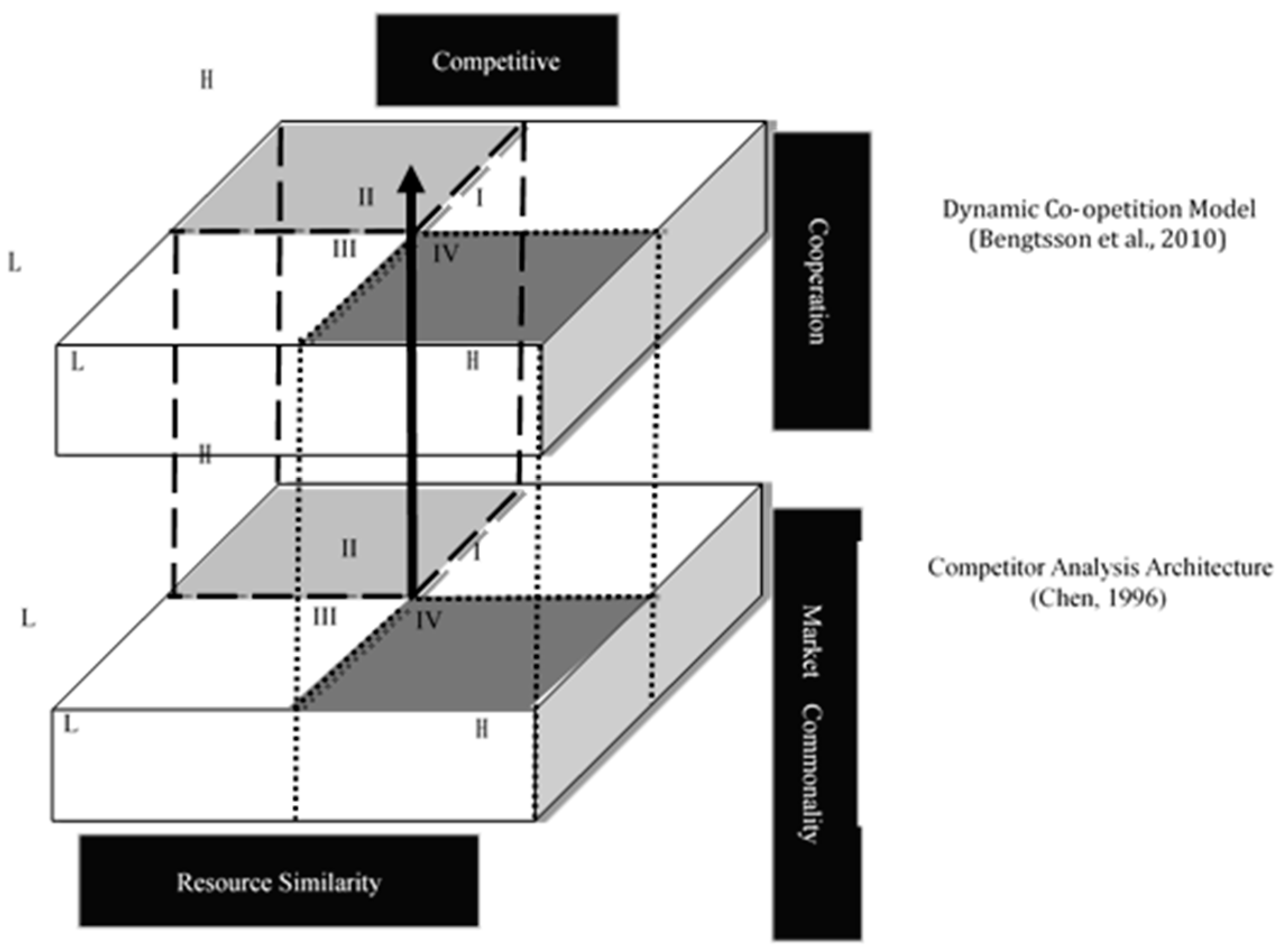

3.4. The Competitor Analysis Architecture Corresponds to the Dynamic Coopetition Model

4. Empirical Results

4.1. ARs and CARs of Patent Litigation

4.1.1. ARs of the Patent Litigation Publication and Suing Days

4.1.2. ARs and CARs of Patent Litigation (Plaintiff) on the Publication Day and the Suing Day in the Different Quadrants

4.1.3. ARs and CARs of Patent Litigation (Defendant) on the Publication Day and the Suing Day in the Different Quadrants

4.2. Estimation of GJR-GARCH

5. Conclusions

Author Contributions

Funding

Acknowledgments

Conflicts of Interest

References

- Lu, W.C.; Chen, J.R.; Tung, I. Trends and volatilities in heterogeneous patent quality in Taiwan. J. Technol. Manag. Innov. 2009, 4, 69–81. [Google Scholar] [CrossRef]

- Bhagat, S.; Bizjak, J.; Coles, J.L. The shareholder wealth implications of corporate lawsuits. Financ. Manag. 1998, 27, 5–27. [Google Scholar] [CrossRef]

- Neuhierl, A.; Scherbina, A.; Schlusche, B. Market reaction to corporate press releases. J. Financ. Quant. Anal. 2013, 48, 1207–1240. [Google Scholar] [CrossRef]

- Bhagat, S.; Umesh, N.U. Do trademark infringement lawsuits affect brand value: A stock market perspective. J. Mark.-Focus. Manag. 1997, 2, 127–148. [Google Scholar]

- Nam, S.; Nam, C.; Kim, S. The impact of patent litigation on shareholder value in the smartphone industry. Technol. Forecast. Soc. Chang. 2015, 95, 182–190. [Google Scholar] [CrossRef]

- Varadarajan, R.; DeFanti, P.M.; Busch, S.P. Brand portfolio, corporate image, and reputation: Managing brand deletions. J. Acad. Mark. Sci. 2006, 34, 195–205. [Google Scholar] [CrossRef]

- Ertekin, L.; Sorescu, A.; Houston, B.M. Hands off my brand! The financial consequences of protecting brands through trademark infringement lawsuits. J. Mark. 2018, 82, 45–65. [Google Scholar] [CrossRef]

- Bhagat, S.; Brickley, J.A.; Coles, J.L. The costs of inefficient bargaining and financial distress: Evidence from corporate lawsuits. J. Financ. Econ. 1994, 35, 221–247. [Google Scholar] [CrossRef]

- Myers, S.C.; Majluf, N.S. Corporate financing and in-vestment decisions when firms have information that investors do not have. J. Financ. Econ. 1984, 13, 187–221. [Google Scholar] [CrossRef]

- Engelmann, K.; Cornell, B. Measuring the cost of corporate litigation: Five case studies. J. Leg. Stud. 1988, 17, 377–399. [Google Scholar] [CrossRef]

- Lee, J.D.; Wang, Y.H.; Lin, C.W.; Lin, H.H. Information value of patent litigation and industry competition in Taiwan. Technol. Econ. Dev. Econ. 2013, 19, 593–605. [Google Scholar] [CrossRef]

- Raghu, T.S.; Woo, W.; Mohan, S.B.; Rao, H.R. Market reaction to patent infringement litigations in the information technology industry. Inf. Syst. Front. 2008, 10, 61–75. [Google Scholar] [CrossRef]

- Burt, R.S. Social contagion and innovation: Cohesion versus structural equivalence. Am. J. Sociol. 1987, 92, 1287–1335. [Google Scholar] [CrossRef]

- Chen, M.J.; Hambrick, D.C. Speed, stealth, and selective attack: How small firms differ from large firms in competitive behavior. Acad. Manag. J. 1995, 38, 453–482. [Google Scholar] [CrossRef]

- Chen, M.J. Competitor analysis and interfirm rivalry: Toward a theoretical integration. Acad. Manag. Rev. 1996, 21, 100–134. [Google Scholar] [CrossRef]

- Schmoch, U. Evaluation of technological strategies of companies by means of MDS maps. Int. J. Technol. Manag. 1995, 10, 426–440. [Google Scholar]

- Lerner, J. The importance of patent scope: Empirical analysis. RAND J. Econ. 1994, 25, 319–333. [Google Scholar] [CrossRef]

- Bengtsson, M.; Kock, S. “Coopetition” in business net-works to cooperate and compete simultaneously. Ind. Mark. Manag. 2000, 29, 411–426. [Google Scholar] [CrossRef]

- Bengtsson, M.; Eriksson, J.; Wincent, J. Co-opetition dynamics an outline for further inquiry. Compet. Rev. Int. Bus. J. 2010, 20, 194–214. [Google Scholar] [CrossRef]

- Koku, P.S.; Qureshi, A.A.; Akhigbe, A. The effects of news on initial corporate lawsuits. J. Bus. Res. 2001, 53, 49–55. [Google Scholar] [CrossRef]

- Bhagat, S.; Romano, R. Event studies and the law: Part I: Technique and corporate litigation. Am. Law Econ. Rev. 2002, 4, 141–168. [Google Scholar] [CrossRef]

- Hirschey, M.; Richardson, V.J. Valuation effects of patent quality: A comparison for Japanese and US firms. Pac.-Basin Financ. J. 2001, 9, 65–82. [Google Scholar] [CrossRef]

- Park, Y.; Park, G. A new method for technology valuation in monetary value: Procedure and application. Technovation 2004, 24, 387–394. [Google Scholar] [CrossRef]

- Sakakibara, M.; Branstetter, L. Do stronger patents induce more innovation? Evidence from the 1988 Japanese patent law reforms. J. Econ. 2001, 32, 77–100. [Google Scholar] [CrossRef]

- Chang, M.C.; Wang, Y.H.; Hung, J.C.; Sun, C. R&D, pa-tent arrangements, and financial performances: Evidence from Taiwan. Period. Polytech.-Soc. Manag. Sci. 2015, 23, 25–40. [Google Scholar]

- Rodger, J.A. QuantumIS: A Qualia consciousness awareness and information theory quale approach to reducing strategic decision-making Entropy. Entropy 2019, 21, 125. [Google Scholar] [CrossRef]

- Bernheim, B.D.; Whinston, M.D. Multimarket contact and collusive behavior. RAND J. Econ. 1990, 21, 1–26. [Google Scholar] [CrossRef]

- Barney, J. Firm resources and sustained competitive ad-vantage. J. Manag. 1991, 17, 99–120. [Google Scholar]

- Chen, M.J. Competitive dynamics research: An insider’s odyssey. Asia Pac. J. Manag. 2009, 26, 5–25. [Google Scholar] [CrossRef]

- Chuang, C.C.; Tsai, C.M. The association between corporate technology positions strategy and corporate value: Evidence from the listed electronic companies in Taiwan. J. Acc. Financ. Manag. Strategy 2011, 6, 31–57. [Google Scholar]

- Dubois, A.; Fredriksson, P. Cooperating and competing in supply networks: Making sense of a triadic sourcing strategy. J. Purch. Supply Manag. 2008, 14, 170–179. [Google Scholar] [CrossRef]

- Wu, Z.; Choi, T.Y.; Rungtusanatham, M.J. Supplier-supplier relationships in buyer-supplier-supplier triads: Implications for supplier performance. J. Oper. Manag. 2010, 28, 115–123. [Google Scholar] [CrossRef]

- Padula, G.; Dagnino, G.B. Untangling the rise of coopetition: The intrusion of competition in a cooperative game structure. Int. Stud. Manag. Organ. 2007, 37, 32–52. [Google Scholar] [CrossRef]

- Li, Y.; Liu, Y.; Liu, H. Co-opetition, distributor’s entrepreneurial orientation and manufacturer’s knowledge acquisition: Evidence from China. J. Oper. Manag. 2011, 29, 28–142. [Google Scholar] [CrossRef]

- Zhang, H.; Shu, C.; Jiang, X.; Malter, A.J. Managing knowledge for innovation: The role of cooperation, competition, and alliance nationality. J. Int. Mark. 2010, 18, 74–94. [Google Scholar] [CrossRef]

- Peng, T.J.A.; Pike, S.; Yang, J.C.H.; Roos, G. Is cooperation with competitors a good idea? An example in practice. Br. J. Manag. 2012, 23, 532–560. [Google Scholar] [CrossRef]

- Chen, M.J.; Miller, D. The relational perspective as a business mindset: Managerial implications for East and West. Acad. Manag. Perspect. 2011, 25, 6–18. [Google Scholar]

- Chen, M.J.; Miller, D. Competitive dynamics: Themes, trends, and a prospective research platform. Acad. Manag. Ann. 2012, 6, 135–210. [Google Scholar] [CrossRef]

- Nieto, M.J.; Santamaría, L. The importance of diverse collaborative networks for the novelty of product innovation. Technovation 2007, 27, 367–377. [Google Scholar] [CrossRef]

- Knudsen, M.P. The relative importance of interfirm relation-ships and knowledge transfer for new product development success. J. Product. Innov. Manag. 2007, 24, 117–138. [Google Scholar] [CrossRef]

- Engle, R.F. Autoregressive conditional heteroscedasticity with estimates of the variance of United Kingdom inflation. Econometrica 1982, 50, 987–1007. [Google Scholar] [CrossRef]

- Engle, R.F.; Ng, V.K. Measuring and testing the impact of news on volatility. J. Financ. 1993, 48, 1749–1778. [Google Scholar] [CrossRef]

- Bollerslev, T. Generalized autoregressive conditional heteroscedasticity. J. Econ. 1986, 31, 307–327. [Google Scholar] [CrossRef]

- Glosten, L.R.; Jagannathan, R.; Runkle, D.E. On the relation between the expected value and the volatility of the nominal excess return on stocks. J. Financ. 1993, 48, 1779–1801. [Google Scholar] [CrossRef]

- Wang, Y.H.; Lin, W.R.; Lin, S.S.; Hung, J.C. How does patent litigation influence dynamic risk for market competitors? Technol. Econ. Dev. Econ. 2017, 23, 780–793. [Google Scholar] [CrossRef]

| Panel A. ARs and CARs of Patent Litigation on the Publication Day | ||||||||||||

| Plaintiff | Defendant | Plaintiff | Defendant | |||||||||

| Period | ARs | t-Value | ARs | t-Value | CARs | t-Value | CARs | t-Value | ||||

| −5 | 0.150 | 0.354 | −0.476 | −0.987 | 0.150 | 0.354 | −0.476 | −0.987 | ||||

| −4 | −0.007 | −0.018 | −0.832 | * | −1.724 | 0.142 | 0.238 | −1.308 | * | −1.917 | ||

| −3 | −0.108 | −0.255 | −0.368 | −0.762 | 0.034 | 0.047 | −1.676 | ** | −2.005 | |||

| −2 | 0.389 | 0.919 | −0.560 | −1.159 | 0.423 | 0.500 | −2.236 | ** | −2.316 | |||

| −1 | −0.347 | −0.821 | −1.375 | *** | −2.849 | 0.076 | 0.080 | −3.610 | *** | −3.346 | ||

| 0 | 0.486 | 1.149 | −2.774 | *** | −5.747 | 0.562 | 0.542 | −6.384 | *** | −5.400 | ||

| +1 | −0.366 | −0.865 | −1.213 | ** | −2.514 | 0.196 | 0.175 | −7.597 | *** | −5.950 | ||

| +2 | −0.724 | * | −1.711 | −1.505 | *** | −3.119 | −0.528 | −0.441 | −9.103 | *** | −6.669 | |

| +3 | −0.748 | * | −1.768 | 0.624 | 1.292 | −1.276 | −1.006 | −8.479 | *** | −5.856 | ||

| +4 | 0.890 | ** | 2.105 | 0.210 | 0.435 | −0.386 | −0.288 | −8.269 | *** | −5.418 | ||

| +5 | 0.361 | 0.853 | −0.570 | −1.181 | −0.025 | −0.018 | −8.839 | *** | −5.522 | |||

| Panel B. ARs and CARs of Patent Litigation on the Suing Day | ||||||||||||

| Plaintiff | Defendant | Plaintiff | Defendant | |||||||||

| Period | ARs | t-Value | ARs | t-Value | CARs | t-Value | CARs | t-Value | ||||

| −5 | 0.648 | 1.471 | −0.164 | −0.362 | 0.648 | 1.471 | −0.164 | −0.362 | ||||

| −4 | 0.826 | * | 1.874 | −0.055 | −0.122 | 1.474 | ** | 2.365 | −0.219 | −0.342 | ||

| −3 | −0.083 | −0.187 | −0.440 | −0.972 | 1.391 | * | 1.823 | −0.659 | −0.840 | |||

| −2 | 0.476 | 1.081 | 0.112 | 0.247 | 1.867 | ** | 2.119 | −0.547 | −0.604 | |||

| −1 | 0.128 | 0.290 | 0.895 | ** | 1.976 | 1.995 | ** | 2.025 | 0.347 | 0.343 | ||

| 0 | −0.489 | −1.110 | −0.356 | −0.785 | 1.506 | 1.396 | −0.008 | −0.007 | ||||

| +1 | 0.401 | 0.911 | −2.107 | *** | −4.653 | 1.908 | 1.637 | −2.115 | * | −1.765 | ||

| +2 | −0.622 | −1.411 | −0.924 | ** | −2.041 | 1.286 | 1.032 | −3.039 | ** | −2.373 | ||

| +3 | −1.041 | ** | −2.362 | 0.377 | 0.834 | 0.245 | 0.186 | −2.661 | * | −1.959 | ||

| +4 | −0.349 | −0.791 | −0.095 | −0.209 | −0.104 | −0.074 | −2.756 | * | −1.925 | |||

| +5 | 0.654 | 1.484 | 1.394 | *** | 3.078 | 0.550 | 0.377 | −1.362 | −0.907 | |||

| Panel A. ARs of Patent Litigation (Plaintiff) on the Publication Day and the Suing Day | ||||||||||||

| Quadrant II | Quadrant III | Quadrant IV | ||||||||||

| Period | Publication Day | Suing Day | Publication Day | Suing Day | Publication Day | Suing Day | ||||||

| −5 | −0.074 | −0.215 | −0.330 | 1.474 | ** | 0.624 | 0.279 | |||||

| −4 | −2.153 | ** | 1.464 | 0.281 | −0.697 | 0.409 | 1.800 | *** | ||||

| −3 | −0.851 | 0.279 | 0.348 | 0.297 | −0.265 | −0.486 | ||||||

| −2 | 1.069 | −0.700 | 0.052 | 0.824 | 0.465 | 0.571 | ||||||

| −1 | −0.052 | −0.809 | −0.225 | 1.163 | * | −0.542 | −0.380 | |||||

| 0 | 0.194 | 0.053 | 0.296 | −1.212 | * | 0.736 | −0.099 | |||||

| +1 | −0.546 | −0.022 | 0.031 | 0.275 | −0.647 | 0.629 | ||||||

| +2 | −0.696 | −0.250 | −0.752 | 0.134 | −0.708 | −1.317 | * | |||||

| +3 | 0.729 | 0.063 | −1.845 | *** | −1.437 | ** | −0.274 | −1.076 | ||||

| +4 | 0.067 | −2.299 | ** | 1.130 | −1.252 | * | 0.941 | 0.947 | ||||

| +5 | 1.301 | 0.991 | 0.111 | 0.321 | 0.283 | 0.807 | ||||||

| Panel B. CARs of Patent Litigation (Plaintiff) on the Publication Day and the Suing Day | ||||||||||||

| Quadrant II | Quadrant III | Quadrant IV | ||||||||||

| Period | Publication Day | Suing Day | Publication Day | Suing Day | Publication Day | Suing Day | ||||||

| −5 | −0.074 | −0.215 | −0.330 | 1.474 | ** | 0.624 | 0.279 | |||||

| −4 | −2.227 | 1.249 | −0.049 | −0.697 | 1.033 | 2.079 | ** | |||||

| −3 | −3.078 | 1.528 | 0.299 | 0.297 | 0.768 | 1.593 | ||||||

| −2 | −2.009 | 0.828 | 0.351 | 0.824 | 1.233 | 2.164 | ||||||

| −1 | −2.061 | 0.018 | 0.126 | 1.163 | * | 0.691 | 1.784 | |||||

| 0 | −1.867 | 0.071 | 0.422 | −1.212 | * | 1.427 | 1.685 | |||||

| +1 | −2.414 | 0.049 | 0.454 | −0.275 | 0.780 | 2.314 | ||||||

| +2 | −3.110 | −0.202 | −0.299 | 0.134 | 0.072 | 0.996 | ||||||

| +3 | −2.381 | −0.139 | −2.144 | −1.437 | ** | −0.202 | −0.079 | |||||

| +4 | −2.313 | −2.438 | −1.014 | −1.252 | * | 0.739 | 0.867 | |||||

| +5 | −1.013 | −1.447 | −0.904 | 0.321 | 1.022 | 1.674 | ||||||

| Panel A. ARs of Patent Litigation (Defendant) on the Publication Day and the Suing Day | ||||||||||||||||

| Quadrant I | Quadrant II | Quadrant III | Quadrant IV | |||||||||||||

| Period | Publication Day | Suing Day | Publication Day | Suing Day | Publication Day | Suing Day | Publication Day | Suing Day | ||||||||

| −5 | −0.639 | −2.828 | −0.180 | 1.656 | * | −0.432 | 0.577 | −0.743 | −1.279 | ** | ||||||

| −4 | 0.943 | −2.294 | −0.102 | 0.133 | −1.354 | * | 0.739 | −1.840 | ** | −0.384 | ||||||

| −3 | −1.410 | −2.420 | 0.870 | 0.817 | −0.858 | −0.420 | −0.512 | −0.321 | ||||||||

| −2 | 0.046 | −0.220 | −0.014 | −1.274 | −0.331 | 0.798 | −1.675 | * | 0.057 | |||||||

| −1 | −4.207 | ** | −2.033 | 0.702 | 1.271 | −1.008 | 1.803 | *** | −2.465 | *** | 0.595 | |||||

| 0 | −4.439 | ** | −3.470 | * | −2.848 | *** | 1.996 | ** | −2.349 | *** | −0.023 | −2.362 | ** | −0.919 | ||

| +1 | 2.053 | −1.453 | −1.270 | −1.544 | −2.396 | *** | −2.671 | *** | −1.411 | −1.868 | *** | |||||

| +2 | −1.958 | −0.602 | −1.078 | −1.456 | −1.125 | −1.056 | −2.150 | ** | −0.511 | |||||||

| +3 | 2.754 | 0.213 | −0.479 | −0.453 | 0.543 | 1.002 | 0.755 | −0.027 | ||||||||

| +4 | 1.989 | −0.775 | 1.280 | −2.681 | *** | −0.499 | 1.069 | −0.924 | 0.032 | |||||||

| +5 | −0.364 | 3.354 | * | −1.812 | ** | 1.424 | 0.168 | 1.022 | −0.291 | 1.013 | ||||||

| Panel B. CARs of Patent Litigation (Defendant) on the Publication Day and the Suing Day | ||||||||||||||||

| Quadrant I | Quadrant II | Quadrant III | Quadrant IV | |||||||||||||

| Period | Publication Day | Suing Day | Publication Day | Suing Day | Publication Day | Suing Day | Publication Day | Suing Day | ||||||||

| −5 | −0.639 | −2.828 | −0.180 | 1.656 | * | −0.432 | 0.577 | −0.743 | −1.279 | ** | ||||||

| −4 | 0.305 | −5.122 | * | −0.282 | 1.790 | −1.786 | * | 1.315 | −2.583 | ** | −1.663 | * | ||||

| −3 | −1.105 | −7.542 | ** | 0.588 | 2.606 | −2.644 | ** | 0.895 | −3.096 | * | −1.984 | * | ||||

| −2 | −1.060 | −7.761 | ** | 0.574 | 1.333 | −2.975 | ** | 1.693 | −4.770 | ** | −1.927 | |||||

| −1 | −5.266 | −9.795 | ** | 1.276 | 2.604 | −3.982 | ** | 3.495 | ** | −7.235 | *** | −1.332 | ||||

| 0 | −9.706 | ** | −13.265 | *** | −1.572 | 4.600 | ** | −6.331 | *** | 3.472 | ** | −9.597 | *** | −2.252 | ||

| +1 | −7.653 | −14.718 | *** | −2.843 | 3.056 | −8.726 | *** | 0.801 | −11.007 | *** | −4.120 | ** | ||||

| +2 | −9.610 | * | −15.320 | *** | −3.921 | 1.600 | −9.851 | *** | −0.254 | −13.158 | *** | −4.631 | ** | |||

| +3 | −6.857 | −15.107 | *** | −4.400 | * | 1.147 | −9.308 | *** | 0.748 | −12.403 | *** | −4.658 | ** | |||

| +4 | −4.868 | −15.883 | *** | −3.120 | −1.535 | −9.807 | *** | 1.816 | −13.326 | *** | −4.626 | ** | ||||

| +5 | −5.232 | −12.529 | ** | −4.932 | * | −0.111 | −9.639 | *** | 2.838 | −13.617 | *** | −3.613 | * | |||

| The Second Quadrant (Strong Market Commonality and Weak Resource Similarity) | |||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| Event Date | Firm | Return | Volatility (t) | Volatility (t − 1) | Residuals (t − 1) | Asymmetric (t − 1) | |||||

| 9 May 2013 | WADO | −0.162 | 3.45 × 10−4 | *** | 1.66 × 10−4 | −9.69 × 10−5 | *** | −4.01 × 10−5 | *** | ||

| (356.037) | (4.54 × 10−5) | (2.33 × 10−4) | (7.52 × 10−6) | (3.03 × 10−6) | |||||||

| 4 June 2006 | VLA Technologies | −3.22 × 10−4 | 6.00 × 10−11 | 2.63 × 10−5 | 2.85 × 10−5 | *** | 1.12 × 10−5 | *** | |||

| (0.145) | (4.30 × 10−10) | (7.06 × 10−5) | (3.42 × 10−6) | (5.98 × 10−7) | |||||||

| 16 June 2002 | MediaTek Inc. | −0.268 | *** | −1.12 × 10−7 | * | 3.07 × 10−4 | 4.83 × 10−4 | *** | 2.34 × 10−4 | *** | |

| (0.099) | (6.49 × 10−8) | (2.93 × 10−4) | (2.90 × 10−5) | (1.17 × 10−5) | |||||||

| 25 December 2009 | MediaTek Inc. | −0.519 | *** | −7.26 × 10−10 | ** | 3.64 × 10−4 | ** | 4.52 × 10−4 | *** | 4.02 × 10−4 | *** |

| (0.018) | (3.56 × 10−10) | (1.63 × 10−4) | (2.31 × 10−5) | (1.92 × 10−5) | |||||||

| The Fourth Quadrant (Strong Resource Similarity and Weak Market Commonality) | |||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|

| Event Date | Firm | Return | Volatility (t) | Volatility (t − 1) | Residuals (t − 1) | Asymmetric (t − 1) | |||||

| 5 December 2000 | UMC | −0.018 | 8.73 × 10−8 | *** | 2.70 × 10−4 | 2.91 × 10−4 | *** | 7.74 × 10−5 | *** | ||

| (0.052) | (9.69 × 10−9) | (1.78 × 10−4) | (1.47 × 10−5) | (4.05 × 10−6) | |||||||

| 13 November 2002 | HON HAI | 0.151 | *** | 5.66 × 10−8 | *** | 2.76 × 10−4 | 2.77 × 10−4 | *** | 9.97 × 10−5 | *** | |

| (0.039) | (5.87 × 10−9) | (2.20 × 10−4) | (1.36 × 10−5) | (5.39 × 10−6) | |||||||

| 7 November 2005 | HON HAI | 0.411 | *** | 2.51 × 10−10 | *** | 1.32 × 10−6 | 1.78 × 10−5 | *** | 6.08 × 10−6 | *** | |

| (0.046) | (2.64 × 10−11) | (3.62 × 10−6) | (8.98 × 10−7) | (3.61 × 10−7) | |||||||

| 15 February 2006 | EMINENT | 0.104 | *** | 5.56 × 10−8 | *** | 2.93 × 10−4 | 5.06 × 10−4 | *** | 5.90 × 10−4 | *** | |

| (0.014) | (6.16 × 10−9) | (3.93 × 10−4) | (2.52 × 10−5) | (3.04 × 10−5) | |||||||

| 18 February 2006 | CML | 0.057 | 1.42 × 10−7 | *** | 1.72 × 10−4 | * | 1.09 × 10−7 | *** | 2.97 × 10−8 | *** | |

| (0.064) | (1.52 × 10−8) | (1.03 × 10−4) | (2.34 × 10−8) | (2.12 × 10−9) | |||||||

| 30 September 2008 | ProMOS TECHNOLOGIES | −0.261 | *** | 5.23 × 10−13 | 1.07 × 10−4 | *** | 7.20 × 10−7 | *** | 1.93 × 10−7 | *** | |

| (0.047) | (0.00 × 100) | (4.05 × 10−5) | (3.86 × 10−8) | (9.49 × 10−9) | |||||||

| 8 October 2008 | EPISTAR | 0.057 | 1.42 × 10−7 | *** | 2.11 × 10−4 | * | 2.85 × 10−4 | *** | 4.57 × 10−5 | *** | |

| (0.064) | (1.52 × 10−8) | (1.17 × 10−4) | (1.44 × 10−5) | (2.43 × 10−6) | |||||||

| 19 October 2010 | HON HAI | −0.067 | ** | 2.60 × 10−8 | *** | 4.91 × 10−4 | * | 2.18 × 10−4 | *** | 1.04 × 10−4 | *** |

| (0.028) | (2.74 × 10−9) | (2.54 × 10−4) | (1.07 × 10−5) | (5.60 × 10−6) | |||||||

| 3 August 2015 | GPTC | −0.978 | *** | 4.44 × 10−17 | 3.73 × 10−4 | *** | −2.95 × 10−8 | *** | −1.40 × 10−7 | *** | |

| (0.005) | (0.00 × 100) | (5.34 × 10−5) | (1.45 × 10−9) | (6.81 × 10−9) | |||||||

© 2020 by the authors. Licensee MDPI, Basel, Switzerland. This article is an open access article distributed under the terms and conditions of the Creative Commons Attribution (CC BY) license (http://creativecommons.org/licenses/by/4.0/).

Share and Cite

Shih, K.-H.; Yang, F.-J.; Shih, J.-T.; Wang, Y.-H. Patent Litigation, Competitive Dynamics, and Stock Market Volatility. Mathematics 2020, 8, 795. https://doi.org/10.3390/math8050795

Shih K-H, Yang F-J, Shih J-T, Wang Y-H. Patent Litigation, Competitive Dynamics, and Stock Market Volatility. Mathematics. 2020; 8(5):795. https://doi.org/10.3390/math8050795

Chicago/Turabian StyleShih, Kuang-Hsun, Fu-Ju Yang, Jhih-Ta Shih, and Yi-Hsien Wang. 2020. "Patent Litigation, Competitive Dynamics, and Stock Market Volatility" Mathematics 8, no. 5: 795. https://doi.org/10.3390/math8050795

APA StyleShih, K.-H., Yang, F.-J., Shih, J.-T., & Wang, Y.-H. (2020). Patent Litigation, Competitive Dynamics, and Stock Market Volatility. Mathematics, 8(5), 795. https://doi.org/10.3390/math8050795